Abstract

The collaboration of inflation or reverse money on the production inventory system is one of the major key factors for successful supply chain management. Here, demand rate of items is increasing with time and decreasing with proportion of selling price which is effective strategy for the market change. The developed model designed for shortages is considered partially backlogged where backlogging rate is decreasing with waiting time. Considering inflation on various costs is providing more reliable result due to real-life problem. This study presents the impact of inflation on production inventory model for deteriorating items with time and selling price-dependent demand under shortages. After that, to illustrate the model, numerical example is provided and solved. At the end, sensitivity analysis is introduced to show the validity and optimality of proposed study in order to analyse the effect of changes of different key parameters.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

3.1 Introduction

In production inventory system, the aim of manufacturer is to calculate the optimal production cost with lowest price of goods. There are many factors such as demand, production, deterioration and backlogging included in the development of inventory models. Hsieh and Dye (2013) addressed the impact of preservation technology on production model having fluctuating demand with time. Majumder et al. (2015) presented a partial delay payment policy on EPQ model under crisp and fuzzy domain with declining market demand. A manufacturing supply chain model with two-level trade credit policies was proposed by Kumar et al. (2015) under the effect of learning and preservation technology. Mishra (2016) investigated order-level inventory model with quadratic demand rate and Weibull deterioration rate under partial backlogging. Panda et al. (2018) studied two-warehouse optimal model of decaying products having variable demand and shortages with permissible delay approach.

In past study, researcher assumed that the demand to be constant or fixed may mislead the result. Now researcher is focusing on variable demand as like stock dependent, price dependent, time dependent, etc. which provides accurate optimum solution. Sometimes, costumer compromises with the quality of items they purchase because of high price. Thus, it is very challenging task for production manufacturer to provide good-quality products in a suitable selling price. Generally, high selling price decreases customer’s demand. A production model for infinite time horizon with time-dependent deterioration and price-sensitive demand has been investigated by Sharma et al. (2015). An inventory model including non-instantaneous deterioration with learning effect was studied by Shah and Naik (2018) in which assumed demand is price dependent. Also, Singh (2019) developed EPQ model with variable demand and backlogging where backlogging rate depends on waiting time.

For researcher, it is significant to include deterioration into account. In inventory models, deteriorating products are those items which we cannot use for future purpose due to decay, damage or spoilage of items. Wee and Wang (1999) introduced production policy with time-dependent demand for decaying goods. Molamohamandi et al. (2014) investigated optimal replenishment policy of EPQ model with shortages under permissible delay on payment for decaying items. Priyan and Uthayakumar (2015) studied economic manufacturing problem for defective items under imperfect production processes and reworking system. Tiwari et al. (2018) examined vendor and buyer inventory policy of imperfect products taking carbon emission into account. A lifetime decreasing model was studied by Singh and Rana (2020) with variable carrying cost and lost sale.

In the development of production models, inflation plays very important role as it affects the economy. Due to inflation, there is sustainable increase in general price or continuous fall in time value of money. Business organization is affected due to rapid inflation so it cannot be ignored. In production plants, inventories of raw materials and goods are big outlay and should be completed financially. Sarkar and Moon (2011) established manufacturing production model for imperfect items taking inflation into account. Kumar et al. (2013) studied effect of inflation on order quantity model for perishable products with lost sale. The effect of inflationary environment on ordering model under trade credit policy for finite time horizon was examined by Muniappan et al. (2015) in which deterioration is time dependent. Singh and Sharma (2016) extended production quantity model for stochastic demand and over finite time horizon. Pervin et al. (2020) developed EPQ model with collaboration of preservation technology investment to reduce deterioration rate.

In traditional models, it is assumed that shortages are completely backlogged, but it is not necessarily true in real-life scenario. Considering daily-life problems, some costumers like to wait especially in shortage period until replenishment, whereas some become restless and head elsewhere. Chang (2004) classified EPQ model for shortages using variable lead time. He also used algebraic method to find the minimum total average cost. Jain et al. (2007) extended EPQ model of decaying product for price- and stock-sensitive consumption under shortages. A non-instantaneous inventory model was proposed by Sharma and Bansal (2017) with learning effect and backlogging. An economic production quantity model for deteriorating items was studied by Khurana et al. (2018) with linear demand and partial backlogging. Handa et al. (2020) derived EOQ model under the effect of trade credit policy.

3.1.1 Our Contribution

In the present study, a production inventory model for deteriorating goods with time and price sensitive demand over a finite planning horizon under the effect of inflation on costs has been established. Due to tough competition in the market, manufacturer has to provide good-quality items to the customers at lowest reasonable rate. Shortages are permitted and partially backlogged with waiting time-dependent rate. To minimize the optimal cost of the proposed model, it has been solved numerically. Furthermore, to examine the stability of this problem, sensitivity analysis has been done for different parameters. The findings suggested that the production model may reduce the total average cost by taking inflation on account.

3.2 Assumptions

The model is supported by the following assumptions:

-

1.

The production cycle is for finite planning horizon.

-

2.

The demand of the items depends on time as well as on price such as

$$D(t,s_{1} ) = \alpha + \beta t - \gamma s_{1} \quad {\text{where }}\alpha > \beta \,{\text{and}}\,\gamma \ll {\text{1}}$$ -

3.

The model has allowed constant rate of deterioration σ.

-

4.

Deteriorating items are not repaired during whole cycle.

-

5.

Inflation is allowed, and lead time is zero.

-

6.

Shortages occur and not completely backlogged.

-

7.

Backlogging rate is assumed to be decreasing with waiting time and given by

$$\lambda (\delta ) = 1 - \frac{\delta }{T}$$ -

8.

The production cycle is for finite planning horizon.

3.3 Notations

- Q1(t):

-

Positive inventory level.

- Q2(t):

-

Maximum inventory level when shortage occurs.

- K :

-

Production rate for manufacturing.

- P 1 :

-

Production cost per unit.

- s 1 :

-

Selling price.

- A :

-

Acquisition cost per unit.

- M :

-

Setup cost per production.

- σ :

-

Rate of deterioration.

- C d :

-

Deterioration cost per unit.

- C 1 :

-

Inventory holding cost per unit.

- S :

-

Inventory shortage cost per unit.

- l :

-

Cost of lost sale per unit.

- α, β:

-

Demand rate parameters where α > β.

- γ :

-

Constant function of selling price.

- δ :

-

Backlogging rate (constant).

- r :

-

Constant rate of inflation.

3.4 Mathematical Modelling

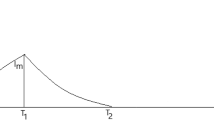

In Fig. 3.1, production starts from t = 0. At t = 0, there is no production and demand. Production and consumption jointly continued during [0, u1], production reaches its maximum size at time t = u1, and it stops at this point. After that, due to combined effect of consumption of inventory and deterioration of items, inventory depletes zero during [u1, u2]. After that, shortages occur including partial backlogging between t = u2 to t = T.

The behaviour of inventory system with time has been specified by below-given differential equations:

Boundary conditions are as follows:

Solution of these equations with the help of boundary conditions:

Maximum inventory in \([0,u_{2} ]\)

And maximum inventory in shortage period \([u_{2} ,T]\)

Total ordered quantity

By using boundary condition

3.5 Cost analysis

Production cost

Acquisition cost

Setup cost

Deterioration cost

Holding Cost

Shortage cost

Lost sale cost

Now, by using Eqs. (3.11)–(3.17), the total average cost (TAC) of the proposed model is

3.5.1 Solution Procedure

The objective of the study is to obtain the optimal value of critical time (\(u_{2}\)) that minimizes the total average cost. Individual optimization method is used to determine the minimum cost per unit time of the proposed model. The value of optimal time will be calculated by using

3.6 Numerical Example

With the help of numerical aptitudes, the optimal value of time and optimal value of total average cost are calculated. For the calculation, mathematical software Mathematica 11.3 is used, and assigned values for parameters are as follows:

\(\begin{aligned} \alpha & = 1500\,{\text{unit}},\beta = 2.5\,{\text{unit, }}\gamma = {\text{ 0}}{\text{.02}}\,{\text{unit}},s_{1} = {\text{28}}\,{\text{rs/unit,}} \\ M & = {\text{1500}}\,{\text{rs}},P_{1} = {\text{6}}\,{\text{rs/unit}},K = {\text{1000}}\,{\text{unit}},r = {\text{0}}{\text{.03, }}A = {\text{10}}\,{\text{rs,}} \\ c_{d} & = {\text{12}}\,{\text{rs/unit}},\sigma = {\text{0}}{\text{.06}},C_{1} = {\text{0}}{\text{.5}}\,{\text{rs/unit}},{\text{l}} = {\text{7}}\,{\text{rs/unit,}} \\ s & = {\text{5}}\,{\text{rs/unit}},\delta = {\text{0}}{\text{.8}},T = {\text{30}}\,{\text{days}} \\ \end{aligned}\)

By considering these values, we obtained (Fig. 3.2).

3.7 Sensitivity Analysis

Sensitive analysis is executed for the different parameters by assigning 15%, 10% and 5% decrease or an increase in each of the parameters keeping all other parameters unchanged. The variation in total average cost and critical time with the change in different parameters such as demand rate, deterioration rate, holding cost, backlogging rate and inflation rate is shown in Table 3.1.

3.8 Observations

-

1.

With the increase in the value of demand parameter beta, critical time and total average cost are decreased.

-

2.

As the coefficient of selling price gamma increases, critical time slightly decreases and total average cost slightly increases.

-

3.

With the increment in deterioration rate, the value of critical time decreases and total average cost quickly increases.

-

4.

On increasing the holding cost, critical time slightly decreases and total average cost decreases.

-

5.

When the value of backlogging rate is increasing, then critical time and total average cost slightly increase.

-

6.

When the value of inflation rate is increasing, then critical time and total average cost decrease.

3.9 Conclusion

In this article, the impact of inflation on production inventory model for deteriorating items has been introduced. This study contributes the idea of time- and price-sensitive demand which is a good strategy in today’s competitive businesses. Due to fluctuating demand, this demand policy is suitable to fulfil customer requirements. The model follows constant deterioration which is appropriate for high deteriorating units. The organization may only save inventory production cost by proper management of deteriorating items. In practical environment, considering inflation on cost is a good policy specifically for long-term investment and forecasting. For profitable business, including shortages and backlogging provides more practical results. With the help of numerical examples, total average cost of the system has been concluded. Convexity and sensitivity have been done to check the availability and stability of the model. This approach is appropriate to meet real-life problems. For future, researcher can further extend this model for different rates of deterioration, trade credit policy, two-warehouse and variable holding cost.

References

Chang H-C (2004) A note on the EPQ model with shortages and variable lead time. Inf Manag Sci 15(1):61–67

Handa N, Singh SR, Punetha N, Tayal S (2020) A trade credit policy in an EOQ model with stock sensitive demand and shortages for deteriorating items. Int J Serv Oper Inf 10(4):350–364

Hsieh TP, Dye CY (2013) A production- inventory model incorporating the effect of preservation technology investment when demand is fluctuating with time. J Comput Appl Math 239:25–36

Jain M, Sharma GC, Rathore S (2007) Economic production quantity model with shortages, price and stock-dependent demand for deteriorating items. Int J Eng Trans Basics 20(2):159–168

Khurana D, Tayal S, Singh SR (2018) An EPQ model for deteriorating items with variable demand rate and allowable shortages. Int J Math Oper Res 12(1):117–128

Kumar S, Handa N, Singh SR (2013) An inventory model for perishable items with partial backlogging under inflation. Int J Trends Comput Sci 2(11):551–565

Kumar S, Handa N, Singh SR, Singh D (2015) Production inventory model for low-level trade credit financing under the effect of preservation technology and learning in supply chain. Cogent Eng 2(1). https://doi.org/10.1080/23311916.2015.1045221

Majumder P, Bera UK, Maiti M (2015) An EPQ model of deteriorating items under partial trade credit financing and demand declining market in crisp and fuzzy environment. Procedia Comput Sci 45:780–789

Mishra U (2016) An EOQ model with time dependent weibull deterioration, quadratic demand and partial backlogging. Int J Appl Comput Math 2:545–563

Molamohamadi Z, Arshizadeh R, Tsmail N (2014) An EPQ inventory model with allowable shortages for deteriorating items under trade credit policy. Discrete Dyn Nat Soc 2014(6):1–10

Muniappan P, Uthayakumar R, Vanish S (2015) An EOQ model for deteriorating items with inflation and time value of money considering time- dependent deteriorating rate and delay payments. Syst Sci Control Eng 3:427–434

Panda GC, Khan MA-A, Shaikh A-A (2018) A credit policy approach in a two-warehouse inventory model for deteriorating items with price and stock- dependent demand under partial backlogging. J Ind Eng Int 15:147–170

Pervin M, Roy SK, Weber GW (2020) Deteriorating inventory with preservation technology under price and stock sensitive demand. J Ind Manage Optim 16(4):1585–1612

Priyan S, Uthayakumar R (2015) An EMQ inventory model for defective products involving rework and sales team’ s initiatives- dependent demand. J Ind Eng Int 11:517–529

Sarkar B, Moon I (2011) An EPQ model with inflation in an imperfect production system. Appl Math Comput 217(13):6159–6167

Shah NH, Naik MK (2018) Inventory model for non-instantaneous deterioration and price sensitive trended demand with learning effects. Int J Inventory Res 2(1):60–77

Sharma MK, Bansal KK (2017) Inventory model for non-instantaneous decaying items with learning effect under partial backlogging and inflation. Global J Pure Appl Math 13(6):1999–2008

Sharma S, Singh SR, Ram M (2015) An EPQ model for deteriorating items with price sensitive demand and shortages. Int J Oper Res 23(2):245–255

Singh D (2019) Production inventory model of deteriorating items with holding cost, stock and selling price with backlog. Int J Math Oper Res 14(2):290–306

Singh SR, Rana K (2020) Effect of inflation and variable holding cost on life time inventory model with multi variable demand and lost sales. Int J Recent Technol Eng 8(5):5513–5519

Singh SR, Sharma S (2016) A production reliable model for deteriorating products with random demand and inflation. Int J Syst Sci 4(4):330–338

Tiwari S, Daryanto Y, Wee H-M (2018) Sustainable inventory management with deteriorating and imperfect quality items considering carbon emission. J Cleaner Production 192:281–292

Wee HM, Wang WT (1999) A variable production scheduling policy for deteriorating items with time-varying demand. Comput Oper Res 26(3):237–254

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Handa, N., Singh, S.R., Punetha, N. (2021). Impact of Inflation on Production Inventory Model with Variable Demand and Shortages. In: Shah, N.H., Mittal, M., Cárdenas-Barrón, L.E. (eds) Decision Making in Inventory Management. Inventory Optimization. Springer, Singapore. https://doi.org/10.1007/978-981-16-1729-4_3

Download citation

DOI: https://doi.org/10.1007/978-981-16-1729-4_3

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-16-1728-7

Online ISBN: 978-981-16-1729-4

eBook Packages: Business and ManagementBusiness and Management (R0)