Abstract

What is the significance of abundant natural resources to the economic development of a country? In this study, we explain the effects of institutions on the economic growth patterns of resource-rich countries theoretically from a macrodynamic perspective by explicitly introducing a capital accumulation and institutions approach to the Big Push model. Our analysis results clarify that two natural-resource-owning countries implementing different institutions converge on two different steady states (high and low). Furthermore, we validate the relationship between the extent of natural resource endowment, the quality of institutions and economic growth using China’s provincial data. The results suggest that the resource curse is present in China’s provincial data; however, it is possible to convert natural resources from a curse to a grace by improving the quality of institutions.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

What is the significance of abundant natural resources to the economic development of a country? Ascher (1999) highlights that abundant natural resources are potentially useful for developing a country’s economy. This is because countries rich in natural resources such as oil and minerals can raise their growth potential by investing resource rents into the accumulation of physical and human capital.

However, the economies of developing countries that actually possess abundant natural resources have a tendency to fall into low growth and expanding poverty. In an analysis based on data from 95 developing countries, Sachs and Warner (1995) find that countries with high rates of natural resource exports in their GDPs have low economic growth rates. Ross (1999) shows that countries with high rates of mineral resource exports in their GDPs tend to have expanding poverty. The relationship between abundant natural resources and the slowdown of growth and the expansion of poverty was termed ‘resource curse’ in the late 1990s. The term resource curse has in recent years become synonymous with the economic decline that occurred since the development of natural resources such as minerals and oil began in Nigeria and sub-Saharan African countries.

However, this is not to say the resource curse phenomenon applies to all resource-endowed countries. Countries such as Botswana, Norway, Australia and Canada possess abundant natural resources while achieving high economic growth. In particular, the diamond industry in Botswana boasts the second-largest output in the world, accounting for approximately 20% of GDP and approximately 30% of government revenue, while the country’s average economic growth rate is approximately 9% over the past 30 years, one of the highest rates of economic growth in the world. Thus, why do differences occur in the economic growth patterns of countries with abundant natural resources? In this study, we explain the reason theoretically from a macrodynamic viewpoint and verify this using China’s provincial data.

Many researchers debate the hypotheses surrounding the paradox of possessing abundant natural resources and economic development. There are broadly two theory systems that prove that levels of output decline in resource-rich countries. One is Dutch disease theory developed by Sachs and Warner (1999) and Gylfason et al. (1999). Dutch disease theory intends to provide a theoretical explanation that a resource boom has the effect of reducing production in the industrial sector, further reducing economic growth. Sachs and Warner (1999) explain the characteristic that countries, believing industrialisation based on abundant natural resources to be possible, conversely experience delayed industrialisation using the Big Push model advocated by Murphy et al. (1989). The model is a one-factor model with natural resources, two industrial sectors that can change from constant-yield technology to increasing-yield technology and labour. The Dush disease theory clarifies that the continuous expansion of the resource sector reduces labour input into the industrial sector, resulting in the failure of technology to change and so delaying industrialisation. Gylfason et al. (1999) analyse the effects of abundant resource endowments on production levels, assuming that learning effects from experience occur only in the industrial sector. Their results show that increases in supply capacity through the discovery and development of resources diminish the industrial sector, but the stagnation of industry, which has large external effects on other industries, reduces the production level.

Another theory that explains the phenomenon of the negative effects of abundant natural resource endowments on economic development is rent-seeking theory proposed by Torvik (2002).Footnote 1 Rent-seeking theory seeks to explain theoretically that the reason an economy with abundant natural resources is inefficient is due to the opportunity costs created by the improper allocation of resources by the government and the pursuit of resource rent. Torvik (2002) argues that the possession of abundant natural resources reduces levels of production and welfare. To show this, his analysis relies on the Big Push model, in which the industrial sector uses constant and increasing-yield technologies. He shows that, because income from rent-seeking activities in resource-rich countries is high, economic actors do not adopt yield-increasing technologies and instead carry out rent-seeking activities, and consequently, production and welfare levels deteriorate.

In both of the above studies, the possession of abundant natural resources leads to a decrease in the level of production and a deterioration in welfare. However, this phenomenon does not apply to resource-rich countries like Botswana, Canada and so on. Acemoglu et al. (2003) indicate that the difference in the patterns of economic development in resource-rich countries is due to the differing institutions. Robinson et al. (2006) focus on the relationship between institutions and the resource curse. They define a ‘good institution’ as an environment of institutions with a high-quality bureaucracy and low corruption surrounding the allocation of natural resources, and show that abundant natural resources will lead to increased national income with good institutions, but will cause national income to fall with bad institutions.

Mehlum et al. (2006) introduce the concept of rent-seeking to the Big Push model and analyse the effects of institutions on the resource curse phenomenon. They construct a model that allows economic agents to choose between rent-seeking activities for resource rents or to adopt yield-increasing technologies. In addition, Mehlum et al. (2006) define institutions by the extent to which they prevent rent-seeking. The analysis results show that under institutions with a low degree of rent-seeking prevention, there is a non-productive equilibrium (agents perform rent-seeking activities), while under institutions with a high degree of rent-seeking prevention, there is a productive equilibrium (agents do not perform rent-seeking activities). Furthermore, Mehlum et al. (2006) also present a discussion of the relationship between good institutions and abundant resource endowments. They take the view that achieving a productive equilibrium requires institutions in which the degree of rent-seeking prevention increases with the abundance of natural resources.Footnote 2

In this way, existing theoretical studies show that the implementation of good institutions enables economies with natural resources to avoid the resource curse. However, the static context of the above literature does not discuss the relationship between abundant natural resource endowments, institutions and economic growth from a long-term perspective.

In this study, we therefore create a dynamic model that can reveal the characteristics by which resource-rich countries follow different growth paths by implementing different institutions. We define institutions by the extent to which they prevent rent-seeking in the model. Specifically, by explicitly introducing a capital accumulation and institutions approach to the Big Push model, we explain the effects of institutions on the economic growth patterns of resource-rich countries theoretically from a macrodynamic perspective and validate it using Chinese province-level panel data. Our analysis results clarify that two natural-resource-owning countries implementing different institutions converge on two different steady states (high and low). In the data analysis, we obtain the empirical result that China has a resource curse, but that by improving the quality of institutions, the government can convert these abundant natural resources from a curse to a grace.

The rest of this chapter proceeds as follows. Section 4.2 establishes the model, while Sect 4.3 considers the economic equilibrium. Then, Sect. 4.4 investigates the relationship between resource ownership, institutions and economic growth using province-level data in China. Lastly, Sect. 4.5 discusses the conclusions and future research topics.

2 Setup of the Model

We perform the analysis using a generational overlap model in which households live for two periods (young and old). Actors born in period t are termed the tth generation. We assume that each generation consists of unskilled and skilled workers, which we can express respectively using a continuous index from 0 to 1. Unskilled workers own only one unit of labour in their young period, and supply it inelastically to intermediate goods companies to obtain wages. Skilled workers have one unit of time in their young period, and may choose to use this for rent-seeking activities for resource rents or for innovation activities. We refer to skilled workers who carry out rent-seeking for resource rents grabbers and those who perform innovation as entrepreneurs. In addition, the economy consists of a resources sector, a production sector and households.

2.1 The Resources Sector

In the resources sector, we assume that only resource rent R is generated in each period. Resource rent R represents the amount of finished goods that can be procured from the international market from the export of resources. The costs of extracting and processing natural resources are abstracted to simplify the discussion. In addition, skilled workers have the opportunity to perform rent-seeking for resource rents, and the results depend on the institutions. In line with Mehlum et al. (2006), we define institutions by the extent to which they prevent rent-seeking. Expressing the quality of institutions as parameter v ∈ (0, 1), v expresses the share of rents acquired by entrepreneurs against the resource rents obtained by grabbers. Therefore, where v is small, the degree of rent-seeking prevention is low, meaning that institutions are friendly towards grabbers. Conversely, where v is large, the degree of rent-seeking prevention is high, meaning that institutions are friendly towards entrepreneurs. Resource rents obtained by entrepreneurs and grabbers are formulated thus:

where \( {\pi}_t^g \) and \( {\pi}_t^e \) are the resource rents obtained by the grabbers and entrepreneurs, respectively. s represents the share of resource rents obtained per grabber. In addition, since the sum of the resource rents obtained by grabbers and entrepreneurs is s, we establish the following equation,

where nt expresses the entrepreneurs’ share and 1 − nt the grabbers’ share. Solving Eq. (4.3) for s, s is given by the following equation,

where, because \( \frac{\mathrm{d}s\left({n}_t\right.,\left.v\right)}{\mathrm{d}{n}_t}=\frac{1-v}{\left(1\right.{\left.-{n}_t+{vn}_t\right)}^2}>0 \) and \( \frac{\mathrm{d}s\left({n}_t,v\right)}{\mathrm{d}v}=\frac{-{n}_t}{{\left(1-{n}_t+{vn}_t\right)}^2}<0 \) are established, s(nt, v) increases as nt increases and decreases as v increases.

2.2 The Manufacturing Sector

The economy has only one finished good of homogenous quality, and various types of intermediate goods. Finished goods are numéraire goods. We assume that intermediate goods can be expressed on a continuous index from 0 to 1. Moreover, we assume that the total number of intermediate goods types is constant.

2.2.1 Production of Finished Goods

The finished goods market is perfectly competitive, and firms continuously inject intermediate goods in the range [0,1] to produce goods. The production function for finished goods is

However, Yt and Xt(i) express the quantity of finished goods produced and the amount of intermediate goods t input in period i, respectively. Finished goods companies determine the amount of intermediate goods input Xt(i)(i ∈ [0, 1]) to maximise profits, taking the price of intermediate goods pt(i)(i ∈ [0, 1]) as given. Thus, the conditional factor demand function for intermediate goods i is

The cost function for finished goods companies is therefore \( \frac{\exp \left[{\int}_0^1\log {p}_t(i)\mathrm{d}i\right]}{p_t(i)}{Y}_t \). Furthermore, since the market for finished goods is perfectly competitive, in equilibrium, the marginal cost for finished goods companies is equal to the price of finished goods.

From Eqs. (4.6) to (4.7), the equation for finished goods’ companies demand for intermediate goods i is

2.2.2 Intermediate Goods Production and Innovation

Each intermediate good is produced by investing labour and capital. Where innovation does not occur, all companies will produce goods using traditional Cobb-Douglas technology. Where skilled workers choose to become entrepreneurs and carry out innovation in one industry, the cost of production in their chosen industry decreases. However, only goods-producing companies established by entrepreneurs carrying out innovation can use that technology.

Where using traditional technology to produce goods, the cost function isFootnote 3

where rt is the rent price of capital and wt is the wage rate. α is a parameter taken as 0 < α < 1. A(i) shows the technology level in the intermediate goods i industry, and we assume that it is constant over time. Under Cobb-Douglas technology, companies’ profits are zero in equilibrium, so the price of intermediate goods i is

On the other hand, we assume that innovation occurs via fixed investment F(F > 0) only. Where innovation occurs in the production of intermediate goods i in period t, we assume that the ratio 1 − μ reduces the cost to produce one unit of goods. Here, μ is the parameter taken as 0 < μ < 1. Therefore, when a given entrepreneur engages in innovation in period t for the production of intermediate goods i, the cost function is

Due to Bertrand competition, intermediate goods i companies that innovated set a price of \( A(i){r}_t^{\alpha }{w}_t^{1-\alpha } \). Therefore, we express the profit of intermediate goods i companies that innovated using the following equation,

To simplify the discussion below, we assume that the technology level is the same in all intermediate goods industries under traditional technology. In other words, we assume A(i) = A. Therefore, for any arbitrary i, we assume \( {p}_t(i)={Ar}_t^{\alpha }{w}_t^{1-\alpha } \). Substituting this into Eq. (4.7) gives the following equation.

Substituting Eq. (4.13) into the intermediate goods demand function Eq. (4.8), the quantity of intermediate goods i produced is given as follows:

Substituting Eqs. (4.13)–(4.14) into Eq. (4.12) and rearranging the terms, the profit of companies that innovated manufacturing intermediate goods i is

Below, we will consider the factor demand for each intermediate goods company. From the cost function in Eq. (4.9), and using Shepherd’s lemma, the demand for the capital and labour of companies using traditional technologies is, respectively,

Similarly, the factor demand for capital and labour from companies that innovated is, respectively,

Due to Bertrand competition, entrepreneurs are able to innovate in different industries. Consequently, the number of companies that innovate in period t is equal to the number of entrepreneurs involved in innovation nt. Therefore, where the share of skilled workers nt becomes entrepreneurs, from Eqs. (4.16) and (4.18) to Eqs. (4.17) and (4.19), the equilibrium supply and demand conditions for capital and labour are as follows, respectively.

From Eqs. (4.20) to (4.21), we establish the following equation.

Furthermore, using Eqs. (4.10) and (4.22), we determine the rent prices of capital and labour as follows.

Therefore, capital income and wage income become \( \alpha {K}_t^{\alpha } \) and \( \left(1-\alpha \right){K}_t^{\alpha } \) respectively. Since income Yt in the manufacturing sector is allocated to capital income, labour income and profit, where the share of the intermediate goods sector performing innovation is nt, the total output satisfies the following equation.

Solving Eq. (4.25) for Yt, we obtain the following for the total output Yt.

By substituting Eq. (4.26) into Eq. (4.15), the profit of innovating companies is given by the following equation.

2.3 The Household Sector

The tth generation households j(j = l, g, p) have the following utility function.Footnote 4

where \( {u}_t^j \) is the utility of household j in generation t, \( {C}_t^j \) is consumption in the youth period and \( {C}_{t+1}^j \) is consumption in the old age period. ρ is the time preference rate. The tth generation households allocate young period income to consumption and savings \( {S}_t^j \), and turn total savings and interest into consumption in their old age period. Expressing the income of the tth generation households in their young period as \( {I}_t^j \), the budget constraint facing tth generation households in their young and old age periods is, respectively,

Eliminating \( {S}_t^j \) from Eqs. (4.29) to (4.30), the lifetime budget constraint of tth generation households is

where l expresses labourers, g grabbers and e entrepreneurs. The tth generation households maximise their utilities in Eq. (4.28) based on Eq. (4.31). Thus, the consumption and savings functions of the t generation households are

3 Equilibrium Analysis

3.1 The Selection of Skilled Workers in Equilibrium

Taking capital stock as given, skilled workers decide whether to rent-seek or to innovate by comparing the income earned as a grabber \( {\pi}_t^g \) to income earned as an entrepreneur \( \left({\pi}_t^p+{\pi}_t(i)\right) \). Below, we will consider that the decisions of skilled workers depend on capital stock. In equilibrium, the following equation is established,

The first term on the left side of Eq. (4.33) is the profit obtained by entrepreneurs through innovation, while term 2 is the resource rent obtained by entrepreneurs. The right-hand side represents the resource rent obtained by grabbers through rent-seeking. Substituting Eq. (4.4) into (4.33) and solving for nt, the share of skilled workers choosing to live as entrepreneurs, namely the ratio of intermediate goods companies that perform innovation nt, is

When all industries use traditional technology, namely when the capital stock in nt = 0 is KR, we can express KR using the following equation.

In addition, when innovation occurs in all industries, namely when capital stock in nt = 1 is KI, we obtain KI as follows.

In order to proceed with the discussion below, we make the following assumptions.

Assumption

The parameter satisfies 1 − v > μ.

Based on this assumption, capital stock when innovation occurs in all industries, KI, is greater than capital stock when all industries use traditional technology, KR. Furthermore, differentiating nt with respect to Kt yields the following equation.

where Kt > KR, \( \frac{\mathrm{d}{n}_t}{\mathrm{d}{K}_t}>0 \) can be confirmed from the above assumption.Footnote 5 In other words, the share of entrepreneurs among skilled workers nt increases as capital stock increases. As capital stock increases, the profit obtained from carrying out innovation increases, making innovation attractive to skilled workers. Thus, the number of skilled workers choosing to live as entrepreneurs increases, and the range of industries in which innovation occurs expands. Therefore, when Kt > KR, some workers choose to live as entrepreneurs, and an equilibrium in which innovation occurs is achieved.Footnote 6

In addition, since \( \frac{\mathrm{d}{K}^R}{\mathrm{d}R}={\left(\frac{1}{\mu}\right)}^{\frac{1}{\alpha }}\left(1-v\right)\frac{1}{\alpha }{\left[\left(1-v\right)R+F\right]}^{1/\alpha -1}>0 \) is established, KR increases as R increases. An increase in the size of the resource endowment means that resource rents obtained by rent-seeking become comparatively larger, and profits obtained from innovation become comparatively smaller. Consequently, the number of skilled workers choosing to live as grabbers increases, and the number of skilled workers choosing to live as entrepreneurs decreases. Therefore, the abundance of natural resources is a curse in the sense that it diminishes the range of industries in which innovation occurs.

We can summarise the results of analysis thus far in the following proposition (Fig. 4.1 illustrates the contents of Proposition 4.1).

Proposition 4.1.

Given Kt ≤ KR, all skilled workers choose to live as grabbers. When Kt≥KI, all skilled workers choose to live as entrepreneurs. When KR < Kt < KI, entrepreneurs and grabbers coexist.

3.2 Dynamic Equilibrium

We assume that the investment of technology into capital goods can convert one unit of finished goods into one unit of capital goods. In addition, the capital depletion rate is assumed to be 1. Therefore, in capital market equilibrium, households’ total savings St matches the capital stock in the next period, Kt + 1. From Eq. (4.32), the total savings among household agents is as follows.

where \( {I}_t^l \) is workers’ income, and workers’ income in manufacturing corresponds to \( \left(1-\alpha \right){K}_t^{\alpha } \). \( {I}_t^g+{I}_t^e \) is the sum of grabber and entrepreneurs’ income, and corresponds to the total income of intermediate goods companies carrying out resource rents and innovation. Therefore, we establish the following equation.

Furthermore, from Proposition 4.1 and Eqs. (4.34) and (4.39), we can express the change in capital stock under equilibrium by the following dynamic equation.

Below, we compare the dynamic equilibrium in which firms use traditional technology and perform innovation. We first consider the growth path when traditional techniques continue to be used. Substituting Kt + 1 = Kt into the dynamic equilibrium, where Kt ≤ KR in Eq. (4.40) obtains the capital stock \( {\underline{K}}^S \) under the equilibrium in which traditional technology is used. We illustrate this outcome in Fig. 4.2. Therefore, when traditional technologies are used, capital stock converges uniformly towards the steady-state value \( K{}_{t+1}=\frac{\rho }{1+\rho}\left[\left(1-\alpha \right){K}_t^{\alpha }+R\right] \) according to the dynamic equation \( {\underline{K}}^S \). At this time, innovation does not take place, and the economy is unable to transition to a higher steady state. Therefore, innovation must be performed at some point before \( {\underline{K}}^S \) in order to shift the economy to a higher steady state.

From Eq. (4.35) and Fig. 4.2, it is understood that while \( {\underline{K}}^S \) is independent of v, KR decreases as v increases. Assuming v to be v∗, which establishes \( {\underline{K}}^S={K}^R \), there are two patterns in which the economy converges to either a low steady state or a high steady state due to the size relation between v and v∗. Figure 4.3 shows these two patterns of economic growth. We can summarise the results of the analysis above in Proposition 4.2.

Proposition 4.2.

Consider two economies that begin with a sufficiently small capital stock,K0. However, the two economies have different institutions. At this time, in the economy that implements institutions such that v < v∗, innovation is not performed in the intermediate goods industries, and the economy converges to the low steady state. On the other hand, in the economy that implements institutions such that v ≥ v∗, innovation is performed and the economy converges to the high steady state.

4 Data Analysis

In this section, we examine the relationship between the size of resource endowment, the quality of institutions and economic growth using China’s provincial data. Speaking from the conclusion, from the China’s provincial data the resource curse is present. However, the economy can escape the resource curse by implementing good institutions.

4.1 Estimate Equation

where the subscript i expresses the province, autonomous region or direct-administered municipality, and t the time period. C is a constant term. In addition, EG, R, INVE, EDU, OPEN and U represent the economic growth rate, extent of natural resource endowment, investment rate, education level, degree of openness and quality of institutions, respectively. As in Sachs and Warner (1999) and James and Adland (2011), we use the share of the natural resource extraction industry against total industrial production as a proxy variable for the extent of resource endowment RQ. Furthermore, we evaluate the quality of institutions U using three indicators: the degree of product market development, the degree of development of the factor market and the legal environment. When the supply and price of a product are determined by the market without interference from local government or protection and better products are being constantly introduced, the degree of development of the product market is high. On the other hand, when the financial and labour markets are more competitive and the ability to put new technology into practical use is high, the degree of development of the factor market is high.

4.2 Data Source, Variable Description and Statistics

Considering the lack of data on the quality of institutions in the Tibet Autonomous Region, we analyse 30 provinces, autonomous regions and directly administered cities in mainland China between 1998 and 2014. We use data from the Chinese Statistical Yearbook for all variables (Table 4.1).

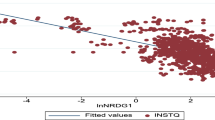

4.3 Estimation Results

Table 4.2 presents the estimation results, and there are three points to note. First, in the analysis using models 1–6, the coefficients for the extent of natural resource endowment QR are all negative and significant. This result shows that there is clearly a resource curse in the China’s provincial data. Second, the three proxy variables for the quality of institutions, MS, MF and LA, are all negative. In other words, the low marketisation of the manufacturing factor market and product market, together with the weak rule of law, lowers the economic growth rate. Third, the coefficients of the cross terms for the quality of institutions and the extent of natural resource endowment are 0.0212, 0.0156 and 0.0337 in the model 5, respectively. This result suggests that by improving the quality of institutions, abundant natural resources can be converted from a curse to a benefit. Therefore, the following policies are effective in increasing economic growth in regions rich in natural resources. The first is to ensure that the rule of law functions adequately while suppressing rent-seeking. Next is for the government to greatly reduce the direct allocation of the factors of production, and to promote their allocation based on market rules, market prices and market competition. Furthermore, high-pressure sales and fraud should be eliminated, and high-quality markets developed where good products are traded for fair prices and better products are constantly being introduced.

5 Concluding Remarks

Existing literature on the ownership of abundant natural resources and institutions is limited to static analysis. Contrary to these prior studies, in this study, we perform dynamic adjustment and present policy implications to promote economic growth in resource-rich countries. We analysed the effects of institutions as a means of preventing rent-seeking on the economic development of resource-rich countries using a Big Push model incorporating the rent-seeking activities of economic actors. The results show that economies follow different economic growth paths under different institutions. Under institutions with a high degree of rent-seeking prevention, some skilled workers choose to live as entrepreneurs who carry out innovation in the intermediate goods sector and the economy converges to the high steady state. On the other hand, under institutions with a low degree of rent-seeking prevention, no skilled workers choose to live as entrepreneurs and the intermediate goods sector uses traditional technologies, and the economy converges to the low steady state.

Furthermore, we validate the relationship between the extent of natural resource endowment, the quality of institutions and economic growth using China’s provincial data. The results suggest that the resource curse is present in China’s provincial data; however, it is possible to convert natural resources from a curse to a grace by improving the quality of institutions.

The conclusion relating to the interdependence of owning abundant natural resources, institutions and economic growth obtained from macrodynamic perspectives and empirical analysis suggests the importance of implementing good institutions when choosing development strategies for developing countries possessing abundant natural resources.

We suggest the following as topics for the future. The theoretical framework in this study treats institutions as exogenous. However, North (1990) views institutions as rules that govern the behaviours of economic agents, and points out that these not only affect economic performance, but are also subject to the effects of economic performance. There is therefore a need to present a theoretical model for the endogeneity of institutions.

Notes

- 1.

Rent-seeking is an action in which an economic agent acts to change their working environment to their own benefit at the expense of others by working with governments and bureaucrats. Resource rents in this case refer to the excess profit remaining after subtracting the cost of extraction and processing from the final price of the natural resource.

- 2.

- 3.

In the rest of this paper, we will use cost functions to express production technology.

- 4.

In this chapter, the subscript l expresses laborers, g grabbers and e entrepreneurs.

- 5.

From Eq. (4.37), we establish \( \frac{{\mathrm{d}}^2{n}_t}{\mathrm{d}{K}_t^2}=\alpha \mu {K}_t^{\alpha -1}\left(1-v-\mu \right)R\left(1-v\right)\left(\mu {K}_t^{\alpha }-F-\mu R\right)\cdot \frac{\left(1-\alpha \right)\left(F+\mu R\right)-\left(\mu +\alpha \right){K}_t^{\alpha }}{K_t} \), where \( {K}_t>{\left[\frac{\left(1-\alpha \right)\left(F+\mu R\right)}{\mu +\alpha}\right]}^{1/\alpha } \) and we establish \( \frac{{\mathrm{d}}^2{n}_t}{\mathrm{d}{K}_t^2}<0 \). Under assumption 1 − v > μ, this becomes \( {\left[\frac{\left(1-\alpha \right)\left(F+\mu R\right)}{\mu +\alpha}\right]}^{1/\alpha }<{K}^R \). Therefore, where Kt > KR, nt is positive with respect to Kt but diminishing.

- 6.

\( \mu {K}_t^{\alpha }<F \), namely, when \( {K}_t<{\left(\frac{F}{\mu}\right)}^{1/\alpha } \), the profit when carrying out innovation becomes negative, and income decreases. From 0 < v < 1, we can confirm that \( {\left(\frac{F}{\mu}\right)}^{1/\alpha }<{K}^R \).

References

Acemoglu D, Johnson S, Robinson JA (2003) An African success: Botswana. In: Rodrik D (ed) In search of prosperity: analytic narratives on economic growth. Princeton University Press, Princeton, pp 145–172

Ascher W (1999) Why governments waste natural resources: policy failures in developing countries. The Johns Hopkins University Press, Baltimore

Gylfason T, Herbertson TT, Zoega G (1999) A mixed blessing: natural resources and economic growth. Macroecon Dyn 3:204–225

James A, Aadland DD (2011) The curse of natural resources: an empirical investigation of US counties. Resour Energy Econ 33:440–453

Kolstad I (2009) The resource curse: which institutions matter? Appl Econ Lett 16:439–442

Mehlum H, Moene K, Torvik R (2006) Institutions and the resource curse. Econ J 116:1–20

Murphy K, Shleifer A, Vishny R (1989) Industrialization and the Big Push. J Polit Econ 97:1003–1026

North DC (1990) Institutions, institutional change and economic performance. Cambridge University Press, Cambridge

Robinson JA, Torvik R, Verdier T (2006) Political foundations of the resource curse. J Dev Econ 79:447–468

Ross M (1999) The political economy of resource curse. World Polit 51:297–322

Sachs JD, Warner AM (1995) Natural resource abundance and economic growth. NBER working paper series, vol 5398, pp 399–420

Sachs JD, Warner AM (1999) The Big Push, natural resource booms and growth. J Dev Econ 59:43–76

Torvik R (2002) Natural resources, rent seeking and welfare. J Dev Econ. 67:455–470

Wang XL, Fan G, Yu JW (2016) Marketization index of China’s province: Neri report 2016. Social Sciences Academic Press, Beijing

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Jinghong, G. (2021). Abundant Resource Endowments, Institutions and Economic Growth: A Theoretical Framework and Validation Using China’s Provincial Data. In: Ikeshita, K., Ikazaki, D. (eds) Globalization, Population, and Regional Growth in the Knowledge-Based Economy. New Frontiers in Regional Science: Asian Perspectives, vol 43. Springer, Singapore. https://doi.org/10.1007/978-981-16-0885-8_4

Download citation

DOI: https://doi.org/10.1007/978-981-16-0885-8_4

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-16-0884-1

Online ISBN: 978-981-16-0885-8

eBook Packages: Economics and FinanceEconomics and Finance (R0)