Abstract

The phenomenon of production and consumption of commodities and services is at the centre stage of economic theory and policy. However, it is now well known that any production process will have a bio-physical foundation, and the entropy law will have a role to play in economic processes. Consequently, sustained economic growth will require a continued support of the ecosystem for the economy by way of resource supply and waste absorption. Characterizing sustainability as a process of non-declining inter-temporal well-being of a society, the paper first expands the Leontief input–output model to incorporate the environment as a sector of resource extraction and waste disposal, in addition to the usual sectors of industrial production. Secondly, it factors in the ecological processes of resource regeneration and waste absorption by the ecosystem explicitly into the dynamic version of the Leontief model of multi-sectoral growth. This is helpful for deriving the sustainability condition of economic growth, by recognizing the economy–ecosystem interactive linkages. Since sustainability is conceptualized as a monotonic behaviour of some well-being index, which has as its basis the satisfaction derived by households from consumption, the paper further builds on Leontief’s model of inter-industrial interdependence, with a view towards developing an index of well-being, as an alternative to that of per capita GDP. It offers a new approach to modelling an economy, with the objective of optimizing the use of a production system with inter-sectoral interdependence for attaining a level of human satisfaction at the societal level, without any requirement for monetary evaluation of satisfaction conceived at an abstract level. In this context, the paper shows how the essence of Leontief’s notion of interdependence can be extended not only to the ecosystem–economy interactive interface, but also to the analysis of the level, composition and distribution of consumption for delivering social well-being as an output of such consumption.

Keynote Paper in the 19th National Conference of the Input–Output Research Association of India held at Pune, January 2017.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

- Input–Output models

- Leontief interdependence

- Environment and natural resources

- Sustainable development

- Ecological economics

JEL Code

- C67 (Input–output models)

- O13 (Natural resource and environment under economic development)

- Q56 (Environment and development: sustainability)

- Q57 (Ecological economics)

1 Introduction

Leontief’s model of input–output analysis, which is based on his model of production, essentially shows how inter-sectoral interdependence determines the structural features of an economy, the sectoral composition of its production, the generation of income, the pattern of inputs—primary or intermediate—and their final uses. The final users comprise households, government, the business sector and the rest of the world. Input–output analysis has provided an immensely powerful tool of analysis of the behaviour of an aggregate economy in a multi-sectoral framework. It has contributed immensely to our understanding of an economy in multiple ways, ranging from macroeconomic accounting, with its linkages to sectoral accounting, to both macroeconomic and sectoral planning, and policy analysis. Its versatile potential applications have covered almost all sectoral issues in agriculture, industry and services, including power and energy, transport and other infrastructure (irrigation), natural resources, environmental protection and climate change through pollution abatement. As sectoral interdependences must be recognized when deriving implications for planning and policies in any of these areas, the input–output literature has been dominant in the arena of methodology of planning and policies for over six decades. The removal of poverty, redistribution, the inflow and dependence of foreign capital, and many other issues from disparate areas have also often required, directly or indirectly, the incorporation of inter-sectoral interdependences for a full assessment of the economy-wide implications of any specific planning or policy measures.

The recent focus on sustainable development and the notion of human well-being has attracted the attention of not only economists, but also other natural and social scientists, who have explored how the Leontief-type relations of interdependence could be used to analyse such issues by appropriate extension or restructuring of the basic model in an interdisciplinary context.

This paper shows how Leontief’s notion of interdependence can be extended to the ecosystem–economy interactive interface, as well as to the analysis of the level, composition and distribution of consumption for delivering the output of social well-being out of such consumption.

2 The Ecosystem and the Economy: The Entropy Law, Limitationalism and Issues of Sustainable Development

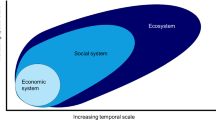

In the conventional Leontief-based input–output model, the interdependence analysis was confined to the boundaries of economic sectors of production and use. However, this missed a very important aspect of interdependence between the economy and natural ecosystems, which lay outside the boundary of the economy. Indeed, it is now well known and recognized that there exists a bio-physical foundation of production, which points to the interactive relationship between the natural ecosystem and the human economy (Ayres 1978). There are two-way flows of materials and resources from the natural ecosystem to the economy and a return flow of used resources in the form of compounds of wastes from the economy to nature. As pointed out by Georgescu-Roegen, Daly and others, the operation of the law of entropyFootnote 1 in economic processes and the bio-geochemical cycles of the earth drive these flows and regenerate resources to the extent permitted by the regenerative power of the ecosystem concerned and the laws of material balance, especially the law of conservation of matter and energy (Georgescu-Roegen 1971; Daly 1973; Ayres 1978; Daly and Farley 2004; Sengupta 2013). These considerations raise the issue of sustainability of resource supply from the ecosystem, on the one hand, and the capacity limit of absorption of waste by nature, on the other. However, the waste arising from the economic system, if not degraded by the ecosystem, accumulates in our ecosystem as non-degraded waste or pollution, which is a source of negative externalities that cause damage to human health, as well as to that of the ecosystem; what is more, the damage to the ecosystem is, in turn, either directly or indirectly harmful to human well-being. These developments partly offset the well-being that humans derive from the material consumption of the products of the economic system. The phenomenon of scarcity of eco-services of resource supply and that of waste absorption have led to the issue of sustainable development. Development is held to be “sustainable” if the size of an economy and its pace of growth do not disrupt the equilibrium of the ecosystem’s functioning or produce any consequent inequity in the distribution of benefits from the use of the limited resources.

Nevertheless, developments in science and technology have provided ways of conserving resources, as well as abating pollution, so as to facilitate the support of the eco-services of nature for economies. Even so, such conservation and abatement efforts involve costs and require part of the resources to be used for such purposes. This calls for an integrated environment–economy analysis so that the problem of allocation of resources recognizes both the cost and the benefit of conservation of scarce natural resources as well as those of abatement of pollution. These considerations obviously require appropriate extension or alteration of the conventional input–output model, to take care of the requirements of an integrated analysis.

Neoclassical economics has suggested introducing the environment as an economic sector. It is, however, not the ecosystem as such that has been reoriented to define an environmental sector. What has been done is that two types of activities, in particular, resource extraction and waste disposal, have been characterized as the activities of the environmental sector (Leontief 1970; Perman et al. 1999; Sengupta 2013). The input–output flows that would be involved in such activities would characterize the additional columns and rows of the input–output table of such an extended model, yet this would represent a somewhat trivial extension of the linear model of Leontief in the activity analysis framework. Indeed, the proper incorporation of the ecosystem–economy interaction would further require the incorporation of some module describing the resource-regenerative function and waste degradation functions of nature and their interface with the environmental sector of an economy-wide input–output model, with sectors comprising the resource extraction and waste disposal activities of an economy. These two functions of the ecosystem operate over time as a dynamic process, which delivers the eco-services needed by an economy. Both the dynamics of resource growth in an economy and the degradation of wastes in the sink of the ecosystem would depend on a complex of interactive dynamic flows driven by the solar energy, bio-geochemical cycles, weather and climate system of our natural environment. Unlike economic production activities, these vital activities or functions of ecosystem supporting economy are not immediately amenable to any input–output representation with linear (fixed coefficient) structure. These can be factored into the economy-environment model of integration, by incorporating them in the concerned dynamic equations of growth of resource stocks or degradation of stock of pollution which would very likely involve nonlinearity.

The issue of the sustainability of economic development or growth can, in fact, be analysed in a dynamic version of Leontief’s multi-sectoral input–output model (Dorfman et al. 1958; Chakravarty 1971). The model does need to factor in the interdisciplinary issue of resource regeneration and waste degradation as a subsystem of the equations. We present below a dynamic model of resource use for sustainability developed for this purpose, extending the framework of Leontief’s dynamic input–output model. The model characterizes the sustainability of dynamic resource use as one that requires utilization of man-made capital and other natural capital of the ecosystem over time, so that the value of the total inter-temporal well-being yielded by the economic process does not decline over time. It will, in fact, be shown to imply that the environmentally adjusted saving or investment, after taking into account the depreciation of the value of natural capital stocks in addition to those of man-made capita due to their depletion or degradation, should be non-negative over the entire time trajectory of development (Dasgupta 2001; Dasgupta and Mäler 2000). Such measure of genuine savings provides an alternative indicator of sustainability, based on the integration of environmental resource costs with the benefits of economic growth.

3 Extension of the Dynamic Leontief Model for Sustainable Resource Use

Here we extend the dynamic Leontief model to incorporate the development and extraction of natural resources and the disposal into the sink of nature of the wastes arising from the entropic use of those resources. This is achieved by adding new sectors and activities to the analysis. The two-way interaction between the ecosystem and economy, in terms of the flow of virgin natural resources, as regenerated by the ecosystem and flowing to the economy to supply various natural resources and eco-service inputs, and the return flow of wastes from the economy to the sink of nature for their absorption, is the basis for extending the scope of the Leontief modelling framework. It is not only conventional industrial activities but also agriculture, livestock raising, forestry, aquaculture and fishery development that require eco-services because these are essentially products of photosynthetic activities of nature, as aided by human energy, science and technology. Besides, the solar energy flows through the food chain as well as through the atmospheric system of our planet. The bio-geochemical cycles as driven by these flows degrade the degenerated material compounds called wastes and facilitate their absorption into the environment and ecosystem of the planet.

Production activities require as inputs the eco-service of waste absorption that arises at different stages of the life cycle of the resource product chain. Furthermore, since the ecosystem has an upper bound on its capacity to provide such eco-services of supply of natural resources and waste absorption per unit of time, it is the bio-physical foundation of production and the finiteness of our planet that ultimately pose the challenge of sustainability of economic growth and expansion of the human economic system. In order to encompass sustainability, the Leontief-type dynamic model structure needs to incorporate relevant ecological functions and stock dynamic equations, as we describe in the model presented below (Dorfman et al. 1958; Chakravarty 1971; Perman et al. 1999).

In the extended input–output framework for sustainable development analysis, we can classify the input flows into the following categories:

-

i.

Intermediate inputs of produced goods and services. These would include the extracted or harvested natural resources that are ready for use for conversion into products.Footnote 2

-

ii.

Primary inputs of labour and capital, where capital includes goods produced in earlier periods for use as means of production, including fixed capital and circulating or inventory capital. Labour can also be conceived as human capital owing to skill and capability acquired through spending on education and health.

-

iii.

Natural resources in place or as geo-resources as primary resourceFootnote 3 for the economic or human system in any given period, but generated only by the functioning of the ecosystem which has only been mapped as information and therefore been given as primary input for the economic system.

-

iv.

Environmental services of abatement or disposal of waste or pollution.

The producing sectors of the economy can be classified into the following categories:

-

(a)

Environmental sectors of development and extraction of natural resources, e.g. coal, oil and minerals. It is the products of these resources that are used by other sectors as intermediate inputs. Such products are distinct from the natural resources of coal, oil or minerals, which represent geological reserves made available by nature through their generation via a geological process.

-

(b)

Environmental protection activities, including safe disposal or abatement of wastes, so that no economic agent or the ecosystem suffers from negative externalities owing to damage to human health or to that of the ecosystem. It may be noted here that the degradation of wastes by the ecosystem is a natural process carried out by the laws of functioning of the ecosystem.

-

(c)

Other industrial or non-industrial production activities (including so-called primary producing sector or service activities).

Let \( \varvec{A}_{{\mathbf{1}}} \) be the inter-sectoral intermediate coefficient matrix for non-environmental goods and services by the non-environmental goods and services producing sector and \( \varvec{A}_{{\mathbf{2}}} \) be the corresponding matrix for the waste disposal sector for environmental protection. Note that a subscript 1 denotes a non-environmental sector, whereas a subscript 2 denotes an environmental sector. Let X be the level of production or activity of the industrial sectors other than the environmental one, and let Z be the level of production or activity of the waste abatement or disposal sectors. However, we integrate the activities of non-environmental sector group (c) and those of environmental protection activities of group (b) separately and vertically with those of group (a) so that the shares of input requirements of natural resource development and extraction, i.e. of activities of group, (a) are integrated with the concerned activities of group (b) and (c)—both of which use the outputs of the former as inputs.

Let \( B_{1} \) and \( B_{2} \) be the Leontief capital coefficient of its dynamic system,Footnote 4 i.e. coefficients of non-environmental goods required for stock use in basic industrial activities and those in waste abatement and disposal sector.

Let \( \varvec{D}_{{\mathbf{1}}} \) and \( \varvec{D}_{{\mathbf{2}}} \) denote the matrices of coefficients of primary labour and capital services. As regards environmental inputs, \( \varvec{R}_{{\mathbf{1}}} \) and \( \varvec{R}_{{\mathbf{2}}} \) represent the matrices of coefficients of requirements of in situ raw material for extraction or exploitation by the two subsectors. \( W_{1} \) and \( W_{2} \), on the other hand, represent the sets of coefficients of waste arising in the different activities of the two groups; \( W_{2} \) is likely to be near null matrix. Wf is the waste of various kinds arising from the final use of all goods and services, \( \overline{W} \) is the vector of flow of wastes to the sink in unabated form, while Z is the total gross wastes abated in the economy, as already mentioned. Finally, let \( d = D_{1} X + D_{2} Z \) be the total primary factor service required by X and Z, and \( r = R_{1} X + R_{2} Z \) be the vector of total requirement of natural resources in the different sectoral production activities.

In our simple model, we assume the economy to be closed and final consumption to consist of the expenditure of households and government, denoted by C and G, respectively. We assume investment to be endogenized in the dynamic formulation of this Leontief-type model. If \( \dot{X} \) and \( \dot{Z} \) denote the change in X and Z per unit of time, the investment use of the sectoral products would be \( B_{1} \dot{X} + B_{2} \dot{Z} \). We denote again the waste arising from the final uses of the sectoral products \( W_{f} \), which would be determined by \( C + G + B_{1} \dot{X} + B_{2} \dot{Z} \).

Let p and t be the vectors of prices of goods of group (i) goods of conventional sectors and group (iv) waste disposal and abatement services. Let v and \( \pi \) further represent prices of primary factors of labour and capital services and those of in situ in-place natural resources groups of (ii) and (iii).

We can present the multi-sectoral dynamic resource-allocation problem as follows. We assume some given initial stocks of natural capital, man-made stock of goods and services, as congealed or contained in the fixed capital and inventory stock of physical capital, and finally pollution stock. We can consider labour here as a kind of capital good (human capital) produced by spending on goods and services like education and health.

\( S(0) \): Vector of initial stock of goods as contained in the fixed capital stocks of various sectors and goods inventory,Footnote 5

\( N(0) \): the initial stock of natural resources,

\( P(0) \): the initial stock of pollutants.

Control variables: C, G and \( \overline{W} \) whence C and G are aggregate macro-level private consumption and government consumption, respectively, as already noticed and \( \overline{W} \) is the residual unabsorbed aggregate waste vector.

Any dynamic path of \( X(t),Z(t),C(t),G(t),N(t),P(t),S(t) \), which would satisfy Eqs. (1)–(5) along with the initial condition, and \( \dot{S} = B_{1} \dot{X}(t) + B_{2} \dot{Z}(t) \),Footnote 6 would describe a feasible path. In order to evaluate the welfare contribution of any such feasible path, we need an inter-temporal social welfare function. Let us assume the following as one such welfare function:

where u is the current utility out of the flow of consumption and environmental quality in terms of level of concentration of pollution as a stock, \( P(t) \) is the stock of the pollutant, \( V(\tau ) \) thus represents the discounted present equivalent value of the stream of current utility where \( \rho \) is the time rate of discount. In accordance with the meaning of capitalized value of any flow of benefit like utility, V(\( \tau \)) can be shown to be equivalent to the total value of the initial stocks according to their accounting prices based on their respective marginal value contributions.

However, the value of wealth actually obtained would depend on the behaviour of the economy with reference to its objectives. This, of course, would depend on the resource-allocation mechanism of an economy, which would be determined by the behavioural pattern of various agents of the economy, their individual values and social norms, the institutional pattern of regulation or incentives in the society and the quality of governance, among other factors (Dasgupta 2001). A given resource-allocation mechanism and the corresponding choice of a path of dynamic solution would yield a value of inter-temporal social welfare. The additional marginal value contribution from this inter-temporal welfare function (6) that would be achieved for a marginal increase (variation) of any initial stock of capital or resource would give us the shadow or accounting price of the stock concerned at the initial date \( \tau \). Sustainable development would require that the value of inter-temporal welfare, as attained for a given resource-allocation mechanism, should not decline over time.

i.e. \( \frac{{{\text{d}}V^{*} }}{{{\text{d}}\tau }} \ge 0 \), where

where \( p_{Si} (\tau ) \), \( p_{Nj} (\tau ) \) and \( p_{Wk} (\tau ) \) denote the accounting or shadow prices of the ith man-made capital stock, the jth natural capital stock and the kth waste or pollutant stock, respectively, and \( \frac{{{\text{d}}S_{i} }}{{{\text{d}}\tau }} \), \( \frac{{{\text{d}}N_{j} }}{{{\text{d}}\tau }} \) and \( \frac{{{\text{d}}P_{Wk} }}{{{\text{d}}\tau }} \) represent changes in these respective physical stocks in the initial period \( \tau \). Thus, \( I_{S} (\tau ) \), \( I_{N} (\tau ) \), \( I_{W} (\tau ) \) and \( I(\tau ) \) would indicate values of the investment or growth in assets in the form of man-made capital, natural capital, bad stock of pollutants and total investment, respectively. The prices based on marginal value contributions are likely to be non-negative for commodity and natural capital stocks, and negative for the pollutant stock. When we require the sum of all three types of investments in stocks to be non-negative for sustainability, we really take a weak view of sustainability, so that all three types of resource capital or stocks are substitutable for ultimately delivering the same level of welfare. In other words, if \( I_{N} \) is negative and \( I_{W} \) is also negative, as expected, investment in the man-made capital stock \( I_{S} \) has to be sufficiently high to make net total investment non-negative, which is the requirement for sustainability.

However, two issues become clear from our above discussion. First, the genuine or environmentally adjusted investment or savings that would be obtained by accounting for depreciation of not only of all kinds of man-made capital stocks, but also of all kinds of natural capital stocks due to their depletion or degradation, would be a true indicator of sustainability of the development process. For the measurement of the value of such an indicator for monitoring sustainability, it is important to inventorize the physical stocks of all the natural resources concerned and the stocks of pollutants in concentrated form, as well as to evaluate them, respectively, with appropriate prices.

In view of the public good nature of many of the environmental goods and services, and ill-defined ownership rights on the space of the ecosystem and non-tradable character of the many of the environmental goods and eco-services, both the tasks pose big challenges, requiring serious efforts in understanding and collecting environmental statistics and developing the methodology of ascertaining their shadow prices in the absence of price and market data. Substantive research and advancement have already taken place in the methodology of evaluation of environmental damages and benefits of improvement either via various indirect methods of revealed environmental preferences through various types of market transaction or through direct stated preferences for alternative contingent situations, as obtained through various types of surveys.

We also need to take note of the fact that a non-negative value of genuine investment may be necessary, but not sufficient, for environmental sustainability. The reason behind the inadequacy for non-negative investment in any particular period is that, in many countries or economies, the ecosystem has already been severely degraded owing to the past neglect of action to protect and conserve it. What is needed in many situations is not merely the conservation and protection of the existing environmental resources but a restoration of environmental conditions to their previous levels via restraint on environmentally damaging consumption and use of resources. However, such restoration would involve high investment and costs and would require finances to be mobilized for that purpose. This would again require cost–benefit analysis of such project initiatives using our conventional input–output model to yield some of the basic data. Planning for environmental enhancement projects cannot thus be taken in isolation and would have to be mainstreamed in the strategy of development. An integrated view of sustainability based on the extension of interdependence analysis to economy-ecosystem interface relations would enable us to analyse efficiency of multidimensional development. An analysis based on an economy-environment integrated model should yield better results and policy insights into the issues concerned.

4 Leontief’s Interdependence in Consumption and the Notion of Social Well-Being

Leontief’s input–output system has been criticized for the lack of realism of its rigid assumptions of fixed coefficient linear technology and the attendant limitations. The novelty of Leontief’s approach lies in its essential idea of interdependences among different sectors, whose application need not be confined to inter-sectoral production–cost analysis, but is extendable to encompass interdependences between the economic system and ecosystem—the latter being governed by the laws of solar energy flow, geochemical cycle and, finally, very much by the entropy law characterizing interaction between the two systems, as discussed above. We have shown how the dynamic Leontief model can be extended to incorporate the role of the ecological process in economic growth and evolution and how sustainability of development can be characterized.

Sustainability, as we have defined it, is a dynamic characterization of the development of a nation’s well-being. The concept of well-being is itself a functional one, which depends on the material consumption of various goods and services by a society. We will now demonstrate how Leontief’s idea of interdependences can be applied to the extended context of consumption, rather than merely confining it to production. We will attempt to define well-being at the societal level in concrete terms and try to estimate this apparently abstract conceptual entity in empirical terms.

In this section, we define a concept of social well-being which is different from the one underlying Eq. (6) of the preceding section as a part of the model of sustainable resource dynamics and growth as presented. It has nothing to do with the equation under reference. Eq. (6) presents an inter-temporal welfare function where well-being was defined in a top-down approach being entirely determined by the aggregate consumption at societal level along with its inter-temporal distribution, but irrespective of interpersonal distributive consideration. We have conceived well-being of an individual household to be the satisfaction that it derives from the consumption of the different goods and services, separable in such a way that the satisfaction derived from each good is a monotonic increasing function of its amount of consumption. However, given the interpersonal distribution of its consumption (households being ordered according to monthly per capita total consumption expenditure), a typical individual of a household derives satisfaction which is dependent not on the absolute amount but on the relative amount of its consumption with respect to the maximum amount of its per capita consumption as attained by a typical household of the highest expenditure class, i.e. the top or the 10th decile class.

Accordingly for any given commodity or service and its consumption distribution across consumption expenditure classes, the level of satisfaction derived by its consumers of any given expenditure class (say of a given decile) as per such conceptualization can be taken to be the ratio of its actual consumption to the aggregate amount of supply of the concerned commodity that would have been required to provide all the households of the concerned expenditure class with the hypothetical maximum satisfaction. In other words, since any decile class has 10% of the entire population, the societal satisfaction for the consumption of consumers of any decile class of the concerned good would be the ratio or share of its mean per capita consumption to that of the mean consumption of the top (10th) decile class for the same commodity.

Table 1 describes the distribution of per capita consumption expenditure and that of a specific given good and the corresponding societal satisfaction derived for the different consumption expenditure classes for any given good or service. In Table 1, dei and dci are the per capita total consumption expenditure and per capita consumption of a given specific commodity, respectively, of the households belonging to the ith decile class of monthly/yearly consumption expenditure. Qi is the total amount of the concerned good actually consumed by the households of the ith decile class. Since all the classes have the same number of people, Q10 would also provide the amount of the good that would be required for providing all the people of any decile class of monthly per capita consumption expenditure with the per capita mean consumption of the concerned good as attained by the top or 10th decile expenditure class. Normalizing the maximum achievable satisfaction to the level of 100%, we obtain (Qi/Q10) 100 as the estimate of the societal satisfaction level of the ith decile expenditure class. These are presented in column 4 of Table 1.

If Sij denote the satisfaction level of the people of ith decile expenditure class derived from the consumption of the jth good, then \( S_{ij} = (Q_{i}^{j} /Q_{10}^{j} )*100 \) where \( Q_{i}^{j} \) denotes the total consumption of the jth good by the ith decile class. Let us define for the jth good, Sj to be the societal satisfaction level from the consumption of the jth good taking all expenditure classes together. This is here taken to be the Sj = mini Sij for all i for which Sij > 0. Again if, for all the goods and services together, the overall satisfaction level of consumptions for all households together be denoted by S, then S is defined to be min Sj over all j. In such definition, the level of social welfare is thus determined both by the household-wise distribution of consumption goods and also the commodity composition, quite independently. It would point to the necessity of both redistribution of consumption of various goods across income or expenditure class and also alter the product mix of supplies of the different goods. The latter would require the use of conventional input–output model to decide on the sectoral reallocation of resources to raise the overall level of welfare.

Once Table 1 has been generated from the data, we may fit a smooth function or curve to trace the relationship between per capita consumption of a given good and the normalized satisfaction level attained. Its inverse function would be quite useful for the purpose of policy and planning use of such empirical data and model. We have viewed here social well-being as an output of a society or economy where the consumptions of the people of various expenditure classes of the variety of commodities are the inputs. The restructuring of the consumption data in such format along with the analytical frame as presented here illuminates how both the restructuring of production and redistribution of goods produced among income–expenditure classes become important to remove bottlenecks or obstacles in maximizing the societal overall satisfaction which arises from relative scarcity or availability of any good as well as their sharing among different income–expenditure classes. The kind of reallocation of resources of production for changing supply structure of goods and services and redistribution of products for consumption across income classes that would be suggested by such empirical model-based analysis, is likely to be insightful and helpful for policy guidance for contributing towards greater social sustainability.

From this curve, the results in Table 2 were derived by using the inverse of the fitted function and by way of appropriate interpolation and extrapolation.

However, such basic tables would need to be moderated in the light of various experts’ opinion and experience. Thereafter, we could derive the best-fitting curves or functions, so that we could use the model for various analytical and policy purposes.

From the product-wise attainable levels of satisfaction, once we have generated Table 2 for all commodities, the overall attainable level of well-being, or satisfaction, for all commodities together could be determined as follows. Given the physical availability of each product, in physical quantity or value terms, we would need to read from Table 2, for the commodity or service concerned, the maximum level of attainable satisfaction. However, this derivation would assume that, for all other commodities, there is no availability constraint. Since the actual availability of the different products need not be adequate to provide unconstrained maximum satisfaction for all commodities or services, we could determine the maximum attainable overall social satisfaction, as given by the minimum of maximum satisfaction across commodities and services. This would be read from Table 2 for the commodities and services concerned. Here we implicitly assume the non-substitutability of sectoral products for generating welfare, as all of them are required for producing certain levels of overall welfare or satisfaction.

5 Concluding Remarks

The paper thus points to the potential of Leontief’s idea of interdependences in the existing the input–output model to accommodate the following: (a) analysis of inter-temporal natural and man-made capital resource use for sustainable growth of income and capital (b) the application of input–output relationship in defining the concept and content of social welfare which is determined by inter-household distribution of consumption as well as the relative scarcity or availability of the product mix of the consumption goods. While social well-being has been conceptualized in both the parts of the paper, the former part has taken a top-down approach while the latter one a bottom-up one. Besides, the former model analysis has focused on the inter-temporal aspect of social welfare and intergenerational equity, the latter uses a cross-sectional analysis of the state of interpersonal consumption distribution with focus on intra-generational equity. The relative consumption hypothesis of welfare has extended the notion of interdependence of Leontief in the domain of consumption in producing social welfare which is an output delivered by the consumption process. Again, the overall social welfare will be ultimately determined by the most scarcely available commodity in the economy. Its relaxation would require inter-sectoral resource reallocation taking account of conventional sectoral interdependence in production. Finally, both the analytics of the two parts point to the role and importance of data of resources stocks on the one hand and consumption distribution on the other for monitoring sustainability of development process. In view of all these, the paper which has its conceptual foundation in Leontief’s sectoral interdependence should have important bearing on the development of database as well as strategy for sustainable development. It is thus essentially the interdependences of consumption of various goods that would generate an overall level of social satisfaction. The paper thus points to the widening of scope of the interdependencies-based analysis, to explain not only sustainable development, but also the notion of social well-being whose monotonic rising trend characterizes sustainability.

Notes

- 1.

The second law of thermodynamics is the entropy law. In our context, it is important to note that this law plays an important role in ecological economics by providing justification for the view that all economies would have limits to their growth. Any economy uses low entropy energy and matter drawn from its surrounding natural environment or ecosystem to produce a good for consumption or capital use, and some residual high entropy wastes and heat for being sent back into the environment. Georgescu-Roegen defines a closed thermodynamic system to be the one in which there is no exchange of matter or energy with its environment. An economy as situated in its eco-environment is conceived as a closed system. As a result, the molecular structure of any biochemical compound defining a resource gets disrupted once used in the production process due to no possibility of replenishment of the basic molecular constituents. In view of this, those residual high entropy molecular substances cannot be put back to the same use with same efficiency again and become a waste from anthropocentric point of view. The process of continuous use of resources in production processes is one of continuous degeneration in this finite planet. It is in this philosophical sense we characterize, following Georgescu-Roegen, any process of economic production as an entropic one and can explain “Limitationalism” in the context of economic growth (see Georgescu-Roegen 1971; Ayres 1978).

- 2.

The resources as converted into products like “coal extracted from mines and ready for use in power industry”. It is an intermediate good produced with the help of human labour, and service of machinery of coal mines and other inputs.

- 3.

Geological resource such as coal as lying in the seam underground, but not yet extracted, yet only discovered as prior geological information obtained through seismic survey or satellite imagery, etc.

- 4.

B1 and B2 are matrices of capital coefficients of the Leontief dynamic model for the sectors of non-environmental goods and services corresponding to our production group of activities (c) denoted by subscript 1 here, and those of environmental protection services corresponding to our activities of production group (b) denoted by the subscript 2 here, respectively. The typical element bij of matrices would represent the amount of the concerned good i that would be required for capital stock use for capital formation for a unit increase of output capacity in sector j over time.

- 5.

Where Q(P) is the depreciation of the stock of pollutant due to its degradation as an ecological process, where P is the stock of pollutant.

- 6.

\( \dot{S} \) is not savings. It should be interpreted as change in stocks of goods per unit of time as contained in the form of fixed capital stocks of various sectors and goods inventory as already noted above.

References

Ayres, R. U. (1978). Application of physical principles to economics. In R. U. Ayres (Ed.), Resources, environment and economics: Applications of the materials/energy balance principles. New York, USA: Wiley.

Chakravarty, S. (1971). Capital and development planning. MIT Press.

Daly, H. E. (1973). Towards a steady state economy. San Francisco: W.H. Freeman & Company.

Daly, H., & Farley, J. (2004). Ecological economics: Principles and practice. Washington, DC, USA: Island Press.

Dasgupta, P. (2001). Human well-being and the natural environment. Oxford University Press.

Dasgupta, P., & Mäler, K. G. (2000). Net national product, wealth, and social well-being. Environment and Development Economics, 5(1), 69–93.

Dorfman, R., Samuelson, P. A., Solow, R. M. (1958). Linear programming and economic analysis. Courier Corporation.

Georgescu-Roegen, N. (1971). The entropy law and the economic process. Cambridge MA: Harvard University Press.

Leontief, W. (1970). Environmental repercussions and the economic structure: An input-output approach. The Review of Economics and Statistics, 52(3), 262–271.

Perman, R., Ma, Y., & McGilvray, J. (1999). Natural resource and environmental economics. England: Addison Wesley Longman Limited.

Sengupta, R. (2013). Ecological limits and economic development: Creating space. New Delhi, India: Oxford University Press.

Acknowledgements

The author would first like to thank the Peter Wall Institute of Advanced Studies of the University of British Columbia (UBC) and the Department of Electrical and Computer Engineering of the same university for supporting his work in developing the research ideas behind this paper. He also would like to thank Prof. Kakali Mukhopadhyay of Gokhale Institute of Politics and Economics, Pune, and McGill University, Montreal, Canada, for inviting him to deliver the keynote address in the 19th National Conference of the Input–Output Research Association of India, 2017. He would further like to thank Prof. Jose Marti of the Department of Electrical and Computer Engineering of UBC, and Mr. Ehssan of his i2sim research team, for many fruitful interactions and exchanges of ideas. He would finally wish to express thanks to Mr. Sovik Mukherjee for his valuable research assistance. However, the burden of all assertions in the paper lies with the author.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Sengupta, R. (2018). Extension of the Leontief Input–Output Model to Accommodate New Concepts of Sustainability and Social Well-Being. In: Mukhopadhyay, K. (eds) Applications of the Input-Output Framework. Springer Proceedings in Business and Economics. Springer, Singapore. https://doi.org/10.1007/978-981-13-1507-7_16

Download citation

DOI: https://doi.org/10.1007/978-981-13-1507-7_16

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-13-1506-0

Online ISBN: 978-981-13-1507-7

eBook Packages: Economics and FinanceEconomics and Finance (R0)