Abstract

This chapter discusses the effect of two technical barriers to trade (TBT) adopted by Ecuador in November 2013 on the import flows of perfumes and toilet waters. The study considers two TBTs: Resolution 116 and Resolution 093. In order to obtain an unbiased estimate, the study uses a synthetic control method combined with a difference-in-difference estimation. To the best of the authors’ knowledge, this is the first study that uses the synthetic control method to estimate the causal effect of a particular barrier to trade. In that sense, the contribution of this chapter is mainly methodological.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

1 Introduction

Countries actively use policies that limit international trade. Understanding the opportuneness of these policies from a theoretical point of view has attracted the attention of policy makers and academics for decades. See for instance (Mill 1848; Bhagwati 1965; Brander and Krugman 1983; Krugman 1986; Anderson and Neary 2005). The need to quantify the effects of specific barriers to trade has also brought about the development of empirical methods in this field. In that context, the main objective of this chapter is to contribute to the understanding of the effects of barriers to trade using a novel empirical method.

The measures that countries might impose to limit international trade are categorized as tariff or non-tariff barriers . Non-tariff barriers (NTBs) imply restrictions that have the form of prohibitions or specific market requirements that limit or make the importation or exportation of a product more expensive. “NTBs include all policy-related trade costs incurred from production to final consumer, with the exclusion of tariffs” (United Nations Conference on Trade and Development 2013). NTBs are broadly categorized as technical barriers: sanitary and phytosanitary (SPS) , certification procedures and pre-shipment inspections, among others; and non-technical measures.

The World Trade Organization (WTO) has specific agreements for NTBs. WTO agreements allow countries to achieve legitimate objectives in the use of these kinds of barriers. For instance, the “Technical Barriers to Trade (TBT) Agreement aims to ensure that technical regulations, standards, and conformity assessment procedures are non-discriminatory and do not create unnecessary obstacles to trade” (GATT Secretariat 1994).

TBTs refer to regulations, standards, testing and certification procedures imposed with non-trade objectives that seek to protect human, animal or plant life or health, and so on. Despite their objectives, TBTs may have substantial impacts on international trade. This chapter attempts to identify the effects on import flows of the two TBTs adopted by Ecuador in November 2013: Resolution 116 and Resolution RTE 093. In particular, we study the impact on the Ecuadorian imports of perfumes and toilet waters (HS 330300). We selected these products because of their relative importance among those affected by Resolution 116 , and because we were able to obtain trade flows under the same codification for other countries.Footnote 1

The literature has developed empirical methods to estimate effects of international trade policies. They include general and partial equilibrium models, applications of Industrial Organization, gravity model of trade, comparative case studies, time series analysis and panel data models, among others.Footnote 2

In this chapter, we use a comparative case study to consistently estimate the causal effect of a specific TBT. In particular, we use an application of the synthetic control method proposed in Abadie and Gardeazabal (2003) and Abadie et al. (2010). This method uses convex combinations of potential control units to construct a counterfactual for the unit under study.

The main advantage that this method offers over traditional time series options is that it does not require that the policy under study does not coincide with other unobserved shocks, or that is exogeneous. The method instead uses a data-driven approach to construct an appropriate control, the “synthetic control,” which by construction was not affected by the policy under study, but by assumption was impacted by those other shocks. We combine the results of this method with a difference-in-difference estimation to obtain the causal effect. Therefore, the identifying assumption is that in the absence of the policy change, the treatment unit would have had the same tendency as the synthetic control. Hence, we use a standard parallel trends assumption, and do not need to impose any structural assumption.

To our knowledge, this is the first study that uses synthetic control to estimate the causal effect of a particular barrier to trade. In that sense, the contribution of this chapter is mainly methodological. The results indicate that the TBTs under study produced a statistically significant reduction in imports of around 61%, which is equivalent to 147.32 dollars per thousand people per month. We compare this estimate to a simpler before-and-after calculation and find that they are very similar. This comparison is evidence that the policy shock is not confounded with other relevant but unobserved shocks, or that it is exogenous. This implies that the method utilized in this chapter can be used as a robustness check for time series estimations, and as an indirect test for exogeneity of policy shocks.

Importantly, if the shock under study occurred simultaneously with other relevant shocks, then the synthetic control method might be the best reduced form option to estimate the causal effect of interest. We believe that the estimation method utilized in this chapter has also the potential to be used to evaluate the impact of particular trade policies on outcome variables such as taxes collected, investment flows and job creation, among many others. This chapter is organized as follows. Section 13.2 makes a brief review of the technical barriers to trade reforms in Ecuador in 2013, Sect. 13.3 describes the data and methodology used, Sect. 13.4 presents the results and Sect. 13.5 concludes.

2 The 2013 Technical Barriers to Trade Reforms in Ecuador

In Ecuador, the Foreign Trade Committee (Consejo de Comercio Exterior – COMEX in Spanish) is the highest authority that regulates international trade. The Organic Code of Production, Trade and Investment (Código Orgánico de Comercio e Inversiones – COPCI in Spanish) states that, among other functions, COMEX issues rules about records, authorizations, licenses, and import and export procedures, except customs formalities. This is important because COMEX issues the rules about which products have to demonstrate conformity with Ecuadorian technical regulations, but is the Ecuadorian Institute for Standardization (Instituto Ecuatoriano de Normalización, INEN in Spanish) that is in charge of the technical standards and their implementation.

In November 2013, COMEX issued Resolution 116, affecting 293 Nandina System 10-digit codes (Resolución 116 2013). This regulation requires certificates of recognition for certain products in order to demonstrate compliance with Ecuadorians’ technical regulations. According to COMEX, the application of the measure was justified under the arrangements in the Ecuadorian Political Constitution, and the WTO TBT Agreement that allowed the establishment of rules that guarantee the quality of the products sold in the country. However, this justification was not satisfactory to some members of the WTO who “raised concerns that Resolution 116 and the various technical regulations may be intended to address Ecuador’s trade balance rather than address legitimate health or safety concerns.” (United States Trade Representative 2015).

Resolution 116 was subject of analysis within a WTO TBT Committee. Specifically, it was matter of concern six times for 11 members. The principal concerns were about the lack of early notification of the measure, the duplication of requirements in the case of some products such as food and cosmetics and lack of accredited test laboratories and accredited certification bodies. (World Trade Organization – Committee on Technical Barriers to Trade 2016a).

3 Data and Methodology

Data on imports were obtained from Trade Map, International Trade Centre, www.intracen.org/marketanalysis. For the analysis that follows, the treatment period is November 2013, the pre-treatment period ranges from December 2012 to October 2013, and the post-treatment period goes from December 2013 to October 2014. Therefore, each period of analysis has 11 months. We do this to include the same months within a year in each period. Table 13.1 shows the products that experienced the biggest reduction among the 293 codes affected by Resolution 116 . The code with the biggest absolute reduction was “Generating sets, diesel/semi-diesel engines, of an output exceeding 375 KVA” (USD 102 million CIF), whereas the biggest reduction in percentage terms was “Hot rolled bar/rod, irregular coils, nes” (−98%).

We decided not to consider products belonging to the groups 85 (Electrical and electronic equipment) and 72 (Iron and Steel), since the Ecuadorian government invested heavily in construction, electric and transport infrastructure in the years surrounding our period of study. These investment decisions were also very volatile. For instance, the public investment in natural resources (including hydroelectric generators), communications, urban development and housing were USD 2769 million in 2012, USD 4068 in 2013, and USD 3668 in 2014.(Secretariat of Planning and Development – SENPLADES). Changes in imports of products belonging to these codes might be explained by public investment decisions and not by the application of Resolution 116 . The relatively high coefficient of variation of the monthly imports for the pre-treatment period is suggestive evidence that products under these codes were responding to factors exogenous to the Ecuadorian commercial policy.

Taking into account the aforementioned restriction, and considering Table 13.1, were are left with products belonging to the code 33 (Essential oils, perfumes, cosmetics, toiletries). In particular, we selected the code 3303000000 (Perfumes and toilet waters) for analysis since it had the biggest absolute and relative reductions (See Table 13.1).The selection of 3303000000 has the additional advantage of being the only product included in the HS 6-digit code 330300. This means that we can compare the Ecuadorian imports of this product to the imports of other countries. This is especially important considering the estimation methodology we propose later.

It is important to mention that in November 2013 another regulation affecting the imports of perfumes and toilet waters was issued (Resolución 13392 – RTE 093 2013). This regulation, which applies to cosmetic products (including perfumes and toilet waters), specifies that importers have to demonstrate conformity with Ecuadorian quality standards. This technical regulation establishes requirements for cosmetic products to protect the life, safety and health of people and the environment and avoid practices that may misinform the users. This standard includes requirements on labeling, safety, microbiological quality and procedures for conformity assessment. RTE 093 is applied in conjunction with Resolution 116 , which demands the submission of recognition certificate (INEN-1) as a supporting document with the customs declaration. Therefore, the estimations that follow include the combined effect of both technical regulations.

In order to estimate the causal effect of a shock such as the implementation of a barrier to trade, one may want to use a time series approach. To do this, the researcher has to assume that the estimations are not confounded by events happening around the implementation of the policy, in particular, economic shocks at the national or international level that are not observed by the researcher. Notice that a before-and-after estimation that assumes stationarity, and is the simplest time series estimation, was already calculated in Table 13.1 for certain products.

Given this potential threat, an option is to focus attention on a particular group of products (treated group), and find a suitable “counterfactual” for it. Once the counterfactual is estimated, the causal effect can be obtained by its difference with the treated group, or by using a difference-in-difference method, depending on the assumptions the researcher is willing to accept. We have already discussed the selection of the Ecuadorian imports of perfumes and toilet waters for analysis. The next step is to select a proper counterfactual.

In the context of this study, one alternative is to select, within the Ecuadorian imports, products not affected by the policy under analysis. This option has the potential benefit of reducing the bias caused by shocks affecting all the economy. However, it is likely that the cross-elasticities are non-zero. Meaning that the potential control units are likely influenced indirectly by the trade policy.

Another option is to consider imports of the same treated products by another country as potential counterfactuals. By using this approach, we have to assume that the changes in Ecuadorian imports of perfumes and toilet waters do not affect international prices. This is most likely the case given the small participation of Ecuador in this market. Between 2009 and 2012, the Ecuadorian imports of perfumes and toilet waters represented on average 0.15% of the world imports.

The next question is which country or countries to use. One might be tempted to select a country or group of countries that are similar to Ecuador considering certain relevant variables. Instead of doing this arbitrarily, the alternative we take is to use a data-driven method to perform the selection. In particular, we use the method proposed in (Abadie and Gardeazabal 2003) and (Abadie et al. 2010). This method uses convex combinations of potential control units (donors) to construct a counterfactual for the unit under study.

Consider J + 1 countries and T periods. The treated country is Ecuador and we call it J, the remaining countries are called the “donor countries.” The treatment starts at period T0 and continues until the last period of analysis. The treatment in our case is the implementation of resolutions 116 and RTE 093 in November 2013. The outcome of interest for the treated unit (imports of perfumes and toilet waters in thousands of dollars C.I.F. per 1000 people) is denoted Y A and the matrix containing the outcome for the donor units is denoted Y B.Footnote 3

The synthetic control method chooses weights for each donor country to solve the following minimization problem:

Where X A is the vector of pre-intervention variables used as predictors of Y A, X B W is a weighted average of the same pre-treatments variables, but corresponding to the donor countries. W is a (J × 1) vector of non-negative weights that add up to one. S is a positive (k × k) semidefinite matrix used to allow different weights to the predictor variables. Once\( \widehat{W} \)has been estimated, the counterfactual, or synthetic control for period t is calculated as \( \widehat{Y_{\mathrm{At}}}=\widehat{W^{\prime }}{Y}_{\mathrm{Bt}} \). We will call this estimate the “synthetic Ecuador.” For the estimation of the causal effects, we use a difference-in-difference approach, which uses the synthetic Ecuador as control. Therefore, the identifying assumption is the usual common trends one. In words, in the absence of resolutions 116 and RTE 093 , Ecuador would have had the same trend as the synthetic Ecuador.

The estimations were obtained using the Stata code provided in (Abadie et al. 2011). We utilized the default option for the S matrix, which uses a regression-based approach to minimize the mean squared error for the pre-intervention period. The fully nested method produced the same estimates, so we decided not to report them. For the results that follow, we used the pre-treatment values of the outcome variables as predictors. In an additional specification, used as robustness check, we included pre-treatment values of the annual Real GDP and the monthly Real Exchange Rate as additional predictors.Footnote 4

The group of donor countries from which we obtained the weights to estimate the synthetic control belong to the World Bank classifications: lower-middle-income economies, and upper-middle-income economies.Footnote 5 Hence, we excluded from analysis low-income and high-income economies. We do this to avoid comparing Ecuador to countries with dissimilar economies. We also exclude from analysis countries with no imports of perfumes and toilet waters in more than four months in the pre-treatment period. We therefore have 46 countries for analysis, 45 donors and Ecuador. Another option would have been to use only countries in Latin America and the Caribbean region. However, there are only 24 countries in this group with information available for analysis, so we decided to use them to perform a robustness exercise. If a country imposed barriers to commerce for perfumes and toilet waters in the period under analysis, then it must be excluded because these barriers can be consider treatments similar to the regulations imposed by Ecuador. We carefully explored this possibility and discarded it. In the period ranging from 2012 to 2015, the only country that faced trade concerns specific to perfumes and toilet waters (HS 330300), raised by WTO members, was Ecuador (World Trade Organization 2016b).

To our knowledge, this is the first study that uses synthetic control to estimate the causal effect of a particular barrier to trade. Nonetheless, this method has been used to study the effect of economic liberalization (Billmeier and Nannicini 2013); anti-immigration policy (Bohn et al. 2014; Sanchez 2017); comparative politics (Abadie et al. 2015) and in many other topics.

To perform inference analysis, we follow (Abadie et al. 2010). Specifically, we use a permutation approach in which we repeat the estimation outlined before, but for each of the donor countries. For each repetition we exclude Ecuador as a potential donor. This exercise provides the distribution of “placebo” estimates. Then we compare the estimated effects for Ecuador within this distribution. This is equivalent to compare the estimated effect to that of a country chosen at random. By doing this, we can study the null hypothesis of non-negative effect. In other words, the hypothesis that resolution 116 and RTE 093 did not reduce the Ecuadorian imports of perfumes and toilet waters. In particular, if the estimated effect takes an atypically large negative value, then there is evidence against the null hypothesis. To obtain one-sided p-values, we rank the estimated treatment effects from the smallest (most negative) to the largest, then the position of Ecuador over the total number of countries gives the p-value.Footnote 6

4 Results

Table 13.2 presents the weights that were selected to construct the synthetic control applied to the Ecuadorian imports of perfumes and toilet waters. The presence of Colombia, with a contribution to the synthetic Ecuador of more than 15.7%, is not a surprise, given the similarities of the two Andean countries. In contrast, the presence of Thailand, which was given a weight of nearly 30%, and the Republic of Congo with a weight close to 29%, is somehow surprising. Nevertheless, and as pointed out in the previous section, the method does not rely on – any priors and only uses historical information to construct the synthetic control. Therefore, despite the differences between Ecuador and the selected donors, what is relevant is the capacity of them to reproduce the pre-treatment trajectory of the former. Notice that we are using a difference-in-difference approach to calculate the treatment effect. Hence, the assumption we need is that in the absence of the treatment, Ecuador and its synthetic counterpart had the same trends. The other countries that received positive weights were Malaysia (10.5%), Paraguay (9.3%), Tunisia (4.2%), Fiji (1.2%) and Dominican Republic (0.6%).

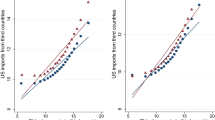

Figure 13.1 plots the results. The synthetic Ecuador tracks very closely the trajectory of Ecuador before November 2013. In contrast, starting in December 2013, the two series diverge, and stay separated until the last period analyzed. Notice that the figure also suggests that the shock seems to have changed the level, but not the tendency of series.

This graphic evidence suggests that there is a negative treatment effect. Table 13.3 presents the difference-in-difference estimates obtained from the synthetic control results. The average difference between Ecuador and its synthetic counterpart before treatment is −1.12, whereas the post-treatment average difference is −148.4. This brings about a difference-in-difference estimate of the average treatment effect of −147.32 dollars per thousand people per month. Notice that this estimate corresponds to the average over 11 months. A back-of-the-envelope calculation brings about a reduction in imports of around USD 24.6 million, or 63%.Footnote 7

Notice that the simple before-and-after calculation in Table 13.1 produced an estimated reduction of approximately 61%. In other words, if our estimations are correctly specified, then the before-and-after approach has a small positive bias. However, we cannot rule out the possibility that the two estimates are equal to each other. Moreover, these results suggest that the policy under study was indeed exogenous and did not coincide with other shocks, and therefore a time series approach could have been applied. If this is true, then the synthetic control method is useful as a robustness check.

It is important to mention that in supplementary specifications we added as predictors of the outcome variables the pre-treatment monthly real exchange rate and annual real GDP. The results were exactly the same as the simple model that uses only the pre-treatment values of the outcome as predictors, which implies that the results are robust to the use of additional predictors. Hence, we decided to report only the parsimonious specification.

The next step is to determine if the effect is significant in statistical terms. We do this by applying the permutation method described in the previous section. First, we repeat the synthetic control method to each of the donor countries . Table 13.3 present the corresponding p-values. The estimated effect for Ecuador brings about a p-value of 0.043 (2/46), since Ecuador had the second most negative estimated effect.

These results are also depicted in Fig. 13.2, which plots the difference between each country and its synthetic control. The difference corresponding to Ecuador seems to be among the most negative; however, it also seems to be significantly smaller than some of the most volatile series. Notice that for most countries, the difference in the pre-treatment period is small and comparable to the corresponding to Ecuador. However, for some the fit is very poor. In order to get a better graphic sense of the relative position of Ecuador, and following Abadie et al. (2010), we do not consider countries with pre-treatment mean squared error 20 times larger than that of Ecuador. Figure 13.3 plots the results. It is easier to see that Ecuador is among the countries with most negative differences. Finally, Fig. 13.4 plots the results excluding countries with pre-treatment mean squared error twice as large of that of Ecuador. This figure makes it more evident Ecuador has an atypically larger negative effect. It is important to point out that the p-values reported in Table 13.3 were obtained without excluding any country.

As a robustness check, we repeat the synthetic control estimations, but considering countries in the Latin America and the Caribbean Region. Results are reported in Table 13.3, column 2. The difference-in-difference estimate is −178 dollars per thousand people per month, which implies an effect of −76%. By using the inference method outlined before, we find a p-value of 0.125. Hence, the estimates in the second column are larger but imprecisely estimated. Taking this into account, we consider column 1 our preferred specification.

5 Concluding Remarks

Technical barriers to trade are frequently used by most countries. In that sense, it is important to quantify their effects. A better understanding of these effects can be very useful for policy designers and to academics interested in studying trade policy empirically. This chapter contributes to the literature by applying a method that allows the estimation of the causal effect of a particular technical barrier to trade on import flows.

In particular, this chapter studies the impact of technical barriers to trade imposed by the Ecuadorian government in 2013, which require certificates of recognition and conformity with Ecuadorian quality standards. We focus attention on the products belonging to the HS code corresponding to perfumes and toilet waters in Ecuador (330300). In order to get an unbiased estimate, we use a difference-in-difference approach combined with a synthetic control method, which builds a suitable control by combining information from units not affected by the policy change.

The results indicate that these restrictions produced a statistically significant reduction in imports of around 63%, which is equivalent to 147.32 dollars per thousand people per month. Interestingly, this estimate is very similar to a before-and-after calculation. This might be evidence that the policy shock we study did not happen simultaneously with other relevant but unobserved (by the researcher) shocks, or that it is exogenous. The exogeneity, together with the seemingly stationarity of the series, imply that a before-and-after comparison provides a good estimate of the treatment effect.

In this sense, the main contribution of this chapter is methodological. The synthetic control method has potential to be used as a robustness check for more traditional specifications, and as an indirect test for exogeneity of policy shocks. Moreover, if the policy under study coincides with other observed changes at the national or international level, and hence is confounded with them, then the synthetic control method might be the best reduced form option to estimate the causal effect of interest.

Finally, the estimation method utilized in this chapter has also the potential to be used to evaluate the impact of particular trade policies on outcome variables different than trade flows, such as taxes collected, investment flows and job creation, among others. We believe that more work needs to be done to explore this possibility.

Notes

- 1.

See Sect. 13.2 for details.

- 2.

For a detailed review of empirical methods applied to quantify the impact of TBT trade, see (Maskus and Wilson 2001).

- 3.

We analyze monthly series of imports by country. In order to obtain a comparable metric among countries, we calculate the imports of perfumes and toilet waters in thousands of dollars C.I.F. per 1000 people. We use the population corresponding to 2011 (World Bank 2016). The use of other years as denominator did not change our results.

- 4.

- 5.

See World Bank: http://data.worldbank.org/about/country-and-lending-groups

- 6.

Notice that the p-value is bounded from below to 1/46 = 0.022

- 7.

We use a population of 15.17 million to get these calculations.

References

Abadie, A., & Gardeazabal, J. (2003). The economic costs of conflict: A case study of the Basque country. The American Economic Review, 93(1), 113–132.

Abadie, A., Diamond, A., & Hainmueller, J. (2010). Synthetic control methods for comparative case studies: Estimating the effect of California’s tobacco control program. Journal of the American Statistical Association, 105(490), 493–505.

Abadie, A., Diamond, A., & Hainmueller, J. (2011). SYNTH: Stata module to implement synthetic control methods for comparative case studies. Statistical Software Components S457334, Boston College Department of Economics, revised 28 January 2014.

Abadie, A., Diamond, A., & Hainmueller, J. (2015). Comparative politics and the synthetic control method. American Journal of Political Science, 59(2), 495–510.

Anderson, J., & Neary, J. (2005). Measuring the restrictiveness of international trade policy. Cambridge, MA: MIT Press.

Bhagwati, J. N. (1965). On the equivalence of tariff and quotas. In R. E. Baldwin (Ed.), Trade growth and balance of payment. Amsterdam: North Holland.

Billmeier, A., & Nannicini, T. (2013). Assessing economic liberalization episodes: A synthetic control approach. Review of Economics and Statistics, 95(3), 983–1001.

Bohn, S., Lofstrom, M., & Raphael, S. (2014). Did the 2007 legal Arizona workers act reduce the state’s unauthorized immigrant population? Review of Economics and Statistics, 9(2), 258–269.

Brander, J. A., & Krugman, P. R. (1983). A reciprocal dumping model of international trade. Journal of International Economics, 15, 313–321.

Darvas, Z. (2012). Real effective exchange rates for 178 countries: A new database. Working paper. Department of Mathematical Economics and Economic Analysis, Corvinus University of Budapest, Budapest. Retrieved from http://unipub.lib.uni-corvinus.hu/612/

GATT Secretariat. (1994). The results of the Uruguay Round of multilateral negotiations: The legal texts. Geneva: GATT.

Krugman, P. (1986). Strategic trade policy and the new international economics. Cambridge, MA: MIT Press.

Maskus, K., & Wilson, J. (Eds.). (2001). Quantifying the impact of technical barriers to trade: Can it be done? Ann Arbor: University of Michigan Press.

Mill, J. S. (1848). Principles of political economy. London: John W. Parker.

Resolución 116. (2013). Consejo de Comercio Exterior del Ecuador. Published in Registro Oficial 140, Quito.

Resolución 13392 – RTE 093. (2013). Subsecretaría de Calidad del Ecuador. Published in Registro Oficial 121, Quito.

Sánchez, G. E. (2017). The short-term response of the Hispanic noncitizen population to anti-illegal immigration legislation: The case of Arizona SB 1070. Journal of Economics, Finance and Administrative Science, 22(42), 25–36.

UNCTAD. (2013). Non-tariff measures to trade: Economic and policy issues for developing countries. New York/Geneva: United Nations.

United States Trade Representative. (2015). 2015 National Trade Estimate Report on Foreign Trade Barriers (NTE). Office of the United States Trade Representative, Washington, DC. Retrieved from https://ustr.gov/sites/default/files/NTE%20Final%20Printed_0.pdf

World Bank. (2016). World development indicators 2016. Washington, DC. Retrieved from http://data.worldbank.org/products/wdi

World Trade Organization. (2016a). Committee on technical barriers to trade. 21st annual review of the implementation and operation of the TBT agreement, Geneva.

World Trade Organization. (2016b). Integrated analysis and retrieval of notified non-tariff measures. Retrieved from http://i-tip.wto.org/goods/Default.aspx

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 The Author(s)

About this chapter

Cite this chapter

Sánchez, G.E., Vargas, P.A. (2017). Estimating the Impact of Technical Barriers to Trade: The Case of Perfumes and Toilet Waters in Ecuador. In: Mathur, S., Arora, R., Singh, S. (eds) Theorizing International Trade. Palgrave Macmillan, Singapore. https://doi.org/10.1007/978-981-10-1759-9_13

Download citation

DOI: https://doi.org/10.1007/978-981-10-1759-9_13

Published:

Publisher Name: Palgrave Macmillan, Singapore

Print ISBN: 978-981-10-1758-2

Online ISBN: 978-981-10-1759-9

eBook Packages: Economics and FinanceEconomics and Finance (R0)