Abstract

Over the last decade, public patent subsidies have played an important role in several countries in enhancing international filings by domestic companies, especially SMEs. In this paper, we first analyze patent subsidies implemented in Italy from 2002 to 2012 and classify them according to four different typologies, based on their rationale and objectives. We then use data from a sample of 222 patents subsidized by the Chamber of Commerce of Milan in Northern Italy, and a control group of non-subsidized patents, to assess the impact of patent subsidies on patent value and firms’ turnover growth. We conclude by discussing policy recommendations for the optimal design of patent subsidy schemes.

Liang Xu is Associate Professor at the Research Center for International Business and Economy in School of International Business of Sichuan International Studies University. She received a Ph.D. in Management at Chongqing University, China. She has been a Post-doctor researcher at University of Bologna, Italy. Her research interests are in the fields of technological innovation and strategic management.

Federico Munari is the author for correspondence. He is Professor of Technology and Innovation Management at the Department of Management of the University of Bologna. He was the Director of the Ph.D. Program in General Management of the University of Bologna. He is the author of several published articles and books on issues related to entrepreneurial finance, intellectual property management, technology transfer, and R&D management.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Over the last decade, patent subsidies have played an important role in several countries in enhancing international filings by domestic companies, especially SMEs. Patent subsidies refer to a series of policies, undertaken at the national or local level, aimed at financing firms’ patent applications, examination, and maintenance (Li 2012). They are intended to stimulate firms’ patenting activities (in particular those undertaken at the international level) by lowering the financial burden, something that tends to be particularly relevant for SMEs. Significant policy actions centered on public subsidies for SMEs have been launched over the last decade in a number of countries (i.e. Italy, Spain, Belgium, Japan, China, India, and the United Kingdom), with the aim of fostering the innovation capabilities of domestic inventors.

However, in spite of a rich literature addressing the rationale and effectiveness of R&D subsidies programs (Klette et al. 2000; Gonzalez and Pazo 2008; Colombo et al. 2011), very limited attention has been paid to the mapping and assessing of patent subsidies (Dang and Motohashi 2013; Lei et al. 2013; Li 2012), and only a small number of empirical exercises have been undertaken to evaluate their impact, especially in countries outside China. We have, therefore, a limited understanding of how to design these types of schemes optimally in order to encourage innovation and competition. Regarding this latter point, a critical issue surrounding this type of policy measure relates to patent quality. A debate involving government insiders, legal experts, and academic scholars (Dang and Motohashi 2013; Li 2012; Prud’homme 2012), and reflected in the financial press (Financial Times 2008; The Economist 2010, 2014), has raised concerns about the possibility that subsidization by public bodies leads to an increase in the number of patents of low quality.Footnote 1 According to more sharply critical views, reducing or eliminating initial fees and costs to be paid by applicants could in fact lead to an inflation of patent filings that do not meet statutory requirements (and whose legal validity can therefore be challenged) and that are characterized by limited economic value for the applicants.

Building on such debate, our study intends therefore to fill a gap in the literature, by analyzing policy actions based on patent subsidies implemented in Italy from 2002 to 2012. It also assesses in more depth the impact on patent value of the first and largest of such programs, the one promoted by the Chamber of Commerce of Milan (in collaboration with the province of Milan and the region of Lombardy) in Northern Italy. The case of Italy is particularly interesting given that numerous and diversified schemes centered on patent subsidies and specifically oriented to SMEs have been established there over the last decade, promoted by local, regional, or national authorities. In particular, the measure promoted in the province of Milan in Northern Italy has funded, since its inception in 2002, hundreds of SMEs by covering some of the expenses related to their international patent filings. Based on this empirical evidence, this study addresses the following three research questions: (1) What are the design characteristics of patent subsidies programs for SMEs? (2) What is the impact of such programs on the quality of subsidized patents (as compared to a control group of non-subsidized ones)? (3) What is the impact of such programs on the growth of target companies?

The objective of the first part of the study is therefore to investigate the characteristics of all the policy measures established in Italy at various levels (national, regional and local) in order to promote patent filings and their exploitation by domestic firms. At this stage, we first identify and map 35 patent subsidies measures implemented in Italy since 2002 and analyze them in terms of several dimensions relevant to the program design: main objectives; promoting institutions; geographical scope of the measure; eligible expenses; eligible companies; amount of funding; and ex-ante and ex-post evaluation. We are therefore able to identify four different categories of measures, based on their ultimate objectives: measures promoting patent-filings; measures promoting patented technology maturation; measures promoting patent exploitation; and measures promoting patent leverage to access external financing.

The second part of the study focuses on a specific measure, namely that implemented by the Chamber of Commerce of Milan. It aims to assess the impact of this policy action on patent value and turnover growth, by analyzing, in a regression framework, differences in patent value between two groups of patents: a group of 111 patents that were subsidized over the period 2002–2007 in the province of Milan, and a control group of 111 non-subsidized patents. The control group was created using a matched-paired research design, identifying, for each subsidized patent, a corresponding patent with the same priority year and filed by an SME located in the province of Milan. In order to measure patent value, we adopted measures based on patent information, identified and validated in the literature, resorting in particular to the number of forward citations and the legal status of the patents (Lanjouw and Schankerman 2004; Munari and Sobrero 2011; Pakes and Schankerman 1984; Reitzig 2003, 2004; Trajtenberg 1990).

We therefore aim to contribute to the empirical literature that evaluates the effects of public support of R&D and innovation activities (Klette et al. 2000; Gonzalez and Pazo 2008), by focusing on the design and impact of patent subsidies programs, a topic that, despite its increasing relevance for policymaking, has been overlooked until now by empirical studies. In terms of policy implications, our study intends to shed light on the role of public intervention in fostering SME patents, in order to stimulate innovation, promote markets for new ideas and products, and enhance economic development. Ultimately, we intend to provide policy guidelines for the design and implementation of effective patent policies for SMEs.

The rest of the chapter is organized as follows. In the first section, we review the relevant literature and provide an overview of the different actions centered on patent subsidies implemented around the world. We then focus on the Italian experience, by mapping and analyzing the different actions realized at the national, regional, and provincial levels. We then describe in more detail our sample and variables, related to a group of patents filed by SMEs in the province of Milan. We finally report the results of our regression analyses and conclude by discussing policy implications.

2 Literature Review

2.1 Patenting by SMEs: Is There a Market Failure?

Endogenous-growth theory claims that technological change is a major factor driving economic growth (Arrow 1962; Grossman and Helpman 1994; Davidson and Segerstrom 1998). Moreover, the growing body of literature on the importance of spillovers in R&D and innovative activities (Honore et al. 2014; Klette et al. 2000; Munari and Oriani 2005) has recognized the existence of market failures as one of the main justifications for policy measures subsidizing R&D and innovation programs. Subsidies are thus intended to adjust market failures and to augment the supply of socially rewarding technologies. Such market failures tend to be particularly pronounced for small and medium-sized enterprises (SMEs) due to the limited financial resources available to support R&D, patent, and innovation expenditures (Gabriel and Florence 1993) and to the absence of scale and scope economies in R&D (Ortega-Argilés et al. 2009). As a consequence, extensive innovation support programs have explicitly targeted SMEs over the last decades across many countries (Hoffman et al. 1998).

The patent system itself can be viewed as a policy instrument originally aimed at encouraging the generation and diffusion of innovation. Similar to issues explored in the R&D subsidies literature, the design of effective patent systems represents a key area of attention for both scholars and policymakers (Guellec and van Pottelsberghe de la Potterie 2007). On this point, Encaoua et al. (2006), in an overview of the economics of patents and patent policy, suggest that economic research should focus more on how to design effective policies in the patents field, in order to lever the innovation process.

In particular, SMEs represent a very important and specific target for patent policies, since it is well documented that they are characterized by a low propensity to file for and use patents, for several reasons (Blind et al. 2006; Munari et al. 2012). An initial explanation deals with the high costs involved in patent filings and maintenance and with the honoraria of IP consultants, which can represent a significant financial burden for small enterprises. Moreover, IP rights are costly to enforce. Consider, for instance, the type of costs that an innovator has to undertake in case of infringement disputes. On the one hand, there are direct legal costs. In addition to that, there are business costs related to litigation, which can take several forms, going from the time devoted by managers and researchers to preparing documents and depositions to the court, to the blockage of cooperative relations with suppliers and customers, to the shut-down of production and sales activities during the litigation period. SMEs may not have the financial resources to fund such dispute resolution procedures and face the related risks, and hence may prefer to resort to informal protection mechanisms (such as trade secrets). Finally, an important organizational resource for exploiting IP strategies fully is represented by the availability of firm-level expertise in the areas of IP law and IP management. However, given the resource constraints that typically characterize SMEs, it is often very difficult for them to retain in-house the necessary expertise, either in terms of formalized IP departments or individual IP professionals.

Building on such premises, existing empirical evidence supports the view that a firm’s size is a driving force behind patenting activity and that SMEs tend to be disadvantaged in comparison to large companies (Blind et al. 2006). It is therefore likely that a specific market failure will characterize patent activity by SMEs. To address this issue, policy actions centered on patent subsidies have been established in many countries around the world over the last few decades.

2.2 Patent Subsidies for SMEs: International Experiences

Over the last decade, an increasing number of countries and regions around the world have established subsidies or funds to support R&D/innovation activities for national enterprises, research institutes, and universities (OECD 2013; WIPO 2006). Among such measures, the use of patent subsidies, in particular those favoring SMEs, has recently gained increasing attention from policymakers (WIPO 2006). The most relevant experience in this area has probably been that of China, although many other countries have implemented similar programs.Footnote 2 Typically, patent subsidies measures take the form of direct financial support of some of the expenses related to national and, more often, international patent filings. Such schemes are generally intended to cover part of the filing costs, with a few of them also subsidizing maintenance fees or enforcement expenses. Such measures may be funded by the national government, through a ministry or a specialized agency. Patent subsidies may also be awarded by regional authorities, through a department or a specialized innovation agency. Domestic SMEs constitute the primary target of patent subsidies measures, even though there are also other beneficiaries, such as large enterprises, research institutes, and universities. Although the number of patent subsidies conferred to beneficiary firms varies widely from country to country, most are executed via the reimbursement of a certain proportion of costs incurred (typically with an upper limit), or through the awarding of a fixed amount for each subsidized patent.

2.3 The Design and Impact of Patent Subsidies: Insights from the Literature on R&D Subsidies

Despite the growing diffusion and relevance of patent subsidies measures around the world, some of which we have partially documented here, to the best of our knowledge only a limited number of attempts have been made in the literature to assess their characteristics and effectiveness (Dang and Motohashi 2013; Li 2012; Lei et al. 2013; Prud’homme 2012). Most of the studies have analyzed the context of China, given the important diffusion of these measures in that country. Li’s article (2012) examines a number of influential forces that may have contributed to the explosive growth of Chinese patenting in recent years, including regional patent subsidy programs. The empirical analyses in Li’s article show that the launch of patent subsidy schemes has indeed stimulated the rapid upswing of patenting in China. The study also shows an increase in the ratio of patent applications granted by national patent office SIPO, although it does not perform more specific analyses of the dynamics of patent quality. The study by Dang and Motohashi (2013) analyzed a merged dataset of Chinese patent data and industrial survey data to assess the patenting and innovation activities of Chinese large and medium-sized enterprises. Their empirical results show that that patent count is correlated with R&D input and financial output, and that patent subsidy programs significantly increased patent counts more than 30 %. Finally, the paper by Lei et al. (2013) analyzes the seasonal trends of patent filing counts in China from 1986 to 2007, by comparing domestic and foreign filings. They show a strong monthly pattern of domestic filings, with peaks in December, which seems to suggest the existence of politically driven influences on domestic patent filings. They do not, however, find differences in the quality of domestic patents filed in December, as measured by grant rates.

Such initial analyses help to shed light on the influence exerted by patent subsidy measures on patenting and innovation activities, although they also present a series of limitations. First, they are largely focused on the experience of China, while similar analyses of other contexts are largely missing. Second, they tend to assess the impact on patent quality by adopting a limited set of quality measures (i.e. grant ratios). Third, they do not analyze the effectiveness of patent subsidies at the level of recipient companies, as might be revealed by, for instance, assessing the ultimate impact of such measures on the economic performance of awardees. We therefore rely on the established literature on R&D subsidies to infer some additional useful indications for the appropriate design, implementation, and assessment of patent subsidies measures. Several efforts have been dedicated to evaluating the effects of R&D subsidies on firms’ R&D behavior and growth. A key area of attention concerned the balance between public and private R&D, in terms of complementarity or substitution. On one hand, the positive impact of R&D subsidies on firms’ R&D expenditures has been suggested by works such as those by Leyden and Albert (1991), Busom (2000), Almus and Czarnitzki (2003), Koga (2005), Hussinger (2008), Aerts and Schmidt (2008), and among others. On the other hand, the substitutive effect of public R&D crowding out private R&D has been observed in studies by Lichtenberg (1984, 1987, 1988), Mamuneas and Nadiri (1996), and Wallsten (2000).

Previous studies have analyzed the allocation process of R&D subsidies. Blanes and Busom (2004), for instance, reveal the heterogeneity of projects and of firms’ selection rules across different agencies and industries. They suggest that national and regional programs end up supporting different types of firms and that each agency may use R&D subsidies with different policy goals in each industry. Giebe et al. (2006) identify two sources of inefficiency in the selection rules for allocating R&D subsidies and propose an improved mechanism designed to correct this allocation inefficiency, including a form of auction in which applicants bid for subsidies. A recent study of Colombo et al. (2011), based on a sample of new technology-based firms in Italy, compares the effects of different types of subsidization schemes, distinguishing between ‘automatic’ and ‘selective’ subsidies, in which the latter provide financial support only to selected applicants based on substantive examination. Their results suggest that the receipt of selective R&D subsidies tends to have a greater impact on a firm’s performance than do automatic subsidies, thus making the former more effective in terms of the economic success of target firms.

On a different level, Scherer and Harhoff (2000) suggest that technological policy should allocate government subsidies in order to support a sizeable array of projects, with the emphasis placed on a relatively small number of big successes, as a consequence of the highly skewed distribution of the value of innovations (i.e. the fact that a small minority of innovations yields the lion’s share of all innovations’ total economic value). This observation is particularly important when assessing the effectiveness of patent subsidies because of the tremendous heterogeneity in the value of patents, something that has been well documented in the literature (Munari and Sobrero 2011).

The rich literature on R&D subsidies thus provides several important indications on how to assess the effectiveness of patent subsidies for SMEs. First, as mentioned by Encaoua et al. (2006), more empirical testing of the economic effects of patent policies is required. Second, the debate on the additionality or crowding-out effects of R&D subsidies provides important methodological guidelines for the assessment of patent subsidies measures, particularly in terms of the application of a matching estimations method (Bérubé and Mohnen 2008). Third, the review highlights the need to assess the impact of policy measures not only in terms of the number of additional patent filings undertaken by SMEs, but also in terms of the value of subsidized patents.

This latter point appears of particular interest in light of the recent debate involving government insiders, legal experts, and academic scholars (Li 2012; Lei et al. 2013; Prud’homme 2012), and reflected in the financial press (Financial Times 2008; The Economist 2010, 2014), about the possibility that patent subsidization by public authorities may lead to an increase in the number of patents of low quality. More critical voices have argued that, by reducing or eliminating the initial fees and other costs to be paid by the applicants, such measures may inflate weak patents that may generate little or no economic value for their owners, and whose legal validity can ultimately be challenged (The Economist 2014). This concern would most often apply to types of patents that are not substantively examined, as is often the case for utility models and designs. However, this could also apply to invention patents if subsidies are awarded to invention patent filings prior to substantive examination by the responsible patent authorities.Footnote 3

The economic literature has convincingly questioned the assumption that “more patents is better,” arguing that a surge in the number of low-value patents can have, on the contrary, a detrimental effect on innovation and competition (Guellec and van Pottelsberghe de la Potterie 2007). One practical concern is related to the difficulties experienced by patent offices coping with an inflated workload, ultimately inducing a significant backlog that can cause delays in procedure (Encaoua et al. 2006). More importantly, a marked increase in the volume of patents of low quality, or in outright illegitimate patents (i.e. not novel or not sufficiently inventive), can raise uncertainties about the enforceability of property rights and give rise to overlapping patents (patent thickets), ultimately increasing patent disputes and discouraging innovation (Lemley and Shapiro 2005).

As to this point, Encaoua et al. (2006) highlight that patent application and renewal fees can act as “self-selection mechanisms” to encourage the patenting of highly valuable inventions and discourage that of the least valuable ones. Arguing this, it becomes important to assess whether or not the provision of public subsidies to SMEs has an impact on the value of patents, and in turn on the subsequent economic performance of the recipient company. In the empirical part of our work, we address such research questions by first mapping the characteristics of patent subsidy measures adopted in Italy. We then focus on a specific measure and assess its effectiveness in terms of patent value and in terms of the subsequent growth of the company by comparing a sample of subsidized and control patents. The analyses we perform are primarily oriented toward deriving lessons for policymakers that can be applied usefully in the design of patent policy measures, as discussed in the final part of our work.

3 Research Design

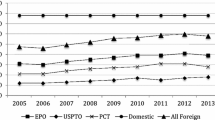

We focus our analysis on policy actions taken in Italy to foster patenting by SMEs. The case of Italy is of particular interest for several reasons. First, the Italian economic system is characterized by a strong diffusion of SMEs, which account for the lion’s share of persons employed and value-added generated in the country, with value considerably above average EU levels. As far as innovation is concerned, according to the European Innovation Scoreboard (EIS 2013), Italy lags behind its main European partners in many indicators of technology and innovation—and in particular in those indicators concerning European Patent Office (EPO) and United States Patent and Trademark Office (USPTO) patent applications. In order to address such issues, several policy actions have been taken over the last decade in Italy at different levels (national, regional, and local) in order to promote patent applications by domestic firms, in particular by SMEs. For all these reasons, Italy represents an ideal context in which to address our research interests.

3.1 The Research Context

We performed our data collection and analyses in two steps. We were first interested in identifying the main characteristics in the design of patent subsidies measures implemented in Italy. We thus initially conducted a detailed mapping of all such measures realized in Italy by national, regional, or provincial authorities. We then focused our attention on the experience of the Chamber of Commerce of Milan, in the Lombardy region of Northern Italy, in order to assess the impact of subsidies on patent value. We analyzed the different measures established by the Chamber of Commerce of Milan (in collaboration with the province of Milan and the region of Lombardy) in order to support European and international patent filings by SMEs located in the province of Milan. Such measures started in 2002, with total available funding of EUR 2 million that year.

In this policy measure, the subsidy was assigned automatically, based on the chronological order of applications, after a check of formal requirements related to the satisfaction of eligibility criteria for the applicant and the expenses incurred for patent filings.Footnote 4 However, no substantive examination was conducted of applications for the subsidies. The subsidy covered up to 50 % of expenses incurred by an SME for an international patent filing (including drafting expenses), up to a maximum amount of EUR 15,000. The policy was renewed annually up to and including 2011 (with the exception of 2004), funding hundreds of companies. Until August 2011 it was by far the most important measure of this kind in Italy, in terms of amount of funding and number of companies involved.Footnote 5 In this section we first present the sources we used to collect the data, and then describe in more detail the sample and variables we adopted in our analyses of how subsidies affect patent value.

3.2 Data Sources

In order to identify all the patent subsidies measures promoted in Italy over the last decade, we first analyzed the web pages of all the chambers of commerce in Italy, since they are responsible, through local offices, for patent filing registrations, in collaboration with the Italian Patent and Trademark Office (UIBM).Footnote 6 In addition to this role, the local chamber of commerce is typically responsible for a series of activities aimed at promoting the diffusion of a patent culture. We then complemented this initial search by performing a more general web search using keywords related to patent subsidies.Footnote 7 In order to complement this initial search, we then performed five further interviews with, respectively, representatives of the patent offices of two major Italian chambers of commerce (Milan and Bologna); consultants with two leading IP consulting firms in Italy; and a consultant with a major Italian consulting firm specializing in enterprise and public funding. The interviews were intended to enrich our knowledge and understanding of the main measures implemented in Italy to promote patenting, to clarify their design and logic, and to give us feedback on their impact and effectiveness.

Based on this data collection, we were able to identify 35 patent subsidy actions implemented in Italy over the period 2002–2012: 25 actions were promoted by the local chamber of commerce, three by provincial authorities, three by regional authorities, and four at the national level by the Ministry of Economic Development (Ministero per lo Sviluppo Economico). We then focused on the patent subsidy measures established from 2002 onward by the Chamber of Commerce of Milan, the province of Milan, and the region of Lombardy, in Northern Italy.

3.3 Sample

In our study on the different measures established by the Chamber of Commerce of Milan, we decided to focus on the calls published in 2002, 2003, 2005, and 2006 (in 2004 the policy was not implemented), in order to have a time period sufficient to assess the final outcome of the patent application process (i.e. whether or not a grant was received). We were able to identify all patents and companies receiving the subsidies in these years (as well as those companies that applied for a subsidy but were not selected), using information from the website of the Milanese Chamber of Commerce.

Our data gathering was structured in three phases. In the first phase, we identified all SMEs and the related patents that obtained a subsidy in 2002, 2003, 2005, and 2006. This initial sample consisted of 146 SMEs in the province of Milan, operating in industries ranging from biotechnologies and healthcare to electronics and ICT, as well as mechanics and materials. In the second phase, we collected information on patent applications for cases registered as EPO or PCT applications, using Espacenet as a data source.Footnote 8 From the initial sample we retained only those SMEs for which information on their subsidized patents was available in the patent database. After whittling down the initial sample following these criteria, we were left with a sample of 136 SMEs and 191 subsidized patents.

In the third and final phase of our data collection, we constructed a matched sample of SMEs (and related patents) located in the province of Milan that did not receive a patent subsidy over the period of analysis. In order to construct such a control group, for each subsidized patent we identified a corresponding patent satisfying the following three conditions: (1) having an SME as applicant; (2) having Milan as the applicant’s address; (3) having the same priority date as the subsidized patent. We applied the SME definition of the European Commission in order to filter the patents in the control group. We thus checked whether the applicant’s turnover (in the priority year of the subsidized patent) fell within the limits posed by the EC definition of SMEs, matching companies included in the same category of either micro, small, or medium-sized enterprises.Footnote 9 This means that a subsidized patent from a micro enterprise was matched to a corresponding unfunded patent, with the closest priority date, filed by another micro enterprise located in the province of Milan.Footnote 10 Following the same logic, we identified the control patents for the small and medium-sized companies included in our sample. Information on firms’ turnover and addresses for the initial and matched samples came from the AIDA commercial database, including accounting information on both public and privately held companies in Italy.

In this process, we were not able to find a corresponding match for some of the subsidized patents, since in some instances accounting information was not available on AIDA for either beneficiaries or target companies. Because of this, we were left with a final sample of 111 subsidized patents—including 60 EP patents and 51 PCT patents—applied for by SMEs in the province of Milan with priority years ranging from 2000 to 2007. Such patents were matched to a corresponding group of 111 control patents (including 60 EPO patents and 51 PCT patents) that did not receive a subsidy, identified through the procedure described above.

3.4 Methods and Variables

We employed two main regression models in order to evaluate the effects of subsidies on patent value. We first used the number of forward citations received by each patent as the dependent variable, since it represents the most frequently used proxy for the value of patents in the literature (for a review of this literature see Munari and Sobrero 2011; Omland 2011). As dependent variable in the second model, we used a dummy variable to capture whether or not the patent was granted up to March 2015. Because of the non-negative, discrete, and highly skewed nature of the first dependent variable (“Number of forward citations”), we adopted a Poisson regression model in the first equation. In the second equation, we used a logit specification to analyze the impact of patent subsidies on the likelihood of grant.

Dependent variables. As a measure of patent value we used the number of forward citations received by each patent from patents subsequently issued. Forward citations were identified and collected through Espacenet. Citations from later patents of the patent under examination (forward citations) represent a significant indicator of value, and have been analyzed, validated, and used in numerous scientific studies for several decades (Harhoff and Narin 1999; Reitzig 2003, 2004; Trajtenberg 1990). Several theoretical arguments explain this empirical fact (Omland 2011). The existence of citations from later patents indicates that patents on similar technology continued to be applied for, meaning that subsequent investments building on the initial invention were made and that the technology is perceived as attractive and useful. Moreover, citations indicate that the claims of the later patent may have been limited by what was already described in the earlier patents; this suggests that the newer invention might integrate aspects already protected by earlier patents. Hence, the ‘old’ patent claims appear to be still relevant in the newer technology space. For these reasons, the number of forward citations is probably the most commonly used proxy in the literature for the value of patents (Munari and Sobrero 2011; Sapsalis et al. 2006).

As an additional variable for patent quality, we used the legal status of the patent, constructing a dummy variable, Patent grant, that takes the value 1 if the patent was granted as of March 2015. This serves as another empirical indicator widely used in the literature to approximate the quality of a patent by indicating the probability of getting a patent granted (Guellec and van Pottelsberghe de la Potterie 2000, 2001). In addition to that, it has been generally employed by previous articles assessing the impact of patent subsidies (Li 2012; Lei et al. 2013).

As a measure of economic performance at the company level, we referred to Turnover Growth. This was computed as the growth (in percent) of turnover levels in the three years after receipt of the subsidy, for both subsidized and control companies. More precisely, for each company i, this variable is computed as:

where Turnoveri(0) captures turnover level in the year of receipt of the subsidy (for control companies, this year is identified with reference to the corresponding subsidized company) and Turnoveri(+3) is the third year after receipt of the subsidy. We were able to compute such variables only for a subset of sample companies, due to limited data availability on turnover levels.

Independent variable. In our regression models, we included a dummy variable, Patent Subsidy, taking the value 1 to indicate the beneficiary status of the subsidized patent in our sample, and 0 otherwise (for patents in the control group). We use this dummy as a key explanatory variable in order to evaluate the effectiveness of patent policy measures on patent value.

Control variables. The number of inventors for each patent was counted and collected as a potential determinant of patent value. It is established as an indicator of the number of researchers involved in a research project, and a proxy reflecting the importance of the research to the company and the potential profits expected (Sapsalis et al. 2006). Another variable used to determine the value of a patent in our study is the number of co-assignees, which indicates the level of collaboration with other knowledge-generating institutions or individuals (Sapsalis et al. 2006). We then built a patent scope variable, counting the number of IPC classes to which the patent is assigned. IPC classes encode and classify the technical content of patent documents, which is positively correlated with the patent’s value (Lerner 1994; Harhoff and Reitzig 2004). We also counted the number of backward citations for each patent as another determinant of patent value. This measure could indicate the extent to which a patent is based on previous science or technological knowledge, and it is theorized to operationalize the technical novelty of a patent (Sapsalis et al. 2006; Reitzig 2004). We also included a dummy variable, PCT, to separate PCT patents from others. The choice of application route has been proposed as a potential value indicator (van Zeebroeck and van Pottelsberghe 2008). The observed choice of the applicant to use the PCT system has been tested as a value indicator by Harhoff and Reitzig (2004), and Harhoff and Hoisl (2007). We also constructed a dummy Utility patent to distinguish utility models from patents for technical inventions. The time effect of patents being cited or granted is taken into account through a set of time dummies (Sapsalis et al. 2006), corresponding to the priority year of each patent, from 2000 to 2007.

A variable Firm’s turnover was adopted in order to capture size effects that might have an impact on the quality of the patent. For each firm, turnover levels were measured in the priority year of the patent, according to AIDA. Finally, to control for industry-level effects, we constructed four sector dummies, based on the main ATECO code of the company: Manufacturing takes the value 1 for companies in manufacturing sectors (ATECO codes from C10 to C19, and from C23 to C33); Chemical and Pharma takes the value 1 for companies in chemical and pharma sectors (ATECO codes from C20 to C22); Scientific Sector takes the value 1 for companies operating in scientific, technical and professional activities (ATECO codes M); Other Sectors takes the value 1 for the remaining sectors. In our regression analyses we used the Manufacturing sector as the baseline case (and excluded the related dummy in the models).

4 Analyses and Results

4.1 The Design of Patent Subsidies Measures in Italy

In the first step of our research, we identified all patent subsidies measures established in Italy from 2002 to 2012, for a total of 35 actions that we were able to map and analyze. Table 4.1 briefly analyzes these different measures in terms of dimensions that are relevant to the design of the scheme: (1) promoting institutions and geographic coverage; (2) rationale and objectives; (3) target beneficiaries of the measure; (4) eligible costs; (5) maximum amount of funding; (6) overall budget; (7) selection and evaluation criteria.

It is possible to classify such measures along the first two dimensions reported in Table 4.1, which are particularly relevant for their design and implementation: their geographic scope and their rationale and objectives. In terms of geographic scope, it is important to note that the greatest number of measures is promoted at the local (provincial) level, typically by provincial chambers of commerce, thus limiting the number of intended beneficiaries to the SMEs located in the province. A few measures have been implemented by regional authorities, and in more recent years (2011–2012), four major programs have been implemented at the national level, three of them by the Ministry of Economic Development (Measures Brevetti+ Premi, Measure Brevetti+ Incentivi valorizzazione, and Fondo Nazionale per l’Innovazione) and one by the Ministry of Education, Universities and Research (Proof of Concept Network). The second dimension of analysis deals with the rationale and objectives underlying such measures. In this sense, it is possible to identify four different types of measures: measures promoting patent-filings; measures promoting patented technology maturation; measures promoting patent exploitation; and measures promoting patent leverage to access external financing.

In the first and largest group are included those measures aiming to encourage SMEs to protect their IPRs at an international level, thus fostering innovation and internationalization activities, particularly by SMEs. Typically, they provide subsidies to cover patent filing fees and expenses for patent attorneys. This group includes the vast majority of the measures included in our sample (30 programs). In addition to that, all measures with a local geographic scope (with the exception of the one in the Province of Trento) have a strict focus on promoting patent filings. The remaining three types, on the other hand, in addition to promoting patent filings, also try to support beneficiary companies in their subsequent commercial exploitation and financial valorization.

The second type of measure intends to promote the maturation of patented inventions up to a stage at which they can attract the interest of external acquirers or investors. In this case, public subsidies are provided in order to cover, for instance, feasibility studies, realization of prototypes and demos, and market analyses. This measure is particularly suited for patents generated by universities and public research organizations, since they typically operate at the frontier of scientific advancements and involve considerable uncertainties regarding their market potential (Kochenkova et al. 2015). A recent example of this type of measure in Italy is the Proof of Concept Network, coordinated by Area Science Park in Trieste and funded in 2012 by the Ministry for Education, Universities and Research (see Annex II).

A third type of measure aims to promote patent exploitation, by providing funding to cover expenses related to drafting and finalization of licensing/sale agreements for patented technologies (such as technology marketing analyses, due diligence, patent valuation, and legal costs of licensing agreements). Examples of this type of measure include the Fund Brevetti+, established by the Italian Ministry for Economic Development, or the Fund Trentino Brevetti, established by the province of Trento in Northern Italy (see Annex II). The fourth and final type of measure supports SMEs in exploiting their patented invention in order to access external financing, either from banks or venture capital funds. An example of this innovative funding scheme is provided by the measure Fondo Nazionale per l’Innovazione, established with a budget of EUR 75 million by the Italian Ministry for Economic Development, through two different schemes: the first scheme acts as a credit risk guarantee fund to incentivize banks in providing credit to innovative SMEs with patented technologies; the second scheme acts as a public-private venture capital fund to provide risk capital to innovative IP-rich new ventures (see Annex II).

Looking at Table 4.1, it clearly emerges that most of the programs centered on patent subsides established in Italy are included in the first category, promoting patent filings, whereas measures in favor of patent exploitation are more limited in number, tend to be promoted at the national level, and are still largely pilots. Below, we present more specific comments related to the first set of subsidy measures, centered on patent filings, given their wider diffusion and more settled nature. From an analysis of Table 4.1, some critical issues that have characterized the design of patent subsidy schemes centered on patent filings in Italy are immediately evident. First is the marked fragmentation of the different programs, due to the activation of several schemes that are often geographically bounded to single provinces, have limited available budgets (in many cases of less than EUR 50,000), and award to beneficiary firms only a small amount of funding to cover a minimal amount of patent expenses. Therefore, such measures are often established with a mere signaling role, but it is unlikely that they will have real impact as an incentive for SMEs to file additional patents. Moreover, the emerging picture is that of limited coordination among the different institutional actors involved in the process (chambers of commerce, provinces, regions, foundations), which hinders the possibility of establishing sizeable programs with the critical mass needed to make a real contribution.

A second critical point relates to the definition of the measures’ objectives. The vast majority of the schemes have a strong focus on supporting an increase in the number of patents filed by SMEs as a way to strengthen innovation and the internationalization process. In other words, the measures are centered on augmenting the number of patents filed, with limited or no attention to improving the quality of patents filed or fostering the economic valorization of intellectual property rights. No measure in our sample has been established with the declared objective of enhancing the number of “high-quality” patents.

A third critical issue, which stems directly from the previous one, is the lack of predefined criteria to guide the evaluation and selection of the patents to be subsidized. In the vast majority of the schemes under analysis, no ex-ante evaluation of the submitted patent was made, with the exception of a formal check on the satisfaction of eligibility criteria.Footnote 11 Typically, the subsidies were automatically awarded based on the chronological order of the submissions, up to the consumption of the overall budget. In only four cases were the programs managed as selective schemes providing financial support only to selected applicants. In such cases, a committee of experts was formed to make a selection based on predefined criteria (including the geographic and technological scope of the patent; the degree of innovation; potential market size and scope; the competences of the applicant; and collaborations with universities and public research centers). A direct consequence of three such shortcomings in the design of policy measures centered on patent filings is the risk of subsidizing patents of low quality and limited exploitation potential, thus limiting the effectiveness of the measure. This is essentially what we wanted to test in our next analyses, based on data from patents subsidized in the province of Milan.

4.2 The Impact of Subsidies on Patent Value and Turnover Growth: Descriptive Analyses

In the following sections, we report the results of our analyses designed to test whether the receipt of subsidies has an impact on patent value, based on data related to patent subsidy schemes implemented by the Chamber of Commerce of Milan. Table 4.2 reports descriptive statistics on our sample of 222 patents from SMEs located in the province of Milan, including 111 subsidized and 111 control patents with priority years ranging from 2000 to 2007.

Table 4.2 shows that the average patent in the sample receives less than 1 forward citations by subsequent patents (0.91), with a maximum number of 10 citations per patent. About 44 % of patents in our sample were granted by March 2015, with the remaining patents being either refused or withdrawn. The average breadth of patents, as measured by the number of four-digit IPC classes, is around 3. The average number of inventors and of applicants reaches nearly 2 per sample patent, with maximum levels of 8 and 9 respectively. The number of backward citations on average is nearly 5. Such descriptive statistics related to different measures of patent quality—such as the number of forward citations, the likelihood of grant, the number of IPC classes, the number of inventors, the number of applicants, and the number of backward citations—suggest high skewing in the value distributions, which are consistent with findings of previous studies demonstrating high heterogeneity in the value of patents (Munari and Sobrero 2011). The SMEs responsible for these international filings have, on average, an annual turnover of EUR 6 million.

We then used a corrected t-test to compare the mean values of different indicators of patent quality between the two samples of subsidized patents and control (i.e. non-subsidized) patents. Table 4.3 reports the results of this comparison, showing in general terms that no statistically significant differences in patent quality seem to emerge between the two samples.

The number of forward citations received by subsidized patents is indeed slightly higher than the matched sample, with average values of 0.94 citations as compared to 0.87 citations, even though the difference is not statistically significant at conventional levels. Similarly, subsidized patents have a higher likelihood of receiving a final patent grant as compared to control patents (more precisely, 49 % of them are granted as to March 2015, as compared to 39 % of control patents), but the difference is not statistically significant either. Moreover, the number of backward citations in the sample of patents with subsidies is greater than in the matched sample, with the average value of 5.1351 compared to 4.7838, but the difference is not significant. On the other hand, the patent’s breadth, the number of inventors, and the number of applicants are all smaller for subsidized patents than for the matched sample, but only in the case of the number of inventors is such difference statistically significant, at the 10 percent level. Regarding turnover data, it is noteworthy that, as a consequence of the matching procedure we adopted in the construction of the control group of patents, average turnover levels are similar between subsidized firms and control firms. The average value of turnover growth results, however, is higher for companies included in the control group compared to those subsidized (43.12 % vs. 28.83 %), and such difference is statistically significant, at the 10 percent level.

4.3 The Impact of Subsidies on Patent Value and Turnover Growth: Regression Analyses

We then performed regression analyses in order to control for other factors that might influence patent value and turnover growth, in addition to the receipt of a subsidy. Table 4.4 first reports the correlation matrix for our main variables in the full sample. It shows that traditional patent value determinants, such as patent breadth, number of inventors, number of applicants, and number of backward citations tend to be positively correlated with each other. However, no significant evidence of multi-collinearity seems to emerge from the data.Footnote 12

Turning to the regression models reported in Table 4.5, Model 1 adopts the total number of forward citations received by each patent as the dependent variable. We adopted a negative binomial regression model in order to estimate this, given the count nature of the dependent variable.Footnote 13 As an additional check, we repeated such estimates using a Poisson regression model (Model 2). Both Models 1 and 2 include the dummy Patent Subsidy as the independent variable, and other value determinants as control variables. Model 3, on the other hand, adopts a Logit estimation, with the dummy Patent Grant used as dependent variable. It adopts the same explanatory variables used in the previous two models.

The results of the regression models largely confirm those of the t-test analyses. The evidence presented in Model 1 shows that obtaining a patent subsidy does not have a significant effect on patent value as measured in terms of subsequent forward citations. In this model, the coefficient of the dummy Patent Subsidy is positive, but not statistically significant at conventional levels. By looking at these results, we thus cannot conclude that the Milanese Chamber of Commerce’s specific patent subsidy measure has provided incentives for developing low-quality patents, but neither can we support the assertion that it has had a positive impact on patent quality.

When examining the effect of other value determinants, in Model 1 we notice that the coefficient of the number of IPC classes is positive and significant, at the 10 percent level, signaling that patents with a larger scope are more likely to be cited subsequently. This is consistent with the findings of previous literature on the breadth of patents (Munari and Toschi 2014a), showing that broad patents are more likely to have a subsequent impact in different technical domains. Moreover, the number of inventors has a positive and significant impact (at 5 %) on patent value, as measured by forward citations. Indeed, the size of the research team can be linked to the quality of the underlying invention and its expected impact. A larger inventors’ team would thus suggest a better patent quality with a higher expected value. The dummy variable Other Sectors is also positive and statistically significant, at the 10 percent level. Not surprisingly, the coefficient of the time dummies in this model suggests that more recent patents have a lower likelihood of receiving subsequent citations than do older ones. Finally, our results do not suggest that a firm’s size has a significant effect on patent value, probably due to the fact that all firms in our sample are included in the SME category. The results of Model 2, adopting a Poisson specification, are largely in line with the findings of Model 1. In this case as well, the Patent Subsidy variable does not show a statistically significant relationship with the number of forward citations received by the patent.

If we move to Model 3, on the other hand, we notice that, after controlling for other influential factors, the dummy Patent Subsidy is positive and statistically significant, although only at the 10 percent level. In this specific case, therefore, it seems that receiving a subsidy increases the likelihood of having the patent granted. This result is consistent with previous studies on the effects of patent subsidies on grant ratios (Li 2012; Dang and Motohashi 2013). It could suggest that the receipt of the subsidy may encourage applicants to proceed with the examination process, by reducing the likelihood of applicants withdrawing the patent request due to financial constraints. In this model, the control variables on the number of backward citations has a negative and statistically significant (at the 10 percent level) relationship with the grant likelihood. Since backward citations indicate the presence of a higher number of previous patents upon which the current patent builds, this can reduce the inventive step of the patent and ultimately result in a lower likelihood of obtaining the patent. We do not find statistically significant effects for other control variables in this model.

Finally, Model 1 in Table 4.6 reports the results of the OLS regression analyses using turnover growth as the dependent variable. The dummy Patent Subsidy is used as the main explanatory variable in this model, in addition to other control variables. Table 4.6 does not support the existence of significant differences between subsidized and matched patents in terms of assignees’ turnover growth in the three years following the receipt of the subsidy, once one controls for additional influential factors. Indeed, the coefficient of the dummy Patent Subsidy is not significant at conventional statistical levels. Such findings therefore do not support the idea of a strong positive impact on companies’ economic performance resulting from the receipt of patent subsidies. In this specification, the variable Nr Inventors is positive and statistically significant (at the 10 percent level). This is consistent with the idea that a larger team of inventors leads to innovation with a stronger commercial impact. The dummy variable for the Chemical and Pharma sector is also positive and statistically significant (at the 10 percent level) in this model.

5 Conclusions and Policy Implications

This chapter has investigated a series of issues related to the design and assessment of patent subsidies schemes to foster patent activities by SMEs. Such measures have gained increasing importance over the last few years in a number of countries as a way to address the market failures connected with innovation and patenting activities by small and medium enterprises. We thus contribute to an emerging literature that aims to investigate empirically the optimal design of such schemes and to evaluate their effectiveness (Prud’homme 2012). We were particularly interested in assessing the impact of public subsidies on the value of patents and on their ultimate impact on economic performance levels, inspired by a series of concerns related to a potential increase in low-quality patents following the adoption of these kinds of measures (Financial Times 2008; The Economist 2010, 2014).

From an empirical standpoint, we first mapped and analyzed a series of 35 policy programs centered on patent subsidy schemes activated in Italy by local, regional, or national authorities starting in 2002. We then studied a sample of 222 patents, including 111 subsidized and 111 control patents, from the province of Milan in Northern Italy to test whether the receipt of a subsidy was associated with low patent value. Our mapping exercise highlights some limitations that seem to characterize the majority of patent subsidy measures activated in Italy: a strong fragmentation among the measures themselves, often resulting in a limited budget and a small amount of funding provided to beneficiary firms; a lack of coordination among actions undertaken at different levels (local, regional, national); a focus on increasing the number of patent fillings, but not on increasing the quality of patents; the predominant automatic assignment of the subsidies based purely on chronological order, and the consequent absence of ex-ante evaluation of the quality and economic potential of submitted inventions. All such shortcomings may have negative consequences, such as providing inadequate incentives for SMEs to apply or funding patents with limited economic potential, thus generating inefficiencies in the distribution of public financial resources.

We then assessed in a regression framework the impact of subsidies on patent quality in the specific case of the measure implemented by the Chamber of Commerce of Milan. The results from our regression analyses provide mixed evidence on this issue. Our results do not support the concern that the receipt of a subsidy may be associated with lower patent value. In one model, the receipt of the subsidy is significantly and positively related to the probability that the patent will be granted; we do not find any statistically significant effect, however, on the number of forward citations received by the patent as a proxy of its underlying value. Besides that, our analyses do not show the existence of statistically significant differences in a firm’s turnover growth in the three years after the receipt of a subsidy when compared to the control group of non-subsidized companies. Based on such evidence, therefore, our findings do not show a strong economic impact resulting from the measure we analyzed.

Such results should be interpreted with caution, given our focus on a single policy measure and the relatively small number of patents we were able to analyze. The findings could be a direct consequence of the design of the specific measure we analyzed, based on the automatic awarding of subsidies to qualified applicants, following a mere check of the formal requirements, but with no substantial examination of the quality of the patent or the underlying technology. The findings could also be explained by the limited amount of financial support provided by this measure to recipient companies. In any case, our findings suggest that the effectiveness of policy measures centered on patent subsidies is likely to be reduced when these measures are characterized by limited funding and lack of ex-ante quality assessment in the selection process.

Our study therefore identifies some important lessons and implications for policymakers in designing and implementing effective patent policies for SMEs based on subsidies. A first issue concerns the size of the programs. Rather than fragmenting financial resources into narrowly designed schemes (often with rigid geographical limits) with limited budgets and small subsidies, the implementation of sizeable programs should be encouraged (Scherer and Harhoff 2000). Future research should address this issue more directly by assessing the influence not just of receiving a subsidy, but also of subsidy levels. Ideally, future studies should compare the effectiveness of different measures centered on patent subsidies in order to understand in greater depth the influence of specific design dimensions (including the amount of funding provided per project).

A second issue relates to the importance of jointly boosting the quantity and the quality of patents filed. It is well documented in the literature that the value of patents is extremely skewed, and the large majority of patents are of limited, if any, value to the applicants, since they are not subsequently exploited in downstream product developments or licensing agreements (Munari and Sobrero 2011). The twin challenges of patent quantity and quality should therefore be encouraged by policymakers, particularly in light of the explosion in both the number and volume of patent filings for all patent offices over the last two decades (Guellec and van Pottelsberghe de la Lotterie 2007).

A third issue, strongly linked to the previous one, relates to the selection and evaluation criteria used to identify beneficiaries of the scheme. It is doubtful whether the establishment of patent subsidy schemes that assign money via an automatic procedure based on chronological order, with no substantive examination of applications, would reach this goal, as suggested by our results. As to this point, previous research on the impact of public R&D subsidies has highlighted that when competition among applicants is tough and the support program is administered by a reputable government agency, selective schemes are likely to be more beneficial than automatic ones for fostering SMEs’ value creation (Colombo et al. 2011).

Moreover, as suggested by Lerner (1999), selective schemes may provide certification of the quality of beneficiary firms (and the underlying patents) to uninformed third parties, such as external investors or potential licensees. In the case of patent subsidies, therefore, selective schemes providing financial support only to selected applicants, based on an ex-ante evaluation of the quality of the patent and the economic potential of the invention, could be more appropriate for reaching this goal. Our analysis of the measures implemented in Italy has suggested a series of criteria that can be used by a committee of experts to implement this kind of selection, including the geographic and technological scope of the filed patent; the degree of innovativeness of the technology; potential market size and scope; the applicant’s competences and skills; and the existence of collaborations with universities and public research centers.

Finally, and as a direct consequence of the previous point, from a policy perspective, it appears important to encourage not only domestic and international patent filings by SMEs, but also their actual use to generate economic value. SMEs in particular can take advantage of their patents in a wide variety of ways, including the protection from imitation and freedom to operate, but also outward licensing, access to external financing, and reputation building (de Rassenfosse 2012; Giuri et al. 2013; Munari and Toschi 2014b). As we highlighted in the assessment of the patent measures implemented in Italy, an ideal extension of policy measures centered on patent filings is thus also the encouragement of the economic exploitation of patents through coverage not only of expenses related to patent fees and drafting, but also to services related to their use and commercialization (for instance, costs for services related to patent evaluation and due diligence, marketing studies, license drafting, feasibility studies, and proofs of concept). In this sense, the recent pilot initiatives implemented in Italy promoting maturation, exploitation, and financial leverage of patents appear extremely interesting, although it is too early to assess their actual impact.

A critical element that emerges in the implementation of this experience is the importance of methods and approaches to assess the value of the patent and the underlying technology. For this purpose, qualitative methods to assess the value of the patented technology have been developed (Munari and Oriani 2011), although their validation and effectiveness are still under scrutiny. Policy initiatives are therefore also required in this area, in order to favor the emergence of valuation approaches that are validated and mutually recognized. The evidence we have presented here provides several implications that are worth some reflection by policymakers, due to the increasing diffusion of public patent subsidies measures around the world.

Notes

- 1.

For instance, referring to subsidized patents in China, an article from The Economist (2014) states: “The quality of many of these patents is in doubt. Of the desired 2m filings, many will be for ‘utility’ or ‘design’ patents, which are less substantial than ‘invention’ patents. Critics suggest that even in the latter category, many Chinese filings fall short of global standards.”.

- 2.

See Annex I for a presentation of a selected set of policies centered on patent subsidies from various countries outside China.

- 3.

As mentioned above, such debate has been particularly centered on the experience of China, whose impressive growth in the number of patent filings over the last decade has been in part encouraged by a relevant program of patent subsidies administered by the central, provincial, and city governments (Lei et al. 2013). The fact that most Chinese patents over the period 2001–2008 were related to new design appearances or new models, thus not requiring great technical innovation, has been interpreted as a signal that public subsidies to cover patent application costs can artificially inflate the number of filings (Financial Times 2008; The Economist 2010).

- 4.

The eligibility criteria referred, for instance, to compliance with the EU definition of SME on the part of the applicant, and the compliance of incurred expenses with those specified in the call.

- 5.

In August 2011 the Italian Ministry of Economic Development launched an ambitious subsidy scheme with the objective of boosting the number of patent filings by SMEs and of their economic exploitation, allocating a budget of EUR 40 million to this measure. This is, however, too recent to be included in our assessment exercise, given that a significant time span is required to construct the patent quality measures we adopt in the analyses. In addition, information on patents subsidized through such policies is not publicly available.

- 6.

Patent applications for industrial inventions in Italy can be filed with the chamber of commerce or directly with the Italian patent and trademark office. In the former case, the chamber sends the documents received to the central office.

- 7.

Patent applications for industrial inventions in Italy can be filed with the chamber of commerce or directly with the Italian patent and trademark office. In the former case, the chamber sends the documents received to the central office.

- 8.

We did not collect information on domestic (Italian) patent applications, given that the website of the Italian IP Office (UIBM) did not allow the collection of information on forward citations.

- 9.

We use Recommendation 2003/361/EC, adopted by the European Commission, as a criterion here, categorizing micro enterprises as those with a turnover no greater than EUR 2 million, small enterprises as those with a turnover no greater than EUR 10 million, and medium-sized enterprises as those with a turnover no greater than EUR 50 million.

- 10.

We proceeded in the following way. First, we selected from the OECD Regpat database (a comprehensive database presenting patent data that have been linked to regions and provinces) all EP and PCT patents filed by applicants located in the province of Milan. We identified in this set of patents the patent with the nearest priority date. We used this patent as a control only if the company was included in the corresponding turnover category (micro, small, or medium). If this was not the case, we moved to the next patent with the nearest priority date, until we found a company in the same category of turnover level, and used such a patent as a control.

- 11.

Such formal checks typically regarded the following aspects: the nature of the participating company (i.e. correspondence with the EU definition of SME); the type of IP for which the grant was requested (i.e. correspondence with the eligible types of IP described in the call); and whether the expenses for which the company was requesting the grant corresponded with the eligible expenses described in the call.

- 12.

The strongest correlation levels regarded the variables Number of Inventors and Number of Applicants, and the variables PCT and Number of Applicants. We therefore decided not to include Number of Applicants as a control variable in our regression models.

- 13.

Poisson models and negative binomial models are typically used for count data. Poisson models assume that the conditional mean and variance of the distribution are equal. Given that forward citations data rarely satisfy this assumption, we decided to adopt a negative binomial regression model in our analyses. As a robustness check, we also tested the Poisson model, obtaining similar results.

References

Aerts K, Schmidt T (2008) Two for the price of one? Additionality effects of R&D subsidies: a comparison between Flanders and Germany. Res Policy 37:806–822

Almus M, Czarnitzki D (2003) The effects of public R&D subsidies on firms’ innovation activities: the case of Eastern Germany. J Bus Econ Stat 21:226–236

Arrow K (1962) Economic welfare and the allocation of resources for invention. In: Universities-National Bureau Committee for Economic Research, Committee on Economic Growth of the Social Science Research Council (eds) The rate and direction of inventive activity: economic and social factors. Princeton University Press, Princeton, NJ, pp 609–626

Bérubé C, Mohnen P (2008) Are firms that receive R&D subsidies more innovative? Can J Econ 42(1):206–225

Blanes JV, Busom I (2004) Who participates in R&D subsidies programs? The case of Spanish manufacturing firms. Res Policy 33:1459–1476

Blind K, Edler J, Frietsch R, Schmoch U (2006) Motives to patent: empirical evidence from Germany. Res Policy 35(5):655–672

Busom L (2000) An empirical evaluation of the effects of R&D subsidies. Econ Innov New Technol 9:111–148

Colombo M, Grilli L, Murtinu S (2011) R&D subsidies and the performance of high-tech start-ups. Econ Lett 112:97–99

Dang J, Motohashi K (2013) Patent statistics: a good indicator for innovation in China? Patent subsidies program impacts on patent quality. IAM Discussion Paper Series #029 Available from http://pari.u-tokyo.ac.jp/unit/iam/outcomes/pdf/papers_131118.pdf

Davidson C, Segerstrom P (1998) R&D subsidies and economic growth. Rand J Econ 29:548–577

de Rassenfosse G (2012) How SMEs exploit their intellectual property assets: Evidence from survey data. Small Bus Econ 39(2):437–452

EIS (2013) European innovation scoreboard. European Commission, Brussels (downloaded on 9 September 2014 from http://ec.europa.eu/enterprise/policies/innovation/policy/innovation-scoreboard/index_en.htm)

Encaoua D, Guellec D, Martínez C (2006) Patent systems for encouraging innovation: lessons from economic analysis. Res Policy 35:1423–1440

Financial Times (2008) The value of branding becomes patent. Financial Times, July 2 (downloaded on 10 September 2014 from http://www.ft.com/cms/s/0/3389c83a-4850-11dd-a851-000077b07658.html#axzz42XxZXogw)

Gabriel D, Florence EM (1993) Technology watch and the small firm. OECD Observer 182:31–34

Giebe T, Grebe T, Wolfstetter E (2006) How to allocate R&D (and other) subsidies: an experimentally tested policy recommendation. Res Policy 35:1261–1272

Giuri P, Munari F, Pasquini M (2013) What determines university patent commercialization? Empirical evidence on the role of IPR ownership. Ind Innov 20(5):488–502

Gonzalez G, Pazo G (2008) Do public subsidies stimulate private R&D spending? Res Policy 37:371–389

Grossman GM, Helpman E (1994) Endogenous innovation in the theory of growth. J Econ Perspect 8:23–44

Guellec D, van Pottelsberghe de la Potterie B (2000) Applications, grants and the value of patent. Econ Lett 69(1):109

Guellec D, van Pottelsberghe de la Potterie B (2001) The internationalization of technology analysed with patent data. Res Policy 30(8):1256–1266

Guellec D, van Pottelsberghe de la Potterie B (2007) The economics of the European patent system. IP Policy for Innovation and Competition. Oxford University Press, Oxford

Harhoff D, Hoisl K (2007) Institutionalized incentives for ingenuity—patent value and the German Employees’ Inventions Act. Res Policy 36(8):1143–1162

Harhoff D, Narin F (1999) Citation frequency and the value of patented inventions. Rev Econ Stat 81(3):511–515

Harhoff D, Reitzig M (2004) Determinants of opposition against EPO patent grants: the case of pharmaceuticals and biotechnology. Int J Ind Organ 22:443–480

Hoffman K, Parejo M, Bessant J, Perren L (1998) Small firms, R&D, technology and innovation in the UK: a literature review. Technovation 18(1):39–55

Honore F, Munari F, Van Pottelsberghe de la Potterie B (2014) Corporate governance practices and companies’ R&D orientation: evidence from European countries. Res Policy 44(2):533–543

Hussinger K (2008) R&D and subsidies at the firm level: an application of parametric and semiparametric two-step selection models. J Appl Econometrics 23:729–747

Klette TJ, Møen J, Griliches Z (2000) Do subsidies to commercial R&D reduce market failures? Microeconometric evaluation studies. Res Policy 29:471–495

Kochenkova A, Grimaldi R, Munari F (2015) Public policy measures in support of knowledge transfer activities: a review of academic literature. J Technol Transfer (forthcoming)

Koga T (2005) R&D subsidy and self-financed R&D: the case of Japanese high-technology start-ups. Small Bus Econ 24:53–62

Lanjouw JO, Schankerman M (2004) Patent quality and research productivity: measuring innovation with multiple indicators. Econ J 114(495):441–465

Lei Z, Sun Z, Wright B (2013) Are Chinese patent applications politically driven? Evidence from China’s domestic patent applications. Fung Institute Berkley Innovation Seminar paper (downloaded on 12 Nov 2014 from http://www.funginstitute.berkeley.edu/research/spring-2013)

Lemley M, Shapiro C (2005) Probabilistic patents. J Econ Perspect 19:2, 75–98

Lerner J (1994) The importance of patent scope: an empirical analysis. RAND J Econ 25(2):319–333

Lerner J (1999) The government as venture capitalist: the long-run effects of the SBIR program. J Bus 72:285–318

Leyden DP, Albert LN (1991) Why are government R&D and private R&D complements? Appl Econ 23(10):1673–1681

Li X (2012) Behind the recent surge of Chinese patenting: an institutional view. Res Policy 41(1):236–249

Lichtenberg FR (1984) The relationship between federal contract R&D and company R&D. Am Econ Rev 74(2):73–78

Lichtenberg FR (1987) The effect of government funding on private industrial research and development: a re-assessment. J Ind Econ 36(1):97–104

Lichtenberg FR (1988) The private R&D investment response to federal design and technical competitions. Am Econ Rev 78(3):550–559

Mamuneas TP, Nadiri IM (1996) Public R&D policies and cost behavior of the U.S. manufacturing industries. J Publ Econ 63(1):57–81

Munari F, Oriani R (2005) Privatization and economic returns to R&D activities. Ind Corp Change 14(1):61–91

Munari F, Oriani R (2011) Why, when and how to value patents. In: Munari F, Oriani R (eds) The economic valuation of patents: methods and applications. Edward Elgar Pub, Cheltenham, pp 3–24

Munari F, Sobrero M (2011) Economic and management perspectives on the value of patents. In: Munari F, Oriani R (eds) The economic valuation of patents. Methods and applications. Edward Elgar Pub, Cheltenham, pp 56–81

Munari F, Toschi L (2014a) Running ahead in the nanotechnology gold rush. Strategic patenting in emerging technologies. Technol Forecast Soc Chang 83(1):194–207

Munari F, Toschi L (2014b) Do patents affect VC financing? Empirical evidence from the nanotechnology sector. Int Entrepreneurship Manage J 11(3):623–644

Munari F, Sobrero M, Malipiero A (2012) Absorptive capacity and localized spillover: Focal firms as technological gatekeepers in industrial districts. Ind Corp Change 21(2):429–462

OECD (2013) Commercialising Public Research: new trends and strategies. Organization for Cooperation and Economic Development, Paris

Omland N (2011) Valuing patents through indicators. In: Munari F, Oriani R (eds) The economic valuation of patents. Methods and applications. Edward Elgar Pub, Cheltenham, pp 169–204

Ortega-Argilés R, Vivarelli M, Voigt P (2009) R&D in SMEs: a paradox? Small Bus Econ 33(1):3–11

Pakes A, Schankerman M (1984) The rate of obsolescence of patents, research gestation lags, and the private rate of return to research resources. In: Griliches Z (ed) R&D, Patents and Productivity. University of Chicago Press for the NBER, Chicago

Prud’homme D (2012) Dulling the cutting edge: how patent-related policies and practices hamper innovation in China. European Chamber, Beijing

Reitzig M (2003) What determines patent value? Insights from the semiconductor industry. Res Policy 32:12–26

Reitzig M (2004) Improving patent valuations for management purposes—validating new indicators by analyzing application rationales. Res Policy 33:939–957

Sapsalis E, Van Pottelsberghe B, Navon R (2006) Academic versus Industry patenting: an in-depth analysis of what determines patent value. Res Policy 35:1631–1645

Scherer FM, Harhoff D (2000) Technology policy for a world of skew-distributed outcomes. Res Policy 29:559–566

The Economist (2010) Innovation in China: patents yes, ideas maybe. The Economist, 14 Oct (downloaded on 11 Sept 2014 from http://www.economist.com/node/17257940)

The Economist (2014) Patent fiction. Intellectual property in China. The Economist, 13 Dec (downloaded on 20 Dec 2014 from http://www.economist.com/)

Trajtenberg M (1990) A penny for your quotes: patent citations and the value of inventions. RAND J Econ 21:172–187

van Zeebroeck N, van Pottelsberghe B (2008) Filing strategies and patent value. CEPR discussion paper 6821

Wallsten SJ (2000) The effects of government-industry R&D programs on private R&D: the case of the Small Business Innovation Research Program. RAND J Econ 31:82–100

WIPO (2006) Managing patent costs: an overview. Working paper, World Intellectual Property Organization, Geneva