Abstract

This paper analyzes the importance given by Venture Capital firms (VCs) to the patent portfolios of start-up companies in their financing decisions. In particular, the contributions presented are twofold. First, we determine whether the amount of VC financing is associated with three elements related to technological portfolios: number of patent, patent scope and number of “core technology” patents (i.e., those patents related to core technological capabilities of the company). Second, we examine whether the relevance of patents for the financing decisions varies across different types of VC firms, depending on their industry specialization and affiliation. We provide empirical evidence from a sample of 332 VC-backed companies in the nanotechnology sector for the period 1985–2006. Our results confirm the importance of core technology patents in the VC investment decisions, especially for specialized VCs, when compared with generalist VCs. However, no differences are found between corporate and independent VCs.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The economic literature points to the superior ability of Venture Capital firms (VCs) in accurately assessing the value of early-stage company technological capabilities and patent portfolios. For instance, previous studies have shown a positive association between patenting rates and total amount of VC financing (Baum and Silverman 2004; Mann and Sager 2007) and between patent scope and VCs’ valuation of new companies (Lerner 1994). Moreover, previous works have examined the effects of VC on patented innovations at an industry level (Kortum and Lerner 2000) or at a company level (Bertoni et al. 2006), showing a positive association between VC and patent productivity.

In general, however, there is only a limited understanding of the elements related to technological portfolios that are more directly taken into consideration by VC firms in their investment decisions. Indeed, it is likely that such decisions are influenced by other factors in addition to the mere number of patents and patent scope. In particular, in this study we assess whether VCs take more into consideration patents that are directly related to the core technological capabilities of a target company, which we label as core technology patents.

In addition, given the high heterogeneity among VCs, in terms of age, affiliation, managerial style, reputation, experience, investment focus (Manigart et al. 2002; Gompers et al. 2009; Bertoni et al. 2010a; Dimov and Gedajlovic 2010; Smolarski and Kut 2011), it is likely that the importance given to technology and intellectual property might not be the same among VCs. We focus on two elements, acknowledged by scholars as critical: industry specialization and affiliation. The former enables a distinction to be made between industry specialized and generalist VCs while with the latter it is possible to distinguish between independent and corporate VCs. With a high degree of specialization, uncertainty and risk can be controlled, access to networks and information gained, or a deeper knowledge of the venture environment can be possessed (Gupta and Sapienza 1992; Norton and Tenenbaum 1993; Cressy et al. 2007, 2012; Gompers et al. 2009). Different affiliations, instead, can impact on VCs’ selection criteria due to differences in objectives and capabilities (Gompers 2002; Bertoni et al. 2006, 2010a). However, to our knowledge no attempt has been made in the literature to assess whether and how VCs differ in their attention towards technological portfolios.

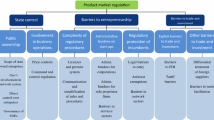

Thus, the purpose of our paper is twofold: on the one hand, we determine whether the amount of VC financing obtained by the company is associated with the number of core technology patents of the start-up technological portfolios. We argue that, ceteris paribus, companies with a higher number of these patents tend to receive a higher amount of VC funding. On the other hand, we examine whether the amount of VC financing obtained by the company varies across VCs, depending on their industry specialization and affiliation. We argue that VCs specialized in the same industry as the investee company and corporate VCs tend to place more importance in their financing decisions on the number of core technology patents, compared to generalist and independent VCs. To keep the analysis clear, Fig. 1 summarizes our thinking about the links between the amount of VC financing received by the start-up and the characteristics of its patent portfolio, in particular concerning the number of core technology patents held (and not only the simple count of all the patents as in previous literature). These relationships are tested on the whole sample of VC investors (Hp. 1) and on two sub-samples of investors, depending on their degree of industry specialization (Hp. 2) and type of affiliation—corporate versus independent VCs (Hp. 3).

We analyze such topics with a sample of 332 VC-backed companies in the nanotechnology sector in the period 1985–2006. Our results show that the number of patents belonging to the nanotechnology class (which represents the core technological domain of the companies in our sample) has a positive and significant effect on VC financing. Moreover, VCs specialized in nanotechnology tend to place more relevance on nanotech patents in their financing decisions, compared to generalist VCs. However, we do not find significant differences between Corporate and Independent VCs.

The rest of the paper is organized as follows. We first briefly summarize previous literature on the relationship between patenting and VC investments. Moreover, we discuss the association between specialization and affiliation of VCs and the propensity to consider the patent portfolios of the investee company. We then describe the nanotech sector, the sample and the variables used in the empirical analysis. We present the results of different regression analyses. In the final section we outline the main conclusions to be drawn from the theoretical and empirical analysis, and discuss the implications for future research.

Background

Venture Capitalists (VCs), i.e. financial intermediaries investing equity in young companies, are a distinct type of investors for entrepreneurial companies operating in dynamic and uncertain industries. One of the major peculiarities of VC investments is the difficult and uncertain valuation on which their selection process is based. Indeed, the lack of a clear performance history for early-stage companies does not allow the application of conventional financial evaluation methods. Thus, VCs have to rely on a subjective assessment procedure driven by a multidimensional list of characteristics: financial aspects, product-market attractiveness, technological characteristics, strategic-competitive impact, management team features and deal criteria (see, for example, Tyebjee and Bruno 1984; Muzyka et al. 1996; Boocock and Woods 1997; Baum and Silverman 2004; Streletzki and Schulte 2012). For the purpose of our work, we will focus on the set of technological capabilities developed by the new venture (and in particular on those protected by core technology patents) as a potential driver of the investment decision by VCs, as summarized in Fig. 1. We will then discuss whether and how some VC characteristics (degree of industry specialization and type of affiliation) are particularly important in considering such technological capabilities in the funding process.

The relationship between patenting and VC investments

The academic literature confirms that patents are an important signal of a start-up’s innovative capabilities, increasing the likelihood of obtaining VC financing (Hall 2004; Haeussler et al. 2009; Munari et al. 2011; Conti et al. 2013; Hsu and Ziedonis 2013). In a study of 204 Canadian biotech start-ups, Baum and Silverman (2004) found that start-ups with more patent applications and grants obtained significantly more VC financing. A study by Mann and Sager (2007) in the software and biotechnology industries found similar results: patenting increases the likelihood of start-up firms receiving VC financing, even though the relationship seems to be present in later financing rounds, but weak, if not absent, in initial ones. It also shows that the relationship between patenting rates and VC financing depends less on the size of the patent portfolio than on the firm’s receipt of at least one patent. Hirukawa and Ueda (2008) analyse the causality issue of VC investments and innovation in the US manufacturing industry and finds support only for the “innovation-first hypothesis”, that is, innovations spur VC activity. Bertoni et al. (2010b), on the contrary, based on an Italian sample of VC-backed and non-VC backed companies, show opposite results: VC investments seem to positively affect subsequent patenting activity. Finally, Conti et al. (2013) present a theoretical model to test the importance of multiple signals that start-ups can use to obtain VC financing and potential differences among investors. In particular, the authors find that VCs appear to value patents more highly than founder, friends and family (FFF) money, while the reverse is true for business angles. Moreover, the impact of patents on VCs is larger than the impact of FFF money on business angels.

Besides presenting some controversial results, the above-mentioned literature focuses on the effect of the mere number of patents on VC investment decisions. One exception is the work by Lerner (1994), predicting that, in the biotech field, patent scope is positively associated with higher valuations by VCs.

We take these works as our foundation and we extend and integrate them by introducing a third element referred to patents, which VCs could include among their selection criteria. This factor is the technological content of the start-up’s patent portfolio. The logic that underpins our hypotheses is that patents differ not only in their potential economic value, but also in terms of the fit with specific types of technological capability. The Resource-based View (RbV) highlights the critical role played by capabilities, considering a firm’s resources as the primary determinant of competitive advantage (Barney 1991; Lockett et al. 2009; Gruber et al. 2010; Kraaijenbrink et al. 2010; Barney et al. 2011). In recent years, the idea that competencies constitute the foundation for obtaining sustainable competitive advantages over time has been further emphasised (Wu 2009). Competencies are conceptualized as “measurable patterns of knowledge, skills, abilities, behaviors, and other characteristics that differentiate high from average performance” (Wu 2009, p. 9575). More recently, a work by Martin de Castro et al. (2011) proposes a framework that applies the traditional RbV to the specific context of the New Economy, characterized by the predominance of intellectual capital as a relevant factor of production and a key resource for obtaining a firm’s competitive advantages. This framework, which is labelled “Intellectual Capital-based View” of the firm, highlights the strategic role played by different intangible assets.

Among the firm’s resources and capabilities, Prahalad and Hamel (1990) mainly pointed out the critical benefits embedded in the distinctive (or core) competencies. The authors suggested that a core technological competency is a source of long-run competitive advantage for the firm because it provides potential access to a wide variety of markets, makes a significant contribution to the perceived customer benefits of the end product and is difficult for competitors to imitate. More recently, technological distinctive competencies have been defined as “the organization’s expertise in mobilizing various scientific and technical resources through a series of routines and procedures which allow new products and production processes to be developed and designed” (Real et al. 2006, p. 508; Martín Rojas et al. 2011). Moreover, in a recent work Bolivar Ramos et al. (2012) emphasize the importance of technological distinctive competencies as they impact on the firm’s organizational performance, directly and indirectly through organizational innovation. However, the evidence that firms are becoming more technologically diversified over time challenges the conventional wisdom that for every company there exists only a narrow set of technological competencies on which the company should focus (Patel and Pavitt 1994, 1997; Gambardella and Torrisi 1998). In line with this thinking, Granstrand et al. (1997) suggested a classification of technological competencies showing that in addition to distinctive competencies, management needs to sustain a broader set of technological competencies (background, marginal and niche), in order to co-ordinate continuous improvement and innovation in the corporate production system. Thus, firms typically become multi-technology, with a set of competencies distributed across several technical fields, and tend to construct diversified technological portfolios, where each patent refers to a different type of technical competency, distinctive or not. Brusoni et al. (2001) confirm this evidence, as multi-technology firms have to cope with disparities caused by uneven rates of development in the technologies underlying their products and with unpredictable product-level interdependences. For this reason they need to have knowledge in excess of that which is needed for the things they make.

In this paper, we investigate whether technological heterogeneity, in terms of technological competence underlying the patents of the start-up portfolio, is considered by VCs and influences their financing process. Thus, we do not analyze all patents as a whole, but we focus on those patents protecting a specific core technology. Accordingly, we introduce the concept of core technology patents to isolate the importance of the technology which is strongly linked to the core competencies of the firm (Patel and Pavitt 1994; Granstrand et al. 1997; Bolivar Ramos et al. 2012). When deciding to invest, for instance, in a nanotech start-up, it is likely that VCs put more emphasis and importance on those patents that are more directly related to the core technological competencies of the company, represented in this case by the nanotech patents. Indeed, core technology patents which refer to the resources the company can use to create unique levels of competitive advantage, could be considered by VCs as the most valuable because they are the most critical and distinctive resources a company possesses. Thus, as a first contribution of the paper, we test the following hypothesis:

-

Hp 1:

The number of core technology patents held by a company has a positive impact on the amount of funding received by a VC firm.

The heterogeneity of VC firms

The role of specialization: specialist versus generalist VC firms

Most of the financial and strategic literature on VC tends to ignore the significant differences in objectives, investment decisions and managerial styles among VCs. On the contrary, more recent works have shown that VC characteristics can make a difference in terms of the outcome of their investments (Cressy et al. 2007, 2012; Gompers et al. 2009; Dimov and Gedajlovic 2010; Krishnan et al. 2011; Matusik and Fitza 2012).

VCs adopt different strategies regarding the composition of their investment portfolios (Gupta and Sapienza 1992; Norton and Tenenbaum 1993; Knill 2009; Munari and Toschi 2011). Some VCs tend to specialize in some industries and development stages, in order to acquire expertise, better understanding and deeper knowledge of the technological, market and competitive specificities of the investee companies’ context and, in turn, gain greater value, through a more correct assessment of new investment opportunities and more competent monitoring and advice. Others, instead, tend to be more generalist and diversify among several industries and technological areas. Gupta and Sapienza (1992) show that smaller VCs and VCs focused on early stage ventures prefer less industry diversity and narrower geographic scope when compared with bigger VCs and those focused on later stage ventures. Busenitz et al. (2004) point out that VC learning should result in long-term positive performance implications, given that a VC investor with a significant experience of both successes and failures in an industry could gain a deeper insight into how to select potential “winners” and improve their performance over time. Norton and Tenenbaum (1993) acknowledge the importance of maintaining a high degree of specialization in order to control risk and gain access to networks and information. Also Cressy et al. (2007) find that possessing a deeper knowledge of the ventures’ environment confers competitive advantages in terms of reduced information asymmetries and uncertainty in the valuation and selection process. Gompers et al. (2005) point out that, when there are complementarities and a direct relationship between the investments embedded within the portfolio, the VC more quickly liquidates its investments through an initial public offering (IPO) and with higher valuations. The results obtained by Matusik and Fitza (2012) are slightly different. Drawing on the knowledge and organizational learning literature, the authors suggest a U-shaped relationship between level of diversification and performance. Under low levels of diversification VCs can exploit efficiencies in processing knowledge, while under high levels of diversification they can have access to broad information that facilitates solving complex problems and directing a portfolio company down different trajectories. Furthermore, under conditions of high uncertainty, these effects seem to be more pronounced.

Given these premises, the level of attention towards technology might not be the same for all the VCs, but it might be a function of their specialization in an industry. More precisely, we expect that, ceteris paribus, VCs specialized in the same industry as the investee company give more importance to patents related to the core technological capabilities of the company, compared to generalist VCs. We therefore suggest the following hypotheses:

-

Hp 2a:

The number of core technology patents held by a company has a positive impact on the amount of funding received by an industry-specialized VC firm.

-

Hp 2b:

The number of core technology patents held by a company has no significant impact on the amount of funding received by a generalist VC firm.

The role of affiliation: independent versus corporate venture capitalists

A particularly important distinction in the VC community, in terms of affiliation, is the one between Independent VCs (IVCs), where the capital is provided by financial institutions, and Corporate VCs (CVCs), where the investor is a corporation (Hellmann and Puri 2002).

These two types of investors differ widely in terms of structure of incentives, monitoring behaviour, time horizon, scale of capital invested and set of objectives pursued (Chesbrough 2000; Dushnitsky and Shapira 2010). As far as the latter is concerned, the main financial aim of IVCs is to liquidate their investments through IPO or sell the company to a larger firm in the shortest possible time. In contrast, CVCs generally aim to capture the value from strategic assets, open up a window on new technologies, respond more competitively in dynamic industries and accelerate market entry (Brody and Ehrlich 1998; Dushnitsky and Lenox 2006; Ivanov and Xie 2010; Toschi et al. 2012). These differences explain the need to analyze IVCs and CVCs as autonomous forms of equity financing (Bertoni et al. 2010a).

In the literature, such evidence led to the analysis of the distinct contributions of IVC and CVC to the investee ventures. Jain and Kini (1995) compared the growth of IVC- and CVC-backed firms, finding that the former outperformed the latter; Bertoni et al. (2006) suggested that, even though both IVC and CVC positively affect venture growth, the benefits of the former considerably exceed those of the latter. These results can be explained considering the commercial ability and financial knowledge of IVCs. IVCs are able to obtain additional financing for their investee companies by cultivating a broad network of commercial partners and allies in the financial markets (Macmillan et al. 1989; Sapienza et al. 1996), professionalize start-up firms by recruiting valuable managers to complement or replace the existing members of the entrepreneurial team (Hellmann and Puri 2002) and improve the ventures’ performance at the IPO (Brav and Gompers 1997).

On the other hand, IVCs do not possess the same influence in areas that are closely related to the core business of the investee companies and, as “outsider” investors, it is likely that they are less able to support the technological and commercial quality of the venture (Stuart et al. 1999). CVCs, on the other hand, are affiliated to corporations with well-defined businesses and competencies, internal expertise and specific technological knowledge. Furthermore, corporations engaged in CVC are generally active in high-tech industries and often operate in the same area as the investee company. Thus, CVCs have the reputation needed to help companies in their growth by easily providing them with business partners and the ability to evaluate technological resources in their due diligence processes. Ivanov and Xie (2010), for instance, “present evidence that CVCs add value to start-up companies only when the start-ups have a strategic fit with the parent corporations of CVCs”. As a consequence, it is likely that CVCs will develop more expertise than IVCs in specific technological capabilities. Guo et al. (2012) propose a model of investment, duration, and exit strategies for start-ups backed by IVCs and CVCs. Their analysis predicts that start-ups backed by the latter remain longer in the investment status before exiting and receive larger investment amounts than those financed by IVC funds. In the light of this stream of research, we thus expect IVCs and CVCs to differ not only in terms of objectives but also regarding investment strategies, especially concerning the criteria adopted to select financing ventures. More precisely, we suggest that while IVCs may consider the number of patents as signal of quality, CVCs may pay more attention on the technological content of patents.

-

Hp 3a:

The number of core technology patents held by a company has a positive impact on the amount of funding received by a Corporate VC firm.

-

Hp 3b:

The number of core technology patents held by a company has no significant impact on the amount of funding received by an Independent VC firm.

Method

The context

Nanotechnology can be defined as the study and use of the unique characteristics of materials at the nanometre scale, between the classical large-molecule level to which traditional physics and chemistry apply and the atomic level at which the rules of quantum mechanics take effect (Lemley 2005).

An important characteristic of patents in nanotechnology is their inter-disciplinarity: nanotechnology is sometimes referred to as a general-purpose technology, because in its advanced form it will have a significant impact on almost all industries and all areas of society (Huang et al. 2011). It attracts scientists from many areas of science (e.g., physics, chemistry, biology, computer science, etc.), and in the wide spectrum of potential market applications, which can involve very different businesses (e.g., computers, flat-panel displays, diagnostic products sensors, lighting devices and many others).

The field of nanotechnology is an optimal setting to study how VCs evaluate patent portfolios in their investment decisions. Several new ventures have been created in nanotechnology around the world, favoured by the wide availability of funding from governments, established companies and VCs. In particular, VC investments in the nanotech field have steadily increased over the last decade, reminiscent of the earlier development of the biotech industry. Second, patents represent an important and effective mechanism to protect the returns stemming from nanotech investments, as witnessed by a real “boom” in the number of nanotechnology patents registered all over the world during the last 10 years. For many nanotech start-ups, the intellectual-property portfolio represents the main asset, to be exploited through business models based on the commercialization of new products or licensing revenues.

However, defining a nanotechnology patent is not an easy task, given the newness of the field and the many different scientific and technical areas involved. Such characteristics make it extremely difficult to adopt the conventional International Patent Classification (IPC classes) to tag nanotech patents, inducing high levels of uncertainty for patent examiners, inventors and prospective investors, including VCs.

In order to facilitate interdisciplinary searches and monitor trends in nanotechnology, the European Patent Office (EPO) has recently developed a new code (the Y01N) in order to tag all nanotech patentsFootnote 1. All European patent applications have been classified ex-post by a group of patent experts in order to tag them, if applicable, with the new code. The new classification has been publicly disclosed by the EPO since January 2006. Since that date, with a simple query on the search engines of the EPO website, it has been possible to collect information on all the patents in the nanotech field.

The sample

We created a sample of companies operating in nanotechnology and financed by VC over the period 1985–2006. We focused on this period for two main reasons. First, we started from 1985 as, even if some seminal research on nanotechnology started in the 1950s, the propagation of a conceptual framework for the goals of nanotechnology began with the 1986 publication of the book “Engines of Creation” by K.E. Drexel (Munari and Toschi 2013). Second, we concluded our data extraction in 2006 in order to fully capture the biggest wave of VC deals which occurred in the 1990s with a peak in 2000 and a decrease in the mid 2000s, and exclude at the same time the significant boost in VC investments brought about by the 2008 financial crisis. Indeed, the financial crisis which started in 2008 lead to marked drops in venture capital fundraising and investment activity, and critically affected venture capital valuations (Block et al. 2012). Thus, with this time period, we are able to test our research model on a considerable pool of data for the VC industry in the specific case of nanotechnology. Our data on VC investments are taken from Thomson Venture Economics (Venture Expert), which can be considered the most comprehensive commercial data source on the global VC industry. We first identified all the 361 VC-backed companies operating worldwide in the field of nanotechnology over the period 1985–2006Footnote 2. For each company, we collected the country, main industries, VC firms investing in the company, founding year, year of the stages of investment and amount obtained in each round. Information on the initial amount of funding received by VC was available for only 332 companies, which therefore represents our final sample.

For each VC-backed company, we identified the leading investor as either (a) the VC firm that at the moment of the deal was explicitly mentioned as the leading investor or (b) the firm that held the largest equity stake in the deal. We then complemented such information by gathering the data on VC firms such as firm name, affiliation, number of companies in the current portfolio and industry focus.

The searches of patent portfolios of our companies were conducted using the Patstat database, created by the EPO. We referred to patent applications at the EPO in the field of nanotechnology over the period 1980–2006, through the code Y01N in the European Classification System (ECLA). As of June 2007, the date of data extraction, the EPO register contained 9,813 nanotech applications.

Variables

Dependent variable

VC Financing Amount measures the log transformation of the total amount of VC financing (in million US $) obtained by the company at the first investment roundFootnote 3. Limiting the study to the initial financing round eliminates the problems related to the causality link between patenting and VC financing (Bertoni et al. 2006; Kortum and Lerner 2000). By considering only the initial financing rounds, we could directly assess the impact of the characteristics of patent portfolios on VC investment decisions, our research question, and rule out the “chicken-egg” problem related to the positive impact of VC investments on patenting activity.

Independent variables

Patents measures, for each company, the number of patent applications at the EPO at the date of the first financing round. For each company, Nanotech Patents measures the number of patent applications at the EPO with the Y01N code. This variable represents the previously labelled core technology patents in the specific case of nanotechnology-based companies. Patent scope captures the average breadth of patents included in the portfolio of the VC-backed company at the year of the first financing round. According with Lerner (1994), we counted the number of the first four-digit IPC classes of each patent. We then computed the average value of this measure for all patent applications included in the company’s portfolio during the year of the first financing round. If the company had no patents, we coded the average patent scope as zero.

In order to identify different types of VCs investing in nanotechnology we used two dummy variables. Specialized VC takes value 1 if the company was financed by a leading VCFootnote 4 specialized in nanotechnology and 0 otherwise. The measure of specialization of the leading VC in nanotechnology is adapted from Cressy et al. (2007, 2012). For each VC, we first defined the Revealed Industrial Advantage index (RIA) in nanotechnology, computed as:

where: C iN is the number of portfolio companies of VC firm i in the field of nanotechnology, C .N is the total number of companies invested in the nanotechnology field by all VC firms, C i. is the total number of portfolio companies of VC firm i and C .. is the total number of companies invested by all VC firms (i.e. across all sectors).

The numerator in this measure (C iN /C .N ) represents the VC firm i’s share of all investments in the field of nanotechnology and the denominator (C i. /C .. ) the VC firm i’s share in all investments (i.e. across all sectors). RIA ij therefore measures the VC firm i’s investment focus in nanotechnology relative to that of its VC competitors. Note that:

so that a value of RIA iN less (greater) than one indicates that the VC firm i is relatively unspecialised (specialised) in nanotechnology.

We used Venture Economics in order to identify, for each VC firm, the share of its portfolio companies in nanotechnology, as well as the total number of portfolio companies included in each industrial sector over the period 1990–2006. We computed the RIA index over the period 1990–2006, consistently with the time period under study. We then used the RIA index to create the dummy variable Specialized VC, which takes the value 1 when the company was financed by a leading VC firm specialized in nanotechnology (i.e. with a RIA greater than 1), and 0 otherwise.

Finally, following Chemmanur et al. (2010) and based on the classification provided by Venture ExpertFootnote 5, Corporate VC is a dummy taking value 1 if the company was financed at least by one CVC and 0 otherwise.

Control variables

We also included the following control variables. Company Age measures the age of the company at the date of the initial financing round, computed as the difference between the investment year and the foundation year of the company. Market scope captures the degree of market diversification of the investee company by counting the different industrial sectors provided by the classification of Venture Economics. Previous research has shown that the number, size and attractiveness of the product markets in which the target companies operate represent important determinants of the investment decision by VCs (Tyebjee and Bruno 1984; MacMillan et al. 1985). It is thus likely that companies operating in different markets are characterized by a higher growth potential, obtaining higher valuations and financing by VC firms. This variable is measures as the count of different industries to which the company is assigned by Venture Expert. Dummy US is a dummy with value 1 for companies located in the United States, and 0 otherwise. Since the VC industry in the US is by far the most developed in the world, it is possible that US nanotech ventures benefit from higher investment opportunities than their foreign counterparts. Dummy Early VC takes value 1 for investment in the “seed” or “start-up” stages of development. Gompers (1995) has shown that the amount of VC financing received is higher, on average, in later rounds compared to earlier rounds, as a consequence of reduced uncertainty and information asymmetries.

Analyses and results

Descriptive statistics and correlation analysis

Table 1 presents descriptive statistics from the sample of VC-backed companies. In the first round of VC financing, our companies received, on average, 5.01 million US $, had a mean of 0.84 patents and 0.28 nanotech patents. Only 28 % (95/332) of the companies had a patent at initial VC financing, whereas this number lowers to 10 % (35/332) for nanotech patents. Patent scope is, on average, 0.46 and market scope is 1.7. The mean age of the companies at the date of the initial VC investment is around 2 years. The large majority of them are located in the United States (around 86 %), followed by Europe (7 %), Canada (3 %) and Israel (1.5 %).

Table 2 reports the correlation matrix for our variables. Whilst most correlations are moderate, there is a rather high correlation (0.54) between Patents and Patent scope, which might pose problems of multicollinearity. As a robustness check, we therefore replicated our regressions excluding Patent Scope, but the results substantially remain the same. For the sake of simplicity, we report only the tables of the full models with both the variables. We also calculated the Variance Inflation Factors (VIF). None of the scores approached the commonly accepted threshold of 10 to indicate potential problems (Chatterjee and Price 1977; Freund and Wilson 1998).

Regression analyses and results

We analyzed the relationship between start-up companies’ patent portfolio characteristics and the total amount of VC financing in a multivariate regression framework, in order to control for the potential influence of other factors. As we are interested in the signalling value of the start-up’s technological assets for attracting the attention of VC investors, we assessed our main explanatory variables (i.e., number of patents, number of core patents and patent scope) and control variables at the moment of the first VC financing round received by the company. As a consequence, our patent measures were computed as stock variables at the date of the first VC financing round. In a similar way, our dependent variable VC Financing Amount captures the log transformation of the total amount of VC financing (in million US $) obtained by the company at the first investment round. Given the cross-sectional nature of our data, we adopted an ordinary least squares (OLS) specification in our regression analyses. The main regression model we estimate is therefore as follows:

Column 1 of Table 3 shows the results on the full sample of VC investors. Patents does not have a significant impact on the amount of funding obtained by VCs (0.013, but not statistically significant).

This preliminary result shows that VCs do not simply consider the existence of patents in the process of investment screening and due diligence. In particular, Nanotech Patents which is positive (0.154) and statistically significant at the 1 % level suggests that the relatedness of the patent with the core technological activities of the start-up is more relevant. Our hypothesis 1 is supported. This suggests that VCs are sophisticated investors with a strong propensity to place great relevance on core technology patents, in this specific case related to nanotechnology.

On the other hand, we do not find a support for the positive impact of Patent Scope on VC financing. This evidence, in conflict with the results obtained by Lerner (2002) showing the positive effects of patent scope, might be due to the newness and uncertainty of patenting in the nanotechnology sector, still characterized by a real rush towards strategic patenting. On the one hand, first inventors have strong incentives to stake patents with a broad patent scope in the early days of a technology, in order to safeguard their inventions from infringements and increase their innovation’s rents (Merges and Nelson 1990; Munari and Toschi 2013). At the same time, however, in the specific case of nanotechnology, “[…] a proliferation of patents, especially broadly defined ones, could hobble innovation and produce a thicket of conflicting legal claims that could eventually drive up costs for consumers” (WSJ, 18/6/04).

Among the control variables, only companies in earlier stages of development (i.e. seed, start-up) tend to receive a lower amount of financing in the initial rounds, also as a way of reducing uncertainty and opportunistic behaviour by entrepreneurs (Gompers 1995).

When we introduce the impact of VC characteristics, we find interesting results. We first look at the effects of specialization, by splitting our observations into two sub-samples depending on whether the leading VC firm is specialized (253 observations) or not (77 observations)Footnote 6 in nanotechnology.

Columns 2 and 3 report the results. The coefficient of Patents is positive (0.035) and not significant in the sub-sample of companies backed by VCs specialized in nanotechnology, whereas it is negative (−0.450) and significant at the 1 % level in the sub-sample of generalist VCs. On the contrary, Nanotech Patents is positive (0.149) and statistically significant at the 1 % level in the former sub-sample (hypotheses 2a supported), whereas it becomes insignificant in the latter sub-sample (hypothesis 2b supported). In addition, among generalist VC-backed companies, Patent Scope is positive (1.347) and statistically significantFootnote 7. Such results confirm that VCs with a stronger focus in the nanotech sector tend to accumulate a specific knowledge allowing them to consider in detail those patents that are closely related to nanotechnology, i.e. the core technology of the start-ups in our sample. On the contrary, generalist VCs are not influenced by this distinction.

Finally, we show the results of the split sample analysis related to the type of affiliation of VCs in Column 4 which refers to CVC-backed companies (142 observations), and Column 5 for IVC-backed companies (190 observations). Independently of the VC’s affiliation, the coefficients of Nano Patents are positive and statistically significant at the 5 % level (only hypothesis 3a is supported), whereas the mere number of Patents and Patent Scope are not statistically significant. Our analysis, therefore, does not provide evidence of significant differences in the importance given to patent portfolios by CVCs and IVCs in the course of the selection and financing process.

Robustness check

To test the robustness of our results we also performed a set of OLS regressions including additional control variables regarding the characteristics of the entrepreneurial team (Knockaert et al. 2010). It is relatively uncontroversial that the high quality of human capital of a new start-up is positively associated with superior ability to attract VC financing. The main characteristics analysed in previous studies has been the entrepreneur’s experience and personality (MacMillan et al. 1985), the educational skills (Bates 1990), the experience of start-up management teams (Kaplan and Stromberg 2004) and teams with prior founding experience, strong social networks and members holding a doctoral degree (Hsu 2007).

In line with these works, we collected information through Venture Expert and the websites of our companies and we gathered data on the top-management teams of 168 companies included in our sample (out of 332)Footnote 8. For this sub-sample, we were able to construct three dummies characterizing the start-up’s top management team. PhD, MBA and Founding Experience take value 1 if at least one member of the team has respectively a doctoral degree, an MBA degree, or has previously founded a new firm.

The results obtained in the previous analyses are in large part confirmed. The number of nanotech patents is positively associated to the amount of VC financing, thus supporting hypothesis 1 (Table 4, Column 1). Specialized VCs tend to give more emphasis to core technology patents (the coefficient of Nanotech Patents is positive, 0.138, and statistically significant at the 5 % level) than generalist VCs (Table 4, Columns 2 and 3). Also in this case, hypotheses 2a and 2b are supported. Furthermore, while in the previous models (Columns 3 and 4 in Table 3) we did not find significant differences between CVCs and IVCs, in Models 3 and 4 of Table 4 we find a clearer distinction. Controlling for top-management teams’ characteristics, CVCs commit greater amounts of equity financing toward a start-up with a number of core technology patents than IVCs. Indeed, the coefficient of Nanotech Patents in the sub-sample of CVCs is positive (0.175) and significant at the 10 % level, whereas it is not significant for the sub-sample of IVCs (both hypotheses 3a and 3b are supported).

Finally, the dummies PhD and MBA are both not statistically significant in all the models. On the other hand, the dummy Founding Experience is positive and significant (0.514 at the 5 % level in Column 1, Table 4).

Conclusions

This paper analyzed the impact of the characteristics of patent portfolios by start-ups—in terms of size, scope and number of core technology patents—on the amount of financing obtained by VCs. It provides two main contributions to the existing literature. First, it moves beyond the simple analysis of the number of patents, by claiming that VC firms consider the technological focus on core technological competencies of the patents possessed by target companies in their selection process. Second, it recognizes that VCs are not all alike when it comes to the criteria adopted in their investment decisions. In particular, we argued that their specialization in the specific industry of the company under scrutiny and their type of affiliation might influence their evaluation criteria.

Our results on a sample of nanotech 332 VC-backed companies show that the mere number of patents applied by the company before the first investment round does not have a significant impact on the amount of financing obtained, after controlling for the age, stage of development, degree of market diversification and location of the start-up. On the contrary, the start-up’s number of patents belonging to the nanotechnology class, representing its core technological competencies, has a positive and significant effect on VC financing. Such findings help to interpret previous evidence by Mann and Sager (2007) showing no impact of patents obtained before financing and the amount invested by VCs. We show that it is the type of patents owned by the start-up that matters in the financing decision, in particular in terms of their technological content, rather than their quantity.

Moreover, it also suggests that these kinds of selection skills are not evenly distributed amongst VCs. In fact, we showed that VCs which are relatively more specialized in nanotechnology tend to place a higher emphasis on nanotech patents in their financing decisions than generalist VCs. Specialization therefore seems to provide a better understanding and deeper knowledge of the technological specificities of the investee companies’ context.

On the contrary, we did not find significant differences between CVCs and IVCs. It might be that CVCs retain an evaluation advantage compared to IVCs only if they possess a sufficient absorptive capacity, in terms of previous technological knowledge stock, as shown by Dushnitsky and Lenox (2005). The ability of an investing incumbent firm to appropriately identify and transfer knowledge through interaction with a new venture requires the former to have sufficient technical understanding. In this paper we were not able to discriminate CVCs in terms of levels of absorptive capacity, in particular regarding the nanotechnology field, although this is an issue which could be directly addressed by future research.

These findings also highlight threefold managerial implications. Although the benefits deriving from specialization are well known in the literature (Gupta and Sapienza 1992; Norton and Tenenbaum 1993; Busenitz et al. 2004), this work suggests how the kind of VC experience plays an important role in investment decisions. More precisely, VCs with a previous knowledge of technological areas which fit with those of the core competencies developed by the investee company could better recognize and leverage these distinctive resources. At the same time, as our findings highlight that core technology patents are positively considered by VCs, high degrees of specialization of the start-ups (that is, focus on activities which better characterize their core business) represent a positive signal allowing a greater amount of financing to be obtained. Finally, investors may prefer funds managed by specialized VCs, as they have a specific knowledge needed to carefully analyze the content of patents. Also, investors may have a further guarantee of success if this knowledge is closely related to the core competencies of the funded companies, as they represent those technological areas in which the start-ups have more experience.

To conclude, there are some limitations and suggestions for future research. Our analysis relied on data from a single sector, nanotechnology, characterized by a high degree of newness, uncertainty and inter-disciplinarity. As we have already mentioned, such specificities raise concerns about the extent to which our results can be applied to other contexts, in particular to more mature and established businesses.

Second, it is likely that investment decisions by VCs are also influenced by other characteristics of patent portfolios that we did not consider, for instance patent lifetime (as a proxy of the remaining economic usefulness of the patent), patent family size (as a proxy of the market size of the underlying invention) or patent legal status (i.e. existence of renewal or opposition). There are therefore opportunities to analyze other determinants of patent value that are more directly taken into consideration by VCs in their investment choices.

Third, the effect of affiliation needs to be investigated in other fields as well, other than nanotechnology. Indeed, due to the few observations of our sample in which the investee company was financed by a CVC, the distinction in terms of affiliation is not extremely strict. To construct our split sample, we considered a company as CVC-backed if it had at least one corporate firm in their group of investors. Gathering information, for instance, on biotech firms, would enable the collection of more comprehensive information, contributing to addressing this issue through a more accurate procedure. The presence of a corporate firm as leading investor, rather than simply belonging to the group of investors, could provide different results.

Finally, we limited our analysis to the initial financing rounds of the VC cycle, as a way of circumventing the causality problems which limited previous research on patenting and VC investments. Mann and Sager (2007) suggest that patents have their greatest value for companies at the later stage of the investment cycle, whereas in earlier stages other determinants, such as the characteristics of the entrepreneurial team, play a dominant role. However, they do not provide a direct empirical test for such claims. Further research should investigate in more depth the relative importance of the different criteria adopted by VC firms in the evaluation of start-up companies and how they change during the VC cycle.

Notes

In the Y01N subclass the term ‘nanotechnology’ covers all things with a controlled geometrical size of at least one functional component below 100 nanometres (nm) in one or more dimensions susceptible to make physical, chemical or biological effects available which cannot be achieved above that size without a loss of performance (Scheu et al. 2006).

Venture Economics classifies all VC deals in 6 main categories, according to the stage of development of the investee company: seed, early-stage, expansion, later-stage, buyout/acquisition, and other. Since our interest resides in new ventures, we focused exclusively on deals belonging to the first 4 categories. In order to identify companies operating in nanotechnology, we adopted the classification of Venture Economics, which assigns each company to specific technological areas, including nanotechnology.

Venture Economics identifies the date and number of investors for each financing round, and in most cases the amount invested by each investor, but it does not systematically track the price paid per share. Given that data on the so called pre-money valuation were largely unavailable, we were unable to assess the impact of patent portfolio size, focus and scope on firm value, as in Lerner (1994).

For syndicated deals, we refer to the degree of specialization of the lead investors, based on previous evidence showing that they tend to exert a primary role and influence in such cases (Wright and Lockett 2003). More precisely, syndicates consist of consortia of VC firms co-investing in a company and sharing a joint pay-off. Previous research has shown that the lead investor holds on average larger equity stakes compared with non-lead investors and adopts a more hands-on approach than his colleagues, being much more involved in the monitoring and managing of the investee company (Gorman and Sahlman 1989; Barry 1994; Das and Teng 1998; Wright and Lockett 2003).

Differently from the distinction between Specialized versus Generalist VCs which is driven by the presence (absence) of a specialized (generalist) leading investor, in this second case we do not consider the presence of a corporate leading investor. Indeed, the few observations in which the leading investor is a CVC firm (17 observations) do not permit the application of the same proxy used in the previous case.

We were not able to compute the index of specialization in nanotechnology for two companies in our sample, due to missing data.

However, as the correlation matrix for the subsample of companies financed by generalist VCs shows a high correlation (0.81) between Patents and Patent Scope, we ran further estimates dropping the latter variable. In this case, Patents result positive but not statistically significant, whereas Nano Patents remains positive and not statistically significant, confirming that nano-specialized VCs consider more nanotech patents in their investment decisions than generalist VCs.

Since data on top-management teams were available only for a limited number of companies included in our sample, we decided to present these results in a distinct “Robustness check” section.

References

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120.

Barney, J., Ketchen, D. J., Jr., & Wright, M. (2011). The future of resource-based theory: revitalization or decline? Journal of Management, 37(5), 1299–1315.

Barry, C. B. (1994). New directions in research on venture capital finance. Financial Management, 23(3), 3–15.

Bates, T. (1990). Entrepreneur human capital inputs and small business longevity. Review of Economics and Statistics, 72, 551–559.

Baum, J. A. C., & Silverman, B. S. (2004). Picking winners or building them? Alliance, intellectual, and human capital as selection criteria in venture financing and performance of biotechnology start-ups. Journal of Business Venturing, 19(3), 411–436.

Bertoni, F., Colombo, M. G. & Grilli, L. (2006). Venture capital financing and the growth of new technology-based firms: A longitudinal analysis on the role of the type of investor. Working Paper, Politecnico di Milano, Department of Management, Economics and Industrial Engineering.

Bertoni, F., Colombo, M. G., & Croce, A. (2010a). The effect of venture capital financing on the sensitivity to cash flow of firm’s investments. European Financial Management, 16(4), 528–551.

Bertoni, F., Croce, A., & D’Adda, D. (2010b). Venture capital investments and patenting activity of high-tech start-ups: a micro-econometric firm-level analysis. Venture Capital An International Journal of Entrepreneurial Finance, 12(4), 307–326.

Block, J., De Vries, G., & Sandner, P. (2012). Venture capital and the financial crisis: An empirical study across industries and countries. In: D. Cumming (Ed.), Oxford handbook of venture capital, chapter 2. Oxford University Press.

Bolivar Ramos, M., Garcia Morales, V. J., & Garcia Sanchez, E. (2012). Technological distinctive competencies and organizational learning: effects on organizational innovation to improve firm performance. Journal of Engineering and Technology Management, 29(3), 331–357.

Boocock, G., & Woods, M. (1997). The evaluation criteria used by venture capitalists: evidence from a UK venture fund. International Small Business Journal, 16(1), 36–57.

Brav, A., & Gompers, P. (1997). Myth or reality? The long-run underperformance of initial public offering: evidence from venture and non-venture-backed companies. Journal of Finance, 52(4), 1791–1821.

Brody, P., & Ehrlich, D. (1998). Can big companies become successful venture capitalists? McKinsey Quarterly, 2, 50–63.

Brusoni, S., Prencpe, A., & Pavitt, K. (2001). Knowledge specialization, organizational coupling, and the boundaries of the firm: why do firms know more than they make? Administrative Science Quarterly, 46(4), 597–621.

Busenitz, L. W., James, O. F., & Douglas, D. M. (2004). Reconsidering the venture capitalists’ “value added” proposition: an interorganizational learning perspective. Journal of Business Venturing, 19(6), 787–807.

Chatterjee, S., & Price, B. (1977). Regression analysis by examples. New York: Wiley.

Chemmanur, T. J., Loutskina, E., & Tian, X. (2010). Corporate venture capital, value creation, and innovation. SSRN working paper.

Chesbrough, H. W. (2000). Designing corporate ventures in the shadow of private venture capital. California Management Review, 42, 31–49.

Conti, A., Thursby, M. C., & Rothaermel, F. (2013). Show me the right stuff: Signals for high tech startups. NBER Working Paper 17050.

Cressy, R., Munari, F., & Malipiero, A. (2007). Playing to their strengths? Evidence that specialization in the private equity industry confers competitive advantage. Journal of Corporate Finance, 13, 647–669.

Cressy, R., Munari, F., & Malipiero, A. (2012). Does VC fund diversification pay off? An empirical investigation of the effectsof VC portfolio diversification and fund performance. International Entrepreneurship Management Journal, 13, 647–669.

Das, T. K., & Teng, B. S. (1998). Between trust and control: developing confidence and partner cooperation in alliances. Academy of Management Review, 23, 491–512.

Dimov, D., & Gedajlovic, E. (2010). A property rights perspective on venture capital investment decisions. Journal of Management Studies, 47, 1248–1271.

Dushnitsky, G., & Lenok, M. J. (2005). When do firms undertake R&D by investing in new ventures? Strategic Management Journal, 26, 947–965.

Dushnitsky, G., & Lenox, M. J. (2006). When does corporate venture capital investment create firm value? Journal of Business Venturing, 21, 753–772.

Dushnitsky, G., & Shapira, Z. (2010). Entrepreneurial finance meets organizational reality: comparing investment practices and performance of corporate and independent venture capitalists. Strategic Management Journal, 31, 990–1017.

Freund, R. J., & Wilson, W. J. (1998). Regression analysis: Statistical modelling of a response variable. San Diego: Academic.

Gambardella, A., & Torrisi, S. (1998). Does technological convergence imply convergence in markets? Evidence from the electronics industry. Research Policy, 27, 445–463.

Gompers, P. (1995). Optimal investment, monitoring and the staging of venture capital. Journal of Finance, 50, 1461–1490.

Gompers, P. (2002). Corporations and the financing of innovation: The corporate venturing experience. Economic Review of Federal Reserve Bank of Atlanta fourth quarter.

Gompers, P., Kovner, A., Lerner, J., & Scharfstein, D. (2005). Venture capital investment cycles: The role of experience and specialization. NBER Working paper, Cambridge, MA

Gompers, P. A., Kovner, A., Lerner, J., & Scharfstein, D. (2009). Specialization and success: evidence from venture capital. Journal of Economics and Management Strategy, 18(3), 817–844.

Gorman, M., & Sahlman, W. A. (1989). What do venture capital do? Journal of Business Venturing, 4(4), 231–248.

Granstrand, O., Patel, P., & Pavitt, K. (1997). Multi-technology corporations: why they have “distributed” rather than “distinctive core” competencies. California Management Review, 39(4), 8–25.

Gruber, M., Heinemann, F., Brettel, M., & Hungeling, S. (2010). Configurations of resources and capabilities and their performance implications: an exploratory study on technology ventures. Strategic Management Journal, 31(12), 1337–1356.

Guo, B., Lou, Y., & Perez Castrillo, D. (2012). Investment, duration, and exit strategies for corporate and independent venture capital-backed start-ups. Working paper 895.12: http://hdl.handle.net/2072/204084.

Gupta, A. K., & Sapienza, H. J. (1992). Determinants of venture capital firms’ preferences regarding the industry diversity and geographic scope of their investment. Journal of Business Venturing, 7(5), 347–362.

Haeussler, C., Harhoff, D., & Mueller, E. (2009). To be financed or not… - The role of patents for venture capital financing. ZEW Discussion Paper no. 09–003.

Hall, B. H. (2004). Exploring the patent explosion. Journal of Technology Transfer, 30(1–2), 35–48.

Hellmann, T., & Puri, M. (2002). Venture capital and the professionalization of start-up firms: empirical evidence. Journal of Finance, 57(1), 169–197.

Hirukawa, M., & Ueda, M. (2008). Venture capital and innovation: which is first? Pacific Economic Review, 16(4), 421–465.

Hsu, D. H. (2007). Experienced entrepreneurial founders, organizational capital, and venture capital funding. Research Policy, 36, 722–741.

Hsu, D. H. & Ziedonis, R. H. (2013). Patents as quality signals for entrepreneurial ventures. Strategic Management Journal, forthcoming.

Huang, C., Notten, A., & Rasters, N. (2011). Nanoscience and technology publications and patents: a review of social science studies and search strategies. Journal of Technology Transfer, 36(2), 145–172.

Ivanov, W., & Xie, F. (2010). Do corporate venture capitalists add value to start-up firms? Evidence from IPOs and acquisitions of VC-backed companies. Financial Management, 39(1), 129–152.

Jain, B. A., & Kini, O. (1995). Venture capitalist participation and the post- issue operating performance of IPO firms. Managerial and Decision Economics, 16(6), 593–606.

Kaplan, S., & Stromberg, P. (2004). Contracts, characteristics, and actions: evidence from venture capitalist analyses. Journal of Finance, 59, 2173–2206.

Knill, A. (2009). Should venture capitalists put all their eggs in one basket? Diversification versus pure-play strategies in venture capital. Financial Management, 38(3), 441–486.

Knockaert, M., Wright, M., Clarysse, B., & Lockett, A. (2010). Agency and similarity effects and the VC’s attitude towards academic spin-out investing. Journal of Technology Transfer, 35(6), 567–584.

Kortum, S., & Lerner, J. (2000). Assessing the contribution of venture capital to innovation. The RAND Journal of Economics, 31(4), 674–692.

Kraaijenbrink, J., Spender, J.-C., & Groen, A. J. (2010). The resource-based view: a review and assessment of its critiques. Journal of Management, 36(1), 349–372.

Krishnan, C. N. V., Ivanov, V. I., Masulis, R. W., & Singh, A. K. (2011). Venture capital reputation, post-IPO performance, and corporate governance. Journal of Financial and Quantitative Analysis, 46(5), 1295–1333.

Lemley, M. (2005). Patenting nanotechnology. Stanford Law Review, 58, 601–630.

Lerner, J. (1994). The importance of patent scope: an empirical analysis. The Rand Journal of Economics, 25, 319–333.

Lerner, J. (2002). Boom and bust in the venture capital industry and the impact on innovation. Federal Reserve Bank of Atlanta Economic Review Fourth Quarter, 2002, 25–39.

Lockett, A., Thompson, S., & Morgenstern, U. (2009). Reflections on the development of the RBV. International Journal of Management Reviews, 11(1), 9–28.

MacMillan, I. C., Siegel, R., & Narasimha, P. N. S. (1985). Criteria used by venture capitalists to evaluate new venture proposals. Journal of Business Venturing, 1(1), 119–128.

Macmillan, I. C., Kulow, D. M., & Khoylian, R. (1989). Venture capitalists involvement in their investments - extent and performance. Journal of Business Venturing, 4(1), 27–47.

Manigart, S., Waele, D., Wright, M., Robbie, K., Desbrières, P., Sapienza, H., & Beckman, A. (2002). Determinants of required Return in venture capital investments: a five-country study. Journal of Business Venturing, 17, 291–312.

Mann, R. J., & Sager, T. W. (2007). Patents, venture capital and software start-ups. Research Policy, 36, 193–208.

Martin de Castro, G., Delgado Verde, M., Lopez Saez, P., & Navas-Lopez, J. (2011). Towards ‘an intellectual capital-based view of the firm’: origins and nature. Journal of Busines Ethics, 98, 649–662.

Martín Rojas, R., García Morales, V. J., & García Sánchez, E. (2011). The influence on corporate entrepreneurship of technological variables. Industrial Management & Data Systems, 111(7), 984–1005.

Matusik, S. F., & Fitza, M. A. (2012). Diversification in the venture capital industry: leveraging knowledge under uncertainty. Strategic Management Journal, 33(4), 407–426.

Merges, R., & Nelson, R. R. (1990). On the complex economics of patent scope. Columbia Law Review, 90, 839–916.

Munari, F., & Toschi, L. (2011). Do venture capitalists have a bias against investment in academic spinoffs? Evidence from the micro and nanotechnology sector in the UK. Industrial and Corporate Change, 20(2), 397–432.

Munari, F., & Toschi, L. (2013). Running ahead in the patent gold rush. Strategic patenting in emerging technologies. Technological Forecasting and Social Change, forthcoming.

Munari, F., Odasso, C., & Toschi, L. (2011). IP-backed finance. In F. Munari & R. Oriani (Eds.), The economic valuation of patents. Methods and applications. UK: Edward Elgar Publishing Limited di Cheltenham.

Muzyka, D., Birley, S., & Leleux, B. (1996). Trade-offs in the investment decisions of European venture capitalists. Journal of Business Venturing, 11(4), 273–287.

Norton, E., & Tenenbaum, B. (1993). Specialization versus diversification as a venture capital investment strategy. Journal of Business Venturing, 8, 431–442.

Patel, P., & Pavitt, K. (1994). Technological competencies in the world’s largest firms: complex and path-dependent, but not too much variety. Research Policy, 23, 533–546.

Patel, P., & Pavitt, K. (1997). Technological competencies in the world’s largest firms: complex and path-dependent, but not much variety. Research Policy, 26(2), 141–156.

Prahalad, C., & Hamel, G. (1990). The core competencies of the firm. Harvard Business Review, 439–465.

Real, J. C., Leal, A., & Roldán, J. L. (2006). Information technology as a determinant of organizational learning and technological distinctive competencies. Industrial Marketing Management, 35(4), 505–521.

Sapienza, H. J., Manigart, S., & Vermeir, W. (1996). Venture capitalist governance and value added in four countries. Journal of Business Venturing, 11(6), 439–469.

Scheu, M., Veefkind, V., Verbandt, Y., Molina Galan, E., Absalom, R., & Forster, W. (2006). Mapping nanotechnology patents: the EPO approach. World Patent Information, 28(3), 204–211.

Smolarski, J., & Kut, C. (2011). The impact of venture capital financing method on SME performance and internationalization. International Entrepreneurship and Management Journal, 7, 39–55.

Streletzki, J.-G., & Schulte, R. (2012). Which venture capital selection criteria distinguish high-flyer investments? Venture Capital: An International Journal of Entrepreneurial Finance, 15(1), 29–52.

Stuart, T. E., Hoang, H., & Hybels, R. C. (1999). Interorganizational endorsements and the performance of entrepreneurial ventures. Administrative Science Quarterly, 44(2), 315–349.

Toschi, L., Munari, F., & Nightingale, P. (2012). Mix and match: corporate diversification and CVC portfolio strategies. Paper presented at the DRUID Society Conference 2012 on Innovation and competitiveness, Copenhagen, 19–21 June 2012.

Tyebjee, T. T., & Bruno, A. V. (1984). A model of venture capitalist investment activity. Management Science, 30(9), 1051–1066.

Wright, M., & Lockett, A. (2003). The structure and management of alliances: syndication in the venture capital industry. Journal of Management Studies, 40, 2073–2102.

Wu, W. W. (2009). Exploring core competencies for R&D technical professionals. Expert Systems with Applications, 36(5), 9574–9579.

Acknowledgments

Financial support by the EIBURS programme of the European Investment Bank (EVPAT Project, “The Economic Valuation of Patents”) is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Munari, F., Toschi, L. Do patents affect VC financing? Empirical evidence from the nanotechnology sector. Int Entrep Manag J 11, 623–644 (2015). https://doi.org/10.1007/s11365-013-0295-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11365-013-0295-y