Abstract

In this paper, we derive an economic production model having two-parameter Weibull distribution deterioration. In this model, we considered a demand rate that depends on price stock and indirectly on time. Shortage is allowed and partially backlogged. We assume that customer return is a factor of quantity sold, price, and inventory level. Time horizon is finite. Production is also dependent on demand. The goal of this production is to maximize the profit function. An illustrative example, sensitivity analysis, and a graphical representation are used to interpret the usefulness of this model.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

- Production model

- Two parameter Weibull distribution deterioration

- Shortage

- Partial backlogging

- Customer return

1 Introduction

In every supply chain model, maintaining of deteriorating inventories is a major issue for almost all business organizations. Most of the goods decay over time. In general, some products deteriorate in a certain fixed period of storage like seasonal goods fruits, vegetables, etc., but certain goods lose their potentiality when the time passes, such as electronic items, radioactive substances, etc. Certain inventories like highly volatile liquids as ethanol, gasoline, etc., undergo depletion due to evaporation, so that deterioration is one of the most influential factors that affect the decision related to production and inventory management. Each business organization considers it quite seriously. With regard to all these issues, deterioration function is of various types that may be constant and time dependent. In our production model, we consider Weibull distribution as a deterioration function. Weibull distribution is one of the most reliable deterioration functions because it presents a perfect view of deteriorating inventory level. Covert and Philip [1] established an inventory model for deteriorating items having variable rate of deterioration. In their model, they use two-parameter Weibull deterioration. Misra [2] also presents a production model with two-parameter Weibull deterioration to show inventory depletion. Choi and Hwang [3] present an optimization of product planning problem with continuously distributed time lags. Aggarwal and Bahari-Hashani [4] synchronized production policies for deteriorating items in a declining market. Pakkala and Achary [5] present a deterministic inventory model for deteriorating items with two warehouses and finite replenishment rate. Jong et al. [6] developed an EOQ inventory model with time-varying demand and Weibull deterioration with shortages. Wu [7] presented an EOQ inventory model for items with Weibull distribution deterioration, ramp type demand rate, and partial backlogging. Lee and Wu [8] formulate an EOQ model for items with Weibull distributed deterioration, shortages, and power demand pattern. Banerjee and Agrawal [9] analyzed a two-warehouse inventory model for items with three-parameter Weibull distribution deterioration, shortages, and linear trend in demand. Roy and Chaudhuri [10] scheduled a production inventory model under stock-dependent demand, Weibull distribution deterioration, and shortage. Begum et al. [11] worked on an EOQ model for varying items with Weibull distribution deterioration and price-dependent demand. Konstantaras and Skouri [12] dealt a note on a production inventory model under stock-dependent demand, Weibull distribution deterioration, and shortage. Shilpi et al. [13] introduced an EPQ model of ramp type demand with Weibull deterioration under inflation and finite horizon in crisp and fuzzy environment.

In any production model, demand is a reliable factor on which the whole working of inventory model depends. Most researchers assume that demand depends on time as well as other factors. Stock-dependent demand is another way to look at practical situations. Many of the factors affect demand on a serious mode, but stock affects it in the most powerful manner. It may influence the production directly or indirectly, such as low stock raises the price of commodity in the market which decreases the demand and, if the stock level increases, then the price goes down and as a result demand increases. Therefore, it is observed that the stock level affects the demand in many ways. For example, if there are a large pile of goods available in the stock then the vendor announces a large discount to clear the stock. Many practitioners and researchers have analyzed this issue very seriously. Many researchers consider this as a realistic assumption, such as Datta et al. [14], Balki and Benkherouf [15], Teng and Chang [16], Wu et al. [17], Singh et al. [18], Singh and Singh [19], and finally, Sarker and Sarkar [20], Yang [21].

Customer return is also one of the most important factors that affect the production model. Customer returns are the products that may be returned by the customer after purchase. Customer may return these products due to several reasons such as defect in the product, customer is not satisfied with the product, some money-back guarantee, or maybe to replace the product, etc. Nowadays, customer returns occur in many different ways. Many researchers working in the stream like Hess and Mayhew [22] proposed a return of modeling merchandise in direct marketing. It is useful for the future studies of many researchers. Pasterneck [23] proposed a model for return policies of deteriorating items. In the same field, Anderson et al. [24] developed a relation between return and demand. Further, Ahmed et al. [25] introduced an inventory model for production as well as remanufacturing for quality and price-dependent return rate. In the same field, Hani et al. [26] derived an advertising policy customer’s disadoption and subscriber services cost learning. Now Jiang and Chan [27] establish a lot of sizing polices for expiry date deteriorating items and partial trade credit risk customers.

In this proposed model, we considered a production inventory model with shortage, partial backlogging, and customer returns. Two-parameter Weibull deterioration is considered here. In this model, production is dependent on demand and demand depends on stock and price. Customer return is a function of price, quantity sold, and inventory level. To match the illustrated model with realistic situations, we discussed three cases of Weibull deterioration as constant, linear, and quadratic. To illustrate the model utility numerical example, sensitivity analysis, and concavity of the profit functions are shown here.

2 Notations and Assumptions

2.1 Notations

- c h :

-

Holding cost per unit per unit time

- c d :

-

Deterioration cost per unit per unit time

- c l :

-

Cost of lost sale per unit

- p :

-

Selling price per unit, where p > c

- θ :

-

Two-parameter Weibull deterioration rate

- Q :

-

Order quantity

- T :

-

Length of replenishment cycle time

- B :

-

Backlogging rate

- P :

-

Production rate

- SV:

-

Salvage value per unit item

- A :

-

Setup cost

- I 1(t):

-

Inventory level at the time \( t \in [0, t_{1} ] \)

- I 2(t):

-

Inventory level at the time \( t \in [t_{1} , t_{2} ] \)

- I 3(t):

-

Inventory level at the time \( t \in [t_{2} , t_{3} ] \)

- I 4(t):

-

Inventory level at the time \( t \in [t_{3} , t_{4} ] \)

2.2 Assumptions

-

1.

Two-parameter Weibull distribution deterioration is considered here. \( \theta = \alpha \beta t^{\beta - 1} \).

-

2.

Time horizon is finite.

-

3.

The demand rate is \( D\left( {p,t} \right) = \left( {a - {\text{bp}} + {\text{cI}}\left( t \right)} \right) \) (where a > 0, b > 0) is a linearly decreasing function of the price but for the shortage and partial backlogging period demand depends on price only.

-

4.

Shortage is allowed. The unsatisfied demand is backlogged, and the fraction of shortage back ordered is B, (B > 0), and 0 ≤ B ≤ 1.

-

4.

We assume that the customer returns increase with both the quantity sold and price using the following general form: \( R\left( {p,t} \right) = {\text{AD}}\left( {p,t,I\left( t \right)} \right) + {\text{Bp}}\left( {B \ge 0,0 \le A < 1} \right). \)

-

5.

Production is demand dependent, where P(t) = KD(t).

3 Model Formulation

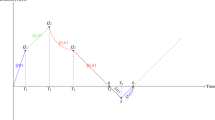

For the mathematical formulation of presented model, we solve the different inventory level as well as different costs. Firs, we can see that production starts when t = 0 then the inventory level goes up, but at the same time inventory goes down due to demand and deterioration. After time t 1, inventory decreases due to demand and deterioration. At the time interval t 2 < t < t 3, shortage occurs and the inventory level becomes negative and at the same time backlogging starts. In the fourth phase, production again starts and the backlogged demands get fulfilled partially.

As we see in Fig. 1.

Now solving the above equations, we get

Now using the above equations, we can find the following cost:

The deterioration cost for the period (0, t 2 )

Holding cost for the inventory

Return cost for the inventory

Lost sale cost for the inventory

Production cost for the inventory

Sales revenue for the inventory

Shortage cost for the inventory

4 Profit Function

PT = sales revenue (shortage cost–deterioration cost–production cost–lost sale cost–return cost–holding cost).

5 Numerical Example for All Three Cases

We use the following parameters to illustrate the numerical example for the described model.

a = 24; b = 0.2; c s = 0.03; c h = 0.3; c d = 0.05; c l = 0.03; c p = 100; B = 0.001; A = 0.01; p = 110; P = 10; SV = 100; α = 0.005; k = 3;

To solve the numerical example for all the three deterioration cases, we use the software mathematica 7 and the optimal results are presented as follows:

-

Case 1:

When β = 1 the value of profit function and other variables is

PT = 31921.6; t 1 = 12.436; t 3 = 59.4748.

-

Case 2:

When β = 2 the value of profit function and other variables is

PT = 17560.4; t 1 = 5.64778; t 3 = 35.5941.

-

Case 3:

When β = 3 the value of profit function and other variables is

PT = 3719.8; t 1 = 3.5438; t 3 = 9.72077.

6 Sensitivity Analysis for Different Parameters

To study the behavior of profit function w.r.t different parameter, see below.

Parameters | Change in values | When β = 1 | When β = 2 | When β = 3 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

TP | t 1 | t 3 | TP | t 1 | t 3 | TP | t 1 | t 3 | ||

c h | 0.3 | 31912.6 | 12.436 | 59.4748 | 17560.4 | 5.6477 | 35.5941 | 13055.5 | 3.84339 | 26.278 |

0.4 | 31931.1 | 12.439 | 59.4767 | 17561.3 | 5.6380 | 35.5810 | 13054.2 | 3.81433 | 26.2429 | |

0.5 | 31904.6 | 12.4462 | 59.4785 | 17562.1 | 5.6294 | 35.5684 | 13053.0 | 3.78729 | 26.2101 | |

0.4 | 31950.1 | 12.4453 | 59.4797 | 17563.0 | 5.6202 | 35.5563 | 13052.1 | 3.81433 | 26.1796 | |

c | 0.01 | 31912.6 | 12.436 | 59.4748 | 17560.4 | 5.6477 | 35.5941 | 13055.5 | 3.84339 | 26.278 |

0.02 | 17586.2 | 10.4011 | 35.2377 | 9196.28 | 5.1735 | 20.7431 | 6751.02 | 3.6896 | 15.1687 | |

0.03 | 12577.4 | 9.2922 | 27.0972 | 6438.04 | 4.9260 | 15.8394 | 4701.31 | 3.5464 | 11.4945 | |

0.04 | 9882.97 | 8.5089 | 23.0866 | 5092.38 | 4.8097 | 13.5562 | 3719.8 | 3.5438 | 9.7207 | |

B | 0.001 | 31912.6 | 12.436 | 59.4748 | 17560.4 | 5.6477 | 35.5941 | 13055.5 | 3.84339 | 26.278 |

0.002 | 31932.8 | 12.4364 | 59.4917 | 17564.0 | 5.6487 | 35.5997 | 13057.5 | 3.8444 | 26.2815 | |

0.003 | 31944.0 | 12.4365 | 59.5074 | 17576.5 | 5.6497 | 35.6054 | 13059.5 | 3.8454 | 26.2849 | |

0.004 | 31955.2 | 12.4368 | 59.528 | 17571.1 | 5.6508 | 35.6112 | 13061.4 | 3.8463 | 26.2881 | |

c s | 0.03 | 31912.6 | 12.436 | 59.4748 | 17560.4 | 5.6477 | 35.5941 | 13055.5 | 3.84339 | 26.278 |

0.04 | 31904.0 | 12.4364 | 59.4762 | 17560.1 | 5.6488 | 35.6073 | 13056.8 | 3.84431 | 26.289 | |

0.05 | 31886.4 | 12.4365 | 59.4769 | 17559.8 | 5.6498 | 35.6207 | 13058.2 | 3.84499 | 26.301 | |

0.06 | 31868.8 | 12.4367 | 59.4776 | 17559.6 | 5.6512 | 35.6343 | 13059.5 | 3.84621 | 26.312 | |

θ | 0.91 | 31912.6 | 12.436 | 59.4748 | 17560.4 | 5.6477 | 35.5941 | 13055.5 | 3.84339 | 26.278 |

0.92 | 31868.8 | 12.4366 | 59.4776 | 17560.2 | 5.6477 | 35.5940 | 13055.2 | 3.8431 | 26.276 | |

0.93 | 31864.6 | 12.4368 | 59.4777 | 17560.1 | 5.6476 | 35.5938 | 13055.1 | 3.8429 | 26.274 | |

0.94 | 31860.4 | 12.4369 | 59.4774 | 17559.4 | 5.6478 | 35.5936 | 13054.4 | 3.8428 | 26.272 | |

7 Observations

In this paper, we discussed the three cases of Weibull deterioration where we considered the different values of β such as β = 1, β = 2, and β = 3 in case first, second, and third case, respectively. For all these cases the values of profit function and decision variable are different. Now, we see the effect of change of different parameters on profit function and decision variables.

-

Case 1:

When β = 1 (constant deterioration)

-

I.

If we increase the value of parameter c h the value of profit function is fluctuated up and down but the value of t 1 and t 3 increases regularly.

-

II.

If we increase the value of c the value of profit function t 1 and t 3 decreases continuously.

-

III.

If the value of B increases there is a continuous increase in the value of profit, as well as in t 1 and t 3.

-

IV.

When there is increase in the value of c s the profit function decreases but the value of t 1 and t 3 increases regularly.

-

V.

On increasing the value of θ, profit decreases but the value of t 1 and t 3 increases.

-

I.

-

Case 2:

When β = 2 (linear deterioration)

-

I.

When we increase the value of c h the value of profit function increases but the value of t 1 and t 3 decreases.

-

II.

If we increase the value of c the value of profit as well as t 1 and t 3 decreases vastly.

-

III.

On increasing the value of B, value of profit function t 1 and t 3 increases simultaneously.

-

IV.

If we increase the value of c s the value of total profit decreases and the value of t 1 and t 3 increases.

-

V.

When we increase the value of θ the value of total profit and t 1 and t 3 decreases.

-

I.

-

Case 3:

When β = 3 (quadratic deterioration)

-

I.

After increasing the value of c h , the values of TP, t 1, and t 3 decrease.

-

II.

On increasing the value of c again, the values of TP, t 1, and t 3 decrease regularly.

-

III.

When we increase the value of B the values of TP, t 1, and t 3 increase.

-

IV.

On increasing the value of c s the values of TP, t 1, and t 3 increase.

-

V.

When we increase the value of θ the values of TP, t 1, and t 3 decrease.

-

I.

9 Conclusion

In this paper, we worked on an economic production model having two-parameter Weibull deterioration. Demand is considered as a function of stock, price, and time but demand for shortage period depends only on price. Production also depends on demand. Shortage is allowed and is partially backlogged. To frame this model in real-life situations, we also considered customer return as a factor of quantity sold, price, and inventory level. As we know that in a realistic situation, deterioration may differ with time, so to be more practical, we consider three types of Weibull deterioration rates. We considered three cases in which deterioration rate is constant, linear, and quadratic. By sensitivity analysis, the difference between concavity of graph and behavior of profit function is recognizable. We also compare these cases by numerical example, sensitivity analysis, and concavity of profit function.

References

Covert, R.P., Philip, G.C.: An EOQ model for items with weibull distribution deterioration: AIIE Trans. 5(4), 323–326, (1973)

Misra, R.B.: Optimum production lot size model for a system with deteriorating inventory. Int. J. Prod. Res. 13(5), 495– 505 (1975)

Choi, S., Hwang, H.: Optimization of production planning problem with continuously distributed time-lags. Int. J. Syst. Sci. 17(10), 1499–1508 (1986)

Aggarwal, V., Bahari-Hashani, H.: Synchronized production policies for deteriorating items in a declining market. IIE Trans. Oper. Eng. 23(2), 185–197 (1991)

Pakkala, T.P.M., Achary, K.K.: A deterministic inventory model for deteriorating items with two warehouses and finite replenishment rate. Eur. J. Oper. Res. 57(1), 157–167 (1992)

Wu, J.-W., Lin, C., Tan, B., Wen-Chuan.: An EOQ inventory model with time-varying demand and Weibull deterioration with shortages. Int. J. Syst. Sci. 31(6), 677–683 (2000)

Wu, K.S.: An EOQ inventory model for items with Weibull distribution deterioration, ramp type demand rate and partial backlogging. Prod. Planning Control 12(8), 787–793, (2001)

Lee, W.C., Wu, J.-W.: An EOQ model for items with Weibull distributed deterioration, shortages and power demand pattern. Int. J. Inf. Manag. Sci. 13(2), 19–34 (2002)

Banerjee, S., Agrawal, S.: A two-warehouse inventory model for items with three-parameter Weibull distribution deterioration, shortages and linear trend in demand. Int. Trans. Oper. Res. 15(6), 755–775 (2008)

Roy, T., Chaudhuri K.S.: A production-inventory model under stock-dependent demand, Weibull distribution deterioration and shortage. Int. Trans. Oper. Res. 16(3), 325–346 (2009)

Begum, R., Sahoo, R.R., Sahu, S.K., Mishra, M.: An EOQ model for varying items with Weibull distribution deterioration and price-dependent demand. J. Sci. Res. 2(1), 24–36 (2010)

Konstantaras, I., Skouri, K.: A note on a production-inventory model under stock-dependent demand, Weibull distribution deterioration, and shortage. Int. Trans. Oper. Res. 18(4), 527–531 (2011)

Shipi, P., Mahapatra, G.S., Samanta G.P.: EPQ model of ramp type demand with weibull deterioration under inflation and finite horizon in crisp and fuzzy environment. Int. J. Prod. Econ. 156, 159–166 (2014)

Datta, T.K., Paul, K., Pal, A.K.: Demand promotion by up-gradation under stock-dependent demand situation–a model. Int. J. Prod. Econ. 55, 31–38 (1998)

Balkhi, T.Z., Benkherouf, L.: On an inventory model for deteriorating items with stock dependent and time varying demand rates. Comput. Oper. Res. 31, 223–240 (2004)

Teng, J.T., Chang, C.T.: Economic production quantity models for deteriorating items with price and stock dependent demand. Comput. Oper. Res. 32, 297–308 (2005)

Wu, K.S., Ouyang, L.Y., Yang, C. T.: An optimal replenishment policy for non-instantaneous deteriorating items with stock-dependent demand and partial backlogging. Int. J. Prod. Econ. 101, 369–384 (2006)

Singh, S.R., Kumari, R., Kumar, N.: Replenishment policy for non-instantaneous deteriorating items with stock-dependent demand and partial back logging with two-storage facility under inflation. Int. J. Oper. Res. Optim. 1(1), 161–179 (2010)

Singh, C., Singh, S.R.: An EPQ model with stock dependent demand under imprecise and inflationary environment using genetic algorithm. Int. J. Eng. Res. Technol. 1(4), (2012)

Biswajit, S., Sumon, S.: An improved inventory model with partial backlogging time varying deterioration and stock dependent demand. Econ. Model. 30, 924–932 (2013)

Yang, C.T.: Inventory model with both stock dependent demand and stock dependent holding cost rate. Int. J. Prod. Econ. 155, 214–221 (2014)

Hess, J.D., Mayhew, G.E.: Modeling merchandise returns in direct marketing. J. Interact. Mark. 4(2), 347–385 (1997)

Pasternack, B.A.: Optimal pricing and returns policies for perishable commodities. Mark. Sci. 4(2), 166–176 (1985)

Anderson, E.T., Hansen, K., Simister, D., Wang, L.K.: How are demand and return related? Theory and empirical evidence: Working paper, Kellogg school of management, Northwestern University (2006)

Ahmed, M.A., Saadany, E.L., Jaber Mohomad, Y.: A production\remanufacturing inventory model with price and quality dependent return rate. Comput. Ind. Eng. 58(3), 352–362 (2010)

Mesak Hani, I., Abdullahal, B., Babin Barry, J., Biron Laura, M., Antony, J.: Optimum advertising policy over time for subscriber services cost learning and customer’s disadoption. Eur. J. Oper. Res. 211(3), 642–649 (2011)

Wu, J., Ya-Lan, C.: Lot sizing policies for deteriorating items with expiration dates and partial trade credit risk customers. Int. J. Prod. Econ. 155, 292–301 (2014)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2016 Springer Science+Business Media Singapore

About this paper

Cite this paper

Chaman Singh, Kamna Sharma, Singh, S.R. (2016). A Production Model with Stock-Dependent Demand, Partial Backlogging, Weibull Distribution Deterioration, and Customer Returns. In: Pant, M., Deep, K., Bansal, J., Nagar, A., Das, K. (eds) Proceedings of Fifth International Conference on Soft Computing for Problem Solving. Advances in Intelligent Systems and Computing, vol 436. Springer, Singapore. https://doi.org/10.1007/978-981-10-0448-3_2

Download citation

DOI: https://doi.org/10.1007/978-981-10-0448-3_2

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-10-0447-6

Online ISBN: 978-981-10-0448-3

eBook Packages: EngineeringEngineering (R0)