Abstract

Shell has been using scenario planning for 40 years to help deepen its strategic thinking. Developing and applying scenarios is part of an ongoing process in Shell that encourages decision-makers to explore the features, uncertainties, and boundaries of the future landscape, and engage with alternative points of view.

The scenarios go beyond conventional energy outlooks and consider long-term trends in economics, energy supply and demand, geopolitical shifts and social change. They are based on plausible assumptions and quantification, and include the impact of different patterns of individual and collective choices.

Shell’s latest scenario publication, the New Lens Scenarios, published in 2013, provides an in-depth analysis of how economic, social and political forces might play out over the twenty-first century, as well as their consequences for the global energy system and environment. Its ‘Mountains’ and ‘Oceans’ scenarios set out two distinct paths the world might take in the decades ahead. They reinforce the urgency and complexity of addressing the world’s resource and environmental stresses, and highlight the need for business and government to find new ways to collaborate, fostering policies that promote the development and use of cleaner energy, and improve energy efficiency.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

Introduction

From blackouts around the globe to the boiling tensions in the Middle East, recent events have thrown up many uncertainties about how the world will meet its growing future energy needs. While these dramatic events have grabbed the headlines, they come on top of several relentless trends that have been shaping our global energy future.

The worldwide financial crisis ushered in an era of macro-economic volatility and accelerated the shift in influence from West to East. As wealth levels rise in the emerging economies, hundreds of millions of people are emerging from poverty. And the global population, which is growing by more than 200,000 people every day is projected to reach over nine billion by 2050.Footnote 1 That is like adding one more China and India to the world, with basic needs for food, water, and energy that will have to be met.

At the same time, many countries are making the journey from rural to urban societies. According to one projection, the world will build the equivalent of one new city of 1.3 million people every week for the next 40 years.Footnote 2

The upshot of these trends? Surging energy demand and growing environmental stress. If we continue to use energy in the same ways we do today, global energy needs could triple in the first half of this century. At the same time, many scientists agree that CO2 emissions must be halved by mid-century if we are to avoid dangerous changes to the global climate.

Of course, over the coming decades we will surely find creative ways to improve the energy efficiency of our cars, homes, and factories. And technology will help us unlock additional sources of energy. But those gains still may not be enough to keep up with the pace of underlying demand growth.

Closing this gap in energy supply and demand will require a dramatic ramp-up in energy production or a drastic moderation in energy use – or, more likely, some mix of both. But just how this might be achieved remains unclear, giving rise to a ‘zone of uncertainty’.Footnote 3 This could turn out to be a zone of extraordinary misery or extraordinary opportunity, depending on how the world responds.

For over four decades, Shell has developed and applied scenarios as part of its strategic thinking to help grapple with such uncertainties. Most companies monitor changes in their business environment, but Shell is one of the few that routinely employs alternative outlooks as a core strategic tool. Given the long lifetimes of investments in the energy industry, decisions made today have consequences for decades. Long-term scenario considerations are helpful in shaping those decisions.

The success of the scenarios is not just their ability to provide strategic insights, but their approach to developing and sharing these insights. They enable the company’s decision-makers to think about the possible wider and longer-reaching implications of unfolding trends and potential discontinuities. They stretch and clarify thinking, helping to improve the company’s prospects, not only through enriching the context for decision-making, but also by developing a leadership cadre that is more sensitive to changes in the external environment.

Scenarios in Shell

From the outset of the practice in the company, scenario developers embraced intuition, uncertainty, and engagement. They did not shy away from talking about what could be considered ‘unimaginable’. Producing neither rigid predictions nor wild fantasies, scenario building is a craft that holds real commercial value for Shell.

“While we can’t predict the future, science-based creative thinking can give us some clues,” says Dr. Angela Wilkinson, from the Smith School of Enterprise and the Environment at Oxford University.

Shell’s scenario analysis focuses on four main areas – economics, (geo)politics and socio-cultural issues, energy, and the environment – to understand how consumers, governments, oil energy producers, and regulators are likely to behave and respond to change in the decades ahead.

Today’s scenario builders use complex econometric modeling and sophisticated methodologies. The scenarios development process now includes a multitude of short-, medium-, and long-term portraits of global energy developments, but also individual country analyses and consideration of major trends in areas like public health and urbanisation. Scenarios can take a global view or focus on specific issues in specific countries, such as the future for the emerging democracies of Libya or Iraq. They often look decades ahead, but can also have a shorter-term focus, such as with the financial crisis in the Eurozone.

The ultimate goal of scenarios for Shell is to encourage and equip business decision-makers to consider the factors that shape their choices right now. That is important for an industry investing billion-dollar sums in infrastructure which can operate for decades. Today scenarios continue to influence thinking across the company, from the Board and Executive Committee right across the operating businesses.

Many important strategic decisions taken over the last four decades have the fingerprints of scenario activity on them. Of course, all major choices involve multiple inputs from many people, but scenarios have explicitly highlighted specific threats and opportunities or, more frequently, implicitly informed the fundamental mind-sets underpinning decisions.

Scenarios under discussion in 1973 first established Shell’s reputation for using this hitherto academic approach to inform strategic business planning. When the Yom Kippur War broke out in October of that year, the West’s support for Israel angered oil-rich Arab states, triggering an oil embargo. Fuel shortages sparked a global recession and a massive stock market crash. The world reeled. But Shell’s decision makers were mentally prepared for the worst because they had already imagined such a scenario. This helped the company weather the volatility of the 1970s, bringing financial gains running into the billions of dollars thanks to the re-configuration or sale of refineries and installations, or decisions not to replace them.

Scenarios contribution to strategic thinking helped the company to anticipate, adapt, and respond to another oil shock in 1979, as well as to the decline and eventual collapse of the Soviet Union in the 1980s. It also prepared the company for the rise of environmental concerns linked to carbon dioxide in the 1990s and to explore the dynamics of recession and recovery in the 2000s. In the past two decades, scenarios prepared the company for the impact of technology, terrorism, and globalisation in a rapidly changing world.

Long before the collapse of the Berlin wall in 1989, scenarios workshops had imagined potential new opportunities in new markets opening up behind the old Iron Curtain – not only in the Soviet Union, but also across Eastern Europe. Shell not only opened refineries in Eastern Europe, it closed down or sold some in Western Europe.

In the 1990s, growing social and environmental stresses were highlighted, helping Shell develop a constructive, pro-active attitude to the threat of climate change.

In 2005, scenarios also raised the probability of a looming gap between the world’s surging demand for energy and global supplies and reinforced the significance of natural gas in the company’s energy mix.

A few years later they highlighted a mix of circumstances that made sustainable biofuels appear to be an attractive business opportunity. In 2011, Shell moved into the production of low-carbon bio-ethanol from Brazilian sugar cane.

In Shell’s 2011 Signals & Signposts publication, one of the key factors raised was the impact of heightened political tension in the developing world. In early 2011, the Arab Spring took the world by surprise with popular revolts toppling rulers in Egypt and Tunisia and sowing the seeds for reform throughout the Middle East.

While scenarios couldn’t, of course, predict the exact date of the uprising in the Middle East and North Africa, they had highlighted conditions that would make the rebellions increasingly likely: growing resentment, youthful populations with little opportunity for employment, economic volatility, and rising unemployment and inflation.

Shell has shared at least half a dozen far-reaching global scenarios with the wider world since the 1990s, probing the impact of profound developments like the fall of the Iron Curtain and the war in Iraq, as well as the evolution of alternative energy resources like biofuels, shale gas, and wind, solar, and other renewable energy resources. In 2013, a summary of recent work entitled New Lens Scenarios was published (www.shell.com/scenarios).

Scenarios and Executive Decision-Making

Drawing on the knowledge of a network of specialists – both within and outside the company – is central to the process of building scenarios. But engaging the company’s own decision-executives throughout the development process is vital to scenarios’ impact.

Scenarios provide quantified insights and a language for executives to apply when grappling with increasingly unfamiliar and challenging conditions. They aim to be thought-provoking yet plausible, highlighting matters already in the foreground and also, crucially, background developments that should be brought to the fore. Used effectively, these alternative outlooks can help organisations address difficult issues that need to be explored collaboratively even though there may be deeply divided opinions about them.

Such an approach also helps equip decision-makers with a deeper awareness of the very different perspectives others may have, the need to engage with these perspectives effectively, and the significance to their own future of the choices made by others. In that sense, scenarios are deeply relational as they focus on people and their behaviour, and not only on seemingly impersonal economic, political, and social forces.

The scenario alchemy as we experience it in Shell is a combination of a strategic thinking process, a mode of analysis, a social process of engagement and influence, and, at its most powerful, an enabler of individual and group exploration and discovery.

At least one of the functions of scenario work is to bring people together to explore areas in a way that may reveal ‘unknown unknowns,’ in the words of former US Secretary of Defense Donald Rumsfeld. This exploration is not primarily intended to produce attractive booklets or reports, nice though those can be. It is most importantly about helping people take a journey that guides them into better choices based on richer considerations of the world around them.

This journey can be difficult. As the philosopher Schopenhauer pointed out, new truths are first ignored or ridiculed, then vehemently opposed, and then, ultimately, taken to be self evident – so at different points specific scenarios may be considered irrelevant, foolish, irritating, or even unnecessary. Nevertheless, experience in Shell has deepened our belief of the value to our company of taking this journey.

The journey is never simple or linear. Fresh insights are rarely absorbed from a single reading of a report or from attending a presentation – no matter how brilliant. Understanding this fact helps to avoid the disappointing fate of scenario approaches that are separate from the central strategic deliberations of an organization. While such deliberations are generally embedded in a formal strategic process, much reflection and influence also occurs through parallel channels. In Shell, scenario activity is intrinsically bound up with ongoing assessment of economic, political, and market signals, and the strategic conversations that take place around these. Hundreds of conversations, often informal, with decision-executives over many months prepare fertile ground for the crystallization of insights into scenarios, and also shape the understanding of how scenarios can be best shaped to be impactful.

The Energy Outlook and the Zone of Uncertainty

As an energy company, developments affecting this industry will always be a central concern of Shell scenarios. Our energy modeling looks at over 80 individual countries, with regions to cover the smaller countries, and 14 different sectors of energy demand within each country. Analysis suggests that underlying global demand for energy by 2050 would triple from its 2000 level if emerging economies follow historical patterns of development and if there were no supply constraints.

Natural innovation and competition could spur improvements in energy efficiency to help moderate underlying demand by about 20% over this time. Ordinary rates of supply growth – taking into account technological, geological, competitive, financial, and political realities – could naturally boost energy production by about 50%. But this still leaves a gap between business-as-usual supply and business-as-usual demand equal to approximately the size of the whole industry in 2000.

This gap – this Zone of Uncertainty – will have to be bridged by some combination of extraordinary demand moderation and extraordinary production acceleration. So, we must ask: Is this a zone of extraordinary opportunity or extraordinary misery? For example, smart urban development, sustained policy encouragement and commercial and technological innovation can all result in some moderation. But so can price-shocks, knee-jerk policies, and frustrated economic aspirations (Chart 1.1).

Shell Scenarios Team (2011). Energy drivers and the zone of uncertainty, signals & signposts, page 9. See more on www.shell.com/scenarios

Timescales are a key factor. Buildings, infrastructure, and power stations last several decades. The stock of vehicles can last a couple of decades. New energy technologies must be demonstrated at commercial scale and require three decades of sustained double-digit growth to build industrial capacity and grow sufficiently to feature at even 1–2% of the energy system.

The policies and possibilities in place in the next 5 years will shape investment for the next 10 years, which will largely shape the global energy picture out to 2050. How fast will tensions rise? How fast can we make the right choices, and how quickly can positive developments happen?

In considering these questions, previously published Shell scenario work has highlighted our entry into an era of volatility and transition – economically, politically, socially, and within the energy and environmental systems:

-

Intensified economic cycles as the conditions have changed that underpinned the period from the mid 1980s to mid 2000s – referred to as ‘the great moderation’ in the advanced industrial economies.

-

Heightened political and social instability, stimulated in part by economic volatility.

-

Tensions in the international order, as multilateral institutions struggle to adjust to shifts in economic power, and other arrangements proliferate.

-

Significant demographic transitions involving ageing populations in some places, youth bulges in others, and relentless urbanisation in both fast-emerging and less-developed economies.

-

Surging energy demand driven by growing populations and prosperity, with new energy supplies emerging while others struggle to keep pace, and greenhouse gas emissions increasing, particularly from growth in coal consumption.

-

The deployment of technological advances enabling rapid growth in resource plays such as shale gas and liquid rich shales in, for example, North America, with ripples across the globe, but uncertain prospects elsewhere. The technology for using renewable resources, such as solar photovoltaic, also advances with rapidly growing supply from a small but established base.

-

Better defined and significantly challenged planetary ecological boundaries, including pressures arising from the energy-water-food ‘Stress Nexus’, as each component experiences supply/demand tightness. Because of their linkages, these resources feed off each other and accelerate the combined growth in stress.

New Lenses

Inevitably, given these developments, any plausible outlooks will be messy and patchy. Nevertheless, we have found that a number of new lenses can help us view familiar landscapes from fresh angles so that we can focus and clarify possible futures.

The Paradox Lenses

Paradoxes embody tensions. Three paradoxes highlight key features of the emerging landscape.

The Prosperity Paradox – Economic development raises living standards, but also imposes environmental, resource, financial, political, and social stresses that can undermine the benefits of prosperity. Globalisation reduces income inequality between nations while increasing inequalities within them.

The Leadership Paradox – Addressing global stresses requires coordination among increasing numbers of constituencies, but the more groups involved, the more vested interests block progress. Fresh forms of collaboration need to cut across familiar national, public-private, and industry-sector boundaries, but there are no strong models for such collaborations, and they are difficult to get off the ground as different parties remain focussed on their individual responsibilities.

The Connectivity Paradox – Growing connectivity stimulates creativity but also puts intellectual property at risk, threatening creativity. Connectivity facilitates individual expression and empowerment, but also encourages herd behaviour and amplifies swings in confidence and demand.

Two Archetypal Pathway Lenses

The tensions inherent in these paradoxes fuel an emerging era of transitions. Through examining a range of historical transformations and various models of transition, two archetypal ‘Pathway Lenses’ may help bring clarity and insights to current circumstances.

For example, countries around the world face challenges to their current economic models, political regimes, and social arrangements. The US is dealing with a long term decline in relative global power, economic recession, and a deadlocked political system. China and the other large emerging economies, which appeared resilient in 2008, are now grappling with a range of uncertainties in their search for stability and continued growth. Europe appears to be postponing the challenge of fundamental reform, “kicking the can down the road.” Countries face divergent paths. Will they respond to the challenges they face through adaptation and reform, following a Room to Manoeuvre pathway? Or will change be postponed and a Trapped Transition pathway ensue, until there is either a fundamental reset or collapse?

New Lens Scenarios for the Twenty-First Century

Of course, not all countries or actors will follow one single Trapped Transition or Room to Manoeuvre pathway. Nevertheless, the pathway lenses highlight patterns recurring throughout the broader panorama.

Of particular prominence is the crucial relationship between those who are more or less privileged under current arrangements, and the influence this will have on future developments. In fast-emerging nations, a growing middle class will make increasing demands on governance and welfare entitlements. In developed countries, we see globalisation ‘hollowing out’ the middle class as average household incomes stagnate while the top tier prospers. In global geopolitics, there are growing tensions between established and emerging powers, within an increasingly inadequate multilateral institutional structure.

Two vistas present themselves – high Mountains where the benefits of an elevated position are exercised and protected, and wide Oceans with rising tides, strong currents, and a churning of established perspectives for new ones. A detailed evaluation of these scenarios has been published elsewhere (www.shell.com/scenarios) and a summary of key features follows.

Mountains– an outlook in which current advantages and influence lock-in further future influence, and concentrate prevailing power, benefiting the already advantaged.

Latent opposition is minimised through a combination of ‘carrots and sticks’. Supply-side investments are stimulated, and philanthropy flourishes. But growing rigidities and a lack of structural adjustment begin to moderate economic development and even limit international trade. Some fast-emerging economies fall into the middle-income trap, ratcheting up social and political stresses.

The moderation of economic growth takes some pressure off energy demand, and this looser supply/demand boundary can be pushed further if progress is made with supply-side energy policies that unlock resources.

New shale and tight gas resources enjoy widespread success and grow to form a new ‘gas backbone’ to the global energy system. Major oil resource holders fear market loss, and some face severe political/social stresses in periods of modest prices. Supply-side incentives, the abundance of gas, and policies that encourage smarter compact city development open the route to transport electrification and enable hydrogen infrastructure to be developed for storage and transport of energy from intermittent or remote renewables. Oil prices remain elevated and volatile, but grow only modestly, and global gas pricing emerges due to high levels of liquidity and inter-regional transport.

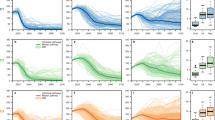

Sluggish economic growth in the early period, the relative displacement of coal growth by gas over the longer term, and the incentivisation of carbon capture and storage (CCS), all contribute to a moderation in greenhouse gas emissions. Nevertheless, these still remain consistent with a global average temperature rise in excess of 2 °C aspirations over the longer term. By the end of the century, however, there is the potential for net zero annual emissions from the energy sector, and even net negative emissions as the result of the contribution of CCS with a proportion of biomass feedstock. This opens the longer-term prospect that the cumulative build-up of greenhouse gas emissions in the atmosphere may overshoot aspirations but could then be repaired (Chart 1.2).

Shell Scenarios Team (2013). New lens scenarios, ‘Mountains’ scenario total primary energy by source, page 34

Oceans– an outlook in which there is greater accommodation of competing interests and broader diffusion of influence.

At first, economic pressures strain social cohesion, forcing changes in economic and political structures. A refreshed philosophical narrative of ‘accommodation’ or ‘social coherence’ arises, consistent with reforms to welfare and other social structures. Productivity is boosted, as is catch-up growth by developing countries. An ethos of accommodation and compromise promotes growing aspirations and rising confidence, reinforcing pressures for continuing reform and for further accommodation.

Globalisation strengthens, and the key emerging economies move to more balanced growth. But over time, the ‘newly advantaged’ eventually become more defensive, even reactionary, when faced with new policy choices and the impact of rapidly rising resource and social stresses further ahead.

With emerging economies continuing to surge and boost energy demand, this tighter supply/demand boundary can be pushed further if energy policies lag on the supply side – partly due to newly empowered populist sentiment – and some resource developments ultimately disappoint.

Shale and tight gas performance outside North America disappoint as a result of lower resource development than anticipated and policy delays, and growth in oil production from some major resource holders is constrained in the early period as leadership transitions take their toll. This is a particularly high oil-price world which economically unlocks new high-cost resources and technological opportunities and invokes a ‘long liquid fuels game’. Global gas volume growth is steady but more modest than anticipated, and prices remain regionalized but strong where there is relative scarcity.

As a result of strong growth in coal consumption and the extension of the oil age, resource stresses become severe, and prices plus crises eventually stimulate strong demand-side investment to increase end-user efficiency. Stimulated by higher energy prices, renewable energy also grows, and by the 2060s solar becomes the world’s largest primary energy source. Nevertheless, greenhouse gas emissions follow a pathway towards a high degree of climate change, ocean acidification, and the need for significant adaptation. As the impact of delays in responding to resource stresses becomes apparent, there are eventually late and urgent moves to deploy CCS at scale. In combination with the growth in solar energy and biofuels, this enables net zero CO2 emissions from energy to be approached by the end of the century (Chart 1.3).

‘Oceans’ scenario total primary energy by source, Shell New Lens Scenarios (Shell Scenarios Team, 2013), page 59. See www.shell.com/scenarios.

Scenarios and the ‘Stress Nexus’

Over the next couple of decades global demand for energy, water and food is expected to increase by between 30% and 50% 1 , placing growing pressure on supplies of these vital resources and the environment. In recent years, the Shell scenarios team, together with academics and other organisations, has researched the complex relationships between these interdependent systems. The work has yielded important insights and influenced both the way Shell runs its own operations and how it works and engages with others to address these issues.

Water is essential to the energy industry. It is used in various stages of oil and gas extraction as well as to cool power plants. In 2009, the scenarios team started to take a close look at the growing challenge of water scarcity in many regions of the world and how it might affect operations and potential investments.

Whilst identifying likely hotspots where limited water supplies and energy demand might overlap, the team became increasingly interested in the complex interactions water has with other dynamic systems: water is used to extract energy and generate power, energy is used to purify, distribute and treat water and wastewater; and both energy and water are essential to the growth and processing of food. If there is stress on one of the three, it has an effect on the other two – a relationship that Shell called the ‘Stress Nexus’.

This early work caught the attention of Shell’s then CEO Peter Voser, who recognised its strategic significance and sponsored a dedicated group of specialists from the fields of energy, water, food and climate to conduct further research. Working with Dr. Eric Berlow, an expert in complexity science at the University of California, Berkeley, they mapped many thousands of interactions and identified over 100 of the most significant factors, ranging from how bio mass resources are used, to the price variability of food, to technology innovation in water efficiency.

As a result of this work, water has become an increasingly important consideration for Shell and the company has taken further steps to manage its water footprint effectively. There are numerous illustrations of how this has translated directly into the way Shell operates.

At Shell’s major facilities, water management plans are in place, helping minimise water use where necessary. At Shell’s Groundbirch ‘tight gas’ development project in Canada, for example, Shell has worked with the community to find ways to reduce the amount of fresh water that is used from local sources. The project recycles some 75% of water involved in the extraction process. Shell draws the remainder of the water required from a reclamation facility which it funded and operates with the local council. The plant treats the community’s waste water to a standard suitable for industrial and municipal uses.

In 2011, Shell partnered with the University of Utrecht to develop a new accounting methodology to improve the measurement of water use. Shell can now estimate more accurately the amount of water needed to generate energy from different sources – including oil, gas, coal, nuclear and biofuels – using different technologies in different locations. The findings were published in 2012 in a peer reviewed Elsevier academic journal titled “Water accounting for (agro) industrial operations and its application to energy pathways”.

Shell has used this data to extend its proprietary ‘World Energy Model’ that is used for scenario planning. This gives a better understanding of the demands the global energy system will place on water resources in decades ahead, and support strategic planning for operations. It also shared this data with the wider business community through the World Business Council for Sustainable Development and with the International Energy Agency (IEA). The IEA used the data and findings in “The World Energy Outlook 2012”.

The work helped Shell recognise that strong cross – sector collaboration is needed to achieve meaningful solutions to improving Shell’s own water use and preparing for future water challenges. Shell is currently working with Veolia – a leading multinational specialising in waste, water, and energy management operations – to explore new water management solutions and business opportunities. For example, by combining expertise to extract and treat water from sewage systems and use it to cool power plants, and taking the waste steam from power plants and using it to heat nearby industrial zones. And together they are further developing the water accounting methodology by doing a comparative water risk assessment pilot at various Shell projects including in Canada and China.

Of course, as a shared resource, effective national and international policy is key to ensuring sustainable water resources are available for both the energy and agricultural sector. With its greater understanding of the complexity of the ‘Stress Nexus’, Shell has been able to engage governments and local stakeholders to encourage strategic water management plans are put in place. This is essential for Shell’s business, and also the broader community. There is great opportunity to create social and commercial value through the investments required to meet the ‘Stress Nexus’ challenges.

-

1.

World Economic Forum, United Nations and International Energy Agency

Reflections

Each of these scenarios has different political, economic and social trajectories, with different central patterns and counter-currents. Interestingly, overall energy consumption is relatively similar, although there are significant differences in the mix of resources, the price trajectories, sector-level specifics, and levels of resource stress. Total global energy consumption by 2050 is some 80% higher than today, with the underlying upward pressure on demand due to stronger economic growth in Oceans offset to a large extent by higher prices.

Both scenarios exhibit extraordinary moderation of demand growth and extraordinary acceleration of supply – both of which, as was previously noted, would be necessary to bridge the Zone of Uncertainty. In Mountains, demand moderation occurs through economic sluggishness and the development of efficient infrastructures such as compact cities, whereas in Oceans the main moderators are high prices and end-user efficiencies. On the energy production side, the main contribution to acceleration in Mountains is the global extension of North America’s ongoing shale and tight gas revolution, while in Oceans this occurs through growth in enhanced oil recovery, biofuels, and other frontier developments, as well as solar eventually growing to become the single largest primary energy source.

In fact, both scenarios witness a shift in the largest global primary energy source in the decades ahead. In Mountains, natural gas becomes the largest source in the 2030s, ending a 70-year reign for oil. Before that, coal’s reign as the number one global energy source had lasted around 50 years (circa 1910–1960), taking over from traditional sources of biomass like wood, peat, dung, and agricultural waste. In Oceans, solar becomes the largest source by the 2070s (Fig. 1.1).

The world’s number one energy source, Shell Scenarios Team (2013)

Concluding Remarks

Shell’s New Lens Scenarios suggest that addressing the challenges of the twenty-first century will be difficult and often uncomfortable. It may require many people and organisations to reconsider their own vested interests, to forge innovative partnerships, and to move towards more effectively accommodating the interests of others as a necessary component of their own flourishing.

The scenario approach encourages decision-makers to explore the features, uncertainties, and boundaries of the future landscape, and engage with alternative points of view. For example, it is becoming clearer that a prosperous and sustainable global outlook must encompass both energy-efficient infrastructures like compact cities as well as efficient end-use in vehicles and buildings. Similarly, a prosperous and sustainable outlook requires both cleaner fossil fuels and also a revolution in renewable energy as well. A ‘both/and’ rather than an ‘either/or’ attitude is required in policy making.

Although, of course, there needs to be a sensible understanding of the pros and cons of both approaches, the true battle is against time. Every year that passes sees, for example, strong growth in coal burning and the ratcheting upwards of cumulative greenhouse gas concentrations in the atmosphere. The pace at which CCS technology is deployed at scale and at which natural gas substitutes for coal growth is the main driver of difference between cumulative emissions in the Mountains and Oceans scenarios. If it were possible to accelerate these developments even more than described in the Mountains scenario, the cumulative emissions for the twenty-first century would be closer to a level consistent with containing global average temperature rise to 2 °C.

The scenarios highlight many opportunities, but they also underline the complexity and urgency of resource stresses. Technology deployment is important, but political and societal choices are as influential as resources and technology. Both scenarios have positive and troubling features. The challenge is to see if it is somehow possible to deliver the best of both worlds.

Achieving a greater balance of positive features in the future depends on the capacity of business, government, and civil society to work more effectively together. Beyond its value within individual organisations, working with scenarios can play a constructive role in supporting the cross-sector dialogue necessary for this.

Notes

- 1.

Based on UN data.

- 2.

Based on UN data.

- 3.

Shell Scenarios Team, 2011. Signals & Signposts, page 10.

References

Shell Scenarios Team. 2011. Signals & Signposts. www.shell.com/scenarios.

———. 2012. 40 years of shell scenarios. www.shell.com/scenarios.

———. 2013. New lens scenarios. www.shell.com/scenarios.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Royal Dutch Shell plc, Disclaimer

Royal Dutch Shell plc, Disclaimer

The companies in which Royal Dutch Shell plc directly and indirectly owns investments are separate entities. In this report “Shell”, “Shell group” and “Royal Dutch Shell” are sometimes used for convenience where references are made to Royal Dutch Shell plc and its subsidiaries in general. Likewise, the words “we”, “us” and “our” are also used to refer to subsidiaries in general or to those who work for them. These expressions are also used where no useful purpose is served by identifying the particular company or companies. “Subsidiaries”, “Shell subsidiaries” and “Shell companies” as used in this report refer to companies over which Royal Dutch Shell plc either directly or indirectly has control. Companies over which Shell has joint control are generally referred to “joint ventures” and companies over which Shell has significant influence but neither control nor joint control are referred to as “associates”. In this report, joint ventures and associates may also be referred to as “equity-accounted investments”. The term “Shell interest” is used for convenience to indicate the direct and/or indirect ownership interest held by Shell in a venture, partnership or company, after exclusion of all third-party interest.

This report contains forward-looking statements concerning the financial condition, results of operations and businesses of Royal Dutch Shell. All statements other than statements of historical fact are, or may be deemed to be, forward looking statements. Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements. Forward-looking statements include, among other things, statements concerning the potential exposure of Royal Dutch Shell to market risks and statements expressing management’s expectations, beliefs, estimates, forecasts, projections and assumptions. These forward-looking statements are identified by their use of terms and phrases such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “goals”, “intend”, “may”, “objectives”, “outlook”, “plan”, “probably”, “project”, “risks”, “schedule”, “seek”, “should”, “target”, “will” and similar terms and phrases. There are a number of factors that could affect the future operations of Royal Dutch Shell and could cause those results to differ materially from those expressed in the forward-looking statements included in this report, including (without limitation): (a) price fluctuations in crude oil and natural gas; (b) changes in demand for Shell’s products; (c) currency fluctuations; (d) drilling and production results; (e) reserves estimates; (f) loss of market share and industry competition; (g) environmental and physical risks; (h) risks associated with the identification of suitable potential acquisition properties and targets, and successful negotiation and completion of such transactions; (i) the risk of doing business in developing countries and countries subject to international sanctions; (j) legislative, fiscal and regulatory developments including regulatory measures addressing climate change; (k) economic and financial market conditions in various countries and regions; (l) political risks, including the risks of expropriation and renegotiation of the terms of contracts with governmental entities, delays or advancements in the approval of projects and delays in the reimbursement for shared costs; and (m) changes in trading conditions. All forward-looking statements contained in this report are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Readers should not place undue reliance on forward-looking statements. Additional risk factors that may affect future results are contained in Royal Dutch Shell’s 20-F for the year ended December 31, 2014 (available at www.shell.com/investor and www.sec.gov). These risk factors also expressly qualify all forward looking statements contained in this report and should be considered by the reader. Each forward looking statement speaks only as of the date of this report, September, 2015. Neither Royal Dutch Shell plc nor any of its subsidiaries undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or other information. In light of these risks, results could differ materially from those stated, implied or inferred from the forward-looking statements contained in this report.

We may have used certain terms, such as resources, in this report that United States Securities and Exchange Commission (SEC) strictly prohibits us from including in our filings with the SEC. US Investors are urged to consider closely the disclosure in our Form 20-F, File No 1-32575, available on the SEC web site, www.sec.gov.

Rights and permissions

Copyright information

© 2019 Springer Science+Business Media B.V.

About this chapter

Cite this chapter

Bentham, J. (2019). The Scenario Approach to Possible Futures for Oil and Natural Gas. In: Lenssen, G.G., Smith, N.C. (eds) Managing Sustainable Business. Springer, Dordrecht. https://doi.org/10.1007/978-94-024-1144-7_1

Download citation

DOI: https://doi.org/10.1007/978-94-024-1144-7_1

Published:

Publisher Name: Springer, Dordrecht

Print ISBN: 978-94-024-1142-3

Online ISBN: 978-94-024-1144-7

eBook Packages: Business and ManagementBusiness and Management (R0)