Abstract

This chapter focuses on one of the key issues in technology management that is the most problematic in the transfer of technology from research institutions and universities. That key issue is about the translational journey, which is little understood in terms of dynamics, motivations, reward mechanisms, and legal and structural mechanisms.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Early Adopter

- Entrepreneurial Process

- Technology Transfer Office

- Technology Commercialization

- Senior Academic

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

Introduction

This chapter focuses on one of the key issues in technology management that is the most problematic in the transfer of technology from research institutions and universities. That key issue is about the translational journey, which is little understood in terms of dynamics, motivations, reward mechanisms, and legal and structural mechanisms.

There is growing desire by policy makers for innovation to solve societal problems, whether it is big challenges or economic growth. Innovation and to a greater degree entrepreneurship are seen as engines that can stimulate growth and jobs resulting in prosperity, political stability, and increased standards of living. This view, in itself, is not new. What is new is that policy makers are seeing a connection between research in universities and other institutions as sources of that growth.

For example:

Startups are engines of job creation. Entrepreneurs intent on growing their businesses create the lion’s share of new jobs, in every part of the country and in every industry. And it is entrepreneurs in clean energy, medicine, advanced manufacturing, information technology, and other innovative fields who will build the new industries of the 21st century, and solve some of our toughest global challenges (Obama 2012).

In January 2011, President Obama called on both the federal government and the private sector to dramatically increase the prevalence and success of entrepreneurs across the country. In the year since launch, the Obama administration rolled out a set of entrepreneur-focused policy initiatives in five areas:

-

1.

Unlocking access to capital to fuel start-up growth

-

2.

Connecting mentors and education to entrepreneurs

-

3.

Reducing barriers and making government work for entrepreneurs

-

4.

Accelerating innovation from “lab to market” for breakthrough technologies

-

5.

Unleashing market opportunities in industries like healthcare, clean energy, and education

In January 2012, Prime Minister David Cameron launched a major initiative in an attempt to boost entrepreneurship in the UK. Prime Minister Cameron said:

Small businesses and entrepreneurs are the lifeblood of the British economy and I am determined that we, working with the private sector, do everything we can to help them to start up and to grow in 2012 (Small Business 2012).

Addressing the 99th Indian Science Congress, the Prime Minister Manmohan Singh emphasized that:

the overriding objective of a comprehensive and well-considered policy for science, technology and innovation should be to support the national objective of faster, sustainable and inclusive development. Innovation can fulfil needs which are not met by conventional means, and this is critical in view of the numerous challenges the country is facing in delivering services to the people, especially at the bottom of the national pyramid (The Guardian 2012).

Although these are recent citations of political support for innovation, the desire and links between research outputs and innovation/entrepreneurship began in earnest in certain key locations much earlier. Silicon Valley is well recognized for its entrepreneurial cluster, as indeed, increasingly are other locations such as Boston, Cambridge,Footnote 1 Oxford, and Munich. These cities have benefited greatly from the presence of top universities, and many of the start-ups and spinouts can trace their genetic roots to the research and the people at their respective research institutions.

With the backdrop of political will, policy makers have started to formulate initiatives to assist research-based universities, which are seen as providers of talent and intellectual property to commercialize their outputs.

Common Strategies

The primary response has been the setting up of technology transfer officesFootnote 2 as indicated in a recent OECD report. The TTOs are primarily focused on the commercialization of intellectual property rights of the institutions where these IPRs are created. And, commercialization takes two main forms – licensing to industry and the creation of spin-offs.

There are mixed reviews about the efficacy of TTOs. It appears they have grown in number but are often under resourced and not managed by people with any particular commercialization expertise. This author has traveled to and met with many institutions in India, USA, UK, Brazil, Egypt, Germany, Italy, Spain, Finland, Denmark, Australia, and Malaysia as a result of invitations to speak on the topic of entrepreneurship. In addition to personal insights from these visits and conversations, there is also evidence from literature about the challenges faced by the commercialization agenda.Footnote 3

The Main Emergent Issues

There is indeed support at a political level, and policy makers set the context in terms of legislative changes, government-based grants are becoming more available, and industry is increasingly receptive to arrangements with universities and research institutions. But there is a severe bottleneck due to the lack of TTOs’ efficacy through lack of know-how within such organizations and their host institutions.

In addition to the lack of understanding of the translational journey, perhaps because of the lack of understanding, it has proved difficult to unlock private capital in terms of investments in innovations. The lack of more general understanding of the complexity of this translational journey means that we will continue to develop innovation processes on anecdotal levels, relying on ad hoc social networks for advice.

Typical Problems of Operational and Policy Bottlenecks at TTOs

TTOs are often chaired and governed by senior academics who have never commercialized any inventions. Their focus is therefore on governance rather than on outcomes.

Boards that are set up to review disclosures and IP filing are often attended by senior academics and trusted individuals from industry rather than people with domain expertise in commercialization. This often leads to heated debates based on deep misunderstanding.

The processes and reward mechanisms are often unclear, and the very people who are to implement the policies also poorly understand them. The resulting atmosphere is one of mistrust.

People who do not have prior commercial expertise staff the offices. This is a crucial problem as they are being tasked with understanding how to negotiate with industry or assist with the creation of spin-offs when in fact they are not equipped to undertake such tasks.

The TTO office is often seen as a policing agency rather than as an enabling organization as they are unable to secure the hearts and minds of the research community and are not seen as the first port of call by industry.

The positioning of TTOs is typically not a major strategic thrust of the research institution and may not always have the full backing of the leadership. So they remain outside mainstream activities and do not get into the social networks and industry bodies to assist them with commercialization.

The TTO is most often disconnected with the teaching agenda of the institution, and this is a major disadvantage. The author will demonstrate that connecting the teaching of entrepreneurship and creating links with entrepreneurs and industry can play a major positive role.

The list of bottlenecks is not extant, but highlights some of the major issues that can stifle the very process they are created to alleviate.

Some institutions have been working to overcome the problems listed, through a mix of training for staff of TTOs, hiring people with business development expertise, outsourcing their commercialization agenda, and establishing much more robust relationships with entrepreneurs and industry. There are good examples of such practice at places such as MIT, Stanford, Cambridge, and Imperial College – London.

The central contention of this chapter is that until we have improved understanding and a more systematic approach to the translational journey of innovations from research-based institutions, we will not see the significant changes that are expected by society and the taxpayers. The rest of this chapter sets out lessons learnt over the past 10 years and offers suggestions for improving the understanding of the translational journey of IPR out of the laboratory.

Freeing Up the Bottlenecks

At the University of Cambridge, due to funding that was made available from government to establish a culture of enterprise, one of the major investments has been in the development of education for entrepreneurship. This resulted in the creation of the Centre for Entrepreneurial Learning (CfEL). There are five flagship courses,Footnote 4 one of which is called “Emerging Technology Entrepreneurship” (ETECH Projects). This course is run three times and relies on securing emerging technologies from laboratories and having students conduct commercial feasibility studies on them. The students on one course are undergraduates from physical sciences; on another course, they are executive MBAs (part-time MBA) and finally full-time MBAs. In the latter course, we embed collaborative PhDs and postdocs to work alongside the MBAs.

It has taken a very long time for this course to get under way, because in the early years of the project, the TTO was reluctant to engage in the process. As the course outcomes became known and understood and as staff changes took place within the TTO, there have been growing links between teaching and technology translation.

But what is it about ETECH Projects that provides wider lessons for improved innovation management?

The ETECH Model for Institutions

This section of this chapter presents an argument for such a course and the links that it can provide. It also presents briefly the curriculum that was originally developed and recent adaptations that have been absorbed from the world of practice and finally presents recommendations for improved innovation management at research-based institutions.

Why Do Institutions Need a Course Like ETECH?

At a societal level, we need more people who understand the process of translation. To be able to provide exposure to the process early in the career of graduates helps to build human capital in this field.

If we review the general management studies courses available, such as the MBA and other undergraduate courses in business, none of them targets this complex journey as part of its syllabus. Therefore, the only route to generating management expertise in this arena is through long experience in organizations and that experience does not always translate into university technology incubation contexts. Thus, we do not have any formal or systematic ways of understanding the translational journey and nor do we have any mechanisms to develop the human capital in this field.

Students are seeking practical experience with real projects so that they can relate to the world of practice. Such courses can make students more employable as they begin to understand complex commercialization processes.

The reports they produce can provide the TTO and the faculty with insights about the commercial prospects for the technologies and inventions. The reports can also act as education for the faculty.

The supervisors for such projects can be from industry thus providing helpful insights and forward links for commercialization from the institution.

There is a strengthened possibility of actual results. Students may well uncover markets and companies that can be conduits for the technologies.

Such courses provide a more robust front end to the innovation funnel. They do not replace the experienced mentors and entrepreneurs that are needed to do the hard work of actually forming commercial proposals, business plans, and so forth, but what they do is provide insights into markets and opportunities that are not otherwise available to TTOs and industry.

What Should a Course Like ETECH Contain in Terms of Curriculum?

At Cambridge, this course has developed the following minimum criteria into the curriculum:

-

1.

Conducting due diligence on the science and technology – How to carry out due diligence to validate and verify the underpinning science. Understanding the importance of validating the ownership of intellectual property (who are the inventors) alongside the uniqueness of the proposed invention.

-

2.

Applying creativity in commercializing novel technologies – Learning to apply principles of creativity to identify potential applications and markets for the emerging technology.

-

3.

Stepping stones for commercialization – How to establish the technology and commercial advantages that will yield core propositions for commercialization. One of the early steps is to understand the proposed invention in detail, in terms of “IP” strategy and positioning against competing solutions.

-

4.

Market and industry assessment – Although emerging technologies are far removed from markets/industries of today, one needs to be able to assess competing solutions and the main companies that operate in the sector and to identify the trends and dynamics of the markets and industry sectors.

-

5.

Routes to market – How to identify the best routes to market and business models for commercializing early-stage technologies. In other words, when and how will the technology start to recover the investment and start to “make money”?

-

6.

Leadership and management of emerging technologies – Provide an understanding of how to identify a project leader for commercialization, when and how to introduce business-aware team members, how to reward them and how to transfer the ownership of the business vision from the inventor to the entrepreneur and finally to a professional management team.

These topics are provided as illustrations only as they will vary from institution to institution. But underneath this is a more intriguing issue that has become apparent through running the course over several years.

Methodology

The methodology of running a course like ETECH requires five stakeholders to come together:

The technology transfer office holds the formal remit and must therefore engage in the process of translational activity. They can also provide links to professional service organizations such as IP lawyers and others who can assist with early vetting of technologies at a technical level.

Principal investigators and their students/postdocs whose work will be used as project stimuli. Each of their technologies can provide multiple projects for students who can develop market application projects for anyone given technology.

Teaching faculty who need to teach and to orchestrate learning by the students.

Entrepreneurs and industrialists who have prior experience of commercializing technology and can add very practical insights to the process, especially to those elements that cannot be found in textbooks. They also act as role models to illustrate to students and to principal investigators – that “it can be done.” They also bring a reality check to the projects, and if things look interesting, their networks can be helpful to move to the next level.

The students need to be motivated to carry out the projects. Often the workload for such a venture far outweighs the actual number of credits allocated to such activity, and so the students need to be inspired to get into the depths of the investigation.

Courses like these need to be highly interactive, demanding outputs from students at interim stages. The core outputs from student projects can be a presentation and a written report. The first output firms up their abilities to articulate complex translational projects, and the second output provides all the arguments and detailed evidence to back up their recommendations.

Outcomes So Far

ETECH has enabled a review of some 75-technologies over the past 7 years. This has involved around 200 students and 20 principal investigators. For the purpose of this chapter, the focus is on the lessons learnt rather than the outputs.

What have we learnt about materials, processes, stakeholders, technology suitability for commercialization, and the reality of university research being used to stimulate the economy and innovation ecosystem?

Materials

One of the first lessons learnt is that none of the extant textbooks in the field of technology innovation and management provide the tools with which to actually carry out the task of assisting in the translation of research into market readiness.

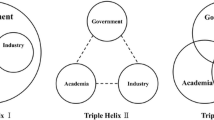

The essential models in entrepreneurship textbooks summarize the process into three stages as in Fig. 1.

The entrepreneurial process consists of three stages:

-

1.

Innovation phase – time when entrepreneurs generate and select ideas for new products or services

-

2.

Implementation phase – a triggering event and the acquisition of capital and other resources

-

3.

Growth phase – the success of the new venture and the need to acquire new managerial skills

Each of these phases is influenced by a number of factors such as personal characteristics, the environment, and the characteristics of the innovation as shown in Fig. 1 (Vyakarnam 2012).

This model has been articulated as opportunity recognition followed by validation and then execution. These three stages are described in numerous journal articles (Shane and Venkataraman 2000) and are adapted in Fig. 2.

Adapted schematic of opportunity recognition (Adapted from Shane and Venketaraman 2000)

These steps are also seen in corporate models of innovation that depict the three stages within funnels, where ideas are developed at the wide-open end, with validation into the narrowing part and eventually new ventures and products emerging from the funnel. Open innovation models now depict the funnel as porous and argue that ideas can come from anywhere and commercialization can take place at any time along the funnel. The open innovation model argues that large institutions need to recognize that expertise can be anywhere in the world as they will not possess all the brightest people (Chesborough 2003).

The interesting element of these texts on innovation processes is that they completely ignore the translational journey and begin with the assumption that the technology is somehow ready for commercialization.

Figure 3 illustrates the point. TTO materials as offered by Praxis Unico,Footnote 5a leading-edge not-for-profit organization in the field of training, have courses and content on topics such as business development, spinouts, fundamentals of technology transfer, pitching, research contracts, and UK-related impact measures. Other organizations that have deep expertise in technology commercialization are the Fraunhofer InstituteFootnote 6 and ETH ZurichFootnote 7 among others. They provide hands-on support for licensing and for spinouts. It is not evident that they leverage their student bodies to scale the number of potential technologies through the funnel. There are of course many preeminent institutions that have a remit for technology commercialization, and they cover the translational journey quite well. However, the wider picture is that of a rather limited flow from disclosures, through patent filing to commercialization. Especially in recent years, the number of spinouts has reduced although the number of TTO organizations has increased.Footnote 8

Meanwhile, the typical materials one covers in entrepreneurship areas that relate to business (as distinct from personal development) include business planning, marketing, strategy, and venture capital. What has become evident from several years of development with ETECH is that there is a gap between what TTO professionals know, what entrepreneurs work with, and the translational journey.

The gap is the result of the two worlds not being connected. The translational journey is missing a framework.

The questions raised on the missing content include:

-

Technology readiness – at what stage of development has the technology reached? See, for example, the NASA Technology Readiness Levels (Table 1).

-

Who actually owns the IP and when was it filed? Have patents been granted or is there any other form of protection of IP rights giving the TTO or the principal investigators the rights to commercialization?

-

Is the project still at the level of publications or are there working prototypes or even proof of working concept? Do they work only in the lab or is there evidence that the technology can function outside the lab?

-

Has there been any kind of study to demonstrate market need? Often this is limited to narrow considerations, but with emerging technologies, it is essential to search for global opportunities.

-

Can early funding be secured from potential clients to establish that there is a need and that organizations are willing to engage in the process of converting an idea into a product?

-

Is there scope of joint ventures or open innovation style work groups to codevelop products? Often a disruptive technology will require a complete set of stakeholders to develop the standards, applications, and surrounding regulatory standards.

-

Are there codevelopment opportunities of funding that mix government grants with industry investments? This may be needed to mitigate commercial risk. Governments can play a crucial role to move technologies forward to the point that the private sector can take up the commercialization of resultant products and services.

This author has attempted to capture the translational journey in two ways. The first (Fig. 4) depicts how a scientific discovery goes through a number of stages to include, in the first instance, the conversion of scientific discover or invention into a product or service of merit in the marketplace. The product or service needs to be turned in a holistic set of features and benefits that clients can engage with, and this opens up the question of routes to markets, segmentation, and finally definitions of unmet needs that the evolved technology can address.

As an example, if one takes the invention of the light bulb, it was not possible to truly commercialize this until electricity, the development of fittings, switches, trained electricians, and the design elements needed to install in homes, in offices, and on streets were more widely available. There has been continuous development of lighting, with tube lights and now with LEDs, all of which are only possible because of the systems that are now in place.

This is a simplified figure, and one can imagine radiating out from the core in numerous directions with a discovery that may have multiple applications. The headline descriptors need to be turned into task lists to enable managers of TTOs, entrepreneurs, and investors to make decisions and choices.

It is important too to understand the possibilities that result from this process, for example, when to file for IP, what exactly is one filing, and is there likely to be a more lucrative piece of IP that comes later? There are risks of filing too early because those who truly understand the marketplace can box in a core piece of IP later. These kinds of issues can only be dealt with once a deep dive has been conducted into the technology/market interface.

In reality, research from research institutions is rarely ready for the market, and a lot of work is needed to get the technology, product, and commercial value proposition ready for markets.

The translational journey in Fig. 4 can be combined with the entrepreneurial process described by Timmons and by Shane and Venkataraman and results in the following seven-stage framework in Fig. 5.

-

1.

The actual discovery or invention

How novel is it when compared to those that might be from other competing laboratories? How “leading edge” is the discovery? What are the publications in the area? Is it patentable in itself? This first stage can be refined using the NASA Technology Readiness Levels. Of course for technologies in fields other than rocket science, the TRL must be used as a metaphor.

-

2.

Technical attributes

Does the discovery or invention actually create major advantages over rival technologies? Is it better, faster, and cheaper, or does it create completely novel effects that might then open up new markets that were not otherwise possible?

-

3.

Technical advantages

If there are advantages, are these sufficiently exciting in the sense that customers would be willing to switch over? Are the advantages 10 times better or even more in terms of price/performance, lifetime costs, or other metrics that are used by customers?

-

4.

Applications

What might be all the opportunities for the discovery or invention? It is not sufficient to address only one market. There may be many applications for the technology, and this is important to make decisions about IP filing, investments, and creating road maps that are attractive to investors and management teams. A full-scale creative exercise is required at this stage of development to explore where and how to enter various market opportunities. Teams should be encouraged to find at least 5–6 major opportunities to get started with ideas of where to explore those that are commercially viable. This is quite hard for those with scientific training, as they will start to evaluate the opportunities too early and become judgmental about opportunities. Multiskilled teams should undertake this task.

-

5.

Applications commercial advantages

From a large landscape, teams can undertake some detailed analyses of markets and competitors and iterate around issues of technology development, product design, and other detail to narrow down from a broad set of opportunities to a more focused set of markets/customers.

-

6.

Viable applications

It is at this stage that one should engage in highly experienced entrepreneurial teams that have domain expertise, so that a hard-nosed assessment can be made and perhaps detailed plans can be set out for commercialization. It is at this stage that value propositions can be developed for clearly defined market segments and decisions about whether to spin out a venture or develop license agreements with selected companies can be taken.

-

7.

Significant wins

Finally, if the work has gone well with a strong wind from behind, the chances of success are increased through such a process of technology and commercial feasibility studies.

Stages 1–3 of the translational journey in Fig. 5 can be answered with help from using the NASA TRL index (Table 1). This table is most helpful as it can also assist in setting timelines and budgets for understanding the complexities of converting a scientific discovery or invention into usable products and services. In aerospace currently, it is assumed to take approximately 1 year per TR Level. High tech and investor patience would run out at those speeds, but the levels themselves are highly usable.

Progress onward from stage 3–4 of the translational journey can be developed with the help of the technology adoption life cycle model, but in an updated form. This is because the nearness to markets and customers starts to come nearer to focus, and a strong market-led strategy is needed for the further development of the innovation.

Technology Adoption Life Cycle

There has been a highly influential text by Geoffrey Moore in his two books: Crossing the Chasm and Inside the Tornado. He draws on the work of Everett Rogers (Geoffrey Moore 2006) building on the technology adoption life cycle. In terms of generally available materials, this work is probably the most helpful for technologists to fill in the missing content in the translational journey.

Moore segments the markets and then builds a case for how managers can develop product and entry strategies according to the segments.

The Market Is Segmented into Numerous Stages

Innovators and early adopters – individuals who will experiment and explore new products when they are first made available. They do not mind if things do not work as promised. They are happy to tinker with the product and the service. There are very few people who fall into this market category.

Then comes the mainstream marketplace, which is very different. Here, customers want to buy things that are proven and have a full product offering that includes back, aftersales, augmented value propositions, and so forth. And it is this marketplace that provides the real scope for growth. Between the first phase of early adopters and the mainstream market, there is thought to be a chasm into which many high-tech firms fall. They are unable to adapt their offerings, management teams, and resource capabilities to meet the needs of the mass market. The use of the Everett Rogers model by Geoffrey Moore has become legendary in high-tech marketing. It is a useful text and is based on entrepreneurial strategies giving executives a language with which to take their plans to boards and investors.

It is not used enough and the mysteries of failure continue to haunt investors and entrepreneurs of early-stage ventures. Even in large corporations with significant innovations, this model has proved difficult to implement, because they actually often lack the internal mechanisms to get their projects to early adopters. Their systems are set for mainstream markets, and this in turn makes it attractive for small firms to eventually target larger firms for being acquired. They can prove the market and the product; the big company can then take them into the mainstream. At least that is the theory.

But there is more than one chasm and a better understanding of the later stages of the translational journey is needed.

But There Is More than One Chasm

The process can be seen in Fig. 6. The translational journey reaches its first chasm once it has generated ideas and applied filters such as the NASA TRL. At this point, the decision needs to be made about developing proof of concepts and demonstrators and creating business plans. Between the two stages, there is likely to be a need to raise funding, file for IP, hold confidential discussions with potential clients, and get market feasibility studies. Decisions will need to be made about what type of demonstrator to build, in turn raising questions about who the innovator client organizations will be.

Triple chasm model (Phadke 2010)

Assuming that the first chasm is crossed successfully, the next stage is to get beyond the “innovator” clients to those who are early adopters. They need different buying value propositions. For them, it is not about exploration of new technologies; it is more about finding out if the technology solves a particular problem for them (the so-called unmet need). They may be willing to pay a premium at this stage as they realize that the solution is not yet fully worked up. They also need to see results from the demonstrator.

From here, the technology can reach the third chasm, which actually is the chasm that Geoffrey Moore talks about in his two books. This is where the venture has probably been well established and the key objective is to gain scale. The customers are now completely different, wanting price/value, needing a complete service with augmented offerings. They will not tolerate exploration or high-priced experiments with their problems.

The TRL methodology is used in aerospace and in aircraft manufacture, but has so far not made its ways into empirical testing in translational research situations. The NASA TRL methodology is presented below for information.

Discussion

Society is demanding more from its research institutions in terms of converting blue-sky research into applications. For many years, research institutions have not been answerable to the taxpayer, and as governments become more aware of their scare resources, universities are being expected to create additional sources of income from leveraging their research.

Beyond the financial imperative, there is growing recognition that innovation can provide solutions to big problems like climate change, poverty, affordable healthcare, and water paucity. And research does exist in these areas, but how to bring them out in financially sustainable ways remains the big challenge.

It is in this context that mechanisms for scalable approaches are needed and a workable translational journey needs to be developed. Each step of the journey will need adapting to local needs; for example, at the idea validation stage, there is a framework that can be adapted from the NASA Technology Readiness Levels framework. Over several years of running ETECH, we have found that many projects have reached between TRL 2 and 4.

Perhaps because we were not using such a readiness framework or the visionary eye of the principal investigators and/or the hype surrounding academic citations has resulted in companies being formed at premature stages. This has caused many failures and inappropriate funding and IP strategies have been pursued. So, the simple inclusion of a TRL framework may assist at the early stages of development.

For the later stages, where TTO staff are not connected to markets and customers, there is need to manage the chasms more carefully, to combine creative market making skills with risk mitigation. Using a tool such as the triple chasm model and working with people with deep domain expertise will more likely provide positive results.

There are of course many tools from the box of management literature, such as from strategy, marketing, and finance, that are needed to augment the process described above, but these tools can be easily discovered when using the translational journey approach to innovation management.

Notes

- 1.

Kate Kirk and Charles Cotton recently published The Cambridge Phenomenon: 50 Years of Innovation and Enterprise. Third Millennium Publishing Company 2012.

- 2.

- 3.

Meredith Wadman: The winding road from ideas to income http://www.nature.com/news/2008/080611/full/453830a.html

- 4.

A full listing of the flagship courses can be found at the website: www.cfel.jbs.cam.ac.uk

- 5.

- 6.

- 7.

- 8.

References

Chesborough H (2003) Open innovation: the new imperative for creating and profiting from technology. Harvard Business Press, Boston

Moore GA (2006) Crossing the chasm marketing and selling disruptive products to mainstream customers, 1st edn. Collins Business Essentials, New York

Obama (2012) Start Up America. The White House, Washington, DC. http://www.whitehouse.gov/economy/business/startup-america. Accessed 20 May 2012

Phadke U, Muthirulan A (2010) Building high technology businesses: the triple chasm model. White paper, January. White paper, January. www.acceleratorindia.com

Rogers EM (1995) Diffusion of innovation. The Free Press, New York

Shane S, Venkataraman S (2000) The promise of entrepreneurship as a field of research. Acad Manag Rev 25(1):217–226

Small Business (2012) Cameron launches entrepreneurship campaign. http://www.smallbusiness.co.uk/channels/start-a-business/news/1687118/cameron-launches-entrepreneurship-campaign.thtml. Accessed 19 May 2012

The Guardian (2012) India plans science policy to help tackle poverty and development. Guardian Development Network, 4 Jan 2012. http://www.guardian.co.uk/global-development/2012/jan/04/india-science-policy-tackle-poverty. Accessed 28 May 2012.

Vyakarnam S (2012) Missing step in the translational journey.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2013 Springer India

About this chapter

Cite this chapter

Vyakarnam, S. (2013). Emerging Issues in Technology Management: Global Perspectives: The Need for and Understanding of a Technology Commercialization Framework. In: Akhilesh, K. (eds) Emerging Dimensions of Technology Management. Springer, India. https://doi.org/10.1007/978-81-322-0792-4_1

Download citation

DOI: https://doi.org/10.1007/978-81-322-0792-4_1

Published:

Publisher Name: Springer, India

Print ISBN: 978-81-322-0791-7

Online ISBN: 978-81-322-0792-4

eBook Packages: Business and EconomicsBusiness and Management (R0)