Abstract

We introduce a market-expanding measure, advertising, into the model of a mixed oligopoly and show how advertising affects the levels of production for both public and private firms. We also investigate the advertising level of these firms under a mixed oligopoly and after the privatization of the public firm. Through this analysis, we clarify the critical role of the public firm in expanding market demand. The public firm increases its level of advertising because it acknowledges the expanding effect on the behavior of private firms.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

JEL Classification

Keywords

1 Introduction

In this chapter, we introduce into the oligopolistic model the activity of firms to expand the market or demand size. The focus of this chapter is on advertising and we attempt to portray its realistic role. We investigate how advertising affects the economy in both a mixed oligopoly and a pure private oligopoly.

Theories on mixed oligopolies have been developed in various directions, as the topics treated in this book show. One direction is the incorporation of advertising. In Japan, advertising activity by public firms, as well as private firms, has been prevalent. For instance, until the 1980s, the Japanese National Railways (JNR) aired television commercials and posted billboard advertisements in many stations to encourage consumers to travel by rail. JNR also created advertisements for more historic cities such as Kyoto and Nara to evoke feelings of nostalgia. Furthermore, private railway companies created similar advertisements. Today, three companies that operate rail routes between Osaka and Kyoto (i.e., Hankyu, Keihan, and JR, the former JNR) have engaged in advertising campaigns to promote their trains.

This chapter has three main focuses. It is understood that the advertisements of one railway company can induce people to use the services of another company because people’s objective is simply to travel from A to B. That is, the advertisements of one company can expand its own demand as well as the market itself. Furthermore, if a public firm exists in the market, then it necessarily behaves differently from private firms. From the viewpoint of private firms, they can benefit from the advertisements of other firms, especially those of the public firm . Thus, private firms and the public firm might concentrate on (i.e., specialize in) either their output level of products and services or advertising. This is the first focus of this analysis.

Our second focus is on the effect of the number of (private) firms on outcomes, specifically output levels and the level of advertising. When the number of firms increases in the general framework of an oligopoly (including a mixed oligopoly), because the market approaches perfect competition, the output level of each firm decreases. In our framework, however, when firms (especially the public firm ) engage in advertising, it is not clear whether this outcome holds or not. In addition, how does advertising change when the number of firms increases?

The third focus is on the change in the output levels and advertising expenditure when the public firm is privatized and the economy moves from a mixed oligopoly to a pure private oligopoly. In general, the output level of each private firm increases . We need to clarify these changes in a scenario where firms engage in advertising.

There are few studies that consider advertising to expand market demand in a mixed oligopoly (or duopoly).Footnote 1 The exceptions are Matsumura and Sunada (2013) and Han and Ogawa (2012). Matsumura and Sunada (2013) considered advertising competition in a mixed oligopoly, but their main focus was on second-best outcomes. Furthermore, they investigated misleading advertising as developed by Glaeser and Ujhelyi (2010), which does not affect the consumer surplus but does affect the production costs of firms.Footnote 2 Han and Ogawa (2012) examined demand-boosting advertising and investigated the level of privatization in accordance with the reaction of consumers to advertising in a mixed duopoly . They clarified that because consumers have a significant reaction to advertising, the level of privatization should be lower. Their result implies that the effect of advertising should be considered, whether or not the public firm is privatized.

This chapter follows the framework presented by Han and Ogawa (2012); however, there are three clear differences in motivation. The first is that they treat advertising expenditure in the same way as the production of the commodity. The cost functions for advertising and those for production take a quadratic form and are independent. In our model, although the production cost is linear in the amount of commodity itself, the advertising cost increases. In addition, these costs are dependent, which illustrates how advertising works in a mixed oligopolistic market . The second difference stems from the fact that our interest lies mainly with the effect of the (full) privatization of a public firm . In contrast, Han and Ogawa (2012) focus on the partial privatization of a public firm . In other words, we aim to investigate the role of the public firm in maximizing social welfare via advertising, and Han and Ogawa (2012) consider how the degree of privatization should be set from the viewpoint of social welfare maximization. Third, we consider n private firms, which makes it possible to analyze the difference in the number of firms or the size of the market. This is in contrast to Han and Ogawa (2012) who only considered one private firm.

In this study, we obtained the following novel results. First, in a mixed oligopoly, the number of (private) firms determines whether the output level of the public firm is larger than that of the private firms. That is, when the number of private firms is comparatively large, the output level of the private firms is larger than that of the public firm , and vice versa. In contrast, the level of advertising of the public firm is always larger than that of the private firms. This result reflects the crucial role of the public firm to expand the market via advertising. Second, when the number of private firms increases, the output level of the private firms, as well as the level of advertising, also increases. However, after the privatization of the public firm , the opposite occurs. Whether the output level of the public firm in a mixed oligopoly increases depends on the cost and demand factors. Third, although the advertising level of private firms increases and that of the public firm decreases, the total level of advertising decreases after privatization . This result also indicates that privatization weakens the key role of the public firm to expand market demand.

The reminder of this chapter is as follows. Section 13.2 presents the mixed oligopoly model. Section 13.3 considers the case where a public firm is privatized and compares outcomes in a mixed oligopoly and a pure private oligopoly, and Sect. 13.4 concludes the chapter.

2 Mixed Oligopoly Model

There are n + 1 firms, which produce a homogenous commodity using the same inputs and production technologies. When they supply the market, they can use the mean to increase demand (or equivalently, expand the market) via their advertising expenditure. This issue will be discussed in greater detail below. In this chapter, we first consider the case where firm 0 is assumed to be a public firm , with an objective to maximize social welfare , and the other n firms are assumed to be private firms, seeking to maximize their own profit.

2.1 Setting

As evident in the standard settings of previous studies, the inverse demand function that the firms face is assumed to be linear, and its slope is −1. In addition, we assume that advertising expenditure expands the market size. That is, when each firm increases its advertising expenditure by one unit, the intercept of the vertical axis and the (market) inverse demand curve shift upward by \( 0<\beta <1 \) unit. Then the inverse demand function is given by

where p, q i , and a i represent the price of the commodity, the output level of the commodity, and the advertising by firm i, respectively.

When firms produce goods, they should pay for the costs of its input and advertising expenditure. The total cost function of the firms is assumed to be

where c is a constant of the marginal cost of production. In addition, the marginal cost of production also linearly depends on advertising with a coefficient of γ. Therefore, the greater the number of firms that produce goods in the market, the higher the level of advertising. Then, the total cost represents any increase in advertising. It should be noted that in contrast to Han and Ogawa (2012), the cost of production and the advertising expenditure are asymmetrically incorporated into the cost function.Footnote 3 , Footnote 4 In addition, for analytical convenience in the qualitative analysis in the latter part of this chapter, we set ε as 1.

Regarding the parameters relating to the above cost function, we make the following assumption.

Assumption 13.1

Production

This assumption means that the expansion effect of advertising expenditure is larger than the cost of advertising. In other words, the net benefit of advertising is positive. Regarding the advertising cost, as usual, the marginal cost is smaller than the marginal revenue even when advertising expenditure is 0.

Finally, the profit of the firms can be expressed as

Private firms maximize the above profit (13.3) by choosing the output levels and advertising expenditure, given the levels determined by the other firms. The public firm maximizes social welfare (consisting not only of its own profit but also the profits of the other private firms) and the consumer surplus. Therefore, social welfare can be written as follows:

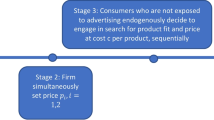

Furthermore, the private and public firms are in Cournot–Nash competition.

2.2 Mixed Oligopoly

As mentioned above, the private firms maximize their own profit (13.3), and the public firm seeks to maximize social welfare (13.4), given the activities of the other firms. Under a mixed oligopoly, the set of the first-order conditions can be given as follows:

where the superscripts r and u represent the variables of the private and public firms, respectively. Note we obtain the above conditions on the assumption that the (private) firms are identical.

It is helpful to explain the properties of the Cournot–Nash equilibrium in the model by investigating the firms’ reaction functions. In the above first-order conditions, (13.5) and (13.6) give the reaction functions for the output levels of the private firms:

and (13.7) and (13.8) give the reaction functions for the output levels of the public firm :

With q r as the horizontal axis and q u as the vertical axis, the slopes of (13.9) and (13.10) are \( n{\beta}^2+{\gamma}^2-\left(1+n\right)\left(1+\beta \gamma \right)<0 \) and \( \frac{n\left[1-\beta \left(\beta -\gamma \right)\right]}{{\left(\beta -\gamma \right)}^2-1}<0 \), and both are negative. Furthermore, the former minus the latter gives \( \frac{1+\left(\beta -\gamma \right)\left\{n{\beta}^3-\left(1+n\right)\beta +\left[2+n-\left(1+2n\right){\beta}^2\right]\gamma +\left(2+n\right)\beta {\gamma}^2-{\gamma}^3\right\}}{{\left(\beta -\gamma \right)}^2-1} \), whose denominator is negative but the numerator is indeterminate. To guarantee the stability of the Cournot–Nash equilibrium in strategic substitutes with respect to the outputs, we assume that this is negative (or that the numerator is positive).

Similarly, the reaction functions of the private and public firms for advertising level can be obtained as follows:

Following the same procedure, when taking a r as the horizontal axis and a u as the vertical axis, the slopes of (13.11) and (13.12) are \( \frac{1+n-n{\beta}^2+\beta \gamma +n\beta \gamma -{\gamma}^2}{\beta \left(\beta -\gamma \right)}>0 \) and \( \frac{n\beta \left(\beta -\gamma \right)}{{\left(\beta -\gamma \right)}^2-1}>0 \), and both are positive. The former minus the latter is \( \frac{1+\left(\beta -\gamma \right)\left[\beta +\left({\beta}^2-2\right)\gamma -2\beta {\gamma}^2+{\gamma}^3\right]+n\left(\beta -\gamma \right)\left\{-\gamma +\beta \left[2+\left(\beta -\gamma \right)\gamma \right]\right\}-n}{-\beta \left(\beta -\gamma \right)\left[1-{\left(\beta -\gamma \right)}^2\right]} \), and the denominator is negative, but the numerator is indeterminate. We also assume here that this is positive (or that the numerator is negative). This assumption then guarantees the stability of the Cournot–Nash equilibrium in strategic complements with respect to advertising.

In sum, we propose the following assumption.

Assumption 13.2

Stability conditions

-

(i)

Strategic substitute for the output of the good:

-

(ii)

Strategic complement for advertising expenditure:

Assumptions 13.1 and 13.2 give the following lemma.

Lemma 13.1

Under Assumptions 13.1 and 13.2, in a mixed oligopoly:

-

(i)

The Cournot–Nash equilibrium is stable.

-

(ii)

q r and q u are strategic substitutes.

-

(iii)

a r and a u are strategic complements.

By solving the set of equations for the first-order conditions of (13.5), (13.6), (13.7) and (13.8), the output level of the good and the private firm’s level of advertising can be obtained as

where \( \phi \equiv 1-{\beta}^2+\beta \left[3-\left(1+n\right){\beta}^2\right]\gamma -\left[2+n-\left(3+2n\right){\beta}^2\right]{\gamma}^2-\left(3+n\;\right)\beta {\gamma}^3+{\gamma}^4 \). Similarly, those of the public firm can be obtained as

It should be noted that from Assumption 13.1, \( \phi >0 \) must hold in (13.16). In addition, because the output level of the public firm , (13.15), should be positive, \( 1+\left(\beta -\gamma \right)\gamma -n\beta \gamma >0 \) must hold. Therefore, we put forward the following assumption.

Assumption 13.3

Output level and advertising are positive if (i) \( \phi >0 \) and (ii) \( 1+\left(\beta -\gamma \right)\gamma -n\beta \gamma >0 \).

It should be noted that Assumption 13.3(ii) determines the upper bound of the number of private firms, \( \overline{n}\equiv \frac{1+\left(\beta -\gamma \right)\gamma }{\beta \gamma }>n \). From (13.13), (13.14), 13.15) and (13.16), we can see the relationships between the advertising and the output level of each firm, the advertising of the private and public firms, and the output levels of these firms . These relationships are shown in Lemma 13.2.

Lemma 13.2

In a mixed oligopoly:

-

(i)

\( {a}^r=\left(\beta -\gamma \right){q}^r \), and \( {a}^u=\frac{1+\left(\beta -\gamma \right)\gamma -n\beta \gamma }{\left(\beta -\gamma \right)\left[1+\left(\beta -\gamma \right)\gamma \right]}{q}^u. \)

-

(ii)

\( {q}^r=\frac{\left(\beta -\gamma \right)\gamma }{1+\left(\beta -\gamma \right)\gamma -n\beta \gamma }{q}^u \), and \( {a}^r=\frac{\left(\beta -\gamma \right)\gamma }{1+\left(\beta -\gamma \right)\gamma }{a}^u \).

From Lemma 13.2, we have the following proposition.

Proposition 13.1

In a mixed oligopoly:

-

(i)

If \( \frac{1}{\beta \gamma }<n<\overline{n} \) (i.e., n is relatively large), then \( {q}^r>{q}^u \),

and if 1 \( <n \) < \( \frac{1}{\beta \gamma } \) (i.e., n is relatively small), then \( {q}^r<{q}^u \).

-

(ii)

\( {a}^r<{a}^u \) holds.

Proposition 13.1(ii) can be easily interpreted. As the public firm recognizes its overall effect on the market (expansion), it spends more on advertising than private firms. This means that advertising, especially by the public firm , increases the commodity output of not only the public firm but also the other private firms. Based on this finding, Proposition 1(i) provides two important implications. First, whether advertising increases the output level of the public firm depends on the number of private firms, n. When n is large, private firms produce more than the public firm because the public firm spends more on advertising for a larger market. In contrast, when n is small, as the public firm ’s advertising expenditure is relatively low, private firms should advertise more. This is at the expense of output, and therefore the supply of the public firm is higher than that of each private firm. This result is in contrast to that given by De Fraja and Delbono (1989). They stated that the output of the public firm is always larger than that of the private firm because the public firm has an incentive to increase the consumer surplus by setting the marginal cost equal to the marginal benefit of the consumer. In our model, in addition to controlling the output level, the public firm (as well as private firms) should care about their advertising expenditure. It is not necessary to allocate resources to produce more goods than the private firms.

Next, we investigate how the number of private firms (or equivalently, the size of the market) affects the above outcomes. The effects on the above output levels and advertising expenditure can be calculated as follows:

From these results, we can obtain the following proposition.

Proposition 13.2

In a mixed oligopoly, as the number of private firms increases:

(i) Both the output level and the advertising level of the private firms increase.

(ii) The advertising level of the public firm increases.

(iii) The output level of the public firm increases (decreases) if \( 2\beta \left(\beta -\gamma \right)-1>\left(<\right)0 \).

Similar to Proposition 13.1, Proposition 13.2 means that advertising expands the market so that the output level of one private firm increases. This is in contrast to that usually seen in a general mixed oligopoly model (e.g., De Fraja and Delbono 1989). In our model, when the number of private firms increases, the public firm , as well as the private firms , increases their level of advertising, as shown in Proposition 13.2(ii). This expands the market demand, and therefore, the output level of both the private and public firms increase, as long as \( 2\beta \left(\beta -\gamma \right)-1>0 \).

Proposition 13.2(iii) implies whether the output level of a public firm increases is indeterminate. Furthermore, if the net benefit of advertising, \( \beta -\gamma \), is large, then the output level of the public firm increases, and vice versa. This can be interpreted as follows. When \( \beta - \gamma \) is large, the public firm tends to expand the market by increasing its advertising taking social welfare (including the profit of the public firms) into consideration. This leads the public firm to increase its output level even if the number of private firms is large.

Taking the sum of the levels of output and the advertising expenditure of each firm, we can obtain the total amount of output and advertising as follows:

where Q r and A r are the total amount of output and advertising expenditure of the private firms and Q and A are those of all firms. Following the same procedure for each firm, an increase in the number of private firms affects the total output levels and advertising as follows:

We can directly obtain the results of (13.25), (13.26), and (13.28) from (13.17), (13.18), and (13.20). That is, the total output of the private firms and the advertising level of the private firms and all firms increase when the number of private firms increases. In addition, (13.27) means that, as we have seen in (13.19), although the output level of the public firm decreases as the number of private firms increases, the total output increases.

Corollary 13.1

In a mixed oligopoly, as the number of private firms increases, the total output level and the level advertising of the private firms and those of all firms increase.

Finally, we focus on the profits and social welfare . The profits of private and public firms can be obtained as follows:

From (13.29), it is natural that the private firms return positive profits; however, from (13.30), the profit of the public firm is negative, even if there is no fixed cost in our model. As \( 0<c<1, \) Assumption 13.1 implies that the marginal cost of production itself can be below the market price; however, the marginal cost also depends on advertising. Therefore, as long as the public firm has a role in expanding the market via advertising, its profit becomes negative.

Proposition 13.3

In a mixed oligopoly with advertising, the profit of private firms is positive, but that of a public firm is negative.

Then, when the number of private firms increases, the effects on the profits of both the private and public firms can be obtained as follows:

These results can be summarized as the following proposition.

Proposition 13.4

In a mixed oligopoly with advertising, the profits of both private and public firms decrease as the number of private firms increases.

From Proposition 13.2, each private firm increases its output level when the number of private firms increases, and, as Corollary 13.1 implies, the market size also becomes larger because the level of advertising increases. However, this expansion brings about an increase in the cost of advertising (as a quadratic cost function), and the cost of production also increases because of the increase in advertising. Therefore, the profit decreases.

Finally, the level of social welfare and the effect of the increase in the number of private firms on social welfare can be obtained as follows:

As the expression of the level of social welfare is complex, the effect of the increase in the number of private firms is indecisive. In other words, it is possible that social welfare decreases as the number of private firms increases.

3 Privatization

3.1 Pure Private Oligopoly

In this section, we investigate the privatization of the public firm . In this case, all the firms maximize their own profit and the market becomes purely oligopolistic . Then, the output level and the advertising level of each firm can be obtained as follows:

where \( \psi \equiv 2-{\left(\beta -\gamma \right)}^2+n\left[1-\beta \left(\beta -\gamma \right)\right]>0 \) and the variables with hats represent those in a pure private oligopoly. The total output level and advertising level can be easily obtained by multiplying (13.35) and (13.36) by n, that is, \( \widehat{Q}=n{\widehat{q}}_i \) and \( \widehat{A}=n{\widehat{a}}_i \).

Then, the effect of an increase in the number of firms on the above variables can be calculated as follows:

From these results, we obtain the following proposition.

Proposition 13.5

In a pure private oligopoly, as the number of firms increases, both the output level and the advertising level of the private firms decrease.

Previous studies have shown that the output of each firm decreases as the number of firms increases. This occurs because the market conditions are approaching perfect competition. In our setting, it is not clear whether such a tendency can be seen because the firms buy advertising to expand the market. Even so, both the output level and advertising level of each firm decrease. This implies that in a pure private oligopoly, the decline in oligopolistic power resulting in anincrease in the number of firms dominates the effect of market expansion by an increase in advertising. This can be also attributed to the cost structure of the firm that exhibits this quadratic form.

The level of profit and the effect of the increase in the number of firms on profit can be obtained as follows:

From (13.40), as the number of firms increases, the profit of each firm decreases, which is generally true in a pure private oligopoly model without advertising.

Finally, the level of social welfare and the effect of the increase in the number of firms on social welfare can be calculated as follows:

Summarizing these results, we obtain the following corollary.

Corollary 13.2

In a pure private oligopoly, as the number of firms increases:

-

(i)

The profit decreases.

-

(ii)

Social welfare increases.

These results have already been seen in typical oligopoly models. As we pointed out in Proposition 13.4, the profit of both private and public firms decreases. However, the production level increases in our mixed oligopoly with advertising when the number of firms increases. Furthermore, in a pure private oligopoly, social welfare increases; however, in our mixed oligopoly, it does not. This fact implies that advertising clearly expands demand and increases the consumer surplus, but represents a greater cost for firms when the number of firms increases. Therefore, advertising brings benefits to consumers but might also harm the profits of firms.

3.2 Comparison

Finally, we compare the outcomes in a mixed oligopoly with those in a pure private oligopoly. First, we present the difference between the levels of output for the two cases as

From (13.43), we can see that the output of the private firm is larger for a pure private oligopoly than for a mixed oligopoly. This result has been acknowledged in previous studies. However, (13.44) means that it is not possible to determine whether the output levels of the public firm are larger than that of the privatized (public) firm, which is positive in previous studies. As we have seen in Proposition 13.1, this depends on the cost and demand factors and can be attributed to advertising . This result also means that it is not possible to determine whether (13.45) is positive or negative.

Next, we compare advertising for the two cases:

In contrast to the above comparison for output levels, the signs from (13.46), (13.47) and (13.48) are all determinate. It is interesting to note that the advertising level of private firms increases after privatization . This occurs because private firms should increase advertising after the privatization of a public firm , which had previously advertised aggressively to maximize social welfare (13.46). Therefore, after privatization , none of the firms consider social welfare (or consumer surplus), and the total level of advertising decreases.Footnote 5

To summarize, we obtain the following proposition .

Proposition 13.6

When a public firm is privatized:

-

(i)

The output level of private firms increases, but the change in that of privatized (public) firms is ambiguous. Therefore, the change in the total output level is ambiguous.

-

(ii)

The advertising level of private firms increases and that of public firms decreases. The total advertising expenditure decreases as the decrease in the role of the public firm to expand the market size dominates the increase in the advertising of private firms.

4 Concluding Remarks

This chapter considered advertising as a means of expanding the market or demand size in two oligopolistic models: a mixed oligopoly and a pure private oligopoly. We also investigated how the output level and advertising change when the number of private firms increases in a mixed oligopoly and pure private oligopoly and how these change when a public firm is privatized. In contrast with the results of previous studies on mixed oligopolies, we showed that in a mixed oligopoly, when the number of private firms is relatively large (small), the output level of the private firms is larger (smaller) than that of the public firm . Regarding the advertising level of the public firm , it is always larger than that of private firms. Furthermore, when the number of private firms increases, the output level of the private firms, as well as their advertising level, increases in a mixed oligopoly. Finally, although the advertising level of private firms increases and that of the public firm decreases, the total advertising level decreases after privatization . These results are unique in our study because advertising, especially that of the public firm , contributes to expand the market.

Although our results provide new insights, our analysis does have some limitations. First, we did not fully analyze the effects of privatization on profit and social welfare . Further investigation should determine how these levels are affected by a change in the number of firms and by the privatization of public firms. This will clarify whether the public firm should be privatized in accordance with the strength of the market expansion under advertising or the market structure (e.g., the number of firms). Regarding this issue, it would be helpful to provide a numerical example. Second, a graphical explanation , as given in Chap. 2 of this book, might be useful. This would help readers to intuitively understand how advertising alters market demand and the behavior of firms.

Throughout this study, we have acknowledged the crucial role played by public firms in using advertising to expand the market. In this way, the public firm is a social welfare maximizer. It can induce private firms to supply more products to increase the consumer surplus. It can be argued that this is one of the key roles of the public firm .

Notes

- 1.

In addition to competition in the supply of production, we consider advertising, which expands demand. In contrast, there exists another strand of research in which R&D investment (affecting the cost or productivity) is taken into account. For example, see Delbono and Denicoló (1993), Nishimori and Ogawa (2002), Haruna and Goel (2015), and Zhang and Zhong (2015).

- 2.

Matsumura and Sunada (2013) also considered the situation where the public firm and private firms play a two-stage game: after determining the level of advertising, firms choose the level of supply. In our framework, they simultaneously determine these levels.

- 3.

The role of advertising is considered in much the same way in both Han and Ogawa (2012) and the present study. When goods are supplied to the market, advertising (i.e., its expenditure) is required to expand the market (demand). Furthermore, this expansion effect benefits the firm and other firms. On this point, this type of advertising can be acknowledged as a public good. In addition, it can also be recognized as the “supply” of goods.

- 4.

The marginal costs of production differ in Han and Ogawa (2012) and the present study. Han and Ogawa (2012) assumed that the marginal cost of production, as well as the marginal expenditure for advertising, is linear in the amount of production (i.e., the cost function takes a quadratic form). In contrast, in the present study, we consider the marginal cost of production as the combination of the constant term and the level of advertising.

- 5.

We were not able to obtain clear results for a comparison of profit levels and social welfare levels.

References

De Fraja G, Delbono F (1989) Alternative strategies of a public enterprise in oligopoly. Oxford Econ Pap 41(1):302–311

Delbono F, Denicoló V (1993) Regulating innovative activity. Int J Ind Organ 11(1):35–48

Glaeser EL, Ujhelyi G (2010) Regulating misinformation. J Public Econ 94(3):247–257

Han L, Ogawa H (2012) Market-demand boosting and privatization in a mixed duopoly. Bull Econ Res 64(1):125–134

Haruna S, Goel RK (2015) R&D strategy in international mixed duopoly with research spillovers. Aust Econ Pap 54(2):88–103

Matsumura T, Sunada T (2013) Advertising competition in a mixed oligopoly. Econ Lett 119(2):183–185

Nishimori A, Ogawa H (2002) Public monopoly, mixed oligopoly and productive efficiency. Aust Econ Pap 41(2):185–190

Zhang Y, Zhong W (2015) Are public firms always less innovative than private firms? Jpn Econ Rev 66(3):393–407

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer Japan

About this chapter

Cite this chapter

Kunizaki, M., Yanagihara, M. (2017). Market Expansion by Advertising and a Mixed Oligopoly. In: Yanagihara, M., Kunizaki, M. (eds) The Theory of Mixed Oligopoly. New Frontiers in Regional Science: Asian Perspectives, vol 14. Springer, Tokyo. https://doi.org/10.1007/978-4-431-55633-6_13

Download citation

DOI: https://doi.org/10.1007/978-4-431-55633-6_13

Published:

Publisher Name: Springer, Tokyo

Print ISBN: 978-4-431-55632-9

Online ISBN: 978-4-431-55633-6

eBook Packages: Economics and FinanceEconomics and Finance (R0)