Abstract

We consider a framework à la Wirl (Public Choice 80:307–323, 1994) where political liberalization is the outcome of a lobbying differential game between a conservative elite and a reformist group, the former player pushing against political liberalization in opposition to the latter. In contrast to the benchmark model, we introduce uncertainty. We consider the typical case of an Arab resource-exporting country where oil rents are fiercely controlled by the conservative elite. We assume that the higher the oil rents, the more reluctant to political liberalization the elite is. Two states of nature are considered (high vs. low resource rents). We then compute the Markov-perfect equilibria of the corresponding piecewise deterministic differential game. It is shown that introducing uncertainty in this manner increases the set of strategies compared to Wirl’s original setting. In particular, the cost of lobbying might be significantly increased under uncertainty with respect to the benchmark. This highlights some specificities of the political liberalization in Arab countries and the associated risks.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Rent-seeking activities in countries with developed extraction sectors are abundantly documented. Examples range from timber industries in the Philippines and Malaysia (as detailed in Ross 2001) to fossil energy-related sectors like in OPEC countries (see a recent paper by Gylfason 2001). In general, the rents deriving from the exploitation of natural resources fall under the fierce control of conservative elites. These elites typically manipulate national legislation (pretty much in the sense given by Tullock 1967 to rent-seeking) to perpetuate themselves in power.Footnote 1 Empirical evidence show that the so-called “resource curse” can be a consequence of the latter behavior. Bad governance and weak institutions are the main reasons behind the failures of several resource-rich countries to launch a sustainable growth process (see Gylfason 2001; Mehlum et al. 2006; Cabrales and Hauk 2011; Tsui 2011). The “resource curse” is by no way the mere outcome of an automatic mechanism penalizing these otherwise blessed countries.

On the other hand, the impact of rent-seeking behavior on economic efficiency is a quite old idea tracing back to Tullock (1967). Key aspects of the theory are the strategic and non-strategic behaviors of the players involved in rent-seeking and their implication to public policy. As players are roughly the representatives of interest groups in practice, the theory ends up modeling the determinants and outcomes of lobbying in different theoretical contexts (see Becker 1983; Linster 1994; and Kohli and Singh 1999; for more recent examples of the literature stream opened by Tullock). An influential contribution is the one by Becker (1983). He modeled lobbying in a two-player setting, each player with his own lobbying cost and productivity. It was assumed that the larger lobbying expenditures, the stronger the lobby and the more effective a player can be in orienting public (fiscal) policy. However, Becker’s model does not entail any strategic behavior of any sort: each player acts as if the lobbying effort exerted by the opponent is independent of his own choice.Footnote 2 Researchers after Becker have tried to get rid of this shortcoming. To our knowledge, Wirl (1994) is the first to use differential games in this stream of literature. Wirl uses a linear-quadratic model to investigate the impact of the game structure on the outcomes expressed in terms of players’ strategies. Though the government is passive in this framework (in other words, public policy only changes in response to lobbying actions), the paper has two important contributions. First, the game structure matters (the open-loop equilibria are, indeed, carefully compared to the subgame-perfect equilibria derived as linear Markov strategies). Second, in the subgame-perfect equilibria, optimal lobbying expenditures are remarkably lower (than those observed in the open-loop case). This provides a rationale for a conjecture made by Tullock. The cost of rent-seeking activities are rather small compared to the rents, therefore implying not too high social costs. The reason behind this striking result is inherent in the feedback nature of the Markovian strategies, which discourages too aggressive lobbying strategies (see Wirl 1994, for more details).

This paper qualifies this important claim by Wirl by introducing uncertainty. If the players do not know with certainty the future politico-economic environment, and provided they are not too averse to risk, they might well depart from the overly cautious behavior described in Wirl (1994). This is especially the case if they anticipate a favorable evolution of the environment. We apply our framework to the process of liberalization in oil exporting countries, and more specifically to Arab countries. The Arab Spring has shown the deep inequalities that characterize the Arab world. On one hand, there are ruling dynasties who usually control all types of economic and political activities. On the other, there is a majority of Arab citizens which are partially or totally excluded from relevant decision-making. A fundamental characteristic of these countries is the essential role played by the oil rents both on the political and economic grounds (see Caselli and Cunningham 2009). The larger these rents are, the bigger the incentives of the elites to stay in power and to block any initiative to open the political game.Footnote 3 In many Arab countries, starting with the Gulf emirates and kingdoms, a lot has been already done towards economic liberalization, notably in order to attract more foreign direct investment. However, no significant move has been made in favor of political liberalization (see Dunne and Revkin 2011, on Egypt).Footnote 4 We shall consider a framework à la Wirl where political liberalization is the outcome of a piecewise deterministic differential game between a conservative elite and a reformist group: oil rents may be high or low (two states of nature). In the former state of nature, the elite is more reluctant to political liberalization. This volatility of the benefits from oil rents is inherent in resource-dependent economies. For instance, van der Ploeg and Poelhekke (2009) show that liquidity constraints are exacerbated when oil rents are volatile. In a subsequent study, van der Ploeg and Poelhekke (2010) has also observed that natural resources worsen macroeconomic volatility and thus impede output growth. Taking into account this context, we thus revisit Wirl’s findings. We particularly show how uncertainty alter the optimal strategies in the Markov-perfect equilibria. Incidentally, we highlight some of the specific risks inherent in the current political liberalization process in Arab countries.

This paper is structured as follows. Section 2 introduces the dynamic model of political liberalization. Section 3 considers a setting with uncertainty and derives the MPE of a piecewise deterministic game. Finally, Sect. 4 concludes.

2 Benchmark Model

In this section, the differential game on lobbying proposed by Wirl (1994) is adapted to the context of the Arab Spring. For the meantime, the case with no uncertainty is discussed. In the next section, we extend Wirl’s model by considering a stochastic environment with two states of nature. Throughout the paper, we consider only symmetric games (in the precise sense of Wirl, see Sect. 2.1 just below). This is done for algebraic amenability, as no analytical solution is allowed outside this class of games. Realistically, players engaged in the political liberalization struggle in Arab countries do not have equal power since they do not have equal access to oil rents, etc.Footnote 5 Nonetheless, the symmetric set-up adopted includes two important features of political liberalization: the conservative elite is reluctant to liberalization, while the reformist minority pushes for it. This reluctance is an increasing function of oil rents. The former point will be apparent in the stochastic extension of the benchmark.

2.1 The Setup

We consider two competing players (denoted as i=1,2) who engage in investment efforts x 1 and x 2. Player 1 is a reformist who exerts pressure towards greater political liberalization. On the other hand, Player 2 prefers a conservative system. In the context of the Arab Spring, Player 2 can be considered as the elite government who wants to retain the political status quo. Player 1 represents the groups who prefer regime change. The state of liberalization is measured by z∈(−∞,∞). As in Wirl, z=0 is the neutral level of political liberalization. Consequently, the following differential equation captures the evolution of z in response to the efforts of players 1 and 2:

with z(0)=z 0 given. As a reformist, Player 1 prefers a higher level of political liberalization. A high value of z, on the other hand, is not beneficial to the conservative stance of Player 2. Thus, the investment x 1 of Player 1 increases z, while Player 2 exerts effort x 2 to lower z.

The benefit from the current level of liberalization is denoted by α i (z) with: \(\alpha_{1}(z)=a_{0}+a_{1}z+\frac{a_{2}}{2}z^{2}\) and \(\alpha_{2}(z)=a_{0}-a_{1}z+\frac{a_{2}}{2}z^{2}\). We follow Wirl (1994) by qualifying this game as a symmetric one. The opposite signs of the second term in the players’ benefit functions represent their antagonistic interests with regard to liberalization. Without loss of generality, we assume that a 1>0. We also assume that a 2≤0 to ensure concavity. Meanwhile, efforts x 1 and x 2 are also associated with cost \(\gamma(x_{i})=\frac{d}{2}(x_{i})^{2}\).

Players maximize the present value of benefits from liberalization minus the associated costs, F i =α i (z)−γ(x i ). With an interest rate r>0, players choose effort levels to maximize the following objective function subject to the evolution of z (equation (1)):

The solution to this differential game is essentially the same as the symmetric version found in Wirl (1994). In the next subsection, we will summarize the resulting open-loop and feedback strategies. In Sect. 3, we will provide a comprehensive solution to a game under uncertainty and provide analytical comparisons.

2.2 Open-Loop and Feedback Strategies

As mentioned above, this subsection provides an overview of the open-loop and Markov-perfect equilibrium (MPE) solutions to the political liberalization game with no uncertainty. Similar to Wirl (1994), the strategy pair \(\{x_{1}^{O}(t), x_{2}^{O}(t), t \in[0,\infty)\}\) comprises an open-loop Nash equilibrium (OLNE) if both strategies, which depend on t, maximize the respective objective functions of the players. In summary, the open-loop case (presented in the feedback form) at a symmetric equilibrium results to:

which leads the system to a unique steady state characterized by:

While the open-loop equilibrium is time-consistent, it is not subgame perfect. That is, using open-loop strategies might not make sense when considering an anticipated change in the evolution of the game. Thus, following literature (Dockner et al. 2000), feedback strategies are deemed suitable. Utilizing the usual Hamilton–Jacobi–Bellman (HJB) equations (refer to Wirl 1994, p. 315, for a detailed discussion), the resulting MPE strategies in the case without regime switching are (the superscript N is used here):

which leads the system to a steady state characterized by:

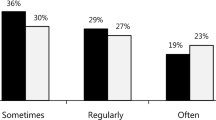

The strategies computed have some interesting implications. First, note that in the MPE, the strategy of Player 1 is decreasing in z. This is in strong contrast to Player 2. In terms of our political liberalization framework, it means that the reformist would exert less effort when the level of political freedom is rising. The conservative takes the opposite strategy. Much more interestingly, one can use the previous feedback rules to conclude that \(x_{i\infty }^{O}>x_{i\infty}^{N}\), for i=1,2, which is the main result of Wirl’s benchmark. Lobbying activities are lower in the MPE compared to the open loop, at least in the steady state. Therefore, the social cost of lobbying activities are less significant than one may expect. This finding is confirmed through some quantitative exercises.Footnote 6

3 Political Liberalization Game Under Uncertainty

We now consider the dynamic game of political liberalization under a setting with uncertainty.

3.1 MPE of the Piecewise Deterministic Game

The symmetric case found in Wirl (1994) is extended by taking into account the possibility of regime switching. A stochastic differential game is analyzed. More specifically, we derive the Markov-perfect Nash equilibria of a piecewise deterministic game.Footnote 7

The pay-offs of players 1 and 2 are altered to:

Uncertainty is characterized in the coefficient representing the linear benefits incurred from liberalization, \(a_{i}^{j}\). There exist two states of the world, denoted by j. In Regime 1, \(a_{1}^{1}=\overline{a}_{1}\). On the other hand, \(a_{1}^{2}=\underline{a}_{1}\) for Regime 2. We assume that \(\underline{a}_{1}<\overline{a}_{1}\). In the context of the Arab Spring in predominantly oil-rich economies, Regime 1 can be the state when resource windfalls are high.Footnote 8 Meanwhile, Regime 2 can be considered as the scenario during which gains from oil are low. Only the linear term of benefits is dependent on the regime. This assumption is sufficient to characterize resource volatility inherent in many Arab countries (van der Ploeg and Poelhekke 2009). More importantly, it captures the heterogeneity in players’ sensitiveness to regime change.Footnote 9

In Regime 1, oil revenues are high. This makes Player 2 even more reluctant to liberalization. This relatively higher reluctance translates into the fact that α 2(z) worsens in Regime 1, compared to Regime 2. This is due to a higher a 1, in absolute terms. This means that, by symmetry, Player 1’s gains from liberalization are higher in the first regime. Furthermore, the probability to switch from Regime 1 to 2 is denoted as q 12∈(0,1). Similarly, the probability of switching from Regime 2 to 1 is q 21∈(0,1). Depending on the current regime and taking into account the switching probabilities, players maximize the discounted net payoffs in (7) subject to (1).

As discussed in Dockner et al. (2000), the HJB equations are modified and solved for each regime. The HJB equations for the piecewise deterministic game take the following form:Footnote 10

Suppose we are in Regime 1, the HJB equation for Player 1 is denoted as:

where we guess that the value function has the following form

The first-order condition yields:

Similarly, from Player 2’s HJB equation, we derive:

Substituting \(x_{1}^{1}\) and \(x_{2}^{1}\) by the expressions given in (10) and (11) in (9), we obtain for Player 1 (disregarding the constant terms):

Let’s now proceed with the identification step. From the equation above, we have the following for Player 1:

Similarly, for Player 2:

Suppose instead players are in Regime 2. Following the same methodology as before, we get:

To identify the parameters relevant for each player, we first consider the system (14), (16), (18) and (20). Let us assume that C j parameters are identical for players in any regime j: \(C_{1}^{j}=C_{2}^{j}\) for j=1,2. This sounds reasonable since the game is entirely symmetric in each regime. Substituting these relationships into our system, we are left with a system of two equations

in two unknowns (\(C_{1}^{1}\), \(C_{1}^{2}\)). Taking the difference between these two equations, one obtains:

Observing (22), two cases are possible: 1. \(C_{1}^{1}\neq C_{1}^{2}\) and 2. \(C_{1}^{1}=C_{1}^{2}\).

-

First, suppose that \(C_{1}^{1}\neq C_{1}^{2}\). Then, (22) simplifies to:

$$ C_{1}^{2}=\frac{d}{3} (r+q_{12}+q_{21} )-C_{1}^{1}. $$(23)Using (23), the first equation in (21) can be rewritten as

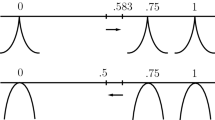

$$ \frac{3}{d}\bigl(C_{1}^{1} \bigr)^{2}- (r+2 q_{12} )C_{1}^{1}+ \frac{d q_{12}}{3} (r+q_{12}+q_{21} )+a_{2}=0. $$(24)Assuming that \(\varDelta _{1}=r^{2}-\frac{12}{d}a_{2}-4 q_{12} q_{21}>0\), two solutions thus exist

$$ \begin{aligned} C_{1}^{1-}&=C_{2}^{1-}=C^{1-}= \frac{d}{6} (r+2q_{12}- \sqrt{\varDelta _{1}} ) \\ C_{1}^{1+}&=C_{2}^{1+}=C^{1+}= \frac{d}{6} (r+2q_{12}+ \sqrt{\varDelta _{1}} ), \end{aligned} $$(25)each corresponding to a particular \(C_{1}^{2}\)

$$ \begin{aligned} C_{1}^{2+}=C_{2}^{2+}=C^{2+}= \frac{d}{6} (r+2q_{21}+ \sqrt{\varDelta _{1}} ) \\ C_{1}^{2-}=C_{2}^{2-}=C^{2-}= \frac{d}{6} (r+2q_{21}- \sqrt{\varDelta _{1}} ). \end{aligned} $$(26)Specifically, solutions are (C 1−,C 2+) and (C 1+,C 2−).

-

Second, consider that \(C_{1}^{1}=C_{1}^{2}\). Then, the C parameter is the same for both regimes and for both players. It is equal to

$$ \begin{aligned} C^{+}&=\frac{d}{6} (r+ \sqrt{\varDelta _{2}} ) \\ C^{-}&=\frac{d}{6} (r- \sqrt{\varDelta _{2}} ) \end{aligned} $$(27)with \(\varDelta _{2}=r^{2}-\frac{12}{d}a_{2}>0\) if Δ 1>0. In this case, players’ response to a change in z is similar to one of Wirl, obtained in the problem with no uncertainty (Sect. 2).

We now turn to the identification of B-parameters by solving the system (13), (15), (17), and (19). Guessing that \(B_{2}^{j}=-B_{j}^{i}\) for j=1,2, this system simplifies to:

Combining these equations, we obtain the general solution for B coefficients:

Depending on the particular C considered, there are four potential solutions to our uncertain problem. The first type of solution exhibits identical C-parameters in both regimes. Each player adapts her strategy to changes in the liberalization level in the same way, whatever the regime. In this sense, this solution looks like Wirl’s outcome. There also exist solutions for which C-parameters change from one regime to the other, which gives rise to more considerable differences in players’ behavior. The next section investigates the properties of these two types of solutions. Particular attention will be paid to the impact of uncertainty on players’ strategies through the comparison between solutions for the cases with and without uncertainty.

3.2 Markov Perfect Equilibria with Regime-Independent Responses to Political Liberalization

Wirl (1994) has a unique MPE in his deterministic problem. Indeed, he uses a stability argument to select, among the two possible values of C given in (27), the negative one. For the sake of comparison, we report players’ strategies at our MPE with identical Cs, given that C=C − (and \(\varDelta _{2}=r^{2}-\frac{12}{d}a_{2}\)):Footnote 11

Proposition 1

Players’ efforts, at MPE, are

For each regime separately, the dynamics drive the system toward a steady state with:

By assuming q 12=q 21=0, \(a_{1}^{2}=a_{1}^{1}=a_{1}\), one can check that strategies in (30) reduce to Wirl-type MPE, \((x_{1}^{N},x_{2}^{N})\) defined in (5). These strategies share similarities with the ones of the deterministic situation. In particular, for the solution with identical Cs, the effort of Player 1 is always decreasing in z. Regardless of the regime, the opposite holds for Player 2. When the level of liberalization is higher, Player 1 would have less incentive to call for reforms as the system is already more favorable to his interests. On the other hand, a higher z hurts the conservative stance of Player 2. Hence, in order to counteract this, he exerts more effort.

However, there are notable differences between equilibrium strategies found above and those derived for the Wirl-type, symmetric case in Sect. 2.2. The existence of uncertainty plays an integral role in determining the effort levels of players. In what follows, results found in Sects. 2.2 and 3.1 are compared analytically. For ease of notation, we again denote “MPE” as the ones found for the uncertain case (with identical and different Cs) and “Wirl-type MPE” for the certain case. With \(a_{1}^{1}>a_{1}^{2}\), the following proposition can be established.

Proposition 2

-

MPE with identical Cs vs. Wirl-type MPE: \(x_{i}^{N}>x_{i}^{j}\) for i=1,2 and j=1,2 iff the deterministic economy is associated with \(a_{1}=a_{1}^{1}\). The opposite holds, that is \(x_{i}^{N}<x_{i}^{j}\) iff \(a_{1}=a_{1}^{2}\).

-

MPE with identical Cs vs. OLNE at the steady state: When \(a_{1}=a_{1}^{1}\), it is straightforward that \(x_{i\infty }^{O}>x_{i\infty}^{j}\) for all i and all j since \(x_{i\infty}^{O}>x_{i\infty}^{N}\) and \(x_{i}^{N}>x_{i}^{j}\) for all z. When \(a_{1}=a_{1}^{2}\), \(x_{i\infty}^{j}>x_{i\infty}^{O}\), for all i, for all j, if \(a_{1}^{2}<\hat{a}_{1}^{2}\) with

$$ \hat{a}_{1}^{2}=a_{1}^{1} \frac{36 r q_{21}}{(5r+\sqrt{\varDelta _{2}}) (5 r+\sqrt{\varDelta _{2}}+6 (q_{12}+q_{21})-36 r q_{12})}. $$(32)

The proof is relegated to the appendix (see the Appendix). Proposition 2 has several implications. First, recall that from (30) it can be shown that \(x_{i}^{1}>x_{i}^{2}\). In the MPE with identical Cs, the efforts of players are greater when they are in a state with high windfalls than when they are in the low regime. This finding is analogous to taking \(\frac{\partial x_{i}^{N}}{\partial a_{1}}\) for the deterministic, Wirl-type case. An incremental increase in the coefficient representing the linear benefits from the liberalization level z implies an increase in the effort levels. All other things constant, the reformist’s investment will rise when a 1 goes up. Knowing that this increase in a 1 may hurt him, the conservative will invest more to counteract Player 1’s action.

Second, the impact of uncertainty on the comparative relationship between the MPE with identical Cs and the Wirl-type MPE is not clear-cut. Uncertainty lowers the equilibrium investment levels in comparison to the case when a 1 is surely in a high state. Assume that players are in Regime 1 at the present. Knowing that there is a probability that the regime will shift to a setting with low windfalls, players have less incentive to impact liberalization (i.e. relative to the scenario when they are certain that they will always be in Regime 1). Consequently, we find the following relationship: \(x_{i}^{N}>x_{i}^{j}\) when \(a_{1}=a_{1}^{1}\). Contrast this to the case when \(a_{1}=a_{1}^{2}\). The opposite is observed when comparing our MPE to the Wirl-type MPE for the low state. Suppose players are in Regime 2. Since there is a possibility that the regime will alter to a system with higher windfalls, they invest more. Due to an anticipation of a potential shift to the high state, the MPE with identical Cs is higher relative to the Wirl-type MPE for the low state: \(x_{i}^{N}<x_{i}^{j}\).

Third, the steady state levels of the MPE with identical Cs and the OLNE can be compared. When \(a_{1}=a_{1}^{1}\) (high state regime), the open-loop equilibrium investments are greater than the MPE with identical Cs when z ∞=0. Similar to the deterministic case, players exert relatively less effort into affecting the level of political liberalization. This is because feedback strategies among players are characterized by a dynamic retaliation mechanism. Whenever Player 1 succeeds in shifting the liberalization level towards his favor, she knows that Player 2 will retaliate more. As Wirl (1994) argued, this common knowledge deters aggressive strategies. However, this is not the case when \(a_{1}=a_{1}^{2}\). In particular, the above-mentioned observation does not apply when \(a_{1}^{2}\) is low enough. At the steady state, the OLNE for the symmetric case in the low state is below the MPE with identical Cs. Even in the potential presence of retaliation, the existence of uncertainty induces players to exert more effort compared to the OLNE in the low state. Remember that for the Wirl-type solution, players know that they will always be in the low state. Compare this when they are facing uncertainty. Suppose they are initially in Regime 2. The possibility of shifting to Regime 1 may imply more aggressive investment. As a result, the cost of lobbying along the MPE equilibria under uncertainty might be significantly increased with respect to Wirl’s deterministic benchmark. In the context of the political liberalization process at stake in Arab countries, this highlights the property that oil volatility is likely to generate significant social costs inherent in the game. This is contrary to what is predicted by standard deterministic theory. The higher the uncertainty, the larger the social costs as strategies will become more aggressive. Furthermore, independent of the economic costs associated with resource prices in exporting countries, this volatility will make the political liberalization process itself more costly. Another complication of uncertainty is the emergence of alternative strategies which do not show up in deterministic frameworks.

3.3 Markov Perfect Equilibria with Regime-Driven Responses to Changes in Liberalization

The solution discussed in the preceding section can be contrasted with a (C 1,C 2)-type of solution, with C 1, C 2 given in (25)–(26). Players’ reaction to a change in the liberalization level is dependent on the current regime of the economy. Given that a certain regime is more favorable to a player than the other, it will be useful to investigate how this regime-driven reaction affects the properties of the solution. In the next proposition, we present equilibrium strategies for the case where C 1=C 1−, C 2=C 2+, and \(\varDelta _{1}=r^{2}-\frac {12}{d}a_{2}-4q_{12}q_{21}\). A discussion about the features of this solution and how it compares to the Wirl-type MPE is later conducted.Footnote 12

Proposition 3

Suppose there exists a MPE with regime-driven response to changes in liberalization, then the strategies are given by

It is out of the scope of this paper to provide a full analysis of the ergodicity properties of the solutions. However, we can mention some distinctive features of the alternative MPEs through a separate analysis of our two regimes involved. Paying attention to Regime 2, from (33), we observe that the limit value of z is infinite, positive or negative depending on the sign of the initial level of liberalization z 0. As mentioned in footnote 11, this means that if the economy were to stay in Regime 2 for a sufficiently long interval of time, then Player 2’s effort would become negative. It is also worth checking how the system behaves in Regime 1. Indeed, it turns out that Regime 1’s dynamics are qualitatively similar to the ones of Regime 2 when one assumes

because under this condition, C 1−,C 2+>0.

Given that the economy randomly switches from Regime 1 to Regime 2, and vice-versa, one may prefer imposing the opposite of (34). The resulting dynamics of Regime 1 are similar to the ones holding at the Wirl-type MPE or at our MPE with identical response to changes in liberalization. It implies that the limit value of z would be zero whereas \(x_{1}^{1}\) and \(x_{2}^{1}\) would reach finite values.Footnote 13

Several remarks can be discussed from the comparison of the solution in Proposition 3 and the Wirl-type MPE. First, the impact of an increase in z on effort levels is different from those observed from the Wirl-type MPE (and the MPE with identical Cs). From (33), notice the obvious effect of a higher z on the efforts of players in the second regime. In Regime 2, Player 1’s (Player 2) investment increases (decreases) with z. Regardless of the switching probabilities, Regime 2 is always characterized by the above-mentioned results. The low state of \(a_{1}^{2}\) gives greater incentive to Player 1 to exert more effort when z increases. This is because he wants to take more advantage from political liberalization. There exists a form of intensified reinforcement. In contrast, when z goes up, Player 2 knows it becomes more favorable to Player 1. Knowing that exerting effort is costly, it is actually strategic for Player 2 to lessen his investment. When z already acquired a much higher level, it might be more difficult for him to shift the system to his favor. There is deterrence in his incentive to change the system.

From the discussion above, the reasoning is less obvious for Regime 1. The findings are similar to those in Regime 2 only when Condition (34) is satisfied. This is more likely, given that switching probabilities are high enough. In this case, the strategy of Player 1 increases with respect to the state z while the opposite is relevant for Player 2. When the C-parameters are different, the impact of uncertainty becomes more prominent. Interestingly, the results become the inverse of those observed for the deterministic, Wirl-type MPE. Suppose players are currently in Regime 1. Given a relatively high probability of switching to Regime 2, an incremental increase in z induces Player 1 to exert more effort. This happens because Player 1 knows that he obtains less linear benefits from liberalization in Regime 2 (due to lower a 1). With the anticipation that he might be in Regime 2 the next period, Player 1 tries to compensate and invests more aggressively in the favorable Regime 1. In contrast, Player 2’s effort in Regime 1 decreases with z when the likelihood of switching to Regime 2 is high enough. Given that Regime 2 is more favorable to Player 2, i.e. a 1 is reasonably lower, then he has less incentive to invest in Regime 1.

If Condition (34) does not hold, then the results in Regime 1 are similar to those found in the MPE with identical Cs and the Wirl-type MPE. Indeed, when players are in Regime 1 and the probability of switching to Regime 2 is rather low, their incentives are different from those observed when they are Regime 2. Knowing that there is a higher likelihood that he will stay in the favorable Regime 1, Player 1 invests less when political liberalization is more prevalent. Meanwhile, a higher z combined with being in Regime 1 harms the other player more. Player 2 mitigates this by trying to shift the system to his favor, i.e. exert more effort against liberalization.

Finally, it is worth noting that when a 2=0, the MPE strategies are constant for the Wirl-type MPE and the solution with identical Cs. However, because switching probabilities appear in the solution for different Cs, this is not the case for the MPE with dissimilar C-parameters. The strategies of players in the MPE with different Cs still vary with z. Taking into account the role of uncertainty (i.e. C varies for each regime), the effort levels do not remain constant. Player 1’s (Player 2) effort is always increasing (decreasing) in z. The explanation for this result utilizes a similar logic as above.

4 Conclusion

In this paper, we have developed a dynamic game of political liberalization under uncertainty. This is done by using the context of the Arab Spring in resource-rich countries. It has been observed that effort levels of reformists (those who benefit from greater liberalization) and conservatives (those who are against liberalization) tend to differ depending on the setup of the game. In the case with no uncertainty, the strategy of the reformist decreases with respect to the liberalization level while the opposite is true for the conservative. In striking difference, opposite results were observed in the case with uncertainty. When the regime switching probabilities are high enough, the reformist’s effort increases with respect to the state z. On the other hand, the conservative’s investment decreases with intensified political liberalization. In the presence of uncertainty and greater likelihood of regime shift, an increase in z reinforces the reformist’s incentive to induce change. In contrast, when z goes up, the conservative is in a less favorable position and is surprisingly deterred from altering the system. Finally, it was observed that in certain circumstances, the cost of lobbying might be significantly increased under uncertainty with respect to Wirl’s benchmark. In the context of the political liberalization in Arab countries, this implies oil volatility is likely to generate significant social costs. Increased uncertainty in rents will make the political liberalization process itself more costly. This aggravates the economic costs associated with volatility of resource prices in exporting countries.

Subject to analytical tractability, the present model may be extended in the following directions. First, one may introduce uncertainty in the cost functions, e.g. it is less costly to invest in Regime 1 than in 2. Second, one may explore a different stochastic environment by incorporating a Wiener-type process that may affect the evolution of political liberalization.

Notes

- 1.

The recent Arab Spring uprising shed light on another form of these long lasting rent-seeking activities, not related to natural resources but to the control of financial and trade flows as it was the case in Tunisia under the presidency of Benali.

- 2.

The main point made by Becker is that increasing competition among interest groups should improve the efficiency of the tax system.

- 3.

Gylfason (2001) makes the point that the elites would eventually block human capital education to perpetuate themselves in power. As outlined by Boucekkine and Bouklia-Hassane (2011), this is certainly not the case of Tunisia, the starter in the Arab Spring uprising: more than 20 % of the Tunisian budget has gone to public education in the last decade, much better than many advanced European countries.

- 4.

Algeria is a case where even economic liberalization efforts have been tightly linked to the level of the oil barrel, as explained in Boucekkine and Bouklia-Hassane (2011).

- 5.

For example, in the Algerian case, the conservative elites benefit from the support of the powerful National Popular Army and the intelligence services (DRS).

- 6.

In the numerical cases studied by Wirl, the comparison is quantitatively striking. The ratio of total lobbying expenditures in the MPE compared with the open loop is only around one third for the symmetric case, and even much less in some asymmetric configurations considered.

- 7.

We do not consider the piecewise open-loop equilibria as closed-form solutions for this case are rarely derived in literature (Dockner et al. 2000). For analytical tractability, we thus focus on feedback strategies.

- 8.

In most oil-dependent Arab countries, natural resource rents are usually received by the governing political elite (Caselli and Cunningham 2009).

- 9.

In addition, it allows us to get analytical solutions, which would not be possible by, for instance, making the entire payoffs be regime dependent.

- 10.

Compared to the general form of HJBs utilized in Wirl (1994), there is an additional (last) term which accounts for the possibility of uncertain regime switching from one regime, j, to the other, −j.

- 11.

In our stochastic framework, we also have a solution corresponding to C=C +, which can’t be eliminated using the stability argument. However, straightforward calculations reveal that this solution has undesirable features: the level of liberalization goes to infinity, which implies that the liberalization effort of Player 2 goes to −∞ (in the absence of nonnegativity constraint on x). That is why we choose to focus on the other solution, that is also more consistent with Wirl’s outcome.

- 12.

The conclusions drawn from analysis of the other MPE candidate, corresponding to (C 1+,C 2−), are qualitatively similar to the ones obtained for (C 1−,C 2+). For this reason, this case is not dealt with by the subsequent study.

- 13.

Thus, in some sense, the dynamical system valid in Regime 1 offsets the explosive trend of Regime 2.

References

Becker, G. (1983). A theory of competition among pressure groups for political influence. The Quarterly Journal of Economics, 98, 371–400.

Boucekkine, R., & Bouklia-Hassane, R. (2011). Rente, corruptionet violence: l’émergence d’un ordre nouveau dans les pays arabes? Regards Economiques, 92. Available at http://sites.uclouvain.be/econ/Regards/Archives/RE092.pdf.

Cabrales, A., & Hauk, E. (2011). The quality of political institutions and the curse of natural resources. The Economic Journal, 21, 89–115.

Caselli, F., & Cunningham, T. (2009). Leader behaviour and the natural resource curse. Oxford Economic Papers, 61, 628–650.

Dockner, E., Jorgensen, S., Van Long, N., & Sorger, G. (2000). Differential games in economics and management science. Cambridge: Cambridge University Press.

Dunne, M., & Revkin, M. (2011). Egypt: how a lack of political reform undermined economic reform. Carnegie Middle East Center, Carnegie Endowment for International Peace. Available at http://carnegie-mec.org/publications/?fa=42710.

Gylfason, T. (2001). Natural resources, education, and economic development. European Economic Review, 45, 847–859.

Kohli, I., & Singh, N. (1999). Rent-seeking and rent-seeking with asymmetric effectiveness of lobbying. Public Choice, 99, 275–298.

Linster, B. (1994). Cooperative rent-seeking. Public Choice, 81, 23–34.

Mehlum, H., Moene, K., & Torvik, R. (2006). Cursed by resources or institutions? World Economy, 29, 1117–1131.

Ross, M. L. (2001). Timber booms and institutional breakdown in Southeast Asia. New York: Cambridge University Press.

Tsui, K. (2011). More oil, less democracy: evidence from worldwide crude oil discoveries. The Economic Journal, 121, 89–115.

Tullock, G. (1967). The welfare costs of tariffs, monopolies, and theft. Western Economic Journal, 5, 224–232.

van der Ploeg, F., & Poelhekke, S. (2009). Volatility and the natural resource curse. Oxford Economic Papers, 61(4), 727–760.

van der Ploeg, F., & Poelhekke, S. (2010). The pungent smell of “red herrings”: subsoil assets, rents, volatility, and the resource curse. Journal of Environmental Economics and Management, 60(1), 44–55.

Wirl, F. (1994). The dynamics of lobbying: a differential game. Public Choice, 80, 307–323.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix

Appendix

1.1 A.1 Proof of Proposition 1

1.1.1 A.1.1 MPE with Identical Cs vs. Wirl-Type MPE

Here we compare the MPE in the deterministic case (Wirl-type results)

with the MPE obtained with uncertain regime switching and identical Cs. In case of Regime 1,

and in case of Regime 2,

-

Let us first consider that the deterministic a 1 is the high one: \(a_{1}=a_{1}^{1}\). Then, it is trivial to show that \(x_{i}^{j}<x_{j}^{N}\Leftrightarrow a_{1}^{2}<a_{1}^{1}\) for i,j=1,2 and for all z. This is satisfied by definition.

-

Next, suppose that the deterministic a 1 is the one corresponding to Regime 2: \(a_{1}=a_{1}^{2}\). Then, one can check easily that \(x_{i}^{j}>x_{i}^{N}\Leftrightarrow a_{1}^{2}<a_{1}^{1}\) for i,j=1,2 and for all z, which is true by definition.

1.1.2 A.1.2 MPE with Identical Cs vs. OLNE at the Steady State

Again, we make a distinction between two cases, depending on whether the deterministic a 1 is the high one or not. Following Wirl (1994), attention is paid only to the steady state.

When \(a_{1}=a_{1}^{1}\), the comparison is straightforward: from what we learnt in the preceding appendix, we know that \(x_{i}^{j}<x_{i}^{N}\) for all z. In particular, it holds that \(x_{i\infty}^{j}<x_{i\infty}^{N}\) (recall that in both cases, z ∞=0). In addition, Wirl (1994) has shown that \(x_{i\infty}^{N}<x_{i\infty}^{O}\). So, we have \(x_{i\infty}^{j}<x_{i\infty}^{O}\) for all i,j=1,2.

When \(a_{1}=a_{1}^{2}\), the comparison is less obvious because, at the same time, \(x_{i\infty}^{j}>x_{i\infty}^{N}\) and \(x_{i\infty }^{N}<x_{i\infty}^{O}\). In Regime 1, from the definition of the open-loop solution (see equation (3)),

Note that the coefficient in the LHS is larger than the one in the RHS. So, given that \(a_{1}^{1}>a_{1}^{2}\), \(x_{i\infty}^{1}<x_{i\infty}^{O}\) is equivalent to

this defines an upper bound \(\tilde{a}_{1}^{2}\) on the coefficient a 1 valid in the low regime.

In Regime 2, following the same approach, we obtain that

the coefficient in the LHS being again larger than the one in the RHS. Hence, \(x_{i\infty}^{2}<x_{i\infty}^{O}\) is equivalent to

this defines a second boundary \(\hat{a}_{1}^{2}\) on the coefficient a 1 valid in the low regime.

Now, given that \(\tilde{a}_{1}^{2}>\hat{a}_{1}^{2}\), \(a_{1}^{2}<\hat{a}_{1}^{2}\) implies that \(x_{i\infty}^{j}<x_{i\infty}^{O}\) for i,j=1,2 when \(a_{1}=a_{1}^{2}\).

This completes the proof.

Rights and permissions

Copyright information

© 2014 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Boucekkine, R., Prieur, F., Puzon, K. (2014). The Dynamics of Lobbying Under Uncertainty: On Political Liberalization in Arab Countries. In: Haunschmied, J., Veliov, V., Wrzaczek, S. (eds) Dynamic Games in Economics. Dynamic Modeling and Econometrics in Economics and Finance, vol 16. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-54248-0_4

Download citation

DOI: https://doi.org/10.1007/978-3-642-54248-0_4

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-54247-3

Online ISBN: 978-3-642-54248-0

eBook Packages: Business and EconomicsEconomics and Finance (R0)