Abstract

One of the most difficult issues for using wind power in practice is that the power output largely depends on the wind condition, and as a result, the future output may be volatile or uncertain. Therefore, the forecast of power output is considered important and is key to electric power generating industries making the wind power electricity market work properly. However, the use of forecasts may cause other problems due to “forecast errors”. The objective of this chapter is to summerize conventional tools to manage such risks in the wind power electricity market. In particular, we focus on possible insurance claims or the so-called weather derivatives, which are contracts written on weather indices whose values are constructed from weather data.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

In this chapter, we introduce weather derivatives based on wind conditions combined with their forecast information. In other words, we consider “wind derivatives” whose payoffs are determined by the forecast errors of wind conditions. In contrast to the standard weather derivatives in which the underlying index is given by observed weather data only (say, temperature), the wind derivatives discussed here take advantage of forecast data and the payoff depends on the difference between the actual and forecast data. Such a derivative contract is expected to be useful for hedging the possible loss (or risk) caused by forecast errors of power outputs associated with the forecast errors of wind conditions in wind energy businesses. We also demonstrate the hedge effect of wind derivatives using empirical data for a wind farm located in Japan.

1 Introduction

Motivated by a worldwide growing trend towards the production of wind energy, new problems associated with risk management and operation have appeared on the new energy market. Because the wind generated output largely depends on the wind condition, one of the most difficult issues in practice is that the wind generated output may be volatile and is uncertain in advance. This undesirable property may significantly reflect on the schedule of generation and control of frequency in the electricity grid, which leads to increased demand of accurate wind power forecast in various countries.

The forecast of wind condition is considered important and is key to electric power generating industries making the wind power electricity market work properly. However, the use of forecasts may cause other problems due to “forecast errors” of power output. In this chapter, we summerize conventional tools to manage such risks in the wind power electricity market. In particular, we focus on possible insurance claims or the so-called “weather derivatives,” which is potentially useful for wind power trades in the wind energy market.

Weather derivatives are contracts written on weather indices, which in turn are variables whose values are constructed from weather data. The payoffs of these contracts are based on weather indices (e.g., temperature, rain, snow, wind, etc.) at a specific site (e.g., Tokyo, Japan) over a prespecified period. Although the underlying variables describing weather dynamics are manifold, a large portion of contracts are currently written on a temperature-based index, such as monthly average temperature, or heating/cooling degree days (HDDs/CDDs). Here HDDs and CDDs are defined relative to a base temperature to represent winter/summer energy demands concerning temperature. For example, an HDD of a day may be defined as the maximum between the base minus daily average temperature and zero [1], and the monthly contracts are based on the cumulative HDDs in a specific calender month.

The difference of weather derivatives from financial derivatives is that the underlying index (i.e., weather data) has no direct cash value unlike stocks or bonds. Therefore, the weather derivatives are usually traded for insurance purpose (not for investment purpose), and may be used by organizations/individuals to reduce risk associated with adverse or unexpected weather conditions. Note that the difference between insurances and derivatives is that, the payoff for insurance is determined by the loss associated with the underlying event, whereas for derivatives, the payoff is determined based on the value of the underlying index, i.e., weather data in the case of weather derivatives; it does not matter if the actual loss was caused due to the change of weather condition.

It should be mentioned that the total amount of transactions has been increasing worldwide. According to the Weather Risk Management Association,Footnote 1 the total limit of weather transactions executed amounted to $4.7 billion in the twelve months 2003–2004, but in the period 2005–2006, this number jumped nearly tenfold to $45.2 billion. There are a number of ways in which a weather derivative trade can take place. Primary market trades are usually over the counter (OTC), meaning that they are traded privately between the two counterparties. A growing part of the secondary market is traded on the Chicago Mercantile Exchange (CME), which lists, as of June 2010, weather derivatives on temperature for 24 cities in the US, 11 cities in Europe, 6 cities in Canada, and 6 cities in Japan and Australia.Footnote 2

In this chapter, we introduce weather derivatives based on wind conditions combined with their forecast information. In other words, we consider “wind derivatives” whose payoffs are determined by the forecast errors of wind conditions. Here we mainly explain the result of [2] where weather derivative contracts based on forecast errors are first demonstrated. It is fair to say that the most literature on weather derivatives discusses temperature related issues [3–9] in which the underlying index is defined by the observation data (of temperature) only. On the other hand, the weather derivatives considered here take the forecast data into account and the payoff depends on the difference between the actual and forecast data. Such a weather derivative contract is expected to be useful for hedging the possible loss (or risk) caused by forecast errors of power outputs associated with the forecast errors of wind conditions in wind energy businesses.

We use the following notation: For a sequence of observations of a variable, \( x_{n} ,\;n = 1, \ldots ,N \), the sample mean and the sample variance are denoted by \( {\text{Mean}}\left( {x_{n} } \right) \) and \( {\text{Var}}\left( {x_{n} } \right) \), respectively. \( {\text{Cov}}(x_{n} , y_{n} ) \) and \( {\text{Corr}}(x_{n} , y_{n} ) \) represent the sample covariance and the sample correlation, respectively, where \( y_{n} ,\;n = 1, \ldots ,N \) is a sequence of observations for another variable. The set of real number is denoted by \( \Re \), and an \( n \times m \) matrix with real entries is denoted by \( A \in \Re^{n \times m} \).

The rest of this chapter is organized as follows: In Sect. 2, we explain the basic structure of derivatives and show some foundations of pricing problems. In particular, we formulate a general pricing problem using a payoff function that satisfies a zero expected value condition. In Sect. 3, we demonstrate wind derivatives on forecast errors of wind speed, and provide hedging problems by introducing a loss function for a wind farm (WF). Then, we define four types of problems based on combinations of payoff and loss functions. An empirical analysis is provided in Sect. 4, where we estimate the hedge effect of wind derivatives using empirical data for a WF located in Japan. In Sect. 5, we make a further discussion concerning the risk management on forecast errors and provide a future research direction. Section 6 offers a summary of this chapter.

2 Basic Structure of Derivatives

Before discussing wind derivatives, we need to know some basic terminology and payoff structure which are common with financial derivatives.

2.1 Foundations of Derivative Pricing

A forward contract is probably the simplest example among all types of derivatives, which is a contract made at time 0 (without initial cost) to purchase or sell the underlying asset, say one stock, at a specific price (called the “forward price”) at a prespecified future time \( T > 0 \). If the stock price at time \( T \) is above the forward price, the buyer makes a profit by the amount of the difference between the actual (realized) price of stock and the forward price. On the other hand, the buyer makes a loss if the stock price drops below the forward price. In either case, the profit (or loss) for the buyer is given as

where \( S_{T} \) is the price of stock at time \( T \) and \( F_{0} \) is the forward price determined at time 0. We can say that the forward contract has a “payoff” of \( S_{T} - F_{0} \) at time \( T \) by considering the cash settlement. Figure 1 shows a payoff function of forward contract, where the \( x \)-axis refers to \( S_{T} \) and \( y \)-axis to the payoff. We see that the payoff function is linear in the case of forward contract.

On the other hand, the payoff function of call option has a nonlinear structure as depicted in Fig. 2, where a call option is a right (not obligation) to buy a stock at a future time \( T > 0 \) (i.e., the maturity) at a specific price \( K \) (called the “strike price”). In contrast with forward contracts, the option holder does not have to buy the underlying stock if \( S_{T} \le K \) at time \( T \), and in this case, the option becomes worthless. In other words, the value of option at time \( T \) is zero when \( S_{T} \le K \). Note that, if \( S_{T} > K \) holds, the option holder may be considered to earn a profit of \( S_{T} - K \) similar to the forward contract. Taking both cases into account, the payoff of call option at time \( T \) is given by

which provides a payoff function of \( S_{T} \) as shown in Fig. 2.

A put option is a right to sell a stock with a strike price \( K \) at a specified future time \( T \). With the similar argument, the payoff function of \( S_{T} \) is given by

and is drawn in Fig. 3.

Although one can introduce an option contract having a flexibility with respect to the choice of timing to sell or buy the underlying stock, here we focus on options and other derivatives whose payoffs occur at a given future time \( T > 0 \) only. Then the pricing problem at the initial time 0 may be formulated as follows:

Let \( V_{0} \) be the value of option at time 0. Then \( V_{0} \) may represent an initial cost to carry out such an option contract. On the other hand, the initial cost for a forward contract is always zero, which is an essential difference between forward and option contracts.

Instead of paying initial costs in option contracts, we can assume that the option holder pays a fixed amount at time \( T \), i.e., at the same time as the payoff is made. The fixed payment may correspond to the initial cost \( V_{0} \), but we need to take a time value into consideration, where a risk free interest rate \( r > 0 \) is compounded between time 0 and time \( T \). Then, the fixed payment at time \( T \) is computed to be \( e^{rT} V_{0} \), which is known at time 0. We can regard that this type of contract is a “swap” between a fixed payment, \( e^{rT} V_{0} \), and an uncertain payoff, e.g., \( \hbox{max} \left( {S_{T} - K,\;0} \right) \) in the case of call option. In this case, the payoff function of \( S_{T} \), denoted by \( \psi \left( {S_{T} } \right) \), for a call option is modified to

as shown in Fig. 4.

Note that the value denoted by Eq. (4) may be thought of a cash flow for the option holder at time \( T \). On the other hand, the cash flow for the counterparty (i.e., the seller for the option) is given as

Therefore, a fair contract may satisfy that the expected value of \( \psi \left( {S_{T} } \right) \) is zero, which may be written as follows:

where \( {\mathbb{E}} \) is the expected value operator. Then \( V_{0} \) is obtained as

Similarly, in the case of forward contracts, we have

which provides the forward price as follows:

According to the fundamental theorem of asset pricing [10], the pricing formula in (7) is valid if \( {\mathbb{E}} \) is defined under a risk neutral probability measure, that coincides with the original results of [11, 12] known as the “Black–Scholes–Merton model” for option pricing. On the other hand, in empirical data analysis, we usually work on the real probability measure so that the sample statistics (such as sample mean and variance) of observed data may provide proxies of the underlying probability distribution. Although one can usually transform the real probability measure to a risk neutral probability measure using a suitable change of measure technique, here we assume that, for simplicity, the real probability measure provides a risk neutral probability measure, and evaluate the value of derivatives under the real probability measure. Note that a further discussion of the relation between the real and risk neutral probability measures is beyond the scope of this article and that the interested reader may refer to [13].

2.2 General Pricing Problem with Payoff Functions

As discussed in the end of Sect. 2.1, the swap contract for a call option has a payoff function of (4) satisfying condition (6). Moreover, the forward price also satisfies (8). These conditions are generally said that swap and forward contracts have zero expected values with respect to payoff functions of \( S_{T} \), i.e.,

holds with a suitable choice of payoff function \( \psi \). For example, \( \psi \) is given as

for a forward contract, or

for a call option.

Then, the problem can be reformulated as follows:

where \( \varPsi \) is a set of functions defined as

in the case of forward contracts, or

in the case of call options. In any cases, we see that a given contract is fair as far as condition (10) is satisfied with a specific payoff function in \( \varPsi \), so that we can search for a suitable payoff function by taking \( \psi \in \varPsi \) as a variable. This is a basic idea for constructing payoff functions for wind derivatives in the following sections.

3 Wind Derivatives on Forecast Errors and Hedging Problems

In this section, we demonstrate wind derivatives with respect to forecast errors and define associated hedging problems.

3.1 Loss Functions for WFs and Problem Settings

We will consider two basic positions, a seller and a buyer, for trading wind generated electricity, in which the seller is assumed to be a WF having a responsibility to quote the promised power output in advance using forecast information. A possible sales contract for the power output may be described as follows, which specifies a loss function for a WF on forecast errors of power output:

In general, the value of electricity generated by wind power is considered to be low due to the uncertainty of the tradable volume. Here we assume that the electricity price without forecast is estimated to be 3 yen per 1 kWh. On the other hand, the value of the electricity would be estimated to be higher, if the tradable volume were quoted in advance by forecast, but the seller has to guarantee the quoted volume or has to pay the penalty in case of shortages. Suppose that the value of electricity with forecast is given as 7 yen per 1 kWh and that the penalty of the shortage is 10 yen per 1 kWh. These assumptions are not so far from the current situation discussed in the forecast business [14]. In this case, the loss function caused by forecast errors is depicted in Fig. 5, which shows the relation between the forecast error for the power output \( P - \hat{P} \) (the actual power output minus its forecast) and the loss caused by the forecast error. Note that, even if the forecast error is positive, we can also think of this situation as an opportunity loss to sell the output with a suitable price.

Taking the above situation into consideration, we formulate the problem more precisely. Let \( n = 1, \ldots ,N \) be the time index (say, hourly index) and define the following variables:

- \( P_{n} \) :

-

: Total power output at time n

- \( \hat{P}_{n} \) :

-

: Forecast of \( P_{n} \) (which is computed, e.g., 1 day in advance).

The buyer is willing to trade the power output by using the reference \( \hat{P}_{n} \), and may require a penalty if the forecast error exceeds a certain level.

Let \( \varepsilon_{p,n} (n = 1, \ldots ,N) \) be the forecast error of the power output at time \( n \), which causes a loss for the seller due to the penalty or opportunity loss to sell the output. Suppose that the loss associated with the forecast error of the power output is defined using a loss function as \( \phi \left( {\varepsilon_{p,n} } \right) \). For instance, the loss function may be given as the one shown in Fig. 5 if the seller is a WF owner. Also, there is a case in which the forecast is sufficiently accurate or the forecast error is less than a certain (small) level. In this case, the seller can be thought of getting a bonus because of a higher price of power output with forecast, which results in a profit for the seller and makes the loss negative, i.e., \( \phi \left( {\varepsilon_{p,n} } \right) < 0 \). We assume that

so that the sum of profit/loss is zero on average. Note that we take the sample mean instead of using the expected value operator \( {\mathbb{E}} \), because we will work on empirical data in the next section.

Consider a situation in which the seller with \( \phi \left( \cdot \right) \) would like to compensate their loss on \( \varepsilon_{p,n} \) using a weather derivative on the forecast error of the wind speed. To this end, define the following variables:

- \( W_{n} \) :

-

: Wind speed at time n

- \( \hat{{W_{n} }} \) :

-

: Forecast of \( W_{n} \) (which is computed, e.g., 1 day in advance).

Let \( \varepsilon_{w,n} \) be the forecast error of the wind speed. Without loss of generality, assume that \( {\text{Mean}}\left( {\varepsilon_{w,n} } \right) = 0 \). Let \( \psi \) be a payoff function such that

Note that, in the case of simple forward contracts, \( \psi \left( {\varepsilon_{w,n} } \right) \) may be given as a linear function, e.g.,

Based on the above settings, we will first consider the following problems:

-

(P1)

Given the loss function and the payoff function of wind derivatives, find the optimal volume of wind derivative.

-

(P2)

Given the loss function, find the optimal payoff function of wind derivatives.

We will investigate the hedge effect of wind derivatives and show that using wind derivatives on forecast error of wind speed is highly effective to hedge the loss caused by forecast errors of power output.

Then we will consider a situation in which there already exists a standardized derivative contract with a certain payoff function, but there is some room for improvement on the loss function, e.g., for a WF owner. The problem can be thought of as a reverse problem of (P2), which is given as follows:

-

(P3)

Given the payoff function of wind derivatives, find the optimal loss function against forecast errors of power output.

Finally, we will formulate a simultaneous optimization problem of payoff and loss functions as (P4) below:

-

(P4)

Optimize the payoff function of wind derivatives and the loss function simultaneously.

3.2 Standard Minimum Variance Hedging Problem

With the notation and definitions introduced in the previous subsection, the first optimization problem, (P1), is formulated as follows:

Contract volume optimization problem:

The contract volume optimization problem may be considered as the standard “minimum variance hedge,” and the optimal volume \( \varDelta^{ * } \) may be computed analytically as

To estimate the hedge effect, we define the variance reduction rate (VRR) as follows:

Because the minimum variance can be computed as

we obtain

Note that VRR satisfies

and that a smaller VRR provides a better hedge effect in terms of minimum variance.

In the case of standard minimum variance hedge, the optimal volume is also found by solving a linear regression problem, where \( \phi \left( {\varepsilon_{p,n} } \right) \) is regressed with respect to \( \psi \left( {\varepsilon_{w,n} } \right) \), and the regression coefficient gives the optimal volume for fixed loss and payoff functions. On the other hand, we can expect to obtain a better hedge effect if we could optimize the payoff function of the weather derivative directly. This can be done by applying non-parametric regression techniques introduced in the next section, and we will find that using a non-parametric regression corresponds to optimizing the derivative contract directly by choosing a suitable payoff function.

3.3 Minimum Variance Hedging Using Non-Parametric Regression

In this section, we first introduce a non-parametric regression technique, and then formulate the second optimization problem, (P2).

In the previous section, we showed that the contract volume optimization problem is formulated as standard minimum variance hedging and can be solved by applying linear regression. A similar idea may be employed to solve the payoff function optimization problem of (P2) [or the loss function optimization problem of (P3)] by introducing a non-parametric regression technique. Since we will apply a non-parametric regression to find a payoff function (or loss function) by assuming that a loss function (or payoff function) is fixed, it may be useful to specify which function is given explicitly. To this end, we use overlines as

to indicate that a loss function (or a payoff function) is fixed.

3.3.1 Generalized Additive Models

The non-parametric regression technique introduced here is to find a (cubic) smoothing spline that minimizes the so-called penalized residual sum of squares (PRSS) among all regression spline functions with two continuous derivatives. Let \( y_{n} \) and \( x_{n} \) be dependent and independent variables, respectively, and express \( y_{n} \) as

using a smooth function \( h( \cdot ) \) and residuals \( \varepsilon_{n} \). Here the function \( h( \cdot ) \) is a (cubic) smoothing spline that minimizes the following PRSS,

among all functions \( h\left( \cdot \right) \) with two continuous derivatives, where \( \lambda \) is a given parameter. In (23), the first term measures closeness to the data while the second term penalizes curvature in the function. Note that, if \( \lambda = 0 \) and \( h\left( \cdot \right) \) is given by a polynomial function, the problem is reduced to the standard regression polynomial and is solved by the least squares method. It is shown that (23) has an explicit and unique minimizer and that a candidate of optimal \( \lambda \) may be found by using the so-called generalized cross validation criteria (See [15]). Note that regression splines can be extended to the multivariable case with additive sums of smoothing splines, known as generalized additive models (GAMs; see e.g., [16]). Also note that GAMs can be computed using free software “R (http://cran.r-project.org/),” and we will refer to the class of smoothing splines for non-parametric regression as GAMs in this chapter. We will apply GAMs to solve (P2)–(P4) and estimate the hedge effect of wind derivatives.

Note that, instead of writing the problem as an unconstrained optimization problem, we can reformulate it as an optimization problem constrained on \( h\left( \cdot \right) \) as follows:

where \( \alpha \) is a given parameter. Based on the similar argument to that in [15], we can verify that the objective function of problem (24) is quadratic subject to a convex constraint and that the minimization problem (24) is equivalent to the following problem,

using a Lagrange multiplier \( \lambda > 0 \). Therefore, we see that fixing \( \lambda \) in (23) corresponds to fixing \( \alpha \) in (24) and that the non-parametric regression problem using GAM may be recast as a minimization problem of the sample variance with a smooth constraint.

3.3.2 Optimization of Derivative Contracts

It is in a position to formulate the the second optimization problem, i.e., the payoff function optimization problem, in the context of minimum variance hedge using non-parametric regression as follows:

Payoff function optimization problem:

The minimization problem (26) may be recast as (24) by taking \( y_{n} : = \overline{\phi } \left( {\varepsilon_{p,n} } \right) \), \( x_{n} : = \varepsilon_{w,n} \), and \( h\left( \cdot \right): = - \psi \left( \cdot \right) \), and therefore, can be solved by applying GAM. Let \( \psi^{ * } ( \cdot ) \) be the optimal payoff function. Then VRR may be defined as

Although it is possible to find the optimal payoff function by solving GAM once, it may be worthwhile to mention that we have a slight improvement by applying a linear regression after finding the optimal payoff function \( \psi^{ * } ( \cdot ) \) as

In this case, VRR may be given as

or equivalently,

where \( a^{ * } \in \Re \) is the regression coefficient to solve (28). Note that (30) is independent of \( a^{ * } \), or any scaling parameter to \( \psi^{ * } \left( {\varepsilon_{w,n} } \right) \), and that it can be computed if \( \psi^{ * } \left( \cdot \right) \) is specified. Therefore, we use the right hand side of (30) as a proxy of VRR. It is readily confirmed that VRR in (27) is actually an upper bound of (30). However, as indicated in the end of Sect. 4.2, the gap between (27) and (30) is very small from our numerical experience.

3.4 Optimization with Loss Functions and Simultaneous Optimization

3.4.1 Optimal Loss Function

Next, we will consider a case in which a payoff function of wind derivative is given but we would like to find a loss function that is desirable for using the wind derivative, i.e., in a case where there already exists a standardized derivative contract with a certain payoff function, but there is some room for improvement on the loss function \( \phi \) for a WF owner.

Assume that the loss function \( \phi \left( {\varepsilon_{p,n} } \right) \) satisfies

We will compute an optimal loss function satisfying the above constraints for a given payoff function \( \psi = \overline{\psi } \) such that

The problem is then formulated as follows:

-

Loss function optimization problem:

Note that the constraint \( {\text{Var}}\left( {\phi \left( {\varepsilon_{p,n} } \right)} \right) = c \) is also quadratic if \( \phi \) is given by a cubic natural spline function, and hence, the problem might be reformulated as an unconstrained optimization problem by introducing another Lagrangian term for the variance constraint. On the other hand, we can still apply GAM directly to solve the problem without the variance constraint (i.e., \( {\text{Var}}\left( {\phi \left( {\varepsilon_{p,n} } \right)} \right) = c \)), similar to the payoff function optimization problem (26). Then we can scale the minimizing function so that it satisfies the variance constraint (32). In this case, condition (31) is also satisfied.

Let \( \hat{\phi }\left( \cdot \right) \) be the optimizer of problem (34) without the variance constraint (i.e., \( {\text{Var}}\left( {\phi \left( {\varepsilon_{p,n} } \right)} \right) = c \)), which can be computed by applying GAM. By scaling \( \hat{\phi }\left( \cdot \right) \) to satisfy (32), we obtain the optimal loss function \( \phi^{ * } \left( \cdot \right) \) as follows:

Note that the optimal volume of wind derivative with the given payoff and loss functions, \( \overline{\psi } ( \cdot ) \) and \( \phi^{ * } ( \cdot ) \), will be found by solving the standard minimum variance hedging problem as in Sect. 3.2, and VRR may be computed as

3.4.2 Simultaneous Optimization

It may be interesting to consider a simultaneous optimization of the payoff and loss functions, \( \psi \left( {\varepsilon_{w,n} } \right) \) and \( \phi \left( {\varepsilon_{p,n} } \right) \). Recall that VRR can be computed using the correlation between the payoff function and the loss function as

Since the larger correlation the smaller VRR, the minimization of VRR boils down to the maximization of correlation between \( \phi \left( {\varepsilon_{p,n} } \right) \) and \( \psi \left( {\varepsilon_{w,n} } \right) \). Therefore, the simultaneous optimization of the payoff and the loss functions may be formulated as follows:

-

Simultaneous optimization problem:

The simultaneous optimization problem may be solved using an iterative algorithm by solving the payoff function optimization problem with \( \phi ( \cdot ) = \overline{\phi } ( \cdot ) \) fixed, or the loss function optimization problem with \( \psi ( \cdot ) = \overline{\psi } ( \cdot ) \) fixed, at each step. The following is the iterative algorithm:

Iterative algorithm:

-

1.

Given \( \phi ( \cdot ) = \overline{\phi } ( \cdot ) \), find \( \psi ( \cdot ) \) to solve the payoff function optimization problem. Let \( \psi^{ * } ( \cdot ) \) be the optimal function, and let \( \overline{\psi } ( \cdot ) = \psi^{ * } ( \cdot ) \).

-

2.

Given \( \psi ( \cdot ) = \overline{\psi } ( \cdot ) \), find \( \phi ( \cdot ) \) to solve the loss function optimization problem. Let \( \phi^{ * } ( \cdot ) \) be the optimal loss function and let \( \overline{\phi } ( \cdot ) = \phi^{ * } ( \cdot ) \).

-

3.

Repeat steps 2 and 3 until the objective function in (37) does not change.

Note that the optimal loss function obtained from the above iterative algorithm satisfies (32) and that we can consider additional constraints to take more realistic situations into account for the loss and payoff functions. Although we may need to specify \( \alpha_{\theta } \) and \( \alpha_{\phi } \) for solving the iterative algorithm, an optimal selection of smoothing parameters for \( \phi ( \cdot ) \) and \( \psi ( \cdot ) \) may be applicable at each step by using GAMs in stead of fixing these parameters a priori in the algorithm.

Remark 1

The above iterative algorithm is formally in the class of so-called “Alternating Conditional Expectations (ACE) algorithm (see, e.g., Chap. 7 of [16]).” The ACE algorithm seeks optimal transformations of \( \theta (Y) \) and \( f(X) \) for two random variables \( X \) and \( Y \) so that the squared error loss

is minimized. Since the zero functions trivially minimize the square error, ACE has a constraint so that \( \theta (Y) \) has unit variance at each step, which is exactly the same as our variance constraint (32). Note that the convergence of ACE algorithm is also discussed in [16], although we omit the details for brevity.

4 Empirical Analysis and Numerical Experiment

In this section, we demonstrate the solutions to (P1)–(P4) and estimate their hedge effect using empirical data for the power output, wind speed, and their forecasts.

4.1 Data Description and Preliminary Analysis

Here we consider the power output from a WF located in Japan, where the power output from the WF is predicted based on the numerical weather forecast and the power generating properties for turbines. The numerical weather forecast consists of the following two steps:

-

Japan Meteorological Agency announces the hourly data of regional spectral models for the next 51 h twice a day (9 am and 9 pm).

-

Using them as initial and boundary values, a public weather forecasting company computes more sophisticated values for the next day’s hourly data by 12 pm.

In this chapter, we use the forecast data obtained from the Local Circulation Assessment and Forecast System (LOCALS) developed by ITOCHU Techno-Solutions Corporation for the wind speed and the power output of a WF in Japan [17, 18]. The data set is given as followsFootnote 3:

-

Data specifications:

Realized and predicted values of total power output for the WF, and those of wind speed for the observation tower in the WF.

-

Data period:

2002–2003 (1 year), hourly data, everyday.

-

Total number of data:

8,000 for each variable excluding missing values.

Let \( n = 1, \ldots ,N \) be the time index (where \( N\,{ \simeq }\,8,000 \)), and assume that the actual power output and the wind speed at time \( n \) are, respectively, denoted by \( P_{n} \) and \( W_{n} \). Also, let \( \hat{P}_{n} \) and \( \hat{W}_{n} \) be the forecasts of the corresponding power output and the wind speed obtained from LOCALS, which are computed by noon one day before the actual data is observed. Figure 6 shows a scatter diagram for the wind speed \( W_{n} \) and the power output \( P_{n} \), where the power output \( P_{n} \) is normalized so that its maximum equals 100. From Fig. 6, we can see that:

-

The generator starts providing the power output when the wind speed exceeds around 2 [m/s].

-

The power output increases with the wind speed between 5–15 [m/s].

Also note that, because each electricity generator is controlled so that the maximum output does not exceed a certain value, the total output is also bounded as shown in Fig. 6.

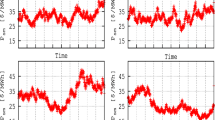

Figure 7 shows a partial residual plot for

i.e., the scatter diagram of \( \left( {\hat{W}_{n} ,\;W_{n} - b_{w} } \right) \), where \( a_{w} \) and \( b_{w} \) are a regression coefficient and an intercept, respectively, and \( \varepsilon_{w,n} \) is a residual satisfying \( \left( {\varepsilon_{p,n} } \right) = 0 \). The partial regression line is depicted using a solid straight line as shown in Fig. 7. In this case, the sample variance of residuals is found to be

On the other hand, the regression spline \( f( \cdot ) \) to fit the same data of Fig. 7 using GAM is shown as a solid line in Fig. 8, where \( f\left( \cdot \right) \) satisfies

In this case, the sample variance of the residuals is

Noting that the sample variance of the measured values is computed as “11.0,” we can say that the variance of the wind speed is reduced by 50 % (from “11.0” to “5.12”) using the predicted value and the linear regression, and it is improved a little using GAM, i.e., from “5.12” to “4.95.” In this section, we define the forecast error of the wind speed as the one given by GAMs, i.e., \( \varepsilon_{w,n} \) in (40).

Similarly, we can draw a partial residual plot for the power output \( P_{n} \) with respect to the predicted value \( \hat{P}_{n} \) as shown in Fig. 9, where the solid line is obtained from a linear regression for partial residuals. In this case, the sample variance of the residuals is found to be “249.” The solid line in Fig. 10 refers to the regression spline function \( g\left( \cdot \right) \) satisfying

using GAM. Note that the sample variance of residuals in this case is given as “239”, whereas the sample variance of the measured value of the power output is “504”. Similar to the case of wind speed, we can say that the variance of power output is reduced to less than half (from “504” to “249”) using the predicted value and the linear regression, and it is improved a little using GAM, i.e., “249” to “239”.

Although we should be able to define the forecast error of the power output using the residual in (42), it might be worthwhile to mention that there is another way to define the forecast error of the power output. As stated in the beginning of this section, the power output is predicted using numerical weather forecast, and therefore, we can define a regression model such that the power output \( P_{n} \) is a dependent variable and the wind speed forecast \( \hat{W}_{n} \) is an independent variable, i.e.,

where \( h( \cdot ) \) is a regression spline that minimizes PRSS.

Figure 11 shows the relation between the predicted values of the wind speed and the measured values for the power output, where the solid line in Fig. 12 is the regression spline \( h( \cdot ) \). In this case, the sample variance of the residuals is computed as

which is, in fact, higher than the one given by (42). However, it will turn out that using the forecast error in (43) provides not only a better hedge effect but also a smaller variance of the hedged loss when combining with the optimal wind derivative. Therefore, we will use the residual \( \varepsilon_{p,n} \) in (43) to define the forecast error of the power output. An empirical analysis using the forecast error defined by the residual in (42) may be found in [19].

4.2 Construction of Wind Derivatives

Next, we will construct wind derivatives and demonstrate their hedge effect on wind power energy businesses.

We first solve the minimum variance hedging problem for the simplest case where the loss and the payoff functions are both linear. Let

without loss of generality. In this case, the problem is reduced to solving a linear regression for the following regression function:

where \( \eta_{n} \) is a residual. Since the linear regression computes \( a_{w} \) that minimizes variance of \( \eta_{n} = \varepsilon_{p,n} - a_{w} \varepsilon_{w,n} \), the regression coefficient provides the optimal volume as

in the problem (16) under condition (45), where

Figure 13 shows a scatter plot of \( \varepsilon_{w,n} \) versus \( \varepsilon_{p,n} \) with a linear regression line. The sample correlation is computed as

and VRR as

We see that the forecast errors of the wind speed and the power output, \( \varepsilon_{w,n} \) and \( \varepsilon_{p,n} \), are highly correlated and that the sample variance is reduced to 43 % from the original one using the wind derivative in the case where the loss and the payoff functions are both linear.

Now, we apply GAMs to compute an optimal payoff function. The solid line in Fig. 14 shows the optimal payoff curve obtained by solving the optimization problem (26) when \( \phi ( \cdot ) \) is linear. In this case, the VRR is computed as

where \( \psi^{ * } \left( \cdot \right) \) is the optimal payoff function. Moreover, the variance of the hedged loss \( \varepsilon_{p,n} + \psi^{ * } \left( {\varepsilon_{w,n} } \right) \) is computed as

The above variance is actually lower than that of the hedged loss using (42) with the optimal wind derivative, which is computed as “119”. Therefore, we see that, even though the variance of the original loss might be larger, it can be reduced more effectively by combining it with the wind derivative if we define the forecast error by (43) instead of (42).

Next, we will consider the case in which the loss function \( \phi ( \cdot ) = \overline{\phi } ( \cdot ) \) is given as shown in Fig. 5 with zero mean constraint (13), i.e.,

where

and \( \left| \cdot \right|^{ + } \) and \( \left| \cdot \right|^{ - } \) are defined as

for \( x \in \Re \). The solid line in Fig. 15 shows the optimal payoff function to solve the problem (26). In this case, VRR in (27) is computed as

whereas the right hand side of (30) is found to be

From this example, we see that VRR can be approximated by (30) with high accuracy.

4.2.1 Optimal Loss Function and Simultaneous Optimization

In this subsection, we first provide an illustrative example for solving (P3) to compute an optimal loss function, and then solve the simultaneous optimization problem of (P4).

Since the linear correlation between \( \varepsilon_{p,n} \) and \( \varepsilon_{w,n} \) is high in this example, it would be more interesting to consider the case where a payoff function is non-linear with respect to \( \varepsilon_{w,n} \). Therefore, we assume that there already exists a derivative contract with the payoff being proportional to the size of the wind speed forecast error, \( \left| {\varepsilon_{w,n} } \right| \). Noting that \( \psi \left( {\varepsilon_{w,n} } \right) \) satisfies (14), such a payoff function may be given as

Fig. 16 shows the payoff function with respect to \( \varepsilon_{w,n} \).

Now we will solve (P3) with the given payoff function in (56). Assume that the sample variance of the loss, \( \phi \left( {\varepsilon_{p,n} } \right) \), satisfies

and we solve the problem (34) with the assumption that the optimal loss function satisfies the above variance constraint. The solid line in Fig. 17 shows the optimal loss function, which is obtained by applying GAM and scaling the minimizing function as in (35). In this case, VRR is found to be

Next, we demonstrate the simultaneous optimization of P4). Here we also introduce a nonlinearity using the absolute value of \( \varepsilon_{w,n} \). Assume that the payoff of the wind derivative is a function of \( \left| {\varepsilon_{w,n} } \right| \), and consider a maximization problem of

We apply the iterative algorithm for a fixed loss function \( \phi \left( \cdot \right) \) or a fixed payoff function \( \psi \left( \cdot \right) \) at each step to maximize (59). Assume that the payoff function is initially set to the one given in (56) and we solve the loss function optimization problem. The initial loss function in this case is given by the one shown in Fig. 17. We repeatedly apply steps 1 and 2 in the iterative algorithm until the objective function does not change or the relative change of the values of the objective function is less than a sufficiently small number. In this example, we obtained

after the 8th iteration. Figure 18 shows the optimal loss function after the 8th iteration, where the loss function is scaled to satisfy the variance constraint (57). We see that the loss function became smoother compared to the one given in Fig. 17.

5 Further Discussion

The main contribution of this study is summarized as follows:

-

Constructed a type of weather derivative contracts based on the forecast errors, which might be applicable for other situations (or businesses) and/or other indices such as temperature, rain falls, and so on.

-

Provided an application of non-parametric regression techniques in the context of minimum variance hedge using smooth functions, which can be thought of a generalization of the standard minimum variance hedge based on linear regression.

Here we assumed that the payoff functions are just smooth. Therefore, the approximation of these functions using the standard payoff functions for puts or calls may be required in practice when the standardized derivative contracts are only available. Also, the convergence of the iterative algorithm for simultaneous optimization is an important issue. These are interesting topics to be discussed further in the future work.

It should be mentioned that there is another important issue concerning the risk management on forecast errors such as usage of storage battery system, i.e., a storage battery may be installed to compensate the shortage of the scheduled power output of a WF. Note that the advantage of installing the storage battery is not only to achieve the scheduled power output in certain period, but also to reduce the variability of the wind generated electricity that may significantly effect on the frequency of electricity grid. However, the installation of storage battery requires an additional cost [20], say, as much as the total capacity of the WF in the worst case scenario that the WF quoted the maximum power output but the actual one was zero. As the capacity of storage battery is reduced, the installation cost becomes lower, but in this case, the possibility of shortage may be increased. Therefore, in such a situation, we may still need wind derivatives to hedge the loss caused by forecast errors. For the wind power energy business to be profitable, it should be important to study an optimal balance of the capacity of storage battery and the possible introduction of wind derivatives.

6 Summary

In this chapter, we have introduced weather derivatives based on wind conditions combined with their forecast information, namely ``wind derivatives.’’ The payoffs of wind derivatives were determined by the forecast errors in contrast to the standard weather derivatives in which the underlying index is given by observed weather data only (say, temperature). In other words, the wind derivatives discussed here take advantage of forecast data and the payoff depends on the difference between the actual and forecast data.

Here we began by explaining the basic structure which are common with financial derivatives and showed some foundations of pricing problems. In particular, we demonstrated a general pricing problem using a payoff function that satisfies a zero expected value condition. Then, we introduced wind derivatives on forecast errors, and derived a loss function for a WF based on the possible sales contract using forecasts. The following four types of optimization problems are formulated using combinations of payoff and loss functions: The first is a contract volume optimization problem that computes an optimal volume of wind derivatives for given loss and payoff functions. The second is a payoff function optimization problem that constructs optimal payoff function using a non-parametric regression technique called GAM. The third is a loss function optimization problem to find an optimal loss function that is desirable for a given payoff function of wind derivative, i.e., in a case where there already exists a standardized derivative contract with a certain payoff function, but there is some room for improvement on the loss function for a WF owner. The forth is a simultaneous optimization problem of loss and payoff functions, which may be solved using an iterative algorithm for a given payoff function or a loss function. To estimate the hedge effect, we defined the VRR as the ratio of variances of the losses with and without the hedge.

An empirical analysis was provided using the total power output data of a WF located in Japan, the wind speed data at the observation tower in the WF, and their forecasts. The power output from the WF was predicted based on the numerical weather forecast and the power generating properties for turbines. In particular, we used the forecast data of the power output and the wind speed obtained from LOCALS developed by ITOCHU Techno-Solutions Corporation. Based on the empirical data, we first solved the contract volume optimization problem in the case where the loss and the payoff functions are both linear. In this case, we saw from the VRR that the sample variance was reduced to 43 % from the original one using the wind derivative. Then, we applied GAMs and computed an optimal payoff function, where the VRR was obtained as \( {\kern 1pt} {\text{VRR}}{\kern 1pt} \simeq 0.407 \), showing the slight improvement by using GAMs. Also, we considered the case in which the loss function is given as the one used in the example of sales contract to compare the original VRR with its approximation formula given by one minus squared correlation coefficient. In this case, we were able to obtain a high accuracy of approximation.

Next, we solved the loss function optimization problem by introducing a nonlinearity using the absolute value of wind speed forecast error. We assumed that the payoff function is proportional to the size of wind speed forecast error and obtained \( {\kern 1pt}{\text{VRR}}{\kern 1pt} \simeq 0.56 \) by solving the problem. Then, we applied the iterative algorithm to solve the simultaneous optimization problem, where the initial payoff function was set to the same as in the above loss function optimization problem. We repeated the iterative procedure until the relative change of objective function is less than a sufficiently small number. By solving the simultaneous optimization, we concluded that VRR was improved from \( {\kern 1pt} {\text{VRR}}{\kern 1pt} \simeq 0.56 \) to \( {\kern 1pt} {\text{VRR}}{\kern 1pt} \simeq 0.53 \) compared to the case of loss function optimization.

Notes

- 1.

See http://www.wrma.org/.

- 2.

- 3.

All the data used in this chapter were provided by ITOCHU Techno-Solutions Corporation.

References

Jewson S, Brix A and Ziehmann C (2005) Weather derivative valuation—the meteorological statistical financial and mathematical foundations. Cambridge University Press, Cambridge

Yamada Y (2008) Optimal hedging of prediction errors using prediction errors. Asia-Pacific Finan Mark 15(1):67–95

Brody DC, Syroka J, Zervos M (2002) Dynamical pricing of weather derivatives. Quant Financ 2:189–198

Cao M, Wei J (2004) Weather derivatives valuation and market price of weather risk. J Futures Mark 24(11):1065–1089

Davis M (2001) Pricing weather derivatives by marginal value. Quant Financ 1:305–308

Kariya T (2003) Weather risk swap valuation Working Paper Institute of Economic Research. Kyoto University, Japan

Platen E, West J (2004) Fair pricing of weather derivatives. Asia-Pacific Finan Mark 11(1):23–53

Yamada Y (2007) Valuation and hedging of weather derivatives on monthly average temperature. J Risk 10(1):101–125

Yamada Y, Iida M, and Tsubaki H (2006) Pricing of weather derivatives based on trend prediction and their hedge effect on business risks. Proc inst stat math 54(1):57–78 (in Japanese)

Harrison JM, Pliska SR (1981) Martingales and stochastic integrals in the theory of continuous trading. Stoch Process Appl 11(3):215–260

Black F, Scholes M (1973) The pricing of options and corporate liabilities. J Polit Econ 81:637–654

Merton RC (1973) Theory of rational option pricing. Bell J Econ Manage Sci 4(1):141–183

Shreve SE (2004) Stochastic calculus for finance (2): continuous-time models. Springer, New York

Takano T (2006) Natural Energy Power and Energy Storing Technology, trans Inst Electri Eng Jpn (B) 126(9):857–860 (in Japanese)

Wood SN (2006) Generalized additive models: an introduction with R. Chapman and Hall, London

Hastie T, Tibshirani R (2005) Generalized additive models. Cambridge University Press, Cambridge

Enomoto S, Inomata N, Yamada T, Chiba H, Tanikawa R, Oota T and Fukuda H (2001)Prediction of power output from wind farm using local meteorological analysis. Proceedings of European Wind Energy Conference, Copenhagen, Denmark, p 749–752

Tanikawa R (2001) Development of the wind simulation model by LOCALS and examination of some studies, Nagare, p.405–415 (in Japanese)

Yamada Y (2008) Optimal design of wind derivatives based on prediction errors. JAFEE J 7:152–181 (in Japanese)

Tanabe T, Sato T, Tanikawa R, Aoki I, Funabashi T, and Yokoyama R (2008) Generation scheduling for wind power generation by storage battery system and meteorological forecast. IEEE Power and Energy Society General Meeting—Conversion and Delivery of Electrical Energy in the 21st Century, pp 1–7

Geman H (1999) Insurance and Weather Derivatives, Risk Books

Takezawa K (2006) Introduction to nonparametric regression. Wiley, New Jersey

Acknowledgments

The author would like to thank H. Fukuda, R. Tanikawa, and N. Hayashi from ITOCHU Techno-Solutions Corporation for their helpful comments and discussions.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2013 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Yamada, Y. (2013). Risk Management Tools for Wind Power Trades: Weather Derivatives on Forecast Errors. In: Pardalos, P., Rebennack, S., Pereira, M., Iliadis, N., Pappu, V. (eds) Handbook of Wind Power Systems. Energy Systems. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-41080-2_3

Download citation

DOI: https://doi.org/10.1007/978-3-642-41080-2_3

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-41079-6

Online ISBN: 978-3-642-41080-2

eBook Packages: EnergyEnergy (R0)