Abstract

This study is concerned with the evaluation of wind power projects under the Clean Development Mechanism (CDM), not only for the purpose of CDM verification, but also for the financing of the project. A real options model is developed in this paper to evaluate the investment decisions on wind power project. The model obtains the real value of the project and determines the optimal time to invest wind power project. Stochastic programming is employed to evaluate the real options model, and a scenario tree, generated by path-based sampling method and LHS discretization, is constructed to approximate the original stochastic program.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

9.1 Introduction

Environmental issues have received global attention and carbon trading is considered to be a primary solution to reduce greenhouse gas (GHG) emissions. As a developing country, China is mainly involved in the Clean Development Mechanism (CDM), which is one of the instruments created by the Kyoto Protocol to facilitate carbon trading, and China’s corporations related to environmental investments are facing the decision problems under the uncertainty of carbon price.

According to the statistics of international wind energy committee, over 80 % of carbon emissions come from the energy industry, of which 40 % is due to the generation of electricity. Wind energy holds huge potential in emission reduction since it produces no greenhouse gas. Despite the fact that the production of a windmill itself consumes a significant amount of energy (about 3–6 months of power generated by the plant) and hence causing carbon emission, the average life length of wind turbine can last 20 years or so. Since the implementation of CDM, wind power in China gets substantial development. In 2008, there were 314 wind power projects in China, ranking first in the world, amidst the world total of 647.

However, recent wind power project applications have suffered a major setback due to policy changes of the CDM Executive Board (CDM EB). In 2010, up to 14 wind power projects from China were rejected by the CDM EB. For a wind power project to be approved, the applicant has to show that the project can effectively reduce carbon emission and that the project will be profitable—the argument of ‘additionality’. It is mainly the latter requirement that rule out projects that need funding from CDM. Also, a project can qualify for CDM funding only if no other private investment has been sought and secured. The CDM EB will not approve an application if the applicant is unable to produce a valid revenue/profit model for evaluation by the CDM EB. Therefore, it is interesting to study the real value of wind power projects under CDM mechanism, not only for the purpose of CDM verification, but also for the financing of the project.

In fact, the revenue of a CDM wind power project comes from two parts: income of electricity and earning from Certified Emission Reductions (CERs). The uncertainty of carbon price makes the evaluation of wind power projects more difficult. Low net present value (NPV) means little reward for investors. However, if the strategic value and options value could be considered also, the real value would be different from traditional NPV.

Traditionally, investment decisions are evaluated by means of the discounted cash flow method (DCF) in which the NPV of an investment is often used. However, DCF often tends to underestimate the value of high technology projects which may actually be viable, mainly because of the conservatively high risk rate assumed at the beginning of the investment. Moreover, DCF is not an adequate methodology as the situation requiring strategic flexibility, where investment decisions can, at some cost, be deferred to some proper future date. Another drawback of DCF is that it cannot deal with the possible varying cost of GHG emission credits.

In reality, corporations have the option to defer investment to some future date. One tool that can prove beneficial in this type of investment environment is the use of real options. This approach treats options at different stages as part of its overall decision making process. A real options model is developed in this paper to evaluate the investment decisions on wind power projects under the CDM mechanism. The model determines the optimal time to invest wind power project using real options. Stochastic programming is employed to evaluate the real options embedded in the wind power project investment.

9.2 Literature Review

9.2.1 Environmental Investment Methods

As organisations are becoming increasingly environmentally conscious, the related investment decisions have become an important consideration for management. Some studies have discussed how environmental investments could benefit organisations (Nehrt 1996; Porter and van der Linde 1995; Bonifant et al. 1995). Nevertheless, many studies seem to investigate the issues in an empirical or conceptual way, and do not incorporate any quantitative analysis. On the other hand, some quantitative techniques have been proposed, such as stochastic dynamic optimisation (Birge and Rosa 1996), mixed integer programming (Mondschein and Schilkrut 1997), activity based costing (Presley and Sarkis 1994), and data envelopment analysis (Sarkis 1999). Although these models are advanced and mathematically complex, the most popular technique used by organisations still is the DCF method, which is essentially a cost-benefit analysis based on the time value of money. The DCF method, which is mainly based on the evaluation NPV, is simple and practical. However, DCF largely has ignored the option to defer an investment. It thus seems that the dynamic option value embedded in the options approach, which can be very useful in analysing some investments, has not been adequately explored in assessing the true value of a technology project.

9.2.2 Real Options Analysis

The fundamental hypothesis of the traditional DCF method is that future cash flows are static and certain, and management does not need to rectify an investment strategy in face of changing circumstances (Myers 1977). Nevertheless, this is inconsistent with the real-life situations. In practice, corporations often face many uncertainties and risks, and the management has to deal address such uncertainties proactively. This means that the issues of operating flexibility time strategy have to be considered (Donaldson et al. 1983).

Other than DCF, real options analysis can be used to deal with investment options and managerial flexibility. The real options method has its roots in financial options, and it is the application and development of financial options in the field of real assets investment. It is generally agreed that the pioneering work in real options was due to Myers (1977). The work suggested that, although corporation investments do not possess of forms like contract as financial options do, investments under a situation of high uncertainty still have characteristics which are similar to financial options. Therefore, the options pricing method can be used to evaluate the investments. Subsequently, Myers and Turnbull (1977) suggested a ‘Growth Options’ for corporation investment opportunity. Kester (1984) further developed Myers’ research, and argued that even a project with an unfavourable NPV could also have investment value if the manager had the flexibility to defer investment until a later date.

After three decades of development, the theory of real options has become an important branch and a popular research topic. By examining the different managerial flexibility embedded in real options were able to divide real options into seven categories: Option to Defer, Option to Alter Operating Scale, Option to Abandon, Option to Switch, and so on. Other types of options have also been proposed and studied by researchers (O’Brien et al. 2003; Sing 2002).

The real options theory has been applied to investment problems in many different fields including biotechnology, natural resources, research and development, securities evaluation, corporation strategy, technology and so on (Miller and Park 2002). It has also been applied to a gas company in Britain, leading to the conclusion that certain projects are not economically feasible unless they are permitted to have a faster price rise (Sarkis and Tamarkin 2005). Qin and Chu (2011) developed a real options model to determine the optimal time to invest in Carbon Capture and Storage (CCS) project in China, and analysed the behaviour of China green technology business. It took the emission credits cost into consideration and verified the real options analysis by evaluating environmental related investments.

9.2.3 Stochastic Programming

Stochastic programming is a popular modelling framework for decision making problems under uncertainty in a variety of disciplines. Applications can be found in fields such as portfolio optimisation (Cariño et al. 1998; Cariño and Ziemba 1998) and power generation (Dentcheva 1998). Benefited from the well developed optimisation techniques in mathematical programming, stochastic programming is insensitive to the stochastic processes and constraints, and thus can easily be applied to complex decision making problems including valuating compound real options with path dependency. de Neufville (2004) employed stochastic mixed integer programming to manage path dependency and interdependency of compound real options embedded in a water resources planning problem.

In this paper, stochastic programming is chosen for solving the wind power investment problem for the reason that it can easily model the complexity of the portfolio of the real options embedded regardless of the stochastic processes of uncertain factors.

9.3 Real Options Model

A license to invest in a wind power plant is a real option, which means that the investor has the right, but not the obligation, to exercise the payment of investment to obtain the revenue from the project. Facing the uncertain future and the irreversibility of decisions, the investor would value the opportunity to wait and get more information about future conditions. The objective of this real options model is to obtain an optimal timing of a wind power investment decision problem under carbon price uncertainty.

9.3.1 The Deterministic Model

Different from the traditional NPV method, the real options analysis considers not only whether to invest, but also when to invest. The opportunity to invest in a wind power plant could be taken as an option, whose value is given by the following equation:

where NPVs is the static NPV of the wind power project investment without considering any management flexibility, i.e., investment is made at stage t = 1. NPVo is the investment with timing options, i.e., the investor could delay the investment to the optimal time. Let T be the numbers of the planning periods, normally it is around 20 years as the franchise periods of wind power project in China is 25 years, and it takes several years to construct the power plant. The decision variable is denoted as Xt, where Xt is a 0–1 variable. If the investor exercises the investment at stage t, Xt = 1. Otherwise Xt = 0. \( t \in \left\{ 1, \ldots ,T \right\} \).

Under the CDM mechanism, the revenues due to the investment in wind power come from two sources. The first is derived from the income of the electricity generated and sold (RE). RE is deterministic because the feed-in tariff in China is determined in the bidding. The other revenue is made due to the income of CERs (RC), which is uncertain because the carbon price varies from time to time. The revenue of investment R (per kWh) in wind power is the sum of these two parts: R = RE + RC. In the proposed real options model, we will focus on the income of CERs.

If the wind power plant produces Et (tonne) CERs per unit electricity output every year, and all the CERs are tradable in the carbon trading market. Then, the income from CERs sales is At * Et. Denote by It the initial investment, and the construction will take λ years, Qt as the annual generating capacity (kWh) of the wind power plant, Ct as the unit cost of generating output, NPVo can be expressed as follow:

where

- It :

-

Initial investment

- Qt :

-

Annual generating capacity

- Ct :

-

Unit cost of generating output

- Et :

-

Annual CERs emission

- λ :

-

Construction period

- γ :

-

Discount rate

- γ f :

-

Risk-free rate.

To obtain the real options value, we need to maximise the NPVo. The decision problem can be described as:

s.t.

9.3.2 The Stochastic Model

The revenue of investment R (per kWh) in wind power is uncertain because of the uncertainty of the revenue from CERs (RC), which can change considerably depending on factors such as environment policy legislation, cost of alternative fuels, product market demand and so on. Assume the price of CERs At shifts stochastically over time represented by the geometric Brownian motions:

where

- A t :

-

Price of CERs at the end of time period t

- W t :

-

The standard Brownian motions process

- μ :

-

Carbon price drift

- σ :

-

Carbon price volatility.

The stochastic process is assumed to be exogenous and independent of the decision variables in the deterministic model. In addition, the process is considered to follow some discrete distributions. A scenario tree is used to represent this type of discrete stochastic process.

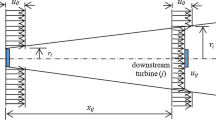

Figure 9.1 shows a scenario tree representing the evolution paths of the stochastic variable At. The nodes in the tree are the states of At. A decision is made at each node so as to choose an option to exercise. Over the planning horizon, each particular scenario is reflected by the path from the root node to the particular ending node. At stage t, nodes are indexed as (t, n), the number of nodes is Nt, where \( \in \left\{ t, \ldots ,T \right\} \) and \( n \in \left\{ t, \ldots ,N^{t} \right\} \). Carbon price on node (t, n) is expressed as \( P_{n}^{t} \), and the unconditional probability is expressed as \( P_{n}^{t} \). Thus, a scenario can be expressed as the vector of \( \left[ {1,n^{2} , \ldots ,n^{t} , \ldots n^{T} } \right] \), with probability \( \Uppi P_{n}^{T} \). Some of the variables and parameters used in the deterministic model should be modified as follows:

Based on the notations above, NPVo can be modified as follows:

and the decision problem can be expressed as:

s.t.

9.3.3 Scenario Generation

Given the assumption that the prices of CERs \( A_{n}^{t} \) shift stochastically over time represented by the geometric Brownian motions, which is expressed in Eq. (9.4), the sample paths of \( A_{n}^{t} \) can be obtained. Figure 9.2 shows the result of 50 sample paths with parameter values in Table 9.1.

In general, continuous distributions cannot be incorporated directly in stochastic programs because of the infinite number of scenarios that need to be examined. For this reason, discrete distributions are generally used to approximate the continuous distribution of stochastic parameters. The quality of scenario tree, which consists of such discretized distributions, is vital to the accuracy of the final solutions.

Various methods have been proposed to generate scenario tree. These can be classified into external sampling and internal sampling methods. External sampling methods consist of optimal discretization sampling, conditional sampling, moment-matching, and path-based sampling. Internal sampling is actually a stochastic program solving algorithm with scenarios to be sampled during the solution procedure. Commonly used internal sampling methods are stochastic decomposition, stochastic quasi-gradient, EVPI-based sequential important sampling (Chu et al. 2005).

Equation (9.4) describes the price of CERs \( A_{n}^{t} \) as a known stochastic process. For the sake of simplicity, path-based sampling is applied to generate the scenario tree, and Latin Hypercube Sampling (LHS) is employed in this study to discretize \( A_{n}^{t} \).

9.4 Case Study

In order to investigate the application of stochastic programming in the evaluation of real options, a case study is carried out. Data are collected from a wind power station in Huitengshile Inner Mongolia China, which began its construction in 2005 and went into operation in 2008 (Zhu 2011). The data is shown in Table 9.1.

We sampled 500 scenarios by LHS. The \( NPV_{0}^{ * } \) is found to be 4.278 million Yuan at year 11, whereas the static NPV is 2.045 million Yuan. The difference between them is the value of real options embedded in the wind power project investment. If the strategic value and options value are not considered, the real value would be underestimated. However, the result also shows that investor tends to delay the exercise of wind power investment until the price of CERs increases to certain level.

9.5 Conclusion

Stochastic programming is a powerful technique for solving decision making problems under uncertainty. In this study, a real options model is developed to evaluate the investment decisions on wind power projects under the CDM. A scenario tree, generated by path-based sampling method and LHS discretization, is constructed to approximate the original stochastic program.

This study has considered only the option to delay in the investment of wind power projects. However, there are other important types of options to consider during the operation of wind power projects, especially under the CDM and China’s franchise clause for power station operation. The proposed model can be extended to incorporate abandon options. In addition, multi-players can also be considered to study the optimal bidding price of electricity.

References

Birge JR, Rosa CH (1996) Incorporating investment uncertainty into green-house policy models. Energy J 17:79–90

Bonifant BC, Arnold MB, Long FJ (1995) Gaining competitive advantage through environmental investments. Bus Horiz 38:37–47

Cariño DR, Ziemba WT (1998) Formulation of the Russell-Yasuda Kasai financial planning model. Oper Res 46:433–449

Cariño DR, Myers DH, Ziemba WT (1998) Concepts, technical issues, and uses of the Russell-Yasuda Kasai financial planning model. Oper Res 46:450–462

Chu LK, Xu YH, Mak KL (2005) Evaluation of interacting real options in RFID technology investment: a multistage stochastic integer programming model. Presented at the 14th international conference on management of technology, Austria

de Neufville TWR (2004) Building real options into physical systems with stochastic mixed integer programming. Presented at the 8th international conference on real options, Montreal

Dentcheva WRD (1998) Optimal power generation under uncertainty via stochastic programming. In: Marti K, Kail P (eds) Stochastic programming methods and technical applications. Springer, Berlin, pp 22–56

Donaldson G, Lorsch J (1983) Decision making at the top: the shaping of strategic direction. Basic Books, New York

Kester WC (1984) Today’s options for tomorrow’s growth. Harv Bus Rev 62(2):153–160

Miller LT, Park CS (2002) Decision making under uncertainty-real options to the rescue? Eng Econ 47:105

Mondschein SV, Schilkrut A (1997) Optimal investment policies for pollution control in the copper industry. Interfaces 27:69–87

Myers SC (1977) Determinants of corporate borrowing. J Finan Econ 5(2):147–176

Myers SC, Turnbull SM (1977) Capital budgeting, and the capital asset pricing model: good news and bad news. J Finan 32:321–333

Nehrt C (1996) Timing and intensity effects of environmental investments. Strateg Manag J 17:535–547

O’Brien JP, Folta TB, Douglas RJ, Timothy B (2003) A real options perspective on entrepreneurial entry in the face of uncertainty. Manag Decis Econ 24:515–544

Porter ME, van der Linde C (1995) Green and competitive: ending the stalemate. Harv Bus Rev 73:120–134

Presley A, Sarkis J (1994) An activity based strategic justification mehodology for ecm technology. J Environ Conscious Des Manuf 3:5–17

Qin H, Chu LK (2011) Real options model for valuating China greentech investments. In: 7th international conference on digital enterprise technology, Greece, pp 134–141

Sarkis J (1999) A methodological framework for evaluating environmentally conscious manufacturing programs. Comput Ind Eng 36:793–810

Sarkis J, Tamarkin M (2005) Real options analysis for “green trading”: the case of greenhouse gases. Eng Econ 50:273–294

Sing TF (2002) Time to build options in construction processes. Constr Manag Econ 20:119–131

Zhu L (2011) Energy investment modeling and its applications under the background of energy security. Doctor, Management Science and Engineering, University of Science and Technology of China

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2013 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Qin, H., Chu, L.K. (2013). A Stochastic Programming Model for Evaluating Real Options in Wind Power Investment Projects. In: Qi, E., Shen, J., Dou, R. (eds) The 19th International Conference on Industrial Engineering and Engineering Management. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-38391-5_9

Download citation

DOI: https://doi.org/10.1007/978-3-642-38391-5_9

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-38390-8

Online ISBN: 978-3-642-38391-5

eBook Packages: Business and EconomicsBusiness and Management (R0)