Abstract

The efficiency of commercial banks is important for Chinese banking to prevent risk and improve the competitiveness, and also the core for China to deepen financial reform. By using the DEA-Malmquist indices approach, the efficiency and the efficiency changes of 14 China’s commercial banks during the period of 2007–2010 were analyzed in this paper. Results showed that the average efficiency of State-owned commercial banks is generally lower than that of joint-stock commercial banks and the urban commercial banks, the average efficiency of urban commercial banks is the highest; the overall efficiency of 14 banks is improved in 4 year due to efficiency progress and technical advance.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

83.1 Introduction

Commercial banks are the main body of China’s financial industry; they play an important role for China’s economy development and the improvement of people’s living standard. However, after the 1990s, the control of the commercial banks is becoming more relaxed with the globalization of economy and financial freedom in China, especially after China’s entry into the WTO which allows foreign banks run the business in China, makes the competition between commercial banks intensified. Since the U.S subprime mortgage crisis, the financial tsunami makes we know that the commercial bank efficiency is the key for them to have a place in the competition. How to improve the efficiency of Chinese commercial banks is the vital problem to be solved for the bank authorities and the bank decision makers. Therefore, evaluating the efficiency situation of China’s commercial banks clearly and correctly, exploring the measures and preferences to improve the efficiency of China’s commercial banks is priority.

At present, the widespread use of the bank efficiency evaluation method is Data envelopment analysis (DEA) in academia. DEA which is raised by Charnes et al. (1978) is an approach for measuring the relative efficiency of peer decision making units (DMUs) that have multiple inputs and outputs. The essence of DEA is using the “frontier analysis”, according to a certain standard to construct a production frontier and the gap between the evaluated bank and the frontier is its efficiency. The advantages of the DEA method are that it need not give the weight of each index by people, also need not given the production function form of frontier in advance, and it can deal the project with multiple outputs and multiple inputs (Chen and Zhu 2004). So this method used in the same industry to analyze the efficiency has its own unique advantages. Penny (2004) investigates X-efficiency and productivity change in Australian banking between 1995 and 1999 using DEA and Malmquist productivity indexes, and finds that regional banks are less efficient than other bank types. Total factor productivity in the banking sector was found to have increased between 1995 and 1999 due to technological advance shifting out the frontier. Zhu et al. (2004) measured the efficiency of China’s largest 14 commercial banks over the period 2000–2001 using the super-efficient DEA model and Tobit regression method. The results show that the overall efficiency of the four state-owned commercial banks is far less than 10 joint-stock commercial banks, and the excessive number of employees is a major bottleneck restricting the state-owned commercial banks efficiency. Chen et al. (2005) examine the cost, technical and allocative efficiency of 43 Chinese banks over the period 1993–2000. Results show that technical efficiency consistently dominates the allocative efficiency of Chinese banks, and the large state-owned banks and smaller banks are more efficient than medium sized Chinese banks.

But from most related literature of evaluating the efficiency of commercial banks, we may find that they mainly adopt DEA model to describe the commercial banking efficiency status, but the description is basically a static comparison, or even though the dynamic description, the description is incomplete (Mette and Joseph 2004; Ariff and Can 2008; Laurenceson and Yong 2008). Therefore, to evaluate bank efficiency by DEA based on Malmquist index began to be widely used. Zhang and Wu (2005) analyzed the efficiency change of China’s commercial banks during the period of 1999–2003 using all Input-Oriented Malmquist Index approach. Gao (Gao et al. 2009) studies the panel data of primary commercial banks over the period of 1997–2006, and it calculates the total factor productivity and its decomposition indexes based on the DEA-based Malmquist productivity index. Maria et al. (2010) develop an index and an indicator of productivity change that can be used with negative data and use RDM efficiency measures to arrive at a Malmquist-type index, which can reflect productivity change, and use RDM inefficiency measures to arrive at a Luenberger productivity indicator.

This paper has introduced the theory of related DEA model and Malmquist index and analyzed the inputs and outputs selection of 14 China’s listed commercial banks, and measured the efficiency and the dynamic changes of the efficiency of 14 China’s listed commercial banks during the period of 2007–2010.

83.2 Methodology

83.2.1 DEA Model

Consider we have n DMUs, and that each \( DMU_{j} \;(j = 1,2, \ldots ,n) \) has m inputs and s outputs. Suppose \( X_{j} \), \( Y_{j} \) are the input and output of \( DMU_{j} \), and \( X_{j} = (x_{1j} ,x_{2j} , \ldots ,x_{mj} ) \), \( Y_{j} = (y_{1j} ,y_{2j} , \ldots ,y_{sj} ) \), then we can define the DEA model as follows:

where \( \lambda_{j} \) are the weights of input/output indexes, \( \theta \) is the efficiency score. And if \( \theta < 1 \), the DMU is inefficient; If \( \theta = 1 \), the DMU is efficient.

83.2.2 Malmquist Index Model

Malmquist index model was brought out by Malmquist in 1953 in the process of analyzing consumption. Nishinizu and Page firstly used this index to measure the change of productivity, since then the Malmquist index model was combined with DEA theory and has a wide use in measuring the efficiency of production (Nishimizu and Page 1982). The Malmquist index is defined as:

From model (2) we cam see that Malmquist index is an efficiency index, which represents the efficiency changes from \( t \) to \( t + 1 \). If \( Malmquist > 1 \), then the efficiency of DMU is improved; If \( Malmquist = 1 \), then the efficiency of DMU is unchanged; If \( Malmquist < 1 \), then the efficiency of DMU is declined.

Further, Malmquist Index can be decomposed into two components, which is efficiency progress index (effch) and technical change index (tech):

Effch is defined as the efficiency improvement part, represented the management level change in two periods—“catching-up effect” which measures the commercial bank management performance is more close to the current production frontier. Tech is defined as part of the technology progress, representing the shift of the production frontier in two periods—“frontier-shift effect”. What’s more, the effch can also be decomposed into pure technical efficiency (pech) and scale efficiency (sech):

83.3 Empirical Analysis

83.3.1 Data Sources

According to the principle of representative, accessibility and integrity, this paper selects 14 listed commercial banks as research objects during 2007–2010. They are Bank of China (BC), China Construction Bank (CCB), Industrial and Commercial Bank (ICBC), Bank of Construction (BCM), China Merchants Bank (CMB), Industrial Bank (CIB), Citic Bank (CITIC), Shanghai Pudong Development Bank (SPDB), Minsheng Bank (CMBC), Hiaxia Bank (HXB), Shenzhen Development Bank (SDB), Beijing Bank (BOB), Nanjing Bank (NOB) and Ningbo Bank (NBB). The input–output data of the banks is from each listed commercial bank’s “Published Financial Statements in 2007–2010” and “Chinese Financial Statistics Yearbook in 2007–2010”.

83.3.2 Indexes Selection

Reasonable definition of inputs and outputs of banks is the key problem using DEA model to measure efficiency of the commercial banks. Recently, the generally accepted method in division of inputs and outputs of the bank in international financial academics are three principal schools: production approach, the intermediation approach and asset approach (Zelenyuk 2006; Feng and Serletis 2010; Giokas 2008).

The production method regards banks as producers which use labor force and their own capital to generate deposits and loans. The number of loan and deposit account is usually seen as outputs, while the number of employees and the capital are seen as outputs in this method.

The intermediary approach consider banks as financial intermediaries where deposits are converted into loans, and getting the profits from the income of loans and investment. Therefore, intermediary method takes fixed capital, labor, and various interest cost as the inputs, and takes all kinds of loans and investments as the outputs.

The Asset approach also regards banks as financial intermediaries. Usually the liabilities on the balance sheet are regarded as inputs, and the loans and investments are regarded as outputs.

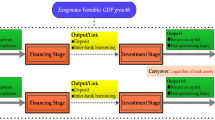

According to the China’s listed commercial banks’ characteristics and the requirements of DEA model, the inputs of the China’s listed commercial banks in this paper are the number of employees, fixed assets, operating expenses and deposits; the outputs are loans and revenue which can seen in Fig. 83.1.

83.3.3 The Empirical Results

Based on DEA and Malmquist indices, we calculate the efficiency of China’s listed commercial banks from 2007 to 2010 which can be seen from Table 83.1 and Efficiency change of China’s listed commercial banks’ Malmquist index during 2007–2010 which can be seen from Table 83.2 by matlab.

According to the empirical results in Table 83.1, we conduct the following analysis:

First, from the aspect of time window, we can find that the average efficiency scores of 14 China’s listed commercial banks are all less than 1, this shows that each listed commercial bank is DEA inefficient. And the overall efficiency of China’s banks shows a declined trend, from 0.982 in 2007 down to 0.979 in 2010. At the same time, the efficiency score in 2008 is the lowest which indicates that the financial crisis had more adverse impact on Chinese banking industry and the risk defense ability of Chinese banking industry is insufficient.

Second, from the bank ownership form, we can find that average efficiency score of urban commercial banks is the highest in the 4 years, reach up to 0.988; the average efficiency score of joint-stock commercial banks is the second; The lowest efficiency score is state-owned commercial banks, only 0.957. In addition, we may find that the average efficiency scores of the urban commercial banks all achieve the DEA efficient respectively on 2008 and 2009 which shows the Operation efficiency of urban commercial banks are Overall good.

Third, from the average efficiency score of each commercial bank in 4 years, we can find that all state-owned commercial banks are DEA inefficient. For the joint-stock commercial banks, CIB and CMBC are all DEA efficient in 4 years, BOB and NOB are also DEA efficient. Moreover, ranking in the last three places respectively is BC, HXB and ICBC.

We evaluate the efficiency of 14 China’s listed commercial banks above using DEA method, but this method calculates the efficiency of the commercial banks from static goniometer, namely horizontal comparison of the efficiency in the same period of different commercial banks which is not suitable for the longitudinal description of the dynamic changes of the efficiency in a period. So we measure the dynamic changes of the efficiency of the commercial banks in China using the Malmquist index to make the evaluation of the efficiency of Chinese commercial banks more detailed and more comprehensive.

According to the empirical results in Table 83.2, we conduct the following results:

First, the average Malmquist index of the 14 China’s listed commercial banks from 2007 to 2010 is 1.005, greater than 1, which means the overall efficiency of China’s banks is rising. The overall efficiency during the period of 2007–2008 and 2009–2010 are all rising but the efficiency in 2008–2009 is only 0.953, less than 1 the reason is the negative influence of financial crisis. In addition, the average Malmquist index of joint-stock commercial banks is less than 1, is declined in four yeas. The largest increased efficiency is state-owned commercial banks. The efficiency of CMB, CITIC and CMBC is declined in 4 years, and the efficiency of SPDB and HXB is nearly unchanged, and the others are rising.

Second, the overall improved efficiency of 14 China’s listed commercial banks is due to the increase of the efficiency progress (effch) and the technical change (tech). The overall declined efficiency of the joint-stock commercial banks is due to the decrease of the technical change (tech). And the increase of the state-owned commercial banks is mainly due to the decrease of the technical change (tech). Moreover, for the increase of efficiency progress (effch) of the urban commercial banks is mainly due to the increase of scale efficiency (sech).

83.4 Conclusion

The paper has introduced the theory of related DEA model and Malmquist index and analyzed the inputs and outputs selection of 14 China’s listed commercial banks, measured the efficiency and the dynamic changes of the efficiency of 14 China’s listed commercial banks during the period of 2007–2010. Through the analysis, the results show that the average efficiency scores of 14 China’s listed commercial banks are all DEA inefficient. The average efficiency score of urban commercial banks is the highest in the 4 years, the average efficiency score of joint-stock commercial banks is the second and the lowest efficiency score is state-owned commercial banks. The average Malmquist index of the 14 China’s listed commercial banks is greater than 1, and the overall improved efficiency of 14 China’s listed commercial banks is due to the increase of effch and tech.

References

Ariff M, Can L (2008) Cost and profit efficiency of Chinese banks: a non-parametric analysis. China Econ Rev 21:260–273

Charnes A, Cooper WW, Rhodes E (1978) Measuring the efficiency of decision making units. Eur J Oper Res 2(6):429–444

Chen XG, Michael S, Brown K (2005) Banking efficiency in China: application of DEA to pre- and post-deregulation eras: 1993–2000. China Econ Rev 16:229–245

Chen Y, Zhu J (2004) Measuring information technology’s indirect impact on firm performance. Inf Technol Manage J 5:9–22

Feng G, Serletis A (2010) Efficiency, technical change, and returns to scale in large US banks: panel data evidence from an output distance function satisfying theoretical regularity. J Bank Finance 34(1):127–138

Gao M, Yang SY, Xie BC (2009) Research on changing tendency of commercial banks productivity efficiency in China. J Xidian Univ Soc Sci Ed 19(5):51–55

Giokas DI (2008) Assessing the efficiency in operations of a large Greek bank branch network adopting different economic behaviors. Econ Model 25:559–574

Laurenceson J, Yong Z (2008) Efficiency amongst China’s banks: a DEA analysis five years after WTO entry. China Econ Rev 1(3):275–285

Maria CA, Portela S, Thanassoulis E (2010) Malmquist-type indices in the presence of negative data: an application to bank branches. J Bank Finance 34:1472–1483

Mette A, Joseph CP (2004) Combining DEA window analysis with the Malmquist Index Approach in a study of the Canadian banking industry. J Prod Anal 21(1):67–89

Nishimizu M, Page JM (1982) Total factor productivity growth, technical efficiency change: dimensions of productivity change in Yugoslavia in 1965–1978. Econ J 92:929–936

Penny N (2004) X-efficiency and productivity change in Australian banking. Aust Econ Pap 43(2):174–191

Zelenyuk V (2006) Aggregation of Malmquist productivity indexes. Eur J Oper Res 174:1076–1086

Zhu N, Zhuo X, Deng Y (2004) The empirical analysis of the efficiency and reform strategy of the state-owned commercial Banks in China. Manage World 2:18–26

Zhang J, Wu H (2005) The empirical analysis of efficiency of Commercial Bank of China based on Malmquist Index Approach. J Hebei Univ Technol 34(5):37–41

Acknowledgments

This paper is supported by National Science Fund for Distinguished Young Scholar (70825006); The Funds for Innovation Research Changjiang Scholar (IRT0916) in China and Hunan Provincial Natural Science Foundation of China(09JJ7002).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2013 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Ding, M., Ma, Cq., Zhou, Zb., Liu, Wb. (2013). Application of DEA-Malmquist Index in Analyzing Chinese Banking’s Efficiency. In: Qi, E., Shen, J., Dou, R. (eds) The 19th International Conference on Industrial Engineering and Engineering Management. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-38391-5_83

Download citation

DOI: https://doi.org/10.1007/978-3-642-38391-5_83

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-38390-8

Online ISBN: 978-3-642-38391-5

eBook Packages: Business and EconomicsBusiness and Management (R0)