Abstract

An investment timing problem which takes into account both taxation (including tax exemptions) and financing by credit is considered. This problem is reduced to the optimal stopping of a two-dimensional diffusion process. We give the solution to the investment timing problem as a function of parameters of the model, in particular, of the tax holiday duration and interest rate for borrowing. We study the question whether the higher interest rate for borrowing can be compensated by tax holidays.

Mathematics Subject Classification (2010): 60G40, 91B38, 91B70

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

- Investment timing problem

- Credit

- Real options

- Optimal stopping

- Tax holidays

- Compensation of interest rate

1 Introduction

There is an important problem how to attract investments to the real sector of the economy when credit risks are high. Our work is devoted to the analysis of related tax mechanisms for such attraction. In economies with increased risks (political, credit etc.) and other unfavorable factors the following question arises: can tax benefits provide investor with the same conditions for investment as he would have in a “standard” economy without any risks and unfavorable factors. In other words, can tax benefits compensate unfavorable factors?

In order to compensate risks and other unfavorable factors the following tax benefits are often used to attract investment: tax holidays, i.e. exemption from tax during a certain period, a reduction in tax rate, and accelerated depreciation.

It is worth noting that increased credit risks imply increasing interest rates on credit. In practice, tax holidays are considered as a mechanism which can compensate all arising risks.

Such a compensation problem was formulated and studied in [3, 4], where the risk is modelled by an additive term to the discount rate (a “risk premium”). Tax holidays, depreciation policy and a reduction in profit tax rate were considered as compensating mechanisms.

In the paper, we study a possibility of applying the tax holidays mechanism (on the corporate profit tax) for the compensation of high-level interest rates.

Various problems related to the influence of tax holidays on investment decisions, especially under risk and uncertainty, were studied in a number of papers (see, e.g. [5, 8, 10]). Potential possibilities of tax holidays as a mechanism for maximization of the expected discounted tax payments from the created firm were explored in [4].

This paper is organized as follows. Section 2 describes the behavior of an investor under uncertainty and in a fiscal environment, who is interested in investing into the project aimed at creating a new firm and faces the investment timing problem. A solution to this problem (an optimal investment rule) is described in Sect. 3. In Sect. 4 we set the problem whether the higher interest rate for borrowing can be compensated by tax holidays. Some conclusions and simulation results are presented in Sect. 5.

2 The Basic Model

Consider an investment project requiring the creation of a new industrial firm (enterprise). We assume that, at any moment, a decision-maker (investor) can either accept the project and proceed with the investment or delay the decision until he obtains new information regarding its environment (product and resource prices, product demand, etc.). Thus, the main goal of the decision-maker is to find, using the available information, a “good” time for investing in the project. Thus, this is an investment timing problem.

The real options theory is a convenient and adequate tool for modelling the process of firm creation since it allows us to study the effects connected with a delay in investment (investment waiting). As in the real options literature, we model investment timing problem as an optimal stopping problem for present values of the created firm (see, e.g. [6, 9]).

A creation of an industrial enterprise is usually accompanied by certain tax benefits (in particular, the new firm is exempted from profit taxes during a certain period). We take into account in explicit form some peculiarities of a corporate profit taxation system, including tax exemption. Such an approach was applied by authors for a detailed model of investment project under taxation in [1, 3, 4].

Uncertainty in the economic system is modelled by some probability space \((\Omega ,\mathcal{F},\mathrm{P})\) with filtration \(\mathbb{F} = (\mathcal{F}_{t},\ t \geq 0)\). \(\mathcal{F}_{t}\) can be interpreted as the observable information about the system up to the time t.

An infinitely-lived investor faces a problem of choosing a stopping time (w.r.t. filtration \(\mathbb{F}\)) τ ≥ 0, when to invest in the creation of a new firm producing some goods. Investment is considered to be instantaneous and irreversible, and an enterprise begins to produce goods just after the investment is made.

The net price for these goods at time t is π t , and the level of production at time t ≥ τ is \(\xi _{t}^{\tau }\). So, \(p_{t}^{\tau } = \pi _{t}\xi _{t}^{\tau }\) is the flow of profits generated by the firm at time t ≥ τ.

To launch a firm at time τ and start production, one needs an investment I τ. We assume that the required investment I τ is financed by a credit of the duration L and the interest rate λ.

Both the flow of profits \(p_{t}^{\tau }\) and the required investment \(I_{\tau }\) are considered as a stochastic processes on the given probability space \((\Omega ,\mathcal{F},\mathrm{P})\).

The principal repayment schedule (without interest repayment) is described by the flow of repayments such that \(C_{\tau +t}^{\tau } \geq 0 : \int \limits _{0}^{L}C_{\tau +t}^{\tau }dt = I_{\tau }\), and \(C_{\tau +t}^{\tau } = 0\) for t > L.

The total repayments (included interest) that the firm pays for borrowing, discounted to the investment time τ are :

where ρ is the discount rate, \(R_{\tau +t}^{\tau } = \int \limits _{t}^{L}C_{ \tau +s}^{\tau }\,ds\) is a remaining debt at time τ + t, and \(F_{\tau } = \int \limits _{0}^{L}C_{ \tau +t}^{\tau }{e}^{-\rho t}dt\).

Further, we assume that the total credit repayments K τ(λ) increase in the interest rate λ. It is a natural economic assumption which allows us to avoid “bad” repayment schemes.

The created firm is granted with tax holidays, during which it does not pay the corporate profit tax. Let γ be a profit tax rate (tax burden), and ν be the duration of the tax holidays.

Interest payments are included in profit tax base, but the maximal value of deductible interest rates is bounded by the limiting value λ b .

The expected net present value (NPV) of the firm, discounted to the investment time τ is:

where \(\bar{\lambda } =\min (\lambda ,\lambda _{b})\). This formula uses the existing principle of full-loss offset (loss carry forward).

The investor solves the following investment timing problem : to find such a stopping time τ (investment rule), that maximizes the NPV from the future firm:

where the maximum is taken over all possible stopping times τ (w.r.t. filtration \(\mathbb{F}\)), and V τ, K τ are defined in (1)–(2).

The starting point of this scheme is the known McDonald-Siegel model [9], which was the base for the real option theory (see, e.g., [6, 13]). More complicated variants of this scheme, which take into account a detailed structure of cash-flows as well as a number of different taxes one can find in [3].

3 Solution to the Investment Timing Problem

3.1 Main Assumptions

Let \((w_{t}^{i},\ t \geq 0),\ i = 1,2,3\) be independent standard Wiener processes on the stochastic basis \((\Omega ,\mathcal{F}, \mathbb{F},\mathrm{P})\). These processes are thought as underlying processes modelling economic stochastics. So, we assume that σ-field \(\mathcal{F}_{t}\) is generated by those processes up to t, i.e. \(\mathcal{F}_{t} = \sigma \{(w_{s}^{1},w_{s}^{2},w_{s}^{3}),\ s \leq t\}\).

Remind that the flow of profits has the following representation \(p_{t}^{\tau } = \pi _{t}\xi _{t}^{\tau }\), t ≥ τ, and specify its components.

The process of net prices π t is geometric Brownian motion :

The level of production \(\xi _{t}^{u}\) is described by a family of non-negative diffusion processes, homogeneous in u ≥ 0, defined as the solution (in strong sense) by the stochastic equations

with given functions \(a(t,x),\ b_{i}(t,x),\ i\,=\,1,2\), which satisfy the standard conditions for the existence of the strongly unique solution – at most linear growth and Lipschitz continuity (see, e.g., [11, Ch.5]).

The fluctuations \(\xi _{t}^{\tau }\) reflects the uncertainty, which can be generated by the firm created at time τ and demand on its production, and are driven by Wiener processes \(w_{t}^{1}\) (related to prices) and \(w_{t}^{2}\). Obviously, \(p_{\tau }^{\tau } = \pi _{\tau }\xi \) for any τ.

The cost of the required investmentI t is also described by the geometric Brownian motion as follows

where \(\sigma _{21} \geq 0,\ \sigma _{22} > 0\). The appearance of the process \(w_{t}^{3}\) in (6) means that the cost of investment I t is correlated with the net price π t .

The flow of the principal repayment at the time t (for the firm created at the time τ) will be represented as:

where (c s , 0 ≤ s ≤ L) is the “repayment density” (per unit of investment), characterizing a repayment schedule, i.e. non-negative deterministic function such that \(\int \limits _{0}^{L}c_{s}\,ds = 1\).

Note that repayment density can depend, in general, on the interest rate λ, i.e. \(c_{t} = c_{t}(\lambda )\).

Such a scheme covers various schedules of credit repayment, accepted in practice (more exactly, their variants in continuous time). For example, fixed principal repayment can be described by the uniform density \(c_{t} = 1/L\), while the well-known annuity scheme (fixed payments for a principal plus interest during the repayment period) corresponds to exponential density \(c_{t} = \lambda {e}^{\lambda t}/({e}^{\lambda L} - 1)\) (0 ≤ t ≤ L).

3.2 Derivation of the Present Value

The above assumptions allow us to obtain formulas for the present value of the future firm.

At first we need the following assertion about the process \(p_{t}^{\tau } = \pi _{t}\xi _{t}^{\tau }\).

Lemma 1.

Let τ be a stopping time. Then for all t ≥ 0

Proof.

From the Dynkin–Hunt theorem follows that for any stopping time τ the processes \(\widehat{w}_{t}^{i} = w_{\tau +t}^{i} - w_{\tau }^{i},\ t \geq 0\ (i = 1,2)\) are Wiener processes independent on \(\mathcal{F}_{\tau }\).

From representation (5) one can see that

This implies that for any stopping time τ the process \(\xi _{\tau +t}^{\tau }\) coincides (a.s.) with the unique (in the strong sense) solution to the stochastic equation

which is independent on \(\mathcal{F}_{\tau }\).

Then, \(p_{\tau +t}^{\tau } = \pi _{\tau }\Pi _{\tau +t}^{\tau }\), where \(\Pi _{\tau +t}^{\tau } =\exp \{ (\alpha _{1} -\frac{1} {2}\sigma _{1}^{2})t + \sigma _{ 1}\widehat{w}_{t}^{1}\}\xi _{ \tau +t}^{\tau }\) is independent on \(\mathcal{F}_{\tau }\).

Moreover, \(\Pi _{t+\tau }^{\tau }\) has the same distribution as \(\exp \{(\alpha _{1} -\frac{1} {2}\sigma _{1}^{2})t + \sigma _{ 1}\widehat{w}_{t}\}\xi _{t}\), i.e. as \((\pi _{t}/\pi _{0})\xi _{t}^{0}\). Therefore, \(\mathrm{E}(p_{t}^{\tau }\vert \mathcal{F}_{\tau }) = \pi _{\tau }\mathrm{E}\Pi _{t+\tau }^{\tau } = \pi _{\tau }\mathrm{E}(\pi _{t}\xi _{t}^{0})/\pi _{0}\). □

Let us define the following function :

where B s are defined in (7), and assume that B(0) < ∞.

Using Lemma 1 one can derive the following formulae for the present value (2):

where

3.3 Optimal Investment Timing

The above assumptions and formulas show that investment timing problem (3) is reduced to an optimal stopping problem for bivariate geometric Brownian motion and linear reward function. Indeed,

where

Let β be a positive root of the quadratic equation

where \(\tilde{{\sigma }}^{2} = {(\sigma _{1} - \sigma _{21})}^{2} + \sigma _{22}^{2} > 0\) is a “total” volatility of investment project. It is easy to see that β > 1 whenever \(\rho >\max (\alpha _{1},\alpha _{2})\).

The following theorem characterizes completely an optimal investment time.

Theorem 1.

Let the processes of profits and required investment be described by relations (4) – (6) . Assume that \(\rho >\max (\alpha _{1},\alpha _{2})\) and the following condition is satisfied:

Then the optimal investment time for the problem (3) is

where

and B(⋅), D(⋅), K(⋅) are defined at (8), (10) , (13) respectively.

Formulas of the type (15)–(16) for the difference of two geometric Brownian motions was first derived, probably, by McDonald and Siegel [9]. But rigorous proof and precise conditions for its validity appeared a decade later in [7]. It can also be immediately deduced from general results on optimal stopping for two-dimensional geometric Brownian motion and homogeneous reward function (e.g., [2]).

In order to avoid the “trivial” investment time τ ∗ = 0, we will further suppose that the initial values of the processes satisfy the relation \(\pi _{0} < {\pi }^{{_\ast}}I_{0}\).

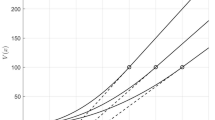

The optimal investment level π ∗ characterizes the time when the investor accepts the project and makes the investment. A decrease in π ∗ implies an earlier investment time, and, on the contrary, an increase in π ∗ leads to a delayed investment.

Knowing the optimal investment rule, one can derive the expected net present value \({N}^{{_\ast}} =\mathrm{ E}\left (V _{{ \tau }^{{_\ast}}}-K_{{\tau }^{{_\ast}}}\right ){e}^{-\rho {\tau }^{{_\ast}} }\) under the optimal behavior of the investor. Using the standard technique for boundary value problems (Feynman-Kac formula – see, e.g., [11, 12, Ch.9]), or the results on homogeneous functionals of two-dimensional geometric Brownian motion ([2]), one can obtain the following formula.

Corollary 1.

Under the assumptions of Theorem 1

where \(C = {(\pi _{0}/\beta )}^{\beta }{[I_{0}/(\beta - 1)]}^{1-\beta }\) .

4 Compensation of Interest Rates by Tax Holidays

Now we formulate the problem of compensating a higher interest rate by tax exemptions.

The question is: can one choose such a duration of tax holidays ν that given the index \(\mathcal{M}\) (related to the investment project) under a higher interest rate λ will be greater (not less) than those index under “the reference” interest rate λ0 and without the tax holidays:

We consider the following indices:

-

1.

Optimal investment level π ∗ , that defines the time when an investor accepts the project and makes the investment;

-

2.

Optimal NPV of the investor N ∗ .

As the reference interest rate we take the limit rate \(\lambda _{0} = \lambda _{b}\), which is deducted in profit tax base.

The assumption about an increasing (in interest rate) total payments on credit and explicit formulas (16)–(17) imply that the above indices are monotone in λ. Namely, π ∗ increases, and N ∗ decreases. Therefore, it makes sense to consider a compensation problem only for λ > λ0.

4.1 Compensation in Terms of Optimal Investment Level

Let us begin with an optimal investment level \({\pi }^{{_\ast}} = {\pi }^{{_\ast}}(\nu ,\lambda )\).

We say that an interest rate λ can be compensated in terms of optimal investment level by tax holidays, if \({\pi }^{{_\ast}}(\nu ,\lambda ) \leq {\pi }^{{_\ast}}(0,\lambda _{0})\) for some duration of tax holidays ν, i.e. in other words, if for some duration of tax holidays ν

Since a decrease of π ∗ implies earlier investment time (for any random event), then a possibility to compensate in terms of an optimal investment level can be interpreted as a possibility to increase investment activity in the real sector. This situation is attractive for the State.

Further, we assume that profits parameters B t , defined in (8), are such that the function B t is differentiable and increasing in t ∈ (0, L). This means that the expected profit of the firm grows in time. We suppose also that the repayment density c t is continuous in t ∈ (0, L). These assumptions allow us to avoid some unessential technical difficulties.

The following result is the criterion for the compensation in terms of an optimal investment level.

Theorem 2.

The interest rate λ can be compensated in terms of an optimal investment level by tax holidays if and only if λ ≤ λ 1 , where λ 1 is a unique root of the equation

and \(F_{0} = \int \limits _{0}^{L}c_{t}(\lambda _{0}){e}^{-\rho t}dt\) corresponds to the repayment schedule with the interest rate λ 0 .

In other words, there is a “critical” value of interest rate λ1 such that if interest rate is greater than this value, it can not be compensated in terms of optimal investment level by any tax holidays. Note that the “limiting” interest rate λ = λ1 can be compensated only by tax holidays with infinite duration.

Proof.

If ν ≥ L then D(ν) = 0, and (16) implies that \({\pi }^{{_\ast}}= \frac{\beta } {\beta -1}\cdot \frac{K(\lambda )} {B(0)-\gamma B(\nu )}\) decreases in ν.

If ν < L let us denote

From (16) we have

where \(Q(\nu ) =\bar{ \lambda }r_{\nu }\widehat{B}(\nu ) -\widehat{ D}(\nu )B_{\nu }.\)

As one can see from (21), the optimal investment level is not, in general, monotone in ν. The sign of its derivative is completely defined by the function Q(ν). Then

since \(\widehat{B}(\nu )\geq (1-\gamma )B(0)>0,\quad \widehat{D}(\nu ) \geq \int \limits _{\nu }^{L}[c_{t}+\lambda (1-\gamma )r_{t}]{e}^{-\rho t}dt \geq 0,\quad B{^\prime}_{\nu } \geq 0\).

Hence, if \(\frac{\partial {\pi }^{{_\ast}}} {\partial \nu } \leq 0\) for some ν = ν0, then \(\frac{\partial {\pi }^{{_\ast}}} {\partial \nu } \leq 0\) for all ν > ν0. So, the function π ∗ is either decreasing or having a unique maximum in ν.

Therefore, applying formula (16) for an optimal investment level and the inequality \({\pi }^{{_\ast}}(0,\lambda ) > {\pi }^{{_\ast}}(0,\lambda _{0})\) for λ > λ0, we have that relation (18) holds if and only if \({\pi }^{{_\ast}}(\infty ,\lambda ) \leq {\pi }^{{_\ast}}(0,\lambda _{0})\), i.e.

where

and \(c_{t} = c_{t}(\lambda _{0})\) corresponds to repayment schedule with interest rate λ0.

Now, the statement of Theorem 2 follows from (22). □

In most cases the “critical” value λ1 can be derived explicitly.

Corollary 2.

Suppose that the schedule of the principal repayments does not depend on the interest rate. Then the interest rate λ can be compensated in terms of optimal investment level by tax holidays if and only if \(\lambda \leq \lambda _{1}\) , where

and F is defined in (13) .

Proof.

The corollary immediately follows from (19) and formula for K(λ) (see (13)). □

4.2 Compensation in Terms of Optimal Investor’s NPV

Now let us consider an optimal investor’s NPV \({N}^{{_\ast}} = {N}^{{_\ast}}(\nu ,\lambda )\).

We say that interest rate λ can be compensated in terms of optimal investor’s NPV by tax holidays, if for some duration of tax holidays ν

An increase in N ∗ implies a growth of expected investor’s revenue, therefore the possibility to compensate in terms of optimal NPV is attractive for the investor.

The following result is similar to Theorem 2 above.

Theorem 3.

The interest rate λ can be compensated in terms of optimal investor’s NPV by tax holidays if and only if λ ≤ λ 2 , where λ 2 is a unique root of the equation

\(F_{0} = \int \limits _{0}^{L}c_{ t}(\lambda _{0}){e}^{-\rho t}dt\) corresponds to the repayment schedule with the interest rate λ 0 , and β is a positive root of the equation (14) .

Proof.

The proof of Theorem 3 follows the general scheme of the proof of Theorem 2.

If ν ≥ L then D(ν) = 0, and N ∗ increases in ν (see (17)).

Using formula (17) and the notations from (20) we have

where \(S(\nu ) = \beta B_{\nu }\widehat{D}(\nu ) - (\beta - 1)\widehat{B}(\nu )\bar{\lambda }r_{\nu }\).

Then we have

Using arguments, similar to those in the proof of Theorem 2, we get that the function N ∗ is either increasing or having a unique minimum (in ν).

Therefore, like in the above case, one can conclude that relation (24) holds if and only if \({N}^{{_\ast}}(\infty ,\lambda ) \geq {N}^{{_\ast}}(0,\lambda _{0})\), i.e.

where \(D(0) = (1 - F_{0})/\rho \) corresponds to the repayment schedule with the interest rate λ0. This implies the statement of Theorem 3. □

Similarly to the previous case of a compensation in terms of optimal investment level, the “critical” value λ2 can be derived explicitly when the principal repayments do not depend on the interest rate.

Corollary 3.

Suppose that the schedule of the principal repayments does not depend on the interest rate. Then the interest rate λ can be compensated in terms of optimal investor’s NPV by tax holidays if and only if λ ≤ λ 2 , where

5 Concluding Remarks

-

1.

It is interest to compare the obtained “critical” interest rates λ1 and λ2 which give limits for the compensation in relevant terms.

As Theorems 2 and 3 show, the bound λ1 is a root of the equation

$$K(\lambda ) = \frac{K(\lambda _{0}) - \gamma \lambda _{0}D(0)} {1 - \gamma } ,$$and λ2 is a root of the equation

$$K(\lambda ) = \frac{K(\lambda _{0}) - \gamma \lambda _{0}D(0)} {{(1 - \gamma )}^{\beta /(\beta -1)}}.$$Since the function K(λ) increases, then λ2 > λ1.

This fact means that interest rates λ < λ1 can be compensated by tax holidays both in terms of optimal investment level and in terms of investor’s NPV. The opposite is not valid, in general, i.e. a compensation in terms of NPV does not always imply a compensation in terms of the investment level, and therefore a growth of investment activity.

-

2.

Note, that the critical bound λ2 for the compensation in terms of investor’s NPV depends (in contrast to the bound λ1) on the parameters of the project but only through the value β (see (14)). As a consequence, if the volatility of the project σ increases, then the bound λ2 of the compensation in terms of NPV will increase also.

-

3.

Usually, it is assumed that the reduction in the refinancing (basic) rate λ{ ref} is a positive factor for a revival of investment activity in the real sector. But this differs from the conclusions of our model.

Indeed, if tax holidays are absent (ν = 0), then an optimal investment level

$${\pi }^{{_\ast}} = {\pi }^{{_\ast}}(\lambda _{ \text{ ref}}) = \frac{\beta } {\beta - 1} \cdot \frac{K(\lambda ) - 1.8\gamma \lambda _{\text{ ref}}D(0)} {B(0)(1-\gamma )}$$decreases in λ{ ref}. So, π ∗ raises and, hence, investment activity (earlier investor entry) falls when λ{ ref} diminishes.

Similarly, the optimal investor’s NPV increases in λ{ ref}, and therefore decreasing refinancing rate λ{ ref} de-stimulates investor.

As calculations show when the refinancing rate λ{ ref} falls to two times (from the current value of 8 %) the optimal investment level grows and optimal investor’s NPV declines up to 20 %.

-

4.

We performed a number of calculations for a “reasonable” (for Russian economy) data range. Namely, the typical parameters were as follows:

-

tax burden γ = 40 %,

-

discount rate ρ = 10 %,

-

credits with period L = 10 (years) and fixed-principal repayment schedule,

-

reference interest rate λ0 = 1. 8 ×(refinancing rate of the CB of Russia) = 14.85 %.

-

Typical characteristics of profits and investment cost gave us the “aggregated” parameter β in the interval between 3 and 8.

Then, the received estimations for “critical” compensation bounds were the following: λ1 ≈ 25–30 %, λ2 ≈ 30–40 %. These values seem to be not extremely high (especially, for the current economic situation in Russia).

References

Arkin, V.I., Slastnikov, A.D.: Optimal stopping problem and investment models. In: Marti, K., Ermoliev, Yu., Pflug, G. (eds) Dynamic Stochastic Optimization. Lecture Notes in Economics and Mathematical Systems, vol. 532, pp. 83–98, Springer, Berlin/Heidelberg/New York (2004)

Arkin, V.I., Slastnikov, A.D.: A variational approach to an optimal stopping problems for diffusion processes. Prob. Theory Appl. 53(3), 467-480 (2009)

Arkin, V.I., Slastnikov, A.D., Arkina, S.V.: Investment under uncertainty and optimal stopping problems. Surv. Appl. Ind. Math. 11(1), 3–33 (2004)

Arkin, V., Slastnikov, A., Shevtsova, E.: Investment stimulation for investment projects in Russian economy. Working Paper No 99/03. Moscow, EERC (1999)

Bond, E.W., Samuelson, L.: Tax holidays as signals. Am. Econ. Rev. 76(4), 820–826 (1986, 1996)

Dixit, A.K., Pindyck, R.S.: Investment under uncertainty. Princeton University Press, Princeton (1994)

Hu, Y., Øksendal, B.: Optimal time to invest when the price processes are geometric Brownian motion. Financ. Stoch. 2, 295–310 (1998)

Jou, J.B.: Irreversible investment decisions under uncertainty with tax holidays. Public Financ. Rev. 28(1), 66–81 (2000)

McDonald, R., Siegel, D.: The value of waiting to invest. Q. J. Econ. 101, 707–727 (1986)

Mintz, J.M.: Corporate tax holidays and investment. World Bank Econ. Rev. 4(1), 81–102 (1990)

Øksendal, B.: Stochastic Differential Equations. Springer, Berlin, Heidelberg/New York (1998)

Peskir, G., Shiryaev, A.N.: Optimal Stopping and Free-Boundary Problems. Birkhäuser, Basel (2006)

Trigeorgis, L.: Real options: managerial flexibility and strategy in resource allocation. MIT, Cambridge (1996)

Acknowledgements

The work is supported by Russian Foundation for Basic Researches (projects 11-06-00109, 10-01-00767) and Russian Foundation for Humanities (project 10-02-00271).

We are especially grateful to an anonymous referee for helpful comments and suggestions which helped us to improve the paper.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2013 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Arkin, V., Slastnikov, A. (2013). A Mathematical Model of Investment Incentives. In: Shiryaev, A., Varadhan, S., Presman, E. (eds) Prokhorov and Contemporary Probability Theory. Springer Proceedings in Mathematics & Statistics, vol 33. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-33549-5_2

Download citation

DOI: https://doi.org/10.1007/978-3-642-33549-5_2

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-33548-8

Online ISBN: 978-3-642-33549-5

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)