Abstract

Established techniques supplied metal for the Industrial Revolution until the electrical age, urbanization, and accelerated transportation in the late nineteenth century created demand that could be met only with transformative innovations in mining, mineral beneficiation, and metallurgy. These happened. Earth- and rock-moving technologies pioneered in Massachusetts transferred westward and enabled underground- and open-pit mining on a scale never before seen. Beneficiation by froth flotation opened low-grade ores to exploitation. Electrowinning and electrolytic refining made pure and light metals. Then concerns about mineral depletion raised by nineteenth-century economists, echoed by mid-twentieth-century geologists, adopted by government agencies, and amplified by futurists were dispelled when geochemists untangled the processes of ore formation, only to be replaced by the realization that sinks, not sources, were limiting. Quantitative methods of tracing the flow of metals with their production wastes and emissions from extraction through use and onto discard revealed the size of the legacy from past mining and consequences of future production. Accidents with toxic tailings and acidic mine waters exposed the unfunded costs and lurking hazards of abandoned mine wastes. Now miners’ biggest problem was not finding more ore; it was gaining acceptance of their operations by communities, environmentalists, and regulators. Transformative innovations to make mining tolerable and remove the legacy of past extraction practices are the agenda for the twenty-first century.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

- Mass destruction

- Mechanized open-pit mining

- Froth flotation

- Tailings

- Rock drilling

- Material-flow analysis

- Pollution

Introduction

As the USA entered the last third of the nineteenth century, a huge expansion of industry was underway that required iron, copper, and other metals in quantities never before seen. The existing methods of finding and evaluating ore deposits (Fig. 3.1) or mining them (Fig. 3.2) no longer sufficed. Only with transformative innovations could the new demand be met. By the early twentieth century, these were in place. Mining ever-lower-grade ores in ever-larger quantities meant generating more wastes (Fig. 3.3), but these tailings could be left in the mining districts, while the benefits of cheap, abundant metals were enjoyed elsewhere. Then, in the mid-twentieth century came the realization that metal resources just might not be inexhaustible, and that waste repositories might have finite capacity. A new discipline, life cycle analysis, traced the size and location of metal stocks and wastes. The news was not good, emphasized by disasters from toxic emissions and failures of waste-containing dams. Here were challenges to technology as great as those of metal abundance. Unresolved social and environmental consequences of mineral extraction became more of a threat to continued economic growth than possible resource scarcity.

Transfer of knowledge and experience from other areas of technology and commerce through diverse individuals and routes was a primary source of the innovations that made an order-of-magnitude increase in metal production. The free flow and exchange of ideas and techniques was essential and was accomplished by people who came from diverse backgrounds and trades and as immigrants from other countries. New printing and papermaking methods distributed knowledge of innovations through journals, trade papers, and manufacturers’ catalogs (Newell 1986). Mining engineering and economic geology were in the first stages of becoming professions, but would be well established by the turn of the century.

Physics and chemistry contributed directly to some innovations, as in electrowinning and refining. But other problems that needed guidance from science were neglected because of their complexity or the absence of basic research yet to be done. The surface chemistry and hydrodynamics of bubble motion in the fluid-solid grain mixtures used for mineral separation by flotation were developed only after the process was perfected through trial and error experimentation. None of the innovations could have been realized without capitalists to assemble the requisite finance and managers to create backward integration from metal producers to ore sources.

Mining

Aside from copper obtained from a few small mines in the East, the USA had depended on imported copper until Michigan was admitted to the Union in 1837. Reports from its newly established geological survey directed by Douglass Houghton on the mineral wealth of the Upper Peninsula attracted prospectors and speculators in search of native copper, which they could pick up in stream beds and trace back to its sources. They soon flooded the area with claims. Mining was a different matter; there was little experience with hard-rock mining on a large scale in the USA. Miners from Cornwall, England, brought the requisite skills and innovations to Michigan. These miners had generations of experience and of up-to-date methods. By the mid-nineteenth century, declining ore resources and the increasing costs of working at ever-greater depths had forced their industry into decline. Rather than host unemployed miners, Cornish parishes often paid passage money for them to immigrate to America, where their skills were immediately applicable in the deep, hard-rock copper mines of the newly opened Lake Superior district and from there throughout the American West (Lankton 1991; Rule 1998).

Extracting ore by hand-jacking shot holes and blasting with black powder, the traditional technique much celebrated in folk song, was labor intensive and unable to achieve production on the scale needed in Michigan or at the new, much larger western mines. Boring the 5000-ft long Hoosac railway tunnel through a mountain of hard rock in northwestern Massachusetts (Fig. 3.4) became a stimulus and test bed for innovations immediately applicable to mining. The tunnel builders got off to a grand start in 1853 with a novel, purpose-built boring machine, but it expired after advancing only a few yards. After a hiatus during the Civil War, Jonathan Couch and Joseph Fowle tried steam-powered drills, with little success. Charles Burleigh, a 42-year-old mechanic from Waterville, Maine, worked at the Putnam Machine Works in Fitchburg, Massachusetts, when in 1866 Couch and Fowle recruited him to help with their steam-powered drills. Burleigh abandoned steam and designed an entirely new rock drill mechanism that rotated and advanced the drill bit as it was repeatedly driven forward with compressed air. Exhaust air absorbed the recoil of the drill bit after it struck the rock face. His mechanism had interchangeable parts to facilitate rapid repair. With Burleigh drills at work, rapid progress was made on the Hoosac. Development of rock drills was going on in Europe as well, and there was a regular trans-Atlantic exchange of patents and descriptions. Nevertheless Burleigh worked independently; his drill was an American original (Schexnayder 2015).

As soon as news of the success of the Burleigh drills on the Hoosac reached managers of northern Michigan copper mines, they adopted them. The Burleighs drilled far faster than was possible by hand jacking, and had the added advantage that the air exhaust helped with mine ventilation. But its mountings were too big and heavy to handle in most mine adits. A.C. Rand and other artisan inventors entered the field with smaller, lighter drills from 1871 onward (Fig. 3.5; Lankton 1991; Newell 1986).

Finding iron in upper Michigan was more difficult than finding copper because it was buried under drift left by the Laurentide Ice Sheet. Houghton’s deputy, William Burt, had learned that running survey lines by magnetic compass was unreliable, and designed an attachment for determining true direction from the sun’s azimuth.Footnote 1 He then used magnetic compass deviation as a geophysical prospecting technique to detect iron ore near Negaunee, the first of the ore bodies of the Marquette Range (Walker 1979).Footnote 2 Established mining methods sufficed here until discovery of soft ore on the Mesabi Range in Minnesota (Lankford et al. 1985).

The Merritt brothers, adventurer entrepreneurs, explored the as yet unmined Mesabi with dip needles and small, exploratory shafts.Footnote 3 In 1887, these methods led them to rich, soft hematite under the glacial overburden. They began extracting it with shaft mines to avoid the cost of removing the overburden and shipped out samples of Mesabi soft ore for trial (Evans 1942; Lankford et al. 1985). Blast furnace operators found that the powerful air blast they used for their more refractory ore blew the fine Mesabi ore out of the furnace before it could react with the carbon monoxide reducing gas. Once they understood that the fine ore reacted faster and lowered their blast pressure, they wanted all the soft ore they could get. Ramping up the scale of production on the Mesabi then took transfer of a novel technique from an unlikely source, a tide-power project in Boston .

Boston industries operated on tide power created by a system of dams in basins built in its Back Bay from 1821 until 1855, when new land was needed more than tide power. Filling the no longer needed basins was an enormous earth-moving project made possible by two Massachusetts innovations, William Otis’s steam shovel (Stueland 1994) and Goss and Munson’s dedicated earth-moving system (Newman and Holton 2008). The shovel excavated glacial sand and gravel from kames, kame terraces, and eskers in Needham and loaded it on purpose-built dumping rail cars that were hauled nine miles to the Back Bay (Fig. 3.6). Trains arrived on a 45-min schedule throughout the day, year in and year out until the filling was completed in 1890. The Mesabi entrepreneurs copied this technique exactly in 1893: steam shovels dug out the soft ore and loaded it in specially designed rail cars. Ore trains took the cars to Duluth, Minnesota, or Superior, Wisconsin, to dump ore directly into the holds of ships at the ore docks. With the mining problem solved, the remaining task was to organize and finance a large, steady flow of ore from the upper lakes to the furnaces along the lower lakes.

Initially getting lake ore to smelters, convincing blast furnace men to use this unfamiliar product, and then organizing a system to provide a reliable supply were undertaken by independent agents, most operating out of Cleveland, Ohio, for the M. A. Hanna Company. They served as conduits for information that miners needed about markets and demand for steel and iron. They also acted as shipping agents arranging charters for the independently owned lake ore carriers (Reynolds 2012). Integrating ore production from the Mesabi into a reliable supply chain required a new scale of financial resources. Henry Oliver, who began his career selling nuts and bolts, owned a mid-size steelworks, and by 1892 was looking for a new endeavor that he found with Leonidas Merritt. Oliver raised the capital to buy the Merritts’ Missabe mine and undertook shipping and selling the ore, while the Merritt brothers went on to open other mines. Unfortunately for them they raised money by borrowing from J. D. Rockefeller who, when they were unable to repay, took over the Merritt mines, ending their pioneering work on the Mesabi (Evans 1942). When Oliver found that he needed more money, he enlisted Henry C. Frick of Carnegie Steel Company. Then financial distress in the mining industry during the 1893 economic depression allowed Oliver and others to sell out to the financiers who were assembling the fully integrated US Steel Company (Reynolds 2012). With centralized management the integrated system from mine to finished steel was in place.

Production of copper in upper Michigan was entering decline just as rapidly expanding use of electric power accelerated demand for copper. Help was on the way when in 1881 miners digging for silver in Butte, Montana, unexpectedly encountered rich chalcocite at the bottom of a 600-ft deep shaft. George Hearst (father of the newspaper mogul) raised capital to finance large-scale underground mining, a smelter at the purpose-built town of Anaconda, and a connecting railway. Within 3 years Montana produced nearly half of the copper used in the USA. Over the next decades, Anaconda advanced deep, hard-rock, underground mining to its fullest development in the USA (Hyde 1998; LeCain 2009).

Meanwhile in Arizona explorers found outcrops of rich copper ore directly after the Gadsden Purchase made the territory part of the USA. Banditry, hostility from local inhabitants, and the absence of a railroad limited the initial mining ventures. Morenci was typical. Mining began there shortly after the 1870 discovery of outcrops of ore containing 15–35% copper. Miners dug it out by driving drifts into hillsides. A smelter was built, a railway connection made, and a mill completed that used gravity separation to process ore containing 6.5% copper into concentrate containing 23% copper. But the Morenci miners soon ran through the initially found, rich oxide ore. The porphyry ore containing 1–4% copper below the worked-out surface enrichment zone was too lean to work with existing technology. Other Arizona mines followed this same path to what would have been a dead end except for Daniel Jackling (Cleland 1952; Hyde 1998).

Daniel C. Jackling (1869–1956) had a job evaluating small silver and gold mines in Utah that took him to the Bingham Canyon in 1898, where he noticed indications of porphyry copper at depth, and confirmed it with test holes. Profitable mining of the abundant but very low-grade ore would have to be by a large open pit that could deliver more ore at lower cost than heretofore attained by mines anywhere. Jackling went to the Mesabi to see the high-throughput, low-cost mining that made direct-shipping iron ore hugely profitable. With financing by the Guggenheim brothers, he transferred the Mesabi technique to Utah. Since the porphyry ore was neither soft nor continuous, Jackling added exploratory drilling to the Mesabi technique . Additionally, the hard porphyry ore had to be loosened and pulverized by explosives set in drilled holes before it could be shoveled into rail cars for transport to the mill. With electric power he eliminated the nuisance of hauling coal to steam shovels within the mine. Then with new shovels that could rotate through a full arc, the Bingham mine extracted ore at a speed never before seen. Today the Bingham (Fig. 3.7) is the world’s largest man-made excavation.Footnote 4

Jackson benefited from another innovation developed at the Hoosac Tunnel project . Black powder was relatively slow burning, which was suitable for use in rifles where the long barrel allowed the full propulsive force of the expanding gas to accelerate a bullet. It did not provide the shock needed to properly spread cracks through hard rock. Nitroglycerine, first made in 1846 by Ascanio Sobrero, could do that but was so overly sensitive that at first its only use was as a remedy for heart attacks. George Mowbray, who described himself as an operative chemist, undertook the rock-blasting challenge (Mowbray 1872). Mowbray was in business in Titusville, Pennsylvania, providing nitroglycerine, known there as blasting oil, for shooting oil wells. He saw opportunity in the Hoosac Tunnel project , moved east, and built a nitroglycerine works near the west portal of the tunnel (Fig. 3.8). Mowbray believed that attaining good purity would make the blasting oil safer to handle but discovered the essential safety key by chance. When detonation of black powder failed to break a dangerous ice jam on the Deerfield River, Mowbray offered some of his product. It was January, and cold, and it was accepted that nitroglycerine was even more unstable when frozen. So he packed shipment in warmed straw covered with fur robes for the sleigh trip to the river. Alas, it arrived frozen. But then it refused to detonate until thawed. Thereafter Mowbray always sent his blasting oil to the tunnel, winter or summer, chilled, and accidents declined to near nil. A remarkable feature of Mowbray’s operation at the Hoosac was the extent to which he had to make nearly everything he needed. There was no off-the-shelf procurement. To make nitroglycerine he used a mixture of sodium nitrate and sulfuric acid dribbled into glycerin with the heat of reaction carried off by running water. His homemade apparatus is shown in Fig. 3.9.

Wider adoption of blasting oil was impeded by numerous users ignoring Mowbray’s safety precautions, to the regret of their families and friends. This problem was solved when diatomaceous earth was impregnated with blasting oil to make dynamite in 1877, at the California Powder Works. Jackling used it to pulverize the Bingham ore so that it could be shoveled into dump cars.

Milling

Metals in the lithosphere are in solid solution in silicate minerals. Only rarely have ore-forming processes concentrated them into oxides or sulfides, as in the sample of zinc ore from Franklin, New Jersey (Fig. 3.10; Skinner 1977). The first step in milling is to break the ore into pieces at least as small as the metal-bearing mineral grains. The Blake ore crusher , patented in 1858 by Eli Whitney Blake (Eli the first’s nephew), was the first innovation to replace traditional comminution, and is still a mainstay in the mineral industry. Nevertheless, comminution remains energy intensive and, unlike subsequent separation processes, has resisted transformative innovation.Footnote 5 After comminution the valuable mineral, the heads, has to be separated from the much larger amount of gangue, the tails. Tailings today are a major environmental problem, discussed below.

At the time Jackling opened the Bingham pit, the available separation techniques relied on gravity separation , James Colquhoun’s vanner (an ore-dressing device that separates heavy ore constituents from light ones by placing finely ground ore on an inclined, laterally vibrated, moving belt upon which a countercurrent flow of water washes the lighter constituents off the belt) invented at Morenci, and Redman Wilfley’s shaking table invented in Leadville. Neither achieved good recovery from low-grade, porphyry ore. Jackling’s venture was saved by the single most important innovation in modern large-scale metal production, the froth flotation process.

Froth flotation attaches sulfides or other metal-bearing minerals to air bubbles that float them, while the quartz and other gangue minerals are not bonded and sink to the bottom of the flotation cell. The method depends on specific mineral surface properties, on modification of those properties by adsorbed reagents, and on control of the surface tension of the flotation medium. A bubble will attach to an ore grain only if there is a decrease in free energy ΔG = γ sg − (γ sl + γ lg) < 0. Here the γs are the surface energies of the solid-gas, liquid-solid, and liquid-gas interfaces. To make the flotation process work, the solid-gas and solid-liquid interfacial energies have to be manipulated with adsorbed reagents to make bubbles in the flotation medium attach only to grains of the valuable mineral while simultaneously keeping the liquid-gas surface energy low enough to assure that ascending bubbles carrying their loads of selected grains do not burst, and thereby drop the attached load of valuable mineral before it could be collected.Footnote 6

It took innovators over 50 years of trial and experimentation to figure out how to use the different interactions of metal-bearing and gangue mineral with fluids in a separation process. They had no guidance from science since the requisite surface chemistry and fluid mechanics did not exist (Rao 2004). The search began in 1860 when William Haynes, in England, observed that sulfides would bond with coal tar in a way that might facilitate their separation from the silicate gangue minerals. How to do it was a task undertaken by diverse artisans and experimenters in the USA, Italy, Great Britain, and Australia. First was Carrie Everson, widowed wife of a medical doctor who had lost all his money through investment in the Denver’s Golden Age Mining Company. Everson made systematic experiments with oils and acids and in 1878 achieved preferential bonding and separation. Her 1885 US patent 348,157 explained that when a mixture of cotton seed or other oils and sulfuric acid was mixed into ground-up ore, the addition of water could flush out the quartz gangue. The often-repeated stories that she made her discovery while washing out her husband’s oily socks, or in another version, the sample bags in an assay office, originated with nineteenth-century authors who had trouble with the notion that women could, or should, do engineering. Everson was, in fact, a competent experimenter who knew chemistry.

Some experimenters thought it would be best to sink the ore grains once they were attached to a fluid. At a small mine in Llanelltyd, North Wales, in 1894, Frank Elmore and his brother Stanley managed to get separation, but in a nasty oily mess. Then, in 1901 Alcide Froment, an engineer at the Traversella mine in Italy found that by reducing the amount of oil and adding acid that reacted with the carbonate in the ore to produce bubbles, the sulfide grains adhered to the bubbles, which carried the valuable mineral to the surface of the separation cell. Following this discovery, the possibilities of the large financial gain that could accrue to successful inventors brought scores of experimenters and entrepreneurs into the search. In Australia, Charles Potter at the Broken Hill Proprietary mine in 1902 also observed how bubbles formed by reaction of acid with carbonates in their lead-zinc ore levitated the metal-bearing sulfides. But his patent failed to adequately explain how this worked, and it added to the growing confusion among experimenters about separation mechanisms. Many experimenters now made incremental improvements in the mechanics of the flotation and collection and the reagents that controlled surface properties. They created swarms of patents that in turn spawned the multiplicity of lawsuits and court testimony that makes the subsequent history of flotation nearly impenetrable. The fully developed process, in place by 1915, used collectors, surfactants that adsorb on the desired mineral to make them hydrophobic, frothers to form the necessary bubbles, activators or depressants for selective flotation, pH regulators, and sometimes flocculants, in quantities that range from 0.2 to 35 ppm. The technique was developed largely through empirical testing at industrial mills but also by A. F. Taggart at the Columbia School of Mines and A. M. Gaudin at MIT (Lynch et al. 2007; Rickard and Ralston 1917). By the 1950s, the flotation process achieved recovery as high as 96% of the copper in porphyry ores in the USA, but it then began to decline as flotation improvement did not keep up with declining ore grade (Gordon 2002).

Froth flotation was the single greatest innovation that has made possible expanded metal extraction from the increasingly lower-grade ores available for mining. It also found application in the beneficiation of coal. Without froth flotation the copper needed for the electrical age could not have been supplied.

Metallurgy: Smelting and Refining

Copper smelters could not attain the purity needed for high electrical conductivity by pyrometallurgy because they could not remove the trace amounts of arsenic that ruin conductivity. This problem was solved by an innovation that originated in pure science but reached practice by way of the decorative arts.

As news of Alessandro Volta’s current-producing pile spread in 1800, investigators throughout Europe gave over experimenting with static electricity in favor of electric currents. In 1804, W. Hisinger and J. J. Berzelius showed that salt solutions were electrical conductors and could be decomposed by flowing current. Faraday’s experiments in 1830 led to his laws of electrolysis. Popular interest in electricity was on the rise. John Wright (1808–1844), a surgeon in Birmingham who experimented with electrochemistry in his spare time, collaborated with his neighbor George Elkington, maker of high-end silver tableware. Elkington (1801–1865) had apprenticed in his uncle’s silver plating business in 1815, became its owner, and brought his cousin Henry into the enterprise. At that time silver plate was made by hot rolling thin strips of silver to a copper substrate. The product, called Sheffield plate , had quality control problems (Fig. 3.11). Elkington paid Wright £500 for the privilege of applying for a patent on their joint work. (Wright got another £500 when British patent 8447 was issued in 1840.) He perfected silver electroplating (British patent 8,447, 1840) and with it achieved closer control over plate thickness and uniformity (Fig. 3.12; Gore 1890; Ulke 1903).

Optical micrograph of Sheffield plate. Specimen is a mid-nineteenth-century table fork excavated at the Glebe House, Woodbury, Connecticut. An alloy of silver with 32% copper was roll-bonded to a base metal substrate. The average thickness of the plate where uniform is 0.06 mm. Length of section in the image is 0.17 mm

George’s son James made the next step to industrial technology in 1865, when he used an electric current to dissolve impure copper from an anode and, with close control of voltage applied to the cell, deposited copper with the purity needed to be a good conductor on a cathode starting sheet. He patented the process in 1869 and obtained a US patent in 1870. That same year he set up a custom refining works in Pembrey, Wales (Gore 1890). Americans were slow to adopt the process. Only in 1882 did Edward Balbach and F. A. Thum set up the first American commercial refinery, in Newark, New Jersey. By 1895 there were 16 more, most on the east coast but also in Montana, at Anaconda and Great Falls.

From electrolytic refining it was not a big step to electrowinning. Copper leached out of low-grade ore or old mine tailings with dilute acid could be used as the electrolyte in a cell with an inert anode and a copper starting-sheet cathode. Passing current through the cell deposited copper from the leachate on the cathode. Electrowinning could also be applied to production of zinc. A commercial process was patented in France as early as 1883, but the first commercial production was not until 1916, probably because electrowinning zinc is more energy intensive than almost any other electrolytic process in metallurgy (Gore 1890; MacKinnon 1984).

The path from pure chemistry to solvent extraction led through medicine rather than the decorative arts or industry. Gold occurs as small particles in massive amounts of gangue (Fig. 3.13). As mining moved to ever-lower-grade ore, the efficacy of mechanical extraction processes diminished to near nothing. Hydrometallurgy solved this problem. John S. MacArthur, a chemist, collaborating with medical doctors Robert and William Forrest in the basement of the Forrests’ Glasgow clinic, found that a very dilute solution of NaCN (0.01–0.1%) dissolves gold and that higher concentrations of cyanide do not speed the process. Adding zinc shaving to the solution precipitated the gold. (See MacArthur’s October 1887 British patent 14174 19. Electrowinning the gold is possible but has not proved useful.) Within 2 years cyanidation was in commercial use and was responsible for doubling world gold production in the next decades (Habashi 1987). At that time it was not necessary to know how the process worked. It was 60 years later, in 1947, that P. F. Thompson in Australia showed that the solution of gold is a corrosion process in which cathodic and anodic processes form on the surface of the gold in the presence of oxygen (Thompson 1947). A consequence of the adoption of the cyanide process was a large drop in demand for mercury (as amalgamation was less effective and more expensive than the cyanide process, although still remained in limited use for onboard gold dredges) and the resulting closure of mercury mining in California, which eliminated both a source of pollution and the destruction of vegetation on hillsides by smelter fumes from mercury smelters (Johnston 2013). The cyanide process was an early step away from extraction of metals by mechanical concentration processes (Hovis and Mouat 1996). Solvent extraction was soon applied to other metals, when James Colquhoun in 1893 designed a plant to recover copper being lost in mill tailings (Hyde 1998). The tailings were leached with sulfuric acid and the copper so dissolved was then precipitated on scrap iron. In the modern version of the process, electrowinning substitutes for the precipitation on scrap iron.

The path from physics and chemistry to electrolytic aluminum smelting was direct rather than via the arts. Both Hall in Ohio and Héroult in France were intrigued with the then novel metal aluminum through reading semi-popular articles. Both launched their searches for a reduction method with boosts from their chemistry professors, and both were aided by women family members, Hall by his sister and Héroult by his mother. But their temperaments could not have been more different. Hall, the serious-minded son of a minister, lived at home in Oberlin, where the college of that name had a strong tradition of training missionaries. Héroult was the mischievous young man dismissed from the École des Mines at the end of his first year (Bickrert 1986; Craig 1986).

Commercial aluminum also depended on an Austrian chemist and the textile and dyestuff industry. Pierre Berthier discovered bauxite, a mixture of hydrated aluminum oxides with silica and iron impurities, in 1821 near the French village of Les Baux (hence the name). He mistakenly thought it could be an iron ore because of its red color. As a source of aluminum, the iron and silica must be removed since they are more easily reduced than aluminum. Louis Le Chatelier (son of Henri of equilibrium principle fame) developed a method of making alumina from bauxite by a three-step process that involved reaction with sodium carbonate, leaching, and precipitating aluminum hydroxide with carbon dioxide. But the recovery attained was small and its application limited.

Karl J. Bayer (1847–1904) invented the two steps used to get pure alumina by solution of bauxite in hot Na(OH) under pressure followed by precipitation of pure, crystalline Al2O3 but in reverse order. Bayer grew up in Silesia, then a part of the Austrian Empire but now in Poland, studied chemistry in Germany, and returned to Austria to a teaching job. Then in 1885 he joined the Tentelev Chemical Works near St. Petersburg in Russia that was using the Le Chatelier process to make the aluminum hydroxide used as a mordant for dyeing cloth. Bayer’s problem was to find a way to precipitate crystalline Al(OH)3 instead of gelatinous oxide. In 1888 he found that aluminum hydroxide could be precipitated from a sodium aluminate solution with a seed of freshly prepared aluminum hydroxide. This made a pure, crystalline product.

Bayer made his second discovery in 1892 at the Elabuga dye works in the Tatarstan. He found that the alumina in bauxite could be selectively dissolved by heating it in a solution of Na(OH) under pressure in an autoclave. The impurities in bauxite were rejected, and pure aluminum hydroxide could then be recovered from the sodium aluminate solution. He adapted the pressure technology from techniques then in use in making organic intermediates for dyestuffs. The process of pressure leaching and controlled precipitation is used today much as it was by Bayer, albeit scaled up with sophisticated quality control. Since gallium is now an important component of electronic devices instead of a curiosity, an advantage of the Bayer process today is that the gallium in bauxite is recovered (Habashi 1983).

Mining and Metallurgical Engineers

Mining engineers do not appear among the innovators above. They only established themselves as a profession with the American Institute of Mining Engineers (AIME) in 1873, when their primary task was evaluating the economic potential of mineral discoveries. Promotors used their reports to enlist investment by financiers, who counted on the accuracy of the engineers’ work to protect them from fraud arising through stock manipulation or salting of prospects. Henry Janin, graduate of Yale and the Freiberg mining academy in Germany, was building a growing reputation for integrity and reliability in 1872 when he was enlisted to investigate a claim of diamond deposits in Arizona. He was taken by the promotors on a long, circuitous journey while blindfolded. In a brief inspection of the site, he recovered gems later appraised by Tiffany as genuine and valuable. A speculative frenzy followed. By chance, geologist Clarence King spotted the promotors emerging from a railroad train and by tracing their rail travels backward found the putative gem mine site, in Wyoming, not Arizona. He and Janin then found it liberally salted. The fraud created a sensation. Janin salvaged his reputation only by a quick retraction of his preliminary report (Grossman 2014). Nevertheless there were great opportunities for mining engineers to make profitable investments. Several universities benefited handsomely, as by Henry Krumb’s bequest to the Columbia School of Mines, and John Hays Hammond’s and Alan Batemen’s generosity to Yale.

The AIME created a code of ethics to help establish mining engineering as a proper profession. Further steps toward professionalism came with the founding of the Columbia School of Mines and a mining engineering program at MIT in 1876. By 1892 16 US schools were graduating mining engineers. Of 871 mining engineers graduated between 1867 and 1892, Columbia produced 402 and MIT 126 (Newell 1986).

Edward W. Davis represents the more mature work of mining engineers that also required participation in politics. At the Minnesota School of Mines, Davis recognized the eventual exhaustion of the easily mined Minnesota iron ores and turned in 1911 to research on beneficiation, picking up where Edison had left off with his failed magnetic separation venture by adding beneficiation by flotation (Manuel 2013). Daniel Jackling returned to Minnesota for a collaboration with Davis. Their Mesabi Iron Company produced ore pellets that contained 60% iron. This development was premature. The pellets had a higher silica content than blast furnace operators were used to, and actual exhaustion of the rich Mesabi ore was still a distant prospect. Davis turned to advocacy to assure the future of iron mining in Minnesota. His work illustrates the range of tasks that an engineer might need to undertake including mining, industrial, economic, and policy-making endeavors. A problem with taconite, the low-grade, hard iron ore, was that once ore was discovered, it was taxed regardless of grade until mined, a strong disincentive to exploration. Davis worked to get the tax code changed. When by the 1950s exhaustion of the high-grade, soft Mesabi ore was at hand rather than a distant prospect, taconite reserves had been located. This enabled the Reserve Mining Company to commence beneficiation of taconite to produce iron pellets that made excellent blast furnace feed, thereby enabling Minnesota to remain a producer of iron ore and avoid the regional economic hardship that typically faced regions with worked-out mines.

A Problem Revealed

The miners and entrepreneurs who facilitated the ever-increasing production of metals were following the ancient principle or the moral duty enunciated by Vannoccio Biringuccio (1540):

For by mining such ore it might happen one day, even in a single hour, without any danger to themselves, but only to their hirelings, and without so many inconveniences, annoying outrages, or other things, they would become very wealthy…For this reason I say and conclude that the gifts of such copious blessings conceded by heaven should not be left to our descendants in future centuries…For this we should denounce them and severely reprove them in the same terms that farmers would deserve if, when the fruits of the earth ripen, instead of gathering them, we should leave them to rot and waste in the fields.

For centuries mines were opened, worked to exhaustion, and their place taken by new ones. Foster Hewitt in 1929 showed how mines typically passed through stages of discovery, expanding, peak, and declining production to abandonment (Hewitt 1929). At the Great Copper Mountain (Stora Kopparberg) in Falun, Sweden, mining began before AD 1080, peaked in 1650, and declined to an end in 1980. The huge pit formed by collapse of its underground workings in the eighteenth century is now a tourist attraction (Rydberg 1979).

Only in the Industrial Revolution did the possibility that mineral exhaustion might actually happen attract attention. Jevons in 1866 warned how depletion of Britain’s mineable coal would terminate its economic growth (Jevons 1866).Footnote 7 Six years later J. S. Mill broached the then radical idea that prosperity could be attained in a steady state rather than a growing economy (Mill 1872). Thereafter little more was heard of either issue outside of scholarly circles.Footnote 8

Dependence on tungsten imported from China needed for high-speed steel cutting tools caused some inconvenience during WWI, but was resolved by substitution of molybdenum, which could be mined in the USA. Commodity supply problems received little further attention until WWII stopped imports of rubber and tin from East Asia. Concern about strategic metals led the federal government to assemble a group of leading scientists—the Paley Commission—in 1952 to assess the natural resources available within the USA (President’s 1952). Two years later Harrison Brown, a distinguished geochemist, addressed mineral exhaustion in his book The Challenge of Man’s Future (Brown 1954). Both the Commission and Brown reached an alarmist conclusion: many metal resources would be exhausted within a few decades.

These predictions were wrong. The Commission determined the nation’s copper resource available for future use to be 25 Mt. Twenty five years later that much copper had been produced in the USA, and a new estimate of the resource available for future use then stood at 35 Mt. More than enough new resource had been found to cover both the metal extracted in the intervening 25 years and create a bigger reserve for future use. The Commission and Brown went astray by misunderstanding the difference between reserves and resources. They arrived at depletion times by dividing the reserves of a metal by the current rate of extraction, both assumed to be constant. They are not (Table 3.1). Reserves are metal in the ground that can be mined profitably at current prices. That means that a price increase can expand reserves just as discovery of new resources would. (Resource is a physical quantity, the amount of ore in the accessible earth.)

The prevailing view of mineral resources through the 1960s is on display in Scarcity and Growth, where economists Barnett and Morse showed that despite a large increase in demand, mineral prices remained constant or fell since 1870 because of decreased extraction costs and the enlargement of reserves (Barnett and Morse 1964). They questioned any need for natural resource conservation. Nevertheless doubts were stirring, stimulated by publication of Garrett Hardin’s 1968 essay on the tragedy of the commons (Hardin 1968). That and the subsequent well-publicized collapse of the Grand Banks cod fishery (Pilkey and Pilkey-Jarvis 2007) prepared the way for the enthusiastic reception of The Limits of Growth in 1972, where Meadows and colleagues warned that unrestrained flow of natural resources into wastes via consumption of food and material goods was a path to social and economic collapse (Meadows et al. 1972). Archaeological evidence of vanished societies showed that collapse can happen. That the doomsday predictions were made with computer models added verisimilitude. Thus Limits had an immediate appeal in the early 1970s that led to the sale of 9 million copies printed in 29 languages.

While the predictions of imminent collapse soon proved unfounded, the real significance of Limits was raising awareness and introducing computer modeling as a tool for exploration of the consequences of unbounded economic growth.Footnote 9 Some economists were now ready to explore resource use more critically. In Scarcity and Growth Reconsidered (Smith 1979), essays by Georgescu-Roegen (1979) and Herman Daly (1979) challenged the established economic doctrine that, for example, assumed when a product reached end of life, the materials in it simply vanished. The launch of spaceship earth was underway (Rome 2016), as evidenced by numerous new journals (Table 3.2).

Geologists expanded the scope of their research in ways that would not have been thought of a few years earlier. Techniques of underwater observation allowed geologists to watch previously inferred processes of ore formation in action. The hydrothermal mid-Atlantic vent field “TAG” has been making an ore deposit for the past 50–100 ky and now has upward of 4 × 106 t of ore containing 1–5% copper. In a new economic insight, deWit showed that the thermal energy derived from the Earth’s internal heat used to form this deposit gives its copper an endowed energy content with a current dollar value 10–20 times the value of copper that we extract from existing ore. This is embodied energy we harvest and do not have to pay for when we extract copper from ore rather than ordinary rock, an insight that gave us a new way of valuing ore deposits (deWit 2005).

Interdisciplinary collaborations blossomed. One originated in geologist Brian Skinner’s suggestion that if the ore of a metal were exhausted, the metal content of ordinary crustal rock could be a backstop resource (Skinner 1977). An econometric model with inputs from economics, geology, and engineering tested this possibility for copper. This linear programming exercise begins with the grade-tonnage relationship for copper ores and the cost of mining and smelting as ore grade diminishes to the backstop level. It assigns discounted costs to each component of copper use, the substitution of alternative materials, and recycling the stock in use. It then computes the path that yields the lowest cost of providing copper services. The results showed that use of the backstop resource would not be a significant drag on the industrial economy when ordinary ore resources were exhausted (Gordon et al. 2006). However, an econometric model does not deal with factors for which monetary values are not assigned, such as displacement of people from new mine sites or destruction of habitats.

New Concepts and Disciplines

That resource depletion and waste accumulation are actually serious problems led to questioning long-accepted assumptions. The ZPG (zero population growth) movement attracted attention. Thomas Princen (2005) and Giles Slade (2006) revisited the consequences of consumer culture. M. King Hubbert showed how fuel resources could be depleted and unresolved waste disposal could limit nuclear power (Inman 2016). Emergence of health problems arising from severe air pollution visible as smog in large cities was a stimulus to action. The enormity of the issues raised by the catastrophists called for broadened scope in materials and environmental research. Metals had to be seen as cycling from extraction through use to discard and reuse. This was not a new idea. In 1762 Jared Eliot explained it in his Essay on Iron:

Water which is raised from the Seas, Lakes, Ponds and Rivers, and carried in Clouds over the Land, is let fall in Dews and rains, and returns by Rills, Brooks, and Rivers, to the Places prepared to receive it; and as Water continues its circular Motion and Rounds, so I conceive it is with Iron; by the Water the Particles of Iron are carried to a proper Bed or Receptacle, thence it is taken and wrought for the Use of Man, and is worn out in his Service; or contracts to Rust and is consumed when it is worn away, as by the Earth in plowing, or from Horses Shoes in traveling, or from Iron Shod Wheels in carting, or by grinding with a grind Stone: The Iron by these means returns to earth again: When it is corrupted by Rust; this is much as when a Tree rots, or a man dies, they Each return to Mother earth again; these same particles of Iron then worn away, are not annihilated or lost, but being joined with Sulphur, and those other materials that constitute Iron Ore, it proceeds and takes the same Journey round till it comes to the Smith’s Forge again: Under all these changes and Revolutions there is no Addition; the same Quantity as there was at first, there remains the same still, and no more.Footnote 10

Now it had to be made quantitative. A beginning was made by Kneese, Ayres, and d’Arge in their Economics and the Environment: A Materials Balance Approach. They initiated research that, expanded by many others, matured as life cycle analysis (LCA) . Components of metal production and use, formerly studied individually, are incorporated into cycles: metal flows from sources through use providing services onward to reuse or to sinks. In the past recycling was seen as just a way of reducing a metal shortage or, less likely, as a way to reduce dependence on landfills; now it and the accumulation of metals in waste repositories are made full components of metal cycles.

Understanding metal cycles and their consequences depended on knowing the size and location of metal stocks in use and in wastes as well as flows between these stocks. Material flow analysis (MFA), undertaken initially in the 1970s and greatly expanded in the 1990s, accomplished this (Fischer-Kowalski and Hüttler 1998). By 2004, when Brunner and Rechberger published their handbook of MFA, the methods and techniques had fully matured (Brunner and Rechberger 2004). In the MFA diagram in Fig. 3.14, boxes show metal stocks and arrows the flows between them. Production incorporates all the processes of mining, milling, smelting, and refining to make primary metal. Newly made metal passes through fabrication and manufacturing into use in products, with some recycling of scrap within manufacturing. The size of the stock of metal in use providing services depends on the balance between inflow of metal contained in new products and outflow of end-of-life products passed to waste management. Here the metal content of the discards divides between recycling and waste repositories , such as landfills. The requirement of a mass balance imposes discipline on the analysis, something lacking in earlier studies of individual flows or stocks. When stocks and flows are determined for a region, nation, or continent, allowance for cross boundary flows originating in trade networks is needed, and can create difficulties in applying mass balance, except for a whole-world cycle. A MFA study is typically done for a specified time interval without establishing initial stocks. When these are wanted, the bottom-up method described below is used.

The flow into stocks in use to replace end-of-life products and addition of new products drives metal production and manufacture. Product lifetimes determine the flow into waste management. Consumerism has forced product lifetimes downward since the 1930s (Princen 2005; Slade 2006). It is now accelerated by the increasingly rapid turnover of electronic devices.

The new perspectives on metal supply and use from MFA is illustrated by a study of copper in North America through the twentieth century. Through these 100 years, 160 Mt of copper was extracted from ores and entered use and formed two new stocks, 70 Mt providing services while 85 Mt were confined to landfills from end-of-life products, wastes from primary metal production in tailings, and slags (Spatari et al. 2005). The results reveal the large losses to waste repositories relative to the metal that continues to provide services. Data on copper production show that 14% of the copper in the ore mined in the USA in the twentieth century was lost in tailings and slag during milling and smelting. A large increase in the price of copper might trigger recovery of some of this lost metal, if new innovations were to provide the means. Recovery of the metal now residing in tailings and slags would supply 10 years of US copper demand. However, 13,000 Mt of copper tailings would still be with us, creating an unresolved environmental hazard (Gordon 2002).

In the study by Spatari et al., changes in stocks were determined from inflows and outflows. This is the “top-down” method. The location and use of stocks can be found by the “bottom-up” method. Applied to New Haven, Connecticut, for example, it shows that a per capita stock of 9200 kg/c (kilograms per capita) of iron and 144 kg/c of copper in buildings, infrastructure, transportation systems, and equipment are used to sustain the population of the city. If this intensity of copper use were extended to less-developed countries, it would require consumption of all presently identified copper reserves (Drakonakis et al. 2007).

These and other studies by MFA show increased pressure on copper resources is expected from economic growth and increased population in coming decades. Providing the needed new metal will depend on the rate of discovery of new sources relative to the rate of extraction. These rates are compared in Fig. 3.15, which shows the cumulative extraction of copper and the cumulative copper resources discovered worldwide since the onset of industrialization began early in the eighteenth century. At first, large copper sources were found as ever-larger parts of the Earth’s surface were explored; the amounts extracted were relatively small. Over successive decades copper extraction converged with copper discovery, suggesting that discovery may not keep up with demand in the future. Offsetting this is the expectation that as basic infrastructure is built and technology finds more efficient ways to use metal, the intensity of metal use relative to GDP will decline. The data in Fig. 3.16 show that this has not yet happened for copper (Gordon et al. 2006).

The MFA technique can be used with alternative economic development scenarios to make projections of future metal demand. Elshkaki et al. (2016) found that copper demand will increase by over 200% by 2050. Meeting this demand would require extracting copper from all of the copper reserves, the reserve base, and up to 80% of the ultimately recoverable resource, confirming the indication in Fig. 3.15. The resulting decrease in ore grade will lead to a rapid increase in the energy used in mining and milling and a close approach to the need to use the backstop resource (Elshkaki et al. 2016).

Copper and iron as still-essential metals in the future are now joined by the rare metals, essential components of electronic devices and renewable energy sources (Abraham 2015; Veronese 2015). Graedel and colleagues use MFA to investigate issues arising with their production and add a series of new concerns under the heading of criticality, an inventory of all the factors that can complicate their supply (Graedel et al. 2015). Nuss and Eckelman (2014) in an expanded MFA analysis assembled cradle-to-grave environmental burdens for 63 metals that include energy used in extraction, warming potential from greenhouse gas emissions during winning from ore, health issues, and environmental damage. On a per kilogram basis, the greatest impact arises from the platinum group metals and gold since these are recovered from very low-grade ores.Footnote 11

The problems of using lower-grade resources with accompanying increased energy demand and creation of greater quantities of ever-more toxic wastes suggest that the concerns of the catastrophists, while distant, may be in view. In the meantime urgent, unresolved issues with the environmental and social costs of metal use await innovation that so far has not been forthcoming.

Environment

“‘Death … more desirable than life?’ The human skeleton record and toxicological implications of ancient copper mining in Wadi Faynan.” So begins a paper on heavy metals ingested by miners at the notorious Roman copper mines of Phaeno in the early-Christian era (Grattan et al. 2002). Mining’s long-established reputation as dangerous and polluting is abundantly documented by archaeological and physical evidence (see Kaufman, Chap. 1, this volume) including the “copper man,” the ancient miner found with his tools preserved by the copper-rich fluids in the mine shaft in which he was trapped in Chile (Bird 1979).Footnote 12 The Phaeno mine remains a health hazard today (Grattan et al. 2003), as do other former mine sites worldwide. They are numerous because whenever mines became unprofitable to work through exhaustion or were too deep for existing techniques, they and their mess were simply abandoned in favor of new sources elsewhere.

Mining districts ancient to modern are littered with mine shafts and waste dumps, plagued by release of toxic drainage, and marked by the remains of formerly prosperous communities that testify to social as well as environmental demise. A horrific event just 50 years ago triggered us to get serious about remediation. At 0910 on 21 October 1966, a pile of mine waste on the slope of the hill above Aberfan, Wales, that had been creeping downward for about an hour liquefied and at 30 km/h crashed into the town’s elementary school to kill 144 children.Footnote 13

The new, transformative techniques of mass mining adopted in the late nineteenth century, with their accompanying milling and smelting industries, created equally massive environmental problems which mine operators did their best to ignore until forced to confront them by lawsuits and legislation. Finding solutions to messes left by mining is today a greater challenge to technology than creating new methods of mining. The failure of innovation to solve these problems is responsible for growing resistance to new mine ventures and a greater threat to the supply of metals than actual resource scarcity.

Successful Innovations

There have been some successes, as in control of atmospheric emissions from smelting. There was a powerful incentive to reduce emissions since otherwise lawsuits would have closed large, profitable non-ferrous metal mines and mills in the late nineteenth and early twentieth centuries.

The processing of sulfide ores , the most abundant sources of copper, lead, and zinc, was the primary culprit in the release of noxious emissions. Industrial copper smelting first concentrated in Swansea, Wales, where it blanketed the city with copper smoke, a mixture of sulfur dioxide and metal-containing particulates. Lawsuits, legislation, and a search for remedies by distinguished scientists including Davy and Faraday achieved little and left building taller stacks to better disperse the smoke as the only alternative. Only closure of the smelters as the industry moved elsewhere finally relieved Swansea of the smoke nuisance (Newell 1997).

The USA avoided copper smoke until the late nineteenth century since it imported copper from Swansea, or mined native copper in upper Michigan. The problem arrived in 1890, when smelters in Tennessee’s Ducktown district, having exhausted their oxide ores, began heap roasting sulfides. Sulfur-rich smoke drifting into neighboring Georgia provoked farmers’ lawsuits that the US Supreme Court decided in the farmers’ favor in 1907. The Ducktown smelters tried three fixes, a high stack, a sulfuric acid plant, and blast furnace smelting of unroasted ore. A market for the acid nearby at a fertilizer works coupled with low arsenic content in the ore made these fixes technically and economically possible and allowed smelting to continue for several decades (Morin 2013; Quinn 1993).Footnote 14

Copper production at Butte, Montana, was on an altogether larger scale with correspondingly larger problems, particularly at the Washoe smelter in Anaconda. Its emissions shriveled farmers’ crops and killed ranchers’ cattle. Lawsuits followed. As at Swansea and Ducktown, the copper company built a tall stack and then another that, though now disused, remains the world’s largest free-standing masonry structure. It diluted the smoke that reached the ground while spreading the pollution further. Next an innovation based on laboratory science made continued copper production possible. Frederick Cottrell, a student of Wilhelm Ostwald and chemistry instructor at UC Berkeley, following up on earlier experiments by Sir Oliver Lodge in 1907 precipitated smoke particles with an electric field. His Western Pacific Precipitation Company was helped by financial backing from DuPont, which had emission problems of its own at its California lead smelter. It had the precipitation process ready to scale up when AS&R called for help at the Garfield smelter that processed ore from Jackling’s Bingham mine. The Cottrell precipitator saved Garfield from closure and was thereafter widely adopted. Cottrell used income from his invention to found the non-profit Research Corporation that continues to advance science through grant programs (LeCain 2009).

Emissions from zinc smelting caused the notorious Donora, Pennsylvania, killer smog in 1948. An atmospheric inversion in October of that year trapped emissions from neighboring zinc works that over several days killed 20 and sickened half the town’s people. The zinc was made by the traditional Belgian retort technique (Fig. 3.17). Electrowinning was a partial solution to this smelter smoke problem. It had been used commercially to make zinc since 1916 (Fig. 3.18), but its widespread use was delayed because it is energy intensive and mineral fuel was cheaper in places that did not have access to inexpensive hydropower. However, sulfide ore still had to be roasted, as the flue and stack seen in Fig. 3.18 show. The last horizontal zinc works in the USA closed in 1976 due in part to emission and health issues. Thereafter all zinc production was by electrowinning (Dutrizac 1983).

Innovations Needed

Milling ever-lower-grade ores made huge quantities of tailings that are now wet slurries carrying unrecovered sulfides and frothing agents. The stuff is dangerous and unstable. What to do with it is a huge, unresolved problem urgently in need of innovative solutions.

Tailings generate no revenue, so the incentive is to get them out of sight and out of mind in the cheapest way possible. At first a popular solution was to dump them into a lake if one were handy (Fig. 3.19). Miners on the Keweenaw Peninsula, Michigan, used Torch Lake. Tailings had advanced the lake’s shoreline by 600 m before mining ended. Years later, with the mines and mills long gone, fishers found that Torch Lake fish had lesions, presumably caused by the flotation agents retained in the tailings. Excavating and reburying the waste was a public responsibility that cost over $12 million (Gordon and Malone 1994). It was a minor prelude to things to come.

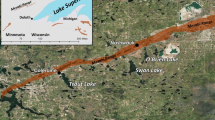

The concern about exhaustion of direct-shipping ores from the Mesabi that had been premature in 1911 was no longer at the end of WWII. ARMCO and Republic Steel revived the 1911 Davis-Jackling plan for beneficiating taconite with the Reserve mill they built in 1951. It could make 6 × 106 t/year of enriched pellets, ideal blast furnace feed. Reserve used a 1948 state regulatory approval to place its tailings in Lake Superior. Years later a new pollution control agency in Minnesota found the fibrous mineral cummingtonite in water samples taken near Duluth, and assumed that the source was the Reserve tailings, and that cummingtonite was an asbestos-form mineral, which it is not. At this time it was easy to find medical doctors with slight knowledge of mineralogy willing to be expert witnesses. With their aid a lawsuit stopped tailings disposal in the lake although no health hazard was proved (Bartlett 1980). Placing tailings from taconite in Lake Superior was a poor idea for aesthetic reasons, but it didn’t lead to disasters. The story is different for the non-ferrous metals. The residue from the leaching step of the Bayer process is red mud, a mixture of iron oxide with rutile, ilmenite, quartz, and hydrated aluminum silicates. Each ton of alumina is typically accompanied by a ton of red mud. Its disposal is a problem. At Ajka, Hungary, failure of a retaining dam in 2010 released 106 m3 of red mud stored in ponds at an aluminum production facility. The neighboring town was flooded with it; there were 10 deaths and over 150 persons injured, many with sever chemical burns since the mud was highly basic, with pH = 13. The toxic mud reached the Danube River (Enserink 2010).

Mineral separation by flotation , the key innovation that made production of copper, lead, and zinc from low-grade high-volume ore possible, also produced a wet, semi-fluid slurry of finely ground rock with residual sulfides that can flow like a liquid. There is a lot of it, even from 0.5% copper ore, which is high grade today. Backfilling a mine is not an option because the volume of the waste is greater than the volume of the ore excavated, and its fluid content would have to be contained. Even where land is nearly valueless, the tailings cannot be just spread around; they have to be confined in ponds by dams, and some of these are the world’s largest (Table 3.3). Tailings dams are made of the lowest-cost material at hand, usually tailings themselves or other mine wastes, and thus are vulnerable to all the problems of earth-fill dams, notorious for failure when penetrated by seeping water.Footnote 15 Since tailings dams generate no revenue, they receive the smallest possible care. Failure can release a flood of slurry bearing toxic chemicals.

Southern Spain has been host to mining of sulfide minerals for copper, zinc, and mercury since before and during Phoenician and Roman times (see Kaufman, Chap. 1, this volume), in the region that gave one of the world’s largest mining enterprises its name, Rio Tinto. The largest pollution event in Spanish history occurred when the tailings dam at the Aznalcóllar mine collapsed in April 1998. The dam , constructed of mine waste, had been started in 1978, when production of zinc, lead, and copper concentrates began, and was built higher year by year to contain a tailings pond 2 km long and 1 km wide. It had reached a height of 25 m and was being raised at the rate of 1 m per year when seepage so weakened it that on 25 April 1998 wind-driven waves initiated rapid disintegration that released 4 × 106 m3 of acidic water and 2 × 106 m3 of slurry into Doñana National Park, the largest reserve for bird species in Europe (Grimalt et al. 1999). Then, just 2 years later, a tailings dam retaining waste from gold production failed in Maramureş County, NW Romania. It released waste containing 100 tons of cyanide into tributaries of the Tasa River, itself a major tributary of the Danube. Cyanide pollution spread through Hungary, Yugoslavia, and Bulgaria.

The long catalog of catastrophic tailings dam failures continued year by year to 5 November 2015, when a dam retaining waste from iron mining in Brazil collapsed and flooded the town Bento Rodrigues with at least 17 killed. The list will continue.

Dry tailings do not pose the same catastrophic flood problem, but create equally intractable hazards. The Picher mining field in northeastern Oklahoma from 1900 into the 1970s produced lead and zinc from sulfide minerals found in limestone. Here 1000 hectares are underlain by mines that when active pumped out 5 × 104 m3 of water a day. Milling created solid waste, known as chat; 12 × 106 t of it are stacked in piles (Fig. 3.20). Residents of Picher and nearby towns accepted the piles of white chat as part of their landscape; children played on them, and adults rode dirt bikes over them (Fig. 3.21). Only years later did a high school teacher notice the growing proportion of children in Picher with learning disabilities. Investigation revealed that the chat piles are a source of lead-bearing dust in particles less than 0.4 mm in size. Returning the chat to mines is impractical because it would displace the contaminated mine water, even if there were enough space for it. Absent a technological fix, the people of Picher had no alternative but to leave; their relatively modern community is now a ghost town like those in the Old West but without the romantic ambience that attracts tourists. The Pitcher district is the nation’s largest Superfund site (Stewart and Fields 2016).

Finding a use for tailings has been tried; as aggregate in concrete, they made houses in Mineville, NY, the center of the Adirondack iron mining district. This was possible since the mineral mined here is magnetite rather than a sulfide. Sulfide tailings aggregate went into concrete for the Wallace, Idaho, county courthouse (Quivik 2013). But the quantities so used are minute. The innovation needed to deal with tailings has not been forthcoming.

Festering Problems

On 7 December 2016, 25,000 snow geese perished when they landed in what appeared to them to be a promising overnight resting place on their annual migration south. It was the Berkeley Pit in Butte, Montana.

Digging the pit began in 1955, when Anaconda switched from underground to surface mining. By 1980 it was 1.5 miles wide and 1800 ft deep. The pit was dewatered through abandoned underground mine working to a sump at the 3600 ft level established by Anaconda in 1901. As pumping continued a cone of depression formed in the surrounding groundwater. When the Atlantic Richfield Company, in what must be one of the worst business decisions ever made, bought out Anaconda in 1977, with the idea of diversifying from oil to copper, it acquired the Berkeley pit. Working it was a money loser. ARCO stopped mining in 1982 and shut off the dewatering pumps (LeCain 2009; Pilkey and Pilkey-Jarvis 2007). The pit is filling with water that in its epilimnion has a pH of 2.5 and abundant heavy metal content. It will reach the level of the regional ground water in about 2020. A pumping and water treatment plant may delay this, but no saving innovation is yet in sight.

Numerous additions could be made to the already long list of environmental and social consequences of metal production awaiting innovative solutions. Begin with waste from electronic devices (Abraham 2015; Stahel 2016; Veronese 2015; Zang and Guan 2016). Add the radioactive waste from power reactors now stored in holding ponds but mandated by law to be placed in impenetrable, permanent, secure isolation where no one would think of drilling for water during the next 10,000 years. (Ten thousand years? What a fantasy.)

Conclusion

In 1880 the USA was on the threshold of the expansion that would make it the world’s largest industrial economy. The innovations that supplied the metals to make this happen were made by diverse individuals including artisans, ingenious mechanics, entrepreneurial adventurers, and some scientists and engineers. Free, open, and easy communication facilitated by low-cost paper and printing contributed. Financial rewards were a powerful incentive, and the externalities could be left for the future. That future is now here.

Seventy years ago professors at mining schools talked of mining without mines. Next there was the idea of transferring mining to the sea floor. These things did not happen. Instead ore is still extracted, milled, and smelted in mining districts, now usually in less-developed countries, and the metal transported to use elsewhere, where the wastes and social disruption of its production are someone else’s problem. This is unsustainable. Here is today’s need for transformative innovation.

Notes

- 1.

Using the sun’s azimuth for direction required that the surveyor know time accurately, usually with the aid of a chronometer. We don’t know if Burt had a chronometer.

- 2.

Since there was no iron smelting in upper Michigan, the newly mined ore had to be sent to blast furnaces on the lower lakes. A steam-powered vessel had been brought in pieces and erected on Lake Superior in 1845, but sending ore to the lower lakes proved uneconomic since it had to be offloaded, carried, and reloaded at Sault Sainte Marie. Upper Michigan entrepreneurs, who had abundant wood fuel at hand, then built charcoal-fired blast furnaces near the mines. Since they clear-cut the forest and sold off the cleared land to immigrant farmers, their wood supply gave out. It was then cheaper to ship ore south to the fuel rather than mineral coal north to the ore (LaFayette 1990). Once the Soo Canal was completed in 1855, the transition to use of lake ore in Pittsburgh, Cleveland, and other steelmaking centers near coking coal was underway (Evans 1942, Reynolds 2012). Erroneous carbon 14 dates are a curious consequence of this trade. Some steelmakers used mixtures of charcoal-smelted and coke-smelted pig in their Bessemer converters. In one example excavated iron artifacts claimed to have been made in pre-colonial America on the basis of their radiocarbon dates were actually fragments of barbed wire made of steel converted from mixed pig.

- 3.

Lewis H. Merritt, from Chautauqua County, New York, joined explorers for mineral resources in northern Minnesota by 1855 and convinced himself that there must be large iron resources west of the Vermilion and other early Lake Superior iron mines, but now buried under a cover of glacial deposits. He passed his enthusiasm on to his five sons. They prospected whenever time and money allowed from 1874 onward, using a dip needle as an indicator of buried ore, thereby ignoring the prevalent belief that nonmagnetic ore would have no magnetic signature. When in 1889 the Minnesota legislature authorized the sale of leases on state land, Leonidas Merritt, the senior brother, got 31 leases that would require royalty payment of 25 cent/ton. In November 1890 the brothers followed up a magnetic anomaly, test pits, and drilling with their Missabe mine. They raised enough capital to get a rail connection in place and commenced mining (Evans 1942). A mining boom on the Mesabi Range followed, and the Merritt’s Missabe would eventually be the largest mine on the range.

- 4.

Jackling’s Bingham and other ventures gained him wealth enough to build an elegant Spanish Colonial Revival mansion in Woodside, an affluent community near San Francisco, in 1926. His house gained notoriety when Steve Jobs purchased it as a teardown, only to be stymied by preservationists (LeCain 2009).

- 5.

Although the fracture toughness of rock can be reduced by stress corrosion, the large friction losses in grinding remain.

- 6.

Achieving selective adsorption of additives to get the needed surface energies on the sulfides was complicated by their surface structure sensitivity. This is illustrated by the search on the surface of a galena crystal with a cat’s whisker needed to make a crystal radio work.

- 7.

Jevons saw coal consumption dependent on population and intensity of use. He noted that since 1800 the population of Britain had doubled but that coal consumption had increased eightfold. He expected that with this rate of growth, the coal supply would be exhausted because of the difficulty of mining at greater depths. His text was written to attract popular attention, which it did. His later work in economics was on a sounder basis (Keynes 1936).

- 8.

Mill’s argument is primarily about population rather than constraints arising from finite resources. He asserted that previous economists believed sustained growth was needed to avert universal poverty arising from population growth. Mill saw stable population as essential to avoiding widespread poverty, advocated a more uniform distribution of wealth, and limits on inherited wealth. He felt that population was already large enough that people need opportunities for solitude, the presence of wildlife, and some land left uncultivated. Only in 1973 did Herman Daly revive the steady-state, sustainable economic model.

- 9.

The predicted collapse was rescheduled for a later date in the Limits to Growth, the 30-Year Update (Meadows et al. 2004).

- 10.

Jared Eliot, minister and doctor in colonial Connecticut, invested in iron mines and with his son, Aaron, was building a cementation steelworks. He had noticed that magnetite was separated from glacial sands by running water, collected it, and made iron from it. The essay reports on this successful experiment (Gordon and Raber 2007).

- 11.

Predictions of metal scarcity arising from exhaustion of metal resources were made by individuals and by government committees in the first part of the twentieth century. They were joined by non-government, not-for-profit organizations. Now in the twenty-first century, a worldwide organization, the International Resource Panel, has taken up the task (Ali et al. 2017). Economic drag due to exhaustion of metal-bearing mineral sources has yet to emerge. Identification of more potential resources continues apace (Kessler and Wilkinson 2008).

- 12.

A “petrified miner” was also recovered in 1719 in Sweden’s Falun copper mine and identified as Fat Matts, who disappeared in the mine in 1677 (Rydberg 1979).

- 13.

The flow resulted from liquefaction due to pore pressure rise in water-saturated slate fines. See also K. T. Ericson on the 1972 Buffalo Creek flood that caused 125 deaths and destroyed 507 homes in West Virginia (Erickson 1976).

- 14.

Local hotel proprietors made the most of a bad situation by advertising the health benefits to be had from the sulfur-rich local air (Quinn 1993).

- 15.

The infamous Johnstown Flood among others originated in the failure of an earth-fill dam.

Bibliography

Abraham D (2015) The elements of power. Yale, New Haven

Ali S et al (2017) Mineral supply for sustainable development requires resource governance. Nature 543:367–372

Barnett H, Morse C (1964) Scarcity and growth. Johns Hopkins, Baltimore

Bartlett R (1980) The Reserve Mining controversy. Indiana University Press, Bloomington

Bickrert C (1986) Paul Héroult, the man behind the invention. In: Peterson W, Miller R (eds) Hall-Héroult centennial. AIME, Warrendale, pp 102–105

Bird J (1979) The ‘Copper man’: a prehistoric miner and his tools from northern Chile. In: Benson E (ed) Pre-Columbian metallurgy of South America. Dumbarton Oaks, Washington, DC, pp 105–132

Biringuccio V (1540) Pirotechnia. (trans Smith C, Gnudi M 1966). MIT, Cambridge p 51–52

Brown H (1954) The challenge of man’s future. Viking, New York

Brunner P, Rechberger H (2004) Practical handbook of materials flow analysis. Lewin, New York

Cleland R (1952) A history of Phelps Dodge 1834–1950. Knopf, New York

Cloud P (1977) Mineral resources and national destiny. Ecologist 7:273–282

Craig N (1986) Charles Martin Hall, the young man, his mentor, and his metal. In: Peterson W, Miller R (eds) Hall-Héroult centennial. AIME, Warrendale, pp 96–100

Daly H (1979) Entropy, growth, and the political economy of scarcity. In: Smith V (ed) Scarcity and growth reconsidered. Johns Hopkins, Baltimore, pp 67–94

deWit M (2005) Valuing copper mined from ore deposits. Ecol Econ 55(3):437–443

Drakonakis K et al (2007) Metal capital sustaining a North American city: iron and copper in New Haven, CT. Resour Conserv Recycl 49(4):406–420

Dutrizac J (1983) The end of horizontal retorting in the United States. CIM Bull 76-850:99–101

Eliot J (1762) An essay on the invention or art of making very good, if not the best iron, from black sea sand. Holt, New York

Elshkaki A et al (2016) Copper demand, supply, and associated energy use to 2050. Glob Environ Chang 39:305–315

Erickson K (1976) Everything in its path: destruction of community in the Buffalo Creek flood. Simon and Schuster, New York

Enserink M (2010) After the red mud flood, scientists try to halt the rumors. Science 330:432–433

Evans H (1942) Iron pioneer: Henry W. Oliver 1840-1904. Dutton, New York

Fischer-Kowalski M, Hüttler W (1998) Societies metabolism, the intellectual history of materials flow analysis, Part I, 1860-1970, Part II, 1970-1998. J Ind Ecol 2:107–136

Georgescu-Roegen (1979) Comments on the papers by Daly and Stiglitz. In: Smith V (ed) Scarcity and growth reconsidered. Johns Hopkins, Baltimore, pp 95–105

Gore G (1890) The art of electrolytic separation, recovery & refining. The Electrician, London

Gordon R, Koopmans T, Nordhaus W, Skinner B (1987) Toward a new Iron Age? Quantitative modelling of resource exhaustion. Harvard, Cambridge

Gordon R (2002) Production residues in copper technological cycles. Resour Conserv Recycl 36:87–106

Gordon R, Bertram M, Graedel T (2006) Metal stocks and sustainability. PNAS 103(5):1209–1214

Gordon R, Raber M (2007) Jared Eliot and ironmaking in colonial Connecticut: an archaeological study of the Eliot ironworks site in Killingworth. Connecticut History 402:227–243

Gordon R, Malone P (1994) Texture of industry. New York, Oxford

Graedel T et al (2015) On the materials basis of modern society. PNAS 112:112–120

Grattan J et al (2002) ‘Death … more desirable than life’? The human skeletal record and toxicological implications of ancient mining and smelting in Wadi Fayman, southwestern Jordan. Toxicol Ind Health 18(6):297–307

Grattan J et al (2003) Modern Bedouin exposures to copper contamination: an imperial legacy. Ecotoxicol Environ Saf 55(1):108–115

Grimalt J et al (1999) The mine tailings accident at Aznalcóllar. Sci Total Environ 242:3–11

Grossman S (2014) Mining engineers and fraud in the U.S.-Mexico borderlands, 1860-1910. Technol Cult 55(4):821–849

Habashi F (1983) A hundred years of the Bayer process for aluminum production. CIM Bull 76:99–101

Habashi F (1987) One hundred years of cyanidation. CIM Bull 80-905:108–114

Hardin G (1968) The tragedy of the commons. Science 162:1243–1248

Hewitt F (1929) Phases of mineral production as seen in the history of European nations. Trans Am Inst Mining Met Pet Eng 85:65–93

Hovis L, Mouat J (1996) Miners, engineers and the transformation of work, 1880-1930. Technol Cult 37-3:29–456

Hyde C (1998) Copper for America. Arizona University Press, Tucson

Inman M (2016) The oracle of oil. Norton, New York

Jevons W (1866) The coal question. Macmillan, London

Johnston A (2013) Mercury and the making of California: mining, landscape, and race, 1840–1890. Colorado, Boulder