Abstract

The chapter presents and discusses the role of dynamic entrepreneurial capabilities in family business succession, addressing the need to support and enhance innovation and competitiveness across family generations. A firm’s innovation capability depends closely on knowledge, thereby making it a key resource for obtaining sustained competitive advantage. Succession and innovation are among the hottest topics in the family business literature since the survival rate for these firms is disappointing, especially beyond the second and third generations. The topic is addressed through three case studies: two from Greece and one from Cyprus. Dynamic entrepreneurial capabilities contribute to widening successor(s) knowledge base and enhancing the successful realisation of succession through building on innovation. Dynamic entrepreneurial capabilities can help family firms defy the ominous mortality rates and not simply survive but thrive, as they build succession on innovative initiatives.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Family businesses have captured the interest of scholars from multiple disciplinary backgrounds due to their strong presence on a global level. Succession is among the hottest topics in this literature since the survival rate for these firms is disappointing, especially beyond the second and third generations. Within this context, an emerging stream explores innovation as an important strategic resource which family-run firms can use to achieve a competitive advantage (Bresciani et al. 2013) and which is affected by and affects succession. Therefore, it appears that both succession and innovation are strategically important for the survival and longevity of family businesses.

Despite significant advances in the fields of family firm innovation and family business succession, a conspicuous gap remains in family business research concerning succession as strategic orientation throughout the life cycle of family businesses under a dynamic capabilities (DC) view and within the field of strategic and innovation management.

The chapter contributes to entrepreneurship and family business research by drawing on the succession, innovation and DC literatures and by introducing the novel concept of dynamic entrepreneurial capabilities (DECs), the measurement of this and its role in innovation and succession. While DCs have received significant attention in strategic management, there are no more than a handful of works on the DC approach in family business management. Considering DECs in this study extends the literature by integrating entrepreneurial and purely strategic capabilities in the succession process and thus contributing to the DC-family business succession research field.

The chapter examines and discusses the role of DECs in family business succession, addressing the need to support and enhance innovation and competitiveness across family generations. A firm’s innovation capability depends closely on knowledge, thereby making it a key resource for obtaining sustained competitive advantage. Quite recently, family business scholars have started to recognise that innovation can be a dynamic capability (Eisenhardt and Martin 2000). Furthermore, business environments are no longer stable, while succession is by definition a dynamic process which requires a renewal of capabilities. From the DC perspective, DECs have been defined as higher-order DCs that rely mainly on knowledge and are capable of denoting changes in business ecosystems and creating new competitive advantages. DECs contribute to widening the successor(s) knowledge base and enhancing entrepreneurial capacities for a successful realisation of succession building on innovation. They can help family firms defy the threatening mortality rates and not simply survive but thrive, as they build on innovative initiatives. The chapter may orient future research in this intriguing field at the intersection of the DC, innovation and family business succession literature.

The topic is addressed through qualitative research and more precisely using three case studies: two from Greece and one from Cyprus. All three firms are family businesses and belong to different industries: food, furniture, and textiles and clothing. The empirical research shows that successors with advanced DECs exploit knowledge and other resources, creating dynamic environments mainly through innovation and achieving high post-succession performances.

2 Theoretical Background

2.1 Family Business, Succession and Innovation

Family businesses constitute the oldest and predominant forms of economic organisation in society since they constitute around 90% of companies worldwide (Gaitán-Angulo et al. 2016). They are controlled by family members and are sustained and further developed across generations. Unification of ownership and control is typical of family businesses and makes different from other firms in many areas, such as goals and culture.

Family firm research has been of interest to researchers since the 1980s, while succession is perhaps the hottest of the top issues that have received particular scholarly attention. This is because it constitutes one of the primary reasons family businesses fail (Benavides-Velasco et al. 2013). Perhaps the most quoted statistic in the world of family business regards rates of failure: 30% of family businesses make it to the second generation, 10–15% to the third and only 3–5% to the fourth generation.

Succession is defined as a process of actions and events that leads to the transition of leadership from one family member to another (Sharma et al. 2001). It is important to note that succession is a dynamic and iterative process and is described by several models underlining the need for planning on the part of the incumbent and successor (Nordqvist et al. 2013), the influence of values, culture and family dynamics (Distelberg and Blow 2010), individual attributes (e.g., Daspit et al. 2016) and so on. Researchers explore several patterns of succession, factors and barriers affecting effectiveness and success, such as the personality traits of incumbents and successors, successor education and training outside the family business, motivation, the business context, and the culture and environment (Tàpies and Fernández-Moya 2012).

Innovation constitutes an essential source of competitive advantage. It can be “a new idea, method, or device. It is the act of creating a new product or process, which includes invention and the work required to bring an idea or concept to final form” (Kahn et al. 2012, p. 454). It introduces change (radical or not) and constitutes a significant factor for entrepreneurship. The literature underpinning the phenomenon of innovation purports to explore a great variety of topics of this multidimensional phenomenon, which is both a process and an outcome.

Family business innovation has been defined as an intentional process resulting from the autonomous and interactive efforts of members of a family-run business (Urbinati et al. 2017). According to Benavides-Velasco et al. (2013), it can be a complex process due to the dichotomy of managing the demands of both family and business. According to Urbinati et al. (2017), it appears mainly as outcome in the form of product innovation.

Research on innovation in family firms is in its infancy (Bresciani et al. 2013; Urbinati et al. 2017). Some scholars have pointed to a negative relationship between family involvement, innovativeness and expenditure on research and development, while empirical evidence is somewhat mixed regarding the effect of family influence on innovation output (De Massis et al. 2015). Some researchers state that innovativeness is negatively affected by the succession event, while others conclude that intra-family succession is the catalyst for revolutionary change and innovation (De Massis et al. 2015) or that generational changes can increase the level of internal and external innovativeness (Zellweger and Sieger 2012).

Following the general trend in the innovation literature, family business scholars have also turned to the notions of knowledge, resources and capabilities required by a firm in order to innovate. Bresciani et al. (2013) link innovation to competitive advantage and investigate the innovative capacity of family businesses with reference to the resource perspective. Benavides-Velasco et al. (2013) propose a resource-based view as a way to identify the resources and capabilities that allow family firms to survive and grow. Padilla-Meléndez Dieguez-Soto and Garrido-Moreno (2015) relate the organisation’s propensity to innovate to a dynamic capability linking it further to resource allocation, organisational learning and knowledge management. Moreover, “familiness”, perhaps the most notable contributions to theories regarding family firms, represents the unique bundle of resources and capabilities generated from the interaction of the family and business systems that contribute to competitive advantage (Daspit et al. 2017).

2.2 The DEC Perspective and “Transgenerational Innovation”

Recently, family business scholars have started to recognise that innovation, as the ability to develop new products and processes or to improve existing ones, can be a dynamic capability (Eisenhardt and Martin 2000) and lead to positive business performance (Chirico and Nordqvist 2010). Furthermore, business environments are no longer stable, no matter the industry (Protogerou and Karagouni 2012), and succession is therefore a dynamic process which requires a renewal of capabilities.

The concept of DCs was introduced by Teece, Pisano and Shuen (1997) and described in Teece (2007). They are defined as a set of specific and identifiable strategic and organisational processes which enable organisations to revise, integrate and reconfigure their internal and external skills and resources to match environmental changes or, according to Helfat et al. (2007), to purposely create, expand and revise their resource base.

DCs have just started to appear in family business literature as a very small but increasing stream, pointing to the importance of adopting a dynamic perspective when studying capabilities which are likely to change over time, especially during distinct dynamic events such as transgenerational succession. Chirico and Nordqvist’s (2010) conceptualisation of how DCs are generated by knowledge and create product innovation by family firms was the first effort to relate the DC view to family firms. Urbinati et al.’s (2017) framework adopts a DC perspective while Lin and Hou (2014) related DCs to the performance of family firms.

Within the DC perspective, DECs have been defined as higher-order DCs that influence the location and the modes of selection of resources, skills and knowledge in order to denote changes in business ecosystems and create new competitive advantages. DECs were initially developed to portray the abilities of an entrepreneurial or a managerial team to engage in non-routine activities and as a paradoxical way of combining a variety of knowledge assets in order to create low-tech ventures (Karagouni and Caloghirou 2013). DECs are operationalised across three dimensions: (1) transcendental capability explains how innovative concepts are built, suggesting that they are the results of knowledge-generation processes—this mainly concerns the process of intangible asset creation, which according to Teece (2011) constitutes the new, hard-to-build “natural resources”; (2) bricolage capability enables agents both to explore and exploit new opportunities that might otherwise be too expensive to investigate; and (3) improvisation capability allows agents to create and execute new plans “on the fly”, using resources available when opportunities or unexpected pieces of knowledge and information emerge.

According to their definition, a significant role of DECs is to activate their entrepreneurial and cognitive component and provide for their flexible shaping and use in cases of strategic changes in organisations, such as in the restructuring of the organisation (Sharma and Chrisman 1999). Entrepreneurs and managers are the key agents of DEC development; DECs can be deliberately cultivated, developed and influenced by the core decision-makers. They are simple, idiosyncratic and iterative. They are related to the firm’s survival, affecting its growth, innovativeness and competitive advantage.

Succession is “not just changing the people, it’s changing the system” (Leach and Bogod 1999, p. 191). This actually means a renewal and development of a new type of business structure, procedure and, often, a new entrepreneurial orientation of the successors. Therefore, we can assume that DECs can indeed play a role in a family business and specifically at transgenerational successions. As successful succession must provoke revolutionary change and innovation (De Massis 2015), bringing constructive organisational change, this becomes a far more dynamic process than is usually believed.

3 Method

3.1 The Empirical Setting

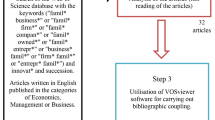

The research is a longitudinal, multiple exploratory case study with the individual family firm as the unit of analysis (Yin 2009). This method permits replication logic since each case is viewed as an independent research study which may confirm, reject or extend the theoretical background through new insights. The sample was selected from among family firms that were governed by the second or the third generation. It consists of three private family firms: two Greek ones from Oinofyta (Alpha) and Agrinio (Beta), and a Cypriot one from the city of Nicosia (Gamma). All firms belong to different industries (Table 3.1) which occupy a prominent position in the European manufacturing sector. The names given to firms and some other information have been disguised for confidentiality reasons.

3.2 Measures

3.2.1 DECs

Transcendental capability constitutes a purely dynamic entrepreneurial capability of a strategic nature that implies the development of two dimensions:

-

(a)

The capacity to develop panoramic ecosystem awareness in order to sense of spaciousness (Karagouni and Caloghirou 2013) and a constant sensation of where the agents are and where they want to go. Spaciousness allows successors to generate opportunities beyond imposed rules, established path-dependencies and limitations. The capacity is related to the openness of the agents to novelty, and their attitudes, experiences and knowledge but it extends to the areas (sectors, sciences and perspectives) they search, the markets they explore, the mechanisms and channels they use, the networks they build and the visions they develop. This requires further an ability to view global markets in a panoramic way and therefore an ability to view a given phenomenon from various points simultaneously.

-

(b)

Transcendental synthesis concerns the process of data and stimuli reception, a spontaneous reaction, and a repetitive action of judgement. This is an act of intelligent unification which regards bottom-up and up-down information-processing capabilities, openness to ideas and external stimuli, as well as sensitivity to internal signs and stimuli. It is complemented by the capacity or process of judgement, which refers mainly to how actors arrange the firm’s assets; it enables the application of specific rules that directly reflect the internal structures of the organisation, thereby generating correspondingly structured outputs.

Bricolage capabilities are strongly shaped by knowledge bases and networks within and outside the bounders of the firm’s sectoral value chain. Bricolage is treated as a process of continuous creation and use of knowledge, and as an exploitation of various types of resources. It has two main dimensions:

-

(a)

“Repertoire building” concerns the ability to collect tangible and intangible resources, such as available materials, financial capital, technical assets and knowledge, including different uses of available resources (Ciborra 1996). The ability to build a repertoire includes the ability to create a proper problem-making environment, codify and formulate problems and find solutions by the exploitation of “resources at hand” that are necessary to achieve the particular goals (Chang et al. 2005). These are firm processes, structural mechanisms, forms and routines (Ciborra 1996), knowledge, physical resources, social capital and networks (Baker et al. 2003). The target is to fill in the gap between vision and reality. In order to achieve the desired results, an important part refers to learning through feedback from collaborators, suppliers and other parts of the business ecosystem.

-

(b)

Concentric cycle networking concerns the ability to expand networks starting from the business networks and interpersonal relations; this actually constitutes the initial network pool and can be considered an aspect of the resources at hand. Networking enables the creation of links to potential sources of knowledge, novel technologies or strategic alliance partners. The dimension concerns the progressive opening up to suppliers, customers and skilled labour, as well as to actors of other industries and other scientific areas.

Improvisation capability allows agents to “read the world in a different way” (Ciborra 2002); instead of the established linear “design-plan-execute” model, they appear to create and execute new plans “on the fly”, using resources available at the moment when opportunities or unexpected pieces of knowledge and information emerge. It concerns:

-

(a)

Information flow between the actors and the environment (Chelminski 2007) that enables real-time communication; this the interaction within and between the teams based on timely information. It can be measured by the communication skills of all stakeholders (Vera and Crossan 2005), the degree of knowledge, information-sharing and flexibility, which implies the spontaneous response to circumstances and obstacles arising, allowing exceptions to rules. Flexibility is further related to the capacity for exploring, continuous experimenting, trial-and-error processes with the tolerance of mistakes and failures, and tinkering with possibilities without knowing how the action will unfold (Barrett 1998).

-

(b)

The provocative organisational competencies sub-dimension denotes the absence of adequate routines, low procedural memory and minimal structures (Vera and Crossan 2005). “Provocative competences” are “any deliberate effort to interrupt habit patterns” (Barrett 1998, p. 606) and are based on trust and specific communication codes among stakeholders. Low procedural memory may concern the engagement of completely new staff or the development of new processes and new shifts (Chelminski 2007; Ciborra 1996).

3.2.2 Performance

Financial outcomes (sales and growth), innovation and strategic choices compose the firm’s entrepreneurial performance (Barney 1991), while growth is the most relevant performance indicator in family business succession (Molly et al. 2010), as measured by sales trends after the formal transfer of the firm to the successors.

Innovativeness performance concerns new or diversified products, or product line extensions, new or improved processes, production methods, promotion methods, business models, novel technology and opening up of new markets. Strategic choices concern new markets or niche markets and new technology (De Massis 2015).

3.3 Data Collection

Data were collected through several face-to-face, in-depth interviews using semi-structured questionnaires with two or more family members actively involved in each firm in 2015/2016. Interviews were conducted across several meetings; they were taped and transcribed soon after. The interviewees were also asked to narrate the stories of the succession events, the obstacles and worries they faced and the family firm’s evolution over time. Additional sources of information were also used to complement the interview data, such as plant visits, company reports, awards, company websites and press attention.

4 Findings

4.1 Transgenerational Innovation and the Impact of Succession on Performance

Alpha’s performance after succession was excellent. Kostas (the father) established a conventional linen company, which soon developed more sophisticated and value-added activities (products for the army and the health sector). Following the innovative father, the two successors took the risk to invest in technical textiles at the time of succession. In almost five years, succession led to a complete change of strategy: Alpha became a pioneering and innovative company, one which is still unique in Greece in the development and manufacture of high-performance textile products for the defence and safety sector and among industry leaders worldwide. The successors tried (and succeeded in their efforts) to differentiate with innovative, high-tech and, sometimes, patented products, registered trademarks and novel promotion methods. They developed a strong research and development image, focusing on research both in-house and in cooperation with high-tech parties. With significant investments in technology and cutting-edge research findings in biochemistry and nanotechnology, they reformed production technologies to the requirements of the new textiles.

During the years following the succession, Alpha entered new niche markets such as bullet-proof products, invested in verticalisation, engaged in e-commerce and developed its own retail network. The company developed strong design and product development capabilities, becoming a constant innovator for niche markets.

“We export to more than 16 countries while NATO, [the] RAF [Royal Air Force] and many Defence Ministries are among our best customers” (Demetris, Economist).

Alpha had an 88% sales increase in the difficult crisis years, accompanied by a 130% export increase with exports to count for almost 80% of its turnover. Significant amounts are reinvested in knowledge, technology and R&D. The new (third) generation is en route: “

My two sons are at University preparing to enter the company” (Michalis, chemist, MSc in Manufacturing System Engineering).

Beta also presented an excellent performance; the third generation consists of five cousins, the children of three brothers. Three cousins were interviewed. According to Kostas, they were educated to take over the company. However, the young successors had to overcome the distrust of the old generation in involving science in rice production. The “bet” was a second plant which would be the basis of innovation for the new generation and the need to preserve leadership for the incumbents:

“The good thing was that our fathers thought that a plant is a plant and we would not have a lot of margin for error!” (Kostas, Economist).

Beta’s successors took over the company in dynamic ways: they invested heavily in innovation and innovation capabilities, patented process methods and cutting-edge technologies, the creation of a strong research and development and quality control department, aggressive new product development and continuous investment in knowledge development. They reoriented its strategy towards differentiation and innovation; they were among the first to delve into circular bio-economy long before the concept became a trend. Indicatively, under the slogan “nothing to be wasted”, they commissioned significant research and now they have launched a number of high-value products for the chemical industry: “When you suspect a need you can create a result. Of course you may change the initial idea more than once. All this way comprises knowledge, research as well as imagination” (Tasos, Mechanical Engineer).Soon after the transfer to the new generation, the company started exporting. Beta has won a number of national and international awards since then. It is the leader in the Greek market with a share of more than 30% and has increased its share in the international market. The company almost tripled sales within a decade, with an increase in size from 120 to around 180 employees. Net income increased considerably up to 2012 and reinvestments in the company have been made. The family company did very well through the severe financial crisis in Greece: “In such crises one should think of a superb management and restructuring. This crisis is a crash test for all enterprises which have a considerable time of existence. I don’t mean companies of 10 or 15 years, but the ones that count even 100 years!” (Vasiliki, Economist).

In Gamma, performance was negatively affected after the transfer to the third generation. Stelios and Anna inherited a modern furniture manufacturing plant and a loyal clientele of high-end customers in Cyprus and the United Kingdom. However, the successors could not follow the father’s pace. The new generation did not invest in any type of technology or in marketing. New products are sometimes launched, which are usually replicas of European design models. The firm has gradually shrunk in size since it lost a significant piece of its market. Stelios says:

“We took over within the crisis. We had to confront many problems. We worked together with father to survive. We could not think of innovating” (Stelios, graphic designer).

Gamma’s size and net income rose substantially after Harris (Stelios’ father) took over in 1977. It increased until 2005 and it was quite stable until 2010. However, the entrance of the two successors (2009–2010) had a negative impact on performance and sales. Harris tries to provide excuses for the successors:

“They were not ready. Maybe, it is not the right job for them! I loved it and I used to search a lot to sense technology, the market, my clients! Stelios is afraid to invest.”

The future for Gamma appears uncertain:

“I just got married. I will not continue to work here. I don’t know about Stelios. I think he also wants to escape this mess! We are thinking of ceasing production. It’s actually a shame. Father had invested heavily in production” (Anna, economist).

4.2 The Role of DECs

Alpha’s successors had developed significant transcendental capabilities. They purposefully developed the “bird’s view” (before and around the time of succession) of Greek and European markets and sensed the threat of the Asian counterparts against mass production in the textiles and clothing industry, while the majority of the Greek sectoral entrepreneurs did not. According to Demetris, “In the early 90s traditional productive activity started moving to eastern countries with low labour costs”. As Michalis said, “Our vision was to advance knowledge and technologies for high-performance products. Our aspiration could be fulfilled through a sustainable technological-oriented and customer-centric path based on continuous innovation.”The panoramic ecosystem awareness exceeded the initial market and sub-sector; they invested in collecting knowledge and information on innovative materials, special functions and technologies, such as anti-ballistic technology. Transcendental synthesis yielded to innovations in technology, marketing and business models as the results of the sub-dimension of receptivity concerning: (1) opportunities due to emerging European norms and existing European standards; (2) technology evolution; (3) the production shift to Asian countries; (4) the advances and innovations of the chemical industry; and (5) the growing interest in high-tech textile products.

The successors grounded the reasons for their idea in: (1) a need to escape conventional mass production; (2) the positive aspects of the emerging trends; and (3) the need to change from a labour-intensive to a knowledge-intensive approach. Their decisions led to: significant knowledge acquisition; the development of a strong research and development department and quality control; a significant investment in the reorganisation of the whole productive process; the creation of an extensive network with global leading chemical industries such as Du Pont; Computer Integrated Manufacturing (CIM) integration; and new customer approaches.

Bricolage capability is strong for Alpha. In order to realise their vision, the two brothers questioned the better fit between protection and the human body and developed networks with firms of high-tech sectors well outside the textiles sector. As Demetris said:

We owned extended knowledge on clothing and knitting technology. Then, we learnt how to handle with military standards. We wanted to differentiate. I mean when you have some advanced know-how and relevant experience, you seek to develop competitive advantages. Then you have to find how. We tried to find people to cooperate to gain knowledge … material … techniques … Whatever we needed for our new vision.

Concentric cycle networking dimension is evident; the successors developed formal and informal relationships in order to build on knowledge coming from external sources through contracts and joint projects. The most important sources of external knowledge, provided in formal or informal ways, are their high-tech suppliers. As Michalis said:

Good relations and trust is important. For example, it was the fire-protection material; we had started an official co-operation with a laboratory in England, the leader in its area. We had a really fine relationship and people would provide information and knowledge when just talking—I mean informally.

Transsectoral and transnational knowledge plays a core role in the two successors’ culture; they invest money and time in seeking knowledge in various scientific, industrial and functional areas. With significant experience of the sector, they have proved to be unconventional and personally involved in the efforts to innovate.

Improvisational capabilities are characterised by conscious and stable communication and interaction with the environment in the pursuit of more novelty and differentiation. Changes can be freely made by all team members. Indicatively, improvisational capabilities have enabled the creation of a special customisation line—a need that emerged through a three-piece order at the family firm during the development phase of the new equipment. Alpha’s successors improvise by experimenting and through trial-and-error regarding both processes and novel products.

It is interesting to note that successors were not affected by core rigidities of the family firm but had developed flexibility in seizing opportunities. Provocative competencies appear in the form of flexibility in decision-making, and in working out of routines, budgets and estimations which, according to Michalis, were crucial for the realisation of their concept. However, it was a common commitment not to use the family firm’s routines in that phase.

Furthermore, it was evident that the actors’ enthusiasm for innovation, the attitude towards knowledge and novelty, their extroversion and their creative and provocative dissatisfaction affected the quality of their improvisational capabilities.

Beta’s successors drew on the significant business success of the family firm, its strong position in the Greek market, and existing contacts with world leaders across the value chain. They had cultivated high-level panoramic ecosystem awareness, due to academic studies, their involvement in the family firm, and their participation in trade and international events. They were raised in an entrepreneurial milieu, encouraged to travel a lot, gain experience and develop the sense of spaciousness:

“Our parents were innovators and pioneers in many ways. They were the first in Greece to invest in packaging and sponsor a TV music show!” (Vasiliki).

Science, institutional settings and trends towards a healthy life-style, functional food, demographic data, environmental issues and globalisation constituted their largest areas of spaciousness. Indicatively, they created new food combinations that suited different customers’ needs and products in intra-sectoral areas (pharmaceutical, chemistry, etc.). As Kostas said:

“Of course all these presuppose knowledge, scientific research and experimentation. Still, nothing exists before you imagine and invent it! All this way comprises knowledge, research as well as imagination!”

It took ten years to engage scientific knowledge, diffuse it throughout the company’s functions and establish a new culture. Knowledge of food technology at a scientific level was further nurtured by the approach to universities for formal research collaborations:

“Our initial aim was to be reinvented in order to suit to the new entrepreneurial international landscape that we felt it would soon come. A sort of knowledge verticalization … Of course, we wanted to keep and enlarge our current market but we bet on innovation too!” (Kostas).

Decisions concerned economic profitability versus the uncertainty of bringing science into rice production. They reflected the internal structures of Beta and referred mainly to productivity, quality, consistency and corporate image. Justification came through a variety of reasons such as the identified gaps in the global market and the emerging environmental challenges. The opportunities exploited were both market driven (covering the existing markets of the family business) and technology driven (innovativeness).

Bricolage capability is very strong. The successors appear keen to use all resources and abilities “at hand” in combinative ways to maximise results: existing codified and tacit knowledge, knowledge sources, strong existing networking cycles, capital resources and even the family firm’s reputation among suppliers and customers. The successors invested mainly in technological knowledge to intervene in innovative ways in known processes focusing on ecological aspects, energy saving and recycling. In all cases, learning comes through conscious knowledge-generation, trial-and-error and experimentation. Interactive learning becomes a highly dynamic process:

“Our success depends on the knowledge gathered by our efforts and of course through the generation. There is an easy flow of information within us and to some extent, between generations” (Kostas).

Beta’s improvisational capabilities are characterised by conscious and stable communication and interaction with the environment. Real-time information excelled the implementation and potential of the new technologies. Contacts are mainly formal but changes were free to be imposed by all team members. The case revealed certain dimensions of improvisational capabilities, such as diversity, a sense of urgency and flexibility, the promotion of experimentation and strong action. As Tasos said:

“I think we managed it well and we really went rather fast! It took us three to four years to formalize the initial idea, experiment, make the plant and improve the product. Initial plans were many times changed; I bet we were flexible. It was quite an adventure!”

Kostas narrates the constant bidirectional knowledge flow of both embodied and disembodied knowledge through skilled personnel, training, plant and equipment design, and description, consulting, experimentation, machinery and equipment.

Gamma can be considered the “weak” case. Insufficient panoramic ecosystem awareness is a result of not getting deeper knowledge of the business ecosystem and of being locked into narrow patterns of expectations. This weakness may have also created a feeling of insecurity and a hesitant prediction of market potential. Weak panoramic ecosystem awareness seems to be further co-responsible for the low post-succession innovation and mediocre business development. As Harris explained:

“Stelios worked with me for many years. However, he did not wish to study and he was reluctant to follow me at trade shows. But it was the same with me when I started. He is a fine carpenter and he likes design; he attended a private school here in Nicosia.”

The panoramic ecosystem awareness was too weak to create preconditions for boosting innovation and creativity. Spaciousness was limited to a search for attractive design products and did not even extend to the exploitation of cutting-edge technology for the plant. This weak sense of spaciousness led to poor bricolage and improvisational capabilities. Gamma’s successors preferred to stay in the secure existing family business system and missed the opportunity to build a new vision and their ecosystem with their own rules. Furthermore, judgements concerned mainly problem-solving and led to mediocre and unsatisfactory plans. Data, stimuli and opportunities were tackled hesitantly and on the basis of former routines: “We asked ourselves, ‘what would father do?’ We actually asked him but e-commerce was all Greek to him!” (Anna).Afraid to expand, the actors became trapped in simply satisfying the current needs of the existing market, which actually offered no new unique advantage to the family firm. On the contrary, many customers turned to other firms since they were loyal mainly to the father. The successors were hesitant to risk an aggressive market entrance at national level, turn to new strategies or invest in building new competitive advantages.

Weak bricolage capabilities are evident. The successors rested on existing networks; this was not a choice (as in the case of Beta) but a consequence of their weak strategy. Furthermore, the pieces of information and knowledge collected were limited and insufficient for creative combinations. As Stelios said:

“We thought of developing our own footprint based on eco-design but it was quite difficult to reach knowledge needed, and materials were too expensive to bring in Cyprus. So, we rejected the idea.”

Both successors were too introvert and not particularly unconventional. They seemed to pursue the established procedures of the family business, which, however, could not fully support the business. The existing competitive advantages of the family business became obsolete in a very short time since they were not nurtured and developed in novel ways.

Gamma is a case of weak improvisation capabilities, where facts are not connected to creative actions “on the fly”. They are exercised mainly in order to solve problems and overcome obstacles, but the successors appear to fail to learn while, in some cases, they could not even recognise failure. They seem unable to engage real-time information (for example, missed opportunities to individualise products in Limassol) or any type of flexibility. This is most evident in the ways they approach experimentation.

5 Discussion and Conclusions

This chapter examines how DECs contribute to widening successor knowledge bases and enhancing their entrepreneurial capacities for a successful succession, building on innovation. Succession is “not just changing the people, it’s changing the system” (Leach and Bogod 1999, p. 191); therefore, it is a highly dynamic process which must provoke revolutionary change and innovation in order to be successful.

The chapter contributes to the family business literature mainly by introducing novel DECs, their measurement and their role in cases of succession and vice versa, to the DC literature by explicating the role of DECs in family business management. The findings imply that scholars should attempt to identify the DECs that allow family firms to engage in non-routine activities, improvisation and a flexible way of collecting and establishing knowledge assets and asset combinations in order to revitalise a family firm’s operations and reorder its core capabilities to suit the new management system of the successors. In line with Bresciani et al. (2013), the new generation should develop the “necessary competencies to continue the family business”. DECs are idiosyncratic and dependent on the particular characteristics of each family business and its culture, encourage innovation as an important strategic resource of successors to sustain existing and achieve new competitive advantages, have a significant impact on post-succession firm performance and shape a firm’s DCs.

Another contribution of this study is to provide a clearer perspective of the managerial issues of the succession processes in family-owned firms. This is critical in competitive environments and those facing rapid change. The findings show that innovation and novel strategic orientation are crucial for the longevity of family businesses. They further indicate that a renewal and development of new type of business structures, novel procedures, and often a new entrepreneurial orientation of the successors is necessary and that DECs can support this.

According to the findings, DECs have a positive impact on diverse performance measures, indicating that they can indeed play a significant role in cases of family business succession and are strongly related to innovative performance. Alpha and Beta develop strong DECs, introduce important process and product novelties through time and create an innovative culture. They take advantage of multifaceted global knowledge and former experience, and innovate by offering patented products and processes, highly differentiated products with unique characteristics, or even novel business models. Their DECs are also related to export orientation and high performances, even during periods of economic crisis. Furthermore, DECs seem to maintain and strengthen these firms’ fit with their changing environment during the sensitive phase of succession, not only with regard to their current family business practices but also in terms of their successful operation under the new management and culture.

The Gamma case reveals that weak DECs are partly due to human capital and resources, including specific attitudes towards the family business. In this case, transcendental synthesis was poor, mainly due to very low spontaneity and judgement. Indicatively, knee-jerk reactions and unreasonable grounding led to false decisions, such as the challenge of eco-furniture, which was abandoned; the successors chose to stay in the family business cocoon.

Transcendental capabilities seem to be responsible for the repositioning of the family business within the business ecosystem and its dynamism. Weak transcendental capabilities result in many inconsistencies regarding competitive advantages, instability in strategies and incapability in communicating novelties. Insufficient panoramic ecosystem awareness affects initial core choices regarding area of activation (spaciousness), limiting innovativeness and choices.

Bricolage capability, composed mainly by dynamic “knowledge-repertoire” creation and networking, has a significant role; the two cases with strong bricolage capabilities exploit the existing networks of the family business and stretch these further in new areas and directions which extend sectoral borders.

Innovative attitude and the underpinnings of new product development can be assigned to the significant improvisation capabilities of Alpha’s and Beta’s successors. A major aspect of the capability is the provision of retrospective interpretation and the creation of new patterns regarding products, processes, targeted markets or models, and the capacity to create information flows between family members, employees, suppliers and other stakeholders. Flexibility within the improvisational capability allows agents to respond to a variety of both unexpected demands and opportunities within a dynamic and uncertain environment during succession by promptly committing resources to the emerging challenges and by overcoming the liabilities of the established family business culture. It should be noted here that it is not intended that the family business strategy is not a successful one before succession; the focus is on the necessity of strategic reorientation due to the significant internal changes which unavoidably cause instabilities in the firm’s business ecosystem. Thus, the successors purposefully cultivate provocative organisational competencies. The persistent tendency for learning and experimenting is also evident.

Finally, an implication for family businesses emerging from this study would be to start early in drawing up a DEC portfolio ready for the time of succession. This concerns a variety of factors such as successors’ education and outside work experience, involvement in the family business decision-making, panoramic ecosystem awareness cultivation and openness of mind. Such culture would facilitate the renewal and strategic reorientation as a means of responding effectively to the changing conditions prevailing in family business succession. In addition, DECs facilitate the translation of knowledge into innovation and consequently growth and longevity.

There are certain limitations in this study, such as the method used, the small size of the sample, and the lack of homogeneity of the cases that do not allow for generalisations. Results may also vary in terms of the sector, the market and the national context, among others. These limitations could be also seen as fruitful avenues for further research. Empirical studies could test the DEC framework on large samples in different contexts.

Besides limitations, it appears that successions in family-owned firms are far more volatile and critical than commonly thought. Therefore, DECs can have a significant role to play in such events: they can ensure survival and growth in sales and innovation. The equally strong development of bricolage, improvisational and transcendental capabilities can assist the creation of strong initial competitive advantages for successors to make their formal debut in the family business, innovate and achieve a high level of performance.

References

Baker, T., Miner, A. S., & Eesley, D. T. (2003). Improvising firms: Bricolage, account giving, and improvisational competency in the founding process. Research Policy, 32(3), 255–276.

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120.

Barrett, F. (1998). Creativity and improvisation in jazz and organizations: Implications for organizational learning. Organization Science, 9(5), 543–555.

Benavides-Velasco, C. A., Quintana-García, C., & Guzmán-Parra, V. F. (2013). Trends in family business research. Small Business Economics, 40(1), 41–57.

Bresciani, S., Thrassou, A., & Vrontis, D. (2013). Change through innovation in family businesses: Evidence from an Italian sample. World Review of Entrepreneurship, Management and Sustainable Development, 9(2), 195–215.

Chang, S. C., Lin, R. J., Chen, J. H., & Huang, L. H. (2005). Manufacturing flexibility and manufacturing proactiveness: Empirical evidence from the motherboard industry. Industrial Management and Data Systems, 105(8), 1115–1132.

Chelminski, P. (2007). A cross-national exploration of the potential cultural antecedents of organisational improvisation. Journal for Global Business Advancement, 1(1), 114–126.

Chirico, F., & Nordqvist, M. (2010). Dynamic capabilities and trans-generational value creation in family firms: The role of organizational culture. International Small Business Journal, 28(5), 487–504.

Ciborra, C. U. (1996). The platform organization: Recombining strategies, structures, and surprises. Organization Science, 7(2), 103–118.

Ciborra, C. U. (2002). The labyrinths of information. Oxford: Oxford University Press.

Daspit, J. J., Holt, D. T., Chrisman, J. J., & Long, R. G. (2016). Examining family firms succession from a social exchange perspective: A multiphase, multi-stakeholder review. Family Business Review, 29(1), 44–64.

Daspit, J. J., Chrisman, J. J., Sharma, P., Pearson, A. W., & Long, R. G. (2017). A strategic management perspective of the family firm: Past trends, new insights, and future directions. Journal of Managerial Issues, 29(1), 6–29.

De Massis, A. (2015). Family business and innovation. In D. B. Audretsch, C. S. Hayter, & A. N. Link (Eds.), Concise guide to entrepreneurship, technology and innovation (pp. 89–92). Cheltenham: Edward Elgar Publishing.

De Massis, A., Frattini, F., Pizzurno, E., & Cassia, L. (2015). Product innovation in family versus non- family firms: An exploratory analysis. Journal of Small Business Management, 53(1), 1–36.

Distelberg, B., & Blow, A. (2010). The role of values and unity in family businesses. Journal of Family and Economic Issues, 31(4), 427–441.

Eisenhardt, K. M.,. a., & Martin, J. A. (2000). Dynamic capabilities: What are they? Strategic Management Journal, 21(10–11), 1105–1121.

Gaitán-Angulo, M., Viloria, A., Robayo-Acuña, P., & Lis-Gutiérrez, J. P. (2016). Bibliometric review on management of innovation and family enterprise. International Journal of Control Theory and Applications, 9(44), 247–253.

Helfat, C., Finkelstein, S., Mitchell, W., Peteraf, M., Singh, H., Teece, D., & Winter, S. (2007). Dynamic capabilities: Understanding strategic change in organizations. Malden: Blackwell Publishing.

Kahn, K. B., Barczak, G., Nicholas, J., Ledwith, A., & Perks, H. (2012). An examination of new product development best practice. Journal of Product Innovation Management, 29(2), 180–192.

Karagouni, G., & Caloghirou, Y. (2013). Unfolding autotelic capabilities in low-tech knowledge-intensive entrepreneurship. Journal of International Business and Entrepreneurship Development, 7(1), 21–36.

Leach, P., & Bogod, T. (1999). Guide to the family business. London: Kogan Page Publishers.

Lin, H. J. C. S. J., & Hou, J. J. (2014). An investigation of family business from the perspective of dynamic capabilities. Web Journal of Chinese Management Review, 17(1), 1.

Molly, V., Laveren, E., & Deloof, M. (2010). Family business succession and its impact on financial structure and performance. Family Business Review, 23(2), 131–147.

Nordqvist, M., Wennberg, K., & Hellerstedt, K. (2013). An entrepreneurial process perspective on succession in family firms. Small Business Economics, 40(4), 1087–1122.

Padilla-Meléndez, A., Dieguez-Soto, J., & Garrido-Moreno, A. (2015). Empirical research on innovation in family business: Literature review and proposal of an integrative framework. Revista Brasileira de Gestão de Negócios, 17(56), 1064.

Protogerou, A., and Karagouni, G. (2012). Identifying dynamic capabilities in knowledge—intensive new entrepreneurial ventures actors sectoral groups and countries, D1.8.2. AEGIS Project. Retrieved from http://www.wfdt.teilar.gr/papers/AEGIS_Deliverable_1.8.2.pdf

Sharma, P., & Chrisman, J. J. (1999). Toward a reconciliation of the definitional issues in the field of corporate entrepreneurship. Entrepreneurship Theory and Practice, 23(3), 11–27.

Sharma, P., Chrisman, J. J., Pablo, A. L., & Chua, J. H. (2001). Determinants of initial satisfaction with the succession process in family firms: A conceptual model. Entrepreneurship Theory and Practice, 25(3), 17–36.

Tàpies, J., & Fernández- Moya, M. (2012). Values and longevity in family business: Evidence from a cross-cultural analysis. Journal of Family Business Management, 2(2), 130–146.

Teece, D. J. (2007). Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strategic Management Journal, 28(13), 1319–1350.

Teece, D. J. (2011). Dynamic capabilities: A guide for managers. Ivey Business Journal, 75(2), 29–32.

Teece, D. J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18(7), 509–533.

Urbinati, A., Franzò, S., De Massis, A., & Frattini, F. (2017). Innovation in family firms: A review of prior studies and a framework for future research. In A. Brem & E. Viardot (Eds.), Revolution of innovation management (pp. 213–246). London: Palgrave Macmillan.

Vera, D., & Crossan, M. (2005). Improvisation and innovation performance in teams. Organization Science, 16(3), 203–224.

Yin, R. K. (2009). Case study research: Design and methods (4th ed.). Thousand Oaks: Sage.

Zellweger, T., & Sieger, P. (2012). Entrepreneurial orientation in long-lived firms. Small Business Economics, 38(1), 67–84.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 The Author(s)

About this chapter

Cite this chapter

Karagouni, G. (2018). The Role of Dynamic Entrepreneurial Capabilities and Innovation in Intergenerational Succession of Family Firms. In: Vrontis, D., Weber, Y., Thrassou, A., Shams, S., Tsoukatos, E. (eds) Innovation and Capacity Building. Palgrave Studies in Cross-disciplinary Business Research, In Association with EuroMed Academy of Business. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-319-90945-5_3

Download citation

DOI: https://doi.org/10.1007/978-3-319-90945-5_3

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-319-90944-8

Online ISBN: 978-3-319-90945-5

eBook Packages: Business and ManagementBusiness and Management (R0)