Abstract

In today’s context of economic crisis, certain structures such as industrial clusters have been forced to change in order to remain competitive. For years, local supporting organizations have been focused on strengthening cluster networks, providing specialized services, and fostering innovation practices. Nowadays, thanks to their increasing connectivity, supporting organizations have become hybridizers and catalyzers of knowledge that spreads among local firms after an intense process of refinement. Acting as mediators between local firms and gatekeepers of extra-cluster knowledge, they smooth firms’ access to fresh knowledge and nourish the innovativeness of the system. Using data collected in the Toy Valley cluster during 2014, this chapter looks at the mechanisms allowing supporting organizations to successfully diffuse knowledge and pays attention to these two in-between positions. In line with previous research, findings corroborate the particular relevance of facilitators of knowledge. However, important differences emerge when considering the profile of the local organization and the type of knowledge shared.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

The sharing of experiences across organizational boundaries creates opportunities for transferring knowledge and, subsequently, stimulates knowledge production and innovation (Inkpen and Tsang 2005; Phelps et al. 2012). Strategically important positions within networks, where knowledge is exchanged, allow organizations to better access external knowledge sources (Buckley et al. 2009), facilitate common learning processes (Schoenmakers and Duysters 2006; Nooteboom 2008), and improve performance (Zaheer and Bell 2005; Shipilov and Li 2008).

In-between positions connecting two different actors that otherwise would not have a relationship are one of those strategic locations in a network (Burt 1997; Ahuja 2000; Zaheer and Bell 2005; Hargadon and Sutton 1997). This intermediary or brokerage situation enables privileged access to information transferred between unconnected partners and opportunities for arbitrage and better capitalizes on existing capabilities (Burt 1997; Hargadon and Sutton 1997; Zaheer and Bell 2005; Shipilov 2006). Accordingly, brokers emerge as facilitators of knowledge transfers (Nooteboom 2003) and innovators that recombine external knowledge to create novel solutions (Hargadon 1998; Verona 2006).

The knowledge-based theory of industrial clusters (Maskell and Malmberg 1999; Maskell 2001) describes them as concentrations of firms and supporting organizations (also labeled as institutions) in which geographical co-location fosters face-to-face interactions and knowledge creation (Dahl and Pedersen 2004). Although place may matter for knowledge creation and exchange (Audretsch and Feldman 1996), connectedness with other local actors seems to be the pathway for acquiring the knowledge and competencies within these spatial agglomerations (Lazerson and Lorenzoni 1999; Boari and Lipparini 1999; Munari et al. 2012; Giuliani 2011).

Not all cluster members build knowledge linkages to the same extent. In fact, cluster members largely differ in terms of both linkages and position within the network (Giuliani and Bell 2005) and unevenly participate in local knowledge exchanges (Giuliani 2007; Morrison 2008). Due to the particularities of their portfolio of linkages, intermediaries within these innovation systems accomplish functions of knowledge creation, transformation, and transmission (Howells 2006) whose loss would greatly affect the systemic survival. Supporting organizations are locally oriented entities such as business associations, universities, or technological institutes that provide firms in the area with a host of collective services. In addition to providing advanced services, these local organizations also act as knowledge intermediaries or brokers that compile and disseminate knowledge and reduce search costs for individual firms (McEvily and Zaheer 1999). By developing this function in certain regions, local organizations offset the lack of large firms that frequently perform this role too (Kauffeld-Monz and Fritsch 2013).

While intra-cluster mediation allows cluster members to learn easily and continuously through recombination of knowledge (Molina-Morales et al. 2016), extra-cluster connections are crucial for the acquisition of new knowledge which is critical for the long-term survival of the cluster (Bathelt et al. 2004; Wolfe and Gertler 2004). Firms or local organizations with strong connections outside the agglomeration, which identify trans-local novel ideas that once combined with local knowledge (Graf and Krüger 2011; Munari et al. 2012), are disseminated within the cluster (Morrison 2008; Graf 2011; Giuliani 2011; Munari et al. 2012). Either cluster firms (Morrison 2008; Giuliani 2011) or local supporting organizations (McEvily and Zaheer 1999; Molina-Morales 2005; Kauffeld-Monz and Fritsch 2013; McDermott et al. 2009; Clarke and Ramirez 2014; Lee et al. 2010) can potentially perform as knowledge gatekeepers of the cluster to hook onto the global innovation system and circumvent lock-in risks.

Probably blinded by firm-level benefits, the contextual specificities of clusters or the implications for upgrading local capabilities (Clarke and Ramirez 2014) concomitant with mediating positions, scholars have relatively left aside other realms of analysis (Stam 2010). In this vein, notwithstanding the value of prepublished contributions, the benign effects of the mediating role of supporting organizations are still subject to controversy as their effects remain diluted among different factors (Molina-Morales and Martínez-Cháfer 2016). This chapter refines our comprehension of the brokerage phenomenon in clusters by exploring the relevance of supporting organizations as intra-cluster brokers and their propensity to bridge the local and the global sphere. By quantitatively comparing cluster supporting organizations and firms, we elucidate the foundations and mechanisms underlying the different processes facilitating or curbing knowledge flows from local and nonlocal repositories of knowledge. Furthermore, we also extend current literature by controlling the implications induced by the characteristics of different knowledge flows (Alberti and Pizzurno 2015).

Data collected in the Toy Valley in the Valencia region (Spain) using roster-recall methodology and social network analysis corroborate the prevalence of local supporting organizations in knowledge mediation activities. Findings also reveal that not all these organizations broker knowledge to the same extent due to the specificities of each organization and the characteristics of knowledge shared. After this introduction, we present the theoretical framework. Then, the context of the investigation, the methodology, and the results of the analysis carried out are described. Finally, the conclusions are discussed, and the main limitations and potential future lines of investigation are presented.

2 Theoretical Framework

Clusters are agglomerations of related firms and supporting organizations where a strong overlap of the territory and interorganizational linkages exist. Within clusters, actors use different networks (Alberti and Pizzurno 2015) or interact differently (Sammarra and Biggiero 2008) depending on the knowledge shared. Previous research has clearly distinguished between technical knowledge and business information networks (Giuliani 2007; Balland et al. 2016). Morrison and Rabellotti (2009) relate the configuration of each network to the degree of codification of the knowledge shared. In their analysis of the Barletta footwear cluster, Boschma and ter Wal (2007) reveal when complex knowledge prevails, networks become more selective, less dense, and higher in reciprocity.

Either technical or business knowledge is not in the air (Giuliani 2007) but flow through intra-cluster relational architectures. So, firms and supporting organizations do not access valuable information by passively locating operations in a cluster. A significant level of embeddedness in the local network is needed to successfully share or transfer knowledge. Well-connected cluster central actors have a varied portfolio of knowledge sources at their disposal; however a minimum threshold of absorptive capacity is needed to assimilate and apply the potential knowledge assets (Giuliani and Bell 2005).

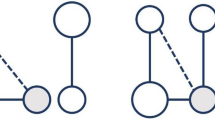

Strategic positions in the cluster network, overall centrality, depend on the actor’s attributes and brokerage roles (Vicente et al. 2011). Even in mature clusters, both centrality and brokerage positions in tacit or explicit territorialized networks significantly affect innovation (Casanueva et al. 2013). A network actor in a brokerage position connects two unrelated partners and spans the structural hole between them (Burt 1992). When bridging unilateral ideas from two independent organizations, the broker absorbs knowledge and boosts its dissemination within the system (Hargadon and Sutton 1997; Hargadon 2002). By internally recombining the acquired knowledge and spreading more polished knowledge, brokers reinforce both the cluster and their own innovation potential. To do so efficiently throughout the cluster life cycle, the organizational skills of intermediaries evolve as firms in the cluster assume a broader range of practices (Clarke and Ramirez 2014).

Using different context and alternative grouping criteria, previous research has identified different brokerage structures and the implications derived (e.g., Lissoni 2010; Kirkels and Duysters 2010; Belso-Martínez et al. 2015). Most of this research relies on the idea of brokerage behavior as a facilitator of information flows. In their seminal contribution, Gould and Fernandez (1989) recognize non-exclusive brokerage categories depending on different configurations of group membership among the three actors involved. In general, this typology assumes that information that flows within a homogenous group should be distinguished from flows between groups.

Cluster actors can play one or more brokerage roles, especially if various types of knowledge that are selectively exchanged through different flows are considered. Following the methodology suggested by Gould and Fernandez (1989), cluster literature has frequently categorized brokerage based on firms’ position within the local value chain (Belso-Martínez et al. 2015; Boari et al. 2016), differentiating between firms and diverse supporting organizations (Alberti and Pizzurno 2015) or splitting the population into two strata with location inside or outside the cluster (Vicente et al. 2011).

Some of this research shows how government agencies and supporting organizations act as mediators fostering cluster development (Mesquita 2007; Gagné et al. 2010). Their role as facilitators has been addressed, not only by innovation researchers (Howells 2006; Kirkels and Duysters 2010) but also by sociologists (Smith-doerr and Powell 2005) or geographers (Schamp et al. 2004; Morrison 2008; Giuliani 2011). The focus of their activities is generally on improving the cooperation atmosphere by building trust. As facilitators, local associations and knowledge organizations establish a flow of information, ideas, and resources within clusters (Gagné et al. 2010) and provide new knowledge to innovate (Molina-Morales 2005).

Evidence from the Boston biotech cluster points out that supporting organizations frequently act as coordinators, conveying knowledge between local firms (Owen-Smith and Powell 2004). In their analysis of the regional innovation systems, Kauffeld-Monz and Fritsch (2013) prove that public research organizations are profoundly involved in knowledge exchange process and possess central (broker) positions within the regional innovation network. More recently, Molina-Morales and Martínez-Cháfer (2016) show that supporting organizations are relevant intermediaries of knowledge in the Tile cluster of Castellon and provide evidence of the benefits they generate.

Further than mediating locally, cluster actors may also act as gatekeepers connecting the local buzz and the global pipelines (Bathelt et al. 2004; Montoro Sánchez and Díez Vial 2016). By doing so, they introduce external novelties into the system, enable new knowledge production, minimize risk of lock-in (Molina-Morales and Expósito-Langa 2013), and induce cluster renewal (Hervas-Oliver and Albors-Garrigos 2014; Molina-Morales and Expósito-Langa 2013). Although leader firms frequently play this role of gatekeepers of knowledge (Morrison 2008; Giuliani 2011; Randelli and Lombardi 2014; Giuliani and Bell 2005; Munari et al. 2012; Graf and Krüger 2011), supporting organizations can also exert external effects on the innovation system. In fact, they serve the functions of a gatekeeper to a greater extent than private actors (Graf 2011; Kauffeld-Monz and Fritsch 2013) and are crucial in lagging regions that suffer a lack of large firms.

3 Methodology

3.1 The Context

3.1.1 The Toy Valley in Perspective

The heart of the toy sector in Spain is in the Valencian Community where 41.3% of jobs and 38.4% of total sales are concentrated. Approximately, 88% of the Valencian companies agglomerate in the Toy Valley, specifically in the cities of Ibi, Onil, Castalla, Tibi, and Biar. Manufacturers are usually family-owned and small in size. The geographical concentration of related productive activities and the tight linkages between socioeconomic actors allowed previous research to identify this area as a Marshallian industrial district (e.g., Boix and Galletto 2006).

The origin of the Toy Valley cluster dates back to the late nineteenth century; when influenced by external stimuli, some families brought their experience and knowledge acquired through handicraft occupations to start producing dolls, miniatures, or small cars. Progressively, a solid industrial atmosphere surrounded the area, and outdated manufacturing practices were replaced. During the 1960s and 1970s, the cluster underwent intense development which favored an accelerated accumulation of resources and strong spin-off dynamics.

The following decades witnessed a decline in the average number of workers per firm and the acceleration of outsourcing practices. In line with other Valencian clusters, economic perspectives deteriorated due to fierce global competition and the erosion of traditional competitive advantages (mainly based on labor costs). This decline slowed in the 1990s after an intense reorganization of the system in which many flagship companies disappeared because of scarce flexibility. Technological innovations and the fragmentation manufacturing processes materialized in a compact population of firms, tightly linked in cooperative networks.

Four key factors determine the cluster’s current situation. Firstly, even the programs implemented, toys sales remain highly seasonal. Secondly, the spiraling competition from low-cost producers has widely reduced the market share of traditional Spanish toys. Thirdly, new market trends show preference for electronic gadgets in general. Fourthly, opportunism and irregular practices have become a major problem. Cheap imitations or unsafe products from Asia are having a detrimental effect on the track record of many local manufacturers.

3.1.2 The Toy Valley: Systemic Structure and Supporting Organizations

The systemic structure is complex. As Fig. 1 shows, a wide variety of networked organizations operate from different perspectives and close cities. For decades, in line with the “Marshallian” tradition, co-location fostered cooperative relationships and a climate of trust among the different actors (Hernández Sancho 2004; Ybarra Pérez and Santa María Beneyto 2006). However, both local and particularly international sourcing have turned out to be major strategies (Belso Martínez and Escolano Asensi 2009). The openness of local manufacturers assuming the inherent transaction cost has also favored the acquisition of extra-cluster knowledge and diminished the potential risks of cognitive lock-in (Hervás Oliver et al. 2015). Figure 1 shows how manufacturers interact with nonlocal actors by maintaining trade or regular information flows with suppliers located in different regions or economic sectors.

In particular, many local supporting organizations have also increased their extra-cluster linkages (see Table 1 for a comprehensive list and description of the cluster organizations). Most of their objectives relate to the “Marshallian” tradition such as R&D, consolidation of local networks, professional training, or specialized services. However, growing efforts devoted to scrutinizing and interacting in the global arena have enhanced their role as catalyzers and hybridizers of novel knowledge that is subsequently diffused within cluster boundaries. Just like in other clusters (Molina-Morales 2005; Molina-Morales and Martínez-Cháfer 2016), once the potential advantages of opportunities that exist beyond the district’s borders had been evaluated, they have become transmitters of this technical and managerial knowledge at the local level.

AIJU and AEFJ have exemplified the abovementioned activities. By providing specific services at reasonable cost, AIJU still plays a pivotal role actor in the construction of firms’ and systemic capabilities (Holmström 2006). Additionally, it serves as a valuable repository of novel knowledge and fosters innovation by assisting in spheres such as product development, manufacturing, or training. AEFJ has also contributed decisively to local competitiveness and innovation. In addition to providing a variety of services (legal assistance, institutional representation, or training), the business association represents a real forum where valuable managerial experiences are diffused within local firms. Besides, several projects have transformed AEFJ into a real guiding star for the development of new products or the identification of market trends. The launch of Spora, a specialized site that brings together all the creative potential generated by designers and supporting organizations with the purpose of being disseminated among toy firms, should be particularly mentioned.

3.2 Data and Measures

We developed a questionnaire on the basis of previous literature (Giuliani 2007; Morrison and Rabellotti 2009) and eight in-depth interviews with relevant local manufacturers, researchers, and institutions. Our tool tackled different aspects such as the firm’s characteristics, innovation practices, interorganizational relationships, and economic performance. The preliminary questionnaire was only slightly modified as few problems were encountered during the pretest pilot. To collect network data, “roster-recall” methodology was applied. Each interviewee was asked to select from an open list of local firms and supporting organizations from which technical or business information was received.Footnote 1 Additionally, participants were invited to include other firms not listed from whom technical advice or business information had been obtained.

To guarantee accuracy of responses, a local technician largely involved in the toy industry and innovation programs administered the questionnaire to top-level managers and business owners through a 45–50-minute face-to-face interview. At the beginning of each meeting, the benefits of the project were explained, and confidentiality was guaranteed to encourage accuracy in the replies given (Eisenhardt 1989). Strong interest of informants guarantees the accuracy of records, so access to final results was offered an incentive (Miller et al. 1997).

At the end, a total number of 85 firms and supporting organizations located in the Toy Valley are accepted to collaborate during 2014. This yields a response rate of 95% on the total population identified from reliable databases (SABI, AIJU, and AEFJ). Toy manufacturers accounted for 39%, while suppliers and local organizations represented 49% and 12%, respectively. Peer debriefing by AIJU experts confirmed that all relevant players were considered and missing actors were very scarce.

Since relational data collected refer to two different networks, we organized them into two matrices composed of 85 rows and 85 columns, corresponding to the number of firms and local organizations in the cluster. The cells in the matrix show 1 for the existence of a tie between actor i in the row to actor j in the column and 0 otherwise. The matrices are asymmetric, given that the transfer of knowledge from actor i to actor j may not be bi-directional.

To test the mediating behavior of the surveyed firms and local organizations, we first assume b as being involved in brokerage if i is directly connected to j and g, but j and g are not directly tied (Gould and Fernandez 1989). Additionally, we distinguished three different brokerage scores using four different cluster actors (toy manufacturers, suppliers, supporting organizations, and others).Footnote 2

-

(a)

Coordinator score: counts the number of times an actor i brokers between two unconnected actors, j and g. All three actors belong to the same category.

-

(b)

Interconnector score: counts the number of times an actor i links together two unconnected actors j and g. All three actors belong to different groups.

-

(c)

Global brokerage score: counts the number of times an actor i mediates between j and g, regardless of what group the actors belong to.

In order to evaluate the relevance of extra-cluster connectedness, we use information on the existence of extra-cluster linkages with providers, customers, competitors, consultancy services, universities, public research centers, and private research centers. We created a dummy variable for all different types (1, extra-cluster linkages exist; 0, otherwise).

3.3 Empirical Results

We first computed several indicators such as density, reciprocity, and transitivity (see Table 2). The density of our technical networks, number of ties between firms divided by the total possible connections, reveals tightly knit structures and suggests a quicker flow of resources. In networks, reciprocal relationships exist whenever a tie is connected from actor A to actor B and there is a tie from actor B to actor A. Our reciprocity value, calculated as the proportion of pairs of actors that have reciprocated ties, shows a trend of members to exchange knowledge mutually. Transitivity of a relation means that when there is a tie from A to B, and also from A to C, then there is also a tie from B to C. Transitivity is measured by proportion of transitive triads of actors among all possible triad in the network and indicates existence of stronger ties.

Social analysis techniques were also used to calculate the three brokerage scores for both networks. Once obtained, we applied permutation models for statistical analysis of dependent data and ranked the supporting organizations to statistically observe significant differences between brokerage structures. Permutation tests are a versatile class of statistic procedures in which the distribution of the test statistic is obtained by repeatedly permuting data (5000 times in our case). These procedures are widely used within the field of social network analysis because of their robustness to dependence within the input data (Butts 2007). In addition, analysis of variance was conducted to verify theoretical insights regarding gatekeeper behavior.

Cluster actors were successively divided into two factions, based on their profile, to examine the difference in each brokerage score between the subgroup of interest and the rest. Table 3 displays permutation model results based on the actor subgroup affiliation. Supporting organization presents the highest global brokerage activity in both the technical network (p-value <0.01) and the business network (p-value <0.05). Within the technical network, note that both toy firms and local organizations significantly perform the coordinator role (p-value <0.1 and p-value <0.05, respectively) and the interconnector roles (p-value <0.05 and p-value <0.01). In the business network, supporting organizations, only, coordinate (p-value <0.05), and toy firms interconnect (p-value <0.01) with significantly high frequency. These findings again demonstrate that supporting organizations are the most prominent subgroup among the brokers and thus have the most opportunities for facilitating coordination or transferring valuable resources in the cluster.

Table 4 lists the ten supporting organizations in the Toy Valley ranked by their global brokerage score. Only a few of the organizations have scores that are significantly high across the different types of brokerage in either the technical or the business network. Furthermore, individual organizations show differential tendencies for specific brokerage roles (significance levels are determined using network permutation models). Note that both AIJU and AEFJ occupy all roles in the two networks with a significantly high frequency (p-value <0.01). UA and UPV occupy coordinator positions with a significantly high frequency but do not evidence a relevant interconnector or very scarce global brokerage. “Fundación Crecer Jugando” is tightly linked to AEFJ, brokers’ technical knowledge through the three structures (p-value <0.01). Finally, ADL Castalla achieves statistical significance for horizontal brokerage in the technical network (p-value <0.01). This unexpected result can be explained as it is the only actor providing technical training in this city.

Table 5 displays the results of the analysis of the “gatekeeper behavior”.Footnote 3 Local supporting organizations attain the greatest number of extra-cluster connections. However, most of their linkages are limited to knowledge-intensive service providers such as consultancy services, public research centers and universities (p-value <0.01), or private research centers (p-value <0.05). Toy producers and suppliers infuse knowledge from similar ones located outside the cluster (p-value <0.05 and p-value <0.1, respectively).

4 Discussion and Conclusions

Using data collected in the Toy Valley, this chapter adds to cluster literature by thoroughly analyzing brokerage behavior. Generally speaking, our findings highlight that cluster innovativeness is sustained by different knowledge flows in which local actors participate unevenly and selectively. Firms and supporting organizations exchange different types of knowledge in different ways. Additionally, endorsing microlevel polymorphism in clusters, this study verifies that cluster actors perform diverse roles when transferring different knowledge.

Consistent with recent research (Kirkels and Duysters 2010; Alberti and Pizzurno 2015), we demonstrate that brokerage activities are only performed by certain cluster actors, particularly local supporting organizations. At a first glance, our findings also reveal that distinctive knowledge may systematically imply different levels of participation in brokerage. Market knowledge is brokered by a much more reduced set of actors, thereby suggesting more selective knowledge diffusion.

When we examine the supporting organizations group, we see that there are important asymmetries among them. In our cluster, knowledge is mediated by universities, a technological institute, and the toy business association. This suggests that being a broker depends on certain microlevel characteristics. Particularly, as per our qualitative insights, the portfolio of local relationships seems to be a crucial element.

In line with previous research (Alberti and Pizzurno 2015), the prevailing positions of AEFJ, AUJI respond to their capability to mix market and technical knowledge thanks to a wide number of relationships, helping to circumvent potential technological bias (Alberti and Pizzurno 2015). Interestingly, we support the prominence of business associations in brokering any kind of knowledge that will increase cluster competitiveness through the activation of networks and the channeling of resources. This is possible due to the increasing involvement of AEFJ in the innovation field, either directly or indirectly (the “Fundación Crecer Jugando”).

Although limited to coordination and despite their technological focus, universities mediate both technical and business knowledge. On the one hand, this finding implies the existence of specific capabilities to successfully developed businesses. On the other hand, as coordinators, universities possibly acquire and refine knowledge that is later inoculated to cluster firms through other supporting organizations. Furthermore, as per our qualitative insights, this finding also leads us to believe that a certain degree of brokerage specialization exists.

As far as gatekeeper activities are concerned, each group of local actors acts as gatekeepers of a specific repository of extra-cluster knowledge. This finding endorses our arguments about brokerage specialization. Interestingly, cluster actors usually translate and diffuse new knowledge from similar alters located outside. While suppliers or toy manufacturers import knowledge from other producers, local organizations mostly focus their gatekeeper activities on other supporting organizations.

These results have valuable managerial and policy implications. First, cluster actors engaged in innovation practices need access to diverse repositories of knowledge. Managers should design networking strategies to optimize their acquisition or diverse knowledge to innovate. Particularly, linkages with supporting organizations maximize the opportunities to simultaneously obtain both technical and business knowledge. However, care should be taken when selecting potential partners among them, as not all local supporting organizations source knowledge to the same extent. Second, policy makers should conceive programs in view of the asymmetric capacity of cluster actors to disseminate knowledge locally. Partnerships including relevant brokers like supporting organizations or certain firms would be advisable in order to benefit from more recombinable knowledge. In addition, local supporting organizations should consider potential strategies to build extra-cluster relationships with toy manufacturers and suppliers that would engender complementary knowledge flows and synergies.

This study is not without limitations. The analysis concerns one cluster during its maturity stage. Comparisons with systems in other industries and evolutionary stages may generate complementary results and discard potential biases. Longitudinal research based on network data would also throw interesting insights. Our analysis of gatekeeper activities seems limited compared to intra-cluster brokerage. Supplementary research should try to refine and extend these results. Including extra-cluster relationships in the network data would be advisable. Finally, another research path is related to innovative returns provided by each brokerage structure and broker profile. The analysis of potential differences derived from the knowledge shared would also add to present state of the art.

Notes

- 1.

The respective questions read as follows: (a) To which of the following firms on the list did you regularly ask for technical advice? (b) To which of the following firms on the list did you regularly ask for business information?

- 2.

Supporting organizations comprise government agencies, business associations, universities, and technical centers. Suppliers are mainly providers of specialized inputs for the toy industry (e.g., eyes and hair for dolls). The final category, others, amalgamates firms producing nonspecialized inputs (e.g., boxes).

- 3.

Values reflect mean differences between the group of interest and the rest of the sample. Only statistically significant positive mean differences are highlighted to ease the interpretation of results.

References

Ahuja, G. (2000). Collaboration networks, structural holes, and innovation: A longitudinal study. Administrative Science Quarterly, 45(3), 425–455.

Alberti, F. G., & Pizzurno, E. (2015). Knowledge exchanges in innovation networks: Evidences from an Italian aerospace cluster. Competitiveness Review, 25(3), 2015.

Audretsch, D. B., & Feldman, M. P. (1996). R&D spillovers and the geography of innovation and production. American Economic Review, 86, 630–640.

Balland, P. A., Belso-Martínez, J. A., & Morrison, A. (2016). The dynamics of technical and business knowledge networks in industrial clusters: Embeddedness, status or proximity? Economic Geography, 92(1), 35–60.

Bathelt, H., Malmberg, A., & Maskell, P. (2004). Clusters and knowledge: Local buzz, global pipelines and the process of knowledge creation. Progress in Human Geography, 28(1), 31–56.

Belso Martínez, J. A., & Escolano Asensi, C. V. (2009). La externalización de actividades como estrategia competitiva en el sector juguetero español. Consideraciones desde la perspectiva espacial. Economía Industrial, (372), 115–127.

Belso-Martínez, J. A., Molina-Morales, F. X., & Martínez-Cháfer, L. (2015). Contributions of brokerage roles to firms’ innovation in a confectionery cluster. Technology Analysis & Strategic Management, 27(9), 1014–1030.

Boari, C., & Lipparini, A. (1999). Networks within industrial districts - organising knowledge creation and transfer by means of moderate hierarchies. Journal of Management & Governance, 3(4), 339–360.

Boari, C., Molina-Morales, F. X., & Martínez-Cháfer, L. (2016). Direct and interactive effects of brokerage roles on innovation in clustered firms. Growth and Change, 48(3), 336–358.

Boix, R., & Galletto, V. (2006). Sistemas industriales de trabajo y distritos industriales marshallianos en España. Economía Industrial, 165–184.

Boschma, R. A., & ter Wal, A. L. J. (2007). Knowledge networks and innovative performance in an industrial district: The case of a Footwear District in the south of Italy. Industry and Innovation, 14, 177–199.

Buckley, P. J., et al. (2009). Knowledge accession and knowledge acquisition in strategic alliances: The impact of supplementary and complementary dimensions. British Journal of Management, 20(4), 598–609.

Burt, R. S. (1992). Structural holes: The social structure of competition. Cambridge: Harvard University Press.

Burt, R. S. (1997). The contingent value of social capital. Administrative Science Quarterly, 42(2), 339–365.

Butts, C. T. (2007). Permutation models for relational data. Sociological Methodology, 37(1), 257–281.

Casanueva, C., Castro, I., & Galán, J. L. (2013). Informational networks and innovation in mature industrial clusters. Journal of Business Research, 66(5), 603–613.

Clarke, I., & Ramirez, M. (2014). Intermediaries and capability building in “emerging” clusters. Environment and Planning C: Government and Policy, 32(4), 714–730.

Dahl, M. S., & Pedersen, C. Ø. R. (2004). Knowledge flows through informal contacts in industrial clusters: Myth or reality? Research Policy, 33(10), 1673–1686.

Eisenhardt, K. M. (1989). The Academy of Management Review, 14, 532–550.

Gagné, M., et al. (2010). Technology cluster evaluation and growth factors: Literature review. Research Evaluation, 19(2), 82–90.

Giuliani, E. (2007). The selective nature of knowledge networks in clusters: Evidence from the wine industry. Journal of Economic Geography, 7(2), 139–168.

Giuliani, E. (2011). Role of technological gatekeepers in the growth of industrial clusters: Evidence from Chile. Regional Studies, 45, 1329–1348.

Giuliani, E., & Bell, M. (2005). The micro-determinants of meso-level learning and innovation: Evidence from a Chilean wine cluster. Research Policy, 34(1), 47–68.

Gould, R. V., & Fernandez, R. M. (1989). Structures of mediation: A formal approach to brokerage in transaction networks. Sociological Methodology, 19, 89–126.

Graf, H. (2011). Gatekeepers in regional networks of innovators. Cambridge Journal of Economics, 35, 173–198.

Graf, H., & Krüger, J. J. (2011). The performance of gatekeepers in innovator networks. Industry & Innovation, 18, 69–88.

Hargadon, A. B. (1998). Firms as knowledge brokers : Lessons in pursuing continuous innovation. California Management Review, 40(3), 209–227.

Hargadon, A.B., 2002. Brokering knowledge: Linking learning and innovation,

Hargadon, A., & Sutton, R. I. (1997). Technology brokering and innovation in a product development firm. Administrative Science Quarterly, 42(4), 716–749.

Hernández Sancho, F. (2004). El sector del juguete: caracterización sectorial y dinámica productiva. Economía Industrial, 345–354.

Hervás Oliver, J. L., et al. (2015). La necesidad de las cadenas de valor globales para evitar inercias cognitivas en clusters: el caso del Valle del Juguete-Plástico en Alicante. Economía Industrial, (397), 37–46.

Hervas-Oliver, J.-L., & Albors-Garrigos, J. (2014). Are technology gatekeepers renewing clusters? Understanding gatekeepers and their dynamics across cluster life cycles. Entrepreneurship & Regional Development, 26(5–6), 431–452.

Holmström, M. (2006). Globalisation and good work: Impiva, a Spanish project to regenerate industrial districts. Tijdschrift voor Economische en Sociale Geografie, 97, 491–502.

Howells, J. (2006). Intermediation and the role of intermediaries in innovation. Research Policy, 35(5), 715–728.

Inkpen, A. C., & Tsang, E. W. K. (2005). Social capital, networks, and knowledge transfer. The Academy of Management Review, 30(1), 146–165.

Kauffeld-Monz, M., & Fritsch, M. (2013). Who are the knowledge brokers in regional systems of innovation? A multi-actor network analysis. Regional Studies, 47(5), 669–685.

Kirkels, Y., & Duysters, G. (2010). Brokerage in SME networks. Research Policy, 39, 375–385.

Lazerson, M. H., & Lorenzoni, G. (1999). The firms that feed industrial districts: A return to the Italian source. Industrial and Corporate Change, 8(2), 235–266.

Lee, S., et al. (2010). Open innovation in SMEs-an intermediated network model. Research Policy, 39(2), 290–300.

Lissoni, F. (2010). Academic inventors as brokers. Research Policy, 39, 843–857.

Maskell, P. (2001). Towards a knowledge-based theory of the geographical cluster. Industrial and Corporate Change, 10(4), 921–943.

Maskell, P., & Malmberg, A. (1999). Localised learning and industrial competitiveness. Cambridge Journal of Economics, 23, 167–185.

McDermott, G. a., Corredoira, R. a., & Kruse, G. (2009). Public-private institutions as catalysts of upgrading in emerging market societies. Academy of Management Journal, 52(6), 1270–1296.

McEvily, B., & Zaheer, A. (1999). Bridging ties: A source of firm heterogeneity in competitive capabilities. Strategic Management Journal, 20, 1133–1156.

Mesquita, L. F. (2007). Starting over when the bickering never ends: Rebuilding aggregate trust among clustered firms through trust facilitators. Academy of Management Review, 32(1), 72–91.

Miller, C. C., Cardinal, L. B., & Glick, W. H. (1997). Retrospective reports in organizational research: A reexamination of recent evidence. Academy of Management Journal, 40(1), 189–204.

Molina-Morales, F. X. (2005). The territorial agglomerations of firms: A social capital perspective from the Spanish tile industry. Growth and Change, 36(1), 74–99.

Molina-Morales, F. X., Belso-Martinez, J. A., & Mas-Verdú, F. (2016). Interactive effects of internal brokerage activities in clusters: The case of the Spanish Toy Valley. Journal of Business Research, 69(5), 1785–1790.

Molina-Morales, F. X., & Expósito-Langa, M. (2013). Overcoming undesirable knowledge redundancy in territorial clusters. Industry & Innovation, 20(8), 739–758.

Molina-Morales, F. X., & Martínez-Cháfer, L. (2016). Cluster firms: You’ll never walk alone. Regional Studies, 50(5), 877–893.

Montoro Sánchez, Á., & Díez Vial, I. (2016). Redes de conocimiento local e internacionalización: el papel de los gatekeepers en los parques cienticos. Economia Industrial, 397, 73–81.

Morrison, A. (2008). Gatekeepers of knowledge within industrial districts: Who are they, how do they interact. Regional Studies, 42, 817–835.

Morrison, A., & Rabellotti, R. (2009). Knowledge and information networks in an Italian wine cluster. European Planning Studies, 17, 983–1006.

Munari, F., Sobrero, M., & Malipiero, A. (2012). Absorptive capacity and localized spillovers: Focal firms as technological gatekeepers in industrial districts. Industrial and Corporate Change, 21(2), 429–462.

Nooteboom, B. (2003). Problemas and solutions in knowledge transfer. In D. Fornahl & T. Brenner (Eds.), Cooperation, networks and institutions in regional innovation systems (pp. 105–127). Northampton: Edward Elgar.

Nooteboom, B. (2008). Learning and innovation in interorganizational relationships. In S. Cropper, M. Ebers, C. Huxham, & P. S. Ring (Eds.), The Oxford handbook of inter-organizational relations (pp. 1–43). Oxford: Oxford University Press.

Owen-Smith, J., & Powell, W. W. (2004). Knowledge networks as channels and conduits: The effects of spillovers in the Boston biotechnology community. Organization Science, 15(1), 5–21.

Phelps, C., Heidl, R., & Wadhwa, A. (2012). Knowledge, networks, and knowledge networks: A review and research agenda. Journal of Management, 38(4), 1115–1166.

Randelli, F., & Lombardi, M. (2014). The role of leading firms in the evolution of SME clusters: Evidence from the leather products cluster in Florence. European Planning Studies, 22(6), 1199–1211.

Sammarra, A., & Biggiero, L. (2008). Heterogeneity and specificity of inter-firm knowledge flows in innovation networks. Journal of Management Studies, 45(4), 800–829.

Schamp, E. W., Rentmeister, B., & Lo, V. (2004). Dimensions of proximity in knowledge-based networks: The cases of investment banking and automobile design. European Planning Studies, 12(5), 607–624.

Schoenmakers, W., & Duysters, G. (2006). Learning in strategic technology alliances. Technology Analysis & Strategic Management, 18(2), 245–264.

Shipilov, A. V. (2006). Network strategies and performance of Canadian investment banks. Academy of Management Journal, 49, 590–604.

Shipilov, A. V., & Li, S. X. (2008). Can you have your cake and eat it too? Structural holes’ influence on status accumulation and market performance in collaborative networks. Administrative Science Quarterly, 53(1), 73–108.

Smith-doerr, L., & Powell, W. W. (2005). Networks and economic life. In N. Smelser & R. Sweberg (Eds.), Handbook of economic sociology (pp. 379–402). Princeton University Press: Princeton.

Stam, W. (2010). Industry event participation and network brokerage among entrepreneurial ventures. Journal of Management Studies, 47(June), 625–653.

Verona, G. (2006). Innovation and virtual environments: Towards virtual knowledge brokers. Organization Studies, 27(6), 765–788.

Vicente, J., Balland, P. a., & Brossard, O. (2011). Getting into networks and clusters: Evidence from the midi-Pyrenean global navigation satellite systems (GNSS) collaboration network. Regional Studies, 45(8), 1059–1078.

Wolfe, D., & Gertler, M. (2004). Clusters from the inside and out: Local dynamics and global linkages. Urban Studies, 41, 1071–1093.

Ybarra Pérez, J. A., & Santa María Beneyto, M. J. (2006). El sector del juguete en España: dinámica y estrategias productivas ante el proceso de globalización. Boletín Económico de ICE, 21–33.

Zaheer, A., & Bell, G. G. (2005). Benefiting from network position: Firm capabilities, structural holes, and performance. Strategic Management Journal, 26(9), 809–825.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG, part of Springer Nature

About this chapter

Cite this chapter

Belso-Martinez, J.A., Lopez-Sanchez, M.J., Mateu-Garcia, R. (2018). New Roles for Supporting Organizations in Clusters: Enhancing Connectedness in Knowledge Networks. In: Belussi, F., Hervas-Oliver, JL. (eds) Agglomeration and Firm Performance. Advances in Spatial Science. Springer, Cham. https://doi.org/10.1007/978-3-319-90575-4_11

Download citation

DOI: https://doi.org/10.1007/978-3-319-90575-4_11

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-90574-7

Online ISBN: 978-3-319-90575-4

eBook Packages: Economics and FinanceEconomics and Finance (R0)