Abstract

The relationship between competition and stability of the commercial banking system has been at the heart of scholarly and policy debates over the past two decades, especially since the 2008 financial crisis. In this study, we focus on analysing the relationship between competition and stability with 24 commercial banks in Vietnam for the period 2008–2016. Our study results show that increasing competition helps Vietnam’s banking system become more stable. However, the relationship between competition and stability is nonlinear. The results of our study also show the impact of competition on the stability of Vietnam’s banking system in a crisis situation. In the context of financial crisis, the instability and NPL of Vietnam commercial banks are increased. At the same time, increased competition can cause instability for the commercial banking system in Vietnam.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

In recent years there have been several debates regarding the relationship between competition and the stability of the banking system (Beck 2008; Carletti 2003). The debates on this relationship have formed two contradictory views: “competition-fragility” and “competition-stability”. From the standpoint of “competition-fragility”, increasing bank competition reduces the market power, bank’s profit margins and consequently decreases the franchise value of the bank (Berger et al. 2009). This encourages banks to take more risks to seek profits, causing instability in the banking system (Marcus 1984; Keeley 1990; Carletti and Hartmann 2003).

In contrast, the “competition-stability” view holds that there is a positive relationship between banking competition and the stability of the banking system. Increased competition will lead to the stability of the banking system and vice versa ((Maggie) Fu et al. 2014). In a market where competition between banks is low, it can be more risky when large banks are often considered too important to fail and thus, when faced with difficulties in operating, those banks usually receive support from the government (Mishkin 1999). In addition, in a low-competition market, large market-power banks will offer higher lending rates, which will cause difficulties for borrowers in repayment capacity and increase the risk exposure of the bank ((Maggie) Fu et al. 2014). In contrast, in a market where competition among banks is high, lending rates are low; problems of “too big to fail” receive less attention, and therefore positively impact on the stability of the banking system (Boyd and De Nicolo 2005; Beck et al. 2006; Schaeck 2006; Turk-Ariss 2010).

Studies supporting these two points suggest that the effects of competition on the stability of the banking system are inconsistent across countries. In addition, very few studies examine the relationship between competition and stability before and after the financial crisis. To strengthen the theoretical foundation of the relationship between competition and stability, our study aims to assess the relationship between competition and stability of the commercial banking system in Vietnam. The study also looks at this relationship in the context of the financial crisis of 2008 and 2010.

This study is designed in 6 sections. Following the introduction of the research in Sects. 1 and 2 will present theoretical background and empirical evidences about the relationship between competition and stability of the banking system. Section 3 will show the research methodology and data. The empirical results and discussion are presented in Sect. 5. Based on the results of the study, Sect. 6 will draw conclusions and policy implications.

2 Theoretical Background and Related Studies

2.1 Theoretical Background of Competition and Stability of the Banking System

From the traditional viewpoint of a “competition-fragility” relationship, a more competition or less centralized banking system increase instability. This is explained by the franchise value theory studied by Marcus (1984) and Keeley (1990), suggesting that competition motivates banks to pursue more risky strategies. These studies show that less competition or a more exclusive monopoly of some banks will lead to higher franchise value of these banks, and may prevent excessive risky decisions of the bank’s executives. Because when the Franchise value is higher, the opportunity cost of bankruptcy is higher, leading to the reluctance of bank executives and bank shareholders to participate in dangerous decisions, thereby improving the quality of bank assets.

Boot and Greenbaum (1993) and Allen and Gale (2000, 2004) show that in a competition environment, banks receive less information from their relationships with borrowers, making it difficult to check credit records and increase the risk and instability.

Boyd et al. (2004) argue that banks with a higher level of presence or higher monopolies in a centralized banking system can increase profits and thereby reduce financial breach ability by providing “Buffer Capital” to protect the system against macroeconomic shocks and external liquidity problem.

From a “competition-stability” standpoint, a more competitive or less monopoly banking system will be more stable, in other words, less competitive or more monopoly banking system will be more unstable. This can be explained by the “too big to fail” theory proposed by Mishkin (1999) indicating that policymakers will be more concerned about the collapse of the bank when there are so few banks in the banking system. Thus, large banks are more likely to receive government guarantees or grants, which can create moral hazard problems, encourage dangerous decisions and increase instability of the banking system. Moreover, the spreading risk may increase in the centralized banking system with large banks.

Caminal and Matutes (2002) argue that less competition can lead to easier credit granting and larger loans, which increases the probability of bank collapse. Boyd and De Nicolo (2005) argue that high monopoly banking systems allow banks to charge higher interest rates, and may encourage borrowers to take greater risks. Therefore, the amount of non-performing loans can increase, resulting in higher probability of bank’s bankruptcy. However, Martinez-Miera and Repullo (2010) suggests that higher lending rates also bring higher interest income to banks. This offset effect can create a U-shaped relationship between bank competition and stability.

2.2 Empirical Evidence of Competition and Stability of the Banking System

There is considerable debate relating to the impact of bank competition on the stability from the literature, especially in the context of financial crisis. As observed from the recent financial crisis, instability can be spread widely to the entire economy through the banking system. Vulnerabilities are mainly due to the collapse of the interbank lending and payment markets, the reduction in credit supply, and the freezing of deposits (Berger et al. 2008). There have been a number of studies showing that the greater the bank competition is, the more likely it is that financial instability will be triggered by a decline in market power, which in turn will reduce profits and lower franchise value. These studies support the “competition-fragility” hypothesis. From this view, banks are encouraged to take more risks to increase profitability and deteriorate the quality of their loan portfolio (Marcus 1984; Keeley 1990 and Carletti and Hartmaan 2003). There have been various empirical studies supporting this relationship, such as Keeley (1990), finding that increased bank competition and the deregulation in the US during the 1990s reduced the monopoly and contributed to bank failures. Hellmann et al. (2000) concluded that removing the interest rate ceiling, and thereby creating higher price competition, reduced franchise value and encouraged more moral hazard behavior in banks. Jimenez et al. (2007) study the banking sector in Spain and show that the greater the bank competition is, the higher the risk of the loan portfolio (higher non performing loans). Berger et al. (2008) study 23 developed countries and came to the conclusion in favor of the “competition-fragility” view, in which the higher the market power or lower competition would reduce the risk of the bank. However, this study also shows that higher market power increases the risk of loan portfolio, which can be interpreted as evidence of a “competition-stability” view. Vives (2010) evaluate theories and empirical studies on the “competition-stability” relationship and argue that although competition is not a determinant of instability but could aggravate more instability issues.

However, many recent studies have advocated a “competition-stability” view. Beck et al. (2006) study a group of 69 countries and find that countries with low market concentration or high competition are less likely to suffer financial crisis. Boyd and De Nicolo (2005) argue that the greater market power or less competition in lending markets increases the risk for banks because higher interest rates make it more difficult for customers to repay. This can exacerbate moral risk and at the same time, higher interest rates will attract higher risk borrowers. Moreover, in highly centralized monopolies, financial institutions may believe that they are “too big to fail” and this can lead to riskier investments (Berger et al. 2008). There are some recent empirical studies supporting this hypothesis. Studies of Boyd et al. (2006), De Nicolo and Loukoianova (2006) find the opposite relationship between high levels of market monopoly concentration or low competition and stability of the banking system. These studies suggest that the risk of bank failures increases in higher monopoly markets. Financial stability is estimated using the Z-score and the level of market monopoly concentration is measured by the Herfindahl-Hirschman index (HHI). Schaeck et al. (2006) study the banking sector of a group of countries by applying logit model and time analysis. Furthermore, the Rosse-Panzar index (H-Statistics) is used to measure the level of competition. The key finding of these studies show that the higher level of bank competition, the lower likelihood of banks failure or being more stable than the monopoly banking system.

Other recent studies adopt the Lerner Index and measure bank stability through the Z-score to examine the relationship between competition and stability of the banking system. Berger et al. (2008) study the sampling of more than 8,000 banks in 23 countries using the Generalized Methods of Moments (GMM) data table. The main results of this study indicate that banks with higher market power or less competition have less overall risk, favoring “competition-fragility” views. On the other hand, this study also find evidence of the positive relationship between competition and stability, implying that higher market power increases the credit risk. Turk-Ariss (2010) studies the impact of market power on banking efficiency and financial stability in the banking sector of a group of emerging economies. This study applies three different techniques of Lerner’s competitive index and uses Z-score to represent the stability of the banking system. Research results indicate that increasing market power leads to more bank stability, despite significant losses in cost-effectiveness. Liu et al. (2010) analyzes competitive conditions in 11 EU countries for the period 2000–2008 to examine “competition-stability” relationships in the banking sector. This study uses Lerner index and Z-score to respectively represent the level of bank competition and bank stability. The results show the non-linear relationship between competition and stability in the banking sector in Europe. More specifically, they see the shift of risk in highly concentrated markets, where the increase in bank competition reduces net interest margins (higher deposit rates and lower lending rates) and increase bank stability. However, they also recognize that the marginal effect exists in highly competition markets, where increased competition reduces interest payments and bad debt provisions.

3 Research Methodology and Data

In this study, we seek evidence of the impact of competition on the stability of the Vietnam’s commercial banks under normal and crisis conditions. The study uses data from 24 commercial banks in Vietnam for the period 2008–2016. To overcome the potential endogenous problem in the model, we use the GMM estimation technique.

3.1 Measure the Stability of Commercial Banks in Vietnam

There have been many studies that developed the methods of measuring commercial bank stability, most of which use Z-scores. In this study, we follow the studies of Boyd and Graham (1986), Hannan and Hanweck (1988), and Boyd et al. (1993) to use Z-scores, which are calculated as follows:

Where: \(Zscore_{it}\) is the Z-score measures the bank i’s financial stability in year t.

\(ROA_{it} \) is the return on total assets of bank i in year t, calculated as the after-tax profit divided by total assets.

\(EQTA_{it}\) is the ratio of equity to total assets of bank i in year t, calculated by the average equity divided by total assets.

\(ROA_{ip}\) is the standard deviation of the bank’s ROA in the study period p.

According to the above formula, the lower the Z-score, the lower the financial stability of the bank. In contrast, the higher the Z-score, the higher the financial stability of the bank.

3.2 Measure the Level of Competition of Commercial Banks

To proxy the degree of competition of commercial banks, we use the Lerner index which has been used by Berger et al. (2008), Fernández de Guevara et al. (2005), Maudos and Solis (2009), (Maggie) Fu et al. (2014). The Lerner index for banks is calculated as follows:

where \(P_{it}\) is the output price of bank i in year t, calculated by the ratio of total income to total assets. \(MC_{it}\) is the marginal cost of bank i in year t. However, marginal cost can not be observed directly, so it is estimated based on the function of the total bank cost (Ariss 2010; Fernández de Guevara et al. 2005; (Maggie) Fu et al. 2013). The total cost function is as follows:

where TC is the total cost, w is the price of the three inputs (personnel expenses/total assets, interest expenses/total deposits, and other operating expenses/fixed assets), Y is total asset, T is the time trend reflecting the effect of technical progress, \(\mu \) captures the individual fixed effects, and \(\epsilon \) is the error term.

Total bank cost functions are estimated using fixed effects with robust standard error. After estimating the total cost TC, the MC marginal cost is determined by taking the first derivative of the total cost function, as follow:

3.3 Empirical Model

To search for empirical evidence for “competition-stability” and “competition-fragility” views, we use dynamic model proposed by Fernández and Garza-García (2015). According to Gambacorta (2005) and Gunji and Yuan (2010), a dynamic model is also constructed with the latency of the dependent variable as a independent variable. Because the sample size is relatively small, only the first latency is considered, so the research model is as follows (Table 1):

To proxy risk, we use 2 variables Z-score and NPL. In these two models, \(ln(Z_{it})\) is the natural logarithm of Z-score, which measures the stability of commercial banks. The degree of fragility of commercial banks is measured by Non performing loans in terms of total loans (NPLs) (Fernández and Garza-García 2015). The level of competition of commercial banks is measured by the Lerner index. According to Liu et al. (2010), there is a non-linear relationship between competition and stability existing in banking system. So we use \(lerner^2\) as the squared measure of the Lerner index to test this non-linear relationship. Also, according to studies by Schaeck and Cihak (2008), Laeven and Levine (2009) and Uhde and Heimeshoff (2009), we also include a series of characteristic variables for each bank: Banksize is defined as the logarithm of total assets, the ratio of total loans to total assets (loanta), and the own dummy variable reflecting foreign ownership in bank capital. In addition, in order to find evidence of the impact of competition on the stability of commercial banks under crisis conditions, we add the crisis dummy variable representing period of financial crisis. The dummy variable value is 1 in 2008, 2010 and is set to 0 in the remaining years. Specific models are as follows:

The dual impact of competition in crisis conditions on the stability of commercial banks is assessed by the lerner x crisis, as follows:

This study uses the Difference GMM (DGMM) method of Arellano and Bond (1991). This method is commonly used in dynamic panel data estimation. This estimator is designed for situations with “small T, large N” panels, meaning few time periods and many individuals; with independent variables that are not strictly exogenous, meaning correlated with past and possibly current realizations of the error; with fixed effects; and with heteroskedasticity and autocorrelation within individuals. In these cases, the classical linear estimates of panel data such as FE (fixed effects), RE (random effects), LSDV (least squares dummy variable) are no longer effective and reliable. The DGMM method is appropriate for this study because the panel data has small T (8 years), large N (25 banks), which means few time periods and many individuals.

4 Research Data

This study uses a sample of 24 commercial banks in Vietnam for the period from 2008 to 2016. This is a balanced panel, consisting of 216 observations. The data is derived from the annual financial statements of commercial banks. Information needed for research collected from audited financial statements, annual reports and public disclosures of commercial banks. The descriptive statistics for the variables used in this study are shown in Table 2.

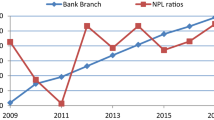

Table 2 shows that the sample of banks studied had an average Z-score of 24.696. Of which the most stable bank has a relatively high Z-score of 62.195. The bank with the lowest stability has Z-score of 1.322. Banks in the sample had an average NPL ratio of 2.33% at safe levels compared to the regulations of the State Bank of Vietnam. The Lerner index of banks in the sample has an average value of 0.296 indicating that the degree of monopoly in the banking market in Vietnam is relatively low.

5 Empirical Results

Table 3 presents the empirical results using the DGMM estimation. Two dependent variables Z-score and NPL representing stability and degree of fragility are used in the model to assess the impact of competition on the stability of Vietnam commercial banks. For each dependent variable, we estimate three models described in Sect. 3.3. Estimates for each dependent variable are conducted in the following order: (i) consider the impact of competition on the stability of the commercial banks in Vietnam; (ii) consider the impact of the financial crisis on the stability of the Vietnam banking system; (iii) consider the dual effects of competition in crisis conditions on the stability of the Vietnamese banking system.

The following model reliability tests have been performed:

Verification of self-correlation of the residual: According to Arellano and Bond (1991), the GMM estimate requires a first degree correlation and no second correlation of the residual. Thus, when testing the hypothesis \(H_{0}\): there is no first ordered correlation (test AR (1)) and no second ordered correlation of residual (test AR (2)), we reject \(H_{0}\) at the AR test (1) and acceptance of \(H_{0}\) at the AR test (2), the model satisfies the requirements.

Similar to other models, F test will test statistical significance for the coefficient of estimation of the explanatory variable with the hypothesis \(H_{0}\): that all coefficients in the equation are equal to 0, therefore, in order for the model to conform, we must reject the hypothesis \(H_{0}\). In addition, the Sargan/Hansen test is also used to test the validity of instrument variable based on the hypothesis \(H_{0}\): the instrumental variables are consistent.

Estimated results in Table 3 show that all six models have a p-value of AR (1) test less than 5% and have a p-value of AR (2) test greater than meaning level of 5%. Therefore, the model has a first ordered correlation but no second ordered correlation of the residual. At the same time, the Hansen test in all six models has a p-value greater than 5%, meaning that the instrument variables used in the model are appropriate. On the other hand, the p-value of the F test is also less than the 5% significance level, indicating that the estimated modelfit the panel data reasonably well. With Z-score variable, the results in Table 3 show that the regression coefficients of lerner and \(lerner^2\) in (1) and (3) are statistically significant at 1%. In addition, the regression coefficient of lerner is positive while the regression coefficient of the \(lerner^2\) is negative, indicating that there exists an inverse U-shape nonlinear relationship between the two variables lerner and Z-score. Specifically, the higher the lerner index the higher Z-score. In other word, increased banking competition results in greater stability of Vietnam banking system. This result is consistent with studies by Boyd et al. (2006), De Nicolo and Loukoianova (2006) supporting for a “competition-stability” hypothesis. However, when the lerner index exceeds a certain limit, the Z-score will decrease which means increase the instability of Vietnam banking system. This inverse U-shaped nonlinear relationship has also been shown in studies by Ariss (2010), Liu et al. (2010).

The results of the model (3) also show evidence of financial crisis impact on the stability of the commercial banking system in Vietnam. Specifically, the regression coefficient of the crisis variable is statistically significant at 1% and negative. This shows that when the financial crisis occurs, there will be a negative impact on the stability of Vietnam commercial banks. In addition, the results of model (5) also show evidence of the dual effects of competition in the context of the financial crisis on the stability of the banking system. The regression coefficient of the lernerxcrisis variable was statistically significant at 5% and negative. This indicates that when the financial crisis occurs, competition will have a negative impact on the stability of Vietnam commercial banks.

With the NPL dependent variable, the results in Table 3 show that the regression coefficients of the variables lerner and \(lerner^2\) in (2) and (4) are statistically significant at 1%. In addition, the regression coefficient of lerner is positive while the regression coefficient of \(lerner^2\) is negative, indicating that there is an inverse U-shaped nonlinear relationship between the lerner variables and the NPL. This is consistent with the results from Z-score model. In particular, as the lerner index increases the NPLs increased, i.e. increased bank competition results in increased fragility of the banking system in Vietnam. Under competition pressure, commercial banks may loosen their lending conditions and lead to an increase in NPL. This result is consistent with studies by Marcus (1984), Keeley (1990), Carletti and Hartmaan (2003), Berger et al. (2008) supporting a “competition-fragility” hypothesis. The results of the model (4) also show evidence of financial crisis impact on the fragility of the commercial banking system in Vietnam. In particular, the regression coefficient of the crisis variable is statistically significant at 1% and has a positive value. This shows that when the financial crisis occurs, there will be a positive impact on the non-performing loans of Vietnam commercial banks. In addition, the results of the model (6) also show evidence of the dual effects of competition in the context of the financial crisis on the fragility of the banking system. The regression coefficient of the lernerxcrisis variable is statistically significant at 1% and is positive. This shows that when the financial crisis occurs, competition will have a negative impact on the non performing loans of Vietnam commercial banks.

In all 3 models (2), (4) and (6), the ratio of non performing loans over total loans of the previous period also had an impact on that of the current period. Specifically, the regression coefficient of the \(NPL_{(t-1)}\) delayed variable was statistically significant at 1% and positive.

6 Conclusions and Policy Implications

6.1 Conclusions

Competition is an important factor not only for non-financial businesses, but also for commercial banks especially in the context of higher challenges and risks in banking and financial industry of Vietnam. In this study, we examine the impact of bank competition on the bank stability in order to test “competition-stability” and “competition-fragility” views for the commercial banking system of Vietnam. The Lerner Index is used to measure the level of competition among banks, while the degree of bank stability and fragility are measured through the Z-score and ratio of non performing loans over total outstanding loans. The results from DGMM estimation support the “competition-stability” hypothesis. In particular, increased competition results in Vietnam’s banking system to be more stable. However, if the level of competition exceeds a certain threshold, it will cause instability. This implies that the relationship between competition and stability of the commercial banking system in Vietnam is an inversed U-shaped nonlinear relationship. In addition, the results of our study also show that as competition intensifies, NPL ratio increased as banks under competitive pressure may be forced to loosen their lending conditions. This result partly shows that the “competition-fragility” view can happen in medium and long term.

In addition, the results of our study also show that in the context of financial crisis, the instability and NPL of Vietnam commercial banks are also increased. At the same time, increased competition can cause instability for the commercial banking system in Vietnam.

6.2 Policy Implications

Based on the results of our study, we draw some policy implications as follow:

Firstly, in managing bank’s operations, the executive officers need to well manage the bank’s operating expenses and incomes. This will help banks to improve their competitiveness thus contributing to the stability of the bank.

Second, under increasing and intensive competition in Vietnam’s banking market, bank executives need to have action plans to improve the quality of their products and services, to take advantages of modern technology to maximize the satisfaction of customers needs. Banks should be alert and avoid loosening their lending conditions to compete for market share and customers.

Third, the Government and the State Bank of Vietnam should take actions to encourage and promote healthy and transparent competition in the banking system.

Fourth, in parallel with the creation of an environment that encourages healthy competition, the Government and the State Bank of Vietnam need to increase the inspection and supervision of credit quality at commercial banks to limit excessive risk exposure.

References

Allen, F., Gale, D.: Financial contagion. J. Polit. Econ. 108, 1–33 (2000)

Allen, F., Gale, D.: Competition and financial stability. J. Money Credit Bank. 36, 453–480 (2004)

Arellano, M., Bond, S.: Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 58(2), 277–297 (1991)

Beck, T.: Bank Competition and Financial Stability: Friends or Foes? Policy Research Working Paper No. 4656, World Bank (2008)

Beck, T., Demirguc-Kunt, A., Levine, R.: Bank concentration, competition, and crises: first results. J. Bank. Financ. 30, 1581–1603 (2006)

Berger, A., Klapper, L., Turk-Ariss, R.: Bank competition and financial stability. J. Financ. Serv. Res. 35, 99–118 (2009)

Berger, A., Klapper, L., Turk-Ariss, R.: Bank Competition and Financial Stability, World Bank Policy Research Working Paper 4696 (2008)

Boot, A., Greenbaum, S.: Bank regulation, reputation and rents: theory and policy implications. In: Mayer, C., Vives, X. (eds.) Capital Markets and Financial Intermediation, pp. 262–285. Cambridge University Press, Cambridge (1993)

Boyd, J.H., De Nicolo, G., Smith, B.D.: Crises in competitive versus monopolistic banking systems. J. Money Credit Bank. 36, 487–506 (2004)

Boyd, J.H., De Nicolo, G.: The theory of bank risk-taking and competition revisited. J. Financ. 60, 1329–1343 (2005)

Boyd, J.H., De Nicolo, G., Jalal, A.M.: Bank risk taking and competition revisited: New theory and evidence. IMF working paper, WP/06/297 (2006)

Boyd, J.H., Graham, S.L.: Risk, regulation, and bank holding company expansion into nonbanking. Res. Depart. Fed. Reserv. Bank Minneap. 10(2), 2–17 (1986)

Boyd, J.H., Graham, S.L., Hewitt, R.S.: Bank holding company mergers with nonbank financial firms: effects on the risk of failure. J. Bank. Financ. 17(1), 43–63 (1993)

Caminal, R., Matutes, C.: Market power and bank failures. Int. J. Ind. Organ. 20, 1341–1361 (2002)

Carletti, E., Hartmann, P.: Competition and financial stability: what’s special about banking? In: Mizen, P. (ed.) Monetary History, Exchange Rates and Financial Markets: Essays in Honour of Charles Goodhart, vol. 2. Edward Elgar, Cheltenham (2003)

De Nicolo, G., Loukoianova, E.: Bank Ownership, Market Structure, and Risk. IMF Working paper, WP/07/215 (2006)

Carletti, E.: Competition and regulation in banking. In: Boot, A.W.A., Thakor, A. (eds.) Handbook of Financial Intermediation and Banking. Elsevier, Amsterdam (2008)

Fernández de Guevara, J., Maudos, J., Perez, F.: Market power in European banking sectors. J. Financ. Serv. Res. 27, 109–137 (2005)

(Maggie) Fu, X., (Rebecca) Lin, Y., Molyneux, P.: Bank competition and financial stability in Asia Pacific. J. Bank. Finan. 38(1), 64–77. https://doi.org/10.1016/j.jbankfin.2013.09.012 (2013)

(Maggie) Fu, X., (Rebecca) Lin, Y., Molyneux, P.: Bank competition and financial stability in Asia Pacific. J. Bank. Financ. 38(issue C), 64–77 (2014)

Gambacorta, L.: Inside the bank lending channel. Eur. Econ. Rev. 49(7), 1737–1759 (2005)

Gunji, H., Yuan, Y.: Bank profitability and the bank lending channel: evidence from China. J. Asian Econ. 21(2), 129–144 (2010)

Hannan, T.H., Hanweck, G.A.: Bank insolvency risk and the market for large certificates of deposit. J. Money Credit Bank. 20(2), 203–211 (1988)

Hellmann, T., Murdock, K., Stiglitz, J.: Liberalization, moral hazard in banking, and prudential regulation: are capital requirements enough? Am. Econ. Rev. 90, 147–165 (2000)

Jimenez, G., Lopez, J., Saurina, J.: How does Competition Impact Bank Risk Taking? Banco de Espana Working Papers 1005 (2007)

Keeley, M.: Deposit insurance, risk, and market power in banking. Am. Econ. Rev. 80, 1183–1200 (1990)

Laeven, L., Levine, R.: Bank governance, regulation and risk taking. J. Finan. Econ. 93, 259–275 (2009)

Liu, H., Molyneux, P., Wilson, J.: Competition and Stability in European Banking: A Regional Analysis. Working Paper No. BBSWP/10/019. School of Management, University of St. Andrews (2010)

Marcus, A.J.: Deregulation and bank financial policy. J. Bank. Financ. 8, 557–565 (1984)

Martinez-Miera, D., Repullo, R.: Does competition reduce the risk of bank failure? Rev. Financ. Stud. 23, 3638–3664 (2010)

Maudos, J., Solis, L.: The determinants of net interest income in the Mexican banking system: an integrated model. J. Bank. Financ. 33, 1920–1931 (2009)

Mishkin, F.S.: Financial consolidation: dangers and opportunities. J. Bank. Financ. 23, 675–691 (1999)

Fernández, R.O., Garza-García, J.G.: The Relationship between Bank Competition and Financial Stability: A Case Study of the Mexican Banking Industry. Working Paper 03.12 (2015)

Schaeck, K., Cihak, M., Wolfe, S.: Are More Competitive Banking Systems More Stable? IMF Working Paper WP/06/143 (2006)

Schaeck, K., Cihak, M.: How does competition affect efficiency and soundness in banking? New empirical evidence. Working Paper No. 932, European Central Bank (2008)

Turk-Ariss, R.: On the implications of market power in banking: evidence from developing countries. J. Bank. Financ. 34(4), 765–775 (2010)

Vives, X.: Competition and Stability in Banking. IESE Working Paper 852 (2010)

Uhde, A., Heimeshoff, U.: Consolidation in banking and financial stability in Europe: empirical evidence. J. Bank. Finan. 33(7), 1299–1311 (2009)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG

About this paper

Cite this paper

Nguyen, T.L., Le, A.H., Tran, D.M. (2018). Bank Competition and Financial Stability: Empirical Evidence in Vietnam. In: Anh, L., Dong, L., Kreinovich, V., Thach, N. (eds) Econometrics for Financial Applications. ECONVN 2018. Studies in Computational Intelligence, vol 760. Springer, Cham. https://doi.org/10.1007/978-3-319-73150-6_46

Download citation

DOI: https://doi.org/10.1007/978-3-319-73150-6_46

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-73149-0

Online ISBN: 978-3-319-73150-6

eBook Packages: EngineeringEngineering (R0)