Abstract

Many authors emphasize that regions are key elements and political tools for economic growth and that regional competitiveness significantly shapes entrepreneurial behavior, and also say, that high-tech firms choose their location based on their assessment of regional competitiveness (productivity, innovations) and that highly innovative firms settle in highly competitive regions. Scholars analyze the knowledge spillovers and their impact on firms’ productivity, demand and successful implementation of product and process innovations. Other scholars suggest that for economic growth promotion it is necessary to take actions to support the creation and dissemination of knowledge, to support research and development activities, investment in appropriate infrastructure and communication technology. Therefore, the significance of innovation is today more and more frequently emphasized as a key engine for regional growth, standard of living and international competitiveness. The goal of this chapter is to provide an analysis and evaluate the influence of selected drivers—determinants of the knowledge economy on the selected output—turnover from innovated production and provide some practical implications for policy makers not only in selected countries. The analysis will be conducted by using a multiple linear regression models constructed by the authors. Results show that determinants of innovation activities vary across countries and, separately, influence innovation activities less than in combination with each other. These findings confirm previous studies on the general shift towards a knowledge economy and the importance of factors such as knowledge, innovation and cooperation with different partners that allow the creation of synergies and spillover effects.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

- Regional Competitiveness

- Innovative Products

- Public Research Institutions

- Innovative Environment

- Innovation Paradox

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Currently, competitiveness is a topic that is frequently discussed and dealt with in economic analysis. This applies not only to individual companies or sectors but also to regions by whatever definition. Competitiveness is an entity’s ability to be successful in a competitive environment so that its goals are achieved to the greatest possible extent (and in the most effective way). In fact, competitiveness is considered to be one of the most significant determinants of economic development; gradual increase of this determinant results to the fulfillment of objectives of regional policy and to the growth of welfare, quality of life and long-term economic development (Amin 1999; Prokop and Stejskal 2015b). Companies must respond dynamically to adapt to the situation on international markets. They must change production processes and find new resources for the needs of innovative production. These consist of valuable knowledge and skills that complement their own capabilities. Firms must dramatically change their innovative activities as well as company strategy and the company’s access to innovations (Autio et al. 2014). Similarly, entrepreneurs must understand that firms are part of an innovative environment where individual entities affect others. This innovative environment plays an important role in the innovation process at the firm level (Stejskal and Hajek 2012). Knowledge, spillover effects, cooperation, and complex R&D have become the new production factors in this third phase. These factors, mainly cooperation activities with other firms or institutions, open up opportunities for accessing complementary technological resources (such as skill sharing), which can contribute to faster innovation development, improved market access, economies of scale and scope, cost sharing, and risk spreading (De Faria et al. 2010).

There are many methods of achieving maximum effectiveness. On one hand, they are dependent on the type of entity in question, but they are also influenced by the environment and the conditions of the economic system surrounding the competing entities. Sources of competitive advantage also continue to develop within the current globalized system; therefore, researchers also try to discover the most effective possible way to increase competitiveness both for economic entities and regions (and, thus, for the entire economy). Thanks to globalization and technological progress, methods of communication, the Internet and IT technology are important production factors that often play a key role in achieving competitiveness (Chen et al. 2004). More and more often, these results in progress towards a knowledge economy, in which knowledge represents an important national, regional or company asset that creates a source of competitive advantages (McAleer and Slottje 2005). Each entity’s economic potential is determined by its ability to create, use and share knowledge (Malecki 2000).

Knowledge and the ability to transform it into innovation are becoming the foundation for individual regional and national economic systems. These often try to support the creation, acquisition and transfer of knowledge—both financially and non-financially. In this way, the economy often becomes dependent or based on knowledge. Regarding each government’s limited financial possibilities, the question arises as to the effectiveness of such attempts (and support for such attempts) to create and develop a knowledge economy. There are no standard, generally recognized methods that are able to determine to what degree an economy is based on knowledge (Kitson et al. 2004). Various studies argue about whether economies’ knowledge base is measurable or how to measure a knowledge economy’s outputs, which are necessary for different types of economic analysis (Leydesdorff et al. 2006). That is why it can be very difficult to evaluate the effects of each driver (determinant) in innovation environment. Typical examples are the effects of the soft determinants—for example the level of cooperation. The second determinant what is difficult to evaluate, is the public support, i.e. financial resources to support collaboration and knowledge transfer, acquisition and application in practice. Very often the (mainly the support from the EU budget and national budgets are applied).

Therefore, the goal of this chapter is to provide an analysis and evaluate the influence of selected drivers—determinants of the knowledge economy on the selected output—turnover from innovated production and provide some practical implications for policy makers not only in selected countries. The analysis will be conducted by using a multiple linear regression models constructed by the authors.

The remainder of this chapter is divided in the following way. The first two sections are focused on the knowledge economy and the determinants of environment what lead to innovations. The third section describes the methodology, analysis and results. The last section comprises the research’s concluding evaluations and provides practical implications for policy makers.

2 The Innovation Environment and the Drivers

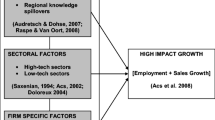

Adopted from Prokop et al. (2017)

Economic development and the gradual improvement of the living conditions in a country and its regions is a basic long-term strategic goal (Safiullin et al. 2012; Pachura and Hájek 2013). Many authors emphasize that regions are key elements and political tools for economic growth and that regional competitiveness significantly shapes entrepreneurial behavior, and also say, that high-tech firms choose their location based on their assessment of regional competitiveness (productivity, innovations) and that highly innovative firms settle in highly competitive regions (Boschma 2004; Annoni and Kozovska 2010; Prokop and Stejskal 2015a). This leads to the attempt by regional governments to look for the most effective possible ways to increase their regional competitiveness—i.e., one of the main engines for the region’s growth (Snieska and Bruneckienė 2009; Stejskal and Hajek 2012). A number of factors influence the success of these attempts.

One of these is knowledge, which has been an increasingly significant production factor as of the start of the twenty-first century (Malecki 2000). This fact is supported by a number of studies investigating the connection between the increase in regional competitiveness and knowledge (Audretsch et al. 2012; Kwiek 2012; Sum and Jessop 2013; Camagni and Capello 2013). Knowledge undoubtedly represents a new source of economic growth; however, from the economic perspective, utilizing knowledge is not a new issue (Snieska and Bruneckienė 2009). Around 1911, Schumpeter had already come up with the idea of using knowledge and its combinations as a foundation for innovative activities and entrepreneurship and we can see a shift from material and capital inputs to the input information, respectively knowledge (Cooke and Leydesdorff 2006; Hajek and Stejskal 2015). The number of scholars analyzes the knowledge spillovers and their impact on firms’ productivity, demand and successful implementation of product and process innovations. Other scholars suggest that for economic growth promotion it is necessary to take actions to support the creation and dissemination of knowledge, to support research and development activities, investment in appropriate infrastructure and communication technology. Therefore, the significance of innovation is today more and more frequently emphasized as a key engine for regional growth, standard of living and international competitiveness (Acs et al. 2002a). The role of knowledge and its ties to innovation and economic performance continues to be more frequently analyzed (Shapira et al. 2006). It is clear that it is no longer possible to attain economic growth in the same ways as in the past, i.e., by hiring an ever greater number of workers as an input resource or by increasing consumer demand (Pulic 1998; Chen et al. 2004). Therefore, individual economic entities must seek new ways of keeping up with the competition and coping with the tempo of quick changes (Stejskal and Hajek 2015). New, economically useful knowledge that leads to the creation of innovation (product or process) therefore plays a significant role in (i) achieving economic growth; (ii) international trade; and (iii) regional development (Acs et al. 2002b).

The efforts to save the resources during the innovation production (product, service and process or marketing innovations), the accelerating their entry into the market and the gaining a competitive advantage in a globalized economy, these all lead to massive use of the second determinant of the innovation environment. The cooperation is this second determinant (Lee et al. 2012; Fitjar and Rodríguez-Pose 2013). A common platform of cooperation is a variant of the (quadruple) triple helix (Leydesdorff 2012). It is proven in many studies that cooperation (in all its forms: cooperation only within the enterprise or business networks; collaboration with universities and research institutions, and broad platform for industry-university-government cooperation) contributes to the formation of innovations, it accelerates and cheapens the all processes (Lee et al. 2012; Fitjar and Rodríguez-Pose 2013; Schilling 2015). However, there has been intensive cooperation; many conditions in the economic environment must be fulfilled (e.g. generally positive business atmosphere, trust or creation of the appropriate incentives for development of cooperation at various levels). Due to globalization, it is not necessary to think about collaboration just on a regional level or platform (Conrad et al. 2014). On the other hand, studies point to the fact that the level of trust with the increasing distance of the cooperating entities is decreased (Connell et al. 2014).

Many studies highlight the fact that effective collaboration requires the creating of favorable business environment, adequate incentives to innovation processes and helpful attitude from the public sector (Kaihua and Mingting 2014; Wang et al. 2016). A common characteristic of the listed drivers is the public support, which can help to create the above mentioned environment, and initiate the cooperation on the (initially the mostly) regional level (De Blasio et al. 2015). The practice shows that public support providing to foster innovation is not very effective. Often, businesses are investing own funds in own R&D activities; respectively they invest the internal money to innovative collaboration (Bronzini and Iachini 2014). The second option is to purchase knowledge or whole innovation in the market by other economic subject, which is also financed from internal funds. Given the EU’s interest to maximize the production of innovations and innovative products on its territory, there are many grants in this area and to various entities (including businesses, public sector organizations, knowledge-based sectors, as well as other support organizations and agencies). Condition for the disbursement of European funds is often the co-financing from national and internal funds. The evaluating the effectiveness of this public support is very problematic as evidenced by numerous studies (Zúñiga-Vicente et al. 2014; De Blasio et al. 2015). There are many obstacles for detailed analysis, for example missing micro data, very long period between using money and the innovation birth, missing output criterion and very of the un-measurable quality etc. (Czarnitzki and Lopes-Bento 2013). There are many studies that demonstrate the positive effects of public funding, but some authors are critical and the effectiveness of public subsidies is evaluated as inadequate (Antonioli et al. 2014).

Many mentioned studies show that in various countries the situation is different. Often the settings of financing terms, bureaucracy procedures or the existence of different legal barriers are different. Our previous research (e. g. Prokop and Stejskal 2016a, b) shows that many of the drivers of innovation environments operate independently and influence positively the outcome of the innovation process. On the other hand, the effects what are generated from the combination of different drivers were detected and analyzed. But there is no international comparative study that would analyze the combination of drivers and compared the situation internationally.

3 Data and Methodology

Data for the analyses were obtained from the Community Innovation Survey for 2010–2012. The Community Innovation Survey (CIS) is a harmonized questionnaire, which is part of the EU’s science and technology statistics; it is carried out every 2 years by the EU member states and a number of ESS member countries. For our analysis, we created original multiple linear regression models that are commonly used for these kinds of analyses (e.g. Nieto and Quevedo 2005; Chen and Huang 2009; Bishop et al. 2011—logistic regression; Schneider and Spieth 2013—multiple linear regression) and therefore we suppose these models sufficient. We investigate the relationship between one dependent variable, represented by the % of turnover in new or improved products introduced during 2010–2012 (new to the market), and a number of selected independent variables (innovation activity determinants, see Table 1). In total, we analyzed 10,804 enterprises from 8 countries (see Table 2) from the manufacturing industries (NACE Categories 10–33).

Regression models take the general form as follows (Chatterjee and Hadi 2013):

where:

-

y is a dependent variable;

-

x 1, x 2 … x n are independent variables;

-

ε is an error term that accounts for the variability in y that cannot be explained by the linear effect of the n independent variables;

-

β 1, β 2 … β n , called the regression parameters or coefficients, are unknown constants to be determined (estimated) from the data.

Verification of whether the data from the CIS were correlated was conducted using Spearman’s test. Spearman’s coefficient (r s ) measures the strength of the linear relationship between each two variables when the values of each variable are rank-ordered from 1 to N, where N represents the number of pairs of values (the N cases of each variable are assigned integer values from 1 to N inclusive, and no two cases share the same value). The difference between ranks for each case is represented by d i . The general formula for Spearman’s rank correlation coefficient takes the general form as follows (Weinberg and Abramowitz 2002; Borradaile 2013):

The values of Spearman’s test rejected the hypothesis that the data are correlated with a level of significance at p < 0.05. Moreover, we also tested the collinearity among the independent variables by using Variance Inflation Factor (VIF) for each regression model (country). Multicollinearity was not observed in any of the models (VIF < 5).

All calculations were made using the statistical software STATISTICA (StatSoft Inc. 2011). After fulfilling the first prerequisite (uncorrelated data) and the rejection of multicollinearity in the model, the analysis itself was conducted.

4 Drivers of Innovative Activities Analysis

For every country, we created 8 models (M1–M8) analyzing the influence of selected variables (Table 1) and the creation of spillover effects. Firstly, we analyzed the relationship between each of the independent variables (the determinants of innovative activities) and the target (dependent) variable (the growth of turnover from innovated products between 2010–2012). This is presented in model M1. Most of the determinants of innovation activities differ within countries and most of these determinants do not influence the innovation activities separately. There are number of studies that analyze the spatial distribution of innovative activities and the role of technological spillovers in the process of knowledge creation and diffusion across firms, regions, and countries (e.g., Moreno et al. 2005; Cabrer-Borras and Serrano-Domingo 2007; Lee et al. 2015). For example, Fritsch and Franke (2004) investigated the impact of knowledge spillovers and R&D cooperation on innovation activities in German regions; Andersson and Ejermo (2005) showed that there is a positive relationship between the innovativeness of a corporation and its accessibility to university researchers in Sweden; and Dahl (2002) and Engelstoft et al. (2006) analyzed knowledge flows within clusters in Denmark with respect to spillover effects as a positive technological externality.

Therefore, we subsequently analyzed how the addition of variables and their interactions could influence the strength of models. We created other advanced models (M2–M8) that analyzed influence of public funding and cooperation on dependent variable. We analyzed influence of combinations between public financing and cooperation within groups of companies (M2), cooperation with suppliers (M3), cooperation with customers (M4), cooperation with universities (M5), cooperation with government or public research institutes (M6). We also analyzed influence of combinations between cooperation with universities and other cooperation partners (M7) and influence of combinations between cooperation with government or public research institutes and other cooperation partners (M8). All results (for all selected countries) are shown in following Sects. 4.1–4.8.

4.1 Romania

In Romania, spillover effects rarely occurred because of a lack of innovative background and facilities. The results in Table 3 show that the majority of the research results are not significant. We assume that there are other factors that affect the output variable than those examined in this study. The most significant determinant of innovative activities in Romanian companies seems to be collaboration. It is apparent from the various models that the companies working together with their suppliers (on a regular supplier-customer base) positively influenced their innovation outcomes. Surprisingly, it was found that collaborating with customers did not lead to changes that would positively affect any subsequent levels of revenue from innovation. Romanian businesses also collaborated with public research organisations. Collaboration with them also positively influenced the innovation outputs and, consequently, innovation revenue.

Examining the combination of the effects of the selected variables does not yield any results. No form of public support acts sufficiently strongly on innovation activities and does not affect the output variable significantly. No significant (and positive) effect of collaboration or public funding of innovative activities was revealed.

Romania is a typical example of a country where there is an innovation paradox. In this country, a background for innovation is missing, and the country faces obstacles in elements of its environment (e.g., insufficient infrastructure). Therefore, determinants of innovative activities are not able to influence the growth of turnover from innovation even if they were provided with sufficient public funds. The country struggles with a lack of absorption capacity but may also be hampered by a lack of demand for innovation outputs (from both enterprises and research organizations). Therefore, we strongly suggest coordinating public policies, building sufficient infrastructure in the country, supporting the identification of innovative needs and the demand for innovation outputs, and helping promote trust among organizations.

4.2 Croatia

The results in Table 4 show that the determinants of innovative activities examined (acting alone) do not affect innovation outcomes and subsequent revenue from innovation in a significant way. The only positive result was revealed in the co-innovation of a group of companies (CO_GP). Here, in all examined models and variants of cross-determinants, positive results have appeared. Similarly, it is possible to say that Croatian companies are influenced by the market in which they operate and which is their target outlet. Even this determinant was able to influence the amount of revenue from innovative production.

Unfortunately, even in Croatia, no positive effects from the combinations and interactions of determinants (collaboration and financing) have been demonstrated. To a certain extent, this testifies to the development of the local knowledge sector and the innovative maturity of manufacturing companies.

In Croatia, the situation was initially similar to that in Romania and most of the determinants did not influence the growth of turnover from innovation on their own (see Table 4).

The results show that Croatian companies do not sufficiently cooperate with each other. This may indicate some type of lock-in problems. However, this approach is justifiable and often occurs in CEE countries. It results from an underdeveloped business environment where public sector institutions are unlikely to contribute to the removal of barriers to entrepreneurship. They also often do not contribute to the creation of innovation systems and do not sufficiently support the involvement and cooperation of various market and non-market entities in them. It is not possible then to create the spill-over effects of knowledge, or other positive externalities resulting from synergy. As a good basis, we can see the positive influence of cooperation in business networks and the willingness to influence the requirements of the target markets and their entities.

We would suggest strengthening cooperation with universities and public research institutes in addition to focusing on promoting cooperation with clients and customers—and with competitors, because these kinds of cooperation has not yet led to significant results. Collaboration with clients is an important element of competitive advantage, as evidenced, for example, by the lead user theory, which states that user-centered innovation is a very powerful and general phenomenon that supports innovative activities (Von Hippel 1986, 2005). Also, cooperation with competitors can lead to significant results. Gnyawali and Park (2011) state that co-opetition (the simultaneous pursuit of collaboration and competition) is viewed as the sum of many different relationships, and the cooperative and competitive parts are divided between different actors. They also state that it occurs, evolves, and impacts the participating firms and the industry and that it plays an important role in enhancing common benefits as well as in gaining a proportionately larger share of the benefits. Co-opetition is a challenging yet very helpful way for firms to address major technological challenges, create benefits for partnering firms, and advance technological innovation. Moreover, co-opetition between giants causes subsequent collaboration among other firms and results in advanced technological development.

4.3 Slovenia

In Slovenia, interactions of determinants occurred rarely, even though firms effectively utilize the various determinants of innovation activities, and these determinants have strong influence on the growth of the firms’ turnover from innovation in the manufacturing industry on their own. An interesting finding is the inability of Slovenian companies to use public funds from the central government effectively. Combination analyses give almost identical results (negative), which enhances the predictive power of these findings. The combination of FUNGMT * CO_GP also negatively affected the output variable. On the other hand, the use of EU resources supporting business networking has been positively evaluated. The development of a high-quality business sector (within the surveyed industry) is supported by the finding that the inclusion of the university and its research into these networks positively supports the turnover from innovative production (0.046***) (Table 5).

Companies in Slovenia are probably not forced to seek new sources of competitive advantage and change their current situation. Narula (2002) states that firms are by definition resistant to radical change, and firms will always to prefer to maintain the status quo if it does not endanger their competitiveness (firms are often slow in changing their dominant designs, because they are path dependent and technologically locked in). By their very nature, all innovation systems have some degree of inertia, and this may lead to lock-in. Moreover, while offering a veneer of protection to existing systems in the shorter term, innovation lock-in tends to create barriers to more sustainable innovation (Aylward 2006); this can lead to a country’s decline in innovation performance as well as a decline in its competitive advantage and prosperity.

In Slovenia probably, the firms protect their know-how; there is no trust between firms or between firms and universities or public research institutes, which leads to a lack of cooperation and the lock-in effect. Narula (2002) states that this type of small country, for instance, simply does not have the resources to sustain world-class competences in as wide a variety of technologies as the economy may require. As such, the knowledge infrastructure may be unable to overcome lock-in as rapidly as firms need to sustain their competitiveness. Innovation lock-in, while offering a veneer of protection to existing systems in the shorter term, tends to create barriers to more sustainable innovation, and this could lead to a decline in a country’s innovation performance as well as to a decline in its competitive advantage and prosperity. We therefore propose greater company openness and promoting trust and cooperation between firms as well as between firms and universities or public research institutes. In Slovenia, an open innovation approach is necessary to develop and promote to use of purposive inflows and outflows of knowledge to accelerate internal innovation and expand the markets for external use of innovation. This concept is based on different research trends and suggests that valuable ideas can come from inside or outside the company and can also go to market from inside or outside the company (Chesbrough 2006; Chesbrough and Appleyard 2007). Therefore, cooperation is seen as a crucial way to increase firms’ growth of turnover and a country’s competitiveness.

4.4 Czech Republic

In manufacturing industries in the Czech Republic, regression models in Table 6 showed more interesting results than in the previous countries. The analysis of the influence of the individual determinants on the dependent variable showed that the innovation activity of the Czech companies is influenced mainly by the choice of the target market. Independent financial determinants gave expected results. Funds from local, regional, or national sources do not significantly affect the turnover of innovative companies. EU budget funds affect them, but in all cases negatively. All models have shown that the independent impact of EU subsidies creates a hindrance for processing companies. This is due to an unclear and complicated system of applying for European subsidies, as well as very difficult accounting and a high risk of having to repay the subsidy in the event of violating the usage conditions. These results confirm the obstacles mentioned above in the form of a high degree of bureaucracy and the instability of the legal environment affecting the innovation activity of Czech companies.

As in other countries, no positive impact of collaboration has been demonstrated. Among Czech companies in the basic group, the impact of suppliers (in M3) and universities in the M5 model was confirmed. Collaboration of a business and a university, funded from a European project, resulted in the positive influence of the company’s innovation turnover. Other types of funding did not have a significant positive influence on the dependent variable. Other combinations of collaborating entities and type of funding did not provide a significant result.

The results of the analysis show that there are also many important determinants of the innovation environment in the Czech Republic (as in other CEE countries), which are more effective in their ability to innovate. It was found that these fundamentals are not actually a type of collaboration or financial support. To improve the situation, it is essential to improve the business environment; to encourage “bottom-up” cooperation. Regional innovation systems can be developed across the country to encourage greater collaboration between businesses, universities and other support organisations. Financial frameworks appear to be inadequately defined and targeted, and do not encouragie innovative cooperation. Similarly, it is necessary to eliminate the high degree of bureaucracy and formalism in the request for EU funding, which in practice in the Czech Republic appears to be a form of innovation paradox.

4.5 Slovakia

In Slovakia, regression models did not provide any significant results. The results obtained do not have sufficient information from any of the models presented (M1-M8). Without emphasis on significance, it can be argued that Slovak companies are not fundamentally influenced by the type of target market (whether domestic or international). Similarly, companies in Slovakia which collaborated with universities did not achieve a positive increase in innovation turnover. Collaboration with governmental research organisations did not appreciably affect the turnover of companies (but any influence detected was mostly positive) (Table 7).

The impact of public funds on company innovation has not been confirmed. Any public funds provided are rather inefficiently used. Similarly, the impact of collaboration has not been confirmed, even with public R&D organisations and universities.

We assume that weak results in Slovak manufacturing firms are due to the smaller sample of companies.

4.6 Hungary

In Hungary, proper market orientation, as well as in the Czech Republic, leads to creation of strong links influencing dependent variable (in all cases). The force of this determinant is evident from its invariant value in all regression models. Hungarian firms are also trying to establish new subsidiaries in Hungary or in other European countries (Table 8).

A very weak (but not significant) positive was the impact of collaboration with public research institutions and universities. Supplier inputs are also used, which have a positive effect on companies’ turnover from innovation.

An interesting point was the fact that Hungarian firms seeking an innovative product or service, or process innovation, have failed to use these innovative incentives and effectively commercialise them. Significant negative effects on turnover from innovative production were identified. It can be assumed that this is a result of a time lag between the application of market innovation and its commercialisation.

Regression models have shown that, in the manufacturing industry, public funds provided by the central government act rather negatively, thus not affecting the innovation capability of these companies. They do not act positively even when they finance collaboration with public research institutions. However, this collaboration is supported in Hungary by European subsidies, which have been found to have a positive and significant result (0.042***).

The combinations analysed worsened the results of the regression models. On the basis of the results found, it is not possible to postulate any main conclusions, but rather to estimate the causes of these results. It may be true that in Hungary (as in other CEE countries), other factors such as the business environment, lack of openness, a high degree of bureaucracy, clientelism and corruption in public financing predominate.

4.7 Estonia

The results in Table 9 show the selected combination of variables in Estonia. Significant positive effects have been identified here on the turnover of innovation revenue (even at the lowest level of significance).

The analysis allows for positive effects when implementing product innovations (though not significant). Other types of innovation do not positively affect companies’ innovation performance.

None of the analysed combinations of “cooperation and funding” provided significant results. Support from national sources does not work in practice in line with its objective (negative effects, however insignificant, have been found in all combinations). Any combination of cooperation and funding from the EU budget improves the impact of these funds. Individual models showed rather positive effects. Mutual combinations of different forms of cooperation also did not bring significant results.

We can conclude that public support does not always bring positive effects, especially if subsidies are not carefully targeted to the appropriate industry and to the target activity (totally clear type of innovation).

4.8 Lithuania

The results in Table 10 show that Lithuania has different situation regarding the impact of public finance as in Estonia. We found that the greatest influence on companies’ innovation capabilities in Lithuania is the choice of the markets that firms are oriented towards. Almost identical effects were found in all models.

Public funding from EU funds positively affects corporate results. The results are almost unchanged in each model, which confirms the information capability. The impact of funds from public budgets has not been confirmed or was found to be insignificant, or negative. Innovative results of Lithuanian companies are also affected by collaboration with universities. Their importance is enhanced by collaboration with public research institutes.

Examination of individual combinations did not lead to any clear results in this country either. The impact of public finances on the development of collaboration has also not been confirmed in Lithuania. This is a result common to the CEE countries. For example, if a company collaborated with a university and used a subsidy from the national budget, it did not positively offset the revenues from innovative production. This result (though insignificant) is also supported by the results of the study of the impact of municipal and European public subsidies. This suggests that even Lithuanian companies will likely have to overcome the barriers to bureaucracy associated with the use of subsidies (which may be reflected in the fact that companies are more committed to fulfilling these claims than the innovation itself). Similarly, no positive impact of collaboration with universities or R&D organisations has been confirmed. Again, it can be assumed that the reason is the inflexibility and the completely dichotomous objective of these knowledge-based organisations which are incompatible with the objectives of business entities.

5 Conclusions

Nowadays, innovation plays an important role in the process of gaining competitive advantage and economic growth of firms or countries. However, finding the proper determinants of innovative activities represent a complex process lacking universal formula of which variables positively affect innovation creation. Therefore, the aim of this study was to fill the gap and find proper determinants of innovative activities—drivers of economic growth in twenty-first century, and make international comparison providing some practical implications not only for these countries. Results show that determinants of innovation activities vary across countries and, separately, influence innovation activities less than in combination with each other. These findings confirm previous studies on the general shift towards a knowledge economy and the importance of factors such as knowledge (Conceição et al. 1998; Wessel 2013), innovation (Aghion et al. 2013; Braha et al. 2015) and cooperation with different partners (Brink and Neville 2016; Vásquez-Urriago et al. 2016) that allow the creation of synergies and spillover effects.

An important implication arising from these results is that public policies to encourage the innovations creation should to be selective, and should be directed to selected sector. Cooperation in the creation of a specific innovation has to be the aim. In this case, it is possible to record even the existence of knowledge spill-over effects mostly in knowledge networks. Therefore, public support should be allocated wisely and only in selected areas of the industry. Individual projects must be clearly defined and measurable outputs of innovation and policy makers should carefully decide which projects and centers they will support (from national or European funds) and which not. The massive uncontrolled support should be mistaken for selective support focused on achieving the highest possible efficiency. The declaration of interest towards maximum efficiency should be incorporated into different strategies from national to the regional level. Public institutions and decision makers must use monitoring tools and methods using ex ante effectiveness evaluation (financial schemes must be prepared and “fit” to targeted applicants well because it is unable to apply the approach “all fits to all”). All these results should help to improve the strategic management of public sector organizations (also the regional governments) to prepare better strategies and various sectoral policies.

To increase efficiency, we recommend the clear definition of expected outputs, continuous monitoring and conditional funding. Likewise, we show that cooperation may have a greater positive effect if it occurs during the formation of a certain innovation and in combination with different entities, especially with universities and within groups of companies. These combinations significantly influence the growth of turnover from innovated products within different countries.

References

Acs ZJ, Anselin L, Varga A (2002a) Patents and innovation counts as measures of regional production of new knowledge. Res Policy 31(7):1069–1085

Acs ZJ, de Groot HL, Nijkamp P (eds) (2002b) The emergence of the knowledge economy: a regional perspective. Springer Science & Business Media, Berlin

Aghion P, Howitt P, Prantl S (2013) Revisiting the relationship between competition, patenting, and innovation. Adv Econ Econ 1:451–455

Amin A (1999) An institutionalist perspective on regional economic development. Int J Urban Reg Res 23(2):365–378

Andersson M, Ejermo O (2005) How does accessibility to knowledge sources affect the innovativeness of corporations?—evidence from Sweden. Ann Reg Sci 39(4):741–765

Annoni P, Kozovska K (2010) EU regional competitiveness index. European Union, Luxembourg

Antonioli D, Marzucchi A, Montresor S (2014) Regional innovation policy and innovative behaviour: looking for additional effects. Eur Plan Stud 22(1):64–83

Audretsch DB, Hülsbeck M, Lehmann EE (2012) Regional competitiveness, university spillovers, and entrepreneurial activity. Small Bus Econ 39(3):587–601

Autio E, Kenney M, Mustar P, Siegel D, Wright M (2014) Entrepreneurial innovation: the importance of context. Res Policy 43(7):1097–1108

Aylward D (2006) Innovation lock-in: unlocking research and development path dependency in the Australian wine industry. Strateg Chang 15(7–8):361–372

Bishop K, D’Este P, Neely A (2011) Gaining from interactions with universities: multiple methods for nurturing absorptive capacity. Res Policy 40(1):30–40

Borradaile GJ (2013) Statistics of earth science data: their distribution in time, space and orientation. Springer Science & Business Media, Berlin

Boschma R (2004) Competitiveness of regions from an evolutionary perspective. Reg Stud 38(9):1001–1014

Braha K, Qineti A, Serenčéš R (2015) Innovation and economic growth: the case of Slovakia. Visegrad J Bioecon Sustain Dev 4(1):7–13

Brink T, Neville M (2016) SME cooperation on innovation & growth. Euram 2016

Bronzini R, Iachini E (2014) Are incentives for R&D effective? Evidence from a regression discontinuity approach. Am Econ J Econ Policy 6(4):100–134

Cabrer-Borras B, Serrano-Domingo G (2007) Innovation and R&D spillover effects in Spanish regions: a spatial approach. Res Policy 36(9):1357–1371

Camagni R, Capello R (2013) Regional competitiveness and territorial capital: a conceptual approach and empirical evidence from the European Union. Reg Stud 47(9):1383–1402

Chatterjee S, Hadi AS (2013) Regression analysis by example. Wiley, Hoboken, NJ

Chen CJ, Huang JW (2009) Strategic human resource practices and innovation performance—the mediating role of knowledge management capacity. J Bus Res 62(1):104–114

Chen J, Zhu Z, Yuan Xie H (2004) Measuring intellectual capital: a new model and empirical study. J Intellect Cap 5(1):195–212

Chesbrough HW (2006) Open innovation: a new paradigm for understanding industrial innovation. In: Chesbrough HW, Vanhaverbeke W, West J (eds) Open innovation: researching a new paradigm. Oxford University Press, Oxford

Chesbrough HW, Appleyard MM (2007) Open innovation and strategy. Calif Manage Rev 50(1):57–76

Conceição P, Heitor MV, Gibson DV, Shariq SS (1998) The emerging importance of knowledge for development: implications for technology policy and innovation. Technol Forecast Soc Chang 58(3):181–202

Connell J, Kriz A, Thorpe M (2014) Industry clusters: an antidote for knowledge sharing and collaborative innovation? J Knowl Manag 18(1):137–151

Conrad DA, Grembowski D, Hernandez SE, Lau B, Marcus-Smith M (2014) Emerging lessons from regional and state innovation in value-based payment reform: balancing collaboration and disruptive innovation. Milbank Q 92(3):568–623

Cooke P, Leydesdorff L (2006) Regional development in the knowledge-based economy: the construction of advantage. J Technol Transfer 31(1):5–15

Czarnitzki D, Lopes-Bento C (2013) Value for money? New microeconometric evidence on public R&D grants in Flanders. Res Policy 42(1):76–89

Dahl M (2002) Embedded knowledge flows through labor mobility in regional clusters in Denmark. In: DRIUD summer conference on “Industrial dynamics of the new and old economy—who is embracing whom”

De Blasio G, Fantino D, Pellegrini G (2015) Evaluating the impact of innovation incentives: evidence from an unexpected shortage of funds. Ind Corp Chang 24(6):1285–1314

De Faria P, Lima F, Santos R (2010) Cooperation in innovation activities: the importance of partners. Res Policy 39(8):1082–1092

Engelstoft S, Jensen-Butler C, Smith I, Winther L (2006) Industrial clusters in Denmark: theory and empirical evidence. Pap Reg Sci 85(1):73–98

Fitjar RD, Rodríguez-Pose A (2013) Firm collaboration and modes of innovation in Norway. Res Policy 42(1):128–138

Fritsch M, Franke G (2004) Innovation, regional knowledge spillovers and R&D cooperation. Res Policy 33(2):245–255

Gnyawali DR, Park BJR (2011) Co-opetition between giants: collaboration with competitors for technological innovation. Res Policy 40(5):650–663

Hajek P, Stejskal J (2015). Obstacles to innovation activity in Czech Manufacturing Industries. In: Proceedings of the 25th International Business Information Management Association conference, 7–8 May, 2015, pp 1828–1835

Kaihua C, Mingting K (2014) Staged efficiency and its determinants of regional innovation systems: a two-step analytical procedure. Ann Reg Sci 52(2):627–657

Kitson M, Martin R, Tyler P (2004) Regional competitiveness: an elusive yet key concept? Reg Stud 38(9):991–999

Kwiek M (2012) Universities, regional development and economic competitiveness: the Polish case. In: Universities and regional development. A critical assessment of tensions and contradictions. Routledge, New York, pp 69–85

Lee SM, Olson DL, Trimi S (2012) Co-innovation: convergenomics, collaboration, and co-creation for organizational values. Manag Decis 50(5):817–831

Lee HH, Zhou J, Hsu PH (2015) The role of innovation in inventory turnover performance. Decis Support Syst 76:35–44

Leydesdorff L (2012) The triple helix, quadruple helix,…, and an N-tuple of helices: explanatory models for analyzing the knowledge-based economy? J Knowl Econ 3(1):25–35

Leydesdorff L, Dolfsma W, Van der Panne G (2006) Measuring the knowledge base of an economy in terms of triple-helix relations among ‘technology, organization, and territory’. Res Policy 35(2):181–199

Malecki EJ (2000) Knowledge and regional competitiveness. Erdkunde 54:334–351

McAleer M, Slottje D (2005) A new measure of innovation: the patent success ratio. Scientometrics 63(3):421–429

Moreno R, Paci R, Usai S (2005) Spatial spillovers and innovation activity in European regions. Environ Plan A 37(10):1793–1812

Narula R (2002) Innovation systems and ‘inertia’ in R&D location: Norwegian firms and the role of systemic lock-in. Res Policy 31(5):795–816

Nieto M, Quevedo P (2005) Absorptive capacity, technological opportunity, knowledge spillovers, and innovative effort. Technovation 25(10):1141–1157

Pachura P, Hájek P (2013) Mapping regional innovation strategies in Central Europe: a fuzzy cognitive map approach. In: Conference proceedings, the international conference Hradec Economic Days

Prokop V, Stejskal J (2015a) Influence of university-industry collaboration on firms’ performance: comparison between Czech and Slovak industries. In: Proceedings from conference ICERI2015, 16–18 November, 2015, pp 8153–8161

Prokop V, Stejskal J (2015b) Impacts of local planning to competitiveness index change – using approximate initial analysis to the Czech regions. WSEAS Trans Bus Econ 12(1):279–288

Prokop V, Stejskal J (2016a) Determinants of business innovation activities in manufacturing industries—Czech Republic and Estonia case study. In: Proceedings from conference the economies of Balkan and Eastern Europe Countries in the changed world, EBEEC 2016, 6–8 May, 2016

Prokop V, Stejskal J (2016b) Engines for enterprises’ innovation activities in German industries. In: Proceedings from conference 11th European conference on innovation and entrepreneurship—ECIE2016, 15–16 September, 2016

Prokop V, Stejskal J, Kuvikova H (2017) Different drivers of innovative activities within European countries: comparative study between Czech, Slovak and Hungarian manufacturing firms. Ekonomický Časopis 1(65):31–45

Pulic A (1998) Measuring the performance of intellectual potential in knowledge economy. In: Second McMaster word congress on measuring and managing intellectual capital by the Austrian Team for Intellectual Potential

Safiullin LN, Ismagilova GN, Safiullin NZ, Bagautdinova NG (2012) The development of welfare theory in conditions of changes in the quality of goods and services. World Appl Sci J 18:144–149

Schilling MA (2015) Technology shocks, technological collaboration, and innovation outcomes. Organ Sci 26(3):668–686

Schneider S, Spieth P (2013) Business model innovation: towards an integrated future research agenda. Int J Innov Manag 17(1):1–34

Shapira P, Youtie J, Yogeesvaran K, Jaafar Z (2006) Knowledge economy measurement: methods, results and insights from the Malaysian knowledge content study. Res Policy 35(10):1522–1537

Snieska V, Bruneckienė J (2009) Measurement of Lithuanian regions by regional competitiveness index. Inzinerine Ekonomika Eng Econ 1(61):45–57

StatSoft, Inc. (2011) STATISTICA (data analysis software system), version 10. www.statsoft.com

Stejskal J, Hajek P (2012) Competitive advantage analysis: a novel method for industrial clusters identification. J Bus Econ Manag 13(2):344–365

Stejskal J, Hajek P (2015) Modelling knowledge spillover effects using moderated and mediation analysis—the case of Czech high-tech industries. In: Knowledge management in organizations. Springer International Publishing, Cham, pp 329–341

Sum N-L, Jessop B (2013) Competitiveness, the knowledge-based economy and higher education. J Knowl Econ 4(1):24–44

Vásquez-Urriago ÁR, Barge-Gil A, Rico AM (2016) Science and Technology Parks and cooperation for innovation: empirical evidence from Spain. Res Policy 45(1):137–147

Von Hippel E (1986) Lead users: a source of novel product concepts. Manag Sci 32(7):791–805

Von Hippel E (2005) Democratizing innovation: the evolving phenomenon of user innovation. J Betriebswirtschaft 55(1):63–78

Wang S, Fan J, Zhao D, Wang S (2016) Regional innovation environment and innovation efficiency: the Chinese case. Technol Anal Strateg Manag 28(4):396–410

Weinberg SL, Abramowitz SK (2002) Data analysis for the behavioral sciences using SPSS. Cambridge University Press, Cambridge

Wessel T (2013) Economic change and rising income inequality in the Oslo region: the importance of knowledge-intensive business services. Reg Stud 47(7):1082–1094

Zúñiga-Vicente JÁ, Alonso-Borrego C, Forcadell FJ, Galán JI (2014) Assessing the effect of public subsidies on firm R&D investment: a survey. J Econ Surv 28(1):36–67

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG

About this chapter

Cite this chapter

Prokop, V., Stejskal, J., Hajek, P. (2018). The Influence of Financial Sourcing and Collaboration on Innovative Company Performance: A Comparison of Czech, Slovak, Estonian, Lithuanian, Romanian, Croatian, Slovenian, and Hungarian Case Studies. In: Stejskal, J., Hajek, P., Hudec, O. (eds) Knowledge Spillovers in Regional Innovation Systems. Advances in Spatial Science. Springer, Cham. https://doi.org/10.1007/978-3-319-67029-4_8

Download citation

DOI: https://doi.org/10.1007/978-3-319-67029-4_8

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-67028-7

Online ISBN: 978-3-319-67029-4

eBook Packages: Economics and FinanceEconomics and Finance (R0)