Abstract

By examining firms’ internal and external knowledge sources, this paper explains how external knowledge sources influence firms’ production and process innovation output. In other words, this chapter presents analysis of how open innovation (inbound) activities are innovation drivers. This paper presents results of a study that took place in low- and medium-tech (LMT) sectors, principally consisting of SMEs. The paper also explores key variables that determine innovation performance of both R&D and non-R&D innovators. Panel data spanning 4 years (2003–2006) was used for this analysis. This yielded dynamic results, offering an original contribution to discussions on entrepreneurship-driven innovation management. Results also reveal the role of external knowledge sources. Empirical analysis was based on a representative panel of 1,145 Spanish manufacturing firms. Data came from the Spanish Ministry of Industry.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Process Innovation

- Open Innovation

- Absorptive Capacity

- Innovation Output

- International Standard Industrial Classification

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

18.1 Introduction and Background

Cohen and Levinthal (1990) highlighted firms’ necessity to develop certain capabilities so that they may profit from external knowledge flows. They defined the concept of absorptive capacity as the “ability to recognize the value of new, external information, assimilate it, and apply it to commercial ends”. This capacity is a critical part of innovation performance. Factors like market internationalization – due to globalization – or improvements in diffusion – thanks to advances in technology – have increased the importance of this capability. The proportion of crucial knowledge generated outside a firm’s boundaries is expected to grow in coming years. The open innovation model (Chesbrough 2003), in contrast to the closed innovation model, was built under the assumption that firms can and should use external as well as internal ideas to improve their technology. Instead of focusing on controlling ideas, emphasis would be on developing a business model to implement and capitalize on these ideas, whether via internal or external means. Concepts such as patent acquisition and spin-offs are cited as examples of important external innovation sources that arise from entrepreneurial action.

The term open innovation (Vareska van de Vrande et al. 2009) has taken hold in the scientific community since being coined by Chesbrough (2003). Despite this, recent studies have revealed a reluctance among academics to accept the impact of such knowledge acquisition strategies and their knock-on effects on businesses. An example of such a research stance is the study by the European Commission (Ebersberger et al. 2011), which linked open innovation with absorptive capacity. Nevertheless, the issues surrounding open innovation are not as novel as they at first seemed. Doubts as to its effectiveness have surfaced, supported by empirical evidence. In general, input activities (inbound) or the use of marketing (outbound) to gain knowledge for innovation (i.e., open innovation) are established topics in management literature (e.g., Huizingh 2011; Dahlander and Gann 2010). In fact, as Dahlander and Gann (2010) argued, the concepts of absorptive capacity (Cohen and Levinthal 1990), complementary assets for innovation (Teece 1986) or lead users (von Hippel 1986) already suggest the existence of activities related with input and output knowledge in order to complement and/or take advantage of the innovative efforts of companies. Although most studies have extolled benefits of open innovation (e.g., Escribano et al. 2009), they have offered little evidence of potential disadvantages. For instance, Grant (1996) suggested that managing collaborations with partner companies may increase coordination costs and lead to opportunistic behavior. This would generate more rivalry. Laursen and Salter (2006) indicated that too much openness to innovation (i.e., the number of external knowledge sources which companies draw upon, including suppliers, customers, universities, and the like) can worsen innovative performance. Limited resources and projects for companies to focus on can create an inverted U-curve for performance versus open innovation. Similarly, Laursen and Salter (2014) suggested that open innovation begets the following paradox: Although collaboration with external agents increases company exposure to new ideas and therefore improves innovation performance, subsequent collaboration may mean that companies fail to capture returns from this innovation. In other words, innovation requires openness to external knowledge sources and ideas, but marketing innovation output needs protection. As Laursen and Salter’s (2014) study empirically demonstrated, firms more oriented towards protecting and appropriating innovations collaborate less and are less open to external knowledge sources, especially in terms of formal relationships. This finding yet again demonstrates an inverted U-curve between these constructs. This fear effect not to appropriate returns on investment leads to greater internalization – instead of being open to new ideas – regarding the innovation process. Therefore, too much openness can lead to failure to appropriate innovative results. Thus, open innovation is interesting only up to a certain degree. Hence, empirical research to analyze disadvantages in addition to advantages is necessary.

This chapter presents a study of open innovation application in SME’s and/or low-tech firms – as opposed to R&D intensive firms – in traditional sectors (Spithoven 2010). Many issues to do with this business area require further investigation, especially for countries like Spain, Portugal, and Italy, where SME’s and/or low-tech firms in traditional sectors abound. Chiaroni (2011) focused on “understanding the relevance of Open Innovation beyond high-tech industries and studying how firms implement Open Innovation in practice” by studying the leading cement manufacturer in Italy. Segarra-Blasco and Arauzo-Carod (2008) focused on determinants of R&D cooperation between innovative firms and universities for a sample of innovative firms in Spain.

Even interaction (moderation) effects between internal and external resources are unclear. Some scholars have claimed they are positive (see Cassiman and Veugelers 2006; Nieto and Quevedo 2005; Escribano et al. 2009), whereas others have reported negative effects (Laursen and Salter 2006; Vega-Jurado et al. 2008). This paper offers valuable insight on this core topic in the innovation management field.

The purpose of our study was to explore how R&D and non-R&D activities explain firms’ innovation performance. Research focused on low- and medium-tech (LMT) sectors where most firms are SMEs. Traditionally, innovation management scholars have focused on R&D innovators, under the assumption that innovation equates to R&D activities. In addition, this study’s scope was longitudinal (dynamic analysis using panel data). The consideration of dynamic effects is an original contribution.

We analyzed innovation management and performance in low-tech contexts. Although the chosen research context was Spain, we could also have performed our research for Portugal, Greece, Italy, or any other such economy. Our aim was to show that innovation not exclusively relying on R&D can also be viable in certain countries, at least in the short or medium term. Analyzing innovation in some low-tech contexts by examining only R&D efforts fails to capture the reality of these contexts.

18.2 Research Hypotheses

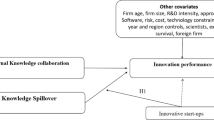

After drawing upon the existing literature, we formulated the following hypothesis:

-

H1: Engaging in open innovation activities – i.e. access to external (inbound) knowledge sources – influences innovation output.

-

H2: Absorptive capacity and external (inbound) knowledge sources influence innovation output.

In addition, we explored which activities are significant in explaining innovation output

18.3 Methodology

18.3.1 Data

The original data came from the Encuesta sobre Estrategias Empresariales, or ESEE (Suvery on Business Strategy) by the Fundación SEPI (SEPI Foundation), a public foundation in Spain that is part of the Spanish Ministry of Industry. ESEE is designed to provide data on manufacturing companies with 10 or more workers. The geographical reference is the entire Spanish national territory. Variables are annual. Each year, a sample is chosen using stratified sampling. It is intended to be as representative as possible of the manufacturing sector. An average of 1,800 companies are surveyed yearly with a questionnaire comprising 107 questions with more than 500 fields. The questionnaire includes information about revenues and annual accounts.

A panel database comprising 4,357 Spanish firms was published annually in 2003, 2004, 2005, and 2006. We chose 1,145 of these firms for study between 2003 and 2006. We classified these companies according to CNAE (Clasificación Nacional de Actividades Económicas). CNAE is an adaptation for Spay of NACE (Classification of Economic Activities in the European Community) and ISIC (International Standard Industrial Classification of all Economic Activities) (Table 18.1).

18.3.2 Variables

Next, we identified and defined relevant variables, identifying dependent and independent variables. Below, we provide descriptive sample statistics for these variables. The variables came directly from the survey. They were nonetheless modified to match the variables under study:

-

Variables related to innovation (R&D, absorptive capacity, etc.) were selected. Other variables of no interest were discarded.

-

Dichotomous variables for years 2003–2006 were added to yield constructs measuring intensity according to a scalar variable for 2003–2006.

-

Variables in monetary units (€) were added to measure, for example, investment or results for 2003–2006.

-

Other variables (€/worker, percentages, etc.) were averaged over 2003–2006.

Transforming dichotomous variables into scalars aggregated for years 2003–2006 also allowed us to control the dynamic effect of innovation, a variable scarcely mentioned in the literature. Table 18.2 gives details on the variables under study.

18.3.3 Data Processing

To process the data, we used OLS and logistic regression methods. Our aim was to explain innovation performance in the form of the following expression:

18.4 Results

Table 18.3 shows results of the degree of product innovation (IP) and process innovation (IPR) for companies in the sample. Results are stated as an accumulated percentage of companies engaging in each type of innovation. More than 76 % of companies are occasional product innovators or non-innovators. Around 10 % are occasional – they claim to perform innovations once every 4 years – , and more than 66 % are non-innovators – declaring no innovation at all. Results for process innovation (Table 18.4) are very similar. Strategic innovators are marginally more prevalent in this case (141 companies that innovate during the whole period vs. 122 in product innovation), but more than 70 % of companies are occasional process innovators (around 15 %), or non-innovators (more than 54 %).

Analysis of coefficients (Table 18.4) shows that product innovation performance increases with higher values of embeddedness or interactions like CUSTOMER, SUPPLIER, and so forth. The same result holds for process innovation (Table 18.5). A direct relationship between open innovation activities and innovation performance emerges, thus confirming the first hypothesis.

ANOVA results are shown in the following tables. All β coefficients from regressions are significant, including variables related to absorptive capacity and those associated with open innovation. This confirms the second hypothesis. As expected, more innovative companies appear to perform several activities that are significant in explaining their improved innovation performance. In general, predictive variables differ depending on type of innovation. External R&D activities and Technological Collaboration with Providers are key variables in explaining product innovation. Key explanatory variables for process innovation are Technological collaboration with customers, Innovation Activity Planning, and Hi-tech activities. Internal Research and development activities, however, emerges as the only variable important for both types of innovation (Tables 18.6 and 18.7).

18.5 Conclusions

Key findings of our study are that firms that tap into external knowledge sources are more likely to achieve innovation output in product and process innovation. These external sources include suppliers, customers, competitors, and public research organizations (PROs) such as universities or research transfer offices. Thus, open (inbound) innovation activities are a crucial driver of innovation in this entrepreneurial activity framework.

This paper focuses on low- and mid-tech companies, characteristic of the Spanish manufacturing sector. This sector generally has poor innovation performance in comparison with other members of the European Union. Our study makes a substantial contribution to research because most papers on open innovation are focused on high-tech samples. The variables with significant effects in LMT firms are different from those that are important in hi-tech firms. This finding is consistent with the idea that neglected (non-R&D performers) innovators rely on a different set of activities from R&D (Piva and Vivarelli 2002; Albaladejo and Romijn 2000), which in many cases means that these non-R&D performers are unsupported by policies (Arundel et al. 2008).

This study’s limitations include the limited reference period for the data, which ended in 2006. Challenging questions would probably arise when analyzing data after 2006. Changes in firms’ strategy and effects on innovation of the economic environment, which worsened post-2006, may be quite distinct.

Further studies could also be conducted to explore the interaction effect between internal and external resources in light of contradictory results in the existing literature. Some scholars claim this effect is positive (see Cassiman and Veugelers 2006; Nieto and Quevedo 2005; Escribano et al. 2009), whereas other assert that it is negative (Laursen and Salter 2006; Vega-Jurado et al. 2008).

References

Albaladejo M, Romijn H (2000) Determinants of innovation capability in small UK firms: an empirical analysis, WP 00. 13. ECIS. Technische Universiteit Eindhoven, Eindhoven

Arundel A, Bordoy C, Kanerva M (2008) Neglected innovators: how do innovative firms that do not perform R&D innovate? Results of an analysis of the Innobarometer 2007 survey No. 215. INNO metrics thematic paper, The Hague

Cassiman B, Veugelers R (2006) In search of complementarity in innovation strategy: internal RD and external knowledge acquisition. Manag Sci 52:68–82

Chesbrough H (2003) Open innovation: the new imperative for creating and profiting from technology. Harvard University Press, Cambridge, MA

Chiaroni D (2011) The open innovation journey: how firms dynamically implement the emerging innovation management paradigm. Technovation 31(1):34–43

Cohen W, Levinthal D (1990) Absorptive capacity: a new perspective on learning and innovation. Adm Sci Q 35(1):128–152

Dahlander L, Gann D (2010) How open is innovation? Res Policy 39(2010):699–709

Ebersberger B, Herstad S, Iversen E, Som O, Kirner E (2011) Open innovation in Europe. PRO INNO Europe: INNO-Grips II report. European Commission, DG Enterprise and Industry, Bruselas

Escribano A, Fosfuri A, Tribó J (2009) Management external knowledge flows: the moderating role of absorptive capacity. Res Policy 38:96–105

Grant RM (1996) Toward a knowledge-based theory of the firm. Strat Manag J 17(7):109–122

Huizingh E (2011) Open innovation: state of the art and future perspectives. Technovation 31:2–9

Laursen K, Salter A (2006) Open for innovation: the role of openness in explaining innovation performance among U.K. manufacturing firms. Strat Manag J 27(2):131–150

Laursen K, Salter A (2014) The paradox of openness: appropriability, external search and collaboration. Res Policy 43(5):867–878. doi:10.1016/j.respol.2013.10.004

Nieto M, Quevedo P (2005) Absorptive capacity, technological opportunity, knowledge spillovers, and innovative effort. Technovation 25:1141–1157

Piva M, Vivarelli M (2002) The skill-bias: comparative evidence and econometric test. Int Rev Appl Econ 16(3):347–357

Segarra-Blasco A, Arauzo-Carod J (2008) Sources of innovation and industry–university interaction: evidence from Spanish firms. Res Policy 37(8):1283–1295

Spithoven A (2010) Building absorptive capacity to organise inbound open innovation in traditional industries. Technovation 30(2):130–141

Teece DJ (1986) Profiting from technological innovation: implications for integration collaboration, licensing and public policy. Res Policy 15:285–305

Vareska van de Vrande, Jeroen PJ de Jong, Wim Vanhaverbeke, Maurice de Rochemont (2009) Open innovation in SMEs: trends, motives and management challenges. Technovation 29(6–7):423–437

Vega-Jurado J, Gutierrez-Gracia A, Fernández-de-Lucio I, Manjarrés-Henríquez L (2008) The effect of external and internal factors on firms product innovation. Res policy 37:616–632

von Hippel E (1986) Lead users: a source of novel product concepts. Manag Sci 32(7):791–805

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2015 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Trujillo-Ruiz, F.d.B., Hervás-Oliver, J.L., Peris-Ortiz, M. (2015). Entrepreneurship and Open Innovation in Spanish Manufacturing Firms. In: Peris-Ortiz, M., Sahut, JM. (eds) New Challenges in Entrepreneurship and Finance. Springer, Cham. https://doi.org/10.1007/978-3-319-08888-4_18

Download citation

DOI: https://doi.org/10.1007/978-3-319-08888-4_18

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-08887-7

Online ISBN: 978-3-319-08888-4

eBook Packages: Business and EconomicsBusiness and Management (R0)