Abstract

Material flow analysis is a key tool to quantify and monitor natural resource use. A very visual way to undertake such analyses representing the mineral trade of a certain nation or continent is through the well-known Sankey diagrams, in which the mineral resources that are extracted, imported, exported, recycled and consumed within the given boundaries are represented with the arrows proportional to their respective quantities. Yet Sankey diagrams alone are not sensitive to the quality of the resources as they only reflect tonnage. This issue can lead to misleading conclusions and thereby ineffective resource policies. A way to overcome this deficiency is using Grassmann diagrams instead, in which instead of tonnage the flows are represented in exergy terms, thereby accounting for the physical value of minerals. In this chapter we use the exergoecology method to evaluate mineral trade and foreign dependency in EU-28 for the 1995–2012 period. Using the year 2011 as a case study, we can see that 45.8% of the total input tonnes of minerals are imported resulting in low values of self-sufficiency (Domestic Extraction to Domestic Material Consumption ratio). With data expressed in exergy replacement costs we can better reflect the real material dependency, 0.45 for minerals and 0.41 for fossil fuels, in contrast to 0.79 and 0.52 obtained respectively when using tonnes. Analyzing 10 of the 20 minerals considered critical by the European Commission, imports represent 6.74% of the total imports while extraction represents only 3.19% of the total extraction. This external dependency leaves Europe in a delicate situation regarding fossil fuels and non-fuel mineral supply and highlights the importance of recycling and the search for alternative sources.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Raw materials, particularly fossil fuels and non-fuel minerals, are crucial to maintain the European Union’s economy. Despite having a rich endowment of mineral deposits, producing 1.2% and 1.4% of the world level needs of iron and aluminum respectively (British Geological Survey 2011), European countries depend on raw material secure supply. As this is a critical issue, in November 2008 the European Commission published the Raw Materials Initiative to establish the raw material strategy along with a list of actions that the member states should carry out (European Commission 2008).

While historically the importance of fossil fuels has been regarded as a priority issue, non-fuel minerals, which are essential both for electronic equipment and for the development of renewable energies, have only gained importance in the recent years. Since minerals are a non-renewable resource that is linked to geological features of the ground, it is important to analyze its use and the mineral trade between the different countries.

Material flow analysis has demonstrated to be a key tool to monitor and quantify the use of natural resources. Usually this analysis of material use, consumption and trade is carried out through aggregated indicators that take into account minerals as a whole, sometimes differentiating at most industrial minerals, construction minerals and fossil fuels (Weisz et al. 2006; Schandl and Eisenmenger 2006; Steinberg et al. 2010; Bruckner et al. 2012; Kovanda et al. 2012). Nevertheless it is important to have disaggregated studies to observe the impact and supply risk of the different materials (Achzet and Helbig 2013) and so provide valuable input for decision-making processes aiming at improving the sustainable use of raw materials (Tiess 2010; Tiess and Kriz 2011; Marinescu et al. 2013).

This chapter undertakes an analysis of the mineral trade in the European Union (EU-28) from 1995 to 2012. This analysis is done firstly using tonnage as a yardstick, accounting for the tons of input (production and imports) and output materials (recycling, exports and consumption). Then, the same analysis is carried out using exergy, particularly the so-called exergy replacement costs, which is explained in the next section. This allows us to compare both methodologies and bring out the significant differences regarding reliability and representativeness. The final aim is to observe the trend and evolution of the mineral trade in Europe and highlight which of the analyzed minerals can be considered critical due to external dependency.

2 Methodology

The analysis of the mineral trade of Europe is going to be firstly undertaken in tonnes. Domestic extraction, export and import data for the 1995–2012 period have been obtained from the British Geological Survey European Mineral Statistics (2014), completed with data from United States Geological Survey yearbooks of mineral statistics and national services from some European countries. As individual data for recycling rates of each of the member states of the European Union are not available, average recycling rates for several metallic minerals have been obtained from the Recycling Rates of Metals report (UNEP 2011).

In order to assess the mineral depletion more comprehensively, we are going to apply the exergoecology method initially proposed by Valero (1998) to analyze the mineral trade in Europe (EU-28) for both fossil fuels and non-fuel minerals. With this methodology we can evaluate the loss of natural resources through exergy, a property that is based on the second law of thermodynamics and that can be used to measure the quality of a system with respect to a given reference. This methodology is based on calculating the exergy that would be needed to replace a mineral deposit starting from an environment where all the minerals are dispersed in the crust into the initial conditions of composition and concentration found in the mine where it was originally extracted. To perform these calculations we need a model of average dispersed crust, Thanatia, a planet that represents a possible state of the Earth where all minerals have been dispersed, all fossil fuels have been consumed and which has specific atmospheric conditions (Valero et al. 2011a, b). This Thanatia model includes a list of minerals with their respective concentration in the crust which delimits the lowest ore grades of the minerals and that can serve as a boundary to our calculations. Therefore, the exergy replacement costs of a mineral can be calculated as the exergy required to restore the minerals from Thanatia into the conditions found in nature with the current available technology. As quality is being taken into account in those calculations, scarcer and difficult-to-extract minerals (in terms of energy expended) will have a higher weight in the final accounting process as the exergy needed to recover a mineral that is dispersed increases exponentially with scarcity. Accordingly for instance, in the case of limestone, a material that can be easily extracted and that is very abundant in the crust, its exergy replacement costs are 2.6 GJ/ton. If we look at scarcer minerals, such as gold or mercury, these values go up to 583668.4 and 28298.0 GJ/ton, respectively. These numbers provide hints of which minerals would be the most complicated to replace hence also giving information about their quality. Thus, carrying out the analysis using only tonnage can result in biased information since it seems logical that 1 tonne of limestone should not have the same weight in the calculations as 1 tonne of gold in quality terms.

Since reliable and comparable data are not always easy to find, the substances that are included in this study are the following: aluminum, antimony, arsenic, barite, bismuth, boron, cadmium, chromium, cobalt, copper, feldspar, fluorspar, gold, graphite, gypsum, indium, iron ore, lead, limestone, lithium, magnesium, manganese, mercury, molybdenum, nickel, phosphate rock, potassium, selenium, silicon, silver, sodium, tantalum, tin, titanium, uranium, vanadium, wolfram, zinc and zirconium. The exergy replacement costs of these minerals have already been calculated in previous studies (Valero and Valero 2014). As for fossil fuels, their exergy replacement costs can be approximated to their high heating values as once they are consumed and burned they cannot be recovered (Valero and Valero 2012).

To better depict mineral trade, the analysis of EU-28 as a general system is conducted using Sankey and Grassmann diagrams. The main difference between both types of graphic representations is that the first usually depicts energy or material flows of a system with the width of the arrows being proportional to the flow quantity. Grassmann diagrams in turn are essentially the same but represent such flows in exergy units. These types of representations are very visual and can be used to evaluate the evolution of the mineral trade of a country or several countries and also the self-sufficiency and external dependency. Additionally, several dependency indicators based on domestic material consumption will be calculated for the year 2011 in order to evaluate the self-sufficiency and foreign dependency and have a complete picture of mineral trade in the European Union.

3 Mineral Trade in the EU-28

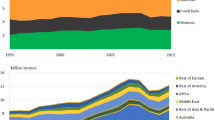

Over the last decades there has been a decreasing tendency in the domestic extraction, especially notable in the case of fossil fuels. In Fig. 1 we have the total mineral extraction of the EU-28 from 1995 to 2012, separated by countries. As it can be seen, the United Kingdom, Spain, Poland, Italy and Germany are historically the main producers of minerals in EU-28.

Regarding non-fuel minerals, Spain, Italy, the United Kingdom and Germany are the main extractors. Limestone accounted for an average of 85.3% of the yearly total non-fuel mineral production, followed by gypsum (8.7%) and salt (4.4%). From 2007 onwards the non-fuel mineral domestic production has been decreasing, a change that can be attributed, among other factors, to a combination of resource management improvements and resource efficiency policies but also to the financial crisis which has been affecting the member states.

As for fossil fuels, during the period under consideration, the United Kingdom, France, Germany and Poland were the main European extractor countries. Coal remained the principal fossil fuel extracted, accounting as an average for 66.7% of the total EU-28 fossil fuel yearly production. Still, between 1995 and 2012 the total fossil fuel EU-28 domestic production decreased approximately 28%.

Figure 2 shows a general overview of the imported minerals. Although the total amount of imported materials is increasing, the fluctuations caused by the financial crisis can also be appreciated. Between 2003 and 2004 the total amount of imported fossil fuels increased 27%, but from 2007 onwards there has been a sharp decrease.

Between the years 2001 and 2011, the amount of minerals imported in Europe increased around 35% while the domestic extraction decreased almost 6% during that same period. The substances mainly imported were metallic minerals and fossil fuels, the latter mainly coming from Russia, Norway and North Africa. Even if Europe is rich in natural resources, both domestic production and import values approximately move within the same range, which highlights the importance of imports for the states belonging to the European Community.

Material trade deficit (exports minus imports) was analyzed for the 1995–2012 period. Imports exceed exports during the whole time period, generating a substantial trade deficit. The maximum amount of imported non-fuel minerals was 257 million tonnes in 2007 and the maximum exports were 63.3 million tonnes in 2001. On average, exports were equivalent to 23.7% of the imports, and the maximum trade deficit, 210 million tonnes, occurred in 1998.

4 Using Year 2011 as a Case Study

A detailed analysis of the mineral trade in the EU-28 for the year 2011 was made in order to better observe the weight of the different substances. In Fig. 3 we can see the European mineral balance for 2011 expressed in tonnes for the 40 minerals and the three main fossil fuels that were selected in this study.

Sankey diagram for the European mineral balance for 2011(data in tonnes) (Source: British Geological Survey (2014))

The general behavior that can be inferred is that European member states mainly imported oil, natural gas and iron. The domestic production consisted of coal and limestone in large quantities and oil, natural gas, iron and potash in lower quantities. Still scarcer minerals, which are usually critical and more important from an economic point of view, here remain hidden because in mass terms they have a considerably lower weight.

As stated before, import dependency for European countries is very high, and we can see that in 2011 approximately 45.8% of the input materials came from other countries. It is also noteworthy that all of the imported and produced minerals ended up being consumed within the European member states’ borders, stressing that, at least regarding these substances, Europe is an extremely dependent economy.

An alternative to reducing imported materials lies in recycling, saving both energy consumption and natural resources. The low weight of recycling in Europe is striking: less than 3.2% of the total inputs (domestic production plus imports) were recycled in 2011. Although some countries have higher recycling rates, such as Austria, Germany or Belgium, Europe is still wasting vast quantities of valuable resources and sending them to landfills. Due to low efficiencies in the processing and collection of metal-bearing products that are discarded and because primary materials are often abundant, the end-of-life recycling rates are very low. At world level, of the 60 metals analyzed by the United Nations Environment Programme (UNEP 2011), only 18 had above 50% end-of-life recycling ratios while more than 34 had lower than 1% ratios.

Exports represented 10.7% of the total output and they mainly consist of oil, natural gas and iron. On the other hand, internal consumption in the EU-28 accounted for 86.2%. These data can help emphasize that Europe is a region mainly based on domestic consumption.

In Fig. 4 fossil fuel trade data have been removed from the scenario, so we can specifically focus on non-fuel mineral trade.

If we compare the mineral trade in mass terms and in exergy replacement costs, we can clearly see that minerals have different weight. When expressed in mass terms, limestone and iron are the most traded minerals, accounting for 77.1% of the total input materials. If we express the same data in exergy replacement costs, limestone and iron only represent 10.8%, as they are abundant minerals in the crust and easier to extract. A counter example of limestone is gold, which seemed negligible in mass units but that in exergy replacement costs represents almost 12% of the total imports.

Therefore, with data in tonnes we can display quantities, which can give us a general idea of the mineral trade, but at the same time it also gives biased information as many minerals are not extracted in sufficient quantity to be represented in the graphics. With exergy replacement costs we can evaluate the quality of the minerals, bringing out those that are scarcer or less concentrated in the crust.

In 2014 the European Commission updated the list of critical minerals for the European Union (European Commission 2014), which now includes antimony, beryllium, borates, chromium, cobalt, fluorspar, gallium, germanium, indium, magnesite, magnesium, natural graphite, niobium, PGM, phosphate rock, REE, silicon and tungsten, of which the vast majority has been taken into account in this study. For this reason, comparing the results in mass terms and in exergy replacement costs becomes fundamental to analyze the mineral trade as scarcer minerals are better represented with the latter analysis.

When evaluating the mineral depletion caused by trade in 2011 in the EU-28, we can see for instance that the internal production of 10 of the 20 minerals considered critical by the EC in its 2014 report accounted for 0.88% of the total production expressed in tonnes and 3.19% when expressed in exergy replacement costs. The critical minerals that were imported from other countries accounted for 5.01% of the total imports expressed in tonnes and 6.74% when expressed in exergy replacement costs.

In 2011 consumption played an important role both in mass terms and in exergy terms, representing respectively 86.2% and 74.5% of the total outputs. What draws our attention is that in tonnes, the percentage corresponding to production (54.2%) is higher than the one corresponding to imports (45.8%), but in the case of exergy replacement costs we have the opposite situation (34.1% and 65.9%). The fact that consumption is always very important is not surprising; what is noteworthy is the reversed importance of production and imports depending on how the resources are being evaluated. If we only add tonnes of minerals the production is higher than imports, but if we take into account the quality of those minerals it is the imports that become more relevant since as stated before, Europe imports scarcer and more valuable minerals (from a physical point of view) than those that are domestically extracted.

5 Mineral Dependency in the EU-28 in 2011

With domestic extraction, imports, exports, consumption and recycling data we can calculate a number of ratios to evaluate several factors of dependency.

The indicator Domestic Material Consumption (DMC) is calculated as follows: DMC = extraction + imports − exports. Proceeding from this information, we can also obtain the ratio of Domestic Extraction to Domestic Material Consumption (DE/DMC), that is, the self-sufficiency ratio. If this value is 1 or more, it means the self-sufficiency ratio is high and thus the country does not need to rely on mineral trade.

We can also obtain the import-to-DMC (I/DMC) and export-to-DMC (E/DMC) ratios, used to evaluate the foreign dependency and trade intensity. These ratios will be calculated using initial data expressed both in tonnes and exergy replacement costs.

In Table 1 we can see the ratios obtained for the case of non-fuel minerals. In this first case the DE/DMC ratio is 0.79 with data expressed in tones and 0.45 with data expressed in exergy replacement costs. If we used only the first value to evaluate external dependency on non-fuel minerals, we could conclude that EU-28 is not very dependent on external supply since it is relatively close to 1. However, there is a 34% difference between these two DE/DMC values. Again, this is mainly due to the relevance in mass terms of the limestone extracted in the EU-28, which was 295 million tonnes or 74.5% of the total mineral extraction in 2011. As construction materials are hardly traded due to their lower price and abundance, putting them at the same level as scarcer minerals can mask the real situation. Therefore, the ratio with data expressed in tonnes does not truly reflect the situation of external dependency, which is expected to be higher if those materials were removed from the calculations. Using exergy replacement costs we have a better approximation of DE/DMC (0.45) which shows a more accurate value of the EU-28 self-sufficiency.

As for the import and export ratios, I/DMC and E/DMC, we have the opposite situation. These two ratios expressed in exergy replacement costs are higher than when data are expressed in tonnes, which indicates that EU-28 is extremely dependent on foreign trade for non-fuel mineral supply (0.94 in the case of imports and 0.40 for exports).

In Table 2 we can see the ratios obtained for the case of fossil fuels, using data from natural gas, oil and several types of coal. In this case the ratios are not so distant from each other when expressed in tonnes or in exergy replacement costs.

The dependency on imports becomes clear when observing the I/DMC ratio, 0.62 when using data in tonnes and 0.76 when using exergy replacement costs.

As it happens with non-fuel minerals, Europe is also very dependent on fossil fuel supply.

The EU-28 average ratios for DMC, DE/DMC, I/DMC and E/DMC are represented in Table 3.

In Europe there is a large variation between each of the member states regarding size, GDP, economic growth, geology, characteristics of the mining industry, etc. This is why the average ratios obtained must be taken only as a reference. The average self-sufficiency (0.54) and the elevated import dependency (0.77) make clear that Europe must rely on other regions to cover its own needs.

6 Conclusions

In this chapter we have analyzed mineral trade in Europe from 1995 to 2012, using the year 2011 as a case study to obtain several ratios to evaluate self-sufficiency and external dependency.

For the period under consideration, domestic extraction has been decreasing continuously. Especially notable is the case of fossil fuels, which decreased 28% between 1995 and 2012. This general decrease can be attributed to emphasis on resource efficiency policies as well as to the financial crisis. With the recent initiatives promoting raw material strategies, increasing recycling rates and creating synergies between industries, these results are expected to improve in the following years.

As shown by the results, Europe mainly extracts construction and bulk materials (limestone, gypsum and salt) and depends on other regions for scarcer minerals and fossil fuel supply. Considering the elevated trade deficit, the average self-sufficiency ratio of the EU-28 (0.54) and the import dependency (0.77), it can be stated that the European Union heavily relies on imports and consumption rather than on domestic production or exports.

As demonstrated by the data presented in this chapter, a conventional Multiple Factor Analysis (MFA) analysis does not truly reflect the real situation of mineral dispersion, as all the minerals, regardless of their quality, are considered at the same level. Thus, applying the exergoecology methodology can be useful for policy makers to obtain more realistic data for the loss of mineral natural capital since it allows for more robust and reliable analysis. It also avoids subjectivity issues associated with monetary assessments and places the focus on scarcer resources. Accordingly, complementing the data in mass terms with exergy replacement costs we can have a better picture about the current situation with the help of Grassmann diagrams. Representing the data with both Sankey and Grassmann diagrams has demonstrated to be a practical way to better differentiate material flows separated by minerals and to assess external dependency.

References

Achzet, B., Helbig, C.: How to evaluate raw material supply risks – an overview. Resour. Policy. 38, 435–447 (2013)

British Geological Survey: European Mineral Statistics 2007–2011. A Product of the World Mineral Statistics Database. British Geological Survey, Keyworth (2011)

British Geological Survey: European Mineral Statistics 2008–2012. British Geological Survey, Keyworth (2014)

Bruckner, M., Giljum, S., Lutz, C., Svenja Wiebe, K.: Materials embodied in international trade – global material extraction and consumption between 1995 and 2005. Glob. Environ. Chang. 22, 568–576 (2012)

European Commission: The raw materials initiative – meeting our critical needs for growth and jobs in Europe. Available online at http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=COM:2008:0699:FIN:EN:PDF (2008)

European Commission: Report on critical raw materials for the EU. Report of the Ad hoc working group on defining critical raw materials. Available online at http://ec.europa.eu/enterprise/policies/raw-materials/files/docs/crm-report-on-critical-raw-materials_en.pdf (2014)

Kovanda, J., van de Sand, I., Schütz, H., Bringezu, S.: Economy-wide material flow indicators: overall framework, purposes and uses and comparison of material use and resource intensity of the Czech Republic, Germany and the EU-15. Ecol. Indic. 17, 88–98 (2012)

Marinescu, M., Alexander, K., Günter, T.: The necessity to elaborate minerals policies exemplified by Romania. Resour. Policy. 38, 416–426 (2013)

Schandl, H., Eisenmenger, N.: Regional patterns in global resource extraction. J. Ind. Ecol. 10, 133–147 (2006)

Steinberg, J.K., Krausmann, F., Eisenmenger, N.: Global pattern of material use: a socioeconomic and geophysical analysis. Ecol. Econ. 69, 1148–1158 (2010)

Tiess, G.: Minerals policy in Europe: some recent developments. Resour. Policy. 35, 190–198 (2010)

Tiess, G., Kriz, A.: Aggregates resources policies in Europe. Int. J. Environ. Prot. 1, 63–66 (2011)

UNEP – United Nations Environment Programme: Recycling Rates of Metals: a Status Report. Nairobi: United Nations Environment Programme, 48 pp (2011).

Valero, A.: Thermoeconomics as a conceptual basis for energy-ecological analysis. In: Ulgiati, S. (ed.) Advances in Energy Studies. Energy Flows in Ecology and Economy, pp. 415–444. Musis, Roma (1998)

Valero, A., Valero, A., Gómez, J.B.: The crepuscular planet. A model for the exhausted continental crust. Energy. 36, 694–707 (2011a)

Valero, A., Agudelo, A., Valero, A.: The crepuscular planet. A model for exhausted atmosphere and hydrosphere. Energy. 36, 3745–3753 (2011b)

Valero, A., Valero, A.: What are the clean reserves of fossil fuels? Resour. Conserv. Recycl. 68, 126–131 (2012)

Valero, A., Valero, A.: Thanatia: the Destiny of the Earth’s Mineral Resources: a Thermodynamic Cradle-to-Cradle Assessment. World Scientific Publishing Company, Hackensack (2014)

Weisz, H., Krausmann, F., Amann, C., Eisenmenger, N., Erb, K.-H., Hubacek, K., Fischer-Kowalski, M.: The physical economy of the European Union: cross-country comparison and determinants of material consumption. Ecol. Econ. 58, 676–698 (2006)

Acknowledgments

We would like to thank Teresa Brown from the British Geological Survey for her assistance for obtaining the historical data.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG, part of Springer Nature

About this chapter

Cite this chapter

Calvo, G., Valero, A., Valero, A. (2018). Sankey and Grassmann Diagrams for Mineral Trade in the EU-28. In: Aloui, F., Dincer, I. (eds) Exergy for A Better Environment and Improved Sustainability 2. Green Energy and Technology. Springer, Cham. https://doi.org/10.1007/978-3-319-62575-1_7

Download citation

DOI: https://doi.org/10.1007/978-3-319-62575-1_7

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-62574-4

Online ISBN: 978-3-319-62575-1

eBook Packages: EnergyEnergy (R0)