Abstract

In this chapter, we explore the portfolio selection problem involving uncertainty, in other words: risk. To deal with this uncertainty, we will utilize Value at Risk (VaR) and Conditional Value at Risk (CVaR). Moreover, we present a Robust Optimization method for specifying the parameter uncertainty while minimizing the Conditional Value at Risk. We investigate optimization problems in order to minimize CVaR. Our approach consists in the use of robust optimization techniques for minimization of CVaR. We research Robust CVaR (RCVaR) optimization models under ellipsoidal uncertainty. Finally, we conclude that one can control the parameteric uncertainty with some robust distribution assumptions and obtain certain optimal solutions.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

- Coherency

- Value at Risk

- Conditional Value at Risk

- Robust Conditional Value at Risk

- Optimization

- Robust optimization

1 Introduction

Quantifying risk in a portfolio optimization problem is an issue that should be taken seriously because it is the first step of portfolio risk management. Especially, the high volatile nature of financial markets necessitates comprehensive risk analysis and risk measurement which generate optimal solutions. Value at Risk, or simply VaR, is a specified quantile based risk measure which has been increasingly used as a risk management tool, especially, after the Risk Metrics document of Morgan [16]. VaR is so often used because it is easy to compute and understand, however, it has some undesirable properties which are widely criticized by researchers. For example, Uryasev [24] discussed that VaR does not take into account the risk that exceeds VaR, and for different confidence levels it can provide conflicting results. Artzner, Delbaen, Eber and Heath [2] in 1998 stated some axioms which a risk measure should satisfy. A risk measure that satisfies these axioms is called a coherent risk measure. After their study in 1998, coherent risk measure concept has become a criterion to evaluate risk measures. VaR is not a coherent risk measure since it fails to hold subadditivity axiom of coherence. Further, Acerbi and Tasche [1] in 2001 noted that VaR contrasts with portfolio diversification (diversification reduces risk) due to it is failure in holding axiom and they then commented that VaR is not a risk measure, since a risk measure cannot violate the subadditivity axiom. Since VaR is not coherent, risk professionals have started to search for an alternative risk measure to VaR which is coherent [1].

As a measure of downside risk, Conditional Value at Risk, or simply CVaR, came into existence and exhibited some attractive properties. CVaR is defined as the expected loss under the condition that loss exceeds VaR. First of all, CVaR is attractive since it is a coherent risk measure. Since CVaR is convex, it is relatively easy to control and optimize. Rockafellar and Uryasev [25] in 2000 first defined CVaR as a solution of an optimization problem and they have stated a minimization formula. They showed with numerical experiments, that minimization of CVaR also leads to near optimal solutions in VaR since VaR never exceeds CVaR. In their study [25], they created a new technique, minimization formula, and using this technique one can compute the VaR value and optimize CVaR at the same time. Rockafellar and Uryasev [24] in 2002 noted that as a tool in optimization modeling, CVaR has predominant properties in many respects. CVaR has a computational advantage over VaR, such as CVaR can be employed for optimizing over very large numbers of instruments and scenarios by simply using the minimization formula and applying this formula to a linear programming technique [24]. Researchers are still continuing to study on the mathematical and computational properties of CVaR [17, 18, 27].

However, the optimization processes have been recently illustrated as possibly being weak, since they lead to solutions which heavily depend on parameter relaxation. This dependence makes the theoretical and numerical results highly unreliable for practical purposes. An approach that can overcome this drawback is robust optimization. Robust optimization is a type of mathematical optimization problem and methodology which focuses on parameter uncertainty [3,4,5]. It assumes that parameters are only known to belong to certain intervals with a certain confidence level, and their value can cover certain variation ranges. By treating the uncertainty in parameters deterministically, one can have a more conservative portfolio selection. Pinar and Tutuncu [21] used robust models for risky financial contracts and they stated that the most robust profit opportunity can be solved as a convex quadratic programming problem. Further, Pinar [20] applied a robust multi-period portfolio selection problem based on minimizing one sided return from a target return level. The study found relatively stable portfolios in face of market risk and showed that robust models diminish the variability of a portfolio value. Chen et al. [29] and Ghaoui et al. [11] investigated robust portfolio selection using Worst Case Value at Risk. Chen et al. [29] provided robust Worst-Case VaR optimization under an interval random uncertainty set. With some numerical experiments they presented that the behaviour of portfolios can be improved significantly by using the robust Worst-Case VaR. Further, Ghaoui et al. [11] showed that optimizing the Worst-Case VaR can be solved exactly by solving convex, finite dimensional problems. Quaranta and Zaffaroni [31] in their study applied Robust Conditional Value at Risk methodology to deal with uncertainty in the portfolio selection problem. In their study [31], they converted the Rockafellar and Uryasev minimization model into a linear robust model. However, their study resulted with very conservative results. Zhu et al. [35] applied Worst Conditional Value at Risk Approach as an effective alternative to CVaR in complex financial markets in case, where the exit time of investors is uncertain. This makes the model interesting to risk and asset managers [35]. Zhifeng and Li in their study [33] also used robust optimization techniques to minimize CVaR of a portfolio. In their new optimization method, they captured asymmetries in the return distributions by using a robust optimization methodology. Zhu et al. [34] showed in their research paper that min-max portfolio optimization with an ellipsoidal ucertanity set is more attractable than other uncertianty set structures. They further used this min-max portfolio optimization model in CVaR robust optimization. They have stated that when the confidence level is high, CVaR robust optimization focuses on a small set of extreme mean loss scenarios and the resulting portfolios are optimal against the average of these extreme mean loss scenarios and tend to be more robust.

Some of the existing part of literature focuses on not only the robust formulation of robust portfolio selection but also the size and the shape of the set of the uncertain parameters in the robust portfolios. Here, the size of the set gives the probability that the uncertain parameter takes on a value in the set, while the shape of the set shows the robust optimization problem complexity [37]. Goldfarb and Iyengar [12] specified a factor model for the shape and the set of uncertain parameters in robust selection problems. By using this factor model framework, some new robust risk measures are proposed. The reason for the choice of factor models in robust risk measures is that the resulting problem can be formulated in a tractable way. Zhang and Chen [32] showed a new risk measure for the optimal selection with specification of a factor model. In their framework, the uncertainty in the market parameters is unknown and bounded, and optimization problems are solved assuming worst case behavior of these uncertainties. Gotoh, Shinozaki and Takeda [13] studied on the use of factor models in coherent risk minimization. In their study, they applied a simplified version to the factor model based on CVaR minimization, and showed that it improves the performance, achieving better CVaR, turnover, standard deviation and Sharpe ratio than the empirical CVaR minimization and market benchmarks.

The main objective of this chapter is to quantify the risk in an optimization problem from the view of a risk averse optimization. In Sect. 2, we shall shortly describe the coherent risk measure concept and we will present and compare the properties of VaR and CVaR both in practical and theoretical settings. With the motivation in the study [11], we shall extend the Robust VaR results to Robust CVaR and we will provide a robust optimization method for minimizing the CVaR of a portfolio. In Sect. 3, we will state applications of robust optimization methodologies which are described in the study [4] for the minimization of the conditional value at risk of a portfolio. Finally, in Sect. 4, we will conclude our results.

2 Methodology

The main objective of this study consists in modeling risk within an optimization problem from the viewpoint of a risk averse investor. Before stating the optimization problem, we will briefly review the coherent risk measure, VaR and CVaR concepts.

2.1 Coherent Risk Measures

In 1997, Artzner, Delbaen, Eber and Heath introduced the concept coherent risk measures. In their paper, they defined a complete set of axioms that have to be satisfied by a measure of risks in generalized sense [1].

Definition 1

(Coherent Risk Measures) Let \(\varOmega \) be a fixed set of scenarios. \(L^2\) denotes the set of all functions on \(\varOmega \) relative to the probability measure P. Then, a risk measure \(\rho \) is a mapping from \(L^2\) to \((-\infty ,\infty ]\), i.e., \(\rho :L^2\rightarrow (-\infty ,\infty ]\). A measure of risk \(\rho \) is called coherent if it satisfies the following four axioms:

-

1.

This axiom is called as the translation invariance axiom of a risk measure. For all random losses X and constants \(\alpha \), \(\rho (X+\alpha )=\rho (X)+\alpha \).

-

2.

This axiom is called as the subadditivity axiom of a risk measure. For all random losses (or costs) X and Y, \(\rho (X+Y)\le \rho (X)+\rho (Y)\).

-

3.

This axiom is called as the positive homogeneity axiom of a risk measure. For all \(\lambda \ge 0\) and random losses X, \(\rho (\lambda X)= \lambda \rho (X)\).

-

4.

This axiom is called as the monotonicity axiom of a risk measure. If \(X\le Y\) for each scenario, then, \(\rho (X)\le \rho (Y)\).

Artzner, Delbaen, Eber and Heath’s Coherent Measures of Risk study is important since it defined properties of portfolio statistics in order to be an appropriate risk measure for the first time. Thus, the risk management process has its own scientific rules with this deductive framework [1]. Furthermore, the theory of coherent risk measures relies on the idea that a sensible measure of risk is coherent with the finance theory and portfolio theory [9]. The coherence axioms concretize the risk measure properties in the statistics of portfolio theory [1]. One of the most important consequences of coherency for portfolio optimization is that it preserves convexity.

2.2 Value at Risk

For a fixed \(\alpha \)-quantile, in other words: for a fixed confidence level \(\alpha \in (0,1)\), and a random variable X, the Value at Risk (VaR) level at \(\alpha \) is defined as:

Let \(\varOmega \) be a fixed set of scenarios. Costs or losses of a financial position can be considered as a mapping from \(X:\varOmega \rightarrow \mathbb {R}\), where positive outcomes \( X(\omega )\,\) of \(\, X \) are disliked, while the negative outcomes are liked at the end of the trading period if the scenario \( \omega \in \varOmega \) is realized. Furthermore, we should note that X belongs to a linear \(L^2\) space relative to probability space P on \(\varOmega \), which means \(E[X^2]<0\). VaR as a risk measure assigns to each random cost \( X \in L^2\) a numerical quantity. Here, we should state that \(z=f(x,y)\) represents the cost function. Moreover, x is the decision vector, \(x= (x_1,x_2,...,x_q) \in \mathbb {R}^q \in S\) where \(S=\{x=(x_1,x_2,...,x_q)\mid x_j\ge 0 (j=1,2,...,q), x_1+x_2+...+x_q=1\} \), and y is a random variable on the probability space \((\varOmega ,F,P)\) representing the uncertainties that can affect the cost. The underlying probability distribution of y in \({\mathbb R}^q\) will be assumed to have a density denoted by p(y). With a known probability distribution of y as a random variable, z will also be a random variable as like X. The distribution of z depends on the decision vector. Here, \(F_X(\beta )\) is the cumulative distribution function for z. When the confidence level \(\alpha \) is given, the probability of f(x, y) not exceeding a given threshold \(\beta \) is shown by

The statistic \(VaR_\alpha (X)= -q^+_\alpha (X)\) responds the minimum loss that can occur in the set of all \(\alpha \)-quantiles of X over a holding period of time. Thus, VaR equals to the \(\alpha \)-percentile of the loss distribution (\(\alpha \) is the smallest value such that the probability that losses exceed or equal to this value is greater or equal to \(\alpha \)). VaR is based on probabilities, so it cannot be established on certainty, but is rather a level of confidence which is selected by the user in advance. As a risk measure VaR satisfies translation invariance, positive homogeneity and monotonicity, however, it fails to hold subadditivity property [2]. Thus, VaR is not a coherent risk measure. It is known that portfolio diversification always leads to risk reduction. However, VaR contrasts with portfolio diversification [1]. In the paper [1], it is strongly believed that VaR is not a risk measure, since a risk measure can not violate the subadditivity axiom.

Moreover, VaR is not a convex risk measure. This is due to the fact that subadditivity and positive homogeneity together sufficiently show the convexity of a function, and VaR fails to satisfy subadditivity property. In an optimization problem, VaR may come out with many local minima which is a result of VaR being is not convex [22]. It should be noted that in the particular process of risk minimization, only strictly convex surfaces lead to local minima as unique globally optimal solutions [1]. Thus, in optimization problems, since VaR is non-convex, it has many extrema, and that makes it difficult to control and optimize.

Value at Risk (VaR) is one of the most widely used tools for managing risk, however, it has some undesirable properties which are widely criticized by researches, such as it is not a coherent measure of risk and it is difficult to optimize VaR when it is calculated from scenarios [25]. In addition to these two undesirable properties, VaR is a model-dependent measure of risk.

2.3 Conditional Value at Risk

Value at Risk is the predicted worst case loss of at a specified 1-\(\alpha \) confidence level of a portfolio over a holding period of time. Differently from VaR, Conditional Value at Risk (CVaR) gives the expected loss that can occur in 1-\(\alpha \) confidence of a portfolio over a holding period of time, if the portfolio distribution function is continuous. Conditional Value at Risk (CVaR) measures how much we lose on the average given we exceed our VaR. Thus, it is a measure to capture losses beyond VaR. Formally, CVaR is defined as in the following manner [24]:

Moreover, CVaR can be defined as the conditional expectation of the loss related to X that loss equals or is greater than \(q_\alpha (X)\):

Now we focus on a vector variable x of certain realizations of the random variable X where x serves as decision variable, representing, e.g., a portfolio. Let \(q_\alpha (x)\) be the \(VaR_\alpha \) of a loss function f(x, y). Then, \(CVaR_\alpha (x)\) is defined as:

Here, the distribution function in Eq. (5) is defined as \(\alpha \)-tail distribution \(z=f(x,y)\) and it is truly another distribution. This new distribution function is non-decreasing and right continuous, and it is obtained by rescaling the distribution function of \(z=f(x,y)\) in the interval \([\alpha ,1]\) [24].

CVaR is a coherent risk measure in the basic sense since it satisfies the properties of translation invariance, positive homogeneity and monotonicity and subadditivity [22].

Rockafellar and Uryasev [25] showed that CVaR and VaR of a loss function \(z=f(x,y)\) can be computed by solving a basic, one-dimensional, convex optimization problem under a specified confidence level \(\alpha \), respectively. In the study [25], the main approach is to benefit from a special convex function \(F_\alpha (x,\beta )\) to characterize \(\phi _\alpha (x)\) and \(q_\alpha (x)\). Thus, the characterization function of \(\phi _\alpha (x)\) and \(q_\alpha (x)\) is defined as follows [24]:

Theorem 1

(Optimization of CVaR) [25] If we minimize \(F_\alpha (x,\beta )\) over all \((x,\beta )\in S \times \mathbb {R}\), it gives us the equivalent result of minimizing the CVaR value \(\phi _\alpha (x)\) with respect to \(x \in S\) which is:

In our study, we will state the optimization problem which focuses on capturing risk by CVaR. Then, optimization problem has the following form:

where \(\alpha \) represents the desired confidence level and \(S=\{x=(x_1,x_2,...,x_q)\mid x_j\ge 0 (j=1,2,...,q), x_1+x_2+...+x_q=1\} \). Here, \(x_i\) is the decision variable for the portfolio weight for sub-portfolio of i. Now, with the help of Theorem 1, we can convert the optimization problem in Eq. (8) to a linear programming problem as follows:

However, the joint probability distribution of returns p(y) is unknown which makes the problem in Eq. (9) still hard to solve. Before, in our study [8], we did not have any assumptions about the density p(y) for simplicity, and we generated a sample from p(y) only using some algorithms. But, most frequently, the decision making process is influenced by uncertain parameters, so we cannot ignore the possible implementation errors [31]. Now, to deal with data uncertainty, we shall utilize the Robust CVaR (RCVaR) approach.

2.4 Robust Conditional Value at Risk

In order to minimize implementation errors, we utilize robust estimation methods which are described in the paper Ben-Tal et al. [4]. With this method, we can control the parameter uncertainty with some steady distribution assumptions. Using this method, we can reduce modeling risk which arises due to parameter uncertainty.

In CVaR optimization problems, uncertainty is related to the distribution of portfolio return. Here, we will consider Robust CVaR in the situation, where the underlying probability distribution of return data is partially known [37].

Therefore, we will assume that the density function of portfolio return is only known to belong to a certain set P of distributions, i.e., \(p(\cdot ) \in P\), which covers all the possible distribution scenarios [36]. Our aim is to compute the CVaR value assuming the worst case of underlying probability distribution based on a special certain set P. Referring to the papers of Zhu and Fukushima [35], we define the Robust CVaR (RCVaR) for fixed \(x \in S\) with respect to P as:

Now, we shall firstly assume that y follows a discrete distribution. This assumption still contributes to the case of a continuous distribution in the CVaR formula. In fact, by sampling the probability distribution of y and its density p(y), the integral of continuous distribution can be approximated [36]. Moreover, we will investigate an ellipsoidal uncertainty set which is a special case of P. We have chosen ellipsoidal uncertainty set structure since it is not only easy to specify but also tractable for practical usage [36].

Let a random variable y have a sample space which is given by \(\{y_{[1]},...,y_{[q]}\}\) with discrete probability \(Pr\{y_{[i]}\}=\pi _i\) and \(\sum _{j=1}^q\pi _j=1\), \(\pi _i \ge 0 (i=1,2,...,q).\) Further, we denote probability \(\pi =(\pi _1,\pi _2,...,\pi _q)^T\) and define:

Referring to Rockafellar’s and Uryasev’s fundamental minimization formula (2000), the minimization of CVaR value with respect to x and \(\pi \) is same as minimizing the function in Eq. (11) with respect to \(\beta \in \mathbb {R}\), as follows:

Especially for any discrete distribution, we will present P as \(P_\pi \) which is a subset of \(\mathbb {R}^q\). Then, RCVaR is defined as:

or, equivalently,

Now, we will start to discuss computational aspects of minimization of RCVaR. We want to minimize \(RCVaR_\alpha (x)\) over \(x \in S\). First of all, we will consider the following optimization problem:

In the linear problem of Eq. (15) we pay attention to the fact that the term \([f(x,y_k)-\beta ]^+\) in the objective function be simplified. This can be done by using new variables instead of \([f(x,y_k)-\beta ]^+\). First, let \(k_j:=f(x,y_j)-\beta \) for all \(j=1,2,...,q\). Then, let be given the variables \(u_j=k_j^+\). Another way to state, \(u_j=k_j\) if \(k_j \ge 0\), and \(u_j=0\) otherwise [6]. Thus, we should change the problem of Eq. (15) according to these new variables and should add new constraints. Then, the problem in Eq. (15) is equivalent to the following linear program [25]:

Further, one can always convert Eq. (16) into an equivalent problem in which all the complex terms are put into constraints, namely [22]:

Theorem 2

[36] If \(P_\pi \in \mathbb {R}^q\) is a compact convex set, then for each x, we have [36]:

Theorem 2 indicates that the problem of minimizing \( RCVaR_\alpha (x)\) over \(x \in S\) is equivalent to following minimization problem:

However, the optimization problem in Eq. (18) is still not appropriate for application since it includes a max operation. Now, we will specify the uncertainty set. Let us assume that \(\pi \) belongs to an ellipsoid set \(P_\pi ^E\), i.e.,

where \(\pi ^0\) is a nominal distribution having the center of the ellipsoid, and \(\mathcal {A} \in \mathbb {R}^{q \times q}\) is the scaling matrix of the ellipsoid. By \(\mathbf 1 \) we denote the vector \( (1,1,...,1)^T \) in \({\mathbb R}^q\). We have the conditions \(\mathbf 1 ^T \mathcal {A}d = 0,\pi ^0+\mathcal {A}d\ge 0\) in order to provide that \(\pi \) to be a probability distribution [36]. Since

we have

where \(\gamma (u)\) is the optimal value for the following linear program:

Furthermore, the dual of Eq. (14) can be written as follows [36]:

In this case, we can equivalently reformulate the optimization problem as follows:

3 Results and Discussion

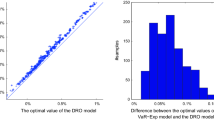

This chapter focuses on modeling the uncertainty in optimization problems. We have stated three different risk measure called VaR, CVaR and RCVaR, respectively. In optimization problems, VaR is undesirable since it contrasts with portfolio diversification. Furthermore, VaR is difficult to optimize since it is not a convex risk measure. An alternative to VaR is CVaR, which is very sound when we compare it with VaR. Conditional Value at Risk is a coherent measure of risk and it can be easily optimized with a linear programming problem. In our earlier study [8], we have seen that CVaR optimization leads up to optimal portfolio results which are very sensitive to the inputs, where the inputs are estimated from the historical data. As a result, the optimal portfolio weights for some assets prone to be imprecise. In order to minimize implementation errors, we utilize robust estimation methods which are described in the paper Ben-Tal et al. [4]. Furthermore, we present a robust conditional value at risk optimization problem for discrete distribution cases of the uncertainty where the uncertainty set is ellipsoidal. With this method, one can control the parameter uncertainty with some robust distribution assumptions and have certain optimal solutions. Perhaps, the most important direction for future work is to apply robust optimization of CVaR for nonlinear loss/cost functions f(x, y) and to robustify the unknown parameters that affect the return vector y with a reasonable specification of the uncertainty sets. In this respect, nonlinear cost functions can be eventually treated like linear functions when assuming additive models [14].

As we have shown, CVaR optimization can be applied in many areas in finance practically. For example, it can be used to calculate the risk of cost associated with the consideration of uncertainties or it can be used to solve the problems associated with a company such as reducing enterprise risks and to increase profit. The Optimization of Conditional Value-at-Risk work of Rockafeller and Uryasev [25] demonstrates hedging of a portfolio of options (target portfolio) through a portfolio of stocks, indices, and options (hedging portfolio) by using CVaR. Shang and Uryasev [26] used CVaR constraints in a cash flow matching problem. A cash flow matching problem optimizes a portfolio of given financial instruments (typically bonds) to match existing liabilities and assets over several time periods in the form of portfolio payments. The model is constructed on minimizing of cost subject to a CVaR constraint on matching liabilities/obligations over several time periods. In this chapter, we definitely demonstrate a robust methodology for minimization of CVaR so that many other applications of RCVaR in financial optimization and risk management can be applied. The difference between RCVaR and CVaR is that RCVaR finds a solution to the parameter uncertainities in CVaR. We naturally come up with a solution like this: CVaRs usage in practice is applicable for RCVaR. For Robust CVaR, one innovative application area is studied by Chan et al. [7]. In their study, they employ their own robust CVaR approach using radiation therapy treatment planning of breast cancer, where the uncertainty is in the patients breathing motion and the states of the system are the phases of the patients breathing cycle.

4 Conclusion

In this chapter, first we have stated coherent risk measures, VaR and CVaR concepts. Then, we have posed the optimization problem which minimizes the CVaR. Further, we have presented robust optimization method to deal with parameter uncertainties and, finally, we discussed the results. As for the future studies, we can consider an empirical portfolio selection problem and apply robust optimization of CVaR for cost functions and with respect to robustify unknown parameters that affect the return vector.

References

Acerbi, C., Tasche, D.: Expected shortfall: a natural coherent alternative to value at risk. Economic Notes of Banca Monte dei Paschi di Siena SpA 31(2), 1–10 (2002)

Artzner, P., Delban, F., Eber, J.M., Heath, D.: Coherent measures of risk. Math. Financ. 9(3), 203–228 (1998)

Ben-Tal, A., Nemirovski, A.: Robust solutions of linear programming problems contaminated with uncertain data. Math. Program. 88, 411–424 (2000)

Ben-Tal, A., Nemirovski, A.: Robust optimization-methodology and application. Math. Program. 92, 453–480 (2002)

Bertsimas, D., Brown, D.B., Caramanis, C.: Theory and applications of robust optimization. University of Texas, Austin, USA, Tech. Rep. (2007)

Boduroglu, I.: Portfolio Optimization via a Surrogate Risk Measure: Conditional Fundamental Value at Risk (CFVaR). Namik Kemal University, Turkey (2010)

Chan, T.C.Y., Mahmoudzadeh, H., Purdie, T.G.: A robust-CVaR optimization approach with application to breast cancer therapy. Eur. J. Oper. Res. 238, 876–885 (2014)

Cobandag, Z.: Risk Modeling in Optimization Problems Value at Risk and Conditional Value at Risk. The Department of Financial Mathematics, Term Project, IAM, METU (2011)

Eksi, Z., Comparative Study of Risk Measures, The Department of Financial Mathematics, Master Thesis, IAM, METU, 2005

Fabozzi, F.J., Huang, D., Zhou, G.: Robust portfolios: contributions from operations research and finance. Ann. Oper. Res. 176, 191–220 (2010)

Ghaoui, L., Oks, M., Oustry, F.: Worst case value at risk and robust portfolio optimization: a conic programming approach. Oper. Res. 51(4), 543–556 (2003)

Goldfarb, D., Iyengar, G.: Robust portfolio selection problems. Math. Oper. Res. 28, 1–38 (2003)

Gotoh, J.Y., Shinozaki, K., Takeda, A.: Robust portfolio techniques for mitigating the fragility of CVaR minimization and generalization to coherent risk measures. Quan. Financ. 10, 1621–1635 (2013)

Hastie, T., Tibshirani, R., Friedman, J.: The Elements of Statistical Learning, 2nd edn. Springer, Berlin (2009)

Karasozen, B., Pinar, M.C., Terlaky, T., Weber, G.W.: Feature cluster “Advances in continuous optimization”. Eur. J. Oper. Res. 169, 1077–1078 (2006)

Morgan J.P., Reuters, Risk Metrics-Technical Document, Fourth Edition, 1996

Mafusalov, A., Uryasev, S.: Buffered Probability of Exceedance: Mathematical Properties and Optimization Algorithms, Research Report, University of Florida, USA (2014)

Pavlikov, K., Uryasev, S.: CVaR norm and applications in optimization, Optim. Lett. 1–22 (2014)

Pinar, M.C.: Static and dynamic var constrained portfolios with application to delegated portfolio management. Optimization 62, 1419–1432 (2013)

Pinar, M.C.: Robust scenario optimization based on downside-risk measure for multi-period portfolio selection. OR Spectr. 29, 295–309 (2007)

Pinar, M.C., Tutuncu, R.: Robust profit opportunities in risky financial portfolios. Oper. Res. Lett. 33, 331–340 (2005)

Rockafellar, R.T.: Coherent approaches to risk in optimization under uncertainty. Tutor. Oper. Res. INFORMS 38–61, 2007 (2007)

Rockafellar, R.T., Uryasev, S. The fundamental risk quadrangle in risk management. In: Optimization and Statistical Estimation Surveys in Operations Research and Management Science, vol.18 (2013)

Rockafellar, R.T., Uryasev, S.: Conditional value-at-risk for general loss distributions. J. Bank. Financ. 26, 1443–1471 (2002)

Rockafellar, R.T., Uryasev, S.: Optimization of conditional value-at-risk. J. Risk 2(3), 21–41 (2000)

Shang, D., Uryasev, S.: Cash flow matching problem with CVaR, Research Report, (2011)

Uryasev, S.: Buffered Probability of Exceedance and Buffered Service Level: Definitions and Properties, Research Report, University of Florida, USA (2014)

Uryasev, S., Optimization Using CVaR: Algorithms and Applications, Stochastic Optimization Lecture Notes 7, University of Florida, USA

Yang, D., Tan, S., Chen, W.: Worst-case VaR and robust portfolio optimization with interval random uncertainty set. Expert Syst. Appl. 38, 64–70 (2011)

Zabarankin, M., Uryasev, S.: Statistical decision problems, selected concepts and portfolio safeguard case studies. In: Springer Optimization and Its Applications, vol. 85. Springer, Berlin (2014)

Zaffaroni, A., Quaranta, A.G.: Robust optimization of conditional value at risk and portfolio selection. J. Bank. Financ. 32, 2046–2056 (2008)

Zhang, F., Chen, Z.: Robust Portfolio Selection With a Combined Tail Mean-variance and Factor Model. Jiaotong University, China

Zhifeng D., Li, D.: Robust conditional value-at-risk optimization for asymmetrically distributed asset returns. In The 8th International Conference on Optimization: Techniques and Applications(2010)

Zhu, L., Coleman, T.F., Yuying, L.: Min-max robust and CVaR robust mean-variance portfolios. J. Risk 11–3, 1–31 (2009)

Zhu, S.S., Huang, D., Fabozzi, F.J., Fukushima, M.: Portfolio selection with uncertain exit time: a robust CVaR approach. J. Econ. Dyn. Control. Tech. Doc. 32(2), 594–623 (2008)

Zhu, S.S., Fukushima, M. Worst-case conditional value at risk with application to robust portfolio management. Oper. Res. (2008)

Zhou, G., Huang, D., Fabozzi, F.: Robust portfolios: contributions from operations research and finance. Oper. Res. 176, 191–220 (2010)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this paper

Cite this paper

Cobandag Guloglu, Z., Weber, G.W. (2017). Risk Modeling in Optimization Problems via Value at Risk, Conditional Value at Risk, and Its Robustification. In: Pinto, A., Zilberman, D. (eds) Modeling, Dynamics, Optimization and Bioeconomics II. DGS 2014. Springer Proceedings in Mathematics & Statistics, vol 195. Springer, Cham. https://doi.org/10.1007/978-3-319-55236-1_8

Download citation

DOI: https://doi.org/10.1007/978-3-319-55236-1_8

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-55235-4

Online ISBN: 978-3-319-55236-1

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)