Abstract

This chapter defines a number of Cost Engineering challenges from industry and their potential best practice solutions as industry case studies and industry practices surveys completed during the previous 5 years. In particular Life Cycle Costing in the context of upgrade and revamp in the process industry and also an example of design for full life cycle target cost for the manufacturing industry. Life Cycle Costing of complex long life cycle facilities is exemplified by identification and development of a life cycle costing of oil refineries through a survey of 15 companies and full life cycle experts and a review of the literature. Life cycle costing practices and a standardised life cycle cost breakdown structure are identified. Design to full life cycle target cost practices have been identified in the development of a full life cycle cost estimating tool for marine radar systems. In particular a survey of 17 companies and a case study with a marine radar systems company has identified specific practices useful in developing products to full life cycle target cost. In planning for future Through Life Engineering Services it is proposed that the collection of cost data and the understanding of Cost Engineering practices is a potential competitive advantage.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Cost Engineering is a potential key enabler in Through Life Engineering Services. There are two systems considered in this research, one of Oil Refineries and one of Marine Radar Systems. The research provides examples of industry best practices from two industry surveys on best practices in the area of Design To Target Cost (DTC) and Life Cycle Costing (LCC). Each one contributes to the Through Life Engineering Services Function. Two tools have been developed to contribute to decision making in this research. A Life Cycle Cost Breakdown (LCCB) Structure has been developed to specifically identify the life cycle cost concepts in an oil refinery relevant to Through Life Engineering Services. A Life Cycle Cost Estimation Software Tool Prototype was developed to provide cost information in decision making for design to Target full Life Cycle Cost for radar systems.

2 Contents

Section 3 states the aims and objectives of the research. Section 4 introduces life cycle costing concepts possible for Through Life Engineering Services. Section 4 describes an industry best practices survey in life cycle costing practices for oil refineries and a life cycle cost breakdown structure. Section 5 describes an industry best practices survey in manufacturing for Design to Target Full Life Cycle Cost. Sections 6 and 7 defines the development and structure of an industry proprietary Cost Estimation Decision Making tool to make design for target cost decisions. Section 8 discusses the potential benefits and drawbacks of the Cost Engineering concepts deployed in the Through Life Engineering Services context. Section 9 ends with conclusions.

3 Aim and Objectives of the Research

The aim of the chapter is to demonstrate the potential of Cost Engineering in Through Life Engineering Services, in particular Life Cycle Costing and Design to Target Life Cycle Costing.

The objectives of the chapter are to:

-

Identify example best practices in life cycle costing for oil refineries in the literature and in industry

-

Identify example best practices in design to Target Life Cycle Costing for manufacturing systems in the literature and in industry

-

Define a prototype cost estimation tool for use in Design to Target Cost (DTC).

4 Life Cycle Costing in Oil Refineries Industrial Survey

A questionnaire was used to collect industry best practices about life cycle costing from a variety of existing industry contacts at Cranfield University. The purpose of the questionnaire is to collect information about the current life cycle costing practices in the oil refining industry. The information gathered assists in the development of a conceptual life cycle costing model and its cost breakdown structure as defined in Sect. 17.4.4.

4.1 Research Methodology and Questionnaire Design

The survey was carried out in five consecutive stages. Most of the questions were ‘open-ended’ as this gave the respondents the flexibility to respond without being restricted by the context of the questions.

Questions 1–7 were used to identify the role of the companies in the oil and gas industry, the kind of petroleum products they deliver, and the configurations and complexities of their units.

Questions 8–20 were used to gather information on current life cycle costing practice in the industry.

Questions 21–24 were used to solicit information on current operation and maintenance challenges being experienced in industry.

Questions 25–27 cover environmental impact issues and challenges.

Questions 28–30 were used to collect information on current risks and uncertainties associated with oil refinery life cycle costing.

It must be emphasised that the choice of respondents was done on purposive basis because of the high level of specialisation and professionalism required in this sector of the oil and gas industry [1]. The questionnaire was sent to a sample of 32 individuals and companies, all of which have been known to be experienced oil refiners, oil/chemical plant cost engineers, chemical engineers, design engineers, and independent consultants with interest in the life cycle costing of industrial plants. An introductory letter was written to solicit their participation in the study, as well as stating the overall goal of the survey. Following an information process check, 20 completed questionnaires were received but subsequent preliminary examination of the answers showed that usable responses found to be adequate for analysis amounted to 15. This corresponds to 47% of the total sample. This is unusually high because of the targeted nature of the survey. In line with the commitment given to the respondents, individuals and companies are not identified by name.

4.2 Life Cycle Costing in Oil Refineries Data Analysis

The results and analysis of every question will be presented in this section. It is important to state that not all respondents answered all the questions, and some answers are synonymous, hence are reworded to convey the same meaning. To increase the accuracy of the descriptive analysis of the results, the number of answers conveying the same meaning were categorised and put in parenthesis in a number of instances. The results of the survey have been arranged question by question.

Question 1: What sector of the oil and gas industry do your company operate?

Comments:

-

Oil refining industry (7 respondents)

-

Offshore/Upstream sector of the oil and gas industry (2 respondents)

-

Industrial plants cost engineering (3 respondents)

-

Design and project management (2 respondents)

-

Power generation and chemical plant installation (1 respondent).

Question 2: What kind of products and services do you deliver?

Comments: Responses received include:

-

Major petroleum products (6 respondents)

-

Refinery decontamination chemicals and services (2 respondents)

-

Consultancy related services (5 respondents)

-

Offshore oil production and facilities maintenance (2 respondents).

Question 3: What are the main functions of your business?

Comments: This question is similar to Question 1, so almost all the respondents repeated the answers they gave in Question 1.

Question 4: What is the number of employees in your business unit?

Comments: Responses to this question varied according to the size of the organisations and consultancy outfits. The average number of employees for consultancy firms is 20 while the average number of employees in companies is 200.

Question 5: What is the average life expectancy of your plant?

Comments: Respondents from consultancy firms did not answer this question while almost all respondents involved in crude oil processing chose over 20 years as the lifespan of their plants or equipment. This means that the physical life of an oil refinery is above 20 years.

Question 6: What is the installed capacity of your refinery?

Comments: 80% of respondents involved in oil refining chose 100,000–150,000 bpd (barrels per day) as the installed capacity of their main unit. Refineries of this charge capacity are therefore common in UK and Nigeria.

Question 7: What is the level of complexity of your refinery?

Comments: Shows that 80% of the respondents involved in oil refining chose catalytic cracking refinery, 10% of the respondents chose hydro-skimming, 10% chose topping while no respondent opted for Coking refinery.

Question 8: What is your role in cost engineering in the oil and gas sector?

Comments: The percentage numbers of respondents and their roles are: equipment/spares procurement, maintenance costs and performance data reporting (47%); cost engineering consultancy services (33%); contract reviews and preparation of in-house estimates for new and existing facilities (13%); preparation of risk-based investment plans and models (7%).

Question 9: What do you consider to be the current challenges in oil refining and oil and gas industry?

Comments: The percentage numbers of responses according to the challenges are:

-

Low capacity utilisation and rising cost of ownership (33%)

-

Plant complexity and turnaround maintenance (20%)

-

Non-availability of trained and experienced personnel to replace an aging work force (7%)

-

Competition and dwindling profit (20%)

-

Scope definition (7%)

-

No response (13%).

Question 10: What do you understand to be Life Cycle Costing?

Comments: 80% of the respondents have basic knowledge of what life cycle costing means. The aggregation of their definitions implies that life cycle costing is the total cost of a product from conception to disposal.

Question 11: What methods do you use in life cycle costing?

Comments: 53% of the respondents acknowledged the existence of various investment appraisal methods that could be used by decision makers. The methods they presented ranged from net present value to cost benefit analysis. But net present value (NPV) is an economic evaluation method which is just a step among several steps to be undertaken in the life cycle costing analysis of a product, while cost benefit analysis is an evaluation method undertaken during the feasibility studies of new investments. The respondents from their answers do not have in-depth understanding of the life cycle costing methods. This implies that there is a lack of a standardised and normalised procedure that could be applied in the life cycle costing analysis of oil refineries. Hence, the standardisation of procedures is the main deficiency to be tackled.

Question 12: What data and information (sources) are used in life cycle costing?

Comments: 13% of the respondents answered this question. They said that the Cost Breakdown Structure, historical plant data, and corporate asset maintenance registers could be used as sources of data. The number of responses shows that the entrenchment of LCC techniques in the industry still appears to be insufficient.

Question 13: What are the challenges in life cycle costing?

Comments: 60% of the respondents answered this question. The answers are: poor asset historical data, uncertainty in performance, high cost of plant replacement, cost of revamping, and increased operation and maintenance cost. This implies that lack of historical plant data, uncertainties in plant performance (reliability and maintainability), cost of replacement or upgrading, revamping cost, and increased operation and maintenance costs are the challenges facing the industry and the successful implementation of life cycle costing.

Question 14: What is your understanding of the technological options in oil refining?

Comments: This question was completely misunderstood by the respondents. The author could have reframed it to convey its real meaning. However, the author meant “their understanding of refinery configurations”. I presume that Question 7 must have taken care of this question?

Question 15: Could you please describe the life cycle costing process? For instance, what are the steps? Do you have an example?

Comments: Most of the respondents repeated the answers they gave in Question 11. This question refers to the detailed steps to be undertaken in arriving at the life cycle cost of a product, which is more elaborate than just mentioning the conceptual life cycle costing model that shows cost categories in the life cycle costing process or framework. Notwithstanding the mix up, it was identified that no respondent made mention of a cost breakdown structure (CBS) which is the engine room of any life cycle costing analysis. The responses show that there is no standardised cost breakdown structure with the features needed for life cycle costing to be progressively executed. This implies that staff and departments responsible for evaluating investments in the oil refining industry lack a long-term perspective of asset management. The lack of a standardised CBS could make it impossible to conduct comparative analysis between different projects or to conduct single project analysis for budgetary purposes. A standardised CBS is therefore recommended for the industry.

Question 16: Please indicate the cost drivers you consider relevant for the life cycle costing of an oil refinery/oil and gas industrial assets?

Comments: 80% of the respondents answered this question. The responses include: plant investment; plant reliability and maintainability; plant complexity; energy; downtime; plant flexibility; and plant capacity. Hence, the aforementioned refinery cost contributors could be taken as the high level cost drivers.

Question 17: What are the relationships between the more significant ones?

Comments: 53% of the respondents said that reliability could drive down maintenance cost as presented. However, 47% of the respondents did not answer this question. Reliability as a matter of fact can reduce maintenance cost because if a plant is reliable the frequency of failure will be reduced thereby reducing maintenance cost.

Question 18: What are the life cycle stages of an oil refinery?

Comments: 80% of the respondents mentioned various life cycle stages with terminologies that could be categorised to portray the same meaning and provide standard life cycle stages for the oil refinery. For example, R&D, concept, and definition stages could be taken as a Research/Development Stage. Design/development, development, design, assessment, production, and manufacturing stages could be taken as Design/Manufacturing Stage. Investment, installation, acquisition, construction, and commissioning could be taken as Acquisition/Installation Stage. While in-service, facility usage, operation, maintenance, utilisation, and operation/support could be taken as Operation/Maintenance Stage. For the disposal stage, some respondents used retirement, end of life, recycle, remanufacture, and decommissioning. These stages could be categorised to mean Retirement/Disposal Stage.

Question 19: How many codes and standards of which the title includes the term “Life Cycle Costing” do you know?

Comments: Only 2 respondents answered this question. They mentioned PAS 55, ISO 15663, HM Treasury ‘Green Book’, and NATO/RTO Code of Practice for Life Cycle Costing. This means that most respondents are not aware of International Standards for Life Cycle Costing.

Question 20: How many of the codes and standards are specifically meant for the oil and gas industry?

Comments: There is no response to this question except one that mentioned ISO 15663—Petroleum and Natural Gas Industries: Life Cycle Costing Standard.

Question 21: What are the challenges in operation and maintenance?

Comments: 80% of the respondents gave the challenges as: lack of experienced staff, making value-based decisions on maintenance intervals, cost of maintenance, turnaround maintenance scheduling, and downtimes, while 20% of the respondents gave their challenges as technical and managerial problems. This implies that major operation and maintenance challenges in the industry are: expertise, mean-time-to-repair (Maintainability), reliability, routine maintenance planning, cost of lost production, and management policies.

Question 22: What are the issues in operation and maintenance related to life cycle cost?

Comments: This question is similar to the last question but with emphasis on life cycle costing. The answer given by 80% of the respondents includes: maintenance cost, spare parts availability, budget restrictions, increasing risk with declining condition, long lead items, downtimes (cost of lost production).

Question 23: What bottlenecks are there in operation and maintenance?

Comments: 60% of the respondents answered this question and gave the logjams as: resources, staff skills, and plant’s performance.

Question 24: What operations and maintenance models do you use? For example mathematical models, decision making models, or scheduling models.

Comments: 67% of the respondents answered this question. The responses include: Primavera planning/scheduling, and macro project models.

Question 25: What are the environmental impact challenges of CO2 emission and its cost related issues?

Comments: 80% of the respondents answered this question. The responses centred on the topical issue of international legislation on the impact and cost of CO2 emission (CO2 taxes). From the responses it seems some companies are contemplating the inclusion of CO2 cost into the design of new plants and cost models because of the international regulations on CO2 emission.

Question 26: What are the technologies to curb environmental impact for now and in the future?

Comments: 60% of the respondents answered this question and gave the technologies as: carbon sequestration technology, flue gas desulphurisation. Carbon sequestration technology involves capturing CO2 emitted from power plants and other industrial complexes and injecting it into geological structures deep below ground for long-term storage. The recovered CO2 could be used for enhanced oil recovery (EOR) projects.

Question 27: What are the environmental impacts cost drivers and cost models?

Comments: 60% of the respondents mentioned environmental remediation cost while 40% gave CO2 tax and health damages as cost drivers. However, they did not mention any cost model currently in use for the evaluation of environmental impacts.

Question 28: What are the significant risks associated with an oil refinery and appearing in the life cycle costing?

Comments: 47% of the respondents gave the associated risks as: plant upgrading and revamping, data availability, plant reliability, high investment cost while 53% of the respondents mentioned plant operation, maintenance, and environmental remediation cost as risks.

Question 29: What are the uncertainties in life cycle costing in refineries?

Comments: 47% of the respondents gave the uncertainties as plant lifespan, discount rates, energy cost while 40% mentioned data accuracy and estimating errors.

Question 30: What are the methods used to model risk and uncertainty?

Comments: Few companies and firms (20%) possess standardised procedure for evaluating risk analysis and uncertainty and this ranged from risk analysis based on individual task measurement, Monte Carlo simulation, and provision of a defined risk register. 60% lack a systematic procedure for this purpose. The responses to this question show that minimal use is made of risk and uncertainty estimation, and this could impinge on the full advantage that could be derived from the LCC technique.

4.3 Life Cycle Costing in Oil Refineries Questionnaire Summary

The results of the data analysis raised a vital issue about standardised procedures for the determination of a comprehensive life cycle cost analysis for oil refineries. The implications of the findings suggest that indeed there is a lack of a standard conceptual life cycle costing model with major cost categories and cost breakdown structure specifically designed for oil refineries. The recommendation is therefore for a standardised model and its cost breakdown structure to be integrated into an overall LCC framework.

4.4 Life Cycle Cost Breakdown Structure

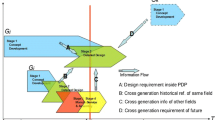

Despite the existence of standards like PAS 55, there was not a useful reference Cost Breakdown Structure (CBS) for use in life cycle costing of oil refineries. From a literature review of 20 journals and the use of the industry survey in Sect. 17.4 then the Cost Breakdown Structure (CBS) was developed in Fig. 17.1. The CBS provides identification of significant costs for cost estimation, cost reduction or other potential Cost Engineering activities.

5 Design to Full Life Cycle Target Cost Best Practices

The second part of this chapter is about design to target life cycle cost in a marine radar systems company. The research method was similar for the life cycle cost study in Sect. 17.4. However the individual best practices have been delineated, aggregated and summarised in the following section:

5.1 Results of the Design to Target Cost Survey

5.1.1 Design to Cost

Any product that is being designed, previously to the design phase it must be clear the features it will include, the value added of them and how it is possible to take into account all the costs. This is an important part because you need to know how you will deal with costs and if the level of detail requested can be achieved.

Then the Work Breakdown Structure (WBS) of the product must be detailed to its lowest level (e.g. to a component level for a software). DTC is not possible without a WBS.

Next step would be data collection. Lack of data was found to be a potentially common issue. In order to estimate or complete the data required for design to target cost task all the resources available must be used:

-

Historical

-

Experience

-

Expert judgement

-

Public domain data

-

Supplier

Not always 100% data requested is available, so it can have a subjective part based on own experience or experts’ opinion without losing validity.

The subsequent step is to define the appropriate Cost Estimation Methodology that will be used. If possible more than one methodology should be used and also cross data used to validate results. The most used in industry are detailed cost estimation, cost estimation by analogy and parametric cost estimation.

Parametric Cost Analysis potentially provides reasonable results for decision making. However sometimes it is too complex.

Analogy Cost Analysis is based on previous knowledge.

Detailed Cost Analysis is the easiest one, but is not always available, especially for a high level of detail.

It is important to model risk and uncertainty to improve the level of detail in the cost information. This cost information is identified by having a contingency cost. Fundamentally the process should begin with the identification of risks and then a process to find a way to mitigate these risks.

Best practice companies on DTC have been found to potentially use trade-off methodologies to assist in the decision making process during the design phase.

5.1.2 Life Cycle Cost

Best practice companies on Design To Target Cost use the Life Cycle Costing methodology. It is important to define the different Life Cycle Stages. This allows the knowledge of where major costs of the product are and then the subsequent decision making about cost. For some products it may be one stage that drives the major part of the Life Cycle Cost but even for those products it is needed to define the different stages to build a cost trade off-tool and determine what the optimal LCC is.

When all the stages are identified the Design Tom Target Cost process focusses on the one that drives the major part of the cost. The next stage is to define the cost drivers associated to these Life Cycle Stages. Build more accurate models for the most relevant stages.

5.1.3 Parametric Cost Estimation

Estimation techniques used in industry are:

-

Analogy method. The analogy method is based on actual project data but cannot be applicable due to a new different technology.

-

Detailed Cost Method. The detailed method may be laborious and time consuming, but it can result in a fairly accurate estimate if the work content is well understood.

-

Parametric Method. The parametric estimation is a flexible and potentially reasonable methodology. However it can appear that it is a complex analysis not applicable to develop a new product.

Then in summary use a contingency cost that will cover variability in the estimation of costs, as all are estimations, the final cost will be different. Contingency cost should be a percentage of each of the costs estimated.

5.1.4 Cost Trade-Off

From the survey the best practices identified on the trade-off tools are:

-

Choose the most cost effective technical solution.

-

Identify all hidden costs such as quality. Quality should be treated as any other attribute, with an associated cost and that also adds value.

-

Increase quality which leads to an increase in market share.

-

Cost trade-off is many times used in the Make or Buy decision. It is suggested to keep competitive manufacturing in house.

6 Marine Radar Systems Full Life Cycle Costing System

A Cost Estimation tool was built for the Marine Radar System. Requirements were captured using face to face interviews with the senior managers and directors of the company, and prototyping during an agile development process.

The user interface was to allow an easy and user friendly interaction between the user and the tool. This graphical interface is developed in Microsoft Excel using VBA coding. To achieve that it is necessary to identify precisely who will be the end users of the tool. In this case it is quite broad as every employee of the company might use the tool. Therefore it is even more consequential that the interface is well informed with notes and accurate words and that it is aesthetically easy to understand.

Once the end user is identified, the global outputs expected by the user have to be defined. For the tool, the requirements were to calculate the new cost after making some changes on the product during the design phase. This is done via use cases.

To make sure the requirements are met, the user interface can be updated and improved through a precisely commented code. This code is using data from the database, as well as user inputs, to make calculations depending on the changes made from the former configuration of the product in order to get the costs of the new product.

7 Parametric Design to Target Cost Components and Architecture

The requirements led to the following design of the Parametric Cost Model Development Tool. The software tool system includes inputs, processes, outputs and system constraints for the proposed system. The main components can be considered to be:

Inputs as selections

-

Type of product, starting product(s), ways of connecting multiple products; building blocks and components of a product present in the new configuration, i.e. a Bill of Materials; building blocks and components that will be studied during the cost estimate.

-

Level of the cost estimation (building block level or component level); the estimation method that will be used for each unit; inputs as values; percentage of similarity at the “analogic estimation” method; cost driver value at the “parametric estimation” method; actual cost at the “detailed cost” method.

Processes

-

“Analogic estimation” method; “Parametric estimation” method; “Detailed cost” method; adding new products, building blocks and components at the database; modifying existing units in the database.

Outputs

-

Total cost of the starting and the new product configuration; Cost of each lifecycle stage for the starting and the new product configuration; contribution percentage of each lifecycle stage to the total cost.

System constraints

-

The tool needs to use an existing product configuration as a starting point; specific fields in the database must be complete in order to use any of the estimating methods; system maintenance will be needed in order to ensure the continuous effectiveness of the tool and the accuracy its parametric provide.

The architecture of the final tool can be seen in Fig. 17.2. Fundamentally three cost estimation philosophies are deployed using a cost estimating database. The parametric cost equations are developed and stored with the data in the database.

8 Discussion

Life Cycle Costing is a process which has potential for improvement by scientific methods in the oil refinery business as shown by the simple and limited methods currently in operation. There is a requirement to improve cost reduction for the operating costs to improve the case for asset management. Understanding of cost drivers will aid in the calculation of availability. Reliability is of main importance in oil refineries, in particular loss of availability is of more importance than cost. Design to Target Cost is a novel Cost Engineering philosophy in the Marine Radar Systems industry. In the case study in particular there was no specific Cost Engineering capability in the company. The project identified a software based cost estimating system, utilising all three philosophies of detailed cost estimation, cost estimation by analogy and parametric cost estimation. The centralised collection of cost data was a main novelty and provided a significant improvement to decision making. Indeed the main problem in the company was cost effective decision making in new product development in the context of through life engineering services.

In the respect of the Design To Cost (DTC) concept then it was found in the industrial case study that these ideas were of importance in generating the design to cost intervention. Namely how to organise for Design To Cost (DTC), the cost of Design To Cost, what cost estimation tools support Design To Cost (DTC), what are the Design To Cost (DTC) activities in the process of Design To Cost (DTC), who are the stakeholders involved in the Design To Cost (DTC) process.

Organising for DTC involved the concepts of an organisational hierarchy occurring at customer level, director level and manager level. Stakeholders occurring below this hierarchy level are Engineering, Manufacturing, Procurement, Logistics, Finance and Procurement for instance.

There are fundamental philosophies of cost estimation, in particular detailed cost estimation, costing by analogy, parametric cost estimation and expert judgement. Design to Cost and Design to Target Cost require cost information during the full life cycle of the product including the use and disposal stages. These latter stages have historically not facilitated the collection of cost information in order to make cost predictions. Therefore cost estimation philosophies like parametric cost modelling or expert judgement are the only tools which can be potentially effective in this space. In the case study in this research it was decided to plan to develop all cost estimation philosophies into one tool as a proprietary solution.

Cost effectiveness in Design To Cost (DTC) is found in several areas. The capability to collect cost information and make predictions during the Design To Target Cost process is the significant cost driver in cost estimation. Accuracy is proportional to the amount of information available in order to make cost predictions.

Cost information collection from suppliers introduces the problem space of cost management. It is actually price information that is collected. In this case study there were minimal data points available in the form of price data as the homogeneous product data sets were of limited size and range. This meant that in the prototype proprietary system cost models were only able to provide indicative trends and in a visual way. However a start had to be made in order to build future systems.

The Design To Cost (DTC) activities which were of main importance in the case study were the independent use of the proprietary cost estimation tool by stakeholders. Previously cost related decisions were expensive since they involved senior level decision makers and had to be appropriately coordinated. In addition lack of a cost estimation process, cost information and use of subjective judgement are the main points to be addressed and solved in the current design to target cost process.

The general concepts discussed in design to cost are about methodology, roles, budget, risk management, data collection and cost breakdown structure.

9 Conclusions

The advent of Through Life Engineering Services has meant a new and novel requirement for Cost Engineering research. This is because the service presents novel scenarios with novel cost information required. The example marine radar sector although possesses supplier data for manufacturing cost still requires expert judgement about full life cycle cost like obsolescence cost. The larger complex oil refinery industry lacked cost engineering tools from a more scientific background but understood that reliability and availability were significant drivers over cost. Best practices in Cost Engineering from industry show a fundamentally basic level of capability currently being used in recent Through Life Engineering Services. The indication is of a low level of maturity and indicates a potential opportunity to improve new services. Data collection and database development is a part of capability which introduces problems in uncertainties and risks in cost estimation and provides the problem of cost effectiveness in developing cost estimates for robust decision making in TLES. Because TLES can be a new concept for companies then design to target cost industry best practices and a database and proprietary cost estimation tool have been found to be useful capability for initial improvement. However it is not clear at the moment what a long term roadmap might be. That is in the context of a company which competes on full life cycle cost elements but does not necessarily contract for them. In large complex industries cost elements are significant and subject to significant variation. Life cycle cost is an important consideration for upgrade and revamp; however reliability is known to be the critical factor.

Reference

Robson C (2002) Real world research: a resource for social scientists and practitioners-researchers, 2nd edn. Blackwell Publishers Ltd., UK

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this chapter

Cite this chapter

Baguley, P. (2017). Best Practices in the Cost Engineering of Through-Life Engineering Services in Life Cycle Costing (LCC) and Design To Cost (DTC). In: Redding, L., Roy, R., Shaw, A. (eds) Advances in Through-life Engineering Services. Decision Engineering. Springer, Cham. https://doi.org/10.1007/978-3-319-49938-3_17

Download citation

DOI: https://doi.org/10.1007/978-3-319-49938-3_17

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-49937-6

Online ISBN: 978-3-319-49938-3

eBook Packages: EngineeringEngineering (R0)