Abstract

This paper deals with the problem of estimating the compensation for the expropriation or easement of land to be used as a wind farm and the infrastructure essential for its activity. Bear in mind that the construction of a wind farm requires the acquisition (through expropriation, or amicable agreement of the surface rights) of at least the land that must be transformed for the realization of the windmill support, while other land could be encumbered with easements. Areas identified by the ground projection of the blades are, in fact, affected by overflight easements, and all transport infrastructures linked to the wind farm generate easements (underground conduits or power lines). The issue involves many aspects and takes place in a changing regulatory framework. The case law, in relation to the frequency of cases (expropriation is certainly much more frequent than easements), has developed a well-established approach that makes specific reference to the expropriation of the entire property and not merely of the right of fruition. If one pays attention to urban planning, there is a profound difference between the two cases. In the case of easement, unlike expropriation, the procedure does not require a change in the urban destination of land. A land intended for agricultural use remains as such even if it houses a plant for the production of alternative energy. This, without a thorough analysis of the principles that underlie the decisions of the judges, could also lead to profound inequality in terms of compensation payments. The issue is therefore considered by trying to transfer those principles already established with regard to the expropriation of property, even in the case of easements, where in both cases the beneficiary is a private individual, who by virtue of the possession of land, reaps a profit.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

In recent decades, renewable energy has achieved a significant share of power generation. Among the various sources of renewable energy, wind-power generation has experienced considerable growth. From 1998 to 2008, worldwide, the global installed capacity of wind power has increased from approximately 10 to 120 GW (EWEA 2009; Blanco 2009).

At the end of 2011, Europe accounted for 41% of the globally-installed wind-power capacity, and the top ten countries by installed capacity accounted for 86% of the total. On the same date, Italy had achieved seventh place in the world rankings with the percentage of 2.8% of the total installed wind-power capacity (IRENA 2012).

In 2015, installed wind turbines in Europe have a total capacity of 120 GW, and produce 284 TW of electricity per year (D’Amico et al. 2015). Even then, the installed capacity in Europe grows with a mean of 3% per year (Suomalainen et al. 2014).

This is why the state governments have played a key role by promoting, via various means, investment in this area. In the United States, as elsewhere, state and federal governments have considered or implemented a range of policies to create more sustainable energy-generation systems. These policies include both regulatory instruments and market incentives (Horner et al. 2013). In Europe, the Directive 2009/28/EC established a common policy framework for the promotion of renewable energy committing the member states to achieve scheduling targets in 2020.

The growth of investment in this sector is obviously influenced by the expected return. On the one hand, the profits depend on energy prices (gross of state incentives); on the other hand, they are related to the total installed cost and operating and maintenance costs of the wind farms. The following section provides a description of the factors characterizing the investment in a wind farm.

This paper focuses on a component of the investment cost: the land rent. In 2006, the land rent comprised 3.9% of total investment costs (cost structure of a typical 2 MW wind turbine installed in Europe in EWEA 2009). This study examines specifically the Italian case. This issue involves a discussion on a legal framework that regulates the compensation for the acquisition of land rights and on the jurisprudence that has formed over the matter (Sect. 3). Based on that discussion a solution is proposed to make consistent with the framework outlined the current compensation mode and the amounts paid to landowners, which exceed the value of agricultural land (Sect. 4).

2 Investments in Wind Farms

The wind farm and its related infrastructure was duly authorized by the competent body that simultaneously provided for the application of the pre-established confiscation constraint on property rights and other actual rights required for the construction of the plant, in accordance with art. 10 par. 1 of Presidential Decree 327/2001 (Manganelli 2015).

The wind farm, however, is not a public work, nor is its management exclusively granted to a public authority. It is built and operated by a private party, the so-called ‘beneficiary’. The wind farm and works related thereto bring a profit to the private business that deals with the construction and management thereof.

It is true that electricity produced from renewable sources cannot yet compete with conventional sources in a free market. For this reason, the various states of the European community, including Italy, in order to promote renewable energy, and taking into account their obligations under the Kyoto Protocol, have identified various forms of incentives: investment subsidies, fixed price mechanisms, fixed premium mechanisms, and quota systems based on auctions or tradable green certificates (Ragwitz et al. 2007; EWEA 2005).

A study conducted in January 2010 by Unindustria Bologna shows that, in the context of investments in renewable energy and the gross of government incentives, wind power has very good yields, lower than biomass but higher than mini-hydro and photovoltaic (Manganelli 2014). Prior to 2010, yields reached 30% of the internal rate of return, where the percentage of self-consumed energy was equal to zero and the percentage of external capital was very high (around 90%).

There is no doubt that incentives were crucial for the achievement of these performances and now, as a result of increased competition and a perimeter of incentives for new initiatives confined to a certain amount of resources, profitability levels are no longer as high.

Figure 1 shows the reduction of the discounts on the offers of the tenders with which some companies won the most recent bids for allocation of incentives in Campania.

The increase of the discount is partly due to the increased competition in the field, but partly justified even in a progressive improvement of the production technology that enables savings in installation costs and greater technical efficiency.

Note that in recent decades, the cost of a kilowatt per hour of wind energy has dropped sharply. The reduction of investment costs was very strong between 1980 and 2000, both in the US (Wiser and Bolinger 2011) and in Europe (EWEA 2009). It resulted from technological innovations and increased production volumes leading to economies of scale. The development of larger turbines at the same time has led to a decrease in costs related to works and infrastructures—for example, roads and underground cables—that were interrupted between 2004 and 2010 (Tegen et al. 2010). The trend reversal was driven by increases in turbine costs until they reached a plateau in 2009–2010 (Lantz et al. 2012). Turbine costs, in turn, have been affected by various factors elaborated in detail by Wiser and Bolinger (2011). Once the downward pressure has run out, due to the growth of the power of the turbines, one of the critical factors that caused the increase in turbine costs was the dramatic increase in demand. However, other significant factors may be those associated with the need to use less suitable sites, leading to additional costs for infrastructures, but also the awareness of the proprietors who have increased their compensation claims over a period of time. Some analyses identify scenarios where the cost in the future will again decrease (Lantz et al. 2012). Since 2008, wind-turbine prices have declined substantially. Because approximately 75% of the total cost of energy for a wind farm is related to upfront costs such as the cost of the turbine, foundation, electrical equipment, grid-connection, and so on, a reversal of the previously mentioned underlying trends is likely to occur. The future of wind power will depend on the ability of the industry to continue to achieve cost reductions.

Of the renewable sources, the energy sector is the one that has a technology, that, when applied to large-scale plants, is very mature and closer to economic competitiveness.

Although incentives are still necessary for the increase of renewable generation and for achieving the objectives set by the EU, the reduction of investment costs in the near future could enable the achievement of grid parity. This refers to the ‘parity’ between the cost of producing energy from renewable sources and the cost of buying energy from the network, which, instead, relies almost entirely on electricity production from fossil fuels. Grid parity is achieved when investing in a wind farm becomes profitable, in terms of return on investment, even without incentives.

This appears to be reachable in view of the scenario envisaged by the Energy Markets Operator (Fig. 2) that describes a probable increase in real returns obtained from investments in this field in the near future. However, grid parity will not be able to be achieved in a short time. The European condition is not different from that of the US (or other countries) where some studies show that, without dramatic cost declines and improvements in efficiency and utilization, it is unlikely to reach grid parity without state incentives within the next 10–15 years (Motyka and Given 2015; Yao et al. 2015).

However, the presence of government incentives, although fundamental for the assessment of the actual return on investment, does not entail any impact on the ensuing discussion about the legal and economic aspects involved in the process of acquiring land for the installation of a wind farm and works connected to it.

3 The Legal and Urban-Planning Aspects

The Consolidated Law on expropriation (Presidential Decree 327/2001 and subsequent amendments) and, in particular, art. 44 paragraph 1, requires that compensation, payable to the owner of the land encumbered with easements, is commensurate with the permanent decrease in value due to the loss or reduced ability to exercise the rights of property.

Article 44 of Presidential Decree 327/2001 substantially repeats the provision of art. 46 of the Law n° 2359/1865: whereby, compensation for servitude is due whenever a lawful government activity, consisting of the implementation of public works, directly involves the obligation of an easement or the production of permanent damage to the private property.

The Supreme Court (Sec. I, January 12, 2006 n° 464) established that compensation for easements should be determined as a percentage compensation for expropriation, in relation to the content of the easements imposed and for any damage incurred, having to determine the compensation for expropriation according to the criteria in force. Hence, the current criteria for estimating compensation for expropriation, with regards to building plots or not, all refer to the market value in relation to the use allowed by law.

As a matter of fact, art. 36 of Presidential Decree 327/2001 has already identified a distinct criterion for the estimation of compensation in case of expropriation of building soils aimed at the implementation of private works of public utility. When Presidential Decree (June 2003) was issued, a compensation equal to the market value of the property was recognized, thus excluding the application of penalizing criteria valid until 2007 for building areas and up to 2011 for non-building areas.

With regard to non-building land and following the ruling of the Constitutional Court (n° 181/2011), the market value should be assessed with reference to objective characteristics, taking into account their possible economic usability, different to an intended agricultural use, midway between the latter and a buildable one, permitted by law and conformable to urban planning instruments.

Given that easement is a form of partial expropriation of full ownership rights, given the unique legislation that regulates the procedure (Presidential Decree 327 of 2001), and taking into account the concurrence of the criteria to be used for the estimation of compensation (see art. 33 par. 1 governing compensation for partial expropriation, and art. 44 par. 1 concerning the criteria for the estimate of compensation for the imposition of easements), the rulings issued by the Supreme Court and the consolidated case law on this subject can reasonably be transferred to the case of the easement.

Hence, an urban constraint becomes part of the property if the transformation of the land, as permitted by the same constraint, generates an income; this element contributes exclusively to the acknowledgement of the building rights (Supreme Court including n. 11129/2009). Basically, the application of a pre-established confiscation constraint, provided for by the planning instrument or following a variation, also takes effect in the qualification of the land in order to estimate compensation for expropriation. The constraint therefore becomes ‘confirmative’ of the property, if what is to be built on the land is privately owned and the private individual can derive an economic benefit from it.

In this case, the constraints imposed have changed the conformation of the land, or its intended use. It is not reasonable to assume that the land retains a value corresponding to its agricultural use, although its use was agricultural, at least up to the establishment of the bond.

Therefore, if the value attributable to this land is not that of an agricultural area, what is its market value?

The case law has retained that the market value should be commensurate with the actual and/or potential exploitation of land, to be defined with reference to its income capacity but not resulting in the building exploitation (Supreme Court Sec. 1 n° 8873/2014). The issue of compensation for expropriation, though still conditioned by a fundamental dilemma, suitability for building or not, where there is no space for recognition of income of land development, admits the reference to a wide range of human activities that can develop in the territory, with the aim of rewarding freedom of private initiative.

The Supreme Court also specified (Sec. 1 n° 12548/2014) that private initiative, is essential in determining compensation: “Private initiative is the measure which, in a market economy, identifies the demand for land as a factor of production in the business logic… Where expropriation is necessary, compensation should take into account the potential profitability of the land. It therefore constitutes a transversal parameter, which helps to determine the market value for each type of land”.

This principle is actually stated by the legislature in art. 36 of Presidential Decree 327/2001.

4 The Solution

With regard to the easement or expropriation that is discussed here, although the bonds from which they stem are not to be included by the planning instrument or entail its variation, the estimate of the compensation cannot ignore the fact that by acquiring those rights some private entities generate profits.

If, then, the court has stated that, in case of the expropriation of land intended for an entrepreneurial venture, pending of course public utility, expropriated persons must, somehow, benefit from the income brought on by that specific activity. This principle cannot be rejected if the expropriation relates only to the right of fruition or when the expropriation does not change the urban land use. The land is a productive factor of a business, and a remuneration should be acknowledged (i.e., to those who possessed the right) by those exploiting it and who are obtaining a profit therefrom.

This remuneration should therefore be determined in proportion to the actual potential economic exploitation according to the legitimate use for which the property is intended (Supreme Court Sec. 1 n° 8873/2014). Although the urban destination of these soils has not changed, they were legitimately intended to accommodate a wind farm and related infrastructure. This type of constraint comes from land-use decisions legitimately defined by the region or by the territorial government, which has jurisdiction over the exercise of administrative functions inherent the authorization procedures.

Land use decisions, which have no reflection or proof on the certificates or evidence of urban destination, must have an effect on estimates of compensation. In practice, the urban use of land has not changed but its economic utility does.

Because the value of the land must reflect this utility, the benchmark for estimating the compensation may not be the agricultural value.

In order to give legitimacy to the view sustained, an attempt has been made to identify similar current cases, through the case law already resolved with solutions anchored to the principles laid out. Research has highlighted the case of quarries. These are non-building land with earning capacities that are not however connected to agricultural use, but to the availability of the natural resources on the site. The extraction capacity of a site can somehow be compared to the capacity to generate wind power or transferring it. Note that, in economics, production (the creation of utility) is synonymous with transformation, which in turn may be material, spatial, or temporal. The transfer of an asset or a resource in space from a site where it is available in abundance to another place where the availability is rather limited generates utility. The operation of a power line may be regarded as a productive activity.

Case law has always treated the compensation offered for land assigned to mining differently with respect to the criteria of clear distinction between building areas and does not consider the quarry “as a tool for the production of income related to the extraction of the material for the period of its planned usability”, identifying this income as “the rational reference to keep in mind in order to calculate compensation for the expropriation of this source of income” (Supreme Court n° 12354/99).

The Supreme Court Section I (n° 13911/2012) states that the negation of a third category, that is, another different case with regards to building or non-building areas, is not applicable to land that contains a quarry or a mine from which it is possible to extract specific products susceptible to particular industrial or commercial uses (in the present case, it is produced by the wind energy that is characteristic of this land). These areas are opposed to the first two (building or non-building land), because of the concurrent presence of a negative aspect (building ban) and a positive one relating to the possibility of a different economic use, more so than one or the other category (building or agricultural use).

Lastly, the United Section of the Supreme Court has dealt with the issue (judgments n° 6309/2010, n° 19433/2011), stating that “quarries, being entities open to the appropriation of non-reversible or renewable materials, are goods with their own legal and economic status”. They are not comparable to land intended for agricultural use, with the result that the criteria provided for non-building areas cannot be applied (art. 40, paragraph 1 of Presidential Decree 327/2001). They should refer to the net income obtainable for the entire duration of the planned quarrying, or, in the case of a lease to a third party, to the relevant income, subject to the calculations of discounting.

Although wind energy is a renewable energy source, unlike mining activity, it is not immediately recognizable as physically belonging to the land, and the possibility of its exploitation in terms of income capacity derives from the availability of the resource, precisely the wind, its speed, and continuity. These elements, although non-exhaustible, are characteristics of the site, as is the availability of material in the subsoil.

5 Conclusions

The land used for wind farms and related infrastructure in line with what was stated previously can be considered as assets with their own legal and economic status, and not comparable to the land intended for agricultural use.

With regard to their assessment, market research has also confirmed that these lands have actually changed their agricultural nature.

In recent years, several wind farms have been created in the territory under study. The construction of these numerous wind farms comprising windmills or wind turbines and related infrastructures (cable ducts and power lines, cabins, power stations, etc.), has imposed on those companies who have the rights for the creation and management of the such farms, the need to obtain from the landowners of the interested properties, the accessibility for the use and transformation of the land, through the conclusion of lease agreements, the assignment of surface rights, and/or of easement.

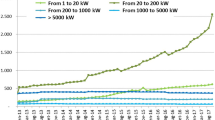

The amounts agreed upon between the parties were stipulated as one-off payments for a limited duration (normally 20 years renewable) or defined as annual rents for a similar duration. The prices paid have reached levels that cannot in any way be justified in relation to the agricultural use of the land.

Another interesting aspect that confirms the above statements is that the payments, from voluntary transfers of rights over land, reflect the typical dynamics of differential rent. On the territories under investigation, it was observed that the first companies who invested in the sector, occupying the best positions and thus guaranteeing the best energy-output performance, had paid the proprietors very high sums of money.

The data processing of the contracts for the sale of annual surface rights, related to wind farms comprising wind turbines with power 2.0 or 2.5 MW, define unit values of about 300 €/m2 (2010–2011). The construction of index numbers showed that these amounts have been reduced over time (Salvo et al. 2014).

If it is true that currently the most appealing land is being depleted and also state funding is being reduced (the latter somehow offset by the reduction of plant costs), then a reasonable estimate of the land today could be performed looking for the value investment through the development of the investment financial plan and the application of one of the models that use the Discounted Cash Flow Analysis (Afanasyeva et al. 2016; Petković et al. 2016; Venetsanos et al. 2002). This approach would lead to determine levels of landowner compensation depending on many factors, including wind speed, turbine size, price of energy, nature of the soil, and distance from grids.

References

Afanasyeva S, Saari J, Kalkofen M et al (2016) Technical, economic and uncertainty modelling of a wind farm project. Energy Convers Manage 107:22–33

Blanco MI (2009) The economics of wind energy. Renew Sustain Energy Rev 13(6–7):1372–1382

D’Amico G, Petroni F, Prattico F (2015) Economic performance indicators of wind energy based on wind speed stochastic modelling. Appl Energy 154:290–297

EWEA European Wind Energy Association (2005) Support schemes for renewable energy—a comparative analysis of payment mechanisms in the EU. http://www.ewea.org/fileadmin/ewea_documents/documents/projects/rexpansion/050620_ewea_report.pdf

EWEA European Wind Energy Association (2009) The economics of wind energy. http://www.ewea.org/fileadmin/ewea_documents/documents/00_POLICY_document/Economics_of_Wind_Energy__March_2009_.pdf

Horner N, Azevedo I, Hounshell D (2013) Effects of government incentives on wind innovation in the United States. Environ Res Lett 8. Online at http://stacks.iop.org/ERL/8/044032 (7 pp)

IRENA International Renewable Energy Agency (2012) Renewable energy technologies: cost analysis series 1(5/5). http://www.irena.org/documentdownloads/publications

Lantz E, Hand M, Wiser R (2012) The past and future cost of wind energy. Preprint presented at the 2012 world renewable energy forum denver, Colorado, 13–17 May

Manganelli B (2014) Economic feasibility of a biogas cogeneration plant fueled with biogas from animal waste. Adv Mater Res 864–867 (Environ Eng 451–455)

Manganelli B (2015) The loss in value of land due to renewed planning restrictions introduced prior to compulsory purchase. J Valori e Valutazioni 14:41–46

Motyka M, Given G (2015) Journey to grid parity—three converging forces provide a tailwind for US renewable power. http://www.deloitte.com/us/energysolutions

Petković D, Shamshirband S, Kamsin A et al (2016) Survey of the most influential parameters on the wind farm net present value (NPV) by adaptive neuro-fuzzy approach. Renew Sustain Energy Rev 57:1270–1278

Ragwitz M, Held A, Resch G et al (2007) Assessment and optimisation of renewable energy support schemes in the European electricity market. Fraunhofer IRB Verlag

Salvo F, Ciuna M, De Ruggiero M (2014) Property prices index numbers and derived indices. Property Manage 32(2):139–153

Suomalainen K, Pritchard G, Sharp B, Yuan Z, Zakeri G (2014) Correlation analysis on wind and hydro resources with electricity demand and prices in New Zealand. Appl Energy 137:445–462

Tegen S, Hand M, Maples B et al (2010) Cost of wind energy review. Technical Report, NREL/TP-5000–52920

Venetsanos K, Angelopoulou P, Tsoutsos T (2002) Renewable energy sources project appraisal under uncertainty: the case of wind energy exploitation within a changing energy market environment. Energy Policy 30:293–307

Wiser R, Bolinger M (2011) 2010 Wind technologies market report. U.S. Department of Energy, Office of Energy Efficiency and Renewable Energy. http://www1.eere.energy.gov/wind/pdfs/51783.pdf

Yao X, Liu Y, Qu S (2015) When will wind energy achieve grid parity in China?—connecting technological learning and climate finance. Appl Energy 160:697–704

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this chapter

Cite this chapter

Manganelli, B. (2017). Compensation for Land/Property Owners Hosting a Wind Farm. The Italian Case. In: Stanghellini, S., Morano, P., Bottero, M., Oppio, A. (eds) Appraisal: From Theory to Practice. Green Energy and Technology. Springer, Cham. https://doi.org/10.1007/978-3-319-49676-4_20

Download citation

DOI: https://doi.org/10.1007/978-3-319-49676-4_20

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-49675-7

Online ISBN: 978-3-319-49676-4

eBook Packages: EnergyEnergy (R0)