Abstract

Often there is underinvestment by rating agencies for developing countries with detrimental consequences. Investors will both be totally unaware of this underinvestment and base their decisions on inefficient credit ratings or they will have to supplement the credit ratings with additional information (Ferri, J Appl Econ 7:77–98, 2004). The importance of obtaining a sovereign credit rating from an agency is still underrated in some developing economies and even more so in Africa. Less than half of the African countries have a formal sovereign credit rating even though Africa has been identified as an emerging investment destination. Africa is a very unique continent and African countries are at various development stages and are classified by the World Bank according to income groups. Literature on the determinants of sovereign credit ratings in Africa is scarce. Therefore, the purpose of this research is to determine what the determinants are for sovereign credit ratings in Africa and whether these determinants differ between regions and income groups. A sample of 27 countries’ determinants of sovereign credit ratings is compared between 2007 and 2014. Sovereign credit rating variables are classified as categorical variables, and conventional econometric methods used in identifying the determinants are not always appropriate for a model with a categorical-dependent variable. The ordered response panel data model which allows for a categorical-dependent variable and a panel framework that accounts for unobserved country heterogeneity will be employed in addition to the standard panel models. The results indicated that the determinants of sovereign credit ratings differ between African regions and income groups. The Southern African region’s determinants were mostly in line with findings in literature. The developmental indicators, including variables such as regulation and corruption, as determinants of sovereign credit ratings were the most significant determinants across most income groups.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

JEL Classifications

36.1 Introduction

Sovereign credit ratings play an imperative role in the decision-making process of where and when to invest and determine the interest that is paid to investors for sovereign debt borrowings.

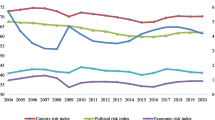

Literature shows that most research on this topic identifies the determinants of sovereign credit ratings of developed and developing countries around the world. However, the research in developing countries excludes the African continent at large. Africa is a continent characterised by a very volatile economic environment, plagued by conditions like political and labour unrest as well as civil wars almost on a daily basis. The economic environment in Africa is different from most developing countries, and thus this paper aims to investigate whether the determinants identified in literature are also relevant for countries on this unique continent.

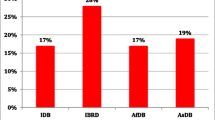

The importance of obtaining a credit rating from an agency is still underrated in some developing economies and even more so in Africa (African Development Bank 2011). Various African countries are rated by the three major rating agencies, but a South African-based research entity, known as NKC African Economics, issues credit ratings to more African countries than the major three rating agencies.

The advantage that NKC has is that it is based in Africa and has a competitive advantage over the international rating agencies due to first-hand experience of African business and economic environments. NKC rates more African countries than any of the other international agencies which only rate a limited selection of African countries, and NKC also focus on regional aspects of the African continent. In our previous research, the ratings between NKC, S&P, Fitch and Moody’s were compared for a selection of African countries (Pretorius and Botha 2014). Contrary to findings from Cantor and Packer (1996), it seems as if these rating agencies do not follow each other when ratings in Africa are concerned. Far less determinants identified in literature were significant for African ratings for the three major rating agencies. The determinants for the NKC ratings however were in line with literature. This research is a follow-up on the previous research by focusing on the differences in the degree of development of these African countries in order to see if it has an influence on the significant determinants and their weights. Therefore, the countries will be divided into geographical regions and their levels of income classification according to the World Bank to test whether there is a difference in the significant determinants for these regions and group of countries.

The paper is organised as follows: firstly, literature on the African continent will be discussed followed by the literature on the determinants of sovereign ratings. Thereafter, the discussion on the data and method will follow after which the results and conclusion will be represented.

36.2 Literature Review

36.2.1 Sovereign Credit Ratings in Africa

According to the African Development Bank (2011), some African countries do not realise the benefits of obtaining a credit rating from a formal credit rating agency. The cost of obtaining a credit rating and a lack of knowledge of the benefits of obtaining a rating seem to be the main deterrents why African countries are not pursuing formal credit ratings (African Development Bank 2011). Furthermore, the African Development Bank (2011) holds that it is sometimes difficult for these countries to first of all provide the necessary financial and economic data that is required to obtain a credit rating, and secondly, they may not be ready for the required discipline that accompanies a formal credit rating. These countries could also be apprehensive of an unfavourable rating which could further discourage investors (African Development Bank 2011). The scepticism over credit ratings has contributed to the slow development of credit ratings within the African region.

Some African countries have entered the highly indebted poor countries (HIPC) debt relief programme and have started structural reform programmes that aim to transform their economic performance (African Development Bank 2011). Gueye and Sy (2010, p. 3), state that many low-income African countries have benefited from debt relief initiatives, to such an extent that such countries are now able to tap sources of financing that have not been opened to them in the past. More African countries are trying to enter international debt capital markets with the aim to finance their developmental expenditures.

The benefits to African countries specifically to obtaining a formal credit rating are endless. Sovereign credit ratings can aid in the development of financial markets in a country (Kim and Wu 2008). The authors found that long-term foreign currency ratings have a strong link to international capital flows. Furthermore, according to Dahou et al. (2009), the deepening of financial markets in Africa could optimise the use of Africa’s resources and unlock Africa’s growth potential through the resourceful channelling of savings and investments into productive activities.

Sovereign credit ratings enhance the transparency of many developing countries by attending to the information asymmetry in the market by adding new information and thereby improving the countries’ ability to attract private capital flows (Kaminsky and Schmukler 2002; Özatay et al. 2009). Acquiring a credit rating will not only open up funding from international markets, but it will also allow these countries to obtain a suitable interest rate for borrowed funds compared to a situation where a country does not have a formal rating (Kahn 2005, p. 77).

According to the African Development Bank (2011), other benefits to African countries getting a credit rating include attracting FDI and giving support to the private sector so that they can access global markets too, it will provide better public sector transparency and it will foster deeper regional capital markets. In addition, ratings could also add to the credibility of the reforms that African countries have started, and subsequently, it could generate funds which can be used to meet debt obligations (African Development Bank 2011).

The African continent can be divided into five different geographical regions, namely, North Africa, West Africa, East Africa, Central Africa and finally Southern Africa. The African continent is the most fragmented region globally with 54 countries of which almost 50 % have populations of less than 10 million people and more than 33 % are landlocked (World Economic Forum 2013). The possible gains for Africa from increased regional integration are therefore significant.

Over the years, there have been various initiatives to help promote the development of the African continent. Very few of these initiatives targeted investment in Africa explicitly—increased investment was usually a by-product of development initiatives.

In 2002 the United Nations Development Plan (UNDP) launched an initiative to promote the attainment of sovereign credit ratings to sub-Saharan Africa and other developing countries (Standard and Poor’s 2003). The aim of the project was to give support to countries in order to gather funds from private capital markets (Standard and Poor’s 2003). The initiative did not only explain the potential benefits to sovereigns but also provided technical and financial support to countries who requested ratings (African Development Bank 2011). Before this initiative, only six African countries have been rated by Standard and Poor’s, namely, Botswana, South Africa, Tunisia, Egypt, Morocco and Senegal (Panapress 2004).

A similar initiative was also launched in 2002 by the U.S. Department of State, Bureau of African Affairs (U.S. Department of State 2009). Fitch was awarded the contract to conduct the ratings for 12 sub-Saharan countries over the period 2002–2006 (U.S. Department of State 2009). Before the project was launched, only four sub-Saharan African countries had a formal sovereign credit rating. At the end of 2006, there were 19 sub-Saharan African countries with a formal rating (U.S. Department of State 2009).

Data collected from the respective credit rating agencies indicate that by 2015, 23 African sovereign states have obtained at least one formal foreign currency credit rating from the three major rating agencies. This indicates that just over 43 % of African countries have sovereign credit ratings provided by at least one of the big three rating agencies. In 2015, Fitch Ratings was responsible for issuing credit ratings to 17 sovereigns in the African region (NKC 2015). Moody’s Investor Services was responsible for 18 sovereign ratings and Standard and Poor’s for 17 in the African region (NKC 2015).

NKC is a political and economic research unit based in South Africa and in operation from 2002 (NKC 2015). In 2015, NKC was responsible for the rating of 27 African sovereigns. It is majority owned by Oxford Economics, a UK-based economic advisory firm, since May 2015 (Reuters 2015). The entity analyses the political and macroeconomic environment of the African continent. NKC has developed a sovereign risk rating model and is able to assess countries not rated by the major credit rating agencies. In cases where those ratings are available from other credit rating agencies, NKC gives its own comparative rating (NKC 2015). NKC makes use of the same letter grading system that Standard and Poor’s and Fitch make use of.

36.2.2 Determinants of Credit Ratings

One of the first studies that identified the determinants of country risk ratings by making use of a direct measure of creditworthiness was that of Feder and Uy (1985). Earlier research on the topic made use of proxy variables related to creditworthiness like risk premiums or credit volumes (see, e.g. Sargen 1977; Kapur 1977; Eaton and Gersovitz 1981). Brewer and Rivoli (1990) and Lee (1993) concluded that both political instability and economic indicators are taken into account in the determination of credit ratings, although bankers place a greater emphasis on economic indicators. Cosset and Roy (1991) extended the study by Feder and Uy (1985).

In a seminal paper, Cantor and Packer (1996) presented the first systematic investigation of the determinants of sovereign credit ratings by making use of two leading U.S. rating agencies, Moody’s and Standard and Poor’s. They identified several significant variables (per capita income, GDP growth, inflation, fiscal balance, external balance, external debt, economic development and default history) that determine credit ratings by making use of sample correlation statistics of the broad letter category as well as an OLS multiple regression with credit ratings as dependent variable. Mulder and Perrelli (2001) focused on Moody’s and Standard and Poor’s and made use of pooled ordinary least squares (POLS) regressions and feasible generalised least squares (FGLS) panel data regressions to show that significant determinants are different from those identified by Cantor and Packer (1996). Their results show that the ratio of investment to GDP has the most significant impact on rating changes across countries (Mulder and Perrelli 2001). Other important determinants identified include the ratio of debt to exports and rescheduling history.

Eliasson (2002) made use of Standard and Poor’s credit ratings for emerging markets in both a static and dynamic context and used only macroeconomic indicators as explanatory variables due to the unavailability of objective sociopolitical variables. Afonso (2003) identified GDP per capita, external debt, level of economic development, default history, real growth rate and the inflation rate as the most relevant in determining country credit ratings. Rowland (2004) tested for significant differences between his results and those of Cantor and Packer (1996) focusing only on developing countries.

Bissoondoyal-Bheenick (2005) was one of the first researchers who changed the modelling framework in this field of study by incorporating an ordered response model (specifically a panel-ordered probit model). Other studies that incorporated similar ordered response models included Afonso et al. (2009) and Teker et al. (2013).

Bissoondoyal-Bheenick et al. (2006) made use of a completely different type of model to identify the determinants of credit ratings, namely, case-based reasoning. In addition, Bissoondoyal-Bheenick et al. (2006) also made use of an ordered probit model in their study. They found very similar results in the two different approaches in terms of significant determinants and forecast precision. This study emphasises the importance of including a proxy for technological development.

All research conducted in this field focuses on either developed or developing countries or a combination of the two with none focusing exclusively on African countries. The lack of the availability of reliable data for African countries might play a significant role in this shortcoming. Ferri (2004) found evidence of absolute underinvestment of most rating agencies in less developed countries. When there is underinvestment by rating agencies, the information content of the ratings is inefficient (Ferri 2004). The consequences of underinvestment for developing countries could be very detrimental to their economies. Investors will both be totally unaware of this underinvestment and base their decisions on inefficient credit ratings, or they will have to supplement the credit ratings with additional information (Ferri 2004).

The lack of research on sovereign credit ratings in Africa and the fact that only 43 % of the countries on the continent have a formal rating are testament to the purpose of this research.

36.3 Data and Method

36.3.1 Data

This study examines what the determinants are of sovereign credit ratings in Africa classified according to regions and income groups. A panel of 27 African countries has been constructed for the time period between 2007 and 2014 on an annual basis. The sample was selected for countries where adequate data were available. The study will make use of qualitative ratings due to the availability of symbol grades for African countries. The data for the ratings and other explanatory variables were sourced from the NKC database as well as the World Bank.

African countries were divided into their geographical regions (North, South, West, East and Central). In addition, the African countries were also categorised into their level of income as classified according to the World Bank. The 27 countries included in this study fall into three categories, namely, low income (Benin, DRC, Ethiopia, Malawi, Mozambique, Rwanda, Tanzania, Uganda and Zimbabwe, GNI per capita of $1035 or less), lower middle income (Cameroon, Egypt, Ghana, Kenya, Lesotho, Morocco, Nigeria, Senegal, Swaziland and Zambia, GNI per capita between $1036 and $4085) and upper middle income (Algeria, Angola, Botswana, Gabon, Mauritius, Namibia, South Africa and Tunisia, GNI per capita between $4086 and $12,615) (World Bank 2013). This geographical and income division is done in order to identify if there are any differences in the significant determinants of African countries in specific regions and income levels of countries. This is done since the countries on the African continent are at different stages of development.

The dependent variable is the sovereign credit rating. Only the ratings of NKC African Economics were used since they rate the most African countries. Dummy variables were created for each of the regions and income classes. Interactive dummies were also created by multiplying each dummy with the identified explanatory variables. The interactive dummies will highlight the differences in significant determinants between regions and income levels in the model.

To quantify the rating categories, there is a choice between a linear or non-linear transformation. Some researchers do not find significant differences between the two transformations (see, e.g. Beers and Cavanaugh 2004; Ferri et al. 1999). For the purpose of this study, the linear transformation will be used. The credit ratings were transformed into a linear scale (Cantor and Packer 1996) with D assigned a one, through to AAA assigned a value of 26.

The study includes a selection of explanatory variables as possible determinants of ratings in Africa. The choice of variables was based on literature by Cantor and Packer (1996), Mulder and Perrelli (2001), Rowland and Torres (2004), Mellios and Paget-Blanc (2006) and Afonso et al. (2011). The choice of variables was categorised in the broad groupings as specified by Afonso et al. (2007).

The categories were macroeconomic variables (GDP, inflation and FDI to GDP), government performance (budget balance to GDP, external debt to GDP), external balance (current account to GDP, foreign reserves to GDP) and developmental indicators (GDP per capita, corruption perceptions index, regulatory quality, number of Internet users).

36.3.2 Method

The explanatory variables identified in literature that determine sovereign credit ratings will be tested on African regions and income groups by using various panel data methods. Panel data methods are preferred since it will increase the number of observations, and the nature of the data used in this study is a combination of cross-sectional and time series data.

Due to the ordinal nature of sovereign credit ratings, an ordered probit model is technically better suited for the sovereign credit rating data. Therefore, this study will make use of the ordered probit model as well. The ordered panel probit model is specified as follows (Teker et al. 2013):

where y * it is an unobservable latent variable that represents the sovereign credit rating of country i in period t; x it is a vector of time-varying explanatory variables; β is a vector of unknown parameters; and ε it is a random disturbance term. According to Teker et al. (2013), if ε it is normally distributed, Eq. (36.1) delivers an ordered probit model. It is assumed that y * i is related to the observed variable y i , the sovereign credit rating, in the following way (Long and Freese 2006):

where τ m are known as cutpoints or threshold parameters and are estimated through maximum likelihood estimation (MLE).

36.4 Results

The results are represented in the tables below.

The included countries for North Africa were Algeria, Egypt, Morocco and Tunisia and for West Africa Benin, Ghana, Nigeria and Senegal. Cameroon, DRC, Gabon and Rwanda were included for Central Africa and Ethiopia, Kenya and Uganda for East Africa. The Southern Africa region encompasses the most countries—Angola, Botswana, Lesotho, Malawi, Mauritius, Mozambique, Namibia, South Africa, Swaziland, Tanzania, Zambia and Zimbabwe.

From Table 36.1, it is clear that none of the explanatory variables are statistically significant for East and West Africa. For Central Africa, three explanatory variables turned out to be statistically significant—economic growth, GDP per capita and the regulatory quality of their respective governments. The economic growth variable is significant and it has a negative sign. For the North Africa region, the significant variables are the external debt, foreign reserves as well as the regulatory quality variable.

When looking at the results for Southern Africa, it can be deduced that this model is best geared towards this region. A total of eight of the eleven included variables are significant for this region. The fiscal balance, external balance, investment, foreign reserves, GDP per capita, corruption, regulatory quality and Internet users are all significant in this model.

Interestingly enough, the sign for the Internet variable for Southern Africa is puzzling. A positive relationship is expected of this proxy for the technological advancement of countries—therefore, the more Internet users there are in a country, the higher the credit rating is expected to be. The reason for this might be that the technological development is unevenly spread between the different countries.

If the results for the regional model are considered in addition to Table 36.2 which shows which countries fall into the mentioned income categories, it can be seen that the regional model is more geared towards the countries that fall under the lower-middle and upper-middle income classes. These are also the emerging African countries.

Table 36.2 shows that the countries of West and East Africa fall in the low- and lower-middle income categories with no countries in the upper-middle income category. North Africa only has countries in the lower-middle and upper-middle income categories. Central and Southern Africa have countries spread over all the income categories. Southern Africa has the most countries in the upper-middle income category. The model performs better in the lower-middle and upper-middle categories (it is also confirmed in Table 36.3 where the ordered probit model was conducted again with the income classification groups). This could be the reason why none of the included explanatory variables are significant for the West and East Africa regions. This could also explain why so many variables are statistically significant for the Southern Africa region.

Table 36.3 shows that the investment, corruption and regulatory quality variables are significant for the low-income countries. The lower-middle income countries have the most significant variables—the external balance, inflation, foreign reserves, per capita income, corruption, regulatory quality and Internet users are all significant. Lastly, the fiscal balance, external debt, per capita income, corruption and regulatory quality variables are significant for the upper-middle income countries. These determinants are in line with the findings in literature (Cantor and Packer 1996; Eliasson 2002; Afonso 2003; Afonso et al. 2011; Mellios and Paget-Blanc 2006; Rowland and Torres 2004; Rowland 2004).

The importance of the developmental indicators (corruption and regulatory quality) for African countries is emphasised in this model through the statistical significance throughout all three categories. The African continent is a volatile environment politically, and the proxies for governance, i.e. regulatory quality and corruption, are both significant. The regulatory quality variable captures the capability of government to formulate and implement sound policies and regulations in the economy (World Bank 2013). The better the regulatory quality in a country, the higher the credit rating of that country and therefore the positive sign in the model makes economic sense. The corruption indicator has a negative sign (except for upper middle) and indicates that the more corrupt a country appears, the lower the credit rating of that country. The support for political or governance variables as determinants of sovereign credit ratings is very substantial (see, e.g. Feder and Uy 1985; Lee 1993; Alexe et al. 2003; Borio and Packer 2004).

Internet users were used as a proxy for the technological advancement of the country. This variable measures the amount of people per 100 people who have made use of the Internet via electronic devices in the past 12 months. The variable was found to be highly statistical significant with a positive sign (lower middle) that reflects that the more Internet users a country has, the higher that country’s credit rating will be. This finding is in line with research conducted by Bissoondoyal-Bheenick et al. (2006) who identified a proxy for technological development (in their case mobile phone use) as the most significant determinant of sovereign credit ratings in their case-based reasoning and ordered probit models.

36.5 Conclusion

The purpose of this paper was to investigate the determinants of sovereign credit ratings in Africa focusing on the difference between regions and income groups. A static panel model (with pooled OLS, fixed effects, random effects and ordered probit estimation) was used to identify the explanatory variables that influence the sovereign credit ratings in Africa.

The continent is characterised by different levels of development, and this trend was captured by dividing the continent into different regions and different income classifications. The results showed that there are a difference in the importance of certain determinants between regions and income groups. None of the identified explanatory variables are significant for East and West African countries, whereas most of the variables are significant for the Southern African region. This could be due to the fact that East and West Africa do not have any countries that fall into the upper-middle income class, and most of the Southern Africa countries lie in the upper-middle income category. The determinants for this region confirmed the determinants identified in literature.

The significance of the variables in the developmental indicator group such as GDP per capita, corruption, regulatory quality and Internet users was found to be statistically significant for lower-middle and upper-middle income groups. Most of these countries are in the Southern African region. The lower-middle and upper-middle income groups are identified as the emerging markets in Africa and therefore should all obtain a formal sovereign credit rating in order to attract investment.

References

Afonso A (2003) Understanding the determinants of sovereign debt ratings: evidence for the two leading agencies. J Econ Finance 27(1):56–74

Afonso A, Gomes P, Rother P (2007) What “hides” behind sovereign debt ratings? European Central Bank Working Paper Series, 711

Afonso A, Gomes P, Rother P (2009) Ordered response models for sovereign debt ratings. Appl Econ Lett 16(8):769–773

Afonso A, Gomes P, Rother P (2011) Short- and long-run determinants of sovereign debt credit ratings. Int J Finance Econ 16(1):1–15

African Development Bank (2011) African countries credit ratings: key for effective resource mobilisation on international capital markets. Available from: http://www.afdb.org/en/about-us/financial-information/ratings. Accessed 22 July 2015

Alexe S, Hammer P, Kogan A, Lejeune M (2003) A non-recursive regression model for country risk rating. Rutcor Research Report, 9-2003

Beers DT, Cavanaugh M (2004) Sovereign credit ratings: a primer. Available from: http://info.worldbank.org/etools/docs/library/139503/S&P_Primer.pdf. Accessed 23 July 2015

Bissoondoyal-Bheenick E (2005) An analysis of the determinants of sovereign ratings. Global Finance J 15(3):251–280

Bissoondoyal-Bheenick E, Brooks R, Yip A (2006) Determinants of sovereign ratings: a comparison of case-based reasoning and ordered probit approaches. Global Finance J 17(1):136–154

Borio C, Packer F (2004) Assessing new perspectives on country risk. BIS Q Rev 16:47–65

Brewer TL, Rivoli P (1990) Politics and perceived country creditworthiness in international banking. J Money Credit Bank 22(3):357–369

Cantor R, Packer F (1996) Determinants and impact of sovereign credit ratings. Econ Policy Rev 2(2):37–54

Cosset J, Roy J (1991) The determinants of country risk ratings. J Int Bus Stud 22(1):135–142

Dahou K, Omar HI, Pfister M (2009) Deepening African financial markets for growth and investment. NEPAD-OECD Ministerial Meeting and Expert Roundtable. Available from: www.oecd.org/investment/investmentfordevelopment/43966839.pdf. Accessed 15 Oct 2015

Eaton J, Gersovitz M (1981) Debt with potential repudiation: theoretical and empirical analysis. Rev Econ Stud 48(2):289–309

Eliasson A (2002) Sovereign credit ratings. Research Notes in Economics and Statistics, 02-1, pp 1–24

Feder G, Uy LV (1985) The determinants of international creditworthiness and their policy implications. J Policy Model 7(1):133–156

Ferri G (2004) More analysts, better ratings: do rating agencies invest enough in less developed countries? J Appl Econ 7(2):77–98

Ferri G, Liu LG, Stiglitz JE (1999) The procyclical role of rating agencies: evidence from the East Asian crises. Econ Notes 28(3):335–355

Gueye CA, Sy ANR (2010) How much should African countries pay to borrow? IMF Working Paper, 10/140, pp 1–21

Kahn B (2005) “Original Sin” and bond market development in Sub-Saharan Africa. Africa in the world economy: the national, regional and international challenges. Foundation for Debt and Development, The Hague

Kaminsky GL, Schmukler SL (2002) Emerging market instability: do sovereign ratings affect country risk and stock returns? World Bank Policy Research Working Paper Series, 2678

Kapur I (1977) An analysis of the supply of Eurocurrency finance to developing countries. Oxford Bull Econ Stat 39(3):171–188

Kim S, Wu E (2008) Sovereign credit ratings, capital flows and financial sector development in emerging markets. Emerg Mark Rev 9(1):17–39

Lee S (1993) Relative importance of political instability and economic variables on perceived country creditworthiness. J Int Bus Stud 24(4):801–812

Long JS, Freese J (2006) Regression models for categorical dependent variables using Stata. Stata Press, Texas

Mellios C, Paget-Blanc E (2006) Which factors determine sovereign credit ratings? Eur J Finance 12(4):361–377

Mulder C, Perrelli R (2001) Foreign currency credit ratings for emerging market economies. IMF Working Paper, WP/01/191

NKC (2015) Mauritius country profile. Available from: www.nkc.co.za. Accessed 15 Oct 2015

Özatay F, Özmen E, Sahinbeyoglu G (2009) Emerging market sovereign spreads, global financial conditions and US macroeconomic news. Econ Model 26(2):526–531

Panapress (2004) UNDP rating scheme spotlights African economies. Available from: http://www.panapress.com/UNDP-rating-scheme-spotlights-African-economies--13-542279-17-lang4-index.html. Accessed 3 Nov 2015

Pretorius M, Botha I (2014) A panel ordered response model for sovereign credit ratings in Africa, ERSA, Working paper, 464, September, 2014

Reuters (2015) Oxford economics takes majority stake in NKC. Available from: http://af.reuters.com/article/southAfricaNews/idAFL5N0YH22Q20150526. Accessed 9 Sept 2015

Rowland P (2004) Determinants of spread, credit ratings and creditworthiness for emerging market sovereign debt: a follow-up study using pooled data analysis. Borradores de Economia 296:1–37

Rowland R, Torres J (2004) Determinants of spread and creditworthiness for emerging market sovereign debt: a panel data study. Banco de la Republica de Colombia, Borradores de Economica: 295

Sargen N (1977) Economic indicators and country risk appraisal. Federal Reserve Bank of San Francisco Economic Review Fall:19–35

Standard and Poor’s (2003) First sovereign credit ratings assigned under new UNDP initiative for Africa. Available from: http://www.standardandpoors.com. Accessed 18 Oct 2015

Teker D, Pala A, Kent O (2013) Determination of sovereign rating: factor based ordered probit models for panel data analysis modelling framework. Int J Econ Financ Issues 3(1):122–132

U.S. Department of State (2009) Sovereign credit ratings for sub-Saharan Africa. Available from: http://www.state.gov/p/af/rt/scr/. Accessed 4 Nov 2015

World Bank (2013) New country classifications. Available from: http://data.worldbank.org/news/new-country-classifications. Accessed 15 Jan 2016

World Economic Forum (2013) Regional integration is a must for Africa. Available from: https://agenda.weforum.org/2013/05/regional-integration-is-a-must-for-africa/. Accessed 17 Oct 2015

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this paper

Cite this paper

Pretorius, M., Botha, I. (2017). The Determinants of Sovereign Credit Ratings in Africa: A Regional Perspective. In: Tsounis, N., Vlachvei, A. (eds) Advances in Applied Economic Research. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-319-48454-9_36

Download citation

DOI: https://doi.org/10.1007/978-3-319-48454-9_36

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-48453-2

Online ISBN: 978-3-319-48454-9

eBook Packages: Economics and FinanceEconomics and Finance (R0)