Abstract

When search frictions are present on financial markets, money demand arises endogenously as not all savings will be seamlessly invested in productive capacity. In such a situation, monetary and fiscal policies affect households’ portfolio decisions through their impact on the value of real balances. With exogenous growth, money continues to be neutral. In case of endogenous growth, however, money-induced portfolio shifts allow for the existence of an optimal inflation rate. Similarly, portfolio shifts induced by governments’ fiscal interventions allow to enhance growth as public debt helps to overcome search externalities by providing additional assets on the financial market. Finally, when monetary and fiscal policy interact, growth is maximum in comparison to each of the two policies taken individually. The results of the paper suggest that balance-sheet recessions can be overcome by targeted monetary and fiscal interventions that provide additional assets and induce portfolio shifts whereby these additional assets are invested in productive capacity.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Endogenous growth

- Financial and labor market matching frictions

- Monetary and fiscal policy interactions

- Optimal monetary policy

- Optimal level of public debt

JEL codes:

1 Introduction

Balance-sheet recessions and the effect of private sector develeveraging on aggregate demand have come to play an important part in the discussion of the causes of the Great Recession (Eggertsson and Krugman 2012; Koo 2015). In the face of binding debt sustainability constraints in depressed financial markets, housholds and firms aim at reducing their leverage ratio, thereby withdrawing liquidity from goods markets to increase their savings. Governments—to the extent that they are facing less binding constraints—ought to intervene in such situations to restore a faster growth path through deficit-spending and increasing the stock of public debt. Such macro-economic portfolio shifts can help restore sufficient aggregate demand growth and overcome liquidity traps, in which monetary policy interventions are essentially ineffective. And indeed, most of the recent fiscal policy literature argues that under such conditions, public spending multipliers can be significantly above unity, making such interventions highly desirable to get the economy back on a recovery path (Woodford 2011; Batini et al. 2014).

The underlying stock-perspective that is taken by this literature has, however, wider implications. Indeed, it can be argued that in a dynamically growing economy, the impact of such portfolio shifts on the equilibrium interest rate will affect the steady state growth rate. In economic models, where growth is exogenously determined, a rising interest rate would only lead to a shift in the capital-labour ratio. However, in economies with endogenously determined growth patterns, a rise in the equilibrium interest rate can attract more savings to boost technological change and hence economic growth. This is essentially the mechanism underlying the current debate on secular stagnation and the flight to safety whereby high economic uncertainty and lack of suitable assets cause investors to oversubscribe to assets with low yields and little long-term economic benefits (Caballero and Farhi 2014).

Portfolio shifts cannot only be induced by public sector debt, however. Money creation also can play an essential role in this respect. For the short run, money has come to play a key role in determining output dynamics in modern macroeconomics. In the presence of product market show rigidities with sluggish price setting, the New Keynesian macroeconomic model how central banks can influence economic activity in the short-run despite the long-run neutrality of money (e.g. Woodford 2003). Even though the resulting short-run trade-off between nominal and real variables is not permanently manipulable, it will cause aggregate demand shocks to have both real and nominal effects, sufficient for monetary policy to be able to reach its inflation target.

The transmission mechanism of these New Keynesian workhorse models runs counter earlier insights in the tradition of cash-in-advance (CIA) models. In particular those versions where both consumer and capital goods where subject to the CIA-constraint were characterized by a negative impact of rising money supply on growth due to portfolio shifts (Stockman 1981). The empirical case for such a negative relationship between inflation and growth is not particularly strong (e.g. Cooley and Hansen 1989) but subsequent developments of this CIA literature have extended the New Keynesian insights, making use of limited participation models (e.g. Lucas 1990; Christiano 1994; Fuerst 1992). These models rely on financial market imperfections more than on price rigidities in imperfectly competitive product markets and seem indeed to better account for certain macroeconomic dynamics than their sticky price counterparts (Christiano et al. 1997), albeit being subject to demanding parameter assumptions.

Money-induced portfolio shifts and monetary non-neutrality even in the longer run, however—the thrust of James Tobin’s original insights (see Tobin 1965)—seem to have come out of fashion. In light of the empirical evidence on the positive relationship between inflation and growth, at least at low levels of inflation (see e.g. Ahmed and Rogers 2000) and the possibility of a long-run trade-off between inflation and employment as put forward by Akerlof et al. (2000), Tobin’s ideas nevertheless seem to continue to bear relevance. Recently, the possibility of inflation as greasing the wheels of friction-ridden labour markets has finally attracted some attention (Wang and Xie 2012), albeit within a model that relies on a restrictive interpretation of the CIA-constraint with firms being obliged to hold cash in order to pay out workers.

Long-run effects of either variations in public sector debt or monetary balances rely on macroeconomic portfolio shifts, which are relevant also during normal times of economic expansions. This paper demonstrates the working of such mechanism and generating higher economic growth through such macroeconomic portfolio shifts even in the absence of short-term fluctuations. In particular, the paper attempts at taking up the original approach favoured by limited-participation models by using financial market imperfections to motivate both the demand for money and its long-run effects. One simple way of introducing imperfect financial markets in an otherwise standard macro-model is to consider search frictions that extend to financial markets in a similar fashion as the—by now standard—set-up of search frictions on labour markets. This allows a natural role for financial intermediaries and costly adjustment of capacity depending on the liquidity of financial markets. Such a framework would allow to mimic limited participation as part of the funds are not being funnelled to productive investments but stuck in the matching process, while on the other hand providing some appealing characteristics both methodologically and theoretically.

The methodological advantages of a search-theoretic approach lie in the parametric nature of its rigidities that can be modelled by references to the parameters both of the matching function and of the institutional framework in which the economy operates. In this regard, the matching approach has made strong inroads into labour economies precisely because it adopts a black-box approach that avoids introducing real and nominal rigidities in an ad hoc manner. Hence, methodologically such a generalised search approach would be attractive as it would stay away from mixing parametric and ad hoc forms of rigidities such as those in the current New Keynesian macroeconomics literature.

Theoretically, such an approach could prove fruitful due to the specific set-up of search models: the stock-flow link for each individual decision economic agents make in these models. This stock-flow link is a peculiar feature of the search literature—in contrast to the competitive RBC world where households will invest in only one asset—as every decision (to work, to open a vacancy, to supply funds, to search for a new product) is modelled in terms of an asset that is being accumulated (the expected discounted wealth of a wage contract, the expected net present value of a filled job, etc.) through an investment decision. These models allow for far more different types of liquidity effects than in the standard literature creating new interesting transmission mechanisms of shocks. In particular, labour supply and savings decisions no longer depend only on current wages, prices and interest rates but on the future expected liquidity of the labour and financial markets.

Based on such a framework with search and matching on financial markets, money demand arises naturally in the model of this paper without any additional assumptions regarding cash-in-advance or the Sidrauskian “money in the utility function” hypotheses. This allows us to formulate straightforwardly an optimal money supply rule against which different monetary policy regimes must be assessed. In addition, the characteristics and determining factors of such a rule can be analysed, in particular the impact of endogenous (AK-)growth, and possible Mundell-Tobin liquidity effects on growth.

Similar to the role of money in the growth process, fiscal policy—in particular the financing side of fiscal policy—can occupy a central role in models where perfect intermediation between deposits and bonds do not exist. Here, we consider a model where government is perfectly social waste but where government activity in form of the financing through taxes or bonds can modify the optimal growth path. Government spending needs to be backed by taxation (at least in the Ricardian set-up that is considered here) but government bonds will provide liquidity to the financial market that raises incentives for households to save and deposit money rather than to consume their income. Hence, there will be an optimal tax-bond equilibrium with non-trivial public debt such as to maximise the optimal growth path.

The paper starts with a discussion of the search and matching methodology applied to both labour and financial markets, based on earlier work by Amable and Ernst (2005), Becsi et al. (2000), Den Haan et al. (2003), Ernst and Semmler (2010), and Wasmer and Weil (2004). Introducing intertemporally optimising households and firms, the financial and labour market equilibria are determined, first in a stationary model without growth and then in an endogenous growth model based on a simple AK-growth mechanism. Then the paper turns to analyse the implications of portfolio shifts induced by monetary and fiscal policies and discusses optimal inflation rates and public debt ratios. In particular, it is shown that due to the ambiguous role played by the inflation rate, an optimal, positive inflation rate is shown to exist that balances the direct negative impact of inflation on growth with its positive impact on financial market liquidity through the household’s portfolio decisions. A similar effect can be shown to exist for tax-financed public debt, albeit being limited to a particular sub-set of financial market equilibria. Finally, a positive interaction between monetary and fiscal policy can be demonstrated. In the appendix, a first attempt to assess the out-of-equilibrium dynamics is undertaken based on a calibrated discrete-time version of the model and its reaction to monetary policy and technology shocks.

2 Equilibrium Money Demand and Unemployment

The models short-term dynamics will be determined both by the nominal rigidities on the product market and by search frictions on financial and labour markets. The long-term steady state behaviour of the model, however, will be exclusively determined by the interaction between search frictions on the latter two markets.

2.1 Financial and Labour Market Search

Three types of agents are considered: entrepreneurs, workers and financiers. Entrepreneurs have ideas but cannot work in production and possess no capital. Worker transform entrepreneurs’ ideas into output but have neither entrepreneurial skills nor capital; financiers (or bankers) have access to the financial resources required to implement production but cannot be entrepreneurs nor workers. A productive firm is thus a relationship between an entrepreneur, a financier and a worker. In the following, decentralised economy, however, only the optimal program of firms and households are considered, the activity of financial investors in intermediating deposits into bonds is assumed to be summarised in a matching function of the financial market.

Labor market frictions are present under the form of a matching process à la (Pissarides 2000), with a constant returns matching function \(m^{L}\left (\mathcal{U},\mathcal{V}\right )\).Footnote 1 Matches between workers and firms depend on job vacancies \(\mathcal{V}\) and unemployed workers \(\mathcal{U}\). From the point of view of the firms, labor market tightness is measured by \(\theta \equiv \frac{\mathcal{V}} {\mathcal{U}}\). Labor market liquidity will be 1∕θ. The instantaneous probability of finding a worker is thus \(m^{L}\left (\mathcal{U},\mathcal{V}\right )/\mathcal{V} = m^{L}\left (1/\theta,1\right ) \equiv q\left (\theta \right )\), \(q_{\theta }\left (\theta \right ) < 0\) while for the worker the instantaneous probability to find a firm writes as \(m^{L}\left (\mathcal{U},\mathcal{V}\right )/\mathcal{U} = m^{L}\left (\theta \right ) \equiv \theta q\left (\theta \right )\), \(\frac{\partial \left (\theta q\left (\theta \right )\right )} {\partial \theta } > 0\). Finally, the aggregate matching process yielding N filled jobs, and normalising the labour force to unity, i.e. L = 1, we have \(\mathcal{U} = L - N \Rightarrow u^{l} \equiv \frac{L-N} {L} = 1 - n\), with \(n \equiv \frac{N} {L}\).

Similarly, in order to increase its capital stock, a firm needs to find external funding on financial markets (no internal funding is supposed to be available), which are subject to search frictions, in parallel to those on labour markets. As with labour market search, matching on financial market is characterised by the constant returns matching function \(m^{B}\left (\mathcal{D},\mathcal{B}\right )\) where \(\mathcal{D}\) is the deposit amount by households to be intermediated into entreprises’ bonds \(\mathcal{B}\) to finance an increase of their capital stock. From the point of view of firms, credit market tightness is measured by \(\phi \equiv \mathcal{B}/\mathcal{D}\) and 1∕ϕ is an index of credit market liquidity, i.e. the ease with which entrepreneurs can find financing. The instantaneous probability that an entrepreneur will find a banker is \(m^{B}\left (\mathcal{D},\mathcal{B}\right )/\mathcal{B} = m^{B}\left (1/\phi,1\right ) \equiv p\left (\phi \right )\). This probability is increasing in credit market liquidity, i.e. \(p^{{\prime}}\left (\phi \right ) < 0\).

2.2 The Optimal Program of Households

Household hold their wealth in three different assets: firm equity, government bonds or money. The economy’s capital account, therefore, writes (in real terms) as:

Households hold part of their financial wealth (b) in government bonds, the rest is invested in equity (1 − b).Footnote 2 In addition, money demand arises endogenously in this model as search friction on the financial market put a wedge between households’ deposits, \(\mathcal{D}\), and their transformation into interest bearing titles (either equity, K, or government bonds, B). Hence, the rate of unmatched financial assets can be defined as: \(u^{\,f} = \frac{W-\left (K+B\right )} {W} = \frac{M} {W}\). This can be used to write \(K = \left (1 - b\right )\left (1 - u^{\,f}\right )W\) and \(B = b\left (1 - u^{\,f}\right )W\).Footnote 3

Households earn different returns on these three assets, denoted as r K , r B and r M . Real money balances do not earn interest but depreciate with the inflation rate, π, hence r M = −π, where the inflation rate is supposed to be controlled directly by the monetary authority through the evolution of the money supply, M S, i.e. \(\pi = g^{m} = \frac{\dot{M}} {M} =\hat{ M}\).Footnote 4 , Footnote 5 Moreover, households have to pay taxes on capital income, hence the after tax rate of return on capital holdings write as \(r_{K} = \left (1 -\tau _{K}\right )r_{K}\), with τ K : taxes on capital income. Finally, in the absence of stochastic returns, the equilibrium condition for households to hold either bonds or financial assets in non-trivial amounts requires that the return on investment on each of the two assets are equal, i.e. r K = r B .

Households accumulate wealth through deposits \(\mathcal{D} = Y - c\) with income generated from asset returns and gainful employment \(Y = r_{W}W + \left (1 -\tau _{w}\right )w \cdot N\), with τ w : taxes on labour income, \(r_{W} = \left [r_{K}\left (1 - b\right ) + r_{B}b\right ]\left (1 -\tau _{K}\right )\left (1 - u^{\,f}\right ) -\pi u^{\,f}\) the average ex post return on wealth and N the level of employment:

In addition, households face an employment constraint, which depends on the number of jobs created by firms and determines the evolution of their disposable income:

where σ: the rate of job destruction assumed to be exogenously given. Households, then, maximise their intertemporal utility by determining their optimal path of consumption, c, subject to the job dynamics N according to the optimal household program:

with the contemporaneous utility function \(u\left (c\right ) = \frac{\left (c\cdot N^{-\gamma }\right )^{1-\eta }} {1-\eta }\) where η: the (constant) relative risk aversion, ρ: the intertemporal time preference rate and \(-\gamma \left (1-\eta \right )\): the disutility from labour.Footnote 6

Using standard dynamic programming techniques, the above optimal program can be solved to yield to the optimal path of consumption summarised in the following proposition:

Proposition 2.1

In steady state, households optimal consumption evolve according to:

Proof

See Appendix 1, p. 277. ■

Note that consumption growth accelerates with the rate of return on capital and slows down when capital taxes, inflation or unmatched financial resources increase, in line with earlier findings of the CIA literature.

2.3 Capital and Labour Input of Intermediate Firms

2.3.1 The Optimal Program of Firms

Firms post vacancies on the labour market and raise funds for investment on the capital market. Firms transform inputs according to a constant-returns-to-scale production function with labour-saving technological progress, A:

Keeping a vacancy open is costly and measured in proportion to the ongoing average wage (opportunity costs), \(\zeta \cdot w\mathcal{V}\). Similarly, opportunity costs arise for fund raising and finding a financial investor that is ready to buy the firm’s obligations, supposed to be measured by \(\kappa \cdot r_{K}\mathcal{B}\). Once a post filled, the job disappears at an exogenous rate σ. Similarly, installed capital depreciates at rate δ. The firm then maximises profits selecting vacancies, \(\mathcal{V}\geq 0\), and issues of bonds, \(\mathcal{B}\geq 0\), according to the following optimal program:

where ρ stands for the intertemporal preference rate and \(\nu _{1}\left (t\right )\) for the household’s shadow variable related to its accumulation constraint,Footnote 7 which firms maximise against the constraints of employment and capital accumulation:

2.3.2 Determining Wages and Interest Payments Through Nash Bargaining

Wages and interest rates are negotiated on labour and financial markets respectively. Workers enjoy bargaining power β, financial investors pressure for interest rates with bargaining power γ. In order to simplify the bargaining process, we will follow Eriksson (1997), here assuming that the bargaining power describes the bounds between which wages and interest rates have to fall:

-

Workers have a fall-back option provided by the social security system, which guarantees a replacement income in form of unemployment benefits, R 0. Hence, wages will be determined as a weighted average of on the one hand marginal productivity, F N , and the gain of filling a vacancy, θ ζ 0, and unemployment benefits, R 0, on the other:

$$\displaystyle{w =\beta \left (F_{N} +\theta \zeta _{0}\right ) + \left (1-\beta \right )R_{0}}$$ -

Interest payment will be determined as a part of the marginal productivity of capital and the gain of matching issued debt, assuming that the fall-back option for financial investors is zero (we are assuming a closed economy here, i.e. no investment opportunities on international financial markets). Moreover, interest payments will be negotiated before the firm hires its employees, hence the effect of installed capital on raising wage claims are being taken into account:

$$\displaystyle{r_{K} =\gamma \left (F_{K} - w_{K}\left (\theta \right )N +\phi \kappa _{0}\right ).}$$

Unemployment benefits are assumed to be adjusted in line with real wages in order to capture increases in productivity. This will affect the increase in the reservation wage, the vacancy costs and the costs of scheduling new debt over time, we write R 0 = R ⋅ w (0 ≤ R < 1), ζ 0 = ζ ⋅ w and κ 0 = κ ⋅ r K . We, therefore, can reformulate the two prices as:

Hence, wages are only affected by labour market conditions in the current period, while interest rates are influenced by both labour and financial market conditions.Footnote 8

2.3.3 Equilibrium on Capital and Labour Markets

The program set up by (4) subject to (5)–(8) yields an equilibrium on capital and labour markets summarised in the following proposition.

Proposition 2.2

Firms select the optimal stream of jobs and investment according to:

Proof

See Appendix 2, p. 278. ■

3 Macroeconomic Policies and Long-Run Steady State Shifts

3.1 Steady State with Exogenous Growth

Once the optimal paths for consumption and labour supply determined, the availability of financial funds from which firms can draw their resources derives. This can be used to determine the optimal capital-labour ratio, k, that has been left undetermined in the model thus far. Let multi-factor productivity grow at an exogenously given rate g, i.e. \(A\left (t\right ) = A_{0}e^{gt}\). In equilibrium, given a constant population, i.e. \(\dot{L} = 0\), all dynamic variables need to grow at the same rate:

Note that when growth is exogenously given, the optimal financial and labour market liquidities can be uniquely determined from (9) and (10). This, in turn, allows to derive steady-state employment as:

Moreover, given that \(\dot{K}/K = g \Rightarrow p\left (\phi \right )\mathcal{B}/K-\delta = g\) we have:

Now, recall the optimal consumption path \(\frac{\dot{c}} {c} = \frac{1} {\eta } \left (r_{W}-\rho \right )\), which leads to the steady state return on equity:

The exogenously given growth rate of consumption, g, together with the wage- and interest-rate curves (7) and (8), can then be used to determine the steady-state capital intensity as the solution of the set of non-linear equations:

The following proposition can be immediately derived from the above equilibrium interest and wage rates:

Proposition 3.1

When growth is exogenously given, a rise in the inflation rate, π, will increase the equilibrium interest rate, r ∗ , and lower the steady-state capital-labour ratio, k ∗ . As a consequence, it will lower the optimal wage level, w ∗ . Equilibrium liquidity on labour and capital markets, θ ∗ and ϕ ∗ , remain unaffected.

Proof

By inspection of Eqs. (11) and (12). ■

Hence, in line with the CIA literature, the introduction of financial and labour market search frictions does not change the effect of inflation on the macroeconomic equilibrium. With growth given exogenously, inflation is by assumption neutral to the aggregate dynamics. It will, however, have an effect on portfolio decisions through its positive impact on the ex-post warranted real interest rate, r ∗. Consequently, the aggregate capital stock will be lower, negatively affecting the base level of negotiated wages. In sum, an increase in inflation will lead to a decrease in economic welfare through a portfolio shift, even so the growth rate remains unaffected.

3.2 Long-Term Shifts of the Steady State

How do these results change when growth is endogenously determined in the model? Existing CIA-models that include assumptions on endogenous growth suggests that superneutrality of money should also hold in these cases (e.g. Grinols and Turnovsky 1998a,b). In addition, public debt does not serve any purpose; instead, the government should be issuing assets so as to help stabilising the economy.

However, these papers do not consider financial market frictions and therefore do not take any portfolio shifts into account that may be induced by monetary and budgetary policies. As seen in the previous section, such portfolios do not have any long-run steady state effects when growth is exogenous. However, they may induce changes in the steady state when growth is endogenous. In particular, changes in the equilibrium interest rate will have immediate consequences for the rate of growth in equilibrium, irrespective of the underlying mechanism that generates endogenous growth (e.g. AK, Schumpeterian or multi-sector models with human capital spillovers).

In order to demonstrate the importance of such a mechanism, endogenous growth is introduced in its simplest form in the above model. Here, we follow Romer (1986, 1994) and consider spillovers from installed capital to the overall economy. In order to avoid scale effects (Jones 1995), we consider average capital per worker to be the relevant externality. Hence, the production function for each single firm i writes as:

where \(\overline{K} = \frac{\sum _{i}K_{i}} {\sum _{i}N_{i}} = \frac{K} {N}\) and A i : a base technology parameter. Hence, in equilibrium where \(\overline{A} = A_{i} = A_{j}\) and K i = K j , N i = N j , i ≠ j, aggregate production writes as:

The externality now stems from the number of firms, i, rather from the size of the economy. Letting \(A = i \cdot \overline{A}\), the equilibrium interest rate (8) now writes as:

This can be used to rewrite the optimal growth of consumption (3) as:

Equation (13) shows that growth depends on both financial and labour market liquidity: Tighter financial markets lead to an increase in interest rates, which helps channeling more resources into savings and hence capital accumulation; this will contribute to a faster increase in technological progress and hence faster growth.Footnote 9 On the other hand, the growth rate decreases with labour market tightness due to the strong effects on wage increases.Footnote 10

Plugging (13) into (9) and (10) allows to determine the impact of endogenous growth on the labour and financial market steady states. The long-term equilibrium in endogenous growth can then be derived from:

where \(\frac{\partial r_{K}} {\partial \phi } > 0, \frac{\partial r_{K}} {\partial \theta } < 0\), \(\Theta \left (\theta,\beta,\zeta,R\right ) =\eta q\left (s,\theta \right )\frac{\left (1-\beta \right )\left (1-R\right )-\beta \theta \zeta } {\zeta \beta \left (\eta -1\right )}\), \(\Theta _{\theta } < 0\), \(\Theta _{\beta } < 0\), \(\Theta _{R} < 0\), \(\Theta _{\zeta } < 0\) and \(\Phi \left (\phi,\gamma,\kappa \right )\), \(\Phi _{\phi } < 0\), \(\Phi _{\gamma } < 0\), \(\Phi _{\kappa } < 0\). Given that growth is negatively affected by rising labour market tightness due to an increase in the labour income share (\(w\left (\theta \right )N\) unambiguously increases with θ), Eq. (14) now allows two roots in θ, one stable and one unstable. In the following, we want to concentrate on the stable one.

Proposition 3.2

Let η > 1. Then, at the stable root liquidity on the labour market declines but increases on financial markets with an increase in the level of labour productivity, A. Moreover, both labour and financial markets become tighter with increases in the inflation rate, π.

Proof (Sketch, for Full Proof See Appendix 3, p. 279.)

The equilibrium interest rate, r K , increases linearly with ϕ at slope γ κ. The growth rate, in turn, is positively affected by an increase in the interest rate and a decrease in the amount of unused funds that suffer from the inflation tax:

As regards the productivity level, A, note that it affects both labour market and financial market liquidity in a negative way provided that η > 1. Given that financial market liquidity impacts positively on labour market liquidity, the sign of \(\frac{d\theta } {dA}\) is unambiguously negative, at least for values of η greater than unity.■

3.3 Monetary Policy

In the long run, the monetary authority is supposed to control the money supply to reach its inflation target. This can be done without further repercussions to the real economy only to the extent that growth is exogenously given. In this case, inflation will have no impact on the rate of accumulation of household wealth. However, both in the case of exogenous and endogenous growth, the depreciation of real money balances will impact on the portfolio balance through the financial market liquidity. In particular, financial market tightness will increase as households prefer to withdraw their funds and to redirect them towards consumption when inflation rises.

In the exogenous growth model, this does not have any further consequences. However, in the endogenous growth model, a reduction in the financial market liquidity will lead to a rise in the equilibrium before-tax interest rate; this causes the steady state growth rate to increase. Hence the following proposition can be proven:

Proposition 3.3

In the exogenous growth case, money is neutral in the long-run. In the endogenous growth case, however, an optimal inflation rate \(\overline{\pi } > 0\) exists such that for \(\pi < \overline{\pi }\) the steady state growth rate increases with the inflation rate and decreases for \(\pi > \overline{\pi }\) , leading to a hump shaped impact of inflation on growth.

Proof

See Appendix 4, p. 283. ■

Similar to the spirit of the original Tobin model, therefore, we get an impact of portfolio choices on growth that is determined by the inflation rate (Walsh 2001, Chap. 2). However, due to the still negative impact of inflation on the overall return of the households’ portfolio, there will only be a certain range of inflation rates for which the impact is positive. Hence, to the extent that monetary authorities control the inflation rate directly, there will be a growth maximising money supply rule. This, in turn, is in line with recent research on search models focussing on labour market search only and introducing money demand through a cash-in-advance rule (Wang and Xie 2012) and also matches empirical evidence cited in the introduction.

Moreover, it can be shown that having employment as an additional or alternative objective for the central bank would complicate matters in this model:

Proposition 3.4

A central bank that maximises a weighted sum of growth and inflation will not opt for the growth-maximising inflation rate but a lower one. Moreover, a central bank that targets both growth and employment (besides inflation) will face a trade-off between employment-maximisation and output growth-maximisation.

Proof

From (14) follows that inflation has a positive (negative) impact on the vacancy rate for η > 1 (η < 1). On the other hand, growth will have a negative (positive) impact on employment creation for η > 1 (η < 1). Therefore, whatever the value of η, there exists an employment-maximising inflation rate \(\pi ^{E}\neq \overline{\pi }\) that is different from the growth-optimizing inflation rate.■

3.4 Fiscal Policy

The model only considers Ricardian budgetary policies—i.e. there is no fiscal dominance—and their impact on steady state labour and financial market equilibrium. Under such a fiscal rule, public debt is supposed to remain on a non-explosive path with the government running a balanced budget (most of the time). Unproductive government expenditures and interest payments on government bonds are being financed by tax revenues and changes in government debt:

where T = τ K r K K +τ w wN.

To simplify matters even further, government spending is assumed to be constant and nil (G = 0) and the government uses the tax burden, T, to control the size of public debt given that in a Ricardian fiscal regime a rise in public debt cannot be financed through higher deficits. In our set-up, taxes and the tax structure have a particular role to play as taxes on labour and taxes on capital do not work the same way: Indeed, as can be seen from (13), only capital taxes will directly affect the equilibrium growth rates. Labour income taxes, on the other hand, will impact on capital accumulation only indirectly via possible effects of labour market liquidity on the financial market equilibrium. Their main effect, however, will come from the labour supply, thereby principally leading to a level shift instead of a growth effect.

Similarly to the impact of monetary policy, the impact of taxes can be assessed using the full system of financial and labour market equations. While labour market liquidity reacts ambiguously with an increase in τ K —it increases for η > 1 and decreases otherwise—financial market tightness, ϕ, increases and so do interest rates as government bonds compete with bonds issued by firms. Hence, ceteris paribus an increase in government financing through bonds will lift ϕ. Hence, two competing channels of the impact of taxes on growth arise, opening the possibility for an optimal, growth-maximising stock of public debt. In this regard, a comparison of a no-tax regime \(\left (\tau = 0,\phi ^{{\ast}}\right )\) with a regime with positive capital income taxes and positive government debt \(\left (\tau > 0,\phi ^{{\ast}{\ast}}\right )\), where ϕ ∗∗ > ϕ ∗ due to government bonds, yields the following proposition. Note that in order to assess the impact of fiscal policy in isolation, we abstract from monetary policy for the moment, setting the inflation rate to zero, i.e. π = 0.

Proposition 3.5

For sufficiently low equilibrium financial market tightness \(\phi \leq \overline{\phi }\) , there exists an interior value for tax-backed bond financing of government spending (i.e. Ricardian fiscal policy). The upper bound of a positive optimal tax policy depends on the share of government revenues financed through capital taxation, \(\varpi = \frac{\tau _{K}} {\tau }\) , i.e. \(\overline{\phi } = \overline{\phi }\left (\varpi \right )\) , \(\overline{\phi }^{{\prime}} < 0\) .

Proof

See Appendix 5, p. 284. ■

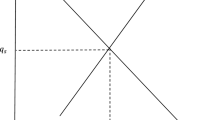

By introducing a competing asset that raises steady state interest rates, the government can affect the equilibrium growth rate above the rate obtained in a no-government equilibrium. This, however, is only the case for relatively low financial market tightness: the higher it is, the less of an impact will the introduction of government bonds on interest rates have. Unfortunately, there is no guarantee that the optimal tax policy will be positive at the financial market equilibrium and the optimal inflation rate implicitly defined by Proposition 3.3, and no closed-form algebraic solution can be derived. In order to get a sense of the equilibrium values, the following two graphs give an idea on the parameter space \(\left (\gamma,\kappa \right )\) that would allow positive optimal tax policies, one for a fully capital-taxed financed budget (right panel) and one for a budget financed at one quarter by capital taxation, as is common in OECD countries (Fig. 1).

Allowable parameter space for positive optimal tax rates. (a ) Full capital taxation financed public deficit (ϖ=1). (b ) Public deficit financed through capital taxation by 25 %(ϖ=0.25). Note: The light grey shaded areas indicate the parameter tupels \(\left (\kappa,\gamma \right )\) for which the financial market equilibrium is consistent with a positive optimal tax rate

3.5 Interaction Between Monetary and Fiscal Policy

The growth rate of the economy can be maximised through a coordination of monetary and fiscal policies. In this case, we have to introduce seignorage into the government’s budget constraint to account for the impact of different levels of inflation (and money supply growth). The new government budget constraint including seignorage (s) now writes as:

Lemma 3.6

Raising the money supply growth rate increases the optimal rate of taxation \(\left (\tau _{K}^{{\ast}},\tau _{w}^{{\ast}}\right )\) provided that \(\phi \left (\overline{\pi }\right ) \leq \overline{\phi }\) .

Proposition 3.7

The growth rate can be maximised when government spending is financed through a combination of seignorage and bonds. The optimal growth rate of money is in this case also higher than in the absence of government spending (and hence the inflation rate is higher).

Proof

See Appendix 6, p. 285. ■

In other words, government inactivity is not optimal and the policy mix can be set in such a way that it improves over the individual instruments.

4 Conclusion

Search and matching frictions on financial and labor markets have been introduced in an otherwise standard dynamic general equilibrium model. In the absence of product market frictions the analysis has emphasised the long-run behaviour of the model at the steady state, both when growth is exogenous and endogenous. In particular, the reaction of the stationary state with respect to changes in monetary and fiscal policies has been analysed.

In this model, households have a demand for money that arises endogenously with the fact that not all deposits will be immediately transformed into profitable savings as financial markets are ridden by search frictions. This creates portfolio effects of inflation as households will face a lower rate of return on their total wealth when inflation increases. Nevertheless, and in the absence of endogenous growth, money is superneutral.

However, when growth is endogenous and depends on the state of the financial market due to the effect the real interest rate has on capital deepening and hence on growth, monetary and fiscal policies are shown to be no longer neutral. As they affect financial market liquidity through portfolio shifts (monetary policy) and the introduction of a competing, risk-free asset (public debt), growth will no longer be unaffected in steady state by macroeconomic policies. In particular, the paper demonstrates the existence of a growth-maximising inflation rate, a (possible) trade-off between growth and employment maximisation, and the possibility for fiscal policies to increase the growth rate in case of very illiquid financial markets (from the point of view of households) by offering tax-backed public debt. Finally, positive interaction between monetary and fiscal policy has been shown to exist due to their complementary effect on the financial market equilibrium, inducing an optimal policy mix that maximises growth over and above the individual contribution of either monetary or fiscal policy.

The paper demonstrates the usefulness of introducing search frictions not only on the labour market but also on the financial market in particular when attempting to generate and analyse portfolio shifts induced by monetary policy. Further developments along these lines would concentrate more on the short-term dynamics, introducing price or information stickiness in order to generate a downward-sloping short-run Phillips curve. Moreover, the endogenous growth mechanism that has been retained for this paper is fairly standard; different mechanisms—for instance Schumpeterian growth—could be introduced instead, in order to assess to what extent the results presented here carry over to these alternative growth mechanisms.

Notes

- 1.

m L has positive and decreasing marginal returns on each input.

- 2.

In this deterministic case, the portfolio decisions between firm equity and government bonds are exogenously given. They could be endogenized by moving to a stochastic set-up.

- 3.

For notational convenience, the time subscript is being dropped here and in the following.

- 4.

In the spirit of the original (Tobin 1965) model, the analysis here concentrates on changes in the long-run, steady state behaviour, in which any short-term effects of money market interest rates have already played out.

- 5.

The following notational conventions are being used: \(\dot{X} \equiv \frac{\partial X} {\partial t}\), \(\hat{X} \equiv \frac{\dot{X}} {X}\).

- 6.

In most applications of search-based models to short-term macroeconomics, an additive-separable utility function is assumed to guarantee the characteristics of employment lotteries (see the discussion in Andolfatto 1996; Trigari 2009). Such a utility function is not compatible with long-run steady state (endogenous) growth. Here, we make the assumption that labour supply is exogenously given and that households maximise their intertemporal utility against the expected path of employment opportunities given by the expected employment rate.

- 7.

This follows the spirit of Merz (1995) determination of the competitive search equilibrium (see Merz 1995, pp. 287–293). It is, indeed, easy to show that this formulation is equivalent to the one where the intertemporal preference rate for firms is replaced by the—commonly used—interest rate for capital. In both cases, it is assumed that capital is ultimately owned by households.

- 8.

In a more elaborate version, one could introduce a fully intertemporal negotiation model where wages and interest rates would also be affected by future developments in their respective markets, as discussed in Layard et al. (1991).

- 9.

Note that u f declines with increases in financial market tightness.

- 10.

Note that in this model, prices are fully flexible and wage increases do not lead to an expansion of aggregate demand.

- 11.

This follows the spirit of Merz (1995) determination of the competitive search equilibrium (see Merz 1995, pp. 287–293). It is, indeed, easy to show that this formulation is equivalent to the one where the intertemporal preference rate for firms is replaced by the—commonly used—interest rate for capital. In both cases, it is assumed that capital is ultimately owned by households.

- 12.

Note that given the labour productivity externality the cross derivate writes as:

$$\displaystyle{\frac{\partial ^{2}F\left (K_{i},A_{i}N_{i}\right )} {\partial N\partial K} = \frac{\partial } {\partial K}\left ( \frac{\partial F} {\partial N}\right ) = \frac{\partial } {\partial K}\left (\alpha A_{i} \cdot \overline{K}^{\alpha }N_{i}^{\alpha -1}K_{ i}^{1-\alpha }\right ) =\alpha A_{ i} \cdot \overline{K}^{\alpha }N_{ i}^{\alpha -1}K_{ i}^{-\alpha }}$$and in equilibrium:

$$\displaystyle{ \frac{\partial ^{2}F} {\partial N\partial K} =\alpha A \cdot N^{-1}.}$$Hence, the term containing the optimal wage reaction can be written as:

$$\displaystyle{\begin{array}{ll} w_{K}^{{\ast}}\left (\theta \right ) \cdot N & = \frac{\beta } {1-\beta \theta \zeta -\left (1-\beta \right ) R}F_{NK}N = \frac{\beta } {1-\beta \theta \zeta -\left (1-\beta \right ) R}\alpha A \cdot N^{-1}N \\ & = \frac{\beta \alpha A} {1-\beta \theta \zeta -\left (1-\beta \right )R} \end{array} }$$

References

Ahmed, S., & Rogers, J. H. (2000). Inflation and the great ratios: Long term evidence from the U.S. Journal of Monetary Economics 45, 3–35.

Akerlof, G. A., Dickens, W. T., & Perry, G. L. (2000). Near-rational wage and price setting and the optimal rates of inflation and unemployment. Brookings Papers on Economic Activity, 1, 1–45.

Amable, B., & Ernst, E. (2005). Financial and labour market interactions. Specific investment and market liquidity, CEM Working Paper 93. Bielefeld: University of Bielefeld.

Andolfatto, D. (1996). Business cycles and labor-market search. American Economic Review, 86(1), 112–132.

Batini, N., Eyraud, L., Forni, L., & Weber, A. (2014). Fiscal multipliers: Size, determinants, and use in macroeconomic projections. Tech. rep. Washington, DC.: International Monetary Fund (IMF).

Becsi, Z., Li, V., & Wang, P. (2000). Financial matchmakers in credit markets with heterogeneous borrowers, Working Paper 2000-14. Atlanta: Federal Reserve Bank of Atlanta.

Caballero, R., & Farhi, E. (2014). The safety trap, Working Paper 19927. Cambridge, MA.: NBER.

Christiano, L. J. (1994). Modeling the liquidity effect of a money shock. In R. Fiorito (Ed.), Inventory, business cycles and monetary transmission. Lecture Notes in Economics and Mathematical Systems (Vol. 413, pp. 61–124). Berlin/Heidelberg: Springer.

Christiano, L. J., Eichenbaum, M., & Evans, C. L. (1997). Sticky price and limited participation models of money: A comparison. European Economic Review, 41(6), 1201–1249.

Cooley, T. F., & Hansen, G. D. (1989). The inflation tax in a real business cycle model. American Economic Review, 79(4), 733–748.

Den Haan, W. J., Ramey, G., & Watson, J. (2003). Liquidity flows and fragility of business enterprises. Journal of Monetary Economics, 50(6), 1215–1241.

Eggertsson, G. B., & Krugman, P. (2012). Debt, deleveraging, and the liquidity trap: A fisher-minsky-koo approach. Quarterly Journal of Economics, 127(3), 1469–1513.

Eriksson, C. (1997). Is there a trade-off between employment and growth? Oxford Economic Papers, 49, 77–88.

Ernst, E., & Semmler, W. (2010). Global dynamics in a model with search and matching in labor and capital markets. Journal of Economic Dynamics and Control, 34(9), 1651–1679.

Fuerst, T. S. (1992). Liquidity, loanable funds, and real activity. Journal of Monetary Economics, 29(1), 3–24.

Grinols, E. L., & Turnovsky, S. J. (1998a). Consequences of debt policy in a stochastically growing monetary economy. International Economic Review, 39(2), 495–521.

Grinols, E. L., & Turnovsky, S. J. (1998b). Risk, optimal government finance and monetary policies in a growing economy. Economica, 65(259), 401–427.

Jones, C. I. (1995). Time series tests of endogenous growth models. Quarterly Journal of Economics, 110, 495–525.

Koo, R. (2015). The escape from balance sheet recession and the QE trap. Singapore: Wiley.

Layard, R., Nickell, S., & Jackman, R. (1991). Unemployment. Macroeconomic performance and the labour market. Oxford: Oxford University Press.

Lucas, R. E. (1990). Liquidity and interest rates. Journal of Economic Theory, 4(2), 103–124.

Merz, M. (1995). Search in the labor market and the real business cycle. Journal of Monetary Economics, 36, 269–300.

Pissarides, C. (2000). Equilibrium unemployment theory. Cambridge, MA: The MIT Press.

Romer, P. M. (1986). Increasing returns and long-run growth. Journal of Political Economy, 94(5), 1002–1037.

Romer, P. M. (1994). The origins of endogenous growth. Journal of Economic Perspectives, 8(1), 3–22.

Stockman, A. C. (1981). Anticipated inflation and the capital stock in a cash-in-advance economy. Journal of Monetary Economics, 8, 387–393.

Tobin, J. (1965). Money and economic growth. Econometrica, 33, 671–684.

Trigari, A. (2009). Equilibrium unemployment, job flows and inflation dynamics. Journal of Money, Credit and Banking, 41(1), 1–33.

Walsh, C. E. (2001). Monetary theory and policy. Cambridge, MA: MIT Press.

Wang, P., & Xie, D. (2012). Real effects of money growth and optimal rate of inflation in a cash-in-advance economy with labor-market frictions, MPRA Paper 42291. Munich: RePEc.

Wasmer, E., & Weil, P. (2004). The macroeconomics of labor and credit market imperfections. American Economic Review, 94(4), 944–963.

Woodford, M. (2003). Interest and prices: Foundations of a theory of monetary policy. New York: Princeton University Press.

Woodford, M. (2011). Simple analytics of the government expenditure multiplier. American Economic Journal: Macroeconomics 3(1), 1–35.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendices

Appendix 1: The Household Program

To solve the problem, the Hamiltonian is set up as follows:

The household’s first-order condition can then be determined as:

The co-state variable W evolves according to:

Deriving (16) with respect to time, noting that \(\dot{N} = 0\) in steady state and substituting \(\dot{\nu }_{1}\) and ν 1 in (17), the household’s optimal consumption path can be determined as:

Appendix 2: Equilibrium Investment and Hiring

The firm maximises profits selecting vacancies, \(\mathcal{V}\geq 0\), and issues of bonds, \(\mathcal{B}\geq 0\), subject to costs of job vacancy creation, \(\zeta \cdot w \cdot \mathcal{V}\), and finding a financial investor, \(\kappa \cdot r_{K} \cdot \mathcal{B}\). Accordingly, its optimal program writes as:

where ρ stands for the intertemporal preference rate and \(\nu _{1}\left (t\right )\) for the household’s shadow variable related to its accumulation constraint,Footnote 11 which firms maximise against the constraints of employment and capital accumulation, Eqs. (5) and (6).

Capital is predetermined with respect to the wage bargaining process and firms will take the impact of their capital decision on wages into account. The Hamiltonian therefore writes as:

leading to the first-order conditions:

and the evolution of the co-state variables:

Deriving the first-order conditions with respect to time, one obtains:

and hence:

which can be rewritten as:

where \(\hat{w} \equiv \frac{\dot{w}} {w}\) and \(\hat{r_{K}} \equiv \frac{\dot{r_{K}}} {r_{K}}\).

Using the wage- and interest-rate curves, Eqs. (7) and (8), and noting that in the steady-state equilibrium \(\hat{r}_{K} = 0\) and \(\nu _{1}\left (t\right ) = c^{-\eta }\Rightarrow \frac{\dot{\nu }_{1}\left (t\right )} {\nu _{1}\left (t\right )} = -\eta \frac{\dot{c}} {c}\) will give the steady state conditions for labour and financial market liquidity (9) and (10) as given in the proposition.

Appendix 3: Changes in Growth Following Supply and Demand Shocks

Instead of assuming simultaneous negotiations of wages and interest rates, a more realistic assumption would be to consider wages to be set after the capital stock has been built. In this case, interest payment will take into account the effect of the capital stock development on wages, in addition to the marginal productivity of capital and the gain of matching issued debt:

Hence the equilibrium interest rate writes as:

When endogenous growth is introduced, the rate of return on capital writes asFootnote 12:

and we have:

The simultaneous equilibrium on labour and financial markets therefore writes as:

Using (3), the equilibrium condition for returns to investment, r W = r B = r K and inputting the equilibrium value for r K , we obtain:

and, hence, after rearranging terms:

These equilibrium conditions are no longer characterised by a triangular structure. In order to determine the effect of inflation and multi-factor productivity on the labour and financial market liquidity, we will make use of Cramer’s rule. Writing \(x \in \left \{A,\pi \right \}\) and fully differentiating LL and FF we obtain:

Applying Cramer’s rule allows to write:

Independently of the value of η we have:

and

Furthermore:

and

Hence, the determinant is positive at the stable root for θ for η > 1:

Moreover, we have:

-

For x = A:

$$\displaystyle\begin{array}{rcl} \left \vert \begin{array}{ll} \frac{\partial LL} {\partial A} &\frac{\partial LL} {\partial \phi } \\ \frac{\partial FF} {\partial A} &\frac{\partial FF} {\partial \phi }\end{array} \right \vert & =& \stackrel{(-)}{\frac{\partial LL} {\partial A} }\stackrel{(-)}{\frac{\partial FF} {\partial \phi } } -\stackrel{(-)}{\frac{\partial FF} {\partial A} }\stackrel{(-)}{\frac{\partial LL} {\partial \phi } } = \stackrel{(-)}{\frac{\partial LL} {\partial A} }\left [\stackrel{(-)}{\frac{\partial FF} {\partial \phi } } -\stackrel{(-)}{\frac{\partial LL} {\partial \phi } }\right ] > 0 {}\\ \left \vert \begin{array}{ll} \frac{\partial LL} {\partial \theta } &\frac{\partial LL} {\partial A} \\ \frac{\partial FF} {\partial \theta } &\frac{\partial FF} {\partial A}\end{array} \right \vert & =& \stackrel{(+)}{\frac{\partial LL} {\partial \theta } }\stackrel{(-)}{\frac{\partial FF} {\partial A} } -\stackrel{(+)}{\frac{\partial FF} {\partial \theta } }\stackrel{(-)}{\frac{\partial LL} {\partial A} } < 0 {}\\ \end{array}$$ -

For x = π:

$$\displaystyle\begin{array}{rcl} \left \vert \begin{array}{ll} \frac{\partial LL} {\partial \pi } &\frac{\partial LL} {\partial \phi } \\ \frac{\partial FF} {\partial \pi } &\frac{\partial FF} {\partial \phi }\end{array} \right \vert & =& \stackrel{(+)}{\frac{\partial LL} {\partial \pi } }\stackrel{(-)}{\frac{\partial FF} {\partial \phi } } -\stackrel{(+)}{\frac{\partial FF} {\partial \pi } }\stackrel{(-)}{\frac{\partial LL} {\partial \phi } } < 0 {}\\ \left \vert \begin{array}{ll} \frac{\partial LL} {\partial \theta } &\frac{\partial LL} {\partial \pi } \\ \frac{\partial FF} {\partial \theta } &\frac{\partial FF} {\partial \pi }\end{array} \right \vert & =& \stackrel{(-)}{\frac{\partial LL} {\partial \theta } }\stackrel{(+)}{\frac{\partial FF} {\partial \pi } } -\stackrel{(+)}{\frac{\partial FF} {\partial \theta } }\stackrel{(+)}{\frac{\partial LL} {\partial \pi } } < 0{}\\ \end{array}$$

The above conclusions regarding the effect of monetary and fiscal policies therefore carry over to the Stackelberg case.

Appendix 4: Monetary Policy and the Optimal Inflation Rate

Proof

As seen from (13), inflation has a first-order negative impact on the growth rate: \(\frac{\partial g} {\partial \pi } = -\frac{u^{\,f}} {\eta }\) which is independent from the inflation rate. However, inflation also affects financial market liquidity, as an increase in inflation leads to a portfolio shift by households away from savings towards consumption; totally differencing the financial market equilibrium condition (14) yields (note that in the following equations \(u^{\,f} \equiv u^{\,f}\left (\phi ^{{\ast}}\right )\) and \(r_{K} \equiv r_{K}\left (\phi ^{{\ast}}\right )\)):

As shown before in Proposition 3.2, both the equilibrium interest rate and the growth rate increase with financial market tightness as less funds are left unused in the household’s deposits (u f decreases with ϕ). Hence, inflation has a positive second-order impact on the growth rate via its impact on the financial market liquidity.

Combining the impact of inflation on financial market liquidity and financial market liquidity on growth, the second-order positive effect writes as:

The growth-maximising inflation rate, therefore, can be determined as:

The impact on employment can be determined in a straightforward way by totally differentiating (15). ■

Appendix 5: Optimal Debt and Growth

In the following we adopt the convention that \(\phi \left (\tau _{K}\right ) =\phi +\tau\) for convenience only. The financial market equilibrium is unaffected by capital taxes (only indirectly through impact on savings and consumption decision). The negative direct impact of taxes on growth increases with the equilibrium value of ϕ:

This has to be weighted against the positive effect of government bonds on the financial market equilibrium, which increases the growth rate:

given that \(\frac{\partial ^{2}r_{ K}} {\partial \phi ^{2}} = 0\). Under our functional assumption regarding the constant-elasticity-to-scale property of the matching process, \(\frac{\partial ^{2}g} {\partial \phi ^{2}}\) will be negative except for very small values of ϕ < ϕ with ϕ > 0. Moreover, we have that at ϕ = 0:

Hence, a zero-tax policy cannot be optimal at ϕ = 0. Given that \(\left \vert \frac{\partial g} {\partial \tau _{K}}\right \vert \) is monotonically increasing with ϕ and \(\frac{\partial g} {\partial \phi }\) is monotonically decreasing with ϕ, at least from ϕ > ϕ onwards. Hence there will be a \(\overline{\phi } >\underline{\phi }> 0\) such that \(\frac{\partial g} {\partial \phi } + \frac{\partial g} {\partial \tau _{K}} = 0\) for τ K > 0.

When only ϖ % of public spending is financed through corporate taxation, then the growth rate writes as:

and consequently, the direct negative effect of a tax-financed increase in public debt is reduced:

hence \(\frac{\partial g} {\partial \phi } + \frac{\partial g} {\partial \tau } \left (\varpi \right ) = 0\) is satisfied for a financial market equilibrium \(\overline{\overline{\phi }}\left (\varpi \right ) > \overline{\phi } > 0\).

Appendix 6: Interaction Between Monetary and Fiscal Policy

Proof of Lemma

The inflation rate does not affect the direct negative impact of corporate taxation on growth. However, it has an impact on the way financial market liquidity affects growth. Recall that the growth rate increases with financial market liquidity at rate:

This derivative depends positively on the inflation rate:

which is unambiguously positive for non-negative growth rates (for which \(r_{K}\left (1 -\tau _{K}\right ) > r_{K}\left (1 -\tau _{K}\right )\left (1 - u^{\,f}\right ) >\rho\) holds). ■

Proof of Proposition

This first part follows directly from the lemma above. Moreover, note that

depends positively on ϕ ∗ when the matching function is characterised by constant returns to scale. ■

Rights and permissions

Copyright information

© 2016 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Ernst, E. (2016). Might Tobin be Right?. In: Bernard, L., Nyambuu, U. (eds) Dynamic Modeling, Empirical Macroeconomics, and Finance. Springer, Cham. https://doi.org/10.1007/978-3-319-39887-7_11

Download citation

DOI: https://doi.org/10.1007/978-3-319-39887-7_11

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-39885-3

Online ISBN: 978-3-319-39887-7

eBook Packages: Economics and FinanceEconomics and Finance (R0)