Abstract

The standard IS–LM model considers all types of financial assets, excluding money, as bonds. We construct a modified IS–LM model to better represent the characteristics of financial markets and investigate the stability of the economy. We present bank behavior explicitly and consider household portfolio preferences through the rate of return on financial assets. We build both static and dynamic models that incorporate the dynamic equation of monetary policy. In our model, an increase in the debt–capital ratio may have a negative impact on the profit rate and bring about the so-called “paradox of debt.” We indicate that factors such as the sensitivity of bank lending to the profit rate and the degree of substitutability between the household’s equity and money have a significant effect on the volatility of the profit rate and equity price. Particularly, the latter may lead to an unstable economy in the long run. We show that it is always possible for the economy to become unstable endogenously. The government and central bank must formulate loan regulations and adopt the appropriate monetary policy to stabilize the economy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Financial markets have become increasingly complicated in modern capitalist economies, with monetary factors having induced many financial crises worldwide in recent times. Of course, the discussion on the interactions between financial markets and the real economy is not new. Fisher (1933) focuses on firm liability structures and analyzes the U.S. economy from the period of the Great Depression to the early 1930s. He proposes the theory of debt deflation, which suggests that recessions and depressions are a result of an increase in the real value of the overall debt level and deflation. Keynes (1936) develops an investment theory of why capitalist economies are particularly susceptible to fluctuations, and emphasizes the effects of financial market instability.

Minsky (1975) develops his own ideas about financial crises based on his interpretations of Fisher’s and Keynes’ theories and the writings of Henry Simons. He proposes the financial instability hypothesis, which posits that a financially dominated capitalist economy is inherently unstable. He stresses the importance of government interventions in financial markets and the role of the central bank as a lender of last resort, to avoid severe financial fluctuations.

Minsky’s ideas led to the development of various mathematical models. Taylor and O’Connell’s (1985) model is a representative model that considers long-run expectations and household portfolios. The model proves that an economy will experience a financial crisis if a decline in the expected profit rate worsens firms’ financial condition and increases households’ preference for liquidity. Recent studies in this direction include Hein (2007), Lima and Meirelles (2007), and Charles (2008, 2016).Footnote 1 These models apply the Kaleckian investment function with factors such as the firm debt–capital ratio, and demonstrate the economy’s instability. Ryoo (2010, 2013a) discusses “the paradox of debt” in the Minsky model, while Ryoo (2013b) contributes to this literature by considering the active role of a profit-seeking bank.Footnote 2

The standard IS–LMFootnote 3 model treats all kinds of financial assets, excluding money, as bonds. However, in the modern economy, bank loans and equity issues are important means of financing, and their volatilities significantly influence the real economy.Footnote 4 Minsky (1986) stresses the role of corporations’ asset structure and banks’ behavior in influencing the real economy by stating “[o]nce corporations dominate in owning capital assets and stock exchanges exist, the holding period of investors can conform to their changing needs and preferences even though the corporation’s commitment to the ownership of capital assets can be for their expected productive life” (p. 315), and “[t]he higher leverage ratio of banks was part of the process that moved the economy towards financial fragility, because it facilitated an increase in short-term borrowing (and leverage) by bank customers” (p.238).

Accordingly, our model is characterized by the following features. First, following Tobin (1969), we choose to abandon the perfect substitutability assumption in relation to financial assets.Footnote 5 We consider the financial instability brought about as a result of the relationship between investments and financing, and household portfolio preferences. Therefore, we investigate bank lending and equity markets directly, and eliminate the money market using Walras’s law.

We consider profit-seeking bank behavior following Ryoo (2013b) and discuss credit creation by banks. Unlike in Taylor and O’Connell (1985), the supply of money is endogenous in our model. In addition, we explicitly treat the issue of firm equity and household portfolio selection. The equity demand of the household is expressed using the substitutability effect, which is consistent with standard price theory. The goal is to develop a modified LM curve that reflects both the equity market and banks’ behavior.

Second, we analyze the effect of monetary policy.Footnote 6 We assume that the bank lending rate is exogenously given at the beginning of the term and held constant during the period. As a response to the economic situation, the central bank can change the interbank rate. Under these assumptions, the bank lending rate is endogenous in the long term.Footnote 7 This approach is similar to that of Fontana (2009), who consolidates the views of horizontalists and structuralists. Fontana interprets the differences among these viewpoints as being the same as Hicks’ distinction between single-period and continuation analysis.Footnote 8 Horizontalists rely on a single analysis built on the assumption that the state of expectations of all agents is constant. Structuralists depend on the continuation of agents, which may change in light of realized results. The integration of both viewpoints gives a more general theory of endogenous money. In our model, the idea of the former is applied to the static analysis and that of the latter to the dynamic analysis.

Many studies, including Taylor and O’Connell (1985), analyze the policy effects when the central bank adopts a non-activist monetary policy of fixing the rate of money supply growth. By contrast, we assume that the central bank adopts a monetary policy suited to real conditions. We consider that the central bank changes the interbank rate by referring to the actual profit rate, and investigate the effectiveness of this policy.

Finally, we investigate the stability of the economy as a whole, unlike Hein (2007), who examines the effect of monetary policy only at the steady state.Footnote 9 We also investigate the structural factors that affect economic stability and cause financial instability.

From the static model, we conclude that an increase in the debt–capital ratio may decrease the profit rate. This result is different from that of Ryoo (2013a, b), who shows that a rise in the debt–capital ratio leads to an increase in the profit rate and, therefore, does not reflect “the paradox of debt.” In our model, the effect on the equity price depends largely on banks’ lending behavior and households’ portfolio behavior. When the sensitivity of bank lending to the profit rate is high, there will be greater volatility in equity prices in response to the debt–capital ratio. In addition, in the dynamic model, we show that the high degree of substitutability between the household’s equity and money in relation to the debt–capital ratio may lead to an unstable economy. Finally, we investigate whether a monetary policy based on the profit rate can effectively stabilize the economy and show the limitations of monetary policy.

The rest of the paper is organized as follows. Section 2 presents an overview of the model. Section 3 discusses the behavior of banks and firms, while Sect. 4 discusses the behavior of households. We explicitly derive the lending function from the bank and the equity supply function from the firm. Section 5 considers the equilibrium of the commodity and equity markets, and analyzes the short-run equilibrium of the economy. Section 6 investigates the economy’s stability by constructing a dynamic system and considering the effect of monetary policy. Finally, Sect. 7 presents the conclusion.

2 Model framework

The economic system considered in this study consists of four sectors (firms, banks, households, and the central bank) and six markets (commodities, bank lending, equity, deposits, cash currency, and call loans).

The firm decides a capital accumulation rate, raises equity, and normally pays a dividend. Investment is financed through retained earnings, issuance of new equity, or borrowings from the bank.

It is assumed that the bank lending rate is exogenous in the short run and composed of an original component decided by the private bank and an interbank rate-dependent component controlled by the central bank.Footnote 10 The bank decides its lending under profit maximization. We assume that the deposit rate is regulated and the bank accepts all household deposits. We also assume that the bank’s profit is distributed to the household via the bank’s labor cost and other factors.

The interbank rate is exogenously determined at the beginning of each period. The central bank adopts the interbank rate as a monetary policy tool and supplies funds requested by banks. We suppose that the revenue of the central bank and the banks’ transaction costs also belong to the household.Footnote 11 Therefore, the entire national income, except the retained earnings of the firm, belongs to the household, which saves in the form of deposits, equity, or cash currency.

Table 1 presents the balance sheet matrix of this economy, while Table 2 provides the flow matrix, which describes the transactions among the four sectors of the economy and distinguishes the case of firms between present and capital transactions. Footnote 12Footnote 13 We present portfolios of each sector and construct a dynamic model that includes microeconomic foundations.

3 The behavior of firms and banks

3.1 The firm’s investment decision

We suppose that the firm has four categories of decisions to make.Footnote 14 First, the firm must decide what the markup on costs will be. Second, it must decide how much to produce. We assume an imperfectly competitive firm with markup pricing over labor cost at a constant rate \(\tau\), where the firm also fully adapts supply to demand within each period. This implies that sales are always equal to output, and hence, aggregate supply is exactly equal to aggregate demand.

We denote the nominal wage, labor, output, and labor–output ratio by \(\omega\), \(N\), \(Y\), and \(n\), respectively. Then, the price level \(p\) is given by:

The rate of profit on capital \(r\) evaluated at the present price level is defined as:

For simplicity, we assume that \(\tau\), \(\omega\), and \(n\) are constant, and the price of capital goods relative to that of consumer goods remains constant throughout this study.

The third decision made by the firm concerns its investment. Once the investment decision has been made, the firm must decide how it will be financed. The fourth decision is the method for raising funds.Footnote 15

In this section, we focus on the firm’s investment decision.Footnote 16 At the beginning of each period, a firm inherits a real level of capital \(K\), a real level of equity \(E\), a nominal level of debt \(L\), and a nominal level of net worth \(Z\).

Given the existing capital stock, the firm’s investment decisions are made based on the expected returns over the periods during which the newly installed equipment will be used. However, the firm cannot realize returns when it makes bad investments and goes bankrupt. The expected returns are discounted by the bank lending rate.

Let us denote the expected returns of investment \(I\) by {\({Q}_{0},{Q}_{1},\cdots {Q}_{n},\cdots\)}, and the bank lending rate during the present period by \(i\). Here, the lifetime of capital goods is assumed to be infinite. Then, the capitalized value of expected earnings for investment, \(PV\), is defined as:

For simplicity, we may assume that the sequence of returns from investment {\({Q}_{t}\)} are represented by a constant series {\(Q\)} that satisfies:

Let us call \(Q\) the average expected return. With this definition of \(Q\), the present value of expected returns from investment is written as:

As for factors that determine \(Q\), we make the following assumptions under Keynes’s theory of investment.Footnote 17 First, we assume that the ratio of prospective investment yields to investment, \(pI\), is a function of the capital accumulation rate \(k\) and the state of the firm’s expectations \({\varepsilon }^{f}\):

We assume that \({\phi }_{k}\) is negative, since we suppose that the opportunities for investment are finite.Footnote 18 Keynes emphasized the effect of the state of expectations on investment. An improvement in \({\varepsilon }^{f}\) raises the expected return on investment. We express the elasticity of \(\phi\) with respect to \(k\) as \(\eta\) and assume it is constant.Footnote 19

Let us consider how expectations of prospective yields \({\varepsilon }^{f}\) are formed.Footnote 20 When the current profit rate is higher, the state of expectations will improve. In addition, when the debt to capital ratio \(l\) is high, the interest payment will increase and net profit will decrease, worsening the state of expectations.Footnote 21 We assume that the state of expectations is a function of the profit rate and the debt-capital ratio:

In view of this assumption, Eq. (4a) may be written as:

Substituting Eq. (4c) into Eq. (3c), the expected net cash flows from investment are defined as:

We assume that the firm determines investment to maximize the value of \({\Pi }^{f}\). Maximizing Eq. (5) with respect to \(k\) yields:

The left-hand side of Eq. (6) indicates the marginal efficiency of capital and decreases as \(k\) increases. The right-hand side indicates marginal cost. The capital accumulation rate, \(k\), can be expressed as:

The capital accumulation rate is a decreasing function of the bank lending rate and the debt–capital ratio, and an increasing function of the profit rate.Footnote 22

3.2 Bank behavior and lending

Like firms, banks also seek profits. A bank obtains new deposits from households and borrows from the call market. The bank uses these funds to supply new loans and satisfy the reserve requirements.

From the bank’s balance sheet, we have:

where \(\dot{{L}^{s}}\),\(\dot{R}\), \(\dot{{D}^{d}}\), and \(\dot{A}\) denote new bank loans, bank reserves, deposits from the household, and borrowings from the call market, respectively.

The bank reserves must satisfy reserve requirements. This is represented by:

where \(\theta\) denotes the legal reserve rate and remains constant.Footnote 23

Substituting Eq. (8b) into the bank’s balance sheet Eq. (8a) and dividing by \(pK\), we obtain:

The bank earns revenue from lending to firms and makes interest payments to depositors and the lenders of call loans.Footnote 24 In addition, we take into account the transaction costs, \(G\). These costs involve losses in the event of corporate failures and firms’ auditing and monitoring costs. We assume that the deposit rate is regulated and the bank accepts all the deposits that the household would like to make.

The bank’s profit per unit of capital \({\pi }_{t}^{b}\) is given by:

where \({\Pi }^{b}\), \({i}^{d}\), and \({i}^{a}\) denote bank profit, the deposit rate, and the interbank rate, respectively.

Let us consider the transaction cost function, \(G\). This cost is plausibly dependent on a lender’s subjective risk, and is, therefore, a risk premium.Footnote 25 It becomes higher when the bank estimates that the possibility of firm bankruptcy is high. We assume that the risk premium depends on the bank’s subjective evaluation of the firm’s debt–capital ratio and profit rate. When the debt–capital ratio is high and the profit rate is low, the bank’s subjective evaluation of the firm becomes negative and transaction costs increase. We express the subjective evaluation \({\varepsilon }^{b}\) as:

In addition, the bank’s operating costs increase as bank lending increases. We assume that cost \(g\) is an increasing function of the ratio of bank lending to capital. Then, the cost function \(g\) is written as:

We assume that the marginal cost of bank lending increases more than proportionally as \({l}^{s}\) increases, and decreases as \(l\) decreases and the profit rate \(r\) increases.

For simplicity, we assume that the bank lending rate is exogenous in the short term. It is composed of an original component decided by the private bank \({i}^{b}\) and an interbank rate-dependent component controlled by the central bank. We express the bank’s loan rate as:

where \(\kappa\) denotes the degree of the effect of the interbank rate on the bank lending rate.Footnote 26

Substituting Eqs. (9b–9d) into the bank profit Eq. (9a), we have:

To sum up, the bank’s problem is to maximize Eq. (9e), subject to the constraints in (8c). In this problem, bank lending \({l}^{s}\) and the borrowings from the call market \(a\) are controlled by the bank. The first-order condition to maximize \({\pi }^{b}\) is:

The left-hand side of Eq. (10) indicates the marginal revenue from lending and the right-hand side indicates the marginal cost. Bank lending can be expressed as:

Bank lending is an increasing function of the profit rate and a decreasing function of the debt–capital ratio and interbank rate.Footnote 27

4 Finance and household behavior

4.1 Investment financing

Let us consider the financing plan of the firm. We assume that the sources of financing for investment consist of retained earnings, bank loans, and equity shares. These relationships are represented as:

where \(F\) stands for retained earnings, \(\dot{{L}^{d}}\) represents new borrowings from the bank in the present period, \(q\) is the equity price, and \(\dot{{E}^{s}}\) stands for new equity issues.

We assume that the firm has a constant ratio \(v\) of gross earnings as retained earnings. This is represented by:

where \(v\) denotes the retained earnings rate.

Similar to Ryoo (2013b), we assume that debt financing is constrained by bank lending, which satisfies:

Substituting Eqs. (11), (12b), and (12c) into Eq. (12a) and dividing it by \(pK\), we can express the financing equation as:

In regard to the capital accumulation rate, substituting Eq. (9d) into Eq. (7), we can rearrange as:

Substituting Eq. (12e) into Eq. (12d), we can rewrite the financing equation as:

The increase in the profit rate simultaneously increases investment, bank lending, and retained earnings. Therefore, the effect on equity financing is not clearly determined. When investment significantly increases with respect to the profit rate, equity financing will also increase. Similarly, the effect of the debt–capital ratio and the interbank rate will be undetermined.

4.2 Household portfolio behavior

We formulate the household’s portfolio behavior. First, let us consider the source of funds. The gross income of the firm is distributed as wages and firm profit. Firm profit is further distributed as interest payments to the bank, dividends, or retained earnings; the household earns wages and dividends from the firm. We assume that the bank’s profit is distributed to the household via the bank’s labor cost and other factors. The household can earn interest from deposits. Finally, we assume that the central bank’s revenue and the bank’s transaction costs also belong to the household. Consequently, the bank and central bank have no retained earnings, and the household obtains the entire national income, except for the retained earnings of the firm. The household uses the revenue to consume \(pC\) and hold new equity \(q{\dot{E}}^{d}\), deposits \({\dot{D}}^{d}\), and cash currency \({\dot{J}}^{d}\).

First, we can express the household income \(p{Y}^{h}\) in the present period as follows:

Therefore, we can express the budget constraint as follows:

The left-hand side of Eq. (13b) indicates total expenditure, which includes new purchases of financial assets, and the right-hand side indicates the revenue of the household at the present period.

We assume that the economy’s consumption \(pC\) is the sum of part of the flow income \(p{Y}^{h}\) and part of the household assets \(W\). As for assets, we obtain from the firm’s balance sheet:

Taking into account the economy as a whole, the assets one has are the liabilities of another. The following equation is satisfied:

From Eqs. (13c) and (13d), we can obtain:

We express the propensity for consumption of flow income and assets as \({c}_{1}\) and \({c}_{2}\), respectively. The consumption function is written as:

From Eqs. (13a) and (13f), we obtain the household saving function:

Substituting Eqs. (1) and (2) into Eq. (13g) and dividing by \(pK\), we have:

For simplicity, we define new money demand \(\dot{{M}^{d}}\) in the present period as the sum of new deposits and cash currency:

Finally, substituting Eqs. (13f) and (13i) into Eq. (13b) and considering Eq. (13g), we can rearrange Eq. (13b) as follows:

The household allocates the saving \(p{S}^{h}\) to holding new equity \(q{\dot{E}}^{d}\) and money \(\dot{{M}^{d}}\) to maximize the expected utility. We assume that it allocates money to deposits and cash currency at a constant rate.Footnote 28 We do not go into the details of the derivation of asset demand functions, but simply represent them by the rate of return and savings, which are relevant factors for portfolio selection.

We express the ratio of new equity demand to the household’s savings as \(\alpha\) and money demand as \(1-\alpha\).Footnote 29 The demand functions of equity and money are, respectively:

We suppose that equity demand varies with the anticipated dividend. It depends on the expectations of the prospective yields of the household \({\varepsilon }^{h}\), which are primarily based on the profit rate and debt–capital ratio. An increase in the profit rate and a decrease in the debt–capital ratio improves the prospective yield expectations. We assume that the household’s state of expectations is a function as follows:

Therefore, we express the ratio of equity demand to household savings as:

Substituting Eq. (14d) into Eqs. (14a) and (14b), respectively, we have the asset demand functions:

An increase in the profit rate increases equity demand. Meanwhile, the effect on money demand will be undetermined. An increase in the debt–capital ratio and equity price reduce the equity demand. The effect of the debt–capital ratio on money demand will be undetermined.

5 Equilibrium of markets

The economic system in our model consists of six markets: commodities, bank lending, equity, deposits, cash currency, and call loans. We assume that the deposit rate is regulated and the bank accepts all household deposits. The supply of deposits is constrained by demand. Similarly, we assume that the interbank rate is exogenously determined and the central bank supplies the call loans that are requested by the bank. Finally, the firm’s debt financing is constrained by bank lending. The bank lending rate is exogenous, and the bank supplies funds to maximize its profit at this rate.

We consider the equilibrium of three markets: commodities, equity, and cash currency. Using Walras’s law, we can eliminate the analysis of the cash currency market, and consider only the commodity and equity markets.

First, the commodity market achieves equilibrium when investments and savings are equal. The savings of the economy \(pS\) are equal to the sum of household savings \(p{S}^{h}\) and the firm’s retained earnings \(F\) as follows:

Dividing this equation by \(pK\) and taking into account Eqs. (1) and (2), we have:

From Eqs. (12e) and (15b), we can express the balance equation of the commodity market as follows:

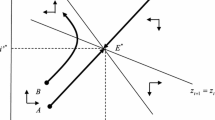

We can draw the balance equation of the commodity market on the \(Orq\) plane and call this curve the \(IS\) curve. The slope of Eq. (16a) is represented mathematically by:

When the numerator in Eq. (16b) becomes negative, the slope of the \(IS\) curve is positive.

By contrast, we consider the equity market as the financial market. Using Eqs. (12f) and (14e), we obtain the balance equation of the equity market as follows:

We also draw the balance equation of the equity market on the \(Orq\) plane and call this curve the \(EE\) curve. The slope of Eq. (17a) will be ambiguous and is represented mathematically by:

When the values of \({\alpha }_{r}\) and \({l}_{r}^{s}\) are large, the numerator in Eq. (17d) becomes positive. Hence, the slope of the \(EE\) curve becomes positive. The value of \({\alpha }_{r}\) represents the degree of substitutability between the household’s equity and money with respect to the profit rate. Although Eq. (17a) forms a system analogous to the usual LM curve in the IS–LM framework, a feature of our model is that it explicitly considers bank and household behaviors and indicates that the slope of the financial market’s balance equations on the \(Orq\) plane may either be positive or negative.

We now consider a short-run equilibrium. The system comprises Eqs. (16a) and (17a) and determines the profit rate and the equity price. We suppose that the economy as a whole is stable after taking account the interaction between the commodity market and the equity market. The Routh–Hurwitz conditions for stability are expressed as follows:

We assume that all the above stability conditions are satisfied. The stability condition (18b) means that the slope of the \(IS\) curve becomes algebraically greater than that of the \(EE\) curve in the neighborhood of equilibrium. Solving Eqs. (16a) and (17a), we obtain the short-run equilibrium as:

Let us consider the effect of a change in the exogenous variables. The effects of the debt–capital ratio on the profit rate and the equity price are undetermined. The reason for this is that the effects of the debt–capital ratio on both the \(IS\) and \(EE\) curves are ambiguous. These are represented mathematically by:

From Eq. (19c), when the absolute values of \({\alpha }_{l}\) and \({l}_{l}^{s}\) are large, \({r}_{l}\) will be negative. By contrast, the effect on the equity price is more complicated. For simplicity, we suppose that \({F}_{11}\) is negative. In this case, the slope of the \(IS\) curve becomes positive. From Eq. (19d), when \({F}_{21}\) is positive and \({k}_{l}+\left(1-{s}_{2}\right)\) is negative and/or the absolute values of \({\alpha }_{l}\) and \({l}_{l}^{s}\) are large, \({q}_{l}\) will be negative.

When the slope of the \(IS\) curve becomes positive, we can draw the short-run equilibrium as we did in Figs. 1 and 2. As shown in Fig. 3, when \({F}_{21}\) is positive, the slope of the \(EE\) curve is positive, and the equity price falls more sharply in response to an increase in the debt–capital ratio. As mentioned above, the key factors that make the slope of the \(EE\) curve positive are the absolute values of \({l}_{r}^{s}\) and \({\alpha }_{r}\), which represent bank and household behavior, respectively.

Similarly, the effect of the interbank rate is also undetermined. The reason for this is that the effect of the interbank rate on \(EE\) curves is ambiguous:

When the absolute value of \({l}_{{i}^{a}}^{s}\) is large, \({r}_{{i}^{a}}\) will be negative. In addition, when the absolute values of \({\alpha }_{r}\) and \({l}_{r}^{s}\) are large, \({q}_{{i}^{a}}\) will be negative.Footnote 30

Finally, let us consider the effect of the equity–capital ratio on the profit rate and equity price. An increase in the equity–capital ratio moves the \(IS\) curve rightward and the \(EE\) curve downward. These movements are canceled, and the profit rate remains constant. By contrast, the increase in the equity–capital ratio decreases the equity price:

Our model shows that the debt–capital ratio may have a negative impact on investment and the profit rate. This result is different from that of Ryoo (2013a, b). Ryoo assumes that the accumulation rate is independent of the debt–capital ratio. In his model, an increase in the debt–capital ratio leads to an increase in the profit rate, and, therefore, does not exhibit “the paradox of debt.”

Proposition 1

In the short run, the effects of the debt–capital ratio and interbank rate will be ambiguous. These effects will largely depend on the sensitivity of bank lending to the profit rate and the degree of substitutability between the household’s equity and money.

Proposition 2

In the short run, an increase in the equity–capital ratio keeps the profit rate constant and decreases the equity price.

6 Dynamic model

6.1 Dynamic model and the steady state

In this section, we construct a dynamic model to analyze the characteristics of the steady state. We express the dynamic system through the differential equations. So far, we have treated the debt–capital ratio \(l\), equity–capital ratio \(e\), and interbank rate \({i}^{a}\) as exogenous variables. We also formulate the monetary policy rule, incorporate the dynamic equation of the interbank rate, and examine the effectiveness or limitations of monetary policy in ensuring the stability of the economy.

First, let us derive the dynamic equation of the debt–capital ratio \(l\). Taking the logarithmic derivative of the debt–capital ratio from the definition of \(l\), we have:

In our model, the debt–capital ratio is subject to bank lending behavior. Considering Eqs. (11), (12c), and (12e), we can derive the dynamic equation of the debt–capital ratio:

Similarly, we express the equity–capital ratio as follows:

Considering Eq. (12f), we can derive the dynamic equation of the equity–capital ratio:

The policy variable that the central bank can control is the interbank rate. Since, in our model, the consumer goods price remains unchanged, the main purpose of policy is to accommodate business cycles.Footnote 31 When the current profit rate is higher than expected, the central bank will increase the interbank rate. We use the normal long-run level of the profit rate \({r}_{n}\) as the central bank’s expected level, which is given exogenously. Then, the behavior of the interbank rate through time is given by:

where \(\rho\) is the speed of adjustment to the profit rate.

Considering \({r}_{e}=0\) and substituting the other results of the static analysis into Eqs. (20b), (20d), and (20e), we have:

We represent the steady state by \(l={l}^{*}\), \(e={e}^{*},\) and \({i}^{a}={i}^{a*}\), and assume the capital accumulation rate is positive. We have the following steady-state relationships:

At the steady state, the debt–capital ratio \({l}^{*}\) and the equity–capital ratio \({e}^{*}\) remain constant and the actual profit rate is equal to the normal long-run level.

In the dynamic system that consists of Eqs. (21a–21c), Eqs. (21a) and (21c) are independent of the equity–capital ratio. The dynamics of variables \(l\) and \({i}^{a}\) are captured by two equations, (21a) and (21c). Furthermore, calculating the value of \(\dot{{e}_{e}}\) evaluated at the steady state, we obtain \(\dot{{e}_{e}}=0\).Footnote 32 This means that the dynamics of the equity–capital ratio depend on \(l\) and \({i}^{a}\). Therefore, we will focus on Eqs. (21a) and (21c) to analyze the stability of the steady state.

6.2 Monetary policy and the stability of the economy

We derive the Jacobian matrix \({M}_{d}\) from Eqs. (21a) and (21c). The values of each element of the matrix \({M}_{d}\) are evaluated at the steady state:

From the Routh–Hurwitz conditions, the dynamic system represented by Eqs. (23a–23e) is stable if and only if the following conditions are satisfied:

We can derive the following conditions to satisfy Eqs. (24a) and (24b):

Assuming that the absolute value of \({l}_{{i}^{a}}^{s}\) is greater than that of \({k}_{{i}^{a}}\), the increase in the interbank rate will suppress the economy:

Under the assumption (25e), the following equations are satisfied:

Let us consider each stability condition. First, Eq. (25b) is independent of the factor of monetary policy ρ. We notice that this condition depends on economic agents’ behaviors. This condition may be satisfied when the absolute value of \({\alpha }_{l}\) is small; otherwise, there is always the possibility that the economy will become unstable endogenously. Unless the system satisfies Eq. (25b), monetary policy is not directly effective in stabilizing the economy. To stabilize the economy, the central bank and the government must implement regulations and rules to keep the financial markets transparent and prevent households’ excessive reactions to the debt–capital ratio.

Furthermore, even if the system satisfies Eq. (25b), the central bank has to adjust the speed of the interbank rate ρ to satisfy condition (25a). Since ∆ is positive, when the debt–capital ratio is high, A may be negative:

In that case, when the absolute value of \({\alpha }_{l}\) is high, the central bank must increase the value of \(\rho\) for the stability of the economy.

The appropriate value of \(\rho\) that stabilizes the economy depends on a number of economic factors, including the degree of substitutability between the household’s equity and money, and the sensitivity of the investment to the profit rate. The central bank considers all of these factors and has to choose the appropriate adjustment speed ρ. This means that monetary policy may have a stabilizing effect in theory, although there would be considerable difficulties in achieving stability in practice.

Let us examine the effects of monetary policy. We suppose that the economy has a high debt–capital ratio. In this situation, the risk of both the borrower and the lender tends to become high. The profit rate and bank lending decrease. Then, the central bank will lower the interbank rate to increase the profit rate and keep it within the appropriate range. The lending rate and the profit rate begin to decrease and increase, respectively. However, the debt–capital ratio is still high, and the increase in the profit rate will slowly increase the investment. In a short time, the debt–capital ratio will decrease.

Figure 4 depicts a phase diagram in the stable case. We suppose that \({T}_{1}\) and \({T}_{2}\) are positive, and \({R}_{1}\) and \({R}_{2}\) are negative. In a stable economy, the effects of the debt–capital ratio on the household portfolio are less sensitive than that in the unstable economy. Therefore, the absolute value of T1 is small, and the slope of \(\dot{i}^{a} = 0\) is steeper than that of \(\dot{l} = 0\).

In this case, if the central bank chooses the interbank rate appropriately, the profit rate and debt–capital ratio will move moderately. Hence, the economy will converge to the steady state cyclically.

In the unstable economy, the household tends to become sensitive to the debt–capital ratio. In this situation, an increase in the debt–capital ratio significantly decreases the profit rate. Although the central bank will decrease the interbank rate to increase the profit, if the speed of the adjustment ρ is low, the effect of the interbank rate on the economy will be weak. Even if the central bank continues to decrease the interbank rate, the profit rate and the accumulation rate remain low and the debt–capital ratio will increase. The economy cannot converge to the steady state and will be on the divergence path.

Above all, financial instability may occur, because economic agents operate under uncertainty and the real and financial factors are interdependent. To avoid financial instability, the central bank and government implement regulations, along with monetary policy, to promote a moderate reaction by economic agents to shocks. Relevant regulations for financial asset holders play a crucial role in stabilizing the economy. Furthermore, the central bank has to choose an appropriate value for ρ to stabilize the economy.

Proposition 3.

The economy can always become unstable endogenously.

Proposition 4.

To stabilize the economy, the following conditions have to be satisfied: (1) the central bank and government implement regulations to promote a moderate reaction by economic agents to shocks; and (2) the central bank has to choose an appropriate adjustment speed of the interbank rate in response to economic agents’ behaviors.

7 Conclusions

We construct a dynamic macroeconomic model using the differential equations included in the debt–capital ratio, equity–capital ratio, and interest rates in monetary policy rules. We show that when the degree of substitutability between the household’s equity and money with respect to the debt–capital ratio is high, the steady state becomes unstable. In addition, we consider the effectiveness of monetary policy in stabilizing the economy. However, in the modern capitalist economy, the stability conditions are not always satisfied. In an unstable economy, an increase in the debt–capital ratio causes a subsequent recession. Once the economy diverges from the stable path, it is difficult to return it to the steady state. This result corresponds with the financial instability hypothesis that Minsky proposed. To stabilize the economy, the government and central bank must formulate some loan regulations and design a robust financial system. Furthermore, the central bank considers all economic behaviors and has to choose an appropriate adjustment speed \(\rho\).

There are a few possible extensions to our model. First, financial instability must be quantitatively analyzed and the stable region in parameter space must be determined using numerical researchFootnote 33. Second, monetary policy must be enhanced with price flexibility. Finally, as the advancement of globalization may cause a worldwide financial crisis, an open economy model must be extended and stability must be investigated in the context of the global economy.

Notes

In addition, Nishi (2012) focuses on the Minskian taxonomy of firms’ financial structure (hedge, speculative, and Ponzi types) and analyzes its relationship with an economic-growth regime (debt‐led and debt‐burdened regimes).

Bernanke and Blinder (1988) provide a model for analyzing the role of bank loans in macroeconomic activity. However, their intention is to reconsider the standard IS–LM model; consequently, they do not examine the instability of the economy.

IS stands for investment/saving, while LM stands for liquidity preference/money supply.

In Keynes’ (1936) words, “In my Treatise on Money (vol. ii, p. 195) I pointed out that when a company’s shares are quoted very high, so that it can raise more capital by issuing more shares on favorable terms, this has the same effect as if it could borrow at a low rate of interest” (p. 151).

Tobin (1969) illustrates a general framework for monetary analysis. Our model is similar to Tobin’s model in that he abandoned the perfect substitutability assumption in relation to financial assets. However, there are some differences between our model and that of Tobin: we do not adopt the q-theory of investment for two reasons. First, the validity of the q-theory of investment has not been fully verified despite much empirical research [Chrinko (1993) and Oliner et al. (1995)]. Second, our model separates the investment decision from the price of equity. This is a corollary derived from our model, which treats the financial behaviors of households and firms independently. Our model also differs from Tobin’s model in that it considers the role of banks in credit creation. Finally, we extend a static model and perform a dynamic analysis.

Asada (2014) formulates a series of mathematical macro dynamic models that contribute to the theoretical analysis of financial instability, resulting in a four-dimensional model of flexible prices with a central bank’s monetary stabilization policy. Our model, by contrast, is a dynamic model of fixed prices.

The choice of interest rate, rather than money supply, as a monetary policy instrument is common in the recent literature. For example, Asada (2014), Isaac (2009), and Lavoie (2006) analyze the effect of monetary policy from the post-Keynesian viewpoint. The same trend can also be seen in new-Keynesian literature. Romer (2000) proposes the IS–MP model as a substitute for the IS–LM model. One potential reason for this is that the central banks in almost all industrialized countries have recently been controlling the real interest rate. For a given inflation rate, the real rate rule is a horizontal line in the output-real rate space. Romer refers to this line as the MP curve, different from the LM curve.

See Hicks (1956).

Hein (2007) investigates the stability conditions in the long run and then focuses on the analysis of the steady state. He finds that the long-run equilibrium value of the debt–capital ratio is positive and stable only if interest rates are extremely high and if the short-run equilibrium exhibits the ‘debt-led’ growth regime. However, this conclusion triggered some debates. Sasaki and Fujita (2012) point out that Hein’s conclusion crucially depends on the assumption that the retention ratio of firms equals unity. In addition, although Hein (2013) replaces a given retention rate with a given dividend rate, Franke (2016) reveals that in the model, the retained earnings of the firms will be non-positive in a long-run financial equilibrium.

The balance sheet shows that the central bank controls the interbank rate through the call market.

Under these assumptions, in our model, we can ignore the retained earnings of the bank and the central bank.

Symbols with plus signs describe sources of funds and those with negative signs indicate uses of funds.

This assumption of the firm’s behavior follows Lavoie and Godley (2001).

This formulation is different from that of Asada (1999). Asada formulates a model in which real and financial decisions are simultaneously determined to maximize the value of the firm. By contrast, since we follow Lavoie and Godley (2001), the firm’s real and financial decisions are separately determined. Therefore, the budget constraint shown as Eq. (12a) plays no role in the investment decision. These assumptions of Lavoie and Godley are often used [e.g., Franke and Semmler (1991) and Ryoo (2013a, b)].

With regard to the analysis of the investment decision, Minsky insists “[t]he capitalization of the prospective yields to generate a demand price for capital assets is a more natural way to approach the problem of fluctuating investment than the marginal efficiency of capital schedule” (Minsky 1975, p.98). However, we use the marginal efficiency of capital approach based on Keynes (1936), who writes, “the rate of investment will be pushed to the point on the investment demand schedule where the marginal efficiency of capital in general is equal to the market rate of interest” (p. 136–137). Although our model is similar to that of Adachi and Miyake (2015), there is difference in the definition of the marginal efficiency of capital. See footnote 18.

By contrast, Asada (1999) focuses on the theory of the “principle of increasing risk” proposed by Kalecki (1937), and does not consider the state of expectations. Asada presents the borrower’s risk as an increasing function of the debt–capital ratio and substitutes it into the model as an additional cost function. The increase in the debt–capital ratio influences investment via the cost function.

Keynes argues, “[i]f there is an increased investment in any given type of capital during any period of time, the marginal efficiency of that type of capital will diminish as the investment in it is increased, partly because the prospective yield will fall as the supply of that type of capital is increased, and partly because, as a rule, pressure on the facilities for producing that type of capital will cause its supply price to increase; the second of these factors being usually the more important in producing equilibrium in the short run, but the longer the period in view the more does the first factor take its place” (Keynes 1936, p. 136). In the model, \(\phi\) corresponds to what Keynes called the marginal efficiency of capital; we assume that \(Q/pI\), the marginal efficiency of capital decreases as \(k\) increases. The assumption \({\phi }_{k}<0\) is nothing but a formulation of the first factor.

This assumption ensures that the maximization problem has a meaningful solution.

Keynes (1936) writes, “[t]he considerations upon which expectations of prospective yields are based are partly existing facts which we can assume to be known more or less for certain, and partly future events which can only be forecasted with more or less confidence.” We focus on “existing facts” and denote them using the present profit and the debt–capital ratio. For simplicity, we ignore “future events.”

It may be said that this formulation also expresses the borrower’s risk. See also footnote 25

The characteristics of the investment function in our model are to a large extent the same as those in Asada’s model (1999, 2001). However, there are some differences in the approach and derivation. In addition, Asada focuses only on the investment decision. The model simultaneously includes both the borrower’s risk and the lender’s risk in the investment decision. By contrast, we formulate the lender’s risk as part of bank behavior.

The bank does not hold excess reserves, because they do not yield interest.

For simplicity, in our model, the central bank supplies the call loans that are requested by the bank.

Keynes (1936) stressed the importance of the lender’s risk. We note the following remarks made by Keynes: “But where a system of borrowing and lending exists, by which I mean the granting of loans with a margin of real or personal security, a second type of risk is relevant which we may call the lender's risk. This may be due either to moral hazard, i.e., voluntary default or other means of escape, possibly lawful, from the fulfillment of the obligation, or to the possible insufficiency of the margin of security, i.e., involuntary default due to the disappointment of expectation.” In our model, the lender’s risk has an indirect influence through the bank’s cost function.

To allow banks to make profits, we assume that the loan rate exceeds the deposit rate, \(i>{i}^{d}\).

For simplicity, we assume that \({i}^{b}\) remains constant throughout this study.

We can express the demand for deposits as \({\dot{D}}^{d}=\lambda \dot{{M}^{d}}\). \(\lambda\) is constant.

The portfolio behavior functions follow Tobin (1969).

\(\frac{dq}{{di^{a} }} = \frac{{k_{{i}^{a}} \left[ {\alpha_{r} \cdot s^{h} + l_{r}^{s} - \left( {1 - \alpha } \right)s_{1} \left( {\frac{1}{\tau } + 1 - v} \right)} \right] - l_{{i}^{a}}^{s} \left\{ {k_{r} - [s_{1} \left( {\frac{1}{\tau } + 1 - v} \right) + v]} \right\}}}{{\left( {1 - s_{2} } \right)e\Delta }}.\)

Taylor (1993) proposes that the nominal interest rate should respond to the divergence of actual inflation rates from target inflation rates and of actual GDP from potential GDP.

References

Adachi H, Miyake A (2015) A macrodynamic analysis of financial instability. In: Adachi H, Nakamura T, Osumi Y (eds) Studies in medium-run macroeconomics. World Scientific Publishing, Singapore, pp 117–146. https://doi.org/10.1142/9789814619585_0005

Asada T (1999) Investment and finance: a theoretical approach. Ann Oper Res 89:75–87

Asada T (2001) Nonlinear dynamics of debt and capital: a post-Keynesian analysis. In: Japan Association for Evolutionary Economics and Y. Aruka (eds.) Evolutionary controversies in economics: a new transdisciplinary approach, Springer, Tokyo, pp. 73–87

Asada T (2014) Mathematical modeling of financial instability and macroeconomic stabilization policies. In: Dieci R, He XZ, Hommes C (eds) Nonlinear economic dynamics and financial modelling: essays in honour of Carl Chiarella. Springer, Switzerland, pp 41–63. https://doi.org/10.1007/978-3-319-07470-2_5

Bernanke BS, Blinder AS (1988) Credit, money, and aggregate demand. Am Econ Rev 78:435–439. https://doi.org/10.3386/w2534

Charles S (2008) A post-Keynesian model of accumulation with a Minskyan financial structure. Rev Political Econ 20(3):319–331. https://doi.org/10.1080/09538250802170236

Charles S (2016) Is Minsky’s financial instability hypothesis valid? Camb J Econ 40:427–436. https://doi.org/10.1093/cje/bev022

Chrinko R (1993) Business fixed investment spending: modeling strategies, empirical results, and policy implications. J Econ Lit 31(4):1875–1911

Dos Santos CH (2005) A stock-flow consistent general framework for formal Minskian analyses of closed economies. J Post Keynesian Econ 27:711–735

Dos Santos CH (2006) Keynesian theorizing during hard times: stock-flow consistent model as an unexplored ‘frontier’ of Keynesian macroeconomics. Camb J Econ 30:541–556. https://doi.org/10.1093/cje/bei069

Fazzari S, Ferri P, Greenberg E (2008) Cash flow, investment, and Keynes-Minsky cycles. J Econ Behav Organ 65:555–572. https://doi.org/10.1016/j.jebo.2005.11.007

Fisher I (1933) The debt-deflation theory of great depressions. Econometrica 1(4):337–357. https://doi.org/10.2307/1907327

Fontana G (2009) Money, uncertainty and time. Routledge, Abingdon. https://doi.org/10.4324/9780203503294

Franke R (2016) A supplementary note on professor Hein’s (2013) version of A Kaleckian Debt Accumulation. Metroeconomica 67(3):529–550. https://doi.org/10.1111/meca.12110|

Franke R, Semmler W (1991) A dynamical macroeconomic growth model with external financing of firms: a numerical stability analysis. In: Nell E, Semmler W (eds) Nicholas Kaldor and Mainstream Economics. Macmillan, London

Hein E (2007) Interest rate, debt, distribution and capital accumulation in a post-Kaleckian model. Metroeconomica 58(2):310–339. https://doi.org/10.1111/j.1467-999x.2007.00270.x

Hein E (2013) On the importance of the retention ratio in a Kaleckian model with debt accumulation-a comment on Sasaki and Fujita (2012). Metroeconomica 64(1):186–196. https://doi.org/10.1111/meca.12002|

Hicks JR (1956) Methods of Dynamic Analysis. In: 25 Economic Essays in Honor of Erik Lindahl, Stockholm: EKonomisk Tidskrift, reprinted in Hicks, J. (1982), Money, Interest, and Wage: collected essays on economic theory of John Hicks, vol 2.2, Clarendon Press, Oxford

Isaac AG (2009) Monetary and fiscal interactions: short-run and long-run implications. Metroeconomica 60(1):197–223. https://doi.org/10.1111/j.1467-999x.2008.00342.x

Kalecki M (1937) The principle of increasing risk. Economica 14:440–447. https://doi.org/10.2307/2626879

Keynes JM (1936) The general theory of employment, interest, and money. Macmillan, London

Lavoie M (2006) A post-Keynesian amendment to the new consensus on monetary policy. Metroeconomica 57:165–192. https://doi.org/10.1111/j.1467-999x.2006.00238.x

Lavoie M, Godley W (2001) Kaleckian models of growth in a coherent stock-flow monetary framework: a Kaldorian view. J Post Keynesian Econ 24(2):277–311. https://doi.org/10.1080/01603477.2001.11490327

Lima GT, Meirelles AJ (2007) Macrodynamics of debt regimes, financial instability and growth. Camb J Econ 31:563–580. https://doi.org/10.1093/cje/bel042

Minsky HP (1975) John Maynard Keynes. Columbia University Press, New York. https://doi.org/10.1007/978-1-349-02679-1

Minsky HP (1986) Stabilizing an unstable economy. Yale University Press, New Haven

Nishi H (2012) A dynamic analysis of debt-led and debt-burdened growth regimes with Minskian financial structure. Metroeconomica 63:634–660. https://doi.org/10.1111/j.1467-999X.2012.04158.x

Oliner S, Rudebusch G, Sichel D (1995) New and old models of business investment: a comparison of forecasting performance. J Money, Credit Bank 27(3):806–826. https://doi.org/10.2307/2077752

Romer D (2000) Keynesian Macroeconomics without the LM Curve. J Econ Perspect 14(2):149–169. https://doi.org/10.1257/jep.14.2.149

Ryoo S (2010) Long waves and short cycles in a model of endogenous financial fragility. J Econ Behav Organ 74(3):163–186. https://doi.org/10.1016/j.jebo.2010.03.015

Ryoo S (2013a) The paradox of debt and Minsky’s financial instability hypothesis. Metroeconomica 64(1):1–24. https://doi.org/10.1111/j.1467-999X.2012.04163.x

Ryoo S (2013b) Bank profitability, leverage and financial instability: Minsky-Harrod model. Camb J Econ 37:1127–1160. https://doi.org/10.1093/cje/bes078

Sasaki H, Fujita M (2012) The importance of the retention ratio in a Kaleckian model with debt accumulation. Metroeconomica 63(3):417–428. https://doi.org/10.1111/j.1467-999X.2011.04143.x|

Taylor JB (1993) Discretion versus policy rules in practice. Carnegie-Rochester Conf Series Public Policy 39:195–214

Taylor L, O’Connell SA (1985) A Minsky crisis. Quart J Econ 100:871–885. https://doi.org/10.1093/qje/100.supplement.871

Tobin J (1969) A general equilibrium approach to monetary theory. J Money, Credit Bank 1:15–29. https://doi.org/10.2307/1991374

Acknowledgements

I wish to thank two anonymous referees and Shin Imoto (Onomichi City University) for their many valuable comments. Any errors remaining in this study are the authors’ sole responsibility.

Funding

This study was funded by Fukui Prefectural University.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author has no conflict of interest, including funding sources and/or any entity.

Ethical approval

The manuscript does not contain any studies performed by the author that include human participants or animals.

Informed consent

Informed consent is not required for this type of study.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

About this article

Cite this article

Watanabe, T. Reconsideration of the IS–LM model and limitations of monetary policy: a Tobin–Minsky model. Evolut Inst Econ Rev 18, 103–129 (2021). https://doi.org/10.1007/s40844-020-00189-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40844-020-00189-8