Abstract

In this chapter, we apply the mean-expected tail loss (ETL) portfolio construction to fundamental data from the US equity market during the period between 2000 and 2013. Consensus temporary earnings forecasting (CTEF), US expected return (USER), price momentum (PM), and McKinley Capital Quant Score (MQ) variables have been examined and the out-of-sample scenarios are generated by using time series model with multivariate normal tempered stable (MNTS) innovations. We find that these variables are valuable in US portfolio construction and the mean-ETL portfolios can produce statistically significant active returns. We compare these mean-ETL portfolios and find the portfolio based on CTEF variable that performs the best.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

7.1 Introduction

Fundamental data have been used as the criteria to select stock for a long time in both industry and academic work. For example, Jaffe, Keim, and Westerfield (1989) find the relation between stock returns and the earnings to price ratio to be significant. Fama and French (1992) add fundamental data of stocks, size and book-to-market to explain stock returns. Jegadeesh and Titman (1993) show the price momentum effect that buying stocks that performed well in the past and selling stocks that performed poorly in the past can generate statistically significant positive returns over both 3-month and 12-month holding periods. Bloch, Guerard, Markowitz, Todd, and Xu (1993) develop an underlying composite model to describe stock returns using fundamental variables. By adding the consensus earnings forecasting (CTEF) and price momentum (PM) variables to this model, Guerard, Gültekin, and Stone (1997) develop the US Expected Returns (USER) stock selection model.

As the pioneering work, Markowitz (1952 1959) uses a mean-variance portfolio construction model to maximize the portfolio return for a given level of risk. In Markowitz’s mean-variance portfolio optimization, the portfolio risk is represented by the portfolio variance. There are many previous works that have been done to examine the efficiency of mean-variance portfolio on fundamental variables in the stock markets. For example, Guerard, Rachev, and Shao (2013) show that both mean-variance and mean-ETL portfolios on global expected returns (GLER) model are capable of generating statistically significant active returns.

The organization of this chapter is as follows, Sect. 7.2 provides an overview of the importance of different fundamental variables used in the mean-ETL portfolio construction. Section 7.3 describes the methodology used to generate the scenarios and construct the portfolios based on the fundamental variables. Simulation results of the mean-ETL portfolios during the period 1990–2013 are presented in Sect. 7.4 and we provide the conclusions in Sect. 7.5.

7.2 Fundamental Variables

In this section, we discuss different fundamental variables that are used to construct the US mean-ETL portfolio in this study which are consensus temporary earnings forecasting (CTEF), price momentum (PM), US expected return (USER) and McKinley Capital Quant Score (MQ) variables.

As one of the most important fundamental variables, earning expectation has been used for stock selection for many years. Graham, Dodd, and Cottle (1934) select stocks based on fundamental valuation techniques, and show that stocks with higher earnings-per-share (EPS) outperform the ones with lower EPS. In 1975, Lynch, Jones, and Ryan collected and published consensus statistics for EPS forecasting, forming the beginning of what is now known as the Institutional Brokerage Estimation Service (I/B/E/S) database (Brown 1999). Besides the original earnings yield, Guerard et~al. (1997) also find that the earnings revision (EREV) and earnings breadth (EB) which represents the direction of the revisions are also important in stock selection. Guerard et~al. (1997) create CTEF variable which is a weighted sum of the forecasted earnings yield (FEP) from I/B/E/S, EREV, and EB. Guerard, Blin, and Bender (1998) find that a value-based model with CTEF variables produces statistically significant models for stock selection in the US and Japanese markets. More recently, using the CTEF variables of global equities, Xia, Min, and Deng (2015) show that the mean-variance portfolio construction produces robust returns. Similarly, also using the CTEF variables of global equities, Shao, Rachev, and Mu (2015) show that robust returns can be generated via the mean-ETL portfolio construction.

In the global expected return model (see Guerard et~al. 2013), CTEF and PM variables account for the majority of the forecast performance. The role of PM variable in stock selection has also been studied for a long time (Jegadeesh & Titman 1993) find that 3-month, quarterly, 6-month, and 1-year PM variables are statistically significant with excess returns. Grinblatt, Titman, and Wermers (1995) find that 77 % of the mutual funds are buying stocks with better performance history. Chan, Hameed, and Tong (2000) report that trading strategies based on PM in international equity markets generate statistically significant returns. Brush (2001) shows that quarterly information coefficient (IC) of 3-month PM variable is 0.073, which is higher than the monthly IC of 0.053. The PM variable in this study is defined as the price from last month divided by the price from12 months prior (see Guerard et~al. 2013, for details). However, implementing portfolio construction using PM variable on the US or global markets has not been studied before. We examine the mean-ETL-PM portfolio construction on US market in this chapter. Wealso test the same portfolio construction technique on the McKinley Capital Quant Score (MQ) variable which is the equally weighted sum of CTEF and PM variables.

By adding CTEF and PM variables to the original stock selection model developed by Bloch et~al. (1993), Guerard et~al. (1997) construct the USER model based on fundamental data in US market. The USER variable we use in this study to construct the portfolio is the same as the one used in the USER model developed by Guerard et~al. (1997). At time \( t+1 \), the USER variable is a weighted sum of certain fundamental variables and their derivatives at time t. These fundamental variables and their derivatives include:

-

1.

earnings—price ratio (EP);

-

2.

book value—price ratio (BP);

-

3.

cash flow—price ratio (CP);

-

4.

sales—price ratio (SP);

-

5.

current EP ratio divided by average EP ratio over the last 5 years (REP);

-

6.

current BP ratio divided by average BP ratio over the last 5 years (RBP);

-

7.

current CP ratio divided by average CP ratio over the last 5 years (RCP);

-

8.

current SP ratio divided by average SP ratio over the last 5 years (RSP);

-

9.

csensus temporary earnings forecasting (CTEF);

-

10.

price momentum (PM).

For more details on the methodology and estimation of the USER model, the reader is referred to Guerard et~al. (2013). Guerard et~al. (2013) also report the mean-variance portfolio using USER data can generate an active annual return of 10.70 % with an information ratio of 1.12 and a t-statistic of 3.68 during the period 1999–2009. In this chapter, the mean-ETL portfolio on the USER variable during the period 2000–2013 is examined.

7.3 Mean-ETL Portfolio Construction

In this section, we describe the mean-ETL portfolio construction methodology used in this chapter. Markowitz’s mean-variance portfolio optimization (1952, 1959) is to maximize the portfolio expected return at a given level of portfolio risk. In Markowitz’s framework, the portfolio expected return is measured by the sum of the security weights multiplied by their respective expected return, and portfolio risk is measured by the variance of portfolio. Instead of using the portfolio variance as the risk measure, mean-ETL portfolio optimization uses expected-tailed loss (ETL), also known as conditional Value-at-Risk (CVaR) or the expected shortfall (ES), as the risk measure. Many recent research works show the mean-ETL portfolio construction can generate robust portfolios. For example, Shao and Rachev (2013) show that the mean-ETL portfolio construction based on GLER variable generate statistically significant active return on the global markets.

7.3.1 Mean-ETL Framework

Before introducing the definition of ETL, we need to give the definition of value-at-risk (VaR), which is one of the most frequently used risk measures in the finance industry:

Let X represent the distribution of portfolio returns; then, the VaR of the portfolio at a \( \left(1-\upalpha \right)100\,\% \) confidence level can be defined as the lower α quantile of the return distribution:

Given the definition of VaR, ETL is defined as the average loss beyond the VaR threshold:

As a coherent risk measure (Artzner, Delbaen, Eber, & Heath 1999), ETL has many good properties for the purpose of portfolio risk management. Rockafellar and Uryasev (2000 2002) provide a detailed discussion of the properties of CVaR when used as a measure of risk. The main reasons that we are using ETL instead of VaR as the risk measure in portfolio construction are summarized by Rachev, Martin, Racheva, and Stoyanov (2009): (1) ETL gives a more informative view on extreme events; (2) mean-ETL portfolio optimization problem is a convex problem, which has a unique solution; (3) as a coherent risk measure with the sub-additivity property, ETL accounts for the effect of diversification. For more details on the calculation of ETL in portfolio optimization, the reader is referred to Shao et~al. (2015).

Using ETL as the risk measure, there are several ways to formulate the mean-ETL optimization problem (see Rachev, Stoyanov, and Fabozzi (2007) for details). In this study, we add a few constraints to the portfolio construction: (1) the portfolio needs to be a long only portfolio; (2) maximum weights of single asset cannot exceed 4 %; (3) monthly turnover rate of the portfolio is below or equal to 8 %. We formalize our mean-ETL optimization framework as follows:

where w t is a column vector of optimal securities weights in the portfolio and \( {\hat{\mathbf{Y}}}_t^{(s)} \) is a column vector that contains the sth scenario of all N securities:

and \( {\hat{\mathbf{Y}}}_t \) should be a matrix that consists of all S scenarios at time t:

In this study of mean-ETL portfolio construction, α for ETL is chosen to be 5 % and the risk-averse parameter λ is chosen to be 1.

7.3.2 Scenario Generator

With the above-mentioned mean-ETL portfolio construction framework, the scenarios of fundamental variables, \( {\hat{\mathbf{Y}}}_t \), are required for the optimization.

In this study, we use Y n,t to denote fundamental variable values of the n th stock at time t, where \( 1\le t\le T,\kern0.5em 1\le n\le N \). Here, T and N are the number of data points and the number of securities, respectively. The fundamental variable is chosen from USER, CTEF, PM, and MQ in this study. Before fitting the time series model on the fundamental variable data, we perform the following transformations for the n th stock:

where N denotes the number of securities in the portfolio.

We choose the time series model autoregressive moving average (ARMA) generalized autoregressive conditional heteroskedastic (GARCH) with multivariate normal tempered stable (MNTS) innovations to model and generate the scenarios of time series y n,t . The ARMA-GARCH-MNTS model is a flexible model to capture volatility clustering, heavy tails, asymmetric dependence structure and the dependency between different stocks. The AMRA-GARCH-MNTS model used to model time series y n,t in this study is described as follows:

where \( n=1,2,\cdots, N \) and the joint innovation term \( {\boldsymbol{\eta}}_{\boldsymbol{t}}=\left({\eta}_{1,t},{\eta}_{2,t},\cdots, {\eta}_{N,t}\right) \) is generated from MNTS(α, θ, β, γ, μ, ρ). And the N-dim MNTS(α, θ, β, γ, μ, ρ) is defined as:

where \( \boldsymbol{\upmu} ={\left({\mu}_1,{\mu}_2,\dots, {\mu}_N\right)}^{\mathrm{T}} \), \( \boldsymbol{\upbeta} ={\left({\beta}_1,{\beta}_2,\dots, {\beta}_N\right)}^{\mathrm{T}} \), \( \boldsymbol{\upgamma} ={\left({\gamma}_1,{\gamma}_2,\dots, {\gamma}_N\right)}^{\mathrm{T}} \) and \( \boldsymbol{\upgamma} >0 \). CT is a classical tempered stable (CTS) subordinator with parameter (α, θ), where \( \alpha \in \left(0,1\right) \) and \( \theta >0 \). \( \boldsymbol{\upvarepsilon} ={\left({\varepsilon}_1,{\varepsilon}_2,\dots, {\varepsilon}_N\right)}^{\mathrm{T}} \) is a N-dim standard normal distribution with covariance matrix ρ, independent of the subordinator \( CT>0 \). The reader is referred to Kim, Giacometti, Rachev, Fabozzi and Mignacca (2012) for the details on the application and estimation of MNTS in portfolio optimization.

In this chapter, we are not going into the details surrounding the estimation of ARMA-GARCH-MNTS model and the reader is referred to Shao et~al. (2015) for the estimation methodology. With the estimated ARMA-GARCH-MNTS model, we can generate the scenarios of y n,t , denoted as \( {\hat{y}}_{n,t}^s \) and it represents the sth scenario forecasting the nth stock at time t. To get the scenarios of the fundamental variables R n,t , we do the following reverse transformation:

After generating the scenarios \( {\hat{Y}}_{n,t}^s \) for each stock, we can run the portfolio optimization on different fundamental variables from US markets. The portfolio results with empirical data will be discussed in the next section.

7.4 Portfolio Results and Analysis

We generate the optimal mean-ETL portfolios during the period 2000–2013 based on the scenarios generated from ARMA-GARCH-MNTS. In this chapter, we use mean-ETL-CTEF, mean-ETL-USER, mean-ETL-MQ, and mean-ETL-PM to represent the optimal portfolios based on CTEF, USER, MQ, and PM variable, respectively. In this section, we use the Barra risk model to analyze these portfolios. The US Barra risk model was developed in Rosenberg and Marathe (1975) based on company fundamental data. The Barra attribution analyses here use the US Equity Model (USE3). The benchmark in these attribution reports is chosen to be Russell 3000 Growth index. We also offer the comparison of these portfolios in this section.

7.4.1 Attribution Reports

The attribution of mean-ETL-CTEF portfolio returns is shown in Table 7.1, and we report that the portfolio generates 14.07 % active (excess) annual return with an information ratio of 1.11 and a t-statistic of 4.15. The active return is highly statistically significant. The attribution report also shows that the stock selection produces statistically significant active annual return of 5.95 % with a t-statistic of 3.66. Moreover, the earnings yield contributes 1.24 % annual return with a t-statistic of 3.31. The mean-ETL-CTEF portfolio is based on the CTEF variable which represents the consensus earnings forecasting and revisions. The statistically significant contribution to the active returns from earnings yield shows the CTEF’s predictable ability of earnings.

In Table 7.2, we show the attribution of mean-ETL-USER portfolio returns. The mean-ETL-USER portfolio generates 9.73 % active annual return. The active return is highly statistically significant with a t-statistic of 4.26 and it has an information ratio of 1.14 which is higher than the mean-ETL-CTEF portfolio. We find that the size factor has a factor return of 5.49 % with a t-statistic of 4.05. It is also observed that the portfolio’s average exposure to the size factor is negative, indicating the mean-ETL-USER portfolio’s preference for stocks with small capitalization. Xia et~al. (2015) also have the similar observations from the mean-variance portfolio based on USER variable.

The attribution of mean-ETL-MQ portfolio returns is shown in Table 7.3 and it also produces highly statistically significant active return, 10.75 % annually. Moreover, asset selection produces 6.31 % active annual return, which has an information ratio of 1.36 and a t-statistic of 5.07. Both active return and information ratio of asset selection’s contribution is the highest among all the four portfolios under comparison.

In Table 7.4 presents the attribution of mean-ETL-PM portfolio returns is presented. The mean-ETL-PM portfolio generates active annual return of 8.51 %. The active return is statistically significant and it has an information ratio of 0.86 and a t-statistic of 3.20.

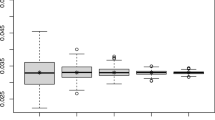

All of the four portfolios produce statistically significant active returns and they are due mostly to the asset selection. As described previously, α for mean-ETL portfolio optimization in this study is chosen to be 5 % and we want to know whether the technique can control the 5 % left tails well. Taking mean-ETL-CTEF and mean-USER-ETL portfolios as examples, we show the quantile–quantile plots of the mean-ETL portfolio monthly returns against benchmark’s in Fig 7.1. The left plot is the mean-ETL-CTEF portfolio against benchmark and the right one is the mean-ETL-USER portfolio against the benchmark. We find that the left tail of mean-ETL portfolio returns is thinner than the benchmark’s in most cases. Another interesting observation is that the return distributions of mean-ETL portfolios have even heavier right tails than the benchmark. It indicates that controlling the tail risk of portfolio does not necessarily deteriorate the right tails in this study.

7.4.2 Comparison

Figure 7.2 below shows the equity curve of mean-ETL portfolios and the benchmark portfolio during the period 2000–2013. It’s obvious that the mean-ETL-CTEF portfolio performs better than the other portfolios during this period.

To further compare these portfolios in a more quantitative way, we review their Treynor ratios and Sharpe ratios. Treynor (1965) proposes to use beta as themeasurement of volatility, which is well known as Treynor ratio, to evaluatethe performance of fund. Treynor ratio is calculated as \( T=\frac{R-{R}_{\mathrm{f}}}{\beta } \), where R is the portfolio return, R f is the risk free rate, and β is the portfolio’s beta. One year later, Sharpe (1966) used standard deviation of returns as the measurement of volatility instead of using beta. Table 7.5 presents the performance measured by different risk metrics of the four mean-ETL portfolios under comparison in this study.

All metrics consistently show that the mean-ETL-CTEF portfolio has the best performance among the four portfolios under comparison. In particular, we find that the mean-ETL-CTEF portfolio generates the highest returns while maintains the lowest volatility measured by standard deviation and β. Figure 7.3 presents the characteristic lines of mean-ETL-CTEF and the benchmark index, showing that the mean-ETL-CTEF portfolio is outperforming the benchmark index (see Treynor & Mazuy 1966, for details).

We also find that the mean-ETL-MQ portfolio slightly outperforms the other portfolios except for the CTEF portfolio as shown in Table 7.5. As we described before, the MQ variable is a combination of CTEF and PM variables. The better performance of the mean-ETL-MQ portfolio is partly due to the strong performance of CTEF variable. The mean-ETL-PM portfolio has the lowest return and highest β, making it the worst performing portfolio in the four mean-ETL portfolios. Menchero (2015) also finds that momentum pure factor portfolio is more volatile than the earnings yield factor portfolio. Nevertheless, the mean-ETL portfolio based on PM variable still outperform the benchmark and produce statistically significant active returns as mentioned in the attribution report.

7.5 Summary

In this study, we focus on US stock markets and apply the mean-ETL portfolio construction on stocks’ fundamental variables, CTEF, USER, PM, and MQ. We report that these fundamental variables continue to be very valuable for stock selection and portfolio construction. Also, the returns of the mean-ETL portfolios have thinner left tails, while not deteriorating the right tails. Mean-ETL portfolio with fundamental variables can generate statistically significant active returns in domestic market through asset selection, similar to its application to the global markets (see Guerard et~al. 2013 & Shao et~al. 2015). In this study, we also find that the mean-ETL-CTEF portfolio has the highest risk-adjusted return.

References

Artzner, P., Delbaen, F., Eber, J. M., & Heath, D. (1999). Coherent measures of risk. Mathematical Finance, 9(3), 203–228.

Bloch, M., Guerard, J., Markowitz, H., Todd, P., & Xu, G. (1993). A comparison of some aspects of the US and Japanese equity markets. Japan and the World Economy, 5(1), 3–26.

Brown, L. D. (1999). Annotated I/B/E/S Bibliography.

Brush, J. (2001). price momentum: A twenty year research effort. Columbine Newsletter.

Chan, K., Hameed, A., & Tong, W. (2000). Profitability of momentum strategies in the international equity markets. Journal of Financial and Quantitative Analysis, 35(02), 153–172.

Fama, E. F., & French, K. R. (1992). The cross‐section of expected stock returns. The Journal of Finance, 47(2), 427–465.

Graham, B., Dodd, D. L. F., & Cottle, S. (1934). Security analysis (pp. 44–45). New York: McGraw-Hill.

Grinblatt, M., Titman, S., & Wermers, R. (1995). Momentum investment strategies, portfolio performance, and herding: A study of mutual fund behavior. The American Economic Review, 1, 1088–1105.

Guerard, J. B., Blin, J., & Bender, S. (1998). Forecasting earnings composite variables, financial anomalies, and efficient Japanese and US portfolios. International Journal of Forecasting, 14(2), 255–259.

Guerard, J. B., Gültekin, M., & Stone, B. K. (1997). The role of fundamental data and analysts’ earnings breadth, forecasts, and revisions in the creation of efficient portfolios. Research in Finance, 15, 69–92.

Guerard, J. B., Rachev, S. T., & Shao, B. P. (2013). Efficient global portfolios: Big data and investment universes. IBM Journal of Research and Development, 57(5), 1–11.

Jaffe, J., Keim, D. B., & Westerfield, R. (1989). Earnings yields, market values, and stock returns. The Journal of Finance, 44(1), 135–148.

Jegadeesh, N., & Titman, S. (1993). Returns to buying winners and selling losers: Implications for stock market efficiency. The Journal of Finance, 48(1), 65–91.

Kim, Y. S., Giacometti, R., Rachev, S. T., Fabozzi, F. J., & Mignacca, D. (2012). Measuring financial risk and portfolio optimization with a non-Gaussian multivariate model. Annals of Operations Research, 201, 325–343.

Markowitz, H. (1952). Portfolio selection. The Journal of Finance, 7(1), 77–91.

Markowitz, H. (1959). Portfolio selection: efficient diversification of investments. : Yale University Press.

Menchero, J. (2015). Performance of earnings yield and momentum factors in US and international equity markets. This issue.

Rachev, S. T., Martin, R. D., Racheva, B., & Stoyanov, S. (2009). Stable ETL optimal portfolios and extreme risk management. Risk Assessment Contributions to Economics, 2009, 235–262.

Rachev, S. T., Stoyanov, S., & Fabozzi, F. J. (2007). Advanced stochastic models, risk assessment, and portfolio optimization: the ideal risk, uncertainty, and performance measures. New York: John Wiley & Sons.

Rockafellar, R. T., & Uryasev, S. (2000). Optimization of conditional value-at-risk. Journal of Risk, 3, 21–41.

Rockafellar, R. T., & Uryasev, S. (2002). Conditional value-at-risk for general loss distributions. Journal of Banking and Finance, 26, 1443–1471.

Rosenberg, B., & Marathe, V. (1975). Tests of capital asset pricing hypotheses (No. 32). University of California at Berkeley.

Shao, B. P., & Rachev, S. T. (2013). Mean-ETL optimization of a global portfolio. The Journal of Investing, 22(4), 115–119.

Shao, B. P., Rachev, S. T., & Mu, Y. (2015). Applied mean-ETL optimization in using earnings forecasts. International Journal of Forecasting, 31(2), 561–567.

Sharpe, W. F. (1966). Mutual fund performance. Journal of Business, 1, 119–138.

Treynor, J. L. (1965). How to rate management of investment funds. Harvard Business Review, 43(1), 63–75.

Treynor, J., & Mazuy, K. (1966). Can mutual funds outguess the market. Harvard Business Review, 44(4), 131–136.

Xia, H., Min, X., & Deng, S. (2015). Effectiveness of earnings forecasts in efficient global portfolio construction. International Journal of Forecasting, 31(2), 568–574.

Disclosure

The views and opinions expressed in this chapter are those of the author and do not represent or reflect those of Crabel Capital Management, LLC.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Shao, B.P. (2017). Mean-ETL Portfolio Construction in US Equity Market. In: Guerard, Jr., J. (eds) Portfolio Construction, Measurement, and Efficiency. Springer, Cham. https://doi.org/10.1007/978-3-319-33976-4_7

Download citation

DOI: https://doi.org/10.1007/978-3-319-33976-4_7

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-33974-0

Online ISBN: 978-3-319-33976-4

eBook Packages: Economics and FinanceEconomics and Finance (R0)