Abstract

The share of renewable power sources in the electricity generation mix has seen enormous growth in recent years. Generation from fluctuating renewable energy sources (Wind, Solar) has to be considered stochastic and not (fully) controllable. To align demand with volatile supply, balancing and storage capacities have to be increased. To avoid high costs of storage investments, we suggest exploiting demand side flexibility instead. This can be operationalized through scheduling of electrical loads. Prior research typically assumes that both the set of customers, as well as the flexibility endowments of the scheduling problem, are exogenously given. However, the quality of the scheduling result highly depends on the composition of the customer portfolio. Therefore, it should be designed in an optimal fashion. This includes two decisions: which customers should be part of the portfolio and how much flexibility each customer should offer. Thus, future energy retailers face a complicated decision-making problem.We present a portfolio design optimization model which includes both selecting customers to be part of the portfolio and scheduling their flexibility. Furthermore, we present exemplary results from a scenario based on empirical load and generation data.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

In recent years, power grids across the globe have seen a dramatic increase in variable generation assets [5]. At the same time, integration of these resources has not been actively addressed. Subramanian et al. [8] note that current approaches work with “today’s modest penetration levels, but will not scale [effectively] tomorrow”. A more cost-efficient integration of variable energy sources calls for a more flexible demand side. This will allow to limit the required expensive balancing and storage capacities [5]. Smart Grid systems and novel incentive schemes will play a key role to achieve this goal. Smart Grids enhance the existing grid infrastructure through the provision of bi-directional information and communication technology. In this context, the activation of the historically passive demand through demand side management (DSM) is a central theme. In general, it is expected that the power system will have to change from a system of flexible generation serving random loads to a system of flexible loads adjusting to fluctuating generation. Consequently, system operators will in the future be less concerned about handling demand uncertainty, but rather need to focus on supply uncertainty.

Prior research has established the balancing potentials offered by scheduling flexible load portfolios [8]. Apart from that, little is known with respect to forming these portfolios in the first place. Thus, it is necessary to develop methods that guide the design of demand response portfolios. We present an optimization model to guide the formation and subsequent scheduling of demand response portfolios for energy retailers. We illustrate our model using an example scenario based on empirical load and solar generation data.

2 Related Work

DSM, i.e. the active coordination of load, can offer sizeable control potentials at much lower costs than the expansion of storage capacities [7]. To maximize the benefits obtained from contracted flexible loads, operators need to optimally despatch these loads. Parvania and Fotuhi-Firuzabad [6] schedule load shifting and curtailment as well as decentral generation assets to minimize wholesale electricity costs. Using different scheduling routines, Subramanian et al. [9] show that efficient DSM can already be achieved with modest load flexibility endowments.

Besides this scheduling-oriented literature, demand response assets have also been evaluated with respect to portfolio design concerns. Abstracting from individual load dispatching, this stream of literature analyzes generic demand entities to identify efficient portfolio composition rules. Baldick et al. [1] determine the value and optimal execution of demand-interruption programs using option-pricing techniques. Deng and Xu [3] also consider interruptible load contracts and propose a mean-risk analysis to guide the portfolio design decision. Valero et al. [10] use data mining techniques to test customer demand and response options in different price scenarios.

Our work tries to connect these branches of literature by accounting for the utilization of customer-level load characteristics while at the same time accounting for prior portfolio-design activities.

3 Scenario and Optimization Model

Load scheduling decisions determine which electrical loads are served at what time. The attainable scheduling quality (with respect to a given objective) critically hinges on the composition of the underlying customer portfolio. The customer portfolio design decision needs to determine which loads to contract as well as the corresponding contracting terms. We reflect the interdependency between portfolio design and load scheduling as a two-stage problem. In the first stage, an electricity retailer determines the composition of the customer portfolio. The second stage handles the optimal load scheduling of the chosen portfolio. The main challenge is the integration of fluctuating and hence uncertain renewable generation.

In this paper, we look at the offline integrated optimization problem that simultaneously determines customer selection and load scheduling as a deterministic benchmark. We consider a set C of customers over a horizon of T time slots. Customers are indexed c = 1, …, | C | , time slots t = 1, …, | T | . Customer demand is assumed to consist of three components:

-

base load \((D_{c,t}^{B} \in \mathbb{R}_{+})\) must not be influenced and has to be satisfied at any time

-

shiftable load \((D_{c,t}^{S} \in \mathbb{R}_{+})\) can be shifted over time, although a customer’s total shiftable demand \(\sum _{t\in T}D_{c,t}^{S}\) has to be fully covered over the optimization horizon

-

interruptible load \((D_{c,t}^{I} \in \mathbb{R}_{+})\) can be served at any level from the interval \([I^{P}D_{c,t}^{I},D_{c,t}^{I}]\) at any point in time (I P ∈ [0, 1]: interrupting potential).

Fluctuating renewable energy supply is given by \(R_{t} \in \mathbb{R}_{+}\). If demand deviates from supply, the deviation has to be balanced by conventional power. The variable costs of balancing power are given by \(c^{G} \in \mathbb{R}_{+}\). We assume the resulting balancing power costs \(C^{G} \in \mathbb{R}_{0}^{+}\) to be a quadratic function to reflect increasing marginal costs c G.

Consumer portfolio design needs to decide which customers are contracted. Therefore, a subset C C of the set of customers C is selected to be part of the portfolio and split in to three subsets: inflexible customers C B, shiftable customers C S, interruptible customers C I. Note that the latter sets are not disjoint as a customer can be contracted to offer both his shiftable and interruptible load component. The scheduling variables determine for each customer how much load is shifted from one time slot to another \((X_{c,t,s}^{S} \in \mathbb{R}_{0}^{+})\) and how much interruptible load is served \((X_{c,t}^{I} \in [I^{P}D_{c,t}^{I},D_{c,t}^{I}])\). Obviously, only customer loads contracted with shifting or interruption provisions can be controlled in this fashion with non-contracted loads being merged into the base load component.

When choosing a contract that allows load shifting or interrupting, a customer cedes control to the operator and needs to be compensated with more favorable electricity rates. Let p be the retail price of base load consumption. The price of shiftable demand is then obtained by applying a discount δ S ∈ [0, 1] on the price of base load, that is δ S p. Whenever load shifting is triggered by the operator, a second cost component arises. These additional dispatch-related shifting costs depend on the load shifting distance which is a deviation-measure between a customer’s original and the realized load schedule. The cost structure of interruptible load is fairly similar. A discount factor δ I ∈ [0, 1] defines the price for interruptible load in relation to base load. Obviously, whenever load is interrupted, an electricity retailer forgoes any revenues from this load type. The concrete optimization model is presented in the Appendix.

In the following section we present preliminary results that show the influence of shifting—and interrupting discounts on the customer portfolio composition.

4 Evaluation

To evaluate our optimization model we use two different data sources. Demand data was retrieved from the Irish Social Science Data Archive.Footnote 1 This data set provides smart meter readings from over 5000 Irish homes and businesses and reports each customer’s energy consumption in 30 min intervals. As this is aggregate load, there is no detailed information on the underlying load flexibility. To extract more information from aggregate load data collections, Carpaneto and Chicco [2] suggest interpreting residential load curve collections as probability distributions. Building upon this assessment, Flath [4] suggests approximating the underlying flexibility level using the likelihood of a certain demand level. Following this approach, we derive the demand components of a given customer by splitting up the collection of smart meter readings by the 30, 60 and 85 % quantile. We cut the full demand to smoothen outliers.

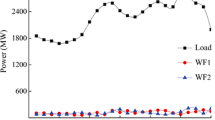

To model the variations of renewable generation, we use empirical solar generation data. We normalize the solar feed-in data to an appropriate scale of the demand level to ensure meaningful results.

To illustrate the dependencies of the portfolio composition and the optimal value from shifting—and interrupting discounts we chose the following scenario. Customers can be precluded from the portfolio. Customers that are part of the portfolio can be assigned to the following flexibility types: Base load, Shiftable, Interruptible and Flexible (a flexible customer offers both, shiftable and interruptible load).

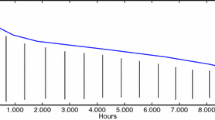

In order to minimize the influence of extreme demand and supply scenarios, we solved the integrated optimization problem ten times for each combination of δ S and δ I. Figure 1 shows the average share customers assigned to one of the flexibility types for given δ S and δ I.

Surprisingly, there are no customers precluded from the portfolio in this scenario instance. This is caused by the normalization of supply and aggregate demand. Obviously, it becomes less attractive for an electricity retailer to pursue interruptible or shiftable contracts when the corresponding discount levels increase. This is because, ceteris paribus, the usage of balancing power will become more attractive than contracting flexibility at a high revenue loss. Both, the impact of changing discounts on base load—and flexible customers and the influence of shifting discounts seems rather minor. The effect of increasing interrupting discounts, on the other hand, is stronger. The share of interruptible contracts shrinks and is substituted by shiftable contracts.

Not surprisingly, the electricity retailer’s overall profit (the optimal value, respectively) decreases with growing discounts (Fig. 2).

Similar to the portfolio composition, the shifting discount influences the optimal value less than the interrupting discount. This results from the tariff design, that ensures that all shiftable load has to be served while interruptible load can be shedded. Therefore, when contracting interruptible load, not only a discount on served load has to be granted but there are no revenues from interrupted load at all.

5 Conclusion and Outlook

Designing optimal customer portfolios includes deciding on which customers should be part of the portfolio as well as how much and which type of flexibility each customer offers. In this paper we introduce a two-stage characterization of a stochastic optimization problem to select an optimal customer portfolio referring to subsequent load scheduling. As a benchmark we introduce an integrated optimization model to illustrate the influence of price discounts on the portfolio composition using empirical input data. Finally, we present exemplary results that clarify the impact on both, the customer portfolio composition and profits attainable.

For further research we plan to investigate if the shiftable and interruptible contracts behave like complements or substitutes. We will evaluate the model for both, stochastic demand and supply and to compare the results with the benchmark solution. Finally, our future research aims to better understand the effect of customer heterogeneity with respect to flexibility assets as well as contracting specifications.

References

Baldick, R., Kolos, S., Tompaidis, S.: Interruptible electricity contracts from an electricity retailer’s point of view: valuation and optimal interruption. Oper. Res. 54(4), 627–642 (2006)

Carpaneto, E., Chicco, G.: Probabilistic characterisation of the aggregated residential load patterns. Gener. Transm. Distrib. IET 2(3), 373–382 (2008)

Deng, S.J., Xu, L.: Mean-risk efficient portfolio analysis of demand response and supply resources. Energy 34(10), 1523–1529 (2009)

Flath, C.M.: Flexible demand in smart grids-modeling and coordination. Ph.D. thesis, Karlsruhe, Karlsruher Institut für Technologie (KIT) (2013)

IEA: The power of transformation - wind, sun and the economics of flexible power systems. International Energy Agency, Paris (2014)

Parvania, M., Fotuhi-Firuzabad, M.: Demand response scheduling by stochastic scuc. IEEE Trans. Smart Grid 1(1), 89–98 (2010)

Strbac, G.: Demand side management: benefits and challenges. Energy Policy 36(12), 4419–4426 (2008)

Subramanian, A., Garcia, M., Dominguez-Garcia, A., Callaway, D., Poolla, K., Varaiya, P.: Real-time scheduling of deferrable electric loads. In: American Control Conference (ACC), 2012, pp. 3643–3650. IEEE (2012)

Subramanian, A., Garcia, M.J., Callaway, D.S., Poolla, K., Varaiya, P.: Real-time scheduling of distributed resources. IEEE Trans. Smart Grid 4(4), 2122–2130 (2013)

Valero, S., Ortiz, M., Senabre, C., Alvarez, C., Franco, F., Gabaldon, A.: Methods for customer and demand response policies selection in new electricity markets. Gener. Transm. Distrib. IET 1(1), 104–110 (2007)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix

Appendix

With the parameters and decision variables described in Sect. 3 the portfolio design problem is formulated as follows. First, we describe the model constraints. We then define the objective function and its components. Constraint (1) ensures that each customer’s overall shiftable demand is covered over the optimization horizon.

Load shifted from t to s cannot exceed the gross shiftable load in t.

Similarly, dispatched interruptible load in t \(X_{c,t}^{I}\) is bounded by the minimum dispatch amount and the gross interruptible load in t.

Total load must equal the sum of available renewable supply and dispatched conventional generation:

The supplier’s objective is to maximize profits which is given by revenues minus costs. We split the costs into two components, contracting costs and dispatching costs:

Contracting costs occur during the portfolio design phase and are driven by the discounts on the two flexibility types:

Dispatching costs reflect the usage of costly conventional generation and shifting distance penalties from shifting execution:

Rights and permissions

Copyright information

© 2016 Springer International Publishing Switzerland

About this paper

Cite this paper

Gärttner, J., Flath, C.M., Weinhardt, C. (2016). Load Shifting, Interrupting or Both? Customer Portfolio Composition in Demand Side Management. In: Fonseca, R., Weber, GW., Telhada, J. (eds) Computational Management Science. Lecture Notes in Economics and Mathematical Systems, vol 682. Springer, Cham. https://doi.org/10.1007/978-3-319-20430-7_2

Download citation

DOI: https://doi.org/10.1007/978-3-319-20430-7_2

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-20429-1

Online ISBN: 978-3-319-20430-7

eBook Packages: Business and ManagementBusiness and Management (R0)