Abstract

The purpose of this study is to evaluate the adoption and aggregated diffusion of solar electric systems in the residential sector. The goal of this paper is to try answer the following questions using an Agent-Based Model (ABM):

-

1.

Is there evidence of a delay in the aggregate adoption of solar electric systems? If so, how can the adoption be improved?

-

2.

What is the relationship between increasing electricity prices, price preference, and rate of adoption?

-

3.

What impact does changing the incentive structure have on the overall electricity savings?

The model could be used by electric utility companies, energy program administrators, and government and state agencies for planning purposes.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

8.1 Aggregated Bass Diffusion Model

One approach followed in determining the impact of incentives is to predict the diffusion of a technology using an s-curve (e.g., Bass model), and use a single parameter to model the impact of these incentives. The problem with this model is that the same characteristics are assumed for all consumers. For the Bass model [1], it is assumed that the effect of advertising and the effect of word of mouth is the same for all consumers, and all consumers are well-mixed and homogeneous (Fig. 8.1). This is obviously not the case, since consumers all behave differently, each have their own characteristics, and interact differently with other consumers. The Bass model therefore does not take into account heterogeneous market dynamics.

8.2 Agent-Based Modeling and Diffusion

Rahmandad and Sterman [2] compare Agent-Based Modeling (ABM) and Differential Equation Modeling (DEM) by creating a contagious disease diffusion model with varying network structures and levels of heterogeneity. These types of models have also been used extensively in evaluating technology diffusion. The authors mention that both models have their own strengths and weaknesses, which should be aligned with the purpose of the model. The granularity of ABM increases computational requirements and it is difficult to link the behavior of a model with its structure as its complexity increases. However ABM can capture diverse relationships among individuals with heterogeneous attributes. For DEM, individuals in each stock (compartment) are assumed to be homogeneous and well mixed, which is not always an accurate assumption; however, it is more computationally efficient. According to the authors, a trade-off needs to be made between keeping a model simple that can be analyzed thoroughly, or disaggregated to capture heterogeneous attributes and relationships of individuals.

The authors created an AB model of the deterministic Susceptible, Exposed, Infected, Removed (SEIR) model, with the same parameters. The AB model was created using five network structures (fully connected, random, small world, scale-free, and lattice), and evaluated with both homogeneous and heterogeneous agents. It was determined that for a highly connected network (fully connected) diffusion for ABM was the closest to DEM, while networks with high clustering (lattice) had a slower rate of diffusion. This is understandable since connected networks allow diseases to spread easily to all other individuals, while for clustered networks the disease can only spread easily to local individuals that are part of the same cluster. For heterogeneous individuals, the initial growth accelerated faster, however the total number of infected individuals reduced. This is because high-contact individuals become infected sooner but are also removed sooner, therefore the number of potential infected high-contact individuals reduce. This is an important concept for technology diffusion that will be discussed under the analysis section.

Bohlmann et al. [3] made use of ABM to examine the effect of different network structures and interpersonal and intersegment communication on the diffusion of a technology. They considered two different types of agents, namely innovators and followers, and used four different network structures (random, cellular automata, small-world, and power-law networks). First, they examined the effect of different network structures and different adoption thresholds by using a fixed amount of initial adopters (innovators), the same adoption thresholds for all agents per simulation, and a fixed external influence by initial adopters. The second part of the study examined relational heterogeneity by using a two-segment model, consisting of an innovators’ segment and followers’ segment. The heterogeneous relationships among innovators, innovators and followers, and followers and followers, were represented by weighted network links. From these two studies they managed to answer nine research questions affecting technology diffusion. First, they established that the initial location of innovators varied the rate of diffusion for different network structures. Second, the diffusion for high-adoption thresholds was more likely to occur with clustered networks, and varied significantly between network structures. Finally and most interestingly, focusing on innovator adoption rather than innovator-follower communication can speed up diffusion.

Laciana and Rovere [4] utilized the Ising model to simulate technology adoption. The Ising model is suitable for social processes since it deals with the interaction between an object and its neighbors. The Isling model can be adapted for adoption, by taking into account the social influences from an agent’s social network and the contribution of an agent’s individual preference towards a technology. The model also allows for individual preferences between two alternative options (e.g., adoption and disadoption, competing products, etc.). The authors used the model to evaluate two competing products and determined that a new product with a clear advantage diffuses quicker with a disperse distribution of early adopters, while when a new product is only slightly better, diffusion does not saturate. The authors also determined that when there was a hub agent with a large number of ties in the network, the rate of adoption accelerated. This type of person is commonly referred to as an opinion leader.

Zhang and Nuttall [5] used ABM to evaluate the effectiveness of the United Kingdom (UK) government policies for encouraging the adoption of smart metering devices. They used two types of agents, namely consumers and electricity suppliers. The consumers interacted with their direct neighbors and a random amount of remote consumers. Three indicators were examined as an output of the model, namely the impact of multiple scenarios on the diffusion of the technology, electricity suppliers’ market share, and the switching of consumers among electricity suppliers. Using real market data to determine initial parameters, the model produced the expected results of a stable market share, the s-curve pattern of typical technology diffusion, and the dynamic switching of consumers among electricity suppliers. Based on the results of the model, the UK was pursuing the least effective scenario.

All the agents, agent behaviors, and agent–agent relationships are summarized in Table 1 under appendix.

The articles discussed above all had different objectives in mind; however, they have a lot of similarities. Most of the reasoning behind using ABM is the requirement for heterogeneous populations and complex interaction among individuals. ABM was seen as a good representation of the complexities that exist within current markets. The main areas of focus in these articles were on the social network structures and the position of initial adopters. The outcome of using different network structures varied significantly, which was represented well in these articles, and was not captured in previous aggregated approaches of evaluating technology diffusion. Additionally, the impact of the location of early adopters in the network was crucial to the rate of diffusion, which cannot be captured by an aggregated model. From all these findings, it is understandable why ABM would be the preferred approach to researching technology adoption and diffusion.

Bohlmann et al. [3] mention that a phenomenon is emergent when it “arises from the heterogeneous and complex interactions among agents in a social system.” Based on this definition, all the above articles demonstrated emergent behavior. However, some of the outcomes from these studies were relatively self-explanatory. As an example, highly connected networks had the quickest rate of diffusion, which is expected. Only once the complexity of these systems was increased by adding additional parameters, or when two alternatives closely resembled one another, were the results more surprising. As an example, Bohlmann et al. varied the adoption threshold for multiple network structures and determined that for high-adoption thresholds, diffusion was more likely to occur for clustered networks. Rahmandad and Sterman [2] did not vary the threshold and determined that the rate of diffusion was the slowest for highly clustered networks. This coincides with what Bohlmann et al. determined using a low adoption threshold; however, Rahmandad and Sterman failed to capture the effect of higher thresholds. Therefore would the outcome of their study be different if they adjusted the threshold they used for the AB and DE models? Additionally, Laciana and Rovere [4] and Bohlmann et al. determined the effect of different initial positions of early adopters. If this was also taken into account by Rahmandad and Sterman, would their results still be the same?

Laciana and Rovere [4] were the only authors to include a hub in the social network, to resemble an important agent with many connections. This increased the rate of diffusion substantially, and could be a good representation of advertising through online social networks. Their unique approach of using a physics model, Ising model, to representation of social interaction, added another dimension to the previous two studies. Their study was the only one to allow for disadoption of a technology and could represent more than one technology in a market. Even though this was the most unique approach, We did not find the results the most compelling. As an example, an increase in the dispersion of initial adopters decreased the time required for market saturation, which is expected when adopters are interacting more with other non-adopters, instead of between themselves. Additionally, when a hub agent was introduced, diffusion increased, which is again expected. There was no real surprising emergent behavior.

Zhang and Nuttall [5] were the only authors to actually apply ABM to a real world situation. They focused on one network structure and used a more complicated but established model for technology adoption, known as the Theory of Planned Behavior (TPB) consumer acceptance model. This model included additional consumer parameters such as price sensitivity, motivation to comply with other agents, and enthusiasm towards the technology. They did not take into account different possible network structures; however, their study was based on the location of households in a 2d environment. Their assumption of households communicating only with neighbors and a few random remote households therefore seemed plausible. As Laciana and Rovere [4] mentioned, when physical proximity among nodes is important, a regular lattice network provides a good approach. Additionally, Beinhocker [6] mentions that people in social networks generally have a cluster of friends and some random friends, which is clearly demonstrated in this article. This was the only study where a surprising emergent behavior from the model was backed up by actual market observations. In the model, consumers moved from one electricity supplier to another, but the electricity suppliers’ market share remained constant, which was actually observed in the market. Also, this was the only study where there were central figures (electricity suppliers) that could influence multiple consumers by adjusting prices.

Of the eight attributes of agents introduced by Gilbert and Troitzsch in the “Simulation for Social Scientist” [7], all models only covered four of these attributes, namely “knowledge and belief,” goals, “knowledge representation,” and inference. Agents in all models based their decision on the current status of the agents they were connected to, and inferred that if a certain amount of agents had adopted the technology, and they preferred the technology, then they should adopt it. This was clearly illustrated by Laciana’s and Rovere’s model that used social influence and individual preference to represent the relative utility of adopting the technology for a specific agent. The goal of agents in all models was to adopt a technology, and the knowledge representation was seen as each agent storing the current status of their connected agents and their own preferences. Based on the description by Gilbert and Troitzsch, none of the agents from the studies had social model attributes, since they did not build the social models while the simulation ran. There was also no representation of language between agents, since agents only determined the current status of their neighbors and there was no back-and-forth communication between them. Finally, there was no planning or emotions by any of the agents.

Epstein and Axtell [8] referred to how simple rules create surprising behavior in the Sugarscape model. Based on all the articles discussed, the rules and goals for each agent were relatively simple. The goal for each agent was simply to reach a certain threshold in order to adopt a technology or disease. The rules for each agent were to assess their neighbors’ states and in most cases, their own individual preferences towards the technology, before adopting. However, unlike the Sugarscape model, there were predefined structures specifying which agents could interact with one another. For the Sugarscape model, agents move around the landscape and interact with one another and the environment. It is therefore possible for an agent to interact with any other agent, similar to the fully connected network, however with a delay requirement for movement. From the articles discussed, there was no movement by the agents or any interactions with the environment. The models are purely based on agent behavior and agent–agent interaction for any changes in the overall behavior of the model. These models can therefore be extended to evaluate the influence of the environment on the behavior and interaction of agents. A good example of this would be the adoption of renewable energy devices, where the solar intensity and wind speeds of an agent’s environment would influence the end decision.

Based on what has been identified throughout these articles, and the fact that individuals in all types of markets have heterogeneous behaviors and interactions, ABM is an obvious approach to understanding technology adoption and diffusion. The only problem noticed from the articles is that the outcomes of the models are not used by themselves for decision making purposes, but mainly as a supplementary tool. As an example, Zhang and Nuttall [5] were the only authors to use ABM for a real market. These authors illustrate the concept of their model as an approach to evaluating policies, but do not go into detail when discussing the outcome. The model was presented more as a concept than an actual forecasting tool for evaluating future adoption. This coincides with Rahmandad and Sterman [2], where they state that a trade-off needs to be made between keeping a model simple that can be analyzed thoroughly, or disaggregated to capture heterogeneous attributes and relationships of individuals.

8.3 Methodology

The methodology for this paper is as follows:

-

1.

Design the model by specifying the agents, environment, relationships among agents, and the decision-making process of each agent

-

2.

Build the model according to the variables and procedures specific under appendix, in Table 2–4

-

3.

Test and debug the code, and verify the operation of the model using boundary values

-

4.

Determine the maximum interaction radius and number of random interactions, using BehaviorSpace, in order to determine the minimum number of links that create ≈100 % awareness

-

5.

Use actual values for electricity price and incentives in Oregon, and installed solar electric system costs in the United States

-

6.

Answer the questions previously mentioned under the paper purpose

8.4 Model Development

8.4.1 Agents, Environment, and Relationships

Figure 8.2 is a simple diagram depicting the agents, patches, and relationships in the solar electric system adoption model. A complete list with descriptions for the agents and the patches can be found under appendix, in Table 3 and 4. The basic idea is that the patches represent the land on which the houses are built. Patches are represented by sun hours, land cost, and land area. For this specific paper only sun hours for each patch is used, which is the amount of solar energy in kWh that can be delivered per day (kWh/day). This value is used to determine what size solar electric system would be required by a household to supply 100 % of the electricity consumption.

Households can influence their neighbors who are within a randomly assigned interaction radius, and influence remote households, also by a randomly assigned value. The interactions are directed, and when each household builds its own network, undirected links form when influences can take place in both directions. When a household influences another household, the id of the influencer is added to a list of influencers of the influenced household. The length of this list is used to determine whether a household is above a certain threshold and should move to the next adoption stage. This will be described in more detail in the following section.

8.4.2 Agent’s Decision Making Process

Each household can be in four possible states; unaware of the technology, aware but not persuaded, persuaded but not decided, and finally decided. A flow diagram showing the decision points for transitioning between stages is illustrated in Fig. 8.3. All agents start off in the unaware stage, except for a few initial adopters who start off in the aware stage. For each tick, all agents not in the unaware stage select a randomly connected neighbor and add their id to the selected agent influencers list, with a probability of adoption stage × 10. The adoption stage is represented by 1 for unaware up until 4 for decided. The idea behind this probability is that the higher the influencing agent’s adoption stage is, the more influential they will be. In other words, if the agent has already decided on the technology, then the agent is going be more influential than an agent who is only aware of the technology.

In order for an agent to move from unaware of the technology to aware, the number of influencers needs to be greater than an awareness threshold. The awareness threshold is a randomly assigned value between 1 and 3 for each agent. Each agent needs at least 1 other agent in its influencers list to become aware. Once the agent becomes aware, all ids are removed from the influencers list.

For an agent to move from aware to persuaded, the number of influencers in the new list must be greater than a persuasion threshold. The persuasion threshold is a randomly assigned value between 0 and 10. Influencers are added to the list in the same manner as described above. In addition to this threshold, the monthly electricity payments by the agent multiplied by a price preference must be greater than or equal to the monthly payments required to purchase a solar electric system. Since the lifespan of a solar electric system is generally assumed to be around 20 years, the total purchase cost of the system is divided by 20 years × 12 months = 240 months, to determine the equivalent monthly payments (not taking into account inflation and present value). The price preference was included to take into account the preference of the agent when making the decision, and is a randomly assigned value between 0 and a max price preference assigned by the user. If the price preference is greater than 1, then the agent will not wait for the solar payments to drop below the electricity payments, and vice versa.

As an example of the above mentioned process, if an agent consumes 1,200 kWh of electricity per month at $0.1 per kWh, the monthly electricity cost would be 1,200 × 0.1 = $120 per month. The size of the solar system required to supply 1,200 kWh per month is calculated to be 8.54 kW using the equation specific under appendix, in Table 3. At $5/W for solar, an incentive of $1/W, and a 20-year payment duration, the monthly solar cost would be 8,540 × (5 − 1)/240 ≈ $142 per month. Therefore if the price preference was 1, then $120 × 1 is not greater than or equal to $142 and the agent will not become persuaded. If the price preference was 2, then $120 × 2 is greater than $142, and the agent would become persuaded. The idea behind using a price preference is that not all agents would react the same to increasing or decreasing prices of electricity and/or solar electric systems. Additionally, the price preference can also take into account agents who are not basing their decision purely off price, but also other factors such as environmental concerns, etc.

Once an agent is persuaded, a decision is made to determine whether the agent has enough budget to pay for the monthly solar payments. If the agent’s monthly budget is greater than the solar payments, then the agent will change to decided and purchase the solar electric system. If the agent remains in the persuaded stage and the electricity monthly payments × price preference becomes less than the solar monthly payments, then an influencer is removed from the agent’s list for each tick that this is true. When the number of influencers becomes less than the persuasion threshold, then the agent moves back to the aware stage.

8.4.3 Communities

The Netlogo model world is divided into four neighborhoods, each with different levels of income. The quadrants represent low-income, medium-income, high-income, and a distribution of income-level households. The intention of creating multiple neighborhoods was to determine whether households joined together to purchase a larger shared solar electric system. However, due to time constraints, sharing of solar electric systems was not included as part of this paper, but can easily be extended for future work.

8.4.4 Assumptions

The following assumptions were taken into account when creating the model:

-

1.

Electricity consumption, income, budget, and price preference for each agent remains constant throughout the simulation

-

2.

No new households are added to the model throughout the simulation

-

3.

Direct links are used to connect the households, assuming that the possibility of influencing another household would take place in one direction

-

4.

A household will only buy a solar electric system that will replace 100 % of its electricity consumption

-

5.

The solar price and electricity price will remain the same unless the user adjusts the sliders while the simulation is running

-

6.

All agents will compare the monthly solar costs against the monthly electricity costs when deciding to purchase a solar electric system

-

7.

The world does not wrap horizontally or vertically

8.4.5 Netlogo Model

The Netlogo model for this paper is illustrated in Fig. 8.4. The colors of the houses represent the current adoption stage of the household (red—unaware, blue—aware, orange—persuaded, green—decided). The color of the patches is scaled according to sun hours, with lighter yellow representing higher sun hours and vice versa. The user adjustable sliders are described in detail under appendix, in Table 2. The graph represents the number of households in each stage of adoption, which is also shown in the monitors below the graph. Additionally, the total electricity consumed, total electricity saved, and total incentives paid out are shown in the monitors below the sliders. Finally, the two switches next to the go button allow the user to hide the links representing the connections between households, and hide the patch colors representing the sun hours for each patch (Fig. 8.4).

8.5 Model Verification

In order to conduct a basic verification of the model, beyond optimizing the code and debugging potential errors, a boundary test for each user adjustable variable was done. The idea of the boundary test was to set the variables to their extreme, and follow the agent’s decision-making process. The boundary test started by setting all variables to 0 except for the housing density. As a result there were no connections between households and no initial adopters, with all households remaining unaware of the technology.

The next test was to introduce a small amount of initial adopters and create a network connecting the households. This allowed the initial adopters to communicate, resulting in all households becoming aware of the technology. None of the households could become persuaded since the maximum budget was set to 0 % and therefore no households could afford the solar system. The next test was to increase the maximum budget to 100 %, keep the solar hotspots at 0 %, and set the solar price to $0/Wdc. Households all became persuaded; however, because there were no solar hotspots (i.e., sun hours), no electricity could be produced by these solar systems and therefore no household ended up purchasing them. The next test set solar hotspots to 100 % resulting in all previously persuaded households to become decided.

Finally, by setting all variables to their maximum value, except housing density and initial adopters, households ended up in three adoption stages, namely aware, persuaded, or decided. This was expected since some households are not influenced by the increased electricity prices and remain aware, some households are influenced but cannot afford a solar electric system and remain persuaded, while the rest have decided to purchase the solar electric system.

BehaviorSpace was finally used to determine the minimum number of links required for ≈100 % awareness by adjusting the maximum interaction radius and maximum random interactions. The values obtained were, 3 for maximum interaction radius, and 5 for maximum random interactions. These values were used for the remainder of this paper (Table 8.1).

8.6 Results and Discussion

8.6.1 Delay in Aggregated Adoption

Is there evidence of a delay in the aggregate adoption of solar electric systems? If so, how can the adoption be improved?

It is common knowledge in marketing literature that a “Chasm” exists in the technology adoption life cycle of disruptive technologies [9] (Fig. 8.5). This is the difficult step of making the transition from early adopters to early majority. The idea for crossing this Chasm is to focus on each of the five main segments of the adoption life cycle, one at a time, and use each segment as a foundation for marketing for the next segment. By allowing agents to be in four different adoption stages in the model, it was possible to understand potential reasons why the early majority were not adopting the technology.

By using actual values for electricity price [10] and incentives in Oregon [11], and installed solar electric system costs for the United States [12], the output shown in Fig. 8.5 was obtained. The maximum price preference was set to 2 and the initial adopters were set to 2.5 %, as shown in the technology adoption life cycle as innovators. The total number of adopters (green) is approximately 20 % of the total number of households, which is slightly more than the 16 % of adopters before the chasm in the technology adoption life cycle; however, 16 % is only an approximation.

It was possible to identify reasons why majority of households were still in the aware stage (blue) and very few households in the persuaded stage (orange). All households had more influencers than the persuasion threshold, therefore this was not restricting agents from moving to the following stage in the adoption process. The restriction was only based on the price of the solar electric system. Agents could not move from the aware to persuaded stage because the monthly payments were too high, and if some agents did move to persuaded, they could not afford the solar electric system due to their budget.

There are two main methods of increasing the adoption, either by increasing the incentives offered to reduce the purchase cost of the system, or by increasing the price of electricity, thereby making the solar electric system the preferred alternative. These two methods are examined in the following two questions.

8.6.2 Impact of Increasing Electricity Prices

What is the relationship between increasing electricity prices, price preference, and rate of adoption?

As was mentioned in the previous section, one way of increasing adoption is by increasing the price of electricity. Figure 8.6 illustrates the impact of increasing electricity prices on the adoption of solar electric systems, using the same parameters as the previous question. As expected, adoption increases with increasing electricity prices, for all maximum price preferences except 0. As was previously stated, each household is randomly assigned a price preference between 0 and the maximum price preference. The equation used in the agent’s decision making process is: electricity monthly payments × price preference ≥ solar monthly payments. By selecting a price preference of 2, there is a 50 % chance that a household will wait after the solar monthly payment falls below the electricity monthly payment, before adopting the technology. There is also a 50 % chance that households will not wait for the cost to be less. The higher the price preference, the less the number of households delaying their purchases, thereby increasing the number of adopters at lower electricity prices. It can be seen that the price preference has a large impact on adoption and it is therefore important to try determining what price preference most accurately represents the community of interest during a study.

8.6.3 Impact of Incentives

What impact does changing the incentive structure have on the overall electricity savings?

Figure 8.7 illustrates the impact of increasing incentives on the overall electricity savings and the total investment made by the organization supplying the incentives. The total electricity savings was simply calculated by adding up all households’ electricity consumption who had already adopted the solar electric system. The total investment was simply calculated by adding up all incentives given to the households who had adopted the system.

As part of the current incentives offered by Energy Trust of Oregon for solar electric systems [11], $5,000 is the maximum incentive that can be offered. Therefore, for large consumers of electricity they will need to pay the remaining amount that is not covered by the incentive. At $5/W for a solar system [12], the average household would need a 8.5 kW system (based on the average monthly consumption in Oregon of 991 kWh and estimated sun hours of 5 kWh/day), which relates to $42,500 without incentives, and $37,500 with the maximum incentive. Even with the maximum incentive, this is still a substantial amount to pay for a solar electric system. As a result, only the small consumers of electricity see a benefit in adopting with incentives. This is the reason why the electricity savings remain relatively constant in the left graph in Fig. 8.7. The right graph shows the result if the maximum limit is removed. The total investment is substantially more without a limit but so is the total savings.

8.7 Conclusion

Even though the model could not be validated using market data, patterns commonly referred to in technology adoption literature were identified in the model. By separating the adoption process into stages allowed for the potential identification of the “Chasm.” Also by observing which households were aware of the technology but did not adopt, can aid marketers in understanding how they can increase the adoption and overcome the “Chasm.” The two main methods of increasing adoption were analyzed by increasing the electricity price and increasing incentives.

The behavior of the model by increasing electricity prices was not really surprising. The higher the price preference, the quicker the number of adopters increased. Since the behavior of the model was easily described by the decision making of the individuals in the model, this does seem to me as an emergent behavior. In other words, we think the aggregated behavior can simply be broken down into the behavior of the individuals. However, the outcome did show us that the price preference had to be heavily weighted towards the solar electric system in order to get households to adopt the technology. High prices for solar electric systems and very low prices for electricity make this decision very easy for the households.

The behavior of the model for increasing incentives was more interesting than the increasing electricity. At first, we thought there was a problem with the model when the electricity savings remained relatively constant as incentives increased. You would think that increasing incentives would increase the adoption and thereby the electricity savings. The problem is, there is just too big of a gap between the cost of electricity and the cost of solar electric systems. Unless the upper limit is removed, it is difficult to see how adoption can increase. The model however does not take into account other motives why households would adopt these systems other than financial reasons.

There are too many unknowns for the model to be used for decision making purposes; however, going through the process of creating the model definitely aids in obtaining a better understanding of the system. Even though this model seemed too “engineered,” it did give some valuable insight that possibly would have been overseen if looking at the system from the top–down. The best example of this was the effect of the incentive limit on the actual adoption. ABM is definitely a good match for understanding adoption, and with the right market research and understanding of the consumers, we think it can be used effectively for successful decision-making purposes.

The following is a list of improvements and extensions that could be done to this paper:

-

A sun hours per day map [13] can be imported into Netlogo if real world conditions are required

-

Market research can be conducted to understand the decision-making process of the households in more detail

-

Actual sales data for solar electric systems can be obtained to determine whether the model represents what is actually happening in the market

-

Data from the Residential Building Stock Assessment [14] can be used to represent the households more accurately

-

Different social network structures [2] can be modeled to determine the impact of each on the adoption process

References

N. Meade, T. Islam, Modelling and forecasting the diffusion of innovation—a 25-year review. Int. J. Forecasting 22(3), 519–545 (2006)

H. Rahmandad, J. Sterman, Heterogeneity and network structure in the dynamics of diffusion: comparing agent-based and differential equation models. Manag. Sci. 54(5), 998–1014 (2008)

J.D. Bohlmann, R.J. Calantone, M. Zhao, The effects of market network heterogeneity on innovation diffusion: an agent-based modeling approach. J. Prod. Innov. Manag. 27(5), 741–760 (2010)

C.E. Laciana, S.L. Rovere, Ising-like agent-based technology diffusion model: adoption patterns vs. seeding strategies. Phys. A: Stat. Mech. Appl. 390(6), 1139–1149 (2011)

T. Zhang, W.J. Nuttall, Evaluating government’s policies on promoting smart metering diffusion in retail electricity markets via agent-based simulation. J. Prod. Innov. Manag. 28(2), 169–186 (2011)

E. Beinhocker, Origin of Wealth (Harvard Business Press, Boston, 2006)

N. Gilbert, K. Troitzsch, Simulation for the Social Scientist, 2nd edn. (Open University Press, New York, 2005)

J. Epstein, R. Axtell, Growing Artificial Societies: Social Science from the Bottom Up (Brookings Institution Press, Washington, DC, 1996)

G.A. Moore, Crossing the Chasm: Marketing and Selling High-Tech Products to Mainstream Customer (HarperCollins, New York, 1999)

U.S. Energy Information Administration, Electric Price Monthly [Online] (2013), http://www.eia.gov/electricity/monthly/epm_table_grapher.cfm?t=epmt_5_6_a. Accessed 1 Dec 2013

Energy Trust of Oregon, Solar Electric for Homes: Your Home Resource for Clean Energy [Online] (2013), http://energytrust.org/residential/incentives/solar-electric/SolarElectric/. Accessed 1 Dec 2013

G. Barbose, N. Darghouth, S. Weaver, R. Wiser, Tracking the Sun VI: An Historical Summary of the Installed Price of Photovoltaics in the United States from 1998 to 2012 (Lawrence Berkeley National Laboratory, Berkeley, 2013)

National Renewable Energy Lab, Dynamic Maps, GIS Data & Analysis Tools: Solar Maps [Online] (2013), http://www.nrel.gov/gis/solar.html. Accessed 1 Dec 2013

D. Baylon, P. Storm, K. Geraghty, B. Davis, Residential Building Stock Assessment: Single-Family Characteristics and Energy Use (Northwest Energy Efficiency Alliance, Seattle, 2012)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix: Model Parameters

Appendix: Model Parameters

8.1.1 Agents and Environment

The global variables, agents, and patches for the solar electric system adoption model.

Global variables (user adjustable variables) | Housing density: The percentage of total patches that are occupied by houses |

Incentives: The incentives offered by utility companies and others to encourage the adoption of the technology | |

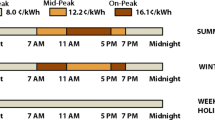

Energy price: The price of electricity (kWh) | |

Solar price: The price of a solar electric system per kWh | |

Inequality: The distribution of wealth for one of the communities under evaluation. This distribution of wealth is defined by the equation min-income × exp(random − exponential(1/inequality)). The intention of this equation is to try creating the Pareto distribution | |

Solar hotspots: The percentage of patches that will have the highest solar intensity level. Random patches are chosen and the solar intensity diffuses to the neighborhood patches | |

Initial adopters: The percentage of households that will already have a solar electric system before the simulation starts | |

Maximum interaction radius: Each household can influence other households within a random radius between 0 and maximum interaction radius | |

Maximum random interactions: Each household can influence a random number of other households between 0 and maximum random interactions | |

Maximum budget: Each household has a random percentage of their income, between 0 and 100 %, which they can spend | |

Maximum price preference: A household will decide to move from aware to persuade if electricity monthly payments × price preference ≥ solar monthly payments. This is a random value between 0 and 3 | |

Hide-links: Hide the links that are connecting the households | |

Show-solar: Show the sun hours by using a scaled yellow color for each patch |

Procedures | Setup global: Initializes all the global variables |

Update plot: Update the plots displaying the number of households in each stage of adoption, the distribution of in and out links, and the distribution of income | |

Update display: Observes the status of show-solar? and hide-links? to determine whether the display should be updated, even when the simulation is running |

Agent | Households: Houses are randomly placed on patches. The number of households is controlled by the global housing-density variable |

Characteristics | Income: The total monthly income from all members of the household |

Budget: Percentage of income which the households can spend per month | |

Electricity consumption: The amount of electricity consumed by the household per month (kWh). This is calculated by multiplying the average electricity consumption in Oregon with the ratio of the households income to the median income | |

Adoption stage: A household can be unaware, aware, persuaded, or decided on the technology | |

Price preference: A household will decide to move from aware to persuaded if electricity monthly payments × price preference ≥ solar monthly payments | |

Awareness threshold: How many households need to mention the technology to this household before they change their adoption stage from unaware to aware | |

Persuasion threshold: How many households need to mention the technology to this household before they change their adoption stage from aware to persuaded | |

Interaction radius: The radius of the circle in which a household can influence other households, or be influenced | |

Random interaction: How many random households outside the radius can be influenced? This resembles the random friends discussed by Beinhocker | |

Solar size-required: The size of the solar electric system required. This is calculated by electricity consumption × 12 × 1,000/(365 × [sun-hours] of patch-here × derate-factor). The derate factor for solar electric systems is generally assumed to be 0.77 | |

Own incentives: The amount of incentives the household can obtain for their solar electric system. The maximum amount defined by Energy Trust of Oregon is $5,000 |

Rights and permissions

Copyright information

© 2015 Springer International Publishing Switzerland

About this chapter

Cite this chapter

van Blommestein, K.C., Daim, T.U. (2015). Technology Adoption: Residential Solar Electric Systems. In: Daim, T., Kim, J., Iskin, I., Abu Taha, R., van Blommestein, K. (eds) Policies and Programs for Sustainable Energy Innovations. Innovation, Technology, and Knowledge Management. Springer, Cham. https://doi.org/10.1007/978-3-319-16033-7_8

Download citation

DOI: https://doi.org/10.1007/978-3-319-16033-7_8

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-16032-0

Online ISBN: 978-3-319-16033-7

eBook Packages: Business and EconomicsBusiness and Management (R0)