Abstract

Firms not only produce or sell their products and services abroad, but increasingly also conduct research and development (R&D) at locations outside their home countries – a phenomenon referred to as the ‘internationalization of business R&D’. This chapter analyses the internationalization of business R&D for OECD countries and identifies specific home and host country characteristics that are conducive or obstructive to R&D expenditure of foreign affiliates. The analysis employs a recently compiled novel data set on R&D expenditure of foreign-owned firms in the manufacturing sectors of a set of OECD countries. The results point to the pivotal role of market size and of cultural, physical and technological proximity for R&D efforts of foreign-owned firms. Moreover, the analysis demonstrates that sufficient human capital and strong indigenous technological capabilities in the host country tend to be conducive to R&D activities of foreign affiliates. In contrast, a rich human capital base in the home country is obstructive to the process of R&D internationalization. Geographic distance turns out to be a strong deterrent.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Firms not only produce or sell their products and services abroad, but increasingly also conduct research and development (R&D) at locations outside their home countries – a phenomenon referred to as the ‘internationalization of business R&D’ (Narula and Zanfei 2005; OECD 2008b; Hall 2010).

The internationalization of business R&D is more of a recent phenomenon. The international economics as well as the international business literature long regarded R&D and the accumulation of knowledge as activities that are bound to the home countries of multinational firms. In their seminal paper on R&D in large multinational enterprises, Patel and Pavitt (1991, p. 17) concluded that the production of technology remained ‘far from globalized’, but was concentrated in the home countries. Hence in the 1990s, R&D was still ‘an important case of non-globalization’ (Patel and Pavitt 1991, p. 17). Theories of the multinational firm following Hymer’s (1976 [1960]) seminal contribution stress that the international expansion of R&D is a means to exploit existing intangible assets and knowledge capital of the firm in foreign markets (Dunning 1988; Markusen 2002; Helpman 2006; Forsgren 2008).

However, during the last two decades, the internationalization of business R&D activities has accelerated strikingly. Specifically, as highlighted by the OECD (2008a), between 1995 and 2003, R&D expenditure of foreign affiliates increased twice as rapidly as their turnover or their host countries’ aggregate imports. This renders R&D activities of foreign affiliates one of the most dynamic elements of the process of globalization. Until recently, the main actors and recipients of cross-border R&D expenditure were developed countries. Lately, some new players emerged, giving rise to new patterns of R&D internationalization. Especially in Asia, emerging economies gained importance as host countries of R&D internationalization activities but developing countries also increasingly engaged in outward R&D activities. Despite these developments, the largest part of international R&D still takes place between the triad area, comprising the US, the EU and Japan (OECD 2008b).

Given the benefits that accrue from the presence and activities of R&D intensive foreign-owned firms, attracting them has been high on the political agenda of many economies. R&D expenditure of foreign-owned firms may increase aggregate R&D and innovation expenditure of the country. It may give rise to substantial information and knowledge spillovers (Blomström and Kokko 2003), foreign-owned firms may boost the demand for skilled personnel including R&D staff, or R&D efforts and the presence of foreign-owned firms may lead to structural change and agglomeration effects (Young et al. 1994).

The ensuing analysis investigates determinants of the process of internationalization of business R&D. It uses a novel and unique database of bilateral business R&D expenditure of foreign affiliates in the manufacturing sector of selected OECD countries for the period from 2001 to 2007. Given the type and quality of the data, the analysis contributes greatly to the ongoing discussion as to key determinants of the process of R&D internationalization as previous data-related shortcomings are remedied. Specifically, since the analysis uses R&D expenditure data instead of patent data, some of the potential biases and limitations patent data suffer from are bypassed and avoided (Cohen et al. 2000; Hinze and Schmoch 2004; Nagaoka et al. 2010). Methodologically, an extended gravity approach is taken which helps shed light on the roles of standard gravitational forces like market size, distance, cultural or physical proximity for the internationalization of R&D, extended to include additional technology and innovation related drivers of R&D internationalization.

The results highlight the essential role of market size, cultural, physical and technological proximity for the process of R&D internationalization. Moreover, it finds evidence that additional scientific or technological capabilities matter strongly: abundant human capital in the host country is conducive to R&D activities of foreign-owned firms, while a lack of human capital in the home country appears to encourage the relocation of innovative activities abroad. Similarly, strong and internationally competitive R&D capabilities in the host country turn out to be conducive to R&D efforts of foreign-owned firms. They can exploit these capabilities for own research activities. Finally, the analysis finds that R&D expenditure of foreign-owned firms is regionally decentralized and not concentrated within the EU.

The remainder of the paper is structured as follows. Section 10.2 presents related literature and previous empirical evidence on important determinants of cross-border R&D activities while Sect. 10.3 discusses the data used in the analysis and provides some general patterns of R&D internationalization. Furthermore, some hypotheses are formulated that will be tested empirically in the ensuing analysis. The econometric specifications tested are outlined in Sect. 10.4 while Sect. 10.5 presents and discusses the results. Finally, Sect. 10.6 concludes.

2 Related Literature

Empirical evidence is quickly mounting: the process of the internationalization of R&D is the product of a number of different key factors and drivers. In that respect, an ever growing body of empirical literature consistently points at the pivotal role played by economic size of countries in fostering cross-border R&D activities. Specifically, foreign-owned firms may have to adapt their products and production processes to suit local demand patterns, consumer preferences or to comply with legal regulations and laws. In view of that, these firms may find it easier to cover the cost of adaptive R&D in larger markets with higher demand for their goods and services, better sales prospects and consequently larger revenues. In the same way, foreign-owned firms may have stronger incentives to develop new products or processes from scratch in faster growing markets. As highly uncertain and risky activities, innovative activities gobble up immense resources that can easier and faster be recovered on larger markets with more promising market potentials. Dachs and Pyka (2010) use EPO patents for the period 2000–2005 to identify essential determinants of cross-border patents. They show that cross-border patenting activities are significantly higher if both home and host economies are larger.

Moreover, empirical studies have stressed that cross-country differences in the quality and size of a skilled workforce are an important determinant of the process of R&D internationalization: Lewin et al. (2009) demonstrate that a shortage of high skilled science and engineering talent in the US explains the relocation of product development to other parts of the world while Hedge and Hicks (2008) stress that innovative activities of overseas US subsidiaries are strongly related to the scientific and engineering capabilities of the host countries. A similar pull-effect of human capital is identified by Erken and Kleijn (2010) who show that strong human resources in science and technology in the host country are strong location factors for international R&D activities.

In addition, technological proximity which captures similarities in technological specialization among countries is found to be conducive to cross-border innovative activities. Guellec and van Pottelsberghe de la Potterie (2001) find that countries with similar patterns of technological specialization tend to more strongly cooperate in patenting activities.

Similarly, stronger R&D efforts in terms of higher R&D intensities in both home and host countries foster the internationalization of R&D (Dachs and Pyka 2010). Moreover, effects tend to differ across countries as the technological strength of the home country appears to exert a stronger push effect than the technological strength of the host country. In a similar vein, Erken and Kleijn (2010) show that the stock of private R&D capital in a country represents an essential driver of the process of R&D internationalization, either as a guarantee for sizeable knowledge spillovers, or as a so-called ‘place-to-be effect’.

The attractiveness of countries for overseas R&D activities is also shaped by public policy intervention. Specifically, as highlighted by Steinmueller (2010), science, technology and innovation (STI) policy measures like public subsidies for R&D performing firms or measures to foster cooperation among firms or between firms and universities or research institutes may remove obstacles to innovation and strengthen the capabilities of national innovation systems. An innovation-friendly environment, in turn, may be a considerable locational advantage and influence internationalization decisions of firms in R&D. Related to that, Dachs and Pyka (2010) emphasize that strong IPR mechanisms also matter for cross-border patenting. As such, they highlight that systematic policies aimed at the strengthening of prevailing IPR mechanisms help render cross-border patenting activities more attractive.

Moreover, while differences in labour cost between the home country and locations abroad are one of the most important motives for the internationalization of production, empirical evidence that differences in the cost of R&D personnel are a major driver for the internationalization of R&D is weak, however: compared to other factors, cost advantages of R&D location are found to be pretty modest (Booz Allen Hamilton and INSEAD 2006; Thursby and Thursby 2006; Kinkel and Maloca 2008; Belderbos et al. 2009; European Commission 2010). However, cost differences appear to gain importance when firms consider to locate R&D and innovation activities in emerging economies, or when firms have to choose between two similarly attractive locations (Booz Allen Hamilton and INSEAD 2006; Thursby and Thursby 2006; Cincera et al. 2009).

The negative relationship between distance and any bilateral flows of either goods, capital or people is one of the most robust findings in the rich strand of literature emerging from the gravity model tradition. Traditionally, as emphasized by Tinbergen (1962), distance is interpreted as a proxy for transportation costs or an index of uncertainty and information costs firms have to shoulder when penetrating foreign markets. In the case of overseas R&D, these costs include additional costs of coordinating geographically dispersed R&D activities, the costs of transferring knowledge over distance, and a loss of economies of scale and scope when R&D becomes more decentralized (Sanna-Randaccio and Veugelers 2007; Gersbach and Schmutzler 2011). Related evidence is provided by Castellani et al. (2011) who throw light on the specific role of distance for cross-border R&D FDI relative to manufacturing investments. They emphasize that once social, cultural and institutional factors like shared language or membership in the same regional trade agreement are accounted for, the location of R&D labs abroad is independent of geographic distance and therefore equally likely to be found close by or farther away. This is taken as conclusive evidence for the limited role of transportation costs but the pivotal role of uncertainty and prevailing informational barriers and costs in deterring cross-border R&D FDI. In contrast, however, geographic distance remains an important determinant for FDI in manufacturing or other types of FDI.

Supportive evidence also emerges for the importance of both cultural and physical proximity between countries for cross-border flows and activities, as typically proxied by common language or common borders, respectively. Such proximity effects potentially counteract the effects of pure geographical distance and thus have to be taken into account separately. In particular, lower cultural barriers between culturally similar countries as well as shared borders between countries often facilitate the flow of goods, capital or people. Strong cultural ties between countries ease communication and the exchange of information and knowledge across borders, rendering cross-border flows and activities easier and less costly. Physical proximity reduces transportation and travel costs and therefore further enhances cross-border flows. Various authors stress that foreign-owned firms have to overcome additional institutional and cultural barriers, a disadvantage that is known as the ‘liability of foreignness’ (Zaheer 1995; Eden and Miller 2004). This concept captures foreign-owned firms’ lack of market knowledge but also their lower degree of embeddedness in informal networks in their host countries, decisive elements for foreign-owned firms when devising innovation strategies in terms of whether and how to develop new or adapt existing products and/or processes to local preferences and what resources to allot to these innovative activities. Supportive empirical evidence is provided by Guellec and van Pottelsberghe de la Potterie (2001) who use patent data for 29 OECD member countries to explain prevailing patterns of cross-border ownership of inventions as well as of research cooperation in the mid-1980s and the mid-1990s. They stress that both cross-border ownership of patent inventions are more widespread among countries that share common borders. Moreover, Guellec and van Pottelsberghe de la Potterie (2001) also demonstrate that cross-border patenting and cooperation is significantly stronger among culturally similar countries.

Finally, empirical evidence also points at the regional concentration or scientific integration of cross-border inventive activities. As such, cross-border patenting is higher among EU-15 countries (Dachs and Pyka 2010), while probably due to the shared history and broad cultural similarities, cross-border ownership of inventions as well as of research cooperation was stronger among Nordic countries (Guellec and van Pottelsberghe de la Potterie 2001).

From this survey a couple of hypotheses concerning R&D expenditure decisions can be extracted which will be explored and tested below. First, market size as proxied by GDP and GDP per capita of the host and home countries is an important determinant of bilateral R&D activities. Second, concerning the quality and size of skilled workforce both push and pull factors are at play with a lack of such workers forcing firms to invest abroad whereas a skill workforce might attract R&D activities in the host countries. Third, existing R&D efforts in both the host and home countries are conducive to further bilateral R&D spending. Finally, there is a set of variables capturing issues of distance and proximity: particularly, geographical distance is expected to correlate negatively with bilateral R&D expenditures whereas factors like technological, cultural and physical proximity (measured e.g. by language and border effects) are expected to correlate positively.

Some potential additional determinants emerge from the literature survey which however could not explicitly be taken into account either due to high correlation with other independent variables or a lack of data. These variables are labour costs (which are highly correlated with GDP per capita) and measures of public policy intervention. Instead, a number of dummies will be included to capture such effects. The next section presents descriptive patterns of bilateral R&D expenditures and discusses the sources of data that will be used for the econometric analysis.

3 The Role of Gravitational Forces

The ensuing analysis is based on a recently compiled database of bilateral business R&D expenditure of foreign affiliates in the manufacturing sector of selected OECD countries.Footnote 1 Bilateral R&D expenditure of firms from country A in country B will be referred to as inward R&D expenditure or R&D expenditure of foreign affiliates throughout the text.

Data on inward R&D expenditure cover the period from 2001 to 2007 and was collected from national sources and compiled by the Austrian Institute of Technology (AIT) and the Vienna Institute for International Economic Studies (wiiw) in 2011.Footnote 2 This data set was complemented by additional data from different sources: standard gravity indicators such as distance (DIST ij ), common language (COMLANG ij ) or common boarder (COMBORD ij ) are taken from databases created by CEPII. Information on real GDP, tertiary school enrolment rates, high-technology exports and patent applications of resident and non-residents and total populations in country i and j come from the World Bank’s World Development Indicators (WDI). Finally, information on the technology distance between country i and j was calculated with patent data provided by the EPO PATSTAT database. This index measures correlations in the technological specialisation between countries. It is designed as a matrix of correlation coefficients such that the technology distance proxy increases with a decreasing technological distance between two countries. Descriptive statistics of all variables used in the estimations are provided in Tables 10.4 and 10.5 in the Appendix.

Figures 10.1, 10.2, 10.3 and 10.4 below give a general picture of the magnitudes of R&D internationalization, identify key players (Fig. 10.1) and attractive locations for R&D efforts of foreign affiliates (Figs. 10.2 and 10.3) and show the spatial structure of the network of bilateral R&D expenditure between European countries (Fig. 10.4). As such, they reveal important phenomena and underpin the hypotheses that will be tested in the ensuing analysis.

Inward R&D expenditure between the EU, the US, Japan, China and Switzerland: manufacturing only (2007, in EUR million at current prices). Reading note: Firms from the European Union spent EUR 774 million on R&D in Switzerland in 2007; Swiss firms spent EUR 2.470 million on R&D in the EU-27 in 2007. Swiss data include also the service sector; data for China is estimated based on national sources and US and Japanese outward data (Source: OECD, Eurostat, national statistical offices, own calculations)

Location of inward R&D expenditure of US firms in the EU,1999–2010. Note: * NMS-10/12 comprises the Czech Republic, Estonia, Cyprus, Latvia, Lithuania, Hungary, Malta, Poland, Slovenia and Slovakia (all from 2004 to 2007) and in 2007 Bulgaria and Romania also. (Source: OECD based on US outward data by the US Bureau of Economic Analysis, own calculations)

Inward R&D expenditure flows between European countries (2007). Note: The strength of lines between country A and B corresponds to the sum of R&D expenditure of firms from country A which operate in country B, and vice versa. The size of the node per country corresponds to the sum of R&D expenditure of all foreign-owned firms in the country (Source: OECD, Eurostat, national statistical offices, own calculations)

A general picture of inward R&D expenditure in the manufacturing sector by country of origin for key global players (that is the EU, the USA, Japan, China and Switzerland) is drawn in Fig. 10.1 below. The size of each pie chart captures the total amount of inward R&D expenditure in a country, while pie slices represent the volume of inward R&D expenditure by country of origin. Arrows illustrate major relations in inward R&D expenditure between countries. Figure 10.1 emphasizes that, as major recipients of inward R&D expenditure, both, the USA as well as the EU are the two key players in the process of internationalization of R&D. Specifically, in 2007, inward R&D expenditure of US firms in the EU and inward R&D expenditure of EU firms in the US together accounted for two-third of total inward R&D expenditure in manufacturing worldwide.Footnote 3

Moreover, Fig. 10.1 points at the strong mutual importance of both key players for their respective inward R&D expenditure volumes: in 2007, US firms accounted for more than 65 % of total inward R&D expenditure in manufacturing in the EU. Similar, around 62 % of EU inward R&D expenditure in the manufacturing sector stem from US firms located in the EU. In addition, Switzerland was the second most important country of origin with around 16 % of all inward R&D expenditure coming from Swiss firms located in the EU and around 22 % located in the USA. In contrast, Japanese firms located either in the EU or the US accounted for a comparatively small fraction of inward R&D expenditure only.

More recently, China emerged as a new attractive location for R&D efforts of foreign-owned firms. While Chinese data is incomplete and plagued by methodological issues which render a comparison with data from OECD countries difficult, data on R&D expenditure of wholly foreign-owned firms that operate in China suggest around EUR 2.5 billion for the year 2007.

Next, Fig. 10.2 takes a closer look at R&D expenditure of foreign affiliates in the US, by country of origin (between 1998 and 2010) and therefore identifies the importance of inward R&D efforts of single EU countries in the US.Footnote 4 Specifically, it depicts the simple country penetration, as the ratio of inward R&D expenditure from a specific EU country to total inward R&D expenditure from the EU in the US and points at the dominance of three EU countries only. As far back as 1998 and up to 2006, affiliates of German, French and British firms accounted for around 80 % of total inward R&D expenditure by EU firms in the US. Throughout, Germany ranked first, followed by the UK and France. Only in 2006 did the UK overtake Germany as the most important investor in R&D in the US. Hence, given that the US is the world’s largest economy with a huge market and attractive sales potentials, this supports the hypothesis that market size matters.

The opposite perspective is taken in Fig. 10.3 which depicts R&D expenditure of US foreign affiliates located in the EU, by country of destination (between 1998 and 2010) as the ratio of US outward R&D expenditure in a particular EU country to total US outward R&D expenditure in the EU. It demonstrates that throughout the period from 1998 to 2010, the UK and Germany were the two most important and attractive individual EU countries for US R&D efforts, together absorbing more than 50 % of all US outward R&D expenditure in the EU. However, starting in 2005, France, Italy and Spain appear to have lost some ground while other, smaller Member States have become more attractive locations for US R&D efforts. The importance of the two largest EU economies as key locations for US R&D efforts in the EU underscores above hypothesis that ‘the size of the market matters’.

In addition, a comparison of Figs. 10.2 and 10.3 shows that US inward R&D expenditure in the EU is much less concentrated in a few economies only than EU inward R&D expenditure in the US, as small and medium-sized EU economies (like Belgium, Ireland, the Netherlands or Austria) are comparatively more important locations for R&D efforts of US companies than the US is for foreign affiliates from small and medium-sized EU economies in the US.

Finally, Fig. 10.4 zooms in on the EU and depicts the spatial structure of the network inward R&D expenditure among European countries. The edge size (that is the link between countries) corresponds to the sum of inward R&D expenditure of firms from country A in country B and vice versaFootnote 5 while the node size of each country corresponds to the total sum of inward R&D expenditure in the country. Nodes are located at the capital cities of each country.

The spatial network map for 2007 reveals a strong regional clustering of inward R&D expenditure in the centre of Europe while the periphery is participating to a lower degree. There are strong neighbouring effects between some countries, in particular Germany, the Netherlands, Switzerland and Austria. Moreover, Germany appears as the central hub, showing high interaction intensity, particularly with its direct neighbours the Netherlands, Switzerland, Austria or France. Similar neighbourhood effects are apparent for the UK or Spain, which show particular high interaction intensity with Sweden and France or France and Belgium, respectively. In contrast, Finland has a diverse and big set of partner countries, in terms of absolute size, however, the interactions are comparatively low.

All in all, while New EU Member States (NMS) are in general connected to the system of R&D investment in Europe, the magnitudes are comparatively low, with the Czech Republic and Hungary showing the strongest R&D-based embeddedness. This peripheral position of NMS may mainly be due to the low number of multinational firms originating from there. Interestingly, business R&D investment of NMS appears far less integrated than public research (including universities and research institutions): Scherngell and Barber (2011) use information on international collaboration patterns in the European Framework Programmes (FPs) and demonstrate that NMS seem to be rather well integrated in pan-European research collaborations, while Fig. 10.4 highlights that this is less so for R&D efforts in the industry sector.

4 Econometric Specification

In order to identify both home and host country characteristics that are either conducive or obstructive to the process of R&D internationalization, a gravity model approach is pursued. Generally, in the empirical literature, gravity models are popular and well known for their success in explaining international trade flows (see Anderson 1979 or Deardorff 1984 for a theoretical discussion and Breuss and Egger 1999 or Helpman et al. 2008 for some empirical results).

In essence, the gravity equation for trade says that trade flows between two countries are proportional to the two country’s size (as proxied by GDP) but inversely related to the distance between them. Moreover, these models also often account for physical or cultural proximity in terms of shared border, common language or colonial history, respectively. Increasingly, gravity models are also used to explain FDI flows (Brainard 1997; Jeon and Stone 1999 or Bergstrand and Egger 2007), migration flows (Lewer and Van den Berg 2008) or flows of workers’ remittances (Lueth and Ruiz Arranz 2006) between countries.

More recently, gravity models also found their way into the analysis of cross-border inventive activities (see, for example Guellec and van Pottelsberghe de la Potterie 2001; Dachs and Pyka 2010 or Castellani et al. 2011). In some cases simple gravity specifications might suffer from interdependencies such that FDI or also R&D expenditures in one destination are not independent from activities in other destinations (see e.g. Bloningen 2005, for a survey of FDI determinants). Furthermore in some cases more complex spatial interdependencies might matter as e.g. market size of neighbouring countries or regions affect FDI or R&D decisions. Given the limitations of the data at hand such effects can however not be considered in the specification used in this paper.

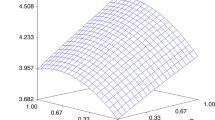

Hence, following the tradition of the gravity literature, the following econometric specifications are estimated to shed light on the roles of home and host country characteristics in driving inward R&D expenditure:

And, if account is also taken of the level of economic development:

where lnRD ijt is the log of business R&D expenditure of foreign affiliates from country j located in the host country i at time t.

lnDIST ij is the log of the geographical distance between country i and j, measured as the simple distance between most populated cities (in km). As an index of uncertainty and additional information costs (like additional costs of coordinating geographically dispersed R&D activities or of transferring knowledge over distance), R&D expenditure of foreign-owned firms is expected to decline with growing distance.

COMLANG ij and COMBORD ij are dummies taking the value 1 if the two countries i and j share a common language or border, respectively. Both are included to capture cultural and physical proximity between country i and j and are expected to foster R&D activities of foreign-owned firms. Specifically, strong cultural ties between countries ease communication and the exchange of information and knowledge across borders, while physical proximity reduces transportation costs, together rendering cross-border R&D activities comparatively easier and less costly.

Furthermore, lnGDP it and lnGDP jt refer to the log of real gross domestic product in country i and j, respectively and are proxies for the economic size of countries i and j. Positive effects are expected, since, given their superior market potentials and sales prospects that allow for an easy and quick recovery of sizeable R&D outlays, larger markets are more attractive and conducive to R&D efforts of foreign-owned firms.

Account is also taken of the role a country’s level of economic development has in attracting business R&D expenditure of foreign-owned firms. As such, wealthier economies (as proxied by their respective real GDPs per capita, namely ln(GDP it /POP it ) for country i and ln(GDP jt /POP jt ) for country j) may not only have a higher purchasing power, but may also be home to consumers with a more pronounced ‘love for variety’ (see Dixit and Stiglitz 1977) so that foreign-owned firms which develop or produce novel products or processes consider economies with higher standards of living more attractive markets with better profit perspectives.

In addition to above standard gravity model indicators, innovation related indicators are included to throw light on their roles in driving the internationalization of R&D. X zijt is a matrix of z additional innovation related variables that are expected to affect R&D expenditure of foreign affiliates to different degrees. In particular, the analysis includes gross tertiary school enrolment rates in country i and j to account for the pivotal role the quality of human capital plays for any successful R&D efforts (ENR_TER). Specifically, empirical evidence highlights that cross-country differences in the quality and size of a skilled workforce are an important determinant of R&D internationalization: Lewin et al. (2009) show that firms relocate product development to other parts of the world if faced with a shortage of skilled science and engineering talent, while Hedge and Hicks (2008) highlight that an abundance of graduates in science and technology and strong scientific and engineering capabilities in a host country are able to attract business R&D into a host country.

Moreover, to capture a country’s general level of inventiveness, the ratio of patent applications of residents to patent applications of non-residents in country i and j is included (PA_RATIO). Specifically, more inventive host countries are attractive for foreign-owned firms seeking to harness prevailing local technology and innovation capabilities for the development of new products or processes.

R&D activities of foreign-owned firms may also crucially depend on differences in countries’ abilities to develop and produce internationally competitive high-technology products. In particular, countries with strong indigenous R&D and technological capabilities tend to specialize in high-technology industries and to generate high-technology products (and services) that more easily withstand fierce competition in the global arena. Hence, a high share of high-technology exports in GDP is indicative of an internationally competitive indigenous R&D base foreign-owned firms can harness to successfully develop new products and processes or to adapt products and processes to local conditions and preferences. Therefore, high-technology exports of country i and j (defined as the share of high-technology exports that are produced with high R&D intensity in total GDP) are included to capture the quality of indigenous R&D and technological capabilities (HTX_SH).

Additionally, cross-country differences in the levels of technological development may also affect the internationalization of R&D. Specifically, there has been a long-standing debate in the FDI literature on the existence and extent of technological spillovers from foreign direct investments with, however, lacking consensus. Some empirical studies lend support to the catching-up hypothesis put forward by Findlay (1978) and find that technological spillovers increase with a widening of the technology distance (e.g. Castellani and Zanfei 2003 or Peri and Urban 2006). Others suggest the opposite such that only a narrow technology distance is conducive to technological spillovers (e.g. Kokko et al. 1996 or Liu et al. 2000) as closer levels of technological development across countries renders them technologically more compatible, with sufficient absorptive capacities to benefit from each other’s research efforts and successes. Hence, the technological distance between country i and j is included, in terms of a correlation coefficient which, by construction, lies between [0, 1] (TDIS). A high value of the coefficient indicates a narrow technological distance and similar specialization patterns between two countries.

Furthermore, dummies for EU membership are included which capture whether only country i is a member of the EU, whether country j is a member of the EU only, or whether both i and j are EU-member countries. This will show whether R&D expenditure of foreign-owned firms is higher between EU member countries or between EU and non-EU countries. Boschma (2005) refers to institutional proximity to capture that a common institutional set-up of two countries may facilitate business activities of firms abroad.

Finally, Eq. 10.1 also includes host and home country fixed effects (α i and α j for country i and j, respectively) to account for country heterogeneity and year fixed effects (λ t ) to take account of common macroeconomic shocks.

5 Results

Results are presented in Table 10.1 for different econometric specifications (see Eqs. 10.1 and 10.2) and estimation techniques: columns (1) to (3) provide results for the basic specification as given in Eq. 10.1, while columns (4) to (6) also account for the effect of the level of economic development on R&D expenditure of foreign-owned firms as specified in Eq. 10.2. Moreover, from a methodological point of view, columns (1) and (4) provide results for pooled OLS, columns (2) and (5) for fixed effects for receiving and sending countries and columns (3) and (6) for random effects specific for bilateral country pairs. The main shortcoming of the pooled OLS approach lies in its inability to allow for heterogeneity of host and home countries since it assumes that all countries are homogeneous. This is remedied by fixed effects (column (2)) and random effects approaches (column (3)) which explicitly account for the heterogeneity of both individual host and home countries as well as for heterogeneity of host-home country pairs, respectively.

As expected, the size of both home and host countries emerges as one key determinant of R&D expenditure of foreign-owned firms. In particular, a 1 % increase in the both host and home country’s market size is associated with a rise in R&D expenditure of foreign affiliates by between 0.8 % and 1 %. However, size effects slightly differ across countries and tend to be stronger in the host country. This again provides supportive evidence of the ‘size matters’ hypothesis.

The analysis also demonstrates that apart from size, prevailing levels of economic development matter for the scale of cross-border R&D expenditure. In particular, cross-border R&D expenditure tends to be higher in wealthier economies: a 1 % rise in the host country’s GDP per capita increases R&D expenditure of foreign-owned firms by around 0.7–0.8 % while a similar 1 % increase in the home country’s GDP per capita has a slightly higher effect and is associated with an around 1 % increase in R&D efforts of foreign-owned firms.

Moreover, light is shed on the particular roles additional innovation-related indicators play for the process of R&D internationalization. Results in Table 10.1 highlight that human capital emerges as a non-negligible determinant of cross-country R&D expenditure of foreign-owned firms. However, results also reveal that underlying dynamics appear to differ across specifications. Specifically, column (1) to (3) show that, in line with findings by Hedge and Hicks (2008), there is evidence that a strong human capital base in the host country attracts business R&D: a 1 % point increase in the host country’s tertiary enrolment rate is associated with a 2.9 % increase in inward R&D expenditure. In contrast, results presented in columns (4) to (6) stress that, once levels of economic development of both host and home country are also taken into account, an abundance of human capital in the home country appears to discourage R&D internationalization activities of foreign-owned firms. This is in line with findings by Lewin et al. (2009) who emphasize that firms tend to relocate product development to other parts of the world if faced with a shortage of skilled science and engineering talent at home. However, diverging results on the role of human capital for the process of R&D internationalization are not – as it may seem – contradictory but suggest that, once levels of economic development are also controlled for, the host country’s endowment with human capital becomes of secondary importance while its level of development (together with its economic size) assumes the role of main driver of the process of R&D internationalization.

Similarly, there is evidence that a strong and internationally competitive indigenous R&D base in the host country is conducive to R&D expenditure of foreign-owned firms. Hence, host countries that specialize in and generate internationally competitive high-technology products are attractive R&D locations for foreign-owned firms as they possess indigenous technological capabilities foreign-owned firms can exploit for their innovative activities. In contrast, no decisive role can be attributed to a country’s general level of inventiveness in fostering R&D expenditure of foreign affiliates.

Finally, the results support the hypothesis concerning distance and proximity related determinants. The analysis finds consistent evidence for the pivotal role geographic distance between countries plays in curbing the process of R&D internationalization. Specifically, inward R&D expenditure falls by between 0.3 % and 0.8 % in response to a 1 % increase in distance between countries, where distance captures additional coordinative costs of regionally dispersed R&D activities or diseconomies of scale and scope as a result of more decentralized R&D activities.

Moreover, cultural proximity tends to be a conducive determinant of R&D expenditure of foreign affiliates. This supports the ‘liability of foreignness’ hypothesis formulated above: lower cultural barriers improve market knowledge and the understanding of customer needs and facilitate communication and the exchange of information and knowledge across borders. In a similar vein, physical proximity also fosters the internationalization of R&D such that foreign affiliates located in neighbouring countries tend to spend significantly more on R&D activities than affiliates located farther away.

In line with results by Guellec and van Pottelsberghe de la Potterie (2001), the analysis also emphasizes that technological distance matters. In particular, R&D expenditure of foreign-owned firms appears to be higher between countries with similar technological specializations which may indicate that R&D activities of foreign-owned firms are attracted by potential spillovers in technological domains similar to their own specialization. Finally, the analysis also demonstrates that cross-border R&D expenditure tend to be regionally dispersed across EU as well as non-EU member countries.

6 Summary and Conclusion

In the course of the last two decades, R&D expenditure of foreign-owned firms increased tremendously, an indication that firms increasingly conduct research and development outside their home countries. Against that backdrop, the analysis identified important determinants of this more recent process of increased R&D internationalization. It used a novel data set on R&D expenditure of foreign-owned firms in the manufacturing sector of a set of OECD countries, spanning the period from 2001 to 2007.

Generally, the results attribute a pivotal role to geographic distance in curbing R&D expenditure of foreign-owned firms. This may be explained by the costs of R&D internationalization (like additional costs of coordinating geographically dispersed R&D activities or of transferring knowledge over distance) which tend to noticeably increase with distance which, in turn, renders highly dispersed R&D activities more costly and consequently less attractive. Moreover, cultural proximity which facilitates communication and the exchange of knowledge as well as physical proximity which turns neighbouring countries attractive R&D hubs emerge as important determinants of the process of R&D internationalization. Furthermore, as expected, economic size and wealth of host and home countries alike are key determinants which – in the light of larger markets with more favourable sales prospects as well as wealthier consumers with a stronger and more pronounced ‘love for variety’ – stimulate R&D efforts of foreign affiliates.

In addition, R&D efforts of foreign-owned firms also respond to additional scientific or technological capabilities. In particular, while some indication is found that a strong human capital base in the host country attracts business R&D of foreign-owned firms, there is additional evidence that an abundance of human capital in the home country tends to curtail the relocation of innovative activities to other parts of the world. Similarly, a strong and internationally competitive indigenous R&D base in the host country which foreign-owned firms can harness and exploit for their own research activities is conducive to R&D expenditure of foreign affiliates. Furthermore, R&D expenditure of foreign-owned firms is also significantly stronger among countries with similar levels of technological development, which renders technological compatibility among countries a non-negligible driver of the process of R&D internationalization. Finally, some indication is found that R&D expenditure of foreign-owned firms is regionally decentralized and not concentrated within the EU.

These results have important implications for science, technology and innovation policy. They point at areas where governments can take concerted action to render their countries more attractive for R&D activities of foreign-owned firms. These critical areas are science and education. Governments that succeed in strengthening domestic research and development capabilities and in raising tertiary enrolment rates may also succeed in attracting R&D of foreign-owned firms (Veugelers et al. 2005; OECD 2008a; De Backer and Hatem 2010). This study provides empirical evidence on how proximity among countries and country-specific attributes like economic size, wealth, inventiveness, etc. affects the intensity of cross-country R&D flows.

Though this sheds a first light on determinants on this increasingly important phenomenon, analyses in this field still suffer from severe data limitations and inconsistencies which have to be addressed and resolved in future research. Other potentially important factors capturing R&D and innovation systems, interaction with public R&D and institutions like universities and research institutions, market structures and FDI flows, etc. would also have to be considered to give a more complete picture of R&D flows across countries. Methodologically a comprehensive panel data set should allow to further account for spatial dependencies and spatial lag structures incorporating effects of neighbouring countries performance and market potentials (see, e.g., Chap. 6 of this volume by Chun). Finally, R&D patterns are largely determined by a few, potentially large, enterprises suggesting that firm level data and firm as well as country case studies would be enlightening though challenging avenues for future research (see Dachs et al. 2014, for some detailed evidence).

Notes

- 1.

The following OECD countries are covered: Austria (AUT), Belgium (BEL), Bulgaria (BUL) Canada (CAN), the Czech Republic (CZE), Denmark (DNK), Estonia (EST), Finland (FIN), France (FRA), Germany (GER), Greece (GRC), Hungary (HUN), Ireland (IRL), Japan (JPN), the Netherlands (NLD), Norway (NOR), Poland (POL), Portugal (PRT), Romania (ROM), Spain (ESP), the Slovak Republic (SVK), Slovenia (SVN), Sweden (SWE), Turkey (TUR), the UK (GBR) and the US (USA).

- 2.

Data was collected as part of the project ‘Internationalisation of business investments in R&D and analysis of their economic impact’ and have been slightly revised and updated for this paper.

- 3.

The European Union is considered as one entity, and intra-EU relationships (for example R&D of German firms in France) are not taken into account.

- 4.

Due to lacking data on outward R&D expenditure for most EU countries, Fig. 10.2 is based on US inward data.

- 5.

This measure corresponds to weighted degree centrality in the social network analysis literature.

References

Anderson JE (1979) A theoretical foundation for the gravity equation. Am Econ Rev 69:106–116

Belderbos R, Leten B, Suzuki S (2009) Does excellence in academic research attract foreign R&D? UNU-MERIT working paper series no. 066, Masstricht

Bergstrand JH, Egger P (2007) A knowledge-and-physical-capital model of international trade flows, foreign direct investment, and multinational enterprises. J Int Econ 73(2):278–308

Blomström M, Kokko A (2003) The economics of foreign direct investment incentives. NBER working paper no. 9489, Cambridge, MA

Bloningen BA (2005) A review of the empirical literature on FDI determinants. Atlantic Econ J 33:383–403

Booz Allen Hamilton, INSEAD (2006) Innovation: is global the way forward? Paris

Boschma R (2005) Proximity and innovation: a critical assessment. Reg Stud 39:61–74

Brainard SL (1997) An empirical assessment of the proximity concentration tradeoff between multinational sales and trade. Am Econ Rev 87(4):520–544

Breuss F, Egger P (1999) How reliable are estimations of east–west trade potentials based on cross-section gravity analyses? Empirica 26(2):81–95

Castellani D, Zanfei A (2003) Technology gaps, absorptive capacity and the impact of inward investments on productivity of European firms. Econ Innov New Technol 12(6):555–576

Castellani D, Palmero AJ, Zanfei A (2011) The gravity of R&D FDI. Working papers series in economics, mathematics and statistics WP-EMS No. 2011/06. Facoltà di Economia, Università degli Studi di Urbino “Carlo Bo”, Urbino

Cincera M, Cozza C, Tübke A (2009) The main drivers for the internationalization of R&D activities by EU MNEs. In: Draft for the 4th annual conference of GARNET network, IFAD, Rome, 11–13 Nov 2009

Cohen WM, Nelson RR, Walsh J (2000) Protecting their intellectual assets: appropriability conditions and why U.S. manufacturing firms patent (or not). NBER working paper no. 7552, Cambridge, MA

Dachs B, Pyka A (2010) What drives the internationalisation of innovation? Evidence from European patent data. Econ Innov New Technol 19:71–86

Dachs B, Stehrer R, Zahradnik G (eds) (2014) The internationalisation of business R&D. Edward Elgar, Cheltenham

De Backer K, Hatem F (2010) Attractiveness for innovation. Location factors for international investment. Organization for Economic Co-operation and Development, Paris

Deardorff A (1984) Testing trade theories and predicting trade flows. In: Kenen PB, Jones RW (eds) Handbook of international economics, vol 1. Elsevier, Amsterdam

Dixit AK, Stiglitz JE (1977) Monopolistic competition and optimum product diversity. Am Econ Rev 67:297–308

Dunning J (1988) Explaining international production. Harper Collins, London

Eden L, Miller S (2004) Distance matters: liability of foreignness, institutional distance and ownership strategy. In: Hitt MA, Cheng JLC (eds) The evolving theory of the multinational firm, advances in international management. Elsevier, Amsterdam

Erken H, Kleijn M (2010) Location factors of international R&D activities: an econometric approach. Econ Innov New Technol 19:203–232

European Commission (DG Research and Innovation, JRC-IPTS) (2010) Monitoring industrial research: the 2009 EU survey on R&D investment business trends. European communities, Luxembourg

Findlay R (1978) Relative backwardness, direct foreign investment and the transfer of technology: a simple dynamic model. Q J Econ 92:1–16

Forsgren M (2008) Theories of the multinational firm. Edward Elgar, Cheltenham

Gersbach H, Schmutzler A (2011) Foreign direct investment and R&D offshoring. Oxf Econ Paper 63:134–157

Guellec D, van Pottelsberghe de la Potterie B (2001) The internationalisation of technology analysed with patent data. Res Policy 30:1253–1266

Hall BA (2010) The internationalization of R&D. University of California, Berkeley. http://elsa.berkeley.edu/users/bhhall/papers/BHH10_RND_international_August.pdf

Hedge D, Hicks D (2008) The maturation of global corporate R&D: evidence from the activity of U.S. foreign subsidiaries. Res Policy 37(3):390–406

Helpman E (2006) Trade, FDI and the organisation of firms. J Econ Lit 44(3):589–631

Helpman E, Melitz M, Rubinstein Y (2008) Estimating trade flows: trading partners and trading volumes. Q J Econ 23(2):441–487

Hinze S, Schmoch U (2004) Opening the black box. In: Moed HF, Glänzel W, Schmoch U (eds) Handbook of quantitative science and technology research. Kluwer Academic, Dordrecht

Hymer SH (1960 [1976]) The international operations of national firms: a study of direct foreign investment. Ph.D. Dissertation, The MIT Press, Cambridge, MA

Jeon BN, Stone SF (1999) Gravity-model specification for foreign direct investment: a case of the Asia-Pacific economies. J Bus Econ Stud 5(1):33–42

Kinkel S, Maloca S (2008) FuE-Verlagerungen in Ausland – Ausverkauf deutscher Entwicklungskompetenz? Fraunhofer ISI, Karlsruhe

Kokko A, Tansini R, Zejan M (1996) Local technological capability and productivity spillovers from FDI in Uruguayan manufacturing sector. J Dev Stud 32(4):602–611

Lewer JJ, van den Berg H (2008) A gravity model of immigration. Econ Lett 99(1):164–167

Lewin AY, Massini S, Peeters C (2009) Why are companies offshoring innovation? The emerging global race for talent. J Int Bus Stud 40(6):901–925

Liu X, Siler P, Wang C, Wei Y (2000) Productivity spillovers from foreign direct investment: evidence from UK industry level panel data. J Int Bus Stud 31(3):407–425

Lueth E, Ruiz Arranz M (2006) A gravity model of workers’ remittances’. IMF working paper no. 06/290, Washington, DC

Markusen JR (2002) Multinational firms and the theory of international trade. MIT Press, Cambridge, MA/London

Nagaoka S, Motohashi K, Goto A (2010) Patent statistics as an innovation indicator. In: Hall BA, Rosenberg N (eds) Handbook of the economics of innovation, vol 2. Elsevier, Amsterdam

Narula R, Zanfei A (2005) Globalisation of innovation: the role of multinational enterprises. In: Fagerberg J, Movery DC, Nelson RR (eds) The Oxford handbook of innovation. Oxford University Press, Oxford

OECD (2008a) Recent trends in the internationalisation of R&D in the enterprise sector, special session of globalisation’, DSTI/EAS/IND/SWP(2006)1/Final, working paper on statistics. Organisation for Economic Co-operation and Development, Paris

OECD (2008b) The internationalisation of business R&D: evidence, impacts and implications. Organisation for Economic Co-operation and Development, Paris

Patel P, Pavitt K (1991) Large firms in the production of the world’s technology: an important case of ‘non-globalisation. J Int Bus Stud 22(1):1–21

Peri G, Urban D (2006) Catching-up to foreign technology? Evidence on the ‘Veblen-Gerschenkron’ effect of foreign investments. Reg Sci Urban Econ 36:72–98

Sanna-Randaccio F, Veugelers R (2007) Multinational knowledge spillovers with decentralised R&D: a game-theoretic approach. J Int Bus Stud 38:47–63

Scherngell T, Barber M (2011) Distinct spatial characteristics of industrial and public research collaborations: evidence from the 5th EU framework programme. Ann Reg Sci 46(2):247–266

Steinmueller WE (2010) Economics of technology policy. In: Hall BA, Rosenberg N (eds) Handbook of economics of innovation. Elsevier, Amsterdam

Thursby J, Thursby M (2006) Here or there? A survey of factors in multinational R&D location. National Academies Press, Washington, DC

Tinbergen J (1962) The world economy: suggestions for an international economic policy. Twentieth Century Fund, New York

Veugelers R, Dachs B, Falk R, Mahroum S, Nones B, Schibany A (2005) Internationalisation of R&D: trends, issues and implications for S&T policies. Background report for the OECD forum on the internationalization of R&D. Organisation for Economic Co-operation and Development, Brussels

Young S, Hood N, Peters E (1994) Multinational enterprises and regional economic development. Reg Stud 28(7):657–677

Zaheer S (1995) Overcoming the liability of foreignness. Academy Manag J 38:341–364, References

Acknowledgements

The analysis of this paper is based on data collected by the project ‘Internationalisation of business investments in R&D and analysis of their economic impact’, commissioned by the European Commission, DG Research and Innovation (Contract Nr. RTD/DirC/C3/2010/SI2.563818). Special thanks go to Matthieu Delescluse, who supported the project as project officer. Moreover, we acknowledge the support by EUROSTAT in collecting the data. The authors also thank the participants of special session on the internationalisation of business R&D held at the Annual ERSA conference 2012 in Bratislava for their useful comments.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix

Appendix

Rights and permissions

Copyright information

© 2013 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Leitner, S., Stehrer, R., Dachs, B.M. (2013). Determinants of International R&D Activities: Evidence from a Gravity Model. In: Scherngell, T. (eds) The Geography of Networks and R&D Collaborations. Advances in Spatial Science. Springer, Cham. https://doi.org/10.1007/978-3-319-02699-2_10

Download citation

DOI: https://doi.org/10.1007/978-3-319-02699-2_10

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-02698-5

Online ISBN: 978-3-319-02699-2

eBook Packages: Business and EconomicsEconomics and Finance (R0)