Abstract

Internationalization of R&D and innovation by multinational enterprises (MNEs) has undergone a gradual and comprehensive change in perspective over the past 50 years. From sporadic works in the late 1950s and in the 1960s, it became a systematically analyzed topic in the 1970s, starting with pioneering reports and “foundation texts”. Our review unfolds the theoretical and empirical evolution of the literature from dyadic interpretations of centralization versus decentralization of R&D by MNEs to more comprehensive frameworks, wherein established MNEs from advanced economies still play a pivotal role, but new players and places also emerge in the global generation and diffusion of knowledge. Hence, views of R&D internationalization increasingly rely on concepts, ideas, and methods from IB and other related disciplines such as industrial organization, international economics, and economic geography. Two main findings are highlighted. First, scholarly research pays increasing attention to the network-like characteristics of international R&D activities. Second, different streams of literature have emphasized the role of location-specific factors in R&D internationalization. The increasing emphasis on these aspects has created new research opportunities in some key areas, including inter alia: cross-border knowledge-sourcing strategies, changes in the geography of R&D and innovation, and the international fragmentation of production and R&D activities.

Résumé

L’internationalisation de la R&D et de l’innovation des entreprises multinationales (EMN) a subi un changement progressif et complet de perspective au cours des 50 dernières années. A partir de travaux sporadiques à la fin des années 1950 et dans les années 1960, elle est devenue un sujet systématiquement analysé dans les années 1970, à commencer par des rapports novateurs et des « textes fondamentaux » . Notre analyse décrit l’évolution théorique et empirique de la littérature des interprétations dyadiques de la centralisation par rapport à la décentralisation de la R&D par les EMN vers des cadres plus complets, dans lesquels les EMN établies des économies avancées jouent encore un rôle central, mais de nouveaux acteurs et localisations apparaissent également dans la génération mondiale et la diffusion des connaissances. Par conséquent, les conceptions de l’internationalisation de la R&D s’appuient de plus en plus sur des concepts, des idées et des méthodes de l’IB et d’autres disciplines connexes telles que l’organisation industrielle, l’économie internationale et la géographie économique. Deux résultats principaux sont mis en évidence. Premièrement, la recherche académique accorde une attention croissante aux caractéristiques de type réticulaire des activités internationales de R&D. Deuxièmement, différents courants de littérature ont souligné le rôle des facteurs spécifiques à la localisation pour l’internationalisation de la R&D. L’importance croissante accordée à ces aspects a créé de nouvelles opportunités de recherche dans certains domaines clés, notamment les stratégies d’approvisionnement transfrontalier en connaissances, l’évolution de la géographie de la R&D et de l’innovation, et la fragmentation internationale des activités de production et de R&D.

Resumen

La internacionalización de la I+D e innovación de las empresas multinacionales (EMNs) ha sufrido un cambio gradual y exhaustivo en perspectiva en los últimos 50 años. De trabajos esporádicos a finales de los años cincuenta y sesenta, se convirtió en un tema analizado sistemáticamente los setentas, empezando con reportes pioneros y “textos fundacionales”. Nuestra revisión despliega la evolución teórica y empírica de la literatura desde las interpretaciones diádicas de centralización versus la descentralización de la I+D de las EMNs a marcos más exhaustivos, en el que EMN establecidas de Economías Avanzadas aún juegan un papel fundamental, pero en el que nuevos jugadores y lugares también emergen en la generación global y difusión de conocimiento. Por consiguiente, las visiones de la internacionalización de la I+D cada vez más se basan en conceptos, ideas y métodos de Negocios Internacionales y otras disciplinas relacionadas como la organización industrial, la economía internacional y la geografía económica. Dos hallazgos principales son resaltados. Primero, la investigación presta cada vez atención a las características similares a redes de las actividades de I+D internacionales. Segundo, las diferentes corrientes de la literatura han enfatizado el rol de los factores específicos de ubicación en la internacionalización de I+D. El énfasis creciente en estos aspectos ha creado nuevas oportunidades de investigación en algunas de las áreas clave, incluyendo, entre otras cosas: estrategias de fuentes de conocimiento transfronterizo, cambios en la geografía de la I+D y la innovación, y la fragmentación internacional de las actividades de producción y de I+D.

Resumo

A internacionalização de R&D e inovação por empresas multinacionais (MNEs) sofreu uma mudança gradual e abrangente de perspectiva nos últimos 50 anos. De trabalhos esporádicos no final da década de 1950 e na década de 1960, ela se tornou um tema sistematicamente analisado na década de 1970, começando com relatórios pioneiros e “textos seminais”. Nossa revisão revela a evolução teórica e empírica da literatura, de interpretações diádicas de centralização versus descentralização de R&D por MNEs para modelos mais abrangentes, em que MNEs estabelecidas de Economias Avançadas ainda desempenham um papel fundamental, mas novos atores e lugares também emergem na geração e difusão global de conhecimento. Assim, visões de internacionalização de R&D dependem cada vez mais de conceitos, ideias e métodos de IB e outras disciplinas relacionadas, como organização industrial, economia internacional e geografia econômica. Dois principais achados são destacados. Em primeiro lugar, a pesquisa acadêmica presta atenção crescente às características de rede das atividades internacionais de R&D. Em segundo lugar, diferentes correntes de literatura enfatizaram o papel de fatores específicos da localização na internacionalização de R&D. A crescente ênfase nesses aspectos criou novas oportunidades de pesquisa em algumas áreas-chave, incluindo, entre outras: estratégias transfronteiriças de aquisição de conhecimento, mudanças na geografia de R&D e inovação e a fragmentação internacional das atividades de produção e R&D.

摘要

跨国企业(MNEs)研发与创新的国际化在过去50年中经历了渐进的和全面的变化。从20世纪50年代后期和20世纪60年代的零星作品开始, 它从开创性报告和“基础文本”开始成为20世纪70年代的一个系统分析的主题。我们的综述展示了从跨国企业研发的集权与分权二元解释到更全面框架的文献演化, 其中来自先进经济体的跨国企业仍发挥着关键的作用, 但在全球知识的创造与传播中也出现了新参与者和新地方。因此, 研发国际化的观点越来越依赖于IB和其他相关学科的概念、想法和方法, 如工业组织、国际经济学和经济地理学。强调两个主要发现。首先, 学术研究越来越关注国际研发活动的网络化特征。其次, 不同的文献分支强调位置特定因素在研发国际化中的作用。对这些方面的日益重视为一些关键领域创造了新的研究机会, 其中包括: 跨境知识采购战略, 研发与创新的地理变化, 以及生产和研发活动的国际分片。

Similar content being viewed by others

Avoid common mistakes on your manuscript.

INTRODUCTION

This review aims to provide a critical summary of changing views of the internationalization of R&D1 and innovation, and to identify possible avenues for future research. We will rely on some of the earliest contributions in the field as a starting point, and review subsequent developments in the literature.

To illustrate the evolution of this broad and variegated literature, we identify three distinct phases of theoretical and empirical research on cross-border R&D and innovation activities, although characterized by some non-linear developments and overlaps. While a few studies had already documented the presence of multinational enterprises’ (MNEs) R&D activities in some host countries in the 1950s and 1960s,2 the first systematic attempts to understand decentralized R&D in MNEs appeared in the early 1970s. The seminal empirical research conducted by Ronstadt (1978) and Behrman and Fischer (1980a, b) reflected the classic view of horizontally integrated MNEs largely innovating in the home country and merely adapting product and process technology in the host locations (Vernon, 1966; Caves, 1982). In this phase, which roughly spans from the early 1970s to the mid-1980s, empirical studies of the determinants of R&D foreign direct investment (FDI) were mostly based on surveys and qualitative case histories, with a few notable exceptions represented by cross-sectional econometric studies mainly based on US Department of Commerce data, broken down by host country and/or industry.

The second phase began to emerge in the mid-1980s, reflecting the recognition that MNEs were becoming much more strategically complex and diverse, identified as “heterarchy” (Hedlund, 1986) or as “transnational” (Bartlett and Ghoshal, 1989). This phase is characterized inter alia by an increasing perception of the diffusion of home-base augmenting and asset–seeking strategies as opposed to home-base exploiting and asset-exploiting R&D activities. Such strategies co-evolve with national and regional patterns of knowledge accumulation, and contribute to shaping technological specialization, product-technology life cycles, and R&D localization choices, and become a significant component of the innovative capacity of MNEs.

The third, post-2000, phase is, by and large, characterized by the co-existence and partial convergence of complementary disciplines, including economic geography, international trade and industrial organization, and by the proliferation of empirical works. The latter exploit the increasing availability of longitudinal firm-level data, and of more extensive and detailed surveys and case studies. Established MNEs from advanced countries still play a key role in more recent views of R&D internationalization, but they are placed in the more comprehensive context of the changing organization of international production, wherein new players and places are increasingly involved, including MNEs from emerging areas of the world and relations with actors outside the boundaries of the MNE.

It is worth anticipating two important findings that emerge from this review. On the one hand, we will show that scholarly research pays mounting attention to the network-like characteristics of international R&D activities. This implies a fundamental shift from a standard model of MNEs centralizing most R&D at the home-country level, towards a more complex multi-centric view of R&D generation, exploitation and diffusion of knowledge involving a variety of actors both within and across the boundaries of MNEs. On the other hand, we will illustrate how different streams of literature have emphasized the role of location-specific factors in R&D internationalization. The increasing emphasis on these factors has created new research opportunities in some key areas that are highly relevant for R&D internationalization, including inter alia: cross-border knowledge-sourcing strategies, changes in the geography of R&D and innovation, the international fragmentation of production and R&D activities. As we shall discuss in detail, both of these research lines—the network-like evolution of international R&D and the role played by locational factors in cross-border innovation—contributed to important changes in the way R&D internationalization has been conceptualized and measured; and to the co-evolution and cross-contamination between the literature on R&D internationalization and other related disciplinary approaches.

In the rest of this paper, we first provide the intellectual background and motivation to this article, we anticipate the research questions that guided our review work, and explain the methodology we followed. We then illustrate the pioneering studies on the internationalization of R&D and highlight some of the earliest insights on the variety of strategies that were already starting to emerge in the 1970s and early 1980s. We thereafter account for the proliferation of R&D internationalization literature in the 1990s, with specific reference to different taxonomies of MNEs’ cross-border R&D activities, to the literature on the changing organization of internationalization of innovation, and to the studies on locational factors, on entry modes and on National System of Innovation (NSI). Finally, we review the more recent developments in the largely empirical literature after the turn of the 21st century. The focus here is on the numerous attempts to measure and quantify asset-exploiting, asset-seeking, and asset-augmenting R&D FDIs; on international R&D networking; and on the changing locational patterns of R&D internationalization. In the concluding section, we discuss further research avenues.

BACKGROUND, RESEARCH QUESTIONS, AND METHODOLOGY

Background

The texts (Hymer, 1960/1976; Vernon, 1966; Dunning, 1977) that we now see as providing the foundations of what became international business (IB) essentially addressed the issue of how and why purely national firms became international. Within this context, the key question was what gave these proto-multinationals the ability to do something that was already understood to have a distinctive dimension of difficulty: overcoming the liability of foreignness (Hymer, 1960/1976; Zaheer, 1995, 2015). Entering an alien economy characterized by intrinsic institutional differences would in fact impose adjustment costs and risks not faced by incumbent local enterprises. The answer, articulated in somewhat different ways in these foundation texts, was that internationalizing firms would need some source of unique original competitive advantage not possessed by the competitors they would meet in overseas operations: a “superior technology” (Hymer, 1960), “ownership advantages” (OA) (Dunning, 1977) or “firm-specific advantages” (FSA) (Rugman, 1981). The presumption then was that these advantages were created in the firm’s ‘home’ country and reflected the inventive capacities and market conditions of these economies.

Quite quickly, the analytical focus in IB moved from how firms became MNEs to how they behaved as MNEs. Initially, the first insight was that these firms internationalized to pursue the continued exploitation of their home-country-sourced competitive advantages. Market-seeking (MS) and/or efficiency-seeking (ES) subsidiaries (Behrman, 1984; Dunning, 2000; Dunning & Lundan, 2008a; Papanastassiou & Pearce, 2009; Pearce, 2017) were activated to secure appropriate combinations of local conditions (market or input potentials) and the firms’ OA/FSA (Rugman & Verbeke, 2001). However, as we shall see, the increasing attention to the competitive potentials associated with locational factors, paved the way to a gradual extension of the analysis to a larger variety of IB strategies, including knowledge-sourcing and competence creating objectives (Dunning & Narula, 1995; Cantwell & Mudambi, 2005; Dunning 2009; Bartlett & Beamish, 2018).

The literature on internationalization of R&D and innovation reflects this gradual and comprehensive change in perspective. In the 1960s and 1970s, IB studies largely viewed R&D and innovation as concentrated in MNEs’ home countries, with limited involvement of foreign affiliates in the adaptation of extant technologies to local markets. This view largely corresponds to the state of affairs at that time. Moreover, in spite of a remarkable increase in the internationalization of R&D that has been documented over the subsequent decades (UNCTAD, 2005; OECD, 2007, 2011; Dachs, Stehrer & Zahradnik, 2014; Dachs, 2017), a strong home bias has historically characterized and still characterizes R&D and innovation activities (Patel & Pavitt, 1991; Belderbos, Leten & Suzuki, 2013) conditioned to a large extent by the type of data used and empirical analysis applied.3 However, international R&D activities have always exhibited a high heterogeneity across countries, industries and, even more so, across firms – and this is true in both quantitative and qualitative terms. The premises for a deeper role of foreign units of MNEs in innovative activities, and in the absorption and creation of valuable knowledge, were already present in the early stages of multinational expansion (Ietto-Gillies, 2019). Some studies in the 1970s had started to pay attention to the different mandates of subsidiaries in the internationalization of R&D as well as to the existence of various types of overseas R&D laboratories, whose activities went well beyond the mere application and adaptation of extant technology. These seminal contributions opened up a rich stream of research on asset-exploiting, asset-seeking, and asset-augmenting strategies, which has proliferated in the 1990s and has given rise to an extensive empirical literature, especially at the turn of the new century, when detailed and longitudinal data on R&D internationalization have become available. While asset-seeking and knowledge-creating FDIs may not represent the majority of cases, as we shall see there is evidence of their growing importance in some sectors, and the attention to the emergence of such R&D internationalization strategies has certainly increased in the literature (Belderbos, Sleuwaegen, Somers & De Backer, 2016). Accounts on different international R&D strategies intertwine with developments in the literature on the changing organization of MNEs, particularly with the emergence of new heterarchical and networked structures; and with studies on locational factors affecting the nature and direction of international business activities. Hence, works on cross-border R&D and innovation inevitably connect on the one hand with organizational theorizing and, on the other hand, with a wide range of contributions on national (and regional) systems of innovation (SI), on the international fragmentation of value-added activities and on the geography of innovation.

Research Questions

Our review work accounts for these changes in perspectives on the internationalization of R&D. As we shall show, such changes are inextricably connected both with the evolution of the phenomenon under observation, and with a profound transformation in the way authors have been looking at the phenomenon itself.

To explore this broad, heterogeneous, and evolving field of study, the review aims to answer the following research questions (RQs).

Research Question 1:

How do changing views of R&D internationalization combine with the availability of new data-sources and empirical findings?

Answering this question is of paramount importance when dealing with a relatively new, emerging, hardly documented phenomenon, as was the case of R&D internationalization when IB was born as a discipline. In fact, as R&D FDIs were rare events, no standard methods could be applied to measure them, and extant analytical frameworks could not be used nor easily adapted to interpret them. As we shall show in detail, R&D internationalization has progressively imposed itself to the attention of scholars and has entered their research agenda, inducing them to improve their understanding of it; and new theorizing has spurred to search for more comprehensive and convincing evidence. This cumulative process of continuous interaction between empirical and theoretical advancements, often observed in the appearance and consolidation of new scientific paradigms, also generated some conflicting trends in the literature. On the one hand, the availability of more extensive and longitudinal data sources allowed to shed more and more light on several aspects of the internationalization of R&D that could not even be seen nor explored when scholars first looked at this phenomenon. On the other hand, the increasing availability of richer and more comprehensive data has led researchers to often erroneously assume that complex international R&D operations are a very recent phenomenon. This reflects a lack of historical perspective in much of the recent scholarly research. In fact, as we shall show, seminal contributions of the 1970s had already analyzed a variety of R&D laboratories' typologies and of cross-border innovation activities, and had documented their co-location with other MNE functions, hence highlighting that R&D internationalization already was a “complex” phenomenon at the time. Table 1 highlights changes in available data sources and in core themes addressed in the literature in the three historical phases of its evolution.

Research Question 2:

How did the literature on R&D internationalization incorporate contributions from different disciplines?

This research question strictly connects to the line of argument we have sketched above. What we wish to explore here is how perspectives on R&D internationalization are themselves affected by, and contribute to, changing views of international production. Reviewing the literature on R&D internationalization, we will have to deal with different aspects IB studies but also, and increasingly, with other more or less related disciplines, including international trade, economic geography, organization science, economics of innovation and industrial organization, and even some research streams that largely lay beyond the scope of this review work like development economics and R&D management. These different disciplines have “contaminated” each other, shedding new light on different aspects of R&D internationalization. The co-evolution and cross-fertilization among different disciplines can be observed in three research areas in particular. First, developments in organization studies in combination with evolutionary approaches to the economics of innovation have led IB scholars to pay increasing attention to the ways in which MNEs organize themselves into complex cross-border networks, involving a larger number of innovation units active in the exploitation and exploration of technological opportunities, both within and beyond corporate boundaries. Second, studies on innovation systems and more recent advancements in economic geography have stimulated more in-depth analyses of the role of locational factors and agglomeration economies, at the national and subnational levels, in attracting R&D FDIs; and on the impact of R&D internationalization in shaping global value chains. Third, contaminations between international trade and IB literature have led to a reconsideration of distance factors in R&D internationalization. Geographic separation appears to play a less significant role when knowledge transfer and absorption is at stake, and this has implications for both public policies and managerial strategies.

Our reading of the extensive literature on R&D internationalization will help us answer these two research questions. Throughout this review, we will highlight how different streams of contributions have shed light on these issues, and will return to them in the concluding section. We will then pull together the various threads we will unravel while exploring the three phases that have characterized the evolution of the field: the pioneering phase of the early 1970s and 1980s, the consolidation phase of the mid 1980s and 1990s, and the more recent wave of interdisciplinary and predominantly empirical research, after the turn of the century.

Methodology

A variety of methodologies have been applied to studies of internationalization processes. Widely used methods include: content analysis, which heavily depends on the coding principle adopted to capture qualitative and quantitative dimensions of the area investigated (Duriau, Reger & Pfarrer, 2007; Aykol, Palihawadana & Leonidou, 2013; Gaur & Kumar, 2018); meta-analysis, aiming to produce a quantitative estimate of contributions to extant literature (Welch & Bjorkman, 2015: 305; Buckley, Devinney & Tang, 2013; Meyer & Sinani, 2009); a narrative or critical review aiming at developing or evaluating theories or providing the ‘historical account of the development of theory and research on a particular topic’ (Baumeister & Leary, 1997: 312; Martinez-Noya & Narula, 2018; Cantwell, 2017); citation or bibliometric analysis as a meta-analytical technique aiming to “analyze the relations between and among articles of a given research area” (Alon, Anderson, Munim & Ho, 2018: 578; Chabowski, Samiee & Hult, 2013); the antecedents-decisions-outcome (ADO) approach based on the identification in the literature of the explanatory factors and effects of specific facts or objects of observation (Hitt, Tihanyi, Miller & Connelly, 2006; Paul & Benito, 2018); and the Delphi method relying on a systematic collection of views of qualified experts (Liang & Parkhe, 1997; Vrontis & Christofi, 2019).

The choice of methodological tools reflects the different purposes that can be pursued when reviewing extant literature (Welch & Bjorkman, 2015). Moreover, the level of sophistication and complexity of procedures adopted in the selection of relevant literature, and in elaborating views drawn from it, is in turn affected by the richness of approaches and of information sources that need to be examined (Nippa & Reuer, 2019: 3). This is particularly the case when reviewing the literature on R&D internationalization which, as said, relies on contributions from a wide range of disciplines and calls for a large variety of information sources. As our aim is to evaluate existing conceptual and empirical studies through a historical account of different streams of literature on R&D internationalization, and to ultimately suggest future avenues of research, in this paper we adopt the narrative or critical review methodology. Adopting such a method implies an effort, largely guided by the reviewer’s theoretical priors, to deliver the authors’ point of view about the ‘phenomenon under discussion’ (Webster & Watson, 2002: xiv; Welch & Bjorkman, 2015). As in Keupp and Gassmann (2009) and Alon et al. (2018), we defined a precise point of departure, which in our case is represented by pioneering reports of the US Tariff Commission (1973) and The Conference Board by Creamer (1976) as well as the “foundation texts” of Ronstadt (1978) and Behrman and Fischer (1980a, b). We then identified subsequent streams of literature that differentiate themselves from these seminal works in terms of the key themes, data-sources, and/or empirical issues that they emphasize. Consistently with this methodology, and following Welch and Bjorkman (2015) and Paul, Parthasarathy, and Gupta (2017), this led us to tentatively distinguish the three phases of theoretical and empirical analysis which we will discuss in the next sections of this paper.

Based on this general methodological approach, we carried out a systematic search of relevant literature. Here too, we found inspiration in previous review works (Pearce, 1989; Gassmann & von Zedtwitz, 1999; Zanfei, 2000; Kim, Morse & Zingales, 2006; Cantwell, 2017; Freeman, 2019). Some reviews focus on a small number of academic journals, usually the leading ones in a particular subject, while others provide a more extensive textual coverage (Chabowski et al. 2013). Similarly, some reviews analyze more circumscribed periods of time while others have a more extended timespan (Griffith, Cavusgil & Xu, 2008; Nippa & Reuer, 2019; Paul et al. 2017). Our purpose in this review was neither to ‘produce mind-numbing lists of citations and findings that resemble a phone book–impressive cast, lots of numbers, but not much plot’ (Bem, 1995: 173); nor to focus on selected top journals only, as this would restrict the coverage of relevant sources (Webster & Watson, 2002). We rather decided to select relevant literature according to a three-step procedure.

We first selected the works playing a pivotal role as “focal points” in the study of R&D internationalization, according to our own experience of the field. Our selection has been driven primarily by our own theoretical lenses and understanding of IB literatures on MNE R&D internationalization, to start with, also embracing insights and conceptualizations from complementary streams of literature. This preliminary screening based on our priors brought us to identify what we considered as works marking key points of departure and/or leading to fundamental changes in the way R&D internationalization has been viewed over time. As recommended by Webster & Watson (2002: xvi), we double-checked the results of this choice of key authors by adopting a “go backward” approach. Hence, we retrieved the citations of seminal articles per chronological period in order to “determine prior articles” that could be included in the review. This “snow-ball” approach also secured the inclusion of influential books and reports (Martin, 2012).

As a second step, based on the preliminary identification of focal contributions, we defined a tentative periodization in evolution of the literature, which eventually led us to identify three broadly sketched phases characterized by different combinations of research themes and placing different emphasis on specific objects of observation and data sources. We used this tentative periodization to selectively organize further search of relevant literature with the aim of enriching the coverage of themes, concepts, data sources, and empirical findings, and eventually refining the periodization itself.

Our third step consisted of complementing the results of the preliminary stages of selection of the literature by means of Boolean search of pre-determined keywords or phrases using standard bibliographic databases. Selected keywords included inter alia: “R&D internationalization”; “R&D decentralization”; “overseas R&D”; “cross-border R&D”. These were used both in isolation and in combination with other keywords as: “multinationals/MNEs/MNCs”; “FDIs”; “globalization”; “offshoring”; and “knowledge/technology transfer”. Like in other review articles addressing multi-dimensional concepts that have evolved over time, it becomes almost impossible to narrow down literature reviews on few clearly defined keywords (Nippa & Reuer, 2019). Thus, the choice of keywords reflects the evolution of our understanding the subject through time. We conducted our search through: Google Scholar, Business Source Complete, and ScienceDirect. We found Google Scholar to be the most useful one, as it included practically all top-ranking journals while it allowed access to reports and papers that could not be traced elsewhere (Nippa & Reuer, 2019). We analyzed the results of our Google Scholar keyword search through the Publish or Perish software (Harzing, 2007). The software allows for the classification of results based on a series of factors including among others, number of citations per paper, authors, date of publication, Google Scholar Rank (which indicates most relevant query results). An overview of the analysis of keyword search, the steps followed, and outcomes are presented in the “Appendix”.

On the one hand, this third step allowed us to confirm that many of the focal contributions we had identified in the previous steps were also among the most cited and recognized over time. On the other hand, it allowed us to further expand the coverage of the literature that needed to be reviewed as a result of the expanding boundaries of research on this theme. Hence, this step of the review procedure has induced us to partially reconsider the previous steps, inducing us to identify some additional focal contributions and to further refine our understanding of emerging themes and findings in the literature (see Fig. 1 for a summary of the three steps of the iterative search procedure we have followed).

This procedure led us to what we deemed to be a proper balance between concept- and author-centric approaches (Cantwell, 2017; Welch & Bjorkman, 2015; Weber & Watson, 2002). Selected authors are thus associated to key research themes, and main data sources which have been under the spotlight in the different historical phases, as shown in Table 1. This table illustrates the way we will organize the discussion of the extensive literature throughout the three phases of its evolution in time. The subsequent sections of the paper will focus on each of the three parts of this matrix table and discuss how the literature on the internationalization of R&D has addressed the key themes and used the different data sources recalled in the table. The contributions listed in the table, in correspondence with each of the examined phases, are not exhaustive of all scholarly work on the topic. However, they represent quite precisely the core results of the selection procedure we have described in this Methodology section.

THE FIRST PHASE OF R&D INTERNATIONALIZATION. THE EARLY YEARS

Within the widening scope of IB, as a conscious academic interest, two pioneering works opened the way to the systematic analysis of MNEs’ overseas R&D.

The first of these studies was the wide-ranging report of the US Tariff Commission (1973) on the implications for the US economy of its MNEs, which presented and analyzed US Department of Commerce data on the extent of overseas R&D in these firms. Taken along with subsequent regular publication of the Department of Commerce data4, this revealed how the ratio of ‘overseas R&D expenditure by US firms as a proportion of their total R&D budgets’ varied considerably between industries and through time.5

The second of these early studies was conducted by Creamer (1976). Based on US Department of Commerce data, he highlighted that in 1966, 86% of Fortune 500 US companies had foreign R&D expenditure, though the phenomenon did not spread far beyond them, since they accounted for 97% of all overseas R&D expenditure reported by US-based enterprises6. Moreover, by reviewing detailed data on a sample of 75 leading US MNEs and of their foreign affiliates in 1973, Creamer (1976) found substantial differences in behaviors observed at home and overseas, suggesting that these US MNEs activated foreign units to address specific perspectives and objectives.

We consider these two reports as a starting point in the study of the internationalization of R&D because they both demonstrated the presence of a phenomenon that needed to be analyzed, and provided the data sets from which it proved possible to do so.

Indeed, the new evidence on this relatively new and unexplored phenomenon was partially in contrast to IB modeling of the time. Vernon (1966), Kindleberger (1969), and Stopford & Wells (1972) theorized a quasi-colonial relationship between the parent company and foreign subsidiaries, wherein the latter are in charge of replicating the former’s activities abroad, with strategic decisions – including R&D and innovation strategies – being rigidly centralized.

Data illustrated in these pioneering studies would rather appear to suggest a more complex view according to which R&D location decisions resulted from tensions between ‘centripetal and centrifugal forces’ (Hirschey & Caves 1981: 11). While centripetal tensions derived from the need to exploit economies of scale in R&D, control strategic information, and minimize knowledge leakages, it was recognized that some decentralization of R&D might be due to the MS need to adapt products and processes to subsidiaries’ host markets (Mansfield & Romeo, 1980). Accordingly, several studies eventually emphasized that the level of overseas sales/production was a positive determinant of the propensity to implement subsidiary-level R&D (Lall, 1979; Mansfield, Teece & Romeo, 1979; Hirschey & Caves, 1981; Håkanson, 1981; Mansfield & Romeo, 1984; Pearce, 1989: 60–67, 71–89).

Consistent with, and often anticipating, models of centripetal and centrifugal tensions within MNEs, empirical studies in the 1970s and early 1980s did suggest that foreign subsidiaries might pursue a variety of objectives to enhance the MNE’s overall performance.

The most advanced and anticipatory studies conducted along these lines are the ones by Ronstadt (1977) and by Behrman and Fischer (1980a, b) who identified the connection between R&D internationalization and subsidiaries’ roles strategic diversification.

Ronstadt (1977) surveyed the overseas R&D experience of seven US-based MNEs, securing information on the positioning and evolution of 55 such units. The centerpiece of his analysis was the clear delineation of different roles that such laboratories could play.7 He does not see these laboratory roles as fixed or immutable. A key perception is that they can evolve along with the needs and capacities of an associated subsidiary, reflecting the development of its host economy and of the progress and expectations of the parent MNE.

The study of Behrman and Fischer (1980a, b) provides yet another pioneering and perhaps more systematic attempt to relate the presence and roles of overseas R&D units of 50 US and European MNEs to their broad strategic formulation and ambitions. Their findings are illustrative of at least two facts that will draw the attention of subsequent research. On the one hand, the presence of overseas R&D units was at the time relatively limited, even more circumscribed than today, at least by comparison with the host-market subsidiary MNEs. On the other hand, when present, “world-market” MNE laboratories, i.e., those playing specialized roles in centrally coordinated supply chains, were by far the most likely to include ‘new product research’ and ‘exploratory research’.

To sum up, conceptualizations and empirical findings from this early phase are indicative of emerging strategic diversity in R&D internationalization, even in the late 1970s. The fact that many of these MNE subsidiaries operated without institutionalized R&D suggests the predominance market- and/or efficiency-seeking subsidiaries, producing mature goods of the group using accepted and standardized technologies (aligned with Vernon’s standardized product phase). However, the presence of some subsidiaries with clear commitments to innovation-oriented laboratories may provide an early sighting of MNEs’ technology sourcing strategies that have then come later under the spotlight in international business literature.

THE CONSOLIDATION IN MNE R&D INTERNATIONALIZATION: THE 1980S AND 1990S

While the 1970s and the early 1980s have witnessed the emergence of internationalization of R&D as a relatively new and largely unexplored topic in IB, it is in the mid-1980s and 1990s that studies in this field reach their maturity (Cantwell, 1989; Pearce, 1989; Wortmann, 1990; Dunning, 1992; Pearce & Singh, 1992; Cantwell, 1995; Zejan, 1990; Kumar, 1996; Fosfuri & Motta, 1999; Granstrand, 1999; Siotis, 1999; Niosi & Godin, 1999). Howells (1990b) explicitly observes that a transition was taking place from “locational rigidity” towards the “locational/spatial fluidity” of R&D functions.8

Niosi (1999) in his introduction, as the guest editor of a Research Policy Special Issue on The Internationalization of Industrial R&D, provided a detailed overview of the empirical and theoretical trends governing the internationalization of R&D until the late 1990s.9 He argued: “the internationalization of R&D is slowly but surely moving past the transfer to the periphery of technology developed close to headquarters, and (…) at least the most advanced multinational corporations of all industrial nations are now trying to absorb externally-developed science and technology.” In a nutshell, Niosi’s statement indeed captured a change in perspective that had been taking place over a couple of decades, and seemed to have reached a climax at the time he was writing. We will unravel this change in perspective and will examine how scholars understood the process of internationalization of R&D in the 1980s and 1990s. The focus will firstly be on taxonomies of overseas R&D laboratories and on related organizational restructuring of the MNE; secondly, on the study of “where” and “how” cross-border R&D takes place, hence addressing location-specific factors and entry modes.

Overseas R&D Laboratories’ Taxonomies and MNE Organizational Restructuring

A large number of works on internationalization of R&D in the 1990s engaged in the development of taxonomies. Three types of such taxonomies have emerged in the literature. The first type emphasizes how the different R&D functions follow distinct locational patterns (Håkanson, 1981; Howells, 1990a, b; Pearce & Singh, 1992). As von Zedtwitz and Gassmann (2002: 572) stated: ‘Differences between research and development in terms of location rationales and work culture effectuate different geographical distribution and concentration in different regional centers’. A second set of taxonomies focuses on the characteristics and objectives of overseas R&D laboratories (Håkanson & Nobel, 1993a; Medcof, 1997; Zander, 1999). A third set of taxonomies captures the links between overseas R&D laboratories and knowledge sourcing. From this perspective, Cantwell (1995) asserted that technological leaders internationalized their R&D in order to have access to new knowledge and scientific sources (on top of demand-led motives as postulated by Vernon’s (1966) product cycle model). Of great influence was the study by Florida (1997) who linked MNEs’ decisions to establish overseas R&D laboratories with supply-side motivations to access new sources of technology while Kuemmerle (1997, 1999a) distinguished between home-base augmenting (HBA) and home-base exploiting (HBE) overseas R&D sites, often used interchangeably with the juxtaposition between asset-exploiting and asset-seeking (Dunning & Narula, 1995; Archibugi & Michie, 1995; Odagiri & Yasuda, 1996; Chiesa, 1996; Gassmann & von Zedtwitz, 1999; Pearce & Papanastassiou, 1999).

While taxonomies accounted for the large and increasing variety of R&D internationalization patterns, several studies in the 1980s and 1990s have focused on organizational implications of overseas R&D on MNE structure (Gassmann & von Zedtwitz, 1999). Analyses of the organization of cross-border R&D in this phase appeared to follow two main, largely complementary, research lines.

The first stream of research highlighted that the geographic dispersion of R&D activities undermines the traditional centralized structure of the MNE and pushes towards the development of international innovation networks (Granstrand, Håkanson & Sjölander 1993; Malnight, 1996; De Meyer, 1993; Howells, 1990a, 1995; Chiesa 1996; Zander, 1999; Niosi & Godin, 1999).10

The emphasis on innovation networks is quite consistent with a more general view of the MNE as a heterarchy as suggested by Hedlund (1986). Hedlund and Rolander (1990: 25–26) note the presence of ‘many centers of different kinds’ so that there is increasing geographical dispersion of traditional HQ functions, including R&D, and ‘no dimension (product, country, function) uniformly super ordinate’. This geographical dispersion augmented the innovative capacity of MNEs via their network of subsidiaries and overseas R&D laboratories.

MNEs were thus increasingly understood to pursue global innovation strategy (GIS) through a network of interdependent and differentiated subsidiaries and overseas R&D laboratories.11 Gupta and Govindarajan (1991, 1994) and Bartlett and Ghoshal (1990) introduced integrated models of innovation processes in MNEs encompassing the interaction and knowledge flows between different types of subsidiaries and HQs. Research by Molero and Buesa (1993), Hood, Young, and Lal (1994), Molero, Buesa, and Casado (1995), Roth and Morrison (1992), Papanastassiou and Pearce (1997), Forsgren and Pedersen (1998), Pearce (1999b), and Lehrer and Asakawa (2002) provided fresh empirical evidence on how the positioning of R&D in the operations of MNE subsidiaries affected the innovative strategies of MNEs.

Along with analyses of knowledge exchanges and innovation flows within the MNEs, there has also been a growing attention in the 1980s and 1990s to MNEs’ involvement in technical linkages with external parties (local firms and institutions, as well as global suppliers, purchasers, and competitors), which also play a key role in the development of innovation (OECD, 1986; Pisano, 1990; Dunning 1994; Asakawa, 1996, Andersson & Forsgren, 2000). It then appeared that the internationalization of innovation takes place within a context of a “double-network organization”, combining MNE’s internal networks of R&D units with external networks of knowledge intensive relationships with other stakeholders, beyond the boundaries of the MNE (Zanfei, 2000).

The trend towards international networking intertwines with changes in the roles played by foreign R&D affiliates as illustrated and classified in the taxonomies we have recalled earlier. In particular, it has been noted that MNE’s global innovation strategy implies that central laboratories act as orchestrators of knowledge across national borders, enabling MNEs ‘to tap the full potential of their R&D networks’ (Kuemmerle, 1997: 70; Håkanson & Zander, 1988; De Meyer & Mizushima, 1989; Gerybadge & Reger, 1999; Elder, Meyer-Krahmer & Reger, 2002).12 This evolution led to a positive upgrading of the subsidiary’s mandate (Birkinshaw, 1996; Birkinshaw, Hood, & Jonsson, 1998), which was then defined as creative transition (CT) (Papanastassiou & Pearce, 1994; Pearce, 1999a), to the emergence of dynamic types of subsidiaries (Pearce, 1989; Papanastassiou, 1999), and to the assignment of innovation-oriented ‘product mandate’ (PM) subsidiaries.13 In this context, seminal are the works of Poynter and Rugman (1982) and (Rugman & Bennett, 1982; Rugman, 1983; White & Poynter, 1984) as well as Etemad and Seguin Dulude (1986a, b) and Bonin and Perron (1986) on the innovative capabilities of Canadian World Product Mandate (WPM) subsidiaries. As Pearce (1989: 130) noted, WPM subsidiaries generated ‘independent innovative capability through the support of their own R&D laboratory’. This transformation of subsidiaries is indeed part of, and consistent with, the overall change of the organizational structure of the MNE itself, which we referred to above as transnational (Bartlett & Ghoshal, 1989, 1990; Bartlett and Beamish, 2018) and heterarchical (Hedlund, 1986, 1993; Hedlund & Rolander, 1990; Birkinshaw, 1994; Malnight, 1996).

To summarize, the studies we have reviewed bring two issues at central stage. First, these streams of literature highlight the embryonic state of reflections of the time on the organization of R&D internationalization. The proliferation of taxonomies of cross-border R&D activities reflects the fact that R&D internationalization was a rather fluid and heterogeneous phenomenon, characterized by a high variety and variability in time as a result of numerous and variegated actors involved both within and across MNEs. Theorizing on R&D networking of 1980s and 1990s constituted an attempt to move a step forward in the direction of designing new models cross-border R&D. However, while some of these models did emphasize R&D networking within MNEs and the development of R&D linkages with external parties, they still disregarded the complementarities between internal and external networks and remained mainly concentrated on the organizational challenges posed by the expansion of MNEs’ internal webs of R&D labs. Implications of the double network approach to internationalization of innovation are further discussed in subsequent sections of this review.

Second, these works appear to share a tension towards overcoming traditional views of the role of MNEs in innovation activities. In other words, most, if not all, of the examined taxonomies as well as the literature that was then growing on the changing organization of the MNE appear to respond to the need to overcome the previously dominant perception that cross-border R&D activities played a purely ancillary role relative to MNEs’ home-based technology.

Where and How R&D is Internationalized: The Role of Locational Factors and of Entry Modes

In parallel with the studies on the taxonomies of R&D subsidiaries and on MNE organizational restructuring, in the late 1980s and early 1990s, IB literature has started paying increasing attention to where and how cross-border R&D was occurring. This implied, on the one hand, a careful analysis of the interaction between cross-border R&D and locational factors (hence the importance of where R&D is located); and on the other hand an effort to explore alternative modes of entering, and dealing with, local contexts when knowledge creation and transmission is at stake (hence the importance of how R&D enter foreign locations).

In line with the literature on NSI, (Freeman, 1987; Lundvall, 1988, 1992; Nelson 1993), one can envisage a link between location factors, the internationalization of R&D and innovative capability of MNEs. On the one hand, dynamic innovation systems attract knowledge-seeking (KS) subsidiaries, as these can be expected to benefit from local external economies and knowledge (Dunning & Narula, 1995; Cantwell & Mudambi, 2000). The tacit nature of technology implies that even where knowledge is available through markets (as technology markets generally tend to be under-developed), it still needs to be modified to be efficiently integrated within the acquiring firm’s portfolio of competencies. In addition, the tacit nature of knowledge associated with production and innovation activity in these sectors implies that ‘physical’ or geographical proximity is important for transmitting it (Blanc & Sierra, 1999). While the marginal cost of transmitting codified knowledge across geographic space does not depend on distance, the marginal cost of transmitting tacit knowledge increases with distance. This leads to the clustering of innovation activities, in particular at the early stage of an industry life cycle, where tacit knowledge plays an important role (Audretsch & Feldman, 1996).14 On the other hand, MNEs are likely to contribute to the dynamics of NSIs by means of their capacity to transfer valuable knowledge and to generate technological spillovers, which could reinforce local innovation clusters or weaken them (Niosi, Saviotti, Bellon & Crow, 1993; Freeman, 1995; Patel & Pavitt, 2000; Reddy, 2000; Narula 2003).

It has thus been suggested that the types of MNEs’ R&D laboratories have direct and differing implications on host-countries’ NSI technological capacity (Pearce & Singh, 1992; Dunning, 1992; Chesnais, 1992; Pearce, 1997; Pearce & Papanastassiou, 1999; Kuemmerle, 1999b).15 This raises public policy issues concerning measures to enhance innovative capacity of both home and host countries directly (though investments in the creation of innovatory capabilities) and indirectly (via spill-over effects) (Dunning, 1992; Håkanson & Nobel, 1993a, 1993b; Coe & Helpman, 1995; Kesteloot & Veugelers, 1995; Blomström and Kokko, 1996; Narula, 2003),16 the forces behind the creation of ‘technological advantages’ and ‘technological heritage’ of national economies (Mowery & Oxley, 1995; Patel & Vega, 1999; Pearce & Papanastassiou, 1999); the creation of a complex and multidimensional national policy framework to selectively attract R&D via inward FDIs and collaborative agreements, and to secure positive gains of R&D internationalization for local economies (Granstrand et al. 1993; Kokko and Blomström, 1995; Muralidharan & Phatak, 1999), and the challenges of effective policies in an interdependent globalized world (Archibugi & Iammarino, 1999).17

Other streams of literature address the “how” issue, hence focusing on the mode of entry of foreign R&D in the host-locations. This aspect of R&D internationalization has also received considerable attention in the 1980s and 1990s, reflecting once again the interaction of empirical and theoretical works. The variety of entry modes adopted by MNEs has been documented, highlighting the important role played by mergers and acquisitions (M&A) (Hennart & Park, 1993), by the creation of wholly owned subsidiaries (UNCTAD, 1998), and by international technological alliances (OECD, 1986; Mowery, 1988). This evidence contributed to open a debate on the circumstances that made one strategy more advantageous than another when cross-border location decisions are at stake.

From a transaction costs perspective, entry through wholly owned foreign activity would represent a first best especially in the case of R&D internationalization as it reduces the costs and risks associated with the idiosyncratic nature of knowledge assets (Buckley & Casson, 1976; Teece, 1977). As Kogut and Zander (1993) postulate, highly complex technology leads to the establishment of fully owned subsidiaries. Prior entry can be expected to reduce external and behavioral (internal) uncertainty in international operations (Davidson, 1980; Gomes-Casseres, 1989). Nevertheless, once entry has occurred, there might be different effects in terms of subsequent modes of foreign market penetration, especially when combined with knowledge transactions, given the relatively high uncertainty associated to the management and transmission of knowledge assets (Slangen & Hennart, 2007; Ivarsson & Vahlne, 2002; Belderbos, 2003; von Zedtwitz, 2003).18

Other approaches to entry modes pay closer attention to asset-seeking strategies and dynamic efficiency considerations.19 Consistent with a more general view of complementarity between internal and external competence accumulation (Cohen & Levinthal, 1989; Rosenberg, 1990; Arora & Gambardella, 1994), the establishment and activity of foreign subsidiaries over time can be identified as a fundamental asset that increases a firm’s exploration potential, hence paving the way to R&D collaborations (Cantwell, 1995; Castellani & Zanfei, 2004). The need for a timely and effective knowledge access may spur firms to choose strategic alliances even when short-term, static (transaction and organizational) cost minimization would point to different forms of linkages (Teece, 1992; Mowery, Oxley & Silverman, 1996; Hagedoorn & Narula, 1996; Narula & Dunning, 1998; Narula & Hagedoorn, 1999; Oxley & Sampson, 2004; Sampson, 2004).

Empirical research on the choice of entry modes in cross-border R&D in the 1990s reflects the variety of approaches to this issue. Some results unambiguously support the transaction cost view that higher experience favors a higher degree of control over foreign operations (Davidson, 1980; Davidson & McFetridge, 1985; Gomes-Casseres, 1989; Mutinelli & Piscitello, 1998). In a number of cases, the impact of experience variables on the choice of international linkage modes turned out to be more ambiguous (Kogut & Singh, 1988; Anderson & Gatignon, 1986; Erramilli, 1991; Hennart & Larimo, 1998; Padmanabham & Cho, 1999; Arora & Fosfuri, 2000). There is also sparse evidence on a process where the increasing experience with foreign contexts leads to an increase in mutual trust and a reduction of opportunism (lower internal uncertainty), fostering a cumulative involvement of MNEs in collaborations with local firms (see McAleese & McDonald, 1978; Lall, 1979; Dunning, 1993; Bureth, Wolff & Zanfei, 1997; Sachwald, 1998). Other works have found evidence in support of the dynamic capability hypothesis, which would envisage a greater role of more flexible and reversible modes of entry such as joint ventures and strategic alliances. From this perspective, several studies provide convincing evidence of a complementarity between MNEs’ networks of subsidiaries and the development of technical linkages with foreign partners (see Arora & Gambardella, 1990; Malerba & Torrisi, 1992; Steinmueller, 1992; Ernst, 1997; Castellani & Zanfei, 2002 for analyses of collaborative entry modes in biotechnology, software, semiconductor, and electronics industries).

To conclude, the streams of literature we have recalled, concerning locational factors and entry modes, address two key and potentially related issues. On the one hand, they highlight that local innovation systems co-evolve with R&D internationalization, hence placing new emphasis on host-country-specific factors in attracting R&D FDIs and on the role of R&D FDIs in affecting local innovation systems. This paves the way to research on the role locational factors, which will be later carried out at a more fine-grained geographical level, including regions and cities as attractors of R&D FDIs. On the other hand, the literature on entry modes sheds some light on how cross-border R&D can occur in different ways according to the role played by static or dynamic efficiency considerations. This is consistent with subsequent empirical research on asset-seeking and asset-augmenting, which will be at center stage after the turn of the century.

MNEs’ INTERNATIONALIZATION OF R&D AFTER THE TURN OF THE 21ST CENTURY

Research on R&D internationalization after the turn of the 21st century has been largely characterized by the effort to develop comprehensive interdisciplinary frameworks in understanding cross-border R&D activities as an integrated component of the fine-slicing of MNE production on a global scale. From this perspective, a number of studies have found that the capacity to organize effective networks within and across firms’ boundaries is a fundamental asset to exploit in-house technology as well as to enhance access to localized knowledge sources. Depending on disciplines, this emphasis on the fragmentation of production and R&D has been framed alternatively and quite inter-changeably in the contexts of the global factory (Buckley & Strange, 2015); of global production networks (GPN) (Ernst & Kim, 2002); of global value chains (GVCs) (Gereffi, 1999; Gereffi, Humphrey & Sturgeon, 2005; Mudambi, 2008; Saliola & Zanfei, 2009; Pietrobelli & Rabellotti, 2011; Kano, 2018; De Marchi, Di Maria & Gereffi, 2018); of global innovation networks (GNI) (Lema, Quadros & Schmitz, 2015); and of R&D offshoring, captive or outsourced (Yamin, 1999; Mol, 2005; Cusmano, Mancusi & Morrison, 2009; Grimpe & Kaiser, 2010; Demirbag & Glaister, 2010; Sartor & Beamish, 2014; Pisani & Ricart, 2018). While there are differences in analytical tools and focus across these ways of conceptualizing R&D internationalization, these streams of literature largely share a strong emphasis on the changing organization of cross-border production and innovation activities, which inevitably spans across individual firms, sectors, and product lines, and assign distinctive roles to different players, functions, and locations (García-Vega, Hofmann & Kneller, 2019). Advanced countries and regions and established MNEs continue to play a key role, but new international actors, clusters, and regions are increasingly involved in this global organization of innovation, including emerging countries and EMNEs. Moreover, the increasing attention to locational patterns of innovation has led scholars to focus more and more on subnational levels of analysis, with a growing consideration of the role played by regions, cities, and metropolitan areas in attracting global players and R&D investors (McCann & Acs, 2011; Castellani & Santangelo, 2016; Tojeiro-Rivero & Moreno, 2019). These ways of conceptualizing the role of cross-border R&D also have connections with the relatively long tradition of studies on MNEs’ embeddedness in local contexts (Andersson & Forsgren, 2000; Andersson, Bjorkman & Forsgren, 2005) and with the more recent developments of research on MNEs’ “double networks” and “multiple embeddedness”, emphasizing the increasing variety of linkages between different knowledge sources within and across corporate boundaries (Castellani & Zanfei, 2006; Meyer, Mudambi & Narula, 2011; Alcácer, Cantwell & Piscitello, 2016). The streams of literature we have briefly recalled triggered research focusing on at least three key aspects of R&D internationalization that are worth examining in detail. First, more systematic empirical evidence has been produced on the nature and intensity of cross-border R&D, and on asset-seeking and asset-augmenting strategies in particular. Second, more attention has been given to international R&D networking, with a greater emphasis on MNEs’ technical linkages with external parties. Third, changes in the locational patterns of R&D activities have come at center stage.

New Empirical Evidence on Asset-Seeking and Asset-Augmenting R&D Offshoring

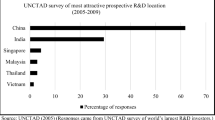

The increasing availability of detailed and longitudinal data has paved the way to more systematic empirical studies on R&D internationalization. MNEs are not only responsible for the largest R&D budgets, but they have also increased significantly the share of R&D and inventive activities carried out outside their home countries over the past two decades, although with substantial differences across countries of origin and destination; and they contribute to a substantial share of local R&D in many host countries and regions (UNCTAD, 2005; OECD, 2007; Dachs et al. 2014, Dachs 2017).20 Even more important, empirical research has also been conducted at more disaggregated levels and has yielded valuable evidence on the asset-seeking and asset-augmenting nature of R&D internationalization (Narula & Zanfei, 2005; Blomkvist, Kappen & Zander, 2010).

A path-breaking empirical work on motives underlying R&D FDIs is the one conducted at the beginning of the new century by Le Bas and Sierra (2002) on a sample of 345 MNEs with the greatest patenting activity in Europe between 1988 and 1996, which accounted for about half of the total patenting through the European Patent Office (EPO). The authors emphasized that MNEs are likely to pursue different motivations in their cross-border innovation according to how their technological profiles compare with those of firms active in host locations. MNEs with high ‘revealed technological advantage’ (RTA) are likely to exploit advantages created at home, when the host economy has no RTA in the same field (asset exploiting). As opposed to this quite traditional circumstance, MNEs may aim at accessing complementary knowledge assets abroad in two different circumstances. On the one hand, they will be induced to access external knowledge sources when they have some technological weakness (no RTA) as compared to a revealed advantage (high RTA) of local firms (technology sourcing). On the other hand, when both MNEs and local firms have some revealed advantage in the same technological field, MNEs and local firms may be willing to exchange knowledge on a reciprocal basis (asset augmenting). Le Bas and Sierra (2002) confirmed previous findings by Patel and Vega (1999) that MNEs seldom internationalized their activities to compensate for a technological weakness at home (13% of all observed cases) – hence pure “technology sourcing” turned out to be rare. Much more frequent was what they dubbed as “asset exploiting” (30% of cases). However, what is even more interesting is that the most frequent circumstance was “asset augmenting”, when the MNE had an RTA at home in the presence of an RTA of the host economy in the same technology (47% of all cases).21 This may indicate the formation of “centers of excellence” in which strong domestic research environments function as attractors of asset-augmenting multinational activities. Moreover, the authors showed that this circumstance had become more frequent over the examined period.

While Le Bas and Sierra have the clear merit of highlighting the circumstances that are most likely associated with different R&D FDI strategies, their analysis is subject to two important sources of criticism. First, there is a clear sample bias: the observed importance of asset augmenting strategies might well be due to the fact that they consider firms that are by definition the most innovative firms as they are the top ranking in patenting activities. Second, they only make inference on the likelihood that FDIs generate knowledge flows, but their data do not allow to control for the type of FDIs (whether they are R&D FDIs or not) nor to directly investigate whether and to what extent MNEs are actually sourcing (or augmenting) their knowledge through their foreign R&D activities.

Several studies have tried to fill this gap using patent citation data to evaluate the extent to which foreign-based firms relied on local knowledge.22 Cantwell and Noonan (2002) showed that MNE subsidiaries located in Germany between 1975 and 1995 sourced a relatively high proportion of knowledge (especially new, cutting-edge technology) from this host country. Altogether, these data lend support to the idea that foreign-owned technological activities undertaken in Germany are often asset-augmenting. Using US Patent and Trademark Office (USPTO) patents granted to over 4000 MNEs from six countries (USA, Japan, Germany, France, UK, and Canada) over the period 1986–1995, Singh (2004) highlighted that foreign subsidiaries cited host-country patents more often than did home-country inventors. However, this pattern appeared to vary significantly across countries and sectors, depending on the knowledge-intensity of FDI. Criscuolo, Narula, and Verspagen (2005) focus on a large number of recipient countries and obtained less-straightforward evidence. Using both USPTO and EPO citations, the authors found that US affiliates in the EU relied mainly on home-region knowledge sources, while EU affiliates in the US, especially when they had an R&D mandate, had a relatively higher propensity to cite patents granted in the host country.

Technology sourcing and asset-augmenting strategies have also been detected by estimating the effects of R&D FDIs on MNEs’ innovation performance. Nieto and Rodriguez (2011) use the Spanish Technological Innovation Panel in which firm innovation (detected by a dichotomous variable that takes the value 1 if the firm engages in any product or process innovation) is estimated as a function of R&D offshoring (which is a dichotomous variable that assumes the value 1 if the firm acquired R&D services abroad, therefore both captive and outsourcing), and a set of controls. From over 12,000 firms in 2004–2007, they find a positive relation between firm innovation and R&D offshoring; such a relation is stronger for product than for process innovation, the latter being based more on tacit knowledge. De Beule and Van Beveren (2019) use the Community Innovation Survey data for Belgium to investigate the role of external knowledge sources on foreign affiliates’ research efforts and innovation and distinguish between different types of subsidiaries in order to disentangle differences in the use of knowledge sources between technology-exploiting, -seeking, and -creating subsidiaries. They find that technology-creating foreign affiliates are able to tap into a combination of industry-based value chain partners and science-based partners. Technology-seeking subsidiaries make more use of collaboration with competitors. Technology-exploiting subsidiaries make significantly less use of external knowledge sources and have a lower R&D intensity.

More indirect measures of technology sourcing and asset-augmenting strategies are based on productivity data, used to detect the effects of R&D FDIs on the performance of firms investing in advanced countries (Driffield & Love, 2004; Griffith, Harrison & Van Reenen, 2006); to evaluate how R&D offshoring in emerging countries affect the knowledge basis at home (Piscitello & Santangelo, 2010); and to estimate EU regional performance as a function of R&D offshoring (Castellani & Pieri, 2013).

Based on this overview, one may tentatively conclude that the increasing availability of longitudinal micro-level data has allowed scholars to obtain detailed evidence on the links between FDIs, innovation, and productivity, which appears to be broadly consistent with the asset-seeking/knowledge augmenting hypothesis. As compared with previous studies, which were characterized by a greater use of surveys, case studies, and of cross-section sectoral data, these more recent works can rely on a longer series of data to illustrate that R&D internationalization has indeed increased in intensity, and that in some circumstances R&D FDIs are associated with improvements in firm performances over time. In addition, the longitudinal nature of datasets allows to better control the direction of causality and to highlight some of the circumstances under which cross-border R&D can actually affect firm performance. However, these studies still have a limited capacity to support the often-alleged view that R&D internationalization is mainly or largely an asset-seeking/knowledge-augmenting activity. On the one hand, they are mostly circumscribed to a few countries and sets of sectors, hence their results can hardly be generalized. Moreover, they provide indirect evidence of the actual motivations underlying R&D investment decisions. This calls for more comprehensive analyses that mix quantitative with more qualitative methods to explore the mechanisms that are conducive to the absorption and accumulation of knowledge through cross-border R&D.

MNEs’ International R&D Networking

Attention to networking in the organization of MNEs’ innovative activities has been significantly growing since the late 1990s and early 2000s, and partly intertwines with the theoretical and empirical research on asset-seeking and asset-augmenting motives for R&D internationalization which we have accounted for. From this perspective, it has been increasingly acknowledged in the literature that the combination of traditional asset-exploiting objectives with increasing asset-seeking/asset-augmenting activities entails a transition of multinationals towards a double network structure (Zanfei, 2000; Castellani & Zanfei, 2006). On one hand, MNEs are more and more characterized by the interconnection of a large number of internal units that are deeply involved in the company’s use, generation, and absorption of knowledge (Bergek & Bruzelius, 2010; Narula, 2017). On the other hand, units belonging to the internal network tend to develop external networks with other firms and institutions that are located outside the boundaries of the MNE, in order to increase the potential for use, generation, and absorption of knowledge (Ivarsson, 2002; Ivarsson & Jonsson, 2003; Narula & Duysters, 2004; Franco, Marzucchi, & Montresor, 2014; Santangelo, Meyer & Jindra, 2016; Chen, Zhang & Fu, 2019). The development of external networks is thus largely complementary to the growth of multinationals through internal networks (Castellani & Zanfei, 2006; Phene & Tallman, 2018; De Beule & Van Beveren, 2019).23 In a similar vein, Cantwell (2017) explains how the process of organizational MNE structure entails inter-unit differentiation and the development of international innovation networks evolving around internal and external knowledge exchange (see also Alcácer et al. 2016).

Indeed, most of the literature on competence-creating activities by MNE subunits has stressed the importance of being embedded in local business networks and in national or regional innovation systems of a host country (Cantwell & Mudambi, 2005; Savona & Schiattarella, 2005; Forsgren, Holm & Johanson, 2005). A crucial issue in this respect is how local embededdness increases reliance on host-context specific-knowledge sources (Frost, 2001), with possible lock-in effects (Narula, 2003), and often changes the nature, direction, and intensity of MNEs’ R&D (Håkanson & Kappen, 2016). Frenz and Ietto-Gillies (2009) use two waves of Community Innovation Survey (CIS) data for the UK to show that the international dimension of internal networks heavily affects firms’ innovation performance, while interactions between the own-generated knowledge and external sources increase the innovation potential of enterprises. Recent work by Blomkvist, Kappen, and Zander (2019) relate the technological interactions among multinational units (between “sister’ subsidiaries, and between subsidiaries and HQs) with the mode of entry. They conclude that greenfield subsidiaries are better technologically integrated within the MNE as compared to acquired ones.

Moreover, a growing literature has documented that MNEs tend to be deeply embedded in multiple locations, enabling them to leverage tangible and intangible resources across national borders (Collinson & Wang, 2012; Figueiredo, 2011). As suggested by Meyer et al. (2011: 236), this concept must be analyzed at two levels. At the MNE level, multiple embeddedness implies the need to interact with a larger number of heterogeneous contexts, in each of which the firm has to place its roots. Hence, MNEs can be expected to significantly differ in terms of their abilities to manage complex portfolios of assets across different locations, and to extract economic value out of them (Achcaoucaou, Miravitlles & León-Darder, 2014). At the subsidiary level, multiple embeddedness reflects the need to reconcile possibly conflicting tensions. On the one hand, subsidiaries are forced to be responsive to local pressures deriving from the contexts where they are active; on the other hand, they must comply with the rules of corporate governance leading to the integration of individual affiliates within the multinational corporation (Asakawa & Aoki, 2016; Ciabuschi, Forsgren, & Martín, 2017; Asakawa, Park, Song & Kim, 2018). From this perspective, Santangelo et al. (2016) and Martínez-Noya & García-Canal, (2018) pointed out that the decision of a subsidiary to outsource its R&D activities heavily depends, inter alia, on the quality of local sub-national institutions, while Pisani and Ricart (2018) emphasize the role of national institutions.

The actual propensity of MNEs to develop external R&D networks has been questioned in several empirical studies. Veugelers (1997) finds that foreign firms do not exhibit any higher propensity to set up R&D linkages with local firms as compared to national firms. In Belderbos, Carree, Diederen, Lokshin, & Veugelers (2004: 1256), ‘foreign multinationals were found to have a lower propensity to engage in horizontal cooperation, but were not less inclined to cooperate vertically or with universities and research institutes’. However, when they restrict their analysis to R&D cooperation with local partners, they find a strong negative impact for multinational firms. The negative impact of foreign ownership on R&D cooperation with local firms has been found also by Veugelers and Cassiman (2004, 2005) for Belgium, Knell and Srholec (2005) for the Czech Republic. In partial contrast with evidence referring to other countries, Holl and Rama (2014) and García Sánchez, Molero and Rama (2016) find that belonging to a foreign MNE active in Spain increases the probability to cooperate in innovation locally, at least vis-à-vis unaffiliated local firms. Guimòn and Salazar-Elena (2015) assess the probability of subsidiaries of foreign MNEs to cooperate with local universities. They find ‘that foreign subsidiaries exhibit a lower propensity to collaborate with Spanish universities than local group firms, while both collectives collaborate more often with universities than unaffiliated local firms’ (2015: 451).

Using RS1 data from the Italian National Bureau of Statistics (ISTAT) combined with Bureau van Dijk data, Cozza, Perani and Zanfei (2018) distinguish foreign MNEs from domestic owned MNEs active in Italy and find that the former exhibit no premia in terms of R&D cooperation as compared to non MNEs, while domestic MNEs do outperform other firms in this respect. They suggest that this is revealing that while multinationality is associated with advantages in terms of R&D intensity and absorptive capacity, foreignness entails a “liability” that translates into higher costs and risks when undertaking transactions and setting up technical linkages with local counterparts (see discussion on multinationality and foreignness in Higón & Antolín, 2012; Miotti & Sachwald, 2003; Srhrolec, 2009, 2015).24

To summarize, two important developments seem to emerge from the recent literature on R&D networking. First, while attention to either internal networking and to the MNE’s embeddedness in nexuses of local relationships is quite well rooted in IB literature, what appears to be indeed new in more recent research is the complementarity between internal and external networking. It is by combining multiple relationships within and across firm boundaries that MNEs can leverage upon a variety of knowledge sources. This is a key aspect of the cross-border organization of R&D which is still under-explored and calls for greater consideration. Second, there is rather conclusive evidence that while foreign MNEs do develop linkages with local firms, they are more prone to cooperate with “international” partners, signaling that they are probably better at exploiting their global networks of innovation.

Changes in the Locational Patterns of MNEs’ R&D Activities

Patterns of geographical location of R&D FDIs have received particular attention over the past two decades. This has been partially the result of the increasing convergence of economic geography and international business studies (see Castellani, 2018, for a recent review). Economic geographers have emphasized that innovation is spatially concentrated, and knowledge spillovers are geographically localized (Feldman & Kogler, 2010). In fact, innovation activities tend to cluster in order to take advantage of locally available knowledge (Gertler, 2003; Bathelt, Malberg & Maskell, 2004; Balland, Boschma & Frenken, 2015). Building on the Marshallian concept of “atmosphere”, Storper and Venables (2004) have characterized this cumulative process of geographic clustering of innovation as the result of “local buzz”, that is the localized capacity of people and firms present in the same industry, place, and region to communicate and transmit sticky, non-articulated, tacit forms of knowledge.

On the other hand, virtually no region can be completely self-sufficient, and isolated clusters and districts are likely to be less dynamic than globally connected ones (Gertler, 2008; see Turkina & Van Assche, 2018; Esposito & Rigby, 2019, for studies on cluster global connectedness). From this perspective, agglomeration forces may not yield efficient outcomes, to the extent that path dependencies prevail and localized patterns of technical change are pursued creating barriers to the “contaminating” effect of external investors. Myles Shaver and Flyer (2000) emphasize the role of firm heterogeneity in location decision-making. Similarly, Mudambi and Santangelo (2016) show that MNE subsidiaries in less competitive regions may exhibit dismal performances and it is the gradual evolution of their mandates that can determine the growth path of less competitive regions or countries. Quite consistently, Schotter and Beamish (2013) discussed the impact of the hassle factor on individual managers, which eventually puts them off from particular locations.