Abstract

In 2021, the European Union (EU) was the largest exporter of plastic waste in the world, followed by the United States and Japan. Within the EU, the Netherlands, with a population of just 18 million, was the largest exporter of plastic waste to non-OECD countries, totaling plastic waste export of over 200 million kg. Despite existing international legislation such as the Basel Convention and the EU Waste Shipment Directive, the export of plastic waste from the Netherlands to non-OECD countries such as Indonesia, Vietnam, and Malaysia has increased sharply following the ban on imports of plastic waste by China in 2018. In 2021, the Netherlands was the world’s largest exporter of plastic waste to Indonesia, totaling 70 million kg, and exported almost 64 million kg to Vietnam. Thus, the Netherlands is a major contributor to the global plastic waste trade which shifts the burden of plastic pollution (or plastic pollution colonialism) to vulnerable poorer countries who are already severely challenged with managing their domestic waste. Prior to January 1, 2018, most plastic waste from the Netherlands was exported to China. Now, the Netherlands exports most of its plastic waste to countries in Southeast Asia such as Indonesia, Vietnam, Thailand, and Malaysia. Unfortunately, more than 50% of the imported plastic waste is mismanaged in these countries, with up to 83% in Indonesia. Mismanagement includes open dumping, open burning, and waste incineration resulting in the release of harmful chemicals, plastic and microplastic residues causing widespread chemical and plastic pollution in the local environment. This pollution causes indiscriminate ecological and human health impacts. Thus, the export of plastic waste to vulnerable countries by the Netherlands is plastic pollution trafficking.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

Introduction

Unsustainable plastic production and overconsumption has resulted in a global plastic waste and plastic pollution crisis (Walker, 2018; Lau et al., 2020; Walker & McGuinty, 2020; Walker & Fequet, 2023). Geyer et al. (2017) estimated that more than 75% of all plastics ever produced now exists as waste in landfills or as plastic pollution in the environment. Based on data from 2016, Borrelle et al. (2020) estimated that 19–23 million metric tons of plastic pollution enters aquatic and marine environments annually. In the Netherlands, with a population of almost 18 million people, this plastic waste and plastic pollution crisis is no different than anywhere else, although arguably maybe contributing more than its fair share beyond its national borders (CBS Statistics Netherlands, 2019).

Single-use plastics are the major contributors to this plastic waste and pollution crisis as they are produced and discarded after a single use and are notoriously difficult to recycle (Navarre et al., 2022) or have limited end of life recyclable market value (Diggle & Walker, 2020, 2022; Diggle et al., 2023). Yet, despite their limited recyclability or end of life value, single-use plastics are widely used in food packaging (Walker et al., 2021; Kitz et al., 2022), in plastic grocery bags (Xanthos & Walker, 2017; Schnurr et al., 2018; Adam et al., 2020), and in plastic containers or utensils for takeout food (Molloy et al., 2022).

One of the major issues with this unsustainable plastic use and increasing waste generation is that most countries can not properly manage their domestic waste. This has resulted in a global plastic waste trade that lacks adequate transparency or accurate monitoring of plastic waste trade flows (March et al., 2022). This lack of transparency is further exacerbated as mismanaged or lost volumes are often not accounted for, which falsely increases recycling performance rates of high-income countries, such as the Netherlands, which export their waste to low-income countries for so-called recycling (Lau et al., 2020; Walker, 2023a, b). Another major problem of this global plastic waste trade is that it is often contaminated with food scraps, comingled with other plastic polymers, or is simply of too poor quality that it is impossible to “recycle” (Navarre et al., 2022). Thus, much of this traded plastic waste is landfilled, incinerated, burned in open pits or is released into the environment as plastic pollution (Lau et al., 2020; Gündoğdu & Walker, 2021; Walker, 2023a, b).

Southeast Asian countries have been adversely impacted by plastic pollution from domestic and transboundary sources as well plastic imports from high-income countries (Jambeck et al., 2015; Brooks et al., 2018; Liang et al., 2021; Navarre et al., 2022). In 2015, it was reported that five Asia Pacific countries (including China, Indonesia, the Philippines, and Thailand) were collectively responsible for ~60% of ocean plastic pollution (Jambeck et al., 2015), giving rise to the commonly held misperception that Southeast Asian countries are the biggest sources of global plastic pollution (Walker et al., 2021). However, recent research on sources of this plastic pollution suggests otherwise, as a lot of this plastic waste often does not originate from these importing countries (Navarre et al., 2022). In other words, plastic waste and plastic pollution from high-income countries are exacerbating the plastic pollution problem in low-income countries with inadequate waste management infrastructure (Walker, 2023a, b). This practice has now recently been referred to as plastic pollution colonialism by several plastic pollution researchers (Liboiron, 2021; Fuller et al., 2022).

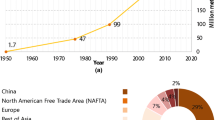

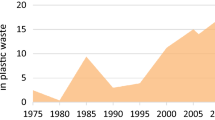

Since 1993, global annual imports and exports of plastic waste, as part of the global plastic waste trade, increased rapidly to 723% and 817% in 2016, respectively (Brooks et al., 2018). High-income countries, including the Netherlands, have overwhelmingly been the primary exporters of plastic waste to low-income countries since the 1980s, which has been valued at $71B USD (Liu et al., 2021). Prior to 2018, most of the global plastic waste trade from high-income countries was exported to China. In 2012, imports to China from high-income countries accounted for over 50% of the global plastic waste trade, which was used by Chinese plastic waste recycling industries for feedstock materials for use in the massive manufacturing sector in China (Liu et al., 2021). However, in January 2018, China enacted the “National Sword” policy, which banned the import of most plastics and other materials (Liu et al., 2018; Walker, 2018).

After China closed its doors to plastic waste imports in 2018, high-income countries began exporting plastic waste to other low-income countries (Liu et al., 2018; Walker, 2018; Gündoğdu & Walker, 2021). However, many of these importing countries lack adequate waste management facilities, which has led to excessive open dumping or burning of plastic waste, including waste-to-energy incineration (Walker, 2023a, b). Burning plastic waste for energy releases greenhouse gases, contributes to accelerating climate change, and produces toxic atmospheric pollutants and toxic ash residues impacting local communities and surrounding ecosystems, including locally produced food (DeWeerdt, 2022; Walker, 2023b; Teebthaisong et al., 2021). Even when recycling infrastructure exists, they have been found to be major contributors of microplastic pollution to aquatic receiving environments (Brown et al., 2023).

International Plastic Waste Trade

The global plastic waste trade is managed by multiple levels of government (international, national, and municipal levels) and by a myriad of private sector companies making the international trade in plastic waste a complex web of regulations and middlemen lacking transparency (Liu, 2021; March et al., 2022). If plastic waste is not recycled domestically, it can be exported but must be issued with a specific trade code (Plastic Soup Foundation, 2022). Although plastic waste should be traded in compliance with international agreements, such as the Basel Convention, stringent enforcement is often lacking (Yang, 2020; van Der Marel, 2022). Traded plastic waste can be transported to various intermediate countries via waste brokers before arriving at the destination country (Plastic Soup Foundation, 2022). Waste brokers can profit from each of these intermediate transactions, and the plastic waste trade can be even more lucrative when selling plastic waste to recycling plants at the final destination. Government regulations and financial subsidies can make it attractive for plastic waste to be processed in other countries (Plastic Soup Foundation, 2022). This has created a highly complex and competitive international market for plastic waste in which huge quantities of plastic waste are transported globally, but at every step there is a lack of transparency making it increasingly difficult to oversee the trade (Liu, 2021; March et al., 2022).

Eurostat and the European Environment Agency are the overarching agencies that monitor waste of European countries (Ministerie Van Infrastructuur en Waterstaat, 2021a). Monitoring of general waste streams in the Netherlands is covered by Rijkswaterstaat (Ministerie Van Infrastructuur en Waterstaat, 2021a). Prezero (previously known as Suez) is the biggest company for the collection and separation of plastic household waste in the Netherlands, and they monitor these processes to keep track of their recycling rates, which is now known to be falsely inflated by many high-income countries participating in plastic pollution trafficking (Lau et al., 2020). However, monitoring of plastic waste generated from individual trading or recycling companies is virtually nonexistent since there is a lack of management oversight (Snijder & Nusselder, 2019). Liang et al. (2021) documented the conditions which Asian countries established for incoming waste. For example, monitoring of what goes into the containers for export to Asia is inconsistently reported. Low-quality plastic waste continues to end up in Asia. This may be due to lax interpretations of the Basel Convention: “Non-hazardous plastic wastes listed in Annex IX can be moved among Parties without any specific control under the Convention” (Yang, 2020; van Der Marel, 2022).

Exporting plastic waste for high-income countries that produce and consume huge quantities of plastic is one way to get rid of (“manage” or “recycle”) excess plastic waste, much of which is hard to recycle (CBS Statistics Netherlands, 2019). For a long time, China was the primary importer until, in the face of large-scale pollution, it closed its borders for almost all imports of plastic waste in 2018 (Liu et al., 2018; Walker, 2018; Gündoğdu & Walker, 2021; Plastic Soup Foundation, 2022). In 2018, over three-quarters of plastic waste were destined for a country within Europe. Germany was one of the most important destinations and recorded the strongest increase compared to 2010. Plastic waste exports to Asian countries (other than China) such as Indonesia and Vietnam rose during the period (CBS Statistics Netherlands, 2019; Plastic Soup Foundation, 2022).

Plastic Waste Management Internationally

The Basel Convention governs plastic waste exports. It is an international treaty that is legally binding for 186 countries (Yang, 2020; van Der Marel, 2022). The focus, however, lies more on hazardous waste. The most important rules governing the international trade in waste products are laid down in the Basel Convention (1989). This agreement was passed to regulate the international transport and processing of hazardous waste. In May 2019, several amendments were introduced to the Basel Convention to make the trade in plastic waste more transparent and enforceable. These amendments took effect on January 1, 2021. One important amendment was the introduction of a “prior informed consent” (PIC) for mixed plastic waste, which means that it is easier to monitor the export of plastic waste and that countries may reject shipments (Plastic Soup Foundation, 2022). However, for plastic waste that is separated according to polymer type (e.g., polyethylene (PE), polyvinyl chloride (PVC), or polyethylene terephthalate (PET)) and is labelled “almost free from contamination,” no permission is required. Unfortunately, the Convention does not define what falls under this description so that there is plenty of room for misinterpretation resulting in the export of huge quantities of contaminated plastic waste which inevitably ends up as plastic pollution at the final destination.

The Basel Convention specifies separate trade codes for various plastic waste streams that must be used by relevant parties and which should make it clear whether the PIC is needed. This is a different coding system than that used for the UN COMTRADE database. All the codes in the Basel Convention fall under the umbrella of UN COMTRADE trade code 3915. As of 2021, countries that have ratified the Convention may only export contaminated or mixed plastic waste (unseparated) to another country if that country has signed the Convention and in doing so has given permission. Countries that have not ratified the Convention, such as the United States, may make separate agreements with the receiving convention about the import and export of plastic and other waste, resulting in a patch work of regulation, mismanagement, and lack of transparency or harmonization (Plastic Soup Foundation, 2022).

Plastic Waste Management in the European Union and in the Netherlands

In addition to the Basel Convention, the European Union (EU) has implemented its own legislation and regulations for packaging material. The transport of waste must meet the terms of the “Directive on shipments of waste” (1013/2006) (EU, 2006). This Directive also covers the trade in plastic waste. The export of waste that will end up in landfill in countries outside the EU is banned. Permission must be obtained from the relevant authority in the receiving country for some, not polluted, specified waste streams. For the export to countries outside the EU, 2% of the waste may be contaminated, and for export to countries within the EU, 6% may be contaminated (Plastic Soup Foundation, 2022). In this case, “contaminated” means irregular plastic waste or plastic waste that is of low quality and cannot be recycled. These EU rules follow from the European Green Deal, the Waste Framework Directive, and the Circular Economy Action Plan (European Commission, 2008, 2020, 2022). The objective is for “keeping the value of products, materials and natural resources in the economy as long as possible and, at the same time, minimising waste, the transition to a circular economy can make an important contribution to the creation of a low-carbon, resource-efficient, competitive economy” (Ministerie Van Infrastructuur en Waterstaat, 2019, p. 1). These plans also make shipment possible between member states (EU, 2006). Additionally, “waste must be classified as a good” (Ministerie Van Infrastructuur en Waterstaat, 2019, p. 72). This means that extra monitoring on the quality of the “waste” is not always required and can be overlooked, which can lead to the transportation of mismanaged plastic waste (Ministerie Van Infrastructuur en Waterstaat, 2019). The EU is currently modifying this legislation. The proposed new regulations on the transport of waste, including plastic, will be more stringent (Plastic Soup Foundation, 2022). However, they should ensure that the EU no longer exports waste that is too difficult or expensive to recycle domestically. The EU should address the illegal export of waste more effectively. The EU should only export waste that receiving countries can guarantee will be processed responsibly and transparently. Despite the call of environmental organizations, up to now the proposed regulations do not impose a general ban of the export of plastic waste to countries outside the EU (Plastic Soup Foundation, 2022).

Apart from legal waste streams, such as those included in the UN COMTRADE database, there is also a sizeable illegal trade in plastic waste. In a 2020 report, Interpol noted a strong rise in criminality connected to the trade in plastic waste. In recent years, under the name of “recycling,” ever more plastic has been dumped (INTERPOL, 2020). Criminals take advantage of the highly complicated legislation, irregular control in the export countries, and the lack of control in countries that receive illegal container freight. One of the ways in which plastic waste is illegally traded is by hiding it behind bales of old paper for export (Plastic Soup Foundation, 2022). Although the Netherlands has an extensive management plan for waste management called Landelijk Afvalbeheer Plan (LAP3) or National Waste Management Plan, which became effective on March 2, 2021 (Bergsma et al., 2014), the government relies heavily on individual companies and institutions for proper management of their waste (Ministerie Van Infrastructuur en Waterstaat, 2021c).

Plastic Waste Management in Municipalities

Typically, collection of household waste is the responsibility of municipalities (i.e., local governments) (Walker & Xanthos, 2018). In the Netherlands, there are two ways in which plastic waste is collected: separately in Plastic packaging material, Metal/Cans and Drinks cartons (PMD) bins for source separation or mixed with other material. These two options depend on individual municipalities (Ministerie Van Infrastructuur en Waterstaat, 2021b). Prezero (the largest plastic recycling company using source separation in the Netherlands) handles 80,000 tons/year (Çevikarslan et al., 2022; Prezero, 2022). Although material in PMD bins is intended for recycling, a substantial portion of the plastic waste ends up in waste-to-energy facilities which produce greenhouse gas emissions and contribute to climate change (Government of the Netherlands, 2018). After collection, the plastic waste is separated into homogeneous streams used to make plastic flakes of which new plastic materials are made. However, not all plastic waste is suitable for recycling (e.g., mixed and/or colored plastics are difficult for detection machinery to recognize and separate). Thus, these are not appropriate for producing flakes and directed to mixed waste stream (Prezero, 2022). Mixed streams are sent to companies that attempt to retrieve useful materials out of the waste stream or make new products from the mixed plastics, but this can be extremely difficult, even when infrastructure exists (Vollmer et al., 2020). However, because of their low quality, these mixed plastic waste streams have extremely low or even negative value and when exported to Asia have little chance of ever being recycled.

Management of Waste Exports

The exportation of recyclable plastic waste is allowed within the EU (EU, 2006; Ministerie Van Infrastructuur en Waterstaat, 2019). The Netherlands does this, claiming that the country is too small and greater recycling capacity exists elsewhere. The exporting country must make sure that the material exported is indeed “recyclable” and the importing country can have conditions on what type of waste they accept (Faraca & Astrup, 2019; Liang et al., 2021). After the import ban on plastic waste from China, most Asian countries updated their conditions for accepting specific recyclable materials (e.g., clean, no composites, certain polymers) (Liang et al., 2021). However, according to Navarre et al. (2022), the quality of exported waste from the Netherlands does not meet the specific criteria required by importing countries. Since these countries do not want to accept low-quality plastic waste for recycling, there are no management strategies to address this pressing issue. Therefore, the opportunity for proper recycling in these countries is not possible and combined with a lack of monitoring results in widespread leakage of Dutch plastics into the environment.

The European Environment Agency states that “The objective is a shift towards a circular economy, handling natural resources as efficiently as possible and ensuring the lowest possible environmental impact” (European Environment Agency, 2021, p. 5). To reach this objective, the following action plans have been proposed next to the LAP3.

The Transition Agenda Circular Economy focuses on moving toward a circular economy which means relying less on raw materials and concentrating on the reuse of materials. The goal is that plastics are fully circular by 2050. To achieve this, the emphasis will lie on prevention, supply of renewable plastics, quality, and strategic chain operation (Government of the Netherlands, 2018). This report mentions the intended result, action holders, the budget required, and the timeline. It can therefore be considered as a solid plan. Afvalpreventie programma (the waste prevention program) focuses on the prevention of creating waste, the negative consequences of waste products for the environment, and lowering the number of dangerous substances in materials (Rijksoverheid, 2021). Circulair Materialen Plan (Circular Material Plan) has a stronger legal basis. It also supports the treatment of materials from companies and, with that, offers incentive for innovation (Ministerie Van Infrastructuur en Waterstaat, 2022). This plan has been written as an extension of the LAP3.

Within the Organization for Economic Cooperation and Development (OECD), the EU, as a trading block comprising of 27 member states, was the largest exporter of plastic waste in the world to non-OECD countries in 2021. The net weight of exported plastic from the EU to non-OECD countries in 2021 was 887 million kg. After the EU, the following individual countries were the top 5 exporters of plastic waste to non-OECD countries in 2021: Japan (462 million kg), the United States (250 million kg), the Netherlands (211 million kg), Germany (95 million kg), and Australia (84 million kg), respectively (Plastic Soup Foundation, 2022).

Following China’s import ban in 2018, the export of plastic waste from the Netherlands to non-OECD countries decreased but increased dramatically in 2020 and 2021, despite stricter rules in the Basel Convention taking effect in 2021. Indonesia, Vietnam, and Malaysia were the main destinations for plastic waste export from the Netherlands in 2021, with Indonesia being the main export destination country. Further, the Netherlands is the largest exporter of plastic waste to Indonesia during the 5 years prior to 2021 (Plastic Soup Foundation, 2022). This is in stark contrast to the sharp decrease in exports to OECD countries from the Netherlands. In 2021, the Netherlands was the world’s largest exporter of plastic waste to Indonesia, totaling 70 million kg, and exported almost 64 million kg to Vietnam (Plastic Soup Foundation, 2022).

Is the Netherlands Wish Cycling?

Up until the import ban on plastic waste, the Netherlands had been exporting much of its waste to China, with the intention that it would be recycled into feedstock materials for the Chinese manufacturing industries (Brooks et al., 2018). However, the quality of the plastic that was exported by the Netherlands was too low for the creation of raw materials, and there was also a lack of technology for recycling of this material in China and other importing countries (Liang et al., 2021). With the overflow of low-quality plastics to Asian countries following the import ban by China, it is now continuing to leak into marine and terrestrial environments causing harm to wildlife and local communities.

This chapter provides insights on the plastic waste trade of the Netherlands. According to Brooks et al. (2018), the Netherlands is the seventh biggest exporter of plastic waste in the world. The Dutch Afvalfonds voor Verpakkingen (Waste Fund for Packaging) claims that 50% of plastic packaging is recycled; however, this claim is misleading as this does not include mixed plastics since these are already considered nonrecyclable materials (Snijder & Nusselder, 2019).

Limitations, Recommendations, and Future Considerations

Companies are not required to separate plastics from their waste (Ministerie Van Infrastructuur en Waterstaat, 2021b). This means that the waste is mostly going to incineration and the recycling rates for this sector are low (Snijder & Nusselder, 2019). To obligate companies to cooperate with plastic recycling, a law should be implemented that requires companies to take part in recycling. Proper monitoring is required with random spot checks at recycling companies.

The Netherlands has a strict policy on landfill of household waste but when recycling is not possible, incineration is used (Snijder & Nusselder, 2019; Çevikarslan et al., 2022). The tax on landfill reduced the use of landfills discernably. Therefore, it can be assumed that a tax on recyclable plastic waste, which is being shipped abroad or incinerated, will make a positive impact on this problem. The money obtained can be used for improving recycling rates (Government of the Netherlands, 2018, p. 31).

There is a wide variety in materials used for plastic packaging. This makes recycling extremely difficult. Producers should not mix or color plastics to help decrease the mixed waste stream and increase the recycling rate in the Netherlands to help prevent useless exportation. To push this transition, the government should help by providing rewards for companies that improve their products and fine companies that neglect innovation.

For customers, it is extremely difficult to select products with less packaging material. Supermarkets should help the customer in this. There is already one example of a supermarket chain that moved away from useless packaging material: Ekoplaza (2022). Other supermarkets should follow their example. The Netherlands is not the only country exporting plastic waste, but this is no excuse for its actions. Other countries that have reduced their export of plastic waste should be looked at to learn from their successes and failures. This can help the transition away from the exportation of plastic waste faster for the Netherlands. The United Kingdom and Norway are great examples for management, monitoring, and mitigation strategies in Europe (Plastics Europe, 2022).

Current plastic production use and disposal may continue to undermine implementation of many of the UN SDGs by 2030 without reductions in global consumption of fossil fuel-based plastics (Walker, 2021). Although solutions required to reduce plastic waste and plastic pollution are diverse and cannot be adequately addressed in this chapter, some solutions include extended producer responsibility programs (Diggle & Walker, 2020, 2022; Diggle et al., 2023), prevention initiatives to reduce single-use plastic use (Xanthos & Walker, 2017; Schnurr et al., 2018; Adam et al., 2020; Bezerra et al., 2021; Clayton et al., 2021), and the Plastics Treaty which will consider the entire plastic life cycle including curbing production, circular economy and environmental reporting standards, increased consumer awareness, and improved performance measures (Ammendolia & Walker, 2022; Bergmann et al., 2022; Dey et al., 2022). For example, plastic packaging and plastic waste comprise complex mixtures consisting of over 13,000 chemical substances such as additives, processing aids, and non-intentionally added substances, and many of them are known to be hazardous to human health and the environment (Wiesinger et al., 2021; Dey et al., 2022). Thus, toxic chemicals used in plastic production hamper recycling efforts.

Conclusions

Despite its small size and population compared to other EU countries, the Netherlands remains a large player in the international trade in plastic waste, and this is also despite the modifications to the Basel Convention. The Netherlands exports most of its plastic waste to Indonesia, Malaysia, and Vietnam. This suggests that greater transparency is required in the Basel Convention, which would allow the public to gain access to data of the trade streams originating from the Netherlands. Current updates to the European Waste Shipment Directive also offers opportunities to improve transparency about plastic waste exports from the Netherlands to non-OECD countries. However, a ban on the export of plastic waste to countries outside the EU would be the most effective mitigation to curb this plastic pollution trafficking, yet it is not included in the proposed changes. A ban would lead to pollution being tackled as close to the source as possible and make the illegal trade in plastic waste much more difficult. The current legislation and regulations are too complicated and leaves too much space for transporting contaminated plastic waste.

References

Adam, I., Walker, T. R., Bezerra, J. C., & Clayton, A. (2020). Policies to reduce single-use plastic marine pollution in West Africa. Marine Policy, 116, 103928.

Ammendolia, J., & Walker, T. R. (2022). Global plastics treaty must be strict and binding. Nature, 611(7935), 236.

Basel Convention (1989). Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and Their Disposal, Mar. 22, 1989, 1673 UNTS 126.

Bergmann, M., Almroth, B. C., Brander, S. M., Dey, T., Green, D. S., Gundogdu, S., Krieger, A., Wagner, M., & Walker, T. R. (2022). A global plastic treaty must cap production. Science, 376(6592), 469–470.

Bergsma, G. C., Vroonhof, J., Blom, M. J., & Odegard, I. Y. R. (2014). Evaluatie Landelijk Afvalbeheerplan (LAP) 1 en 2. https://ce.nl/wp-content/uploads/2021/03/CE_Delft_2C95_Evaluatie_landelijk_Afvalbeheerplan_LAP_1_en_2.pdf

Bezerra, J. C., Walker, T. R., Clayton, C. A., & Adam, I. (2021). Single-use plastic bag policies in the Southern African development community. Environmental Challenges, 3, 100029.

Borrelle, S. B., Ringma, J., Law, K. L., Monnahan, C. C., Lebreton, L., McGivern, A., Murphy, E., Jambeck, J., Leonard, G. H., Hilleary, M. A., Eriksen, M., Possingham, H. P., De Frond, H., Gerber, L. R., Po, B., & Rochman, C. M. (2020). Predicted growth in plastic waste exceeds efforts to mitigate plastic pollution. Science, 369(6510), 1515–1518. https://doi.org/10.1126/science.aba3656

Brooks, A. L., Wang, S., & Jambeck, J. R. (2018). The Chinese import ban and its impact on global plastic waste trade. Science Advances, 4(6), 1–8. https://doi.org/10.1126/sciadv.aat0131

Brown, E., MacDonald, A., Allen, S., & Allen, D. (2023). The potential for a plastic recycling facility to release microplastic pollution and possible filtration remediation effectiveness. Journal of Hazardous Materials Advances, 10, 100309.

CBS Statistics Netherlands. (2019). Less recyclable plastic waste sent to China. https://www.cbs.nl/en-gb/news/2019/11/less-recyclable-plastic-waste-sent-to-china

Çevikarslan, S., Gelhard, C., & Henseler, J. (2022). Improving the material and financial circularity of the plastic packaging value chain in The Netherlands: Challenges, opportunities, and implications. Sustainability, 14(12), 7404. https://doi.org/10.3390/su14127404

Clayton, C. A., Walker, T. R., Bezerra, J. C., & Adam, I. (2021). Policy responses to reduce single-use plastic marine pollution in the Caribbean. Marine Pollution Bulletin, 162, 111833.

DeWeerdt, S. (2022). How to make plastic less of an environmental burden. Nature, 611(7936), 2–5.

Dey, T., Trasande, L., Altman, R., Wang, Z., Krieger, A., Bergmann, M., Allen, D., Allen, S., Walker, T. R., Wagner, M., & Syberg, K. (2022). Global plastic treaty should address chemicals. Science, 378(6622), 841–842.

Diggle, A., & Walker, T. R. (2020). Implementation of harmonized Extended Producer Responsibility strategies to incentivize recovery of single-use plastic packaging waste in Canada. Waste Management, 110, 20–23.

Diggle, A., & Walker, T. R. (2022). Environmental and economic impacts of mismanaged plastics and measures for mitigation. Environments, 9(2), 15.

Diggle, A., Walker, T. R., & Adams, M. (2023). Examining potential business impacts from the implementation of an extended producer responsibility program for printed paper and packaging waste in Nova Scotia, Canada. Circular Economy, 2(2), 100039.

Ekoplaza (2022). Sparen voor zomerse bio producten. https://www.ekoplaza.nl/nl/campagnes/verwenpakket

EU. (2006). Regulation (EC) No 1013/2006 of the European Parliament and the Council of 14 June 2006 on shipments of waste. Official Journal of the European Union, L190, 1–98. https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32006R1013&from=EN

European Commission. (2008). Waste framework directive. https://environment.ec.europa.eu/topics/waste-and-recycling/waste-framework-directive_en

European Commission. (2020). A European green deal. https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_en#Highlights

European Commission. (2022). Circular economy action plan. https://environment.ec.europa.eu/strategy/circular-economy-actionplan_en

European Environment Agency. (2021). Overview of national waste prevention programmes in Europe The Netherlands. https://www.rijksoverheid.nl/documenten/rapporten/2021/02/

Faraca, G., & Astrup, T. (2019). Plastic waste from recycling centres: Characterisation and evaluation of plastic recyclability. Waste Management, 95, 388–398. https://doi.org/10.1016/J.WASMAN.2019.06.038

Fuller, S., Ngata, T., Borrelle, S., & Farrelly, T. (2022). Plastics pollution as waste colonialism in Te Moananui. Journal of Political Ecology, 29(1), 534–560.

Geyer, R., Jambeck, J. R., & Law, K. L. (2017). Production, use, and fate of all plastics ever made. Science Advances, 3(7), 3–8. https://doi.org/10.1126/sciadv.1700782

Government of the Netherlands. (2018). Transition agenda circular economy – Circular construction economy. https://hollandcircularhotspot.nl/wp-content/uploads/2018/06/TRANSITION-AGENDA-PLASTICS_EN.pdf

Gündoğdu, S., & Walker, T. R. (2021). Why Turkey should not import plastic waste pollution from developed countries? Marine Pollution Bulletin, 171, 112772.

INTERPOL. (2020). INTERPOL report alerts to sharp rise in plastic waste crime. https://www.interpol.int/News-and-Events/News/2020/INTERPOL-report-alerts-to-sharp-rise-in-plastic-waste-crime

Jambeck, J., Geyer, R., Wilcox, C., Siegler, T. R., Perryman, M., Andrady, A., Narayan, R., & Law, K. L. (2015). Plastic waste inputs from land into the ocean. Science, 347(6223), 768–771.

Kitz, R., Walker, T., Charlebois, S., & Music, J. (2022). Food packaging during the COVID-19 pandemic: Consumer perceptions. International Journal of Consumer Studies, 46(2), 434–448.

Lau, W. W., Shiran, Y., Bailey, R. M., Cook, E., Stuchtey, M. R., Koskella, J., Velis, C. A., Godfrey, L., Boucher, J., Murphy, M. B., & Thompson, R. C. (2020). Evaluating scenarios toward zero plastic pollution. Science, 369(6510), 1455–1461.

Liang, Y., Tan, Q., Song, Q., & Li, J. (2021). An analysis of the plastic waste trade and management in Asia. Waste Management, 119, 242–253. https://doi.org/10.1016/j.wasman.2020.09.049

Liboiron, M. (2021). Pollution is colonialism. Duke University Press.

Liu, Z. (2021). Regulate waste recycling internationally. Nature, 594(7863), 333–333.

Liu, Z., Adams, M., & Walker, T. R. (2018). Are exports of recyclables from developed to developing countries waste pollution transfer or part of the global circular economy? Resources, Conservation and Recycling, 136, 22–23.

Liu, Z., Liu, W., Walker, T. R., Adams, M., & Zhao, J. (2021). How does the global plastic waste trade contribute to environmental benefits: Implication for reductions of greenhouse gas emissions? Journal of Environmental Management, 287, 112283.

March, A., Roberts, K. P., & Fletcher, S. (2022). A new treaty process offers hope to end plastic pollution. Nature Reviews Earth & Environment, 3(11), 726–727.

Ministerie Van Infrastructuur en Waterstaat. (2019). LAP3 A.6 International. https://lap3.nl/service/english/

Ministerie Van Infrastructuur en Waterstaat. (2021a). LAP3 A.7 Monitoring van het afvalbeheer. https://lap3.nl/beleidskader/deel-aalgemeen/a7-monitoring/

Ministerie Van Infrastructuur en Waterstaat. (2021b). LAP3 B.3 Gescheiden houden van afvalstoffen. https://lap3.nl/beleidskader/deel-bafvalbeheer/b3-afvalscheiding/

Ministerie Van Infrastructuur en Waterstaat. (2021c). LAP3 D.7 Handhaving. https://lap3.nl/beleidskader/deel-dvergunning/d7-handhaving/

Ministerie Van Infrastructuur en Waterstaat. (2022). Circulair Materialenplan 1. https://www.platformparticipatie.nl/CMP1/default.aspx

Molloy, S., Varkey, P., & Walker, T. R. (2022). Opportunities for single-use plastic reduction in the food service sector during COVID-19. Sustainable Production and Consumption, 30, 1082–1094.

Navarre, N., Mogollón, J. M., Tukker, A., & Barbarossa, V. (2022). Recycled plastic packaging from the Dutch food sector pollutes Asian oceans. Resources, Conservation and Recycling, 185, 106508. https://doi.org/10.1016/j.resconrec.2022.106508

Plastic Soup Foundation. (2022). A neocolonial plastic scandal: The Netherlands plays a leading role in the international trade in plastic waste. https://www.plasticsoupfoundation.org/en/2022/09/netherlands-pivotal-in-global-export-of-plastic-waste-to-non-western-countries-report-finds/

Plastics Europe. (2022). The circular economy for plastics. https://plasticseurope.org/wp-content/uploads/2022/06/PlasticsEurope-CircularityReport-2022_2804-Light.pdf

Prezero. (2022). Prezero. https://prezero.nl/

Rijksoverheid. (2021). Afvalpreventieprogramma Nederland Inhoud Inleiding. https://open.overheid.nl/repository/ronl-a5b3b35c-d786-4f10-8ca6-b04bc8a913ce/1/pdf/afvalpreventieprogramma-nederland.pdf

Schnurr, R. E., Alboiu, V., Chaudhary, M., Corbett, R. A., Quanz, M. E., Sankar, K., Srain, H. S., Thavarajah, V., Xanthos, D., & Walker, T. R. (2018). Reducing marine pollution from single-use plastics (SUPs): A review. Marine Pollution Bulletin, 137, 157–171.

Snijder, L., & Nusselder, S. (2019). Plasticgebruik en verwerking van plastic afval in Nederland. https://ce.nl/wp-content/uploads/2021/03/CE_Delft_2T13_Plasticgebruik_en_plastic_afval_verwerking_NL_DEF.pdf

Teebthaisong, A., Saetang, P., Petrlik, J., Bell, L., Beeler, B., Jopkova, M., Ismawati, Y., Kuepouo, G., Ochieng Ochola, G., & Akortia, E. (2021). Brominated dioxins (PBDD/Fs) in free range chicken eggs from sites affected by plastic waste. Organohalogen Compounds, 82, 199–202.

van Der Marel, E. R. (2022). Trading plastic waste in a global economy: Soundly regulated by the Basel Convention? Journal of Environmental Law, 34(3), 477–497.

Vollmer, I., Jenks, M. J. F., Roelands, M. C. P., White, R. J., van Harmelen, T., de Wild, P., van der Laan, G. P., Meirer, F., Keurentjes, J. T. F., & Weckhuysen, B. M. (2020). Beyond mechanical recycling: Giving new life to plastic waste. Angewandte Chemie – International Edition, 59(36), 15402–15423. https://doi.org/10.1002/anie.201915651

Walker, T. R. (2018). China’s ban on imported plastic waste could be a game changer. Nature, 553(7686), 405–406.

Walker, T. R. (2021). (Micro) plastics and the UN sustainable development goals. Current Opinion in Green and Sustainable Chemistry, 30, 100497.

Walker, T. R. (2023a). The tropics should not become the world’s plastic pollution problem. Journal of Tropical Futures, 27538931231165273. https://doi.org/10.1177/275389312311652

Walker, T. R. (2023b). The Maldives should not become the world’s garbage dump by importing plastic waste. Marine Pollution Bulletin, 189(4), 114749.

Walker, T. R., & Fequet, L. (2023). Current trends of unsustainable plastic production and micro (nano) plastic pollution. TrAC Trends in Analytical Chemistry, 160(3), 116984.

Walker, T. R., & McGuinty, E. (2020). Plastics (pp. 1–12). Springer International Publishing.

Walker, T. R., & Xanthos, D. (2018). A call for Canada to move toward zero plastic waste by reducing and recycling single-use plastics. Resources Conservation and Recycling, 133, 99–100.

Walker, T. R., McGuinty, E., Charlebois, S., & Music, J. (2021). Single-use plastic packaging in the Canadian food industry: Consumer behavior and perceptions. Humanities and Social Sciences Communications, 8, 80.

Wiesinger, H., Wang, Z., & Hellweg, S. (2021). Deep dive into plastic monomers, additives, and processing aids. Environmental Science & Technology, 55(13), 9339–9351.

Xanthos, D., & Walker, T. R. (2017). International policies to reduce plastic marine pollution from single-use plastics (plastic bags and microbeads): A review. Marine Pollution Bulletin, 118(1–2), 17–26.

Yang, S. (2020). Trade for the environment: Transboundary hazardous waste movements after the Basel Convention. Review of Policy Research, 37(5), 713–738.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2024 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Danton, H., Walker, T.R. (2024). The Darker Side of Dutch Colonialism: Exporting Plastic Waste Is Plastic Pollution Trafficking. In: Gündoğdu, S. (eds) Plastic Waste Trade. Springer, Cham. https://doi.org/10.1007/978-3-031-51358-9_8

Download citation

DOI: https://doi.org/10.1007/978-3-031-51358-9_8

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-51357-2

Online ISBN: 978-3-031-51358-9

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)