Abstract

This chapter will provide an acknowledgement of processes, concern regarding them, and geopolitics behind the exploitation of shale gas across the borders of countries to continents. Utilization of natural gases is shifting towards unconventional techniques from conventional. Shale gas reserves are nonuniformly distributed across the globe. This arises the geopolitical competitiveness to possess and exploit shale gas resources beneath their territory. This chapter highlights the growth of shale gas exploration and exploitation in different regions of the world, impact of geopolitics on shale gas exploration, consumption and prices. Exchange of technologies (fracking) to other nations for accessing their shale gas reserves will be further discussed. The chapter also includes possible threats to shale ecosystem, impact of ongoing conflicts and future prospects of shale gas on global politics. The chapter concerns about overview and dilemma of the proceeding towards unconventional gas resources as there are protest arising day to day.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

In the twenty-first century, where natural resources are the basic accounts for the richdom of any region. Understanding the geographical status of the world in respect of politics and international relations is known as Geopolitics. Shale is the reservoir rock for shale gas, extraction of this economically important natural gas is done by a complex process of fracking.Footnote 1 There are always been demand, disputes and insurgence over natural resources; these reserves determine the value of their holders, as there is always a rivalry for its count.

In this chapter, we will discuss and determines the aspects of geopolitics regarding the exercises of shale gas reserves and production. Worldwide reserves, exploitation and transportation mediums will be discussed shortly; it will allow us to attain the significance and economic importance of shale gas (Shiqian 2017). The commercialisation of shale gas is a major part of geological exercises in the recent world, though a brief report on the commencement of its uses and trade will be delineated in the chapter respectively. In recent times various military conflicts and ongoing wars have impacted the supply and demand for the natural gas and shale gas in particular, we have briefly analyzed the effect of the geopolitical conflicts on the economics and development of shale gas exploitation.

2 Exploration and Expansion of Shale Gas

Hydraulic fracturing is the technique operated for the exploration of shale gas, as it is trapped in shale, and natural gasFootnote 2 produced with help of this technique is referred to as ‘unconventionalFootnote 3’. The hydraulic fracking technique uses water at high pressure to generate narrow fractures. Tough in terms of geopolitics, the hydraulic fracking market has lonely reported a turnover of $48.34 billion; where applications of shale gas significantly contributed (Research and Markets 2021).

2.1 Worldwide Resources

Russia accounts for containing the world’s largest natural gas reserves which are about 1.32 quadrillion cubic feet which are approximately 20% of worldwide reserves of natural gas. However, Unites States and China hold up the highest production of shale gas in the world. China (14.3%) in Asia and US, Canada, and Mexico in North America (23%) are the largest technically recoverable resources found in the world (Fig. 1).

Besides the majorly distributed reserves, technically recoverable reserves are also found in the region of Europe (significantly in SE Europe, Ukraine, Poland, France, UK, Denmark, and the Netherland). The rest of the significant countries in terms of long-established hydrocarbon exportation like Algeria, Saudi Arabia, Russia, Libya and Egypt are supposed to have 9.1–1.3% of total abundance. Several nations are concerned about replacing crude oil consumption in power plants with shale gas, for accomplishing the needs of the domestic power market. From a geopolitical perspective, exporting crude oil in the international market develops more revenue than the exportation of natural gas; shifting towards shale gas consumption for domestic purposes will impact the inflation and expenses of domestic needs.

2.2 Shale Gas Exploitation

There was no particular significance of shale gas exploitation and utilisation before a decade, but it is now recognised as a more efficient driving force in universal gas output. Within the last decade, data from global outputs of energy utilisation and greenhouse index in the USA reflect a path to energy independence; with the help of hydrocarbon extraction through shale. Nevertheless, production of shale gas and oil has been sustainably developed with implications of improved drilling machinery and well productivity in respect of altering prices of oil and rig counts. This operation is certainly encouraged by the outcomes observed by shifting shale from coal in the US; according to research conducted from 2007 to 2012, a drop of about 12% in greenhouse gas emissions is reported. Analysis of the issues and complexity of exploitation of shale gas is typically constrained by numerous problems which are horizontal good fracturing, improper resources, and endowment. In particular, non-marine shale deposits and complicated tectonics are the major issues in the exploitation of shale gas.

2.2.1 Asia

China is the lead producer of shale gas in Asia and the world as well, by 2013 shale gas production in China was negligible in terms of overall natural gas production in China. Here the concern of increasing their production arises by 2015, which was assumed to be 30 billion cubic meters (BCM); yearly goals were established in such proportions of forthcoming production which will be equivalent to half of the gas consumption by entire China in 2008. Though it cannot be done with the specific intervention of advanced technology; in 2009, Barack Obama agreed to plead with China for sharing US gas-shale technology, and either in terms of promoting US investment in the development of Chinese shale gas project. Although China faced numerous more difficulties in attainment of their futuristic approach of increasing shale gas development like the complexity of geology and terrain, lack of water resources and undeveloped or limited expertise (Shiqian 2017). Hereby, the government of China has set aggressive goals of achieving 60 bcm per year by 2020. For this attainment, the Chinese government leased their 20 blocks of shale gas to 18 companies, a similar auction for leasing their gas blocks also occurred later. Since China is highly dependent on the South China sea route to procure its energy needs, it leaves China extremely vulnerable to any conflict in this region. Any potential conflict in the south China sea region can result in an effective blockade of the hydrocarbon resources of the country. Hence the leadership of the country has set highly ambitious targets for shale gas production including 65–100 Billion Cubic Meters in 2020. But due to practical reasons like high cost, lack of investments and lack of technological set-up for optimal exploitation of reserves, Chinese producers continuously struggle to meet these targets with 2020 production being 20 bcm (Wei et al. 2022).

2.2.2 South Asia

India approximately contains 96 trillion cubic meters of shale gas reserves. Government policies for exploitation significantly alter the outcomes and production, whereas in India shale gas complications are regulated by Indian policies because government-issued leases in favour of conventional exploration (petroleum) excluding unconventional sources like shale gas. Reliance industries limited and RNRL and others effectively contribute to the battle of prospering country’s economy and growth by accessing unconventional resources of energy also. Policies have been changed under the premises of licencing policy and hydrocarbon exploration which will permit the intrusion of a private organisation to attain a uniform license; this will allow them to explore and exploit conventional as well as unconventional natural resources (oil and gas). The concern of shale gas exploitation was taken forward and a delegation was scheduled for the meeting between officials of the Indian oil ministry, their director-general of hydrocarbons and USGS.Footnote 4 In 2010 meeting was held in Washington, where officials discussed the exploitation and identification of natural resources of shale gas in India. Basins of primary attention identified by the GSIFootnote 5 are the following: Gujarat’s Cambay Basin, the Gondwana Basin of Central India, and the Assam-Arakan Basin situated in northeast India. A supportive statement was then given by US President Obama while a visit to India in 2010; which stated the cooperation in pursuit of pure energy and the mission of zero-emission, along with it opening of the research centre for clean energy in India and perusing combined research in biofuels, shale gas and solar was the most efficient affirmation (Nakano 2012).

Pakistan is the 19th major country for acquiring technically recoverable reserves of shale gas, it has an estimated reserve of 105 trillion cubic meters. Nonetheless, the Islamic Republic of Pakistan consumes 100% of the natural gas whatever it exploits and produces; it delivers no contributions to the export of natural gases in global trade and there may be a chance of growth by shale gas in future.

2.2.3 The Americas

On the land of North and south America’s continent, there are four lead producers of shale gas which are Argentina, Canada, Mexico and the United States. In the list above excluding Argentina, the rest of the three are in North America making it the second heaviest contributor of technically recoverable resources of shale gas in the world. Hydraulic fracturing and horizontal drilling are the two newly introduced technologies for the exploitation of shale gas reservoirs in the United States and their co-operations with other countries is successively delivering the contribution (Kobek et al. 2015). In 2013, EIA reported an estimated reserve of 802 trillion cubic feet in Argentina; making it the third largest reservoir of recoverable shale gas. ‘Vaca Muerte formations are the major contributor of tight oil as well as gas in Argentina.

This was a topic of limited attention by 1800 when exploitation of natural gas was addressed in shale formations, located in the Appalachian Mountains (United States). Norman wells of Northwest Territories of Canada, second white speckled in southeast Alberta, Antrim shale in Michigan basin were later introduced by 1940s. These formations certainly assisted in economic recovery, as their vertical wells were producing at minimum rates for a long duration.

3 Commercialisation of Shale Gas and Geopolitics

With the increase in demand for zero combustion reliability, several nations are on the path of shifting their energy consumption towards natural gases. There are possible figures discussed soon, which will determine the forthcoming possibilities of natural gas production in the next two to four decades. One of the significant events forms 2000 is the trading of global energy; particularly reflecting the stellar expansion of production of shale gas in the US. It has been done by the advancement of technology used for exploitation of the respective resource, management issues of looking over the needs of gas value chain along with the expansion of this business. For this instance, “ETRM (Energy Trading and Risk Management)” efficiently works upon the situation by using an integrated system. Allowing data exchanges among the global traders, artificial surveillance of supply and trading of fuels, gases, refined products and others.

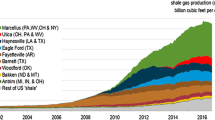

An alteration in the global market can be seen along with the expansion of shale gas production; where the US promotes itself as being the largest producer of natural resources, specifically oil and gas (EIA 2021). Shale gas exploration has begun in 1949 when the government of the USA 1975 enacted limitations on the export of crude oil. It was done in favour of American consumers to provide aid from the price volatility in the global market. Today, all of the bans on exportin have been lifted; just because of the advancement in technology which helped in the blooming of America’s energy industry. However, the laws governing America’s oil exchange were outdated and the lifting of the federal laws assisted in leading the production resulting in the surpassing of Russia and Saudi Arabia. Free trade investments, economic growth and relevant policies like introducing jobs lessen their need for imports from the middle east. As there we are acknowledged how the foreign policy of the United States is affected by the export of crude oil; it also alleviates the needs of imports for US allies by the export of surplus crude oil from the end of the United States. This particular trade strengthens and influences foreign policy as well as the trading position worldwide for America (Fig. 2).

Despite the fact discussed above, rising shale gas production with relevant political disputes has certainly contributed to escalating ‘global gas flaringFootnote 6’. Data observed from the satellite surveillance has shown an increment of 3% global gas flaring in 2018, this estimate is as approximate in comparison to the consumption by south and central America.

Similarly in South Africa, the Karoo region which is sensitive to shale gas development has gathered the attention of various energy companies, organisations, governments and the public typically. Even though, the government of South Africa is waiting with a bated heart to resuscitate economic growth and also in improving energy security to deal with the energy supply crisis which is a special concern and drawback in this modern age of technology; why is South Africa in dark? Questions alike are continuously arising in 2022 still. South Africa has reported a recoverable natural gas estimate of 390 trillion cubic feet which can be exploited from shale in the Karoo basin. While the respective government tries to step forward for the exploration, the dominant coal industry and alike alternatives such as renewable sources and nuclear energy intrude the attention. This increasing concern is related to the economic viability of the shale gas deposits of South Africa.

4 Shale Gas Industry and Sensitive Conflicts

Exploration and exploitation of oil and gas from unconventional techniques like fracking, etc. have been raised once to fulfil the domestic energy supplies and security. It certainly lessens the reliability of other states and their allies over Russia and ‘OPEC’; afterwards the introduction of the Russia-Ukraine war and its consequences, definitely supported the above statement. Despite the western leaning and their supportive statement, there are major environmental issues like contamination of water and land rights were lifted above (Bayley 2015). Nevertheless, everyone knows that the world’s richest continent (in terms of natural resources) is also the world’s poorest. Unquestionably it is a resource abundant as gold, uranium, oil, copper, natural gas and many more are heavily occupied in the African region.

4.1 Russo-Ukrainian Conflict

In February of 2022 Russian army crossed the international border into Ukrainian territory with aim of demilitarizing and changing the regime, this conflict resulted in a full scale war. What followed was the internationalisation of the conflict as the European Union and western countries imposed severe sanctions on Russian Federation targeted to cripple the Russian economy while providing tactical support to Ukraine. As the conflict rolled out European Union which depends on Russian gas for 40% of its natural gas consumption, stated to draw plans to reduce its gas purchase from Russia and started looking for other sources of Gas (EIA 2021).

EU’s shifting away from natural gas means securing demand from other sources the main source which has the potential to replace Russian gas is abundant shale gas production in North America, which can be brought to Europe as LNG. European governments started to upgrade their LNG infrastructure to receive more gas from the USA. Meanwhile, Russian gas supplies to the European bloc were reduced continuously citing technical reasons. If it was not for the American shale revolution Europe could not think about moving away from Russian natural gas. Overall, the increased European gas demand will promote American shale producers to increase their production. Hence in a way, shale gas proved to be the backbone of the western bloc, backing the gas-dependent economies of Western Europe (Shiryaevskaya 2022).

The conflict in Ukraine had a contrasting impact on production in the world’s two major shale producers. China world’s second-largest shale gas producer after the USA will experience a detrimental effect of the conflict (EIA 2016). As Russia is losing its European markets it is looking east, and aggressively marketing its gas with huge discounts to LNG from the Middle East or USA. With the infrastructure right in place with the construction of the 61 billion cubic meter per annum capacity “Power of Siberia” pipeline, Russia is providing the Chinese market with cheap gas rendering the high-cost Chinese shale gas producers uncompetitive (JENNIFER SOR 2022). With Chinese shale producers making fewer profits and a lack of investments in the sector due to larger financial situations, the industry is set to lose its initial progress in forthcoming consequences.

Russia world’s second-largest gas producer and largest exporter of conventional natural gas. It has an immense amount of technically recoverable shale gas around 267 trillion cubic meters and has the world’s single largest hydrocarbon-rich shale basin ‘The Bazhenov formation’ with an estimated initial gas in place of 1920 billion cubic meters. Still, it is not a major producer of shale gas due to two main reasons, first the availability of lower extraction cost dry gas and associated gas wells. Second is the lack of technical capabilities to exploit shale reservoirs. Russian exploration and production giants are largely dependent on western investments and know how to extract shale gas resources (EIA 2021). Due to this conflict, on the one hand, Russian forces have taken control of much of Ukraine’s shale basins in the east of the country thereby adding up reserves of the country by an approximate 8976 billion Cubic meters, on another hand the stringent western sanctions on technology exchange to Russia and voluntary exit of major oil field service companies like Schlumberger, Halliburton etc. will make it difficult for Russian producers to extract these reserves.

Meanwhile, Algeria is in proximity to Europe which is the most competitive natural gas market. With natural gas prices record high after the conflict, the Algerian National oil company The Sonatrach is seeking to increase its production to satisfy the demand. Development of shale gas exploitation is one of the key priorities of the company with many trial projects ongoing to test the potential of exploiting shale reserves. Already Algerian NOC is developing Algeria to Spain Pipeline Medgaz’s capacity by 25% to 10 bcm per annum and increasing LNG export infrastructure.

Europe (including the United Kingdom) even has one of the largest shale gas reserves in the world. France (4.2 tcm), Poland (3.9 tcm), Romania (1.4 tcm), Denmark (0.90 tcm) and others in total Europe have a recoverable reserve of about 13.3 trillion cubic meters. But so far it doesn’t produce any shale gas due to its very strict policies regulating the exploitation of shale resources. Fracking has been systematically demonized by the green parties of Europe, creating a situation where Europe having investments and technology to produce shale gas did not allow its production.

As the Russo–Ukrainian conflict intensifies there are heightened fears of a complete gas supply halt from Russia, insecure about their energy needs European nations are reconsidering their approach to shale resources and started to look at them as an alternative to Russian gas. In this chain of events UK leading the bandwagon has already reconciled its fracking policy and is starting to issue new licences for exploration as early as October 2022. Meanwhile, Europe is still divided in its stance on shale resources with a study showing a higher proportion of 73% of the German parliamentarians voted against the exploitation of share reserves while 27% considered it as a short-term solution for the energy crisis.

4.2 The Middle East—Strait of Hormuz

The Persian Gulf is the source of 21% of hydrocarbon exports in the world. Therefore, the stability of this region plays a crucial role in the price dynamics of hydrocarbon fuels. As the region is home to groups of populations with diverse geopolitical interests and has seen multiple wars in the past few decades. Also due to huge resources of hydrocarbons in the regional geopolitical events like a potential Iran nuclear deal can open the tap of resources in the country which can result in the collapse of natural gas prices making investments in the capital-intensive shale projects unpreferred by the investors and hence reducing the potential of shale gas exploitation worldwide (EIA 2016).

Will shale gas be an important objective of geopolitics in the times to come?

Already North American shale gas has emerged as the saviour of its EU and NATO allies from energy starvation after a reduction in gas from the Russian side and in event of a threat of a complete halt of gas. North American shale gas strengthens the US and NATO alliance and supports the economies of NATO member states as it proves to be an efficient energy resource for them. American shale revolution reduced American dependency on hydrocarbon imports mainly from the dynamic middle east and other producers. It reduced the power of the oil cartel OPEC but the change in administration in capitol hill Washington, and the new anti-fracking stance of new administration is hurting America’s newly found and short-lived energy independence and once again bringing the future of the western bloc in danger and losing its control in the hands of conventional resource-rich nations mainly part of OPEC plus.

China will try to replicate American success with shale gas and create its version of the shale revolution. With some challenges ahead like access to cheaper imported gas and higher cost of production. But if China succeeds to develop and exploit its mammoth shale gas reserves it can strengthen its energy position by securing its internal northern and central parts and taking more risks in the southern part including a more aggressive approach in the South China sea. This can create an aggressive power struggle or a full-blown conflict in the South China sea region mainly with countries like Taiwan and Vietnam which have protested China’s activities in the region. Therefore, it will be of global interest to watch and analyse China’s shale growth story.

5 Conclusion

Though it can be concluded that shale gas plays an important role in attaining the aspects of zero-emission and lowering the impacts of greenhouse effects. Exploration and exploitation need a brief report on the accessible resources of shale gas which must be technically recoverable, United States has certainly delivered their technology of hydraulic fracking and horizontal drilling to the demand of particular nations. This can be a beginning of an era of joint operations which are efficient in delivering more significant results than any country holding resources but not technology to access it. In the chapter, we have discussed the availability of resources worldwide along the continents and determined them for their efforts of shifting fuel consumption for domestic and commercial purpose.

‘We are not wild west’ alike phrases were seen warming up the crowd in Romania, concerning ecological risks involved in shale gas industry. Nations like France, Britain, Lithuania, Algeria, are currently seen active to the regarding protests. These campaigns are grassroots direct actions opposing unconventional gas reserves. Howsoever hinging on the requirement of development will not be affected by these protests of regionally limited people. ‘The world has enough for everyone’s need, but not for everyone’s greed’—M. K. Gandhi.

Notes

- 1.

Hydraulic fracking to dig boreholes.

- 2.

Referring methane and ethane processed out from geological reservoirs.

- 3.

Place of origin and preservation are same.

- 4.

United States Geological Survey.

- 5.

Geological Survey of India.

- 6.

Ignition of natural gases linked with oil extraction, occur due to technical or economic constraints.

References

Bayley, E. (2015, September 16). Conflict Sensitivity of the Shale Gas Industry. Retrieved September 22, 2022, from https://climate-diplomacy.org/magazine/conflict-sensitivity-shale-gas-industry

EIA. (2016, August 15). International Energy Outlook 2016 . Retrieved September 22, 2022, from https://www.eia.gov/todayinenergy/detail.php?id=27512

EIA. (2021). NATURAL GAS. Retrieved September 24, 2022, from https://www.eia.gov/dnav/ng/ng_prod_shalegas_s1_a.htm

JENNIFER SOR. (2022, September 8). China has secured Russian gas at a 50% discount until the end of this year. Retrieved September 22, 2022, from Buisness Insider: https://www.businessinsider.in/stock-market/news/china-has-secured-russian-gas-at-a-50-discount-until-the-end-of-this-year/articleshow/94080030.cms

Kobek, M. P., Ugarte, A., & Campero , G. A. (2015). Shale Gas in the United States: Transforming Energy Security in the Twenty-first Century. Norteamérica. Revista Académica del CISAN-UNAM, 10(1), 7-38. doi:https://doi.org/10.20999/nam.2015.a001

Nakano, J. P. (2012). Prospects for Shale Gas Development in Asia. Center for Strategic and International Studies.

Research and Markets. (2021). Hydraulic Fracturing Market - Forecasts from 2021 to 2026. Dublin: Businesswire.

Shiqian, W. (2017). Shale gas exploitation: Status, problems and prospect. Natural Gas Industry, 5(1), 60-74. doi:https://doi.org/https://doi.org/10.1016/j.ngib.2017.12.004

Shiryaevskaya, A. (2022, July 1). For the First Time, US Is Sending More Gas to Europe Than Russia. (Bloomsberg, Ed.) Retrieved September 20, 2022, from https://www.bloomberg.com/news/articles/2022-07-01/us-lng-supplies-to-europe-overtake-russian-gas-iea-says?leadSource=uverify%20wall

Wei , D., Zhao, Y., Liu, H., Yang, D., Shi, K., & Sun, Y. (2022). Where will China's shale gas industry go? A scenario analysis of socio-technical transition. Energy Strategy Reviews, 44, 100. doi:https://doi.org/https://doi.org/10.1016/j.esr.2022.100990

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2024 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Sharma, R., Meghwal, H. (2024). Geopolitics of Shale Gas. In: Boruah, A., Verma, S., Ganguli, S.S. (eds) Unconventional Shale Gas Exploration and Exploitation. Advances in Oil and Gas Exploration & Production. Springer, Cham. https://doi.org/10.1007/978-3-031-48727-9_7

Download citation

DOI: https://doi.org/10.1007/978-3-031-48727-9_7

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-48726-2

Online ISBN: 978-3-031-48727-9

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)