Abstract

The rapid advancements in artificial intelligence (AI) technologies have significantly impacted various industries, including the accounting profession. This paper examines the adoption of AI in the accounting profession using the Technology Acceptance Model (TAM) as a framework. The TAM provides a theoretical foundation to understand the factors influencing the acceptance and adoption of AI in accounting, including perceived usefulness, perceived ease of use, attitudes towards AI, and external factors. The paper also discusses the implications of AI adoption for accountants and the challenges associated with integrating AI into accounting practices. Finally, recommendations are provided to facilitate successful AI adoption in the accounting profession.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

- Artificial intelligence

- Technology Acceptance Model (TAM 3)

- Accounting

- Technology

- ChatGPT

- Innovation

- Digitisation

1 Introduction

In the words of David Lochhead “We create machines in our own image, and they in turn, recreate us in theirs.” (Bozkurt et al., 2023). These words resonate as generative Artificial intelligence (AI) goes mainstream impacting a number of industries. AI has many applications as demonstrated in Fig. 1. The research article focuses on AI application adoption within the accounting profession. AI application adoption comes with both benefits as well as implications, thus the accounting profession now has the ability to leverage AI in ways that move the industry forward while also putting in place guardrails to protect against the negative implications.

Several potential real-world application areas of artificial intelligence (AI). Source: As adapted from Sarker, I.H. (2022)

Artificial intelligence (AI) by its definition pertains to the application of science and engineering to making machines intelligent (Sutton, 2020). AI has many applications and relevancies to many industries, one industry that lacks adequate research is in the accounting industry. Many manual activities completed by human resource capabilities like accountants, auditors and bookkeepers are now being augmented by applications like startup OpenAI’s ChatCPT (Jammalamadaka & Itapu, 2022). This research focuses on the literature gap that exists on research pertaining to AI and its implications for the accounting industry. Implications include both positive (Mikalef & Gupta, 2021), and negative (Abousaber & Abdalla, 2023).

The accounting profession has witnessed transformative changes due to technological advancements, and AI has emerged as a powerful tool with significant potential to revolutionize accounting practices. This paper explores the adoption of AI in accounting by applying the Technology Acceptance Model (TAM) to understand the factors that influence the acceptance and integration of AI technologies (Jammalamadaka & Itapu, 2022).

2 Literature Review

Agarwal and Gaur (2020) affirmed that artificial intelligence has quickly emerged as a disruptive force in the accounting field, transforming how accounting tasks are performed, from simple data entry to complex analysis, resulting in significant benefits for businesses. Zhang et al. (2019) asserted that artificial intelligence is a fast-growing technology that has the potential to revolutionise several industries, including accounting. Artificial intelligence can automate monotonous tasks, improve decision-making processes, and provide considerable insights that can lead to enhanced performance. There are several applications of artificial intelligence in accounting, such as automated data entry, financial statement analysis, fraud detection, and tax planning and compliance. Artificial intelligence-powered systems can automate data entry tasks, reducing the need for manual input and minimising the risk of errors.

Additionally, AI systems can analyse financial statements, identify trends and patterns, and provide insights that can assist accountants in making informed decisions. Moreover, AI systems can analyse large amounts of financial data and identify potential fraud, allowing accountants to investigate and take appropriate action. On the other hand, AI systems can guide compliance with tax laws and regulations and identify opportunities to reduce tax liabilities. In the past, accounting tasks were carried out manually, which was time-consuming and error prone. However, with the advent of AI, accountants can leverage advanced technologies to automate their tasks, reduce errors, and increase efficiency (Hasan, 2022).

In accounting, artificial intelligence can be traced back to the 1950s, when computers were first used to automate routine accounting tasks. The advent of accounting software in the 1970s allowed accountants to automate bookkeeping tasks. However, these systems lacked intelligence and could not provide meaningful analysis and insights (Agarwal & Gaur, 2020). In the 1980s, expert systems were introduced using artificial intelligence to replicate human experts’ decision-making abilities. Expert systems rely on rule-based approaches to accounting, where a set of predefined rules is used to make decisions (Vărzaru, 2022). In the 1990s, neural networks and fuzzy logic were used in accounting, which provided more flexibility and could learn from data, leading to more accurate decisions. However, these systems still had limitations in analysing large amounts of data (Agarwal & Gaur, 2020).

In the 2000s, the emergence of machine learning and natural language processing revolutionised accounting. Machine learning algorithms could analyse vast amounts of data, learn from it, and make predictions. Natural language processing enabled computers to understand and interpret human language, automating tasks such as financial reporting (Agarwal & Gaur, 2020). Recent technological advancements have enabled accountants to process large amounts of data, analyse it in real-time, and provide valuable insights to businesses, making the current use of AI in accounting possible (Agarwal & Gaur, 2020). Iterated that artificial intelligence has advanced significantly in accounting, from automating simple tasks to performing complex analyses and predictions. Technological advancements in expert systems, neural networks, fuzzy logic, and machine learning have driven the development of artificial intelligence in accounting. Big data analytics, cloud computing, and the Internet of Things have also contributed to the current use of AI in accounting. These technological developments have transformed accounting, improving efficiency, accuracy, and decision-making. Accountants must embrace artificial intelligence technology to remain relevant in a digital economy (Askary et al., 2018; Chu & Yong, 2021; Luo et al., 2018; Berdiyeva et al., 2021).

Zhang et al. (2019) explained that using artificial intelligence (AI), machine learning, and natural language processing tools to automate accounting allows accountants to make better decisions. As a result, the employment of artificial intelligence hastens the process by which accounting systems become more integrated with intelligent logic. For the same reason, investigating how artificial intelligence can improve impact accounting makes logical. This article aims to provide an overview of the adoption of artificial intelligence in accounting through the lens of the Technology Acceptance Model, emphasising its usefulness via use cases identified as well as highlighting AI’s potential benefits and the obstacles it encounters. This article is divided into six sections, the third of which describes the study’s methodology, and the fourth presents and examines the findings. The fifth section of this article presents the adoption of AI in the accounting industry through practical demonstration of AI tools developed by startups, and the sixth section discusses the practical uses of AI in the accounting industry by platforms like OpenAI’s ChatGPT. The conclusion and summary are delivered in section seven.

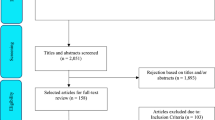

3 Research Methodology

The Technology Acceptance Modelling (TAM 3) research methodology approach was applied as it provides a theoretical foundation to understand the factors influencing the acceptance and adoption of AI in accounting, including perceived usefulness, perceived ease of use, attitudes towards AI, and external factors. The study focuses on the two main attributes perceived usefulness and perceived ease of use as these form part of a user’s intention that then changes one’s behaviour towards a technology and in this instance key adoption drivers for AI tools in the accounting profession Davis et al. (1989) (Fig. 2).

Technology Acceptance Model 3 (TAM 3). Source: As adapted from Venkatesh and Bala (2008)

3.1 Why the Technology Acceptance Model (2) Was Considered

Technology like AI is gaining wide spread adoption due to the perceived usefulness as well as ease of use identified across different industries and the accounting industry is no different. Accounting professionals can now leverage AI to help them analyse and report on financial transactions in a more meaningful manner for example, for financial forecasting more robust models can be built using AI that can take into consideration variables not initially or not thought of by accounting professionals but due to AI having access to a wide dataset it can provide insights on variables used in financial forecasting that it comes across during analysis of prior work done.

The TAM model is appropriate for this study as it is relevant in articulating the adoption AI tools that assist accounting professionals save time. With use cases like the automation of financial statement preparation and reporting and AI tools like Glean AI is an AI-powered tool for accounts payable, aimed at helping finance teams save time and make better spending decisions. The acceptance of AI automation tools in the accounting profession demonstrates the preserved usefulness and perceived ease of use (as noted in the TAM model) (Venkatesh & Bala, 2008).

Error Identification and Handling: Accounting professionals can now make use of AI tools to identify errors in its financial transactions and statements as these can be uploaded into AI tools thus also sharing recommendations on these errors identified. The TAM model makes reference of output quality as a variable in the model. Error identification and handling during the financial preparation and reporting process are areas that require addressing thus AI tools make this possible by assisting accounting professionals (Tater et al., 2022).

4 Findings and Discussions

Askary et al. (2018) emphasised the importance of reliable accounting information, which may be achieved by establishing robust internal control systems. The accounting profession relied on time-consuming, error-prone manual operations for a long time. As a result, whether organisations produce excellent or low-quality accounting information is mainly on their internal control systems. According to Askary et al. (2018), having competent management and auditors who analyse the company’s financial reporting is necessary for strengthening a company’s internal control systems. Findings of various studies (Askary et al., 2018) suggest that employing modern technology, such as artificial intelligence, to address weaknesses in internal accounting control systems would be prudent. By eliminating asynchronous data, digital technologies could increase the quality of decision-making, transparency, and the speed of intra- and inter-organisational communication. This could enable accountants to focus on high-benefit activities such as analysis, problem-solving, decision-making, strategy development, and leadership (Vărzaru, 2022).

The TAM is a widely recognized theoretical model that explains technology acceptance and adoption. It consists of two key factors: perceived usefulness and perceived ease of use. The study revealed use cases pertaining to error identification, handling time as well saving during the financial preparation and reporting processes. These two use cases speak to the perceived usefulness and perceived ease of use variables as noted in the TAM model. These factors influence an individual’s attitude toward using technology, ultimately impacting their intention to adopt it. The TAM also considers external variables that influence the acceptance and adoption of AI in the accounting profession Tater et al. (2022).

The scope of the study was limited to these two main factor attributes of the TAM model (perceived usefulness and perceived ease of use) and adoption use cases around these attributes as these are the driving forces behind adoption of AI in the accounting profession (Venkatesh & Bala, 2008).

4.1 Benefits of Artificial Intelligence Adoption in the Accounting Profession

Accounting functions such as data input, bookkeeping, financial analysis, compliance monitoring, and cost analysis have been automated, thanks to technological advances. As a result, artificial intelligence (AI) has reduced the likelihood of errors, increased efficiency, increased accuracy, and provided substantial insights and recommendations for better decision-making. One of the primary advantages of AI in accounting is automated data entry and bookkeeping. Proposed that AI might input massive volumes of data quickly and reliably, reducing the likelihood of errors and freeing up time for other essential tasks. Data input and bookkeeping automation can save an accountant significant time.

Additionally, artificial intelligence-powered software may analyse financial data, provide insights and recommendations, and proactively detect errors or inconsistencies. This technology allows accountants to make better-informed decisions faster and improve financial performance. Furthermore, AI can improve compliance by automating the process of monitoring and identifying any regulatory issues by analysing financial records for possible fraudulent behaviour or noncompliance with applicable laws. It can also ensure that financial reports are accurate and follow applicable standards, lowering the risk of fines or legal action.

Artificial intelligence is frequently used in robot design, development, and deployment. For example, when robots are combined with human interfaces, the need to change programmes (software store, accounting, and payroll) and the core infrastructure of information technology is eliminated (Berdiyeva et al., 2021). Each robot is logged and monitored to meet audit criteria and ensure data integrity. Software robots, for example, can perform routine labour tasks such as opening, reading and sending emails. Furthermore, robots can process information, format it, decide whether it is accurate, and make decisions (Berdiyeva et al., 2021). For instance, the TICOM model was developed to aid auditors in planning, analysing, and reviewing internal control systems for decision support assistance. The auditor uses the querying function after utilising TOCOM to model the information system to test the effectiveness of the internal control system (Berdiyeva et al., 2021).

Baldwin et al. (2006) asserted that the current audit and assurance environment is the most essential component of the accounting profession. For example, audit results show a high rate of audit failures, which has substantial financial implications; as a result, the government and professional bodies adjust the regulations, rules, and training for accountants, which can lead to problems (Baldwin et al., 2006). Chu and Yong (2021) suggested that artificial intelligence might solve the problem because it incorporates big data analytics, which can assist auditors in focusing their efforts more effectively on exception reporting by detecting outliers throughout the audit. Furthermore, data analytics can help auditors improve the risk assessment process by implementing meaningful procedures and control tests (Chu & Yong, 2021). When auditing a client, for example, a well-designed machine-learning algorithm can make it easier to detect potentially fraudulent transactions in a firm’s financial statements (Chu & Yong, 2021). This is possible because machine-learning algorithms have been trained to recognise such transactions. Another advantage of big data and AI can undertake predictive analysis. This form of analysis helps accounting and auditing professionals understand the future by identifying trends in data acquired in the past. In accounting, for example, predictive analysis is used to generate the credit score, which predicts the likelihood of making future credit payments on time (Baldwin et al., 2006; Chu & Yong, 2021). Finally, yet importantly, auditors and accountants can use AI to create data visualisations from a single Excel graph. These visualisations can then be combined with other vital data to generate dashboards, which allow many pieces of information to be examined simultaneously (Chu & Yong, 2021).

Although AI technology offers excellent benefits to the accounting industry, such as increased efficiency, accuracy, and automation of traditional activities that help reduce costs and improve the overall accounting profession, Artificial intelligence also presents some drawbacks or challenges. Furthermore, AI opens new career opportunities for data analysts, data scientists, and software developers. These positions are critical in developing AI-driven solutions to the challenges the accounting industry is now facing. However, it is critical to remember that artificial intelligence is a technology that will assist accountants rather than replace them. Human skill and judgement are still vitally crucial in accounting; nevertheless, as AI technology advances, we can predict increasingly complicated uses of AI in this field.

4.2 Challenges of Artificial Intelligence Adoption in the Accounting Profession

Despite the numerous benefits, the adoption of AI in accounting also faces challenges and barriers. This section discusses these drawback issues. Several drawbacks affect the application and implementation of AI in the accounting firm. First, AI has been used in several industries, including banking, agriculture, mining, and manufacturing. Generally, the use of artificial intelligence in the accounting industry is in its infancy (Luo et al., 2018), implying a lack of experience. Luo and co-authors claimed that the application of automation is premised mainly on financial reporting, neglecting core areas of accounting such as financial analysis, and has not yet impacted the change of accounting standards. Luo and co-authors believe that if AI is implemented in the accounting industry, it should cover almost all aspects of traditional accounting, including the formation of accounting information, report generation, and decision-making (Shaffer et al., 2020). Generally, this suggests that AI’s capabilities in the accounting industry require further development of use cases across the financial preparation and reporting spectrum. AI tools due to their perceived ease of use and value will make this spectrum adoption possible over time. Goh et al. (2019).

Second, implementing AI requires high investment with slow returns at the beginning (Shin, 2021). Therefore, firms should be ready to invest substantial capital in the long term. In addition, introducing AI requires adjustment to the daily operations of a firm, which affects human resource management through job displacement. It is prudent that decision-making to introduce AI in the accounting industry should be long-term than short-term (Luo et al., 2018). Third, the quality of professionals’ talents needs to be improved, requiring re-skilling or upskilling of a firm’s staff to be able to use the introduced technology. Other employees who cannot be upskilled might lose their jobs (Zhang et al., 2023). For example, digital skills shortages are a salient problem in South Africa. Smith (2023) elucidated that a recent ICT survey shows South Africa has a skill shortage of approximately 77,000 high-value technology jobs. This dictates that the accounting profession does not need professional accounting knowledge, but digital skills are also required. Developed countries encourage accounting professionals to enroll for a dual degree, including artificial intelligence. Other challenges facing AI adoption include the following:

-

Market Understanding: The lack of awareness and understanding of AI technology. Many businesses, especially small and medium-sized enterprises, are unaware of AI-powered accounting solutions’ benefits. Therefore, businesses need to be educated on the benefits of AI technology and how it can help them improve their accounting processes.

-

Data privacy and security: AI-powered solutions rely on large amounts of data to function effectively raises concerns about data privacy and security. Therefore, firms must ensure that their solutions comply with data protection regulations and implement robust data security measures to protect their clients’ data.

Although AI provides more benefits to drive adoption with perceived usefulness and ease of use, such as efficient and effective analysis, regulators have detected an ethical risk associated with AI implementation (Zhang et al., 2023). First, artificial intelligence (AI) lacks transparency, which refers to the openness and clarity of AI’s decision-making processes and algorithms. Accounting artificial intelligence must ensure its algorithms and decision-making processes are explainable and transparent. Holding AI systems accountable for their decisions can be challenging, especially if the system is opaque. In a white paper, “A European Approach to Excellence and Trust,” published in 2020, the European Commission (2020) called for greater openness and transparency in artificial intelligence decision-making processes. Jammalamadaka and Itapu (2022) raised the importance of explainable AI in work in the context of maintaining accountability and transparency. Second, objectivity is critical (‘systematic errors in AI algorithms that result in unequal treatment of different populations’). Jammalamadaka and Itapu (2022) added that artificial intelligence in accounting must ensure that its algorithms are free of bias and do not perpetuate discrimination or unfairness.

Additionally, Jammalamadaka concluded that artificial intelligence (AI) algorithms used by credit scoring firms are biased against some groups, mainly persons with low incomes or no credit history. As a result, various groups may be treated unequally. This has implications for the accounting profession, meaning that data relevant to specific groupings reported on for financial reporting purposes cannot be biased. Third, trustworthiness should be maintained, referring to the algorithms developed by firms to be accepted based on the output or outcome of the activity completed. Trust in the accounting profession is vital as the financial results processed must be able to be specified, measured, monitored, and evaluated by others in ways that direct them toward the achievement of desired objectives. AI firms need to develop platforms that align with acceptable moral behaviour that can be accepted. Other ethical concerns regarding AI include result distortion, accessibility, expectation gap, and competence of developers (Zhang et al., 2023).

5 Adoption Driven by Startups

Several AI start-up companies are driving adoption in the accounting profession by developing AI-powered solutions that offer value and are easy to use. MindBridge AI provides a technology powered by AI that can detect fraudulent conduct in financial transactions. Because the platform uses machine learning algorithms for data analysis and identifying suspicious transactions, auditors can focus their attention on high-risk areas (Alshurafat, 2023). Furthermore, MindBridge AI has been recognised as one of the premier AI start-ups in the accounting business, for which it has received many awards and accolades. Accounting operations such as invoicing, bill payment, and bank reconciliation may all be automated with the help of AI in Xero. The software uses Machine learning algorithms, which learn from user behaviour and suggest improvements. As a result, firms can improve the accuracy of their accounting operations while streamlining them. Botkeeper is an artificial intelligence-powered bookkeeping service that provides businesses with an automated solution. The platform uses machine-learning algorithms to identify transactions, reconcile accounts, and generate financial reports, saving businesses time and reducing the possibility of errors.

The AppZen platform is an AI-powered system that automates expense reporting and audits. According to, the platform examines cost records to identify the risk of fraudulent behaviour, mistakes, or violations of business policy. AppZen has received numerous awards and recognitions, including being named one of the most successful AI start-ups in the accounting business. Canopy has created an AI-powered platform streamlines tax preparation and filing (Lehner & colleagues, Lehner et al., 2022). The platform uses machine learning algorithms to extract document data and automate tax preparation. This allows organisations to save time while also lowering the risk of errors. Receipt Bank is a new start-up that has created software to automate data entry and receipt administration. Receipt Bank is the name of the product. Receipt Bank minimises manual data input by applying artificial intelligence (AI) technology to extract data from invoices and receipts, eliminating the need for such entry. This allows accountants to focus on more strategic operations.

Below is figure that links AI adoption attributes or drivers as per TAM 3 to actual adoption use cases with the AI solutions developed by startups (Fig. 3).

Technology Acceptance Model 3 (TAM 3) and Adoption Use Cases. Source: Venkatesh and Bala (2008)

5.1 Perceived Usefulness

If we look at TAM 3 attribute Perceived Usefulness which is classified as the degree to which an individual believes that using a particular technology would be beneficial. As an individual’s perceived usefulness of a given technology increases, thus their intentions to use the technology also increase. Now for this attribute use cases pertaining to financial preparation and insights come to mind. AI tools like Book AI helps accountants correct transactions using AI in real-time. The usefulness of tools like these enables Management expenses activities to be categorized in real time thus also providing quicker insights on transactions. This then drives greater adoption as it serves a useful purpose within the management accounting domain (Venkatesh & Bala, 2008).

5.2 Output Quality

If we look at a contributing attribute to Perceived Usefulness, Output Quality. This refers to the degree to which an individual believes that the system performs his or her job tasks well. This results in better or improved quality of data and reporting. Use cases like financial data quality comes to mind. Data quality can be improved based on tools used to input and validate the data. AI is being used and adopted by accounting professionals like bookers. AI tools like Truewind is aimed at reducing errors and increasing transparency for faster month-end closings. The tool provides a reliable and accurate bookkeeping and financial model with a concierge-style service (Venkatesh & Bala, 2008).

5.3 Perceived Ease of Use

This refers to the degree to which an individual believes that using a particular technology would be free from effort. As an individual’s perceived ease of use of a given technology increases, their intentions to use the technology also increase. Now, when it comes to use cases from an accounting perspective, automation enables ease of use for certain accounting activities. AI tools like Receipt Cat is an AI-powered tool that helps individuals manage their expenses and receipts. With an advanced OCR scanner, it can automatically capture key information of a receipt thus making the cash receipts transaction journaling process seamless for accounting professionals (Venkatesh & Bala, 2008).

6 ChatGPT Driving Adoption of AI in the Accounting Industry

The ChatGPT is a language model created by Open AI. ChatGPT, an Open AI large language model, is regarded as one of the accounting industry’s most promising artificial intelligence solutions. This model can potentially revolutionise how the accounting industry operates dramatically. Alshurafat (2023) confirmed that ChatGPT could understand natural language questions and provide accurate responses, which can aid in the simplification of accounting processes and the improvement of operational effectiveness. Furthermore, some potential challenges during ChatGPT implementation and solutions are studied and presented. Accounting has long been known for the arduous and time-consuming tasks that its practitioners must perform, such as compiling tax returns, financial reports, and audits. However, the adoption of AI has the potential to make the sector more productive and successful. Alshurafat (2023) added that ChatGPT benefits accountants and other financial specialists since it can read natural language queries and provide relevant answers:

-

Data Analysis: Accountants need to analyse large amounts of data to identify trends, patterns, and anomalies affecting financial decisions. ChatGPT can help accountants with this task by providing quick and accurate answers to queries about financial data if the financial dataset has been integrated with ChatGPT. This can be done by the accountant uploading financial data sets to ChatGPT and requesting for analysis.

-

Automation: Many accounting tasks, such as data entry and record-keeping, are time-consuming and repetitive. ChatGPT can automate these tasks by processing and categorising financial data, generating reports, and even sending reminders to clients about upcoming payments if ChatGPT has access to the financial data that requires automation (Lehner et al., 2022). This can allow accountants to focus on more complex tasks, such as financial planning and analysis.

-

Customer Service: ChatGPT can help improve customer service by providing quick and accurate responses to client queries. Clients can ask ChatGPT about their account balances, payment due dates, and financial planning advice. ChatGPT can provide real-time answers, reducing clients’ need to wait for a human representative to respond. Again, it depends on ChatGPT’s access to the dataset.

With the assistance of ChatGPT, a robust tool, the accounting business can become more productive and efficient. Its ability to understand inquiries in straightforward language and react with correct facts makes it valuable for accountants and other financial professionals (Bertino et al., 2021). ChatGPT can help accounting firms stay competitive in a rapidly changing sector by improving data analysis, automating repetitive tasks, and providing extraordinary customer service. Although there are hurdles to implementing it, they may be addressed with good planning and implementation. As AI continues to advance rapidly, ChatGPT has the potential to become a critical tool for individuals working in the accounting industry.

On the other hand, ChatGPT presents some drawbacks, including ensuring the accuracy of the responses provided by ChatGPT. Accountants must be confident that the responses are correct and can be relied on Alshurafat (2023). Another challenge is ensuring the security of financial data. Therefore, ChatGPT must be integrated into a secure system that protects client data from unauthorised access.

7 Summary and Conclusion

The adoption of AI across the accounting activity spectrum appears to have a promising future, with numerous opportunities for growth and innovation. Prior, accounting has always been done manually, which is a time-consuming, error-prone, and inefficient process. However, the emergence of AI has drastically transformed the accounting environment, allowing accountants to automate their labour and focus on more strategic pursuits (Zhang et al., 2019). Adopting AI technology in accounting is expected to offer new opportunities for accountants. Alshurafat (2023) asserted that AI firms in accounting had used technology to create unique solutions to industry problems. According to Alshurafat (2023) these firms drive accounting industry innovation by developing artificial intelligence (AI)-powered software that automates accounting tasks, increases accuracy and improves decision-making. Added that artificial intelligence technology could assist accountants in providing clients with extra value-added services such as business forecasting, risk management, and strategic planning.

The study’s key findings show that the adoption of AI platforms can benefit the accounting profession by automating data input, bookkeeping, expense reporting, auditing, detecting fraudulent activity in financial transactions, tax preparation, filing, and financial analysis. Accounting professionals make use of these AI tools to save time and money. Furthermore, artificial intelligence creates new employment options in accounting, such as data science, software development, and machine learning. According to the study’s major findings, ChatGPT can communicate with clients via chatbots powered by artificial intelligence. Even though AI has limits, the benefits now outweigh the drawbacks.

In conclusion, the accounting profession will continue to benefit adoption of AI solutions because these solutions increase productivity by automating specific tasks and responsibilities traditionally performed by accountants and bookkeepers which aligns to the TAM model attributes of perceived usefulness and ease of use. The profession will see cost savings while compiling specific financial statements and documentation. AI solutions also aid decision-making by utilising datasets on which machine learning capabilities can be constructed, supporting accountants with financial decisions. This is performed by utilising machine learning. As the accounting industry continues to embrace artificial intelligence technology, AI is expected to eventually become an integral component of accounting practices, ushering in major and exciting developments. It is critical to remain vigilant about the ethical implications of using AI in the accounting industry.

References

Abousaber, I., & Abdalla, H. F. (2023). Review of using technologies of artificial intelligence in companies. International Journal of Communication Networks and Information Security (IJCNIS), 15(11), 101–108.

Agarwal, P., & Gaur, F. (2020). A historical perspective of artificial intelligence in accounting: Evolution, current developments, and future opportunities. Journal of Accounting and Organizational Change, 16(1), 1–12. https://doi.org/10.1108/AAAJ-09-2020-4934

Alshurafat, H. (2023). The usefulness and challenges of chatbots for accounting professionals: Application on ChatGPT. Available at SSRN: https://doi.org/10.2139/ssrn.4345921.

Askary, S., Abu-Ghazaleh, N., & Tahat, Y. A. (2018). Artificial intelligence and reliability of accounting information. In Challenges and opportunities in the digital era (p. 11195). Springer. https://doi.org/10.1007/978-3-030-02131-3_28

Baldwin, A. A., Brown, C. E., & Trinkle, B. S. (2006). Opportunities for artificial intelligence development in the accounting domain: The case for auditing. International Journal of Intelligent Systems in Accounting, Finance and Management, 14(3), 77–86.

Berdiyeva, O., Islam, M. U., & Saeedi, M. (2021). Artificial intelligence in accounting and finance: meta-analysis. NUST Business Review, 3(1), 57–79. Available at SSRN: https://ssrn.com/Abstract=3897848

Bertino, E., Kantarcioglu, M., Akcora, C. G., Samtani, S., Mittal, S., & Gupta, M. (2021). AI for security and security for AI. Association for Computing Machinery Journal, 11, 333–334. https://doi.org/10.1145/3422337.3450357

Bozkurt, A., et al. (2023). Speculative futures on ChatGPT and Generative Artificial Intelligence (AI): A collective reflection from the educational landscape. Asian Journal of Distance Education, 18(1), 53–130. https://www.asianjde.com/ojs/index.php/AsianJDE/article/view/709

Chu, M., & Yong, K. (2021). Big data analytics for business intelligence in accounting and audit. Open Journal of Social Sciences, 9, 42–52. https://doi.org/10.4236/jss.2021.99004

Davis, F. D., Bagozzi, R. P., & Warshaw, P. R. (1989). User acceptance of computer technology: A comparison of two theoretical models. Management Science, 35(8), 982–1003.

Goh, Clarence, et al. (2019). Charting the future of accountancy with AI. Retrieved from https://ink.library.smu.edu.sg/cgi/viewcontent.cgi?article=2833&context=soa_research

Hasan, A. R. (2022). Artificial Intelligence (AI) in accounting & auditing: A literature review. Open Journal of Business and Management, 10(1), 440–465. https://doi.org/10.4236/ojbm.2022.101026

Jammalamadaka, K. R., & Itapu, S. (2022). Responsible AI in automated credit scoring systems. AI Ethics Publication, 1–11. https://doi.org/10.1007/s43681-022-00175-3.

Lehner, O. M., Ittonen, K., Silvola, H., & Ström, E. (2022). Artificial intelligence-based decision-making in accounting and auditing: Ethical challenges and normative thinking. Accounting, Auditing & Accountability Journal, 35(9), 109–135. https://doi.org/10.1108/AAAJ-09-2020-4934

Luo, J., Meng, Q., & Cai, Y. (2018). Analysis of the impact of artificial intelligence application on the development of accounting industry. Open Journal of Business and Management, 6, 850–856. https://doi.org/10.4236/ojbm.2018.64063

Mikalef, P., & Gupta, M. (2021). Artificial intelligence capability: Conceptualisation, measurement calibration, and empirical study on its impact on organisational creativity and firm performance. Journal of Information & Management, 58(3), 1–20. https://doi.org/10.1016/j.im.2021.103434

Sarker, I. H. (2022). AI-based modelling: Techniques, applications and research issues towards automation, intelligent and smart systems. SN Computer Science, 3, 158. https://doi.org/10.1007/s42979-022-01043-x

Shaffer, K. J., Gaumer, C. J., & Bradley, K. P. (2020). Artificial intelligence products reshape accounting: Time to re-train. Development and Learning in Organisations, 34(6), 41–43. https://doi.org/10.1108/DLO-10-2019-0242

Shin, D. (2021). The effects of explainability and causability on perception, trust, and acceptance: Implications for explainable AI. International Journal of Human-Computer Studies, 146, 1–10. https://doi.org/10.1016/j.ijhcs.2020.102551

Smith, L. L. (2023). Decreading the digital skills gap in South Africa through income sharing agreements. Available from https://www.umuzi.org/articles/isa-product-offering# (Assessed 20 May 2023).

Sutton, R. S. (2020). John McCarthy’s definition of intelligence. Journal of Artificial General Intelligence, 11(2), 66–67. https://doi.org/10.2478/jagi-2020-0003

Tater, T., et al. (2022). AI driven accounts payable transformation. Proceedings of the AAAI Conference on Artificial Intelligence, 36(11). https://doi.org/10.1609/aaai.v36i11.21506

Vărzaru, A. A. (2022). Assessing artificial intelligence technology acceptance in managerial accounting. Electronics, 11, 1–13. https://doi.org/10.3390/electronics11142256

Venkatesh, V., & Bala, H. (2008). Technology acceptance model 3 and a research agenda on interventions. Decision Sciences, 39(2), 273–315. IPR2014-00023, No. 1048 Exhibit - Venkatest and Bala 2008 (P.T.A.B. Sep. 25, 2014) (docketalarm.com)

Zhang, Y., Xiong, F., Xie, Y., Fen, X., & Gu, H. (2019). The impact of artificial intelligence and blockchain on the accounting profession. IEEE Open Access Journal, 8, 110461–110477. https://ieeexplore.ieee.org/stamp/stamp.jsp?arnumber=9110603

Zhang, C., Zhu, W., Dai, J., Wu, Y., & Chen, X. (2023). Ethical impact of artificial intelligence in managerial accounting. International Journal of Accounting Information Systems, 49, 1–19. https://doi.org/10.1016/j.accinf.2023.100619

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2024 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Kayser, K., Telukdarie, A. (2024). Literature Review: Artificial Intelligence Adoption Within the Accounting Profession Applying the Technology Acceptance Model (3). In: Moloi, T., George, B. (eds) Towards Digitally Transforming Accounting and Business Processes. ICAB 2023. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-031-46177-4_12

Download citation

DOI: https://doi.org/10.1007/978-3-031-46177-4_12

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-46176-7

Online ISBN: 978-3-031-46177-4

eBook Packages: Business and ManagementBusiness and Management (R0)