Abstract

Artificial intelligence (AI) technology is being adopted across industries. Adoption is a three-phase process- pre-adoption, adoption, and post-adoption. In this study, a systematic literature review is conducted to extract factors that influence the pre-adoption phase or readiness of the organization for adopting AI. These factors are narrowed down to 20 based on the discussion with the domain experts. These factors are mapped to Technology-Organization-Environment-Individual (T-O-E-I) framework that is derived from the technology-organization-environment (T-O-E) and human-organization-technology fit (H-O-T fit) frameworks. The experts ranked these factors independently. These rankings are used to calculate the global ranking of the factors using the Rough Stepwise Weight Assessment Ratio Analysis Method (R-SWARA), a multi-criteria decision-making (MCDM) method. The top seven factors are the following - perceived benefits of AI, AI system capabilities, data ecosystem in the organization, perceived compatibility of AI systems, perceived ease-of-use of the AI systems, IT infrastructure of the firm, and support from the top management. Sensitivity analysis shows that the ranks are robust.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

- Multi-criteria decision making

- Systematic Literature Review

- TOEI framework

- Rough SWARA

- Pre-adoption phase

1 Introduction

The term artificial intelligence (AI) was coined by John McCarthy in 1956 [26]. Artificial intelligence is the ability of machines to solve complex problems by mimicking human intelligence, learn from experiences, and improve their performance in the process. AI is categorized based on cognitive, emotional, and social intelligence as analytical, human-inspired, and humanized AI, respectively [20]. AI could be used for automating processes, obtaining cognitive insight from data, and cognitive engagement with humans [8]. AI is classified as mechanical, feeling, and thinking AI [16]. AI systems are being adopted in all major industries across the globe. The insurance industry has been a traditional industry and is seen as a laggard in adopting digital transformation [27]. Insurance industry needs to adopt digital initiatives and innovations for transformation of culture and value proposition. The strategic importance of information technology (IT) in the insurance industry was established in the context of Italian insurance firms [30]. The adoption of AI systems in Indian insurance sector is commencing [12]. The insurance industry in India is going through a transformative phase, focused on creating an integrated data ecosystem to facilitate the adoption of AI systems across the organization [12]. AI systems have a wide range of applications and immense potential to transform the insurance industry [11].

Adoption is accomplished in three phases- pre-adoption, adoption, and post-adoption [38]. In the pre-adoption phase, an organization determines its readiness for AI. During the adoption phase, AI systems are deployed, and this phase has a lot in common with any other Information System adoption. Adoption readiness affects adoption intention, and positive intention leads to the initiation of implementation of technology [3]. Thus, it is important to determine the factors and their relative importance for AI adoption readiness that in turn affects adoption intention. A factor may represent an attribute of the organization or an individual. Hence, we have created a new technology-organization-environment-individual (T-O-E-I) framework that is an adaptation of TOE framework [42]. The T-O-E-I framework incorporates organizational as well as individual level factors into one. We have done a systematic review of literature to identify the factors. The identified factors were refined using expert opinion and feedback. Experts from insurance and IT industry ranked the final set of factors. The factors and their rankings have been processed using a novel MCDM method, R-SWARA to obtain final ranking of the factors. We review the relevant literature in Sect. 2 and present our methodology in Sect. 3. Results are presented and discussed in Sect. 4. Conclusions are shared in Sect. 5.

RQ1- Identify factors that affect AI adoption readiness in an organization through systematic literature review.

RQ2- To establish a hierarchy of factors that exert a substantial impact on the readiness to adopt AI in the Indian insurance industry using R-SWARA.

2 Literature Review

2.1 Artificial Intelligence in Insurance

The application of AI systems in the insurance processes is currently discrete and addresses specific tasks. AI chatbots are adopted in insurance firms to answer customer queries and thus empower customers to use online channels [11]. AI systems are used to improve prediction accuracy for individual mortality risk scores and underwriting [8, 25]. AI systems are adopted for claims management, i.e., claim reporting, inspecting the damage, calculating the adequate claim amount, and payment of the claim to the customer [1]. In operations, AI systems are adopted to analyze, detect, and flag potentially fraudulent transactions [8, 11]. AI systems are implemented in the customer service space for sentiment detection to enhance the quality of customer service [11, 16]. AI systems extract information from the data collected by sensors and IoT devices which are used for product innovation and personalization. AI systems identify potential customers for cross-selling and up-selling insurance products. AI systems determine premium pricing and loadings for insurance products based on customers’ risk profiles. To test the impact of the new technologies on insurance processes and customers, a regulatory sandbox [18] is used. It is a closed, controlled environment for insurance firms to apply and test new technologies before presenting them to consumers.

2.2 Adoption of Artificial Intelligence

Our focus in this paper is the pre-adoption phase wherein the readiness of an organization is influenced by many factors. A conceptual framework at the level of the organization using the T-O-E framework suggested 7 factors [2, 3]. These factors are Relative Advantage, Compatibility (T), Top Management Support, Organizational Support, Resources (O), Competitive Pressure, and Government Pressure (E). These factors have been further modified and elaborated based on expert opinions [35]. [14] narrowed down compatibility to complexity, resources to financial readiness and added two new factors- technological competence and market dynamics. The factors were verified based on the feedback from 358 insurance industry employees obtained through a questionnaire. Interestingly, the factor of technological competence was found to be insignificant. In addition to the organization, the readiness of its people [36] has been explored, wherein characteristics of Machine Learning have been expanded into perceived benefits, perceived barriers, and tool availability. TOE framework has been extended to TOEH by including a Human dimension to study AI adoption using R-SWARA method [9, 23]. Further, TOEH framework has been used to explore factors that influence pre-adoption as well as adoption phases. For instance, competitive pressure is to be considered before the adoption, whereas change management is relevant during the adoption. The study of the factors that affect AI adoption readiness in an insurance organization is scant in the literature.

2.3 Theoretical Model for Identifying Major Criteria and Sub-criteria

The factors that affect AI adoption have been studied using the T-O-E framework and Human-Organisation-Technology fit (HOT-fit) [9, 23]. In this study, we will incorporate the technology, organization, environment, and individual (human) (T-O-E-I) framework to classify the factors. The factors that affect AI adoption are extracted from the literature [14, 32].

2.3.1 Technology Factors

[35] mention that the characteristics of AI systems are different from other technology that require exploration. One of the technological factors is the anthropomorphism of the AI systems. Anthropomorphism is perceiving the human-like characteristics in a non-human entity. AI systems exhibit anthropomorphic qualities [15, 31, 32]. AI systems possess a wide range of capabilities that could transform the various aspects of the business [8, 16]. Major AI capabilities include AI-powered robot process automation (RPA) [24], analytical capability, predictive capability, generative capability, empathetic capability, etc. The lack of clarity regarding the type of AI capabilities needed in the firm’s business process could inhibit AI adoption [2]. The knowledge of perceived benefits of AI systems in top management could be crucial for AI adoption in an organization [14, 41]. The benefits could include enhanced business processes and operational cost reduction [8, 37]. However, the complexity of AI systems negatively influences adoption intention [14, 41]. The complexity is due to a lack of understanding of technology, low perceived control over technology, and higher effort expectancy [39]. Compatibility of the AI systems with the organizations’ existing IT infrastructure plays a crucial role in determining AI adoption intention [3, 19, 35, 37]. The transparency and explainability of AI systems are important as the outcomes significantly affect the customer experience [21, 33]. The information quality, system quality, and service quality also affect adoption intention [4, 40].

2.3.2 Organization Factors

The support of top management is considered to be quintessential for the adoption of AI systems [14, 22]. Top management support enables financial and other resources [41]. Financial readiness of an organization strengthens the intention for the adoption of AI systems [14, 19, 35, 37, 41]. AI systems need to be strategically aligned with the organization’s business goals, customer expectations, and regulatory requirements [7, 19, 37]. The organization’s existing IT infrastructure impacts AI adoption intention [19]. IT infrastructure encompasses the technical competence of human resources, computing hardware, and software [6]. AI systems need suitable data; a data ecosystem including a strategy for the acquisition and curation of data is indispensable [7, 43]. A siloed and fragmented data architecture could inhibit AI adoption in an organization [12, 28]. Cybersecurity (confidentiality, authenticity, and non-replicability of data) is an important criterion for AI adoption intention [10, 31, 33, 48]. The technical competence of the employees has a positive and significant effect on the adoption intention [3, 41]. The lack of technical expertise and technology resources could pose a challenge to AI adoption in an organization [8].

2.3.3 Environment Factors

Firms could adopt AI systems to gain a competitive advantage in the market [3, 14] or due to competitive pressure [37]. The availability of support from technology partners determines the adoption intention [34, 44]. Adopting AI in an insurance firm raises regulatory concerns over the explainability, transparency, and fairness of the results [14, 21, 28]. Regulators have laid guidelines for the cybersecurity policy in an insurance firm [17].

2.3.4 Individual Factors

In addition to organization-level factors, we have also explored individual-level factors. These factors arise from the individual’s perception and knowledge related to technology [9, 23]. Perceived ease of use and perceived usefulness determines the degree of acceptance of technology [5]. These factors affect AI adoption in various sectors [13, 29]. Users’ trust in AI systems is crucial for adopting AI [45]. Adoption of AI-powered chatbots in insurance firms is influenced by perceived trust. The black box nature and a lack of explainability of AI systems could lead to trust deficiency in the users [21, 28, 31, 46]. The users’ perceived privacy concern significantly affects individuals’ adoption intention [31, 40].

3 Methodology

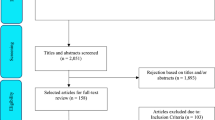

The factors were extracted through a comprehensive literature review. Research papers were searched and reviewed using the following major databases- IEEE Xplore, Science Direct, Emerald Insight, AIS Electronic Library, Springer Link, Harvard Business Review, Sage Journals, and Hawaii International Conference on System Sciences. The keywords used for searching these databases are “artificial intelligence adoption + adoption factors,”; “artificial intelligence adoption + insurance,”; “technology adoption + insurance,”; “artificial intelligence adoption/acceptance + drivers/motivators/enablers,”; “Artificial intelligence adoption + TOE/TAM framework.” Using snowball sampling, the references of the selected paper are searched manually to identify suitable papers. The keywords were used again to search for relevant research papers on the Google Scholar website. The selection of keywords was based on the topics of the papers and the key research themes found in the extant literature. The selected factors were shortlisted after a thorough discussion with the Insurance professionals and the senior academics. The major criteria were categorized as technology, organization, environment, and individual factors. The final factors consisting of major criteria and sub-criteria in the T-O-E-I framework are shown in Table 1. In the second phase, to evaluate the relative importance of the criteria, Rough Stepwise Weight Assessment Ratio Analysis Method (R-SWARA) was used [47]. For getting priority of criteria, experts were chosen from the field of insurance and IT consultancy. One set of experts is managers handling sales, marketing, operations, underwriting, claims, and customer service in insurance firms. The other experts are managers in IT consultancy services, technology solution provider firms, and management consultancy. The relevant work experience of all the experts was around ten years. The responses were collected through social media, emails, and in-person interviews. Responses from 20 experts are used for the data analysis.

3.1 R-SWARA

R-SWARA is a multi-criteria decision-making (MCDM) method [47]. It calculates the relative weight of the criteria involved in the decision-making process. Its predecessor is the SWARA method, to which rough numbers were added to reduce the subjectivity and uncertainty and improve the weights to reflect the relative importance of the criteria. R-SWARA has been used as MCDM in the context of AI adoption and implementation [9, 23]. The perceived most important criterion is given priority as 1, and the perceived most insignificant criterion is given the least priority number. The advantage of this method is its simplicity, objectivity, and user-friendliness. Moreover, it requires lesser pair-wise comparisons of the criteria than other MCDM methods, such as AHP and BWM [9]. The following steps are involved in the R-SWARA.

Step 1: Identify and shortlist the criteria that are involved in the decision-making process. We have shown the criteria in the first column of Table 1. There are 4 major criteria.

Step 2: All experts provide a rank for each criterion, 1 indicates most important, and 4 indicates least important, as we have 4 criteria. The ranks provided by 20 experts are shown in Table 2.

Step 3: Every individual response k1, k2,…, k20 from the experts needs to be converted into a rough group matrix RN(Cj) (Eq. 1 below, Eqs. 1–6 in [47]). The matrix RN(Cj) of major criteria is shown in Table 3.

Step 4: The matrix RN(Cj) is normalized to obtain the matrix RN(Sj) (Eq. 2 below, Eqs. 17–19 in [47]), j = 2 to m. The first row of the matrix is formulated to be –

Step 5: The matrix RN(Kj), is obtained (Eq. 3 below, Eq. 21 in [47]). This operation makes the ranks proper.

Step 6: The weight matrix RN(Qj) is repopulated using (Eq. 4 below, Eq. 23 in [47]).

Step 7: The matrix of relative normalized weight values RN(Wj) is shown in Table 4 (Eq. 25, [47]).

4 Data Analysis and Results

The Rough-SWARA has been used to calculate the weights and ranks for all the major criteria and sub-criteria based on the inputs provided by the experts. The response of the experts regarding the priority for the major factors affecting AI adoption intention is shown in Table 2. Technology criterion has been chosen by 11 out of 20 experts as the most significant factor. Seven out of 20 experts gave top priority to the organization criterion. Individual criterion was given the top priority that affects AI adoption by only 2 experts. The values of rough group matrix RN(Cj), RN(Sj), RN(Kj), RN(Qj) and RN(Wj) are calculated using the R-SWARA method. We have shown RN(Cj) and final weight table RN(Wj) in Tables 3–4. We have not shown intermediate tables as these are simple calculations using Eqs. 18–19, 21, and 23 from [47]. Experts also ranked sub-criteria for each major criterion that was also processed using the R-SWARA method. Finally, the global weight of each sub-criterion was calculated and ranked to obtain global ranks of the sub-criteria depicting their relative importance in affecting AI adoption readiness in an insurance organization (shown in Table 5).

4.1 Discussion

Theoretical implications: The study listed the factors from the literature that affects the adoption readiness of artificial intelligence systems in an insurance in the context of India, the fifth largest economy of the world. Based on the results obtained after applying R-SWARA, technology (TEC) factors are found to be most significant for determining the AI adoption intention, followed by organization factors (ORG), individual factors (IND), and environment factors (ENV) in that order. The perceived benefits of AI (TEC_3) have the highest rank among all the 20 sub-criteria, which is in conformance with the food supply chain domain and insurance organizations [9, 14]. The artificial intelligence system capabilities ranked second among all the sub-criteria, a factor found in conceptual frameworks but rarely explored in empirical work in extant literature. We found that the interpretability of outcomes and explainability of the AI systems are important for determining adoption readiness and in turn, adoption intention. These unique characteristics of AI systems have not been explored so far. The anthropomorphism of AI systems turned out to be the least important of all factors, as the current AI systems have hardly achieved this property. The state of the data ecosystem is ranked very high; this is an ignored factor in the literature that requires more empirical verification. Our study shows that existing IT infrastructure in the firm significantly affects the AI adoption intention. A related factor, technological competence, has been found to be insignificant by [14]. We need to explore further if insurance organizations have in-house or outsourced IT infrastructure. Financial competence turned out to be a low-ranking factor which is quite understandable as insurance companies are cash-rich, and willing top management makes the resources available. At the level of individuals, ease of use and privacy concerns are among the top ten factors. The regulatory environment that includes insurance regulators and laws of the country is an important factor. Competition among firms has the least importance among environmental factors as the adoption of AI systems in insurance firms is in its initial stages. The impact of competitive pressure in determining the adoption intention is comparatively less.

Managerial implications: The top management support and the strategic alignment of AI with the business goals are of high importance. Our study confirms that management’s lack of knowledge of AI systems capabilities could inhibit AI adoption [2]. Most of the Indian firms are transforming their data architecture from silo-ed data at business units to integrated firm-wide data lakes [12]. The complete transformation of the business processes is time-taking. Thus, in the initial stage, the perceived compatibility significantly affects the adoption intention of AI systems. Our findings show that the compatibility of the AI systems with the existing business processes and practices is important and has been ranked high in other industries [9]. The guidelines issued by the insurance regulator regarding the diffusion of the technology in the insurance firms and the cybersecurity measures that should be in place in the organization determine the adoption readiness for the AI systems. Interpretability and explainability are crucial for meeting regulatory requirements and instilling trust in managers and customers [21]. Technology vendor and partner support is important, which is a natural reflection of the fact that IT is not the core expertise of insurance firms. Hence, complexity-related issues are externalized and less important for the host organization.

Sensitivity analysis is performed to test the variations in the global ranks of the sub-criteria, observed by varying the global weights of major criteria as input [9, 23]. The results suggest that the resultant ranking of sub-criteria using R-SWARA is robust and could be used by managers for decision-making.

5 Conclusion

The study explored the factors that affect AI adoption intention. The study resonates with the prior findings in the literature that technology adoption is a three-phase process constituting the pre-adoption, adoption, and post-adoption phase. The study identified the factors from extant literature. The factors have been mapped to the T-O-E-I framework derived from T-O-E and H-O-T frameworks. The 20 factors that affect the AI adoption intention were finalized based on discussions with experts from industry and academia. The study used the response of 20 domain experts from the insurance and IT industry. The MCDM method used in this study is R-SWARA that evaluates the global weights of major criteria and sub-criteria. The 20 sub-criteria were ranked based on their global weights. The study concludes that most experts consider technology the most important factor, followed by organizational factors, individual factors, and environmental factors. The most important factors from sub-criteria that affects AI adoption intention based on expert’s responses are perceived benefits, system capabilities, data ecosystem in the firm, perceived compatibility of AI systems, perceived ease-of-use of the AI systems, the IT infrastructure of the firm, and support from the top management. This study provides a roadmap for managers in India, the fifth largest economy in the world, to prioritize the relative importance of the factors while preparing to adopt AI in their organization.

References

Akkor, D.G., Ozyukse, S.: The effects of new technologies on the insurance sector: a proposition for underwriting qualifications for the future. Eurasian J. Bus. Manag. 8(1), 36–50 (2020)

Alsheibani, S.A., Cheung, D.Y., Messom, D.C.: Factors inhibiting the adoption of artificial intelligence at organizational-level: A preliminary investigation (2019)

Alsheibani, S., Cheung, Y., Messom, C.: Artificial intelligence adoption: AI-readiness at firm-level. PACIS 4, 231–245 (2018)

Ashfaq, M., Yun, J., Yu, S., Loureiro, S.M.C.: I, Chatbot: Modeling the determinants of users’ satisfaction and continuance intention of AI-powered service agents. Telematics Inform. 54, 101473 (2020)

Belanche, D., Casaló, L.V., Flavián, C.: Artificial intelligence in FinTech: understanding robo-advisors adoption among customers. Ind. Manag. Data Syst. (2019)

Broadbent, M., Weill, P., St. Clair, D.: The implications of information technology infrastructure for business process redesign. MIS Q. 159–182 (1999)

Brynjolfsson, E., Mcafee, A.N.: Artificial intelligence, for real. H.B.R (2017)

Davenport, T.H., Ronanki, R.: Artificial intelligence for the real world. H.B.R (2018)

Dora, M., Kumar, A., Mangla, S.K., Pant, A., Kamal, M.M.: Critical success factors influencing artificial intelligence adoption in food supply chains. Int. J. Prod. Res. 60(14), 4621–4640 (2022)

Dutt, R.: The impact of artificial intelligence on healthcare insurances. In Artificial Intelligence in Healthcare, pp. 271–293. Academic Press (2020)

Eling, M., Nuessle, D., Staubli, J.: The impact of artificial intelligence along the insurance value chain and on the insurability of risks. Geneva Pap. Risk Insur. Issues Pract. 1–37 (2021). https://doi.org/10.1057/s41288-020-00201-7

EY India (2022). https://www.ey.com/en_in/ai/ey-nasscom-ai-adoption-index-is-ai-still-incubating-in-your-organization-or-driving-innovation. Accessed 10 July 2023

Go, H., Kang, M., Suh, S.C.L.: Machine learning of robots in tourism and hospitality: interactive technology acceptance model (iTAM)–cutting edge. Tourism Rev. 75(4) (2020)

Gupta, S., Ghardallou, W., Pandey, D.K., Sahu, G.P.: Artificial intelligence adoption in the insurance industry: evidence using the technology–organization–environment framework. Res. Int. Bus. Financ. 63, 101757 (2022)

Gursoy, D., Chi, O.H., Lu, L., Nunkoo, R.: Consumers acceptance of artificially intelligent (AI) device use in service delivery. Int. J. Inf. MGMT (2019)

Huang, M.H., Rust, R.T.: A strategic framework for artificial intelligence in marketing. J. Acad. Mark. Sci. 49, 30–50 (2021)

IRDAI, 2023, IRDAI Information and Cyber Security Guidelines, 2023, https://irdai.gov.in/document-detail?documentId=3314780. Accessed 10 July 2023

IRDAI, 2019, Exposure draft on IRDAI (Regulatory Sandbox) Regulations (2019). https://irdai.gov.in/document-detail?documentId=391491. Accessed 10 July 2023

Jöhnk, J., Weißert, M., Wyrtki, K.: Ready or not, AI comes—an interview study of organizational AI readiness factors. Bus. Inf. Syst. Eng. 63 (2021)

Kaplan, A., Haenlein, M.: Siri, Siri, in my hand: Who’s the fairest in the land? on the interpretations, illustrations, and implications of artificial intelligence. Bus. Horiz. (2019)

Keller, B.: Promoting responsible artificial intelligence in insurance. Geneva Association-International Association for the Study of Insurance Economics(2020)

Kruse, L., Wunderlich, N., Beck, R.: Artificial intelligence for the financial services industry: What challenges organizations to succeed (2019)

Kumar, A., Mani, V., Jain, V., Gupta, H., Venkatesh, V.G.: Managing healthcare supply chain through artificial intelligence (AI): a study of critical success factors. Comput. Ind. Eng. 175, 108815 (2023)

Lamberton, C., Brigo, D., Hoy, D.: Impact of robotics, RPA and AI on the insurance industry: challenges and opportunities. J. Financ. Perspect. 4(1) (2017)

Maier, M., Carlotto, H., Saperstein, S., Sanchez, F., Balogun, S., Merritt, S.: Improving the accuracy and transparency of underwriting with AI to transform the life insurance industry. AI Mag. 41(3), 78–93 (2020)

McCarthy, J., Minsky, M.L., Rochester, N., Shannon, C.E.: A proposal for the dartmouth summer research project on artificial intelligence, August 31, 1955. AI Magazine (2006)

McKinsey & Company Life insurance: Ready for the digital spotlight (2017). https://www.mckinsey.com/business-functions/mckinsey-digital/our-insights/life-insurance-ready-for-the-digitalspotlight. Accessed 9 Feb 2022

Misra, S.K., Sharma, S.K., Gupta, S., Das, S.: A framework to overcome challenges to the adoption of artificial intelligence in Indian Government Organizations. Technol. Forecast. Soc. Chang. 194, 122721 (2023)

Mohr, S., Kühl, R.: Acceptance of artificial intelligence in German agriculture: an application of the technology acceptance model and the theory of planned behavior. Precision Agric. 22(6), 1816–1844 (2021)

Neirotti, P., Paolucci, E.: Assessing the strategic value of information technology: an analysis on the insurance sector. Inf. Manag. 44(6), 568–582 (2007)

Pal, D., Babakerkhell, M.D., Roy, P.: How perceptions of trust and intrusiveness affect the adoption of voice activated personal assistants. IEEE Access 10 (2022)

Pelau, C., Dabija, D.C., Ene, I.: What makes an AI device human-like? the role of interaction quality, empathy and perceived psychological anthropomorphic characteristics in the acceptance of artificial intelligence in the service industry. Comput. Hum. Behav. 122, 106855 (2021)

Peres, R.S., Jia, X., Lee, J., Sun, K., Colombo, A.W., Barata, J.: Industrial artificial intelligence in industry 4.0-systematic review, challenges and outlook. IEEE Access 8 (2020)

Pillai, R., Sivathanu, B.: Adoption of artificial intelligence (AI) for talent acquisition in IT/ITeS organizations. Benchmarking Int. J. 27(9), 2599–2629 (2020)

Pumplun, L., Tauchert, C., Heidt, M.: A new organizational chassis for artificial intelligence-exploring organizational readiness factors (2019)

Rana, R., Staron, M., Berger, C., Hansson, J., Nilsson, M., Meding, W.: The adoption of machine learning techniques for software defect prediction: an initial industrial validation. In: Kravets, A., Shcherbakov, M., Kultsova, M., Iijima, T. (eds.) Knowledge-Based Software Engineering. JCKBSE 2014. Communications in Computer and Information Science, vol. 466. Springer, Cham (2014). https://doi.org/10.1007/978-3-319-11854-3_23

Schaefer, C., Lemmer, K., Samy Kret, K., Ylinen, M., Mikalef, P., Niehaves, B.: Truth or dare? how can we influence the adoption of artificial intelligence in municipalities? (2021)

Sepasgozar, S.M., Loosemore, M., Davis, S.R.: Conceptualising information and equipment technology adoption in construction: a critical review of existing research. Eng. Constr. Archit. Manag. 23(2), 158–176 (2016)

Sohn, K., Kwon, O.: Technology acceptance theories and factors influencing artificial Intelligence-based intelligent products. Telematics Inform. 47, 101324 (2020)

Song, M., Xing, X., Duan, Y., Cohen, J., Mou, J.: Will artificial intelligence replace human customer service? The impact of communication quality and privacy risks on adoption intention. J. Retail. Consum. Serv. 66, 102900 (2022)

Sharma, S., Singh, G., Islam, N., Dhir, A.: Why do smes adopt artificial intelligence-based chatbots? IEEE Trans. Eng. Manag. (2022)

Tornatzky, L.G., Fleischer, M., Chakrabarti, A.K.: Processes of Technological Innovation. Lexington books (1990)

VanGiffen, B., Ludwig, H.: How siemens democratized artificial intelligence. MIS Q. Exec. 22(1), 3 (2023)

Weigelt, C., Sarkar, M.B.: Learning from supply-side agents: the impact of technology solution providers experiential diversity on clients innovation adoption. Acad. Manag. J. 52(1), 37–60 (2009)

Wong, L.W., Tan, G.W.H., Ooi, K.B., Dwivedi, Y.: The role of institutional and self in the formation of trust in artificial intelligence technologies. Internet Res. (2023)

Zarifis, A., Kawalek, P., Azadegan, A.: Evaluating if trust and personal information privacy concerns are barriers to using health insurance that explicitly utilizes AI. J. Internet Commer. 20(1), 66–83 (2021)

Zavadskas, E.K., Stević, Ž., Tanackov, I., Prentkovskis, O.: A novel multicriteria approach–rough step-wise weight assessment ratio analysis method (R-SWARA) and its application in logistics. Stud. Inform. Control 27(1), 97-106 (2018)

Zhang, W.K., Kang, M.J.: Factors affecting the use of facial-recognition payment: an example of Chinese consumers. IEEE Access 7, 154360–154374 (2019)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2024 IFIP International Federation for Information Processing

About this paper

Cite this paper

Pathak, A., Bansal, V. (2024). Factors Influencing the Readiness for Artificial Intelligence Adoption in Indian Insurance Organizations. In: Sharma, S.K., Dwivedi, Y.K., Metri, B., Lal, B., Elbanna, A. (eds) Transfer, Diffusion and Adoption of Next-Generation Digital Technologies. TDIT 2023. IFIP Advances in Information and Communication Technology, vol 698. Springer, Cham. https://doi.org/10.1007/978-3-031-50192-0_5

Download citation

DOI: https://doi.org/10.1007/978-3-031-50192-0_5

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-50191-3

Online ISBN: 978-3-031-50192-0

eBook Packages: Computer ScienceComputer Science (R0)