Abstract

The banking world is moving faster with digital reality, where financial transactions, customer care, fraud prevention, and trading analysis are no longer handled by humans but by computers. Digitalization is marching ahead, and financial industries are not in the back seat to realize the same. Banks are producing a lot of information as part of their daily processes. This information stored either in legacy platforms or in the cloud is amorphous, and a lot of confidential information is kept inside it. Our objective is to read those unstructured data elements and extract meaning from them, which can be used for enterprises for managerial insights and business process innovation. With the evolution of deep neural networks, a sub-domain of artificial intelligence (AI), extracting and classifying unstructured data is much easier nowadays. This chapter is forwarding our research to use deep learning algorithms with natural language processing (NLP) to solve the challenges banks face in reading these unstructured data and extracting meanings. Our approach uses cognitive neural networks (CNN) and recurrent neural networks (RNN) in NLP to obtain performance results that substantially improve Spearman correlation scores above other traditional models. We will also perform a qualitative study of the importance of these unstructured data on why and when it is critical to utilize this framework to improve enterprises in insights extraction and classification. This chapter illustrates the role of deep learning in NLP for sentiment analysis and emotion detection using the extracted features from unstructured data for smart banking.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

6.1 Introduction

In the last decade, the number of banks focusing on developing cutting-edge technologies to create a realistic 24 × 7 banking experience for their customers has risen exponentially. With the rise of social media and technological evolution, banks are getting a lot of pressure to match other industry types. Smart banking focuses on mobility banking, next-generation self-service, advanced security, remote advisory with the chatbot, social computing, and digital signage. As the world is getting digitalized faster, Fintech has been rapidly penetrating the financial core markets by filling in the gaps left by the legacy financial institutions and significantly improving the user experience [1]. E-banking has transferred to innovative banking with better product lines, better service capabilities, and competency. These smart features are integrated with AI technology to streamline processes and strengthen security.

6.1.1 Motivation

Several disruptive concepts, such as peer-to-peer banking, are gaining traction. The world produces 2.5 quintillion bytes of data daily, and the banking and financial industry has one quintillion bytes of data, so the transaction volume has become vast to thrust data-driven banking [2]. If we study these data further, the modern financial or banking industry produces more unstructured data than structured data as part of their daily operation. These unstructured data are the key to understanding customer expectations for business process innovation and quick adaptation. The banking experience is being put under the microscope like never before to attract more and more customers. With the evolution of machine learning (ML) and Deep-NLP learning, extracting and classifying these unstructured data is much easier nowadays than before. Deep-NLP plays a pivotal role in developing knowledgeable virtual assistants and chatbots in Fintech. In the recent past, deep learning models have successfully solved a variety of natural language processing (NLP) problems in the banking domain [3]. It’s worth pointing out that financial sectors that will respond slowly to the adaptation of deep learning suffer lower Returns on Investment (ROI) and profits and could face extinction. In recent years, practitioners and scientists in NLP have been leveraging the power of modern Artificial Neural Networks (ANNs) with many prolific results in Financial Technology (FinTech) [4]. Many technologies are being employed to overcome the drawbacks of traditional financial services in the financial revolution period.

6.1.2 Objective

The objective of the present work is to show where the banking system is now and to lay the groundwork for future studies. With the current technological advancement, the financial industry is evolving daily. Our research uses the technology as an indexing tool (natural language processing (NLP) and deep learning) to showcase how these technologies modernize FinTech.

6.1.3 Contribution

In this chapter, we are forwarding our research to use ML and deep learning algorithms with natural language processing (NLP) to show the usability of modern-day Deep-NLP technologies in Fintech for an intelligent banking experience. The paper focuses on the complicated issues in smart banking and solutions to these issues using deep learning and natural language processing techniques. This study focuses on the works produced between 2018 and 2022. The work’s most important contribution is demonstrating the importance of deep NLP techniques in redesigning intelligent banking experiences. The technical aspects and the applicability of these technological tools are discussed thoroughly for smart banking.

The rest of the chapter is organized as follows: Section 6.2 presents the traditional banking approach. The rise of FinTech and the new era of banking is described in Sect. 6.3. Section 6.4 offers the technologies used for smart banking. Transitions from Now to the Future are given in Sect. 6.5. Section 6.6 describes various applications of Deep-NLP in smart banking. Finally, the conclusion is given in Sect. 6.7.

6.2 Traditional Banking

The brick-and-mortar model of traditional banking was the heart of economic transactions. These traditional banks, referred to as “borrowing short and lending long,” depended on short-term deposits and long-term lending to generate money through interest payments [5]. There were no customer-first policy and no customer lifetime value notions to give more focus to customer expectations. Banks were dictating their rules, and the paper-based transactions were very puzzling and hard to manage. Low risk and high return policy were the fundamental economic factors to drive the profits for traditional banks. It was believed that launching more products and seeking new sources of revenue in derivatives banks may be taking a high risk that could ultimately put them in danger and possibly a threat to the stability of the banking system [5]. But with time, the fundamental economic forces have undercut the role of traditional banks by forcing diminished deposits. In the United States and other developing countries, specialized banking institutions declined their market share from 20% in 1970 to 10% in the early 1990’s [6]. The rise of many private and social banking machinery also created pressure on traditional banks for self-existence. The declining role of conventional banking in the world has forced countries around the globe to have banking regulatory policies and develop customer-centric products. The decline of traditional banking forced executives to think beyond innovation, technology adaptation, and risk mitigation to be customer-centric. The banking revolution 2.0 came into the picture with internet banking through innovation and communication technologies. The development of 3G and 4G communication pushed financial institutions to break the barriers and reach every household through mobiles. Automatic Teller machines (ATMs) and online banking helped bring the lost glory back for many institutions. The same tradition and popularity continued till 2005. After 2005, a new era of banking called revolution 3.0 emerged with innovative banking, which helped customers meet their needs 24×7 with the help of Artificial intelligence 5G and blockchain-like technologies. With greater freedom, innovative banking is now changing the world of finance. It is available at our fingertips anytime, anywhere, with a robot greeter, smart front desk, biosignature, interactive kiosk, video teller machine (VTM), and self-help chatbots [7].

6.3 Rise of FinTech and the New Era of Banking

Financial Technology (FinTech) is one of the expanding domains worldwide, and it is continuously getting new shapes and colors with the advancement of technology. According to the statistics from Google Trends, financial topics and trends are rapidly rising debated topics globally [8]. The financial industry runs with three basic application scenarios: Know Your Customer (KYC), Know Your Product (KYP) and Satisfy Your Customer (SYC). As the FinTech industry, directly and indirectly, influences everyone’s daily life, it is highly regulated by the government. But with modern technologies, the traditional financial sector is going through a revolution while keeping itself compliant with government rules. Every year, many financial and banking-related workshops are organized worldwide to prioritize and transform this sphere.

As a highly regulated industry, the banking industry always emphasizes knowing its customers well (KYC). This industry uses structured and unstructured textual data for customer identification and credit evaluation. As the banking industry deals with corporate and personal customers, AI-enabled technology is crucial in updating customer information and status from news articles and financial statements. Zheng et al. (2019) constructed an end-to-end model using a transformer encoder [9]. Early detection and evaluation of situations for any personal customer is essential for banks when dealing with private customers [10]. With the popularity of social media sites, using daily posts to track the lifelong of a person has become possible [11]. These logs and events are helpful for banks and financial watchdogs rapidly capture the situation and better strategy for the future course of action.

To capture the price movement and understand the financial instruments, it’s always crucial for banks to know their products well (KYP). Banks often have a common problem; they need to learn from their peers to learn from their mistakes to innovate themselves. Some models are in place to predict products and related pricing well to capture the risks [12]. Hu developed a hybrid attention network (HAN) to predict the trends in stocks with the swing in the news. Devlin and his team (2019) developed a model to read the textual data to find the fear index of customers using bidirectional encoder representations from Transformers (BERT) [13]. The crowd’s information has proved to be very useful in reading changing financial trends. Satisfying customers and providing them with the best product they need is the primary goal of the FinTech industry. Many startups in the money exchange market and online lending services are leveraging the best technologies available to better customer satisfaction in customer-to-customer (C2C) or business-to-customer (B2C) segments. So, to remain competitive, banks implement technology for their shake and need to be flexible enough to keep it up to meet customer trends, as highlighted in Fig. 6.1 [14].

6.3.1 Smart Banking

A banking service that permits users to perform various banking activities using smartphones anytime and anywhere is considered smart banking [15]. Smart banking allows banks to present their new product offerings and services, allowing them to enhance their business and sustain in this completive era [16]. Currently, it is the physical image of banking systems and services that customers will access to measure the quality through it. The systems and services can include debit and credit cards, e-banking, convenience, security, real-time chatbots, virtual assists, speed, the accuracy of their transactions, etc. [17]. Smart banking is prevalent but brings more operative risks, such as security and privacy concerns, including personal information and financial status [18]. Also, the 24 × 7 nonstop accessibility to bank products and transactions leads to significant threats, like malware, computer viruses, and hackers [19]. Per a survey conducted by Arcand et al. [20], banks’ responsiveness in handling queries has increased up to 45% through different innovative banking channels. But in one sentence, we can iterate that it’s the core empathy to ensure the customer feels that he is unique and special to his bank.

6.3.2 Data-Driven Fintech Industry and Literature Review

Digitalization in the finance industry came very late, but it is currently going in full fledge to affect the banking world. Many researchers have done significant studies to track the developments in this industry and how it impacts customers’ daily lives across the industry. Table 6.1 below highlights the type of research design and its findings, along with the gaps in the study. All those gaps will be critical indicators when analyzing the technical aspects of this banking industry.

6.4 Technology: A Catalyst for Smart Banking

Technologies in the banking industry are evolving at breath-keeping speed, forcing customers to be more engaging and dynamic. The virtual banking workplace in mobiles and smart devices is becoming more collaborative when processes become more flexible. Customers are trying hard to understand bank products, and banks are trying to understand their diverse customer base better. This creates an ever-connected and collaborative workforce for high-quality service experiences. These experiences are captured and analyzed to predict customer lifetime value and product decision-making. All these are possible due to AI-powered technological advancement, and these technologies are discussed in detail below.

6.4.1 Natural Language Processing

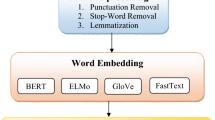

In this section, we review the recent technological advancements in natural language processing, and also, we will also understand the classical and rational models of language analysis.

6.4.1.1 The First Wave and Classicalism

Natural language processing (NLP) is broadly defined as the computerized approach to analyzing text based on statistical theories and a set of technologies. NLP investigates the use of computers and statistical analysis to understand human languages to perform various tasks. With digitalization at its peak, it is hard to believe a modern intelligent system like a chatbot, voice translator, or recommendation engine without NLP [25]. A range of computational techniques is required to accomplish a particular language analysis, and modern NLP processes bind those in a package for better accuracy and swiftness. It all starts with data, then reading it to find pattern meanings, and then the machines reply to all user questions to get the work done. In the first wave of language classification, NLP was mainly designed to understand human-like responses. In 1954, NLP was used to demonstrate the first machine learning translation system capable of translating more than 60 Russian sentences into English. This period coincided with the early development of artificial intelligence and was characterized by different domain experts who devised computer programs and symbolic logical rules like ‘if-then-else’ to get the most from the NLP process. The use of machine learning during the initial phases is shallow, with many data quality issues. But such systems have minimal scope and, unfortunately, worked for only a few use cases [26].

6.4.1.2 The Second Wave and Rationalism

The second wave of NLP started in the mid-nineties and was characterized by exploring data quantities and deep machine learning to use such data. The second phase is data-intensive machine learning and focuses more on data-driven decision-making [27]. More significantly, the analysis-by-synthesis deep generative process gave rise to the first commercial success of deep learning, which is the driving force behind the third generation of Deep-NLP models. The second wave promoted the knowledge-based speech recognition NLP and attempted to generalize from one condition to another and one domain to another [28]. When talking about NLP, we talk about areas such as speech recognition, machine translation, pattern matching, automatic text summarization, part-of-speech tagging, sentiment analysis, etc. [29]. Generally, NLP is a modern-day necessity to manage smart homes and smart offices like Alexa, Cortana, Siri, Google assistance, etc. NLP has experienced significant breakthroughs with the emergence of AI [30, 31]. Language is an essential means of delivering communication, thoughts, and ideas. But when this communication channel is mixed with mathematical rules and fed to machines, it significantly evolves human-machine interaction. Making engines understand the core of communication by understanding the language and returning the response efficiently is the basis of NLP adaptation.

6.4.2 Deep Learning

Deep Learning (DL), a subfield of machine learning, is a solid and robust advanced computational field that has reached significant success recently in many research areas. DL can be viewed as cascading models of cell types inspired by biological neural systems. With the advancement of backpropagation techniques, training deep neural networks from scratch attracted many researchers at the beginning of the twentieth century [32]. In the early days of DL research, without a large volume of training data and proper model design, the learning signals vanish significantly with the number of layers propagated from layer to layer, making it difficult to tune the models for better outcomes [26]. Hinton et al. [26] overcame this challenge by using an unsupervised pre-training method to detect valuable features. Then the process is further polished to train with supervised learning to classify the level data. This significant discovery considerably impacted the deep neural network’s evolution and started to be used in many high-level representations where low-level data representations exist. The present DL can discover intricate structures in high-dimensional data, and deep stacking and deep neural networks have been successfully applied to real-world artificial intelligence tasks, including NLP and speech recognition [33].

The model presented by Hinton et al. [26] above is considered the beginning of deep learning. Unlike classical machine learning models, DL uses Neural Networks (NNs), including several hidden layers of variables to perform automatically, pre-processing, feature extraction, feature selection, and feature learning [34,35,37]. Convolutional Neural Networks (CNN) is one of the deep learning theorems with two convolution layers: pooling and fully connected dense layers. Figure 6.2 shows the CNN model for a text classification framework [35]. CNN’s are extensively used in image and video processing and speech and NLP [38]. It is often not essential to know where certain features occur; instead, whether they appear in certain localities or not. Therefore, pooling operations can minimize the size of feature maps [39]. The CNN model has been applied in the existing literature on NLP and has shown to be very productive in handling sentiment analysis problems.

DL profoundly impacts people’s lives or societies since its applications are consistently the need of the day. It drives advances in many standard technologies, such as self-driving vehicles, image and speech recognition, and natural language processing. DL algorithms depend highly on artificial neural networks for predictive modeling and recognition of complex patterns [38]. The fundamental framework of Deep Neural Networks (DNNs) comprises an input layer, hidden layers, and an output layer, as in Artificial Neural Networks (ANNs). The variation between DNNs and ANNs is the number of hidden layers, which is more than one in DNNs, and this directly affects the depth of the algorithm in DNNs [39]. Also, in DL, the repeated analysis of massive datasets eradicates errors and discrepancies in findings, leading to a reliable conclusion. Therefore, DL is suitable for handling large and complex data. The most famous types of DL networks are Convolutional Neural Networks (CNN), Recurrent Neural networks (RNN), and Recursive Neural Networks (RvNNs). DL gains enormous significance because of a new emerging field called big data analytics. This field offers various business benefits: more viable marketing strategies, better client service, improved operational efficiency, etc. [40].

The modern DL algorithms excel at unsupervised learning as the data is not labeled in this category. DL algorithms require Graphics Processing Units (GPUs), so the complex computation can be optimized efficiently. Neural networks consist of interconnected nodes or neurons, each having several inputs and supplying one output [41]. Each of these output nodes conducts weighted sum computation on the values they receive from the input nodes. These outputs are the sum result of these nonlinear transformation functions. Corrections to these weights are made in response to the network’s individual errors or losses at the output nodes [41]. Such corrections are usually made in modern networks using stochastic gradient descent, considering the derivatives of errors at the nodes, an approach called backpropagation [33]. The main factors influencing the output are the number of layers and the nodes’ connection. While deep neural networks (DNN), there is no clear consensus on precisely what defines a DNN. Generally, networks with multiple hidden layers are considered deep, and those with many layers are considered very deep [42].

Big data is an essential component of building an intelligent banking framework. It can be processed through batch mode or real-time mode. With the advancement of real-time technologies like Apache Spark, Apache Storm, Hive, and Map Reduce to handle streaming data [42, 43], the intelligent banking concept is becoming modernized daily. The problem is how to extract data from different banking components, third-party systems, and subsystems for batch or real-time processing. DL algorithms are evolving with data types, volume, and velocity changes. Table 6.2 details the most popular algorithms of Deep Learning in practical use [34].

6.4.3 Deep-NLP: A Revolution

Machine learning is everywhere in today’s NLP models. But with the advancement of deep learning, the process of NLP has reached its highs in developing features and handling complex interpretation tasks. If we analyze different approaches holistically at a deeper level, we can identify the aspects of a conceptual revolution in human-machine interaction. The cost of analyzing these human-centric ‘rationalistic’ linguistic rules was very high. Still, with the development of Deep-NLP, the cost has been significantly decreased, and accuracy has been increased with the help of bidirectional Long Short-term memory (LSTM) networks. LSTMs are designed to avoid long-term dependency problems faced during RNN architectures. Advances in techniques and hardware for training deep neural networks have recently enabled impressive accuracy improvements across many fundamental NLP tasks [39].

Deep learning in NLP is on the rage and exponentially growing over the past few years due to its supremacy in terms of accuracy and applicability to a broad scope of applications. Deep learning for NLP truly shines to mitigate the problem of combinatorial counting sparseness [40]. Recent advances in deep learning with NLP design have diversely contributed significantly to AI. Even more significantly, DL has outperformed notable Machine Learning (ML) methods in domains like NLP, robotics, optimization, cybersecurity, bioinformatics, and healthcare, among others [41]. Whether it is fraud or anomaly detection, healthcare digital record analysis, FinTech predictions, or automation, NLP methods using DL algorithms are reshaping the world of digitalization. With the evolution of Meta-learning, a learning-to-learn paradigm to learn new tasks faster by reusing previous experience than teaching everything in isolation, the NLP has become a more intelligent system than before. Meta and federated learning contribute more value to NLP research by assisting organizations in managing real-time data analytics for improved decision management, cost reduction, and process optimization.

6.5 Transitions from Now to Future

The banking industry is in the race for insightful digitalization. Banks globally plan to invest US$ 9.7 billion in the last couple of years to enhance digital banking capabilities in the front office alone [42]. Online and mobile banking channels have become as crucial as branches and ATMs. Banks worldwide are already invested in digital technologies and now realizing to get benefits from customer satisfaction and acquisition. If we study the benefits of digitalization in the banking industry, Bank of America confirmed that it received more deposits from mobile channels than directly from its branches [43]. But satisfaction is relative, and different business entities are trying to become leading digital brands like Apple, Amazon, or Google, as these are considered the gold standard of digital engagement. If banks want to keep it up, they must offer a better digital experience to keep the customers emotionally attached to their products and values.

A survey conducted by Deloitte in 2018 took 17,100 banking consumers in more than 17 counties, resulting in restructuring organizations around different stages of customer interaction, which will be the next frontier for digital banking [44]. Banks now focus on integrated digital services with five steps to drive holistic engagement: adoption, consideration, application, onboarding, and servicing. The above study by Deloitte also highlights that transforming banks is the need of the hour than increasing and enhancing digital offerings. Banks need to be aware that if the banking system is unmoved and only focuses on consumer behaviors, it will raise a trust liability between the banks and their consumers.

The rate of digital adaptation is directly proportional to more transactions. Modern consumers are ready for a higher level of digital engagement, which creates more opportunities for banks to increase engagement through improved digital offerings. Currently, 43% of consumers embrace online banking in the global banking system, and 29% embrace digital adventurers. Still, the satisfaction rate of digital adventurers is higher than that of online customers [44]. So, there is a massive opportunity for banks to attract younger tech-savvy customers to digital banking as they are familiar with mobile apps and modern technologies. Putting real in digital and digital in real is route banks need to take seriously to make their digital transformation successful.

In the future, consumers are more likely to increase the use of digital channels and will prefer smart banking outside of brick-and-mortar locations. That will pressure banks to add more self-service screens and preparedness to mitigate cyber threats. AI and NLP will play a key role in self-service analytics to understand customer behaviors and prevent online threats. NLP-enabled Older Adult Technology Assistance (OATA) programs will take center stage for banking on-the-go models [45]. The self-training videos with speech recognition technologies will educate seniors and new bankers about the convenience of digital banking. Digital adventurers are avid mobile users and always expect more from banks, creating a gap in emotional connection. Banks need to work with intelligent chatbots as the go-to help tool for real-time problem-solving to fill that gap. Some banks may consider digital-only banking with limited product features to attract millennials and new-age customers. Also, future banking needs to have a seamless flow of data, and it should break the channel silos. All the branches, ATMs, online and mobile banking, and third-party services need to be connected with popular products like Google Home, Alexa, or Siri to facilitate omnichannel experiences [45]. This experience will boost customer expertise in a Smart Banking Management System (SBMS).

6.6 Application of Deep-NLP in Smart Banking

The banking industry is highly regulated, and executives are very possessive about frequent changes. There are established global regulations to follow standards and guidance around modern technologies as the bank handles sensitive and personally identifiable information (PII). However, deep learning and NLP are vital in the modern banking system as enablers of risk management, better user experience, and self-service analytics. With the evolution of cloud infrastructure, financial institutes now live in a hybrid environment where they manage traditional and smart banking for users. Digital transformation is underway in all kinds of financial sectors in front, back, and shadow office operations [46]. The section below highlights some of the very market-leading use cases of deep learning and NLP in the below section.

6.6.1 Application of NLP in Smart Banking

With the aid of contemporary NLP technology, several viable applications have shown to be highly valuable for the modern banking revolution. Some of the most popular NLP-based technology characteristics are listed and discussed below.

6.6.1.1 Chatbots

Self-service chatbots are in high demand for providing 24 × 7 support to banking customers. To avoid duplicate questioning and prompt response, a chatbot works as a conversational agent for particular domains and specific topics with the help of NLP. These agents are built on understanding users’ input and providing meaningful sentences using a preloaded knowledge base [46,47,48,49]. Figure 6.3 below highlights a sample chatbot application and how this is shaping the world of real-time customer interaction. From testing and developing the model to query handling, all are done by NLP models with the help of machine learning logic.

The architecture model is a stepping stone in building banks’ and financial institutions’ intelligent query handling programs for self-learn support. Chatbots are in high demand in Chat-Apps like WhatsApp, Messenger, and Telegram and on many online platforms for quality customer service. There are many successful use cases of chatbots across the banking world. For instance, according to [50], Erica (the virtual assistant of Bank of America), COIN (contract intelligence platform of JPMorgan), Eno (chatbot assistant of Captial One), Clinc (by USAA), Amy (by HKBC), Haro and Dori (by Hang Seng Bank), Emma (by OCBC Bank), Ceba (by Commonwealth Bank in Australia), POSB by (DBS bank), etc. All these bots can interact with customers via text and voice commands.

6.6.1.2 Auto Feedback and Offline Messaging System

There are situations where bots are not enough to answer all the queries. So, in that situation, sending questions offline and getting a response from an actual customer support representative later is a prevalent option [50]. In these options, the users are not required to call or visit any physical location to get an answer to their queries. The model keeps similar questions in the database if there is no PII information attached to them, and if similar queries are asked in the future, the feedback system will respond to them quickly. In another way, the self-feedback system captures the user feedback on any survey or product experience. If users have ‘disliked’ any of these feedbacks, the system sends the responses to proper authorities to address the concerns. In that way, the enterprise can maintain customer feedback logs to study the Customer Lifetime Value (CLV). The same feedback system can be evaluated using machine learning models later for better decision-making and product development. Figure 6.4 shows the architecture of the feedback and auto messaging system.

6.6.1.3 Developing Self-Learning and Training Models

The knowledge gap in banking due to the lack of proper educational resources is a very costly affair and is undesirable. It is crucial to address the real meaning of all terms and regulations and review the most up-to-date progress. That prompts many organizations to leverage text and speech analytics to build learning and training models for their employees. These self-learning programs benefit online kiosks, ATMs, and self-service portals for off-hour operations. These machines are integrated with Interactive Voice Response (IVR) machines to build a collaborative tech center. These speech-to-meaning and text-to-meaning setups are more efficient, easy to use, and help resolve cases faster [50]. Many banks and enterprises sound like these technologies create a positive and lasting impression on users. Many third-party tech companies offer these services for optimizing and classifying large datasets, resource management, and saving a lot on money-human efforts.

6.6.1.4 Detecting Phishing Attacks Using NLP

Phishing attacks are the most common security threats in the banking system. But the new NLP-enabled semantic analysis can help analyze the texts to detect malicious intent in any email. Security of private information is a significant concern for all organizations irrespective of their domains, and phishing, like social engineering attacks, is there to steal sensitive customer information. Machine learning and NLP are used to blacklist the topics and email subjects whose presence in an email or command suggests malicious intent. The phishing algorithms report five values: true positive (TP), false positive (FP), false negatives (FN), precision, and recall. The precision and recall are calculated as below. The decrease in false negatives shows that semantic information helps detect phishing attacks [51].

Many researchers focus on combing NLP with ML models to address information retrieval (IR) problems to detect if any check payment or loan documents are fabricated to cheat the system. All those systems also detect fraudulent transactions by studying archives of content-based formal documents. Many banks and financial institutes use automated NLP models to examine customers through e-KYC (AI-based Know Your Customer). Also, antifraud chatbots detect scams used in social-banking network services. This field is evolving, and recently the development of efficient NLP models by DistilBERT with traditional ML methods has lower resource computing costs and faster execution in real-time to detect malicious behaviors [52].

6.6.2 Application of Deep Learning in Smart Banking

The latest trend shows that most enterprises are embracing data-driven decision-making and catching up with all new-age technologies that are rapidly evolving to manage data. As unstructured Big Data currently overshadows the total data cloud platforms, organizations encourage relevant skills and technologies to extract information from Big Data using the latest Artificial Intelligence (AI) technologies. The banking industry is one of the most influential domains that directly or indirectly impact people’s daily lives. Hence, this industry actively develops and implements advanced data-driven technologies to prosper globally [53]. AI, ML, and deep learning have rapidly grown over the last few years. Among all these latest trends, deep learning shows the steepest exponential growth curve due to its rapid advancements with closely connected technologies. In many banking enterprises, deep learning is closely implemented with other domains like marketing, customer relationship management (CRM), and risk management (RM) [54].

6.6.2.1 Deep Learning in Marketing

Deep learning has been an effective tool for strategic marketing activities in all industry segments, including banking [55]. In general, under intense competition, deep learning is used for online assessments to acquire the right customers for the right banking products to enhance the effectiveness of marketing campaigns. Many researchers have attempted to implement deep learning techniques for personal and retail banking needs. Deep learning is primarily used to study customer behaviors to prioritize more accurate offers and referrals. Yan [56] demonstrated the application of a convolutional neural network via Kaggle completion on Santander’s data to study customer response behavior for predicting the usage of bank products. For a large retail bank in Poland, Ładyżyński et al. [57] used deep belief networks and stacked Boltzman machines to analyze direct marketing scenarios, showing significant improvements in the performance of a marketing campaign.

6.6.2.2 Deep Learning in CRM

Banking is a data-rich sector that produces and stores much customer-related information. As customer personal and transactional data are vital for personalized services and product design, deep learning is integrated with CRM to improve the productivity of customer interaction [58]. Customer profiling and segmentation are vital for KYC implementation and a customer hierarchy system. Zhou et al. [59] compared the performance of neural networks with other data mining techniques by taking the customer data from the Saman Bank in Iran, and they achieved over 97% in customer behavior segmentation.

Customer satisfaction study is another primary usage of deep learning in banking [60]. Deep learning with NLP is broadly used in many banking systems for improving customer satisfaction with chatbots and feedback systems. Customer churn is a method to evaluate business success and retain existing customers. A recent study by Caigny et al. [61] using CNN models on customer churn prediction proved the improved performance of CNN in text analysis. It is widely noticed that deep learning plays a vital role in the broad scale of CRM in image processing and audio/video processing for information extraction from these unstructured data. Seeing the importance of CRM in any industry, researchers are still working to utilize deep learning capabilities in all segments of the CRM module.

6.6.2.3 Deep Learning in RM

Risk Management is an essential pillar of the banking sector. RM aims to protect assets and prevent potential losses to the banking assets. As this is a crucial task, deep learning is vital in alerting and protecting bank assets to prevent banks from going into solvency. Some of the most critical elements of risk management in banking, like investment, asset risk assessment to loan approval, are done using deep learning techniques [62].

Investment and portfolio management is one of the future-focused areas in any banking operation. Deep learning accurately evaluates repricing, option, and third-party investment risks. Culkin et al. [63] used deep learning in option pricing, and robust performance was confirmed compared to traditional methods. A recent study by Vo et al. [64] used the environmental, social, and governance metrics and the long short-term memory (LSTM) deep learning technique for portfolio optimization with sustainable consideration of social impact. It was considered a highly productive experiment in measuring and calculating portfolio impacts.

Loan approval and fraud detection are a significant portion of day-to-day bank operations. Deep learning successfully evaluates customers’ risks and predicts their credit risks to assess customer risk proportions. Many researchers have investigated these areas to determine the customer risk portfolios before loan approvals. A study by Kvamme et al. [65] investigated the real-world Norwegian mortgage portfolio data set using applied convolutional neural networks for credit risk prediction. Similarly, another research was conducted by Sirignano et al., using USA mortgage data using deep learning to evaluate mortgage risks [66]. Fu et al. applied CNN to a Chinese commercial bank’s real-world transactional data set to study credit and fraud behavior [67]. All USA credit bureaus like TransUnion, Equifax, and Experian use modern AI techniques to research and predict customer credit risks from their daily transactions.

6.6.2.4 Deep Learning on Detecting Cyber Threats

With the advance in technology, Cyberthreats are increasing daily. Financial institutions are the most susceptible to cyber threats. Banks are adopting a cyber resilience strategy to mitigate cyber-attacks. The manage detection and response technique powered by deep learning is useful for investigating potential compromises and providing real-time remediation to those threats. Deep learning techniques are widely used in the context of data-driven cyber security research like malware detection and vulnerability detection [68,69,70,71]. A study by Fang et al. [72] using the BRNN-LSTM framework for predicting cyberattack rates showed that this framework significantly outperforms other ML models in terms of prediction accuracy and decreasing cyber-attack rates. With the advancement of the Internet of Things (IoT) and internet-enabled devices around the banking domains, a high volume of data is generated from these smart environments. By integrating deep learning with these IoT data, institutions can prevent inference attacks using the Deep Variational Autoencoder (DVAE) [73]. These fields still need more attention from researchers to manage the patterns in Commercial Internet of Things (CIoT) environments.

6.6.2.5 Deep Learning on Real-Time Detection in Banks

Financial institutions like banks and Automated Teller Machines (ATMs) are high-security premises heavily guarded by Closed-Circuit Televisions (CCTVs) and video cameras. It is critical to extract data from CCTV footage and process it in real-time or batch processing for better physical security. Video footage is collected from CCTV installed inside and outside the banking premises, and objects are extracted with deep learning algorithms (Fig. 6.5). Object attributes like class, name, type, relative coordinates, and timestamp are processed using DL. Class or class-Id is the key used for object classification identity e.g., human = 1, animals = 2, vehicles = 3 etc. Generated features are then sent from the CCTV servers to the model using the Spark engine. These features are stored in big data systems as logs about the bank premise’s activity history generated by deep learning algorithms. Apache flame duplicates the data from Spark to HDFS in big data systems [72]. The data flow ends with real-time analytics dashboards using visualization tools like Tableau, Qlik Sense, or PowerBI [74].

6.7 Conclusion

The service quality dimensions of the banks are essential to promote offerings and gain customer confidence. Implementing the smart banking environment will give banks the edge to better serve customers. As the growth in the number of banks across the globe is increasing every year, in the future, the performance of the banks will be measured according to their sustainability and technological adaptability. The latest deep learning trends and NLP indicate rapidly rising global interest in these technologies to reshape financial bottlenecks. These technologies hugely contribute to overcoming the knowledge gap between technical experts and the public by promoting their broad applicability in modern data-rich enterprises. There are still many potential deep learning implementations that banks will adapt in the near future, for instance, face recognition, biometric authorization, audio/video processing, etc. This chapter is expected to provide insights into future research by connecting academics, researchers, and practitioners in deep learning, NLP, and banking.

References

Truong, T. (2016). How the FinTech industry is changing the world. Thesis.

Marr, B. (2018). How much data do we create every day? The mind-blowing stats everyone should read. Retrieved October 2, 2019, from https://www.forbes.com/sites/bernardmarr/2018/05/21/how-much-data-do-we-create-every-daythe-mind-blowing-stats-everyone-should-read/#2aa86a2b60ba

Alshemali, B., & Kalita, J. (2020). Improving the reliability of deep neural networks in NLP: A review. Knowledge-Based Systems, 191, 105210.

Collobert, R., Weston, J., Bottou, L., Karlen, M., Kavukcuoglu, K., & Kuksa, P. (2011). Natural language processing (almost) from scratch. Journal of Machine Learning Research, 12, 2493–2537.

Edwards, F. R., & Mishkin, F. S. (1995). The decline of traditional banking: Implications for financial stability and regulatory policy.

Benston, G. J., & Kaufman, G. G. (1988). Risk and solvency regulation of depository institutions: past policies and current options (Vol. 88–1). Federal Reserve Bank of Chicago.

Sahu, P., Elezue, C. J., & Kushawaha, R. (2022). An analysis of consumer expectations, nature and economic implications of smart banking system in India. In Internet of things and its applications (pp. 271–279). Springer.

Chen, C. C., Huang, H. H., & Chen, H. H. (2020). NLP in FinTech applications: past, present and future. arXiv. Preprint arXiv:2005.01320.

Vaswani, A., Shazeer, N., Parmar, N., Uszkoreit, J., Jones, L., Gomez, A. N., ... & Polosukhin, I. (2017). Attention is all you need. In Advances in neural information processing systems (pp. 5998–6008).

Losada, D. E., Crestani, F., & Parapar, J. (2019). Overview of early risk prediction on the internet. In International conference of the cross-language evaluation forum for European languages (pp. 340–357). Springer.

Yen, A. Z., Huang, H. H., & Chen, H. H. (2020). Multimodal joint learning for personal knowledge base construction from Twitter-based lifelogs. Information Processing & Management, 57(6), 102148.

Hu, Z., Liu, W., Bian, J., Liu, X., & Liu, T. Y. (2018, February). Listening to chaotic whispers: A deep learning framework for news-oriented stock trend prediction. In Proceedings of the eleventh ACM international conference on web search and data mining (pp. 261–269).

Devlin, J., Chang, M. W., Lee, K., & Toutanova, K. (2018). Bert: Pre-training of deep bidirectional transformers for language understanding. arXiv. Preprint arXiv:1810.04805.

Legowo, M. B., Subanija, S., & Sorongan, F. A. (2020). Role of FinTech mechanism to technological innovation: A conceptual framework. International Journal of Innovative Science and Research Technology, 5(5), 1–6.

Alhosani, F. A., & Tariq, M. U. (2020). Improving service quality of smart banking using quality management methods in UAE. International Journal of Mechanical Production Engineering Research and Development (IJMPERD), 10(3), 2249–8001.

Manikandan, D., Madhusudhanan, J., Venkatesan, V. P., Amrith, V., & Britto, M. A. (2011). Smart banking environment based on context history. International Conference on Recent Trends in Information Technology (ICRTIT), 2011, 450–455. https://doi.org/10.1109/ICRTIT.2011.5972335

Drigă, I., & Isac, C. (2014). E-banking services–features, challenges and benefits. Annals of the University of Petroşani Economics, 14, 49–58.

Mani, Z., & Chouk, I. (2018). Smart banking: Why it’s important to take into account consumers’ concerns? halshs-01678806f

Jain, H. C., & Godara, A. (2021). Smart banking services resistance across the income levels. Hem Chand Jain, Anubha Godara, Smart Banking Services Resistance across the Income Levels International Journal of Management, 11(11), 2020.

Arcand, M., PromTep, S., Brun, I., & Rajaobelina, L. (2017). Mobile banking service quality and customer relationships. International Journal of Bank Marketing.

Tian, X., He, J. S., & Han, M. (2021). Data-driven approaches in FinTech: A survey. Information Discovery and Delivery, 49(2), 123–135. https://doi.org/10.1108/IDD-06-2020-0062

Seng, J. L., Chiang, Y. M., Chang, P. R., Wu, F. S., Yen, Y. S., & Tsai, T. C. (2018). Big data and FinTech. In Big data in computational social science and humanities (pp. 139–163). Springer.

Suryono, R. R., Budi, I., & Purwandari, B. (2020). Challenges and trends of financial technology (Fintech): A systematic literature review. Information, 11(12), 590.

Gai, K., Qiu, M., & Sun, X. (2018). A survey on FinTech. Journal of Network and Computer Applications, 103, 262–273.

Johri, P., Khatri, S. K., Al-Taani, A. T., Sabharwal, M., Suvanov, S., & Kumar, A. (2021). Natural language processing: History, evolution, application, and future work. In Proceedings of 3rd international conference on computing informatics and networks (pp. 365–375). Springer

Hinton, G. E., & Salakhutdinov, R. R. (2012). A better way to pretrain deep Boltzmann machines. In Advances in neural information processing systems (p. 25)

Xiong, W., Droppo, J., Huang, X., Seide, F., Seltzer, M., Stolcke, A., ... & Zweig, G. (2016). Achieving human parity in conversational speech recognition. arXiv. Preprint arXiv:1610.05256.

Murphy, K. P. (2012). Machine learning: a probabilistic perspective. MIT press.

Liu, B. (2012). Sentiment analysis and opinion mining. Synthesis lectures on human language technologies, 5(1), 1–167.

Hirschberg, J., & Manning, C. D. (2015). Advances in natural language processing. Science, 349(6245), 261–266.

Lu, Y. (2019). Artificial intelligence: A survey on evolution, models, applications and future trends. Journal of Management Analytics, 6(1), 1–29.

Rumelhart, D. E., Hinton, G. E., & Williams, R. J. (1986). Learning representations by back-propagating errors. Nature, 323(6088), 533–536.

Yu, Z., Black, A. W., & Rudnicky, A. I. (2017). Learning conversational systems that interleave task and non-task content. arXiv. Preprint arXiv:1703.00099.

Lima, S. & Terán, L. (2019). Cognitive smart cities and deep learning: A classification framework. In 2019 Sixth International Conference on eDemocracy & eGovernment (ICEDEG) (pp. 180–187). https://doi.org/10.1109/ICEDEG.2019.8734346

Jain, P. K., Saravanan, V., & Pamula, R. (2021). A hybrid CNN-LSTM: A deep learning approach for consumer sentiment analysis using qualitative user-generated contents. Transactions on Asian and Low-Resource Language Information Processing, 20(5), 1–15.

Bhowmik, T., Bhadwaj, A., Kumar, A., & Bhushan, B. (2022). Machine learning and deep learning models for privacy management and data analysis in smart cites. In Recent advances in internet of things and machine learning (pp. 165–188). Springer.

Chandana Mani, R. K., Bhushan, B., Rajyalakshmi, V., Nagaraj, J., & Ramathulasi, T. (2022). A Pilot study on detection and classification of COVID images: A deep Learning approach. In Innovations in electronics and communication engineering (pp. 187–193)

Zhang, Y., & Wallace, B. (2015). A sensitivity analysis of (and practitioners’ guide to) convolutional neural networks for sentence classification. arXiv. Preprint arXiv:1510.03820.

Otter, D. W., Medina, J. R., & Kalita, J. K. (2020). A survey of the usages of deep learning for natural language processing. IEEE Transactions on Neural Networks and Learning Systems, 32(2), 604–624.

Schmidhuber, J. (2015). Deep learning in neural networks: An overview. Neural networks, 61, 85–117.

Dozat, T. & Manning, C. D. (2017). Deep biaffine attention for neural dependency parsing. In ICLR.

Deng, L., & Liu, Y. (Eds.). (2018). Deep learning in natural language processing. Springer.

Alzubaidi, L., Zhang, J., Humaidi, A. J., Al-Dujaili, A., Duan, Y., Al-Shamma, O., et al. (2021). Review of deep learning: Concepts, CNN architectures, challenges, applications, future directions. Journal of Big Data, 8(1), 1–74.

Mayo, D., Cheparthi, A., Gattu, N. S., Pabba, P. G. (2021, December 20). It banking spending predictor: Corporate & amp; Retail – 2021. Omdia. Retrieved March 27, 2022, from https://omdia.tech.informa.com/OM018213/IT-Banking-Spending-Predictor-Corporate%2D%2DRetail%2D%2D2021

Rogers, T. N. (2018, July 16). Mobile deposits surpass in person transactions at Bank of America. TheStreet. Retrieved March 27, 2022, from https://www.thestreet.com/technology/mobile-deposits-surpass-in-person-transactions-at-bank-of-america-14652141

Srinivas, V., & Ross, A. (2018, December). Accelerating digital transformation in banking. Deloitte Insights. Retrieved March 27, 2022, from https://www2.deloitte.com/global/en/insights/industry/financial-services/digital-transformation-in-banking-global-customer-survey.html

Röcker, C., & Kaulen, D. (2014). Smart banking: User characteristics and their effects on the usage of emerging banking applications. Journal ISSN, 2368, 6103.

Kulkarni, C. S., Bhavsar, A. U., Pingale, S. R., & Kumbhar, S. S. (2017). BANK CHAT BOT–an intelligent assistant system using NLP and machine learning. International Research Journal of Engineering and Technology, 4(5), 2374–2377.

Dash, B. (2021). A hybrid solution for extracting information from unstructured data using optical character recognition (OCR) with natural language processing (NLP). Research Gate.

Marous, J. (2018). Meet 11 of the most interesting chatbots in banking. The Financial Brand. Available online: https://thefnancialbrand.com/71251/chatbots-banking-trends-ai-cx/. Accessed on 26 Mar 2020.

Bhagat, P., Prajapati, S. K., & Seth, A. (2020). Initial lessons from building an IVR-based automated question-answering system. In Proceedings of the 2020 international conference on information and communication technologies and development (pp. 1–5).

Peng, T., Harris, I., & Sawa, Y. (2018). Detecting phishing attacks using natural language processing and machine learning. In 2018 IEEE 12th international conference on semantic computing (icsc) (pp. 300–301). IEEE.

Chang, JW., Yen, N. & Hung, J.C. (2022). Design of a NLP-empowered finance fraud awareness model: the anti-fraud chatbot for fraud detection and fraud classification as an instance. J Ambient Intell Human Comput, 13, 4663–4679.

Hassani, H., Huang, X., Silva, E., & Ghodsi, M. (2020). Deep learning and implementations in banking. Annals of Data Science, 7(3), 433–446.

Bose, I., & Chen, X. (2009). Quantitative models for direct marketing: A review from systems perspective. European Journal of Operational Research, 195(1), 1–16.

Yan C. (2018). Convolutional Neural Network on a structured bank customer data. Towards data science. Available online: https://towardsdatascience.com/convolutional-neural-network-on-astructured-bank-customer-data-358e6b8aa759. Accessed on 25 Mar 2020.

Ładyżyński, P., Żbikowski, K., & Gawrysiak, P. (2019). Direct marketing campaigns in retail banking with the use of deep learning and random forests. Expert Systems with Applications, 134, 28–35.

Ogwueleka, F. N., Misra, S., Colomo-Palacios, R., & Fernandez, L. (2015). Neural network and classifcation approach in identifying customer behavior in the banking sector: A case study of an international bank. Human Factors and Ergonomics in Manufacturing & Service Industries, 25(1), 28–42.

Zhou, X., Bargshady, G., Abdar, M., Tao, X., Gururajan, R. & Chan, K. C. (2019). A case study of predicting banking customers behaviour by using data mining. In 2019 6th international conference on behavioral, economic and socio-cultural computing (BESC) (pp. 1–6). IEEE.

Vieira, A. & Sehgal, A. (2018). How banks can better serve their customers through artificial techniques. In Digital marketplaces unleashed (pp. 311–326). Springer.

De Caigny, A., Coussement, K., De Bock, K. W., Lessmann, S. (2019). Incorporating textual information in customer churn prediction models based on a convolutional neural network. International Journal of Forecasting (In Press).

Lin, W. Y., Hu, Y. H., & Tsai, C. F. (2011). Machine learning in financial crisis prediction: A survey. IEEE Transactions on Systems, Man, and Cybernetics, Part C (Applications and Reviews), 42(4), 421–436.

Culkin, R., & Das, S. R. (2017). Machine learning in finance: The case of deep learning for option pricing. Journal of Investment Management, 15(4), 92–100.

Vo, N. N., He, X., Liu, S., & Xu, G. (2019). Deep learning for decision making and the optimization of socially responsible investments and portfolio. Decision Support System, 124, 113097.

Kvamme, H., Sellereite, N., Aas, K., & Sjursen, S. (2018). Predicting mortgage default using convolutional neural networks. Expert Systems with Applications, 102, 207–217.

Sirignano, J., Sadhwani, A. & Giesecke, K. (2018). Deep learning for mortgage risk. Available at: https://doi.org/10.2139/ssrn.2799443

Fu, K., Cheng, D., Tu, Y., & Zhang, L. (2016, October). Credit card fraud detection using convolutional neural networks. In International conference on neural information processing (pp. 483–490). Springer.

Li, D., Baral, R., Li, T., Wang, H., Li, Q., & Xu, S. (2018). Hashtran-dnn: a framework for enhancing robustness of deep neural networks against adversarial malware samples. CoRR. abs/1809.06498: http://arxiv.org/abs/1809.06498

Z. Li, D. Zou, S. Xu, X. Ou, H. Jin, S. Wang, Z. Deng & Y. Zhong (2018). In 25th annual network and distributed system security symposium, NDSS 2018, San Diego, California, USA, February 18–21, 2018. Vuldeepecker: A deep learning-based system for vulnerability detection (Internet Society San Diego).

Singh, R. V., Bhushan, B., & Tyagi, A. (2021). Deep learning framework for cybersecurity: Framework, applications, and future research trends. In Emerging Technologies in Data Mining and Information Security (pp. 837–847). Springer.

Malhotra, L., Bhushan, B., & Singh, R. V. (2021). Artificial intelligence and deep learning-based solutions to enhance cyber security. Available at SSRN 3833311.

Fang, X., Xu, M., Xu, S., & Zhao, P. (2019). A deep learning framework for predicting cyber-attacks rates. EURASIP Journal on Information security, 2019(1), 1–11.

Kumar, P., Kumar, R., Gupta, G. P., Tripathi, R., & Srivastava, G. (2022). P2TIF: A blockchain and deep learning framework for privacy-preserved threat intelligence in industrial IoT. In IEEE transactions on industrial informatics.

Supangkat, S. H., Hidayat, F., Dahlan, I. A. & Hamami, F. (2019). The Implementation of traffic analytics using deep learning and big data technology with Garuda Smart City framework. In 2019 IEEE 8th GLOBAL Conference on Consumer Electronics (GCCE) (pp. 883–887). https://doi.org/10.1109/GCCE46687.2019.9015300

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Dash, B., Swayamsiddha, S., Ali, A.I. (2023). Evolving of Smart Banking with NLP and Deep Learning. In: Ahad, M.A., Casalino, G., Bhushan, B. (eds) Enabling Technologies for Effective Planning and Management in Sustainable Smart Cities. Springer, Cham. https://doi.org/10.1007/978-3-031-22922-0_6

Download citation

DOI: https://doi.org/10.1007/978-3-031-22922-0_6

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-22921-3

Online ISBN: 978-3-031-22922-0

eBook Packages: Computer ScienceComputer Science (R0)