Abstract

Data-driven technologies have been changing every aspect of human life and the fast-developing banking sector with its data-rich nature has become the implementation field of these fast-evolving technologies. Deep learning, as one of the emerging technologies in recent years, has also been inevitably adopted for various improvements in banking. To the best of our knowledge, there is no comprehensive literature review, which focuses on specifically deep learning and its implementations in banking. Therefore, this paper investigates the deep learning technology in-depth and summarizes the relevant applications in banking so to contribute to the existing literature. Moreover, by providing a reliable and up-to-date review, it is also aimed to serve as the one-stop repository for banks and researchers who are interested in embracing deep learning, whilst bringing insights for the directions of future research and implementation.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

It has been proven inevitable that almost all science subjects are embracing the data-driven decision making and catching up with the rapidly evolving data-driven technologies [1,2,3,4,5,6,7,8,9,10,11]. Under the thick blanket of overflowing Big Data, the usually hidden and significantly valuable information is encouraging numerous researchers and practitioners with relevant skills to further improve the capability of nowadays data science empowered by advancing Artificial Intelligence (AI) technologies [12]. As one of the most influential subjects that closely related to almost everything of people’s day-to-day life, banking has been one of the pioneering sectors that actively develop and implement advanced data-driven technologies. Thanks to the data-rich nature of the banking sector as well as the well-developed essential data science infrastructure, banking has been a popular field for data-driven researches on a global scale [13, 14].

One may notice that the variety of terms like machine learning, data mining, deep learning, AI are used interchangeably, especially by the numerous resources made available online. This is the inevitable result of the growing interests of the general public, the rapid developments of these advanced technologies themselves, and the general knowledge gap due to the lack of reliable educational resources in scale. The tech-knowledge gap and its associated problems have been developing faster than ever nowadays, which has already become the challenge for scaling up of many newly emerging industries, not to mention the consequences of fraud-related criminal activities due to lack of knowledge or the most up-to-date information. Thus, it is crucially important to address the real meaning of these terms and summarize the most up to date progresses.

As can be seen in Fig. 1, where the monthly global Google trend’s indices are collected for the terms, including AI, data mining, machine learning and deep learning since 2014. Although data mining attracted much more attention globally from the beginning in comparison with the other three and showed a slightly downward declining trend, yet it is still maintaining a relatively good level of public interest. AI, machine learning and deep learning have all been rapidly growing over the years, where deep learning shows the steepest exponentially growing curve and stays in the highest position closely followed by machine learning and AI. This further confirmed the shift of attention due to the rapid advancements of these closely connected technologies in general. It also further supports the main aim of this paper, which is to thoroughly investigate this emerging domain of deep learning and its implementations in the high profile banking sector.

Regarding the existing literature, there are a few comprehensive review papers, which focus on the data mining applications perspective [13, 15,16,17], few papers further investigated some specific implementations of data mining in banking, e.g. customer relationship management (CRM) [18], fraud detection [19], credit scoring [20], etc. There are also several scholars which addressed the big data implementations in the banking sector [14, 21] investigated the blockchain-ed big data impact in banking, whilst authors in [22] presented a specific analysis for Indian banks. Moreover, some researchers addressed machine learning techniques in credit rating [23], risk management [24, 75], customer profiling and segmentation [25, 26] However, it is to the best of our knowledge that there is no comprehensive review focusing on deep learning and its implementations in banking. Considering the emerging interests of deep learning and fast development of the banking sector, this paper is of paramount importance to connect the researchers of both subjects, summarize the most up-to-date implementations and offer insights for future research directions.

The rest of the paper is organized so that Sect. 2 introduces deep learning in-depth, Sect. 3 summarizes the implementations of deep learning in the banking sector, and the conclusion is provided in Sect. 4.

2 Deep Learning

Deep learning is an emerging branch of machine learning as evident by its peaking trend index in Fig. 1. There have been tremendous acknowledgments of its advancements comparing to other relatively “less deep” machine learning techniques. This section introduces deep learning and its key techniques in detail, and it is also aimed to provide general and clear guidance of understanding the differences among terms including AI, machine learning and deep learning, which are many times used interchangeably.

Most people start to notice the rising of AI over the last decade, whilst AI is a long history field of research back to the 1950s. For any software, programs, platforms, and machines, the capabilities of processing and learning are driven by simulating human intelligence can be generally referred to as AI. The features of AI trending nowadays are the joint efforts of rapid technological revolution and the expanding robotic process automation market [27]. Undoubtedly, as witnessed by the changes AI has brought to our day-to-day life, AI nowadays in the format of automated objects, process and augmented analytics are the keys of success across sectors and subjects.

In general, AI as a much broader umbrella term contains many subsets: expert systems, natural language processing, robotics, planning, speech and vision processing, as well as machine learning, which is a significant subset of AI (the branches of AI can be found in [27]). It is of note that the challenges remain to keep on top of all advancements as every branch involved are rapidly evolving in the dimensions of both, themselves and the combinations with one or multiple other branches or trending techniques. In brief, machine learning, as an important subset of AI, refers to the independent learning ability endowed to technological equipment on data so to allow knowledge acquisition and performance improvements. Specifically, machine learning algorithms enable the tasks to be achieved sufficiently by learning to generalize from data or examples [28]. Considering the levels of involvement of human experiences or judgments in the training process, machine learning can be further divided into supervised learning, semi-supervised learning, unsupervised learning, and reinforcement learning [29]. More details of a variety of machine learning algorithms can be found in established literature [30, 31, 53], thus they are not repeated here.

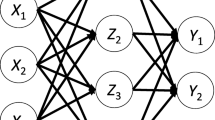

The terms deep learning and machine learning are sometimes used interchangeably, and it is noticed to be relatively blurry in clearly distinguishing these two. Technically speaking, deep learning is machine learning, and it is considered to be a subset of machine learning where different flavours of neural network techniques are incorporated. Deep learning techniques have very strong intuitions of independent decision making, and they are inspired by the mechanism of the neural network of the human brain. The key difference of deep learning is that the machine learns different layers of features following a logical structure from data on its own rather than accepting the design of human engineers [32]. For instance, the AlphaGo by Google has demonstrated a great example of deep learning. The idea of endowing machines the ability to solitarily learn and solve a problem on its own has further promoted the development and implementation of deep learning across sectors [34,34,35,36,37]. Although it is still a questionable debate, many argue that the advancements of deep learning will lead to “true AI” whilst others disagree considering the supervision and labeled data required by deep learning.

Based on the neural network algorithm, deep learning has been rapidly emerging and contains several popular techniques, which are established over the recent years: the recursive neural network (RvNN) [38], recurrent neural network (RNN) [39], convolutional neural network (CNN) [44, 45], deep Boltzmann machine (DBM) [46], etc. A brief summary of the popular key techniques and corresponding milestone literature is summarized in Table 1. Please note that more details of deep learning algorithms and frameworks can be found in [48,47,49] for readers who are interested in the technical aspect of deep learning. One can also refer to deeplearning.net for abundant collections of resources.

3 Implementations of Deep Learning in Banking

According to the wide implementations of deep learning in a broader scale of sectors, it has been observed that the practical implementations of deep learning have many different forms, i.e. virtual service assistants, smart image processing, face recognition, medical diagnosis, personalized marketing, etc. The following subsections systematically summarise the applications of deep learning in practice into three domains of how deep learning is used for benefiting specifically the banking sector. Although practical implementation can be complex or presenting in the format of different combinations, we attempt to group the implementations into three domains including marketing, customer relationship management (CRM) and risk management. Specifically, each domain covers a variety of relevant activities so to assure the comprehensiveness of our review.

The springing up of deep learning applications has been witnessed across sectors, especially in medical diagnosis and biological data processing due to the successful application of pattern recognition and image processing. This section aims to specifically investigate the existing implementations of deep learning in the high profile banking sector. By providing the most up-to-date summary of deep learning applications in banking, this paper contributes to connecting researchers in both domains and bringing insights on the future research directions and potential implementations.

3.1 Marketing

Deep learning has been strategically applied for marketing related activities across sectors [54], and the banking sector is no exception [55]. In general, deep learning can assist banks in targeting the “right” customers with the “right” marketing campaign so to assure the effectiveness of its marketing activities under the intense competition banks are facing nowadays.

Researchers have attempted to implement deep learning techniques in personalized marketing of retail banking, in which the most profitable groups of customers are identified for the corresponding marketing campaign, customer behavior is also learned continuously so that banks can prioritize more precise offers and referrals. The telemarketing data of the Portuguese banking institutions between 2008 and 2010 has been used in [56] with deep CNN architecture for identifying customers who are likely to accept a marketing proposal. The authors in [57] proposed a collection of modified artificial neural networks and applied to the bank direct marketing data set from [58] in verifying the performance in direct marketing. Yan [59] demonstrated the application of a convolutional neural network via a Kaggle competition on Santander’s customer data, in which the customer’s behavior is learned for predicting the usage of bank products. Ładyżyński et al. [60] used customer transactional data from a large retail bank in Poland and identified the group of more promising customers by deep belief networks and stacked restricted Boltzman machines via the H2O platform, this then allows direct marketing and significantly improves the performance of the marketing campaign.

3.2 Customer Relationship Management (CRM)

Just as any other customer-oriented businesses, the banking sector also significantly values customer relationship management (CRM) given its intensely competitive business environment. As a data-rich sector which has access to abundant customer information as well as banking behavior records, it is crucial ability for a bank to be able to understand their customer and offer timely customized service. By interacting with customers and being supportive with personalized services, the aim of successful CRM is to improve its productivity of customer interaction [61]. To the best of our knowledge, we here in this subsection list the observed applications of deep learning in assisting the CRM of the banking sector.

Customer profiling and segmentation is the first important step of knowing your customer and is closely connected with direct marketing. The banks gather customer information systematically and transform all available data into a structured way, so they are analyzable and ready for being exploited further by advanced techniques like deep learning. The banks are learning from the data obtained so to build up the comprehensive profile of their customer and potentially group their customers by different features and tasks. A relatively early research by Davies et al. [62] applied neural network analysis on customer segmentation in regard to one’s attitudinal types against ATM services. Much research (i.e. [63, 64, 68]) followed and investigated customer segmentation via different models learning customer behavior from content-rich data collected by banks. Wang et al. [65] applied BP neural network algorithm on commercial banks’ data set in China for establishing an improved customer hierarchy system. According to the customer’s data of the Saman Bank in Iran, Zhou et al. [66] compared the performance of neural networks with other data mining techniques and achieved over 97% accuracy in customer behavior segmentation.

Customer service and satisfaction is another main usage of deep learning in banking [67] The advancements of deep learning enabled more intelligent chat-bot/service-bot for offering restless customer services and improving customer satisfaction [68]. There have been many successful use cases of chat-bot across the world. For instance, according to [69], Erica (the virtual assistant of Bank of America), COIN (contract intelligence platform of JPMorgan), Eno (chat-bot assistant of Captial One), Ally assistant (by Ally Bank), Clinc (by USAA), AmEx (by American Express), Amy (by HKBC), Haro and Dori (by Hang Seng Bank), Aida (by SEB), Emma (by OCBC Bank), Ceba (by Commonwealth Bank in Australia), POSB by (DBS bank), etc. These AI-driven chat-bots usually accept customer interactions via voice or text commands, as well as tapping options over the screen. They are intelligently engineered to give 24/7 efficient support for most of the day-to-day tasks of bank customers. Quah and Chuan [70] investigated the use of chat-bot in the banking industry of Singapore, which has been recognised as one of the top global FinTech hubs. It is worth mentioning that the concern of trust as a challenge of applying chat-bot in banking is addressed in [71] with a new measure proposed for evaluating chat-bot performance.

Customer churn detection plays a significant role in evaluating business success, customer-centric sectors like banking also pay great attention to retaining customers. Thus, the improvements by embracing the most advanced techniques have been continuously observed on the identification of customer churn. Using the customer data set of a Chinese commercial bank, the authors in [72] addressed the advantage of deep learning algorithms on predicting customers’ churn. The transactional data of the private banks in Iran were adopted in [73] for verifying the capability of recurrent neural networks in preventing customer churn. A research was recently done by Caigny et al. [74] systematically investigated the implementation of convolutional neural networks on customer churn prediction, and proved the improved performance of CNN in processing textual data.

It is noticed that considering the wide scale of CRM, its collaboration with deep learning techniques seems relatively limited, still many potentials are waiting to be discovered. It is possibly due to the fact that deep learning in comparison with typical machine learning techniques has its merits, mainly in image processing, natural language processing as well as audio/video processing. This determined that deep learning techniques in the format of chat-bot/service-bot have better premises of implementation in banking.

3.3 Risk Management

Another essential pillar of the banking sector is risk management. The general aim of risk management can be briefly summarized as protecting assets and preventing potential losses. For the banking sector which provides a variety of services covering almost every aspect of human life, its risk management meanwhile can be a difficult but crucial task. Therefore, it is undoubtedly that the banking sector will actively embrace those advanced data analysis techniques for preventing risks to their business and assets. Parallel researches about general machine learning applications in banking risk management are conducted by Leo et al. [75] and Petropoulos et al. [76], which specifically focused on bank insolvencies prediction. The research was done by Lin et al. [77] reviewed the machine learning applications for predicting the financial crisis. In this subsection, we investigate specifically the implementations of deep learning techniques in some of the most important elements of risk management in banking, these include but not limited to: protecting the values of assets in investment, assessing risks of loan approval and preventing fraud.

Investment and portfolio management It is of note that there has been relatively exhaustive research, which focuses on the forecasting advancements of financial time series via deep learning techniques. More details can be found in a very recent comprehensive review in [78]. The authors systematically summarized over 200 applications between 2005 and 2019, thus we will not reproduce the relevant literature. To assist the accurate evaluation of repricing risk, Karisma and Widyantoro [79] applied a deep neural network algorithm on the monthly report data of the public bank in Indonesia and achieved better identification of repricing gap than the standard backpropagation method. The usage of deep learning in option pricing was investigated in [80] and robust performance was confirmed compared with the empirical approaches. Weigand [81] also focused on the asset pricing domain, and summarized the applications of general machine learning techniques. Chen et al. [82] applied the k-competitive autoencoder deep learning techniques for text processing of financial reports made by US public banks, and it outperformed the other machine learning techniques in terms of identifying the failed bank and assisting financial decision making. Similarly, the authors in [83] used recurrent neural network techniques and analyzed over 6.6 million news articles for the prediction of bank distress. Using over 11 thousand US public companies data set, Mai et al. [84] compared the performances of convolutional neural networks and the average embedding model in terms of predicting bankruptcy. Later, Qu et al. [85] presented a comprehensive review of the implementations of deep learning techniques on bankruptcy prediction. A recent study of Vo et al. [86] incorporated the environmental, social and governance metrics and the long short-term memory (LSTM) deep learning technique for portfolio optimization with sustainable consideration of social impact.

Loan approval It is of crucial importance for banks to comprehensively evaluate the risks before approving loans. Luo et al. [87] adopted the credit default swaps data set and applied deep belief networks and restricted Boltzmann machines for achieving improved credit score modeling. A research project conducted by Sirignano et al. [88] used over 120 million mortgages data in the US between 1995 and 2014, and evaluated the performance of deep neural networks on modeling mortgage risk. The authors in [89] compared the performances of a tree-based and artificial neural network’s methods in predicting loan default probability of over 117 thousand enterprises. Kvamme et al. [90] investigated the real-world Norwegian mortgage portfolio data set and applied convolutional neural networks for credit risk prediction.

Fraud detection The wide-spread use of credit cards has formed a significant portion of the day to day banking services, which brings in both abundant profit as well as risks. The fraud detection is another important domain banks pay extreme attention to in terms of preventing losses. In regard to the relevant implementations of deep learning techniques, the authors in [91] used deep artificial neural networks with 18 months of transactional data set for verifying the performance of fraud detection. Fu et al. [92] applied convolutional neural networks on real word transactional data set of a commercial bank in China and outperformed other established methods in identifying credit card fraud behavior. With the same deep learning technique—convolutional neural network, a similar task was conducted in [93] for online transaction fraud detection. A different deep learning technique—autoencoder was applied in [94] to distinguish credit card fraud from transactional data. In similar research with the autoencoder technique, data set from European banks were used in [95]. Pumsirirat and Yan [96] combined autoencoder and restricted Boltzmann machine techniques for fraud detection experiments on German, Australian and European data set.

4 Conclusion

The springing up of technological advancements in data science has promoted significant changes across sectors on a global scale. This paper aimed to provide further clarification of the emerging “deep learning” in the context of general confusions caused by its interchangeable use with other relevant concepts like AI and machine learning. The trend of deep learning indicates rapidly rising global interests, as such, it is crucially important to provide a clear introduction of deep learning and its key techniques. This contributes to overcome the general knowledge gap between technological experts and the general public, so as to further promote its wide implementations. Here in this paper, we specifically investigated the banking sector due to its data-rich nature and historically welcoming environment in embracing advanced technologies. After the comprehensive review of most up to date deep learning applications in banking, to the best of our knowledge, it is noticed that deep learning techniques offers generally improved capacity in processing more complex data set, and more stable performance thanks to the advancements of deep neural networks. However, the applications of deep learning, in general, have specialties in the domains of image processing and natural language processing. Therefore, its implementations in banking seem overall relatively limited (as being summarized in Sect. 3), still, many more potentials in the broader horizon of banking are waiting to be exploited. It is also noticed that there are relatively small amounts of academic literature on deep learning in banking. Literature mainly investigated the general term machine learning and its applications, much less research that specifically studied deep learning and its applications, not to mention focusing on a specific sector. Many of the most advanced techniques and its applications stay at the stage of conference presentation and proceeding, there is simply not enough reliable academic and public exposure to be widely acknowledged by the general public, which could be one of the reasons leading to the knowledge gap. We discovered that the applications of deep learning in banking mainly targeted customer relationship management and risk management domains, likely due to the availability of big data in banking. There are also many potential deep learning implementations that we could not identify in existing academic literature in banking, for instance, face recognition, user authorization, cybersecurity, audio/video processing, etc. It is expected that this paper can connect the researchers and practitioners in both deep learning and banking fields and provide insights into future research.

References

Saini A, Sharma A (2019) Predicting the unpredictable: an application of machine learning algorithms in indian stock market. Ann Data Sci. https://doi.org/10.1007/s40745-019-00230-7

Ahmed M, Najmul Islam AKM (2020) Deep learning: hope or hype. Ann Data Sci. https://doi.org/10.1007/s40745-019-00237-0

Xu Z, Shi Y (2015) Exploring big data analysis: fundamental scientific problems. Ann Data Sci 2:363–372

Shi Y, Shan Z, Li J, Jianping L, Fang Y (2017) How China deals with big data. Ann Data Sci 4:433–440

Hassani H, Huang X, Silva ES, Ghodsi M (2016) A review of data mining applications in crime. Stat Anal Data Min ASA Data Sci J 9(3):139–154

Hassani H, Huang X, Ghodsi M (2018) Big data and causality. Ann Data Sci 5(2):133–156

Olson D, Shi Y (2007) Introduction to business data mining. McGraw-Hill/Irwin, New York

Shi Y, Tian YJ, Kou G, Peng Y, Li JP (2011) Optimization based data mining: theory and applications. Springer, London

Shi Y (2014) Big Data: history, current status, and challenges going forward. Bridge US Natl Acad Eng 44(4):6–11

Hassani H, Silva E (2018) Big Data: a big opportunity for the petroleum and petrochemical industry. OPEC Energy Rev 42(1):74–89

Hassani H, Huang X, Silva E (2019) Big Data and climate change. Big Data Cognit Comput 3(1):12

Hassani H, Silva ES, Unger S, TajMazinani M, Mac Feely S (2020) Artificial Intelligence (AI) or Intelligence Augmentation (IA): what Is the Future? AI 1:143–155

Hassani H, Huang X, Silva E (2018) Digitalisation and big data mining in banking. Big Data Cognit Comput 2(3):18

Hassani H, Huang X, Silva E (2018) Banking with blockchain-ed big data. J Manag Anal 5(4):256–275

Hormozi AM, Giles S (2004) Data mining: a competitive weapon for banking and retail industries. Inf Syst Manag 21(2):62–71

Chitra K, Subashini B (2013) Data mining techniques and its applications in banking sector. Int J Emerg Technol Adv Eng 3(8):219–226

Jayasree V, Balan RVS (2013) A review on data mining in banking sector. Am J Appl Sci 10(10):1160

Chye KH, Gerry CKL (2002) Data mining and customer relationship marketing in the banking industry. Singap Manag Rev 24(2):1–28

Aburrous M, Hossain MA, Dahal K, Thabtah F (2010) Intelligent phishing detection system for e-banking using fuzzy data mining. Expert Syst Appl 37(12):7913–7921

Ince H, Aktan B (2009) A comparison of data mining techniques for credit scoring in banking: a managerial perspective. J Bus Econ Manag 10(3):233–240

Sun N, Morris JG, Xu J, Zhu X, Xie M (2014) iCARE: a framework for big data-based banking customer analytics. IBM J Res Dev 58(5/6):4:1–4:9

Srivastava U, Gopalkrishnan S (2015) Impact of big data analytics on banking sector: learning for Indian banks. Procedia Comput Sci 50:643–652

Tsai CF, Chen ML (2010) Credit rating by hybrid machine learning techniques. Appl Soft Comput 10(2):374–380

Khandani AE, Kim AJ, Lo AW (2010) Consumer credit-risk models via machine-learning algorithms. J Bank Finance 34(11):2767–2787

Carr M, Ravi V, Reddy GS, Veranna D (2013) Machine learning techniques applied to profile mobile banking users in India. Int J Inf Syst Serv Sect 5(1):82–92

Smeureanu I, Ruxanda G, Badea LM (2013) Customer segmentation in private banking sector using machine learning techniques. J Bus Econ Manag 14(5):923–939

Hassani H, Huang X, Silva ES (2019) Fusing Big Data, blockchain, and cryptocurrency. In: Fusing Big Data, blockchain and cryptocurrency, Palgrave Pivot

Domingos P (2012) A few useful things to know about machine learning. Commun ACM 55(10):78–87

Grossfeld B (2020) Deep learning vs machine learning: a simple way to understand the difference. Available online: https://www.zendesk.com/blog/machine-learning-and-deep-learning/, Accessed 20 Mar 2020

Alpaydin E (2020) Introduction to machine learning. MIT Press, Cambridge

Shalev-Shwartz S, Ben-David S (2014) Understanding machine learning: from theory to algorithms. Cambridge University Press, Cambridge

LeCun Y, Bengio Y, Hinton G (2015) Deep learning. Nature 521(7553):436–444

Guo Y, Liu Y, Oerlemans A, Lao S, Wu S, Lew MS (2016) Deep learning for visual understanding: a review. Neurocomputing 187:27–48

Zhu XX, Tuia D, Mou L, Xia GS, Zhang L, Xu F, Fraundorfer F (2017) Deep learning in remote sensing: a comprehensive review and list of resources. IEEE Geosci Remote Sens Mag 5(4):8–36

Miotto R, Wang F, Wang S, Jiang X, Dudley JT (2018) Deep learning for healthcare: review, opportunities and challenges. Brief Bioinf 19(6):1236–1246

Fawaz HI, Forestier G, Weber J, Idoumghar L, Muller PA (2019) Deep learning for time series classification: a review. Data Min Knowl Discov 33(4):917–963

Fan C, Xiao F, Zhao Y (2017) A short-term building cooling load prediction method using deep learning algorithms. Appl Energy 195:222–233

Socher R, Lin CC, Manning C, Ng AY (2011) Parsing natural scenes and natural language with recursive neural networks. In: Proceedings of the 28th international conference on machine learning (ICML-11), pp 129–136

Mikolov T, Karafiát M, Burget L, Černockỳ J, Khudanpur S (2010) Recurrent neural network based language model. In: Eleventh annual conference of the international speech communication association

Hochreiter S, Schmidhuber J (1997) Long short-term memory. Neural Comput 9(8):1735–1780

Szegedy C, Liu W, Jia Y, Sermanet P, Reed S, Anguelov D, Erhan D, Vanhoucke V, Rabinovich A (2015) Going deeper with convolutions. In Proceedings of the IEEE conference on computer vision and pattern recognition, pp. 1–9

Simonyan K, Zisserman A (2014) Very deep convolutional networks for large-scale image recognition. arXiv preprint arXiv:1409.1556

Chollet F (2017) Xception: Deep learning with depthwise separable convolutions. In Proceedings of the IEEE conference on computer vision and pattern recognition, pp 1251–1258

LeCun Y, Bottou L, Bengio Y, Haffner P (1998) Gradient-based learning applied to document recognition. Proc IEEE 86(11):2278–2324

Donahue J, Jia Y, Vinyals O, Hoffman J, Zhang N, Tzeng E, Darrell T (2014) Decaf: a deep convolutional activation feature for generic visual recognition. In: International conference on machine learning, pp 647–655

Salakhutdinov R, Hinton G (2009) Deep boltzmann machines. In: Artificial intelligence and statistics, pp 448–455

Schmidhuber J (2015) Deep learning in neural networks: an overview. Neural Netw 61:85–117

Pouyanfar S, Sadiq S, Yan Y, Tian H, Tao Y, Reyes MP, Shyu ML, Chen SC, Iyengar SS (2018) A survey on deep learning: algorithms, techniques, and applications. ACM Comput Surv (CSUR) 51(5):1–36

Liu W, Wang Z, Liu X, Zeng N, Liu Y, Alsaadi FE (2017) A survey of deep neural network architectures and their applications. Neurocomputing 234:11–26

Bengio Y, Lamblin P, Popovici D, Larochelle H (2007) Greedy layer-wise training of deep networks. In: Advances in neural information processing systems, pp 153–160

Vincent P, Larochelle H, Bengio Y, Manzagol PA (2008) Extracting and composing robust features with denoising autoencoders. In: Proceedings of the 25th international conference on Machine learning, pp 1096–1103

Kingma DP, Welling M (2013) Auto-encoding variational bayes. arXiv preprint arXiv:1312.6114

Goodfellow I, Pouget-Abadie J, Mirza M, Xu B, Warde-Farley D, Ozair S, Courville A, Bengio Y (2014) Generative adversarial nets. In: Advances in neural information processing systems, pp 2672–2680

Bose I, Chen X (2009) Quantitative models for direct marketing: a review from systems perspective. Eur J Oper Res 195(1):1–16

Sing’oei L, Wang J (2013) Data mining framework for direct marketing: a case study of bank marketing. Int J Comput Sci Issues 10((2 Part 2)):198

Kim KH, Lee CS, Jo SM, Cho SB (2015) Predicting the success of bank telemarketing using deep convolutional neural network. In: 2015 7th international conference of soft computing and pattern recognition (SoCPaR), IEEE, pp 314–317

Zakaryazad A, Duman E (2016) A profit-driven Artificial Neural Network (ANN) with applications to fraud detection and direct marketing. Neurocomputing 175:121–131

Moro S, Cortez P, Rita P (2014) A data-driven approach to predict the success of bank telemarketing. Decis Support Syst 62:22–31

Yan C (2018) Convolutional Neural Network on a structured bank customer data. Towards data science. Available online: https://towardsdatascience.com/convolutional-neural-network-on-a-structured-bank-customer-data-358e6b8aa759, Accessed on 25 Mar 2020

Ładyżyński P, Żbikowski K, Gawrysiak P (2019) Direct marketing campaigns in retail banking with the use of deep learning and random forests. Expert Syst Appl 134:28–35

Ogwueleka FN, Misra S, Colomo-Palacios R, Fernandez L (2015) Neural network and classification approach in identifying customer behavior in the banking sector: a case study of an international bank. Hum Factors Ergon Manuf Serv Ind 25(1):28–42

Davies F, Moutinho L, Curry B (1996) ATM user attitudes: a neural network analysis. Mark Intell Plan 14:26–32

Hsieh NC (2004) An integrated data mining and behavioral scoring model for analyzing bank customers. Expert Syst Appl 27(4):623–633

Laukkanen T, Pasanen M (2008) Mobile banking innovators and early adopters: How they differ from other online users? J Financ Serv Mark 13(2):86–94

Wang G, Bai Y, Sun Y (2018) Application of BP neural network algorithm in bank customer hierarchy system. In: 2017 3rd international forum on energy, environment science and materials (IFEESM 2017), Atlantis Press

Zhou X, Bargshady G, Abdar M, Tao X, Gururajan R, Chan KC (2019) A case study of predicting banking customers behaviour by using data mining. In: 2019 6th international conference on behavioral, economic and socio-cultural computing (BESC), IEEE, pp 1–6

Vieira A, Sehgal A (2018) How banks can better serve their customers through artificial techniques. In: Digital marketplaces unleashed, Springer, Berlin, pp 311–326

Krishnan K (2020) Chapter 7—Banking industry applications and usage. Building Big Data Applications, Academic Press, pp 127–144

Marous J (2018) Meet 11 of the most interesting chatbots in banking. The Financial Brand. Available online: https://thefinancialbrand.com/71251/chatbots-banking-trends-ai-cx/, Accessed on 26 Mar 2020

Quah JT, Chua YW (2019) Chatbot Assisted Marketing in Financial Service Industry. In: International conference on services computing, Springer, pp 107–114

Przegalinska A, Ciechanowski L, Stroz A, Gloor P, Mazurek G (2019) In bot we trust: a new methodology of chatbot performance measures. Bus Horiz 62(6):785–797

Spanoudes P, Nguyen T (2017) Deep learning in customer churn prediction: unsupervised feature learning on abstract company independent feature vectors. arXiv preprint arXiv:1703.03869

Mirashk H, Albadvi A, Kargari M, Javide M, Eshghi A, Shahidi G (2019) Using RNN to predict customer behavior in high volume transactional data. In: International congress on high-performance computing and big data analysis, Springer, pp 394–405

De Caigny A, Coussement K, De Bock KW, Lessmann S (2019) Incorporating textual information in customer churn prediction models based on a convolutional neural network. Int J Forecast (In Press)

Leo M, Sharma S, Maddulety K (2019) Machine learning in banking risk management: a literature review. Risks 7(1):29

Petropoulos A, Siakoulis V, Stavroulakis E, Vlachogiannakis NE (2020) Predicting bank insolvencies using machine learning techniques. Int J Forecast. https://doi.org/10.1016/j.ijforecast.2019.11.005 In Press

Lin WY, Hu YH, Tsai CF (2011) Machine learning in financial crisis prediction: a survey. IEEE Trans Syst Man Cybern Part C Appl Rev 42(4):421–436

Sezer OB, Gudelek MU, Ozbayoglu AM (2020) Financial time series forecasting with deep learning: a systematic literature review: 2005–2019. Appl Soft Comput 90:106181

Karisma H, Widyantoro DH (2016) Comparison study of neural network and deep neural network on repricing GAP prediction in Indonesian conventional public bank. In: 2016 6th international conference on system engineering and technology (ICSET), IEEE, pp 116–122

Culkin R, Das SR (2017) Machine learning in finance: the case of deep learning for option pricing. J Invest Manag 15(4):92–100

Weigand A (2019) Machine learning in empirical asset pricing. Financ Mark Portf Manag 33(1):93–104

Chen Y, Rabbani RM, Gupta A, Zaki MJ (2017) Comparative text analytics via topic modeling in banking. In: 2017 IEEE symposium series on computational intelligence (SSCI), IEEE, pp 1–8

Rönnqvist S, Sarlin P (2017) Bank distress in the news: describing events through deep learning. Neurocomputing 264:57–70

Mai F, Tian S, Lee C, Ma L (2019) Deep learning models for bankruptcy prediction using textual disclosures. Eur J Oper Res 274(2):743–758

Qu Y, Quan P, Lei M, Shi Y (2019) Review of bankruptcy prediction using machine learning and deep learning techniques. Procedia Comput Sci 162:895–899

Vo NN, He X, Liu S, Xu G (2019) Deep learning for decision making and the optimization of socially responsible investments and portfolio. Decis Support Syst 124:113097

Luo C, Wu D, Wu D (2017) A deep learning approach for credit scoring using credit default swaps. Eng Appl Artif Intell 65:465–470

Sirignano J, Sadhwani A, Giesecke K (2018) Deep learning for mortgage risk. Available at: https://doi.org/10.2139/ssrn.2799443

Addo PM, Guegan D, Hassani B (2018) Credit risk analysis using machine and deep learning models. Risks 6(2):38

Kvamme H, Sellereite N, Aas K, Sjursen S (2018) Predicting mortgage default using convolutional neural networks. Expert Syst Appl 102:207–217

Gomez JA, Arevalo J, Paredes R, Nin J (2018) End-to-end neural network architecture for fraud scoring in card payments. Pattern Recognit Lett 105:175–181

Fu K, Cheng D, Tu Y, Zhang L (2016) Credit card fraud detection using convolutional neural networks. In: International conference on neural information processing, Springer, pp 483–490

Zhang Z, Zhou X, Zhang X, Wang L, Wang P (2018) A model based on convolutional neural network for online transaction fraud detection. Secur Commun Netw 2:1–9

Kazemi Z, Zarrabi H (2017) Using deep networks for fraud detection in the credit card transactions. In: 2017 IEEE 4th international conference on knowledge-based engineering and innovation (KBEI), IEEE, pp 0630–0633

Zamini M, Montazer G (2018) Credit card fraud detection using autoencoder based clustering. In: 2018 9th international symposium on telecommunications (IST), IEEE, pp 486–491

Pumsirirat A, Yan L (2018) Credit card fraud detection using deep learning based on auto-encoder and restricted boltzmann machine. Int J Adv Comput Sci Appl 9(1):18–25

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Hassani, H., Huang, X., Silva, E. et al. Deep Learning and Implementations in Banking. Ann. Data. Sci. 7, 433–446 (2020). https://doi.org/10.1007/s40745-020-00300-1

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40745-020-00300-1