Abstract

We examine the effects of supervision activities and structure on the risk-adjusted performance of banking institutions. For a data set of 450 banks from 20 economies of Central Eastern Southern Eastern Europe, we employ the moderation analysis framework and find that the supervision structure affects the supervision activities. Especially, this is relevant for bank units with a status “too-big-to-fail” on the national level. Seemingly, supervision scrutiny does not affect their performance, and it is associated with lower riskiness. On the contrary, such an effect is negligible for bank units with lower capitalization. The findings highlight the area of attention for regulators and policymakers and thus contribute to the designing of effective supervision mechanisms.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1.1 Introduction

While the academic literature has paid increasing attention to the impacts of financial regulations on the banking sector, for example (Demirgüç-Kunt et al., 2008; Laeven & Levine, 2009; Barth et al., 2010, 2013), few studies are dedicated to the analysis of supervision efforts in the monitoring and enforcement of established rules, which are often carried out by national regulators or on behalf of supranational banking authorities, e.g. in the case of cross-border banking activities. Supervision is rarely examined separately from regulations for several reasons. In the practical world, it is difficult to explore regulation and supervision separately due to their overlapping nature as they can interact in a complex way (Ongena et al., 2013). Partly, it is attributable to the relative opacity of supervisory activities, which stems from supervisors’ reliance on confidential information (Eisenbach et al., 2016). Relatively, little is known about the distinct impact of supervisory monitoring efforts on the performance of banks.

In this paper, we build upon the recent studies with the focus on broad concept of supervisory attention without limiting to the specific supervisory programme similar to Eisenbach et al. (2016) and Hirtle et al. (2019) and adapt it to the analysis of the banking sector in Central Eastern and Southern Eastern Europe (CESEE) (Janda & Kravtsov, 2021). We exploit a cross-country difference in supervisory activities and structure to analyze the effects of supervision scrutiny on the risk-adjusted performance of the banking sector. Our hypothesis is that supervisory monitoring is associated with the lower riskiness of banking institutions and simultaneously does not impact their economic performance. Specifically, we attempt to answer the following questions:

-

1.

How the proposed proxies for enhanced supervisory: (i) too-big-to-fail (TBTF) status measured as top three highest-ranking banks on a country level and (ii) low quartile of capitalization relate to the risk-adjusted performance of the banking units in CESEE

-

2.

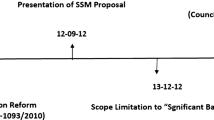

Whether the structure of supervision, i.e. national or decentralized versus centralized or supranational, has an impact on monitoring efforts and supervision activities in the form of the Single Supervisory Mechanism (SSM)

These questions are especially relevant for the regulation of banks in the region of our interest, where cross-border banking activities are significant and supervisory structure plays a significant role in the financial stability of the national economies and, consequently, the European Union (EU). In this study, we are motivated also by the latest European Central Bank (ECB) discussions on the allocation of power and responsibilities for conduct and supervision policies for the economic and financial environment, in the context of integrated supervision and regulations (Schoenmaker et al., 2011; Ampudia et al., 2019; Carstens, 2019).

Our paper contributes to the latest literature dedicated to the investigation of the impact of regulations and supervision structure on the performance of banking institutions; for example, the studies of Ongena et al. (2013), with a focus on the Central Eastern Europe (CEE) region, indicate the presence of cross-border spillover effects of domestic regulation and supervision; Djalilov and Piesse (2019) suggest that banking regulations such as those concerning capital requirements, market discipline and supervisory power are not sufficiently effective to improve the banking efficiency in the region. Bisetti (2020) highlights a novel substitution effect between public monitoring by regulators and private monitoring by shareholders; Hirtle et al. (2019) find that more supervision adds value over and above the effects of regulation. As an example, when it comes to top US banks, ranked by size within supervisory districts, these bank units, which are subject to increased supervisory attention, tend to hold less risky loan portfolios, are less volatile and are less sensitive to industry downturns. However, they have slower growth and are less profitable.

According to Bisetti (2020), the agency theory predicts a positive role for regulation in reducing shareholder monitoring costs. His findings highlight a novel substitution effect between public monitoring by regulators and private monitoring by shareholders. The results of the studies by Djalilov and Piesse (2019) suggest that banking regulations such as those concerning capital requirements, market discipline and supervisory power are not sufficiently effective to improve banking efficiency in the transition countries. This suggests that policymakers and supervisors need to explore the weaknesses of existing banking regulations and improve their effectiveness. While doing so, they need to take account of the specifications of their institutions as well as the business and economic environment.

Kandrac and Schlusche (2019) find that financial institutions that witnessed a reduction in supervision took on much more risks than their counterparts, which were subject to identical regulations but unaffected by a change in supervisory attention. From a policy perspective, their findings underscore the importance of supervision per se as a companion to financial regulation in banking policies. They show that allocating sufficient supervisory resources has an important effect on bank behaviour and is crucial for optimal banking policy and financial stability. Additionally, our paper relates to the stream of theoretical literature with a focus on the analysis of the incentives of regulators in cross-border banking activities (Calzolari & Loranth, 2011; Beck et al., 2012) and the benefits and costs of centralized and decentralized banking supervision (Schoenmaker et al., 2011; Näther & Vollmer, 2019).

Following the conceptual framework (Laffont & Tirole, 1993; Dewatripont & Tirole, 1994; Eisenbach et al., 2016), we construct the proxies for higher supervisory attention on the country level. The identification strategy stems from the cross-country comparison of the supervision structure in relation to the strength of a signal to the enhanced supervision contingent on the individual bank characteristics and country macroeconomic conditions. We propose two proxies as a signal for enhanced supervisory attention from the point of view:

-

1.

Macroprudential: “too-big-to-fail” (TBTF), which is represented by the three largest banks, i.e. the highest ranking by asset size, on a single country level. On an individual bank level, the TBTF status is aligned with the definition of a large bank according to the World Bank statistics. A large bank is defined as such when its total assets account for larger than 20% of the national gross domestic product (GDP).

-

2.

Microprudential: the lowest quartile of the solvency ratio (CAP_low) among peers on a single country level.

The main findings indicate that the supervision structure (i.e. centralized or decentralized supervision) matters only for the segment of larger banks (TBTF) in the national economies in the CESEE region. Supervision scrutiny does not affect their performance and is associated with a decline in the riskiness of these banks. For bank units with lower capitalization (measured as the lowest quartile of solvency ratio on a country level), we do not find any statistical evidence that the supervisory structure affects supervisory efforts ultimately leading to improvement in risk-adjusted performance. This study provides important policy implications highlighting the area of attention on banking regulators and policymakers in the CESEE region.

1.2 Data and Variables

The sample consists of 450 commercial banks from 20 economies of the European Union (EU) and European non-EU member states.Footnote 1 The bank-level data are obtained from the database BankFocus. The data cover a 7-year period, from 2012 to 2018, which corresponds to the time after the financial crisis in 2008–2010. It allows us to consider the effect of changes in economic cycles, as in Stádník et al. (2016), on the results of the calculation. The data from BankFocus are presented in the form of annual results of banks, whose financial statements are available for at least 3 years during the period 2012–2018. We restrict our sample to bank units with total assets above 100 million EUR by the end of 2018. Furthermore, the sample is refined by manually checking and removing bank units that report an error and inconsistent data. To remove the outliers, we winsorize all financial data at lower 2.5% and upper 97.5%. We acquire the macroeconomic data for GDP growth, unemployment and inflation, as well as market power concentration, from the World Bank Development Indicators.

The dependent variables are the risk-adjusted performance metrics. We use several metrics that capture performance, taking into account risk and economic capital, and for robustness, we use mixed metrics, including the simple accounting metrics. The primary measure of performance is a risk-adjusted return on capital (RAROC). It is commonly employed to assess the profitability of a portfolio or financial institution, taking into account the risk that is being assumed. The ratio shows a risk traded off against a benefit. It is defined as the ratio of the expected rate of return to the risk-based required capital or economic capital (Klaassen & Eeghen, 2009):

where ERit is the expected rate of return and ECit is the economic capital of the bank unit i at the time period t. The expected rate of return ERit for banking unit i at time t is its realized profit NI, plus profit fluctuations σi, which can vary across units and over the observation period.

The economic capital EC in the denominator is the amount of capital that is needed to secure survival in a worst-case scenario or potential unexpected losses. Thus, we work with a common benchmark of minimum capital requirements.Footnote 2 It is calculated as risk-weighted assets (RWA) of the banking unit divided by the minimum required regulatory capital (CAR) threshold:

For robustness, we employ other metrics with semi-risk adjusted and pure accounting measures. Semi-risk adjusted metrics are represented by the ratio of return on risk-weighted assets (RORWA). It is an indicator of accounting profit per unit of risk and is measured by profit before tax as a percentage of the total risk-weighted assets. These measures are complemented by the classic accounting metrics on the performance of investments, which is measured by the ratio of net income to average equity (ROAE).

1.2.1 Observable Characteristics

The proposed proxies of supervisory attention, such as the highest ranking and low capitalization, imply certain observable characteristics, which we ought to control in the selection of the relevant covariates. First of all, we control for the size, which is an important determinant of banks’ risk and performance; for example, Demsetz and Strahan (1997) find evidence that size is an advantage due to the diversification effect. Size is represented by a logarithm of total assets (TAlog). The business model and efficiency are the determining factors of the performance and riskiness of banking operations. For this, we consider metrics such as net interest margin (NIM) and the ratio of the gross loan to total assets (LOANTA). These identify the portfolio and business mix and the proportion of standard banking activities, such as lending (Teplý et al., 2015; Kuc & Teplý, 2018). The funding and liquidity structure is represented by the ratio of customer deposits to total liabilities (DLR) and loan-to-deposit ratio (LDR). DLR is capturing the structure of funding with more safe deposits in comparison to other funding sources. LDR ratio is used to assess a bank’s liquidity by comparing its total loans to its total deposits for the same period. If the ratio is too high, it means the bank may not have enough liquidity to cover any unforeseen fund requirements (Table 1.1).

1.3 Empirical Strategy and Methods

Noting the complexity of relationships and interlinks on various levels of policies, regulations and individual bank performance, primarily we attempt in our modelling approach to track evidence of statistical significance in the causal relationships among the model inputs, namely outcome variables of performance, supervision attention proxies, supervision structure and explanatory variables. With the goal of establishing a potential link between the effect of supervision structure and the bank risk-adjusted performance, we adopt the following empirical strategy.

First, since supervisory attention is endogenously related to the current and expected bank performance, we construct the relevant proxies for a signal to enhanced supervisory attention. Identification stems from a cross-country comparison of the supervision structure (mediator) in relation to the strength of a signal to the enhanced supervision (treatment effect). Simultaneously, we control the bank-specific and country macroeconomic conditions that potentially can influence the outcome of interest (bank performance). In modelling, we assume that the effectiveness of supervision activities is identical irrespective of the geography.

Second, we employ the conventional way of analyzing the causal interactions effects in moderation analysis (Judd & Kenny, 1981; Baron & Kenny, 1986) with a help of hierarchical multi-regression approach (Aiken & West, 1991) and adapted to the causal inference framework (Imai et al., 2010; Imai & Ratkovic, 2013). The advantage of such an approach is that it allows researchers to test competing theoretical explanations by identifying intermediate variables or moderators, which contribute to the outcome through the treatment effect. A moderation analysis implies a statistical interaction effect from the interaction between continuous or categorical variables, whereby the introduction of a moderating variable tends to change the direction or magnitude of the relationship between treatment and outcome variables (Hayes, 2013).

1.3.1 How Does a Signal for Higher Supervisory Attention Relate to the Risk-Adjusted Performance of Individual Banks?

We start with testing how the proxies for a signal to enhanced supervisory attention relate to the performance of the banking units in our sample. There are three types of performance metrics for the purpose of cross-examination and robustness, as described in Sect. 1.2. We employ the ordinary least square (OLS) unit and fixed effects regression to the panel data as a baseline model:

where i, c and t represent the bank, country and time period, respectively. Outcome variable Yict is a performance metric that is measured by the following indicators: (i) risk-adjusted return on capital (RAROC), in the definition of Klaassen and Eeghen (2009); (ii) alternatively, return on risk-weighted assets, which is the ratio of net income to risk-weighted assets (RORWA); and (iii) the standard accounting measure of return on average equity (ROAE). Tict is a treatment indicator for the signal of enhanced supervision. It takes a value of 1 if the bank unit belongs to the treated group (e.g. status of TBTF on the national level or with the lowest quartile of the capitalization CAP_low), and 0 is assigned to the control group, i.e. other remaining units in the sample. Controlsit denotes a set of specific characteristics of the bank units. Macroct is a set of country-specific variables that capture macroeconomic conditions: GDP growth, inflation and unemployment. Following Vozková and Teplý (2018), we incorporate also market concentration metrics measured by the Herfindahl Hirschman Index (HHI). ηct represents the dummy variables capturing, within the state, endogenous time-variant macroeconomic country conditions, such as economic growth. εict is the idiosyncratic error.

The results of the specification are presented in Table 1.2 in the Appendix. As anticipated, we observe in the sample that the largest banks show a better risk-adjusted performance in all types of metrics (1–3), probably utilizing the economy of scale effect and benefits of diversification. On the other hand, the bank units with lower capitalization indicate poorer risk-adjusted performance (4–6), most likely due to less efficient operations or defaults in their portfolio.

1.3.2 Does the Centralized or Decentralized Supervision Structure (SSM) Have Any Contribution to the Total Effect of Supervision Scrutiny?

With an ambitious goal of drawing a conclusion on the nature of causal relationships between supervisory structure, proposed proxies and outcome, a finding of any statistical significance will help us confirm the existence (or absence) of a link between supervision structure and the effectiveness of supervision scrutiny. Ultimately, it should lead us to the assessment of the impact on the performance of individual banks and thus fulfilling the main goal of this analysis. To do so, we adopt the hierarchical multi-regression approach of Aiken and West (1991). A common approach to the moderator analysis is based on multiple regressions, where we test the impact of different variables alone and together with interactions by determining whether their coefficients differ significantly from 0 (Baron & Kenny, 1986). In our case, we are interested in the investigation of the effect of the treatment T (supervisory attention) on the final outcome Y (bank performance) through the intermediate variable or moderator M (supervision structure). The intermediate effect variable is a binary variable that equals 1 if the bank unit belongs to the country under the centralized supervisory regime (e.g. SSM) and 0 otherwise. The simple moderation model employed in the study is formally expressed as a series of regression equations:

where X denotes a set of bank-specific characteristics related to the treatment effect (signal to supervisory attention) with the indexes unit i, time period t and country c. The specification includes macroeconomic and market controls all identical to the ones used in Eq. 1.3. If the β1 and β3 coefficients in Eqs. 1.4, 1.5, and 1.6 are non-zero and statistically significant, then the existence of the moderation effect can be confirmed. The interpretation of the β1 and β3 estimates hold greater relevance for the moderation model. In testing the size of the moderation effect, the aim is not just to confirm whether treatment T causes Y contingent on moderator M, controlling a set of confounders X, but also to determine whether β3 deviates too far from 0 or not.

1.4 Results and Discussions

The results of hierarchical linear regressions on the outcome variable of risk-adjusted performance are reported in Table 1.3 in the Appendix. For the treatment indicator “too-big-too-fail” (TBTF) in the models (2–3), the β1 and β3 estimates are significant, and β3 ≠ 0. The results confirm the presence of a moderation effect of the supervision structure through a treatment effect (enhanced supervisory attention) on the outcome. Adding the interaction term in the regression model (3), the explanatory power of the regression model is strengthened negligibly, with a minor increase in the values of the adjusted R2 from 0.274 to 0.276. For a treatment indicator of higher supervisory attention, such as a lower quartile of capitalization (CAP_low), we observe a weak association and an absence of the moderation effect. The estimate β3 shows no statistical significance in the model (6), while the estimate β1 in the model (4–5) indicates a significant statistical power (−0.052**) at a 95% confidence interval. No changes in the values of the adjusted R-squared in the models (4, 5 and 6) confirm the absence of such an effect too. These findings indicate that the supervision structure (i.e. centralized or decentralized supervision) matters only for the category of larger banks (TBTF) on the country level in the CESEE region. Supervision scrutiny does not affect their performance, while seemingly it is associated with lower risk in this category of bank institutions. For the bank units with lower capitalization, we find no statistical evidence that the supervisory structure contributes in any way to supervisory efforts ultimately leading to improving risk-adjusted performance. A more comprehensive analysis has to be performed to get more insights into this matter.

This analysis presents an initial view and is not intended to draw an explicit conclusion about the positive or negative nature of the causal relationships between supervisory structure, proposed proxies for supervisors’ attention and outcome. Nevertheless, a finding of evidence with statistical significance helps us identify the existence of a link between the supervision structure and its impact through the scrutiny of banking supervision on the safety and soundness of the largest banking institutions in the CESEE region. Thus, it fulfils the ultimate goal of this specific study. These findings provide also important policy implications related to the banking regulation and supervisory mechanism of the larger banks in the region. Especially, it is important for ensuring the financial stability of the CESEE region, where the subsidiaries of large multinational banking groups constitute a large proportion of the systemically important banks in the national economies.

1.5 Conclusion

In this paper, we study the impact of the supervision structure and regulatory scrutiny on the risk-adjusted performance of banking institutions. To do so, we employ a novel empirical strategy with the application of the moderation analysis to study intermediary effects based on the data set of 450 banks from 20 economies of the CESEE region. Our findings suggest that the supervision structure (i.e. national or supranational of SSM) matters mostly for larger banks with a status “too-big-to-fail” (TBTF) in the region of our interest. Supervision scrutiny does not affect their performance, while it is associated with lower riskiness. On the contrary, we do not observe a similar effect for bank units with lower capitalization. These findings provide important policy implications related to the banking regulation and supervisory mechanism of the largest and systemic banks. In particular, it is relevant for the supervision of the largest subsidiaries of multinational banking groups, which constitute a major portion of the systemically important banks in the national economies of the CESEE region.

Notes

- 1.

List of countries in sample – EU members: Bulgaria, Croatia, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Romania, Slovakia and Slovenia. Other are non-EU members: Albania, Bosnia and Herzegovina, Kosovo, Macedonia and Serbia, and former Soviet Union independent states: Belarus, Moldova, Russia and Ukraine.

- 2.

Note: the minimum capital requirements may vary slightly across the countries and the period 2011–2016. The exact data for calculation are obtained from the World Bank – Bank Regulation and Supervision Survey

References

Aiken, L. S., & West, S. G. (1991). Multiple regression: Testing and interpreting interactions. Sage.

Ampudia, M., Beck, T., Beyer, A., et al. (2019). The architecture of supervision. Social Science Research Network.

Baron, R. M., & Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51, 1173–1182. https://doi.org/10.1037//0022-3514.51.6.1173

Barth, J. R., Lin, C., Ma, Y., et al. (2010). Do bank regulation, supervision and monitoring enhance or Impede Bank efficiency? Social Science Research Network.

Barth, J. R., Lin, C., Ma, Y., et al. (2013). Do bank regulation, supervision and monitoring enhance or impede bank efficiency? Journal of Banking & Finance, 37, 2879–2892. https://doi.org/10.1016/j.jbankfin.2013.04.030

Beck, T., Todorov, R., & Wagner, W. (2012). Supervising cross-border banks: Theory, evidence and policy. Social Science Research Network.

Bisetti, E. (2020). The value of regulators as monitors: Evidence from banking. Social Science Research Network.

Calzolari, G., & Loranth, G. (2011). Regulation of multinational banks: A theoretical inquiry. Journal of Financial Intermediation, 20, 178–198. https://doi.org/10.1016/j.jfi.2010.02.002

Carstens, A. (2019). The quest for financial integration in Europe and globally. Web page accessed: https://www.bis.org/speeches/sp190912.htm

Demirgüç-Kunt, A., Detragiache, E., & Tressel, T. (2008). Banking on the principles: Compliance with basel core principles and bank soundness. Journal of Financial Intermediation, 17, 511–542. https://doi.org/10.1016/j.jfi.2007.10.003

Demsetz, R. S., & Strahan, P. E. (1997). Diversification, Size, and Risk at Bank Holding Companies. Journal of Money, Credit and Banking, 29, 300–313. https://doi.org/10.2307/2953695

Dewatripont, M., & Tirole, J. (1994). The prudential regulation of banks. ULB—Universite Libre de Bruxelles.

Djalilov, K., & Piesse, J. (2019). Bank regulation and efficiency: Evidence from transition countries. International Review of Economics & Finance, 64, 308–322. https://doi.org/10.1016/j.iref.2019.07.003

Eisenbach, T., Townsend, R., & Lucca, D. (2016). The economics of bank supervision. Federal Reserve Bank of New York.

Hayes, A. F. (2013). Introduction to mediation, moderation, and conditional process analysis: A regression-based approach. Guilford Press.

Hirtle, B., Kovner, A., & Plosser, M. C. (2019). The impact of supervision on Bank performance. Social Science Research Network.

Imai, K., & Ratkovic, M. (2013). Estimating treatment effect heterogeneity in randomized program evaluation. Ann Appl Stat, 7, 443–470. https://doi.org/10.1214/12-AOAS593

Imai, K., Keele, L., & Tingley, D. (2010). A general approach to causal mediation analysis. Psychological Methods, 15, 309–334. https://doi.org/10.1037/a0020761

Janda, K., & Kravtsov, O. (2021). Banking Supervision and Risk-Adjusted Performance inthe Host Country Environment. FFA Working Papers, 3, Article 2021.001. https://doi.org/10.XXXX/xxx.2020.006

Judd, C. M., & Kenny, D. A. (1981). Process analysis: Estimating mediation in treatment evaluations. Evaluation Review, 5, 602–619. https://doi.org/10.1177/0193841X8100500502

Kandrac, J., & Schlusche, B. (2019). The effect of bank supervision on risk taking: Evidence from a natural experiment. Social Science Research Network.

Klaassen, P., & van Eeghen, I. (2009). Economic capital: How it works, and what every manager needs to know. Elsevier.

Kuc, M., & Teplý, P. (2018). A financial performance comparison of Czech Credit Unions and European Cooperative Banks. Prague Economic Papers, 27, 723–742. https://doi.org/10.18267/j.pep.682

Laeven, L., & Levine, R. (2009). Bank governance, regulation and risk taking. Journal of Financial Economics, 93, 259–275. https://doi.org/10.1016/j.jfineco.2008.09.003

Laffont, J.-J., & Tirole, J. (1993). A theory of incentives in procurement and regulation. MIT Press.

Näther, M., & Vollmer, U. (2019). National versus supranational bank regulation: Gains and losses of joining a banking union. Economic Systems, 43, 1–18. https://doi.org/10.1016/j.ecosys.2018.05.004

Ongena, S., Popov, A., & Udell, G. F. (2013). “When the cat’s away the mice will play”: Does regulation at home affect bank risk-taking abroad? Journal of Financial Economics, 108, 727–750. https://doi.org/10.1016/j.jfineco.2013.01.006

Schoenmaker, D., Allen, F., Beck, T., et al. (2011). Cross-border banking in Europe: Implications for financial stability and macroeconomic policies. Centre for Economic Policy Research.

Stádník, B., Raudeliūnienė, J., & Davidavičienė, V. (2016). Fourier analysis for stock price forecasting: Assumption and evidence. Journal of Business Economics and Management, 17, 365–380. https://doi.org/10.3846/16111699.2016.1184180

Teplý, P., Mejstřík, M., & Pečená, M. (2015). Bankovnictví v teorii a praxi/Banking in theory and practice. Knihkupectví Karolinum.

Vozková, K., & Teplý, P. (2018). Determinants of bank fee income in the EU Banking Industry – Does market concentration matter? Prague Economic Papers, 27, 3–20. https://doi.org/10.18267/j.pep.645

Acknowledgements

This chapter is part of a project that has received funding from the European Union’s Horizon 2020 Research and Innovation Staff Exchange programme under the Marie Sklodowska-Curie grant agreement No.870245. We also acknowledge financial support from the Czech Science Foundation (grant 22-19617S). Views expressed represent exclusively the authors’ own opinions and do not necessarily reflect those of our institutions.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Appendix

Appendix

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Janda, K., Kravtsov, O. (2022). Financial Regulations, Supervision Structure and Banking Performance in CESEE. In: Procházka, D. (eds) Regulation of Finance and Accounting. ACFA ACFA 2021 2020. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-030-99873-8_1

Download citation

DOI: https://doi.org/10.1007/978-3-030-99873-8_1

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-99872-1

Online ISBN: 978-3-030-99873-8

eBook Packages: Economics and FinanceEconomics and Finance (R0)