Abstract

In this chapter we analyze the patterns of international labor migration in a two-country world where one country’s production technology is superior to that of the other country. We exploit an overlapping-generations model which enables us to trace the relevant dynamic considerations. We find that in the absence of international capital movements labor will migrate from the technologically inferior to the technologically superior country unless the stationary autarkic equilibrium is characterized by over-investment relative to the Golden Rule and the long-run elasticity of the interest rate with respect to the technological level is sufficiently large, in which case migration will be from the technologically superior country.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

1 Introduction

Among other things, countries differ in their stock of technological knowledge. Quite often, the technological stock is country specific and remains so even though production factors such as labor and capital are mobile across countries. Relatively little effort has been made either to examine the extent to which given differences in technology entail labor migration or to establish conditions under which a labor migration process will continue or come to a halt. Since certain countries appear to consistently maintain technological superiority over other countries, we find it natural to pose and address the question: how does international migration causally relate to the technological gap?

In this chapter we take the technology gap as given and investigate its migration repercussions. Explaining the formation and persistence of a gap is outside the scope of the current chapter, but a brief reference is in order. By technology we mean more than the mechanical process of turning iron into steel; we mean useful knowledge and experience, institutions and organizational forms (such as the modern corporation and stock exchanges), and even norms and values (such as the work ethic and property rights) that impinge upon and govern the processes of production and exchange. Although countries differ in their historical heritage—size, resources, institutions—a difference which could plausibly give rise to an “initial” technological gap, why is it that over time the gap does not close? One reason may have to do with the link between the evolution of technology and actual production. Inter alia, the former depends on there being an active search for new techniques—new ways of doing things while doing things. To the extent that a difference in initial endowments translates into a difference in the levels of production, the additions to the existing stocks of technology will also differ and hence the technology gap will not close. Furthermore, even though countries can partake in the portion of the stock of knowledge which is common, especially through trade and international relations, when and what they take is a selection process that depends on factors and characteristics which, in themselves, differ among countries. This difference arises partly due to the historical heritage and partly due to ongoing decisions pertaining to investments in higher education, the proportion of the national human capital devoted to acquisition of new knowledge, and so on. To our judgment, just as individuals within (as well as across) countries differ in their productive skills—partly due to a difference in endowments and partly due to different histories of investment decisions in skill acquisition—so do nations differ in their “skills.” And just as it is important to recognize that considerable inter-personal skill differences have a tendency to persist and hence their repercussion for the inter-personal flows of income ought to be investigated, so it is appropriate to study the impact of a (given) technology gap between countries on the inter-country distribution of labor, that is, on international migration. Somewhat surprisingly, hitherto this line of inquiry has not been pursued systematically. Hence, the current chapter.

We start with quite simple considerations. Assume a static, perfectly competitive two-country world wherein capital and labor are combined in the production of a single good. The two countries are identical except for one attribute: their production technologies differ; one country exhibits a Hicks-neutral technological superiority.Footnote 1 It follows immediately that if international capital mobility is not allowed yet labor can move freely, labor will migrate from the technologically inferior to the technologically superior country. Migration will entail equalization of the wage rates across countries at which point it will cease. Yet the rental rate will not equalize; the rental rate in the technologically superior country will remain higher than the rental rate in the technologically inferior country. If, however, capital mobility is allowed as well, both labor and capital will move from the technologically inferior to the technologically superior country. Indeed, in this case all production factors will concentrate in the technologically superior country.Footnote 2

When international capital mobility is prohibited, the patterns of labor migration in the described static world depend on two critical considerations: whether the capital-labor ratios are identical across countries and whether labor migration is motivated exclusively by (inter-country) wage differentials. When international capital mobility is unrestricted, the patterns of migration depend solely on differences in the inter-country returns to labor.

Are the predictions of the static model concerning the patterns of migration in a world that is characterized by international differences in technology indeed plausible? If, in the short run, the capital-labor ratios across countries are identical, the returns to the factors of production are higher in the technologically superior country. As this affects the patterns of savings and capital formation, differences in the capital-labor ratios are bound to arise in the long run. This in turn will impinge upon migration incentives. Furthermore, as will become evident from the dynamic model presented in this chapter, inter-country wage differentials do not constitute all the considerations of potential migrants.

In the current chapter we analyze the pattern of international labor migration in a world characterized by international differences in technologies and by identical individuals within as well as across countries. The analysis is conducted within a dynamic general equilibrium framework for a two-country, one-good two-factor perfectly competitive world where each country is characterized by an overlapping-generations model along the lines of Diamond (1965). This framework allows us to trace the dynamic considerations of potential migrants as a natural consequence of intertemporal utility maximization, and to explicitly incorporate into the analysis the impacts of technological differences on both capital formation and factor returns.

In the absence of international capital mobility, the analysis indicates that in contrast to the prediction of the static models, labor may migrate from the technologically superior country to the technologically inferior country. This occurs if and only if in the technologically superior country the stationary autarkic equilibrium is characterized by over-investment relative to the Golden Rule and the long-run elasticity of the stationary autarkic interest rate with respect to the technological level is sufficiently large. However, if international capital movements are unrestricted, the prediction of this dynamic model tallies with that of the static models: migration takes place, unconditionally, from the technologically inferior country to the technologically superior country.

Two clarifications are in order. First, abstracting from international differences in time preferences within as well as across countries results in a somewhat unusual view of migration. Migration plays an equilibrating role solely in the short run. In the long run, however, it plays neither an equilibrating nor a disequilibrating role. Migration results in a concentration of population in the country with the higher stationary lifetime utility and non-migrants’ stationary welfare is unaffected. The long-run neutrality of migration stems in part from the assumption that individuals are identical within as well as across countries. Migrants perfectly assimilate into the recipient country and consequently do not affect the population composition in either country. The patterns and the welfare implications of international labor migration in a two-country overlapping-generations world in which individuals differ within as well as across countries in their time preferences, but technologies are identical, are analyzed in Galor (1986), where the long-run neutrality of migration is naturally eliminated. Migration plays an equilibrating role affecting non-migrants’ stationary welfare.

Second, as pointed out at the outset, the current chapter does not attempt to explain the technology gap across countries; it is taken as exogenously given. The proposed model and its predictions would be subsequently weakened if the technological differences across countries are systematically linked with other potential differences (e.g., time preferences) across countries. Further analyses, based on endogenous technological differences, are therefore clearly desirable.

2 The World Economy in the Absence of International Factor Movements

Consider an infinite time horizon world where economic activity is performed under perfect competition and certainty. The world consists of two countries. At any period of time capital and labor are combined in the production of a single good. In the absence of international factor movements, \( {L}_t^i \), the endowment of labor in country i, i = A, B, at time t, is exogenously given, whereas \( {K}_t^i \), the endowment of capital in country i at time t, is the output produced but not consumed in the preceding period in country i:

where \( {Y}_{t-1}^i \) and \( {C}_{t-1}^i \) are respectively the aggregate production and consumption at time t − 1 in country i. Thus, capital is fully depreciated after a single period and the population does not grow.Footnote 3

2.1 Production

Production occurs within a period according to a constant-returns-to-scale production function. The function is invariant through time. The output produced in country i at time t, \( {Y}_t^i \), is

where αi > 0 is the technological coefficient in country i. For ε > 0 which is sufficiently small, αi + ε = αj, i, j = A, B; i ≠ j. Namely, country j has an infinitesimal Hicks-neutral technological superiority over country i.

The production function is twice continuously differentiable, strictly monotonic increasing and concave, and is defined on the input space \( {R}_{+}^2 \):

The producers operate in a perfectly competitive environment. The inverse demands for factors of production are therefore characterized by the first-order conditions for profit maximization:

where \( {w}_t^i \) and \( {r}_t^i \) are respectively the wage and the rental rate at time t in country i; output is the numeraire.

2.2 Consumption and Factor Supply

In every period t, L−i individuals are born in country i. Individuals are identical within as well as across time. They live two periods. In the first period they work and earn the competitive market wage, \( {w}_t^i \), and in the second they are retired. Individuals born at time t in country i are characterized by their intertemporal utility function \( u\left({c}_t^{t,i},{c}_{t+1}^{t,i}\right) \) defined over consumption during the first and second periods of their lives, as well as by their unit-endowment of labor during the first period of their lives.Footnote 4

The intertemporal utility function is twice continuously differentiable, strictly monotonic increasing, strictly quasi-concave and is defined on the consumption set \( {R}_{+}^2 \). For every ct > 0 and ct + 1 > 0

At time t young individuals in country i supply their unit-endowment of labor inelastically and allocate the resulting income, \( {w}_t^i \), between first-period consumption, \( {c}_t^{t,i} \), and savings, \( {s}_t^{t,i} \), so as to maximize their utility function \( u\left({c}_t^{t,i},{c}_{t+1}^{t,i}\right) \). The individual’s budget constraint is therefore \( {c}_t^{t,i}+{s}_s^{t,i}\le {w}_t^i \). Since capital is the only store of value in each country and international capital movements are not permitted, second-period consumption is \( {c}_{t+1}^{t,i}={r}_{t+1}^i{s}_t^{t,i} \).

Thus, the maximization problem faced by a young individual in country i at time t is

subject to

Given the properties of the utility function, a solution to the intertemporal optimization exists for strictly positive prices and is unique. The optimal consumption vector of an individual of generation t in country i is \( \left[{c}_t^t\left({w}_t^i,{r}_{t+1}^i\right),{c}_{t+1}^t\left({w}_t^i,{r}_{t+1}^i\right)\right] \). The individual’s savings implied by the solution to (8) are

It is assumed that ∂st/∂rt + 1 ≥ 0 and ∂st/∂wt > 0 (i.e., savings are a nondecreasing function of the interest rate and second-period consumption is a normal good).

2.3 A Stationary Equilibrium

Definition. In the absence of international movements of factors of production an autarkic stationary equilibrium in country i is a stationary price sequence \( \left\{{\hat{w}}^i,{\hat{r}}^i\right\} \) under which in every period the demand for labor in country i equals its aggregate supply, L−i, and the demand for capital equals the aggregate supply of savings in the country, \( {L}^{-i}s\left({\hat{w}}^i,{\hat{r}}^i\right) \). Namely,

Remark 1: Under stationary equilibrium the level of utility attained by an individual in country i is

Lemma 1: The steady-state equilibrium in country i displays local stability if

where \( {\hat{s}}^i=s\left({\hat{w}}^i,{\hat{r}}^i\right) \).

Proof: The dynamical system is characterized by (5), (6), and

Local stability is satisfied if

Consequently, local stability is satisfied if

Noting that, by assumption, \( \partial {\hat{s}}^i/\partial {w}^i>0 \) and \( \left(\partial {\hat{s}}^i/\partial {r}^i\right)\ge 0 \), the lemma follows immediately from (16).

Remark 2: The sole distinction between the two countries is the Hicks-neutral difference in technology.

3 The Pattern of International Labor Migration

3.1 International Capital Mobility Is Not Permitted

Suppose that the sufficient conditions for the existence of a unique and globally stable nontrivial steady-state equilibrium (Galor and Ryder (1989)) are satisfied and that each country is at its stationary autarkic equilibrium. International labor migration is now allowed, yet international capital mobility is not permitted. Individuals spend their entire lifetime in either the home country or the receiving country (in which case, to recall, with regard to their work, consumption, and savings behavior, they become perfect replicas of the individuals in the country they join). Thus, incentives for labor migration from country i to country j exist if and only if

Namely, incentives exist if and only if the utility level attained by individuals who migrate to country j and face its stationary autarkic equilibrium prices \( \left({\hat{w}}^j,{\hat{r}}^j\right) \) is higher than that attained in the country of origin where individuals face the stationary autarkic prices, \( \left({\hat{w}}^i,{\hat{r}}^i\right) \).Footnote 5

Remark 3: Whereas in a static one-good two-factor world incentives for international labor migration are determined solely by the international differences in wages, in the current dynamic framework the incentives for migration are determined by international differences in the stationary autarkic indirect utilities, which in turn reflect the differences in the stationary autarkic baskets of wages and interest rate weighted according to the intertemporal preferences.

Suppose that migrants’ children are born in the receiving country. Namely, the labor endowment at time t + 1 in country i, \( {L}_{t+1}^i \), is

where \( {m}_t^i \) is the net inflow of migration to country i, at time t.

Remark 4: Since individuals (and thus time preferences) are identical within as well as across countries, migration has no effect on the stationary savings per capita, the stationary capital-labor ratio, and thereby on the stationary autarkic equilibrium prices.

Lemma 2: The actual patterns of labor migration during the transition period from the pre-migration to the post-migration stationary equilibrium follow the direction determined by the initial incentives for migration given by condition (17).

Proof: Suppose, without loss of generality, that \( v\left({\hat{w}}^B,{\hat{r}}^B\right)>v\left({\hat{w}}^A,{\hat{r}}^A\right) \). Namely, incentives exist for migration from country A to country B. Suppose that at time t0 (within the stationary state) labor is permitted to migrate internationally. Young individuals in country A at time t0 will find it beneficial to migrate to country B. The number of individuals m0, who will actually migrate from country A to country B at time t0, will be determined by the speed of adjustment in the capital-labor ratios and factor prices in the two countries. The capital-labor ratio in country B will be reduced from \( {\hat{k}}^B \) to \( {k}_0^B \), whereas the capital-labor ratio in country A, will rise from \( {\hat{k}}^A \) to \( {k}_0^B \). The associated wages \( {w}_0^A \) and \( {w}_0^B \), and the expected interest rates \( {r}_1^A \) and \( {r}_1^B \) are such that \( v\left({w}^B,{r}^B\right)=v\left({w}_0^A,{r}_1^A\right) \).Footnote 6 Namely, under these prices there are no further incentives for migration in period t0. In period t1 ≡ t0 + 1, as follows from (18), more people are born in country B and less in A relative to period t0. In the absence of further migration, the capital-labor ratios in the two countries will converge to their autarkic steady-state levels. (Note that the stationary equilibrium is globally stable.) Thus, incentives for migration from A to B will ultimately be restored. The process will continue till all individuals migrate from A to B.Footnote 7

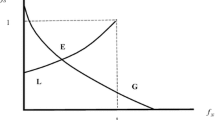

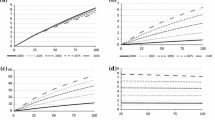

Proposition 1: Consider a stable stationary autarkic equilibrium of a two-country overlapping-generations world where production technologies differ across countries. If restricted or unrestricted international labor migration is permitted, whereas international capital mobility is not allowed,

-

(a)

labor migrates from the technologically superior country (to the technologically inferior country) if and only if

-

(i)

the country’s stationary autarkic equilibrium is characterized by over-investment relative to the Golden-Rule, that is, \( {\hat{r}}^i<1 \), and

-

(ii)

the country’s long-run elasticity of the stationary autarkic interest rate with respect to the technological level is sufficiently large, that is, \( {\hat{\eta}}_{r,\alpha}^i>{\alpha}^if\left({\hat{s}}^i\right)/{\hat{s}}^i\left(1-{\hat{r}}^i\right) \).

-

(i)

-

(b)

labor migrates from the technologically inferior country (to the technologically superior country) otherwise.

Proof: As was established in Lemma 2, international labor migration is in the direction determined by the initial migration condition, which is to say that the pattern of migration is determined by the international differences in the utility levels attained under the stationary autarkic equilibrium. Thus, labor migrates from the technologically superior country, j, if and only if \( v\left({\hat{w}}^i,{\hat{r}}^i\right)>v\left({\hat{w}}^j,{\hat{r}}^j\right) \), whereas labor migrates from the technologically inferior country, i, if and only if \( v\left({\hat{w}}^i,{\hat{r}}^i\right)<v\left({\hat{w}}^j,{\hat{r}}^j\right) \). Noting that the sole difference between the two countries is the technological level, it follows that \( v{\left({\hat{w}}^i,{\hat{r}}^i\right)}_{<}^{>}v\left({\hat{w}}^j,{\hat{r}}^j\right) \) if and only if \( \mathrm{d}v\left({\hat{w}}^i,{\hat{r}}^i\right)/\mathrm{d}{\alpha^i}_{<}^{>}0 \), where, to recall, αi is the technological parameter in country i, αi + ε = αj and ε > 0 is sufficiently small.

Totally differentiating the indirect utility function at the stationary autarkic equilibrium, it follows that

Using the envelope theorem

where \( \mathrm{d}{\hat{p}}^i\equiv \left[\mathrm{d}{\hat{w}}^i,\mathrm{d}{\hat{r}}^i\right] \), and \( {\lambda}^i\equiv \partial v\left({\hat{w}}^i,{\hat{r}}^i\right)/\partial {w}^i \) is the marginal utility of income. \( \left(1/{\hat{\lambda}}^i\right)\mathrm{d}{\hat{v}}^i \) is, therefore, the total change in the stationary per-capita real income in country i.

Using (10) and (11) it follows that

Thus, noting that (11) implies that \( \left[{\alpha}^i{f}^{\prime}\left({\hat{s}}^i\right)-{\hat{r}}^i\right]\partial {s}^i/\partial {\alpha}^i=0 \),

Substituting into (20)

Rearranging terms, it follows that

where \( {\hat{\xi}}^i\equiv {\hat{r}}^i{\hat{s}}^i/{\alpha}^if\left({\hat{s}}^i\right) \) is the share of capital in total output in country i, and \( {\hat{\eta}}_{r,\alpha}^i\equiv -\left[\mathrm{d}{\hat{r}}^i/\mathrm{d}{\alpha}^i\right]\left[{\alpha}^i/{\hat{r}}^i\right] \) is the long-run elasticity of the stationary autarkic interest rate with respect to the technological level.

Lemma 3:

Proof: Totally differentiating the stationary equilibrium conditions (10) and (11) it follows that

where

and

Thus,

where I is the 2 × 2 identity matrix.

Let \( {D}^i\equiv \left[I-{\alpha}^i{M}^i\left(\partial {\hat{s}}^i/\partial {p}^i\right)\right] \). Then it follows that

where ∣Di∣ is the determinant of Di. If the stationary equilibrium is locally stable then ∣Di ∣ > 0 as established in Lemma 1. Adj Di is the transpose of the matrix of the co-factors of Di,

Upon substitution into (30), noting that \( {\alpha}^if\left({\hat{s}}^i\right)={\hat{w}}^i+{\hat{r}}^i{\hat{s}}^i \), the lemma follows. □

Lemma 4: Migration from the technologically superior country to the technologically inferior country occurs only if dri/dαi < 0.

Proof: Using (20)

Thus, since \( \left[\mathrm{d}{\hat{w}}^i/\mathrm{d}{\alpha}^i\right]>0 \) as established in Lemma 2, the lemma follows. □

Applying Lemma 3 and Lemma 4 to (24), the proposition follows, noting that r = 1 if the stationary equilibrium coincides with the Golden Rule. (Recall that full depreciation of capital and zero population growth were assumed.) □

Interpretations: Proposition 1 demonstrates that labor migrates from the technologically superior country to the technologically inferior country if two conditions are fulfilled. The first is that the stationary autarkic equilibrium of the technologically inferior country is characterized by over-investment relative to the Golden Rule. The second is that the long-run elasticity of the stationary autarkic interest rate with respect to the technological parameter must be sufficiently large.

A necessary condition for migration from the technologically superior country is, therefore, a significantly higher rate of interest in the technologically inferior country. Satisfaction of this requirement is demonstrated to be compatible with the local stability of the stationary equilibrium. If the interest rate is indeed higher in the technologically inferior country, then this country has a stationary capital-labor ratio and, thus, stationary output per capita which are lower than those of the technologically superior country.

Consequently, migration from the technologically superior country involves a movement to a country in which the output which is available for distribution between young and old at any point in time is lower. Since, however, the market distribution in the technologically superior country is characterized by dynamic inefficiency (manifested by over-investment relative to the Golden Rule) migration to the technologically inferior country where the interest rate is higher and, thus, closer to the Golden Rule represents an improvement in the intertemporal allocation of wages between first- and second-period consumption. Under the conditions specified in Proposition 1 the improvement in intertemporal efficiency dominates the loss of output from the viewpoint of a migrant (i.e., the improvement in the interest rate is evaluated more than the deterioration in the wage rate). Thus, labor migrates from the technologically superior country to the technologically inferior country.

3.2 Unrestricted International Capital Mobility

Suppose that at the stationary autarkic equilibrium unrestricted international capital movements are permitted. A new stationary equilibrium is achieved in each of the countries, where in the technologically inferior country i,

Proposition 2: Consider a stable stationary equilibrium of a two-country overlapping-generations world where technologies differ across countries and international capital mobility is unrestricted. If international labor migration, restricted or unrestricted, is permitted, labor migrates from the technologically inferior to the technologically superior country.

Proof: Noting (17), since \( {\tilde{r}}^i={\tilde{r}}^j \), an incentive for migration from country i to country j exists if \( {\tilde{w}}^j>{\tilde{w}}^i \). Given the fact that capital movements are unrestricted, wj > wi (where j is the technologically superior country) and hence, incentives exist for migration from country i to country j. The pattern of migration follows the initial incentive since, as long as there is labor in country i, ri = rj and thus, given the technological superiority of country j, wj > wi.

4 Conclusions

In this chapter we provide a microeconomic foundation of international labor migration modeled in a general equilibrium framework of a world characterized by technological differences. Specifically, we have asked which migratory patterns result from technological differences. Although our analysis has utilized a number of specific assumptions, our main results are quite robust to their relaxation. For example, characterizing the technological difference as capital augmenting or labor augmenting will not alter the basic migration rule as stated in Proposition 1; it will only affect the critical magnitude of the long-run elasticity of the interest rate with respect to the technological parameter. Likewise, if transfer of technology takes place and the technological gap narrows yet is not closed, our entire analysis still follows.

We are fully aware that factors other than technological differences impinge on migratory decisions and processes. Since the theme of technological differences and migration has been relatively neglected, our goal has been to isolate several technology-migration connections and explore their repercussions. The role of technological differences in conjunction with other factors such as information, uncertainty, and skill differentiation in the determination of labor migration is a topic of further research.

Change history

27 June 2024

A correction has been published.

Notes

- 1.

- 2.

- 3.

These assumptions are chosen in order to simplify the exposition. The analysis could have been conducted under any feasible rates of population growth and capital depreciation with the main results remaining intact.

- 4.

- 5.

Since time preferences are identical across countries, the phenomenon of bilateral migration as presented in Galor (1986) cannot occur. Furthermore, we do not associate migration with a change in longevity. Clearly, if migration is associated with a change in lifespans, savings and thus capital-labor ratios will be affected. Consequently, migration patterns and welfare will be affected as well.

- 6.

If equalization does not occur, then the lemma is satisfied trivially (i.e., following the initial incentives for migration all individuals from country A migrate to country B).

- 7.

This prediction cannot be brushed aside on the basis of the argument that in reality countries never lose their entire labor force through migration. In reality labor migration is restricted.

References

Bhagwati, J. N. (1964). The Pure Theory of International Trade: A Survey. The Economic Journal, 74, 1–84.

Bhagwati, J. N., & Srinivasan, T. N. (1983). On the Choice Between Capital and Labor Mobility. Journal of International Economics, 14, 209–221.

Diamond, P. A. (1965). National Debt in a Neoclassical Growth Model. The American Economic Review, 55, 1126–1150.

Findlay, R., & Grubert, H. (1959). Factor Intensities, Technological Progress and the Terms of Trade. Oxford Economic Papers, 11, 111–121.

Galor, O. (1986). Time Preference and International Labor Migration. Journal of Economic Theory, 38, 1–20.

Galor, O., & Ryder, H. E. (1989). Existence, Uniqueness, and Stability of Equilibrium in an Overlapping-Generations Model with Productive Capital. Journal of Economic Theory, 49, 360–375.

Kemp, M. C., & Kondo, I. (1986). An Analysis of International Migration: The Unilateral Case. University of New South Wales.

Ruffin, R. S. (1984). International Factor Movements. In R. W. Jones & P. B. Kenen (Eds.), Handbook of International Economics (pp. 237–288).

Wong, K. (1983). On Choosing Among Trade in Goods and International Capital and Labor Mobility: A Theoretical Analysis. Journal of International Economics, 14, 223–250.

Author information

Authors and Affiliations

Corresponding authors

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Galor, O., Stark, O. (2022). The Impact of Differences in the Levels of Technology on International Labor Migration. In: Goulart, P., Ramos, R., Ferrittu, G. (eds) Global Labour in Distress, Volume I. Palgrave Readers in Economics. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-030-89258-6_12

Download citation

DOI: https://doi.org/10.1007/978-3-030-89258-6_12

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-030-89257-9

Online ISBN: 978-3-030-89258-6

eBook Packages: Economics and FinanceEconomics and Finance (R0)