Abstract

This paper shows that different labor market policies can lead to differences in technology across sectors in a model of labor saving technologies. Labor market regulations reduce the skill premium and as a result, if technologies are labor saving, countries with more stringent labor regulation, which bind more for low skilled workers, become less technologically advanced in their high skill sectors, but more technologically advanced in their low skill sectors. We then present data on capital-output ratios, on estimated productivity levels and on patent creation, which tend to support the predictions of our model.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Countries differ in the technologies they use for production. The most studied differences are between rich and poor countries, but even rich countries differ significantly, which is the topic of this paper. We argue that labor market regulations have a significant effect on technology adoption. Labor regulation biases technology toward low skill sectors, while labor deregulation biases technology toward high skill sectors. We present a model, which has this implication, and empirical evidence that tends to support it.

Our theoretical argument relies on the assumption that many technologies are ‘labor cost saving,’ which reduce the amount of labor in production and replace it by machinery, namely by capital. Adoption of such technologies depends on the prices of capital and of labor. High wages induce mechanization, while low wages deter it. We connect wages to labor regulation through changes in the relative supplies of high and low skills. Government regulations of the labor market, like firing costs and other limitations on layoffs, change the supply of low skill workers relative to high skilled. As a result, the low skill wage rises and the high skill wage declines. This leads to more mechanization in the low skill sector and to less mechanization in the high skill sector.

We present the main claim of the paper by a model of ‘labor-cost saving technologies’ with two sectors, high and low skilled. We also assume that workers differ by personal efficiencies and also by education. This heterogeneity enables us to analyze the labor market and its reaction to regulation. We model the labor regulation as firing costs.Footnote 1 When firing costs rise, fewer workers are fired. Since high skilled workers have higher efficiency on average, employers fire fewer of them relative to low skilled workers. As a result, the skill premium declines. Therefore, in countries with more stringent labor regulation, technology adoption is low skill biased, while in countries with less stringent labor regulation, technology adoption is high skill biased.

The model has additional implications, which are empirically testable. One is that labor regulation reduces the ratio between capital in the high skill sector and capital in the low skill sector, due to mechanization. The second result is that labor regulation should reduce productivity in the high skill sector, but its effect on low skill productivity is unclear due to two opposing effects, a negative effect due to lower average efficiency of labor and a positive effect due to higher mechanization. Hence, finding an empirical positive correlation between low skill productivity and labor regulation should indicate that the mechanization effect exists and is even stronger than the other effect. We derive a similar implication with respect to the effect of labor regulation on the skill premium, which can also use to test the mechanization effect. The paper then briefly discusses, for comparison, a model without technology adoption and shows that in this standard model firing costs have different empirical implications than in our model. Finally, we examine the welfare implications of firing costs. While firing costs clearly reduce labor efficiency, they reduce unemployment and reduce taxation due to lower unemployment benefits, so their overall effect on welfare is ambiguous. We present a simulation in which the overall effect is positive.

Our empirical tests use three measures of labor market regulation as explanatory variables. These are Employment Protection Legislation, Union Density, which is the share of union membership, and Union Coverage, which is the share of workers covered by collective bargaining. We test the effects of these three variables on four dependent variables, according to the implications of the model. One is the ratio between capital in the high skill and capital in the low skill sectors. The second variable is productivity in the high and low skill sectors, which we calculate following Caselli and Coleman (2006). The third variable is wage inequality, which represents the skill premium. The fourth variable is patent data by sectors, as we assume that the types of technologies adopted by a country should fit the technologies it develops. Most of the results of the empirical tests support the predictions of our model.

This paper belongs to several lines of research. The first is on technology adoption, trying to understand why it differs across countries. An early contribution to this literature is Parente and Prescott (1994), who point at adjustment costs as barriers to technology adoption. Other papers explain non-adoption by low levels of human capital, or by geographical bias of technologies.Footnote 2 Our model belongs to a specific branch in this literature, called ‘labor costs induced innovations,’ which is an extension of a much earlier literature on ‘directed technical change.’ Our model follows Champernowne (1961) and Zeira (1998), who modeled new technologies as machines that replace workers. Some recent papers that use the idea of labor saving technical change are Hellwig and Irmen (2001), Saint-Paul (2006), Zuleta (2008), and Peretto and Seater (2013). See also Acemoglu (2010) for a summary of this literature.Footnote 3

This paper is also relevant to the research on the recent decline of the share of labor, since replacing workers by machines reduces the share of labor and increases the share of capital in income. Autor et al. (2003) claim that the process of mechanization applies mainly to routine jobs, which are easier to automate. Acemoglu and Autor (2011) argue that automation of routine jobs occurs mainly in middle skill jobs. Karabarbounis and Neiman (2014) and Eden and Gaggl (2016) show that half of the decline in the share of labor is in information and communication technologies (ICT). This paper draws a subtler picture and shows that labor deregulation causes a rise of the share of low skill labor, while it lowers the share of high skill labor, due to differences in technology adoption.

This paper also comments on the research on the relation between technical change and the skill premium. Much of this literature claims that this is a causal relation and skill-biased technical change raises the skill premium.Footnote 4 This paper suggests that the rise of the skill premium and of skill-biased technical change in the US could have been the result of a third development, namely deregulation of labor markets. This paper, therefore, raises the possibility of a reverse causality, where higher wage inequality induces skill biased technical change and not the other way around.Footnote 5

Another related literature is on the economic differences between Europe and the US. While US labor markets have been deregulated and labor unions significantly weakened since the 1980s, most West European countries have kept relatively high levels of labor regulation. According to many economists, these different policies led to the observed differences in unemployment rates between the US and Western Europe and to differences in the skill premium.Footnote 6 The growing differences in labor regulation were documented in many studies, among them Nickell (1997) and Nickell and Layard (1999).Footnote 7 For example, employers can fire workers in France, Germany and Sweden only with advance notices of 7–8 months, while in the US a much shorter time is required. Studies have shown that such differences in labor regulation also led to differences in hours worked.Footnote 8 Other studies have shown that differences in labor regulation have affected also sector distributions.Footnote 9 O’Mahony and Van Ark (2003) argue that labor market regulation led to substitution of labor by capital in some sectors, but do not relate it to technology, as this paper does.Footnote 10 Acemoglu (2003a) and Koeniger and Leonardi (2007) find that labor-capital substitution has been larger than standard production functions imply. Our paper can explain this finding, as technology choice intensifies capital-labor substitution.Footnote 11

The paper is organized as follows. Section 2 presents the basic model. Section 3 derives the main result on technology adoption, while Sect. 4 presents additional results. Section 5 describes the data and Sect. 6 presents some descriptive correlations. Section 7 presents the empirical analysis of the effects of labor regulation on the capital ratio, Sect. 8 on productivities and Sect. 9 on patent creation. Section 10 studies the relation between labor regulation and wage inequality and Sect. 11 concludes. “Appendix A” contains proofs and “Appendix B” contains additional empirical results.

2 A model of technology and labor regulation

Consider an economy with a final good, used both for consumption and for investment, which serves as a numeraire. The population consists of overlapping-generations. In each generation, there is a continuum of people of size 1, who live two periods. In the first period they acquire education, work and save all their net income. In the second period they consume and their utility is described by \(\ln (c)\), where c is consumption in that period of life.

People differ in their labor ability both by education and by personal efficiency. Those who acquire less education are called low skilled, and have a random efficiency e, which is distributed exponentially over [a, \(\infty )\), where \(a>0\) and the density function of efficiency is:

People who acquire more education have on average higher efficiency. More precisely, their efficiency is distributed also exponentially, but over [b, \(\infty )\), where \(b>a\). Let \(L_N \) be the share of low skilled and \(L_S \) the share of high skilled, so that: \(L_N +L_S =1\). We assume that the numbers of high and low skill workers are exogenous.Footnote 12 We further assume that personal efficiency is not verifiable and only employers can observe it, once the worker begins his job. The order of events in the labor market is the following. An employer hires a worker and after she observes his efficiency, she decides whether to keep him employed or to fire him and incur the required firing costs. Due to this informational assumption, individual efficiency is not part of the labor contract, and wages depend only on whether a worker is high or low skilled, which is common knowledge. Note that, although the wage does not depend on individual efficiency, it does reflect average efficiency among the employed, as shown below. We denote the real wage of the skilled by \(w_S \) and the real wage of the unskilled by \(w_N \).

The final good is produced by two goods, the high skilled good S and the low skilled good N, which we call below the high and low skill final goods, using the following CES production function:

The parameter \(\theta \) is the elasticity of substitution between the two goods. As shown in Sect. 5, empirical studies place the elasticity of substitution between high skilled and low skilled labor between 1 and 2. Following these studies, we assume that the elasticity of substitution between the two goods satisfies these bounds as well and hence: \(1<\theta <2\).

The high skilled final good is produced by a continuum of intermediate goods \(i\in [0,1]\), according to the following Cobb–Douglas production function:

where s(i) is the quantity of the high skilled intermediate good i. There are two potential technologies to produce each intermediate good. One is manual, where a unit of i is produced by 1 efficiency unit of high-skilled labor. The second technology is mechanized and one unit of i is produced by a machine of size k(i). Capital depreciates fully within 1 period. We assume for simplicity that once producers want to adopt a mechanical technology, its invention is costless. Hence, the only cost of mechanization is the cost of purchasing the machine. Assume that this cost, k(i), is rising with i, and to simplify the analytical solution we use the following specification:

The coefficient \(\kappa \) is positive. Note that it affects the capital-output ratio and since time-periods in this model are quite long, around 30 years at least, the capital-output ratio should be very low, below 0.1. We therefore assume that \(\kappa \) is low as well. Production of the low skilled final good is similar to that of the high skilled:

Similarly, each low-skilled intermediate good can be produced either by one efficiency unit of low-skilled labor or by a machine of size k(i), where the function k is the same as in (4).

These technological assumptions are important for the model’s results, due to the effect of wages. If wages rise, producers tend to replace labor by new machines, namely they mechanize more intermediate goods and adopt more technologies. Hence, this model is clearly within the literature of ‘labor cost reducing technical change,’ as described in Acemoglu (2010). Our technological assumptions are highly intuitive. Many major technical breakthroughs in the history of economic growth consisted of machines that replaced human and sometimes animal labor. Weaving machines, trains, cranes, computers, and also radio, cinema and television, which replaced many local newspapers and theaters, are just a few examples. Note that such machines can replace low skill labor, like the electric dishwasher, or high skill labor, like GPS, which replaces navigation by map.

We next turn to labor market regulations. Firms face firing costs, which are equal to the wage of the fired worker times h, where \(h<1\). This is a typical employment protection legislation. For simplicity, assume that these costs are payments by firms to the government. We also assume that firms are large, so that the distribution of efficiency within each firm is the same as in the overall economy. Unemployed workers receive a compensation from the government, which is financed by a tax and by the firing costs, which the government collects from firms. The tax is of rate t on wage income. The compensation to unemployed is equal to g times the after-tax wage of the worker, whether high or low skilled, and g is lower than 1.

The economy is open to capital mobility and is small, so that the world interest rate is exogenous and constant. The total cost of capital, which is the sum of the interest rate r and the rate of depreciation, is equal to R = 1 + r.Footnote 13 The economy trades only in the final good, but not in intermediate goods and not in S or N.

We further assume that the parameters of the model satisfy the following three constraints. The first limits the extent of firing costs, to rule out more extreme cases where no workers are fired in equilibrium:

The second constraint limits the labor supplies to ensure that there is a positive skill premium:

The third constraint sets upper and lower bounds on the productivity parameter A:

These constraints guarantee the existence of an interior equilibrium, as shown below.

3 Equilibrium with endogenous technologies

3.1 Employment and firing

Consider a firm in a high skilled sector i that produces by labor and faces a price \(p_S (i)\) and real wage of high skill workers \(w_S \), which is uniform across all sectors. The profit from keeping a worker of efficiency e is \(p_S (i)e-w_S \), while the profit from firing this worker is \(-hw_S \). Hence, the firm will hire only workers with efficiency equal or above a threshold, \(v_S (i)\), where:

To find the price \(p_S (i)\), note that due to free entry, the profits per worker of each firm, which are revenues minus labor costs minus firing costs, are driven to zero:

In “Appendix A” we show how from this condition and from (9) we get:

This equation determines a unique threshold of hiring for each level of regulation h. Due to constraint (6) the threshold satisfies: \(v_S >b\), namely, some workers are fired. The threshold \(v_S (i)\) does not depend on the sector i and hence we denote this hiring threshold from here on by \(v_S \). As a result, prices of high skilled intermediate goods are also equal across sectors that produce with labor and are equal to: \(p_S (i)=p_S =w_S (1-h)/v_S \). The relationship between \(v_S \) and h described by (10) is negative, so that if labor regulation is liberalized, more workers are fired. As h declines toward zero, \(v_S \) rises to infinity. The intuition is that as firing costs disappear, firms fire all workers below average, but this raises the average by more and further increases firing. This result should not worry us too much, as it holds only for extremely low values of h. One way to overcome it is to assume that there is a lower bound for h.Footnote 14

We analyze hiring in low skilled intermediate sectors in a similar way. The hiring threshold in these sectors is independent of the sector as well and is described by:

Similar to high skilled prices, the prices for low skilled intermediate goods are also equal across sectors that produce with labor and is equal to \(p_N =w_N (1-h)/v_N \). From Eqs. (10) and (11) it follows that the threshold \(v_N \) is lower than \(v_S \), but \(v_N -a>v_S -b\), which means that there is more firing in low skilled firms. As h rises, both \(v_S \) and \(v_N \) decline, but \(v_S \) declines by less. This means that higher labor regulation increases the set of high skill workers by more than the set of low skill workers. This leads to an important result of the paper, that labor regulation increases the supply of high skill relative to low skill.

3.2 Technology adoption

Note that the price of a high-skilled intermediate good produced by labor is equal to the average cost of its labor production, as profits are driven to zero by competition. Then, production of a high skill intermediate good is mechanized, if production by labor is more costly than production by a machine, namely if:

Hence, all high skill intermediate goods, for which \(i\le f_S \), are produced by machines, where the technological frontier for high skill workers, \(f_S \), is determined by:

Similarly, all low skilled sectors with \(i\le f_N \), are mechanized, where:

The low cost machines replace workers in the corresponding jobs, while workers in the other jobs remain at work, as machines that can replace them are too expensive. Note, that although technical change substitutes labor by capital, capital is also complementary to labor. Increasing \(f_S \) or \(f_N \) makes the workers in the remaining jobs, \([f_S,1]\) and \([f_N,1]\), more productive, as they work with more machines. Consider for example an accountant, who uses a computer for calculations which she used to do manually before. As a result, she becomes more productive.

3.3 Equilibrium in the goods markets

The supply prices of the high skilled intermediate goods are:

On the demand side, profit maximization in the production of S yields the following first order condition, where \(P_S \) denotes the price of the high skill final good:

A similar condition holds for low skill production as well, where \(P_N \) is the price of the low skill final good. Combining the supply price (14) and the demand price (15) with the production function (3), yields the following equilibrium prices:

The proof of (16) is in “Appendix A”.

We next turn to the demand for the aggregate goods S and N. Profit maximization of the production of the final good (2) leads to the following first order conditions:

By substituting Eq. (17) in the production function (2) and using Eq. (16), we derive the following condition, which describes the equilibrium in the goods markets:

The proof of Eq. (18) is in “Appendix A”. Equation (18) defines a relationship between the two technological frontiers \(f_S \) and \(f_N \), described by the curve G in Fig. 1 below, which is negatively sloped and convex. The constraint (8) implies that the curve G passes below the point (1, 1), and that it crosses the vertical axis above 1.

3.4 Equilibrium in the labor markets

There are two labor markets in the economy, for high skilled and for low skilled. We next describe the equilibrium in each market in efficiency units of labor. Note, that the fired workers are out of the market already, so the amount of employed high skilled labor in efficiency units, denoted by \(E_S \), is equal to:

Applying Eq. (10), we get that the amount of high skilled labor is:

The demand for high skilled labor in efficiency units is equal to:

Using Eqs. (12), (16), and (17) we can show that the demand for high skilled labor is:

Hence the equilibrium condition in the market for high skilled labor is:

Similarly, the equilibrium condition in the market for low skilled labor is:

Dividing Eq. (19) by Eq. (20) leads to the following equilibrium condition:

This labor equilibrium condition describes a positive relationship between \(f_S \) and \(f_N \), which is the positively sloped curve L in Fig. 1 below. Its location is determined by the left hand side of (21), which depends only on the degree of labor regulation, namely on the firing costs parameter h.

3.5 General equilibrium and the effect of labor regulation

Figure 1 describes the two equilibrium conditions of the economy, Eq. (18) of the equilibrium in the goods markets, which is presented by curve G and Eq. (21) of the equilibrium in the labor markets, which is presented by curve L. The two curves intersect at E, which denotes the general equilibrium in the economy. Note that this is a steady state equilibrium which applies to each generation in the economy and to each period. The equilibrium described in Fig. 1 determines the two technology frontiers, \(f_{S}\) and \(f_{N}\). These determine the equilibrium prices according to Eqs. (12), (13) and (16). They also determine the wages of high-skill and low-skill workers at:

Proposition 1

The general equilibrium in this economy exists and is unique. It is always an interior solution: \(0<f_S <1\) and \(0<f_N <1\). Furthermore, in equilibrium the high skill sector is more technologically advanced than the low skill sector: \(f_N <f_S \). If labor regulation is increased, namely if h rises, the L curve shifts downward, and as a result \(f_S \) falls and \(f_N \) rises.

Proof in “Appendix A”.

Proposition 1 presents the main theoretical result of the model. Higher labor regulation reduces the level of technology in the high skill sector, but it increases the level of technology in the low skill sector. The intuition behind this result is the following. Increased firing costs lead firms to fire fewer workers and as a result both \(v_S \) and \(v_N \) decline. This reduces average productivity in both sectors and raises the average cost of labor. This should lead to more technology adoption in both sectors, but due to the constraints in the goods market, this happens only in the market where labor costs increase by more, and this happens in the market for low skill labor. Hence, this sector adopts more technologies, while the high skill sector adopts less.

Note that if skill acquisition is endogenous, and the ratio \(L_S /L_N \) depends positively on the skill premium, we can substitute it in the LHS of (21), and this equation will still depend on the variables \(v_S ,\;v_N ,\;f_S ,\;\hbox {and}\;f_N \) in the same way. As a result, Proposition 1 will hold as well. This justifies footnote (12) above, that the assumption of fixed supplies of skill is not crucial to the main results of the model.

4 Additional results

In this section, we calculate the equilibrium levels of productivity of high and low skilled labor, the skill premium, namely the ratio between wages of high and of low skilled, and the capital ratio between the two sectors. These calculations are important for the empirical analysis, as we can measure these variables, while we do not directly observe \(f_S \) or \(f_N \). In this section we also discuss some welfare implications of the model.

4.1 Capital across sectors

Capital in the high-skilled sector is:

Similarly, capital in the low-skilled sector is equal to:

We divide \(K_S \) by \(K_N \) and use Eq. (16) to obtain the following ratio of capital stocks:

We next examine the effect of more labor regulation, namely higher firing costs h, on the capital ratio. This raises \(f_S \) and reduces \(f_N \). A simple derivation shows that the numerator is a positive function of \(f_S \) if \(f_S (\theta -1)<1\). Since the technology frontier always satisfies \(f_S <1\), and since we assume that \(1<\theta <2\), this condition holds. Hence, the numerator is a positive function of \(f_S \) and similarly, the denominator is a positive function of \(f_N \). As a result, raising h should reduce the capital ratio.

4.2 Productivities of high and low skilled labor

Since the final intermediate goods, S and N, are produced by both labor and capital, we can describe their aggregate production functions. “Appendix A” shows that the production of S depends on \(E_S \), high skill labor in efficiency units, and on capital \(K_S \) in the following way:

Hence, this equation describes a Cobb-Douglas production function where the output-capital elasticity is equal to the technology frontier \(f_S \).

We next write this production function in terms of numbers of workers in each sector, instead of efficiency units. We denote these numbers by \(M_S \) and \(M_N \), respectively. The number of high skill workers is equal to: \(M_S =L_S \exp (b-v_S )\), while high skill labor in efficiency units is equal to: \(E_S =L_S (1+v_S )\exp (b-v_S )\). Hence, effective labor satisfies:

This means that \(1+v_S \) is the average efficiency of high skilled workers. Substituting in (23) we get the following production function:

where productivity of high skill production \(A_S \) is given by:

In a similar way, the production of the low skill good is:

where productivity of low skilled production is:

Next, examine how labor regulation affects the productivities in the two sectors. There are two effects, one through changes in average efficiency of workers and one through changes in technology. A rise in h reduces \(v_S \) and \(v_N \). Hence, average efficiency falls in both sectors and that reduces productivities \(A_S \) and \(A_N \). The effect of the technology threshold on productivity in each sector is more complicated. On the one hand, as technical change reduces the amount of goods produced by labor, more workers operate in each intermediate sector, which increases productivity. On the other hand, as technology increases the number of mechanized sectors, less capital goes to each such sector, which reduces productivity. “Appendix A” examines these combined effects and finds that under plausible assumptions the effect of technology f on productivity, both in (24) and in (25), is positive. Hence, the effect of labor regulation on \(A_{S}\) through technical change \(f_S \) is negative, since labor regulation reduces \(f_S \), while the effect of labor regulation on \(A_{N}\) through technology is positive.

Our model therefore predicts that the effect of labor regulation on \(A_{S}\) should be negative, both due to lower average efficiency of workers and due to the decline of technology in this sector. As for the effect of labor regulation on \(A_{N}\), the result is ambiguous, as labor regulation reduces average efficiency of workers, but it raises technology in the low-skill sectors. Hence, this issue should wait to the empirical tests. If these tests reveal that regulation has a positive effect on \(A_N \), it is an indication that the effect of technology is significant, as it overcomes the lower average efficiency of workers. An alternative test can examine the effect of labor regulation on the ratio between the two productivities, namely on \(\ln A_S -\ln A_N \). We show in “Appendix A” that the change in average labor efficiency increases this difference, while the change in technology reduces it. Hence the empirical test of this ratio can also inform us on which effect is stronger, the labor efficiency or the technology adoption effect.

4.3 The skill premium

We define the skill premium in this model as the ratio between the high and low skill wages, \(W=w_S /w_N \). Using Eq. (9) and the equivalent equation for low skill wage, we get:

Applying Eqs. (12) and (13), we get:

The effect of a rise in h on the skill premium is ambiguous according to Eq. (26), as it increases \(v_S /v_N \) but reduces \(f_S \) and increases \(f_N \), which both reduce W. The reason for this ambiguity is the following. Higher firing costs increase the sets of employed, both high and low skilled, but they push the wage ratio up. Technology adoption works in the opposite direction. Firing costs increase \(f_N \) and hence low skilled workers work with more machines and their marginal productivity increases. The decline of \(f_S \) works in the same direction by reducing the wage of the high skilled. We can therefore conclude that firing costs reduce the skill premium only due to the mechanism of technology adoption. Hence, if the empirical tests reveal such a relationship, it is an additional support to our model of technology adoption.

4.4 Welfare

In this model labor regulation, which is in the shape of firing costs, reduces production efficiency, as firing costs force firms to hire workers with relatively low ability. But the policy has other effects on welfare as well. First, it reduces the set of unemployed. Second, it reduces the tax rate, since the number of unemployed is lower and the government can pay less unemployment benefits. Third and most, it reduces risk, as the group of people who receive low welfare payments is reduced. In this sub-section, we calculate the average expected utility at birth and examine how it behaves, as firing costs h increase. The expected utility of a skilled person at birth is:

Calculating this expected utility by using Eqs. (9) and (12) we get:

In a similar way we find that the expected utility of a low skill person is:

Hence, the average expected utility at birth of each generation in equilibrium is equal to:

As Eq. (27) implies, calculation of the average expected utility requires finding the equilibrium tax rate. Direct calculation of the tax rate, paid by all workers to finance the income of the unemployed minus the firing costs, leads to the following:

Substituting this tax rate in (27) enables calculation of the average expected utility of each generation. Since this calculation is quite complicated analytically, we present a numerical example. We choose the following parameters: \(a = 1\), \(b = 2\), \(L_{S} =0.25\), \((A/\kappa R)^{1-\theta }=1.5\), and \(g = 0.5\). Fig. 2 presents our measure of welfare, the average expected utility of a generation, AVG(U), as a function of h, the intensity of firing costs, which is labor regulation in this model. Figure 2 shows that despite its adverse effect on production efficiency, labor regulation increases welfare, since it is risk reducing, it increases employment, it reduces unemployment payments and thus reduces taxes. Raising firing costs by one percentage point, from \(h = 0.2\) to \(h = 0.21\), increases average expected utility by 0.086, which is equivalent to increasing consumption by 2.77%. This is clearly a significant effect.

4.5 An economy without technological choice

In this sub-section we briefly describe a counter model which is useful for comparison with our results. It is very similar to our model, but it does not have labor-cost-reducing technical change. Consider a model with firing costs which is similar to the one described in Sect. 2, except that production of the high skill good and the low skill good are described by standard production functions. The aggregate production function in this economy is described by:

Here, \(\alpha \) is the output elasticity of capital both in the high and in the low skill sectors.

Since this is a relatively standard model, we do not present here the full solution of the model and just state some of the main results on empirical implications.Footnote 15 The first is the capital ratio between the skilled and unskilled sector:

Since a rise in labor regulation reduces \(v_S \) by less than \(v_N \) it increases the capital ratio as well. This empirical implication is opposite to the one in our model with technology choice. Calculation of the productivities with respect to the number of workers yields:

Hence, higher labor regulation reduces both productivities, since only the average efficiency effect operates in this model. In our main model the effect of technology adoption is added to this effect and might even change the overall effect of labor regulation on \(A_{N}\) from negative to positive.

5 Data

We use three different variables to measure labor regulation. The first is an index of employment protection legislation, denoted EPL. The second is union density, which measures the share of unionized workers and is denoted UD. The third is union coverage, which measures the share of workers covered by collective bargaining and is denoted UC.Footnote 16 EPL is directly related to the firing cost variable h in the theoretical model, but the union variables are correlated with labor regulation, since labor unions in one way or another raise the wages of the lower paid workers and raise firing costs.

Since the main claim of this paper is that changes in labor regulation affect the choice of technology in high and low skill sectors, the ideal empirical strategy would be to test the effect of regulation on some direct measure of technology adoption. Unfortunately, comprehensive data for it are not available. Comin and Hobijn (2004, 2009, 2010) and Comin and Ferrer (2013) have started to collect these data, but what is available is still insufficient for estimating our model, since the number of technologies in this data set, which can be easily classified between high and low skill sectors, is not sufficiently large. Hence, we represent technology adoption with four variables that emerge from the empirical implications of the model. The first is the ratio between capital in high skilled sectors and capital in low skilled sectors, denoted KRATIO. According to our model, it should fall with labor regulation, while in the counter model it should rise. The second variable is productivity, where high skill productivity is denoted AS and low skill productivity AN. According to our model, labor regulation should reduce AS and increase AN, if the technology effect dominates the average efficiency effect. In the counter model it should reduce both. We also examine the effect of labor regulation on a third variable, which is not in the model, but should be correlated with technology adoption. This is country patent production per capita in high and in low skilled sectors, denoted PAT-HS and PAT-LS respectively. Finally, we also test the effect of labor regulation on the skill premium, which we measure by wage inequality. Table 10 in “Appendix B” lists the data sources for all variables.

We next describe the variables in more detail. EPL, from OECD (2013), measures procedures and costs involved in laying-off individuals or groups of workers. More specifically, it is a survey among experts, asked 21 questions in three areas: protection of workers against individual layoff, regulation of temporary employment, and specific requirements for collective layoffs. The survey processes the answers on a scale between 0 and 6, where higher values represent stricter regulation, and then calculates a general score. The variable UD, from Visser (2013), measures the share of union members among workers. We think that it is correlated with labor regulation for three reasons. First, if labor unions are stronger, they apply more pressure on the government to regulate the labor market and to choose policies that reduce wage inequality.Footnote 17 Second, the government can also affect union strength by its labor market policies, both as an employer and as a labor market regulator. Third, governments that tend to regulate labor markets more heavily are usually more favorable to labor and thus tend to curb union activity less. UC measures the share of workers whose wages are covered by collective bargaining. This measure is of course higher than UD and in some cases it is much higher. The correlation between UD and UC is 0.54. Table 1 presents the descriptive statistics of all the variables used in the model.

The measures of labor regulation and unionization vary significantly across countries. In 2000, UD was less than 20% in France (although union coverage was much higher), Korea, Spain and the USA, while it was around 80% in Denmark, Finland and Sweden. While UC was on average 80% over the period in some countries and much higher than UD, it was much lower in the USA, at 22% on average, and with a declining trend, so that it reached 13% in 2011. In 2000 the score for employment protection legislation, EPL, was close to 0 for the USA and lower than 1.5 for Canada, UK, New Zealand, Ireland and Australia. At the same year, it was around 3 for Greece and the Netherlands and it was close to 5 in Portugal. Labor regulation not only differs across countries, but also varies over time. For example, we have observed a significant deregulation of labor markets since the 1980s, which was stronger in the US and milder in Europe.

The calculation of KRATIO uses amounts of capital in low skill and high skill sectors, which are derived from two sources. First, we get the quantities of capital per sector from the EU KLEMS database in O’Mahony and Timmer (2009), which contains information on sectors classified according to the international classification ISIC revision 3. The data contain capital amounts for 56 two digit industries, and end in 2005. We classify these sectors to high-skilled and low-skilled following Robinson et al. (2013), who classify sectors in 4 categories, low-skilled, low-intermediate-skilled, high-intermediate-skilled and high-skilled. Using data on the distribution of skill in sectors, they create three separate taxonomies of sectors by skill, one based on data from the US and the UK, one based on Eurostat data of all EU countries and one on Eurostat data in the 7 largest EU countries. As the three taxonomies are quite similar, they form a final taxonomy that summarizes all three.Footnote 18 We use this classification, but group together for each country the high and high-intermediate skill sectors into high skill and the low and low intermediate skill into low skill. We then calculate for each country the ratio of the amounts of capital for the two sectors, which is denoted KRATIO.

In the calculation of productivities of high and low skilled sectors, we follow Caselli and Coleman (2006) and use similar formulas to calculate productivities from the available data. Since we do not observe the model’s technology frontiers \(f_S \) and \(f_N \), we use the share of capital in output instead and denote it by f, as an average between the two frontiers. The measured productivity of the high skill sector is:

The measured productivity of the low skill sector is:

“Appendix A” shows how these formulas fit our model. It also shows that these measures are biased with respect to the model productivities, but the biases are in direction of our theoretical prediction. A rise in the labor regulation parameter h reduces \(A_{S}\) relative to AS. Thus, if our empirical tests show that labor regulation reduces the measured variable (29), the true effect on high skill productivity is even stronger. Similarly, a rise in h increases \(A_{N}\) relative to (30). Again, if our tests show that labor regulation tends to increase (30), the true effect on productivity is even stronger.

We calculate the two productivities empirically by using data from EU KLEMS on labor, capital, output and high and low skill wage bills. We use data on labor share from PWT 8.0, described in Feenstra et al. (2015). We deviate from Caselli and Coleman (2006) in defining high skilled as workers with secondary education and above.Footnote 19 The elasticity of substitution between high and low skill, \(\theta \), is assumed to be 1.4, as in Caselli and Coleman (2006). Note, that the productivities AS and AN are calculated by using the separate amounts of capital for high and low skill sectors. Such data are available only for countries covered by EU KLEMS. For some empirical tests, we extend the calculation of productivities to more countries by using data on the aggregate amount of capital instead of sector specific capital. This is a less accurate measure, but we present it in “Appendix B”, for robustness.

The information on patent creation is derived from the World Intellectual Property Organization, WIPO (2014). Our data consist of the numbers of high skill patents and low skill patents in a set of countries over many years. The taxonomy of patents by high and low skilled follows Schmoch (2008). We have calculated for each country and each year the numbers of high skill patents and low skill patents per 1000 people.

6 Descriptive evidence

Europe has strong labor regulation, while US labor markets became increasingly deregulated since the 1980s. Table 2 compares the US and Europe with respect to our indicators of technology adoption, namely the capital ratio, productivities and patent creation.Footnote 20 Table 2 shows that the KRATIO is higher in the US than in Europe and it also grows faster. It also shows that high skill productivity is higher in the US than in Europe, while low skill productivity is higher in Europe than in the US. Table 2 also examine the ratio of high skill patents to total patents and shows that this ratio is higher in the US than in Europe. These descriptive statistics are consistent with the empirical implications of our model.

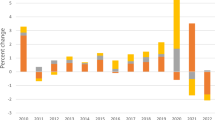

Figure 3 compares the KRATIO for the US and for Europe over the years. It shows the same pattern as emerges from Table 2, but the picture is more detailed. The KRATIO in the US is higher than in Europe and the gap between the two regions is increasing over time, as labor markets in the US become increasingly less regulated.

Figure 4 describes the ratio of AS to AN in a few selected countries, US, UK, Germany, and Italy.Footnote 21 As the figure shows, this ratio is significantly higher for the US and the UK than in the other countries, where labor markets are more regulated. Furthermore, the ratio in the US and the UK is not only higher, but it rises much more than in the other countries. Thus, Fig. 4 indicates that productivity of high skill sectors rises with labor deregulation by more than productivity of low skill sectors. This lends support to the predictions of our model with respect to productivities.

Table 3 presents a more systematic comparison between countries with more and less labor regulation. We divide the countries to low and high EPL, namely above and below the mean, and compare our indicators of technology adoption for these groups of countries. Countries with higher regulation, whether higher EPL, higher UD or higher UC, have a lower KRATIO, higher low skill productivity, lower high skill productivity, and a lower ratio of total patents to PAT-LS.

7 Labor regulation and the capital ratio

Our model implies that more labor regulation reduces the capital ratio between the two main sectors. The results of our tests are described in Table 4. Our dependent variable, KRATIO, is strongly persistent over time, even if there is no evidence of a unit root. A Wald test for all the specifications of Table 4 rejects the null hypothesis of no first-order autocorrelation. Thus, we correct the standard errors according to the procedure of Driscoll and Kraay (1998) and these are the standard errors reported in Table 4. We obtain almost identical results by clustering the standard errors for countries.Footnote 22 Note also that according to Fig. 2, most variability in the KRATIO is across countries, but there is some variability over time, though smaller. We therefore test the effects of labor regulation on KRATIO in panels, to use both variability across countries and over time.

The explanatory variables in Table 4 are our three measures of labor regulation, a constant and two additional variables. One variable is a dummy for the years after 1991, to control for the unification of Germany, since capital ratios differed in Germany before and after the unification.Footnote 23 The second additional variable, Secondary Education, is the percentage share of people with secondary education. We add this variable to account for an alternative explanation for changes in the capital ratio. Both variables happen to have a small and insignificant effect on the results. In addition to testing the direct effects of the measures for labor regulation, we also test for potential interaction between the two main variables, where we test the effect of EPL separately for countries with high and with low union densities. We also include year dummies.

Overall, the regressions in Table 4 support our model and show that labor regulation is negatively correlated with the KRATIO. The regressions show that EPL has a negative effect, of similar size, in all six regressions, and it is significant at least at the 5% level (or better) in all specifications. UC is significant at the 10% level in column (3). UD seems to be dominated by UC, which is indeed a more relevant variable in practice. In column (4) we add to the regression the supply of people with secondary education. The variable has a positive coefficient suggesting that a higher supply of skilled workers is correlated positively with the capital ratio. Finally, in the last two columns, we check if employment protection legislation has an asymmetric effect relative to the presence of unions in the economy. One can possibly claim that in highly unionized countries regulation is less effective, as unions already work in favor of labor. Actually columns (5) and (6) show that this claim is not supported by the data, as the effect of EPL on the capital ratio is stronger in countries with high union density than in countries with low union density.Footnote 24

Table 11 in “Appendix B” examines an additional specification. It tests the effect of labor regulation on the change in the capital ratio over time, denoted \(\Delta \) KRATIO, in a standard panel regression with country fixed effects. The results in Table 11 show a negative effect of labor regulation on the rate of growth of the capital ratio and thus strengthen the message of Table 4. Since the variable KRATIO displays a strong serial correlation, as also shown in the regressions in Table 11, the results could reflect a time trend. We account for that as well by adding a time trend, linear and non-linear, to the regressions on KRATIO. The coefficient of EPL on KRATIO is still negative and significant at 1%, although it becomes smaller.Footnote 25 Hence, the main conclusions of this section survive an addition of a time trend.

8 Labor regulation and productivities

In this section we examine the relationship between labor regulation and the productivities of high and low skill sectors, AS and AN respectively, as calculated in Sect. 5. According to Sect. 4, labor regulation reduces average efficiency of workers in both sectors, but productivity is also affected by technology choice and that reduces AS and increases AN. Hence, examining the correlation between labor regulation and the two productivities allows us to assess the empirical strength of the effect of mechanization. Table 5 presents the tests of labor regulation on the productivities across countries.

Table 5 shows that without year dummies the coefficients are broadly consistent with the implications of our model, but with year dummies the results become inconclusive at best. Without year dummies, the effect of employment protection legislation EPL on AS is negative but insignificant, but after adding the variable UD, the effect of EPL becomes negative and highly significant. The effect of UD on AS is negative and highly significant as well, while union coverage UC has an insignificant effect. The effects of labor regulation on AN are positive, larger in size and more significant. Both EPL and UD increase ln(AN) significantly in all specifications and even UC has a positive and significant effect on ln(AN). Since the effect of labor regulation on low skill productivity is positive, it shows that the technology effect dominates the labor efficiency effect and this supports our assumption on the technology channel.

Clearly, the addition of time fixed effects weakens the support of the tests in Table 5 to our model. One way to account for it, is to note that there is a downward time trend of EPL, due to continuing deregulation. Hence, the year dummies might capture it and reduce the measured impact of the regulation variables. In order to overcome this problem, we examine the effect of labor regulation on the ratio of AS to AN, which is also a litmus paper according to our model, as explained in Sect. 4. This is presented in Table 6. As noted in Sect. 4.2, our model implies a reduction of this difference at higher labor regulation. The results of Table 6 are broadly consistent with this implication of the model, even with year dummies, especially for EPL.

We next discuss some potential alternative mechanisms that could explain the rise of AN with labor regulation. In a series of papers, Acemoglu and Pischke (1999a, b) claim that unemployment insurance or similar transfers enable workers to acquire human capital, which holds mainly for low skill workers. This can be an alternative explanation to the rise in AN, that we observe, but it should lead to a positive effect of labor regulation also on AS, in contrast to our empirical results. Another mechanism, suggested by Moene and Wallerstein (1997), is that labor regulation might increase productivity by forcing less productive firms out. Also, countries with high labor regulation tend to have more vocational education, like apprenticeships, which raises productivity in low skill sectors as well. While these mechanisms are plausible, they cannot explain the negative correlation between labor regulation and productivity in the high skill sector.

Finally, while Tables 5 and 6 present results from a small sample of countries, we extend these results in Tables 12 and 13 in “Appendix B”. There we calculate the productivities for a wider set of countries in the OECD, for which we use of information on aggregate capital instead of sector-specific capital. As noted above, this is a less accurate estimate of productivity. The results of Tables 12 and 13 are broadly similar qualitatively to those of Tables 5 and 6.

9 Labor regulation and R&D

This section examines the correlations between labor regulation and the creation of low skill and of high skill technologies. Our measures of innovation are the number of patents per 1000 people in the high and the low skill sectors, PAT-HS and PAT-LS respectively, as defined in Sect. 5. Table 7 presents the regressions of patent creation on labor regulation, where we use moving averages of patents over intervals of five years. The reason is that patent data reflect the end of rather long R&D activities, and the ending time of such activity is quite random, which adds noise to the data. Hence, patent data might be more erratic than the underlying data on R&D activity, which are the true data we should use in our analysis, if it were observable.Footnote 26 In all the regressions in Table 7 we also add a variable that represents the overall patent activity of the country, as we know that countries differ significantly in their ability to conduct R&D. The variable we use to control for this ability is the number of total patents in the country per 1000 people with a lag. We use a lag to avoid high correlation between this variable and the dependent variables. We denote this variable by PAT-L1.

Columns (1–3) in Table 7 show that labor regulation has a negative effect on high skill patents in the economy. The results are statistically significant for EPL when it is alone and when UD is added to the regression. EPL becomes insignificant in column (3) with the introduction of UC. In this regression the coefficient of UD becomes negative and highly significant. Hence, in all three regressions, the effect of labor regulation is negative and it is significant for at least one of the variables that represent labor regulation. Columns (5–8) present the results of the regressions for low skill patents. Regressions (5–7) show that labor regulation is positively correlated with creation of low skill technologies in a country, as its effect on PAT-LS is positive, especially in regression (6), which includes all the explanatory variables.

In the last columns of each part of this table, regressions (4) and (8), we report results with year dummies. Here our supportive results disappear. We do not have an explanation to this finding. In Table 8 we try to overcome this problem by testing the effect of labor regulation on the ratio of high skill patents to low skill patents. This ratio adds the effect of labor regulation on the two types of patents and can thus identify the effects better, as done in Sect. 8 with respect to productivities. As in Table 7, we include in the regressions in Table 8 also the lagged value of the ratio of patents, in order to control for persistence. The regressions in Table 8 are Blundell–Bond system GMM estimation. The results of Table 8 support the main claim of the paper and the ratio of high to low skill patents depends negatively on two indicators of regulation, EPL and UC. These results hold even if time fixed effects are included.

Finally, we also examine the effect of unemployment benefits on our three measures of technology adoption, as it also represents labor regulation. The variable we use is GRR, gross replacement ratio, in the first and the second year of unemployment. The results are mixed. GRR reduces the capital ratio, like the other variables that we use to measure labor regulation, but it reduces low skill productivity, unlike the other measures of labor regulation. The effect of GRR on patents happens to be insignificant. One possible explanation for such results is that there is a trade-off between EPL and unemployment benefits, as documented by Boeri et al. (2004) and Neugart (2007). Hence, the effect of unemployment benefits on technologies should not be similar to the effects of other labor regulations. These results are available upon request.

10 Labor regulation and wage dispersion

According to our model, the effect of firing costs on the skill premium is ambiguous. On the one hand higher firing costs increase high skilled labor by more than low skill labor, which tends to raise the wage ratio. On the other hand, labor regulation increases low skill technology and reduces high skill technology, which tends to lower the wage ratio. This section examines the empirical correlation between labor regulation and a measure of the wage ratio, which is wage inequality. A negative empirical correlation between labor regulation and wage inequality should be interpreted as domination of the effect of technology adoption over the effect of labor supply and thus as supportive of our model.

We test it by regressing a measure of wage inequality on our variables of labor regulation. We use the observations of the Gini index from the inequality database of UNU-WIDER (2015), which computes them on job earnings. Table 9 presents the results of these regressions, where the regressions that include EPL are over the period 1988–2008, and the regressions with only union variables are over a longer period, 1981–2008. All regressions include year dummies, but regressions with EPL do not include country fixed effects. The reason is that due to a small number of observations, EPL is single valued for almost all countries over time, so it becomes collinear with the fixed effect. As a result, the first four columns are pooled regressions, while the fifth column checks for country fixed effects in a regression of Gini over UD. Overall, the regressions present reasonable evidence of a negative effect of EPL, UD and UC on the Gini index of job earnings.

11 Conclusions

A vast literature studies why countries adopt different technologies. While most of this literature focuses on differences between developed and less developed countries, this paper focuses instead on differences in technology between developed economies. The paper claims that these differences may arise with respect to high and low skill sectors, and that they could be a result of differences in labor market policies. Our model shows that labor market regulation changes the wage premium between high and low skilled and that affects the incentive to adopt technologies. This happens when technologies are embedded in machines that replace workers for specific jobs, or more generally in a model of ‘labor cost induced technical change.’ As a result, countries with high labor regulation adopt more technologies in the low-skill sectors and less in the high-skill sectors, while countries with low labor regulation adopt more technologies in the high-skill sector.

We examine various empirical implications of the model. We identify some measures of labor regulation and then we test how they affect technology adoption. The ratio of capital in the high and low skill sectors falls with labor regulation in our model, while it should rise in a standard model without labor cost reducing technical change. Next, we measure the productivities of high and low skill sectors in each country and examine how they react to labor regulation. Our model predicts that labor regulation should lower productivity in the high skill sector and raise productivity in the low skill sector, while according to the standard model it should lower productivity in both sectors. Our empirical results are somewhat mixed. Overall, they support the model quite well, but some results are sensitive to addition of time fixed effects and some to addition of country fixed effects. We believe that overall, the evidence is positive, but we present all results to the readers, to form their own assessment. We also believe that this important research question deserves further empirical research.

Notes

In a previous version of this paper, we derived similar results using other forms of labor regulation. More details are available by request from the authors.

Koeniger and Leonardi (2007) also raise this possibility.

The effect of such labor institutions on persistent unemployment in the presence of macroeconomic shocks is analyzed by Lazear (1990) and Blanchard and Wolfers (2000). See also Ljungqvist and Sargent (1996), Blau and Kahn (1996a, 2002), Saint-Paul (2004) and Freeman and Katz (2007). For the effect of regulation on the skill premium see Katz and Murphy (1992), Blau and Kahn (1996b, 2002) and Gottschalk and Smeeding (1997).

In Sect. 3.5, we show that the main results of the model hold, even if acquisition of skill is endogenous.

Zuleta (2015) discusses capital flows in a similar model.

A simulation shows that \(v_{S}\) falls sharply as h rises from 0. Another way to avoid v from going to infinity is to assume that even production by labor uses some capital, for structures. In that case, operating profits are not driven to zero. We do not follow this realistic possibility, only because it complicates the solution of the model.

Full proofs of these results are available upon request.

We also experimented with other variables. One is the ratio of minimum wage to average wage, but we decided not to include it in the analysis, since it is clearly an endogenous variable. Another variable we examined is unemployment benefits. We report on its effects in Sect. 10.

Table II.9a in their chapter.

Since our sample of countries includes only OECD economies, this classification is more appropriate than Caselli and Coleman (2006), who use a larger sample of countries and define high skill as primary education. We also tried some form of tertiary education as a definition of high skill, but the results do not change by much.

EU15 are the Western European countries before EU enlargement of 2005. EU27 are all European countries in the EU after the entry of 10 Eastern European countries in 2005 and Bulgaria and Romania in 2007. We have data for all these countries for patents and productivity levels. Finally, the European countries for which we have data in EU KLEMS are Austria, Germany (West before 1990), Denmark, Finland, UK, Italy, Netherlands and from 1995 we have data for Sweden, Portugal, Slovenia and Czech Republic.

Data for France were not available.

These results are available upon request.

We include the dummy for 1991 only for groups of countries, which includes Germany.

We also find that the effects of labor regulation on productivities and on patents, which are discussed in the following sections, do not change sign in highly unionized countries.

These results are available upon request.

It is important to note that this is not the case with respect to the variables in the previous sections, KRATIO and productivities, and this is the reason why we use such averaging only in this section.

References

Acemoglu, D. (1998). Why do new technologies complement skills? Directed technical change and wage inequality. The Quarterly Journal of Economics, 113(4), 1055–1089.

Acemoglu, D. (2003a). Cross-country inequality trends. The Economic Journal, 113(485), 121–149.

Acemoglu, D. (2003b). Factor prices and technical change: From induced innovations to recent debates. In P. Aghion, et al. (Eds.), Knowledge, information and expectations in modern macroeconomics: In honor of Edmund Phelps. Princeton, NJ: Princeton University Press.

Acemoglu, D. (2010). When does labor scarcity encourage innovation? Journal of Political Economy, 188(6), 1037–1078.

Acemoglu, D., & Autor, D. (2011). Skills, tasks and technologies: Implications for employment and earnings. In D. Card & O. Ashenfelter (Eds.), Handbook of labor economics. Amsterdam: Elsevier.

Acemoglu, D., & Pischke, J. S. (1999a). The structure of wages and investment in general training. Journal of Political Economy, 107(3), 539–572.

Acemoglu, D., & Pischke, J. S. (1999b). Beyond Becker: Training in imperfect labour markets. The Economic Journal, 109(453), 112–142.

Alesina, A., Algan, Y., Cahuc, P., & Giuliano, P. (2014). Family ties and the regulation of labor. Journal of the European Economic Association, 13(4), 599–630.

Alesina, A., & Glaeser, E. (2004). Fighting poverty in the U.S. and Europe: A world of difference. Oxford: Oxford University Press.

Alesina, A., Glaeser, E., & Sacerdote, B. (2005). Work and leisure in the U.S. and Europe: Why so different? NBER Macroeconomics Annual, 20, 1–64.

Autor, D., Kerr, W., & Kugler, A. (2007). Does employment protection reduce productivity? Evidence from US states. The Economic Journal, 117(521), 189–217.

Autor, D., Levy, H. F., & Murnane, R. J. (2003). The skill content of recent technological change: An empirical exploration. The Quarterly Journal of Economics, 118(4), 1279–1333.

Barro, R., & Lee, J.-W. (2013). A new data set of educational attainment in the world, 1950–2010. Journal of Development Economics, 104, 184–198.

Beaudry, P., & Collard, F. (2002). Why has the employment-productivity tradeoff among industrialized countries been so strong?. NBER Working Paper No. 8754, Cambridge, MA.

Beaudry, P., & Green, D. A. (2005). Changes in U.S. wages 1976–2000: Ongoing skill bias or major technological change? Journal of Labor Economics, 23(3), 609–648.

Berman, E., Bound, J., & Griliches, Z. (1994). Changes in the demand for skilled labor within U.S. manufacturing: evidence from the annual survey of manufactures. The Quarterly Journal of Economics, 109(2), 367–397.

Berman, E., Bound, J., & Machin, S. (1998). Implications of skill-biased technological change: International evidence. The Quarterly Journal of Economics, 113(4), 1245–1279.

Bertrand, M., & Kramarz, K. (2002). Does entry regulation hinder job creation? Evidence from the French retail industry. The Quarterly Journal of Economics, 117(4), 1369–1413.

Blanchard, O. J. (1997). The medium run. Brookings Papers on Economic Activity, 2, 89–158.

Blanchard, O. J. (2004). The economic future of Europe. The Journal of Economic Perspectives, 18(4), 3–26.

Blanchard, O. J., & Wolfers, J. (2000). The role of shocks and institutions in the rise of European unemployment: The aggregate evidence. The Economic Journal, 110(462), 1–33.

Blau, F., & Kahn, L. (1996a). International differences in male wage inequality: Institutions versus market forces. Journal of Political Economy, 104(4), 791–837.

Blau, F., & Kahn, L. (1996b). Wage structure and gender earnings differentials: An international comparison. Economica, 63(250), S29–S62.

Blau, F., & Kahn, L. (2002). At home and abroad: U.S. labor market performance in international perspective. New York, NY: Russell Sage.

Bound, J., & Johnson, G. (1992). Changes in the structure of wages during the 1980’s: An evaluation of alternative explanations. American Economic Review, 82(3), 371–392.

Boeri, T., Conde-Ruiz, J. I., & Galasso, V. (2004). Cross-skill redistribution and the trade-off between unemployment benefits and employment protection. CEPR discussion paper no. 4711, London, UK.

Caballero, R., & Hammour, M. (1998). Jobless growth: Appropriability, factor substitution and unemployment. Carnegie-Rochester Conference Series on Public Policy, 48, 51–94.

Caselli, F., & Coleman, W. J. (2006). The world technology frontier. American Economic Review, 96(3), 499–522.

Champernowne, D. (1961). A dynamic growth model involving a production function. In F. A. Lutz & D. C. Hague (Eds.), The theory of capital. New York: Macmillan.

Comin, D., & Ferrer, M. M. (2013). If technology has arrived everywhere, why has income diverged?. NBER working paper no. 19010, Cambridge, MA.

Comin, D., & Hobijn, B. (2004). Cross-country technology adoption: Making the theories face the facts. Journal of Monetary Economics, 51(1), 39–83.

Comin, D., & Hobijn, B. (2009). Lobbies and technology diffusion. The Review of Economics and Statistics, 91(2), 229–244.

Comin, D., & Hobijn, B. (2010). An exploration of technology diffusion. The American Economic Review, 100(5), 2031–2059.

Davis, S. J., & Haltiwanger, J. (1991). Wage dispersion between and within U.S. manufacturing plants, 1963–1986. Brookings Papers on Economic Activity, Microeconomics, 2, 115–180.

Davis, S. J., & Henrekson, M. (1997). Industrial policy, employer size and economic performance in Sweden. In R. B. Freeman, R. Topel, & B. Swedenborg (Eds.), The welfare state in transition: Reforming the Swedish model (pp. 353–398). Chicago: University of Chicago Press.

Davis, S. J., & Henrekson, M. (1999). Explaining national differences in the size and industry distribution of employment. Small Business Economics, 12(1), 59–83.

Davis, S. J., & Henrekson, M. (2005a). Wage-setting institutions as industrial policy. Labour Economics, 12(3), 345–377.

Davis, S. J., & Henrekson, M. (2005b). Tax effects on work activity, industry mix and shadow economy size: Evidence from rich-country comparisons. In R. Gómez-Salvador, et al. (Eds.), Labor supply and incentives to work in Europe (pp. 44–104). Cheltenham: Edward Elgar.

Driscoll, J., & Kraay, A. (1998). Consistent covariance matrix estimation with spatially dependent panel data. Review of Economics and Statistics, 80(4), 549–560.

Eden, M., & Gaggl, P. (2016). On the welfare implication of automation. University of Charlotte. Working paper no. 2016-011.

Feenstra, R. C., Inklaar, R. C., & Timmer, M. P. (2015). The next generation of the Penn World Table. The American Economic Review, 105(10), 3150–3182.

Freeman, R. B., & Katz, L. F. (2007). Differences and changes in wage structures. Chicago: University of Chicago Press.

Freeman, R. B., & Schettkat, R. (2005). Marketization of household production and the EU-US gap in work. Economic Policy, 20(41), 6–50.

Galor, O., & Moav, O. (2004). From physical to human capital accumulation: Inequality and the process of development. The Review of Economic Studies, 71(4), 1001–1026.

Gottschalk, P., & Smeeding, T. M. (1997). Cross-national comparisons of earnings and income inequality. Journal of Economic Literature, 35(2), 633–687.

Greenwood, J., & Yorukoglu, M. (1997). 1974. Carnegie-Rochester Conference Series on Public Policy, 46(1), 49–95.

Hellwig, M., & Irmen, A. (2001). Endogenous technical change in a competitive economy. Journal of Economic Theory, 101(1), 1–39.

Juhn, C., Murphy, K. M., & Pierce, B. (1993). Wage inequality and the rise in returns to skill. Journal of Political Economy, 101(3), 410–442.

Karabarbounis, L., & Neiman, B. (2014). The global decline of the labor share. The Quarterly Journal of Economics, 129(1), 61–103.

Katz, L. F., & Murphy, K. M. (1992). Changes in relative wages, 1963–1987: Supply and demand factors. Quarterly Journal of Economics, 107, 35–78.

Koeniger, W., & Leonardi, M. (2007). Capital deepening and wage differentials: Germany versus US. Economic Policy, 22(49), 72–116.

Kramarz, F. (2007). Outsourcing, unions, wages, and employment: Evidence from data matching imports, firms and workers. CREST working paper.

Lazear, E. P. (1990). Job security provisions and employment. The Quarterly Journal of Economics, 105(3), 699–726.

Ljungqvist, L., & Sargent, T. J. (1996). A supply-side explanation of European unemployment. Federal Reserve Bank of Chicago Economic Perspectives, 20(5), 2–15.

Moene, K. O., & Wallerstein, M. (1997). Pay inequality. Journal of Labor Economics, 15(3), 403–430.

Neugart, M. (2007). Provisions of the welfare state: Employment protection versus unemployment insurance. European Commission, economic paper No 279.

Ngai, R. & Pissarides, C. (2009). Welfare policy and the sectoral distribution of employment. 2009 meeting papers, society for economic dynamics, no. 191.

Nickell, S. (1997). Unemployment and labor market rigidities: Europe versus North America. The Journal of Economic Perspectives, 11(3), 55–74.

Nickell, S., & Layard, R. (1999). Labor market institutions and economic performance. In O. Ashenfelter & D. Card (Eds.), Handbook of Labor Economics (Vol. 3b). Amsterdam: North Holland.

OECD. (2013). Protecting jobs, enhancing flexibility: A new look at employment protection regulation. In OECD Employment Outlook 2013. Paris: OECD Publishing. www.oecd.org/els/emp/oecdindicatorsofemploymentprotection.htm.

O’Mahony, M., & Timmer, M. P. (2009). Output, input and productivity measures at the industry Level: The EU KLEMS database. The Economic Journal, 119(538), F374–F403.

O’Mahony, M., & Van Ark, B. (2003). EU productivity and competitiveness: An industry perspective: Can Europe resume the catching-up process? Luxemburg: European Commission.

Parente, S. L., & Prescott, E. C. (1994). Barrier to technology adoption and development. The Journal of Political Economy, 102(2), 298–321.

Peretto, P. F., & Seater, J. J. (2013). Factor-eliminating technical change. Journal of Monetary Economics, 60(4), 459–473.

Prescott, E. C. (2004). Why do Americans work so much more than Europeans? Federal Reserve Bank of Minneapolis, Quarterly Review, 28(1), 2–13.

Psacharopoulos, G. (1994). Returns to investment in education: A global update. World Development, 22(9), 1325–l343.

Robinson, C., Stokes, L., Stuivenwold, E., & Van Ark, B. (2013). Chapter II: Industry structure and taxonomies. In M. O’Mahony & B. Van Ark (Eds.), EU productivity and competitiveness: An industry perspective: Can Europe resume the catching up process? Luxemburg: European Commission.

Rogerson, R. (2007). Structural transformation and the deterioration of European labor market outcomes. Journal of Political Economy, 116(2), 235–259.

Sachs, J. D. (2000). Globalization and patterns of economic development. Weltwirtschaftliches Archiv, 136(4), 579–600.

Saint-Paul, G. (2004). Why are European countries diverging in their unemployment experience? The Journal of Economic Perspectives, 18(4), 49–68.

Saint-Paul, G. (2006). Distribution and growth in an economy with limited needs: Variable markups and the ‘end of work’. The Economic Journal, 116(511), 382–407.

Schmoch, U. (2008). Concept of a technology classification for country comparisons. Final report to the World Intellectual Property Organization (WIPO).

UNU-WIDER. (2015). World income inequality database (WIID3c). September 2015. Retrieved from https://www.wider.unu.edu/project/wiid-world-income-inequality-database.

Visser, J. (2013). ICTWSS: Database on institutional characteristics of trade unions, wage setting, state intervention and social pacts in 34 countries between 1960 and 2012. Amsterdam: Institute for Advanced Labour Studies, AIAS, University of Amsterdam.

WIPO. (2014). World intellectual property organization patent statistics database.

Zeira, J. (1998). Workers, machines and economic growth. The Quarterly Journal of Economics, 113(4), 1091–1117.

Zeira, J. (2009). Why and how education affects economic growth? Review of International Economics, 17, 602–614.

Zuleta, H. (2008). Factor saving innovations and factor income shares. Review of Economic Dynamics, 11(4), 836–851.

Zuleta, H. (2015). Factor shares, inequality, and capital flows. Southern Economic Journal, 82(2), 647–667.

Acknowledgements

We thank the editor, an associate editor and three anonymous referees for their valuable comments. We are also grateful to Daron Acemoglu, Omar Barbiero, Olivier Blanchard, Francesco Caselli, Giovanni Di Bartolomeo, Diego Comin, Giorgio di Giorgio, Gene Grossman, Sharon Haddad, Bart Hobijn, Adam Jaffe, Larry Katz, Francis Kramarz, and Chris Pissarides for their comments and support. Matteo Ferroni, Giampaolo Lecce, Armando Miano, Sarit Weisburd, and Anna Zapesochini provided excellent research assistance. Joseph Zeira thanks the Israel Science Foundation, Grant No. 74/05, the Aaron and Michael Chilewich Chair and the Mary Curie Transfer of Knowledge Fellowship of the European Community 6th Framework Program under contract MTKD-CT-014288 for financial support. Remaining errors are of course ours only.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Proofs

Derivation of Eq. (10)

The zero profit condition is:

Calculating the integrals in this condition yields:

Use Eq. (9) to substitute for \(p_S (i)\) and get:

Eliminating \(w_S \) on both sides leads to Eq. (10).

Derivation of Eq. (16)

Equating the supply price (14) with the demand price (15) and substituting the quantities s(i) in the production function of the high skill good (3), we get:

Calculating the integral yields \(\int _0^{f_S } {\ln (1-i)di} =-(1-f_S )\ln (1-f_S )-f_S \) and hence:

We show similarly that: \(\ln P_N =f_N +\ln (\kappa R)-\ln A.\) This proves Eq. (16).

Derivation of Eq. (18)

From the first order conditions of production of the final good (17), we get \(S=YP_S^{-\theta } \) and \(N=YP_N^{-\theta } \). Substitute these two quantities in the production function of the final good (2) and get:

Eliminating output on both sides, we get the following relationship between the two prices:

Next, substitute in this equation the prices from (16) and get Eq. (18).

Proof of proposition 1

We begin the proof by studying further the curve L, as defined by (21). We first write (21) in logarithms:

Note that if \(f_N \) rises, so does \(f_S \) and as \(f_N \) gets closer to 1, so does \(f_S \), since otherwise the RHS of (31) goes to infinity. Hence the curve L is increasing and it passes through the point (1, 1), as described in Fig. 1. It also follows that this curve is below 1. We next study the location and shifts of this curve.

The LHS of (21) or of (31) depends on \(v_N \) and \(v_S \). These two variables depend on h, through Eqs. (10) and (11), from which we get:

Using (32), we can calculate the derivative of the LHS of (31) with respect to h:

The last inequality is because the function \((1+2x)/(1+x)^{2}\) is decreasing and since \(v_S >v_N \). Hence, as h rises, the LHS of (21) rises. This means that the curve L shifts downward.

As h rises, the LHS of (21) increases, and reaches its maximum at \(h=(1+b)^{-1}\), given the constraint (6). Denote the value of \(v_N \) at this h by \(v*\), so the value of the LHS of (21), at any h, satisfies:

The last inequality is due to constraint (7). Hence, the LHS of (21) is everywhere smaller than 1. It follows from (21) that \(f_N <f_S \) everywhere. Hence, the curve L lies everywhere above the diagonal. It therefore follows that the L curve and the G curve must intersect and due to their opposite slopes, their intersection point E is unique. This proves existence and uniqueness of the equilibrium.

As for the effect of a rise in h on the equilibrium, it shifts the L curve downward and thus increases \(f_N \) and reduces \(f_S \). This proves the Proposition.

Derivation of Eq. (23)

In equilibrium all intermediate high skill goods, which are produced by labor, for \(i>f_S \), use the same amount of effective labor, since they all face the same wage and the same price. Therefore, the amount produced of such a good is:

If the intermediate good is mechanized, for \(i\le f_S \), the amount of capital used in its production is equal, due to Eqs. (9) and (10), to: