Abstract

We consider a random financial network with a large number of agents. The agents connect through credit instruments borrowed from each other or through direct lending, and these create the liabilities. The settlement of the debts of various agents at the end of the contract period can be expressed as solutions of random fixed point equations. Our first step is to derive these solutions (asymptotically), using a recent result on random fixed point equations. We consider a large population in which the agents adapt one of the two available strategies, risky or risk-free investments, with an aim to maximize their expected returns (or surplus). We aim to study the emerging strategies when different types of replicator dynamics capture inter-agent interactions. We theoretically reduced the analysis of the complex system to that of an appropriate ordinary differential equation (ODE). We proved that the equilibrium strategies converge almost surely to that of an attractor of the ODE. We also derived the conditions under which a mixed evolutionary stable strategy (ESS) emerges; in these scenarios the replicator dynamics converges to an equilibrium at which the expected returns of both the populations are equal. Further the average dynamics (choices based on large observation sample) always averts systemic risk events (events with large fraction of defaults). We verified through Monte Carlo simulations that the equilibrium suggested by the ODE method indeed represents the limit of the dynamics.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

- Evolutionary stable strategy (ESS)

- Replicator dynamics

- Ordinary differential equation

- Random graph

- Systemic risk

- Financial network

1 Introduction

We consider a financial network with large number of agents. These agents are interconnected to each other through financial commitments (e.g., borrowing -lending etc.). In addition they make investments in either risk-free (risk neutral) or risky derivatives. In such a system the agents not only face random economic shocks (received via significantly smaller returns of their risky investments), they are also affected by the percolation of the shocks faced by their neighbours (creditors), neighbours of their neighbours etc. In the recent years from 2007–2008 onwards, there is a surge of activity to study the financial and systemic level risks caused by such a percolation of shocks [1, 3,4,5]. Systemic risk is the study of the risks related to financial networks, when individual or entity level shocks can trigger severe instability at system level that can collapse the entire economy (e.g., [3,4,5]). In this set of papers, the author study the kind of topology (or graph structure) that is more stable towards the percolation of shocks in financial network, where stability is measured in terms of the total number of defaults in the network.

In contrast to many existing studies in literature related to systemic risk, we consider heterogeneous agents and we consider evolutionary framework. In our consideration, there are two groups of agents existing simultaneously in the network; one group of agents invest in risk-free instruments, while the other group considers risky investments. The second group borrows money from the other members of the network to gather more funds towards the risky investments (with much higher expected returns). These investments are subjected to large (but rare) economic shocks, which can potentially percolate throughout the network and can even affect the ‘risk-free’ agents; the extent of percolation depends upon relative sizes of the two groups. We consider that new agents join such a network after each round of investment; they choose their investment type (risky or risk-free) based on their observations of the returns (the surplus of the agents after paying back their liabilities) of a random sample of agents that invested in previous round. The relative sizes of the two groups changes, the network structure changes, which influences the (economic shock-influenced) returns of the agents in the next round, which in turn influences the decision of the new agents for the round after. Thus the system evolves after each round. We study this evolution process using the well known evolutionary game theoretic tools.

In a financial network perspective, this type of work is new to the best of our knowledge. We found few papers that consider evolutionary approach in other aspects related to finance; in [7], the authors study the financial safety net (a series of the arrangement of the firms to maintain financial stability), and analyze the evolution of the bank strategies (to take insurance or not); recently in [6] authors consider an evolutionary game theoretic model with three types of players, i) momentum traders ii) contrarian traders iii) fundamentalists and studied the evolution of the relative populations. As already mentioned, these papers relate to very different aspects in comparison with our work.

Evolutionary Stable Strategies. Traditionally evolutionary game models have been studied in the literature to study animal behaviour. The key ingredients of the evolutionary game models are a) a large number of players, b) the dynamics and c) the pay-off function (e.g., see the pioneering work [10]). Replicator dynamics deals with evolution of strategies, reward based learning in dynamic evolutionary games. Typically it is shown that these dynamics converge to a stable equilibrium point called Evolutionary Stable Strategy (ESS), which can be seen as a refinement of a strict Nash Equilibrium [10]; a strategy prevailing in a large population is called evolutionary stable if any small fraction of mutants playing a different strategy get wiped out eventually. Formally, in a 2-player symmetric game, a pure strategy \(\hat{s}\) is said to be evolutionary stable if

-

1.

\( (\hat{s},\hat{s})\) is a Nash Equilibrium; i.e., \(u(\hat{s}, \hat{s}) \ge u( s^{'},\hat{s})\) \(\forall s^{'}\) and

-

2.

If \((\hat{s},\hat{s})\) is not a strict NE (i.e., \(\exists \) some \(s^{'} \ne \hat{s}\) such that \(u( \hat{s} , \hat{s}) = u( s^{'}, \hat{s})\)), then \(u( \hat{s}, s^{'}) > u( s^{'}, s^{'})\).

We study the possible emergence of evolutionary stable strategies, when people choose either a risky or a risk-free strategy; the main difference being that the returns of either group are influenced by the percolation of shocks. The returns of the portfolios depend further upon the percolation of shocks due to layered structure of financial connections, and not just on the returns of the investments, i.e., not just on economic shocks. Our main conclusions are two fold; a) when agents consider large sample of data for observation and learning, the replicator dynamics can settle to a mixed ESS, at which the expected returns of the two the groups are balanced; b) in many other scenarios, through theoretical as well as simulation based study, we observed that the replicator dynamics converges to one of the two strategies, i.e., to a pure ESS (after completely wiping out the other group).

The analysis of these complex networks (in each round) necessitated the study of random fixed point equations (defined sample path-wise in large dimensional spaces), which represent the clearing vectors of all the agents ([1, 3,4,5] etc.). The study is made possible because of the recent result in [1], which provided an asymptotically accurate one dimensional equivalent solution.

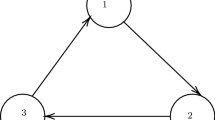

2 Large Population Finance Network

We consider random graphs, where the edges represent the financial connection between the two nodes. Any two nodes are connected with probability \(p_{ss} > 0\) independent of the others, but the weights on the edges depend on (the number of) neighbors. This graph represents a large financial network where borrowing and lending are represented by the edges and the weights over them. The modeller may not have access to the exact connections of the network, but random graph model is a good approach to analyse such a complex system. In particular we consider the graphs that satisfy the assumptions of [1].

The agents are repeatedly investing in some financial projects. In each round of investment, the agents borrow/lend to/from some random subset of the agents of the network. Some of them may invest the remaining in a risk-free investment (which has a constant rate of interest \(r_s\)). While the others invest the rest of their money in risky investments which have random returns; we consider a binomial model in which returns are high (rate u) with high probability \(\delta \) and can have large shocks (rate d), but with small probability (\(1-\delta \)); it is clear that \(d< r_s < u\). We thus have two types of agents, we call the group that invests in risk-free projects as ‘risk-free’ group (\(G_1\)), the rest are being referred to as ‘risky’ group (\(G_2\)).

New agents join the network in each round of investment. They choose their investment type, either risk-free or risky, for the first time based on the previous experience of the network and continue the same choice for all future rounds of investment. The new agents learn from network experience (returns of agents of the previous round of investments) and choose a suitable investment type, that can potentially give them good returns. The new agents either learn from the experience of a random sample (returns of two random agents) of the network or learn from a large number of agents. In the former case, their choice of investment type depends upon the returns of the random sample in the previous round. While in the latter case the decision can also depend on the average utility of each group of the agents, obtained after observing large number of samples.

Two Strategies: As mentioned before, there are two strategies available in the financial market. Risk-free agents of \(G_1\) use strategy 1; these agents lend some amount of their initial wealth to other agents (of \(G_2\)) that are willing to borrow, while the rest is invested in a government security, for example, bonds, government project etc. Risky agents of \(G_2\) are adapting strategy 2, wherein they borrow funds from the other agents and invest in risky security, for example, derivative markets, stocks, corporate loans etc. These agents also lend to other agents of \(G_2.\) Let \(\epsilon _t \) be the fraction of the agents in \(G_1\) group and let n(t) be the total number of agents in round t. Thus the total number of agents (during round t) in group 1 equals \(n_1(t) := |G_1 | = n(t) \epsilon _t\) and \(n_2(t) := |G_2| = n(t) (1 -\epsilon _t )\).

We consider that one new agent is added in each roundFootnote 1, and thus size of the graph/network is increasing. The agents are homogeneous, i.e., they reserve the same wealth \(w >0\) for investments (at the initial investment period) of each round. Each round is composed of two time periods, the agents invest during the initial investment period and they obtain their returns after some given time gap. The two time period model is borrowed from [1, 3, 4] etc. The new agents make their choice for the next (and the future) round(s), based on their observations of these returns of the previous round.

Initial Investment Phases: During the initial investment phases (of any round t), any agent \(i\in G_{1}\) lends to any agent \(j \in G_2\) with probability \(p_{ss}\) and it lends (same) amountFootnote 2 \(w/(n(t) p_{ss})\) to each of the approachers based on the number that approached it for loan; let \(I_{ij}\) be the indicator of this lending event. Note that for large n(t), the number of approachers of \(G_2\) approximately equals \(n(t) (1-\epsilon _t) p_{ss}\), and, thus any agent of \(G_1\) lends approximately \(w (1-\epsilon _t)\) fraction to agents of \(G_2\). The agents of \(G_1\) invest the rest \(w\epsilon _t\) in risk-free investment (returns with fixed rate of interest \(r_s\)).

Let \(\tilde{w}\) be the accumulated wealthFootnote 3 of any agent of \(G_2\) out of which a positive fraction \(\alpha \) is invested towards the other banks of \(G_2\) and \((1-\alpha )\) portion is invested in risky security. Thus the accumulated wealth of a typical \(G_2\) agent is governed by the following equation,

Thus the total investment towards the risky venture equals \(\tilde{w} (1-\alpha )= w(1+\epsilon )\). The \(G_2\) agents have to settle their liabilities at the end of the return/contract period (in each round) and this would depend upon their returns from the risky investments. Thus the total liability of any agent of \(G_2\) is \(y = (w\epsilon +\tilde{w}\alpha )(1+r_b)\), where \(r_b\) is the borrowing rateFootnote 4; by simplifying

Similarly, any agent of \(G_2\) lends the following amount to each of its approachers (of \(G_2\)):

Return and Settling Phases, Clearing Vectors: We fix the round t and avoid notation t for simpler notations. The agents of \(G_2\) have to clear their liabilities during this phase in every round. Recall the agents of \(G_2\) invested \(w(1+\epsilon )\) amount in risky-investments and the corresponding random returns (after economic shocks) are:

This is the well known binomial model, in which the upward moment occurs with probability \(\delta \) and downward moment with \((1-\delta ).\) The agents have to return y (after the interest rate \(r_b\)) amount to their creditors, however may not be able to manage the same because of the above economic shocks. In case of default, the agents return the maximum possible; let \(X_i\) be the amount cleared by the \(i^{th}\) agent of group \(G_2\). Here we consider a standard bankruptcy rule, limited liability and pro-rata basis repayment of the debt contract (see [3, 4]), where the amounts returned are proportional to their liability ratios. Thus node j of \(G_2\) pays back \(X_i L_{ji} / y\) towards node i, where \(L_{ji}\) the amount borrowed (liability) during initial investment phases equals (see the details of previous subsection and Eq. (2)):

Thus the maximum amount cleared by any agent \(j \in \mathcal{G}_2\), \(X_j\), is given by the following fixed point equation in terms of the clearing vector \(\{ X_i\}_{i \in G_2}\) composed of clearing values of all the agents (see [3, 4] etc.):

with the following details: the term \(K_i\) is the return of the risky investment, the term \( \sum _{j\in G_2} X_j\ L_{ji}/y \) equals the claims form the other agents (those borrowed from agent i) and v denotes the taxes to pay. In other words, agent i will pay back the (maximum possible) amount \( K_i+ \sum _{j\in G_2} X_j\frac{L_{ji}}{y} - v\) in case of a default, and in the other event, will exactly pay back the liability amount y.

Surplus of any agent is defined as the amount obtained from various investments, after clearing all the liabilities. This represents the utility of the agent in the given round. The surplus of the agent \(i \in G_{2}\):

while that of agent \(i \in G_1\) is given by:

In the above, the first term is the return from the risk free investment. The second term equals the returns or claims form \(G_2\) agents (whom they lent) and v denotes the amount of taxes.

3 Asymptotic Approximation of the Large Networks

We thus have dynamic graphs whose size increases with each round. In this section, we obtain appropriate asymptotic analysis of these graphs/systems, with an aim to derive the pay-off of each group after each round. Towards this, we derive the (approximate) closed form expression of the Eqs. (6) and (7), which are nothing but the per-agent returns after the settlement of the liabilities.

The returns of the agents depend upon how other agents settle their liabilities to their connections/creditors. Thus our first step is to derive the solution of the clearing vector fixed point Eqs. (5). Observe that the clearing vector \(\{X_j\}_{j \in G_2}\) is the solution of the vector-valued random fixed point Eqs. (5) in n-dimensional space (where n is the size of the network), defined sample-path wise.

Clearing Vectors Using Results of [1]: Our financial framework can be analysed using the results of [1], as the details of the model matchFootnote 5 the assumptions of the paper. By [1, Theorem 1], the aggregate claims converge almost surely to constant values (as the network size increases to infinity):

where the common expected clearing value \({\bar{x}}^{ \infty }\) satisfies the following fixed point equation in one-dimension:

Further by the same Theorem, the clearing vectors converge almost surely to (asymptotically independent) random vectors:

By virtue of the above results, the random returns given by Eqs. (6) and (7), converge almost surely:

Probability of Default is defined as the fraction of agents of \(G_2\) that failed to pay back their full liability, i.e., \(P_d:= P({ X_i} <y)\). For large networks (when the initial network size \(n_0 \) itself is sufficiently large), one can use the above approximate expressions and using the same we obtain the default probabilities and the aggregate clearing vectors in the following (proof in Appendix).

Lemma 1

The asymptotic average clearing vector and the default probability of \(G_2\) is given by:

where, \(c_\epsilon = \frac{\alpha +\alpha \epsilon }{\alpha +\epsilon }\), \(E[W] = \delta k_u + (1-\delta ) k_d-v\) , \(\underline{w} = k_d -v\) and \(\overline{w}= k_u -v\). \(\blacksquare \)

Expected Surplus: By virtue of the Theorem developed in [1, Theorem 1] we have a significantly simplified limit system, whose performance is derived in the above Lemma. We observe that this approximation is sufficiently close (numerical simulations illustrate good approximations), and assume the following as the pay-offs of each group after each round of the investments:

for any agent of \(G_2.\) Observe here that the aggregate limits are almost sure constants, hence the expected surplus of all the agents of the same group are equal, while the random returns of the same group are i.i.d. (independent and identically distributed).

4 Analysis of Replicator Dynamics

In every round of investments, we have a new network that represents the liability structure of all the agents of that round formed by the investment choices of the agents, and, in the previous two sections we computed the (asymptotically approximate) expected returns/utilities of each agent of the network. As already mentioned in Sect. 2, new agents join the network in each round, and choose their strategies depending upon their observations of these expected returns of the previous round.

These kind of dynamics is well described in literature by name replicator dynamics (e.g.,[2, 6, 9] etc.). The main purpose of such a study is to derive asymptotic analysis and answer some or all of the following questions: will the dynamics converge, i.e., would the relative fractions of various populations settle as the number of rounds increase? will some of the strategies disappear eventually? if more than one population type survives what would be the asymptotic fractions? etc. These kind of analysis are common in other types of networks (e.g., wireless networks (e.g., [9]), biological networks [2]), but are relatively less studied in the context of financial networks (e.g., [6]). We are interested in knowing the asymptotic outcome of these kind of dynamics (if there exists one) and study the influence of various network parameters on the outcome. We begin with precise description of the two types of dynamics considered in this paper.

4.1 Average Dynamics

The new agent contacts two random (uniformly sampled) agents of the previous round. If both the contacted agents belong to the same group, the new agent adapts the strategy of that group. When it contacts agents from both the groups it investigates more before making a choice; the new agent observes significant portion of the network, in that, it obtains a good estimate of the average utility of agents belonging to both the groups. It adapts the strategy of the group with maximum (estimated) average utility.

Say it observes the average of each group with an error that is normally distributed with mean equal to the expected return of the group and variance proportional to the size of the group, i.e., it observes (here \(\mathcal{N}(0, \sigma ^2)\) is a zero mean Gaussian random variable with variance \(\sigma ^2\))

for some \({\bar{c}}\) large. Observe by this modeling that: the expected values of the observations are given by \((\phi _1(\epsilon ), \ \phi _2 (\epsilon ) )\) and are determined by the relative proportions of the two populations, while the variance of any group reduces as its proportion increases to 1 and increases as the proportion reduces to zero. We also assume that the estimation errors \(\{ \mathcal{N}_1, \mathcal{N}_2 \}\) (conditioned on the relative fraction, \(\epsilon \)) corresponding to the two groups are independent. Then the probability that the new agent chooses strategy 1 is given by

which by (conditional) independence of Gaussian random variables equalsFootnote 6

Let \(( n_1(t), n_2(t))\) respectively represent the sizes of \(G_1\) and \(G_2\) population after round t and note that \(\epsilon _t = \frac{n_1(t)}{n_1(t)+ n_2(t)} \). Then the system dynamics is given by the following (\(g(\cdot )\) given by (14)):

It is clear that (with \(\epsilon _0\) and \(n_0\) representing the initial quantities),

One can rewrite the update equations as

and observe that (with \(\mathcal{F}_t\) the natural filtration of the process till t)

Further observe that \(0 \le \epsilon _t \le 1 \text { for all } t \text { and all sample paths}\).

Thus our algorithm satisfies assumptionsFootnote 7 A.1 to A.4 of [8] and hence we have using [8, Theorem 2] that

Theorem 1

The sequence \(\{\epsilon _t\}\) generated by average dynamics (15) converges almost surely (a.s.) to a (possibly sample path dependent) compact connected internally chain transitive invariant set of ODE:

\(\blacksquare \)

The dynamics start with initial condition \(\epsilon _0 \in (0, 1)\) and clearly would remain inside the interval [0, 1], i.e., \(\epsilon _t \in [0,1]\) for all t (and almost surely). Thus we consider the invariant sets of ODE (16) within this interval for some interesting case studies in the following (Proof in Appendix).

Corollary 1

Define \({\bar{r}}_r := u \delta + d (1-\delta )\). And assume \(w (1+d) > v\) and observe that \(u> r_b \ge r_s > d.\) Assume \(\epsilon _0 \in (0, 1).\) Given the rest of the parameters of the problem, there exists a \({\bar{\delta }} < 1\) (depends upon the instance of the problem) such that the following statements are valid for all \(\delta \ge {\bar{\delta }}\):

-

(a)

If \({\bar{r}}_r> r_b > r_s\) then \(\phi _2 (\epsilon ) > \phi _1 (\epsilon ) \) for all \(\epsilon \), and \(\epsilon _t \rightarrow 0 \) almost surely.

-

(b)

If \(\phi _1 (\epsilon ) > \phi _2 (\epsilon ) \) for all \(\epsilon \) then \(\epsilon _t \rightarrow 1 \) almost surely.

-

(c)

When \( r_b> {\bar{r}}_r > r_s\), and case (b) is negated there exists a unique zero \(\epsilon ^*\) of the equation \(\phi _1(\epsilon ) - \phi _2(\epsilon ) = 0\) and

$$\epsilon _t \rightarrow \epsilon ^{*} \,\, almost\,\, surely; \,\, further \,\, for \,\, \delta \approx 1\text {, } \epsilon ^{*} \approx \frac{ r_b - {\bar{r}}_r }{ {\bar{r}}_r - r_s } . $$\(\blacksquare \)

From (13) and Lemma 1, it is easy to verify that all the limit points are evolutionary stable strategies (ESS). Thus the replicator dynamics either settles to a pure strategy ESS or mixed ESS (in part (c) of the corollary), depending upon the parameters of the network; after a large number of rounds, either the fraction of agents following one of the strategies converges to one or zero or the system reaches a mixed ESS which balances the expected returns of the two groups.

In many scenarios, the expected rate of return of the risky investments is much higher than the rate of interest related to lending/borrowing, i.e., \({\bar{r}}_r > r_b\). Further the assumptions of the corollary are satisfied by more or less all the scenarios (due to standard no-arbitrage assumptions) and because the shocks are usually rare (i.e., \(\delta \) is close to 1). Hence by the above corollary, in majority of scenarios, the average dynamics converges to a pure strategy with all ‘risky’ agents (i.e., \(\epsilon _t\rightarrow 0\)). The group \(G_1\) gets wiped out and almost all agents invest in risky ventures, as the expected rate of returns is more even in spite of large economic shocks. One can observe a converse or a mixed ESS when the magnitude of the shocks is large (d too small) or when the shocks are too often to make \({\bar{r}}_r < r_b\).

4.2 Random Dynamics

When the new agent contacts two random agents of different groups, its choice depends directly upon the returns of the two contacted agents. The rest of the details remain the same as in average dynamics. In other words, the new agents observe less, their investment choice is solely based on the (previous round) returns of the two contacted agents. In this case the dynamics are governed by the following (see (10)–(11)):

where \( {\bar{x}}^{ \infty } = {\bar{x}}^{ \infty } (\epsilon _t)\) is given by Lemma 1. Here we assume people prefer risk-free strategy under equality, one can easily consider the other variants. Once again this can be rewritten as

As in previous section the above algorithm satisfies assumptionsFootnote 8 A.1 to A.4 of [8] and once again using [8, Theorem 2], we have:

Theorem 2

The sequence \(\{\epsilon _t\}\) generated by average dynamics (17) converges almost surely (a.s.) to a (possibly sample path dependent) compact connected internally chain transitive invariant set of ODE:

\(\blacksquare \)

One can derive the analysis of this dynamics in a similar way as in average dynamics, however there is an important difference between the two dynamics; we can never have random dynamics converges to an intermediate attractor, like the attractor in part (c) of Corollary 1 (unique \(\epsilon ^*\) satisfying \(\phi _1 = \phi _2\)). This is because \(E_\epsilon [G] = P( R^1 (\epsilon ) > R^2 (\epsilon ) )\) equals 0, \(1-\delta \) or 1 and never 1/2 (unless \(\delta = 1/2\), which is not a realistic case). Nevertheless, we consider the invariant sets (corresponding to pure ESS) within [0, 1] for some cases (Proof in Appendix):

Corollary 2

Assume \(\epsilon _0 \in (0, 1).\) Given the rest of the parameters of the problem, there exists a \(1/2< \delta < 1\) (depends upon the instance of the problem) such that the following statements are valid:

-

(a)

If \(E_\epsilon [G] = 0\) for all \(\epsilon \) or \( 1-\delta \) for all \(\epsilon \), then \(\epsilon _t \rightarrow 0 \) almost surely.

-

(b)

If \(E_\epsilon [G] = 1\) for all \(\epsilon \), then \(\epsilon _t \rightarrow 1 \) almost surely.

-

(c)

When \(w(1+d) > v\) and \(u> r_b \ge r_s > d\), there exists a \({\bar{\delta }} < 1\) such that for all \(\delta \ge {\bar{\delta }}\), the default probability \(P_d \le (1-\delta )\) and \(E[G] = 1-\delta \) and this is true for all \(\epsilon \). Hence by part (a), \(\epsilon _t \rightarrow 0\) almost surely. \(\blacksquare \)

Remarks: Thus from part (c), under the conditions of Corollary 1, the random dynamics always converges to all ‘risky’ agents (pure ESS), while the average dynamics, as given by Corollary 1, either converges to pure or mixed ESS further based on system parameters (mainly various rates of return).

From this partial analysis (corollaries are for large enough \(\delta \)) it appears that one can never have mixed ESS with random dynamics, and this is a big contrast to the average dynamics; when agents observe sparsely the network eventually settles to one of the two strategies, and if they observe more samples there is a possibility of emergence of mixed ESS that balances the two returns. We observe similar things, even for \(\delta \) as small as 0.8 in numerical simulations (Table 4). We are keen to understand this aspect in more details as a part of the future work.

To summarize we have a financial network which grows with new additions, in which the new agents adapt one of the two available strategies based on the returns of the agents that they observed/interacted with. Our asymptotic analysis of [1] was instrumental in deriving these results. This is just an initial study of the topic. One can think of other varieties of dynamics, some of which could be a part of our future work. The existing agents may change their strategies depending upon their returns and observations. The agents might leave the network if they have reduced returns repeatedly. The network may adjust itself without new additions etc.

5 Numerical Observations

We performed numerical simulations to validate our theory. We included Monte-Carlo (MC) simulation based dynamics in which the clearing vectors are also computed by directly solving the fixed point equations, for any given sample path of shocks. Our theoretical observation well matches the MC based limits.

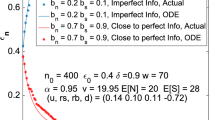

In Tables 1, 2 and 3 we tabulated the limits of the average dynamics for various scenarios, and the observations match the results of Corollary 1. The configuration used for Table 1 is: \(n_0 = 2000, \epsilon _0 = 0.75, r_s = 0.18, r_b = 0.19, w = 100, v = 46, \alpha = 0.1\), while that used for Table 2 is: \(n_0 = 2000, \epsilon _0 = 0.5, r_s = 0.17, r_b= 0.19, w= 100, v= 40, \alpha =0.1\). For both these tables risky expected rate of returns \({\bar{r}}_r\) is smaller than \(r_b\) and the dynamics converges either to ‘all risky’ agents configuration or to a mixed ESS. In Table 3, the risky expected rate of returns \({\bar{r}}_r = .1250 \) which is greater than \(r_b\) and \(r_s\), thus the dynamics converges to all risky-agents, as indicated by Corollary 1.

In Table 4 we considered random dynamics as well as average dynamics. In addition, we provided the Monte-Carlo based estimates. There is a good match between the MC estimates and the theory. Further we have the following observations: a) random dynamics always converge to a configuration with all ‘risky’ agents, as given by Corollary 2; b) when \({\bar{r}}_r > r_b\), the average dynamics also converges to \(\epsilon ^* =0\) as suggested by Corollary 1; and c) when \({\bar{r}}_r < r_b\), the average dynamics converges to mixed ESS or to a configuration with all ‘risk-free’ agents, again as given by Corollary 1.

As the ‘risk increases’, i.e., as the amount of taxes increase and or as the expected rate of return of risky investments \({\bar{r}}_r\) decreases, one can observe that the average dynamics converges to all ‘risk-free’ agents (last row of Table 4) thus averting systemic risk event (when there are large number of defaults, \(P_d\)). While the random dynamics fails to do the same. As predicted by theory (the configurations satisfying part (b) of Corollary 2), random dynamics might also succeed in averting the systemic risk event, when the expected number of defaults is one for all \(\epsilon >0.\) It is trivial to verify that the configuration with \(w(1+u) < v\), is one such example. Thus, average dynamics is much more robust towards averting systemic risk events.

6 Conclusions

We consider a financial network with a large number of agents. The agents are interconnected via liability graphs. There are two types of agents, one group lends to others and invests the rest in risk-free projects, while the second group borrows/lends and invests the rest in risky ventures. Our study is focused on analysing the emergence of these groups, when the new agents adapt their strategies for the next investment round based on the returns of the previous round. We considered two types of dynamics; in average dynamics the new agents observe large sample of data before deciding their strategy, and in random dynamics the decision is based on a small random sample.

We have the following important observations: a) when the expected rate of return of the risky investments is higher (either when the shocks are rare or when the shocks are not too large) than the risk-free rate, then ‘risk-free’ group wipes out eventually, almost all agents go for risky ventures; this is true for both types of dynamics; b) when the expected rate of risky investments is smaller, a mixed ESS can emerge with average dynamics while the random dynamics always converges to all risky agents; at mixed ESS the expected returns of both the groups are equal; more interestingly, when the risky-expected rate is too small, the average dynamics converges to a configuration with all risk-free agents.

In other words, in scenarios with possibility of a systemic risk event, i.e., when there is a possibility of the complete-system collapse (all agents default), the average dynamics manages to wipe out completely the risky agents; the random dynamics can fail to do the same. Thus when agents make their choices rationally and after observing sufficient sample of the returns of the previous round of investments, there is a possibility to avoid systemic risk events. These are some initial results and we would like to investigate further in future to make more affirmative statements in this direction.

Notes

- 1.

This approach can easily be generalized to several other types of dynamics and we briefly discuss a few of them towards the end.

- 2.

This normalization, (after choosing the required parameters, like w, appropriately) is done to derive simpler final expressions.

- 3.

These amounts could be random and different from agent to agent, but with large networks (by law of large numbers) one can approximate these to be constants.

- 4.

For simplicity of explanation, we are considering constant terms to represent all these quantities, in reality they would be i.i.d. quantities which are further independent of other rounds and the asymptotic analysis would go through as in [1].

- 5.

Observe that \(\alpha (1+\epsilon )/(\alpha +\epsilon ) < 1\).

- 6.

Because \(\frac{1}{\epsilon } + \frac{1}{1-\epsilon } = \frac{1}{\epsilon (1-\epsilon )} \).

- 7.

The assumptions require that the process is defined for the entire real line. One can easily achieve this by letting \(h(\epsilon ) = 0\) for all \(\epsilon \notin [0,1]\), which still ensures required Lipschitz continuity and by extending \(M_{t+1} = 0\) for all \(\epsilon _t \notin [0,1]\).

- 8.

In the current paper, we consider scenarios in which \(h_R(\cdot )\) is Lipschitz continuous, basically under the conditions of Corollary 2.

- 9.

When \(\epsilon < 1/2\) and \(\epsilon < \epsilon ^*\) then clearly \( \frac{ (\epsilon - \epsilon ^*) (2\epsilon - 1) }{ \epsilon (1-\epsilon ) } > 0\). When \(\epsilon > 1/2\) we have \((2 \epsilon - 1) / \epsilon < 1/2\) and with \(\epsilon < \epsilon ^*\) we have \(\epsilon ^* - \epsilon < 1 - \epsilon \) and thus

$$ 2 + \frac{ (\epsilon - \epsilon ^*) (2\epsilon - 1) }{ \epsilon (1-\epsilon ) } \ge 3/ 2 > 0 \text{ for } \text{ all } \epsilon < \epsilon ^*. $$In a similar way \(\epsilon > \epsilon ^*\), then we will have that the above term is again positive.

References

Kavitha, V., Saha, I., Juneja, S.: Random fixed points, limits and systemic risk. In: 2018 IEEE Conference on Decision and Control (CDC), pp. 5813–5819. IEEE (2018)

Miekisz, J.: Evolutionary game theory and population dynamics. In: Capasso, V., Lachowicz, M. (eds.) Multiscale Problems in the Life Sciences. LNM, vol. 1940, pp. 269–316. Springer, Heidelberg (2008). https://doi.org/10.1007/978-3-540-78362-6_5

Eisenberg, L., Noe, T.H.: Systemic risk in financial systems. Manag. Sci. 47, 236–249 (2001)

Acemoglu, D., Ozdaglar, A., Tahbaz-Salehi, A.: Systemic risk and stability in financial networks. Am. Econ. Rev. 105, 564–608 (2015)

Allen, F., Gale, D.: Financial contagion. J. Polit. Econ. 108, 1–33 (2000)

Li, H., Chensheng, W., Yuan, M.: An evolutionary game model of financial markets with heterogeneous players. Procedia Comput. Sci. 17, 958–964 (2013)

Yang, K., Yue, K., Wu, H., Li, J., Liu, W.: Evolutionary analysis and computing of the financial safety net. In: Sombattheera, C., Stolzenburg, F., Lin, F., Nayak, A. (eds.) MIWAI 2016. LNCS (LNAI), vol. 10053, pp. 255–267. Springer, Cham (2016). https://doi.org/10.1007/978-3-319-49397-8_22

Borkar, V.S.: Stochastic Approximation: A Dynamical Systems Viewpoint, vol. 48. Springer, Heidelberg (2009)

Tembine, H., Altman, E., El-Azouzi, R., Hayel, Y.: Evolutionary games in wireless networks. IEEE Trans. Syst. Man Cybern. Part B (Cybern.) 40(3), 634–646 (2009)

Smith, J.M., Price, G.R.: The logic of animal conflict. Nature 246(5427), 15–18 (1973)

Saha, I., Kavitha, V.: Financial replicator dynamics: emergence of systemic-risk-averting strategies. arXiv preprint arXiv:2003.00886 (2020)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix

Appendix

Proof of Lemma 1: We consider the following:

Case 1: First consider the case when downward shock can be absorbed, in this case the clearing vector \({\bar{x}}^{ \infty } = y \delta + y(1-\delta ) =y\), default probability is \( P_d = 0\). The region is true if the following condition is meet i.e., if

Case 2: Consider the case with banks receive shock will default and the corresponding average clearing vector \({\bar{x}}^{ \infty } = y\delta + (\underline{w} +c_\epsilon {\bar{x}}^{ \infty })(1-\delta ) \) which simplifies to:

This region lasts if the following conditions hold to be true

Substituting \({\bar{x}}^{ \infty } = \frac{y\delta + \underline{w}(1-\delta ) }{1-c_\epsilon (1-\delta ) }\) we have,

In this regime the default probability is \(P_d =(1- \delta )\). Case 3 can be proved similarly, more details are in [11]. \(\blacksquare \)

Proof of Corollary 1: First consider the system with \(\delta = 1\), i.e., system without shocks. From Lemma 1, \(P_d \le (1-\delta )\) for all \(\epsilon \) because (with \(\delta = 1\))

for all \(\epsilon \) (the lower bound independent of \(\epsilon \)). Under these assumptions, there exists \({\bar{\delta }} < 1\) by continuity of the involved functions such that

Thus from Lemma 1 \({\bar{x}}^\infty = y\) or \({\bar{x}}^\infty = \frac{\delta y +(1-\delta ) \underline{w}}{1-(1-\delta )c_\epsilon }\) for all such \(\delta \ge {\bar{\delta }}\). We would repeat a similar trick again, so assume initially \({\bar{x}}^\infty = y\) for all \(\epsilon \) and consider \(\delta \ge {\bar{\delta }}\). With this assumption we will have:

Note that \(R^2_u \ge w (1+u) - v > 0\) (for any \(\epsilon \)) under the given hypothesis.

Proof of part (a): When \({\bar{r}}_r > r_b\), from (13), it is clear that (inequality only when \(R^2_d \) is negative)

Thus in this case \(\phi _2 > \phi _1\) for all \(\epsilon \) and hence

Therefore with Lyaponuv function \(V_0(\epsilon ) = \epsilon / (1-\epsilon ) \) on defined on neighbourhood [0, 1) of 0 (in relative topology on [0, 1]) we observe that

Further \(V_0(\epsilon ) \rightarrow \infty \) as \(\epsilon \rightarrow 1\), the boundary point of [0, 1). Thus \(\epsilon ^* = 0\) is the asymptotically stable attractor of ODE (16) (see [8, Appendix, pp.148]) and hence the result follows by Theorem 1.

For all \(\delta \ge {\bar{\delta }}\), from Lemma 1, we have the following

for some \(\eta > 0\) , which decreases to 0 as \(\delta \rightarrow 1\). ( The last inequality is due to \(c_\epsilon < 1\) and then taking supremum over \(\epsilon \)). By continuity of the above upper bound with respect to \(\delta \) and the subsequent functions considered in the above parts of the proof, there exists a \({\bar{\delta }} < 1\) (further big if required) such that all the above arguments are true for all \(\delta > {\bar{\delta }}\).

Proof of part (b): The proof follows in similar way, now using Lyaponuv function \(V_1(\epsilon ) = (1- \epsilon ) / \epsilon \) on neighbourhood (0, 1] of 1, and by observing that \(g(\epsilon ) > 1/2\) for all \(\epsilon < 1\) and hence

Proof of part (c): It is clear that \(\phi _1 (\epsilon ) = R^1(\epsilon ) \) decreases linearly as \(\epsilon \) increases:

For \(\epsilon \) in the neighbourhood of 0, \(\phi _2 (\epsilon ) >0\) and is decreasing linearly with slope \({\bar{r}}_r - r_b\), because \(R^2_d (0) = w(1+ d) - v > 0\) and thus for such \(\epsilon \)

From (21), \(R^2_d ({ \epsilon })\) is decreasing with increase in \(\epsilon .\) There is a possibility of an \({\bar{\epsilon }}\) that satisfies \(R^2_d ({\bar{\epsilon }}) = 0\), in which case \(\phi _2\) increases linearly with slope \(\delta w (u - r_b)\), i.e.,

When \({\bar{r}}_r < r_b\) we have,

By hypothesis \(\phi _1 (\epsilon ) < \phi _2 (\epsilon )\) for some \(\epsilon \), hence by intermediate value theorem there exists at least one \(\epsilon ^*\) that satisfies \(\phi _1 (\epsilon ^*) = \phi _2 (\epsilon ^*).\) Further the zero is unique because \(\phi _2\) is either linear or piece-wise linear (with different slops), while \(\phi _1 \) is linear.

Consider Lyaponuv function \(V_*(\epsilon ) := (\epsilon - \epsilon ^*)^2 /( \epsilon (1-\epsilon ) )\) on neighbourhood (0, 1) of \(\epsilon ^*\), note \(V_*(\epsilon ) \rightarrow \infty \) as \(\epsilon \rightarrow 0\) or \(\epsilon \rightarrow 1\) and observe by (piecewise) linearity of the functions we will have

Thus we haveFootnote 9,

Thus \(\epsilon ^* \) is the asymptotically stable attractor of ODE (16) and hence the result follows by Theorem 1. The result can be extended for \(\delta < 1\) as in case (a) and the rest of the details follow by direct verification (at \(\delta = 1\)), i.e., by showing that \(\phi _1(\epsilon ^*) = \phi _2(\epsilon ^*)\) at \(\delta = 1\) and the equality is satisfied approximately in the neighbourhood of \(\delta =1\). \(\blacksquare \)

Proof of Corollary 2: For part (a), \(h_R (\epsilon ) = - c_G \epsilon (1-\epsilon )\), where the constant \(c_G = 1\) (or respectively \(c_G = 2 \delta - 1\)). Using Lyanponuv function of part (a) of Corollary 1, the proof follows in exactly the same lines.

For part (b), \(h_R (\epsilon ) = \epsilon (1-\epsilon )\), and proof follows as in part (b) of Corollary 1. For part (c), first observe (using equations (20)–(21) of proof of Corollary 1)

The last inequality is trivially true for \(\delta = 1\) (and so \({\bar{x}}^\infty =y\)) for the given hypothesis, and then by continuity as in proof of Corollary 1, one can consider \(\bar{\delta } <1\) such that for all \(\delta \ge \bar{\delta }\), the term \(({\bar{x}}^\infty -y) \big (1- \frac{1-\alpha }{\alpha +\epsilon }\big )\) (uniformly over \(\epsilon \)) can be made arbitrarily small. When \(P_d = 0\), i.e., \({\bar{x}}^\infty =y\) for some \(\epsilon \), then \( R^2_d (\epsilon ) - R^1 (\epsilon ) = w(d-r_b) + w\epsilon (d-r_s) < 0\) for all such \(\epsilon \). When \(P_d \ne 0\), then \(R^2_d = 0 \le R^1\). Thus in either case \( R^2_d (\epsilon ) \le R^1 (\epsilon )\) for all \(\epsilon \).

By virtue of the above arguments we have \(P_d \le (1-\delta )\) and \(E[G] = 1-\delta \) and this is true for all \(\epsilon \), for all \(\delta \ge {\bar{\delta }}\). The rest of the proof follows from part(a). \(\blacksquare \)

Rights and permissions

Copyright information

© 2021 Springer Nature Switzerland AG

About this paper

Cite this paper

Saha, I., Kavitha, V. (2021). Financial Replicator Dynamics: Emergence of Systemic-Risk-Averting Strategies. In: Lasaulce, S., Mertikopoulos, P., Orda, A. (eds) Network Games, Control and Optimization. NETGCOOP 2021. Communications in Computer and Information Science, vol 1354. Springer, Cham. https://doi.org/10.1007/978-3-030-87473-5_19

Download citation

DOI: https://doi.org/10.1007/978-3-030-87473-5_19

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-87472-8

Online ISBN: 978-3-030-87473-5

eBook Packages: Computer ScienceComputer Science (R0)