Abstract

In comparison with mean-variance and equally-weighted portfolios, a multi-asset risk parity portfolio can maximize the return per unit of risk by making the total risk contribution of assets equal. However, low-risk assets are weighted significantly more than others, which results in an unbalanced weight allocation. In this study, two modified versions of risk parity portfolios have been introduced to overcome the imbalance problem while focusing on maintaining a low difference of total risk contribution among assets. The performance of risk parity portfolios on Exchange Traded Fund data, as proxies for multiple asset classes, are compared with well-known benchmarks in terms of multiple performance criteria. The out-of-sample results demonstrate that a specific modified risk parity portfolio outperforms the pure risk parity portfolio and benchmarks in terms of annualized return, annualized volatility, annualized Sharpe ratio, Positive Rolling Returns, and Turnover.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Portfolio managers are looking for new solutions to deliver a portfolio with maximal return and minimal risk. Since the introduction of Modern Portfolio Theory (MPT) by Markowitz (1952), researchers have proposed different models to construct an optimal portfolio according to various criteria (Kolm et al., 2014). These innovations continue because different models work well under different conditions.

Since the 2008 financial crisis, risk management and diversification have become more important. At that time researchers questioned traditional portfolio management approaches, demonstrated properties of the Risk Parity Portfolio (RPP), and compared it with two well-known portfolio management techniques, namely Mean-Variance Portfolio (MVP) and Equally Weighted Portfolio (EWP) (Maillard et al., 2010). They described RPP as a trade-off between these two approaches since it outperformed MVP in terms of diversification and beat the EWP in terms of individual asset risk. In other words, RPP concentrates on portfolio risk allocation rather than portfolio capital allocation. Additionally, RPP outperformed MVP during the crisis since it is not as sensitive to input parameters as MVP (Thiagarajan & Schachter, 2011; Chaves et al., 2011). RPP increases diversification and constructs a portfolio such that all assets contribute equally to the total portfolio risk, which leads to maximizing the highest return per unit of risk (Dalio et al., 2015). In other words, if an investor assumes the equal return contribution for all assets, the RPP has the highest Sharpe ratio (Chaves et al., 2011).

A multi-asset portfolio constructed by risk parity optimization makes the total risk contribution of assets equal so that higher weights are assigned to less risky assets. By decreasing the portfolio risk due to downturn of a specific asset, it enables the portfolio manager to face unexpected circumstances. Moreover, RPP attempts to incorporate all assets in the portfolio while making the risk contribution equal, which increases diversification through distributing investment among several asset classes. However, RP tends to concentrate investment in the very low risk assets, whereas portfolio managers may want more diversification. Therefore, the purpose of this study is to survey and prototype different versions of the risk parity optimization model for a systematic multi-asset portfolio construction that not only focuses on assets’ risk contribution but also on balancing the assets’ weight allocation in the optimization process.

The “All Weather” fund, pioneered by Bridgewater Associates LP in 1996, was the first risk parity fund, but portfolio managers were skeptical about its performance. After discovering the importance of RPP in 2008, researchers introduced different formulation and computing methods to optimize the RPP. While the RPP model is roughly straightforward (Kazemi, 2012), yet there is no universally accepted formulation to optimize RPP. Maillard et al. (2010) proposed a convex formulation for RPP which was then modified by Bai et al. (2016). In this study, we have used the RP convex optimization model introduced in Bai et al. (2016). A full review of methods and application can be found in Qian (2016).

Considering the merits of implementing RPP, researchers are still improving its flexibility. One study suggested focusing on risk factors of each asset instead of equalizing the total risk (Bhansali, 2011). They mentioned that by focusing on risk factors, we can prevent the risk of investing in assets that are not likely to continue their historical performance. Moreover, a recent study recognized the high transaction cost of the RPP and mentioned that it is a risk-oriented model which does not consider other performance criteria (Wu et al., 2020). In this regard, we report Turnover (TO) of the RPP as well as other evaluation criteria to compare its performance with benchmarks. To increase the flexibility of RPP, we also have considered the desire of portfolio managers to modify the RPP by constraining the weights.

2 Methodology

To achieve the goal of this study, which is constructing a balanced portfolio in terms of asset risk contribution and weight allocation, first we introduce the basic risk parity (RP) portfolio optimization. Then two modified versions of RP are presented to prevent the portfolio from concentrating too much on a few low risk assets. The mathematical formulation of each proposed portfolio is described below. In this study, we assume that short selling is not allowed.

2.1 Risk Parity Portfolio

The formulation of the basic risk parity optimization is described in Eqs. (1, 2 and 3).

This is a convex optimization model for which Newton’s method is guaranteed to find the stationary optimal point (Bai et al., 2016). In Eq. (1), w i is the weight of asset i in the portfolio, n is the total number of assets, w n × 1 is the weight vector of all assets, Σ n × n is the covariance matrix of assets’ rates of return, and b i is the desired relative risk contribution of asset i to the risk portfolio calculated by Eq. (4), where TRC i is the total risk contribution of asset i and is defined as Eq. (5).

Here, σ P represents the standard deviation of the portfolio’s return and is calculated in Eq. (6).

At a stationary point for the convex objective function in Eq. (1), the risk contributions are equal and risk parity is achieved indirectly by minimizing this function. Equation (2) makes sure that funds are fully invested. And, \( \mathrm{TR}{\mathrm{C}}_{\mathrm{i}}=\frac{{\mathrm{w}}_{\mathrm{i}}\left(\Sigma {\mathrm{w}}_{\mathrm{i}}\right)}{\upsigma_{\mathrm{P}}} \) Eq. (3) enforces the assumption that short selling is not allowed. This formulation (Eq. 1) results in weight concentration on low-risk assets. Because managers may not like how much RP emphasizes these assets, we impose bounds in the following proposed portfolios to prevent too much concentration.

2.2 Uniformly Bounded (UB) Risk Parity Portfolio

In this portfolio, constant values have been chosen as the lower bound (L) and upper bound (U) for all assets’ weights in all asset classes. These bounds are judiciously chosen after analysing the results of the basic risk parity model to channel the portfolio towards allocating weights to high risk assets as well as low risk ones. Therefore, UB is achieved by substituting Eq. (7) for Eq. (3) in the optimization problem.

2.3 Differentially Bounded (DB) Risk Parity Portfolio

In this portfolio, different boundaries have been chosen for assets’ weights in each asset class, separately. These bounds also originated from the results of the UB portfolio that try to distribute the weights among assets as uniformly as possible while concentrating on the objective function. To construct this portfolio, a unique lower and upper bound are set for assets within a class. Therefore, we modified the optimization problem of RP by substituting Eq. (8) for Eq. (3).

3 Results

The daily closing price data of assets falling into three broad classes, namely, commodities (CO), equities (EQ), and fixed income (FI) are considered in this study. Asset (sub)classes and the ETF proxies associated with each are described in Appendix. The dataset includes the daily closing prices of 20 ETFs from 07/01/2013 to 12/31/2019. All steps in the simulation process have been implemented in R, using the riskParityPortfolio package (Griveau-Billion et al., 2019). We evaluated the performance of the proposed portfolios along with three benchmarks regarding the in-sample (the whole dataset is used for model implementation and performance analysis) and out-of-sample performance (different segments of the data are used for model implementation and performance analysis). Three benchmarks considered in this study are, 60/40 (60% EQ, 40% FI), 50/40/10 (50% FI, 40% EQ, 10% CO), and Equally-Weighted (EW) portfolio. In the 60/40 and 50/40/10 benchmarks, the weights are equal within each class. In UB, we set L = 0.02, U = 0.1, and in DB, we set L j = 0.02, U j = 0.06; ∀ i ∈ FI and L j = 0.04, U j = 0.1; ∀ i ∈ EQ, CO. In the in-sample performance analysis, we experimented with different time frames over which to estimate the covariance matrix. Moreover, we assumed that high-frequency trades are not allowed; i.e., trades in small time windows like seconds and minutes are not considered. Thus, we consider other time frames for estimation such as monthly, 3-monthly, 6-monthly, 9-monthly, and annual. The returns over longer time frames are calculated based on the approximate compounding return formula and the covariance matrix is also calculated separately for each time frame (Luenberger, 1998).

In the out-of-sample performance analysis, we considered 1 month as the rebalancing period (Maillard et al., 2010) and simulated the process over 2 years. The training window consists of 54 months from 07/01/2013 to 12/31/2017. The 2 year simulation window starts at 01/01/2018 and ends on 12/31/2019. Both training and simulation windows are rolling for 1 month in each rebalancing repetition.

3.1 In-Sample Performance

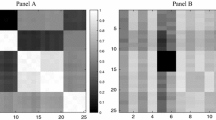

To obtain insight into the motivation for introducing modified risk parity portfolios, we compared the weight allocation and relative risk contribution of assets when using parameters estimated on a daily basis. Similar patterns are seen for other estimation time frames as well.

As can be seen in Fig. 1, weights are distributed more uniformly among assets in all classes when moving from RP to DB, which confirms the contribution of this study.

Figure 2 demonstrates the relative risk contribution of assets in each risk parity portfolio. It can be seen that in the RP, all assets contribute equally to the risk of portfolio. However, in UB and DB the risk contributions of assets are not uniformly distributed. The reason behind this unbalanced risk contribution is the new constraints imposed on the optimization problem of RP, which make the objective function worse and result in unequal risk contribution.

To compare the performance of the different portfolios in different time frames, we calculated their in-sample performances (when the whole dataset is used) based on Annualized Return (AR), Annualized Volatility (AV), Annualized Sharpe Ratio (ASR), Maximum Drawdown (MDD), and percentage of Positive Rolling Return (PRR). MDD and PRR are calculated using Eq. (9) and Eq. (10), respectively where W(t) in Eq. (9) is the portfolio price at time t ∈ [0, τ], τ denotes the time frame and N t in Eq. (10) is the number of days in [0, τ] in which the portfolio return is positive.

Tables 1, 2, 3, 4 and 5 describe the performance of alternative portfolios in terms of the defined performance criteria. As can be seen in Table 1, none of risk parity portfolios compete with the 60/40 and 50/40/10 benchmarks in terms of AR; however, UB and DB beat the EW benchmark using almost all estimation time frames.

According to Table 2, all risk parity portfolios over all time frames outperform the benchmarks in terms of annualized volatility.

According to Table 3, the RP portfolio outperforms UB, DB, and EW in terms of ASR over all time frames; however, it fails to beat the 60/40 and 50/40/10 benchmarks.

It can be seen in Table 4 that RP has the lowest MDD over all time frames in comparison with other portfolios. As the data is collected on a daily basis, MDD is not defined on daily basis since it requires a time interval to be calculated. The differences among percentages of PRR is negligible over different time frames among alternative portfolios according to Table 5. This value lies in the interval (52.8, 54.3) for all portfolios.

3.2 Out-of-Sample Performance

All portfolios are compared in terms of out-of-sample performance criteria (Peterson et al., 2015) and shown in Table 6. The RP portfolio results in negative AR and consequently negative ASR; however, it has the lowest AV and lowest MDD over the rebalancing period. DB outperforms alternative portfolios in terms of ASR and has the lowest Turnover (TO). The TO calculation is shown in Eq. (11). It is not defined for the benchmarks since portfolio rebalancing is implemented only for risk parity portfolios.

Here, D y is the number of days in all test windows, x y is the number of time slots of rolling window in a year, and w i, t + 1 and w i, t+ are the weight of asset i in the portfolio after and before rebalancing, respectively.

Finally, the comparison of investment growth of portfolios over the most recent 2 years (i.e., the simulation window) has been analyzed as shown in Fig. 3. It is assumed that $1000 is invested in each portfolio on the first day of the rebalancing period. As can be seen in Fig. 3, all portfolios show similar trends of investment growth over time. There is no significant difference between the behavior of portfolios over the year 2018, but DB starts to surpass other portfolios in 2019 and ends up with highest investment growth at the end of the simulation window. It should be noted that RP has the lowest fluctuation in investment growth. This fact can be confirmed in the last days of 2018, when almost all portfolios experienced a drop; however, RP demonstrated the lowest decrease of investment value. This performance suggests that RP is an appropriate model for investors who are not interested in high return in a short amount of time and prefer, instead, to capture a steady stream of returns while not exposing the fund to high risks.

4 Conclusion

In this paper, we applied portfolio manager sentiment on relative asset weights to construct two modified version of RP portfolios for a wide range of assets. The first one (UB) applies the same bounds for all asset weights in all classes and the second one (DB) specifies different bounds for assets by class. The risk parity portfolio along with two modified version of it were implemented on ETF data representing 20 assets in three different classes. The performance of these three risk parity portfolios and three well-known benchmarks are compared in terms of multiple performance criteria including annualized return, annualized volatility, annualized Sharpe ratio, maximum drawdown, and percentage of positive rolling return on multiple time frames. Based on the in-sample results, RP outperforms UB, DB, and benchmarks in terms of annualized volatility, maximum drawdown, and annualized Sharpe Ratio; however, DB beats UB, RP and some benchmarks in terms of annualized return. Out-of-sample results based on a 1-month rebalancing period demonstrated that DB has the best performance in terms of annualized return, annualized Sharpe ratio, and turnover, but it also has the highest annualized volatility. In terms of maximum drawdown, DB outperforms RP and UB portfolios, while it cannot beat the benchmarks. Finally, UB and DB have the highest PRR. The out-of-sample results suggest that an investor might increase return and decrease risk by tailoring their investment approach to the current volatility regime – for example, using a traditional approach like 50/40/10 in low volatility periods and switching to RP in volatile ones. On the other hand, because DB appears to perform relatively well throughout the simulation horizon, it could be seen as a promising “all-weather” approach.

References

Bai, X., Scheinberg, K., & Tutuncu, R. (2016). Least-squares approach to risk parity in portfolio selection. Quantitative Finance, 16(3), 357–376.

Bhansali, V. (2011). Beyond risk parity. Journal of Investing, 20(1), 10,137–10,147.

Chaves, D., Hsu, J., Li, F., & Shakernia, O. (2011). Risk parity portfolio vs. other asset allocation heuristic portfolios. Journal of Investing, 20(1), 108.

Dalio, R., Prince, B., & Jensen, G. (2015). Our thoughts about risk parity and all weather. Bridgewater Associates. https://www.scribd.com/document/283103005/Our-Thoughts-About-Risk-Parity-and-All-Weather.

Griveau-Billion, T., Richard, J., & Roncalli, T. (2019). Package riskParityPortfolio. https://cran.r-project.org/web/packages/riskParityPortfolio/riskParityPortfolio.pdf.

Kazemi, H. (2012). An introduction to risk parity. Alternative Investment Analyst Review, 1.

Kolm, P. N., Tütüncü, R., & Fabozzi, F. J. (2014). 60 years of portfolio optimization: Practical challenges and current trends. European Journal of Operational Research, 234(2), 356–371.

Luenberger, D. G. (1998). Investment science. Oxford University Press.

Maillard, S., Roncalli, T., & Teiletche, J. (2010). The properties of equally weighted risk contribution portfolios. Journal of Portfolio Management, 36(4), 60.

Markowitz, H. (1952). The utility of wealth. Journal of Political Economy, 60(2), 151–158.

Peterson, B., Carl, P., Boudt, K., Bennett, R., Yollin, G., & Martin, R. D. (2015). Package PortfolioAnalytics. https://cran.r-project.org/web/packages/PortfolioAnalytics/PortfolioAnalytics.pdf.

Qian, E. E. (2016). Risk parity fundamentals / Edward E. Qian, PhD, CFA. Boca Raton.

Thiagarajan, S., & Schachter, B. (2011). Risk parity: Rewards, risks, and research opportunities. Journal of Investing, 20(1), 8,79–8,89.

Wu, L., Feng, Y., & Palomar, D. P. (2020). General sparse risk parity portfolio design via successive convex optimization. Signal Processing, 170.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Amini, F., Rajabalizadeh, A., Ryan, S.M., Niayeshpour, F. (2022). Modified Risk Parity Portfolios to Limit Concentration on Low Risk Assets in Multi-Asset Portfolios. In: Yang, H., Qiu, R., Chen, W. (eds) AI and Analytics for Public Health. INFORMS-CSS 2020. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-030-75166-1_11

Download citation

DOI: https://doi.org/10.1007/978-3-030-75166-1_11

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-75165-4

Online ISBN: 978-3-030-75166-1

eBook Packages: Business and ManagementBusiness and Management (R0)