Abstract

Can a community have a truly healthy, growing entrepreneurial ecosystem unless all segments of the community have access to the tools and resources to develop as entrepreneurs. The Kauffman Foundation uses the mantra of ‘zero barriers’, that is, if some groups have barriers to entrepreneurship then it holds back the entire ecosystem. Thus, ecosystem building needs to actively focus on inclusion. This chapter provides an overview of the key aspects of how to develop entrepreneurial ecosystems inclusively. Further, it discusses how a focus on true inclusion is a ‘rising tide strategy’ that lifts all entrepreneurial boats in the community. The chapter offers actionable policy recommendations for communities.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Introduction

Can a community have a truly healthy, growing entrepreneurial ecosystem unless all segments of the community have access to the tools and resources to develop as entrepreneurs. The Kauffman Foundation uses the mantra of ‘zero barriers’, that is, if some groups have barriers to entrepreneurship then it holds back the entire ecosystem. Thus, ecosystem building needs to actively focus on inclusion. This chapter provides an overview of the key aspects of how to develop entrepreneurial ecosystems inclusively. Further, it discusses how a focus on true inclusion is a ‘rising tide strategy’ that lifts all entrepreneurial boats in the community. The chapter offers actionable policy recommendations for communities.

Back in the 1980s, Massachusetts (USA) handed over the keys to running the economy to some brilliant tech executives. The result was the ‘Massachusetts Miracle’ where a booming tech economy soared to prominence… then toppled, in large part because the rest of the economy failed to follow suit. One could argue that Japan’s rise in the 1970s and early 1980s came on the back of a similar strategy that overwhelmingly focused on backing the most successful firms in the most successful industries. That too fell back to earth soon enough. Economic history is rife with examples where a narrow focus, even when carefully strategised, had only a temporary impact. So how might populations that are under-represented in start-ups be best supported in terms of entrepreneurial activity?

It is not surprising then that ‘rising tide’ strategies for economic and community development usually work best. In Europe, the eponymous Smart Specialisation programme works well where an area of strong local expertise is accompanied by strong connectivity across the local economy. Similarly, in the USA, it can be seen that asset-based community development (ABCD) which builds on a community’s strengths typically outperforms the usual needs-based development, but only if it also emphasises connectivity and breadth (Kretzmann and McKnight 1996). Nonetheless, the need for genuinely ‘rising tide’ development strategies is even more important as it relates to sub-populations. For example, for many policymakers the critical issue is how to spawn and nurture high-growth firms and the ecosystem model offers some new insights. Indeed, the OECD commissioned a seminal workshopFootnote 1 that brought together a diverse set of experts on what was then (and perhaps still remains) a nascent topic of inquiry on entrepreneurial ecosystems (Mason and Brown 2014).

Academic research lags practitioner work in entrepreneurial ecosystems, but organisations such as the Ewing Marion Kauffman Foundation (2017, 2019) are finding that lowering barriers to under-represented populations tends to lift all boats. Despite academic research being quite limited with respect to under-represented populations in entrepreneurial ecosystems, there has been some excellent work regarding those under-represented populations and entrepreneurship (e.g. Bates et al. 2018; Cooney 2008; Edelman et al. 2010). Part of why academic research on ecosystems has lagged is because it is as messy as the subject matter itself. To that end, the Kauffman Foundation recently embarked on a major overarching strategy called ‘Zero Barriers’ whose ultimate goal is to identify, then minimise or eliminate, dysfunctional barriers to entrepreneurial activity. A very useful place to start is with the barriers facing significantly under-represented groups. Is that population under-represented (or over-represented) because of a structural barrier, real or perceived? If so, what can be done to minimise or eliminate the barrier?

Precipitating Factors

Shapero (1975) was one of the first researchers to explore what conditions impede or facilitate entrepreneurial action. His model of the entrepreneurial event is still applicable today, but before digging too deeply, one particular facet of the model is especially valuable here to understanding how barriers fit into ecosystems. Shapero proposed a process model where individuals may perceive prospective action as an opportunity, but whether they act upon the opportunity was a function of other phenomena (Shapero and Sokol 1982). He had noted that behaviour is typically triggered by what he called a ‘precipitating factor’Footnote 2 whose perceived presence or absence represents a barrier. He conceived this precipitating factor as something that interrupted the inertia or momentum of human behaviour and permits re-equilibration of the system. The precipitating factor could be either positive or negative, that is one might spur action by adding a facilitator or by removing a hindrance. Indeed, the barrier can potentially be the absence of a facilitator or the presence of a hurdle. A person might normally think of barriers as the latter, but it can be a very fine line and one with profound implications for achieving zero barriers. If the underlying issue is getting a venture financed, is it the absence of capital access or the presence of actual barriers? How a person can make attributions of causality is surprisingly critical. Whether the attribution is negative or positive can matter considerably. In this case, consider that an entrepreneur might say: ‘there is a shortage of equity capital’ (pessimistic); or he/she might say: ‘I need to learn how to raise capital’ (optimistic). Effective mentoring programs are thus central to lower barriers to the under-represented.Footnote 3 To zero out barriers, it is important to understand how entrepreneurs make sense of their situation. Moreover, barriers can be very real, but one can also perceive non-existent barriers as impenetrable or turn what appears to be a tangible barrier into an opportunity. Research into high-growth immigrant entrepreneurs found none were able to raise external equity, yet all grew rapidly (Kumar and Krueger 2012). They were ‘forced’ into bootstrapping to phenomenal success (just like the vast majority of Inc.500 growth firms).

-

Advice to communities: One important key to growing a healthy entrepreneurial ecosystem will be to show prospective entrepreneurs that some important barriers (real or perceived) are less daunting than they think or even illusory. Put another way, healthy entrepreneurial ecosystems and growing healthy entrepreneurial activity require managing not just tangible barriers, but also intangible barriers.

Shapero’s model is largely homomorphic to the dominant model of human behavioural intentions, the well-known Theory of Planned Behaviour (Ajzen 1991). Despite differences (such as Shapero including action-focused variables), both models share one important reality, a prospective course of action is most likely actionable if a person perceives it as desirable and if that person also perceives it as feasible.

Cognitively, one’s evoked set of opportunities are those actions that are perceived as feasible and desirable. Of course these perceptions need not be accurate! Whether something is desirable is hostage to one’s experiences, social and family norms, and even familiarity. In many communities, what is known about the realities of the start-up life derive from popular writing, television shows, etc., not from actual personal or vicarious exposure. It is thus important to help those who have not had that experience to get that tacit knowledge. If a person never sees a successful entrepreneur who looks like oneself, that can readily dampen one’s judgement of whether a venture is desirable or feasible (and probably skew it as well). Similarly, if a person does not see an ecosystem builder who looks like oneself that will also likely slow one’s progress as well. The entrepreneurial potential of an ecosystem is a function of its potential entrepreneurs (both quality and quantity). This is not just related to how many in a community perceive entrepreneurial activity as both desirable and feasible, but also the different types of entrepreneurial activity in which they can engage (Krueger and Brazeal 1994; Krueger 2020). Experienced ecosystem builders like the USA-based SourceLink find that infrastructure matters, both tangible and intangible (Meyers and Hodel 2017).

-

Advice for Communities: Develop effectively both human capitalandsocial capital.

Cognitive and Social Infrastructure

While communities can usually identify tangible barriers (e.g. that minorities receive a disproportionately smaller share of resources), it is vital to also monitor the intangibles (Krueger 2000). How many people see entrepreneurial activity as desirable? As feasible? What kinds of activity do they perceive as credible or as not credible? The social and cultural dimensions and actions (and beliefs) of the community are critical influencers of entrepreneurial potential. One early approach was to advise communities to track the various facets of the social infrastructure. Flora and Flora (1993) argued that communities which were highly supportive of entrepreneurial activity share certain specific social and cultural norms and processes (i.e. the entrepreneurial community should mirror the broader community). Consider this as a format to convert social capital into organisational forms that facilitate collective action. They categorise Entrepreneurial Social Infrastructure into three dimensions: Symbolic Diversity (seek heterogeneity, processes nor personalities, permeable boundaries); Resource Mobilization (equitable distribution, willing to cooperate); and Quality of Networks (both vertical and horizontal, depth of entrepreneurial bench). They have successfully used these rubrics to assess ecosystem health, although this predates the rise of ecosystem (Flora et al. 1997).

As the work of the Flora and Flora suggests, a healthy ecosystem facilitates the co-evolution of entrepreneurial human capital and entrepreneurial social capital (Björklund and Krueger 2016). In turn, that facilitates regional competitiveness (Audretsch and Peña-Legazkue 2012). The Global Entrepreneurship Monitor data suggests quite strongly that predicting entrepreneurial activity is a function of entrepreneurial human capital and social capital, one is not enough as you need both (Reynolds 2011). Both human capital and social capital can differ quantitatively and qualitatively—where is the community building entrepreneurial capital (and what kinds) and where is it not building entrepreneurial capital (Audretsch et al. 2019)? In what sectors of the economy and in what segments of the population is this activity happening? If regional competitiveness depends on having and growing entrepreneurial capital, is that not a clear incentive to include as much of the community and the local economy as possible?

Ecosystems 101

To grossly oversimplify, one can look at local economies as driven by institutions and other power players that create and manage conditions that may or may not enable different kinds of entrepreneurial activity. This is the traditional view that continues to dominate economic development thinking and practice. Alternatively, one can view local economies as a complex network of networks where interconnections are in constant flux (Brett 2019). The much vaunted ‘Industry 4.0’ paradigm (e.g. Rüßmann et al. 2015) embraces powerful tools such as Open Innovation and co-optition, assuming firms interact in complex, dynamic networks rather than in stable, often hierarchical relationships. If broad industry sectors have embraced ecosystems and the tools needed to succeed in this messy new world, why has economic policy not adopted ecosystems more broadly, especially for economic development policy?

In the traditional model of economic development, a community can promote economic activity by: (a) attracting new businesses to move in; (b) working to keep businesses from leaving and/or providing them resources so they do not fail; and (c) by helping existing businesses to expand. Some communities have added (d) business incubation, but it is still disappointingly infrequent (Note: most communities publicly support entrepreneurship, but invest little in the process). In this typical model, communities expend the most resources on business attraction, less on retention and even less on expansion. However, communities get the biggest return on investment on spending for business expansion and the least for attraction, the exact opposite of funding priorities. One might well wonder why this massive disconnect exists even in areas with poor infrastructure or smaller populations who have little hope of attracting a large employer (localities who will also not take advantage of the under-resourced community). Part of the reason is because this is all they know; part of it is because this is all they know how to do. Some of their thinking is tradition and part of it is the training of civic officials who honestly believe (despite the massive contrary evidence) that focusing on business attraction is the only real strategy, plus it is all they know how to do. Even today in many Western economies, training on how to grow businesses cannot be found in formal training in economic development.

-

Advice for communities: Find ways to educate and train civic officials regarding how to grow businesses, through both entrepreneurship and business expansion.

From this advice comes a related research question: Can this be measured and what is the impact? Consider these numbers; in one USA western state they found that over an entire business expansion regime (2000–2008) that gross job creation was 58 per cent from new businesses, 40 per cent from existing firms growing and only 2 per cent from business attraction.Footnote 4 To be fair, communities lose jobs when businesses close and when they shrink (or move out). In this same state then, the net job creation was 90 per cent from expanding businesses (less shrinking) and 10 per cent from start-ups (less deaths). National data for the USA was equally clear: even using definitions most-friendly to business attraction, 87 per cent of gross new jobs in the USA are home-grown (Mazerov and Leachman 2016). Getting that data is so important; publicising it even more so.

-

Advice for communities: Find ways to gather reasonable,actionabledata for your community.

As will be discussed later, knowledge is power and strong metrics do matter. From this advice comes a related research question: What metrics do civic officials use currently? This dynamic is compounded by the dominant academic models that either follow this pattern or, perhaps worse, emphasise institution-dominated, top-down models such as the infamous triple helix (Brännback et al. 2008). The triple helix in its basic form proposed that innovation and entrepreneurship only required the presence of three enabling institutions (government, industry and academia). Entrepreneurs will only emerge because of the enabling conditions established by the institutions. Put more bluntly, this model asserts it is possible to have innovation without innovators, entrepreneurship without entrepreneurs. An absurd conclusion? Not to institutions and local elites. What does the research actually say? Institutions do matter, but only insofar as they support bottom-up, entrepreneur-driven activity (Urbano and Alvarez 2014; Aparicio et al. 2016). Fortunately, this picture is evolving in useful directions and is particularly useful for communities in earlier stages of development.

Fourth-Wave of Economic Development: The Rise of Ecosystems

Some researchers have described the rise of ecosystem thinking as the ‘fourth wave’ of economic development (e.g. Gines 2019) where the bottom-up, entrepreneur-led, networks-focused model is added to the mix. As the ecosystem model tends to be highly disruptive, even threatening, this will be a slow transition. No amount of shiny statistics will change those who are committed to the old paradigms. Ecosystem builders need to change the dominant narrative (e.g. with a panoply of success stories). What better success story than one that shows how someone outside the mainstream succeeds through entrepreneurial activity?

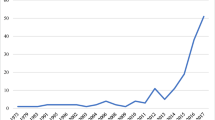

Consider Fig. 1.Footnote 5 It is extraordinarily rare for an economy to be organised in a centralised network which often risks undue market power if successful (e.g. Amazon). It is also rare to see an economy organised as a decentralised network, but that is how many perceive their local economies and try to manage them correspondingly. However, most healthy local economies operate as if they were distributed networks. To make matters even more complicated, most communities (and most organisations) are a mix of hierarchies/silos and networks that connect across and between the hierarchies (Stephenson 2009). Envision how different the roles are for a successful connector. For centralised networks, the connecting is the purview of that central hub about which all things revolve. For the decentralised network, each hub could have its own connectors, but for distributed networks a very different type of connector is needed. A distributed network requires connectors who can guide entrepreneurs through a maze of stakeholders and of resources, connectors who are professional and proactive, what Sweeney (1987) called ‘liaison-animateurs’.Footnote 6 All this led to new narratives and questions, such as ‘is a local economy like an orderly farm to be tended or a chaotic yet productive rainforest’ (Hwang 2020)?

Feldman and Zoller (2012) explored what happens to the social networks in an entrepreneurial community. Introducing the right kind of connector (a genuine liaison-animateur) quickly shows that the new connector is connecting, but that the rest of the social network also increases its connectivity. Similar work by Motoyama (e.g. Motoyama and Knowlton 2017) also shows how networks evolve. However, there are two ‘flavours’ of connector—most true liaison-animateurs are unselfish (often to a fault), but there are also connectors who expect a quid pro quo (usually they wish to be seen as highly connected and appreciated for that). In social network theory terms, they seek to be ‘structural holes’, the only connector between entrepreneurs and a critical resource. Or in Stephenson’s (2009) more felicitous terms, there are connectors and gatekeepers (to valued resources). The quantity and quality of mentoring and coaching also matters in such circumstances.

-

Advice to communities: Find ways to identify the great connectors, especially the unselfish ones? Are these connectors receiving training? Visibly encouraged? Likewise, can great mentors be identified and trained. Moreover, are mentors and connectors who represent under-represented populations be trained as peer-to-peer mentoring is critical for minority entrepreneurship?

From this advice comes some related research questions. Can gatekeepers be identified? Gatekeepers appear to believe in top-down, institutions-led efforts and believe that the local economy is best envisioned as a centralised network. Can this understanding of gatekeepers be demonstrated empirically? Finally, is it possible to rigorously assess the impact of improving connectors and mentors?

What Is the Evidence? The Boulder Thesis

The co-architect of the tech ecosystem of Boulder, Colorado (USA) was serial entrepreneur-turned-venture capitalist Brad Feld. For a population of approximately 100,000, Boulder had an entrepreneurial economy that more resembled a city ten times its size. Feld (2013) set out to examine what Boulder and other successful start-up communities had in common. Strikingly, four of Boulder’s key attributes were shared by almost all successful start-up communities. The most important attribute was that entrepreneurial activity and policy initiatives were bottom-up (not top-down) and led by entrepreneurs (not by powerful institutions). Every city and state believe they are highly responsive to entrepreneurs, but entrepreneurs rarely agree.

-

Advice for communities: For minority entrepreneurs or any under-represented populations, it is essential that not only is their voice be heard clearly, but they need to have influence over policy decisions and public initiatives.

From this advice comes a related research question: How can we measure the bottom-up approach to the local economy? It is quite hard to assess whether institutions are driving efforts or are listening to entrepreneurs and supporting them: An easy question to ask but definitely a challenge to assess accurately. Startup Genome is one of several practitioner groups trying to measure this activity (Gauthier et al. 2018), but are under-represented populations part of a community’s assessment?

The second key commonality is that successful ecosystems are inclusive of all entrepreneurs and their key stakeholders. Feld calls it inclusive of the ‘whole stack’, as it is inclusive of as many stakeholders as possible, especially entrepreneurs who are not part of the usual focus on high-tech, high-growth potential ventures. As under-represented groups are usually over-represented in lower-tech businesses, the importance of this is critical. As previously mentioned, a cautionary tale is the so-called ‘Massachusetts Miracle’ in the early 1980s. At the risk of oversimplifying the situation, the stumbling tech economy of the state was rescued by the state authorities essentially turning over economic development efforts to some leading tech executives. Their strategies were excellent and the tech economy rebounded. However, the rest of the economy did not rebound and eventually this weakness brought down the tech companies also (Corman et al. 1996).

-

Advice for communities: Do not focus just on tech or a specific sector. If a sector is very successful, do try to build on that strength.

As asset-based community development (ABCD) suggests, one can get greater Return on Investment (ROI) from enhancing strengths that remediating weaknesses, but do not forget the ‘whole stack’. For under-represented populations who might be more concentrated in retail and service businesses, one will need to ensure that they benefit from support mechanisms. From this advice comes a related research question: How can one measure whether economic policies are ‘rising tide’ strategies that are inclusive? In particular, are under-represented populations also under-benefiting?

Another commonality found by Feld (2013) was that successful entrepreneurial ecosystems have visible rallying points, things that the whole community celebrates (for Boulder it was the great venture accelerator Techstars). The final commonality was that these communities recognised that any entrepreneurship strategy had to be long-term. If it took Silicon Valley 30 or 40 years to emerge, other local communities cannot expect overnight success. Since then, the ‘Boulder thesis’ or the ‘Feld model’ has been widely adopted globally, at least in words. In recent years, as the Ewing Marion Kauffman Foundation (world’s largest funder of entrepreneurship programming) has evolved to focus heavily on developing entrepreneurial ecosystems, Feld’s first two commonalities are front and centre of their work.

Ecosystems Need Builders (and Operators)

Attention has increasingly turned towards the ‘how’ and the ‘who’ of growing healthy entrepreneurial ecosystems. An increasing focus has grown on the processes that appear to be at the heart of ecosystem building and the people behind those processes. Thought leaders within such organisations as the Ewing Marion Kauffman Foundation argue that there exists a need for the emergence of a new role in economic development, that of the ‘ecosystem builder’. If this is indeed a genuine phenomenon, then the ecosystem builderFootnote 7 becomes absolutely critical. Are they liaison-animateurs? Yes, but what else?

The most recent major Kauffman initiative (which started in earnest in 2017) is dubbed ‘ESHIP’. ESHIP has brought together hundreds of the USA’s (and quite a few non-USA) ecosystem builders in a broad, rich movement to identify mechanisms and tools that will enable and empower ecosystem builders. Perhaps the most prominent output so far is the development of their seven overarching Big Goals (think the UN’s Sustainable Development Goals); its Goal One is Diversity & Inclusion and as befitting the Kauffman Foundation’s own ambition for working towards zero barriers, inclusion issues also pervade the other six Goals.Footnote 8 According to the Kauffmann Foundation, ESHIP Goal 1 is ‘Inclusive Field: Ensure ecosystem builders with diverse perspectives lead our field’. It is argued that those building the ecosystem need to be more heterogeneous to ensure broader participation in entrepreneurial activity. Why does this matter? Entrepreneurial activity takes many forms and is seen through many lenses. For those populations that are under-represented, having role models as entrepreneurs is deeply important, but to generate those role models entails ecosystem builders who understand these different perspectives—whether urban or rural, high-tech or low-tech, female or male, majority or minority, etc.

-

Advice to communities: Do your ecosystem champions reflect all the voices? Are you listening? And hearing what theyactuallysay?

Is a local economy like a diversified investment portfolio? Many policy initiatives certainly act as though firms and industries are connected in reasonably predictable fashion. If any of the foregoing is true (and evidence strongly suggests all are valid), then managing its health suddenly becomes much more of a supervenient process. You have to build policy bottom-up, listening carefully to what the entrepreneurs, both current and potential, are saying.

In every model seeking a greater understanding of healthy entrepreneurial ecosystems, there has been one significant recurring theme. It is difficult to conceive of a truly healthy ecosystem that only engages one sector of the economy and, more importantly, only one segment of the population. Many of the under-represented groups are highly visible and yet it remains difficult to engage them as productively as should be happening. What then about the less visible, even invisible minorities like veterans, people with disabilities (e.g. neurodiverse) and seniorpreneurs (Galloway and Cooney 2012)? While smaller in numbers, in the USA these groups often exhibit above-average success rates, suggesting that they have much to offer the entire ecosystem. Consider growth entrepreneurship. Minority populations are usually much less likely to perceive opportunity to scale their ventures. Even strong role models need not socialise with those populations to see venture growth as an opportunity. That certainly helps communities, but requires ecosystem builders who are personally credible as well (Gines 2019).

Measurement Issues

One final aspect of entrepreneurial ecosystems is metrics. What are the ‘right’ Key Performance Indicators (KPIs) for ecosystems? While there will always be understandably idiosyncratic metrics for each ecosystem, there are likely metrics that will serve most communities to help grow their ecosystems, especially those that are persuasive to critical stakeholders. In traditional economic development, jobs and tax revenue are the usual suspects. However, such measures tend to be backward looking. While it is useful to get feedback on the impact of a community’s efforts, they can also be misleading. Perhaps more important, placing emphasis on lagging indicators is usually a missed opportunity for communities to use process/throughput indicators (e.g. Krueger 2012) and, even more valuable, leading indicators with predictive validity. That is, beyond ‘have we arrived?’ an early warning system is needed that asks: ‘are we on the right track?’ In turn, this argues strongly for developing models that reflect important processes and how they evolve, a rather difficult task within complex and dynamic adaptive systems like a local economy (Brett 2019). To develop a model for a local community is therefore highly challenging. However, there are some nascent efforts that are beginning to bear significant fruit that centre on the maturity level of ecosystems and appear to do a credible job of rating ecosystems, using data analysis that captures and embraces the dynamics. The most notable of these analytics is Startup Genome (e.g. Gauthier et al. 2018) which focuses on communities.Footnote 9

There has long been a cottage industry of ‘places rated’ and ‘top ten’ lists that purport to rank communities and these rankings and ratings are painfully hostage to which criteria are selected. Motoyama and Konczal (2013) cleverly showed how one can game these rankings. Moreover, a single metric can mislead terribly. For example, the Kauffman Index of Entrepreneurial Activity (Mobelix and Russell-Fritch 2017) showed USA cities like Las Vegas and Boise as stellar producers of start-ups, yet near the bottom on growth firms and tech firms. To the point of this chapter, many cities show stark differences across different parts of their community, whether geographic or demographic. But how healthy is an ecosystem that only supports some neighbourhoods, some industries, some populations?

-

Advice to communities: While it is easy and glib to note that ‘you get what you measure’, there is another equally potent maxim of ‘knowledge is power’’.

As just noted, communities are prone to choose metrics that are at best convenient and, at worst, painfully self-serving. Are stakeholders measuring all of the populations in their communities? Having fine-grained statistics has its risks, but aggregated statistics can be painfully misleading. For example, in the USA, if one looked at entrepreneurial activity in the last recession, some groups did better than others. There was little difference evident among Hispanics, but when one looked deeper, Latinas did remarkably well. Understanding how different groups, neighbourhoods and industries are faring is essential to developing strong entrepreneurial ecosystems.

For ecosystem builders, finding the right metrics that are genuinely useful for communities is a good vehicle for building credibility in their community. They can also ensure that one does not select metrics where one can expect good scores, but also metrics that tell where a local community is lagging (e.g. what is happening with currently or historically under-represented populations?). There is some good data freely available in North America and via OECD,Footnote 10 such as www.youreconomy.org and affordable expertise such as www.economicmodeling.com. Nevertheless, it is the responsibility of local communities to identify the right questions to ask before one can answer them. Therefore, it is critical to create a dashboard that the local community itself helps to build. From this advice comes some related research questions: Do the metrics used by a community provide any predictive insight regarding how ecosystems evolve? Do the communities test their metrics for predictive validity (for any kind of validity)? Can it be demonstrated empirically that it matters for a community to be good at metrics?

Conclusion

Despite the painfully slow rate of progress of work to ensure that every facet of the community has access to entrepreneurial activity, several important implications for communities to pursue can be seen. Each of the implications also represents a very low-hanging fruit for researchers to pursue.

-

What Does All This Mean for Communities? If a community wants a truly inclusive local economy, then everyone needs to be included, and as many leaders where possible. And for entrepreneurs and small businesses, listen to them (not those who claim to speak for them) and hear what they are saying. Then take action; easy to say, hard to do.

-

Educate the civic officials and media.Footnote 11 Help them to understand that ecosystems approaches require very different perspectives. Help them to understand that ecosystems are complex adaptive systems (Brett 2019; Smyre and Richardson 2016; Hwang 2020) that resemble rainforests far more than farms. Teach them to think about the intangible infrastructure—the cognitive and social infrastructures—not just tangible issues. Ensure that everyone is in the conversation, not just the ‘usual suspects’. Reward civic officials, both leaders and staff, for getting this and acting in these new directions. In many communities, economic development practitioners are only rewarded for business attraction, no matter how suboptimal that might be. That rarely enhances diversity, let alone inclusion.

-

Support your grass roots, entrepreneur-led entities. In too many communities, the established ‘players’ recognise that entrepreneurship is important, but feel entitled to lead efforts and get paid. How many entrepreneur/small business/tech events are led by under-represented groups? This will likely entail diverting resources from existing power players with the corresponding political risks, hence the need to educate leaders and media. What if the general public started to understand that entrepreneurs are the drivers of their local economy and that anyone can be an entrepreneur? What if they realised the power of listening to them? They do in Boulder, Rotterdam, Gothenburg, Tel Aviv and more. So could any community.

-

Grow entrepreneurial human capital and entrepreneurial social capital. A community’s entrepreneurial potential is a function of the quantity and quality of potential entrepreneurs. What if all of the citizens had access to learning entrepreneurial skills? Access to learning experiences that nurtured an entrepreneurial/innovator mindset? What if a community had broad, rich connectivity where even a novice entrepreneur can access the right resources in timely, cost-effective fashion? Studies have shown that far too many training programmes are disappointing, with many falling painfully short of best practice. It is better to believe and assert the quality of a programme than to shift towards best practices. As a community, leaders can show leadership by demanding the best quality possible, even if that means shifting resources away from established players. Or as Jim Collins famously said, ‘Get the right people on the bus. Get the wrong people off’.

None of these actions are easy, but even a gallant effort in these directions will build an entrepreneurial ecosystem that is more dynamic, deeply connected and welcoming to all potential and existing entrepreneurs.

Resources are plentiful, but often in locations that people may not be aware exists. Expertise at ecosystem building and other bottom-up approaches is available, but those experts are not typically found in the ‘usual suspects’ of economic development and community development. In fact, those who usually claim to be the voice of entrepreneurs and small business may embrace the term ecosystem, but not grasp its implications (and may even have a vested interest in the established models). In the USA, the ESHIP network is readily findable (e.g. via social mediaFootnote 12). People should take full advantage of policy initiatives already developed. The ‘America’s New Business Plan’ (Kauffman 2019) is based on sound theory and strong empirical evidence, and offers dozens of policy actions at national, state and local level. Despite the name, these prescriptions are applicable in most settings. Beyond the ‘Start Us Up Now’ effort, the ‘Right to Start’ initiative should be equally helpful.Footnote 13 For many communities, the relevance of ecosystem building to the UN’s SDGs is a persuasive tool (ICSB 2020, pp. 55–59). But, most of all, start with that very first prescription: listen to the entrepreneurs and innovators, the starters and small businesses; hear what they are saying. Get them involved in the community’s initiatives. Let them lead. A common prescription suggests that: Diversity is inviting people to the dance; Inclusion is asking them to dance. Indeed, true inclusion is inviting them to help pick out the music. And why not have them put on the dance? Shall we dance?

Notes

- 1.

- 2.

Such a slight nudge would cause a supersaturated solution to precipitate into a solid or how a speck of dust might precipitate moist air into rain (or why it is called ‘precipitation’).

- 3.

e.g., see www.venturecapital.org & WomenGetFunded.com. Also, funders like Portfolia (https://www.portfolia.co/) & Next Wave Impact (https://nextwaveimpact.com/).

- 4.

NETS database (but confirmed by other data sets).

- 5.

Note that most local economies are actually a network of networks where connections are highly dynamic.

- 6.

As the name suggests, they are both bridgers and energizers.

- 7.

We would be remiss to ignore that many ecosystem “builders” are better described as ecosystem “operators”—they do more to support and improve existing efforts. I am grateful to Valto Loikannen, Adam Rentschler, Alistair Brett, Anika Horn, Beth Zimmer, Mark Lawrence, and others for this most important insight.

- 8.

- 9.

- 10.

e.g., www.betterentrepreneurship.eu and International Compendium of Entrepreneurship Policies (https://bit.ly/OECD_IntComp).

- 11.

The media is critical as it is vital for the public to understand as well.

- 12.

Author is happy to help and refer you to appropriate experts (norris.krueger@gmail.com; social media) such as www.ecosystembuilderhub.com.

- 13.

www.StartUsUpNow.org and www.RightToStart.org respectively.

References

Aparicio, S., D. Urbano, & D. Audretsch. 2016. “Institutional factors, opportunity entrepreneurship and economic growth: Panel data evidence.” Technological Forecasting and Social Change. 102: 45–61.

Audretsch, D., J. Cunningham, D. Kuratko, E. Lehmann, & M. Menter. 2019. “Entrepreneurial ecosystems: Economic, technological & societal impacts.” Journal of Technology Transfer. 44: 313–325.

Audretsch, D., & I. Peña-Legazkue. 2012. “Entrepreneurial activity & regional competitiveness.” Small Business Economics. 39(3): 531–537.

Ajzen, I. 1991. “The theory of planned behavior.” Organizational Behavior and Human Decision Processes. 50(2): 179–211.

Bates, T., W. D. Bradford, & R. Seamans. 2018. “Minority entrepreneurship in twenty-first century America.” Small Business Economics. 50(3): 415–427.

Björklund, T. A., & N. F. Krueger. 2016. “Generating resources through co-evolution of entrepreneurs and ecosystems.” Journal of Enterprising Communities: People and Places in the Global Economy. 10(4): 477–498.

Brännback, M., A. L. Carsrud, N. F. Krueger, & J. Elfving. 2008. “Challenging the triple helix model of regional innovation systems: A venture-centric model.” International Journal of Technoentrepreneurship. 1(3): 257–277.

Brett, A. 2019. Admired disorder: A guide to building innovation ecosystems: Complex systems, innovation, entrepreneurship, and economic development. BookBaby.

Cooney, T. M. 2008. “Why is community entrepreneurship worth debating?” Journal of Enterprising Communities: People and Places in the Global Economy. 2(2): 1–3.

Corman, J., R. Lussier, & K. G. Nolan. 1996. “Factors that encourage entrepreneurial start-ups and existing firm expansion: A longitudinal study comparing recession and expansion periods.” Academy of Entrepreneurship Journal. 1(2): 43–55.

Cukier, D., F. Kon, & N. F. Krueger. 2015, December. “Designing a maturity model for software startup ecosystems.” In International Conference on Product-Focused Software Process Improvement (pp. 600–606). Springer.

Edelman, L., C. Brush, T. Manolova, & P. Greene. 2010. “Start‐up motivations & growth intentions of minority nascent entrepreneurs.” Journal of Small Business Management. 48(2): 174–196.

Feld, B. 2013. Startup communities: Building an entrepreneurial ecosystem in your city. Wiley.

Feldman, M., & T. D. Zoller. 2012. “Dealmakers in place: Social capital connections in regional entrepreneurial economies.” Regional Studies. 46(1): 23–37.

Flora, C. B., & J. L. Flora. 1993. “Entrepreneurial social infrastructure: A necessary ingredient.” The Annals of the American Academy of Political and Social Science. 529(1): 48–58.

Flora, J. L., J. Sharp, C. B. Flora, & B. Newlon. 1997. “Entrepreneurial social infrastructure and locally initiated economic development in the nonmetropolitan United States.” The Sociological Quarterly. 38(4): 623–645.

Galloway, L., & T. Cooney. 2012. “Silent minorities of entrepreneurship.” International Journal of Entrepreneurship and Innovation. 13(2): 77–79.

Gauthier, J., D. Stangler, M. Penzel, & A. Mobelix. 2018. Global startup ecosystem report 2018: Succeeding in the new era of technology. Startup Genome, LLC.

Gines, D. 2019. The importance of inclusive entrepreneurial ecosystems. Federal Reserve Bank of Kansas City. Retrievable at https://www.mainstreet.org/blogs/national-main-street-center/2019/05/07/main-spotlight-the-importance-of-inclusive-entrepr.

Global Entrepreneurship Monitor. 2018. “Global Report 2017/18.” Global Entrepreneurship Research Association (GERA): London, UK.

Ewing Marion Kauffman Foundation. 2017. “Zero barriers: Three mega trends shaping the future of entrepreneurship.” Washington, DC. Retrieved at https://www.kauffman.org/what-we-do/resources/state-of-entrepreneurship-addresses/2017-state-of-entrepreneurship-address.

Ewing Marion Kauffman Foundation. 2019. “America’s new business plan.” Retrieved at https://www.kauffman.org/currents/americas-new-business-plan-expands-what-it-means-to-be-pro-business/ See also www.StartUsUpNow.org.

Hwang, V. W. 2020. “We are all starters: A manifesto to renew ourselves & our nation.” www.RightToStart.org. Regenwald, Kansas City.

ICSB. (2020). ICSB Annual Global Micro-, Small & Medium-Sized Enterprises Report, ICSB Washington DC. https://bit.ly/ICSB_ESHIP.

Kretzmann, J., & J. P. McKnight. 1996. “Assets‐based community development.” National Civic Review. 85(4): 23–29.

Krueger, N. F. 2000. “The cognitive infrastructure of opportunity emergence.” Entrepreneurship Theory and Practice. 24(3): 185–206.

Krueger, N. F. 2012. “Markers of a healthy entrepreneurial ecosystem.” Available at SSRN 2056182.

Krueger, N. F. 2020. “Entrepreneurial potential and potential entrepreneurs: 25 years on.” Journal of the International Council for Small Business, 1(1) 52–55.

Krueger, N. F., & D. V. Brazeal. 1994. “Entrepreneurial potential and potential entrepreneurs.” Entrepreneurship Theory and Practice. 18(3): 91–104.

Kumar, S., & N. Krueger. 2012. “Making startup visa Act proposal effective: Exploratory study of high-growth Asian Indian immigrant entrepreneurs.” Frontiers of Entrepreneurship Research. 32 (8): 4.

Mason, C., & R. Brown. 2014. “Entrepreneurial ecosystems and growth oriented entrepreneurship.” Final Report to OECD, Paris. 30(1): 77–102.

Mazerov, M., & M. Leachman. 2016. State job creation strategies often off base. Washington, DC: Center on Budget and Policy Priorities. http://www.cbpp.org/sites/default/files/atoms/files/2–3-16sfp.pdf.

Meyers, M. A., & K. P. Hodel. 2017. Beyond collisions: How to build your entrepreneurial infrastructure. Wavesource LLC.

Mobelix, A., & J. Russell-Fritch. 2017. Kauffman index 2017: Growth entrepreneurship national trends. Ewing Marion Kauffman Foundation.

Motoyama, Y., & J. Konczal. 2013. “How can I create my favorite state ranking? The hidden pitfalls of statistical indexes.” Journal of Applied Research in Economic Development. 10, online. Retrieved at http://journal.c2er.org/2013/09/how-can-i-create-my-favorite-state-ranking/.

Motoyama, Y., & K. Knowlton. 2017. “Examining the connections within the startup ecosystem: A case study of St. Louis.” Entrepreneurship Research Journal. 7(1): 1–32.

Reynolds, P. D. 2011. “New firm creation: A global assessment of national, contextual and individual factors.” Foundations and Trends® in Entrepreneurship. 6(5–6): 315–496.

Rüßmann, M., M. Lorenz, P. Gerbert, M. Waldner, J. Justus, P. Engel, & M. Harnisch. 2015. “Industry 4.0: Future of productivity & growth in manufacturing industries.” Boston Consulting Group. 9: 54–89.

Shapero, A. 1975. “The displaced, uncomfortable entrepreneur.” Psychology Today. 9(6): 83–88.

Shapero, A., & L. Sokol. 1982. “The social dimensions of entrepreneurship.” Encyclopedia of Entrepreneurship, 72–90.

Smyre, R., & N. Richardson. 2016. Preparing for a world that doesn’t exist-yet: Framing a second enlightenment to create communities of the future. John Hunt Publishing.

Stephenson, K. 2009. “Neither hierarchy nor network: An argument for heterarchy.” People and Strategy. 32(1): 4 [see also www.bit.ly/Karen_S].

Sweeney, G. 1987. Innovation, entrepreneurs & regional development. NY: St. Martin’s Press.

Urbano, D., & C. Alvarez. 2014. “Institutional dimensions and entrepreneurial activity: An international study.” Small Business Economics. 42(4): 703–716.

Note: Web-based references also available via author.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Krueger, N. (2021). Beyond “Getting Asked to Dance”: Inclusive Entrepreneurial Ecosystems. In: Cooney, T.M. (eds) The Palgrave Handbook of Minority Entrepreneurship. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-030-66603-3_6

Download citation

DOI: https://doi.org/10.1007/978-3-030-66603-3_6

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-030-66602-6

Online ISBN: 978-3-030-66603-3

eBook Packages: Business and ManagementBusiness and Management (R0)