Abstract

The purpose of this article is to examine the influence of institutional dimensions (regulative, normative and cultural-cognitive) on the probability of becoming an entrepreneur. The main findings demonstrate, through logistic regression, that a favourable regulative dimension (fewer procedures to start a business), normative dimension (higher media attention for new business) and cultural-cognitive dimension (better entrepreneurial skills, less fear of business failure and better knowing of entrepreneurs) increase the probability of being an entrepreneur. Data were obtained from both the Global Entrepreneurship Monitor and the International Institute for Management and Development for the year 2008, considering a sample of 30 countries and 36,525 individuals. The study advances the literature by providing new information on the environmental factors that affect entrepreneurial activity in the light of institutional economics. Also, the research could be useful for designing policies to foster entrepreneurship in different environments.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In recent years, scholars have been paying increased attention to the cross-national variation in entrepreneurial activity and the reasons behind this phenomenon (Audretsch 2012; Anderson et al. 2012; Lee et al. 2011; Mueller and Thomas 2000; Nielsen and Lassen 2012; Renko et al. 2012; Shane and Kolvereid 1995).

The preliminary evidence suggests that part of the answer lies in the country-specific institutional context (Busenitz and Lau 1996; Busenitz et al. 2000; Dana 1987, Mueller and Thomas 2000; Reynolds et al. 1999, 2000, 2001) in which the entrepreneurs operate. However, there is limited understanding of the role that the institutional context plays in influencing entrepreneurial activity.

Key questions arising from the finding that the environmental context influences entrepreneurship concern how institutions relate to the entrepreneurial activity and which institutions are most important for explaining entrepreneurship rates. Institutional economics provides a useful theoretical framework for understanding such effects. Specifically, the institutional approach suggests that human behaviour is influenced by the institutional environment (North 1990, 2005); hence, the decision to start a business is also determined by the institutions in which it occurs.

In this context, differences in national institutions may also bring about different levels of entrepreneurial activity across countries. Thus, the main purpose of this article is to examine the impact of institutions on entrepreneurial activity, specifically, to analyse the influence of institutional dimensions (regulative, normative and cultural-cognitive) on the probability of becoming an entrepreneur. Data were obtained from both the Global Entrepreneurship Monitor (GEM) and the International Institute for Management and Development (IMD) for the year 2008, considering a sample of 30 countries and 36,525 individuals.

Some authors have analysed the institutional dimensions in the field of entrepreneurship. From the three institutional dimensions of Scott (1995), Kostova (1997) proposed the concept of a country institutional profile to analyse how the regulative (government policies), normative (social norms and value systems) and cultural-cognitive (shared social knowledge) pillars influence domestic business activity. Later, Busenitz et al. (2000) introduced and validated a measure of the country institutional profile for entrepreneurship. This research is replicated in Spencer and Gomez (2004). In addition, Manolova et al. (2008) validated the Busenitz et al. (2000) instrument to measure a country’s institutional profile in the context of three emerging economies in Eastern Europe. Finally, Gupta et al. (2012), using the Busenitz et al. (2000) instrument, compared the institutional environment for entrepreneurship in South Korea and the United Arab Emirates.

However, few authors have studied the impact of institutional dimensions on entrepreneurial activity using cross-national data. De Clerq et al. (2010) include regulative, normative and cognitive institutions as moderating effects in the relationship between associational activity and the level of new business activity in emerging economies, using data from the Global Entrepreneurship Monitor and the World Values Survey. Also, Stenholm et al. (2013) examined the three dimensions in a cross-national comparison. In this line, Bruton et al. (2010) found that studies including multiple-country databases are the exception, not the rule, when using institutional economics to explain entrepreneurship.

As we mentioned before, our model focuses on the relationship between institutional dimensions and entrepreneurial activity, using data from both the country and individual level. This approach is necessary because the conceptualisation of the regulative and normative dimensions of institutions indicates the national measure; however, according to Scott (2008: 57), the cognitive dimension mediating between the external world of stimuli (institutional environment) and the response of the individuals requires an individual measure. Therefore, in this article we expand the use of institutional economics to examine how entrepreneurial activity is influenced by macro (country) and micro (individual) institutions.

The article is structured as follows. After this brief introduction, in the second section we review the literature on the relationship between institutional dimensions and entrepreneurial activity and propose the hypotheses. The third section presents the details of the research methodology. The fourth section discusses the empirical results of the study. Finally, the article points out the most relevant conclusions and future lines of research.

2 Institutional approach to entrepreneurship

Institutional economics has proven to be especially helpful to entrepreneurship research (Bruton et al. 2010). The institutional environment defines, creates and limits entrepreneurial opportunities, and thus affects entrepreneurial activity rates (Aldrich and Fiol 1994; Dana 1987; Gnyawali and Fogel 1994; Hwang and Powell 2005; Manolova et al. 2008; Shapero and Sokol 1982). However, few authors have linked specifically institutional dimensions and entrepreneurship (Bruton et al. 2010).

There are many definitions of institutions. Veblen argued that institutions are settled habits of thought common to the generality of individuals (Veblen 1919: 191), which include usage, customs, canons of conduct, principles of right and propriety (Veblen 1914: 49). Commons (1924) defined them as collective actions in the restraint, liberation and expansion of individual actions. Also, institutions are a way of thought or action of some prevalence or permanence, embedded in the habits of a group or the customs of a people (Hamilton 1932), and mental constructs, common rules governing sets of activities (Neale 1987: 1186). Other authors have stated that institutions are norms that regulate relations among individuals (Parsons 1990), the rules of the game in a society that function as constraints and opportunities shaping human interaction (North 1990: 3) and social structures that have attained a high degree of resilience (Scott 2008: 48). Therefore, institutions are related to rules, norms and habits, which control social, political and economic interactions and provide stability and meaning to social life.

Institutions operate at multiple levels of jurisdiction, from the world system to localised interpersonal relationships (Scott 2008: 48), and impose restrictions by defining legal, moral and cultural boundaries setting off legitimate from illegitimate activities (Scott 2008: 50), but they also enable behaviour. The existence of rules implies constraints; however, such constraints can open up possibilities, choices and actions that otherwise would not exist (Hodgson 2006: 2).

Applied to the field of entrepreneurship, institutions represent the set of rules that articulates and organises the economic, social and political interactions between individuals and social groups, with consequences for business activity and economic development (Alvarez and Urbano 2012; Liñán et al. 2011; Thornton et al. 2011; Veciana and Urbano, 2008). Thus, institutions can legitimise and delegitimise business activity as a socially valued or attractive activity—and promote and constrain the entrepreneurial spirit (Aidis et al. 2008; Gomez-Haro et al. 2011; Thornton et al. 2011; Welter 2005; Welter and Smallbone 2011).

Authors such as North (1990, 2005) proposed that institutions can be formal (constitutions, regulations, contracts, etc.) or informal (attitudes, values, norms of behaviour and conventions, or rather the culture of a determined society). Then, building on DiMaggio and Powell (1983), North (1990), Selznick (1957) and Scott (1995) categorised these formal and informal institutions more finely into regulative, normative and cultural-cognitive institutional dimensions or pillars. In the following subsections, these dimensions will be developed in the context of entrepreneurship. Also, the research hypotheses will be suggested.

2.1 Regulative dimension

In particular, the regulative dimension involves the capacity to establish law and rules, inspect others’ conformity to them and, as necessary, manipulate sanctions—rewards or punishments—in an attempt to influence future behaviour. These processes may operate through diffuse informal mechanisms involving folkways such as shaming or shunning activities, or they may be highly formalised and assigned to specialised actors, such as the police and courts (Scott 2008: 53–54). People and organisations accede to them for reasons of expedience, preferring not to suffer the penalty for non-compliance (Bruton and Ahlstromb 2003). In responding to a regulative institution, one might ask “What are my interests in this situation?” (March 1981).

In the case of entrepreneurship, the regulative dimension consists of laws, regulations and government policies that provide support for new businesses, reduce the risks for individuals starting a new company and facilitate entrepreneurs’ efforts to acquire resources (Busenitz et al. 2000). Also, laws and regulations can specify the responsibilities of small business owners and assign property rights (Spencer and Gomez 2004). However, the government intervention can both enhance and repress the entrepreneurial intention (Dana 1987).

There are different types of government programmes to support entrepreneurship (Gnyawali and Fogel 1994). The first is to focus attention upon lowering the entry barriers to new firm formation, for example the time taken to start a business, the number and cost of the permits or licenses required, or the minimum capital requirements of a new firm (van Stel et al. 2007). Governmental regulation is generally perceived negatively by potential entrepreneurs (Djankov et al. 2002; Gnyawali and Fogel 1994), who may be discouraged from starting a business if they have to follow many rules and procedures (Begley et al. 2005; Dana 1990).

A second policy option is to reduce the barriers to expansion and growth, including the difficulties over the hiring and firing of labour, the tax regime or closing a business (van Stel et al. 2007). In fact, many empirical studies suggest that rigidities in labour regulations have a negative impact on entrepreneurial activity (Klapper et al. 2006; Stephen et al. 2009; van Stel et al. 2007). A third policy option is to provide finance directly or indirectly, and to improve the access to credit. Thus, government programmes focussed on providing financial support or preferential treatment for entrepreneurial ventures (Ho and Wong 2007; Spencer and Gomez 2004), increased access to bank credit by lowering capital requirements, the creation of investment companies, credit with low interest rates and credit guarantee schemes (Gnyawali and Fogel 1994; van Gelderen et al. 2006) contribute to the promotion of new businesses. A fourth option is to provide information, training and other non-financing support to entrepreneurs. Particularly, entrepreneurs need assistance in preparing business plans and conducting market studies and advice on how to obtain loans and facilitate access to entrepreneurial networks (Gnyawali and Fogel 1994). According to this logic and also reflecting the previously discussed research, we propose the following hypothesis:

Hypothesis 1

A favourable regulative dimension increases the probability of becoming an entrepreneur.

2.2 Normative dimension

The normative dimension imposes constraints on social behaviour through values and social norms (Scott 2008: 55). In this sense, values are conceptions of the preferred or the desirable, together with the construction of standards with which existing structures or behaviour can be compared and assessed. On the other hand, social norms specify how things should be done and define legitimate means to pursue valued ends. Generally taking the form of rules of thumb, standard operating procedures, occupational standards and educational curricula, people and organisations will comply with them for reasons of moral/ethical obligation, or a necessity for conformance to norms established by universities, professional training institutions and trade associations (Bruton and Ahlstromb 2003). In responding to a normative institution, one might ask, “Given my role in this situation, what is expected of me?” (March 1981).

In general terms, this definition of the normative dimension is similar to culture. For example, Hofstede (2001: 9–10) proposes that culture is the collective programming of the mind (thinking, feeling and acting and its consequences for beliefs, attitudes and skills) that distinguishes the member of one group or category of people from another. Several authors have found that culture—values, beliefs and norms—influences the entrepreneurial activity (Dana 1987; Shane 1993; Shapero and Sokol 1982). An early contribution was Weber (1930), who proposed that culture led to economic development. Later, this argument was tested using several measurements of culture by psychologists (McClelland 1961), sociologists (Collins 1997; Delacroix and Nielsen 2001) and economists (Becker and Woessmann 2007). A prior literature review (Hayton et al. 2002) about the relationship between culture and entrepreneurship showed that the research was focussed on the impact of national culture on aggregate measures of entrepreneurship, characteristics of individual entrepreneurs or corporate entrepreneurship.

Applied to the entrepreneurship field, the normative dimension measures the degree to which a country’s residents admire entrepreneurial activity and value creative and innovative thinking (Busenitz et al. 2000).

In some value systems entrepreneurs are admired but in others they are not (Busenitz et al. 2000; Dana 1987). The normative dimension reflects the general status of and respect towards entrepreneurs and whether people consider that starting a business is a desirable career choice. On the basis of this reasoning we offer the following hypothesis:

Hypothesis 2

A favourable normative dimension increases the probability of becoming an entrepreneur.

2.3 Cultural-cognitive dimension

The cultural-cognitive dimension of institutions focusses on the shared conceptions that constitute the nature of social reality and the frames through which individuals interpret information (Stenholm et al. 2013). The cultural-cognitive dimension, mediating between the external world of stimuli and the response of the individual organism, is a collection of internalised symbolic representations of the world (Scott 2008: 57). Also, it reflects the cognitive structures and social knowledge shared by the people in a given country. Cognitive structures affect individual behaviour as they to a great extent shape the cognitive programmes, i.e., schemas, frames and inferential sets, that people use when selecting and interpreting information (Markus and Zajonc 1985). They form a culturally supported and conceptually correct basis of legitimacy that becomes unquestioned; thus, people and organisations will often abide by them without conscious thought (Zucker 1983).

Specifically in the context of entrepreneurship, the cognitive dimension consists of the knowledge and skills possessed by the people in a country pertaining to establishing and operating a new business (Busenitz et al. 2000). Subjective perceptions and beliefs of individuals have a significant influence on entrepreneurial activity (Arenius and Minniti 2005), for example, perceptions of knowledge and skills have an impact on opportunity recognition and exploitation (Kirzner 1973; Shane 2000). Precisely, a low level of technical and business skills could prevent motivated entrepreneurs from starting a new venture (Davidsson 1991; Gnyawali and Fogel 1994). Thus, individuals might be more inclined to start a business if they have the necessary skills (Arenius and Minniti 2005; Davidsson and Honig 2003). In general terms, knowledge about how to start a business may be dispersed in some countries, whereas in others, people know the basic steps required to start and operate a new business (Manolova et al. 2008). Then, in countries with an encouraging cognitive dimension where knowledge about the different steps involved in the creation of a new business is highly developed, the entrepreneurial activity will be particularly high. On the basis of these considerations, we propose the following hypothesis:

Hypothesis 3

A favourable cultural-cognitive dimension increases the probability of becoming an entrepreneur.

3 Data and methods

As we stated before, this article analyses the effect of institutional dimensions (regulative, normative and cultural-cognitive) on entrepreneurial activity. With this aim, the following variables are used.

3.1 Dependent variable

The dependent variable is obtained from the Global Entrepreneurship Monitor (GEM)-2008. The GEM project is currently the most relevant study on entrepreneurial activity worldwide, developed as joint research between two universities, the London Business School (UK) and Babson College (USA), to facilitate cross-national comparisons on the level of national entrepreneurial activity, estimate the role of entrepreneurial activity in national economic growth, determine the factors that account for national differences in the level of entrepreneurship and facilitate policies that may be effective in enhancing entrepreneurship. In this article, the dummy variable total entrepreneurial activity (TEA) is used as the dependent variable. TEA is the best-known indicator of the GEM Project, which defines entrepreneurs as adults in the process of setting up a business they will (partly) own and/or currently owning and managing an operating a young business (up to 3.5 years old). Thirty countries and 36,525 individuals were included in the final sample. Although the sample size varies among countries (1,660 individuals in Russia to 30,879 in the Spain), we selected a random sample of 2,000 individuals per country.

3.2 Independent variables

Three vectors of independent variables are considered in this study: regulative, normative and cultural-cognitive dimensions. The regulative dimension is measured at the country level by three variables from the World Competitiveness Yearbook (WCY) database of the International Institute for Management Development (IMD): business legislation, procedures and venture capital. WCY ranks and analyses the ability of nations to create and maintain an environment in which enterprises can compete. The normative dimension is measured at the country level by three variables from the GEM database: career choice, high status and media attention. The cultural-cognitive dimension is measured at the individual level by three variables from the GEM database: skills, fear of failure and knowing entrepreneurs. Table 1 shows the operationalisation of these variables based on the previous literature review.

3.3 Control variables

Although we were interested in developing an institutional model, other factors may also influence entrepreneurial activity. Recent research has shown the importance of sociodemographic factors (Arenius and Minniti 2005; Langowitz and Minniti 2007) and the level of development in countries in explaining entrepreneurial behaviour. Thus, we have included several control variables, at both the individual and country levels, to ensure that the results were not unjustifiably influenced by such factors. In each model, we controlled for sociodemographic characteristics of the individual (gender, age, education level) and macro-variables (country's per capita income and dummy variables for stage of economic development).

-

Gender. Results of previous research have indicated that female participation rates in entrepreneurship are significantly lower than the rates for men (Arenius and Minniti 2005; Langowitz and Minniti 2007), and men have been shown to be more likely to start a business than women (Blanchflower 2004). A dummy variable for gender is included in this study to test for the significance of gender effects.

-

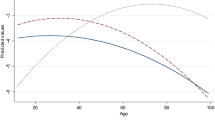

Age. Empirical evidence indicates the existence of an inverted U-shaped relationship between age and entrepreneurial activity (Evans and Leighton, 1989; Levesque and Minniti 2006). Thus, we included age and age-squared variables to verify the inverted U-shaped relationship.

-

Education level. Despite the fact that no clear evidence has been found on the relationship between education and entrepreneurship (Blanchflower 2004), the likelihood of becoming entrepreneurs increases with higher levels of education (Arenius and Minniti 2005). We controlled for education level through a variable that was harmonised across all countries, by GEM, into a four-category variable: some secondary education, a secondary degree, post secondary education and graduate degree. In the logistic regression analysis, the "secondary degree" category is used as the reference category (see data analysis subsection).

-

Country per capita income. Several authors identify a negative relationship between the level of new business activity and economic development, as measured by income per capita, in emerging economies (Wennekers et al. 2005). Therefore, we include the natural logarithm of gross domestic product (GDP) at purchasing power parity (PPP) per capita.

-

Income level. Given that entrepreneurial activity differs strongly across countries (Wennekers et al. 2005), we include a variable that classifies countries into three specific levels: high income, middle and low income (Europe), and middle and low income (Latin American).

Table 2 Description of variables

Table 2 shows the description of variables used in this research.

3.4 Data analysis and model

Given the binary nature of the dependent variable, we analysed the effect of institutional dimensions on entrepreneurial activity through models for binary response, often known as probability models. Similar to regression analysis, models for binary response extend the principles of generalised linear models to better treat the case of dichotomous dependent variables. In fact, models for binary response are extensions of the standard log-linear model and allow the study of a mixture of categorical and continuous independent variables with respect to a categorical dependent variable. The binominal logistic regression estimates the probability of an event happening. The binomial logit model assumes that the decision of the i individual depends on an unobservable utility index Ui (also known as a latent variable), which is determined by one or more explanatory variables in such a way that the larger the value of the index Ui, the greater the probability of the dependent variable taking the value of one. Thus, we express the index Ui as:

where Z 1i collects information related to the regulative dimension, at the country level; Z 2i collects information related to the normative dimension, at the country level; Z 3i collects information about the cultural-cognitive characteristics of individuals; X 1i collects the effect of sociodemographics characteristics of individuals (gender, age-squared, education level); X 2i represents macro variables (GDP and income level of a country); μi is random disturbance.

4 Results and discussion

Table 3 provides the means, standard deviations and pairwise correlation coefficients for study variables, and Table 4 provides the results of the logistic regression models for institutional dimensions and entrepreneurial activity.

Correlations of Table 3 showed some variables to be highly correlated. Thus, we also conducted a diagnostic test of multicollinearity [examining the variance inflation factors (VIFs) of all variables in the analyses], and we found that it was not likely to be a problem in this data set. Also, to address the possibility of heteroskedasticity and autocorrelation among observations pertaining to the same country, robust standard errors, clustered by country, were estimated (White 1980).

In Table 4, model 1 presents the logistic regression results with only the control variables; models 2, 3 and 4 introduce the institutional dimensions and control variables separately. Model 5 is the full model with only significant variables, and model 6 shows significant variables and the interaction term.

As we mentioned before, model 1 includes only control variables, both individual and country level. Thus, following Arenius and Minniti (2005), we entered variables measuring the sociodemographic characteristics of the individuals (gender, age, age-squared, education level) and macro variables (lnGDP and income level of country). Consistent with the existing literature, the results suggest that an individual’s sociodemographic characteristics are quite important for understanding the likelihood of becoming an entrepreneur. The overall model is significant since of the log pseudo likelihood statistic is −9,843.653 with a p value of 0.000, and it predicts 91.35 % of the responses correctly. Most coefficients are significant with a p value ≤ 0.001, and they have the expected sign. According to the existing empirical research (Arenius and Minniti 2005: 234), being a man increases the probability of becoming an entrepreneur. The coefficient of age indicates that the probability of becoming an entrepreneur increases; however, given that the age-squared coefficient is negative and statistically significant, the relationship between age and the likelihood of becoming an entrepreneur peaks at a relatively early age and decreases thereafter (Levesque and Minniti 2006).

On the other hand, the probability of becoming an entrepreneur is lower among those with some secondary education while increasing among those with graduate degree. Furthermore, the probability of becoming an entrepreneur is higher in Latin American countries than in European countries (concretely in middle and low income countries). Finally, the lnGDP negative coefficient indicates that the lower income of a country increased the probability of becoming an entrepreneur. This finding could be explained for necessity entrepreneurship (people who start their own business because other employment options are either absent or unsatisfactory), which usually happens in less developed countries (Reynolds et al. 2001).

In order to explain the impact of the regulative dimension on entrepreneurial activity, in model 2 three variables are added to the control variables: business regulation, procedures for starting a business and venture capital, but the coefficients are not statistically significant.

In model 3 we incorporate variables of the normative dimension (career choice, high status, media attention) and the control variables. The percentage correctly predicted in model 3 is 91.08 %, lower than the percentage in models 1 and 2, but the pseudo R-squared increases. Moreover, according to the Akaike criterion (AIC) and the Schwarz criterion (BIC’), model 2 is better than model 1 and worse than model 2 in explaining the probability of an individual becoming an entrepreneur. In model 3, the importance of gender, age and education level is virtually unchanged, while the lnGDP and Latin American and European dummy decrease. Also, career choice and media attention have a statistically significant positive sign (p ≤ 0.001), while high status is no significant.

Likewise, in order to explain the impact of the cultural-cognitive dimension on entrepreneurship, in model 4 three variables are added to the control variables: skills, fear of failure, know entrepreneurs. The overall model is significant because the log pseudolikelihood statistic is −8,925.313 with a p value of 0.000, and it correctly predicts 91.34 % of the responses. Similarly, all coefficients of the cultural-cognitive dimension are statistically significant (p ≤ 0.001), and they have the same expected sign. Thus, the coefficients for skills to start a business and knowing other entrepreneurs are significant and positive, whereas, as expected, fear of failure is negatively related to being an entrepreneur. Also, we observe that the coefficients of gender and age are lower than in model 1, while the coefficient of having a graduate degree increases.

Model 5 only shows significant coefficients for the institutional dimensions (previously we considered all the variables of interest together, and we tested the statistical significance using Wald statistics). In this case, R-squared increases, and the model correctly predicts 92.48 % of the responses. The Akaike criterion (AIC) and Schwarz criterion (BIC’) are lower than in all previous models. Also, in model 5 the importance of gender, age, income level and lnGDP decreases, and education level is no longer significant. The regulative (measured as procedures for starting a business), normative (measured as media attention) and cultural-cognitive dimensions (measured as skills, fear of failure and knowing entrepreneurs) are statistically significant for explaining entrepreneurial activity. A specification link test is used to test for functional form and omitted variable bias. The results indicate that we should include the interaction term in that model.

Then, in model 6, we include the interaction term between the cultural-cognitive and normative dimensions. In this case, the model specification link test concludes that our model is well specified. Overall, model 6 is significant with a p value of 0.000, all coefficients are statistically significant (p ≤ 0.001), and they have the expected sign. The interaction term is negative and statistically significant, which allows the relationship between entrepreneurial activity and media attention to be different for those entrepreneurs who have skills versus those who do not have them. Thus, if people have not acquired the knowledge/skills to start a business, the media attention mimimally increases the probability of being an entrepreneur. Instead, if people have knowledge/skills, the media attention for new business increases the probability of becoming an entrepreneur more than two-fold (see Fig. 1).

As we mentioned before, hypothesis 1 proposes that a favourable regulative dimension increases the probability of becoming an entrepreneur. As shown in models 5 and 6 in Table 4, the relationship between the procedures for starting a business and entrepreneurial activity is significant and negative (dF/dx = −0.00, p ≤ 0.001). Therefore, the findings offer support for hypothesis 1. Hypothesis 2 suggested that the normative dimension increases the probability of becoming an entrepreneur. We found that higher media attention for new business has a positive and statistically significant influence on entrepreneurship. Finally, hypothesis 3 proposed that the cultural-cognitive dimension (skills, fear of failure and knowing entrepreneurs) increases the probability of becoming an entrepreneur. As shown in models 4, 5 and 6, all the variables considered are statistically significant and have the expected sign. In sum, although the used data support all the hypotheses, hypothesis 3 is strongly supported.

5 Conclusions

The purpose of this research was to analyse the influence of institutional dimensions on the probability of becoming an entrepreneur, when controlling for sociodemographic factors and macro variables. Through six logistic models the study shows that a favourable regulative dimension (fewer procedures to start a business), a favourable normative dimension (higher media attention for new business) and a favourable cultural-cognitive dimension (better entrepreneurial skills, less fear of business failure and better knowing of entrepreneurs) increase the probability of being entrepreneur. Also, we found an interaction between the normative and cultural-cognitive dimensions (the relationship between the normative dimension and entrepreneurial activity is moderated by the cultural-cognitive dimension); hence, while the regulative and normative environments encourage people to become entrepreneurs, a strong cultural-cognitive environment is needed to create a new firm.

This research contributes to the existing literature in the following ways. First, the study adds new empirical insights into the impact of the institutions on entrepreneurial activity, using a sample of 36,525 individuals from 30 countries (GEM and IMD data for 2008), whereas previous studies used very specific samples (Kostova 1997; Busenitz et al. 2000; Spencer and Gomez 2004; Manolova et al. 2008). Second, the work helps to advance the application of institutional economics (North 2000, 2005) for the analysis of the conditioning factors to entrepreneurship (Thornton et al. 2011; Veciana and Urbano 2008), specifically using the institutional dimensions (Scott 1995, 2001, 2008). Finally, the research could be useful for the design of policies to foster entrepreneurship in different environments, considering the three analysed institutional dimensions, especially the relevance of the cultural-cognitive pillar on the creation of new firms.

Future research may improve the proxy for variables, especially for independent variables getting closer to the conceptualisation of the institutional dimensions. Also, we used multilevel modelling to address the issues of unobserved heterogeneity within the context of a cross-country and cross-individual data set. In addition, derived from the results obtained through the lnGDP, the inclusion of variables that differentiate opportunity entrepreneurship (active choice to start a new enterprise based on the perception that an unexploited, or underexploited business opportunity exists) and necessity entrepreneurship (to start a new firm because other employment options are either absent or unsatisfactory), is suggested, also considering specific contexts, such as Latin America (Alvarez and Urbano 2011; Amorós et al. 2012).

References

Aidis, R., Estrin, S., & Mickiewicz, T. (2008). Institutions and entrepreneurship development in Russia: A comparative perspective. Journal of Business Venturing, 23(6), 656–672.

Aldrich, H., & Fiol, C. M. (1994). Fools rush in? The institutional context of industry creation. Academy of Management Review, 19, 645–670.

Alvarez, C., & Urbano, D. (2011). Environmental factors and entrepreneurial activity in Latin America. Academia, Revista Latinoamericana de Administración, 48, 126–139.

Alvarez, C., & Urbano, D. (2012). Factores del entorno y creación de empresas: Un análisis institucional. Revista Venezolana de Gerencia, 57, 9–38.

Amorós, J. E., Fernández, C., & Tapia, J. (2012). Quantifying the relationship between entrepreneurship and competitiveness development stages in Latin America. International Entrepreneurship and Management Journal, 8(3), 249–270.

Anderson, A. R., Dodd, S. D., & Jack, S. L. (2012). Entrepreneurship as connecting: some implications for theorising and practice. Management Decision, 50(5), 958–971.

Arenius, P., & Minniti, M. (2005). Perceptual variables and nascent entrepreneurship. Small Business Economics, 24(3), 233–247.

Audretsch, D. (2012). Entrepreneurship research. Management Decision, 50(5), 755–764.

Becker S., & Woessmann L. (2007). Was weber wrong? A human capital theory of protestant economic history. CESifo Working Paper No. 1987. Munich: CESifo.

Begley, T., Tan, W. L., & Schoch, H. (2005). Politico-economic factors associated with interest in starting a business: A multi-country study. Entrepreneurship Theory & Practice, 29(1), 35–55.

Blanchflower, D. G. (2004). Self-employment: More may not be better. NBER Working Paper No. 10286. Cambridge, MA: National Bureau of Economic Research.

Bruton, G. D., Ahlstrom, D., & Li, H. L. (2010). Institutional theory and entrepreneurship: Where are we now and where do we need to move in the future? Entrepreneurship Theory and Practice, 34(3), 421–440.

Bruton, G., & Ahlstromb, D. (2003). An institutional view of China’s venture capital industry. Explaining the differences between China and the West. Journal of Business Venturing, 18, 233–259.

Busenitz, L. W., & Lau, C. M. (1996). A cross-cultural cognitive model of new venture creation. Entrepreneurship Theory and Practice, 20(4), 25–39.

Busenitz, L. W, Gomez, C., & Spencer, J. W. (2000). Country institutional profiles: Unlocking entrepreneurial phenomena. Academy of Management Journal, 43(5), 994–1003.

Collins, R. (1997). An Asian route to capitalism: Religious economy and the origins of self-transforming growth in Japan. American Sociological Review, 62, 843–865.

Commons. (1924). Legal foundations of capitalism. Wisconsin: University of Wisconsin Press. Reprint Madison.

Dana, L. P. (1987). Evaluating policies promoting entrepreneurship—A cross cultural comparison of enterprises case study: Singapore & Malaysia. Journal of Small Business and Entrepreneurship, 4(3), 36–41.

Dana, L. P. (1990). Saint Martin/Sint Maarten: a case study of the effects of culture on economic development. Journal of Small Business Management, 28(4), 91–98.

Davidsson, P. (1991). Continued entrepreneurship: ability, need and opportunity as determinants of small firm growth. Journal of Business Venturing, 6(6), 405–429.

Davidsson, P., & Honig, B. (2003). The role of social and human capital among nascent entrepreneurs. Journal of Business Venturing, 18(3), 301–331.

De Clercq, D., Danis, W. D., & Dakhli, M. (2010). The moderating effect of institutional context on the relationship between associational activity and new business activity in emerging economies. International Business Review, 19(1), 85–101.

Delacroix, J., & Nielsen, F. (2001). The beloved myth: Protestantism and the rise of industrial capitalism in nineteenth-century Europe. Social Forces, 80(2), 509–553.

DiMaggio, P. J., & Powell, W. W. (1983). The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48(2), 147–160.

Djankov, S., La Porta, R., Lopez-De-Silanes, F., & Shleifer, A. (2002). The regulation of entry. Quarterly Journal of Economics, 117(1), 1–37.

Evans, D., & Leighton, L. (1989). Some empirical aspects of entrepreneurship. American Economic Review, 79, 519–535.

Gnyawali, D. R., & Fogel, D. S. (1994). Environments for entrepreneurship development: Key dimensions and research implications. Entrepreneurship: Theory & Practice, 18(4), 43–62.

Gomez-Haro, S., Aragon-Correa, J. A., & Cordon-Pozo, E. (2011). Differentiating the effects of the institutional environment on corporate entrepreneurship. Management Decision, 49(10), 677–1693.

Gupta, V. K., Yayla, A. A., Sikdar, A., & Cha, M. S. (2012). Institutional environment for entrepreneurship: evidence from the developmental states of South Korea and United Arab Emirates. Journal of Developmental Entrepreneurship, 17(3), 1250013-1-1250013-21.

Hamilton, W. H. (1932). Institution. In E. R. A. Seligman & A. Johnson (Eds.), Encyclopedia of the Social Sciences (Vol. 8, pp. 84–89). New York: Macmillan.

Hayton, J. C., George, G., & Zahra, S. A. (2002). National culture and entrepreneurship: A review of behavioural research. Entrepreneurship Theory and Practice, 26(4), 33–52.

Ho, Y., & Wong, P. (2007). Financing, regulatory costs and entrepreneurial propensity. Small Business Economics, 28, 187–204.

Hodgson, G. M. (2006). What are institutions? Journal of Economic Issues, XL(1), 1–25.

Hofstede, G. (2001). Culture’s consequences. Comparing values, behaviours, institutions, and organizations across nations (2nd ed.). California: Sage Publications, Inc.

Hwang, H., & Powell, W. W. (2005). Institutions and entrepreneurship. In S. A. Alvarez, R. Agarwal, & O. Sorenson (Eds.), Handbook of entrepreneurship research: Disciplinary perspectives (pp. 179–210). New York: Springer.

Kirzner, I. M. (1973). Competition and entrepreneurship. Chicago, IL: University of Chicago Press.

Klapper, L., Laeven, L., & Rajan, R. (2006). Entry regulation as a barrier to entrepreneurship. Journal of Financial Economics, 82, 591–629.

Kostova, T. (1997): Country Institutional profiles: concept and measurement. Academy of Management Proceedings, 180–184.

Langowitz, N., & Minniti, M. (2007). The entrepreneurial propensity of women. Entrepreneurship Theory & Practice, 31(3), 341–364.

Lee, S. M., Lim, S. B., & Pathak, R. D. (2011). Culture and entrepreneurial orientation: A multi-country study. International Entrepreneurship and Management Journal, 7(1), 1–15.

Levesque, M., & Minniti, M. (2006). The effect of aging on entrepreneurial behavior. Journal of Business Venturing, 21(2), 177–194.

Liñán, F., Urbano, D., & Guerrero, M. (2011). Regional variations in entrepreneurial cognitions: Start-up intentions of university students in Spain. Entrepreneurship and Regional Development, 23(3–4), 187–215.

Manolova, T. S., Eunni, R. V., & Gyoshev, B. S. (2008). Institutional environments for entrepreneurship: Evidence from emerging economies in Eastern Europe. Entrepreneurship: Theory and Practice, 32(1), 203–218.

March, J. (1981). Decisions in organizations and theories of choice. In A. van de Ven & W. Joyce (Eds.), Perspectives on organizational design and behavior (pp. 205–244). New York: Wiley.

Markus, H., & Zajonc, R. B. (1985). The cognitive perspective in social psychology. In G. Lindzey & E. Aronson (Eds.), Handbook of social psychology (3rd ed., pp. 137–230). New York: Random House.

McClelland, D. (1961). The achieving society. Princeton, NJ: Princeton University Press.

Mueller, S. L., & Thomas, A. S. (2000). Culture and entrepreneurial potential: A nine country study of locus of control and innovativeness. Journal of Business Venturing, 16, 51–75.

Neale, W. C. (1987). Institutions. Journal of Economic Issues, 21(3), 1177–1206.

Nielsen, S. L., & Lassen, A. H. (2012). Images of entrepreneurship: towards a new categorization of entrepreneurship. International Entrepreneurship and Management Journal, 8(1), 35–53.

North, D. C. (1990). Institutions, institutional change and economic performance. Cambridge: Cambridge University Press.

North, D. C. (2005). Understanding the process of economic change. Princeton, NJ: Princeton University Press.

Parsons, T. (1990). Prolegomena to a theory of social institutions. American Sociological Review, 55, 318–333.

Renko, M., Shrader, R. C., & Simon, M. (2012). Perception of entrepreneurial opportunity: A general framework. Management Decision, 50(7), 1233–1251.

Reynolds, P. D., Hay, M., & Camp, S. (1999). Global entrepreneurship monitor: 1999 executive report. Kansas City, MO: Kauffman Foundation.

Reynolds, P. D., Hay, M., Bygrave, W. D., Camp, S. M., & Autio, E. (2000). Global entrepreneurship monitor: 2000 executive report. Kansas City: Kauffman Center for Entrepreneurial Leadership.

Reynolds, P., Camp, S., Bygrave, W., Autio, E., & Hay, M. (2001). Global Entrepreneurship Monitor. 2001 Executive Report. Babson College, London Business School, Kauffman Center for Entrepreneurial Leadership.

Scott, W. R. (1995). Institutions and organizations. Thousand Oaks, Calif: Sage.

Scott, W. R. (2001). Institutions and organizations (2nd ed.). Thousand Oaks: Sage.

Scott, W.R. (2008). Institutions and organizations: ideas and interests (3rd ed.). Foundations for Organizational Science Series. Sage Publications.

Selznick, P. (1957). Leadership in administration. New York: Harper & Row.

Shane, S. (1993). Cultural influences on national rates of innovation. Journal of Business Venturing, 8(1), 59–73.

Shane, S. (2000). Prior knowledge and the discovery of entrepreneurial opportunities. Organization Science, 11(4), 448–469.

Shane, S., & Kolvereid, L. (1995). National environment, strategy, and new venture performance: A three country study. Journal of Small Business Management, 33(2), 37–50.

Shapero, A., & Sokol, L. (1982). The social dimensions of entrepreneurship. In C. Kent, L. Sexton, & K. Vesper (Eds.), Encylopedia of entrepreneurship (pp. 72–90). Englewood Cliffs, NJ: Prentice Hall.

Spencer, J., & Gomez, C. (2004). The relationship among national institutional structures, economic factors, and domestic entrepreneurial activity: A multicountry study. Journal of Business Research, 57, 1098–1107.

Stenholm, P., Acs, Z. J., & Wuebker, R. (2013). Exploring country-level institutional arrangements on the rate and type of entrepreneurial activity. Journal of Business Venturing, 28, 176–193.

Stephen, F., Urbano, D., & van Hemmen, S. (2009). The responsiveness of entrepreneurs to working time regulations. Small Business Economics, 32(3), 259–276.

Thornton, P., Ribeiro-Soriano, D., & Urbano, D. (2011). Socio-cultural factors and entrepreneurial activity: An overview. International Small Business Journal, 29(2), 1–14.

van Gelderen, M., Thurik, R., & Bosma, N. (2006). Success and risk factors in the pre-startup phase. Small Business Economics, 26(4), 319–335.

van Stel, A., Storey, D. J., & Thurik, R. (2007). The effect of business regulations on nascent and young business entrepreneurship. Small Business Economics, 28(2), 171–186.

Veblen, T. (1914). The instinct of Workmanship and the State of the Industrial Arts, New York: August Kelley (reprinted with a new introduction by M.G. Murphey and a 1964 introductory note by J. Dorfman, New Brunswick, Transaction Book, 1990).

Veblen, T. (1919). The place of science in modern civilization and other essays, New York, Huebsch (reprinted with a new introduction by W.J. Samuels, New Brunswick, Transaction Publishers, 1990).

Veciana, J. M., & Urbano, D. (2008). The institutional approach to entrepreneurship research: Introduction. International Entrepreneurship and Management Journal, 4(4), 365–379.

Weber, M. (1930). The protestant ethic and the spirit of capitalism. New York: Scribner’s.

Welter, F. (2005). Entrepreneurial behavior in differing environments. In H. Grimm, C. W. Wessner, & D. B. Audretsch (Eds.), Local heroes in the global village globalization and the new entrepreneurship policies. International studies in entrepreneurship (pp. 93–112). New York: Springer.

Welter, F., & Smallbone, D. (2011). Institutional perspectives on entrepreneurial behaviour in challenging environments. Journal of Small Business Management, 49(1), 107–125.

Wennekers, S., van Stel, A., Thurik, R., & Reynolds, P. (2005). Nascent entrepreneurship and the level of economic development. Small Business Economics, 24(3), 293–309.

White, H. (1980). A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica, 48, 817–830.

Zucker, L. (1983). Organizations as institutions. In S. Bacharach (Ed.), Research in the sociology of organizations (Vol. 2, pp. 1–47) Greenwich.

Acknowledgments

The authors appreciate helpful comments by David Audretsch in the previous versions of this manuscript. Also, the authors acknowledge the financial support from projects ECO2010-16760 (Spanish Ministry of Science and Innovation) and 2005SGR00858 (Catalan Government Department for Universities, Research and Information Society).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Urbano, D., Alvarez, C. Institutional dimensions and entrepreneurial activity: an international study. Small Bus Econ 42, 703–716 (2014). https://doi.org/10.1007/s11187-013-9523-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-013-9523-7

Keywords

- Entrepreneurial activity

- Entrepreneurship

- Institutional dimensions

- Regulative dimension

- Normative dimension

- Cultural-cognitive dimension

- GEM