Abstract

The chapter solves the problem of numerically predicting the parameters of a business process model (using the cost example) without using multi-pass simulation models. To solve this problem, an apparatus of stochastic GERT networks is used. The edge of the GERT network is associated with the operation of the business process, and the node of the GERT network is associated with the event or branching of the business process. An algorithm for translating a business process model into an equivalent GERT network is given, as well as calculating the parameters of the business process cost distribution law based on the resulting GERT network. The proposed approach allows us to solve the problems of predicting the dynamics of discrete-event models described in standard model notations (IDEF3, ARIS EPC) without using multi-pass simulation models.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Markets of goods and services in the modern economy are highly competitive. The condition for the survival of enterprises in the competition is their effectiveness and ability to quickly change production and management processes. The answer to these requirements in management technologies is the application of a process approach. The process approach is the basis of such standards as ISO 9001: 2015 [1], ISO 12207: 2017 [2]. Best practices in business process management are outlined in BPM CBOK [3].

Most business process management methodologies include one version or another of a continuous improvement cycle. An important role is played by the continuous improvement cycle in Kaizen philosophy [4, 5]. The classic quality manager W. Deming developed and described the PDCA continuous improvement cycle [6, 7]. Continuous improvement cycles are also used in more general tasks. So in Ackoff's works, a cyclic procedure for resolving problem situations in applied system analysis is proposed [8, 9]. According to [10], the business process management cycle includes the stage of “Simulation and Analysis”. The high-level model obtained at this stage is used to predict the behavior of the system when performing various scenarios to detect critical sections and bottlenecks. The results of the analysis are used to configure the process before its implementation. However, this stage of the analysis is characterized by both great laboriousness and high computational complexity. In this work, the authors set themselves the goal of demonstrating a technology that provides a solution to the problems of analysis and forecasting of socio-economic objects, but without this drawback, using a substantial example.

The problem of the complexity of simulation in this chapter is proposed to be solved by using the apparatus of GERT-networks.

Computer simulation models make it possible to evaluate in measurable terms the consequences of changing business processes, to predict with the help of a computational experiment how the “image of the future”, the “to-be” model, will behave. The simulation model allows you to identify potential problems associated with the proposed improvement, to build a forecast of the dynamics of the system.

Simulation, therefore, is a powerful tool for studying the behavior of real systems. Moreover, the simulation itself does not solve optimization problems, but rather is a technique for assessing the values of the functional characteristics of the simulated system, allowing you to identify problem areas in the system [11].

However, imitation is inherently a random process. Therefore, any result obtained by simulation is subject to random fluctuations and, therefore, as in any statistical experiment, should be based on the results of relevant statistical checks [11]. To eliminate these negative features of the approach, the urgent task is to replace simulation experiments with analytical models.

With the accumulation of experience and statistics in the field of complex systems research, alternative stochastic networks, in particular PERT and GERT, are becoming more widespread. Model PERT (Project evaluation and review technique) [12] is used to model projects and programs, and GERT (Graphical evaluation and review technique) [13] is used to model technological and business processes.

A detailed description of GERT networks is presented by Phillips [14], Neumann [15], Pritsker [13]. A significant contribution to the development of the apparatus of GERT networks was made by Alexander Shibanov [16].

Attempts to study business processes based on GERT networks were made by Barjis [17], Aytulun [18]. Barjis and Dietz [17] use the DEMO methodology developed by them based on the BPM standard to model business processes. Neither Barjis and Dietz [17] nor Aytulun [18] apply any of the most widely used business process description methodologies in the world (IDEF, ARIS, BPMN). In these works, there is no description of formal methods and algorithms for converting business process models to GERT-network models; the features of modeling business processes by GERT-networks are not investigated. One of these features is the study of financial and resource flows of business processes, since the study of the probability-time characteristics of processes is not basic, although it provides a lot of useful information.

The article [19] proposes the use of GERT networks to construct an input–output table for a carbon fiber production chain in accordance with the input–output theory.

Article [20] is devoted to an overview of the application of GERT networks to management problems. The authors demonstrate the results of using the GERT network to analyze a hypothetical R&D project. The chapter provides an assessment of improving the efficiency of project planning, workload, resources, and equipment of the project.

Thus, the modeling of business processes based on GERT networks is a poorly studied topic, therefore, additional research is relevant. The authors have already attempted to work with the use of GERT-networks for the analysis of business processes in [21], but the idea to show the application of the same approach to assessing the cost parameters of a business process seemed interesting.

Representation of business processes in the form of a GERT-network will allow for research related to the forecast of business process dynamics. In particular, it is possible to determine the probability density function of runoff performance over time and resources, as well as the required central distribution moments – expectation, variance.

2 Methods

GERT networks are a variant of semi-Markov models, but the random variables in them are characterized not only by dispersion but also by the distribution law. GERT-networks allows you to include random deviations and uncertainty that occur directly during the execution of each individual work [13]. The execution of work (operation) in the system is associated with the branches (arcs) of the GERT-network, which are characterized by additive random variables. To calculate the output characteristics of GERT networks, the generating functions of the moments of random variables are used. Activation of each subsequent branch is generally probabilistic.

A GERT network can be described by a directional weighted graph.

where V is the set of vertices (nodes); E many directed edges (arcs).

GERT network nodes are interpreted as system states, and arcs as transitions from one state to another. Such transitions are associated with the implementation of generalized operations characterized by the density of distribution and probability of completion.

Thus, a GERT network is a network with sources R and sinks S of the “work on an arc” type, in which each node belongs to one of six types of nodes [13], for each arc \(\left\langle {i,j} \right\rangle\) a weight of the form [\(p_{ij}\), \(F_{ij}\)] is defined, where \(p_{ij}\) is the conditional probability of the arc \(\left\langle {i,j} \right\rangle\) execution subject to activation of the node \(i\), \(F_{ij}\) is the conditional distribution function of some random variable.

The calculation of the parameters of the GERT network represents the finding of the first central moments of the distribution of the random value of the network. In particular, the first and second central moments of a random variable are found—the mean and variance, respectively. In addition, for some tasks, it is important to find the probability of the network flow and the distribution function of the random variable of the entire network.

Methods for calculating the parameters of a GERT network are described in [14].

3 Results

Consider the ARIS eEPC model of the “Product Manufacturing” business process (Fig. 1) and the GERT network that corresponds to this business process. The task of translating a business process model into a GERT network model was considered in [22]. We also used assumptions about the laws of the probability distribution of the parameters of business process operations given in [23].

Table 1 and Fig. 1 present a comparison of elements of a business process model and a GERT network.

Note that in the business process under consideration there are two initial events. Each of the events initiates the start of the process with some probability: “Order for a standard product”—60%, “Order for a non-standard product”—40%. Therefore, for the GERT-network model, we introduce the network source V0 and the arcs connecting the source with the vertices V1 and V2.

In Table 2 are presented the parameters characterizing the arcs of the GERT-network, according to the additive parameter—the financial costs of the function. To simplify the notation, we introduced the index k, which replaces the indices ij for the characteristics, corresponding to the arc.

Thus, a GERT-network model is obtained that fully displays the model of the system under study, and for each arc of the network, the conditional probability and the generating function of the moments are determined.

Next, you need to close the GERT network with an arc \(W_{A}\), leading from node V15 to node V1.

Replacing \(W_{A} \left( s \right)\) by \(\frac{1}{{W_{E} \left( s \right)}}\), we obtain the following transmittances for the network loops.

Loops of the first order: \(W_{8} \left( {W_{9} W_{11} + W_{10} W_{12} } \right)W_{13} W_{14} W_{15}\), \(\left( {W_{1} W_{3} + W_{2} W_{4} W_{5} W_{6} } \right)W_{7} W_{8} \left( {W_{9} W_{11} + W_{10} W_{12} } \right)W_{13} W_{16} W_{17} W_{18} \left( {\frac{1}{{W_{E} }}} \right)\).

There are no loops larger than the first order in this GERT network.

Using the topological Mason equation [7], we obtain:

Transforming this expression, we get:

which \(W_{E} \left( s \right) \) is the equivalent W-function for a GERT network.

Substituting the values of the probabilities and generating functions of the moments from Table 2, we find the value \(W_{E} \left( 0 \right)\) and then calculate the first central moment of the distribution relative to the origin.

The mathematical expectation and the variance of the drain of the GERT network are calculated in this way:

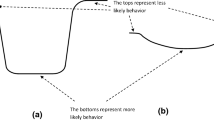

Figure 2 shows the probability density, the mathematical expectation, and the distribution function of the calculated random variable (financial costs for the business process) of the GERT network. Figure 2 shows the probabilistic forecast of the dynamics of the event model of the business process “Product manufacturing” (Fig. 1) based on the GERT network. Thus, we can say that with a probability of 90%, the costs of the business process will be in the range of 11.500 thousand rubles up to 16.000 thousand rubles.

4 Conclusion

Thus, an approach is proposed that allows solving the problems of predicting the dynamics of discrete-event models described in standard model notations (IDEF3, ARIS EPC). The study of business processes based on GERT-networks can provide a lot of useful information about the behavior of the studied system. Unlike simulation experiments, this method is analytical, and therefore has several advantages compared to a simulation experiment—less computational complexity, obtaining a result that does not depend on the randomness factor.

The next steps in the development of this work may be to check the sensitivity of central moments in time and cost to various model parameters (probabilities, laws, and parameters of the distribution of time and cost for individual operations) with access to recommendations for optimizing the investment of resources in improving the business process as a whole.

References

International Organization for Standardization: ISO 9001:2015 Quality management systems—Requirements. 0310070 Manag Syst (2015)

ISO/IEC 12207: Systems and Software Engineering— Software Life Cycle Processes (2008)

Tony, B., Nancy, B., Phil, V., Emmett, P., Dan, M., Marc, S., Denis, L., Gabrielle, F., Todd, L., Raju, S., Michael Fuller, J.F.: ABPMP CBOK Guide (2013)

Ishikawa, K.: What is Total Quality Control : The Japanese Way. New York (1981)

Imai, M.: Kaizen: The Key to Japan’s Competitive Success (1986)

Deming, W.E.: Out of the Crisis: Quality, Productivity and Competitive Position. Massachusetts Institute of Technology. Center for Advanced Engineering Study (1986). https://doi.org/10.1002/qre.4680020421

Propst, A.L., Deming, W.E.: The New Economics: For Industry. Technometrics, Government, Education (1996) https://doi.org/10.2307/1270625

Greenfield, T., Ackoff, R.L.: The Art of Problem Solving (Accompanied by Ackoff’s Fables). Stat (1979). https://doi.org/10.2307/2987880

Ackoff, R.L.: Re-creating the corporation (1999)

Nainani, B.: Closed loop BPM using standards based tools (2004)

Ord, K., Taha, H.A.: Operations research: an introduction. Oper Res Q (1972). https://doi.org/10.2307/3008276

Kerzner, H.: A systems approach to planning scheduling and controlling (20170

Pritsker, A.A.B.: GERT: Graphical Evaluation and Review Technique. RAND Corporation, Santa Monica, CA (1966)

(1982) Fundamentals of network analysis, by Don T. Phillips and Alberto Garcia-Diaz, Prentice Hall, Englewood Cliffs, NJ, 1981, 474 pp. Price: $26.90. Networks 12:209–210. https://doi.org/10.1002/net.3230120210

Neumann, K.: Stochastic Project Networks. Springer, Berlin Heidelberg, Berlin, Heidelberg (1990)

Koryachko, V., Shibanov, A., Shibanov, V., et al.: Hierarchic GERT networks for simulating systems with checkpoints. In: 2017 6th Mediterranean Conference on Embedded Computing (MECO), pp. 1–4. IEEE (2017)

Barjis, J., Dietz, J.L.G.: Business Process Modeling and Analysis Using Gert Networks. In: Enterprise Information Systems, pp. 71–80. Springer, Netherlands, Dordrecht (2000)

Aytulun, S.K., Guneri, A.F.: Business process modelling with stochastic networks. Int J Prod Res 46, 2743–2764 (2008). https://doi.org/10.1080/00207540701543601

Liu, X., Fang, Z., Zhang, N.: A value transfer GERT network model for carbon fiber industry chain based on input–output table. Cluster Comput 20, 2993–3001 (2017). https://doi.org/10.1007/s10586-017-0960-y

Ambika, S., Indhumathi, R., Mytherae, R., Spandana, R.: Application of Gert Analysis in Management. Int J Latest Eng Manag Res 03, 01–04 (2018)

Dorrer, M., Dorrer, A.: Forecasting e-Learning Processes Using GERT Models and Process Mining Tools. In: Solovev D., Savaley V., Bekker A. P V. (eds) Proceeding of the International Science and Technology Conference “FarEastC on 2019”. Smart Innovation, Systems and Technologies, pp. 857–866. Springer, Singapore (2020)

Zyryanov, A.A., Dorrer, M.G.: The algoritnm of business process model translation into the GERT-network model. Bull KrasGAU 13–18 (2012)

Golenko-Ginzburg, D.: Stochastic network models in innovative projecting. Science Book Publishing House, Yelm, WA, USA (2014)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Editor(s) (if applicable) and The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Dorrer, M., Dorrer, A., Zyryanov, A. (2021). Numerical Modeling of Business Processes Using the Apparatus of GERT Networks. In: Kravets, A.G., Bolshakov, A.A., Shcherbakov, M. (eds) Society 5.0: Cyberspace for Advanced Human-Centered Society. Studies in Systems, Decision and Control, vol 333. Springer, Cham. https://doi.org/10.1007/978-3-030-63563-3_5

Download citation

DOI: https://doi.org/10.1007/978-3-030-63563-3_5

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-63562-6

Online ISBN: 978-3-030-63563-3

eBook Packages: EngineeringEngineering (R0)