Abstract

The aim of this paper is to explain an empirical fact by economic models. The fact is that there is a tendency for the share of health spending in GDP to rise. This paper asserts that the fact is partly due to medical innovation. The novelty of models is the explicit incorporation of hospital and doctors who treat patients, with the rise in the parameter of the illness treatment function defined as the medical innovation. Under the monopolistic case, the share always rises, while under the competitive case, it declines for the advanced medical society with a high parameter value; it rises for the basic medical society depending on the ratio between healthy and sick workers, and it rises for the backward medical society with a low parameter value. The theoretical ambiguity of assertion is partly removed by the empirical fact of the monopolistic tendency in the US medical sector. As by-products of this formulation, the emergence of moral hazard and adverse selection is discussed theoretically, where medical insurance—discount of sick workers’ medical fee—is procured as a subsidy from healthy workers to them. Moral hazard and adverse selection emerge depending on the parameters of the models.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

The advancement of medical technology has contributed to the improvement of human well-being. For example, some of the incurable diseases, such as cancer, have become curable, and the human life expectancy has been lengthened. This enhanced benefit, however, has been accompanied by the enhanced cost. The health spending has steadily increased, and sometimes its growth rate exceeded the one of GDP. Data on health spending for 44 countries, including 36 OECD members, reveal that between 2000 and 2017, only two countries reduced their percentage of health spending per GDP (OECD 2020). The USA, the highest spender of GDP on health care, raised its health spending per GDP from 5.542% in 2000 to 14.421% in 2017, which remained the same in 2018 (Pear 2018).

In the present paper, with medical innovation as one of the main culprits in mind, we focus our attention on the reason why national health spending has increased worldwide. For the purpose of examining this problem, Fuchs (1996, p.8) examined whether health economists, economic theorists, and practicing physicians could come to a consensus on the issue: “the primary reason for the increase in the health sector’s share of GDP over the past 30 years is technological change in medicine.” On this issue, 81% of the health economists agreed with a 99% statistical significance, 37% of the economic theorists agreed with no statistical significance, and 68% of practicing physicians agreed with a 95% statistical significance. From a theoretical viewpoint, Chandra and Skinner (2012) attempted to examine this problem in terms of a two-period partial equilibrium model. Their theoretical model follows the health-capital accumulation approach designed by Grossman (1972) (See also Ehrlich and Yin 2013).

The present paper adopts a different approach. Following Arrow (1963), a one-period general equilibrium model is constructed in which there are two types of households: i.e., the “fortunate” one with 365 working days, and the “unfortunate” one with, say, 300 working days—and the hospital recovers a part of “the lost working days” of the unfortunate households with medical treatment. The households maximize utility subject to the income constraint, where sick households purchase medical services from the hospital. The (aggregate) doctor is nothing but a medical engineer (worker) in the present paper, hired by the hospital with a rental fee. The hospital is a “firm” which supplies the medical service, hiring the doctor and procuring medicines. Along with the hospital, there is another firm, which produces a variety of commodities including medicines, hiring households under profit maximization.

Utilizing this general equilibrium model, the relation between the total health spending per GDP and the medical innovation is examined at first. Medical innovation in the present paper is defined as a shift of the illness treatment function with no modification of cost structure. In terms of the simulation approach, we examine whether the medical innovation raises total health spending for the two models. The first model is the one in which the hospital is a competitive medical service supplier, while the second model is the one in which the hospital is a monopolistic medical service supplier. It must be noted that Arrow (1963) describes the medical sector as “collusive monopoly,” and Cutler and Morton (2013) reveal the sector’s statistical trend toward a monopoly in the USA.

Next, as a by-product of this approach, we examine the moral hazard and adverse selection problems emerging on the medical insurance. Following the Arrow-type insurance, medical insurance in the form of medical fee deduction is adopted as a subsidy from the “without sickness” households to the “with sickness” households. The present paper is an extension of Fukiharu (2005), which examined the moral hazard under the monopolistic medical sector. The computation was conducted in Fukiharu (2018a, b, c, d).

In Sect. 2 of the present paper, competitive health care market without medical insurance is formulated as the basic model I. After general equilibrium of the model is guaranteed, the effect of the medical innovation on the health spending is derived for the specified parameters. In Sect. 3, monopolistic health care market without medical insurance is formulated as the basic model II. After general equilibrium of the model is guaranteed, the effect of the medical innovation on the health spending is derived for the specified parameters and the comparison with the one in the competitive case is conducted. In Sect. 4, selecting the parameters randomly, the robustness of the conclusion is examined. In Sect. 5, the medical insurance is introduced in the basic models I and II, and the emergence of moral hazard and/or adverse selection is examined. Section 6 concludes these examinations.

2 Basic Model I: Competitive Health Care Market

In this section, a general equilibrium model incorporating competitive medical sector is constructed, where medical insurance is not available. It is assumed there are three types of economic agents: “fortunate” and “unfortunate” workers, first and second agents, respectively, and doctors, the third agent. Every worker knows the distribution of workers is constant in each year: a1 workers are fortunate (i.e., with good health), and a2 workers are unfortunate (i.e., without good health). No one knows whether each worker is fortunate or unfortunate before the opening of the particular year. Only when the particular year starts, a1 workers know that they are fortunate, while the remainder know that they are unfortunate. In this sense, each worker has the probability, α = a2/(a1 + a2), of being unfortunate in each year. In this section, it is assumed that a1 = 90 and a2 = 10, and the probability of workers being unfortunate is 10%. This assumption is relaxed later in the robustness analysis.

2.1 Behavior of “Fortunate” Workers

When a worker is fortunate and healthy, he or she initially has 365 days of leisure days. Their behavior is stipulated by the traditional utility maximization under the income constraint:

where u (z1, le1) is the utility function, z1 is the consumption of goods, le1 is the leisure consumption, pz is the price of goods, w is the wage rate, and Y1 is the transfer of income to and from others, such as profit, tax, etc. Since a simulation approach is utilized in this paper, the utility function is stipulated by

Under (1) and (2), the fortunate and healthy workers’ demand function for the goods, z11, and the labor supply function, l1, are derived.

2.2 Behavior of “Unfortunate” Workers

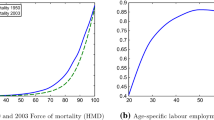

When a worker is unfortunate, i.e., without good health, he or she has H0 days of initial leisure days, say H0 = 300. He or she goes to a hospital, in order to recover a part of lost leisure days in the year. It is assumed that the hospital can recover (365–H0)(1– \( {e}^{-{s}_0x} \)) days of leisure for the sick worker by supplying x medical treatment, employing doctors with a rental price (wage for doctors) wD, and using medicines, while the hospital receives a service charge px per one unit of medical treatment, where s0 is the parameter of the “illness treatment function.” It is assumed in this section that s0 = 1/10. In Fig. 1, the function G(x) = (1–\( {e}^{-{s}_0x} \)) is depicted as the straight curve when s0 = 1/10, while it is depicted as the dashed curve when s0 = 1/7: i.e., the medical innovation case.

The unfortunate worker’s behavior is stipulated by the following utility maximization under the income constraint:

where u (z2, le2) is utility function, z2 is consumption of goods, le2 is leisure consumption, and Y2 is transfer of income to and from others such as profit and tax, etc. In this paper, the simulation approach is utilized with utility function stipulated by (2). Under (2) and (3), the unfortunate household’s demand function for the goods, z21, the demand function for the medical services, x1, and the labor supply function, l2, are derived analytically, where H0 = 300.

2.3 Behavior of Good-Producing Firm

It is assumed that the good-producing firm is under constant returns to labor input. The behavior of this firm is stipulated by profit maximization with production function given by

where z is the output of goods and lg is labor input. The profit maximization under (4) gives rise to pz = w as one of the conditions for general equilibrium.

2.4 Behavior of Hospital and Doctors

The behavior of hospital is stipulated by a “competitive” profit maximization in this section. The production function of medical service is given by

where lx is the input of the doctors’ working days and zx is the input of goods (e.g., medicines, etc.). In order to provide the medical service demanded by the sick households, a2 × x1, the hospital has the demand function for the doctors, lx1, and the one for goods, zx1, derived analytically under cost minimization, where cost is denoted by c = wDlx + pzzx and wD is the wage (rental price) for the doctors. There are D0 doctors, and each doctor’s initial endowment of working days is 365 days. For simplicity, it is assumed that D0 = 1. The doctor’s behavior is the utility maximization under the income constraint:

where uD (zD, leD) is the utility function, zD is the consumption of goods, and leD is the leisure consumption. It is assumed that doctors do not possess the shares of firms. Since the simulation approach is utilized in this paper, the utility function is stipulated by

Under (6) and (7), the doctor’ demand function for goods and leisure, zD and leD, are derived analytically. It is shown that leD = 365/2 under (6) and (7).

2.5 Competitive General Equilibrium with Competitive Medical Sector

Equilibrium condition for the good-labor market is given by the following equation:

Equilibrium condition for the doctors’ market is given by the following:

Utilizing the Newton Method, we can solve competitive medical service charge, px00, and the rental price of doctor, wD00, as follows:

It is easy to check that in equilibrium, c is indeed equal to px × a2 × x1 . Now, the utility level and income for the fortunate worker in this general equilibrium are given by u100 and i100, while the utility level and income for the unfortunate worker in this general equilibrium are given by u200 and i200. The doctor’s utility level and income in the competitive general equilibrium are given by ud00 and id00. Sum of these utilities in this competitive general equilibrium, the Bentham-type social welfare, is given by WLD00, which is computed as follows:

Health spending, HS00, defined by px00 a2 x1, and GDP00, defined by a1i100 + a2i200 + D0id00, are computed as follows:

Thus, health spending per GDP, HS00/GDP00, is approximately 1.2%:

2.6 Medical Innovation under a Competitive Framework

Under this general equilibrium model incorporating a competitive framework, we examine the effect of medical innovation, where medical insurance is unavailable. Medical innovation is defined simply as a shift in “illness treatment function.” In this subsection, we assume that medical innovation emerges and s0, the parameter of “illness treatment function,” rises from 1/10 to 101/1000. Utilizing the Newton Method, we can solve competitive medical service charge, px0, and the rental price of doctor, wD0, as follows:

It is easy to check that in equilibrium, c is indeed equal to px × a2 × x1. Now, the utility level and income for the fortunate worker in this general equilibrium are given by u10 and i10, while the utility level and income for the unfortunate worker in this general equilibrium are given by u20 and i20. The doctor’s utility level and income in the competitive general equilibrium are given by ud0 and id0. The sum of these utilities in this competitive general equilibrium, the Bentham-type social welfare, is given by WLD0, which is computed as follows:

Health spending, HS0, defined by px0 a2 x1, and GDP0, defined by a1i10 + a2i20 + D0id0, are computed as follows:

Thus, health spending per GDP, HS0/GDP0 is approximately 1.2%, lower than HS00/GDP00:

3 Basic Model II: Monopolistic Health Care Market

In this section, the medical sector is assumed to be monopolist. Cutler and Morton (2013) pointed out the trend of monopolization in the US medical sector. For simplicity, we assume that this monopolistic medical sector is owned by the workers with an equal share holding. Thus, monopolistic profit is distributed equally to each worker, whether fortunate or unfortunate. Other assumptions are the same as in Sect. 2, e.g., the good-producing sector is assumed to be a competitive firm. In this modified general equilibrium model, named Basic Model II, we examine the existence of a general equilibrium and a comparison is made with the result in Basic Model I.

3.1 Behavior of “Fortunate” Workers, “Unfortunate” Workers, and Good-Producing Firm

We have exactly the same assumptions as mentioned in Sect. 2. Thus, H0 = 300, a1 = 90, a2 = 10, with the same utility functions and the same production functions. From the same computation, we have exactly the same demand functions and supply functions as in Sect. 2. Note that, the hospital’s demand functions for the doctor and commodities are derived under the cost minimization.

3.2 Behavior of Hospital as a Monopolist and General Equilibrium

We derive the “objective” profit function of the medical sector, OPRO (px), which equalizes the demand and supply of the goods and doctors’ markets. OPRO (px) is derived analytically as follows, from (8) and (9), with w = 1, Y1 = OPRO (px)/100, Y2 = OPRO (px)/100, and pz = 1:

The “objective” profit function of the medical sector, OPRO (px), is depicted in Fig. 2.

The monopolistic medical charge by the hospital, pxM00, is computed as follows by the Newton Method, which is higher than px00. The wage rate (rental price) of the doctor in the monopolistic medical sector, wDM00, is lower than wD00.

Now, the utility level and income for the fortunate worker in this monopolistic general equilibrium are given by u1M00 and i1M00, while the utility level and income for the unfortunate worker in this general equilibrium are given by u2M00 and i2M00. The doctor’s utility level and income in the monopolistic general equilibrium are given by udM00 and idM00. The sum of these utilities in this monopolistic general equilibrium, the Bentham-type social welfare, is given by WLDM00, which is computed as follows:

The difference between WLD00 and WLDM00 may correspond with the dead weight loss in the monopoly. Health spending, HSM00, defined by pxM00 a2 x1, and GDPM00, defined by a1i1M00 + a2i2M00 + D0idM00, are computed as follows:

Thus, the “monopolistic” health spending per GDP, HSM00/GDPM00, is approximately 1.2%, lower than the “competitive” health spending per GDP, HS00/GDP00:

3.3 Medical Innovation under a Monopolistic Framework

As in Sect. 2, medical innovation is defined simply as the shift of “illness treatment function.” In this section, we assume that the medical innovation emerges and s0, the parameter of “illness treatment function,” rises from 1/10 to 101/1000 as in Sect. 2. By exactly the same procedure as in 3.2, we have the following result.

Utilizing the Newton Method, we can solve the monopolistic medical service charge, px0M, and the rental price of doctor, wD0M as follows:

It is easy to check that in equilibrium, c is indeed equal to pxM × a2 × x1.

Now, the utility level and income for the fortunate worker are given by u1M0 and i1M0, while the utility level and income for the unfortunate worker are given by u2M0 and i2M0. The doctor’s utility level and income are given by udM0 and idM0. The sum of these utilities, the Bentham-type social welfare, is given by WLDM0, which is computed as follows:

Health spending, HSM0, defined by pxM0 a2 x1, and GDPM0, defined by a1i1M0 + a2i2M0 + D0idM0, are computed as follows:

Thus, health spending per GDP after the medical innovation, HSM0/GDPM0 is approximately 1.2%, higher than HSM00/GDPM00:

4 Robustness

In the previous sections, opposite conclusions were reached on the problem of whether the medical innovation causes the health spending to rise. The competitive framework asserts that it causes a decline in spending, while the monopolistic framework asserts that it causes a rise in spending. These opposite conclusions were obtained with the parameters of the models specified numerically. In this section, through a relaxing of the assumption of specified parameters, we examine how the opposite conclusions vary, where the relaxation does not imply that all the parameters are selected randomly. Thus, in the following sub-subsections, we examine the robustness for the three cases: the basic medical society-when s0 = 1/10, the advanced medical society-when s0 = 10, and the backward medical society-when s0 = 1/1000. The production and utility functions, and so on, are assumed to be exactly the same as in the previous sections.

4.1 Basic Medical Society (s0 = 1/10)

In this subsection, we conduct simulations for the competitive and monopolistic medical sector cases. We start with the competitive case.

4.1.1 The Competitive Medical Sector Case

We start from the examination of the orthodox case in which a1 = 90 and a2 = 10. In Basic Model I, we derived the health spending when s0 = 1/10 as 222.72943, while the health spending when s0 = 101/1000 was 221.94426: i.e., the medical innovation reduces the health spending for the society. This is the case when there are 80 fortunate workers and 20 unfortunate workers. However, as we move to the unorthodox case in which a1 = 10 and a2 = 90, we enter into a different phase. By simulation, when a1 = 70 and a2 = 30, health spending when s0 = 1/10 is 708.10055, while health spending when s0 = 101/1000 is 709.22855: i.e., medical innovation increases health spending for the society. This conclusion holds even when health spending is divided by the GDP. We have the same situation as the society becomes more unfortunate. Thus, we may conclude that the reduction of the health spending per GDP can be realized through the medical innovation only when the society is quite fortunate. Figure 3 reveals this relation, where the horizontal axis indicates the probability of unfortunate worker: 100a2/ (a1+ a2) and the vertical axis indicates HS0/GDP0– HS00/GDP00.

4.1.2 Monopolistic Medical Sector Case

Defining the medical innovation as the shift of “illness treatment function,” we examine if the shift of this function can reduce health spending when the medical sector is under a monopoly. Suppose that s0 rises from 1/10 to 101/1000. When a1 = 90 and a2 = 10, the health spending when s0 = 1/10 was 229.41696, while the health spending when s0 = 101/1000 was 229.67466: i.e., the medical innovation raises the health spending for the society. This is the case when a1 = 20 and a2 = 90. The same situation continues until there are a1 = 10 and a2 = 90. Thus, we may conclude that the reduction of health spending cannot be realized through medical innovation under the monopolistic case. This relation holds even when health spending is divided by GDP. Figure 4 reveals this relation, where the horizontal axis indicates the probability of an unfortunate worker: 100a2/ (a1+ a2) and the vertical axis indicates HS0M/GDP0M– HS00M/GDP00M.

4.2 Advanced Medical Society (s0 = 10)

The society with a high s0 is named in this paper as the advanced medical society. Compared with the basic society with s0 = 1/10, we examine how the conclusion in this society differs. Suppose that s0 = 10.

4.2.1 Competitive Medical Sector Case

Suppose that s0 rises from 10 to 10 + 1/100. The simulation shows that the health spending declines by the innovation. The conclusion remains the same even if health spending is divided by GDP. Figure 5 reveals this relation, where the horizontal axis 100a2/ (a1+ a2) and the vertical axis indicates HS0/GDP0– HS00/GDP00.

4.2.2 Monopolistic Medical Sector Case

Under the monopolistic case, suppose that s0 rises from 10 to 10 + 1/100. The simulation shows that health spending rises by the innovation. The conclusion remains the same even if the health spending is divided by GDP. Figure 6 reveals this relation, where the horizontal axis 100a2/ (a1+ a2) and the vertical axis indicates HS0M/GDP0M– HS00M/GDP00M.

4.3 Backward Medical Society (s0 = 1/1000)

When s0 is extremely small, we name the society the backward medical society. In this section, we examine a backward medical society, assuming that s0 = 1/1000.

4.3.1 Competitive Medical Sector Case

As in the previous sections, suppose that s0 rises from 1/1000 to 1/1000 + 1/10000. The simulation shows that health spending rises by the innovation. The conclusion remains the same even if health spending is divided by GDP. Figure 7 reveals this relation, where the horizontal axis indicates100a2/ (a1+ a2) and the vertical axis indicates HS0/GDP0– HS00/GDP00.

4.3.2 Monopolistic Medical Sector Case

Under the monopolistic case, suppose that s0 rises from 1/1000 to 1/1000 + 1/10000. The simulation shows that health spending rises by the innovation. The conclusion remains the same even if the health spending is divided by GDP. Figure 8 reveals this relation, where the horizontal axis 100a2/ (a1+ a2) and the vertical axis indicates HS0M/GDP0M– HS00M/GDP00M.

The analysis in this section is summarized in Table 1. In the backward medical society in which s0 is low, the health spending per GDP rises by the medical innovation. In the advanced medical society in which s0 is high, the health spending per GDP rises by the medical innovation when the hospital is monopolist while it declines when the hospital is a competitor.

It must be noted that Cutler and Morton (2013) pointed out that the US medical sector has a tendency toward monopoly. Furthermore, Arrow (1963) described the medical sector as the “collusive monopoly.” Through the robustness analysis in this section, we may conclude that health spending per GDP tends to rise by the medical innovation.

5 Medical Insurance

As a by-product of the formulation in this paper, we can examine the moral hazard and the adverse selection in the context of general equilibrium.

5.1 Competitive Basic Medical Society (s0 = 1/10) under Medical Insurance

In this subsection, a competitive general equilibrium model incorporating the medical sector is constructed, where medical insurance is available. As in the competitive case, under this medical insurance, 100 k% of medical charges on unfortunate and sick workers is deducted by this insurance, while this deduction is made possible by the fortunate workers’ insurance premium. Except for this point, the same assumptions are adopted. We start with an orthodox case in which a1 = 90 workers are fortunate and a2 = 10 workers are unfortunate, and the probability, α = a2/ (a1 + a2) =10/100, of being unfortunate in each year. As for the general equilibrium model incorporating taxing system, see Fukiharu (2014).

5.1.1 Behavior of Agents

When a household is fortunate and healthy, it has 365 days of initial leisure days. Its behavior is stipulated by (1) and (2). Remarks on Y1 are appropriate in this section. We start with the case in which k = 1/10. Thus, the deduction cost, divided by the number of fortunate workers, k px × a2 × x1/a1 is the transfer payment from the fortunate workers to the unfortunate workers as the health insurance premium. The fortunate worker’s demand function for goods, z1, and the labor supply function of healthy worker, l1, are analytically derived. The unfortunate worker’s behavior is stipulated by the following utility maximization under income constraint:

Under (2) and (10), the unfortunate household’s demand function for goods, z21, the demand function for medical services, x1, and labor supply function, l2, are derived analytically. The behavior of the good-producing firm is stipulated by profit maximization, where production function is given by (4). The profit maximization under (4) gives rise to the equilibrium condition, pz = w. The behaviors of the hospital and the doctor are exactly the same as in 2.4.

5.1.2 Competitive General Equilibrium under Medical Insurance in the Basic Medical Society (s0 = 1/10)

Equilibrium conditions are given by (6) and (7), where w = pz = 1, Y1 = –k px a2 x1/a1, and Y2 = 0.

Suppose that s0 = 1/10. Utilizing the Newton Method, we can solve competitive medical service charge, px00k, and the rental price of doctor, wD00k as follows:

It is easy to check that in equilibrium, c is indeed equal to px × a2 × x1. Now, the utility level and income for the fortunate worker in this general equilibrium are given by u100k and i100k, while the utility level and income for the unfortunate worker in this general equilibrium are given by u200k and i200k. The doctor’s utility level and income in the competitive general equilibrium are given by ud00k and id00k. The sum of these utilities in this competitive general equilibrium, the Bentham-type social welfare, is given by WLD00k, which is computed as follows:

This result corresponds with the moral hazard argument (Pauly 1968). Next, we examine the moral hazard for the orthodox case in which a1 = 90 and a2 = 10 when k = 2/10, …, 9/10. The Bentham-type social welfare, WLD00k, computed continues to decline until k = 9/10. Thus, we may assert that the Pauly-type moral hazard does take place for the orthodox case. Finally, we examine the unorthodox case in which a1 = 10 and a2 = 90. Note that the competitive general equilibrium with the medical sector is not necessarily guaranteed for the arbitrary medical payment deduction rate, k, 0 < k < 1, since the incomes of the fortunate worker, i100k, are negative for k = 7/10, 8/10, 9/10, as shown in Fig. 9, in which the x-axis indicates k, 0 < k < 1, and the y-axis indicates the incomes of the fortunate worker, i100k.

In this unorthodox case, we compute the Bentham-type social welfare, WLD00k, for k = 0, 1/10, …, 7/10. When k = 0, WD00k = 2568661.92085, and it declines until k = 3/10. As k increases, however, from k = 4/10, and when k = 5/10, we have WLD00k = 2589358.42616, which is greater than the one when k = 0. Thus, near the boundary of k, the Pauly-type moral hazard does not emerge. In other words, the social inefficiency does not take place when the government adopts the 50% medical payment deduction rate for this unorthodox case.

5.1.3 Competitive General Equilibrium under Medical Insurance in the Advanced Medical Society (s0 = 10)

Suppose that s0 = 10. In the advanced medical society, the competitive general equilibrium with the medical sector incorporating medical insurance is guaranteed for arbitrary k, 0 < k < 1 for both the orthodox and unorthodox cases. Contrary to the basic medical society, the income for the fortunate workers is positive for arbitrary k, 0 < k < 1 in the unorthodox case, as shown in Fig. 10.

Utilizing the Bentham-type social welfare, it is confirmed that the moral hazard emerges for both the orthodox and unorthodox cases: i.e., WLD00k < WLD00 for k = 0, 1/10, …, 9/10.

5.1.4 Competitive General Equilibrium under Medical Insurance in the Backward Medical Society (s0 = 1/1000)

First, it is shown that the existence of general equilibrium with medical sector incorporating medical insurance is guaranteed for k, 0 < k < 1, for the orthodox and unorthodox cases. For the orthodox case, we compute the Bentham-type social welfare, WLD00k, for k = 0, 1/10, …, 9/10. When k = 0, WLD00k = 3222597.65517, and it continues to decline until k = 9/10. Thus, we may assert that when the Bentham-type social welfare is adopted, the Pauly-type moral hazard does take place. For the unorthodox case, when k = 0, WLD00k = 2358097.67700, and it declines until k = 9/10. Thus, Pauly-type moral hazard takes place.

5.2 Monopolistic Basic Medical Society (s0 = 1/10) under Medical Insurance

In this subsection, a monopolistic general equilibrium model incorporating medical sector is constructed, where medical insurance is available. Except for this point, the same assumptions are adopted. Thus, the medical insurance is introduced into Basic Model II: i.e., a1 = 90 workers are fortunate and a2 = 10 workers are unfortunate, and the probability, α = a2/ (a1+ a2) =10/100, of being unfortunate in each year. By the medical insurance, 100 k% of the medical charge of the unfortunate workers is deducted, while the deduction is covered by the insurance premium, paid by the fortunate workers. In this subsection, it is assumed that k = 1/10.

5.2.1 Behavior of Agents

The behaviors of the “fortunate” and “unfortunate” workers are stipulated by (1) and (10), respectively. The remarks, however, on Y1 and Y2 are appropriate. The hospital, as the monopolist, is owned by the workers with an equal share holding, so that the monopolistic profit is distributed into Y1 and Y2. In order to compute the monopolistic equilibrium under a general equilibrium, the “objective” profit function of the medical sector, OPROk (px), which equalizes demand and supply in the goods and doctors markets is derived analytically as follows, from (6) and (7), with w = 1, Y1 = OPROk(px)/100 – ka2pxx1/a1, Y2 = OPROk(px)/100, and pz = 1:

5.2.2 Monopolistic General Equilibrium under Medical Insurance in the Basic Medical Society (s0 = 1/10)

Suppose that s0 = 1/10. The hospital maximizes OPROk with respect to px. The monopolistic medical charge by the hospital, pxM00k, is computed as follows by the Newton Method, which is higher than pxM00 and px00. The wage rate (rental price) of the doctor in the monopolistic medical sector, wDM00k, is higher than wDM00:

Now, the utility level and income for the fortunate worker in this monopolistic general equilibrium are given by u1M00k and i1M00k, while the utility level and income for the unfortunate worker in this general equilibrium are given by u2M00k and i2M00k. The doctor’s utility level and income in the monopolistic general equilibrium are given by udM00k and idM00k. The Bentham-type social welfare is given by WLDM00k, which is computed as follows:

The moral hazard does not emerge under the monopoly. The reason WLDM00k is greater than WLDM00 stems from the fact that the medical insurance in the present paper is a subsidy in the monopoly. Next, it is shown that the existence of monopolistic general equilibrium with the medical sector is guaranteed for the arbitrary medical payment deduction rate, k, 0 < k < 1, in the orthodox case. The non-negativity of i100k is guaranteed. We compute the Bentham-type social welfare, WLDM00k, for k = 0, 1/10, …, 9/10. When k = 0, WLDM00k = 3274807.59664, and it continues to rise until k = 8/10. While it declines when k = 9/10, it is still greater than WLDM00k when k = 0. Thus, we may assert that when the Bentham-type social welfare is adopted, the Pauly-type moral hazard does not take place in this case. Finally, it is shown that the existence is not necessarily guaranteed for arbitrary k, 0 < k < 1 when the society is assumed to be of the unorthodox case. In this unorthodox case, it is impossible to adopt more than a 60% medical payment deduction rate: i.e., k ≥ 6/10. It is the case, since i1M00k < 0, for k ≥ 6/10. With respect to the moral hazard, we have the following: when k = 0, WLDM00k = 2552288.28913, and it rises until k = 5/10. Thus, the Pauly-type moral hazard does not take place until k = 5/10.

5.2.3 Monopolistic General Equilibrium under Medical Insurance in the Advanced Medical Society (s0 = 10)

First, it is shown that the existence of monopolistic general equilibrium with the medical sector is guaranteed for the arbitrary medical payment deduction rate, k, 0 < k < 1, in the orthodox case. We compute the Bentham-type social welfare, WLDM00k, for k = 0, 1/10, …, 9/10. When k = 0, WLDM00k = 3291715.71402, and it continues to decline until k = 9/10. Thus, we may assert that the Pauly-type moral hazard takes place in the orthodox case. Next, it is shown that the existence of a monopolistic general equilibrium is not necessarily guaranteed for the arbitrary medical payment deduction rate, k, 0 < k < 1 when the society is assumed to be of the unorthodox case. In this unorthodox case, it is impossible to adopt more than a 60% medical payment deduction rate: i.e., k ≥ 6/10. Finally, we compute the Bentham-type social welfare, WLDM00k, for k = 0, 1/10, …, 6/10. When k = 0, WLDM00k = 3012255.33964, and it rises until k = 5/10. Thus, the Pauly-type moral hazard does not take place.

5.2.4 Monopolistic General Equilibrium under Medical Insurance in the Backward Medical Society (s0 = 1/1000)

First, it is shown that the existence of the monopolistic general equilibrium with the medical sector is guaranteed for the arbitrary medical payment deduction rate, k, 0 < k < 1, in the orthodox case. We compute the Bentham-type social welfare, WLDM00k, for k = 0, 1/10, …, 9/10. When k = 0, WLDM00k = 8901303584456.00296, and it continues to decline until k = 9/10. Thus, we may assert that the Pauly-type moral hazard takes place in the orthodox case. Next, it is shown that the existence of the monopolistic general equilibrium is guaranteed for the arbitrary medical payment deduction rate, k, 0 < k < 1 when the society is assumed to be of the unorthodox case. We compute the Bentham-type social welfare, WLDM00k, for k = 0, 1/10, …, 9/10. When k = 0, WLDM00k = 169788593194194090.59993, and it declines until k = 9/10. Thus, the Pauly-type moral hazard does take place in this unorthodox case.

5.3 The Adverse Selection

Akerlof (1970) argued that the market for used cars might disappear due to asymmetric information, providing the dynamic adjustment process toward the disequilibrium, where the sellers of used cars know the quality of them, while the purchasers don’t. Rothschild and Stiglitz (1976) asserted that there may not exist (partial) equilibrium in a competitive insurance market with asymmetric information, where the competitive sellers of insurance do not know the exact probabilities of diseases of the purchasers and the insurers must set the insurance fee by the average of those probabilities in a game-theoretic framework. This contribution was extended by Engers and Fernandez (1987), and Dubey and Geanakoplos (2002) in the framework of game theory.

The insurer in the present paper may well be a government, the sole insurer, who attempts to introduce the universal health insurance system. We examined the same non-existence of the market equilibrium under quality uncertainty. In this sense, the adverse selection emerges in the general equilibrium with the medical sector under equilibrium when the insurance system is introduced when the government does not know the probability of health condition of the workers.

6 Conclusion

The main aim of this paper was to conduct an examination on the problem of whether the rise of the health spending’s share in GDP is caused by medical innovation utilizing general equilibrium models with medical sector. In doing so, a minor aim has been to shed light on the problem of the moral hazard and the adverse selection. In this paper, two types of general equilibrium model were constructed for the purpose of comparison of their conclusions. One of them is the general equilibrium model incorporating medical sector under perfect competition. The other is the one under monopoly.

Independently of the assumption on the competition, there are three economic agents: i.e., fortunate workers, unfortunate workers, and (aggregate) doctor. The numbers of fortunate workers with initial labor endowment 365 days and unfortunate workers with initial labor endowment H0 days are a1, and a2, respectively. It was assumed that workers do not know whether they are fortunate or not until the beginning of the year. Thus, the probability of workers being fortunate is a1/ (a1 + a2), and this induces the health care insurance, the deduction of unfortunate workers’ medical payment through the subsidy by the fortunate workers. This insurance follows the idea by Arrow (1963).

The novelty in this paper is the introduction of the “illness treatment function” of the medical sector, with the parameter s0. As s0 rises, it raises the medical sector’s ability of treating patients, a measure of medical technology. In this paper, we defined the medical innovation as the rise of s0. The hospital recovers a part of 365–H0 with a medical charge. The determination of this medical charge is made either competitively or monopolistically. We compared three types of medical society: the basic medical society with s0 = 1/10, the advanced one with s0 = 10, and the backward one with s0 = 1/1000.

With respect to the medical innovation, its effect on health spending per GDP depends on the level of s0 itself in the competitive case: i.e., when s0 is high (the advanced medical society), the further increase of s0 reduces the health spending per GDP. On the contrary, when s0 is low (the backward medical society), the further increase of s0 raises the health spending per GDP, while in between, the conclusion depends on a2/(a1+ a2). In the monopolistic case, however, the effect of innovation does not depend on the level of s0 itself: i.e., the increase of s0 always raises the health spending per GDP.

In order to reach a conclusion on the problem with respect to the relation between medical innovation and health spending, it may be appropriate to refer to Arrow (1963) and Cutler and Morton (2013). The former describes the medical sector as a “collusive monopoly,” whereas the latter pointed out that the US medical sector has a tendency toward monopoly. In consideration of Arrow (1963) and Cutler and Morton (2013), we might be able to assert that the recent rise of health spending in the USA has been, in part, caused by the medical innovation and that there is a causal relation in general between medical innovation and the rise of health spending per GDP.

Utilizing the partial equilibrium analysis, Pauly (1968) argued that the dead weight loss emerges under medical insurance for the health care market with competitive medical sector. On the one hand, in this paper it was shown that the Pauly-type moral hazard emerges in the sense that the Bentham-type social welfare declines under medical insurance for the general equilibrium model with competitive medical sector, except for cases on the boundary. On the other hand, it was shown that the Pauly-type moral hazard does not emerge under medical insurance for the general equilibrium model with monopolistic medical sector in the basic medical society and for the unorthodox cases in the advanced medical society. Akerlof (1970) argued that the market for used cars might disappear due to asymmetric information. In this paper, it was shown that in the sense of the non-existence of the market equilibrium under quality uncertainty, adverse selection may emerge in the general equilibrium with the competitive and monopolistic medical sectors when medical insurance is introduced.

References

Akerlof, G. (1970). The market for lemons: Quality uncertainty and the market mechanism. Quarterly Journal of Economics, 84(3), 488–500.

Arrow, K. J. (1963). Uncertainty and the welfare economics of medical care. American Economic Review, 53, 841–873.

Chandra, A., & Skinner, J. (2012). Technology growth and expenditure growth in health care. Journal of Economic Literature, 50(3), 645–680.

Cutler, D. M., & Morton, F. S. (2013). Hospitals, market share, and consolidation. JAMA, 310(18), 1964–1970.

Dubey, P., & Geanakoplos, J. (2002). Competitive pooling: Rithchild-Stiglitz reconsidered. Quarterly Journal of Economics, 116, 1529–1570.

Ehrlich, I., & Yin, Y. (2013). Equilibrium health spending and population aging in a model of endogenous growth: Will the GDP share of health spending keep rising? Journal of Human Capital, 7(4), 411–447.

Engers, M., & Fernandez, L. (1987). Market equilibrium with hidden knowledge and selfselection. Econometrica, 55, 425–439.

Fuchs, V. R. (1996). Economics, values and health care reform. American Economic Review, 86(1), 1–24.

Fukiharu, T. (2005). Health, uncertainty, and insurance: A social simulation. In: D.R.C. Hill, V. Barra, and M.K. Traore, eds. 2005. Open International Conference on Modeling and Simulation-OISMS2005. France; Blaise Pascal University. pp. 319–330. Accessed Mar 26, 2020, from http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.404.843&rep=rep1&type=pdf#page=319

Fukiharu, T. (2014). A simulation on the public good provision under various taxation systems. In Y. Shi, A. Lepskiy, & F. Aleskeroy (Eds.), 2014. Second international conference on information technology and quantitative management, Procedia Computer Science (Vol. 31, pp. 492–500). Amsterdam: Elsevier.

Fukiharu, T. (2018a). A general equilibrium approach to health care economics: Part I. In Research map. Accessed Mar 26, 2020, from https://researchmap.jp/multidatabases/multidatabase_contents/detail/274811/fa896c3369fb4e84693d0eaadc8d5e66?frame_id=695189.

Fukiharu, T. (2018b). A general equilibrium approach to health care economics (part III): The basic medical society. In Research map. Accessed Mar 26, 2020, from https://researchmap.jp/multidatabases/multidatabase_contents/detail/274811/7a0092a0f845852fd6e0a088eb1831e1?frame_id=695189.

Fukiharu, T. (2018c). A general equilibrium approach to health care economics (part IIIA): The advanced medical society. In Research map. Accessed Mar 26, 2020, from https://researchmap.jp/multidatabases/multidatabase_contents/detail/274811/beef0806570716f24793413d251c7898?frame_id=695189.

Fukiharu, T. (2018d). A general equilibrium approach to health care economics (part IIIB): The backward medical society. In Research map. Accessed Mar 26, 2020, from https://researchmap.jp/multidatabases/multidatabase_contents/detail/274811/8c49c32b3cde98172850882c54049cc7?frame_id=695189.

Grossman, M. (1972). On the concept of health capital and the demand for health. The Journal of Political Economy, 80(2), 223–255.

OECD. (2020). OECD DATA: Health spending.Accessed Mar 26, 2020, from https://data.oecd.org/healthres/health-spending.htm

Pauly, M. V. (1968). The economics of moral hazard: Comment. American Economic Review, 58, 531–537.

Pear, R. (2018). Growth of health care spending slowed last year, Dec. 6, 2018, New York Times.. Accessed Mar 25, 2020, from https://www.nytimes.com/2018/12/06/us/politics/us-health-spending-2017.html

Rothschild, M., & Stiglitz, J. E. (1976). Equilibrium in competitive insurance markets: An essay on the economics of imperfect information. Quarterly Journal of Economics, 88, 44–62.

Acknowledgments

The present author appreciates Prof. Steve Lambacher (Aoyama Gakuin University) for his assistance in making this paper readable. He also appreciates Prof. José Miguel Pinto dos Santos (AESE), participants at the conference, and the editors of these proceedings for their useful comments on the draft of this paper.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Fukiharu, T. (2021). Health Spending and Medical Innovation: A Theoretical Analysis. In: Bilgin, M.H., Danis, H., Demir, E., Vale, S. (eds) Eurasian Economic Perspectives. Eurasian Studies in Business and Economics, vol 16/1. Springer, Cham. https://doi.org/10.1007/978-3-030-63149-9_10

Download citation

DOI: https://doi.org/10.1007/978-3-030-63149-9_10

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-63148-2

Online ISBN: 978-3-030-63149-9

eBook Packages: Economics and FinanceEconomics and Finance (R0)