Abstract

In order to find decisions in finance, regulations, politics including long term strategies for the electricity system and strategic planning on the industrial side, a holistic view on the overall energy system and markets is required at different levels of detail.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

1 Overview

In order to find decisions in finance, regulations, politics including long term strategies for the electricity system and strategic planning on the industrial side, a holistic view on the overall energy system and markets is required at different levels of detail. These include mainly aggregated regional views of:

-

power production units (differentiated according to technologies)

-

electricity networks (ACDC)

-

weather predictions and renewable feed-in

-

demand forecasts (industry, trade sector, households)

and in different representations of markets (long term, spot, intraday, balancing) and participants producers (including productions of renewables)

-

network operators

-

consumers including demand side management

-

policy and regulations

-

traders and aggregators

The aim of a system modelling approach is to investigate the development of the system with respect to different time levels and corresponding questions (see Tables 1, 2 and 3).

2 Long Term Electricity Bilateral Contracts

Electricity markets offer a way to trade on a hourlydaily basis quantities of electricity at a given price. The short term producer’s maximum profit problem has been discussed in another section. However for risk management reasons the producers may want to stipulate longer term bilateral contracts with third parts, i.e. (large) consumers. The problem of defining the amount and the price of such over the counter transactions can be seen as an simulation/optimization one. It is also a simulation problem since the long term horizon calls for the estimation of the future conditions of the spot market that remains an alternative. Although rare, a producer, especially a small one, may in fact want to go spot for all its capacity. The final goal is indeed maximizing the profit while maintaining a certain—quantity and price—risk.

2.1 Modeling and Algorithmic Considerations

From a modelling standpoint, the bilateral contract definition involves the price risk profile and the future conditions of the spot market. Moreover, the bilateral contracts are typically equipped with hourly profile (or blocks of hours) of demand from the counterpart. Therefore, the inclusion of some simplified technical constrains of the power plants must be considered (at least maximum capacity and ramp constraints). All in all, given a certain demand profile requested, the problem can define as variables price and quantity and try to optimize a custom objective function that takes into account the revenues, the costs, and the risk reduction, with respect to pure spot trading along the considered horizon.

3 Multilevel Modeling of Market Design

3.1 Redispatch-Based Electricity Trading

Many European countries have implemented a system of spot market trading of electricity that is redispatch-based [131]. Electricity is traded at power exchanges like the EEX in Leipzig, Germany. During these auctions, no or only a certain part of the technical and physical constraints of electricity transport through the transmission network are respected. For instance, in Germany, only a market clearing is imposed that yields the balance of traded production and consumption. As a result of this drastic simplification, spot market results do not have to be feasible with respect to actual transport through the transmission network. If this turns out to be the case, traded quantities have to be redispatched such that the resulting quantities can actually be transported. Different systems of redispatch rules are implemented in Europe, e.g., cost-based redispatch in Austria, Switzerland, and Germany or market-based redispatch in Belgium, Finland, France, or Sweden [176]. However, and independent of the actual redispatch system, this market design of spot market trading and redispatch yields a two-stage model that involves different agents and stakeholders like

-

producers owning conventional power plants or facilities for producing power from renewables like sun or wind;

-

consumers like municipal utilities or large industrial enterprises; and

-

transmission system operators (TSO) that control and maintain the transmission network and organize the redispatch.

It is shown in the literature that this system of electricity market design may yield significant decreases in total social welfare; see [176, 205] and the references therein. Thus, the natural question arises if and how different markets can be designed that yield improved welfare outcomes. This question is currently an active field of research and involves the investigation of alternative systems like the introduction of zonal pricing [177, 205] or nodal pricing [205, 229].

From a mathematical point of view, the study of different market designs may introduce the regulator or state as an additional agent that decides on certain questions like, e.g., the specification of the actual price zones in zonal pricing or the specification or regionally differentiated network fees. Since the regulator or state anticipates the influence of his decisions on the actions of all other agents, such a rigorous mathematical modeling has important implications on the overall model, since the decisions of the regulating agent couples all other levels of the system, yielding a (typically mixed-integer) multilevel optimization [97].

These models are extremely hard to solve [98, 165, 427]. Hence, there is a political and social need to develop new mathematical theory and algorithms for solving realistic instances of these models.

4 Energy Policy Analysis

Energy planning requires the study of the interactions between the economy (at national or regional levels), the energy sector and the related impacts on the environment. Many countries do not hold indigenous energy resources becoming highly dependent on primary energy imports. In such cases, an increase of energy consumption which greatly relies on fossil fuels is frequently interweaved with economic growth, also leading to the exhaustion of finite resources and to Greenhouse Gas (GHG) emissions. To sum up, negative effects on economic growth and social welfare might be prompted as an outcome of energy and environmental policies. Henceforth, other evaluation facets besides economic concerns such as environmental and social welfare impacts should be explicitly considered in the appraisal of the merits of energy plans and policies to address energy problems in a societal perspective [22].

Thus, the assessment of the trade-offs between economic growth, energy demand/supply, as well as their corresponding environmental and social effects is particularly relevant for energy planners and decision-makers (DM) through the use of reliable tools for supporting the process of energy policy decision-making. In this context, the use of multiobjective programming models and methods combined with Input-Output (IO) analysis can be particularly appropriate for assisting in the process of Economy-Energy-Environmental (E3) policy design [333].

IO analysis is a top-down approach which can be intertwined with environmental satellite accounts provided by national statistical offices, allowing broad impact coverage of all sectors directly and indirectly involved with the energy sector. Furthermore, IO has influenced the outset of linear programming (LP) [430] and it may be considered as a simple particular case of LP [107]. The combined use of the IO methodology with LP models allows attaining value-added information, which would not be possible to achieve with the isolated use of both techniques. Inter/intra-sector relations entrenched in IO analysis allow obtaining the production possibility frontier. LP models enable selecting the level of activities which optimize a given objective function, satisfying the production sector relations imposed by IO analysis. Additionally, IO MOLP models allow assessing different efficient possibilities of production (i.e. output levels for each activity sector for which there is no other feasible solution that allows improving the value of a given objective function without worsening the value of, at least, other objective function) that can be reconciled with the competing axes of evaluation intrinsically at stake [333].

4.1 Strategic Problems

LP formulations of IO systems have been a normal part of standard texts since the 1960s [411]. The first IO LP models developed only addressed the economic system, but after the first oil crisis energy-environmental planning models started to play a prominent role.

IO analysis allows establishing an overarching framework to model the interactions between the whole economy and the energy sector, thus identifying the energy required for the provision of goods and services in an economy and also quantifying the corresponding pollutant emissions. Several indicators (either modelled as constraints or as objective functions) are obtainable with the application of IO LP/MOLP models specifically devoted to energy planning:

Economic

-

Gross Domestic Product (GDP);

-

Gross Regional Product (GRP);

-

Gross Value of Production (GVP);

-

Output levels;

-

Private consumption;

-

Balance of payments;

-

Foreign-trade-balance;

-

Gross value added;

-

Public deficit;

-

Production capacity;

-

Exports and imports;

-

Cost of the energy system;

-

Employment;

Energy

-

Energy imports;

-

Energy use;

-

Storage capacity;

-

Security stocks for hydrocarbons;

-

Wastes with energetic use;

-

Efficient energy use;

Environmental

-

GHG emissions (based on CO2, N2O and CH4 emissions);

-

Acidifying substance emissions (based on SO2, NOx and NH3 emissions);

-

Environmental discharges not related to fuel combustion;

-

Wastes produced.

4.2 Integrated Energy Planning Models

Integrated energy planning (IEP) strives to account for the relevant strategic elements of the energy value-chain at a national level/regional level. IEP is intrinsically a multiobjective problem and when sustained by IO MOLP modelling tools, distinct alternative energy pathways can be assessed which can be consistent with different policy options. The solutions obtained help DMs to assess how energy requirements can be reduced without harming economic growth and socioeconomic development, allowing to understand the relationship (trade-off) between energy supply/demand and economic development/growth and corresponding environmental impacts.

IO MOLP models support IEP and provide help in the design of energy policies, namely guiding:

-

the proposal of balanced energy policy configurations;

-

the selection of appropriate technologies to meet energy demand;

-

the suggestion of strategies to appraise the impacts of energy supply shortages/disruptions in an integrated manner;

-

the development of procedures to assess the effects of nuclear power plant accidents, trade embargoes, and international conflicts, among others;

-

reallocation of production problems;

-

biomass production optimization;

-

energy import resilience;

-

energy-economic recovery resilience of an economy;

-

energy efficiency planning.

4.3 Regional Energy Planning

Since the national energy supply/demand structure cannot reflect regional characteristics, regional energy planning is particularly relevant because it allows capturing each region’s specifics, before being articulated with national energy planning.

IEP Models

Balanced regional policy configurations can be obtained by means of IO MOLP models. With the foregoing in mind, [315] presented a macro-level energy model aimed at minimizing the total cost of the energy system and its application to energy planning for three states in India (Gujarat, Kerala and Rajasthan). The methodology considers a reference energy system, an expanded IO table with disaggregated energy sectors and an LP model combined with a scenario analysis approach.

Cho [78] developed a model which includes the minimization of energy consumption and pollution, and the maximization of employment, being subject to the restriction of the range of outputs for twelve individual sectors considered, regarding the total output level of the Chungbuk economy. The impact multipliers (employment, pollution and energy consumption) are calculated and then combined with decision variables to form the objective functions of the MOLP model. The results of the model are able to illustrate how the regional production structure should be reorganized in order to become a more balanced one.

Assessment of Energy Shortage Impacts

The assessment of energy shortage impacts has been formulated as an LP problem in [265], where an energy flow matrix for Hawaii is built and the 1977 Hawaii IO table is used to evaluate each sector’s direct energy intensity and total energy intensities.

The authors calculate shadow prices for different levels of gasoline availability with the use of an LP model and show that the solution thus obtained provides an efficient distribution of energy resources to various industry sectors during energy shortages.

IEP Models Under Dynamic Assumptions

Leontief [264] suggested the dynamic IO model where a new matrix describing the capital resources is considered, aimed at distinguishing different technological structures in different time frames. With this modelling formulation it is possible to account for the growth potential of an economy, since the final demand vector of the static IO model is replaced by a stock’s coefficient matrix that is then multiplied by the anticipated increase of the output level between the present year and the following year. This new set of differential equations represents the dynamic relations of the IO model, allowing for the description and analysis of the economic growth process [264]. Based on this type of approach [462] applied an LP dynamic IO model considering the case of renewable energy industries, as well as the environmental policy instrument of emission taxes. In addition to exploring the relationships among Beijing’s renewable energy, economy and environment, the model analyses the future trends of the economy and GHG intensity from 2010 to 2025. The objective function is the maximization of the total GRP from 2010 to 2025, being subject to constraints regarding material flow balance, value flow balance, electricity supply-demand balance, investment-savings balance and GHG emissions.

James et al. [221] suggested the combination of the IO model with a dynamic energy technology optimization model to compute the change in total energy demand and technological mix. The authors were able to identify through the use of the model part of the economic repercussions of technological change and inter-fuel substitution.

4.4 National Energy Planning

IEP models at the national level, explicitly incorporating the interactions of the energy system with the economy have been developed based on IO MOLP.

IEP Models

Hsu et al. [209] use the bicriterion NISE method for assessing the trade-offs between GDP and energy use in Taiwan. The solutions obtained represent simulated scenarios of aggressive, moderate and conservative policy alternatives. The evaluation of the outcomes is mainly centred on the economic performances resulting from the different policy alternatives and the energy requirements for supporting that performances.

The impacts of the electricity power industry can also be assessed by coupling IO with goal programming models. A goal programming model has been suggested in [18] to analyse the trade-offs among economic (generation cost minimization) and environmental (CO2 emissions minimization) objectives for the year 2000 in Japan’s electricity power industry, which allows discussing the nature of the trade-off curve and the extent of power generation by source.

Antunes et al. [23] consider the TRIMAP interactive environment to analyse the interactions of the energy system with the economy in Portugal. Another version of this model with six objective functions (maximization of GDP, private consumption, self-power generation and employment, and minimization of energy imports and CO2 emissions) was proposed in [327] and solutions were obtained using the interactive STEM method. In [328] an interactive procedure to obtain solutions is employed based on a min-max scalarizing function associated with reference points, which are displaced according to the DM’s preferences expressed through average annual growth rates. The objective functions considered in the model are: minimisation of acidification potential, maximisation of self-power generation, maximisation of employment, maximisation of GDP, and minimisation of energy imports.

Kravtsov and Pashkevich [248] suggested a three-objective LP model aimed at maximizing the GDP, minimizing the use of fuel and energy resources, and maximizing the foreign-trade balance. Solutions were computed using a weighted sum approach, with information on Belarus over the 1996–2000 period.

Hristu-Varsakelis et al. [208] optimized production in the Greek economy, under constraints relating to energy use, final demand, GHG emissions and solid waste. The effects on the maximum attainable GVP when imposing various pollution abatement targets were considered using empirical data. The results obtained quantify those effects as well as the magnitude of economic sacrifices required to achieve environmental goals, in a series of policy scenarios of practical importance. Because air pollution and solid waste are not produced independently of one another, the settings in which it is meaningful to institute a separate policy for mitigating each pollutant versus those in which only one pollutant needs to be actively addressed are identified. The scenarios considered represent a range of options that could be available to policy makers, depending on the country’s international commitments and the effects on economic and environmental variables.

San Cristóbal [375] proposed an IO MOLP model combined with goal programming to assess economic goals (output levels), social goals (labour requirements), energy goals (reduction of coal requirements by 5%), environmental goals (reduction of total emissions of GHG and waste emissions by 10%). Solutions are obtained by considering the minimization of the total deviations from the goals.

de Carvalho et al. [92] proposed a hybrid IO MOLP model applied to the Brazilian economic system aimed at assessing the trade-offs associated with the maximization of GDP and the minimization of the total energy consumption and GHG emissions, considering the timeframe of 2017. The TRIMAP interactive environment was employed to grasp the trade-offs between these objective functions.

Assessment of Economic or Political Crises

The quantitative effects of economic or political crises can be assessed with IO MOLP models. Examples of such crises are nuclear power plant accidents, trade embargoes, and international conflicts. Kananen et al. [234] showed how a visual, interactive, dynamic MOLP decision support system can be effectively used with this aim in the Finnish economy. The IO MOLP model considers as objectives the maximization of private consumption, trade deficit and employment, and the minimization of the overall energy consumption.

Models Devoted to Reallocation of Production Problems

The reallocation of production problem can be formulated as a constrained optimization problem. Taking Greece as a case study, Hristu-Varsakelis et al. [207] considered the reallocation problem on a sector-by-sector basis, in order to meet overall demand constraints and GHG Kyoto emissions targets. The authors take into account the Greek environmental IO matrix for 2005, the amount of energy utilized and pollution reduction options. The model is aimed at maximizing total GVP subject to upper bounds on energy use and pollution, lower and upper bounds on production, and lower bounds on the GVP of every activity sector.

Models Devoted to Biomass Production Optimization

IO MOLP models can be adjusted to include several alternative technologies. In this case, the LP formulation is able to handle the representation of alternative technologies [430]. This hybrid approach of linking detailed models with aggregated, economy-wide models is the current focus of research in Life Cycle Assessment (LCA). Following this approach, de Carvalho et al. [92] developed a hybrid IO framework coupled with LCA based estimates for two sugarcane cultivation systems, two first-generation and eight second-generation technology systems for bioethanol production scenarios. The integrated- or country-based assessment of the whole economic system has accompanied the process design and process-based analysis, supporting the identification of direct and indirect effects that can counterweight the benefits. The consideration of direct and indirect effects on the whole economic system is critical in policies and technological choices for prospective bioethanol production, since positive direct effects of first-generation and second-generation plants can be offset by indirect impacts on other sectors.

Energy Import Resilience

Energy import shortages may occur in various importing sectors and most of the times cannot be foreseen in advance. Models aimed at addressing energy import resilience can be used to simulate the impact of specified energy import losses on the sectoral production levels, and consequently, the final supply-demand balance. In this context, He et al. [194] developed an IO LP model that focuses on the connection between energy imports, industrial production technologies and capacities. The main value added rests on the possibility offered by the proposed model of appraising the worst-case scenario impact over a family of import loss scenarios. The impact of an energy import loss on the economy is the amount of final demand of goods that cannot be balanced by the given supply and production in the short run. An energy import resilience indicator is then defined, which essentially assesses the highest level of energy import loss possible to the economy. The methodological framework is also extended in order to encompass production capacity designs that allow reaching the maximum possible energy import resilience of a given IO structure.

Energy-Economic Recovery Resilience of an Economy

He et al. [195] proposed an IO LP to appraise the energy-economic recovery resilience of an economy by studying the interactions between energy production disruption, impacts on sectoral production and demands, and post-disruption recovery exertions. The developed model evaluates the minimum level of recovery investments necessary to reinstate production levels so that total economic impacts are tolerable over a specified post-disruption extent. It is presumed that disruptions are uncertain and can take place at different sectors and possibly simultaneously. The optimization model is then solved using a cutting plane method which involves computing a small sequence of mixed integer programming problems of reasonable dimensions. Taking China’s 2012 IO data as a case study, the study illustrates the model’s ability to unravel vital inter-sectoral dependencies at different disruption levels. With this type of approach DMs become acquainted with relevant information regarding the appraisal and enhancement of the energy-economic resilience in a comprehensive manner.

IEP Under Uncertainty

The accurate specification of the coefficients of optimization models is a challenging endeavour in most real world problems since sometimes there is not enough information available. Moreover, the technical coefficients of the IO matrix may be subject to a considerable level of uncertainty. Uncertainty handling in the outline of IO analysis may be essentially based on three different approaches: the probabilistic approach, in which the probabilistic distribution functions associated with all the coefficients are presumably well known (e.g. [411, 440]); the interval approach (unknown but bounded coefficients), where the upper and lower bounds of the coefficients are considered without being associated with a structure of possibilities or probabilities (e.g. [223, 224]); and the fuzzy (or possibilistic) approach, in which membership functions are assigned to all uncertain coefficients (e.g. [62]). Therefore, IO LP/IO MOLP models explicitly handling uncertainty of the model coefficients have arisen in scientific literature.

Borges and Antunes [56] proposed an IO MOLP model with fuzzy coefficients in the objective functions and fuzzy right hand sides of the constraints for E3 planning in Portugal. Interactive techniques were used to perform the decomposition of the parametric (weight) diagram into indifference solutions corresponding to basic non-dominated solutions.

Oliveira and Antunes [329] and Oliveira Henriques and Antunes [331] have considered all IO MOLP model coefficients as intervals, then conveying information regarding the robustness of non-dominated solutions (that is, solutions that achieve desired levels for the objective functions across a set of plausible scenarios) under a more optimistic or pessimistic DM’s stance. With the introduction of (direct and indirect) employment multipliers, this IO structure has been used to extend the interval MOLP to assess the trade-offs between economic growth (GDP), social welfare (employment), and electricity generation based on renewable energy sources [332].

Models Devoted to Biomass Production Optimization

Case studies based on electricity generation from biomass and ethanol production can be assessed to illustrate how the model determines optimal production levels of feedstock within each region, as well as optimal levels of trade between regions and imports from external sources. With this purpose, [407] presented a multi-regional fuzzy IO model to optimize biomass production and trade under resource availability and environmental footprint constraints. Uncertainty was only considered on the upper or lower bounds of the constraints.

Models Devoted to Energy Efficiency Planning

The introduction of a bottom-up approach into an IO MOLP model enables extending its application to the assessment of energy efficiency measures. This methodological framework combined with mathematical interval programming tools was followed in [333] to account for investment options aimed at improving the thermal properties of the building envelope (e.g., the insulation of external walls and roof, and the replacement of window frames and window glazing) in Portugal. The objective functions are the maximization of GDP, the building renovation investment, and the overall level of employment, being subject to several economic and environmental constraints.

Challenges of IEP Planning with MOLP IO Models

The main difficulty found in the studies carried out with these models rests on the availability of statistical information. In fact, the application of the IO approach in the framework of electricity generation can be a complex and challenging task since published IO tables do not allow assessing the environmental impacts that are likely generated from an increase in the demand for electricity generation from renewable energy and/or from conventional energy, but only the impact of an increase in demand for electricity in general. Published IO tables consider a single aggregated electricity sector, where generation, transmission, distribution and supply activities related to the production and use of electricity are included. Therefore, it is important to disentangle the different possible ways to tackle the disaggregation of the electricity sector.

Despite the typical limitations found when considering this type of approach, the power of IO analysis rests upon its capacity of depicting the technology of a country or region with enough accuracy to allow performing a real empirical study. In addition, IO analysis is a flexible tool that can be applied to a wide variety of problems, which can be used to modelling complex systems of economic and physical interrelations. In reality, IO analysis enables assessing any type of environmental burden caused by changes in the output of economic sectors once reliable data is used.

A broad range of (economic, social, energy and environmental) indicators according to coefficient scenarios and output levels attained for the activity sectors (industries) might thus be obtained with IO LP/MOLP models, which provide a useful planning and prospective analysis tool.

A major drawback usually mentioned in scientific literature relates to the static nature of the IO traditional matrix. However, the IO MOLP framework has evolved, explicitly encompassing the uncertainty handling of the model’s coefficients, helping to overcome this particular limitation. This modelling approach could, nevertheless, benefit from the development of a dynamic, multi-period variant, relying on the integration of time-dependent technical parameters to account for technological learning curves and yield improvements, as well as incorporate game theoretical principles to accurately reflect the typical multi-agent’s nature of the problem.

Another possibility for further enriching this modelling framework would be the development of tools for obtaining solutions considering the interaction with multiple planners/DMs with potentially conflicting views. The involvement of distinct stake-holders would bring new insights into the decision-making process at all stages, from model’s definition to the evaluation of solutions.

5 Demand Response and Price Optimization

One of the main research objectives in Demand Response (DR) is the design and implementation of technologies and mechanisms to lower the electricity consumption via energy efficiency measures, and to improve the electricity consumption via demand shifting. Increasing energy efficiency requires a reduction of energy demand peaks by shifting part of the energy consumption in off-peak hours. This can be done via DR mechanisms and load control.

Demand shifting can provide a number of advantages to the energy system [94]:

-

Load management can improve system security by allowing a demand reduction in emergency situations.

-

In periods of peak loads even a limited reduction in demand can lead to significant reductions in electricity prices on the market.

-

If users receive information about prices, energy consumption becomes more closely related to the energy cost, thus increasing market efficiency: the demand is moved from periods of high load (typically associated with high prices) to periods of low load.

-

Load management can limit the need for expensive and polluting power generators, leading to better environmental conditions.

Potential benefits and implementation schemes for DR mechanisms are well documented in the literature. DR programs can be defined as methods to induce deviations from the usual consumption pattern in response to stimuli, such as dynamic prices, incentives for load reductions, tax exemptions, or subsidies. They can be divided in two main groups: price-based and incentive-based mechanisms [6, 7] and [341].

Price-based demand response is related to the changes in energy consumption by customers in response to the variations in their purchase prices. This group includes DR mechanisms like Time-of-Use (ToU) pricing, Real Time Pricing (RTP) and Critical-Peak Pricing (CPP) rates. If the price varies significantly, customers can respond to the price structure with changes in their pattern of energy use. They can reduce their energy costs by adjusting the time of the energy usage by increasing consumption in periods of lower prices and reducing consumption when prices are higher. ToU mechanisms define different prices for electricity usage during different periods: the tariffs reflect the average cost of generating and delivering power during those periods. For RTP the price of electricity is defined for shorter periods of time, usually 1 h, again reflecting the changes in the wholesale price of electricity. In RTP customers usually have the information about prices. CPP is a hybrid ToU RTP program. This mechanism is based on the real time cost of energy in peak price periods, and has various methods of implementation.

Incentive-based demand response consists in programs with fixed or time varying incentives for customers in addition to their electricity tariffs. Incentive-Based programs (IB) include Direct Load Control (DLC), Interruptible/ Curtailable service (I/C), Emergency Demand Response program (EDR), Capacity market Program (CAP), Demand Bidding (DB) and Ancillary Service (AS) programs. Classical IB programs include DLC and I/C programs. Market-Based IB programs include EDR, DB, CAP, and the AS programs. In classical IBP, customers receive participation payments (e.g. discount rate) for their participation in the programs. In Market-Based programs, participants receive money for the amount of their load reduction during critical conditions. In IC programs, participants are asked to reduce their load to fixed values and participants who do not respond can pay penalties based on the program conditions. DB are programs in which consumers are encouraged to change their energy consumption pattern and decline their peak load in return for financial rewards and to avoid penalties. In EDR programs, customers are paid incentives for load reductions during emergency conditions.

DR mechanisms and load control in the electricity market represent an important area of research at international level, and the market liberalization is opening new perspectives. This calls for the development of methodologies and tools that energy providers can use to define specific business models and pricing schemes.

Every actor in the electricity market has different objectives. For example, retailers and generators aim to maximize their own profit by reducing their costs. In contrast, customers would like their electricity bills as low as possible [425]. Game theoretical methods can also be used to capture the conflicting economic interests of the retailer and their consumers. Authors in [466] propose optimization models for the maximization of the expected market profits for the retailer and the minimization of the electricity cost for the consumer.

One implementation approach of DR mechanisms in the electricity market consists in defining economically and environmentally sustainable energy pricing schemes. In this field, optimization approaches to define dynamic prices have been proposed, and they focus on the definition of dayahead prices for a period of 24 h and for a single customer (or a single group of homogeneous customers). In [446], the response of a non-linear mathematical model is analyzed for the calculation of the optimal prices for electricity assuming default customers under different scenarios over a 24 h period. Yusta et al. [446] defines a model of an electric energy service provider in the environment of the deregulated electricity market. This problem studies the impact on the profits of several factors, such as the price strategy, the discount on tariffs and the elasticity of customer demand functions always over a 24 h period.

Consumers may decide to modify their load profile to reduce their electricity costs. For this reason, it is important to analyze the effect that the market structure has on the elasticity demand for electricity. Kirschen et al. [240] proposes an elastic model to characterize the demand-response behavior and load management with ToU programs and it describes how the consumers behavior can be modeled using a matrix of self and cross-elasticities. Aalami et al. [1] and [2] take into account also other schemes, and rely on the elastic model proposed in [240] to model the demand-response behavior. Torriti [413] assesses the impacts of ToU tariffs on a dataset of residential users in terms of changes in electricity demand, price savings, peak load shifting and peak electricity demand at sub-station level.

Response of the customers to the DR programs affects the daily load curve. Therefore, the Load Duration Curve (LDC) changes due to the responsiveness of the customers over a year and even the participation of the customers in DR programs can have considerable effects on the LDC [374]: the effects of DR need to be investigated over the daily time horizon. De Filippo et al. [93] has adapted elasticity model mentioned above to ToU based prices and considered scenarios over a 24 h period to better identify trends and assess how the characteristics of the market and the customers affect the consumption annual profiles.

Consumption and cost awareness has an important role for the effectiveness of demand response schemes for pricing optimization. Tanaka et al. [408] describes a system architecture for monitoring the electricity consumption and displaying consumption profiles to increase awareness. Ito [217] and Borenstein [55] study how customers respond to price changes, and which price indicators are more relevant in this respect.

6 Pricing Problem

Together with long term bilateral contracts, other—possibly additional—ways of managing various risks can be considered by a producer. Indeed he can also buy or sell financial instruments, such as derivatives. The simplest form of derivatives are the call and the put which may be specialized for the electricity commodity. They typically give the right (but not the obligation) to sell or buy a certain amount of energy at a given price. The price of this option is the strike price. Other, more sophisticated, options do exist, for instance a combination of both usually named as collar or other such as swing options. In choosing these options, two fundamental problems arise:

-

From the selling side, the pricing, i.e. how much is the value of the instrument.

-

From the buying side, the portfolio optimization, i.e. given a set of proposed derivatives, decide which one to buy and if/when to exercise them.

The pricing problem can be solved in a closed form with the well-known Black and Sholes (B&S) approach that has been criticized by various authors. However in the context of the electricity market more advanced pricing models may be useful. A recent and interesting approach is based on robust optimization models. Indeed, as the classical B&S approach, the option pricing problem aims to replicate an option with a portfolio of underlying (available) securities in each possible scenario, and therefore the robust valuation scheme proposed by some authors is natural and conceptually sound. Therefore one can use manageable robust optimisation linear programming problems, based on a dynamic hedging strategy with a portfolio of electricity futures contracts and cash (risk-free asset). The model can be used to find a risk-free bid (buyer’s) price of the swing option.

7 Derivative Pricing in Electricity Markets

In portfolio theory, the most commonly used model for estimating the value of an option is the Black and Scholes model [49]. This model is based upon the assumptions of modern portfolio theory, where prices reflect all the available information. The Black and Scholes model gives the value of an option as a function of the spot price and the volatility of the underlying asset, the strike price, the time and the risk free rate. It is suitable for European options, while the estimation of an American option will require in addition to estimate the likelihood of early exercise (generally resulting from discontinuity events such as dividend distribution or bankruptcy).

Option pricing in energy markets raises specific issues, due to difficult storage and the existence of spot price models [204, 257]. For this reason, the time of exercise is a much more crucial parameter than in financial markets, and can be negotiated between the parties. Therefore, European and American options shall be treated separately. European options can be priced by predicting a spot price and using an approach similar to the Black and Scholes model. For American options, the Black and Scholes equation becomes an inequality whose solution can be approximated by robust optimization models [99, 134].

The ongoing transition from centralized architecture to interoperable grids managed by competing operators is expected to boost inter-grid transactions. The expected cost reduction in storage solution will offer to operators a more and more viable alternative to the sale of production surplus. These parameters must be taken into account in a model for derivative pricing.

8 Combined Gas and Power Optimization

Short-term scheduling of a combined natural gas and electric power system may be formulated as a two-stage optimization model and solved using mixed integer stochastic programming [210]. More stages could be considered and approached using the multi-stage stochastic programming. Benders decomposition [37] may be used to solve a nonlinear optimization problem.

A related problem is integration of the natural gas and electricity networks in terms of power and gas optimal dispatch [418]. A mathematical model of the problem may be formulated as a minimization of the integrated gas-electricity system operation cost with constraints involving the power system and natural gas pipeline equations and capacities. The problem may be solved using a hybrid approach combining evolutionary strategies and the Interior point method.

Another related problem is tri-multi-generation [76]. Various models exist for optimizing energy costs, annual costs and CO2 emissions. Optimization methods include linear programming, branch and bound, evolutionary algorithms for single- and multi-objective optimization.

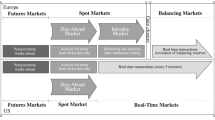

9 European Electricity and Day-Ahead Markets

Besides long-term bilateral contracts, a large part of the production of electricity is traded in day-ahead markets where prices and exchanges of energy are determined for each time slot of the following day, typically an hour. Intraday and balancing markets are then meant to ensure security of supply and to balance positions taken in the day-ahead market which could not be maintained.

Pan-European Market

In Europe, the past decade has seen the emergence of a Pan-European day-ahead electricity market in the frame of the Price Coupling of Regions project (PCR), which is cleared using a common algorithm called Euphemia, handling peculiarities of the different kinds of bidding products proposed by national power exchanges. In a classical microeconomic setting, using supply and demand bid curves submitted by participants, a (convex) optimization problem for which strong duality holds, and aimed at maximizing welfare, yields a market equilibrium. The optimal dual variables then correspond to equilibrium market prices: one for each time slot and each bidding zone.

Non-convexity

These day-ahead markets are non-convex in the sense that participants are allowed to describe operational constraints such as minimum power output levels, and economic constraints such as start-up costs which must be recovered if a unit is started, rendering the primal welfare maximizing problem non-convex, mainly due to the introduction of binary variables.

Near-equilibrium

It can then easily be shown that most of the time, no market equilibrium with uniform prices could exist, where the use of uniform prices means that every bid of a given bidding zone and time slot is cleared at the same common market clearing price. The general approach throughout Europe is to use uniform prices, but to allow some non-convex bids to be paradoxically rejected in the sense that they would be profitable for the computed prices but are none the less rejected, ensuring the existence of feasible solutions, while enforcing all other market equilibrium conditions. This is classically modelled as a Mathematical Program with Equilibrium Constraints (MPEC), and handled by advanced branch-and-cut algorithms (such as Euphemia), see [280, 282, 297].

References

M. Albadi, E. El-Saadany, Demand response in electricity markets: an overview, in In Proceedings of IEEE Power Engineering Society General Meeting (2007)

M. Albadi, E. El-Saadany, A summary of demand response in electricity markets. Electr. Power Syst. Res. 78(11), 1989–1996 (2008)

X. Deng, Complexity Issues in Bilevel Linear Programming (Springer, Boston, 1998), pp. 149–164

S.J. Deng, S.S. Oren, Electricity derivatives and risk management. Energy 31(6), 940–953 (2006)

A. Eydeland, K. Wolyniec, Energy and Power Risk Management: New Developments in Modeling, Pricing and Hedging (Wiley, Hoboken, 2002)

M.R. Garey, D.S. Johnson, Computers and Intractability; A Guide to the Theory of NP-Completeness (W.H. Freeman & Co., New York, 1990)

V. Grimm, A. Martin, M. Schmidt, M. Weibelzahl, G. Zöttl, Transmission and generation investment in electricity markets: the effects of market splitting and network fee regimes. Eur. J. Oper. Res. 254(2), 493–509 (2016)

V. Grimm, K. Thomas, L. Frauke, M. Schmidt, Z. Gregor, Optimal price zones of electricity markets: a mixed-integer multilevel model and global solution approaches. Optim. Methods Softw. 34(2), 406–436 (2017)

W. Hogan, Electricity Market Design: energy trading and market manipulation, in 7th Annual Nodal Trader Conference (2014)

P. Holmberg, E. Lazarczyk, Congestion management in electricity networks: Nodal, zonal and discriminatory pricing. Working Paper Series 915, Research Institute of Industrial Economics (2012)

M.E. Jerrell, Applications of Interval Computations to Regional Economic Input-Output Models (Springer, Boston, 1996), pp. 133–143

M.E. Jerrell, Interval arithmetic for input-output models with inexact data. Comput. Eco. 10(1), 89–100 (1997)

P.L. Joskow, Lessons learned from electricity market liberalization. Energy J. 29, 9–42 (2008)

D.W. Lane, C.W. Richter, G.B. Sheble, Modeling and evaluating electricity options markets with intelligent agents, in DRPT2000. Proceedings of the International Conference on Electric Utility Deregulation and Restructuring and Power Technologies. (Cat. No. 00EX382) (2000), pp. 203–208

M. Madani, M. Van Vyve, Computationally efficient MIP formulation and algorithms for European day-ahead electricity market auctions. Eur. J. Oper. Res. 242(2), 580–593 (2015)

M. Madani, M. Van Vyve, A mip framework for non-convex uniform price day-ahead electricity auctions. EURO J. Comput. Optim. 5(1), 263–284 (2017)

A. Martin, J.C. Müller, S. Pokutta, Strict linear prices in non-convex European day-ahead electricity markets. Optim. Method. Softw. 29(1), 189–221 (2014)

T. Ten Raa, On the methodology of input-output analysis. Reg. Sci. Urban Econ. 24(1), 3–25 (1994)

L. Vicente, G. Savard, J. Júdice, Descent approaches for quadratic bilevel programming. J. Optim. Theory Appl. 81(2), 379–399 (1994)

G.R. West, A stochastic analysis of an input-output model. Econometrica 54(2), 363–374 (1986)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Helmberg, H. et al. (2021). Finance, Regulations, Politics and Market Design. In: Hadjidimitriou, N.S., Frangioni, A., Koch, T., Lodi, A. (eds) Mathematical Optimization for Efficient and Robust Energy Networks. AIRO Springer Series, vol 4. Springer, Cham. https://doi.org/10.1007/978-3-030-57442-0_4

Download citation

DOI: https://doi.org/10.1007/978-3-030-57442-0_4

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-57441-3

Online ISBN: 978-3-030-57442-0

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)