Abstract

Mobile money is an electronic form of currency, which has become popular, particularly in developing countries over the last decade. This chapter summarizes the main findings from the empirical literature of the positive impacts (economic and social) of deploying mobile money platforms. They are reconfiguring and transforming pre-existing financial practices, including the unbanked segments of the population into formal economic relations, and providing self-reliance and security to local communities. This chapter also clarifies the types of data required to conduct more reliable empirical research and enhance cooperation among the parties involved in deploying and studying the effects of mobile money (MM) systems (i.e., among the academic community, policymakers/regulators, central banks, telecommunication companies, and entrepreneurs). Overall, this chapter presents a road map to establish a unified field of MM research by putting forward some lessons of improved inquiry and practice.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Introduction. Mobile Money: Geographical Distribution and How It Works

“Mobile money” (MM) is an electronic form of currency, that is, digital money, which requires the use of an application on an electronic device, such as a tablet or a mobile phone. MM systems often lie outside the formal banking system: MM users can make basic financial transactions (such as transfers, deposits, and withdrawals) without the need of having a formal bank account (therefore, MM is not to be confused with mobile banking, in which customers, typically in developed countries, access their formal bank accounts via mobile devices). MM systems are instead associated with the use of SMS (text messaging) mobile phone technology, typically in developing countries, by the “unbanked” population in order to conduct cashless transactions.

Overall, this chapter points out the need for greater complementary financial services, which ideally emerge out of cultivating collaborative relationships between MM systems and the traditional banking system. There is a growing amount of empirical evidence that the development and deployment of MM systems contribute toward the achievement of sustainable social and economic growth (as described by the UN Sustainable Development Goal 8: “to promote sustained, inclusive and sustainableeconomic growth, full and productive employment and decent work for all” (Sustainable Development Goals, n.d.)). Therefore, business managers and entrepreneurs, regulatoryagencies, governments, as well as academia should engage in establishing closer collaborations with a view to deploying MM systems. This chapter aims at providing some lessons to these stakeholders for improved analysis and practice of MM systems in the future.

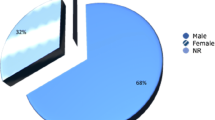

As a noted example of financial “reverse innovation” (Govindarajan and Trimble 2012), the development and deployment of MM systems have unexpectedly occurred at greater pace among the poor and financially excluded populations of low- rather than high-income countries. The African continent has the highest adoption rates for MM compared to all other continents (Lashitew et al. 2019), while adoption lags in Europe and the Middle East. As of 2019, the Global System for Mobile communications Association (GSMA) worldwide network of 750 mobile operators estimated that about 720 million people worldwide have opened an MM account in 90 different countries, and nearly half (350 million) are located in the sub-Saharan Africa and 223 million in South Asia (GSMA 2019a). Kenya’s “M-Pesa” system is the most successful and well-documented example of MM adopted since the mid-2000s (see Aron (2018) for a summary of Kenya’s “M-Pesa” system); however, Somaliland is the African region with the highest percentage of MM users worldwide (Demirguc-Kunt and Klapper 2012) (see Penicaud and McGrath (2013) for a summary of Somaliland’s “Zaad” system).

Overall, the high rate of MM adoption systems in East Africa and in South Asia may, at first, be rather counterintuitive; we typically expect new technologies to be adopted first by the developed countries, and later by developing countries. Nevertheless, several arguments, presented in the next section, can explain this higher adoption rates of MM in developing economies. Furthermore, most MM systems seem to have focused initially on consumer transactions, that is, on allowing person-to-person (P2P) remittances, but at least Kenya’s “M-Pesa” and Somaliland’s “Zaad” systems have now expanded their services to person-to-business (P2B) and person-to-government (P2G) remittances (e.g., merchant payments, electricity payments, university and schooling fees, even livestock trade), business-to-person (B2P) and government-to-person (G2P) remittances (e.g., salary payments), as well as to business-to-business (B2B) payments.

The way MM systems work, in general, is the following: customers first need to register with the provider of the service by showing some form of government identification to an Agent. In most countries, the provider will be a telecommunications company, that is, a Mobile Network Operator (MNO), but MM services can also be delivered by the established banking sector, that is, by the local banks in the economy (see Pelletier et al. 2019). The Agent is typically a small retailer (such as a grocery store or a petrol station), and occasionally, a larger one (such as a supermarket or a utility company). Once registered, users can then deposit cash (i.e., official tender) in their MM accounts and get, in return, the equivalent value in the electronic currency (i.e., e-money). E-money can then be used for transactions with other individuals/businesses/government (who may or may not be holders of an MM account), or money can simply be kept in the mobile wallet in a digital form (i.e., for saving purposes). Finally, different countries introduce varying regulatory frameworks for their MNOs. In general, MNOs are required by their respective governments to comply with the international established “Know Your Customer” (KYC) and “Customer Due Diligence” (CDD) standards so as to prevent financial crimes. Overall, regulations for MNOs are less stringent than those imposed on the formal banking sector (Suri 2017). For instance, MNOs are typically required to secure their electronic money by holding assets of equal value in liquid form (Pelletier et al. 2019). That is, MM deposits need to be held in trust accounts within the commercial formal banking system, while banks are expected to keep only a small proportion of deposits in liquid form.

The next section briefly summarizes the main positive economic and social impacts of deploying MM systems on the unbanked segments of populations in developing countries. We then proceed with some lessons for improved inquiry and practice, by summarizing common empirical challenges encountered by all parties involved in the design and deployment of MM systems. We conclude that MM systems are a promising step toward a new financial market; nevertheless, there seems to be a need for greater standardization of research protocols.

Economic and Social Impacts of Mobile Money

As a subject in the broader field of digital transformations and sustainability, MM systems are an important area of study, as they seem to achieve several positive outcomes, categorized in the following three broad themes:

-

1.

MM systems represent a digital transformation of exchange relations (in the form of the migration of remittancesfrom cash-based systems to electronic media).

-

2.

MM systems show great promise to include unbanked and financially excluded populations in formal economic relations.

-

3.

MM systems seem to contribute to humanization of aspects of financial relations.

Briefly, we now explain how MM systems can be beneficial along the three themes described earlier.

Regarding the theme of digital transformation, MM systems seem to reconfigure pre-existing financial practices by bringing increased transparency and by offering a more secure and convenient alternative method to cash. In other words, MM help record a larger volume of official remittances; help authorities control money laundering practices; reduce transaction costs of transporting money through middlemen; facilitate trade and business planning; and also offer a safer option for savings (as compared to “cash under the mattress,” “jewelry accumulation,” or other practices followed in developing countries; see, for instance, Nelms (2017), for a discussion about Ecuador’s “cajas”).

Regarding the theme of financialinclusion, MM systems seem to have been particularly successful wherever formal banking transactions are limited due to the following three reasons. First, in rural areas, where population density falls, the cost of establishing a geographically wide network of bank branches increases significantly. Instead, MNOs may still find it profitable to launch an MM platform in rural areas, because they can rely on their already available mobile network infrastructure (and their available Agents). Second, the typical rural family (at least in developing countries) tends to have a lower income than that of an urban family; and when poor families cannot meet the requirement for maintaining a minimum account balance, they are excluded from conventional banking. MNOs may instead find it profitable to launch an MM platform in poor areas, because they can rely on charging low commissions for a larger volume of transactions. Third, banks are reluctant to open a bank account (or offer any additional services, such as insurance and loans) to poor people, because hardly any records of financial transactions will be available for such families. Instead, MNOs can rely on the history of transactions they already have for their customers from mobile usage and build profiles; that is, MNOs face less of an asymmetric information problem than banks. Apart from the aforementioned three main reasons (explaining why/when MM achieve financialinclusion of the unbanked), Economides and Jeziorski (2017) also note that MM can be successful in areas with high criminality, that is, where holding cash is a risky activity and therefore mainstream banking services are unavailable.

In some cases, such as in Kenya’s M-Pesa system, financialinclusion extends beyond simple P2P and P2B remittances; that is, the mobile currency may not serve just as a cash-in-cash-out system. Instead, the MNO provider in the above two countries has managed to continuously evolve the system by providing also micro-credit and micro-insurance to poor people. Suri and Jack (2016), for instance, find that access to MM has been effective in improving the economic lives of Kenyan women and has reduced poverty in Kenya by about 2%: women, in particular, seem to have changed their occupation away from agriculture (into small business and retail), as MM provide greater financialinclusion via access to direct remittances, increased privacy for financial dealings, and increased access to credit. Likewise, in Asia, fintechplayers are now diversifying their MM services by offering medical (i.e., insurance) and financial (i.e., wealth management) (GSMA 2019a). Pelletier et al. (2019) find, using data for MM systems on 90 countries, positive economic impacts on the poor due to adopting MM systems (such as an increase in the total value of transactions recorded in the economy). Furthermore, they find that such positive spillover effects are much larger when MM systems are deployed via the banking system, rather than an MNO.

Overall, the empirical literature finds that MM systems allow households in developing countries to integrate into the financial system, and that a prerequisite for their financial inclusion seems to be the development of a robust Agent network. In Kenya, for instance, the number of participating Agents in the M-Pesa system grew, in 2015, to about 65,000 (compared to approximately 10,000 bank branches in the country); in Tanzania, the number of MM Agents, in 2014, grew to around 45,000 (compared to approximately only 580 bank branches); and in Uganda, the number of Agents has grown to around 41,000 (versus only about 470 bank branches in the country) (Suri 2017). Another significant determinant of the practical development of MM systems worldwide has been the successful collaboration of the provider with the regulatory authorities (Lashitew et al. 2019).

Regarding the theme of the humanization of financial relations, MM systems have been viewed as a means of providing self-reliance and security to local communities, particularly as a means of “insulating” local economies either from large exogenous communal shocks (e.g., natural disasters/medical epidemics) or from idiosyncratic financial shocks. In the case of Kenya, for instance, Suri et al. (2012) find that users of the M-Pesa system have been able to utilize their remittance network in order to finance their increased health care cost without reducing food and education expenditures (whereas non-users of MM were found to be more likely to pull their children out of school, as a means to cover increased medical expenditures). In a subsequent study, Suri and Jack (2016) find that the reductions in transaction costs of remittances (achieved through the use of MM) have resulted in M-Pesa users flattening their financial risks, compared to non-users. The reason for this improved risk-sharing is that households participating in MM systems have a larger set of people to rely upon (whenever a negative shock takes place). In other words, MM seem to have the potential to build social relationships of trust, reciprocity, solidarity, mutual aid, and cooperation among communities (resulting therefore to poverty alleviation); perhaps, there is a stronger sense of belonging and solidarity among sparsely populated, or geographically isolated, poor communities. Also, keep in mind that not only MM systems but several other alternate systems of economic exchange, denoted collectively, in the literature, under the terms “complementary currencies,” “parallel currencies,” “local currencies,” “regional currencies,” “alternative currencies,” “social currencies,” or “supplementary currencies,” seem to have similar positive social effects (for a meta-analysis of these alternate forms of currencies and their potential to remedy some of the negative effects of mainstream state-sponsored currencies, see Reppas and Muschert (2019)).

To sum up, MM can be seen as a tool not only for protecting local communities from exogenous financial shocks, but also for building social capital and strengthening social cohesion. That is, today’s widespread use of MM may be explained partly by the fact that many post-materialist societies recognize the potential of MM to boost social integration and achieve social sustainability.

Although most of the literature assesses MM overall positively (for its ability to achieve outcomes as those mentioned in the above three themes), Martin (2019) raises a rather underexplored, but important, feature of MM platforms: MM may be used as a means of increased surveillance because MNOs seem to operate “in-house” monitoring platforms which allow them to build unique behavioral profiles for their customers and Agents (see, for instance, The Economist (2018a) on how some firms try to generate credit judgments in the absence of a conventional financial history). Therefore, Martin (2019) expresses concerns that if MM platforms are perceived, in the future, mainly as a surveillance mechanism (placed by governments), then poor people may eventually step away from them. Another drawback of MM is that they seem to be encouraging overborrowing, particularly in East Africa, where digital lending is yet not regulated (The Economist 2018b).

Lessons for Improved Inquiry and Practice

From a research perspective, there is still much to learn about MM systems. For example, in a critical review of the empirical literature on the micro- and macro-economic impacts of MM, Aron (2017) concludes that the parties potentially involved in the deployment of MM platforms (i.e., academic community, government regulators, central banks, and telecommunication companies) need to better understand the types of data required to conduct more reliable empirical research. Likewise, Pelletier et al. (2019) conclude that partnerships between the two main providers of MM (namely MNOs and the formal banking sector) should be encouraged because none seems to be unambiguously superior to the other: MM systems offered by MNOs have the advantage that they can reach a larger number of financially excluded individuals (than with banks), while MM systems offered by banks have the advantage (compared to MNOs) that they can stimulate better the economy (due to the wider range of products offered along with the MM system).

Overall, this chapter aims at enhancing cooperation among the academic community, government regulators, central banks, and telecommunication companies/entrepreneurs by specifying some of the conditions required for the successful development of MM systems, and by identifying what types of data may be required to conduct more reliable empirical research for the measurement of social and economic impacts of MM.

In the growing field of academic knowledge about MM in a variety of fields, most academic studies seem to focus on iterations of one or both of the following two questions (Aron 2017, 2018):

-

Researchers examine the factors that lead to the development, deployment, and adoption of MM systems, including the economic conditions, social/cultural conditions, the existence of a well-structured network of Agents, and the proper regulatory environment (as already discussed in the previous section).

-

Researchers examine the impacts of MM systems at various levels, including macro- and micro-level, such as enhanced transparency, measures of financialinclusion, poverty reduction, and risk reduction (as already discussed in the previous section).

Among a large proportion of studies examining MM systems, the answers to the above two fundamental research (but also practical!) questions are unclear, primarily due to concerns with the wide variety of ways/forms in which data are collected (including data quality), and the broad swath of methodologies employed (such as Randomized Control Trials, Differences-In-Differences, Propensity Score Methods, and Instrumental Variable Methods). Thus, as Aron (2017, 2018) points out, it is important to exercise caution in making inferences from existing studies about MM systems, about the factors that play a role in their adoption and sustained usage, and about their potential welfare increasing effects. Although some authors tend to make strong claims, many findings in the literature seem potentially emergent from idiosyncratic aspects of the data examined. Similar to Aron (2017, 2018), Khan and Blumenstock (2016) also conclude that behavioral models for the adoption of MM (by using mobile phone data) do not necessarily apply to several developing countries; therefore, predicting the key drivers of MM adoption is difficult and researchers should avoid making generalizations. Suri (2017) also concludes that although MM seem revolutionary, there is still a lot to learn.

Therefore, in the rest of this section, we summarize some common mistakes (or methodological challenges) encountered in the existing empirical studies when trying to answer either of the above two main questions (i.e., trying to identify either factors of deployment or the impacts of MM). We overall aim at providing some lessons for improved analysis and practice in the future.

There are numerous common methodological challenges across the empirical studies of MM, the first of which deals with measurement bias in some of the variables used. There is noted measurement bias on the MM usage variable, such that the definition of MM usage seems to be inconsistent across empirical studies (and occasionally, some authors may fail even to explain exactly how MM usage is measured in their studies). For instance, when usage is defined as the number of registered customers to the MNO, then true participation is overestimated, because some customers may never use the MM service (i.e., being registered to the operator (i.e., ownership of a SIM card or of a mobile phone) does not necessarily mean usage of the MM service). Furthermore, Roessler (2018) points out that ownership of mobile phones is likely to be inflated particularly in surveys for households with lower income, lower education, and older age groups. Therefore, although MM systems seem, in theory, to support the needs of a broad set of users, in practice they may end up reaching a smaller (than expected) number of individuals, which can underestimate measures of digital inequality experienced by excluded households, as it gets increasingly harder for such households to catch up with the rest. On the other hand, true MM usage is underestimated whenever it is measured as households with at least one of its members having had a registered MM account (or a SIM subscription): underestimation occurs because other unregistered customers of the same household who are not the owners of the SIM card might still be using the service.

Further measurement bias is observed in the wealth and education variables, both of which seem to be poorly measured in developing countries, or at other times are completely omitted from the empirical studies. For instance, Munyegera and Matsumoto (2016) measure household wealth in terms of land size and total asset. Blumenstock et al. (2016) use mobile-phone usage data as a proxy for wealth, while others (Jack and Suri 2014; Suri and Jack 2016) omit wealth entirely, even while including other household characteristics in the control variables. Likewise, education may be measured in terms of years of schooling (Jack and Suri 2014; Riley 2018) or entirely omitted (Suri and Jack 2016). Nevertheless, in studies trying to identify the factors for the adoption of MM, both wealth and education seem to be important determinants and therefore should be included in the vector of control variables, as otherwise the omission of such important controls leads to endogeneity problems, as discussed in more detail below.

A second methodological challenge concerns omitted variable bias for structural changes. The adoption of MM systems may depend on political regime changes (such as in Somaliland); on important technological changes (i.e., quality changes in the services provided by the MNO); and/or on network/spillover effects (i.e., whether there exists a threshold, either a critical number of users or a critical number of Agents, above which MM adoption becomes widespread in a community; see Riley (2018) and Centellegher et al. (2018) for spillover effects). Empirical studies should therefore test for any of the above structural changes by introducing dummy variables (and interaction effects of these dummies with other explanatory variables). Researchers might also want to keep in mind that technological changes are likely to occur in the near future in Africa (because the majority of Internet connections there are currently 2G, but 3G is expected to overtake 2G during 2019 (GSMA 2019b); and the rollout of 3G services will be critical for the wider adoption of MM systems).

A third methodological challenge involves the possible existence of endogeneity when MM is introduced as an explanatory variable in the analysis. Some studies measure the impact of MM on different microeconomic outcomes (e.g., household consumption) and therefore introduce a dummy in the right hand side (RHS) for the intervention (adoption of MM), or some continuous variable referring to the usage of MM by individuals. Nevertheless, both the adoption and usage of MM are not uncorrelated with unobservable (or difficult to measure) variables, captured through the error term. For instance, as noted above, adoption and usage of MM seem to be affected by household education, household wealth, technological changes (in the network), and the user’s social network. If any of such difficult-to-measure variables is not explicitly introduced in the empirical analysis (but, instead, is captured through the error term), then the explanatory variables are endogenous (and thus the results biased).

To resolve the endogeneity problem, an instrument should be used to replace the MM adoption (or usage) variable. Some commonly used instruments in the literature are the number of Agents available (Jack and Suri 2014); the distance of a household from the closest available Agent (Munyegera and Matsumoto 2016; Riley 2018); or the change in the Agent’s network density (Suri and Jack 2016). Nevertheless, any of these measures (relating to the Agents network) may still not be a good solution for the endogeneity problem, because the roll-out of Agents (by MNOs) is not random (Aron 2017, 2018). Instead, Agents self-select in locations predicted to bring more profits to them (i.e., toward locations with higher population density, higher income, and education levels).

Conclusions

While studies of MM do indeed suggest that some optimism is warranted regarding the capacity for such systems to lead to the positive inclusion of financially marginal populations, and for the increase in economic and social well-being in environments where they are deployed, there remains a need for greater standardization of research protocols for the study of the socioeconomic aspects of MM systems. As Suri (2017) points out, MM systems are perhaps one promising step toward a new financial market, but researchers should always keep in mind that the robustness of their empirical studies should be tested against different model specifications (Aron 2017, 2018).

This chapter therefore scrutinizes the existing body of research, in order to develop a way toward the establishment of a more unified field of MM research. Drawing upon a meta-analysis of existing studies, with a particular concentration on the two fundamental questions (as described in the previous section), this chapter provides a list methodological concerns for researchers, which if addressed will increase the internal and external validity of MM studies, advocated in the spirit of contributing to the broader fields of digital transformations and sustainability in financial relations.

MM is perhaps the quintessential example of a reversed engineered financial technology (Govindarajan and Trimble 2012), and the successful deployment of such systems speaks a potential growth strategy that, if successfully adopted, can serve the interests of various stakeholders simultaneously. Of course, those interested in development initiatives for poverty reduction among the world’s poorest (see Collier 2007) will find MM systems attractive, because they have shown great potential to include unbanked populations in formal economic relations, to reduce poverty, and to protect less affluent populations from the risks of economic shock. In addition, MM can be appealing to those interested in developing services for the vast consumer base located at the “bottom of the pyramid” (see Prahalad 2010), in a way which rather than competing for existing market share in financial services, relies on the creation of new markets among those who have been excluded. A case in point is that once MM systems have been widely adopted, they have expanded to offer additional financial services to users such as insurance or microcredit. Thus, rather than displacing the vested interests of mainstream financial institutions such as private or public banks, MM systems often include those previously unbanked segments of the population without drawing customers away from traditional financial services. In many cases, MM systems have also linked users to formal banking institutions via interoperability, and therefore have complemented existing banking systems rather than competing with them.

Indeed, there is a great potential in the use of MM systems in a variety of nations to drive progress on the UN Sustainable Development Sub-Goal 8.10 to “strengthen the capacity of domestic financial institutions to encourage and expand access to banking, insurance and financial services for all” (Sustainable Development Goals, n.d.). The key indicator for success would be measured via the “proportion of adults (15 years and older) with an account at a bank or other financial institution or with a mobile-money-service provider” (Goal 8, n.d.). To the extent that development and deployment of MM systems contribute to the achievement of sustainable social and economic growth, then these policies should be encouraged by regulatory agencies, governments, and NGOs.

However, MM systems may not be a silver bullet which solves the problem of financial exclusion without generating any unintended negative consequences. While the record generated via MM remittances can help government and regulators monitor and thereby minimize unauthorized activities such as black marketing, money laundering, and tax evasion, there may be other ethical concerns with MM which have not been deeply explored. While financial inclusion may have benefits for those who were previously excluded, inclusion may create different vulnerabilities. MM systems have potential to subject disempowered segments of the population to greater surveillance and indeed may be a form of “surveillance capitalism” (see Zuboff 2019) which refers to the increased use of data in economic relations and use of automation in decision making. Such commodification of consumer information via the digitization of remittances may serve the interests of data-driven capital accumulation and/or the rise of the surveillance state, and thus should be examined critically (see Martin 2019). Ultimately, the use of MM systems in remittances should serve the interests of those whose exchanges are facilitated via such systems, rather than the other way around.

References

Aron, J. (2017). Leapfrogging: A survey of the nature and economic implications of Mobile money. CSAE working paper WPS/2017–02, Center for the Study of African Economies. https://www.csae.ox.ac.uk/materials/papers/csae-wps-2017-02.pdf

Aron, J. (2018). Mobile money and the economy: A review of the evidence. The World Bank Research Observer, 33(2), 135–188. https://doi.org/10.1093/wbro/lky001.

Blumenstock, J. E., Eagle, N., & Fafchamps, M. (2016). Airtime transfers and mobile communications: Evidence in the aftermath of natural disasters. Journal of Development Economics, 120, 157–181. https://doi.org/10.1016/j.jdeveco.2016.01.003.

Centellegher, S., Miritello, G., Villatoro, D., Parameshwar, D., Lepri, B., & Oliver, N. (2018). Mobile Money: Understanding and Predicting its Adoption and Use in a Developing Economy. https://arxiv.org/abs/1812.03289

Collier, P. (2007). The bottom billion: Why the poorest countries are failing and what can be done about it. Oxford: Oxford University Press.

Demirguc-Kunt, A., & Klapper, L. (2012). Measuring financial inclusion. The global Findex database. Policy Research Working Paper 6025, World Bank, Washington, DC. https://openknowledge.worldbank.org/bitstream/handle/10986/6042/WPS6025.pdf?sequence=1&isAllowed=y

Economides, N., & Jeziorski, P. (2017). Mobile money in Tanzania. Marketing Science, 36(6), 815–837. https://doi.org/10.1287/mksc.2017.1027.

Goal 8: Sustainable Development Knowledge Platform. (n.d.). Retrieved January 20, 2020 from: https://sustainabledevelopment.un.org/sdg8

Govindarajan, V., & Trimble, C. (2012). Reverse innovation: A global growth strategy that could pre-empt disruption at home. Strategy & Leadership, 40(5), 5–11. https://doi.org/10.1108/10878571211257122.

GSMA. (2019a). State of the Industry Report on Mobile Money 2018. https://www.gsma.com/mobilefordevelopment/resources/2018-state-of-the-industry-report-on-mobile-money/

GSMA. (2019b). The Mobile Economy Sub-Saharan Africa 2019. https://www.gsma.com/r/mobileeconomy/sub-saharan-africa/

Jack, W., & Suri, T. (2014). Risk sharing and transactions costs: Evidence from Kenya’s Mobile money revolution. American Economic Review, 104(1), 183–223. https://doi.org/10.1257/aer.104.1.183.

Khan, M., & Blumenstock, J. E. (2016). Predictors without borders: Behavioral modeling of product adoption in three developing countries. In Proceedings of the 22nd ACM SIGKDD International Conference on Knowledge Discovery and Data Mining. ACM, 145–154. https://dl.acm.org/citation.cfm?id=2939710

Lashitew, A. A., van Tulder, R., & Liasse, L. (2019). Mobile phones for financial inclusion: What explains the diffusion of mobile money innovations? Research Policy, 48(5), 1201–1215. https://doi.org/10.1016/j.respol.2018.12.010.

Martin, A. (2019). Mobile platform surveillance. Surveillance & Society, 17(1/2), 213–222. https://doi.org/10.24908/ss.v17i1/2.12924.

Munyegera, G. K., & Matsumoto, T. (2016). Mobile money, remittances, and household welfare: Panel evidence from rural Uganda. World Development, 79, 127–137. https://doi.org/10.1016/j.worlddev.2015.11.006.

Nelms, T. C. (2017). Accounts. In B. Maurer & L. Swartz (Eds.), Paid: Tales of Dongles, Checks, and Other Money Stuff. (chapter 5, pp. 42–50). Cambridge: MIT Press.

Pelletier, A., Khavul, S., & Estrin, S. (2019). Innovations in emerging markets: The case of mobile money. Industrial and Corporate Change, 1–27. https://doi.org/10.1093/icc/dtz049.

Penicaud, C., & McGrath, F. (2013). Innovative inclusion: How Telesom ZAAD brought Mobile money to Somaliland. GSMA. https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2013/07/Telesom-Somaliland.pdf\

Prahalad, C. K. (2010). The fortune at the bottom of the pyramid: Eradicating poverty through profits (Vol. 1, p. 1). Upper Saddle River, NJ: Wharton School Publishing.

Reppas, D., & Muschert, G. W. (2019). The potential for community and complementary currencies (CCs) to enhance human aspects of economic exchange. In: Borisonik, Hernán Gabriel. “Money in the 21st Century: Digital Exchange, Extra-State Currencies, and the Relational Character of Money”. Digithum, 24, 1–11. Universitat Oberta de Catalunya and Universidad de Antioquia. https://doi.org/10.7238/d.v0i24.3180.

Riley, E. (2018). Mobile money and risk sharing against village shocks. Journal of Development Economics, 135, 43–58. https://doi.org/10.1016/j.jdeveco.2018.06.015.

Roessler, P. (2018). The Mobile phone revolution and digital inequality: Scope, determinants and consequences. Pathways for prosperity commission. Background Paper Series no. 15. Oxford. United Kingdom. https://pathwayscommission.bsg.ox.ac.uk/sites/default/files/2018-12/philip_roessler_mobile_phone_revolution_.pdf

Suri, T. (2017). Mobile money. Annual Review of Economics, 9, 497–520. https://doi.org/10.1146/annurev-economics-063016-103638.

Suri, T., & Jack, W. (2016). The long-run poverty and gender impacts of mobile money. Science, 354(6317), 1288–1292. https://doi.org/10.1126/science.aah5309.

Suri, T., Jack, W., & Stoker, T. M. (2012). Documenting the birth of a financial economy. PNAS, 109(26), 10257–10262. https://doi.org/10.1073/pnas.1115843109.

Sustainable Development Goals: Sustainable Development Knowledge Platform. (n.d.). Retrieved January 20, 2020, from https://sustainabledevelopment.un.org/?menu=1300

The Economist. (2018a, May 04). Mobile financial services are cornering the market. https://www.economist.com/special-report/2018/05/04/mobile-financial-services-are-cornering-the-market

The Economist. (2018b, November 17). Borrowing by mobile phone gets some poor people into trouble. https://www.economist.com/finance-and-economics/2018/11/17/borrowing-by-mobile-phone-gets-some-poor-people-into-trouble

Zuboff, S. (2019). The age of surveillance capitalism: The fight for a human future at the new frontier of power. New York: PublicAffairs.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s)

About this chapter

Cite this chapter

Reppas, D., Muschert, G. (2021). Mobile Money Systems as Avant-Garde in the Digital Transition of Financial Relations. In: Park, S.H., Gonzalez-Perez, M.A., Floriani, D.E. (eds) The Palgrave Handbook of Corporate Sustainability in the Digital Era. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-030-42412-1_8

Download citation

DOI: https://doi.org/10.1007/978-3-030-42412-1_8

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-030-42411-4

Online ISBN: 978-3-030-42412-1

eBook Packages: Business and ManagementBusiness and Management (R0)